Exhibit 99.2

LEADING THE WAY in renewable fuels November 2022

Disclaimer Forward - Looking Statements: This presentation (this “Presentation”) contains certain forward - looking statements within the meaning of the federal securitie s laws with respect to the transaction (the “Proposed Business Combination”) between Industrial Tech Acquisitions II, Inc. (“ SPAC” or “ITAQ”) and NEXT Renewable Fuels, Incs . (“NXT” or the “Company”) , including statements regarding the benefits of the transaction, the anticipated timing of the completion of the transaction , t he products to be offered by NXT and the markets in which it will operate, the expected total addressable market for NXT’s pr opo sed products, the sufficiency of the net proceeds of the proposed transaction to fund NXT’s operations and business plans and NXT’s projected future result s i ncluding the extent of redemptions by ITAQ’s public stockholders. These forward - looking statements are generally identified by t he words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continu e,” “will likely result,” and similar expressions. Forward - looking statements are predictions, projections and other statements abo ut future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause future events to differ materi all y from the forward - looking statements in this presentation, including, but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all; (ii) the risk that the transaction may not be completed by ITAQ’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by ITAQ; (iii) the failure to satisfy the conditions to the consummation of the trans ac tion, including the adoption of the business combination agreement by the shareholders of ITAQ and NXT, (iv) the risk that a large percentage of ITAQ’s public stockholders will exerc ise their redemption rights under ITAQ’s certificate of incorporation; (v) the risk that the net tangible book value of ITAQ afte r giving effect to the merger and any equity financing will be less than $5,000,001; (vi) receipt of certain governmental and regulatory approvals; (vi) the lack of a third - party valuation; (vii) the o ccurrence of any event, change or other circumstance that could give rise to the termination of the business combination agre eme nt; (viii) the effect of the announcement or pendency of the transaction on NXT’s business relationships, performance, and business generally; (ix) the risk that NXT’s refinery construct ion costs and cost of debt will significantly exceed NXT’s current estimates; (x) the risk that, following the closing, NXT will no t be able to raise the necessary funding, on acceptable terms, if at all, to complete construction of its proposed facilities or to cover its operating costs before NXT generates revenue; (xi) the risk of any delay in the construction of NXT’s facilities and that any delay in the completion of NXT’s Oregon refinery could delay t he commencement of operations and the generation of revenue by NXT; (xii) the risk that NXT’s costs will be greater than anticipated and revenue will be less than anticipated; (xiii) risks that th e transaction disrupts current plans and operations of NXT as a result; (xiv) the outcome of any legal proceedings that may b e i nstituted against NXT, ITAQ or others related to the business combination agreement or the transaction; (xv) ITAQ’s ability to meet Nasdaq Global Markets listing standards at or following the consumm ati on of the transaction; (xvi) NXT’s ability to recognize the anticipated benefits of the transaction, may be affected by a var iet y of factors, including changes in the competitive and highly regulated industries in which NXT operates, variations in performance across competitors and partners, changes in laws and re gul ations affecting NXT’s business and the ability of NXT and the post - combination company to retain its management and key employe es; (xvii) the ability of NXT to implement business plans, forecasts, and other expectations after the completion of the transaction; (xviii) the risk that NXT may fail to keep pace wi th rapid technological developments to provide new and innovative products or make substantial investments in unsuccessful new p rod ucts; (xix) the ability to attract new customers and to retain existing customers in order to continue to expand; (xx) NXT’s ability to hire and retain qualified personnel; (xxi) the risk tha t the post - combination company experiences difficulties in managing its growth and expanding operations; (xxii) the risk that NX T will not meet the milestones for funding; (xxiii) the risk of product liability or regulatory lawsuits or proceedings relating to NXT’s business; (xxiv) cybersecurity risks; (xxv) the effects of COV ID - 19 or other public health crises or other climate related conditions, including wildfires, on NXT’s business and results of o perations and the global economy generally; and, (xxvi) costs related to the transaction. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the oth er risks and uncertainties described in the “Risk Factors” section of ITAQ’s Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q, the registration statement on Form S - 4 and the proxy statement/prospectus discussed above and other documents filed by ITAQ from time to time with the SEC. These filings identify an d address other important risks and uncertainties that could cause actual events and results to differ materially from those con tained in the forward - looking statements. Forward - looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward - looking statement s, and NXT and ITAQ assume no obligation and do not intend to update or revise these forward - looking statements, whether as a re sult of new information, future events, or otherwise. Neither NXT nor ITAQ gives any assurance that either NXT or ITAQ will achieve its expectations . Industry and Market Data: Although all information and opinions expressed in this Presentation, including market data and other statistical information , w ere obtained from sources believed to be reliable and are included in good faith, ITAQ and NXT have not independently verifie d t he information and make no representation or warranty, express or implied, as to its accuracy or completeness. Some data is also based on the good faith es timates of ITAQ and NXT, which are derived from their respective reviews of internal sources as well as the independent sourc es described above. This Presentation contains preliminary information only, is subject to change at any time, and, is not, and should not be assumed to be, complete or to constitute a ll the information necessary to adequately make an informed decision regarding your engagement with ITAQ and NXT. Use of Projections: This Presentation contains projected financial information with respect to NXT. Such projected financial information constitu tes forward - looking information, and is for illustrative purposes only and should not be relied upon as being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, econo mic , competitive, and other risks and uncertainties that could cause actual results to differ materially from those contained in th e prospective financial information. See “Forward - Looking Statements” paragraph above. Actual results may, and are likely to, differ materially from the results contemplated by the financial fore cas t information contained in this Presentation, and the inclusion of such information in this Presentation should not be regard ed as representation by any person that the results reflected in such forecasts will be achieved. Neither ITAQ’s nor NXT’s independent auditors have audited, reviewed, compiled, or performed any pro cedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, neither of the m expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation. Important Information for Investors and Shareholders: If the Proposed Business Combination is pursued, ITAQ will file a proxy statement and other relevant documents with the SEC. St ockholders and other interested persons are urged to read the proxy statement and any other relevant documents filed with the SE C when they become available because they will contain important information about ITAQ, NXT, and the Proposed Business Combina tio n. Stockholders will be able to obtain a free copy of the proxy statement (when filed), as well as other filings containing i nfo rmation about ITAQ, NXT, and the Proposed Business Combination, without charge, at the SEC’s website located at www.sec.gov . Participants in Solicitation: ITAQ, NXT, and their directors and executive officers and other persons may be deemed to be participants in the solicitations o f proxies from ITAQ’s stockholders in respect of the Proposed Business Combination and the other matters set forth in the pro xy statement. Information regarding ITAQ’s directors and executive officers is available in its Annual Report on Form 10 - K for the fiscal year ended December 31, 20 21. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirec t i nterests, by security holdings or otherwise, will be contained in the proxy statement relating to the Proposed Business Combination when it becomes available. Financial Information: Non - GAAP Financial Measures: The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S - X, promulga ted under the Securities Act of 1933, as amended. Accordingly, such information and data may not be included in, may be adjus ted in, or may be presented differently in, the proxy statement to be field by ITAQ with the SEC. Some of the financial information and dat a contained in this Presentation, such as revenue, run - rate revenue, EBIT, EBITDA, run - rate EBITDA, EBTIDA Margin have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). ITAQ and NXT believe these non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to NXT’s financial condition and results of op erations. NXT’s management uses these non - GAAP measures for trend analyses, for purposes of determining management incentive compensation and for budgeting and planning purposes. I TAQ and NXT believe that the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluatin g projected operating results and trends in and in comparing NXT’s financial measures with other similar companies, many of which present similar non - GAAP financial information in the same manner as NXT, although other companies may not define non - GAAP information in the same manner as NXT. Management does not consider these non - GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these no n - G AAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in NXT’s fi nancial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgement by management about which expense and income are excluded or included i n d etermining these non - GAAP financial measures. In order to compensate for these limitations, management presents non - GAAP financi al measures in connection with GAAP results, and any non - GAAP information should read in context of the GAAP financial statements. Trademarks and Trade Names: NXT and ITAQ own or have the rights to various trademarks, service marks, and trade names that they use in connection with th e operation of their respective businesses. This Presentation also contains trademarks, service marks, and trade names of third pa rties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names, or products in this Pre sen tation is not intended to, and does not imply, a relationship with NXT or ITAQ, or an endorsement or sponsorship by or of NXT or ITAQ. Solely for convenience, the trademarks, service marks, and trade names referred to in this Presentation may appear with the ®, TM, or SM symbols, but such references are not intended t o i ndicate, in any way, that ITAQ or NXT will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, and trade names. Risk Factors: For a description of the risks relating to an investment in NXT, including in business and operations, we refer you to “Risks Re lating to NXT” in the Appendix to this Presentation. 2

ITAQ + NXT Merger Creates Renewable Fuels Leader Transaction Overview • Industrial Tech Acquisitions II, Inc. (“ITAQ”), a publicly listed special purpose acquisition company with $176 million in cash currently held in trust, has agreed to combine with NEXT Renewable Fuels, Inc. (the “Company”) • Upon closing, the business will be conducted under the name NXTClean Fuels, Inc. ("NXT") (1) Assumes no PIPE offering and no redemptions to cash in trust for ITAQ Overview • Create pure - play renewable diesel (“RD”) and sustainable aviation fuel (“SAF”) public enterprise • Secure financing to fund NXT’s business plan and the accelerate path to construction of NXT’s first facility • NXT will receive merger consideration of $450 million in ITAQ common stock and options • NXT shareholders and option holders will roll 100% of their equity into the business • Per the Business Combination Agreement (“BCA”), the amount remaining in the Trust Account after redemptions plus the proceeds from any proposed PIPE Offering, net of expenses, shall not be less $50 million • Pro - forma for the transaction, ITAQ will have approximately $176 million of cash on the balance sheet (1) • ITAQ and/or the Company will seek to raise additional capital to be dedicated to engineering costs, land acquisition, site work, and facilities acquisitions, as well as to ensure the required minimum cash at closing condition of the BCA • NXT is supported by offtake and supply agreements with, and investment from Shell, BP, and Chevron • NXT recently held the initial closing of an up to $37.5 million milestone - driven investment from United Ventures, an affiliate of United Airlines Strategic Rationale Transaction Summary 3

Christopher Efird Chairperson and CEO Gene Cotten President David Kane Senior Vice President & Controller Daniel Kim Chief Strategic Officer & Director NXT Leadership Years in Industry 30+ 30+ 30+ 20+ The NXT management team represents more than 100 years of combined experience in finance, refining, chemical manufacturing, renewable fuels, real estate, and industrial project development both nationwide and in the Pacific Northwest Career Milestones Led or co - led the investment in eighteen growth - stage companies that then became public Worked as a senior executive for several major energy companies and provided scoping evaluations for 20+ RD projects Served as CFO for numerous small and medium sized companies, raising equity and debt in private and public markets Focused on the development of sustainable alternative energy platforms with The Pilot Company in a key business development role Bob Armstrong Chief Commercial Officer 20+ Traded crude oil, natural gas, power, refined products, and RINs for multiple blue - chip companies, and served in a key business development role at a leading midstream company 4

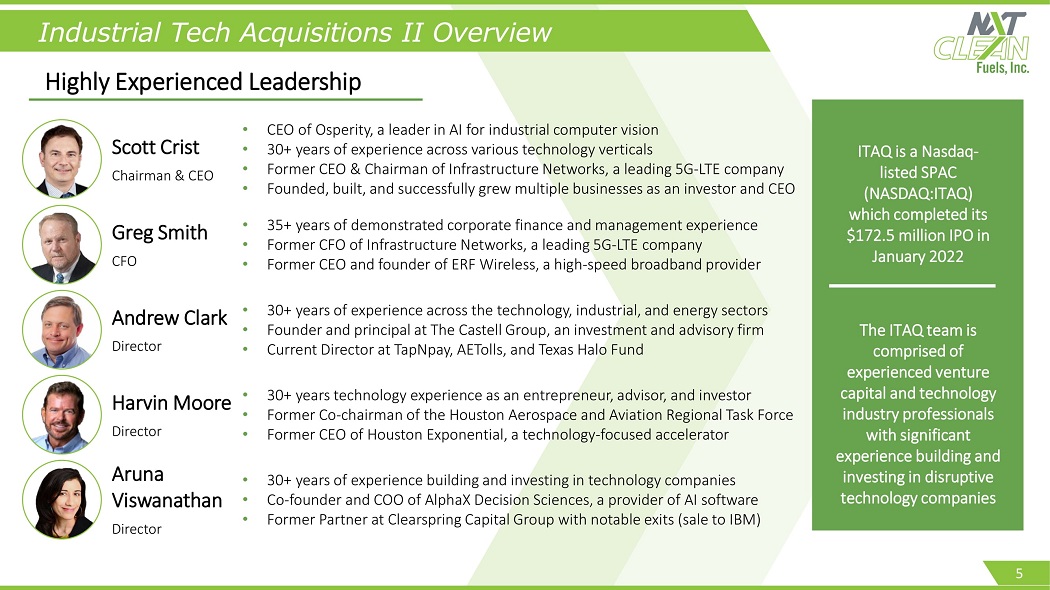

Industrial Tech Acquisitions II Overview Highly Experienced Leadership ITAQ is a Nasdaq - listed SPAC (NASDAQ:ITAQ) which completed its $172.5 million IPO in January 2022 The ITAQ team is comprised of experienced venture capital and technology industry professionals with significant experience building and investing in disruptive technology companies Scott Crist Chairman & CEO • CEO of Osperity, a leader in AI for industrial computer vision • 30+ years of experience across various technology verticals • Former CEO & Chairman of Infrastructure Networks, a leading 5G - LTE company • Founded, built, and successfully grew multiple businesses as an investor and CEO Greg Smith CFO • 35+ years of demonstrated corporate finance and management experience • Former CFO of Infrastructure Networks, a leading 5G - LTE company • Former CEO and founder of ERF Wireless, a high - speed broadband provider Andrew Clark Director • 30+ years of experience across the technology, industrial, and energy sectors • Founder and principal at The Castell Group, an investment and advisory firm • Current Director at TapNpay, AETolls, and Texas Halo Fund Harvin Moore Director • 30+ years technology experience as an entrepreneur, advisor, and investor • Former Co - chairman of the Houston Aerospace and Aviation Regional Task Force • Former CEO of Houston Exponential, a technology - focused accelerator Aruna Viswanathan Director • 30+ years of experience building and investing in technology companies • Co - founder and COO of AlphaX Decision Sciences, a provider of AI software • Former Partner at Clearspring Capital Group with notable exits (sale to IBM) 5

• NXT is a next generation fuels company dedicated to sustainably producing clean, low - carbon fuels • First project being permitted and developed is a 50,000 barrel - per - day (“BPD”) / 750 million gallon - per - year (“ GPY”) RD/ SAF refinery in Oregon with easy access to the West Coast demand markets • RD and SAF are highly profitable liquid transportation fuels worldwide and there is an urgent global need for more of it • NXT’s future plans include hydrogen and clean renewable natural gas (“RNG”) production, and proprietary feedstock aggregation • For its first facility in Oregon, NXT has negotiated long - term offtake agreements and memoranda of understanding (“MOU”) for 90% of nameplate production, implying approximately $10.7 billion of future revenue under the first 5 years of operation • 2/3 of offtake is RD • 1/3 of offtake is SAF • 100% of feedstock supply is contracted from BP under a long - term agreement • Production expected to begin before the end of the 1H 2026 • NXT has secured state permits and anticipates final permit approval in late 2023 • Renewable Identification Numbers (“RINS”), Low Carbon Fuel Standard (“LCFS”), Clean Fuels Program (“CFP”), and newly instated Inflation Reduction Act (“IRA”) hydrogen production credits will enhance margins Investors and Partners: NXT Overview Source: Energy Information Agency, NXT Management Merger valuation is less than 1 times projected first full operating year’s EBITDA 6

Why RD/SAF? Why NXTClean Fuels? Transaction Details NXT and ITAQ – Strong Rationale From All Angles 7

8 Why Renewable Diesel/SAF?

Lowest Carbon Footprint, Highly Profitable Substitute for Petroleum Diesel • One of the cheapest, quickest, and lowest carbon footprints of all renewable fuel alternatives • Multiple lifecycle cost analyses have proven RD to be ¼ of the carbon footprint of electric vehicles and lower than all other fuel alternatives to fossil fuels (2) • No incremental spending needed on conversion or new infrastructure • RD’s higher cetane content burns cleaner and requires less maintenance • NXT RD facility will be one of the largest RD/SAF facilities in the continental U.S. Large, Established Total Addressable Renewable Diesel Market Eager for Change 1 • Diesel accounts for 25% of total energy consumption by the U.S. transportation sector (1) , approximately 47 billion GPY • NXT will produce a drop - in renewable diesel replacement for petroleum diesel, 100% compatible without blending • RD is fully compatible with existing infrastructure for transport and storage • Most diesel engine manufacturers have approved use of RD 2 Source: (1) Energy Information Agency, (2) Crown Oil, NXT Management, (3) JP Morgan Why RD/SAF? Sustainable Aviation Fuels Market Poised For Takeoff • Most airlines have publicly committed to 10% SAF use by 2030, with FedEx and Deutsche Post leading with 30% targets (3) • With established lifecycle assessment methodologies, such as CORSIA, SAF reduces greenhouse gases (“GHG”) by up to 80% compared to fossil jet fuel use • In order to reach expected and government mandated SAF demand, capacity will have to grow at a CAGR of 87% • There are no other scalable alternative fuels that can help airlines achieve the mandate levels 3 9

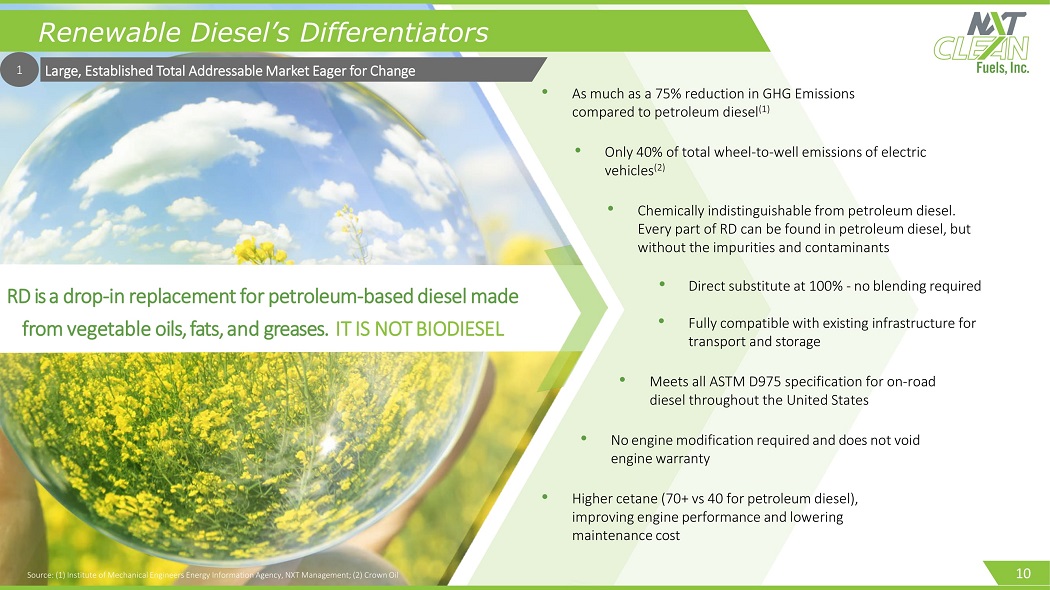

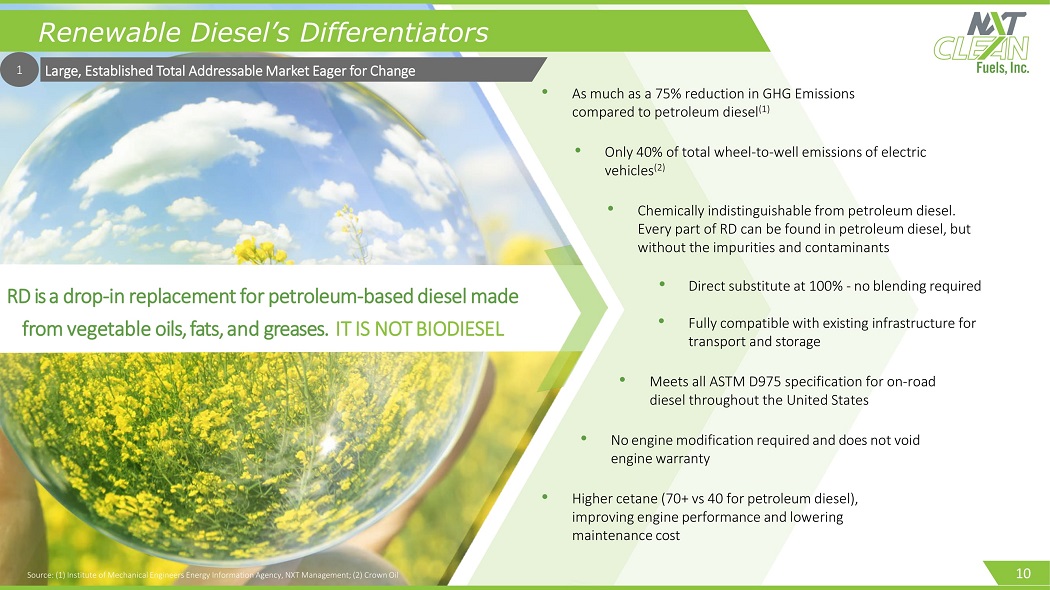

1 1 Renewable Diesel’s Differentiators 1 Large, Established Total Addressable Market Eager for Change Source : (1) Institute of Mechanical Engineers Energy Information Agency, NXT Management; (2) Crown Oil RD is a drop - in replacement for petroleum - based diesel made from vegetable oils, fats, and greases. IT IS NOT BIODIESEL • Direct substitute at 100% - no blending required • No engine modification required and does not void engine warranty • Fully compatible with existing infrastructure for transport and storage • Higher cetane (70+ vs 40 for petroleum diesel), improving engine performance and lowering maintenance cost • Only 40% of total wheel - to - well emissions of electric vehicles (2) • As much as a 75% reduction in GHG Emissions compared to petroleum diesel (1) • Meets all ASTM D975 specification for on - road diesel throughout the United States • Chemically indistinguishable from petroleum diesel. Every part of RD can be found in petroleum diesel, but without the impurities and contaminants 1 10

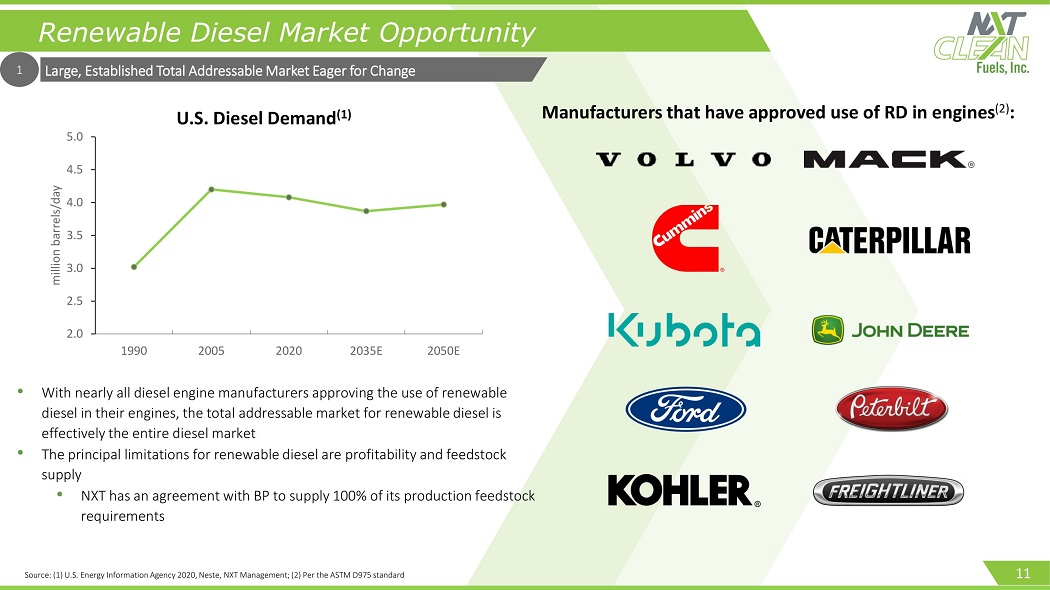

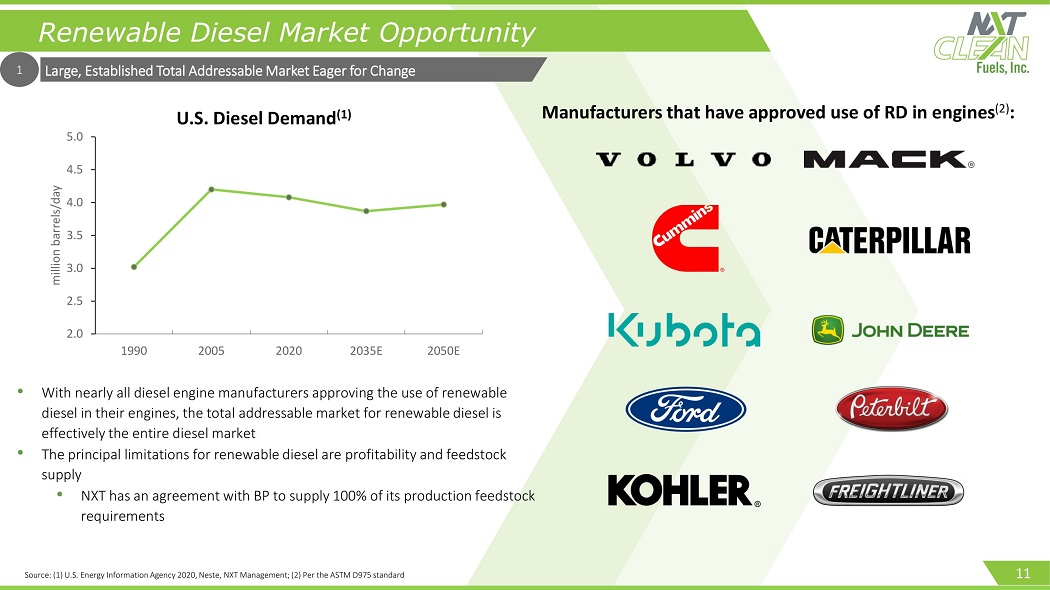

1 • With nearly all diesel engine manufacturers approving the use of renewable diesel in their engines, the total addressable market for renewable diesel is effectively the entire diesel market • The principal limitations for renewable diesel are profitability and feedstock supply • NXT has an agreement with BP to supply 100% of its production feedstock requirements 2.0 2.5 3.0 3.5 4.0 4.5 5.0 1990 2005 2020 2035E 2050E million barrels/day U.S. Diesel Demand (1) Manufacturers that have approved use of RD in engines (2) : Source: (1) U.S. Energy Information Agency 2020, Neste, NXT Management; (2) Per the ASTM D975 standard Large, Established Total Addressable Market Eager for Change Renewable Diesel Market Opportunity 11

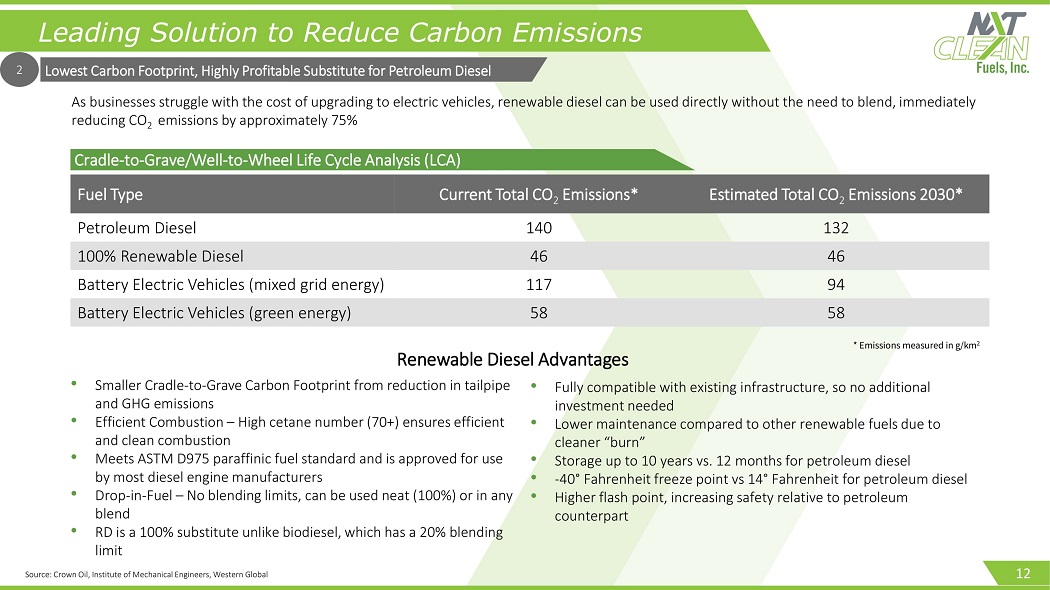

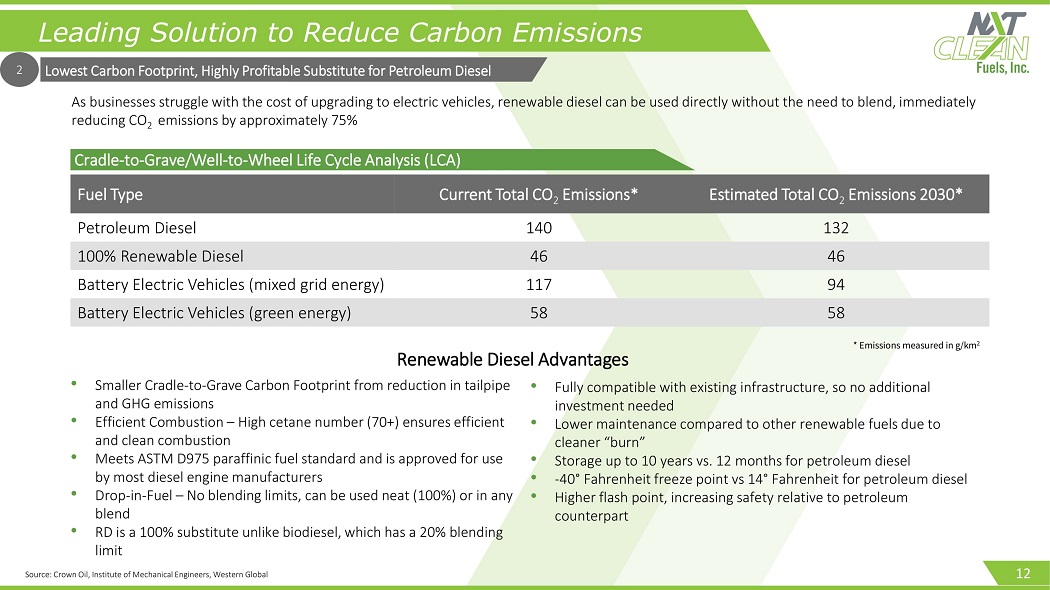

2 As businesses struggle with the cost of upgrading to electric vehicles, renewable diesel can be used directly without the nee d t o blend, immediately reducing CO 2 emissions by approximately 75% • Smaller Cradle - to - Grave Carbon Footprint from reduction in tailpipe and GHG emissions • Efficient Combustion – High ce tane number (70+) ensures efficient and clean combustion • Meets ASTM D975 pa raffinic fuel standard and is approved for use by most diesel engine manufacturers • Drop - in - Fuel – No blending limits, can be used neat (100%) or in any blend • RD is a 100% substitute unlike biodiesel, which has a 20% blending limit Fuel Type Current Total CO 2 Emissions* Estimated Total CO 2 Emissions 2030* Petroleum Diesel 140 132 100% Renewable Diesel 46 46 Battery Electric Vehicles (mixed grid energy) 117 94 Battery Electric Vehicles (green energy) 58 58 Crad le - to - Grave/Well - to - Wheel Life Cycle Analysis (LCA) * Emissions measured in g/km 2 Lowest Carbon Footprint, Highly Profitable Substitute for Petroleum Diesel Leading Solution to Reduce Carbon Emissions Source: Crown Oil, Institute of Mechanical Engineers, Western Global Renewable Diesel Advantages • Fully compatible with existing infrastructure, so no additional investment needed • Lower maintenance compared to other renewable fuels due to cleaner “burn” • Storage up to 10 years vs. 12 months for petroleum diesel • - 40 Σ Fahrenheit freeze point vs 14 Σ Fahrenheit for petroleum diesel • Higher flash point, increasing safety relative to petroleum counterpart 12

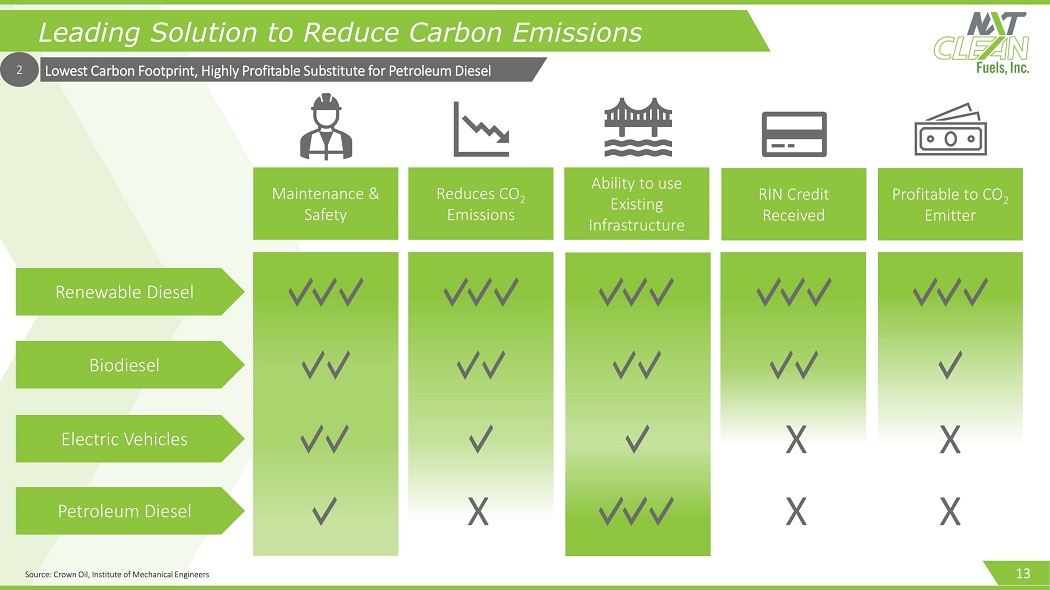

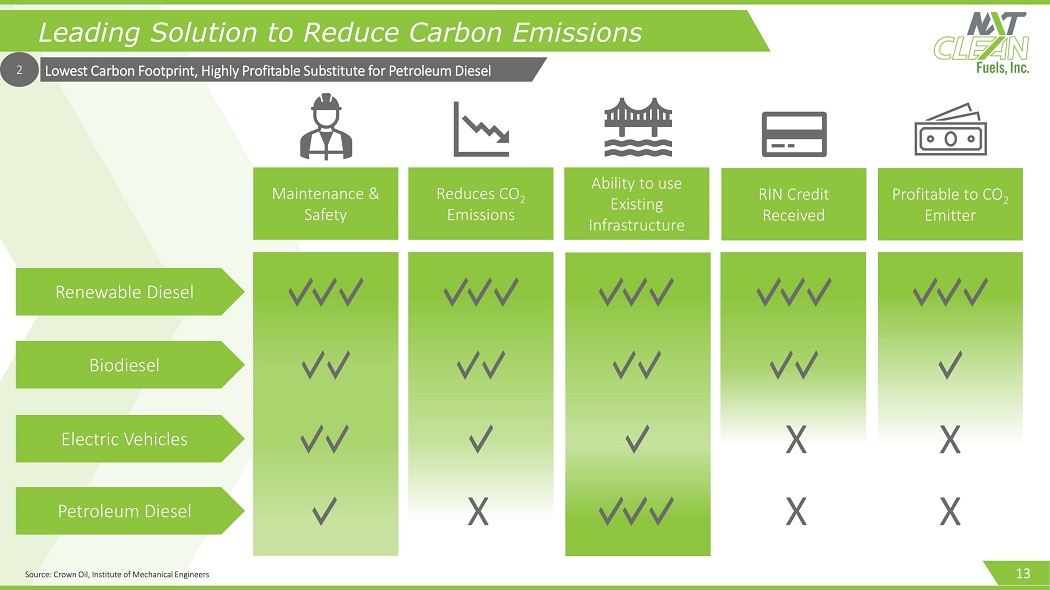

2 Reduces CO 2 Emissions Ability to use Existing Infrastructure RIN Credit Received Profitable to CO 2 Emitter Lowest Carbon Footprint, Highly Profitable Substitute for Petroleum Diesel Maintenance & Safety Renewable Diesel Biodiesel Electric Vehicles X X Source: Crown Oil, Institute of Mechanical Engineers Petroleum Diesel X X X Leading Solution to Reduce Carbon Emissions 13

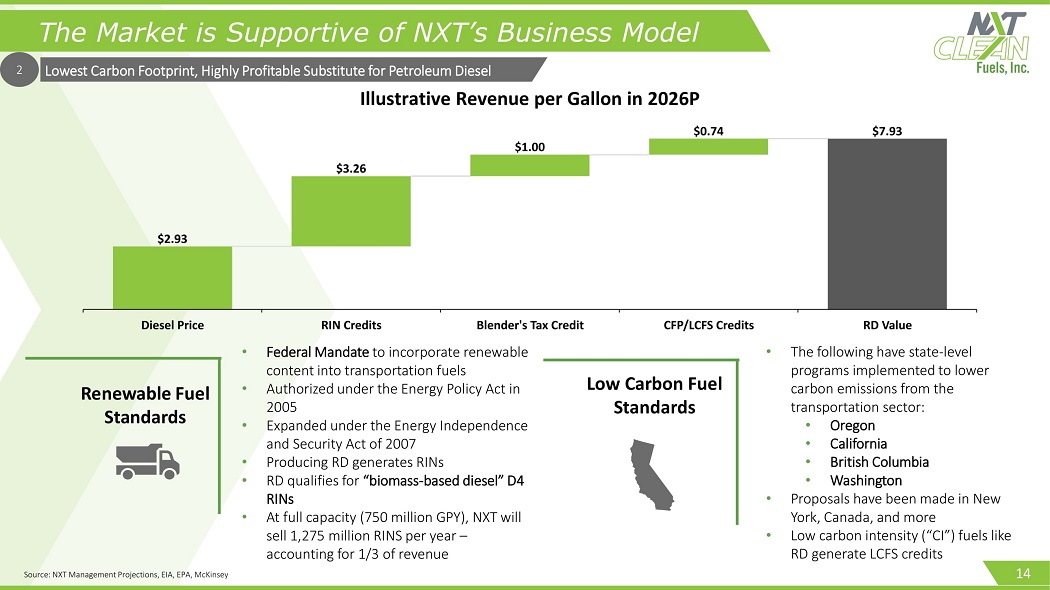

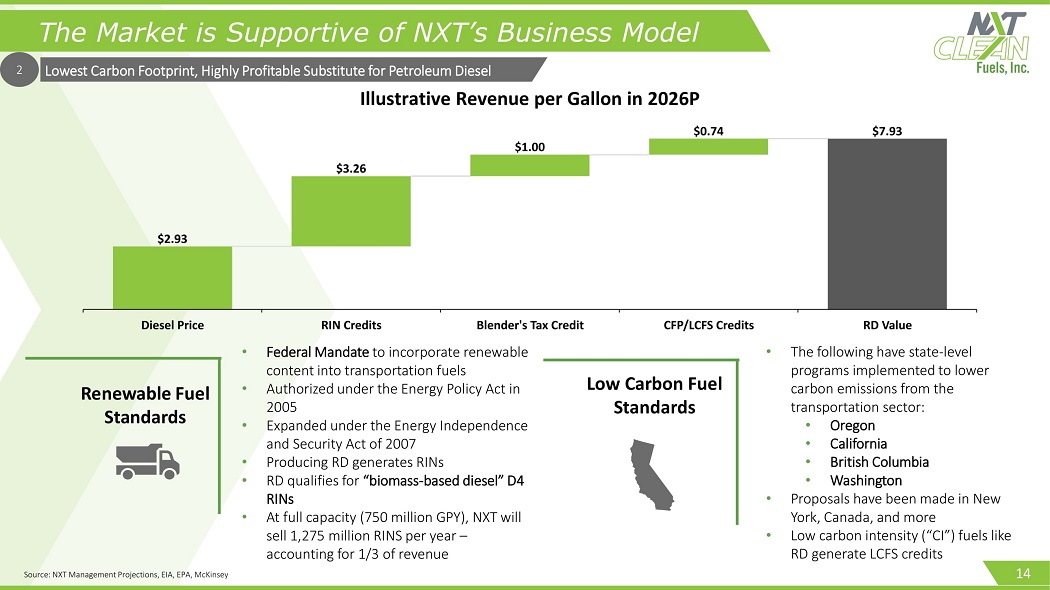

2 • The following have state - level programs implemented to lower carbon emissions from the transportation sector: • Oregon • California • British Columbia • Washington • Proposals have been made in New York, Canada, and more • Low carbon intensity (“CI”) fuels like RD generate LCFS credits The Market is Supportive of NXT’s Business Model Renewable Fuel Standards Low Carbon Fuel Standards Source: NXT Management Projections, EIA, EPA, McKinsey • Federal Mandate to incorporate renewable content into transportation fuels • Authorized under the Energy Policy Act in 2005 • Expanded under the Energy Independence and Security Act of 2007 • Producing RD generates RINs • RD qualifies for “biomass - based diesel” D4 RINs • At full capacity (750 million GPY), NXT will sell 1,275 million RINS per year – accounting for 1/3 of revenue Lowest Carbon Footprint, Highly Profitable Substitute for Petroleum Diesel 14

3 0 20 40 60 80 100 120 140 160 180 2020 2025 2030 2035 2040 billion gallons/year Expected SAF Mandate Total Jet fuel Demand Coalition Notable Companies Represented SAF Target Companies Committed 10% by 2030 30% by 2030 30% by 2035 In order to reach expected and government mandated 2030 SAF demand, global SAF capacity must achieve an 87% CAGR Mandated Global Jet Fuel Demand SAF Market Demand Drivers Select SAF Corporate Commitments Sustainable Aviation Fuels Market Poised For Takeoff Sustainable Aviation Fuel Market Opportunity Source: U.S. Energy Information Agency, Mckinsey & Company, International Air Transport Association 15

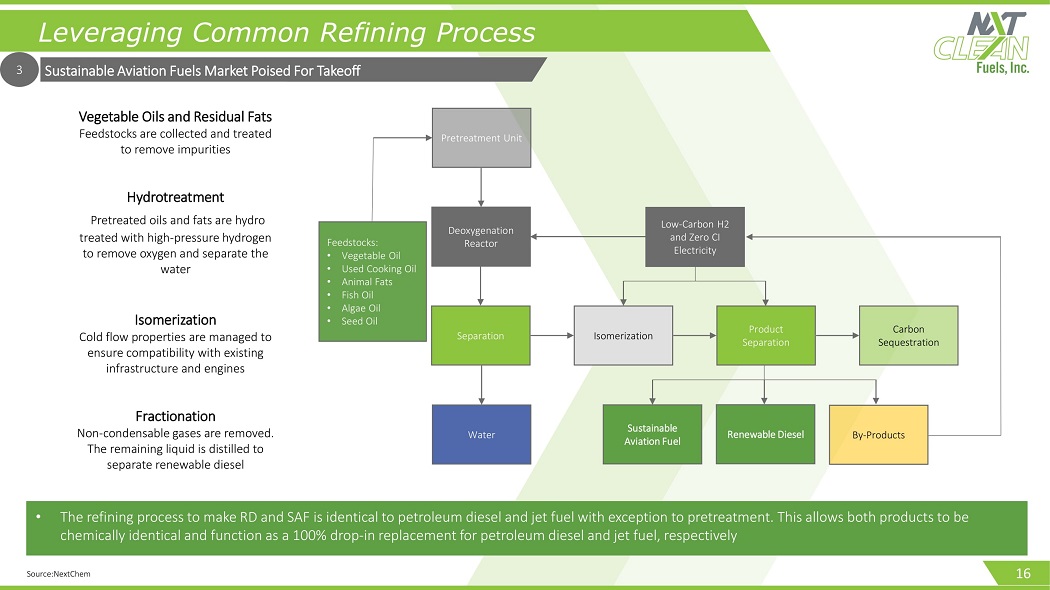

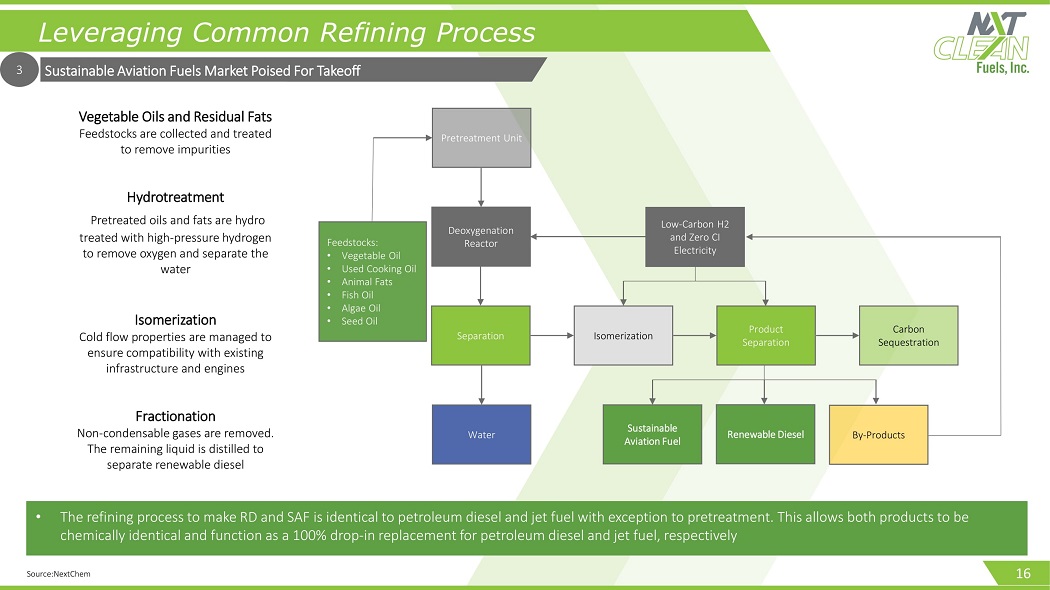

3 Vegetable Oils and Residual Fats Feedstocks are collected and treated to remove impurities Hydrotreatment Pretreated oils and fats are hydro treated with high - pressure hydrogen to remove oxygen and separate the water Isomerization Cold flow properties are managed to ensure compatibility with existing infrastructure and engines Fractionation Non - condensable gases are removed. The remaining liquid is distilled to separate renewable diesel Leveraging Common Refining Process Source:NextChem • The refining process to make RD and SAF is identical to petroleum diesel and jet fuel with exception to pretreatment. This al low s both products to be chemically identical and function as a 100% drop - in replacement for petroleum diesel and jet fuel, respectively Low - Carbon H2 and Zero CI Electricity Separation Isomerization Carbon Sequestration Product Separation Feedstocks: • Vegetable Oil • Used Cooking Oil • Animal Fats • Fish Oil • Algae Oil • Seed Oil Pretreatment Unit Deoxygenation Reactor Water By - Products Sustainable Aviation Fuel Renewable Diesel Sustainable Aviation Fuels Market Poised For Takeoff 16

Why NXTClean Fuels?

Why NXTClean Fuels? Source: NXT Management Strategic Growth Platform that Addresses the Energy Transition 4 • NXT intends to leverage its first RD/SAF refinery into a broader clean fuels enterprise • NXT’s strategic growth plans include development of: • Excess low carbon intensity hydrogen that can be used to supply nearby customers • Renewable feedstock aggregation & consolidation including terminal development with the possibility for pretreatment and custom blending • Multi - site, high - capacity biomass based RNG production First Project: Exceptional Logistics Providing Access to West Coast Markets • NXT has access to over 600 acres in and around Port Westward, Oregon • Port Westward is a deep - water port located strategically close to the Columbia River • NXT’s agreement with the Port provides usage of the dock, road, rail, and utilities infrastructure in connection with its renewable energy projects and SAF production (with some upgrades included) • The NXT refinery will be in commercial proximity of all major West Coast demand centers, allowing for the benefit of California LCFS and/or Oregon CFP tax credits 1 Earned Rare Welcome Into Environmentally Sensitive Markets • Successful in permitting in one of the most rigorous states (Oregon), provides high barriers to entry • Developed deep roots in Oregon and specifically the local community where the plant will be located, garnering essential community support 2 Feedstock and Offtake Agreements with Major Energy Producers • 100% of the feedstock required will be supplied through a long - term agreement with BP • 90% of nameplate production negotiated under long - term offtake agreements and MOUs • 2/3 with several major producers under long - term contracts • 1/3 with one of the top U.S. airlines under MOU • Potential offtakers are expected to be investors in NXT at closing • At projected market prices, the offtake agreements and MOUs generate over $10.7 billion in revenues over the initial 5 years of operation 3 18

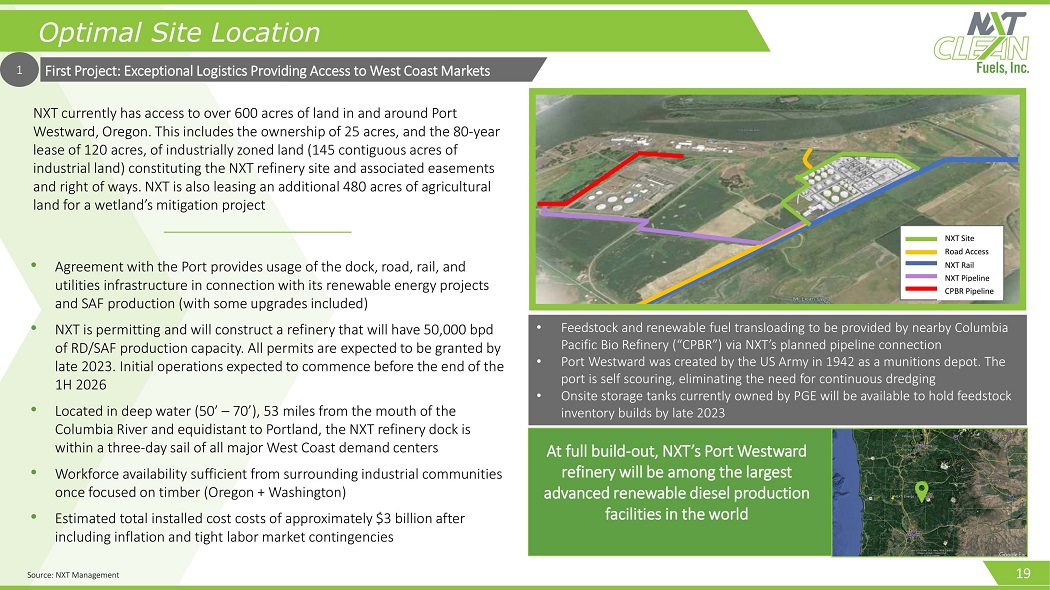

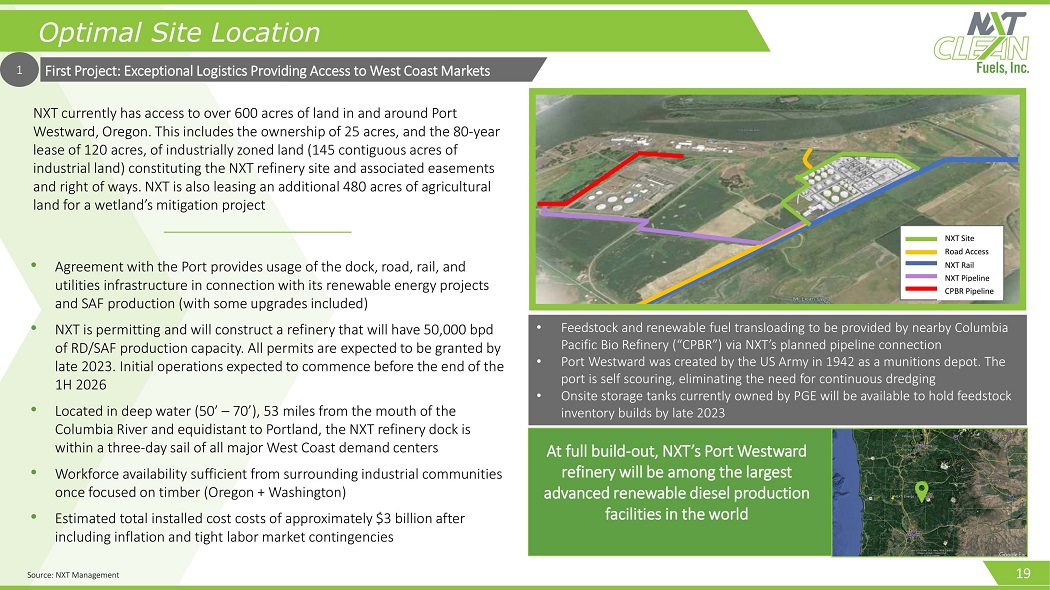

1 • Feedstock and renewable fuel transloading to be provided by nearby Columbia Pacific Bio Refinery (“CPBR”) via NXT’s planned pipeline connection • Port Westward was created by the US Army in 1942 as a munitions depot. The port is self scouring, eliminating the need for continuous dredging • Onsite storage tanks currently owned by PGE will be available to hold feedstock inventory builds by late 2023 First Project: Exceptional Logistics Providing Access to West Coast Markets NXT Site Outline Road Access NXT Rail Branch NXT Pipeline CPBR Pipeline NXT currently has access to over 600 acres of land in and around Port Westward, Oregon. This includes the ownership of 25 acres, and the 80 - year lease of 120 acres, of industrially zoned land (145 contiguous acres of industrial land) constituting the NXT refinery site and associated easements and right of ways. NXT is also leasing an additional 480 acres of agricultural land for a wetland’s mitigation project • Agreement with the Port provides usage of the dock, road, rail, and utilities infrastructure in connection with its renewable energy projects and SAF production (with some upgrades included) • NXT is permitting and will construct a refinery that will have 50,000 bpd of RD/SAF production capacity. All permits are expected to be granted by late 2023. Initial operations expected to commence before the end of the 1H 2026 • Located in deep water (50’ – 70’), 53 miles from the mouth of the Columbia River and equidistant to Portland, the NXT refinery dock is within a three - day sail of all major West Coast demand centers • Workforce availability sufficient from surrounding industrial communities once focused on timber (Oregon + Washington) • Estimated total installed cost costs of approximately $3 billion after including inflation and tight labor market contingencies At full build - out, NXT’s Port Westward refinery will be among the largest advanced renewable diesel production facilities in the world At full build - out, NXT’s Port Westward refinery will be among the largest advanced renewable diesel production facilities in the world At full build - out, NXT’s Port Westward refinery will be among the largest advanced renewable diesel production facilities in the world Optimal Site Location 19 Source: NXT Management

3 COLUMBIA COUNTY x Land Use Approval | GRANTED x Conditional Use Permit | GRANTED OREGON DEPARTMENT OF STATE LANDS x Removal/Fill Permit - Fill in Wetlands | GRANTED OREGON DEPARTMENT OF ENERGY x Energy Facility Siting Council Exemption Request | GRANTED OREGON DEPARTMENT OF ENVIROMENTAL QUALITY x Air Contaminant Discharge Permit - Impacts to Air Quality | GRANTED □ 401 Water Quality Certification - Impact to Water Quality | 2023 US ARMY CORP OF ENGINEERS □ 404 Clean Water Act Permit - Impacts to Wetland | 2023 KEY PERMITS | ANTICIPATED ISSUANCE » Building Permits All key permits have been filed. NXT anticipates final permit approval in late 2023 Local building permits and ministerial approvals not shown Earned Rare Welcome Into Most Difficult Markets Source: NXT Management Permitting Path Succeeding Despite Difficult Regulations 2 20

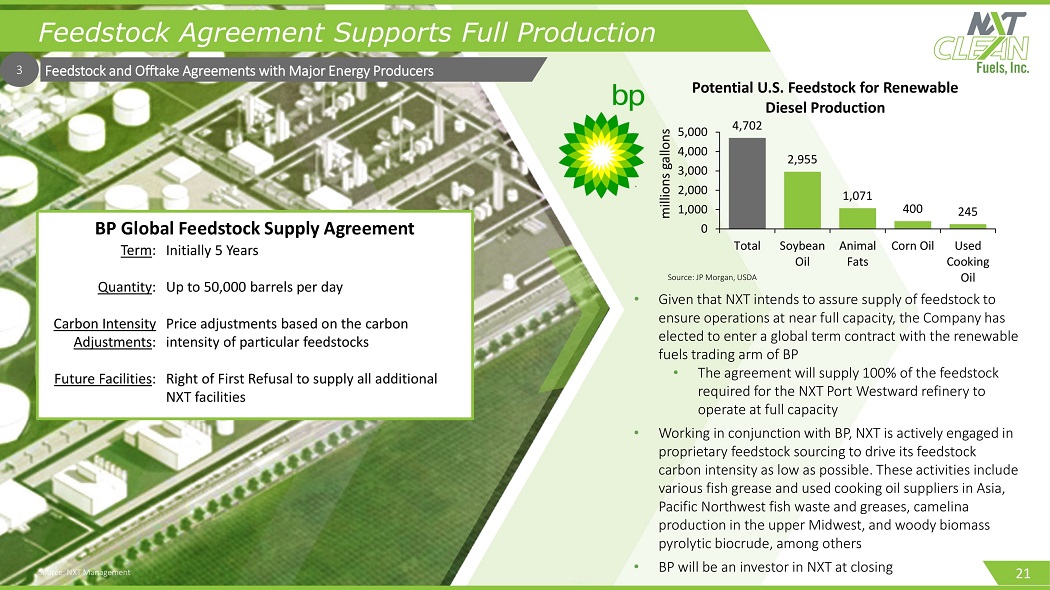

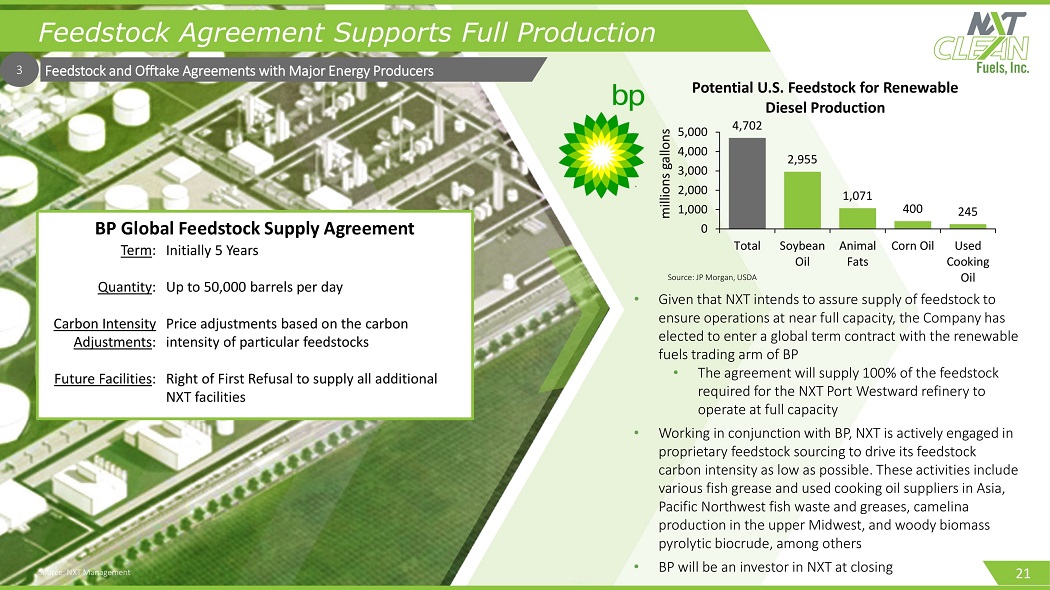

4 . Feedstock and Offtake Agreements with Major Energy Producers Initially 5 Years Up to 50,000 barrels per day Price adjustments based on the carbon intensity of particular feedstocks Right of First Refusal to supply all additional NXT facilities Term : Quantity : Carbon Intensity Adjustments : Future Facilities : BP Global Feedstock Supply Agreement 4,702 2,955 1,071 400 245 0 1,000 2,000 3,000 4,000 5,000 Total Soybean Oil Animal Fats Corn Oil Used Cooking Oil millions gallons Potential U.S. Feedstock for Renewable Diesel Production • Given that NXT intends to assure supply of feedstock to ensure operations at near full capacity, the Company has elected to enter a global term contract with the renewable fuels trading arm of BP • The agreement will supply 100% of the feedstock required for the NXT Port Westward refinery to operate at full capacity • Working in conjunction with BP, NXT is actively engaged in proprietary feedstock sourcing to drive its feedstock carbon intensity as low as possible. These activities include various fish grease and used cooking oil suppliers in Asia, Pacific Northwest fish waste and greases, camelina production in the upper Midwest, and woody biomass pyrolytic biocrude, among others • BP will be an investor in NXT at closing Feedstock Agreement Supports Full Production Source: NXT Management Source: JP Morgan, USDA 3 21

2 Source: NXT Management 3 Offtake Agreements Negotiated for 90% of Production Feedstock and Offtake Agreements with Major Energy Producers NXT has entered into a t erm sheet with a major airline to negotiate SAF offtake that could total 200 million GPY Total contracted RD offtake value over initial five - years of operations estimated at $7.2 billion NXT has negotiated RD offtake agreements with several Major energy producers at agreed upon pricing and delivery terms Potential SAF offtake value over initial term is estimated to be in excess of $3.6 billion 22

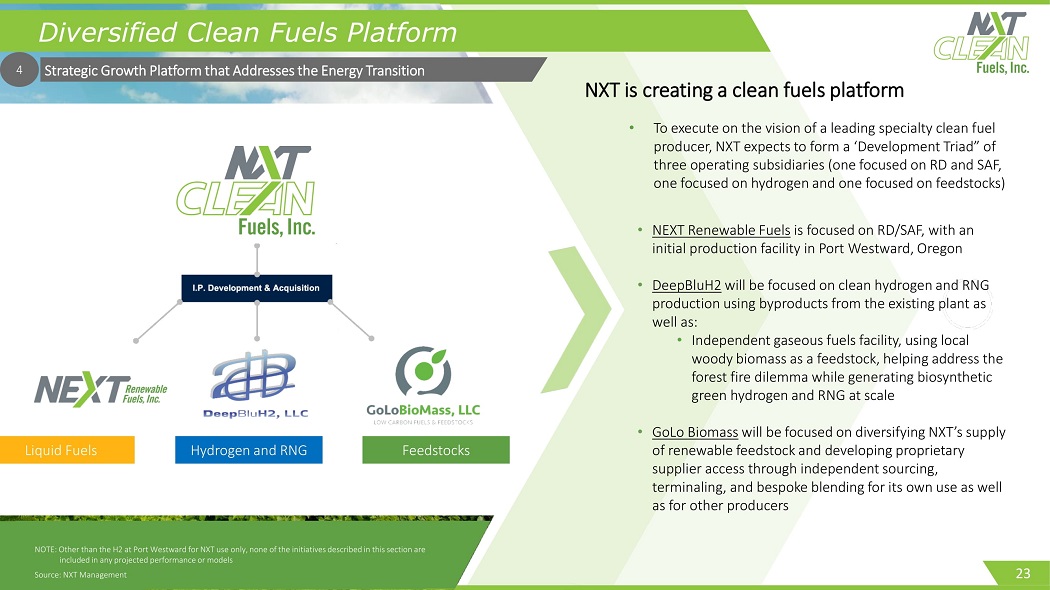

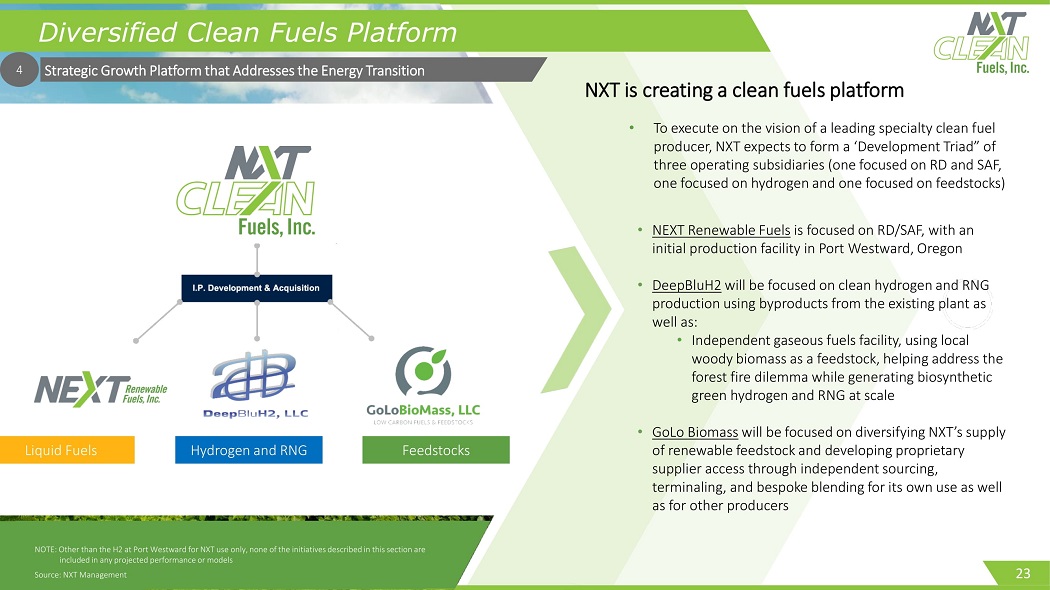

4 NOTE: Other than the H2 at Port Westward for NXT use only, none of the initiatives described in this section are included in any projected performance or models Diversified Clean Fuels Platform Source: NXT Management 4 Strategic Growth Platform that Addresses the Energy Transition NXT is creating a clean fuels platform • NEXT Renewable Fuels is focused on RD/SAF, with an initial production facility in Port Westward, Oregon • DeepBluH2 will be focused on clean hydrogen and RNG production using byproducts from the existing plant as well as: • Independent gaseous fuels facility, using local woody biomass as a feedstock, helping address the forest fire dilemma while generating biosynthetic green hydrogen and RNG at scale • GoLo Biomass will be focused on diversifying NXT’s supply of renewable feedstock and developing proprietary supplier access through independent sourcing, terminaling , and bespoke blending for its own use as well as for other producers • To execute on the vision of a leading specialty clean fuel producer, NXT expects to form a ‘Development Triad” of three operating subsidiaries (one focused on RD and SAF, one focused on hydrogen and one focused on feedstocks) Liquid Fuels Hydrogen and RNG Feedstocks 23

8 Transaction Details

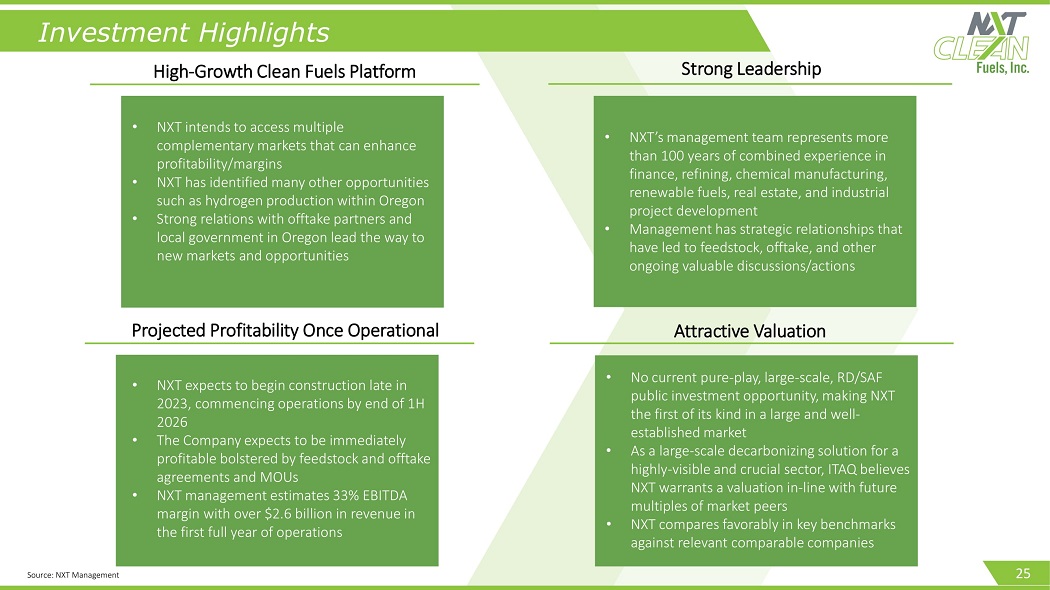

High - Growth Clean Fuels Platform Investment Highlights Source: NXT Management • NXT intends to access multiple complementary markets that can enhance profitability/margins • NXT has identified many other opportunities such as hydrogen production within Oregon • Strong relations with offtake partners and local government in Oregon lead the way to new markets and opportunities • No current pure - play, large - scale, RD/SAF public investment opportunity, making NXT the first of its kind in a large and well - established market • As a large - scale decarbonizing solution for a highly - visible and crucial sector, ITAQ believes NXT warrants a valuation in - line with future multiples of market peers • NXT compares favorably in key benchmarks against relevant comparable companies Attractive Valuation Projected Profitability Once Operational • NXT expects to begin construction late in 2023, commencing operations by end of 1H 2026 • The Company expects to be immediately profitable bolstered by feedstock and offtake agreements and MOUs • NXT management estimates 33% EBITDA margin with over $2.6 billion in revenue in the first full year of operations • NXT’s management team represents more than 100 years of combined experience in finance, refining, chemical manufacturing, renewable fuels, real estate, and industrial project development • Management has strategic relationships that have led to feedstock, offtake, and other ongoing valuable discussions/actions Strong Leadership 25

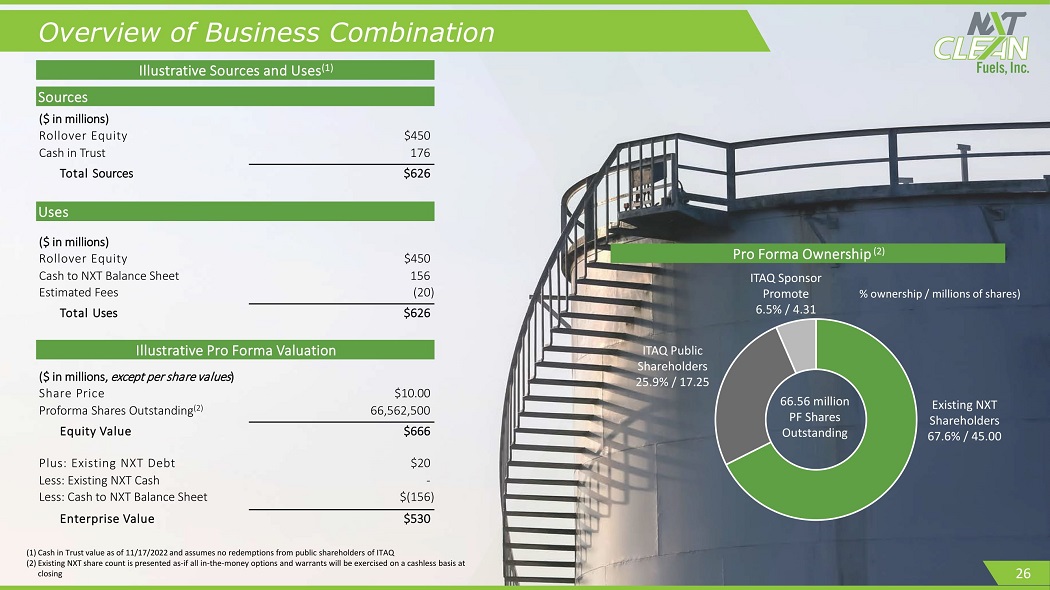

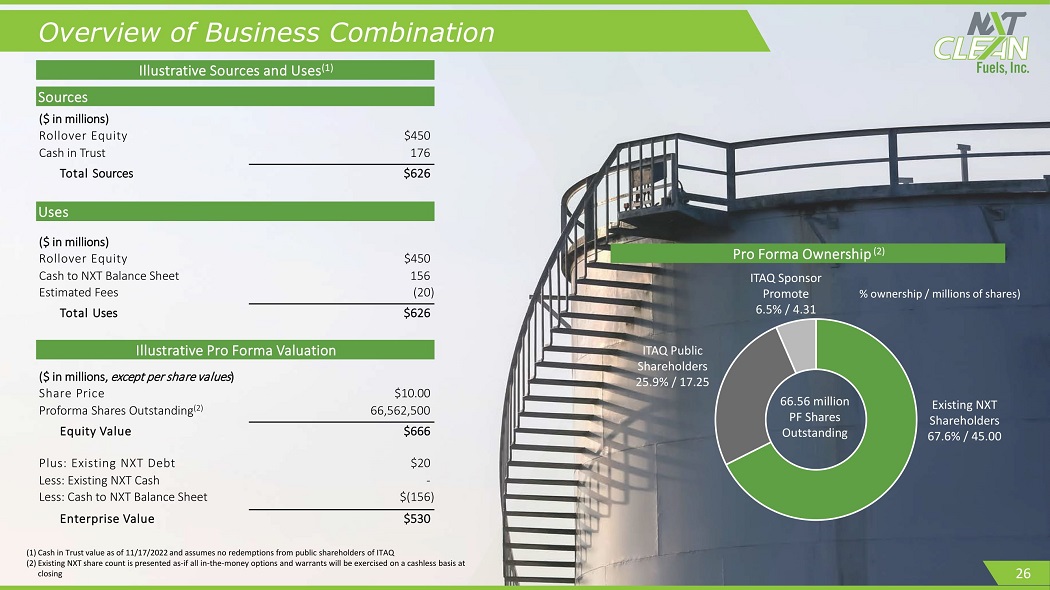

Sources ($ in millions) Rollover Equity $450 Cash in Trust 176 Total Sources $626 Uses ($ in millions) Rollover Equity $450 Cash to NXT Balance Sheet 156 Estimated Fees (20) Total Uses $626 Overview of Business Combination ($ in millions, except per share values ) Share Price $10.00 Proforma Shares Outstanding (2) 66,562,500 Equity Value $666 Plus: Existing NXT Debt $20 Less: Existing NXT Cash - Less: Cash to NXT Balance Sheet $(156) Enterprise Value $530 Illustrative Pro Forma Valuation Illustrative Sources and Uses (1) 66.56 million PF Shares Outstanding % ownership / millions of shares) Existing NXT Shareholders 67.6% / 45.00 ITAQ Public Shareholders 25.9% / 17.25 ITAQ Sponsor Promote 6.5% / 4.31 Pro Forma Ownership (2) 26 (1) Cash in Trust value as of 11/17/2022 and assumes no redemptions from public shareholders of ITAQ (2) Existing NXT share count is presented as - if all in - the - money options and warrants will be exercised on a cashless basis at closing

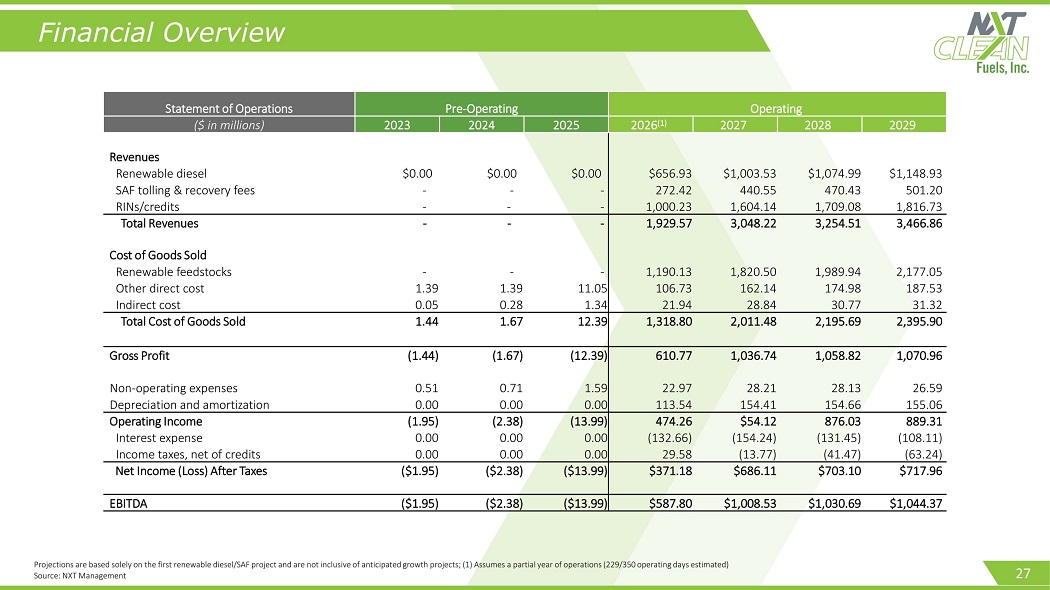

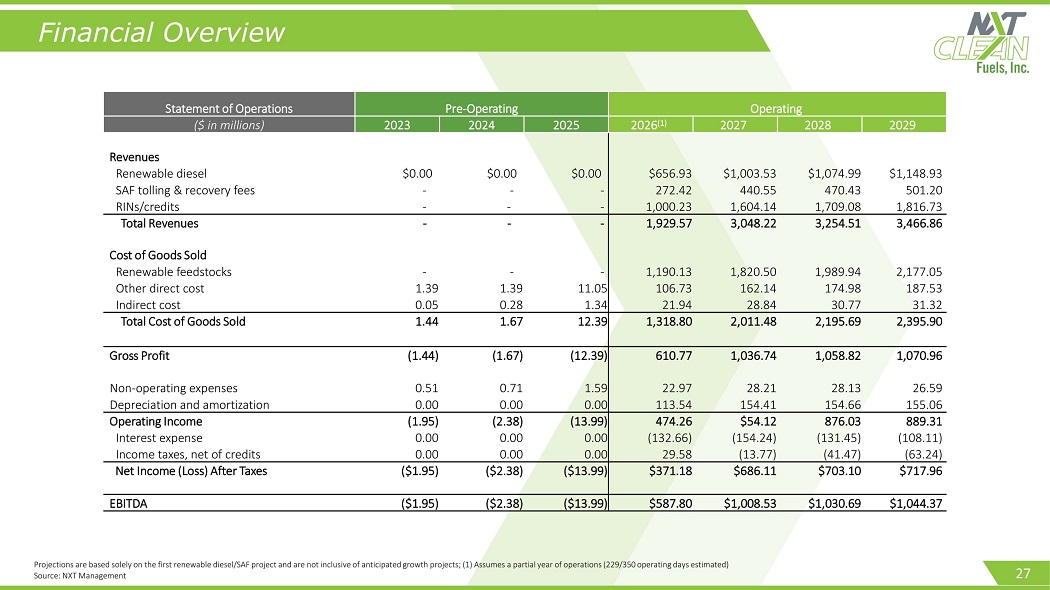

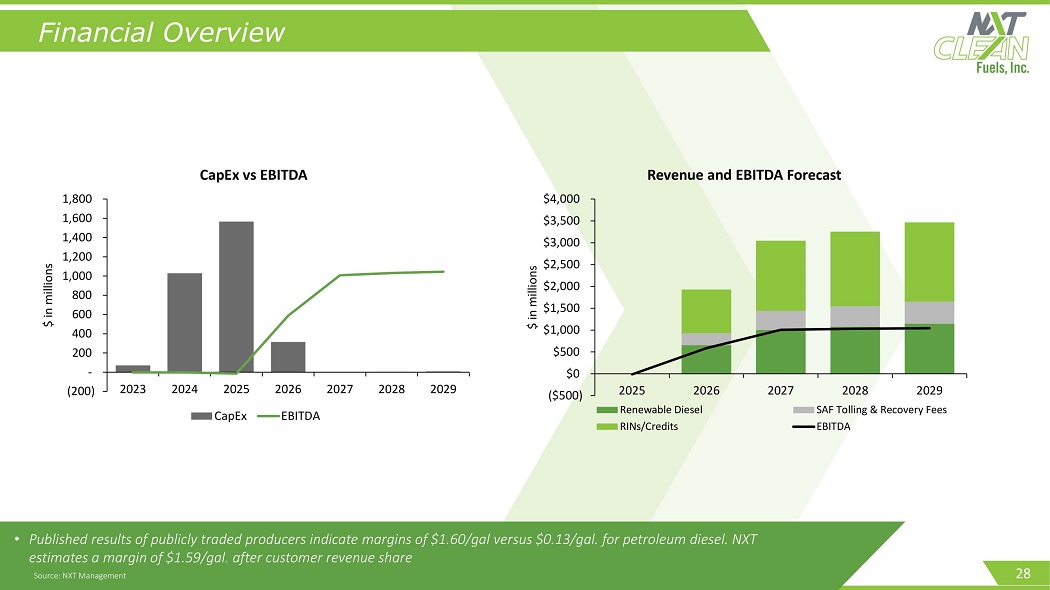

Statement of Operations Pre - Operating Operating ($ in millions) 2023 2024 2025 2026 (1) 2027 2028 2029 Revenues Renewable diesel $0.00 $0.00 $0.00 $656.93 $1,003.53 $1,074.99 $1,148.93 SAF tolling & recovery fees - - - 272.42 440.55 470.43 501.20 RINs/credits - - - 1,000.23 1,604.14 1,709.08 1,816.73 Total Revenues - - - 1,929.57 3,048.22 3,254.51 3,466.86 Cost of Goods Sold Renewable feedstocks - - - 1,190.13 1,820.50 1,989.94 2,177.05 Other direct cost 1.39 1.39 11.05 106.73 162.14 174.98 187.53 Indirect cost 0.05 0.28 1.34 21.94 28.84 30.77 31.32 Total Cost of Goods Sold 1.44 1.67 12.39 1,318.80 2,011.48 2,195.69 2,395.90 Gross Profit (1.44) (1.67) (12.39) 610.77 1,036.74 1,058.82 1,070.96 Non - operating expenses 0.51 0.71 1.59 22.97 28.21 28.13 26.59 Depreciation and amortization 0.00 0.00 0.00 113.54 154.41 154.66 155.06 Operating Income (1.95) (2.38) (13.99) 474.26 $54.12 876.03 889.31 Interest expense 0.00 0.00 0.00 (132.66) (154.24) (131.45) (108.11) Income taxes, net of credits 0.00 0.00 0.00 29.58 (13.77) (41.47) (63.24) Net Income (Loss) After Taxes ($1.95) ($2.38) ($13.99) $371.18 $686.11 $703.10 $717.96 EBITDA ($1.95) ($2.38) ($13.99) $587.80 $1,008.53 $1,030.69 $1,044.37 Financial Overview Source: NXT Management Strong Financials and High Barriers to Entry Projections are based solely on the first renewable diesel/SAF project and are not inclusive of anticipated growth projects; (1) Assumes a partial year of operations (229/350 operating days estimated) 27

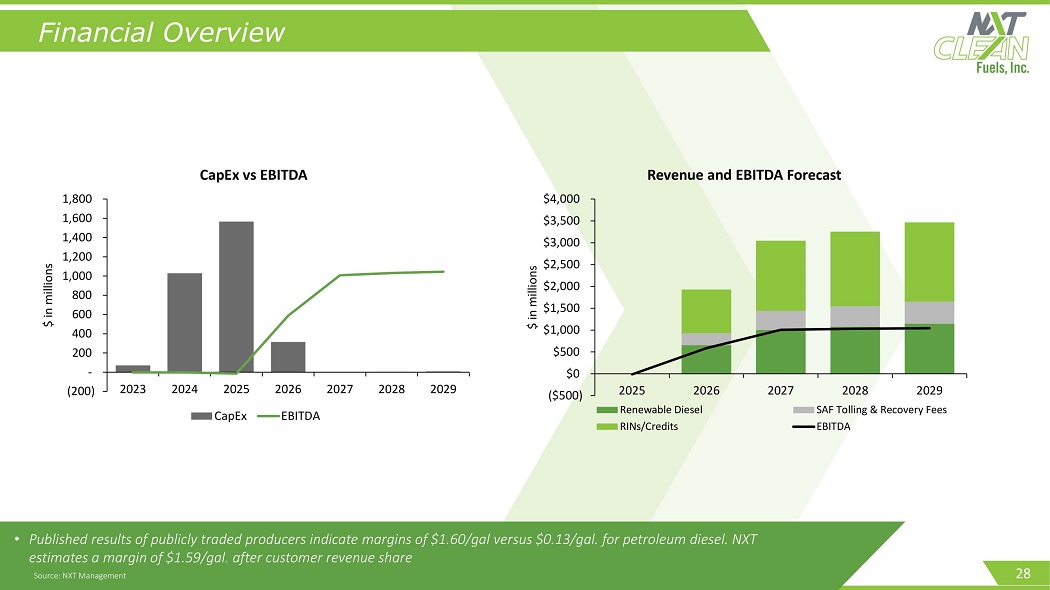

• Published results of publicly traded producers indicate margins of $1.60/gal versus $0.13/gal. for petroleum diesel. NXT estimates a margin of $1.59/gal. after customer revenue share Financial Overview Source: NXT Management Strong Financials and High Barriers to Entry ($500) $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 2025 2026 2027 2028 2029 $ in millions Revenue and EBITDA Forecast Renewable Diesel SAF Tolling & Recovery Fees RINs/Credits EBITDA (200) - 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2023 2024 2025 2026 2027 2028 2029 $ in millions CapEx vs EBITDA CapEx EBITDA 28

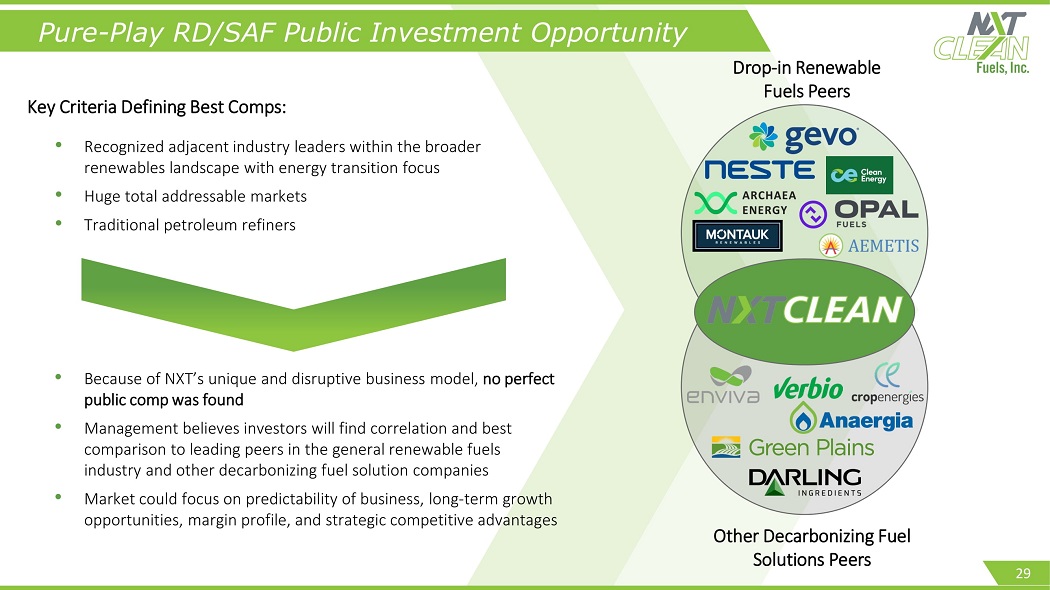

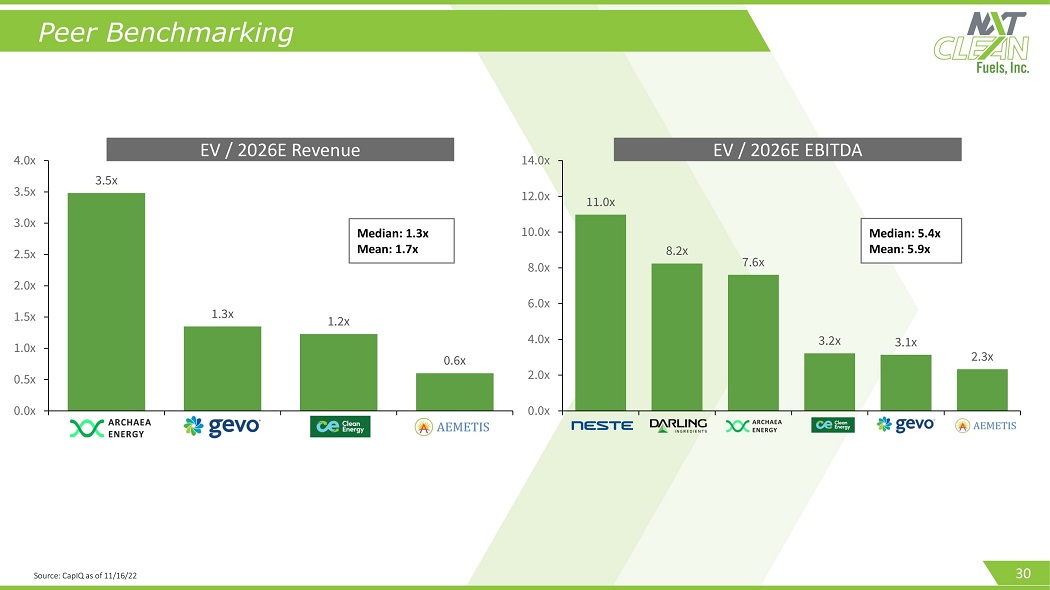

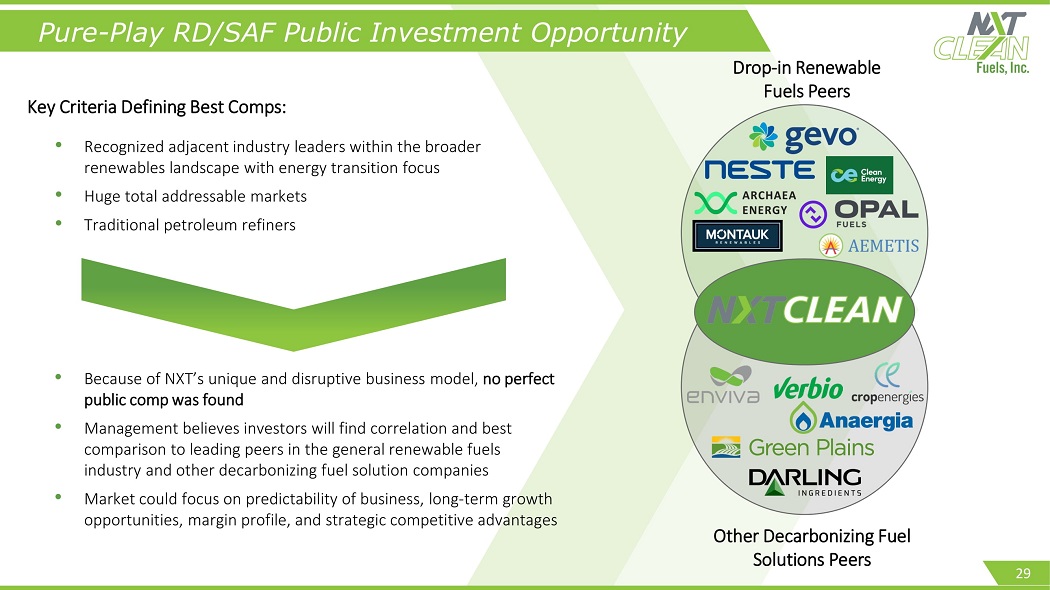

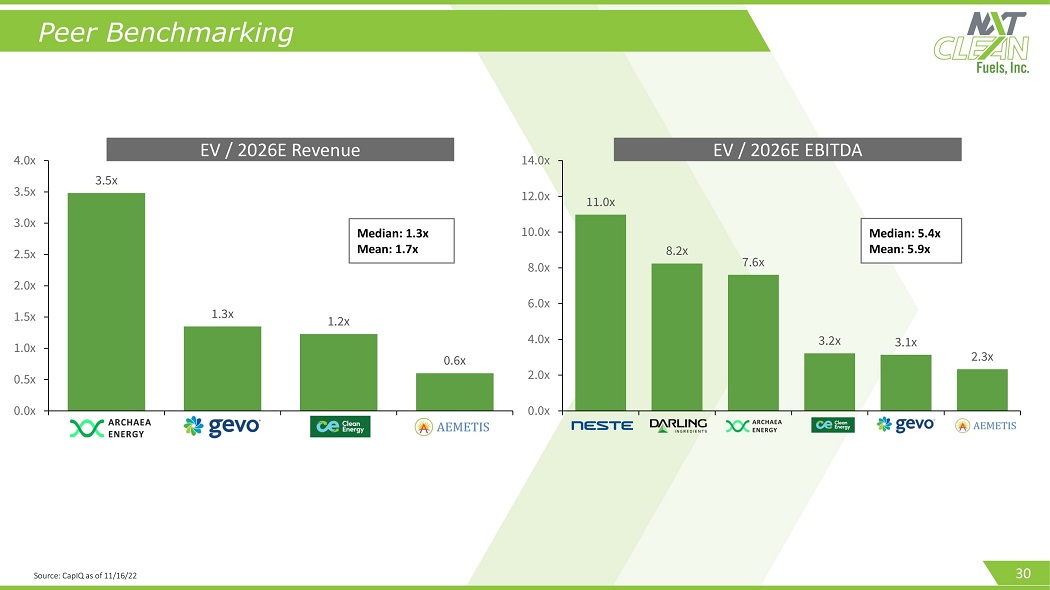

Key Criteria Defining Best Comps: • Recognized adjacent industry leaders within the broader renewables landscape with energy transition focus • Huge total addressable markets • Traditional petroleum refiners • Because of NXT’s unique and disruptive business model, no perfect public comp was found • Management believes i nvestors will find correlation and best comparison to leading peers in the general renewable fuels in dustry and other decarbonizing fuel solution companies • Market could focus on predictability of business, long - term growth opportunities, margin profile, and strategic competitive advantages Drop - in Renewable Fuels Peers Other Decarbonizing Fuel Solutions Peers Pure - Play RD/SAF Public Investment Opportunity 29

11.0x 8.2x 7.6x 3.2x 3.1x 2.3x 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x 14.0x 3.5x 1.3x 1.2x 0.6x 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 4.0x Peer Benchmarking Source: CapIQ as of 11/16/22 EV / 2026 E Revenue EV / 2026 E EBITDA Median: 5.4x Mean: 5.9x Median: 1.3x Mean: 1.7x 30

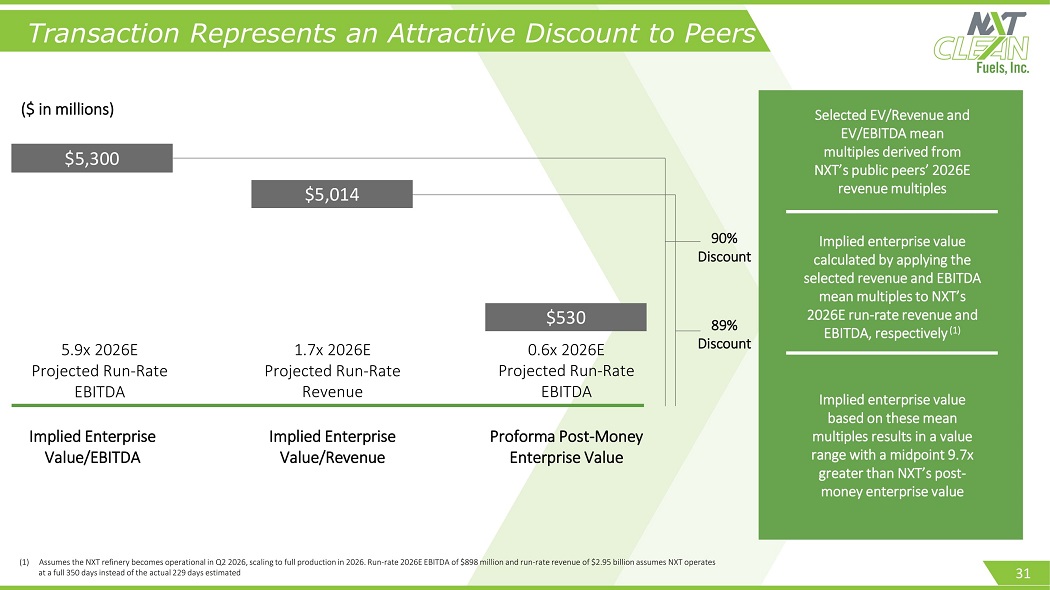

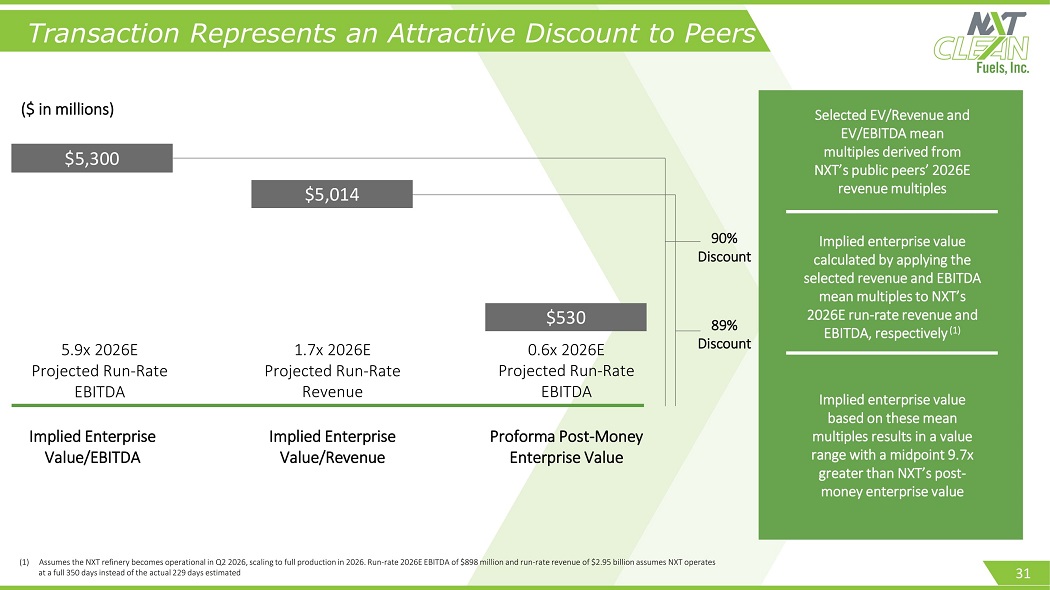

Implied Enterprise Value/EBITDA Implied Enterprise Value/Revenue Proforma Post - Money Enterprise Value $5,300 ($ in millions) $5,014 $530 5.9x 2026E Projected Run - Rate EBITDA 1.7x 2026E Projected Run - Rate Revenue 0.6x 2026E Projected Run - Rate EBITDA Transaction Represents an Attractive Discount to Peers Selected EV/Revenue and EV/EBITDA mean multiples derived from NXT’s public peers’ 2026E revenue multiples Implied enterprise value calculated by applying the selected revenue and EBITDA mean multiples to NXT’s 2026E run - rate revenue and EBITDA, respectively (1) Implied enterprise value based on these mean multiples results in a value range with a midpoint 9.7x greater than NXT’s post - money enterprise value 90% Discount 89% Discount (1) Assumes the NXT refinery becomes operational in Q2 2026, scaling to full production in 2026. Run - rate 2026E EBITDA of $898 milli on and run - rate revenue of $2.95 billion assumes NXT operates at a full 350 days instead of the actual 229 days estimated 31

Appendix

Public Comparables Public Comparables . ($ in millions, unless otherwise stated) Market Enterprise EV/Revenue EV/EBITDA Gross Margin EBITDA Margin Company Value Value 2025E 2026E 2025E 2026E 2025E 2026E 2025E 2026E Neste Oyj $36,730 $38,302 1.6x n/a 10.4x 11.0x n/a n/a 15.3% n/a Darling Ingredients 11,636 15,060 n/a n/a 7.7x 8.2x n/a n/a n/a n/a Archaea Energy 2,154 3,746 4.0x 3.5x 9.2x 7.6x 47.0% 51.0% 43.2% 45.7% Montauk Renewables 1,673 1,650 5.0x n/a 10.5x n/a 55.0% n/a 47.9% n/a Clean Energy Fuels 1,613 1,564 1.9x 1.2x 20.1x 3.2x 33.1% n/a 9.8% 38.1% Aemetis 205 546 0.7x 0.6x 3.1x 2.3x 30.5% 30.7% 23.3% 25.8% Gevo 540 206 1.0x 1.3x 2.4x 3.1x 73.7% 76.4% 41.0% 43.0% First Quartile $1,076 $1,055 1.1x 1.1x 5.4x 3.2x 33.1% 40.9% 17.3% 35.1% Median $1,673 $1,650 1.7x 1.3x 9.2x 5.4x 47.0% 51.0% 32.2% 40.6% Mean $7,793 $8,725 2.4x 1.7x 9.0x 5.9x 47.9% 52.7% 30.1% 38.2% Third Quartile $6,895 $9,403 3.5x 1.9x 10.4x 8.1x 55.0% 63.7% 42.7% 43.7% (1) Clean Energy Fuels Corp. 2025 EBITDA adjusted from CapIQ reported numbers to account for significant investment activities. Source: CapIQ as of 11/16/22 33

Construction Budget Assumptions Construction Budget Plant and equipment $ 1,739.5 Engineering, excluding major components 213.8 Site work 75.8 Catalyst 72.0 Preliminary engineering and permitting 15.9 Process license fees 12.5 Land 7.2 Construction period interest 146.2 Escalation & contingency 389.0 Total Project Capital Cost $ 2,671.9 Note: Estimates from NXT management are subject to revision based upon additional engineering studies and future cost adjustm ent s and updates. Capital costs and construction budget was prepared on November 17, 2022. Actual costs may increase if increases in CPI and cost of debt exceed NXT management’s current expectations 34 ($ in millions)

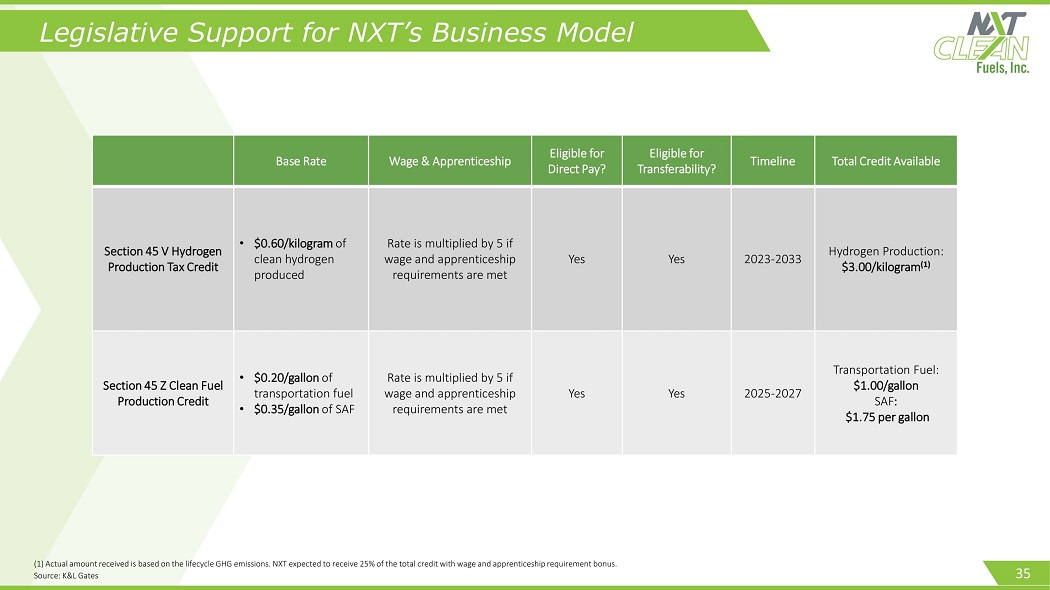

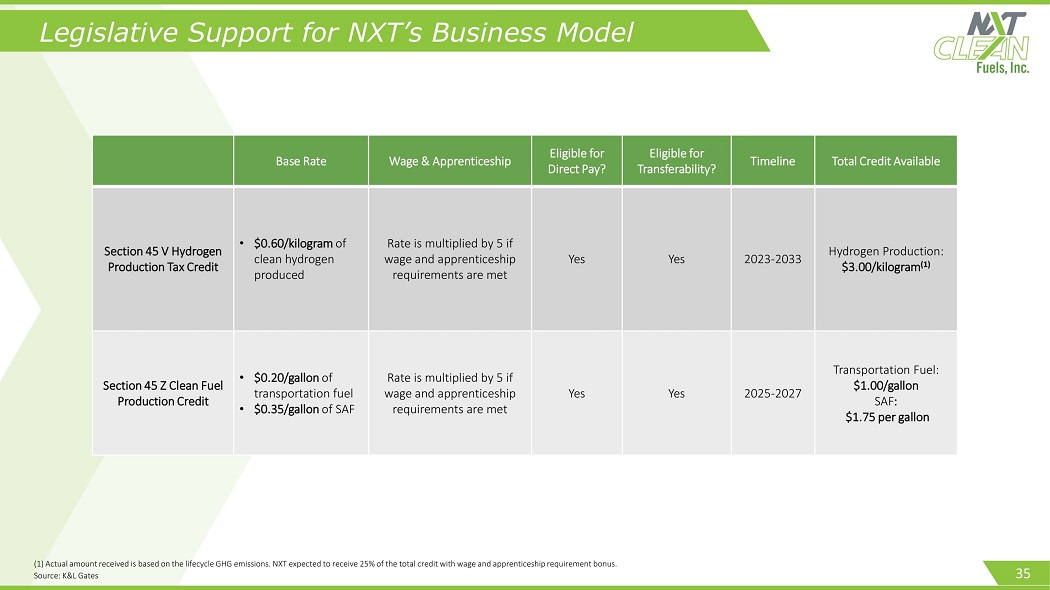

Legislative Support for NXT’s Business Model Source: K&L Gates Base Rate Wage & Apprenticeship Eligible for Direct Pay? Eligible for Transferability? Timeline Total Credit Available Section 45 V Hydrogen Production Tax Credit • $0.60/kilogram of clean hydrogen produced Rate is multiplied by 5 if wage and apprenticeship requirements are met Yes Yes 2023 - 2033 Hydrogen Production: $3.00/kilogram (1) Section 45 Z Clean Fuel Production Credit • $0.20/gallon of transportation fuel • $0.35/gallon of SAF Rate is multiplied by 5 if wage and apprenticeship requirements are met Yes Yes 2025 - 2027 Transportation Fuel: $1.00/gallon SAF : $1.75 per gallon (1) Actual amount received is based on the lifecycle GHG emissions. NXT expected to receive 25% of the total credit with wage an d apprenticeship requirement bonus. 35

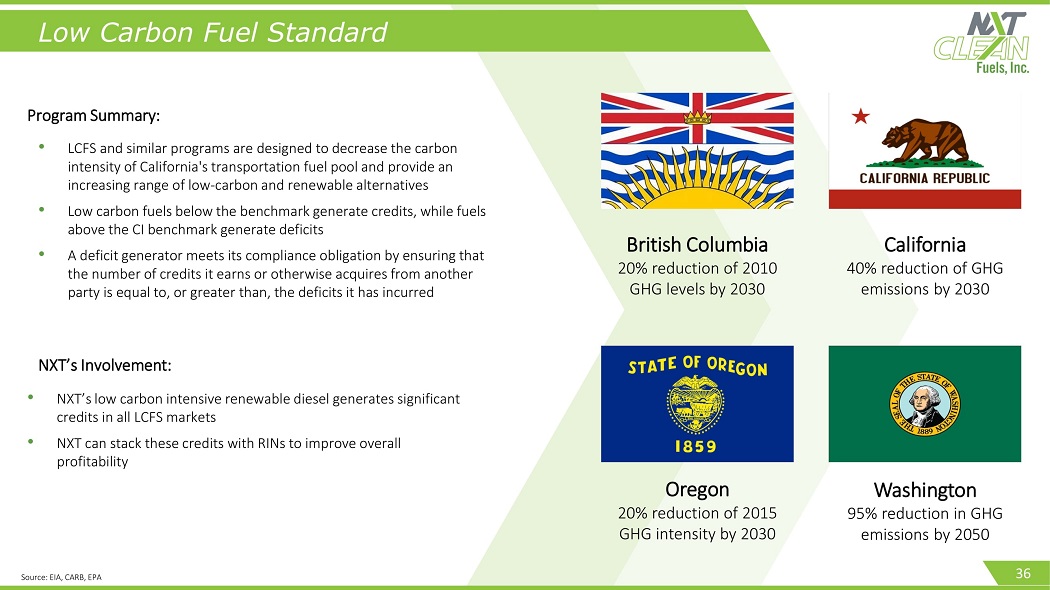

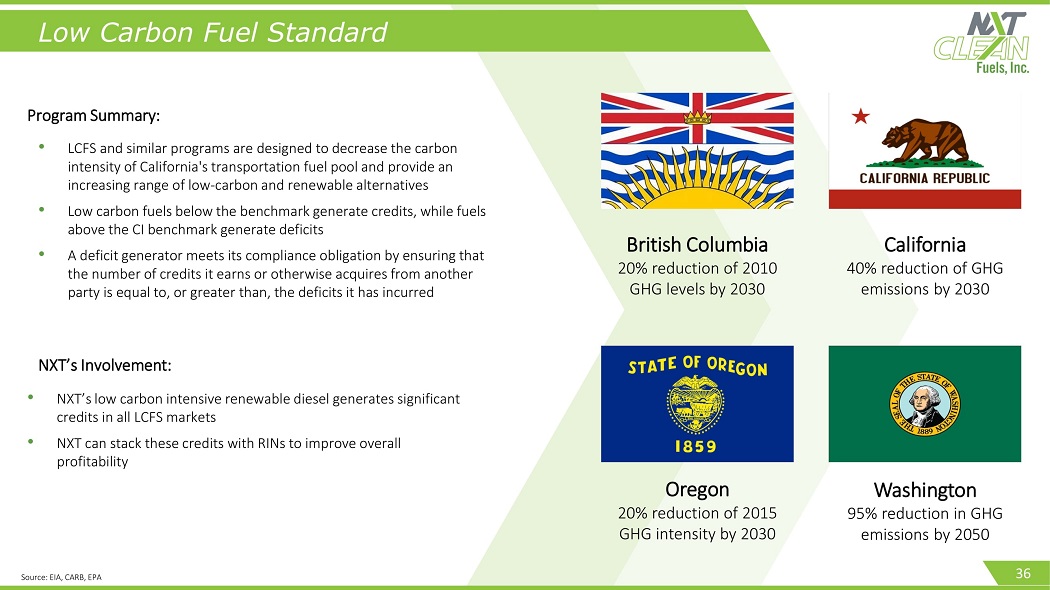

Low Carbon Fuel Standard • LCFS and similar programs are designed to decrease the carbon intensity of California's transportation fuel pool and provide an increasing range of low - carbon and renewable alternatives • Low carbon fuels below the benchmark generate credits, while fuels above the CI benchmark generate deficits • A deficit generator meets its compliance obligation by ensuring that the number of credits it earns or otherwise acquires from another party is equal to, or greater than, the deficits it has incurred Program Summary: NXT’s Involvement: • NXT’s low carbon intensive renewable diesel generates significant credits in all LCFS markets • NXT can stack these credits with RINs to improve overall profitability British Columbia 20% reduction of 2010 GHG levels by 2030 California 40% reduction of GHG emissions by 2030 Oregon 20% reduction of 2015 GHG intensity by 2030 Washington 95% reduction in GHG emissions by 2050 Source: EIA, CARB, EPA 36

Renewable Fuel Standard • Enacted by Congress in 2005, the Renewable Fuel Standard (“RFS”) program establishes minimum renewable volumes to be blended int o traditional petroleum - based fuel products • To comply with the program, a refiner or importer of gasoline or diesel fuel must either blend renewable fuel into transporta tio n fuel or obtain a RIN credit to meet is Renewable Volume Obligation (“RVO”) • Based on the category of biofuel, renewable fuels are classified by “D - Code” which fulfill different RVO categories • RVOs are established annually by the EPA and determine the percentage renewable blend threshold and corresponding RINs an obl iga ted party must obtain for compliance • RINs can be generated by blending renewable fuel products with petroleum - based fuels. Once generated, the blender may sell the R INs independently from the fuel product Renewable Fuel Producer Non - Renewable Fuel Refinery or Importer Blended Fuel Service Station Blender Separated RINs RVO Fulfilled Renewable Fuel Attached RINs RVO Non - Renewable Fuel RINs generated simultaneous with Renewable Fuel creation RVO incurred simultaneous with non - renewable fuel creation or importation RIN separated due to blending and retired to fulfill RVO Source: Aemetis, EPA 37

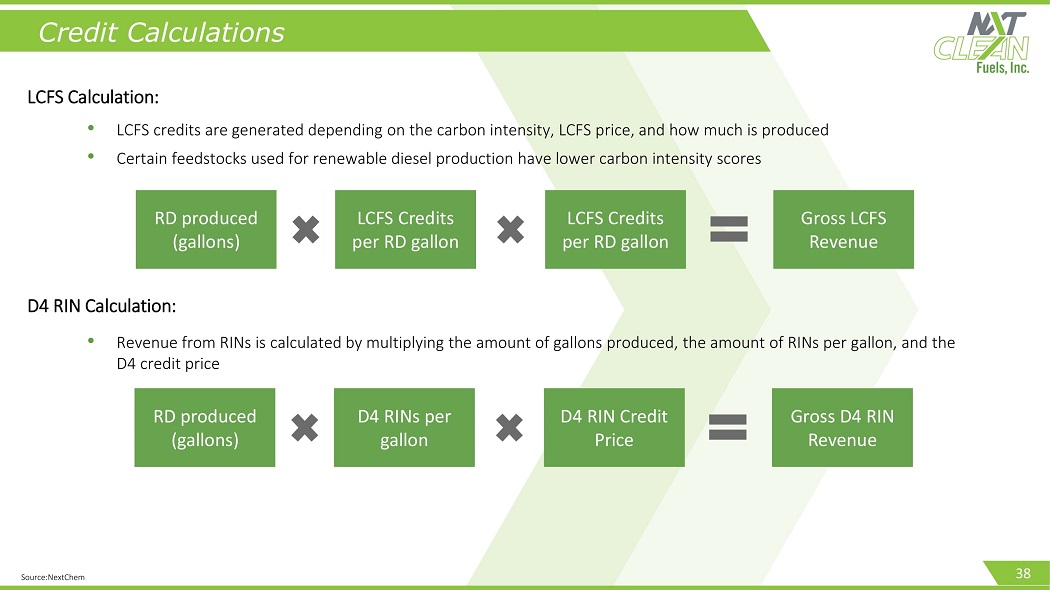

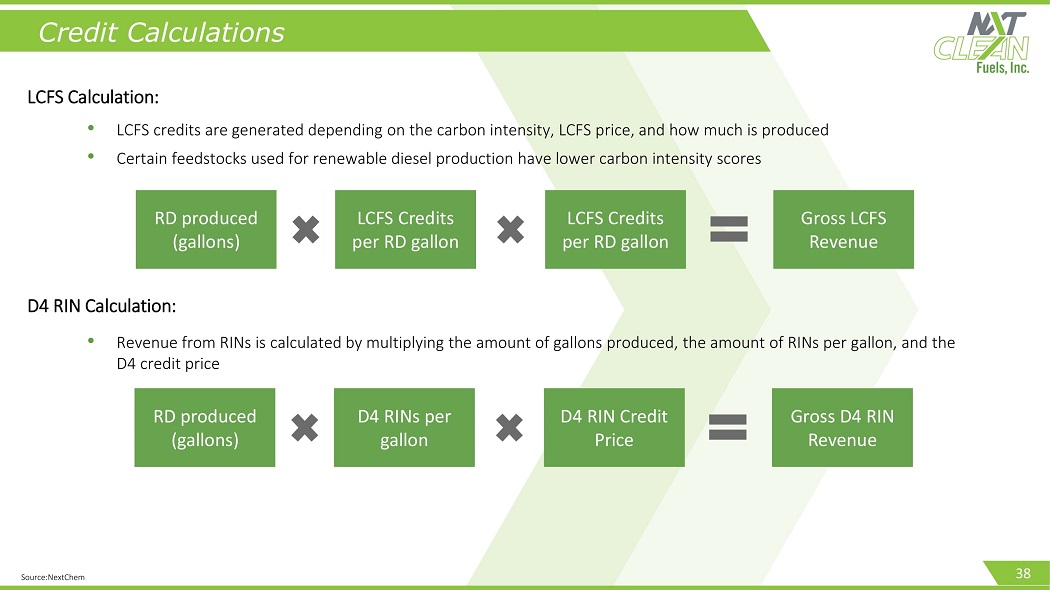

Source:NextChem RD produced (gallons) LCFS Credits per RD gallon LCFS Credits per RD gallon Gross LCFS Revenue RD produced (gallons) D4 RINs per gallon D4 RIN Credit Price Gross D4 RIN Revenue LCFS Calculation: • LCFS credits are generated depending on the carbon intensity, LCFS price, and how much is produced • Certain feedstocks used for renewable diesel production have lower carbon intensity scores D4 RIN Calculation: • Revenue from RINs is calculated by multiplying the amount of gallons produced, the amount of RINs per gallon, and the D4 credit price Credit Calculations 38

$1.17 $1.42 $1.67 $1.92 $2.17 $2.42 $2.67 $2.18 155 240 325 410 495 580 665 $2.43 214 299 384 469 554 639 725 $2.68 273 358 443 529 614 699 784 $2.93 332 418 503 588 673 758 843 $3.18 392 477 562 647 732 817 902 $3.43 451 536 621 706 791 877 962 $3.68 510 595 680 766 851 936 1,021 NXT Model Assumptions and Sensitivity Analysis NXT assumes the following key assumptions in its model used for the financial projections in this presentation : • Operations will commence Q2 2026 • Revenues are derived from offtake agreements and MOU negotiations • Agreed upon split of LCFS and RIN revenue with offtakers • 33% of the annual production yield is SAF • All SAF volume is tolled • Diesel prices in model assumptions range from $2.78 - $2.93/gallon • D4 RIN prices/gallon in model assumptions range from $1.92 - $ 1.99 • RIN multiplier of 1.7x in accordance with the D4 category of RINs for renewable diesel as per EPA guidelines • Assumes Blenders Tax Credit is renewed • Naphtha and LPG do not provide additional revenue directly as they are used as feedstock for hydrogen production. This reduces the overall CI of refined products which increase revenues • Assumes long term CPI increase of 1.8% annually for operation period, but 7.5% for project cost escalations pre - commercial operation date • Feedstock prices are basketed and based on March 2022 spot prices • Adjusted future feedstock prices change based on NXT Management assumptions • Assumes base weighted feedstock CI of 44.29 in 2026, decreasing in subsequent years • Assumes total capital costs estimated at approximately $3 billion • Financed through 65% senior debt, with the balance in mezzanine debt and equity • Senior Debt is assumed at a 7% interest rate during construction and 7% long term • Mezzanine Debt is assumed at an annual interest rate of 8% 2026 Projected EBITDA Sensitivity Analysis (EBITDA $ in millions) Gallon Price of Diesel Source: NXT Management RIN Price per Credit 39

Risks Relating to NXT • Our commercial success depends on our ability to develop and operate production facilities for the commercial production of r ene wable diesel. • Our limited history makes it difficult to evaluate our business and prospects and may increase the risks associated with your in vestment. • Our management has identified conditions that raise substantial doubt about our ability to continue as a going concern, inclu din g those set forth below. • Although information in this Presentation assumes no redemptions by ITAQ public stockholders, it is very unlikely that there wil l be no redemptions, and neither we nor ITAQ can predict the extent of such redemptions, which may be significant. • We may need to raise additional funds in the near future, particularly if a large percentage of ITAQ’s public stockholders ex erc ise their redemption rights, and these funds may not be available when needed. • Borrowings at higher levels than projected and interest at higher rates than projected may impair our ability to operate prof ita bly or generate the anticipated EBITDA • We may be unable to qualify for existing federal and state level low - carbon fuel credits and the carbon credit markets may not d evelop as quickly or efficiently as we anticipate or at all. • In order to construct our proposed commercial production facilities, we expect to face a long and variable design, fabricatio n, and construction development cycle that requires significant resource commitments and may create fluctuations in whether and when revenue is recognized and may have an adverse effect on our business. • Fluctuations in the price of product inputs, including animal fat, vegetable oil, and other feedstocks, is likely to affect o ur cost structure. • Fluctuations in petroleum prices and customer demand patterns may reduce demand for renewable fuels and bio - based chemicals. A p rolonged environment of low petroleum prices or reduced demand for renewable fuels or biofuels could have a material adverse effect on our long - term business prospects, financial condition and results of operations . • We may face substantial competition from companies with greater resources and financial strength, which could adversely affec t o ur performance and growth. • Our proposed growth projects may not be completed or, if completed, may not perform as expected. Our project development acti vit ies may consume a significant portion of our management’s focus, and if not successful, reduce our profitability. • We may not be able to develop, maintain and grow strategic relationships, identify new strategic relationship opportunities, or form strategic relationships, in the future. • We may acquire or invest in additional companies, which may divert our management's attention, result in additional dilution to our stockholders, and consume resources that are necessary to sustain our business with no assurance that such investment will not have a negative effect on our business going forward. • Fluctuations in the price and availability of energy to power our facilities may harm our performance. • We may be subject to liabilities and losses that may not be covered by insurance. • Renewable diesel has not previously been used as a commercial fuel in significant amounts. • The use of our fuel may subject us to product liability risks and we may become subject to product liability claims, which co uld harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims. • Liabilities and costs associated with hazardous materials, contamination and other environmental conditions may require us to co nduct investigations or remediation or expose us to other liabilities, either of which may adversely impact our operations and financial condition. • Our operations, and future planned operations, are subject to certain environmental health and safety laws or permitting requ ire ments, which could result in increased compliance costs or additional operating costs and restrictions. Failure to comply with such laws and regulations could result in substantial fines or other limitations that co uld adversely impact our financial results or operations. • Increased focus on sustainability or other ESG matters could impact our operations. • Failure of third parties to manufacture quality products or provide reliable services in accordance with schedules, prices, q ual ity and volumes that are acceptable to us could cause delays in developing and operating our commercial production facilities, which could damage our reputation, adversely affect our strategic relationships or adversel y a ffect our ability to operate profitably. • We may be unable to successfully perform under future supply and distribution agreements to provide our renewable diesel, whi ch could harm our commercial prospects. • Third parties on whom we may rely for transportation services are subject to complex federal, state and other laws that could ad versely affect our operations. • Our business operations may be significantly disrupted upon the occurrence of a catastrophic event, information technology sy ste m failures or cyberattack. • Our facilities and processes may fail to produce renewable diesel at the volumes, rates, and costs we expect. • We may in the future use hedging arrangements to address certain risks, but the use of such derivative instruments could have a material adverse impact on our results of operations. 40

Risks Relating to NXT • Business interruptions, including those related to the widespread outbreak of an illness, pandemic (such as Covid - 19), fire, adv erse weather conditions and the effects of climate change, particularly as it affects the Pacific Northwest, where we propose to operate, terrorism and other catastrophic events, may have an adverse impact on our business a nd results of our operations. • Even if we are successful in completing our first commercial production facility and consistently produce renewable diesel on a commercial scale, we may not be successful in commencing and expanding commercial operations to support the growth of our business. • We are a development stage company with a history of net losses, we are currently not profitable, and we may not achieve or m ain tain profitability. If we incur substantial losses and are not able to raise the funds to cover the losses, we may have to curtail our operations, which may prevent us from successfully developing, operating and expanding our bu siness. • Our actual costs may be greater than expected in developing our commercial production facilities or growth projects, causing us to realize significantly lower profits or greater losses. • Disruption in the supply chain, including increases in costs, shortage of materials or other disruption of supply, or in the wor kforce could materially adversely affect our business. • We may not be able to obtain, or comply with terms and conditions for, government grants, loans, and other incentives for whi ch we may apply for in the future, which may limit our opportunities to expand our business. • We may expand our operations globally, which would subject us to anti - corruption, anti - bribery, anti - money laundering, trade com pliance, economic sanctions and similar laws of countries in addition to the United States, and non - compliance with such laws may subject us to criminal or civil liability and harm our business, financial condition and/or re sults of operations. We may also be subject to governmental export and import controls that could impair our ability to compete in international markets or subject us to liability if we violate the controls. Further, we may be at a competitive disadvantage to foreign companies that are not subject to laws that affect United States companies including the Foreign Corrupt Practices Act. • Agreements containing confidentiality provisions and restrictive covenants with employees, consultants and other third - parties m ay not adequately prevent disclosures of trade secrets and other proprietary information. • We may be subject to intellectual property rights claims by third parties, which could be costly to defend, could require us to pay significant damages and, if we are unsuccessful in defending such claims, could limit our ability to use certain technologies and compete. • We may be subject to claims that our employees, consultants or independent contractors have wrongfully used or disclosed conf ide ntial information or alleged trade secrets of third parties or competitors or are in breach of noncompetition or non - solicitation agreements with our competitors or their former employers. • Our business and prospects depend significantly on our ability to build our brand. We may not succeed in continuing to establ ish , maintain, and strengthen our brand, and our brand and reputation could be harmed by negative publicity regarding our company or products. • If we fail to comply with our obligations under license or technology agreements with third parties or are unable to license rig hts to use technologies on reasonable terms, we may be required to pay damages and could potentially lose license rights that are critical to our business. • Our projections are subject to significant risks, assumptions, estimates and uncertainties, including assumptions regarding a dop tion of renewable fuels. As a result, our projected revenues, market share, expenses and profitability may differ materially from our expectations in any given quarter or fiscal year. • If our estimates or judgments relating to our critical accounting policies prove to be incorrect or financial reporting stand ard s or interpretations change, our operating results could be adversely affected. • Inflation may adversely affect us by increasing costs of our business. • The alternative fuel industry is rapidly evolving and may be subject to significant changes and developments in alternative t ech nologies may adversely affect the demand for our fuel if we are not able to adapt to use the most current available technologies and processes. • Concerns regarding the environmental impact of renewable diesel production could affect public policy which could impair our abi lity to operate at a profit and substantially harm our revenues and operating margins. • If we lose key personnel, including key management personnel, or are unable to attract and retain additional personnel, it co uld make it more difficult for us to pursue strategic relationships or develop our own products or otherwise have a material adverse effect on our business. • Our management team has limited experience in operating a public company. • We will incur significant increased expenses and administrative burdens as a public company, which could have an adverse effe ct on our business, financial condition and results of operations. • The requirements of being a public company may strain NXTClean Fuels’ resources, divert management's attention and affect its ability to attract and retain qualified board members and offi ce rs. • From time to time, we may be involved in litigation, regulatory actions or government investigations and inquiries, which cou ld have an adverse impact on our profitability and consolidated financial position. 41

AN INTRODUCTION | SPRING 2022 | WWW.NXTRENEWABLES.COM thank you.