P10 to Expand Internationally with Acquisition of Qualitas Funds September 17, 2024

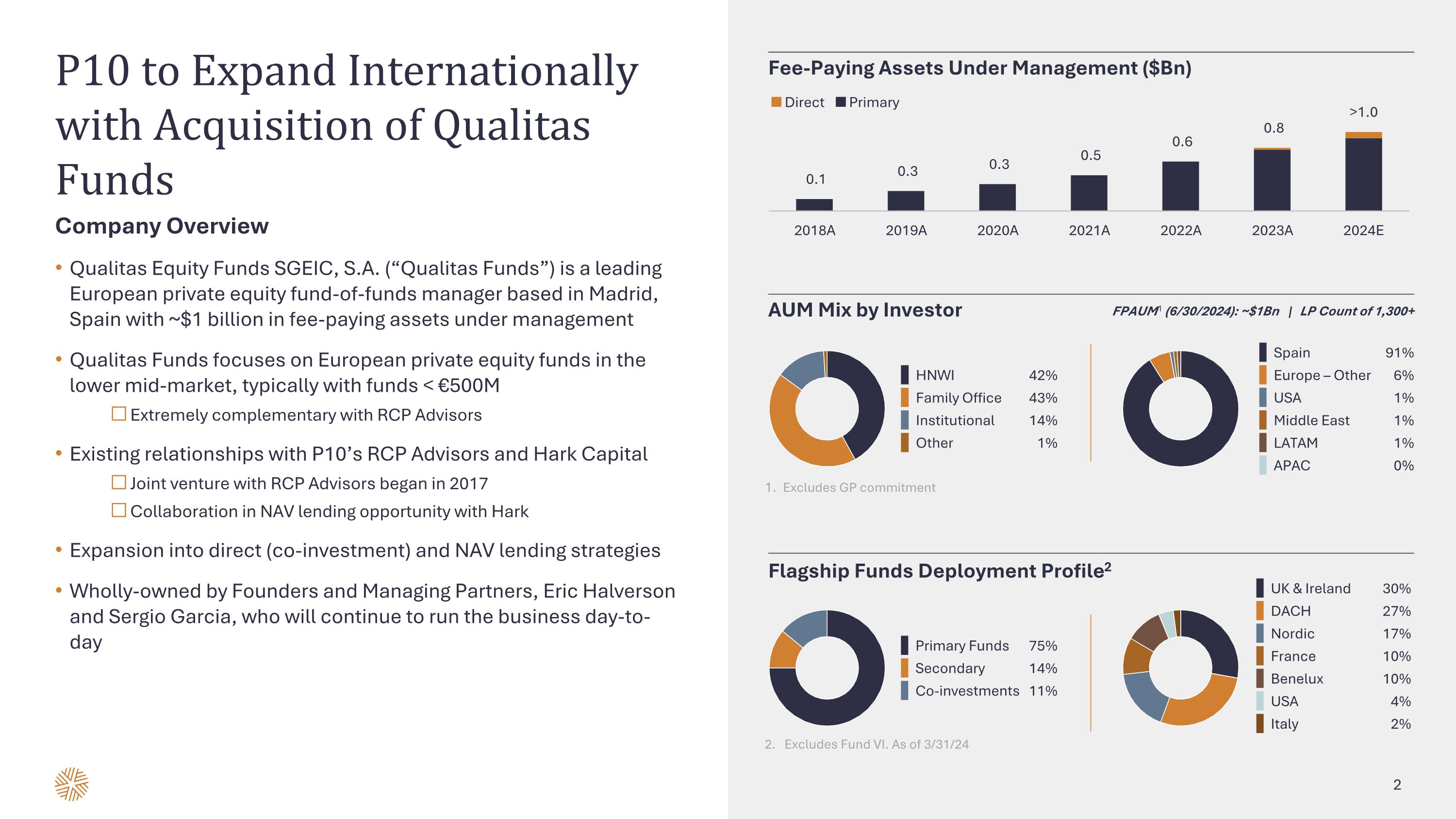

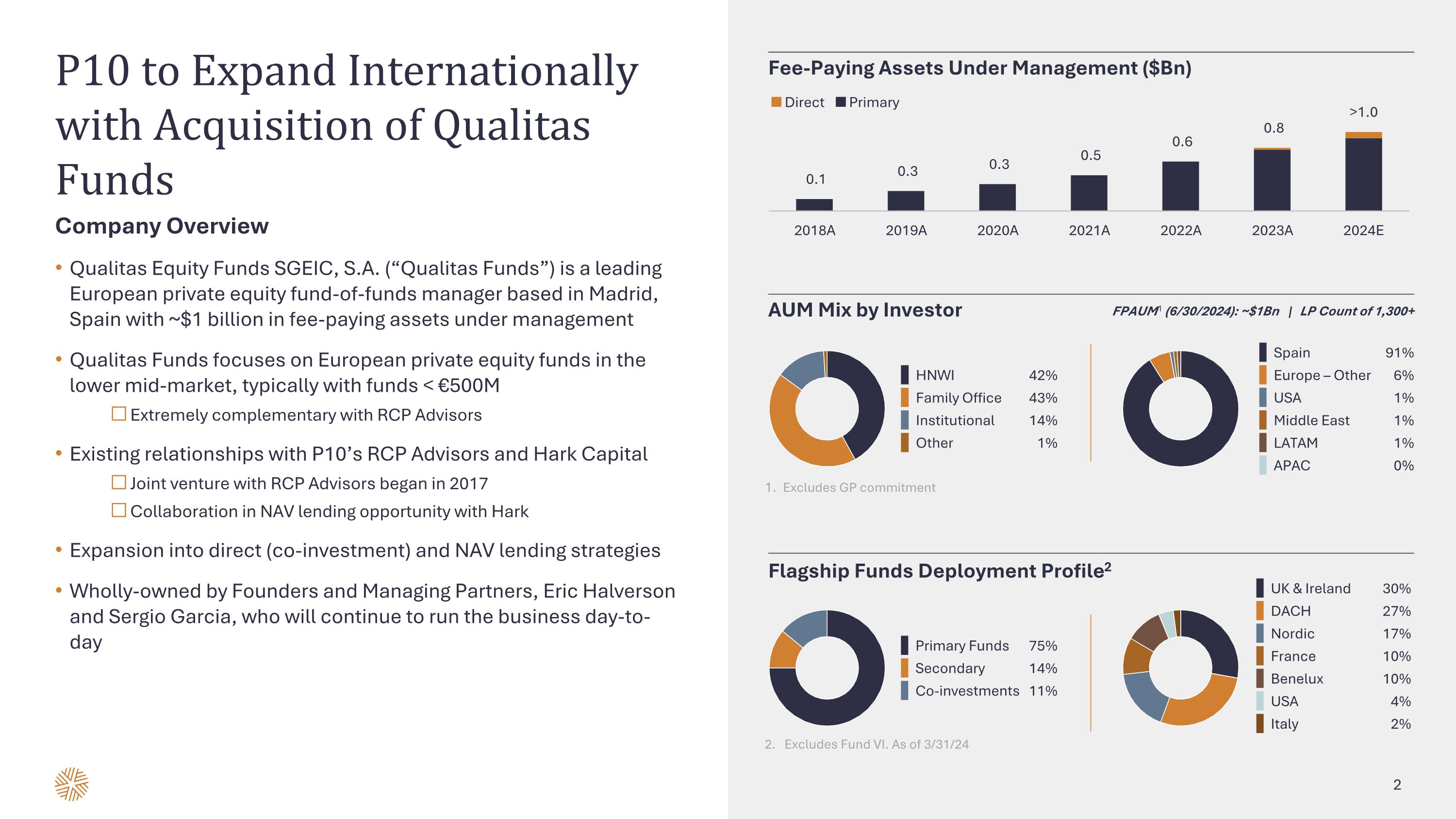

Company Overview Qualitas Equity Funds SGEIC, S.A. (“Qualitas Funds”) is a leading European private equity fund-of-funds manager based in Madrid, Spain with ~$1 billion in fee-paying assets under management Qualitas Funds focuses on European private equity funds in the lower mid-market, typically with funds < €500M Extremely complementary with RCP Advisors Existing relationships with P10’s RCP Advisors and Hark Capital Joint venture with RCP Advisors began in 2017 Collaboration in NAV lending opportunity with Hark Expansion into direct (co-investment) and NAV lending strategies Wholly-owned by Founders and Managing Partners, Eric Halverson and Sergio Garcia, who will continue to run the business day-to-day P10 to Expand Internationally with Acquisition of Qualitas Funds AUM Mix by Investor Flagship Funds Deployment Profile2 FPAUM1 (6/30/2024): ~$1Bn | LP Count of 1,300+ HNWI 42% Family Office 43% Institutional 14% Other 1% Spain 91% Europe – Other 6% USA 1% Middle East 1% LATAM 1% APAC 0% Primary Funds 75% Secondary 14% Co-investments 11% UK & Ireland 30% DACH 27% Nordic 17% France 10% Benelux 10% USA 4% Italy 2% Fee-Paying Assets Under Management ($Bn) Excludes GP commitment 2. Excludes Fund VI. As of 3/31/24

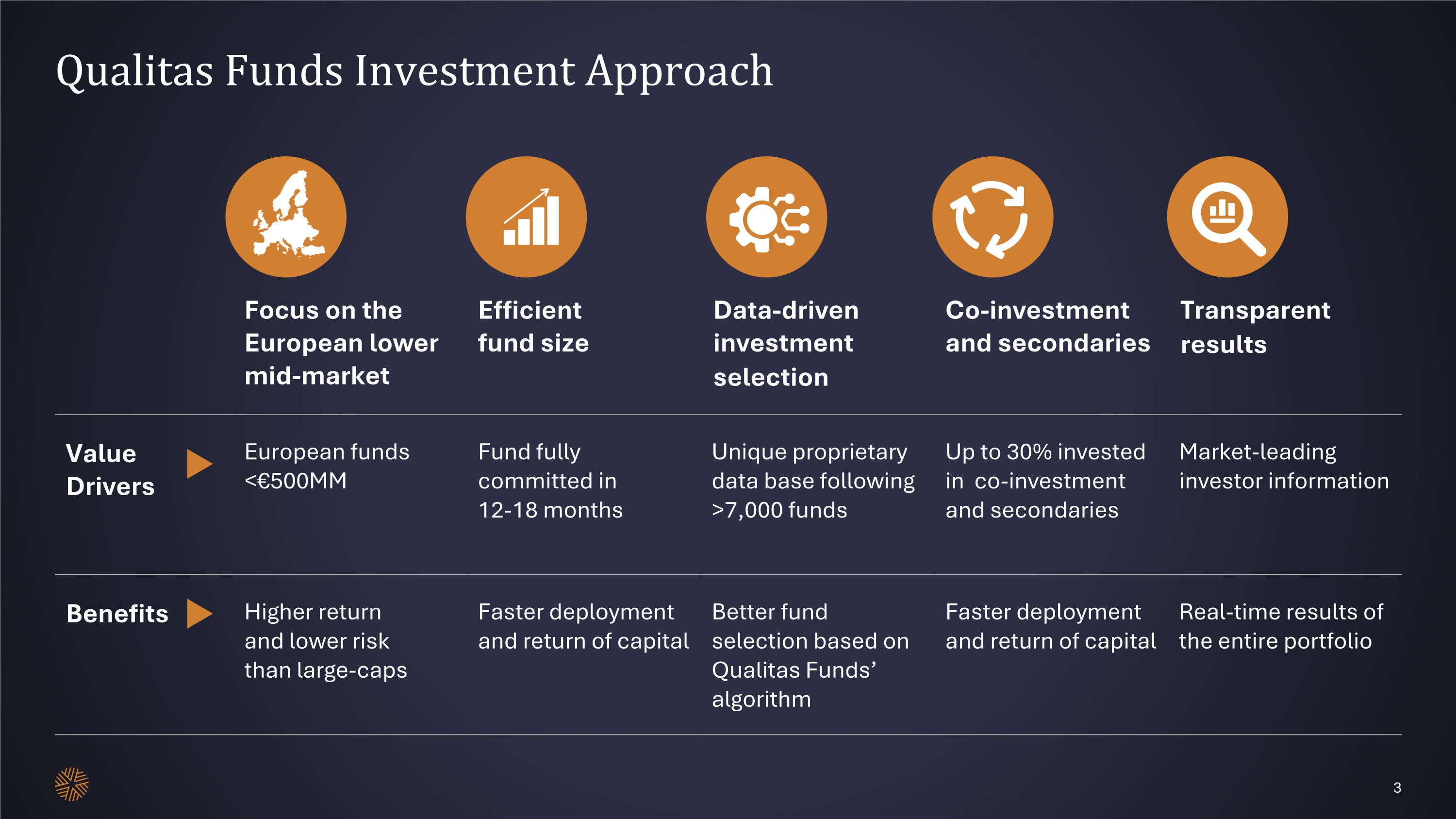

Qualitas Funds Investment Approach Focus on the European lower mid-market Efficient�fund size Data-driven investment selection Co-investment �and secondaries Transparent results Value Drivers European funds <€500MM Fund fully committed in �12-18 months Unique proprietary �data base following �>7,000 funds Up to 30% invested in co-investment and secondaries Market-leading investor information Benefits Higher return �and lower risk �than large-caps Faster deployment �and return of capital Better fund selection based on Qualitas Funds’ algorithm Faster deployment �and return of capital Real-time results of the entire portfolio

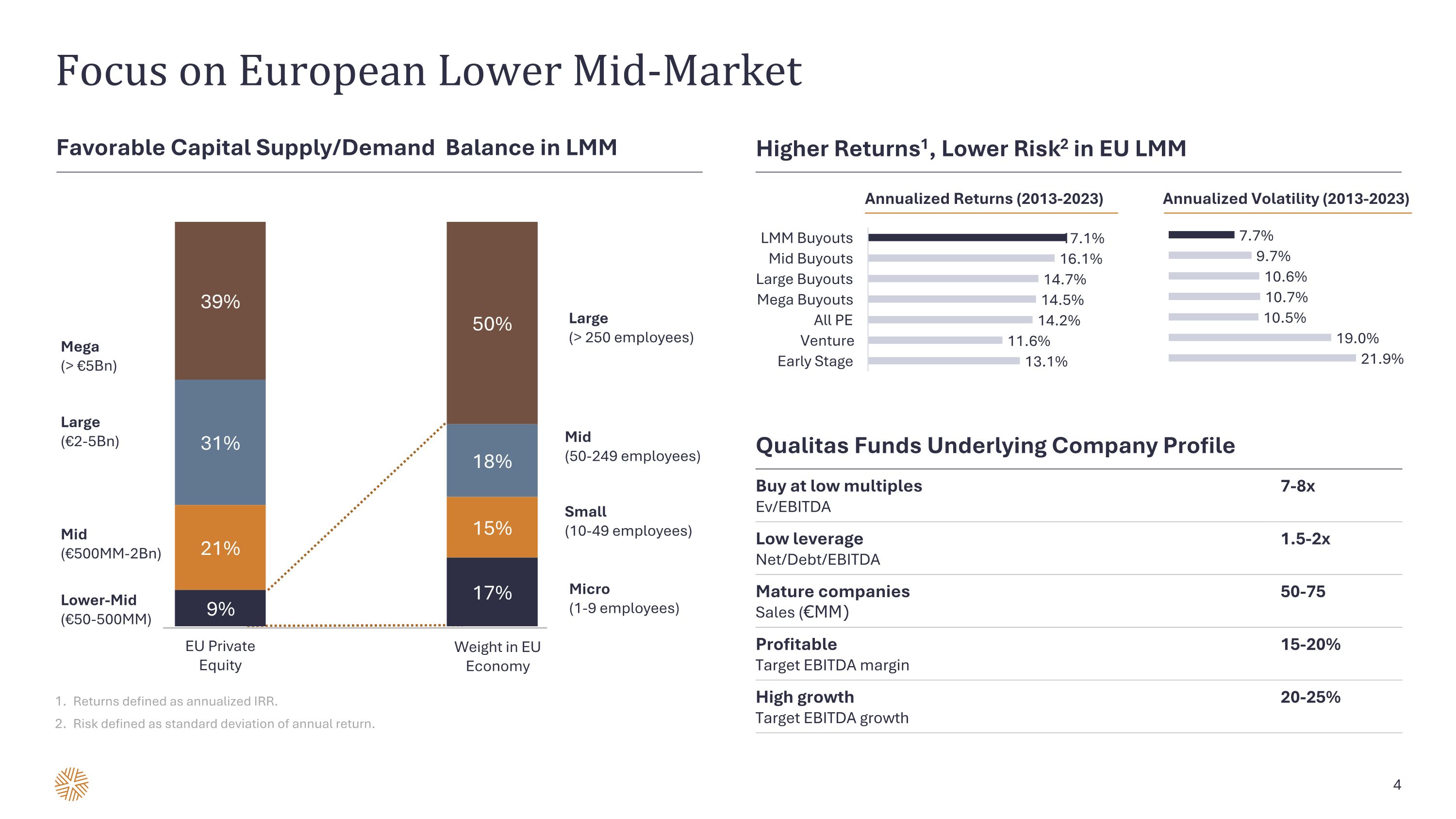

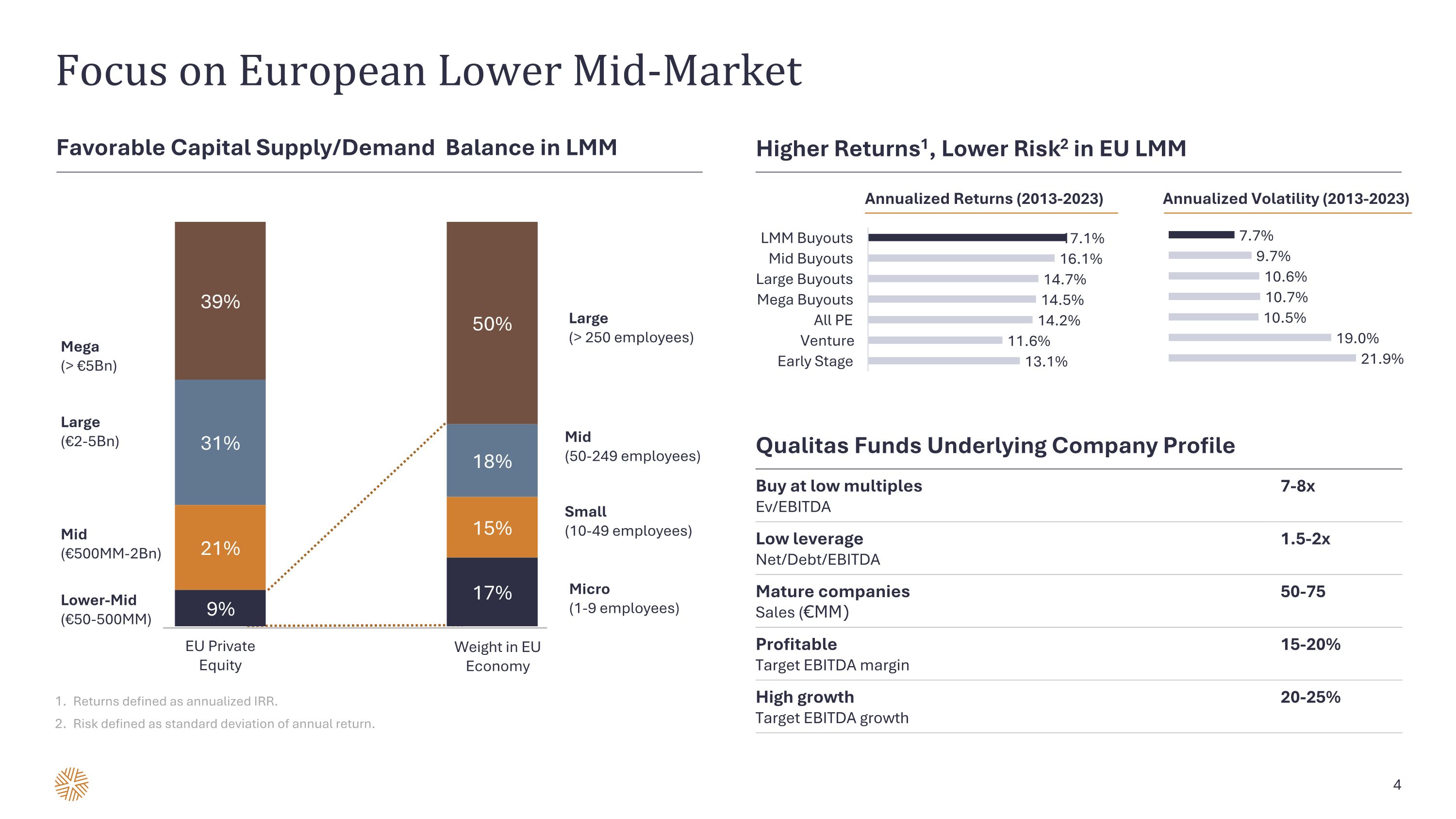

Focus on European Lower Mid-Market Returns defined as annualized IRR. Risk defined as standard deviation of annual return. Favorable Capital Supply/Demand Balance in LMM Higher Returns1, Lower Risk2 in EU LMM Qualitas Funds Underlying Company Profile Mega (> €5Bn) Large (€2-5Bn) EU Private Equity Lower-Mid (€50-500MM) Large (> 250 employees) Mid (50-249 employees) Small (10-49 employees) Micro�(1-9 employees) Weight in EU Economy Mid (€500MM-2Bn) Annualized Returns (2013-2023) Annualized Volatility (2013-2023) Buy at low multiples Ev/EBITDA 7-8x Low leverage Net/Debt/EBITDA 1.5-2x Mature companies Sales (€MM) 50-75 Profitable Target EBITDA margin 15-20% High growth Target EBITDA growth 20-25%

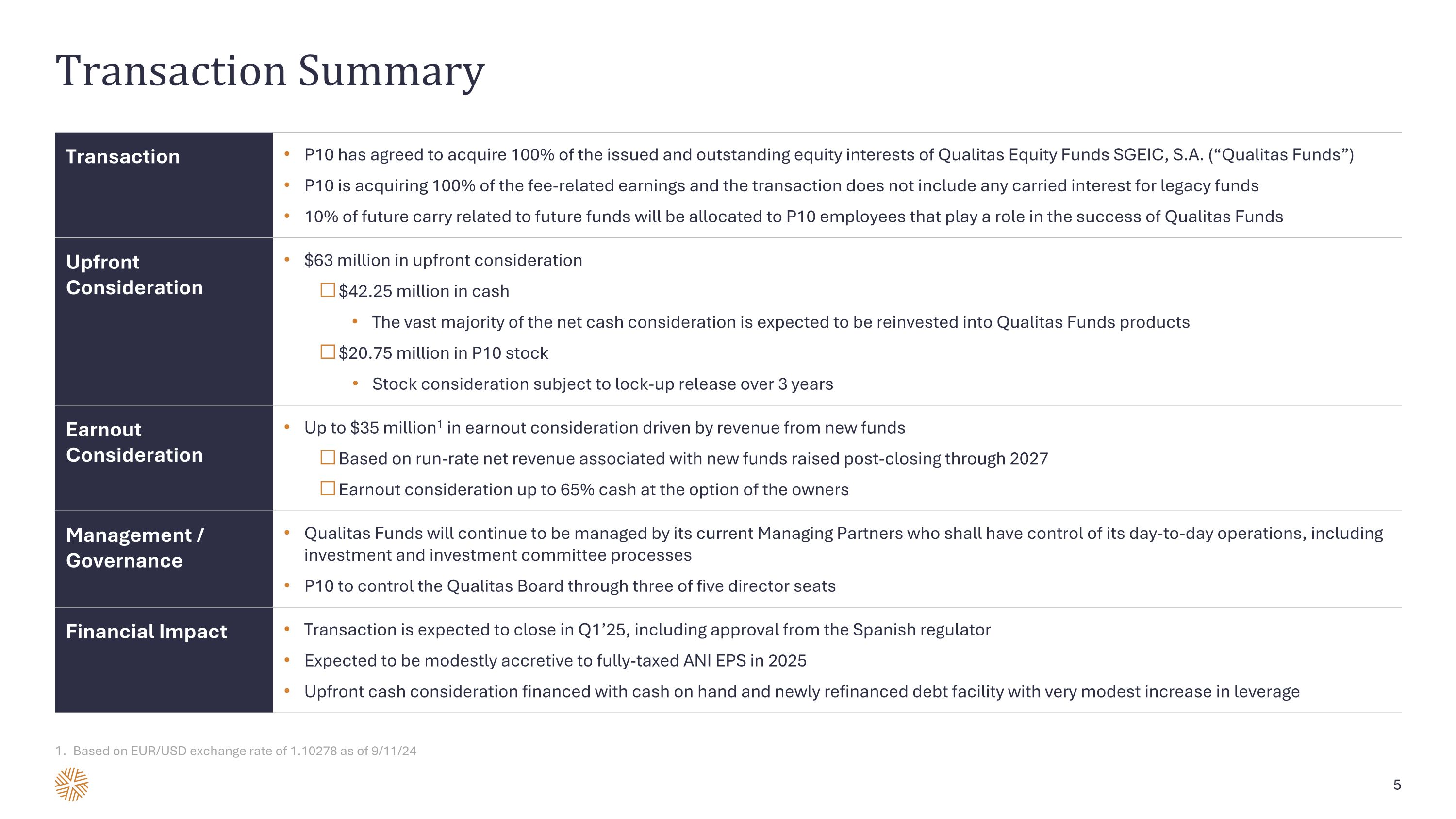

Transaction Summary Transaction P10 has agreed to acquire 100% of the issued and outstanding equity interests of Qualitas Equity Funds SGEIC, S.A. (“Qualitas Funds”) P10 is acquiring 100% of the fee-related earnings and the transaction does not include any carried interest for legacy funds 10% of future carry related to future funds will be allocated to P10 employees that play a role in the success of Qualitas Funds Upfront Consideration $63 million in upfront consideration $42.25 million in cash The vast majority of the net cash consideration is expected to be reinvested into Qualitas Funds products $20.75 million in P10 stock Stock consideration subject to lock-up release over 3 years Earnout Consideration Up to $35 million1 in earnout consideration driven by revenue from new funds Based on run-rate net revenue associated with new funds raised post-closing through 2027 Earnout consideration up to 65% cash at the option of the owners Management / Governance Qualitas Funds will continue to be managed by its current Managing Partners who shall have control of its day-to-day operations, including investment and investment committee processes P10 to control the Qualitas Board through three of five director seats Financial Impact Transaction is expected to close in Q1’25, including approval from the Spanish regulator Expected to be modestly accretive to fully-taxed ANI EPS in 2025 Upfront cash consideration financed with cash on hand and newly refinanced debt facility with very modest increase in leverage Based on EUR/USD exchange rate of 1.10278 as of 9/11/24

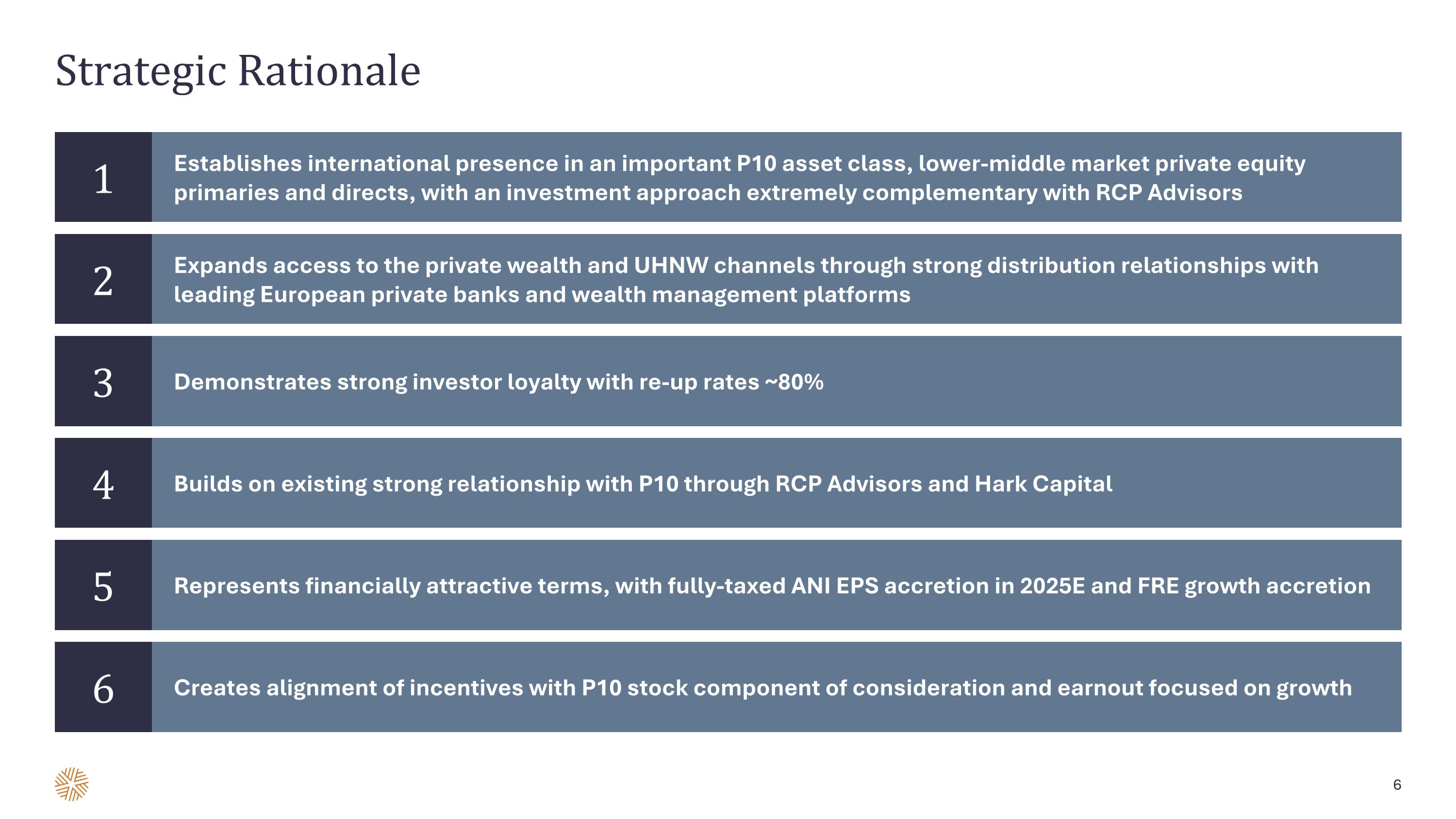

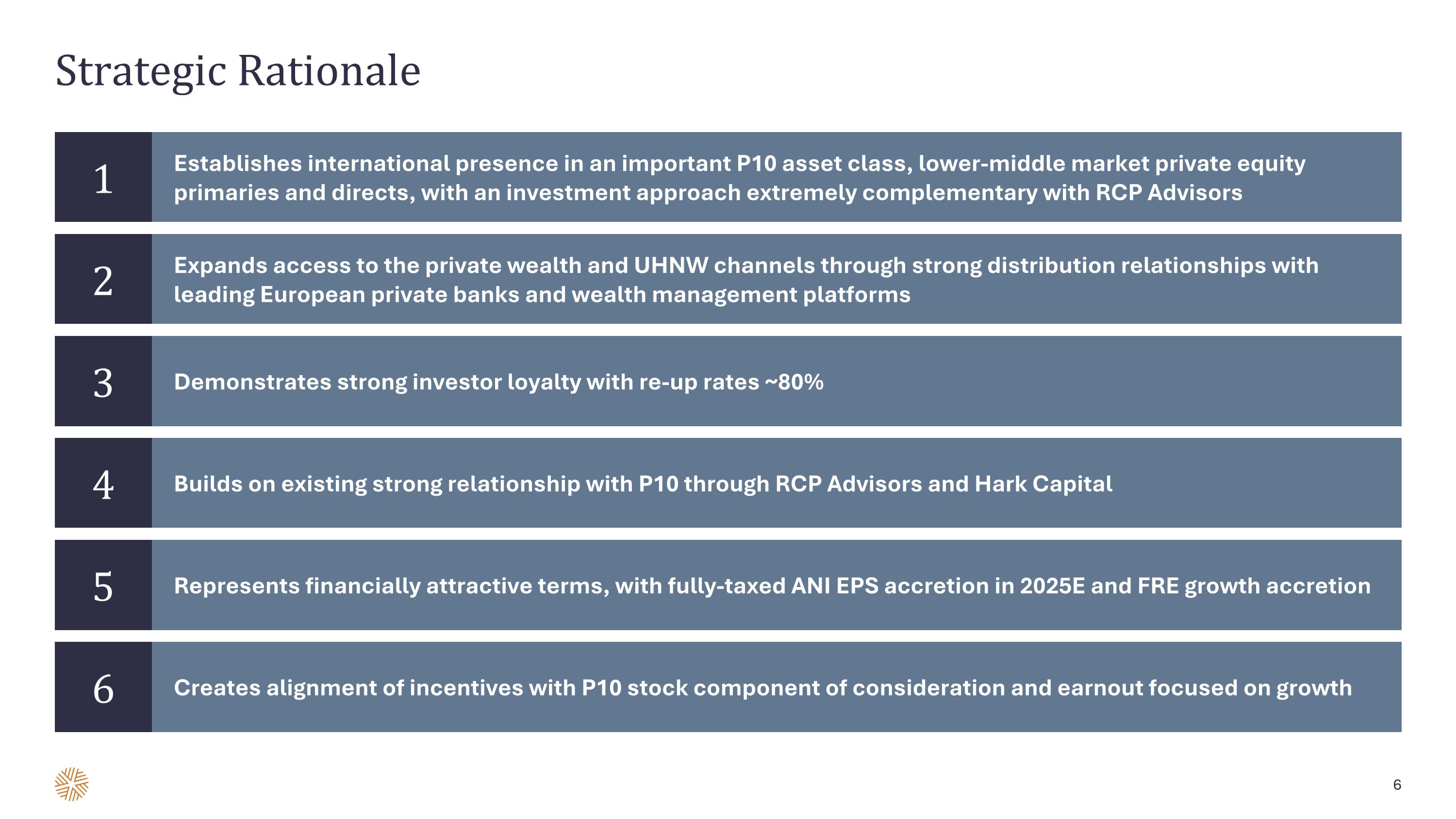

Strategic Rationale Demonstrates strong investor loyalty with re-up rates ~80% 3 Represents financially attractive terms, with fully-taxed ANI EPS accretion in 2025E and FRE growth accretion 5 Builds on existing strong relationship with P10 through RCP Advisors and Hark Capital 4 Establishes international presence in an important P10 asset class, lower-middle market private equity primaries and directs, with an investment approach extremely complementary with RCP Advisors 1 Expands access to the private wealth and UHNW channels through strong distribution relationships with leading European private banks and wealth management platforms 2 Creates alignment of incentives with P10 stock component of consideration and earnout focused on growth 6

FORWARD-LOOKING STATEMENTS Some of the statements in this presentation may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Words such as “will,” “expect,” “believe,” “estimate,” “continue,” “anticipate,” “intend,” “plan” and similar expressions are intended to identify these forward-looking statements. Forward-looking statements discuss management’s current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance, and business. The inclusion of any forward-looking information in this presentation should not be regarded as a representation that the future plans, estimates, or expectations contemplated will be achieved. Forward-looking statements reflect management’s current plans, estimates, and expectations, and are inherently uncertain. All forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other important factors that may cause actual results to be materially different; global and domestic market and business conditions; successful execution of business and growth strategies and regulatory factors relevant to our business; changes in our tax status; our ability to maintain our fee structure; our ability to attract and retain key employees; our ability to manage our obligations under our debt agreements; our ability to make acquisitions and successfully integrate the businesses we acquire; assumptions relating to our operations, financial results, financial condition, business prospects and growth strategy; and our ability to manage the effects of events outside of our control. The foregoing list of factors is not exhaustive. For more information regarding these risks and uncertainties as well as additional risks that we face, you should refer to the “Risk Factors” included in our annual report on Form 10-K for the year ended December 31, 2023, filed with the U.S. Securities and Exchange Commission (“SEC”) on March 13, 2024, and in our subsequent reports filed from time to time with the SEC. The forward-looking statements included in this presentation are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information or future events, except as otherwise required by law. KEY FINANCIAL & OPERATING METRICS Fee-paying assets under management reflects the assets from which we earn management and advisory fees. Our vehicles typically earn management and advisory fees based on committed capital, and in certain cases, net invested capital, depending on the fee terms. Management and advisory fees based on committed capital are not affected by market appreciation or depreciation. OWNERSHIP LIMITATIONS P10’s Certificate of Incorporation contains certain provisions for the protection of tax benefits relating to P10’s net operating losses. Such provisions generally void transfers of shares that would result in the creation of a new 4.99% shareholder or result in an existing 4.99% shareholder acquiring additional shares of P10. Disclaimers