Wells Fargo Midstream and Utilities Symposium December 7, 2023 DT Midstream

Safe Harbor Statement This presentation contains statements which, to the extent they are not statements of historical or present fact, constitute "forward-looking statements" under the securities laws. These forward-looking statements are intended to provide management's current expectations or plans for our future operating and financial performance, business prospects, outcomes of regulatory proceedings, market conditions, and other matters, based on what we believe to be reasonable assumptions and on information currently available to us. Forward-looking statements can be identified by the use of words such as "believe," "expect," "expectations," "plans," "strategy," "prospects," "estimate," "project," "target," "anticipate," "will," "should," "see," "guidance," "outlook," "confident" and other words of similar meaning. The absence of such words, expressions or statements, however, does not mean that the statements are not forward-looking. In particular, express or implied statements relating to future earnings, cash flow, results of operations, uses of cash, tax rates and other measures of financial performance, future actions, conditions or events, potential future plans, strategies or transactions of DT Midstream, and other statements that are not historical facts, are forward-looking statements. Forward-looking statements are not guarantees of future results and conditions, but rather are subject to numerous assumptions, risks, and uncertainties that may cause actual future results to be materially different from those contemplated, projected, estimated, or budgeted. Many factors may impact forward-looking statements of DT Midstream including, but not limited to, the following: changes in general economic conditions, including increases in interest rates and associated Federal Reserve policies, a potential economic recession, and the impact of inflation on our business; industry changes, including the impact of consolidations, alternative energy sources, technological advances, infrastructure constraints and changes in competition; global supply chain disruptions; actions taken by third-party operators, processors, transporters and gatherers; changes in expected production from Southwestern Energy and other third parties in our areas of operation; demand for natural gas gathering, transmission, storage, transportation and water services; the availability and price of natural gas to the consumer compared to the price of alternative and competing fuels; our ability to successfully and timely implement our business plan; our ability to complete organic growth projects on time and on budget; our ability to finance, complete, or successfully integrate acquisitions; the price and availability of debt and equity financing; restrictions in our existing and any future credit facilities and indentures; the effectiveness of the Company's information technology and operational technology systems and practices to detect and defend against evolving cyber attacks on United States critical infrastructure; changing laws regarding cybersecurity and data privacy, and any cybersecurity threat or event; operating hazards, environmental risks, and other risks incidental to gathering, storing and transporting natural gas; natural disasters, adverse weather conditions, casualty losses and other matters beyond our control; the impact of outbreaks of illnesses, epidemics and pandemics, and any related economic effects; the impacts of geopolitical events, including the conflicts in Ukraine and the Middle East; labor relations and markets, including the ability to attract, hire and retain key employee and contract personnel; large customer defaults; changes in tax status, as well as changes in tax rates and regulations; the effects and associated cost of compliance with existing and future laws and governmental regulations, such as the Inflation Reduction Act of 2022; changes in environmental laws, regulations or enforcement policies, including laws and regulations relating to climate change and greenhouse gas emissions; ability to develop low carbon business opportunities and deploy greenhouse gas reducing technologies; changes in insurance markets impacting costs and the level and types of coverage available; the timing and extent of changes in commodity prices; the success of our risk management strategies; the suspension, reduction or termination of our customers' obligations under our commercial agreements; disruptions due to equipment interruption or failure at our facilities, or third-party facilities on which our business is dependent; the effects of future litigation; the qualification of the spin-off of DT Midstream from DTE Energy ("the Spin-Off") as a tax-free distribution; the allocation of tax attributes from DTE Energy in accordance with the agreement that governs the respective rights, responsibilities and obligations of DTE Energy and DT Midstream after the Spin-Off with respect to all tax matters; and the risks described in our Annual Report on Form 10-K for the year ended December 31, 2022 and our reports and registration statements filed from time to time with the SEC. The above list of factors is not exhaustive. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause actual results to vary materially from those stated in forward-looking statements, see the discussion under the section entitled "Risk Factors" in our Annual Report for the year ended December 31, 2022, filed with the SEC on Form 10-K and any other reports filed with the SEC. Given the uncertainties and risk factors that could cause our actual results to differ materially from those contained in any forward-looking statement, you should not put undue reliance on any forward-looking statements. Any forward-looking statements speak only as of the date on which such statements are made. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward-looking statements, whether as a result of new information, subsequent events or otherwise. 2

DT Midstream Investment Thesis Clean assets, clean balance sheet, clean story Integrated and well-positioned assets Haynesville / Appalachia dry gas focus Assets providing wellhead to market service Directly serving growing LNG export demand Highly contracted cash flows Long-term take-or-pay contracts Committed to a durable and growing dividend No direct commodity exposure Strong balance sheet with low leverage Self-funded investment program No significant near-term debt maturities Low and declining leverage Mature environmental, social and governance leadership Executing on energy transition projects Committed to 30% emissions reduction by 2030 and net zero by 2050 3

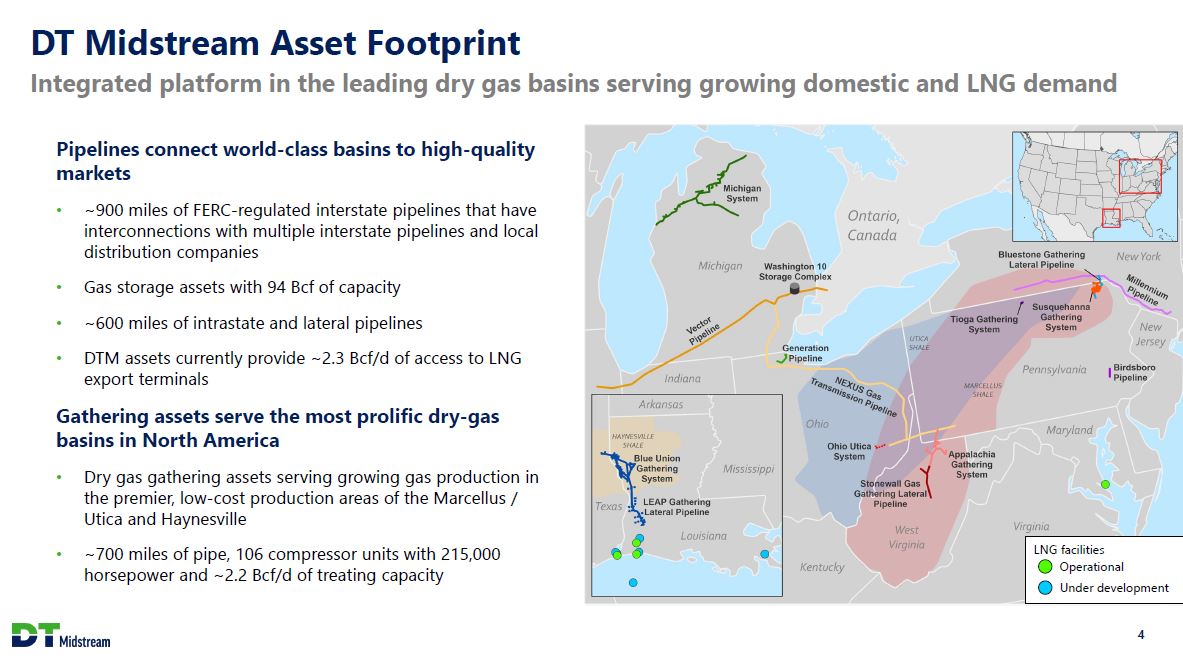

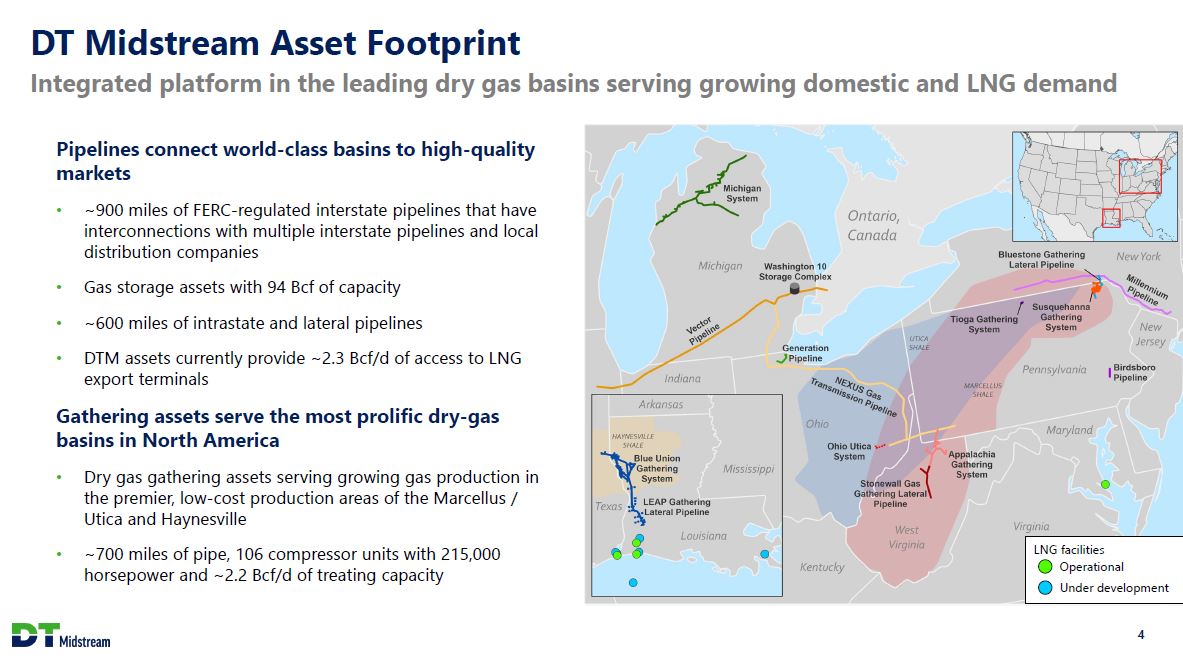

DT Midstream Asset Footprint Integrated platform in the leading dry gas basins serving growing domestic and LNG demand Pipelines connect world-class basins to high-quality markets ~900 miles of FERC-regulated interstate pipelines that have interconnections with multiple interstate pipelines and LDCs Gas storage assets with 94 Bcf of capacity ~600 miles of intrastate and lateral pipelines DTM assets currently provide ~2.3 Bcf/d of access to LNG export terminals Gathering assets serve the most prolific dry-gas basins in North America Dry gas gathering assets serving growing gas production in the premier, low-cost production areas of the Marcellus / Utica and Haynesville ~700 miles of pipe, 106 compressor units with 215,000 horsepower and ~2.2 Bcf/d of treating capacity 4

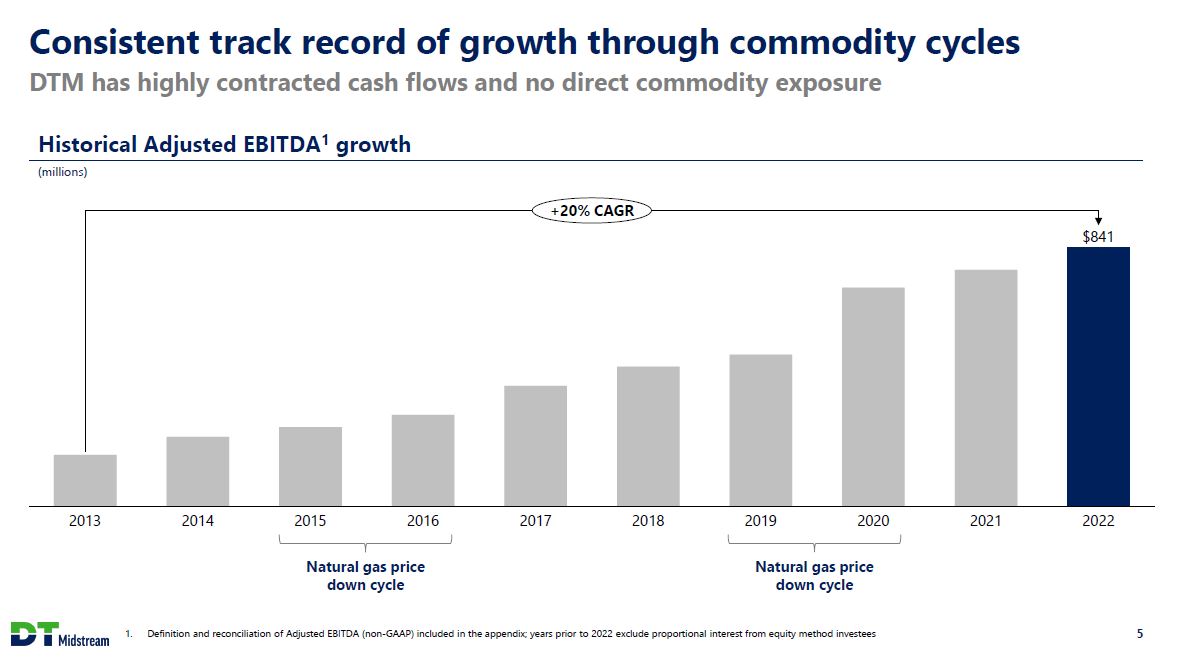

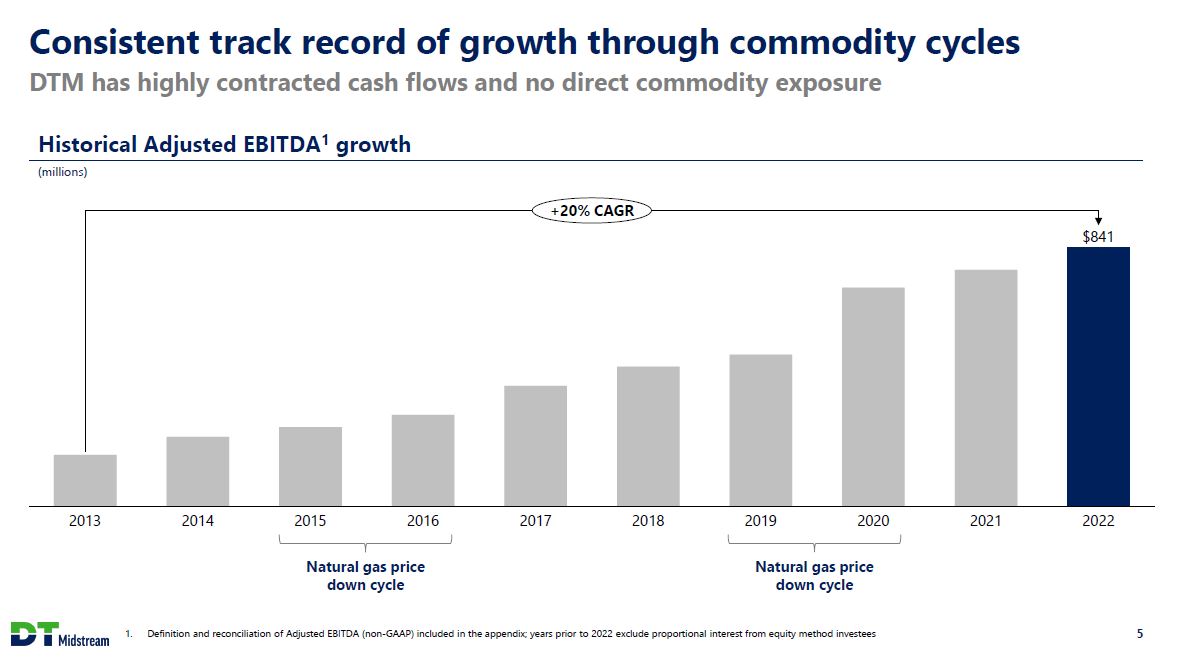

Consistent track record of growth through commodity cycles DTM has highly contracted cash flows and no direct commodity exposure Historical Adjusted EBITDA1 growth (millions) +20% CAGR $841 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Natural gas price down cycle Natural gas price down cycle 1. Definition and reconciliation of Adjusted EBITDA (non-GAAP) included in the appendix; years prior to 2022 exclude proportional interest from equity method investees 5

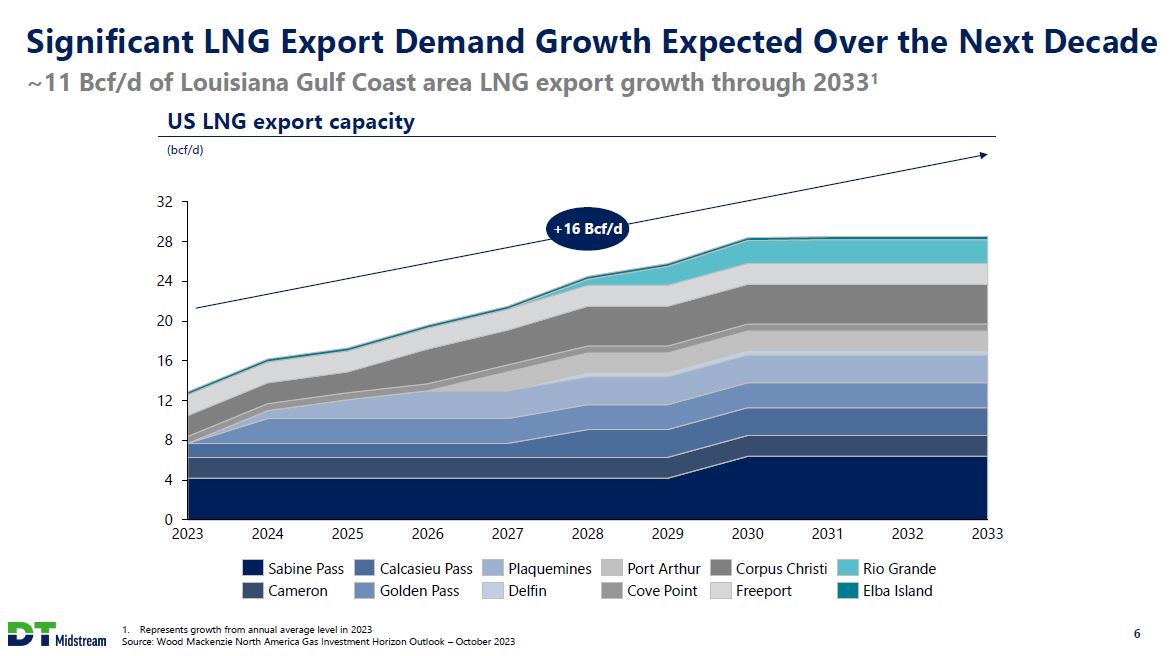

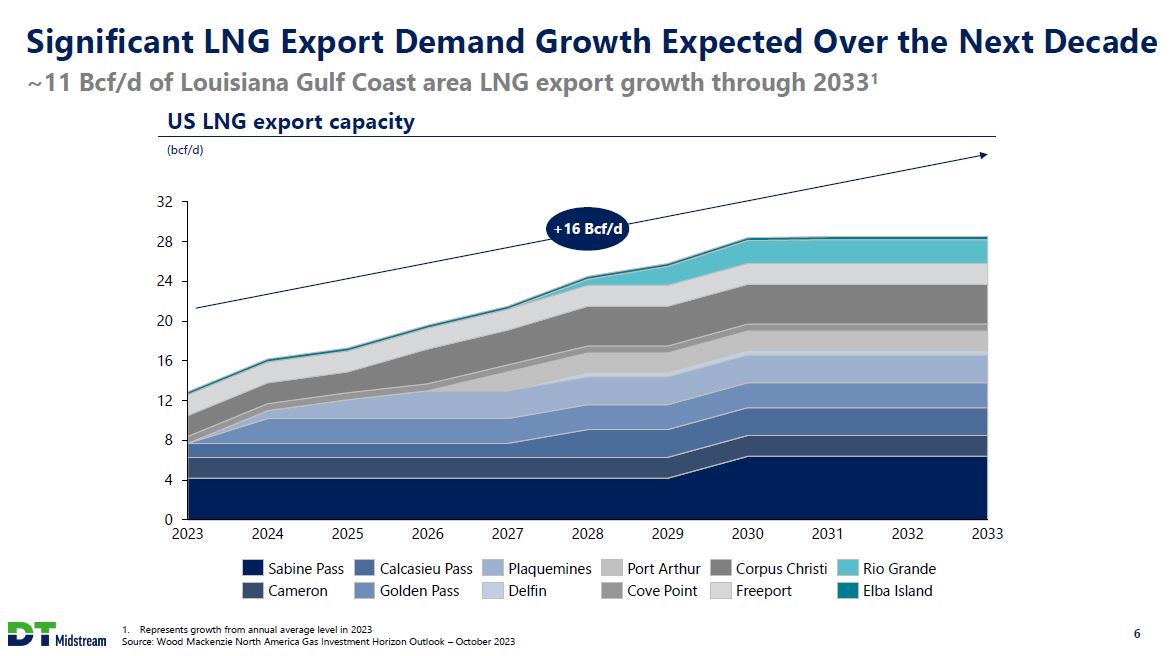

Significant LNG Export Demand Growth Expected Over the Next Decade ~11 Bcf/d of Louisiana Gulf Coast area LNG export growth through 20331 US LNG export capacity (bcf/d) 32 28 24 20 16 12 8 4 0 +16 Bcf/d 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 Sabine Pass Cameron Calcasieu Pass Golden Pass Plaquemines Delfin Port Arthur Cove Point Corpus Christi Freeport Rio Grande Elba Island 1. Represents growth from annual average level in 2023 Source: Wood Mackenzie North America Gas Investment Horizon Outlook - October 2023 6

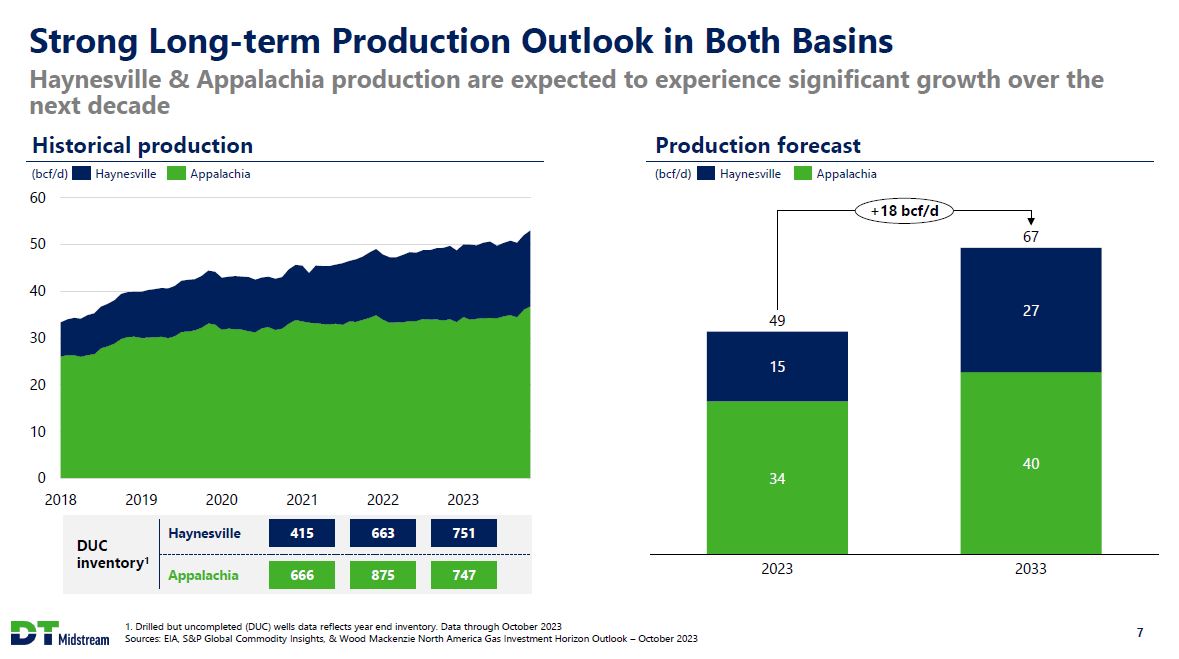

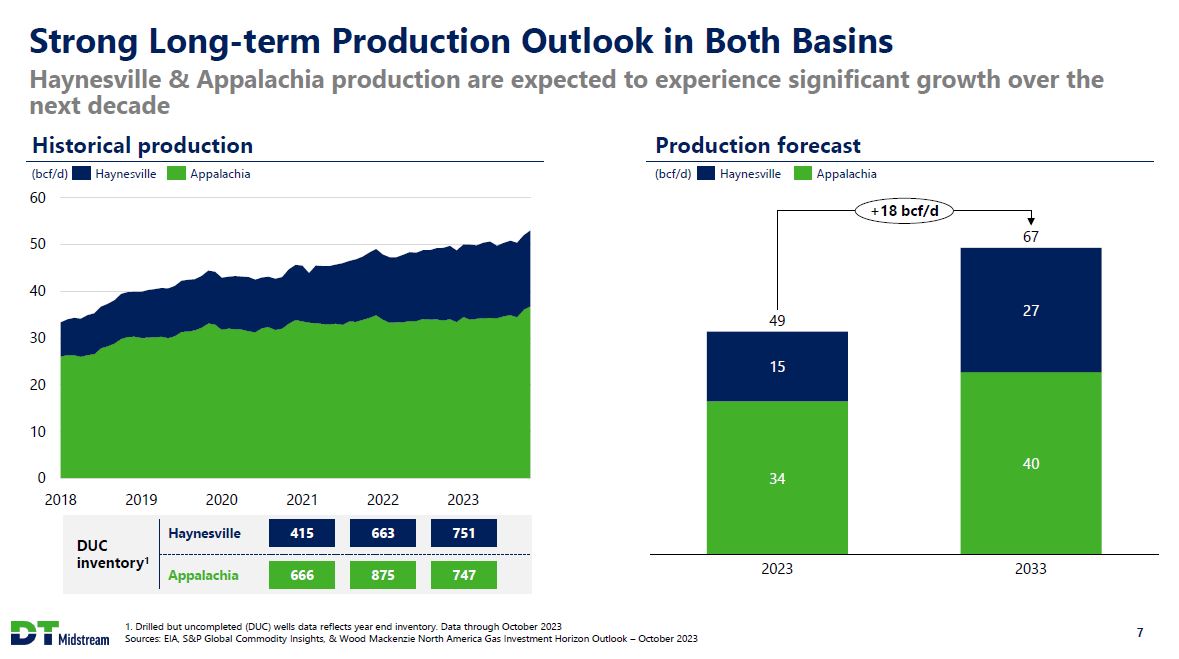

Strong Long-term Production Outlook in Both Basins Haynesville and Appalachia production is expected to experience significant growth over the next decade Historical production (bcf/d) Haynesville Appalachia 60 50 40 30 20 10 0 2018 2019 2020 2021 2022 2023 DUC inventory1 Haynesville 415 663 751 Appalachia 666 875 747 Production forecast (bcf/d) Haynesville Appalachia +18 bcf/d 49 15 34 2023 67 27 40 2033 1. Drilled but uncompleted (DUC) wells data reflects year end inventory. Data through October 2023 Sources: EIA, S and P Global Commodity Insights, and Wood Mackenzie North America Gas Investment Horizon Outlook - October 2023 7

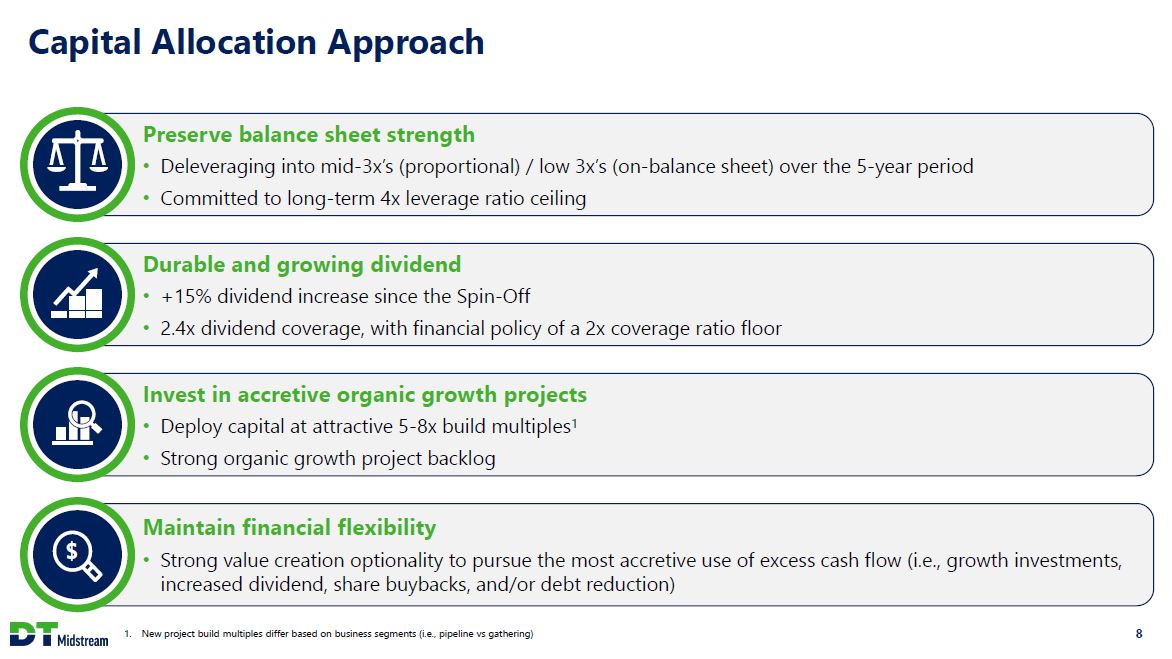

Capital Allocation Approach Preserve balance sheet strength Deleveraging into mid-3x's (proportional) / low 3x's (on-balance sheet) over the 5-year period Committed to long-term 4x leverage ratio ceiling Durable and growing dividend +15% dividend increase since the Spin-Off 2.4x dividend coverage, with financial policy of a 2x coverage ratio floor Invest in accretive organic growth projects Deploy capital at attractive 5-8x build multiples1 Strong organic growth project backlog Maintain financial flexibility Strong value creation optionality to pursue the most accretive use of excess cash flow (i.e., growth investments, increased dividend, share buybacks, and/or debt reduction) 1. New project build multiples differ based on business segments (i.e., pipeline vs gathering) 8

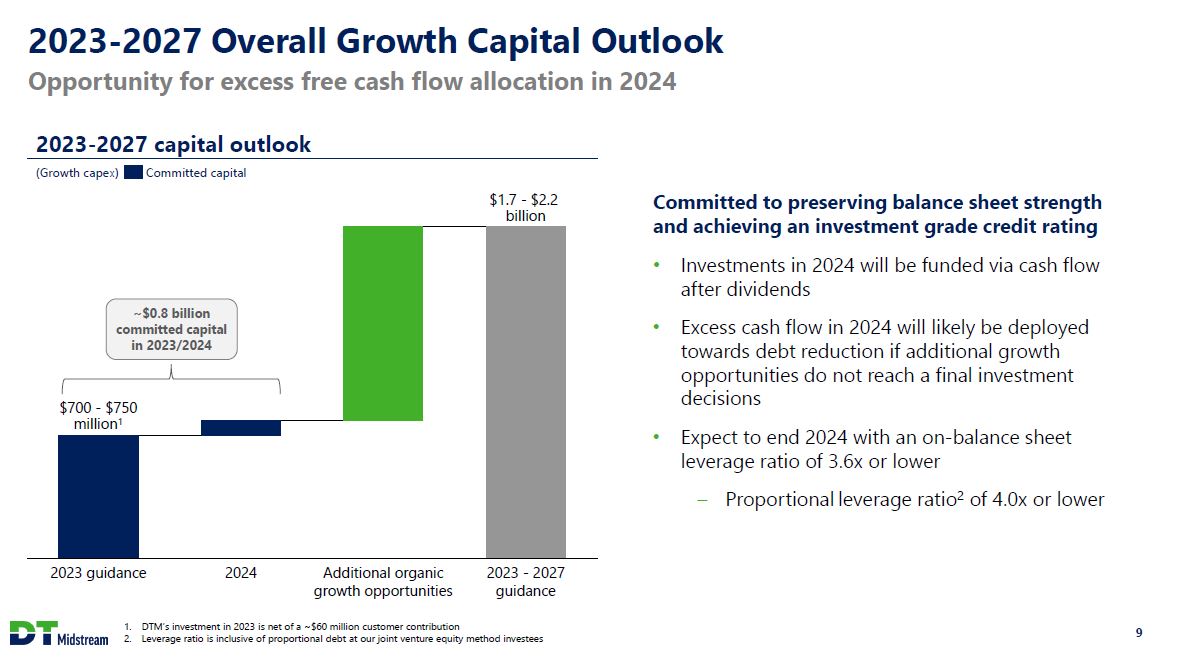

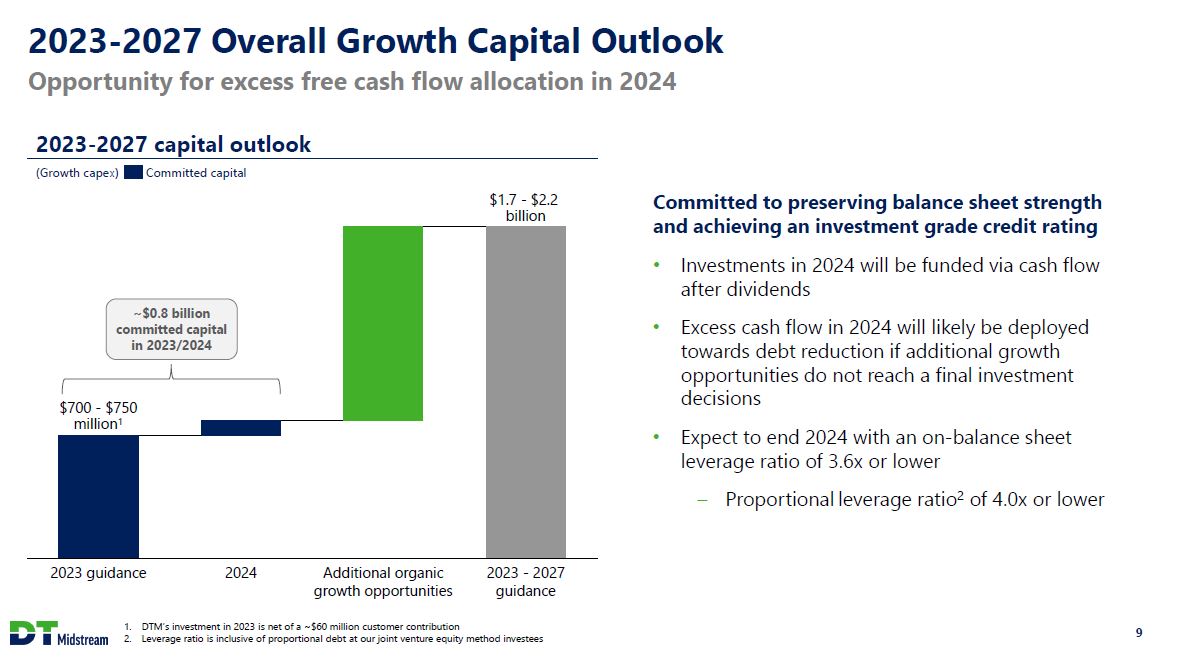

2023-2027 Overall Growth Capital Outlook Opportunity for excess free cash flow allocation in 2024 2023-2027 capital outlook (Growth capex) Committed capital ~$0.8 billion committed capital in 2023/2024 $700 - $750 million1 2023 guidance 2024 Additional organic growth opportunities. $1.7 - $2.2 billion 2023 - 2027 guidance Committed to preserving balance sheet strength and achieving an investment grade credit rating Investments in 2024 will be funded via cash flow after dividends Excess cash flow in 2024 will likely be deployed towards debt reduction if additional growth opportunities do not reach a final investment decisions Expect to end 2024 with an on-balance sheet leverage ratio of 3.6x or lower Proportional leverage ratio2 of 4.0x or lower 1. DTM's investment in 2023 is net of a ~$60 million customer contribution 2. Leverage ratio is inclusive of proportional debt at our joint venture equity method investees 9

Strong Organic Opportunities Across Our Existing Footprint Asset 2023-2027 commercial focus Overview Pipeline LEAP Active discussions for expansions up to ~3 Bcf/d Connecting growing Haynesville supply with growing LNG demand Stonewall Active discussions with existing and new customers for expansion opportunities Providing incremental Appalachia pipeline takeaway to East Coast LNG and Gulf Coast markets NEXUS Generation Pipeline interconnection New supply connections; hydraulic optimization Providing Ohio utility and industrial corridor access to NEXUS supply Millennium Recently completed open season for potential expansion opportunity Enabling additional supply into New York and New England markets through compression expansion Gathering Blue Union Active discussions for gathering and treating expansion opportunities Serving growing production from existing customers; step out expansions to connect new customers Appalachia Gathering Active discussions for further expansion Serving growing production from existing customers Ohio Utica Initial buildout of new trunkline and gathering network Emerging resource development in Ohio Utica Tioga Active discussions regarding full-scale development Supporting new drilling activity in undeveloped acreage Energy Transition Carbon Capture and Sequestration Continue to advance Louisiana CCS opportunity towards final investment decision New project development Permanently sequestering CO2 from DTM treating assets; supported by 45Q tax credit Leveraging strong expertise to advance CCS in new regions Hydrogen Advance hydrogen hub project concepts Work with strategic partner to identify and advance development opportunities Commercializing hydrogen transportation, storage and production 10

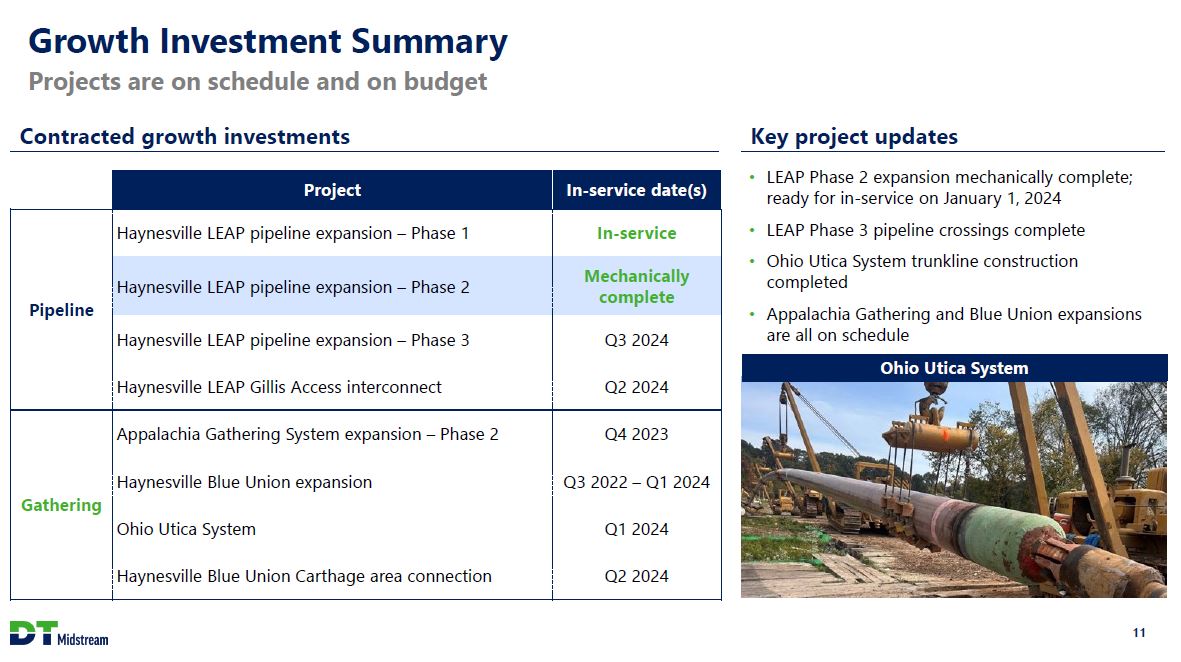

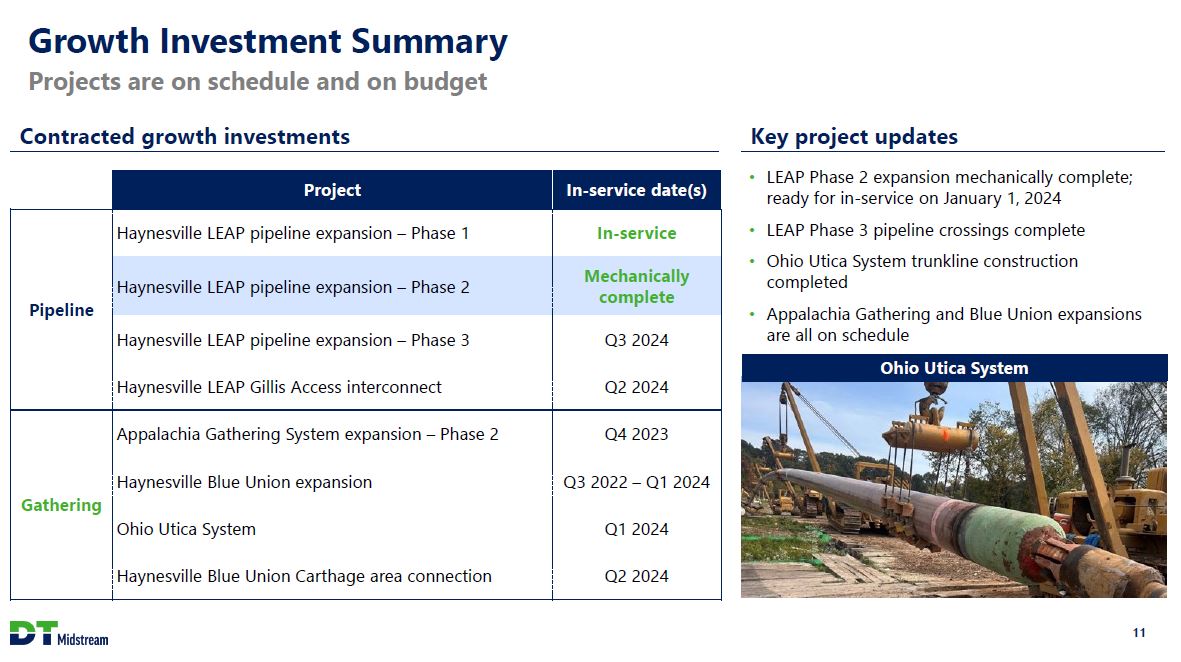

Growth Investment Summary Projects are on schedule and on budget Contracted growth investments Project In-service date(s) Pipeline Haynesville LEAP pipeline expansion Phase 1 In-service Haynesville LEAP pipeline expansion Phase 2 Mechanically complete Haynesville LEAP pipeline expansion Phase 3 Q3 2024 Haynesville LEAP Gillis Access interconnect Q2 2024 Gathering Appalachia Gathering System expansion Phase 2 Q4 2023 Haynesville Blue Union expansion Q3 2022 Q1 2024 Ohio Utica System Q1 2024 Haynesville Blue Union Carthage area connection Q2 2024 Key project updates LEAP Phase 2 expansion mechanically complete; ready for in-service on January 1, 2024 LEAP Phase 3 pipeline crossings complete Ohio Utica System trunkline construction completed Appalachia Gathering and Blue Union expansions are all on schedule Ohio Utica System 11

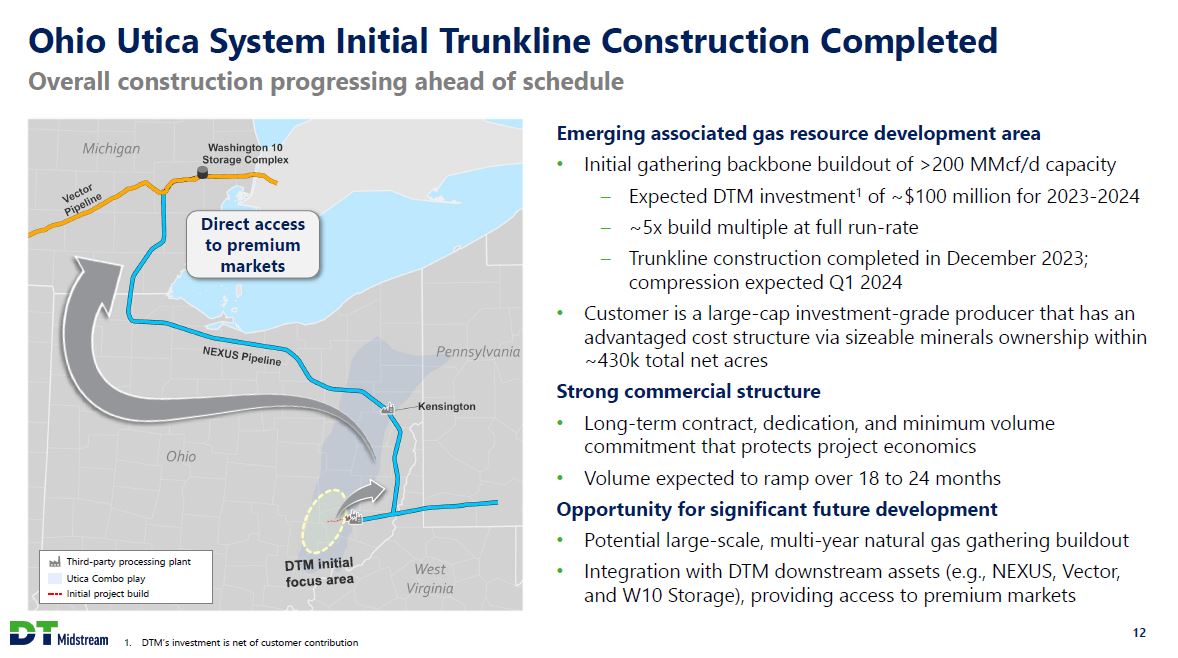

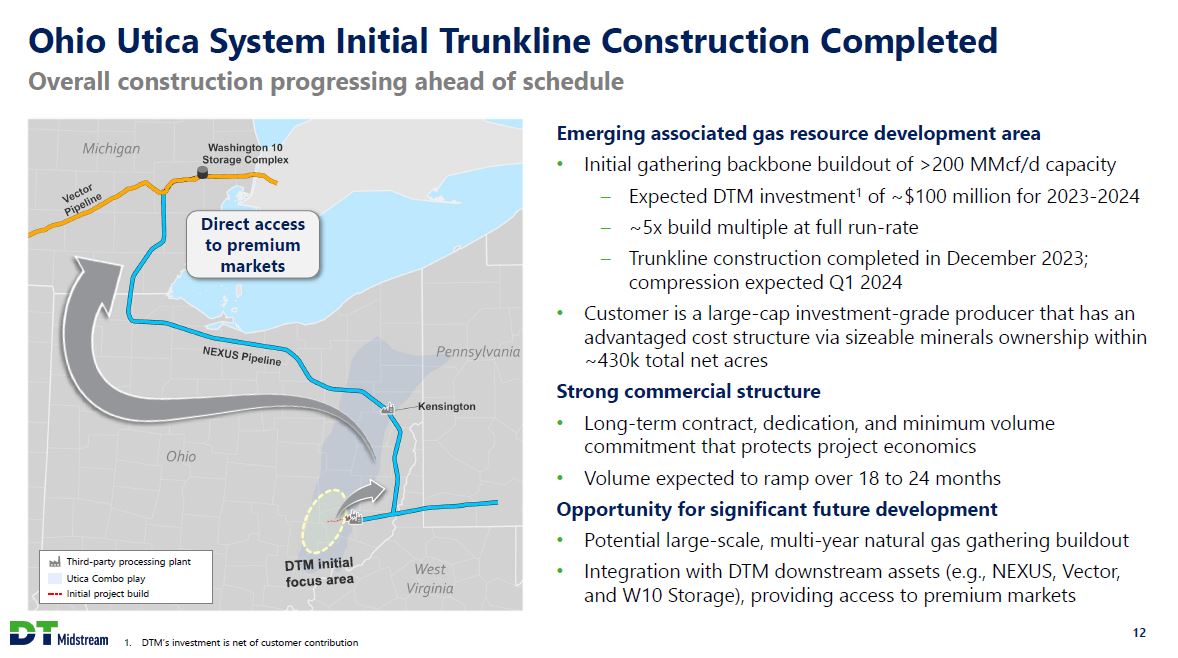

Ohio Utica System Initial Trunkline Construction Completed Overall construction progressing ahead of schedule Emerging associated gas resource development area Initial gathering backbone buildout of >200 MMcf/d capacity Expected DTM investment1 of ~$100 million for 2023-2024 ~5x build multiple at full run-rate Trunkline construction completed in December 2023; compression expected Q1 2024 Customer is a large-cap investment-grade producer that has an advantaged cost structure via sizeable minerals ownership within ~430k total net acres Strong commercial structure Long-term contract, dedication, and minimum volume commitment that protects project economics Volume expected to ramp over 18 to 24 months Opportunity for significant future development Potential large-scale, multi-year natural gas gathering buildout Integration with DTM downstream assets (e.g., NEXUS, Vector, and W10 Storage), providing access to premium markets 1. DTM's investment is net of customer contribution 12

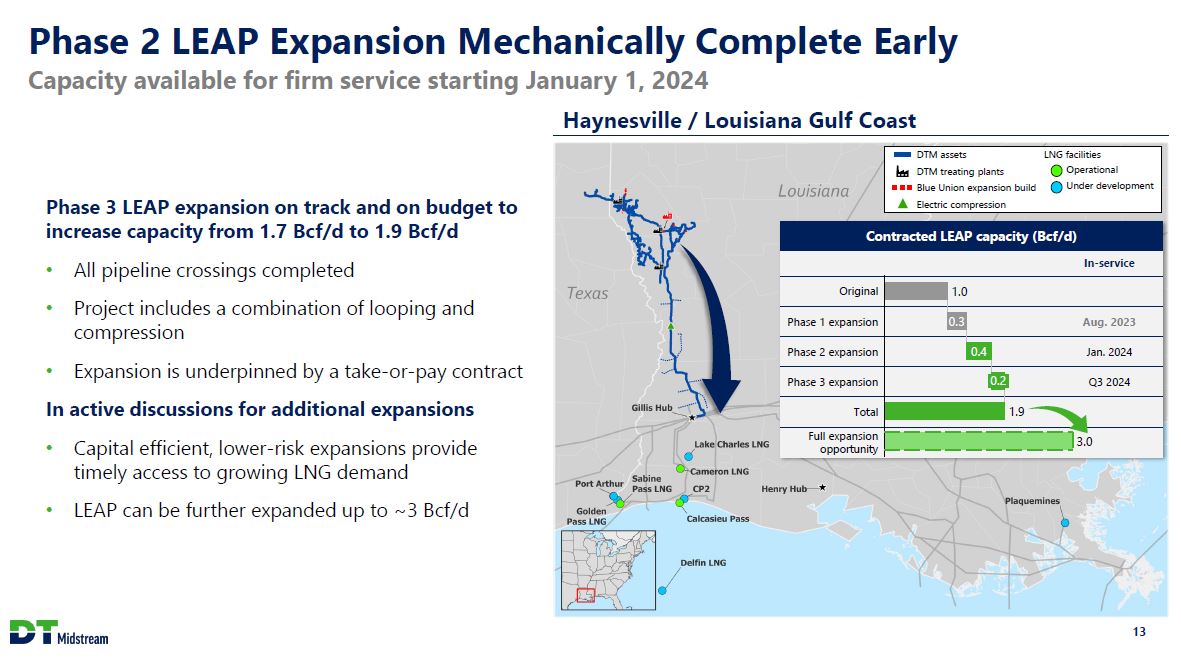

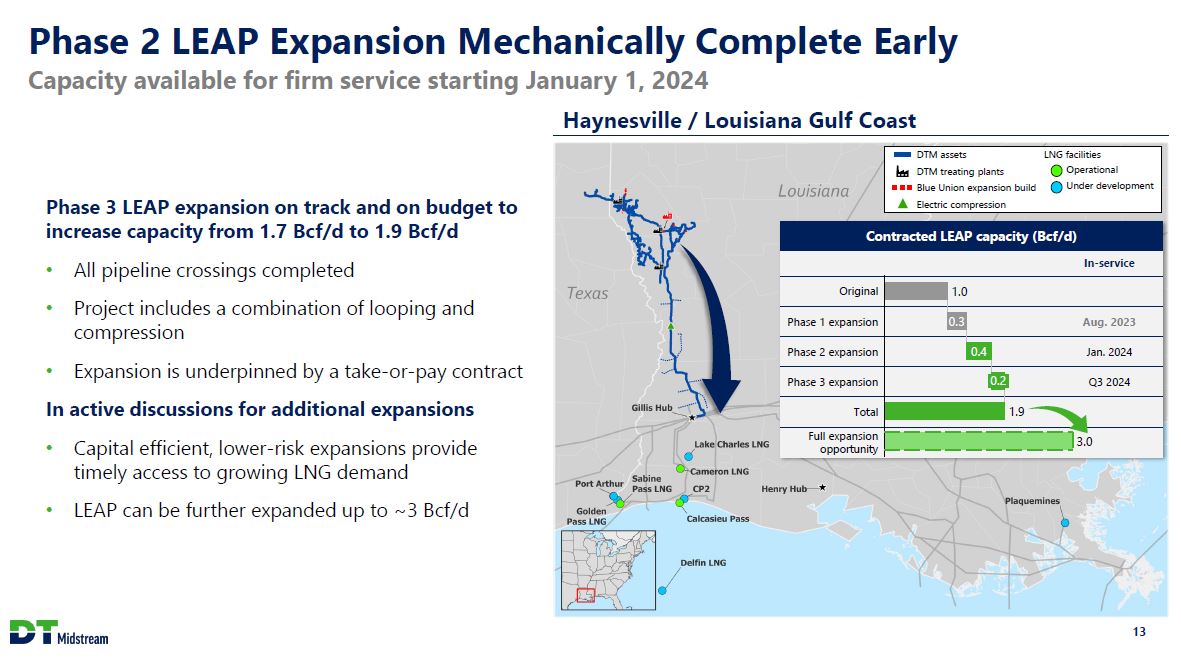

Phase 2 LEAP Expansion Mechanically Complete Early Capacity available for firm service starting January 1, 2024 Phase 3 LEAP expansion on-track and on-budget to increase capacity from 1.7 Bcf/d to 1.9 Bcf/d All pipeline crossings completed Project includes a combination of looping and compression Expansion is underpinned by a take-or-pay contract In active discussions for additional expansions Capital efficient, lower-risk expansions provide timely access to growing LNG demand LEAP can be further expanded up to ~3 Bcf/d Haynesville / Louisiana Gulf Coast DTM assets DTM treating plants Blue Union expansion build Electric compression LNG facilities Operational Under development Contracted LEAP capacity (Bcf/d) Original 1.0 Phase 1 expansion 0.3 Phase 2 expansion 0.4 Phase 3 expansion 0.2 Total 1.9 Full expansion opportunity 3.0 In-service Aug. 2023 Jan. 2024 Q3 2024 13

DTM Assets are Strategically Located to Support Growing Demand LEAP is directly interconnected to ~6 Bcf/d of incremental new LNG export demand growth 1 2 Adding new supply and demand connectivity to Haynesville system to support LNG demand wave 1 New 400 MMcf/d supply interconnect with 3rd-party processing plant in Carthage area on Blue Union; in-service date of Q2 2024 2 Building new 1 Bcf/d interconnect with Gillis Access project on LEAP; in-service date of Q2 2024 Increasing LEAP's market interconnections by ~40% LEAP interconnects Capacity (Bcf/d) LNG facility / market Transco 0.5 Louisiana Industrial / LNG corridor Cameron 0.25 Cameron LNG Creole Trail 1.0 Sabine Pass LNG Texas Eastern 0.75 Calcasieu Pass LNG Targa 0.1 Industrial Total 2.6 Bcf/d TC Energy Gillis Access (Q2 2024) 1.0 Louisiana Industrial / LNG corridor Total future 3.6 Bcf/d 14

Louisiana Carbon Capture and Sequestration Advancing our energy transition platform Louisiana CCS project area DTM assets Operating DTM treating plants DTM treating plant under construction Utilizing CO2 from DTM owned treating facilities Leveraging our strong expertise and integrated asset platform Project scope includes capture equipment, a new CO2 pipeline and storage development Targeting geological storage formation within 30-40 miles of DTM's treating plants and capacity of over 1 million metric tons per annum Class VI application review is proceeding as planned Dual benefit of attractive organic growth and meaningful emissions reduction Economics are fully supported by 45Q tax credit Supports carbon neutral "wellhead to water" service offering on LEAP Reduces DTM emissions in pursuit of net zero by 2050 Project Timeline Class VI well permit application filed Q4 2022 Class V test well permit application filed Q2 2023 Drill Class V well Q1 2024 Final investment decision 1H 2024 Expected Class VI well permit approval Q4 2024 Expected project in-service Q4 2025 15

Committed to a Leading ESG Program Environmental Continuing to advance CCS opportunity in Louisiana Advancing hydrogen development opportunities with strategic partnership and participation in hydrogen hub initiatives Social Established $4 million charitable fund for community investment Implemented talent management program that seeks diverse and creative talent Continue to strengthen safety standards and protocols based on industry best practices Governance Independent and diverse board Long-term incentive plans tied to total shareholder return Board committee focused on ESG The use by DT Midstream of any MSCI ESG Research LLC or its affiliates ("MSCI") data, and the use of MSCI logos, trademarks, service marks or index names herein, do not constitute a sponsorship, endorsement, recommendation, or promotion of DT Midstream by MSCI. MSCI services and data are the property of MSCI or its information providers, and are provided 'as-is' and without warranty. MSCI names and logos are trademarks or service marks of MSCI. 16

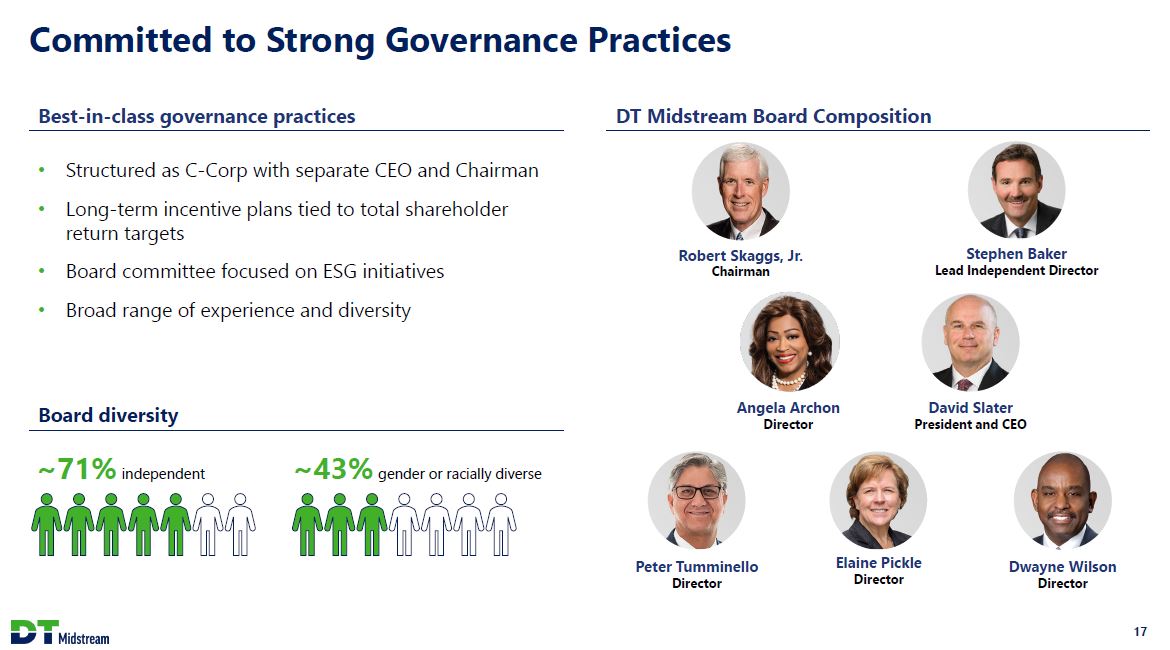

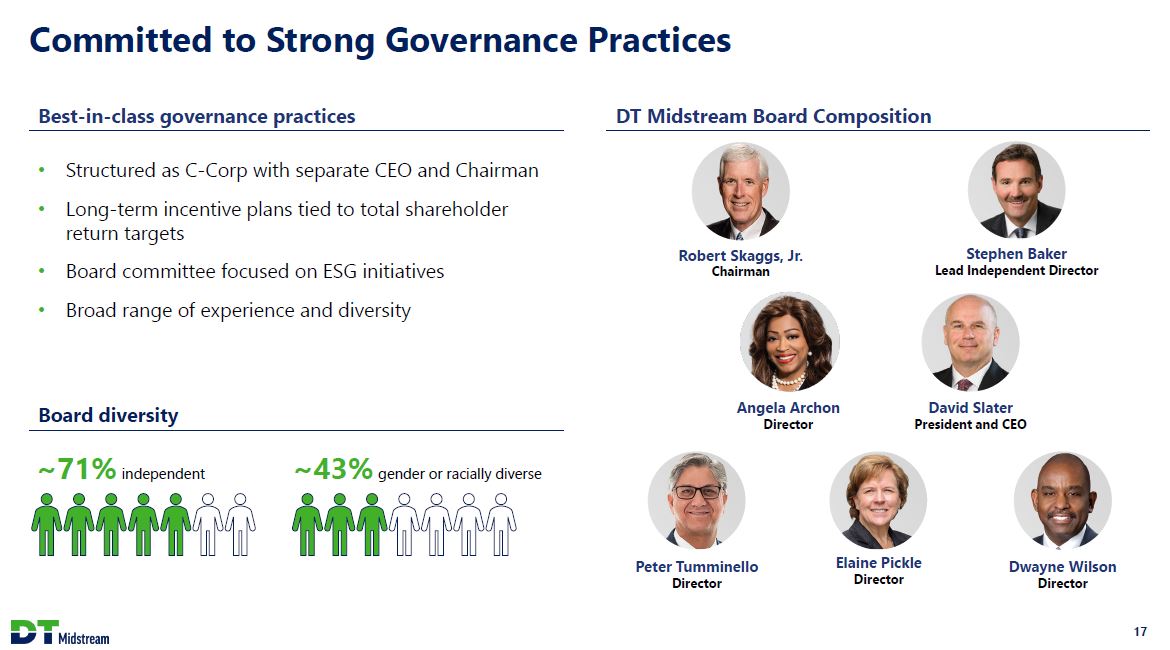

Committed to Strong Governance Practices Best-in-class governance practices Structured as C-Corp with separate CEO and Chairman Long-term incentive plans tied to total shareholder return targets Board committee focused on ESG initiatives Broad range of experience and diversity Board diversity ~71% independent ~43% gender or racially diverse DT Midstream Board Composition Robert Skaggs, Jr. Chairman Stephen Baker Lead Independent Director Angela Archon Director David Slater President and CEO Peter Tumminello Director Elaine Pickle Director Dwayne Wilson Director 17

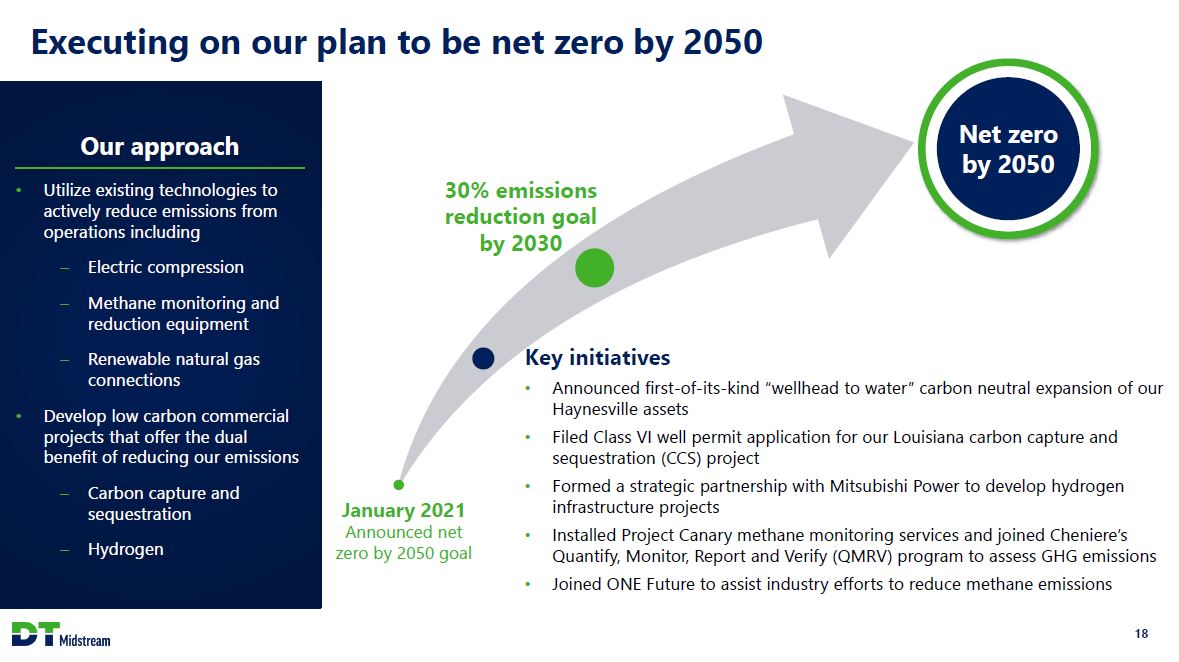

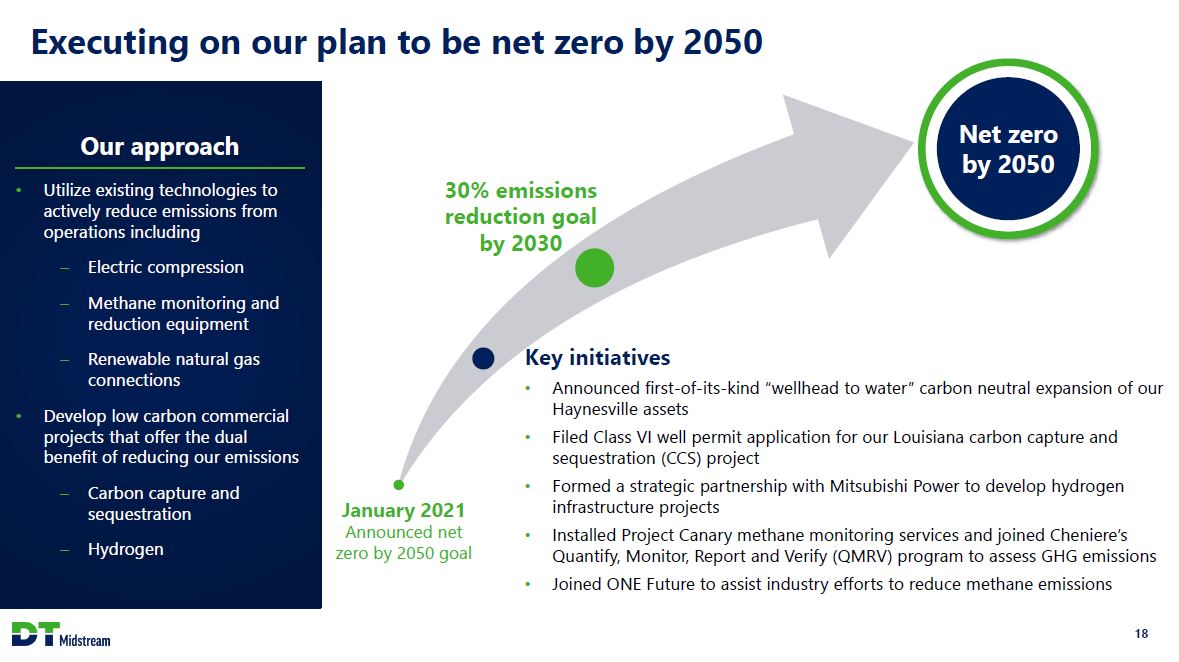

Executing on our plan to be net zero by 2050 Our approach Utilize existing technologies to actively reduce emissions from operations including Electric compression Methane monitoring and reduction equipment Renewable natural gas connections Develop low carbon commercial projects that offer the dual benefit of reducing our emissions Carbon capture and sequestration Hydrogen Key initiatives Announced first-of-its-kind "wellhead to water" carbon neutral expansion of our Haynesville assets Filed Class VI well permit application for our Louisiana carbon capture and sequestration (CCS) project Formed a strategic partnership with Mitsubishi Power to develop hydrogen infrastructure projects Installed Project Canary methane monitoring services and joined Cheniere's Quantify, Monitor, Report and Verify (QMRV) program to assess GHG emissions Joined ONE Future to assist industry efforts to reduce methane emissions January 2021 Announced net zero by 2050 goal 30% emissions reduction goal by 2030 Net zero by 2050 18

Focused on Impactful Sustainability Initiatives 2023 Corporate Sustainability Report Highlights MSCI upgraded DTM to the second highest ESG rating of "AA" Reduced year-over-year employee safety incident rate by 43% Doubled the percentage of ethnically diverse leadership Increased workforce diversity by 44% Created Chief Diversity Officer role to champion diversity initiatives 2,752 volunteer hours logged by employees to support local communities Sustainability and Climate Risks integrated into Enterprise Risk Management 99% compressor availability delivers best in class customer service Link to full report: Corporate Sustainability Report 2023 19

Appendix DT Midstream

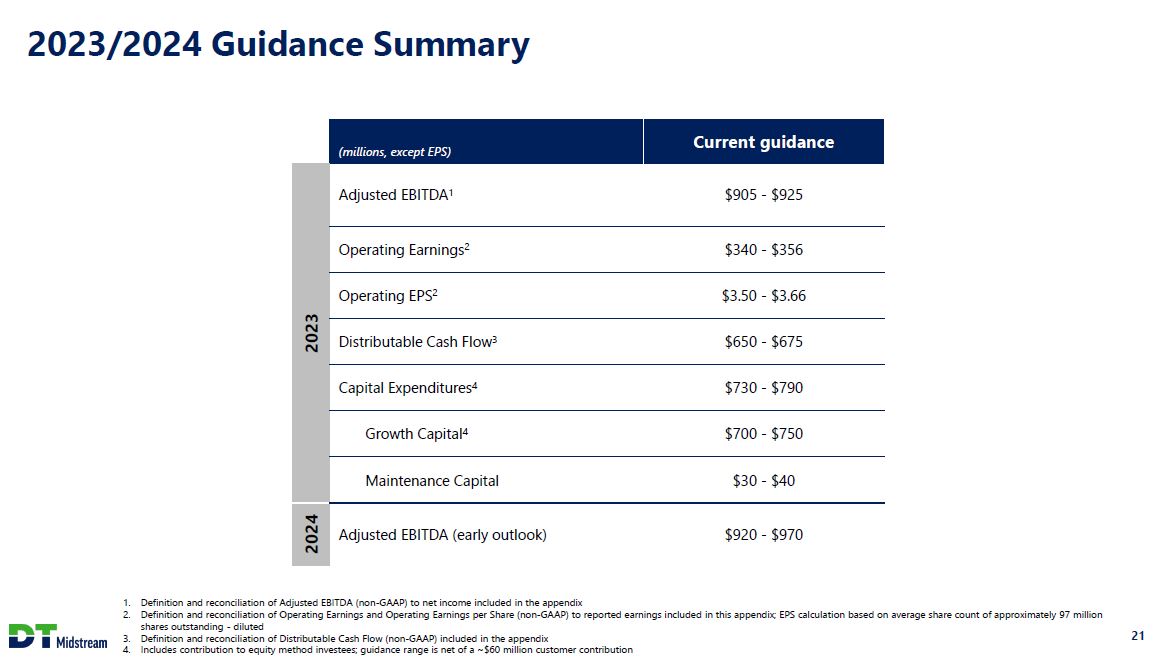

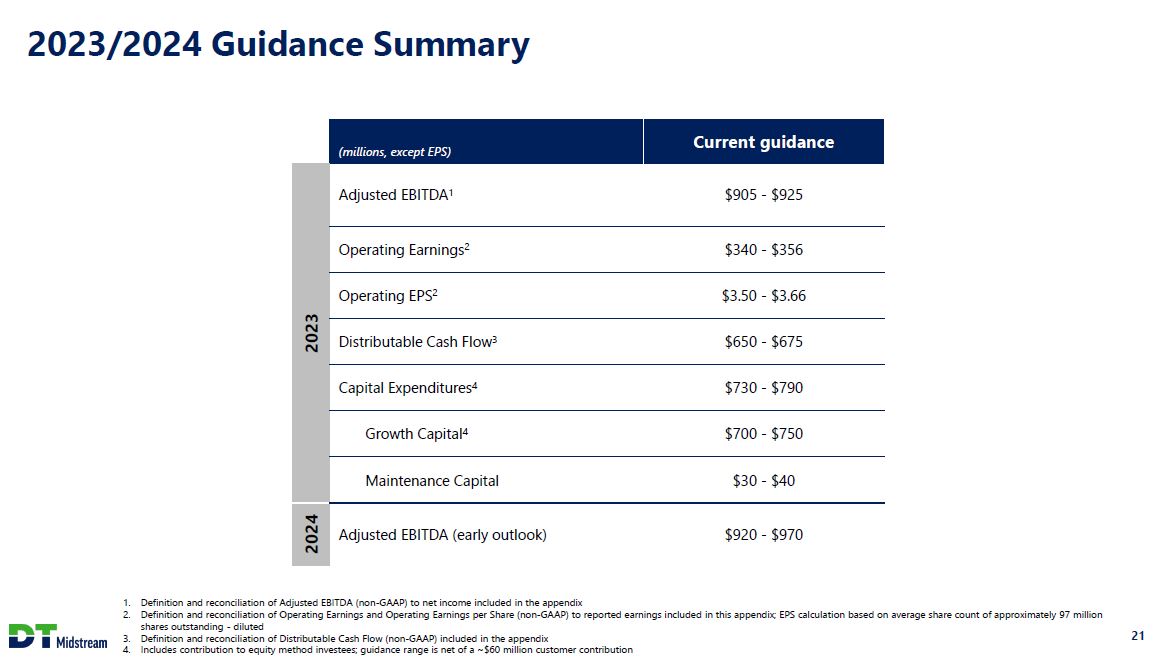

2023/2024 Guidance Summary (millions, except EPS) Current guidance 2023 Adjusted EBITDA1 $905 - $925 Operating Earnings2 $340 - $356 Operating EPS2 $3.50 - $3.66 Distributable Cash Flow3 $650 - $675 Capital Expenditures4 $730 - $790 Growth Capital4 $700 - $750 Maintenance Capital $30 - $40 2024 Adjusted EBITDA (early outlook) $920 - $970 1. Definition and reconciliation of Adjusted EBITDA (non-GAAP) to net income included in the appendix 2. Definition and reconciliation of Operating Earnings and Operating Earnings per Share (non-GAAP) to reported earnings included in this appendix; EPS calculation based on average share count of approximately 97 million shares outstanding - diluted 3. Definition and reconciliation of Distributable Cash Flow (non-GAAP) included in the appendix 4. Includes contribution to equity method investees; guidance range is net of a ~$60 million customer contribution 21

Non-GAAP Definitions Adjusted EBITDA and Distributable Cash Flow (DCF) are non-GAAP measures Adjusted EBITDA is defined as GAAP net income attributable to DT Midstream before expenses for interest, taxes, depreciation and amortization, and loss from financing activities, further adjusted to include our proportional share of net income from our equity method investees (excluding interest, taxes, depreciation and amortization), and to exclude certain items we consider non-routine. We believe Adjusted EBITDA is useful to us and external users of our financial statements in understanding our operating results and the ongoing performance of our underlying business because it allows our management and investors to have a better understanding of our actual operating performance unaffected by the impact of interest, taxes, depreciation, amortization and non-routine charges noted in the table below. We believe the presentation of Adjusted EBITDA is meaningful to investors because it is frequently used by analysts, investors and other interested parties in our industry to evaluate a company's operating performance without regard to items excluded from the calculation of such measure, which can vary substantially from company to company depending on accounting methods, book value of assets, capital structure and the method by which assets were acquired, among other factors. We use Adjusted EBITDA to assess our performance by reportable segment and as a basis for strategic planning and forecasting. Distributable Cash Flow (DCF) is calculated by deducting earnings from equity method investees, depreciation and amortization attributable to noncontrolling interests, cash interest expense, maintenance capital investment (as defined below), and cash taxes from, and adding interest expense, income tax expense, depreciation and amortization, certain items we consider non-routine and dividends and distributions from equity method investees to, Net Income Attributable to DT Midstream. Maintenance capital investment is defined as the total capital expenditures used to maintain or preserve assets or fulfill contractual obligations that do not generate incremental earnings. We believe DCF is a meaningful performance measurement because it is useful to us and external users of our financial statements in estimating the ability of our assets to generate cash earnings after servicing our debt, paying cash taxes and making maintenance capital investments, which could be used for discretionary purposes such as common stock dividends, retirement of debt or expansion capital expenditures. Adjusted EBITDA and DCF are not measures calculated in accordance with GAAP and should be viewed as a supplement to and not a substitute for the results of operations presented in accordance with GAAP. There are significant limitations to using Adjusted EBITDA and DCF as a measure of performance, including the inability to analyze the effect of certain recurring and non-recurring items that materially affect our net income or loss. Additionally, because Adjusted EBITDA and DCF exclude some, but not all, items that affect net income and are defined differently by different companies in our industry, Adjusted EBITDA and DCF do not intend to represent net income attributable to DT Midstream, the most comparable GAAP measure, as an indicator of operating performance and are not necessarily comparable to similarly titled measures reported by other companies. Reconciliation of net income attributable to DT Midstream to Adjusted EBITDA or DCF as projected for full-year 2023 is not provided. We do not forecast net income as we cannot, without unreasonable efforts, estimate or predict with certainty the components of net income. These components, net of tax, may include, but are not limited to, impairments of assets and other charges, divestiture costs, acquisition costs, or changes in accounting principles. All of these components could significantly impact such financial measures. At this time, management is not able to estimate the aggregate impact, if any, of these items on future period reported earnings. Accordingly, we are not able to provide a corresponding GAAP equivalent for Adjusted EBITDA or DCF. 22

Non-GAAP Definitions Operating Earnings and Operating Earnings per share are non-GAAP measures Use of Operating Earnings Information - Operating Earnings exclude non-recurring items, certain mark-to-market adjustments and discontinued operations. DT Midstream management believes that Operating Earnings provide a more meaningful representation of the company's earnings from ongoing operations and uses Operating Earnings as the primary performance measurement for external communications with analysts and investors. Internally, DT Midstream uses Operating Earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DT Midstream provides guidance for future period Operating Earnings. It is likely that certain items that impact the company's future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items (i.e., future non-recurring items, certain mark-to-market adjustments and discontinued operations). These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. 23

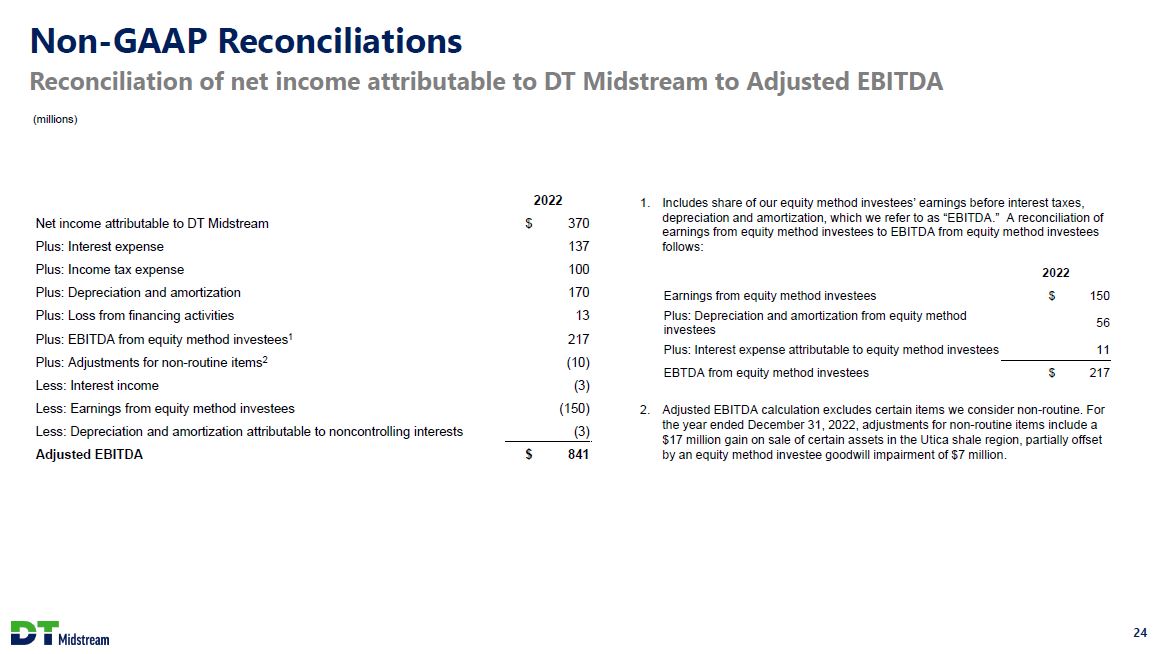

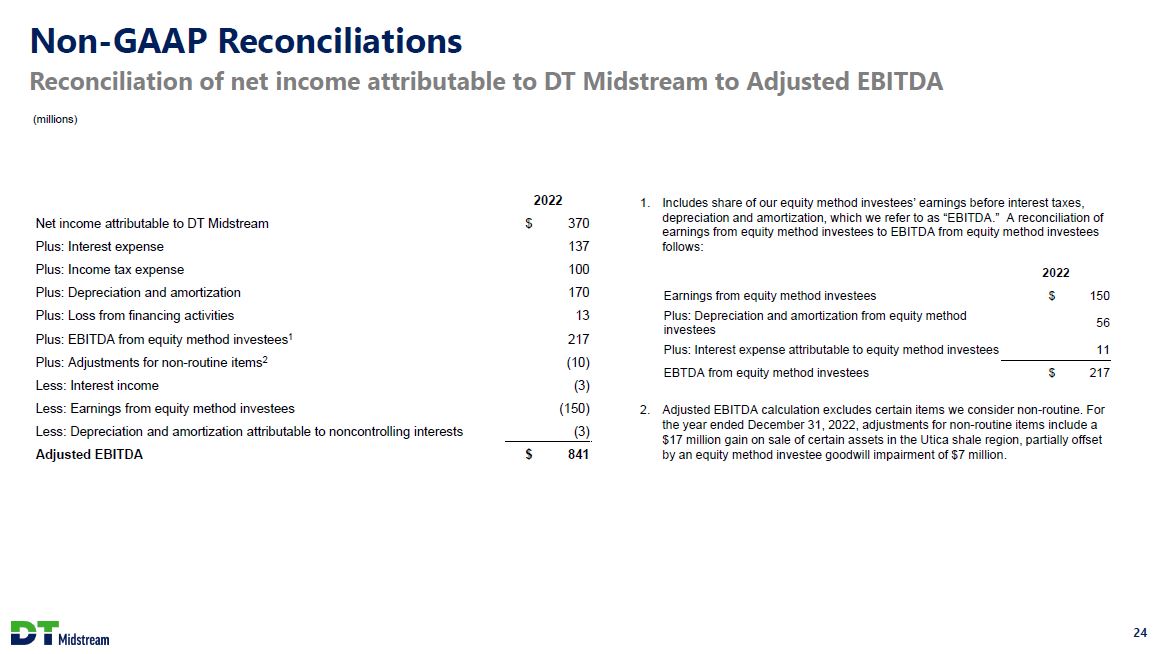

Non-GAAP Reconciliations Reconciliation of net income attributable to DT Midstream to Adjusted EBITDA (millions) 2022 Net income attributable to DT Midstream $370 Plus: Interest expense 137 Plus: Income tax expense 100 Plus: Depreciation and amortization 170 Plus: Loss from financing activities 13 Plus: EBITDA from equity method investees1 217 Plus: Adjustments for non-routine items2 (10) Less: Interest income (3) Less: Earnings from equity method investees (150) Less: Depreciation and amortization attributable to noncontrolling interests (3) Adjusted EBITDA $841 1. Includes share of our equity method investees' earnings before interest taxes, depreciation and amortization, which we refer to as "EBITDA." A reconciliation of earnings from equity method investees to EBITDA from equity method investees follows: 2022 Earnings from equity method investees $150 Plus: Depreciation and amortization from equity method investees 56 Plus: Interest expense attributable to equity method investees 11 EBTDA from equity method investees $217 2. Adjusted EBITDA calculation excludes certain items we consider non-routine. For the year ended December 31, 2022, adjustments for non-routine items include a $17 million gain on sale of certain assets in the Utica shale region, partially offset by an equity method investee goodwill impairment of $7 million. 24