Exhibit 99.1

Wag.co

2 2 This presentation is the confidential information of Wag Labs, Inc. and may be used by recipient for the sole purpose of eval uat ing a possible transaction between recipient and Wag Labs, Inc. These materials do not constitute an offer or solicitation to sell or purchase any securities and are not a c ommitment by Wag Labs, Inc. or CHW Acquisition Corporation (or any affiliate) to provide or arrange any financing for any transaction or to purchase any securit y i n connection therewith. By receiving this information, recipient and recipient’s affiliates agree to maintain the confidentiality of the information con tained herein. Recipient and recipient’s affiliates are strictly prohibited from reproducing any portion of this presentation or disclosing the content to any third party. This presentation is subject to updating, completion, revision, verification and further amendment. These materials were comp ile d on a confidential basis for use by Wag Labs, Inc. in presenting certain materials to specific persons and not with a view to public disclosure or filing thereof und er state or federal securities laws. These materials were designed for use by specific persons familiar with the industries in which Wag Labs, Inc. operates. These materials are not intended to provide the sole basis for evaluating and should not be considered a recommendation with respect to, any transaction or other matter. Any financial and operating forecasts and projections contained herein represent certain estimates of Wag Labs, Inc. as of th e d ate thereof. Wag Labs, Inc.’s independent public accountants have not examined, reviewed or compiled the forecasts or projections and, accordingly, does not express an op inion or other form of assurance with respect thereto. Furthermore none of Wag Labs, Inc. or its management team can give any assurance that the forecasts or proje cti ons contained herein accurately represents Wag Labs, Inc.’s future operations or financial condition. Such information is subject to a wide variety of signif ica nt business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in any prospective financial informat ion . Accordingly, there can be no assurance that any prospective results are indicative of the future performance of Wag Labs, Inc. or that actual results will not differ mat eri ally from those presented in these materials. No representation or warranty, express or implied, is made as to the accuracy or completeness of such information and nothing co nta ined herein is, or shall be relied upon as, a representation, whether as to the past, the present or the future. Wag Labs, Inc. assumes no obligation to update or otherwis e r evise these materials. CONFIDENTIAL Legal Disclaimer

Business Combination Highlights 3 Wag!: Visionary Management Team Garrett Smallwood Chief Executive Officer Adam Storm President & Chief Product Officer Alec Davidian Chief Financial Officer CHW: Consumer Industry Veterans and Deal Making Expertise Paul Norman President Jonah Raskas Co - CEO Mark Grundman Co - CEO Wag! Highlights CHW Investment Criteria ✔ Highly innovative industry disruptor ✔ Proven ability to unlock growth ✔ Mobile first, on - demand platform ✔ Leading industry brand ✔ Seamless customer experience ✔ Outsized competitive advantages ✔ High Barriers to Entry ✔ Public markets management team ✔ Sustainable earnings with significant growth CONFIDENTIAL

Business Combination Rationale CONFIDENTIAL Criteria: Focus on Growth, Brand and Management High growth rate Sector or product category leadership Competitive advantages in technology, e - channel capability, IP or brand Scalable platform with public company readiness Highly driven and experienced management team 4

5 We believe that being busy shouldn’t stop you from owning or taking care of your pet. exists to make pet ownership possible, and bring joy to pets and those who love them.

6 6 CONFIDENTIAL Wag! was created because lonely pets deserve healthier and happier lives Leaving your pet alone at home creates stress and the existing solutions are limited Wag! exists to solve this problem Our Journey Started in 2015

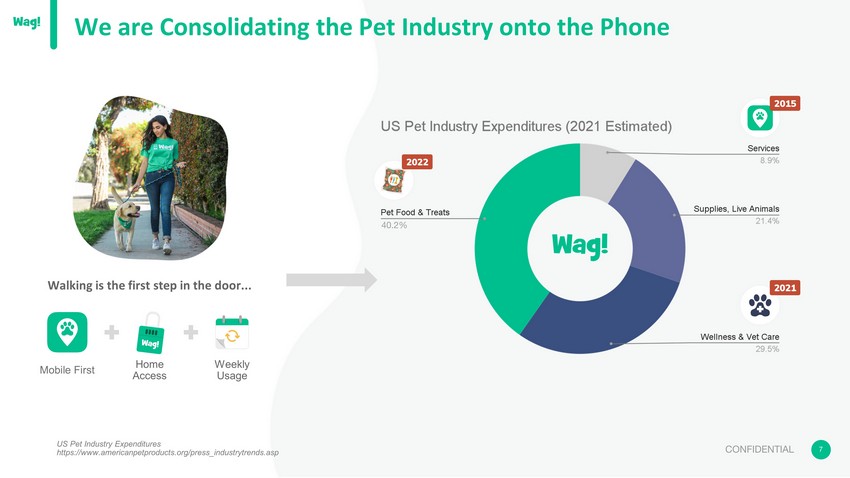

7 7 CONFIDENTIAL We are Consolidating the Pet Industry onto the Phone Walking is the first step in the door... Mobile First Home Access Weekly Usage US Pet Industry Expenditures https://www.americanpetproducts.org/press_industrytrends.asp 40.2%

8 We’re the One Stop Shop for Premium Pet Care Avg. Pet Parent Price per Unit* Dog Walking On - demand and recurring dog walks $20.00 / 30 - min walk Drop - In Visits Quick home visit for dogs and cats $15.00 / visit Boarding A sleepover for your pet in a Pet Caregivers home $59.00 / night House Sitting Overnight pet sitting in the comfort of your home $39.00 / night Training One - on - one training sessions $60.00 / in - home session Wellness Simple and affordable wellness plans and insurance comparison marketplace $42.00 / month Health 24/7 expert pet advice $30.00 / session % of Revenue* 74% 26% ● 10% discount ● 24/7 VIP Customer Service ● Top rated Pet Caregivers ● No booking fees Includes discount plans Includes unlimited pet advice Wag! Premium Benefits $9.99 / month *Avg. Pet Parent Price per Unit, % of Revenue for FY 2021 **% of Premium Subscribers as of December 2021 40% of Active Pet Parents % of Premium Subscribers** CONFIDENTIAL

9 9 CONFIDENTIAL Large, Resilient Category with No Signs of Slowdown 7% CAGR U.S. Pet Spend 2021 Estimated U.S. Pet Industry Expenditures $110B (American Pet Product Association) 2021 Wag! Services TAM $10B (American Pet Product Association) 2021 Wag! Wellness TAM $32B (American Pet Product Association) 2021 US Pet Industry Expenditures https://www.americanpetproducts.org/press_industrytrends.asp https://www.iii.org/fact - statistic/facts - statistics - pet - ownership - and - insurance https://www.statista.com/statistics/253976/pet - food - industry - expenditure - in - the - us/

10 10 CONFIDENTIAL Key Metrics 5,200 Cities 1,100,000 Pet Parents Served $300m Total Bookings Since Launch We’re Rapidly Recovering Out of The Pandemic * Includes pro forma FY2021 M&A of Pet Insurer, Petted, which closed Q3:2021 4 1 1

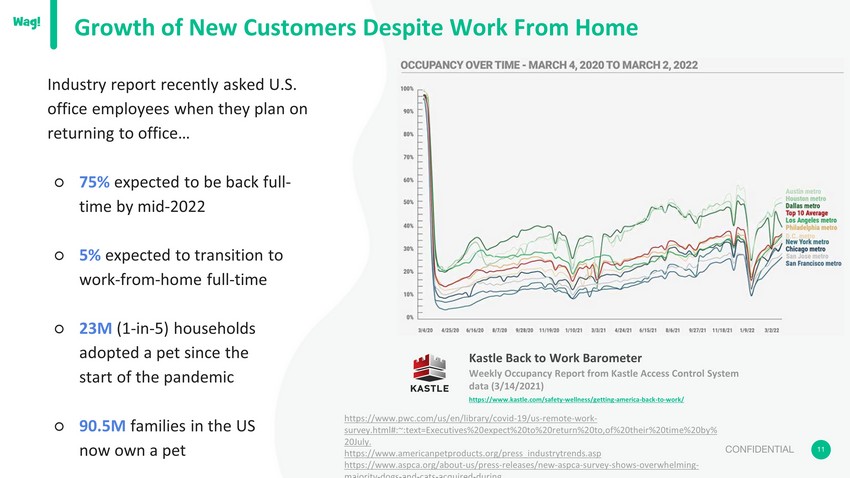

11 11 CONFIDENTIAL Kastle Back to Work Barometer Weekly Occupancy Report from Kastle Access Control System data (3/14/2021) https://www.kastle.com/safety - wellness/getting - america - back - to - work/ Growth of New Customers Despite Work From Home Industry report recently asked U.S. office employees when they plan on returning to office… ○ 75% expected to be back full - time by mid - 2022 ○ 5% expected to transition to work - from - home full - time ○ 23M (1 - in - 5) households adopted a pet since the start of the pandemic ○ 90.5M families in the US now own a pet 11 11 https://www.pwc.com/us/en/library/covid - 19/us - remote - work - survey.html#:~:text=Executives%20expect%20to%20return%20to,of%20their%20time%20by% 20July. https://www.americanpetproducts.org/press_industrytrends.asp https://www.aspca.org/about - us/press - releases/new - aspca - survey - shows - overwhelming - majority - dogs - and - cats - acquired - during

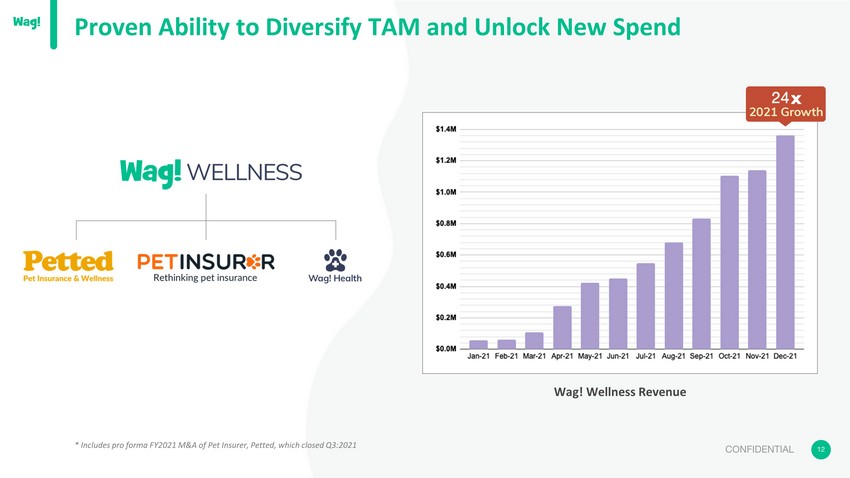

12 12 CONFIDENTIAL Proven Ability to Diversify TAM and Unlock New Spend Wag! Wellness Revenue * Includes pro forma FY2021 M&A of Pet Insurer, Petted, which closed Q3:2021 24

The Wag! Platform 13

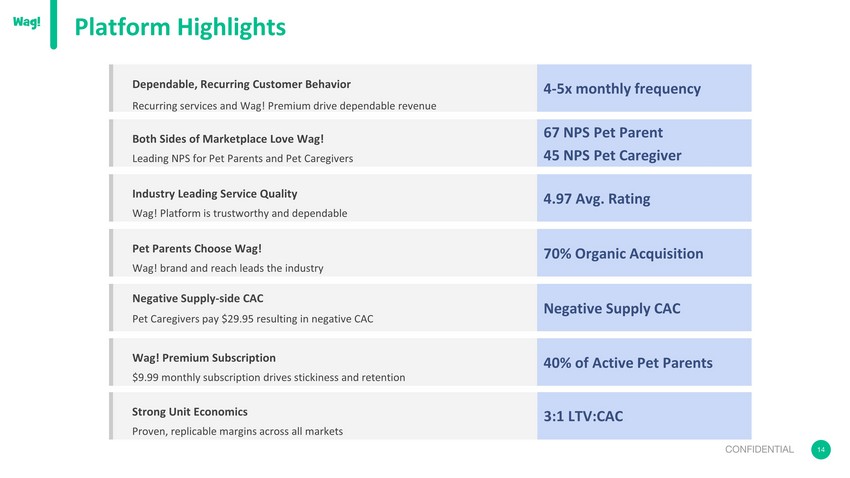

14 Dependable, Recurring Customer Behavior Recurring services and Wag! Premium drive dependable revenue 4 - 5x monthly frequency Both Sides of Marketplace Love Wag! Leading NPS for Pet Parents and Pet Caregivers 67 NPS Pet Parent 45 NPS Pet Caregiver Pet Parents Choose Wag! Wag! brand and reach leads the industry 70% Organic Acquisition Wag! Premium Subscription $9.99 monthly subscription drives stickiness and retention 40% of Active Pet Parents Strong Unit Economics Proven, replicable margins across all markets 3:1 LTV:CAC Industry Leading Service Quality Wag! Platform is trustworthy and dependable 4.97 Avg. Rating Negative Supply - side CAC Pet Caregivers pay $29.95 resulting in negative CAC Negative Supply CAC Platform Highlights CONFIDENTIAL

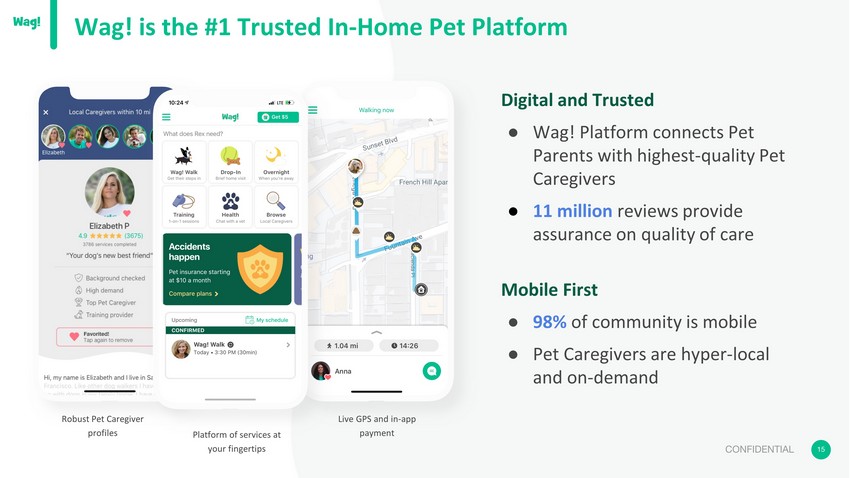

15 15 CONFIDENTIAL Robust Pet Caregiver profiles Digital and Trusted ● Wag! Platform connects Pet Parents with highest - quality Pet Caregivers ● 11 million reviews provide assurance on quality of care Mobile First ● 98% of community is mobile ● Pet Caregivers are hyper - local and on - demand Platform of services at your fingertips Live GPS and in - app payment Wag! is the #1 Trusted In - Home Pet Platform 15 15

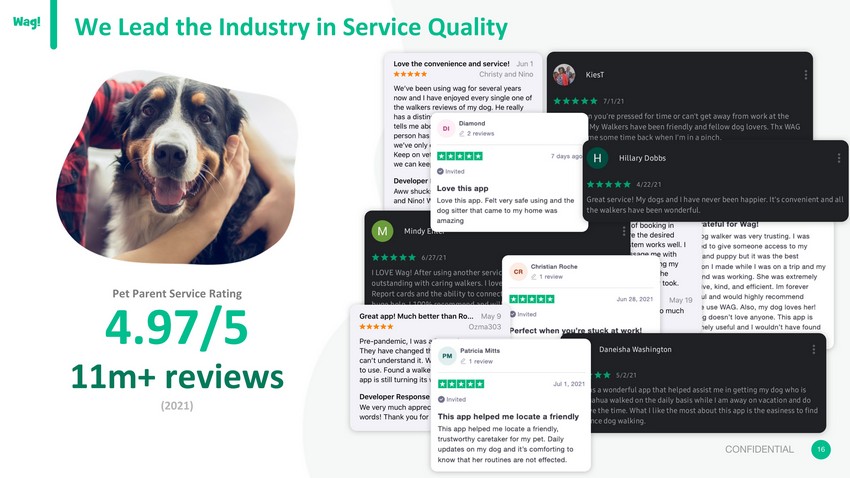

16 16 CONFIDENTIAL Pet Parent Service Rating 4.97/5 11m+ reviews (2021) We Lead the Industry in Service Quality 16 16

17 17 CONFIDENTIAL Before Wag! 90% of customers never used a dog walker We’ve Disrupted Traditional Dog Walking Now, customers use Wag! 4 - 5x per month! We’re Creating an Entirely New Market *Internal consultation survey results 2018 - 2019 **Customer frequency from 2021 cohorts

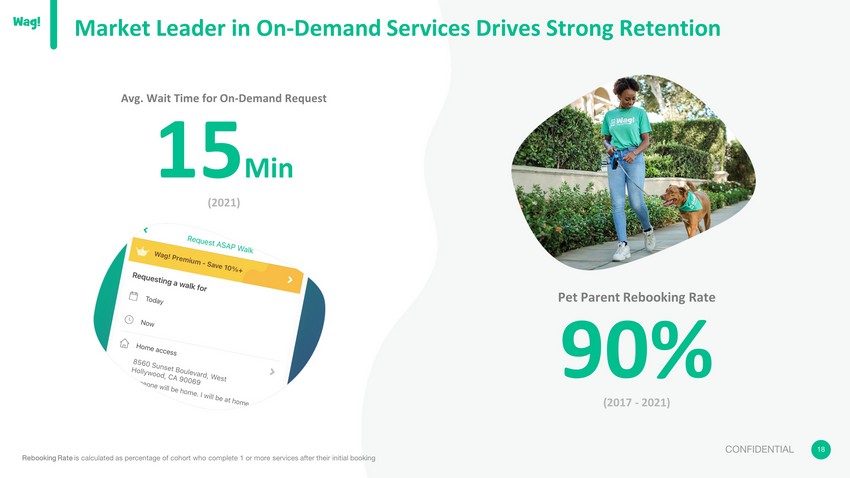

Market Leader in On - Demand Services Drives Strong Retention 18 18 CONFIDENTIAL Avg. Wait Time for On - Demand Request 15 Min (2021) 18 18 Pet Parent Rebooking Rate 90% (2017 - 2021) Rebooking Rate is calculated as percentage of cohort who complete 1 or more services after their initial booking

19 19 Attach Rate* 25% (2020 - 2021) Dog Walking Trusted, local, 5 - star dog walkers in your neighborhood Drop - In A quick home visit for dogs and cats who love having friends over Training One - on - one training sessions, over the phone or in - person Health Chat with a certified pet expert 24/7 Boarding A sleepover for your pet in a Pet Caregivers home Sitting A sleepover for your pet in the comfort of your own home Pet Insurance Compare and purchase top - rated pet wellness and insurance plans Wellness Plans Subscribe and save to premium wellness plans We’re Building the #1 Platform for Pet Wellbeing CONFIDENTIAL Attach Rate calculated as the percentage of customers who’ve completed services in 2 or more service - types on the Wag platform (Walking, Si tting & Boarding, Drop - Ins, Training, Health)

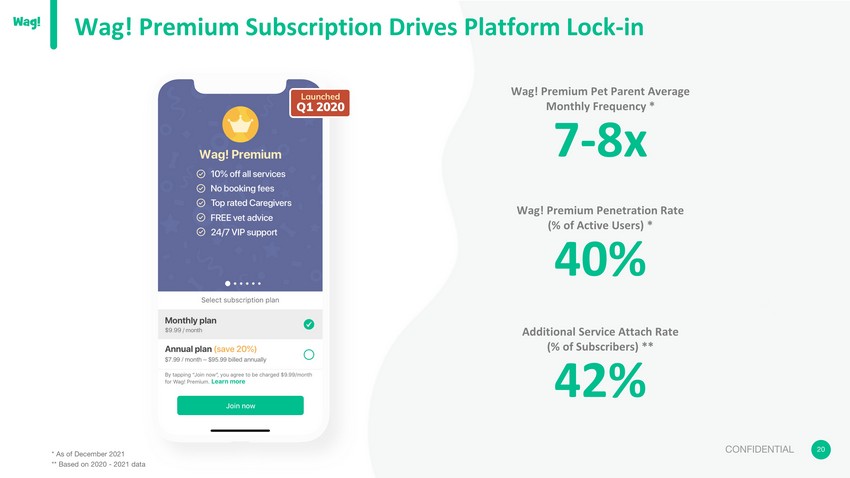

20 20 CONFIDENTIAL Wag! Premium Subscription Drives Platform Lock - in Wag! Premium Pet Parent Average Monthly Frequency * 7 - 8x Additional Service Attach Rate (% of Subscribers) ** 42% * As of December 2021 ** Based on 2020 - 2021 data Wag! Premium Penetration Rate (% of Active Users) * 40%

21 Screened, Background Checked, & Approved Pet Caregivers 400k+ (2021) Extensive Knowledge Testing Property damage insured up to $1,000,000 24/7 Customer Support 21 Screened & Background Checked CONFIDENTIAL Industry Leading Background Checks and Safety Property damage of $1,000,000 subject to applicable plan limitations

Financial Overview 22

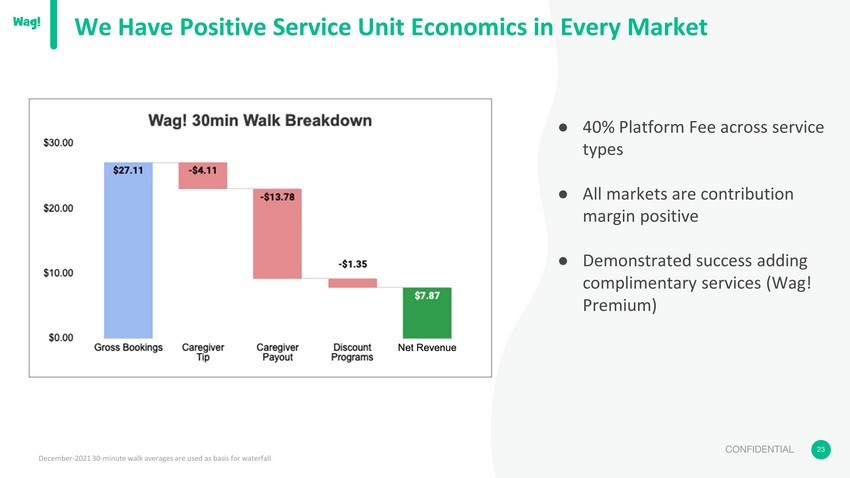

23 We Have Positive Service Unit Economics in Every Market ● 40% Platform Fee across service types ● All markets are contribution margin positive ● Demonstrated success adding complimentary services (Wag! Premium) December - 2021 30 - minute walk averages are used as basis for waterfall CONFIDENTIAL 23 23

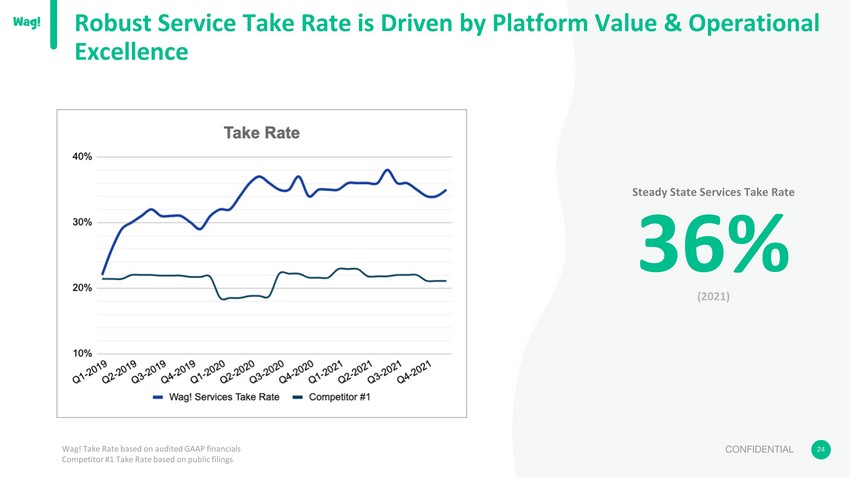

24 24 CONFIDENTIAL Steady State Services Take Rate 36% (2021) Robust Service Take Rate is Driven by Platform Value & Operational Excellence 24 24 Wag! Take Rate based on audited GAAP financials Competitor #1 Take Rate based on public filings

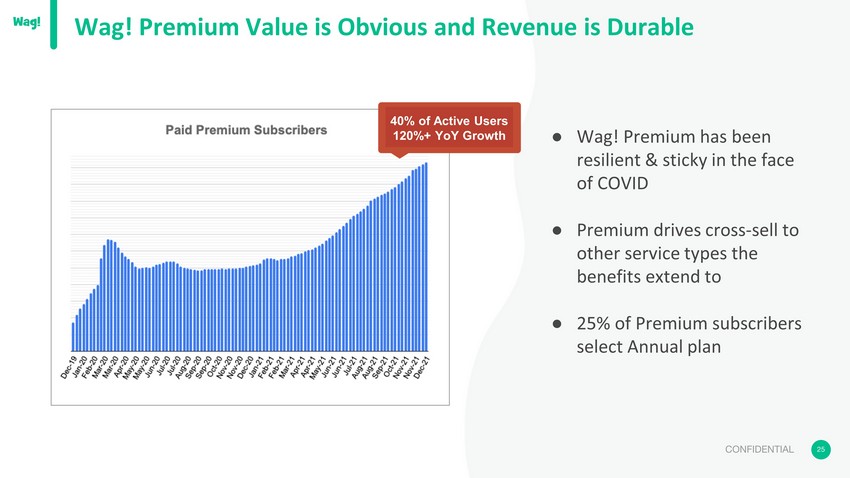

25 CONFIDENTIAL 25 ● Wag! Premium has been resilient & sticky in the face of COVID ● Premium drives cross - sell to other service types the benefits extend to ● 25% of Premium subscribers select Annual plan Wag! Premium Value is Obvious and Revenue is Durable 25 25 40% of Active Users 120%+ YoY Growth

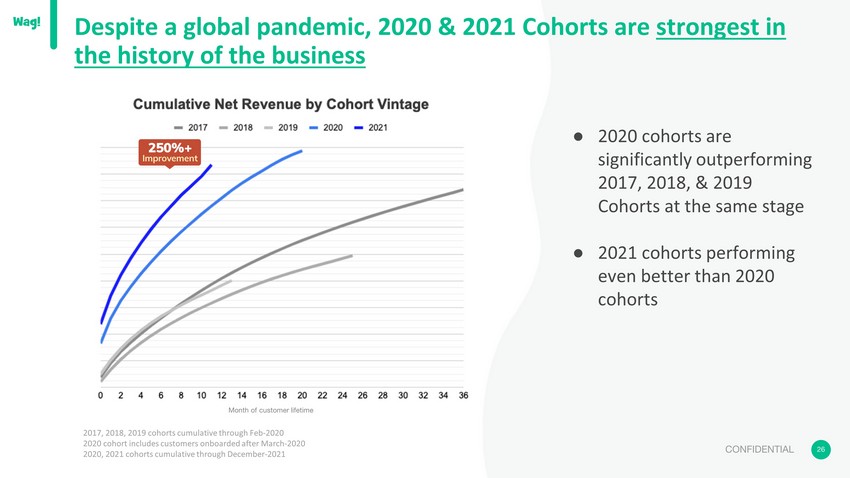

● 2020 cohorts are significantly outperforming 2017, 2018, & 2019 Cohorts at the same stage ● 2021 cohorts performing even better than 2020 cohorts 26 CONFIDENTIAL 2017, 2018, 2019 cohorts cumulative through Feb - 2020 2020 cohort includes customers onboarded after March - 2020 2020, 2021 cohorts cumulative through December - 2021 26 Month of customer lifetime Despite a global pandemic, 2020 & 2021 Cohorts are strongest in the history of the business 26 26

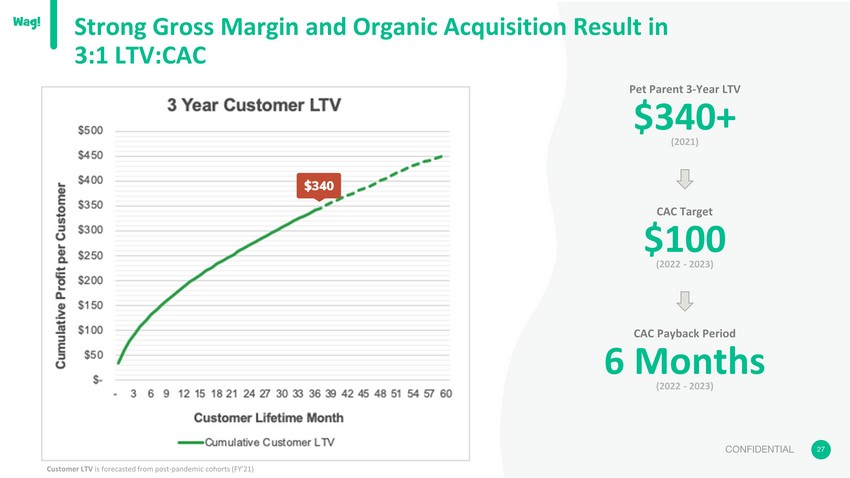

27 27 CONFIDENTIAL Pet Parent 3 - Year LTV $340+ (2021) Strong Gross Margin and Organic Acquisition Result in 3:1 LTV:CAC CAC Payback Period 6 Months (2022 - 2023) Customer LTV is forecasted from post - pandemic cohorts (FY’21) 27 27 CAC Target $100 (2022 - 2023)

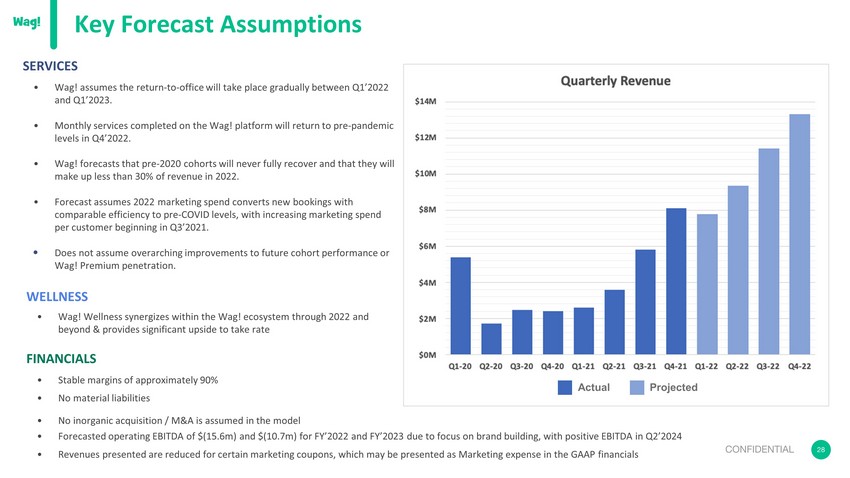

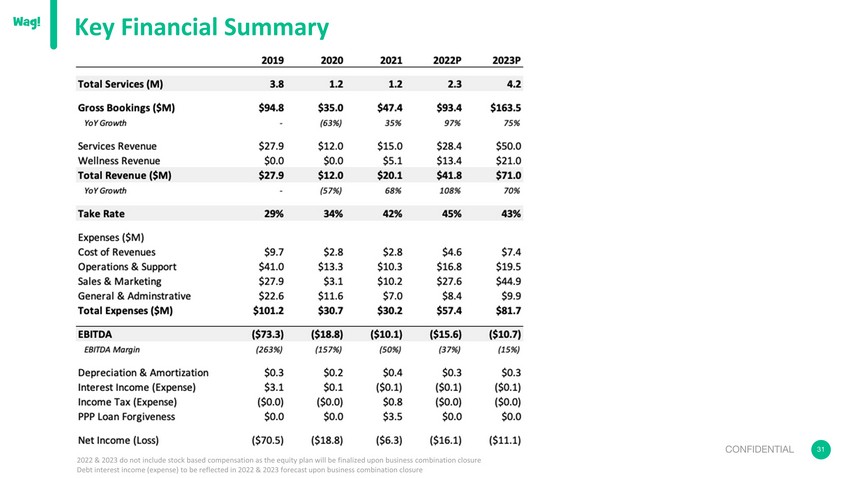

FINANCIALS • Stable margins of approximately 90% • No material liabilities • No inorganic acquisition / M&A is assumed in the model SERVICES • Wag! assumes the return - to - office will take place gradually between Q1’2022 and Q1’2023. • Monthly services completed on the Wag! platform will return to pre - pandemic levels in Q4’2022. • Wag! forecasts that pre - 2020 cohorts will never fully recover and that they will make up less than 30% of revenue in 2022. • Forecast assumes 2022 marketing spend converts new bookings with comparable efficiency to pre - COVID levels, with increasing marketing spend per customer beginning in Q3’2021. • Does not assume overarching improvements to future cohort performance or Wag! Premium penetration. 28 Key Forecast Assumptions WELLNESS • Wag! Wellness synergizes within the Wag! ecosystem through 2022 and beyond & provides significant upside to take rate CONFIDENTIAL • Forecasted operating EBITDA of $(15.6m) and $(10.7m) for FY’2022 and FY’2023 due to focus on brand building, with positive EB ITD A in Q2’2024 • Revenues presented are reduced for certain marketing coupons, which may be presented as Marketing expense in the GAAP financi als Actual Projected

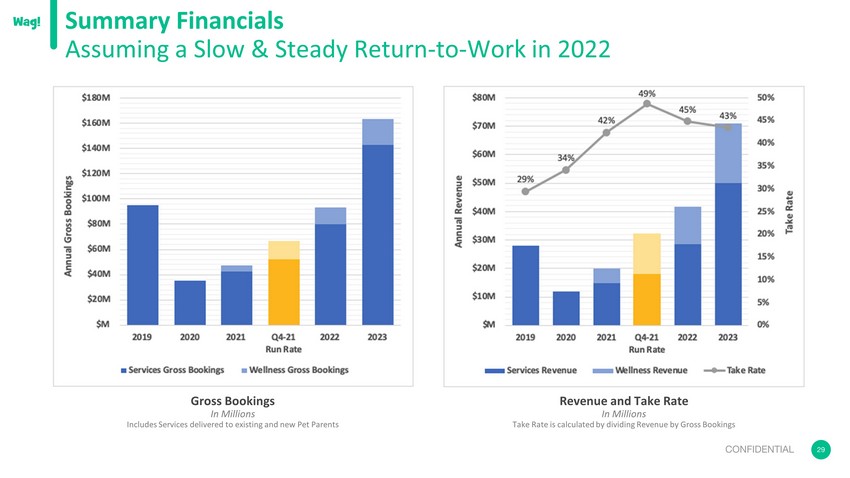

29 Summary Financials Assuming a Slow & Steady Return - to - Work in 2022 Gross Bookings In Millions Includes Services delivered to existing and new Pet Parents Revenue and Take Rate In Millions Take Rate is calculated by dividing Revenue by Gross Bookings CONFIDENTIAL

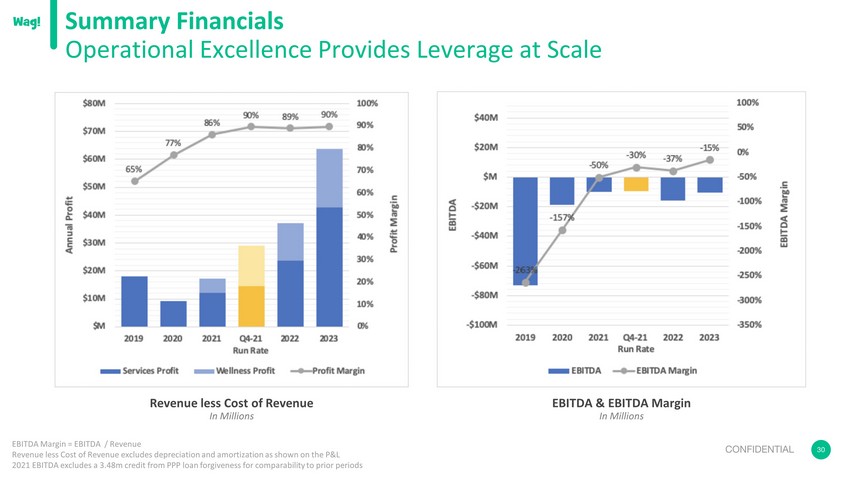

30 Summary Financials Operational Excellence Provides Leverage at Scale EBITDA & EBITDA Margin In Millions Revenue less Cost of Revenue In Millions EBITDA Margin = EBITDA / Revenue Revenue less Cost of Revenue excludes depreciation and amortization as shown on the P&L 2021 EBITDA excludes a 3.48m credit from PPP loan forgiveness for comparability to prior periods CONFIDENTIAL

31 Key Financial Summary CONFIDENTIAL 2022 & 2023 do not include stock based compensation as the equity plan will be finalized upon business combination closure Debt interest income (expense) to be reflected in 2022 & 2023 forecast upon business combination closure

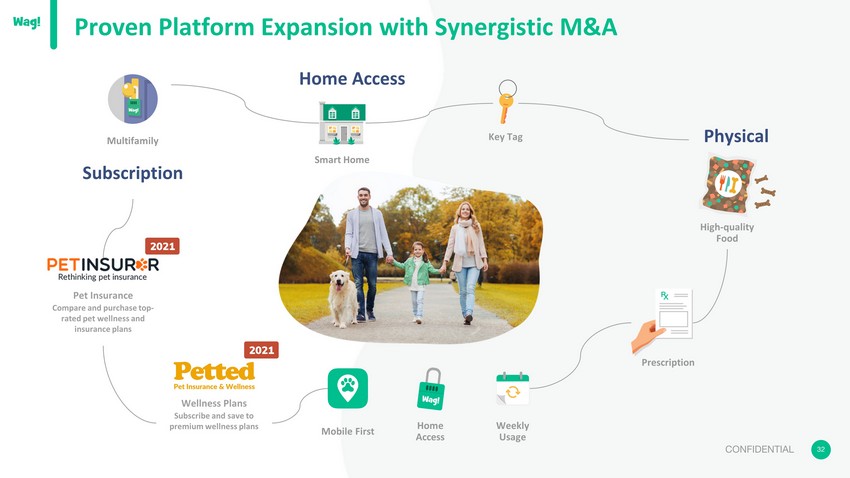

32 32 CONFIDENTIAL Proven Platform Expansion with Synergistic M&A Mobile First Home Access Weekly Usage Physical Subscription Pet Insurance Compare and purchase top - rated pet wellness and insurance plans Wellness Plans Subscribe and save to premium wellness plans Home Access Prescription High - quality Food Smart Home Multifamily Key Tag

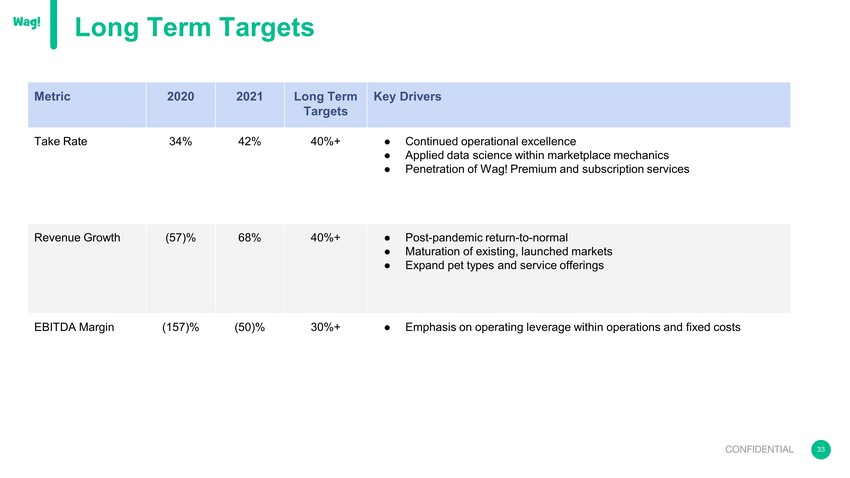

33 Metric 2020 2021 Long Term Targets Key Drivers Take Rate 34% 42% 40%+ ● Continued operational excellence ● Applied data science within marketplace mechanics ● Penetration of Wag! Premium and subscription services Revenue Growth (57)% 68% 40%+ ● Post - pandemic return - to - normal ● Maturation of existing, launched markets ● Expand pet types and service offerings EBITDA Margin (157)% (50)% 30%+ ● Emphasis on operating leverage within operations and fixed costs Long Term Targets CONFIDENTIAL

High growth characteristics with a critical mass of users and activity Public Comparables – Rationale Highly disruptive of traditional industries Strong mobile presence Powerful network effects Leading online consumer marketplaces ● Strong consumer internet brands ● 2 or 3 sided marketplaces ● Similar take - rate economics ● Large user base that leads to improved algorithms and AI/ML supported by Big Data & Analytics ● Either mobile first or a strong multi - platform strategy, with an emphasis on mobile ● Market leaders who were first to move into a brick - and - mortar industry ● Outsized growth in users and topline revenue CONFIDENTIAL 34 Representative Comparables

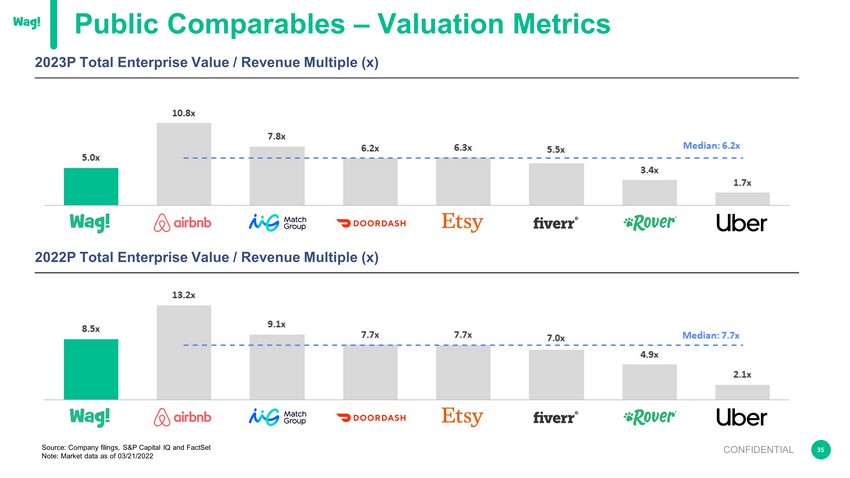

Source: Company filings, S&P Capital IQ and FactSet Note: Market data as of 03/21/2022 CONFIDENTIAL 35 2023P Total Enterprise Value / Revenue Multiple (x) 2022P Total Enterprise Value / Revenue Multiple (x) Public Comparables – Valuation Metrics

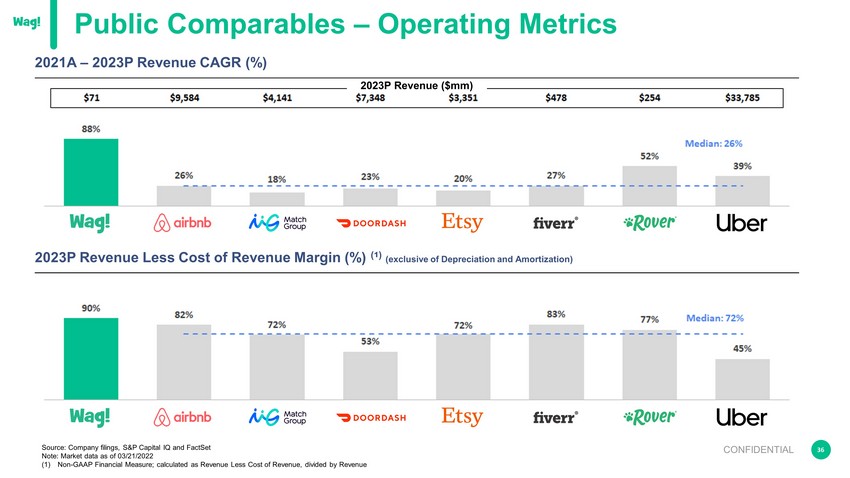

Source: Company filings, S&P Capital IQ and FactSet Note: Market data as of 03/21/2022 (1) Non - GAAP Financial Measure; calculated as Revenue Less Cost of Revenue, divided by Revenue Public Comparables – Operating Metrics 36 2021A – 2023P Revenue CAGR (%) 2023P Revenue Less Cost of Revenue Margin (%) ( ¹ ) (exclusive of Depreciation and Amortization) ` 2023P Revenue ($mm) CONFIDENTIAL

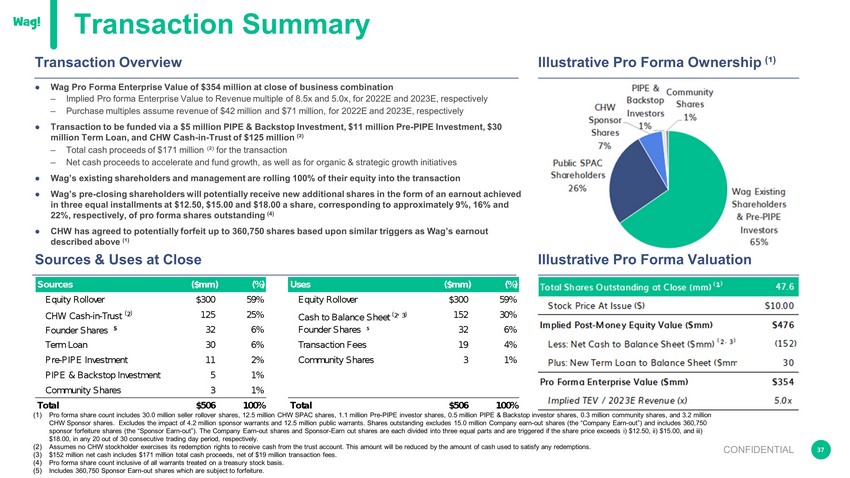

Transaction Summary Illustrative Pro Forma Ownership ( ¹ ) Sources & Uses at Close Illustrative Pro Forma Valuation (1) Pro forma share count includes 30.0 million seller rollover shares, 12.5 million CHW SPAC shares, 1.1 million Pre - PIPE investor shares, 0.5 million PIPE & Backstop investor shares, 0.3 million community shares, and 3.2 million CHW Sponsor shares. Excludes the impact of 4.2 million sponsor warrants and 12.5 million public warrants. Shares outstanding ex cludes 15.0 million Company earn - out shares (the “Company Earn - out”) and includes 360,750 sponsor forfeiture shares (the “Sponsor Earn - out”). The Company Earn - out shares and Sponsor - Earn out shares are each divided int o three equal parts and are triggered if the share price exceeds i) $12.50, ii) $15.00, and iii) $18.00, in any 20 out of 30 consecutive trading day period, respectively. (2) Assumes no CHW stockholder exercises its redemption rights to receive cash from the trust account. This amount will be reduce d b y the amount of cash used to satisfy any redemptions. (3) $152 million net cash includes $171 million total cash proceeds, net of $19 million transaction fees. (4) Pro forma share count inclusive of all warrants treated on a treasury stock basis. (5) Includes 360,750 Sponsor Earn - out shares which are subject to forfeiture. ● Wag Pro Forma Enterprise Value of $354 million at close of business combination – Implied Pro forma Enterprise Value to Revenue multiple of 8.5x and 5.0x, for 2022E and 2023E, respectively – Purchase multiples assume revenue of $42 million and $71 million, for 2022E and 2023E, respectively ● Transaction to be funded via a $5 million PIPE & Backstop Investment, $11 million Pre - PIPE Investment, $30 million Term Loan, and CHW Cash - in - Trust of $125 million ( ² ) – Total cash proceeds of $171 million ( ² ) for the transaction – Net cash proceeds to accelerate and fund growth, as well as for organic & strategic growth initiatives ● Wag’s existing shareholders and management are rolling 100% of their equity into the transaction ● Wag’s pre - closing shareholders will potentially receive new additional shares in the form of an earnout achieved in three equal installments at $12.50, $15.00 and $18.00 a share, corresponding to approximately 9%, 16% and 22%, respectively, of pro forma shares outstanding (4) ● CHW has agreed to potentially forfeit up to 360,750 shares based upon similar triggers as Wag’s earnout described above ( ¹ ) 37 Transaction Overview CONFIDENTIAL

Content is the confidential information of Wag Labs, Inc. and may be used by recipient for the sole purpose of evaluating a possible transaction between recipient and Wag Labs, Inc. By receiving this information, recipient and recipient’s affiliates agree to maintain the confidentiality of the information contained herein. Recipient is strictly prohibited from reproducing any portion of this presentation or disclosing the content to any third party. 38 Thank You! CONFIDENTIAL 38 38 38

Appendix 39

40 40 CONFIDENTIAL Disclaimer This investor presentation (this “Investor Presentation”) has been prepared by Wag Labs, Inc. (the “Company”) and CHW Acquisi tio n Corporation (the “SPAC”) in connection with the proposed business combination (the “Business Combination”) of the SPAC and the Company. This Investor Presentation is for informational purposes only and does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other financial instrum ent s of the SPAC or the Company, or their respective affiliates, which offer may only be made at the time a qualified offeree receives definitive offering documents and other materials (collectively, the “Offering Materials”). Withou t l imiting the generality of the foregoing, this Investor Presentation does not constitute an invitation or inducement of any sort to any person in any jurisdiction in which such an invitation or inducement is not permitted or where the SPAC and the Company are not qualified to make such invitation or inducement. In the event of any conflict between this Investor Presentation and information contained in the Offering Materials, the information in the Offer ing Materials will control and supersede the information contained in this Investor Presentation. No person has been authorized to make any statement concerning the SPAC or the Company other than as will be set forth in the Of fer ing Materials, and any representation or information not contained therein may not be relied upon. Cautionary Language Regarding Forward - Looking Statements This Investor Presentation includes “forward - looking statements” within the meaning of the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward - looking statements may be identified by the use of words such as “may,” “might,” “will,” “would,” “could,” “should,” “forecast,” “intend,” “seek,” “target,” “anticip ate ,” “believe,” “expect,” “estimate,” “plan,” “outlook” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward - looking statements, w hich include estimated financial information, involve known and unknown risks, uncertainties and other factors. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward - looking sta tements. These factors include, without limitation, ● the risk that the proposed Business Combination may not be completed in a timely manner or at all, which may adversely affect th e price of the securities of the SPAC or the Company; ● the risk that the proposed Business Combination may not be completed by the 24 - month deadline to which the SPAC is subject and t he potential failure to obtain an extension of the deadline if sought by the SPAC; ● the failure to satisfy conditions to the consummation of the proposed Business Combination, including the adoption of a busin ess combination agreement (the “BCA”) by the shareholders of the SPAC and the Company; ● the lack of a third - party valuation in determining whether or not to pursue the proposed Business Combination; ● the occurrence of any event, change or other circumstance that could give rise to the termination of the BCA; ● the effect of the announcement or pendency of the proposed Business Combination on the Company’s business relationships, perf orm ance and business generally; ● risks that the proposed Business Combination disrupts current plans and operations of the Company; ● the outcome of any legal proceedings that may be instituted against the Company or the SPAC related to the BCA or the propose d B usiness Combination; ● the ability to maintain the listing of the SPAC’s securities on Nasdaq; ● the volatility of the price of the SPAC’s and the post - combination company’s securities; ● the ability to implement business plans, forecasts and other expectations after the completion of the proposed Business Combi nat ion, and identify and realize additional opportunities; ● the risk of downturns and the possibility of rapid change in the highly competitive industry in which the Company operates; ● the risk that the Company and its current and future collaborators are unable to successfully develop and commercialize the C omp any’s products or services, or experience significant delays in doing so; ● the risk that the post - combination company may not achieve or sustain profitability; ● the risk that the post - combination company will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; and ● the risk that the post - combination company experiences difficulties in managing its growth and expanding operations. Disclaimer 1/4

41 41 You should (also) carefully consider the risks and uncertainties described on pages * and * of this presentation Forward - looking statements are based on current expectations, estimates, projections, targets, opinions and/or beliefs of the SP AC and the Company or, when applicable, of one or more third - party sources. No representation or warranty is made with respect to the reasonableness of any estimates, forecasts, illustrations, prospects or returns, which s hou ld be regarded as illustrative only. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” sec tio n of the SPAC’s registration statement on Form S - 1 (the “Registration Statement”) and the proxy statement/prospectus discussed below and other documents filed by the SPAC from time to time with the U.S. Securities and Exc han ge Commission (“SEC”). These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward - looking statem ents. You are cautioned not to place undue reliance upon any forward - looking statements, which, unless otherwise indicated herein, spe ak only as of the date of this Investor Presentation. Neither the SPAC nor the Company commits to update or revise the forward - looking statements set forth herein, whether as a result of new information, future events or ot herwise, except as may be required by law. Use of Projections This Investor Presentation contains financial forecasts or projections (collectively “Projections”) prepared by the Company. The Company’s independent registered public accounting firm has not audited, reviewed, compiled or performed any procedures with respect to the Projections for the purpose of their inclusion in this Investor Presentation and , a ccordingly, neither the SPAC nor the Company expresses an opinion or provides any other form of assurance with respect thereto for the purpose of this Investor Presentation. These Projections should not be relied upon as bei ng necessarily indicative of future results. The Projections are provided solely for illustrative purposes, reflect the current beliefs of the Company as of the date hereof, and are based on a variety of assumptions and est ima tes about, among others, future operating results, market conditions and transaction costs, all of which may differ from the assumptions on which the Projections are based. The Company does not assume any obligation to updat e t he Projections or information, data, models, facts or assumptions underlying the foregoing in this Investor Presentation. There are numerous factors related to the markets in general or the implementation of any operational strategy that cannot be fu lly accounted for with respect to the Projections. Any targets or estimates are therefore subject to a number of important risks, qualifications, limitations and exceptions that could materially and adversely affect the combin ed company’s performance. Moreover, actual events are difficult to project and often depend upon factors that are beyond the control of the SPAC and the Company. The performance projections and estimates are subject to the on going COVID - 19 pandemic, and have the potential to be revised to take into account further adverse effects of the COVID - 19 pandemic on the future performance of the SPAC and the Company. Projected returns and estimates are based on an assumption that public health, economic, market, and other conditions will improve; however, there can be no assurance that such conditions will improve within the time period or to the extent estimat ed by the SPAC and the Company. The full impact of the COVID - 19 pandemic on future performance is particularly uncertain and difficult to predict, therefore actual results may vary materially and adversely from the Projecti ons included herein. Presentation of Financial Information The Company’s financial statement have been prepared in accordance with International Financial Reporting Standards (“IFRS”), wh ich may not be comparable to financial statements prepared in accordance with US generally accepted accounting principles. CONFIDENTIAL Disclaimer 2/4

42 42 Use of Non - GAAP Financial Measures This Investor Presentation includes certain financial measures not presented in accordance with GAAP, including, but not limi ted to, EBITDA and certain ratios and other metrics derived therefrom. These non - GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in unde rst anding and assessing the Company’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, li qui dity or performance under GAAP. You should be aware that the Company’s presentation of these measures may not be comparable to similarly - titled measures used by other companies, including those peers whose measures are pr esented in this Investor Presentation. The Company believes these non - GAAP measures of financial results provide useful information to management and investors regard ing certain financial and business trends relating to the Company’s financial condition and results of operations. The Company also believes that the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends, and in comparing the Company’s financial measures with other similar companies, many of which present similar non - GAAP financial measures to investo rs. These non - IFRS financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non - GAAP financ ial measures. Please refer to any footnotes where presented in this Investor Presentation, as well as to the table on the final page, for a reconciliation of these measures to what the Company believes are the most d ire ctly comparable measure evaluated in accordance with GAAP. This Investor Presentation also includes certain projections of non - GAAP financial measures. Due to the high variability and di fficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, the Company is unab le to quantify certain amounts that would be required to be included in the most directly comparable IFRS financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP meas ure s and no reconciliation of the forward - looking non - GAAP financial measures are included in this Investor Presentation. Certain monetary amounts, percentages and other figures included in this Investor Presentation have been subject to rounding adj ustments. Certain other amounts that appear in this Investor Presentation may not sum due to rounding. Use of Trademarks and Other Intellectual Property All registered or unregistered service marks, trademarks and trade names referred to in this Investor Presentation are the pr ope rty of their respective owners, and the use herein does not imply an affiliation with, or endorsement by, the owners of these service marks, trademarks and trade names. Third - party logos included herein may represent past customer s, present customers or may be provided simply for illustrative purposes only. Inclusion of such logos does not necessarily imply affiliation with or endorsement by such firms or businesses. There is no guarantee that eith er the SPAC or the Company will work, or continue to work, with any of the firms or businesses whose logos are included herein in the future. CONFIDENTIAL Disclaimer 3/4

43 43 General This Investor Presentation is strictly confidential and may not be copied, reproduced, redistributed or passed on, in whole o r i n part, or disclosed, directly or indirectly, to any other person or published or for any purpose without the express written approval of the SPAC and the Companies. This Investor Presentation may not be reproduced or used for any oth er purpose. By accepting this Investor Presentation, the recipient agrees that it will, and will cause its representatives and advisors to, use this Investor Presentation, as well as any information derived by the recipien t f rom this Investor Presentation, only for initial due diligence regarding the SPAC and the Company in connection with (i) the proposed Business Combination and (ii) the SPAC’s proposed private offering of public equity (“PIPE O ffe ring”) to a limited number of investors and for no other purpose and will not, and will cause their representatives and advisors not to, divulge this Investor Presentation to any other party. The delivery of this Investor Presentation shall not, under any circumstances, create any implication that the Investor Prese nta tion is correct in all respects, including as of any time subsequent to the date hereof, and the SPAC and the Company do not undertake any obligation to update such information at any time after such date. Neither the SPAC nor the Company nor any of their respective affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of this Investor Presentation and nothing contained herein should be relied upon as a promise or representation as to past or future performance of the SPAC, the Companies or any other entity referenced herein. An investment through the PIPE Offering entails a high degree of risk and no assurance can be gi ven that investors will receive a return on their capital and investors could lose part or all of their investment. Each recipient acknowledges and agrees that it is receiving this Investor Presentation only for the purposes stated above and su bject to all applicable confidentiality obligations as well as securities laws, including without limitation the U.S. federal securities laws and the EU Market Abuse Regulation, prohibiting any person who has received mater ial , non - public information/inside information from purchasing or selling securities of the SPAC or the Company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable tha t such person is likely to purchase or sell such securities Participants in the Solicitation The SPAC and its directors and executive officers may be deemed participants in the solicitation of proxies from its stockhol der s with respect to the proposed Business Combination. A list of the names of those directors and executive officers and a description of their interests in the SPAC is contained in the Registration Statement, which was fil ed with the SEC and is available free of charge at the SEC’s website at www.sec.gov. Additional information regarding the interests of such participants will be contained in the proxy statement/prospectus for the proposed Business Co mbi nation when available. The Company and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of the SPAC in connection with the proposed Business Com bination. A list of the names of such directors and executive officers and information regarding their interests in the proposed Business Combination will be included in the proxy statement/prospectus for the proposed Business C omb ination when available. Additional Information The SPAC intends to file with the SEC a proxy statement/prospectus relating to the proposed Business Combination, which will be mailed to its stockholders once definitive. This Presentation does not contain all the information that should be considered concerning the proposed Business Combination and is not intended to form the basis of any investmen t d ecision or any other decision in respect of the proposed Business Combination. SPAC stockholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus and th e amendments thereto and the definitive proxy statement/prospectus and other documents filed in connection with the proposed Business Combination, as these materials will contain important information about the Company , t he SPAC and the proposed Business Combination. When available, the proxy statement/prospectus and other relevant materials for the proposed Business Combination will be mailed to stockholders of the SP AC as of a record date to be established for voting on the proposed Business Combination. Stockholders will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement /pr ospectus and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov. CONFIDENTIAL Disclaimer 4/4

44 44 The following list of risk factors is provided to certain sophisticated institutional investors in connection with a potentia l i nvestment in CHW Acquisition Corporation (the “SPAC”), or a newly formed holding company, as part of a proposed business combination between the Company and the SPAC pursuant to which the combined company will become a publicly tra ded company (the “Business Combination”). References to “we,” “us” or “our” are to the Company and, following the Business Combination, refer to the combined company. The list of risk factors has not been prepare d f or any other purpose. Investing in the combined company’s common shares to be issued in connection with the Business Combination involves a high degree of risk. Investors should carefully consider the risks and un cer tainties inherent in an investment including those described below, and conduct their own due diligence investigation, before making an investment decision. If we cannot address any of the following risks and uncertaint ies effectively, or any other risks and difficulties that may arise in the future, our business, financial condition or results of operations could be materially and adversely affected. The risks described below are not the only one s w e face. The following list of risks is not exhaustive, and additional risks that we currently do not know about or that we currently believe to be immaterial may also impair our business, financial condition or results of operation s. Risks relating to our business will be disclosed in future documents filed or furnished with the US Securities and Exchange Commission (“SEC”), including the documents filed or furnished in connection with the proposed Busine ss Combination. The risks presented in such filings will be consistent with those that would be required for a public company in their SEC filings and may differ significantly from, and will be more extensive than, those pre sented below. • Risks Related to Our Business and Industry • The COVID - 19 pandemic, and any future outbreak or other public health emergency, could materially affect our business, liquidity , financial condition and operating results. • We may experience significant fluctuations in our operating results and rates of growth. • Online marketplaces for pet care are still in relatively early stages of growth and if demand for them does not continue to g row , grows slower than expected, or fails to grow as large as expected, our business, financial condition and operating results could be materially adversely affected. • We face intense competition and could fail to gain, or could lose, market share if we are unable to compete effectively. • Our failure to quickly identify and adapt to changing industry conditions may have a material and adverse effect on us. • Any significant interruptions or delays in IT service or any undetected errors or design faults in IT systems could result in li mited capacity, reduced demand, processing delays and loss of customers, suppliers or marketplace merchants and a reduction of commercial activity. • Our success depends in large part on our ability to attract and retain high quality management and operating personnel, and i f w e are unable to attract, retain and motivate well qualified employees, our business could be negatively impacted. • We may from time to time pursue acquisitions, which could have an adverse impact on our business, as could the integration of th e businesses following acquisition. • Exchange rate fluctuations may negatively affect our results of operations. CONFIDENTIAL Risk Factors

45 45 • Risks Related to Legal, Regulatory and Tax Matters • If pet caregivers are reclassified as employees under applicable law, our business would be materially adversely affected. • Our business is subject to a variety of U.S. laws and regulations, many of which are unsettled and still developing and failu re to comply with such laws and regulations could subject us to claims or otherwise adversely affect our business, financial condition, or operating results. • Government regulation of the Internet, mobile devices and e - commerce is evolving and unfavorable changes could substantially adv ersely affect our business, financial condition and operating results. • Taxing authorities may successfully assert that we have not properly collected, or in the future should collect, sales and us e, gross receipts, value added, or similar taxes and may successfully impose additional obligations on us and any such assessments, obligations, or inaccuracies could adversely affect our business, financial condi tio n and operating results. • Our ability to use our net operating loss carryforwards and certain other tax attributes may be limited. • We are subject to increasingly stringent environmental regulations. • We may not be able to adequately protect our intellectual property rights or may be accused of infringing intellectual proper ty rights of third parties. • We may be unable to continue the use of our domain names or prevent third parties from acquiring and using domain names that inf ringe upon, are similar to or otherwise decrease the value of our brands, trademarks, or service marks. • We may be subject to product liability claims if people or property are harmed by the products sold on our platform. • Some of our potential losses may not be covered by insurance. We may not be able to obtain or maintain adequate insurance cov era ge. • We may be exposed to enforcement for violating anti - corruption laws, anti - money laundering laws and other similar laws and regul ations. • Any actual or perceived breach of security or security incident or privacy or data protection breach or violation could inter rup t our operations, harm our brand and adversely affect our reputation, brand, business, financial condition and operating results. • Changes in laws or regulations relating to privacy, data protection, or the protection or transfer of data relating to indivi dua ls, or any actual or perceived failure by us to comply with such laws and regulations or any other obligations relating to privacy, data protection or the protection or transfer of data relating to individuals, could a dve rsely affect our business. • Systems defects and failures and resulting interruptions in the availability of our website, mobile applications, or platform co uld adversely affect our business, financial condition and operating results. • If third - party payment service providers become unavailable or we are subject to increased fees, our business, operating results and financial condition could be materially adversely affected. • If third parties software providers were to interfere with the distribution of our platform or with our use of such software, ou r business would be materially adversely affected. • We rely on mobile operating systems and application marketplaces to make our applications available to pet parents and pet ca reg ivers and if we do not effectively operate with or receive favorable placements within such application marketplaces and maintain high user reviews, our usage or brand recognition could decline and our bus ine ss, financial results and operating results could be materially adversely affected. CONFIDENTIAL Risk Factors

46 46 • Risks Related to Owning the Combined Company’s Shares • A market for the combined company’s common shares may not develop or be sustained, which would adversely affect the liquidity an d price of the combined company’s common shares. • Sales of a substantial number of the combined company’s common shares in the public market, including those issued upon exerc ise of warrants or options, could cause our share price to decline. • The combined company’s future ability to pay cash dividends to shareholders is subject to the discretion of its board of dire cto rs and will be limited by its ability to generate sufficient earnings and cash flows. • Risks Related to Being a Public Company • The combined company will incur increased costs as a result of operating as a public company, and its management will devote sub stantial time to new compliance initiatives. • If our estimates or judgments relating to our critical accounting standards prove to be incorrect, or such standards change o ver time, our results of operations could be adversely affected. • We could in the future need to disclose, and be required to remediate, material weaknesses or significant deficiencies in our in ternal control over financial reporting. CONFIDENTIAL Risk Factors

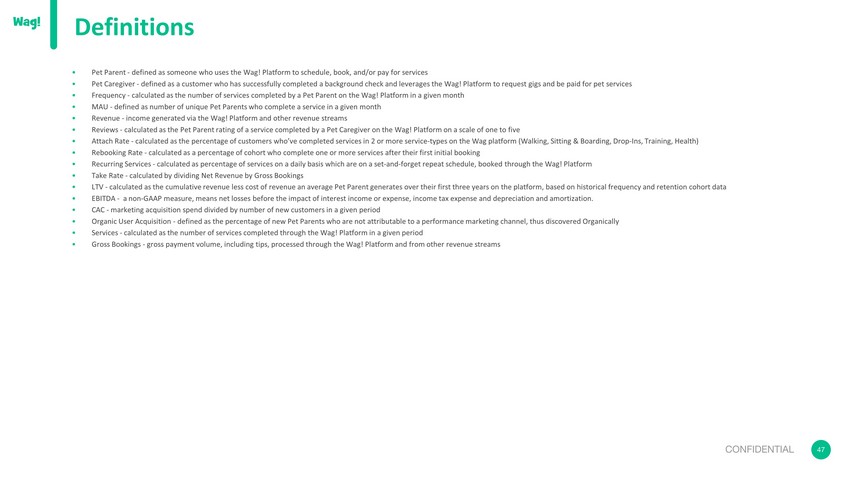

• Pet Parent - defined as someone who uses the Wag! Platform to schedule, book, and/or pay for services • Pet Caregiver - defined as a customer who has successfully completed a background check and leverages the Wag! Platform to reque st gigs and be paid for pet services • Frequency - calculated as the number of services completed by a Pet Parent on the Wag! Platform in a given month • MAU - defined as number of unique Pet Parents who complete a service in a given month • Revenue - income generated via the Wag! Platform and other revenue streams • Reviews - calculated as the Pet Parent rating of a service completed by a Pet Caregiver on the Wag! Platform on a scale of one t o five • Attach Rate - calculated as the percentage of customers who’ve completed services in 2 or more service - types on the Wag platform (Walking, Sitting & Boarding, Drop - Ins, Training, Health) • Rebooking Rate - calculated as a percentage of cohort who complete one or more services after their first initial booking • Recurring Services - calculated as percentage of services on a daily basis which are on a set - and - forget repeat schedule, booked through the Wag! Platform • Take Rate - calculated by dividing Net Revenue by Gross Bookings • LTV - calculated as the cumulative revenue less cost of revenue an average Pet Parent generates over their first three years on the platform, based on historical frequency and retention cohort data • EBITDA - a non - GAAP measure, means net losses before the impact of interest income or expense, income tax expense and depreciat ion and amortization. • CAC - marketing acquisition spend divided by number of new customers in a given period • Organic User Acquisition - defined as the percentage of new Pet Parents who are not attributable to a performance marketing chan nel, thus discovered Organically • Services - calculated as the number of services completed through the Wag! Platform in a given period • Gross Bookings - gross payment volume, including tips, processed through the Wag! Platform and from other revenue streams 47 Definitions CONFIDENTIAL