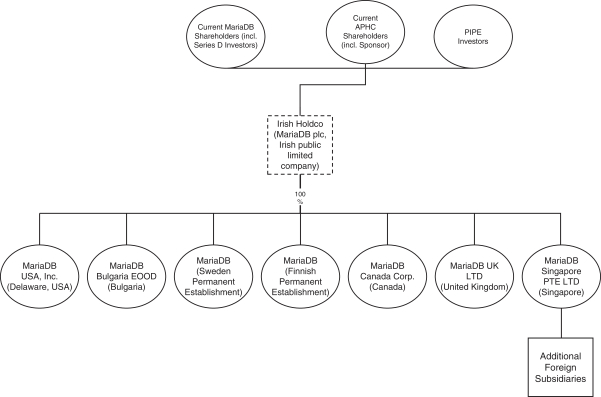

“Subsidiary Shares” has the meaning set forth in Section 3.3(d).

“Subsidiaries” means, of any Person, any corporation, association, partnership, limited liability company, joint venture or other business entity of which more than fifty percent (50%) of the voting power or equity is owned or controlled directly or indirectly by such Person, or one or more of the Subsidiaries of such Person, or a combination thereof.

“Supporting Company Holder” has the meaning set forth in the Recitals.

“Tail Policy” has the meaning set forth in Section 7.11(b).

“Tax” or “Taxes” means all federal, state, local, foreign, and other net or gross income, net or gross receipts, net or gross proceeds, payroll, employment, excise, severance, stamp, occupation, windfall or excess profits, profits, customs, capital stock, withholding, social security, worker’s contributions, employer’s contributions, employment pension contributions, unemployment insurance contributions, group life insurances, accident insurances, deferred, disability, real property, personal property (tangible and intangible), sales, use, transfer, value added, indirect, alternative or add-on, license, minimum, capital gains, user, leasing, lease, natural resources, ad valorem, franchise, license capital, estimated, goods and services, fuel, interest equalization, registration, recording, premium, turnover, environmental or other taxes, charges, duties, fees, levies or other governmental charges of any kind whatsoever, including all interest, penalties and additions imposed with respect to the foregoing, imposed by (or otherwise payable to) any Governmental Entity, and, in each case, whether disputed or not, whether payable directly or by withholding and whether or not requiring the filing of a Tax Return.

“Tax Proceeding” means any audit, examination, claim or Proceeding with respect to Taxes, Tax matters, or Tax Returns.

“Tax Returns” means all federal, state, local and foreign returns, declarations, reports, claims for refund, information returns, elections, disclosures, statements, or other documents (including any related or supporting schedules, attachments, statements or information, and including any amendments thereof) filed or required to be filed with a Taxing Authority in connection with, or relating to, Taxes.

“Tax Sharing Agreement” means any agreement or arrangement (including any provision of a Contract) pursuant to which a Company Entity or APHC is or may be obligated to indemnify any Person for, or otherwise pay, any Tax of or imposed on another Person, or indemnify, or pay over to, any other Person any amount determined by reference to actual or deemed Tax benefits, Tax assets, or Tax savings.

“Taxing Authority” means any Governmental Entity having jurisdiction over the assessment, determination, collection, administration or imposition of any Tax.

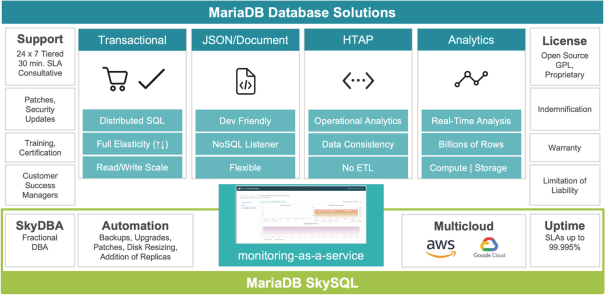

“Technology” means (a) Software, (b) inventions (whether or not patentable), discoveries and improvements, (c) Trade Secrets, (d) Designs, (e) databases, data compilations and collections and technical data, (f) data centers, (g) methods and processes, (h) devices, prototypes, beta versions, designs and schematics, and (i) tangible items related to, constituting, disclosing or embodying any or all of the foregoing, including all versions thereof.

“Trade Control Laws” has the meaning set forth in Section 3.22(a).

“Transaction Expenses” means the aggregate amount of all costs, fees and expenses incurred by or on behalf of the Company Entities, APHC and Irish Holdco, in each case, at or prior to the Closing, including any such amounts which are triggered by or become payable as a result of the Closing, in connection with the review, negotiation, execution and consummation of this Agreement, the Ancillary Agreements and the Transactions, including (a) the fees and expenses of legal counsel, accountants and other representatives, consultants and

A-20