- EONR Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

EON Resources (EONR) CORRESPCorrespondence with SEC

Filed: 15 May 23, 12:00am

HNR Acquisition Corp.

3730 Kirby Drive, Suite 1200

Houston, TX 77098

May 15, 2023

VIA EDGAR

United States Securities and Exchange Commission

Division of Corporation Finance

Office of Energy & Transportation

100 F. Street, N.W.

Mail Stop 6010/3561

Washington, DC 20549

| Attention: | Jenifer Gallagher, Staff Accountant |

| John Cannarella, Staff Accountant | |

| Sandra Wall, Petroleum Engineer | |

| John Hodgin, Petroleum Engineer | |

| Liz Packebusch, Staff Attorney | |

| Karina Dorin, Staff Attorney |

| Re: | HNR Acquisition Corp. |

| Preliminary Proxy Statement on Schedule 14A | |

| Filed February 14, 2023 | |

| File No. 001-41278 |

Dear Miss Packebusch:

HNR Acquisition Corp. (the “Company”) confirms receipt of the letter dated March 13, 2023, from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) with respect to the above-referenced filing. We are responding to the Staff’s comments as set forth below. The Staff’s comments are set forth below, followed by the Company’s response in bold:

Amendment No. 1 to Preliminary Proxy Statement on Schedule 14A filed February 14, 2023 (the “Proxy Statement”)

QUESTIONS AND ANSWERS ABOUT THE PURCHASE AND THE SPECIAL MEETING,

page 6

| 1. | We note your disclosure at page 157 that the White Lion ELOC and EF Hutton PIPE of up to $35 million are necessary to back up your investment funds from IPO investor redemptions. Please revise to include disclosure in this section regarding the Common Stock Purchase Agreement and Registration Rights Agreement with White Lion, including that White Lion will purchase up to $150,000,000 in aggregate gross purchase price of newly issued shares of SPAC Common Stock at a discount to the market price. Please also clarify the status of the EF Hutton PIPE and discuss the key terms of such financings and the potential impact of those securities on non-redeeming shareholders. Highlight material differences in the terms and price of securities issued at the time of the IPO as compared to the ELOC and PIPE contemplated at the time of the business combination. |

RESPONSE: In response to the Staff’s comment, the Company has added disclosure to the Q&A section to include disclosure regarding the Common Stock Purchase Agreement and Registration Rights Agreement with White Lion, including that White Lion will purchase up to $150,000,000 in aggregate gross purchase price of newly issued shares of SPAC Common Stock at a 4% discount to the market price. The White Lion ELOC stock sales will only occur after the closing of the MIPA.

Additionally, the Company has revised the disclosure on page 171 of the Proxy Statement to remove the reference to the EF Hutton PIPE, which is no longer being contemplated.

| 2. | Please add a question and answer that discusses the MIPA termination provisions, including a termination right if the company has not obtained aggregate binding commitments of at least $60,000,000.00 in the form of debt, equity or other additional sources of capital from reputable lenders or financing providers, and in a form reasonably satisfactory to Seller. Please also update disclosure throughout the filing regarding the status of such financing and disclose all material risks. |

RESPONSE: In response to the Staff’s comment, the Company has added a Q&A on pages 15-16 that discusses the MIPA termination provisions in accordance with the comment. The Company will update on a go-forward basis the details of debt and equity financings as those terms become available.

Q: What are the U.S. federal income tax consequences of exercising my redemption rights?, page 10

| 3. | Please revise your discussion of material U.S. federal income tax consequences here to address the intended tax treatment of the MIPA and the related transactions. In that regard, we note the MIPA states that the MIPA and the transactions contemplated thereby are intended to be treated as a taxable sale by the sellers of the target interests and an acquisition by buyer of an undivided interest in all of the assets of the Company. In addition, we note your cross-reference to disclosure under “Certain Material U.S. Federal income Tax Consequences of the Exercise of Redemption Rights to HNRA Stockholders,” but are unable to locate such discussion. Please revise or advise. |

RESPONSE: In response to the Staff’s comment, the Company has revised the Q&A on page 11 and the disclosure on beginning on page 80 to discuss the consequences of the redemption. The Company has also added a Q&A on page 11 that discusses the tax treatment of the MIPA.

Q: What conditions must be satisfied to consummate the Purchase?, page 13

| 4. | We note your disclosure at page 65 that in the event that all Redeemable Common stock is redeemed by the holders the Company would not have sufficient cash to close the Purchase under the terms currently agreed to with Pogo; the Company and Pogo would need to agree to modify the terms of the Purchase to adjust the Cash Consideration and increase the Seller Promissory Note amount issued to the Sellers; that there can be no assurance that such negotiations would be successful, nor that the terms of such amendments to the agreement would be favorable to the Company; and that, in the event that such amendments cannot be negotiated, the Company would not be able to satisfy the conditions to closing of the MIPA. Please revise to additionally include this disclosure in your related Q&A. Please also clearly disclose the redemption scenarios under which you would not be able to meet the condition that the Company will not have redeemed shares of SPAC Common Stock in an amount that would cause the Company to have less than $5,000,001 of net tangible assets. |

RESPONSE: In response to the Staff’s comment, the Company has revised disclosures to the Q&A titled “What happens if a substantial number of public stockholders vote in favor of the Purchase Proposal and exercise their redemption rights?” on beginning on page 11.

2

SUMMARY OF THE PROXY STATEMENT, page 15

| 5. | Please revise to include a diagram of your post-business combination ownership structure that depicts equity ownership under the minimum, interim and maximum redemption scenarios. |

RESPONSE: In response to the Staff’s comment, the Company has revised its disclosures starting on page 21 of the Proxy Statement to include a table of the post-business combination ownership that depicts equity ownership under the minimum, interim and maximum redemption scenarios. The Company has also included diagrams in the Proxy Statement reflecting the post-business combination ownership structure under the minimum, interim and maximum redemption scenarios.

Summary of the Proxy Statement Opinion of RSI & Associates, page 22

| 6. | Please expand the disclosure of total proved reserves (PDP+PNP+PUD) and proved developed producing reserves (PDP) to additionally disclose the natural gas reserves which are reflected in the total PV-10% values. This comment also applies to the comparable disclosure on page 83. |

RESPONSE: In response to the Staff’s comment, the Company has revised the pages 26 and 95 to disclose the natural gas reserves which are reflected in the total PV-10% values.

Risks Relating to Pogo’s Industry, page 24

| 7. | The disclosure stating that a substantial majority of Pogo’s revenues are from the crude oil and gas producing activities of its E&P operators and are derived from royalty payments appears inconsistent with disclosure elsewhere on page 96 stating that Pogo is the sole operator and generates revenue from its net revenue interests associated with a 100% working interest. Please revise your disclosure to correct the inconsistency or tell us why a revision in not needed. |

RESPONSE: We have revised the Proxy Statement throughout to clarify that Pogo is the sole operator and generates revenue from its net revenue interests associated with its 100% working interest in the properties.

Risk Factors, page 32

| 8. | Please revise to include a risk factor that the Common Stock Purchase Agreement which uses a discount to the VWAP at the time of the put results in negative pressure on the stock price following the consummation of the Business Combination. |

RESPONSE: In response to the Staff’s comment, the Company has added risk factors beginning on page 62 of the Proxy Statement describing the Common Stock Purchase Agreement and the potential negative pressure on the stock price of the Company’s Common Stock as a result of any purchases of Company Common Stock and registration of any such Common Stock pursuant to the Common Stock Purchase Agreement.

| 9. | Please include risk factor disclosure discussing that the Sponsor has elected to exercise the extension option to extend the time to consummate an initial business combination to May 15, 2023 and describe the proceeds deposited in the Trust Account by the Sponsor relating to the additional extension period. |

RESPONSE: In response to the Staff’s comment, the Company has added a risk factor on page 61 in the Proxy Statement to disclose that the Sponsor has elected to extend the time to consummate an initial business combination to June 15, 2023 and previously deposited $862,500 and $120,000, on two separate occasions, into the trust account in connection with the extension.

3

The announcement and pendency of the proposed Purchase may adversely affect our business, financial condition and results of operations..., page 53

| 10. | You disclose that you are currently subject to litigation related to the proposed Purchase, which could prevent or delay the consummation of the proposed Purchase or result in significant costs and expenses. Please discuss the facts and circumstances surrounding this lawsuit. |

RESPONSE: In response to the Staff’s comment, the Company has updated the relevant disclosure on page 59 of the Proxy Statement to reflect that the Company is not currently subject to litigation related to the proposed Purchase.

HNRA’s existing stockholders will experience dilution as a consequence of the Purchase, page 55

| 11. | Please revise this risk factor to define the term “Additional Consideration” and discuss the potentially dilutive impact of the White Lion RRA, including the approximate number of shares subject to such agreement. In addition, please quantify the total number of shares of common stock that will have registration rights following the consummation of the transactions. |

RESPONSE: In response to the Staff’s comment, the Company has updated the relevant risk factor to remove the reference to Additional Consideration. In addition, the Company has added additional risk factors discussing the potentially dilutive impact of the White Lion transaction.

Unaudited Pro Forma Combined Financial Information, page 57

| 12. | We note concurrently with the execution of the MIPA, you entered into a SPAC Stockholder Support Agreement with certain holders of your common stock and warrants. Please detail how the terms of this agreement have been considered in the preparation of the pro forma financial information. |

RESPONSE: In response to the Staff’s comment, the Company advises the Staff, and has disclosed on page 66 of the Proxy Statement, that the SPAC Stockholder Support Agreement does not have any impact on the Company’s pro forma financial information, as the SPAC stockholders that are party to this agreement waived their redemption rights.

Note 5. Pro Forma Loss Per Share, page 66

| 13. | We note that you have excluded 8,625,000 shares from your calculation of weighted average shares outstanding, basic and diluted under the maximum redemption scenario. We also note that you have an unfunded $88.1 million purchase price liability under the maximum redemption scenario. Please tell us and disclose whether you potentially intend to fund this liability utilizing the common stock purchase agreements transacted with White Lion. If so, tell us how you considered depicting the pro forma EPS calculation under the full redemption scenario assuming White Lion acquired the appropriate number of shares to raise a sufficient amount required to satisfy cash conditions pursuant to the terms of the proposed business combination. |

RESPONSE: In response to the Staff’s comment, the Company advises the Staff, and has disclosed on page 72 of the Proxy Statement, that as of the date hereof, the Company does not anticipate use of the White Lion Common Stock Purchase Agreement to achieve the necessary funds to close.

| 14. | We note that you have recorded net income available to common shareholders for all periods presented. Footnote 1 to your tabular disclosure specifies that the potentially dilutive outstanding securities were excluded from the computation of pro forma net loss per share, basic and diluted, because their effect would have been anti-dilutive. Please revise this disclosure to clarify that the you recorded net income and disclose the reason why the warrants are anti-dilutive, if this is your conclusion. |

RESPONSE: In response to the Staff’s comment, the Company advises the Staff that the Company has revised its disclosures on page 73 to correct the typographical error, and to specify that the warrants are considered anti-dilutive under the treasury stock method of FASB ASC 260-10-45-23 due to the Company’s common stock market price being less than the exercise price of the warrants.

4

Unaudited Pro Forma Combined Financial Information

Notes to Unaudited Pro Forma Combined Financial Statements

6.Supplemental Oil and Gas Reserve Information (Unaudited) Estimated

Net Quantities of Oil and Gas Reserves, page 67

| 15. | Please expand your disclosure on page 67 to provide the identity of the entity “Lonestar,” the relevance to the estimate of reserves and the standardized measure of discounted future net cash flows, and the relationship with Pogo Resources. Also, please revise your disclosure to correct the figure for the Pro Forma Combined undeveloped reserves presented on page 68. |

RESPONSE: In response to the Staff’s comment, the Company advises the Staff the reference to Lonestar is a typographical error and that the Company has revised its disclosures on page 74 correct such error.

Background of the Purchase, page 78

| 16. | We note your disclosure regarding your search process for a target business, including that your search started with 20 potential targets. Please revise to provide additional detail on the process for identifying potential business combination targets and how you narrowed the original 20 potential targets down to 9 prospects. Please also explain in greater detail why you determined not to pursue a transaction with any other such potential targets. |

RESPONSE: In response to the Staff’s comment, the Company has revised the disclosures on page 88 of the Proxy Statement in response to the Staff’s comment.

| 17. | Please substantially revise your disclosure throughout this section to discuss in greater detail the substance of meetings and discussions among representatives of HNRA and Pogo, including identifying the individuals that participated in each negotiation, the material terms that were discussed, how parties’ positions differed, and how issues were resolved. Revise to clarify the material terms that were included in the letter of intent executed on September 20, 2022 and how the terms of the business combination evolved during negotiations. Clarify how the transaction structure and consideration evolved during the negotiations, including the proposals and counter-proposals made during the course of the negotiations with respect to the material terms of the purchase. Please also discuss the negotiation of key aspects of the proposed transaction, including how the transaction structure and consideration evolved during the negotiations, including proposals and any counter-proposals and the SPAC Stockholder Support Agreement. |

RESPONSE: In response to the Staff’s comment, the Company has revised the disclosures on beginning on page 89 of the Proxy Statement to address the Staff’s comment.

HNRA’s Board’s Reasons for the Approval of the Purchase, page 80

| 18. | The current disclosure appears conclusory in nature. Please revise to clarify the reasons for approval of the business combination and disclose any potentially negative factors the board considered prior to approving the purchase. |

RESPONSE: In response to the Staff’s comment, the Company has revised the disclosures on beginning on page 91 of the Proxy Statement in response to the Staff’s comment.

Fairness Opinion of RSI & Associates, Inc., page 83

| 19. | We note the fairness opinion at Annex C states that RSI & Associates, Inc. reviewed, considered and relied upon Financial Projections prepared by HNRA for periods ending 2023-2025. Please revise to disclose such projections and qualitatively and quantitatively describe all material assumptions underlying such projections. Refer to Item 1015(b)(6) of Regulation M-A. |

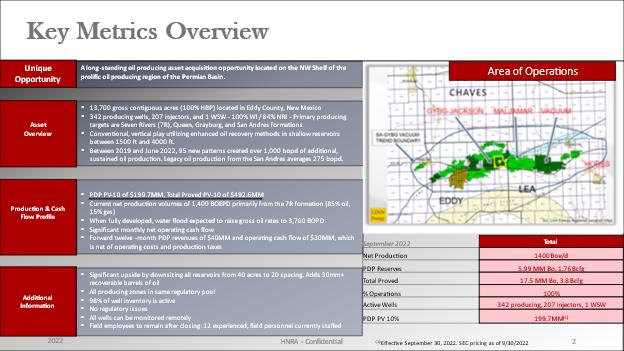

RESPONSE: The projections relating to the operations of the Pogo property presented to RSI & Associates, Inc. for the fairness opinion are based on the September report from William M. Cobb& Associates, Inc. dated November 7, 2022 (Cobb report). Because of the transition of ownership period, there was a shift in timing, but not amounts. The timing shift was primarily a delay in the capital investments start date by six months to July 2023 for PDNP and PUD reserves because in the Cobb report the start date was assumed to be January 2023, which did not occur. We determined that this was the conservative approach because it would have over-inflated the results, which is demonstrated below. There were no material assumptions other than the Cobb report for these projections.

Projections were presented via two slides relating to: revenues and operating cash flow; and investment or capital expenditures (Cap-Ex).

5

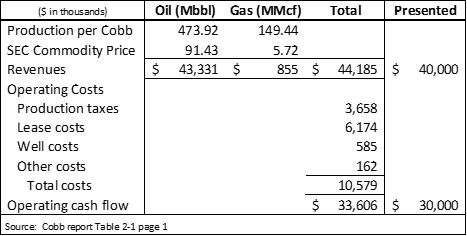

Revenues and operating cash flow: The projections for revenues and operating cash flows for the first 12 months of operations was presented to RSI for review and support to the fairness opinion via the slide below. HNRA specifically presented to RSI the first 12 months of operations for revenues was $40 million (rounded) and operating cash flow was $30 million (rounded).

The revenues were based on the Cobb report for the production of oil and gas using the September 30, 2022 SEC Commodity Price Forecast. The operating cash flows are the revenues less the operating costs and production taxes. Both of which are from the Cobb report. The table below shows the amounts per the Cobb report for 2023, and the conservative amounts presented.

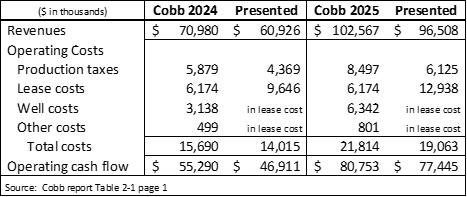

In addition to the slide, HNRA provided projections with respect to the operations performance of the Pogo property for years 2024 and 2025. The table below compares the Cobb report versus the projections primarily due to the shift in the timing of the capital expenditures from the Cobb report with respect to the PDNP and PUD reserves.

6

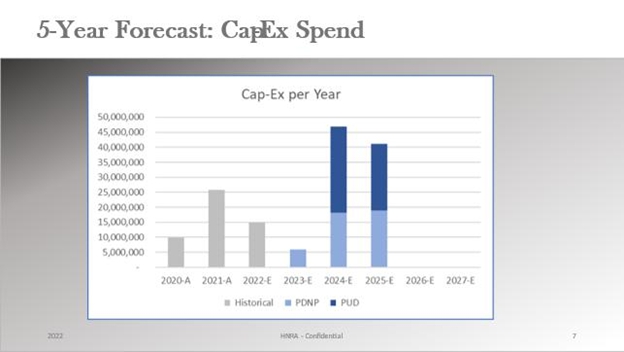

Investment or capital expenditures (Cap-Ex): The projections for Cap-Ex were based on the Cobb report investment amounts with a shift in timing due to the transition of ownership. The shift in timing was a delay in the capital investments start by six months to July 2023 for PDNP and PUD reserves because the Cobb report the start was January 2023, which did not occur. The following slide was presented to RSI for review and support to the fairness opinion. The amount of the investment costs was $94.2 million in the Cobb report and the projections.

The table below compares the Cobb report versus the projections for the timing of the capital expenditures with respect to the PDNP and PUD reserves.

In summary, the financial projections were based on the production volumes, commodity pricing and costs per the Cobb report adjusted for a six month timing delay for capital expenditures and related timing of production and costs.

| 20. | Please expand your disclosure to discuss in greater detail the analysis conducted by RSI & Associates, Inc. in determining that the purchase price is fair. For example, we note your disclosure that RSI & Associates, Inc. considered other similar transactions that also focus on PDP PV-10% proved reserves. Please revise to describe such transactions. |

RESPONSE: In response to the Staff’s comment, RSI & Associates has updated its opinion to include a summary of the public transactions of a comparable nature that were considered by RSI & Associates and the financial and stock information of other companies that RSI & Associates deemed to be applicable.

| 21. | Please revise to disclose the fee paid to RSI & Associates, Inc. for delivery of the fairness opinion. |

RESPONSE: In response to the Staff’s comment, the Company has revised the disclosure on page 95 of the Proxy Statement to disclose the fee paid to RSI & Associates, Inc. for delivery of the fairness opinion.

7

Information About Pogo

Pogo’s Working Interests in Grayburg-Jackson Field, page 96

| 22. | Disclosure on page 97, as of September 30, 2022, states the estimated total proved reserves of 18,169 MBoe were 84% oil and 16% natural gas. These percentages appear to be inconsistent with the figures of 17,531 MBbls of oil (96% of the total reserves) and 3,825 MMcf (4% of the total reserves) disclosed on page 101. Please revise your disclosure to correct the inconsistency or tell us why a revision is not needed. |

RESPONSE: We have revised the Proxy Statement to address this inconsistency. Please see page 111 of Amendment No. 1 to the Proxy Statement.

Summary of Reserves PUDs, page 102

| 23. | Please expand your disclosure to provide the material changes in proved undeveloped reserves that occurred during year ended December 31, 2021. Your disclosure should clearly identify the source of each change, e.g. revisions, improved recovery, extensions and discoveries, transfers to proved developed, sales and acquisitions, and to include an explanation relating to each of the items you identify. If two or more unrelated factors are combined to arrive at the overall change for an item, you should separately identify and quantify each material factor so that the change in net reserve quantities between periods is fully explained. |

The disclosure of revisions in previous estimates of your proved undeveloped reserves in particular should identify the changes associated with individual factors, such as changes caused by commodity prices, costs, interest adjustments, well performance, unsuccessful and/or uneconomic proved undeveloped locations, or the removal of proved undeveloped locations due to changes in a previously adopted development plan. Refer to the disclosure requirements in Item 1203 of Regulation S-K.

This comment also applies to the narrative explanations of the significant changes that occurred in the total net proved reserves provided on page F-56 for each line item shown in the reconciliation, other than production, and for each of the periods presented. Refer to FASB ASC 932-235-50-5.

RESPONSE: We have expanded our disclosure to include tabular reconciliations and a narrative explanation of the material changes in proved undeveloped reserves that occurred during the year ended December 31, 2021. Please see page 116-117 of Amendment No. 1 to the Proxy Statement.

| 24. | We note that you did not convert any of the proved undeveloped reserves disclosed as of December 31, 2021 to developed reserves during the nine months ended September 31, 2022. Please expand your disclosure to discuss the progress made, including the capital expenditures incurred to convert your proved undeveloped reserves during the year, and any factors that impacted or otherwise limited your progress in the conversion of your proved undeveloped reserves to developed status. This comment also applies, as appropriate, to your expanded disclosure of the changes that occurred as of the end of the most recent year-end, for the twelve months ended December 31, 2021. Refer to the disclosure requirements in Item 1203(c) of Regulation S-K. |

RESPONSE: We have expanded our disclosure to address the Staff’s comment. Please see pages 117-118 of Amendment No. 1 to the Proxy Statement.

| 25. | Please refer to Rule 4-10(a)(31)(ii) of Regulation S-X and question 131.04 in the Compliance and Disclosure Interpretations (C&DIs) regarding Oil and Gas Rules and expand your disclosure to clarify that all of the proved undeveloped reserves as of December 31, 2021 are part of a development plan adopted by management including approval by the Board, if such approval is required. |

To the extent that there are material amounts of proved undeveloped reserves that will not be converted to proved developed status within five years of initial disclosure as proved reserves, please expand your disclosure to explain the reasons for the delay. Refer to Item 1203(d) of Regulation S-K and the answer to question 131.03 in the Compliance and Disclosure Interpretations (C&DIs) regarding Oil and Gas Rules.

RESPONSE: We have expanded our disclosure to address the Staff’s comment. Please see page 118 of Amendment No. 1 to the Proxy Statement.

Acreage and Ownership, page 103

| 26. | Please expand the acreage disclosure to provide the figures for both the gross and net developed acreage and the gross and net undeveloped acreage. Please note acreage held by production that encompasses those leased acres on which wells have not been drilled or completed is undeveloped regardless of whether such acreage contains proved reserves. Refer to the disclosure requirements in Items 1208(a) and 1208(b) and the definitions in 1208(c) of Regulation S-K. |

RESPONSE: We have expanded our disclosure to address the Staff’s comment. Please see pages 119-120 of Amendment No. 1 to the Proxy Statement.

8

Drilling Results, page 103

| 27. | Please expand the disclosure of productive wells to provide the figures for the total number of gross and net productive wells and separately disclose the figures for the number of gross and net productive oil wells and the number of gross and net productive natural gas wells. Additionally revise the header to indicate the information relating to the disclosure is for Productive Wells. Refer to the disclosure requirements in Item 1208(a) and the definitions in Item 1208(c) of Regulation S-K. |

RESPONSE: We have expanded our disclosure to address the Staff’s comment. Please see pages 118-119 of Amendment No. 1 to the Proxy Statement.

| 28. | Disclosure on page 97, as of September 30, 2022, states that Pogo had production from 342 vertical wells; however, the Opinion of RSI & Associates on page 22 states there are currently 537 out of 550 wells producing. Please expand the disclosure to explain the reason for the difference or revise your disclosure to correct the inconsistency. |

RESPONSE: We have expanded our disclosure to address the Staff’s comment. Please see pages 118-119 of Amendment No. 1 to the Proxy Statement.

| 29. | Please expand the disclosure under the section Drilling Results to present the information relating to number of net productive and dry exploratory wells and the number of net productive and dry development wells drilled during each of the last three fiscal years. Refer to the disclosure requirements and definitions in Item 1205 of Regulation S-K. |

RESPONSE: We have expanded our disclosure to address the Staff’s comment. Please see disclosure on pages 118-119 of Amendment No. 1 to the Proxy Statement.

| 30. | Please expand you disclosure under a separate section to provide a description of your present activities, including the number of gross and net wells in the process of being drilled, completed, or waiting on completion, the number of waterfloods in the process of being installed, pressure maintenance operations, and any other related activities of material importance at the end of the most recent fiscal year or as of a more current date such as September 30, 2022. Refer to the disclosure requirements in Item 1206 of Regulation S-K. |

RESPONSE: We have expanded our disclosure to address the Staff’s comment. Please see pages 118-119 of Amendment No. 1 to the Proxy Statement.

Management’s Discussion and Analysis of Financial Condition and Results of Operations of Pogo

Overview, page 113

| 31. | We note disclosure indicating Pogo’s assets consist of 13,700 gross (11,508 net) acres on page 113 and Annex C-1, C-2 and that Pogo owned interests in 342 gross (287 net) producing wells on pages 115, 116, 118, and 119. Please refer to the definitions of a gross and a net well or acre in Item 1208(c) and revise your disclosure accordingly. |

RESPONSE: We have revised our disclosure to address the Staff’s comment. Please see pages 130 and Annex C-2 of Amendment No. 1 to the Proxy Statement.

Management’s Discussion and Analysis of Financial Condition and Results of Operations of Pogo

Cash Flows, page 121

| 32. | Please refer to your discussion of investing activities and revise to address the decrease in net cash used in investing activities during the nine months ended September 30, 2022, as compared to 2021 and the increase in net cash used in investing activities during fiscal 2021, as compared to fiscal 2020. |

RESPONSE: We have revised our disclosure to address the Staff’s comment. Please see page 135 of Amendment No. 1 to the Proxy Statement.

MARKET PRICES AND DIVIDENDS, page 157

| 33. | We note your disclosure that the payment of dividends following completion of the Purchase will be at the sole discretion of the Post-Combination Company’s board of directors, which may change its dividend philosophy at any time. Please include a corresponding risk factor. |

RESPONSE: In response to the Staff’s comment, the Company has added a risk factor to page 64 of the Proxy Statement disclosing the fact that the payment of dividends following completion of the Purchase will be at the sole discretion of the Post-Combination Company’s board of directors, which may change its dividend philosophy at any time.

9

Annex C, page C-1

| 34. | We note the fairness opinion from RSI & Associates included as Annex C states that the “opinion is solely for the use and benefit of the Board of Directors of the Company in its consideration of the Transaction.” This language suggests that shareholders may not consider or rely on the information in the opinion which you have included with your proxy statement. Please revise to remove this limitation on reliance. |

RESPONSE: In response to the Staff’s comment, the RSI & Associates Opinion has been revised to provide that it may be relied upon by the Board and the shareholders of HNRA.

Pogo Resources, LLC

Notes to the Consolidated Financial Statements

Note 12. Supplemental Disclosure of Oil and Natural Gas Operations (Unaudited) Reserve Quantity Information

(Unaudited), page F-55

| 35. | We note the total sales volumes for fiscal 2021 disclosed on pages 102 and 120 were 331 MBbls of crude oil and 352 MMcf of natural gas or 389 MBoe in total; however, the production volumes disclosed on page F-56 for the year ended December 31, 2021 were 332 MBbls of crude oil and 355 MMcf of natural gas or 391 MBoe in total. We also note a similar inconsistency in the disclosure of the total sales volumes for fiscal 2020 on page 120 of 199 MBbls of crude oil and 323 MMcf of natural gas or 253 MBoe compared to the production volumes on page F-56 for the year ended December 31, 2020 of 194 MBbls of crude oil and 156 MMcf of natural gas or 220 MBoe in total. Please explain the reason for these differences or revise your disclosure to correct these apparent inconsistencies. |

RESPONSE: We have revised our disclosures beginning on pages 111 and 132 to address the Staff’s comment.

| 36. | We note disclosure of significant additions in total proved reserves due to extensions and discoveries for each period presented. Please expand the discussion of the changes that occurred to separately disclose the net quantities of reserves added as new proved undeveloped reserves apart from the net quantities of reserves, if any, added from the addition of volumes that were not assigned as proved undeveloped reserves at the beginning of the fiscal year but subsequently resulted in the addition of proved developed reserves by fiscal year-end. Refer to the disclosure requirements in FASB ASC 932-235- 50-5. |

RESPONSE: We have revised our disclosure to address the Staff’s comment. Please see beginning on page F-42 of Amendment No. 1 to the Proxy Statement.

Standardized Measure of Discounted Future Net Cash Flows (Unaudited), page F-56

| 37. | Please expand the discussion accompanying the presentation of the standardized measure to clarify, if true, that all estimated future costs to settle your asset retirement obligations have been included in your calculation of the standardized measure for each period presented. This comment also applies to the disclosure on page 68. Refer to the disclosure requirements in FASB ASC 932-235-50-36. |

If the abandonment costs, including such costs related to your proved undeveloped reserves, have not been included, please explain to us your rationale for excluding these costs from your calculation of the standardized measure.

RESPONSE: We respectfully acknowledge the Staff’s comment and advise that abandonment costs and have not been included in the calculation of the standardized measure for any of the periods presented. This determination was made due to the long production histories of our wells and the immateriality of any abandonment costs of each well. We have revised the disclosure on beginning on page F-43 to clarify that abandonment costs are not included in this calculation.

10

Exhibits

| 38. | The reserve reports prepared by William M. Cobb & Associates, Inc. and filed as Annex D, E and F are each addressed to Pogo Resources, LLC; however, the entries shown in the table of contents on page i of the Proxy Statement reference each report to “LH Operating, LLC.” Please explain to us the relationship between LH Operating, LCC and Pogo Resources, LLC and tell us the reason for using the reference to LH Operating, LLC in your disclosure. |

RESPONSE: In response to the Staff’s comment, the Company advises the Staff that pursuant to our disclosures under the section titled “Information about Pogo” on page 110, while Pogo Resources, LLC is the Operator of Record of its oil and gas properties, it owns, manages, and operates 100% working interest in a gross 13,700 acres located on the Northwest Shelf of the prolific oil and gas producing Permian Basin (the “Asset”) through its wholly owned subsidiary LH Operating, LLC. The Company also respectfully advises the Staff about its disclosure on page 120 that LH Operating, LLC was created solely to manage the Asset. The reserve reports of the Asset - hence the references to LH Operating, LLC in the title of the reports - have been prepared by William M. Cobb & Associates, Inc. as of December 31, 2021 and December 31, 2022 and filed as Annex D and E, respectively, to the Proxy Statement.

| 39. | The disclosures in Annex D, E, and F do not appear to address all of the requirements of the reserve report pursuant to Item 1202(a)(8) of Regulation S-K. Please obtain and file revised reserve reports to include disclosure addressing the following points: |

| ● | The purpose for which the report was prepared, e.g. for inclusion as an exhibit in a filing made with the U.S. Securities and Exchange Commission - Item 1202(a)(8)(i). | |

| ● | The date on which the report was completed - Item 1202(a)(8)(ii). | |

| ● | The proportion of the registrant’s total reserves covered by the report - Item 1202(a)(8)(iii). |

| ● | A statement that the assumptions, data, methods, and procedures used are appropriate for the purpose of the report - Item 1202(a)(8)(iv). |

| ● | A discussion of the possible effects of regulation on the ability of the registrant to recover the estimated reserves - Item 1202(a)(8)(vi). |

| ● | Disclosure of the volume weighted average realized prices after adjustments for location and quality differentials, by product type, as part of the discussion of the economic assumptions - Item 1202(a)(8)(v). |

| ● | Clarification as to whether there are any variable operating costs in addition to the fixed monthly operating costs identified in the report as part of the economic assumption - Item 1202(a)(8)(v). |

| ● | A description of the nature of the “Other Costs” shown in the economic summary projection tables as part of the discussion of the economic assumptions - Item 1202(a)(8)(v). |

| ● | Clarification as to whether the cost to abandon the proved properties is included as part of the future development costs as part of the discussion of the economic assumptions- Item 1202(a)(8)(v). |

| ● | A statement that the third party used all methods and procedures it considered necessary under the circumstances to prepare the report - Item 1202(a)(8)(viii). |

| ● | The reserve report refers to a separate report under the heading “Additional Potential” on page 3 which is not provided. The separate reserve report should be included to the extent that it includes estimates of reserves consistent with the definitions in Rule 4-10(a) of Regulation S-X, or alternatively, remove the reference if you do not intend to include this supplemental information. |

RESPONSE: In response to the Staff’s comment, the Company advises the Staff that the Company has filed revised reserve reports as of December 31, 2021 and December 31, 2022 as Annex D and E, respectively, to address the Staff’s points above.

General

| 40. | Please quantify the aggregate dollar amount and describe the nature of what your sponsor and its affiliates have at risk that depends on completion of a business combination. Include the current value of securities held, loans extended, fees due, and out-of-pocket expenses for which the sponsor and its affiliates are awaiting reimbursement. Provide similar disclosure for the company’s officers and directors, if material. |

RESPONSE: In response to the Staff’s comment, the Company advises the Staff that the Company has revised the its disclosure on page 98.

11

| 41. | Please clarify if the sponsor and its affiliates can earn a positive rate of return on their investment, even if other SPAC shareholders experience a negative rate of return in the post-business combination company. |

RESPONSE: In response to the Staff’s comment, the Company has updated the risk factor on page 57 of the Proxy Statement to clarify that the Sponsor and its affiliates can earn a positive rate of return on their investment, even if other SPAC shareholders experience a negative rate of return in the Post-Combination Company. The Company has also updated the disclosure on page 98 of the Proxy Statement reflecting the same.

| 42. | Please highlight the material risks to public warrant holders, including those arising from differences between private and public warrants. Clarify whether recent common stock trading prices exceed the threshold that would allow the company to redeem public warrants. Clearly explain the steps, if any, the company will take to notify all shareholders, including beneficial owners, regarding when the warrants become eligible for redemption. |

RESPONSE: In response to the Staff’s comment, the Company has included disclosure on page 62 to highlight the material risks to public warrant holders, to clarify whether recent common stock trading prices exceed the threshold that would allow the Company to redeem public warrants and to clearly explain the steps the Company will take to notify all shareholders of when the warrants become eligible for redemption.

| 43. | Please disclose the sponsor and its affiliates’ total potential ownership interest in the combined company, assuming exercise of all securities. |

RESPONSE: In response to the Staff’s comment, the Company has added a table beginning on page 21 of the Proxy Statement that includes the Sponsor and its affiliates’ total potential ownership interest in the combined company, assuming exercise of all securities.

| 44. | Disclose the material risks to unaffiliated investors presented by taking the company public through a merger rather than an underwritten offering. These risks could include the absence of due diligence conducted by an underwriter that would be subject to liability for any material misstatements or omissions in a registration statement. |

RESPONSE: In response to the Staff’s comment, the Company has added a risk factor on page 61 to disclose the material risks to unaffiliated investors presented by taking the company public through a merger rather than an underwritten offering.

| 45. | We note your disclosure regarding conflicts of interest as they pertain to material interests in the transaction held by the sponsor and the company’s officers and directors. Please clarify how the board considered those conflicts in negotiating and recommending the business combination. |

RESPONSE: In response to the Staff’s comment, the Company has revised the Q&A on page 16 and the recommendation on page 90 in the Proxy Statement to address the Staff’s comment.

| 46. | Your charter waived the corporate opportunities doctrine. Please address this potential conflict of interest and whether it impacted your search for an acquisition target. |

RESPONSE: In response to the Staff’s comment, the Company has added a risk factor to page 64 of the Proxy Statement disclosing the potential conflict of interest with respect to waiving the corporate opportunities doctrine and indicating whether waiving the corporate opportunities doctrine impacted the Company’s search for an acquisition target.

| 47. | We note your unaudited pro forma condensed combined financial statements show the potential impact of redemptions on the per share value of shares owned by non-redeeming shareholders assuming no redemptions, or the No Redemptions scenario, and assuming maximum redemptions, or the Maximum Redemptions scenario. Please revise to include an interim redemption level. |

RESPONSE: In response to the Staff’s comments, the Company advises the Staff that the Company has revised its unaudited pro forma combined financial statements and related information to include an interim redemption level of 50%.

12

| 48. | Please revise to disclose all possible sources and the extent of dilution that shareholders who elect not to redeem their shares may experience in connection with the business combination. Provide disclosure of the impact of each significant source of dilution, including the amount of equity held by founders, at each of the redemption levels detailed, including any needed assumptions. |

RESPONSE: In response to the Staff’s comments, the Company advises the Staff that the Company has updated its disclosures to reflect all sources of dilution under the three redemption scenarios on pages 35 and 58 of the Proxy Statement.

| 49. | Quantify the value of warrants, based on recent trading prices, that may be retained by redeeming stockholders assuming maximum redemptions and identify any material resulting risks. |

RESPONSE: In response to the Staff’s comments, the Company advises the Staff that the fair value of the warrants that may be retained by redeeming shareholders is $880,000 based on recent trading prices, and 8,625,000 warrants held by Public Shareholders.

| 50. | It appears that the underwriting fee remains constant and is not adjusted based on redemptions. Revise your disclosure to disclose the effective underwriting fee on a percentage basis for shares at each redemption level related to dilution. |

RESPONSE: In response to the Staff’s comment, the Company has included a table on page 21 of the Proxy Statement that reflects the effective underwriting fee on a percentage basis at each redemption level. As of the date of this response, the Company does not have an agreement with EF Hutton to reduce fees based on redemptions, but negotiations have been opened for doing so.

| 51. | We note your disclosure that concurrently with the execution of the MIPA, the Company entered into a SPAC Stockholder Support Agreement with certain of the holders of the Company’s common stock and warrants (each, a “SPAC Stockholder”), pursuant to which, among other things, each SPAC Stockholder agrees not to exercise redemption rights or otherwise elect to redeem, tender or submit for redemption any securities pursuant to or in connection with the transactions contemplated by the MIPA, and waives any redemption rights. Please revise to clarify the aggregate voting power those stockholders hold and describe any consideration provided in exchange for this agreement. |

RESPONSE: In response to the Staff’s comment, the Company has revised the disclosures in the Proxy Statement, including in the Notice of Special Meeting and on pages 2, 13, 20, and 87 of the Proxy Statement.

| 52. | With a view toward disclosure, please tell us whether your sponsor is, is controlled by, or has substantial ties with a non-U.S. person. Please also tell us whether anyone or any entity associated with or otherwise involved in the transaction, is, is controlled by, or has substantial ties with a non-U.S. person. If so, also include risk factor disclosure that addresses how this fact could impact your ability to complete your initial business combination. For instance, discuss the risk to investors that you may not be able to complete an initial business combination should the transaction be subject to review by a U.S. government entity, such as the Committee on Foreign Investment in the United States (CFIUS), or ultimately prohibited. Further, disclose that the time necessary for government review of the transaction or a decision to prohibit the transaction could prevent you from completing an initial business combination and require you to liquidate. Disclose the consequences of liquidation to investors, such as the losses of the investment opportunity in a target company, any price appreciation in the combined company, and the warrants, which would expire worthless. |

RESPONSE: In response to the Staff’s comment, the Company has revised its disclosure on page 18.

| 53. | We note that the execution and delivery of the registration rights agreement and board observer agreement are conditions precedent to the obligation of the Seller to consummate the transactions. Please include the registration rights agreement and the board observer agreement as annexes to the proxy statement. Please also include or incorporate by reference the common stock purchase agreement and registration rights agreement with White Lion. |

RESPONSE: In response to the Staff’s Comment, the Company advises the Staff that it has attached the registration rights agreement as Annex F to the Proxy Statement. Pursuant to Section 7.21 of the MIPA, which is attached as Annex A to the Proxy Statement, the board observer agreement will be delivered and executed concurrently with the Closing of the Purchase. The common stock purchase agreement and registration rights agreement with White Lion are incorporated by reference to Exhibit 10.1 and 10.2 to HNR Acquisition Corp’s 8-K filed with the Commission on October 21, 2022.

13

We trust that this response satisfactorily responds to your request. Should you require further information, please contact our legal counsel Matthew Ogurick at (212) 326-0243.

| Very truly yours, | |

| /s/ Diego Rojas | |

| Diego Rojas | |

| Director | |

| cc: Matthew Ogurick |

14