AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”). INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE SEC IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF ANY SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

REGULATION A OFFERING CIRCULAR UNDER THE SECURITIES ACT OF 1933

PRELIMINARY OFFERING CIRCULAR, SUBJECT TO COMPLETION

DATED NOVEMBER 2, 2021

AMENDMENT NO. 1

CAARY CAPITAL LTD.

UP TO 20,000,000 CLASS A COMMON SHARES

MINIMUM INVESTMENT OF 500 CLASS A COMMON SHARES ($750.00)

186 Bartley Drive

Toronto, Ontario M4A 1E1

1-833-962-2279

www.caary.com

Copy to:

Daniel D. Nauth

Nauth LPC

217 Queen Street West, Suite 401

Toronto, Ontario M5V 0R2

(416) 477-6031

CAARY Capital Ltd., a corporation formed as a “Federal” corporation under the laws of Canada and domiciled in the Province of Ontario (the “Company,” “we,” or “our”), is offering up to 20,000,000 (the “Maximum Offering”) Class A Common Shares, no par value per share (the “Common Shares”) of the Company to be sold in this Tier 2 Offering (this ”Offering”) pursuant to Regulation A under the Securities Act of 1933, as amended (the “Securities Act”). The Common Shares are being offered at a purchase price of $1.50 per share on a “best efforts” basis. FundAmerica Securities LLC, as escrow agent (in such capacity, the “Escrow Agent”), will hold the proceeds of this Offering, which will be transferred to the Company at each closing. The first closing will occur at any time upon the Company requesting the release from escrow of the proceeds received from investors. Thereafter, the Company may continue to undertake one or more closings on a rolling basis, at which time additional proceeds the Escrow Agent holds will be released to the Company. Each investor must invest a minimum of $750.00; however, we reserve the right to waive this minimum in our sole discretion. This Offering will terminate on the earlier of the date on which (i) the Maximum Offering is sold, or (ii) the board of directors of the Company (the “Board”) elects to terminate this Offering (either such case, the “Termination Date”). We expect to commence the sale of the Common Shares on the date on which the SEC qualifies the offering statement of which this offering circular is a part.

The Company has engaged Dalmore Group LLC (“Dalmore”) , a New York limited liability company and a Financial Industry Regulatory Authority (“FINRA”) and Securities Investor Protection Corporation (“SIPC”) registered broker-dealer, to provide broker-dealer services in connection with this Offering.

In addition, the Company has engaged Open Deal Broker LLC (“ODB”, and in its capacity as broker-dealer together with Dalmore, the “Brokers”), also a New York limited liability company and a FINRA and SIPC registered broker-dealer, to assist with processing of investments through the online investment platform at www.republic.co maintained for ODB’s benefit by its affiliates (the “Republic Platform”). ODB will perform substantially the same services as Dalmore, but only for those subscriptions received through the Republic Platform. The Republic Platform will be used to communicate the offering to investors so they may purchase the securities in this offering through ODB.

For the avoidance of doubt, the Brokers do not and will not solicit purchases of Common Shares or make any recommendations regarding the Common Shares to prospective investors.

No application is currently being prepared for the Common Shares to trade on any public market. As a result, the Common Shares sold in this Offering may not be listed on a securities exchange or quoted on an alternative trading system for an extended period of time, if at all. If the Common Shares are not listed on a securities exchange or quoted on an alternative trading system, it may be difficult to sell or trade in the Common Shares. There can be no assurance that a liquid market for the Common Shares will develop or, if it does develop, that it will continue. If a market does develop, it may not be liquid. Therefore, investors may not be able to sell the Common Shares easily or at prices that will provide them with yield comparable to similar investments that have a developed secondary market. Illiquidity may have a severely adverse effect on the market value of the Common Shares and investors wishing to sell the Common Shares might therefore suffer losses.

Investing in the Common Shares involves a high degree of risk. These are speculative securities. An investor should purchase the Common Shares only if the investor can afford a complete loss of the investment. See “Risk Factors” for a discussion of certain risks that the investor should consider in connection with an investment in the Common Shares.

THE SEC DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED, INCLUDING THE COMMON SHARES, OR THE TERMS OF THIS OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THE COMMON SHARES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SEC; HOWEVER, THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE COMMON SHARES OFFERED ARE EXEMPT FROM REGISTRATION.

NOTICE TO FOREIGN INVESTORS

IF THE INVESTOR LIVES OUTSIDE OF THE UNITED STATES, IT IS THE INVESTOR’S RESPONSIBILITY TO FULLY OBSERVE THE LAWS OF ANY RELEVANT TERRITORY OR JURISDICTION OUTSIDE THE UNITED STATES IN CONNECTION WITH ANY PURCHASE OF THE SECURITIES, INCLUDING OBTAINING REQUIRED GOVERNMENTAL OR OTHER CONSENTS OR OBSERVING ANY OTHER REQUIRED LEGAL OR OTHER FORMALITIES. THE COMPANY RESERVES THE RIGHT TO DENY THE PURCHASE OF THE SECURITIES BY ANY FOREIGN INVESTOR.

| Title and Class of Securities to be Offered | Maximum Number of Share to be Offered | Proposed Offering Price per Share | Proposed Maximum Aggregate Offering Proceeds | Commissions and Discounts(1) | Proceeds to Company(2) | |||||||||||||||

| Class A Common Shares | 20,000,000 | $ | 1.50 | $ | 30,000,000 | $ | 2,433,000 | $ | 27,470,000 | |||||||||||

Notes:

| (1) | Assumes this Offering is fully subscribed. The Company’s Shares are being offered on a best efforts basis, (i) directly by the Company and (ii) pursuant to agreements entered into with the Brokers. In consideration for Dalmore’s broker services, Dalmore will receive a $5,000 advance fee for accounting expenses, a $20,000 consulting fee and a one-time fee of $8,000 to FINRA as a pass-through expense of Dalmore. In addition, Dalmore will receive a fee of 1% on the aggregate amount of capital raised under this Offering. In consideration for ODB’s broker services, ODB will receive a cash commission and securities commission of 4% and 1%, respectively, of the aggregate amount of capital raised under this Offering. In addition, ODB will receive a reimbursement in consideration for paying the Escrow Agent, which ODB estimates will be approximately 2% of the aggregate amount of capital raised under this Offering facilitated by ODB. Please see “Plan of Distribution” on page 16 for additional information. The proceeds of this Offering may be deposited directly into the Company’s operating account for immediate use by it, with no obligation to refund subscriptions. |

| (2) | The amount shown assumes deducting offering costs which may include legal, accounting, marketing, consulting and other costs incurred in undertaking the Offering. Such costs are estimated to amount to $2,530,000, including commissions and discounts paid to the Brokers, assuming this Offering is fully subscribed. |

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN TEN PERCENT (10%) OF THE GREATER OF YOUR ANNUAL INCOME OR YOUR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A PROMULGATED UNDER THE SECURITIES ACT. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

THIS OFFERING CIRCULAR CONTAINS ALL OF THE REPRESENTATIONS BY US CONCERNING THIS OFFERING, AND NO PERSON SHALL MAKE DIFFERENT OR BROADER STATEMENTS THAN THOSE CONTAINED HEREIN. INVESTORS ARE CAUTIONED NOT TO RELY UPON ANY INFORMATION NOT EXPRESSLY SET FORTH IN THIS OFFERING CIRCULAR.

The Company is following the “Offering Circular” format of disclosure under Regulation A promulgated under the Securities Act.

In the event that we become a reporting company under the Securities Exchange Act of 1934, we intend to rely on the provisions that relate to “Emerging Growth Companies” under the Jumpstart Our Business Startups Act of 2012. See “Implications of Being an Emerging Growth Company.”

TABLE OF CONTENTS

i

IMPORTANT INFORMATION ABOUT THIS OFFERING CIRCULAR

In this offering (this “Offering”), we are offering to sell, and seeking offers to buy, Class A Common Shares, no par value per share (the ”Common Shares”), of CAARY Capital Ltd., a corporation formed as a “Federal” corporation under the laws of Canada and domiciled in the Province of Ontario (the “Company,” “we,” “our,” and “us”), only in jurisdictions where such offers and sales are permitted. Please carefully read the information in this offering circular and any accompanying offering circular supplements, which we refer to collectively as the “Offering Circular.” You should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date or as of the respective dates of any documents or other information incorporated herein by reference, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale or delivery of the Common Shares shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required by the federal securities laws.

This Offering Circular is part of an offering statement (the “Offering Statement”) that we filed with the Securities and Exchange Commission (the “SEC”) using a continuous offering process. Periodically, we may provide an Offering Circular supplement that would add, update or change information contained in this Offering Circular. Any statement that we make in this Offering Circular will be modified or superseded by any inconsistent statement made by us in a subsequent Offering Circular supplement. The Offering Statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed in this Offering Circular. You should read this Offering Circular and the related exhibits filed with the SEC and any Offering Circular supplement, together with additional information contained in our annual reports, semi-annual reports and other reports and information statements that we will file periodically with the SEC. The Offering Statement and all supplements and reports that we have filed or will file in the future can be read at the SEC website, www.sec.gov.

Unless otherwise indicated, data contained in this Offering Circular concerning the business of the Company are based on information from various public sources. This Offering Circular also includes statistical and other market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Although we believe that these data are generally reliable, such information is inherently imprecise, and our estimates and expectations based on these data involve a number of assumptions and limitations. As a result, you are cautioned not to give undue weight to such data, estimates or expectations. All references in this Offering Circular to “$” or “dollars” are to United States dollars, unless specifically stated otherwise. All references in this Offering Circular to “C$” are to Canadian dollars.

ii

No information contained herein, nor in any prior, contemporaneous or subsequent communication should be construed by a prospective investor as legal or tax advice. We are not providing any tax advice as to the acquisition, holding or disposition of the Common Shares. In making an investment decision, investors are strongly encouraged to consult their own tax advisor to determine the U.S. Federal, state and any applicable foreign tax consequences relating to their investment in the Common Shares. This written communication is not intended to be “written advice,” as defined in Circular 230 published by the U.S. Treasury Department.

iii

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Description of Business” and elsewhere in this Offering Circular constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will” and “would” or the negatives of these terms, or other comparable terminology.

You should not place undue reliance on forward-looking statements. The cautionary statements set forth in this Offering Circular, including in “Risk Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements.

Although the forward-looking statements in this Offering Circular are based on our beliefs, assumptions and expectations, taking into account all information currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. We undertake no obligation, other than as may be required by law, to re-issue this Offering Circular or otherwise make public statements updating our forward-looking statements.

iv

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

We are not subject to the ongoing reporting requirements of the Exchange Act of 1934, as amended (the “Exchange Act”), because we are not registering the Common Shares under the Exchange Act. Rather, we will be subject to the more limited reporting requirements under Regulation A, including the obligation to electronically file:

| ● | annual reports (including disclosure relating to our business operations for the preceding three fiscal years, or, if in existence for less than three years, since inception, related party transactions, beneficial ownership of the Company’s securities, executive officers and directors and certain executive compensation information, management’s discussion and analysis (“MD&A”) of the Company’s liquidity, capital resources, and results of operations, and two years of audited financial statements); |

| ● | semiannual reports (including disclosure primarily relating to the Company’s interim financial statements and MD&A); and |

| ● | current reports for certain material events. |

In addition, at any time after completing reporting for the fiscal year in which the Offering Statement was qualified, if the securities of each class to which the Offering Statement relates are held of record by fewer than 300 persons and offers or sales are not ongoing, we may immediately suspend our ongoing reporting obligations under Regulation A.

If and when we become subject to the ongoing reporting requirements of the Exchange Act, so long as we remain a company with less than $1.07 billion in total annual gross revenues during our last fiscal year, which is currently the case, we will be an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), which will be significant. An emerging growth company may take advantage of certain reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company we:

| ● | will not be required to obtain an auditor attestation on our internal controls over financial reporting pursuant to the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”); |

| ● | will not be required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis”); |

| ● | will not be required to obtain a non-binding advisory vote from our stockholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes); |

| ● | will be exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and Chief Executive Officer pay ratio disclosure; |

| ● | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A; and |

| ● | will be eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under Section 107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under Section 107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended (the “Securities Act”), or such earlier time that we no longer meet the definition of an emerging growth company. Note that this Offering, while a public offering, is not a sale of common equity pursuant to a registration statement, since this Offering is conducted pursuant to an exemption from the registration requirements. In this regard, the JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1.07 billion in annual revenues, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

Certain of these reduced reporting requirements and exemptions are also available to us due to the fact that we may also qualify, once listed, as a “smaller reporting company” under the SEC’s rules. For instance, smaller reporting companies are not required to obtain an auditor attestation on their assessment of internal control over financial reporting; are not required to provide a compensation discussion and analysis; are not required to provide a pay-for-performance graph or Chief Executive Officer pay ratio disclosure; and may present only two years of audited financial statements and related MD&A disclosure.

v

This Offering summary highlights material information regarding our business, and this Offering. Because it is a summary, it may not contain all of the information that is important to you. To understand this Offering fully, you should read the entire Offering circular carefully, including the “Risk Factors” section, before making a decision to invest in the Company. Some of the statements in this Offering Circular are forward-looking statements. See the section entitled “Cautionary Statement Regarding Forward-Looking Statements” above.

Our Business

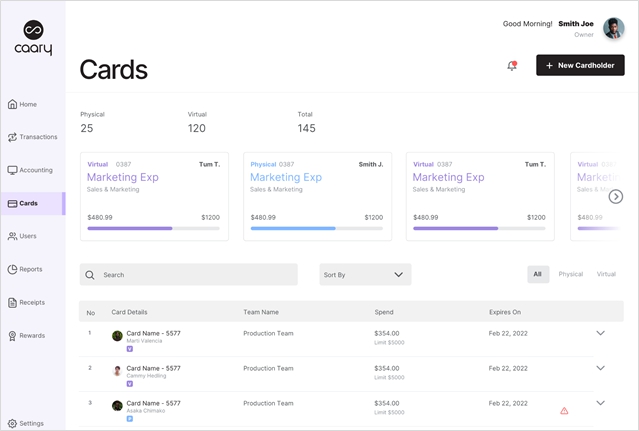

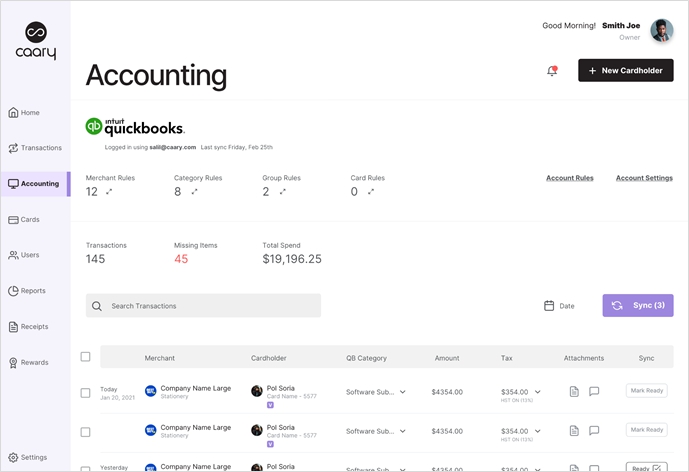

The Company was incorporated on October 4, 2019, as a “Federal” corporation under the laws of Canada and domiciled in the Province of Ontario. We are a financial technology (“FinTech”) company engaged in developing an innovative credit facility model utilizing a CAARY-branded business credit card issued on Mastercard’s global merchant network, as well as an integrated business expense management platform. We expect to release both products during the third quarter of 2021. Additionally, as part of our product offering, we are integrating a third party money transfer solution similar to existing mobile payment apps and interbank payment networks such as CashApp, Interac, and Venmo, which will enable our customers to transfer up to $50,000 between holders of Mastercard or Visa debit payment cards as a fast, low-cost alternative to cheques, wire transfers, ACH deposits, and other traditional money transfer solutions. In addition to high transfer limits, our money transfer solution will enable transfers within Canada and internationally, unlike most existing solutions which are only available for domestic transfers. We expect to release our money transfer solution during the first quarter of 2022. While we will initially offer our products solely to Canadian small and medium-sized enterprises (“SMEs”), we may in the future offer our products to SMEs in the United States.

Several limitations presently exist for SMEs and their founders in Canada and the United States with respect to business credit cards offered by legacy financial institutions, including a common requirement for founders to provide a personal guarantee, fee schedules which often prove costly even with limited usage, credit card rewards programs which typically offer lower earning rates than personal credit cards, and costly and time-consuming money transfer options, among other shortcomings. Furthermore, although many advanced solutions for tracking and managing business expenses are currently offered to SMEs, most require a degree of manual reconciliation with minimal or no synchronization with an organization’s credit cards.

Our credit facility model will enable SMEs to obtain near-instant approval of business credit card applications. Uniquely, we will evaluate applications for business credit cards primarily based on the applicant’s cash balance history, current cash balance, cash flows, assets and holdings, as opposed to a personal guarantee. To mitigate credit risk, our customers may be required to maintain a certain balance of assets at all times as a protective measure against potential credit events, which we anticipate will reduce default rates compared to industry averages. Additionally, we will offer an artificial intelligence (“AI”) and cloud computing-driven business expense management platform, which will automate the organization and reconciliation of SME business expenses and integrate with common accounting platforms, including FreshBooks, NetSuite, Sage, QuickBooks, Wave, and Xero. Our money transfer solution will enable SMEs to send or receive money with faster turnaround times and higher transaction limits than most mainstream providers of small business financial services.

In addition to our credit facility model and integrated business expense management platform, we are currently developing reporting, analytics, and forecasting services for venture capital (“VC”) customers, as well as “white label” services allowing FinTech companies to utilize our user interface, decisioning engine, data ingestion capabilities, and branded card platform. These services will be made available at the discretion of our management based on actual or anticipated market demand. However, we currently expect to begin offering reporting, analytics, forecasting, and white label services during the first quarter of 2022.

Our technologies and services offerings are described in greater detail in “Description of Business” below together with a detailed description of our entire business.

Our personnel consists of sixteen full-time employees and six part-time employees.

Our principal place of business and mailing address is CAARY Capital Ltd., 186 Bartley Drive, Toronto, Ontario, Canada M4A 1E1, and our telephone number is 1-833-962-2279. Our website address is www.caary.com. The information contained therein or accessible thereby shall not be deemed to be incorporated into this Offering Circular.

Description of Property

We do not own any facilities and do not expect to do so in the immediate future. We lease an office at 186 Bartley Drive, Toronto, Ontario, Canada, M4A 1E1 and all of the Company’s personnel operate from this office or virtually from remote locations.

1

Risks Related to Our Business

Our business and our ability to execute our business strategy are subject to a number of risks, which are more fully described in the section titled “Risk Factors” beginning on page 5. These risks include, among others:

Business and industry risks, including:

| ● | We have a history of losses and can provide no assurance of our future operating results. |

| ● | The Company was recently formed and has no operating history and no revenues. |

| ● | We may not have adequate capital to fund our business and may need substantial additional funding to continue operations. We may not be able to raise capital when needed, if at all, which would force us to delay, reduce or eliminate our product development programs or commercialization efforts and could cause our business to fail. |

| ● | Potential changes in SME and business banking may negatively affect our operating results. |

| ● | We have limited existing brand identity and customer loyalty; if we fail to attract customers to use our service offerings, our business could suffer. |

| ● | Our success is dependent on the completed development and potential performance of our credit facility model and business expense management platform. |

| ● | If we do not effectively manage our credit risk relating to our credit facility model, we could experience delinquency or losses which could have a material adverse effect on our financial condition and results of operation. |

| ● | Our relationships with Mastercard, Peoples Trust Company and i2c are crucial elements of our products. |

| ● | Regulations in certain jurisdictions may restrict our business from operating as intended or at all. |

| ● | We will need to increase the size of our organization, and we may be unable to manage rapid growth effectively. |

| ● | We are not subject to Sarbanes-Oxley and lack the internal controls over financial reporting required of public companies. |

| ● | The successful development of our credit facility model and business expense management platform is highly speculative and is dependent on numerous factors, many of which are beyond our control. |

| ● | New products and services may subject us to additional risks. A failure to successfully manage these risks may have a material adverse effect on our business. |

| ● | We may face significant competition in Canada and in other markets where we decide to operate in the future, including the United States. |

| ● | Our revenue could fluctuate from period to period, which could have an adverse material impact on our business. |

| ● | If we are unable to effectively protect our intellectual property and trade secrets, it may impair our ability to compete. |

| ● | Computer, website and/or information system breakdowns, as well as cyber security attacks, could affect our business. |

| ● | We will depend on third-party providers for a reliable Internet infrastructure as well as other aspects of our technology and applications and the failure of these third parties, or the Internet in general, for any reason would significantly impair our ability to conduct our business. |

| ● | Compliance with laws and regulations anti-money laundering and anti-terrorist financing laws and regulations, and our failure to comply with such laws could harm our business. |

| ● | Compliance with laws and regulations designed to protect personal data, and our actual or perceived failure to adequately protect personal data, could harm our business. |

2

| ● | We may be involved in legal and regulatory proceedings. |

| ● | The liability of our directors and officers and others is limited under certain circumstances. |

| ● | Our executive officers, directors and insider shareholders beneficially own or control a substantial portion of the outstanding Common Shares. |

| ● | Because we do not have an audit or compensation committee, shareholders will have to rely on management to perform these functions. |

| ● | We may have difficulty retaining and acquiring personnel. |

| ● | Our directors and officers may have conflicts of interest. |

| ● | Our financial statements have been prepared in accordance with IFRS accounting principles. |

| ● | Public health epidemics or outbreaks could adversely impact our business. |

Risks related to this Offering and the Common Shares, including:

| ● | The Common Shares are being offered on a “best efforts” basis and we may not raise the Maximum Amount being offered. |

| ● | If the Maximum Offering is not raised, it may increase the amount of additional equity we need to raise. |

| ● | This Offering is being conducted without the benefit of an underwriter, who could have confirmed the accuracy of the disclosures in this Offering Circular. |

| ● | We intend to list the Common Shares for trading on a securities exchange, which would increase our regulatory burden; however, it is uncertain when the Common Shares will be listed on an exchange for trading, if ever. |

| ● | If the Common Shares become subject to the penny stock rules, it would become more difficult to trade the Common Shares. |

| ● | We have broad discretion in how we use the proceeds of this Offering and may not use these proceeds effectively, which could affect our results of operations and cause the price of our Common Shares to decline. |

| ● | We may incur increased costs as a result of our public reporting obligations, and our management team will be required to devote substantial time to new compliance initiatives. |

| ● | We may lose our status as a foreign private Company in the United States, which would result in increased costs related to regulatory compliance under United States securities laws. |

| ● | We do not intend to pay dividends on the Common Shares and, consequently, your ability to achieve a return on your investment will depend on appreciation in the price of the Common Shares. |

| ● | We may terminate this Offering at any time during the Offering Period and do not have a minimum capitalization. |

| ● | Terms of subsequent financings, if any, may adversely impact investors’ investments. |

| ● | We determined the offering price for the Common Shares being sold in this Offering. |

If an investor purchases Common Shares in this Offering, the investor will incur immediate and substantial dilution in the book value of the Common Shares.

Regulation A+

We are offering the Common Shares pursuant to rules of the SEC mandated under the JOBS Act. These offering rules are often referred to as “Regulation A+.” We are relying upon “Tier 2” of Regulation A+, which allows us to offer securities of up to $75 million in a 12-month period.

In accordance with the requirements of Tier 2 of Regulation A+, we are required to publicly file annual, semiannual, and current event reports with the SEC.

3

| Company: | CAARY Capital Ltd., a corporation formed as a “Federal” corporation under the laws of Canada and domiciled in the Province of Ontario | |

| Shares Offered: | Up to 20,000,000 Common Shares, no par value per share. | |

| Price per Share: | $1.50 | |

| Minimum Investment: | $750.00 per investor. | |

| Common Shares Outstanding before this Offering: | 141,254,810 Common Shares. | |

| Common Shares Outstanding after this Offering: | 161,254,810 Common Shares, if the Maximum Offering is sold. | |

| Use of Proceeds: | If we sell all of the 20,000,000 Common Shares being offered, our net proceeds (after deducting fees and commissions and estimated offering expenses) will be approximately $27,470,000. We will use these net proceeds for cash reserves, working capital, technology development, marketing and business development, as described in “Use of Proceeds to Company” beginning on page 18. | |

| Risk Factors: | Investing in our Common Shares involves a high degree of risk. See “Risk Factors” beginning on page 5. |

4

An investment in the Common Shares involves a high degree of risk. Each investor should carefully consider the risks described below, together with all of the other information included in this Offering Circular, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the price of the Common Shares could decline and the investors may lose all or part of their investments. See “Cautionary Statement Regarding Forward Looking Statements” above for a discussion of forward-looking statements and the significance of such statements in the context of this Offering Circular.

Risks Related to our Business and Industry

We have a history of losses and can provide no assurance of our future operating results.

As we are engaged in developing and have not yet released and commenced generating revenue from our credit facility model, integrated business management expense platform and reporting, analytics, forecasting, and white label services, we have experienced net losses and negative cash flows from operating activities, and we expect such losses and negative cash flows to continue in the foreseeable future. At June 30, 2021, the Company had positive working capital of C$5,205,040 and a cumulative loss since inception of C$(2,687,351). The Company has a need for equity capital and financing for working capital and development of its projects. The Company’s continuance as a going concern is dependent upon its ability to obtain adequate financing and to reach profitable levels of operation. It is not possible to predict whether financing efforts will be successful or if the Company will attain profitable levels of operations. Management believes it will be successful in raising the necessary funding to continue operations in the normal course of operations, however, there is no assurance that funds will continue to be available on terms acceptable to the Company or at all. Our financial statements do not reflect adjustments to the carrying value of assets and liabilities that would be necessary should the Company be unable to continue operations and such adjustments could be material.

The Company was recently formed and has no operating history and no revenues.

The Company was only recently formed to engage in developing a technology platform with the ability to issue a corporate credit card, utilizing a unique credit adjudication and credit facility model, integrated business expense management platform and reporting, analytics, forecasting and white label services. We have no operating history upon which to base an evaluation of our business and prospects. Operating results for future periods are subject to numerous uncertainties and we cannot assure you that we will achieve or sustain profitability. Our prospects must be considered in light of the risks encountered by companies in the early stage of development, particularly companies in new and rapidly evolving markets. Future operating results will depend upon many factors, including, but not limited to, our success in attracting necessary financing, such as that contemplated in this offering, or obtaining financing from other sources, establishing credit or operating facilities, our ability to develop new products, our ability to successfully market our products and attract customers, our ability to control operational costs, and our ability to retain motivated and qualified personnel, legal and regulatory developments in the jurisdictions in which we operate, as well as the general economic conditions which affect our customers We cannot assure you that we will successfully address any of these risks.

We may not have adequate capital to fund our business and may need substantial additional funding to continue operations. We may not be able to raise capital when needed, if at all, which would force us to delay, reduce or eliminate our product development programs or commercialization efforts and could cause our business to fail.

We have not commenced revenue generating operations and are therefore dependent on securing sufficient capital to fund the further development of our credit facility model, integrated business expense management platform and reporting, analytics, forecasting, and white label services, as well as any other products that we may identify and develop from time to time. Although we believe that we will, assuming that we are able to raise a minimum of approximately $5 million in this Offering, have sufficient capital following the completion of this Offering to fund our planned operations for the next 12 months, we may require additional funding in the future. If our entire original capital is fully expended and additional costs cannot be funded from borrowings or capital from other sources, then our financial condition, results of operations, and business performance would be materially adversely affected. We may require additional capital for the development of our business operations and commercialization of the products we are currently developing or may develop in the future. We may also encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may increase our capital needs and/or cause us to spend our cash resources faster than we expect. Accordingly, we will need to obtain additional funding in order to continue our operations. We may not be able to raise needed additional capital or financing due to market conditions or for regulatory or other reasons. We cannot assure that we will have adequate capital to conduct our business. If additional funding is not obtained, we may need to reduce, defer or cancel development efforts or overhead expenditures to the extent necessary. The failure to fund our operating and capital requirements could have a material adverse effect on our business, financial condition and results of operations.

5

Potential changes in SME and business banking may negatively affect our operating results.

The viability of our business substantially relies upon gaps in the offerings of legacy financial institutions and creditors which place an undesirable burden on SMEs and their founders and offer limited value. In particular, business credit instruments from legacy financial institutions typically require founders to provide a personal guarantee to access credit, impose fees which often prove costly even with limited usage, and offer credit card rewards programs with lower earning rates than personal credit cards on average, in addition to other shortcomings. Furthermore, although many advanced solutions for tracking and managing business expenses are currently offered to SMEs, most require a degree of manual reconciliation with minimal or no synchronization with an organization’s credit cards. While past patterns in SME and business banking do not suggest that any changes to their offerings to address these gaps are imminent, such changes would be likely to impair our value proposition to our target customer base.

We have limited existing brand identity and customer loyalty; if we fail to attract customers to use our service offerings, our business could suffer.

Because we are engaged in developing a technology platform with the ability to issue a corporate credit card, and have not yet released and commenced generating revenue from, our credit facility model, integrated business management expense platform and reporting, analytics, forecasting, and white label services, we currently do not have a strong brand identity or brand loyalty. We believe that establishing and maintaining brand identity and brand loyalty is critical to attracting customers once we have a commercially viable product. In order to attract customers to our subsidiary products, we may be forced to spend substantial funds to create and maintain brand recognition among consumers. We believe that the cost of our sales campaigns could increase substantially in the future. If our efforts to market our products and establish our brand are not successful, our ability to earn revenues and sustain our operations could be harmed.

Our success is dependent on the completed development and potential performance of our credit facility model and business expense management platform.

Because we are still developing our credit facility model, integrated business expense management platform and reporting, analytics, forecasting, and white label services, a number of factors, including technological and regulatory barriers in the markets in which we operate, could delay or prevent the potential launch of such products or limit our potential profitability. As these are our only products in development at this time, our overall financial performance is directly tied to their completed development and potential performance.

If we do not effectively manage our credit risk relating to our credit facility model, we could experience delinquency or losses which could have a material adverse effect on our financial condition and results of operation.

Providing credit to SMEs involves risk, including risks inherent in dealing with individual borrowers, risks of nonpayment, risks resulting from uncertainties as to cash flows available to service debt, and risks resulting from changes in economic and market conditions. Part of our value proposition is our ability to issue credit facilities to SME customers without a personal guarantee from their founders, which is a standard practice in business banking. Although our management team believes that our credit risk approval and monitoring procedures are prudent and sufficient to mitigate potential excessive delinquency of customers’ credit accounts, we may nonetheless fail to identify or reduce credit risks, and we cannot completely eliminate all credit risks related to our credit facility model. If the overall economic climate in the markets in which we operate experience material disruption, our borrowers may experience difficulties in repaying loaned amounts, and the level of nonperforming loans, charge-offs and delinquencies could rise and require additional provisions for loan losses, which would cause our net income and return on equity to decrease.

Our relationships with Mastercard, Peoples Trust Company and i2c are crucial elements of our products.

Based on current agreements and technological setups, our customers will be able to utilize their respective credit facilities through virtual and/or physical credit cards issued by Peoples Bank, a Canadian financial services provider, on the global Mastercard merchant network (operated by Mastercard Incorporated) to make purchases and payments in person as well as virtually through online or telephone orders. Additionally, the Company will rely on i2c to manage electronic payments on the Company’s expense management platform, as well as to detect fraudulent activity on customers’ accounts.

6

In the event that our relationships with Mastercard, Peoples Trust Company, or i2c are suspended, terminated, or compromised, the potential value of our credit facility model and business expense management platform could become substantially impaired. To mitigate this risk, we have retained personnel with extensive experience in managing payment card products for major financial institutions who work to ensure that our relationships with Mastercard, Peoples Trust Company, and i2c remain in good standing. However, we can provide no assurance that we will be successful in maintaining our relationships with these parties and that our license to issue credit cards on the global Mastercard merchant network, or ability to manage electronic payments, will not be suspended, terminated, or compromised. Any such developments could have a material adverse effect on our business, financial condition, and results of operations.

Regulations in certain jurisdictions may restrict our business from operating as intended or at all.

We have investigated potential regulatory hurdles to implementing our credit facility model, integrated business expense management platform, and reporting, analytics, forecasting, and white label services in Canada and the United States, as well as their respective territories, provinces, states, districts, and dependencies, as applicable, and do not currently foresee any substantial regulatory restrictions to developing and releasing these products. It is possible that regulations, whether new or existing and unknown, may prevent releasing such products in their intended form or at all in certain jurisdictions. We intend to retain legal counsel who can navigate regulatory landscapes in which we will operate to mitigate this risk. However, we can provide no assurance that we will not in the future become subject to regulations which restrict or prevent us from developing or implementing our credit facility model, integrated business expense management platform, and reporting, analytics, forecasting, and white label services. Any such restrictions could have a material adverse effect on our business, financial condition, and results of operations.

We will need to increase the size of our organization, and we may be unable to manage rapid growth effectively.

Our failure to manage growth effectively could have a material and adverse effect on our business, results of operations and financial condition. We anticipate that a period of significant expansion will be required to address the development and release of new products and potential internal growth to handle licensing and research activities. This expansion will place a significant strain on management, operational and financial resources. To manage the expected growth of our operations and personnel, we must both improve our existing operational and financial systems, procedures and controls and implement new systems, procedures and controls. We must also expand our finance, administrative, and operations staff. Our current personnel, systems, procedures and controls may not adequately support future operations. Management may be unable to hire, train, retain, motivate and manage necessary personnel or to identify, manage and exploit existing and potential strategic relationships and market opportunities.

We are not subject to Sarbanes-Oxley and lack the internal controls over financial reporting required of public companies.

We currently do not have the internal infrastructure necessary, and are not required, to complete an attestation about our internal controls over financial reporting that would be required under Section 404 of the Sarbanes-Oxley Act. As a result, we may fail to identify material deficiencies or weaknesses in the quality of such internal controls. We may in the future be required, by Sarbanes-Oxley or other applicable laws (including exchange and market regulations) to establish and maintain appropriate internal controls over financial reporting. Establishing such controls may require us to incur significant expenses and diversion of management’s time. Failure to establish appropriate controls, or any failure of those controls once established, could adversely impact our public disclosures regarding our business, financial condition or results of operations.

In addition, management’s assessment of internal controls over financial reporting may identify weaknesses and conditions that need to be addressed in our internal controls over financial reporting or other matters that may raise concerns for investors. Any actual or perceived weaknesses and conditions that need to be addressed in our internal control over financial reporting, disclosure of management’s assessment of our internal controls over financial reporting or disclosure of our public accounting firm’s attestation to or report on management’s assessment of our internal controls over financial reporting may have an adverse impact on the price of our Common Stock.

7

The successful development of our credit facility model, integrated business expense management platform, and reporting, analytics, forecasting, and white label services is highly speculative and is dependent on numerous factors, many of which are beyond our control.

The Company was only recently formed to engage in developing a credit facility model, integrated business expense management platform, and reporting, analytics, forecasting and white label services and we have not commenced revenue-generating operations. Our business is dependent on the development and implementation of such products, or the identification and development of new products and services, all of which are highly speculative and subject to numerous risks and uncertainties. For example, our business is dependent on our success in:

| ● | establishing brand recognition and customer loyalty; |

| ● | increasing the number and total volume of credit products extended to customers; |

| ● | successfully developing and deploying new products; |

| ● | competing with other companies that are currently in, or may in the future enter, the business of providing credit and business expense management solutions to SMEs; |

| ● | managing growth in administrative overhead costs; |

| ● | navigating economic conditions and fluctuations in the credit market; |

| ● | managing the growth of our business; and |

| ● | expanding our business into adjacent markets |

There is no assurance that we will succeed in addressing these risks and uncertainties or that we will generate significant revenues or profits. An investment in the Common Shares is speculative and there is no assurance that investors will obtain any return on their investment. Investors will be subject to substantial risks involved in an investment in us, including the risk of losing their entire investment.

New products and services may subject us to additional risks. A failure to successfully manage these risks may have a material adverse effect on our business.

From time to time, we may develop and implement new products and services. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new products and services, we may invest significant time and resources. Initial timetables for the introduction and development of new products or services may not be achieved and price and profitability targets may not prove feasible. External factors, such as compliance with regulations, competitive alternatives, and shifting market preferences, may also impact the successful implementation of a new product or service. Failure to successfully manage these risks in the development and implementation of new products or services could have a material adverse effect on our business, results of operations and financial condition.

We may face significant competition in Canada and in other markets where we decide to operate in the future, including the United States.

We may face significant competition in Canada and in other markets where we decide to offer our credit facility model, integrated business expense management platform, and reporting, analytics, forecasting, and white label services, or other products and services which we have not yet identified or developed, including the United States. Many of our competitors may have substantially greater financial, technical and other resources, such as larger research and development staff and experienced marketing organizations. Additional mergers and acquisitions in our industry may result in even more resources being concentrated in our competitors. As a result, these companies may obtain market acceptance more rapidly than we can and may be more effective as well. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large, established companies. Competition may increase further as a result of advances in the commercial applicability of financial technologies, potential regulatory changes which could make the marketplace more competitive, and/or adjustments to SME credit and expense management offerings from incumbent financial institutions and financial technology firms.

8

Our revenue could fluctuate from period to period, which could have an adverse material impact on our business.

Our revenue may fluctuate from period-to-period in the future due to a variety of factors, many of which are beyond our control. Factors relating to our business that may contribute to these fluctuations include the following events, as well as other factors described elsewhere in this Offering Circular:

| ● | Changes in state and federal government regulations, international government laws and regulations or the enforcement of those laws and regulations; and |

| ● | General economic and political conditions, both domestically and internationally, as well as economic and political conditions specifically affecting SMEs or “non-traditional” credit products. |

As a result of these and other factors, the results of operations for any quarterly or annual period may differ materially from the results of operations for any prior or future quarterly or annual period and should not be relied upon as indications of our future performance.

If we are unable to effectively protect our intellectual property and trade secrets, it may impair our ability to compete.

Our success will depend in part on our ability to obtain and maintain meaningful intellectual property protection for our intellectual property. The names and/or logos of our brands may be challenged by holders of trademarks who file opposition notices, or otherwise contest, trademark applications by us. Similarly, domains owned and used by us may be challenged by others who contest our ability to use the domain name or URL. Patents, trademarks and copyrights that have been or may be obtained by us may be challenged by others, or enforcement of the patents, trademarks and copyrights may be required. We also rely upon, and will rely upon in the future, trade secrets. While we use reasonable efforts to protect these trade secrets, we cannot assure that our employees, consultants, contractors or advisors will not, unintentionally or willfully, disclose our trade secrets to competitors or other third parties. In addition, courts outside the United States are sometimes less willing to protect trade secrets. Moreover, our competitors may independently develop equivalent knowledge, methods and know-how. If we are unable to defend our trade secrets from others’ use, or if our competitors develop equivalent knowledge, it could have a material adverse effect on our business. Any infringement of our patent, trademark, copyright or trade secret rights could result in significant litigation costs, and any failure to adequately protect our trade secret rights could result in our competitors offering similar products, potentially resulting in loss of a competitive advantage and decreased revenues. Existing patent, copyright, trademark and trade secret laws afford only limited protection. In addition, the laws of some foreign countries do not protect our rights to the same extent as do the laws of the United States. Therefore, we may not be able to protect our existing patent, copyright, trademark and trade secret rights against unauthorized third-party use. Enforcing a claim that a third party illegally obtained and is using our existing patent, copyright, trademark and trade secret rights could be expensive and time consuming, and the outcome of such a claim is unpredictable. Such litigation could result in diversion of resources and could materially adversely affect our operating results.

Computer, website and/or information system breakdowns, as well as cyber security attacks, could affect our business.

Computer, website and/or information system breakdowns as well as cyber security attacks could impair our ability to implement our business plans, leading to reduced revenue and/or reputational damage, which could have a material adverse effect on our financial results as well as the investor’s investment.

We will depend on third-party providers for a reliable Internet infrastructure as well as other aspects of our technology and applications and the failure of these third parties, or the Internet in general, for any reason would significantly impair our ability to conduct our business.

We will outsource some or all of our online presence, server needs, technology development and data management to third parties who host the actual servers and provide power and security in multiple data centers in each geographic location. These third-party facilities require uninterrupted access to the Internet. If the operation of the servers is interrupted for any reason, including natural disaster, financial insolvency of a third-party provider, or malicious electronic intrusion into the data center, our business would be significantly damaged. As has occurred with many Internet-based businesses, we may be subject to “denial-of-service” attacks in which unknown individuals bombard our computer servers with requests for data, thereby degrading the servers’ performance. We cannot be certain we would be successful in quickly identifying and neutralizing these attacks. If either a third-party facility failed, or our ability to access the Internet was interfered with because of the failure of Internet equipment in general or if we become subject to malicious attacks of computer intruders, our business and operating results will be materially adversely affected.

9

Compliance with laws and regulations related to anti-money laundering and corruption, and our failure to comply with such laws and regulations could harm our business.

Once the Company starts offering money transfer solutions, the Company will be subject to a variety of state/provincial/territorial, national, foreign, and international laws and regulations that apply to anti- money laundering and anti-terrorist financing. The Company will be required to implement an anti-money laundering compliance program and appoint a compliance officer that ensures compliance with such laws and regulations. The Company will also have to comply with economic sanctions administered and enforced by Canadian government authorities that prohibit dealings with designated persons Our actual, perceived or alleged failure to comply with applicable anti-money laundering and anti-terrorist financing laws and regulations could result in enforcement actions and significant penalties against us, which could result in negative publicity, increase our operating costs, subject us to claims or other remedies and may harm our business and our investor’s investment.

Compliance with laws and regulations designed to protect personal data, and our actual or perceived failure to adequately protect personal data, could harm our business.

A variety of state/provincial/territorial, national, foreign, and international laws and regulations apply to the collection, use, retention, protection, disclosure, transfer and other processing of personal data. These privacy and data protection-related laws and regulations are evolving, with new or modified laws and regulations proposed and implemented frequently and existing laws and regulations subject to new or different interpretations. Compliance with these laws and regulations can be costly and can delay or impede the development of new products. Our actual, perceived or alleged failure to comply with applicable laws and regulations or to protect personal data, including sensitive cardholder data and account information, could result in enforcement actions and significant penalties against us, which could result in negative publicity, increase our operating costs, subject us to claims or other remedies and may harm our business and our investor’s investment.

We may be involved in legal and regulatory proceedings.

From time to time, we may be a party to legal and regulatory proceedings, including matters involving governmental agencies, entities with whom we do business, customers, and other proceedings arising in the ordinary course of business. We will evaluate our exposure to these legal and regulatory proceedings and establish reserves for the estimated liabilities in accordance with generally accepted accounting principles. Assessing and predicting the outcome of these matters involves substantial uncertainties. Unexpected outcomes in these legal proceedings, or changes in management’s evaluations or predictions and accompanying changes in established reserves, could have an adverse impact on our financial results.

The liability of our directors and officers and others is limited under certain circumstances.

We may provide for the indemnification of directors, officers and others to the fullest extent permitted by law and, to the extent permitted by such law, eliminate or limit the personal liability of directors, officers and others to us and our shareholders for monetary damages for certain breaches of fiduciary duty. Such indemnification may be available for liabilities arising in connection with this Offering. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or others controlling or working with us pursuant to the foregoing provisions, we have been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and, therefore, is unenforceable. Despite this fact, if we provide such indemnification, then it could have a material adverse effect on us.

Our executive officers, directors and insider shareholders beneficially own or control a substantial portion of the outstanding Common Shares.

Our executive officers, directors and insider shareholders beneficially own or control a substantial portion of the outstanding Common Shares, which may limit an investor’s ability to propose or direct the management or overall direction of the Company. Additionally, this concentration of ownership could discourage or prevent a potential takeover of the Company that might otherwise result in an investor receiving a premium over the market price for the Common Shares. The majority of the currently outstanding Common Shares is beneficially owned and controlled by a group of insiders, including our directors, executive officers and inside shareholders. Accordingly, our directors, executive officers and insider shareholders may have the power to control the election of our directors and the approval of actions for which the approval of our shareholders is required. Such concentrated control of the Company may adversely affect the price of the Common Shares. Our executive officers, directors and insider shareholders may be able to control matters requiring approval by our shareholders, including mergers or other business combinations. Such concentrated control may also make it difficult for our shareholders to receive a premium for the Common Shares in the event that we merge with a third party or enter into different transactions which require shareholder approval. These provisions could also limit the price that investors might be willing to pay in the future for the Common Shares.

10

Because we do not have an audit or compensation committee, shareholders will have to rely on management to perform these functions.

We do not have an audit or compensation committee composed of independent directors or any audit or compensation committee. Our directors and management perform these functions as a whole. Thus, there is a potential conflict in that our directors and management will participate in discussions concerning director and management compensation and audit issues that may affect management decisions.

We may have difficulty retaining and acquiring personnel.

The loss of any member of our management team could have a material adverse effect on our business and results of operations. In addition, the inability to hire or the increased costs of hiring new personnel, including members of executive management, could have a material adverse effect on our business and operating results. The expansion of marketing and sales of our impact products will require us to find, hire and retain additional capable employees or consultants who can understand, explain, market and sell our products. There is intense competition for capable personnel in all of these areas, and we may not be successful in attracting, training, integrating, motivating, or retaining new personnel, vendors, or subcontractors for these required functions. New employees and consultants often require significant training and, in many cases, take a significant amount of time before they achieve full productivity. As a result, we may incur significant costs to attract and retain employees and consultants, including significant expenditures related to salaries and benefits and other compensation expenses. We may lose new employees or consultants to our competitors or other companies before we realize the benefit of our investment in recruiting and training them. In addition, as we move into new jurisdictions, we will need to attract and recruit skilled employees and consultants in those new areas.

Our directors and officers may have conflicts of interest.

We may be subject to various potential conflicts of interest because of the fact that some of our officers and directors may be engaged in a range of business activities. In addition, our officers and directors may devote time to their outside business interests, so long as such activities do not materially or adversely interfere with their duties to the Company. In some cases, our officers and directors may have fiduciary obligations associated with these business interests that interfere with their ability to devote time to our business and affairs and that could adversely affect our operations. These business interests could require significant time and attention of our executive officers and directors.

Our financial statements have been prepared in accordance with IFRS accounting principles.

As a Canadian incorporated and resident company, our financial statements are prepared using IFRS accounting principles, which are different from the accounting principles under U.S. Generally Accepted Accounting Principles (“U.S. GAAP”). IFRS is an internationally recognized body of accounting principles that are used by many companies outside of the United States to prepare their financial statements. Regulation A permits Canadian issuers to prepare and file their financial statements in accordance with IFRS rather than U.S. Investors who are not familiar with IFRS may misunderstand certain information presented in our financial statements. Accordingly, we suggest that readers of our financial statements familiarize themselves with the provisions of IFRS accounting principles in order to better understand the differences between these two sets of principles.

Public health epidemics or outbreaks could adversely impact our business.

In December 2019, a novel strain of coronavirus (“COVID-19”) emerged in Wuhan, Hubei Province, China. While initially the outbreak was largely concentrated in China and caused significant disruptions to its economy, it has now spread to several other countries and infections have been reported globally. Because COVID-19 infections have been reported throughout both Canada and the United States, certain national, provincial, state and local governmental authorities have issued proclamations and/or directives aimed at minimizing the spread of COVID-19. Additionally, more restrictive proclamations and/or directives may be issued in the future. The ultimate impact of the COVID-19 pandemic on the Company’s operations is unknown and will depend on future developments that are highly uncertain and cannot be predicted with confidence, including the duration of the COVID-19 outbreak, new information which may emerge concerning the severity of the COVID-19 pandemic, and any additional preventative and protective actions that governments, or the Company, may direct, which may result in an extended period of continued business disruption and reduced operations. Any resulting financial impact cannot be reasonably estimated at this time but could have a material adverse impact on our business, financial condition and results of operations.

11

Risks Related to this Offering and the Common Shares

The Common Shares are being offered on a “best efforts” basis and we may not raise the Maximum Amount being offered.

Since we are offering the Common Shares on a “best efforts” basis, there is no assurance that we will sell enough Common Shares to meet our capital needs. If an investor purchases Common Shares, then the investor will do so without any assurance that we will raise enough money to satisfy the full use of proceeds that we have outlined in this Offering Circular or to meet our working capital needs.

If the Maximum Offering is not raised, it may increase the amount of additional equity we need to raise.

There is no assurance that the maximum number of Common Shares in this Offering will be sold. We believe that we will, assuming that we are able to raise a minimum of approximately $5,000,000 in this Offering, have sufficient capital following the completion of this Offering to fund our planned operations for the next 12 months. If we are unable to sell this amount in this Offering, we may need to incur debt or raise additional equity in order to finance our operations. Incurring debt will make less cash available for distribution to our shareholders after servicing the debt. Increasing the amount of additional equity that we will have to seek in the future will further dilute those investors participating in this Offering.

This Offering is being conducted without the benefit of an underwriter, who could have confirmed the accuracy of the disclosures in this Offering Circular.

We have self-underwritten this Offering on a “best efforts” basis, which means that no underwriter has engaged in any due diligence activities to confirm the accuracy of the disclosure in the Offering Circular or to provide input as to this Offering price; we will attempt to sell the shares and there can be no assurance that all of the shares offered under the Offering Circular will be sold or that the proceeds raised from this Offering, if any, will be sufficient to cover the costs of this Offering; and there is no assurance that we can raise the intended Offering amount.

It is uncertain when the Common Shares will be listed on an exchange for trading, if ever.

No application is currently being prepared for the Common Shares to trade on a public market. As a result, the Common Shares sold in this Offering may not be listed on a securities exchange or quoted on an alternative trading system for an extended period of time, if at all. If the Common Shares are not listed on a securities exchange or quoted on an alternative trading system, it may be difficult to sell or trade in the Common Shares. There can be no assurance that a liquid market for the Common Shares will develop or, if it does develop, that it will continue. If a market does develop, it may not be liquid. Therefore, investors may not be able to sell the Common Shares easily or at prices that will provide them with yield comparable to similar investments that have a developed secondary market. Illiquidity may have a severely adverse effect on the market value of the Common Shares and investors wishing to sell the Common Shares might therefore suffer losses.

Although to date we have not been subject to the continuous and timely disclosure requirements of Canadian securities laws or other rules, regulations and policies of a securities exchange or alternative trading system, we are working with our legal, accounting and financial advisors to identify those areas in which changes should be made to our financial management control systems to manage our obligations as a public company listed on a securities exchange or quoted on an alternative trading system. These areas include corporate governance, corporate controls, disclosure controls and procedures and financial reporting and accounting systems. We have made, and will continue to make, changes in these and other areas, including our internal controls over financial reporting. However, we cannot assure holders of the Common Shares that these and other measures that we might take will be sufficient to allow us to satisfy our obligations as a public company listed on a securities exchange or quoted on an alternative trading system on a timely basis. In addition, compliance with reporting and other requirements applicable to public companies listed on a securities exchange or quoted on an alternative trading system will create additional costs for us and will require the time and attention of management. We cannot predict the amount of the additional costs that we might incur, the timing of such costs or the impact that management’s attention to these matters will have on our business.

12

If the Common Shares become subject to the penny stock rules, it would become more difficult to trade the Common Shares.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or authorized for quotation on certain automated quotation systems, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. If we do not obtain and retain a listing or quotation of the Common Stock and if the price of the Common Stock is less than $5.00, the Common Stock will be deemed a penny stock. The penny stock rules require a broker-dealer, before a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document containing specified information. In addition, the penny stock rules require that before effecting any transaction in a penny stock not otherwise exempt from those rules, a broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive (i) the purchaser’s written acknowledgment of the receipt of a risk disclosure statement; (ii) a written agreement to transactions involving penny stocks; and (iii) a signed and dated copy of a written suitability statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for the Common Stock, and therefore stockholders may have difficulty selling the Common Shares.

We have broad discretion in how we use the proceeds of this Offering and may not use these proceeds effectively, which could affect our results of operations and cause the price of our Common Shares to decline.

We will have considerable discretion in the application of the net proceeds of this Offering. We intend to use the net proceeds from this Offering to fund our business strategy, including without limitation, new and ongoing technology development; marketing and business development; working capital; general corporate purposes, including hiring additional personnel; and expenses of this Offering. As a result, investors will be relying upon management’s judgment with only limited information about our specific intentions for the use of the balance of the net proceeds of this Offering. We may use the net proceeds for purposes that do not end up yielding a significant return or any return at all for our shareholders. In addition, pending their use, we may invest the net proceeds from this Offering in a manner that does not produce income or that loses value.

We may incur increased costs as a result of our public reporting obligations, and our management team will be required to devote substantial time to new compliance initiatives.

We may become subject to the periodic reporting requirements for public reporting companies in the United States and Canada in the near future. Particularly after we are no longer an “emerging growth company,” we will continue to incur significant legal, accounting and other expenses that we have not incurred as a private company. Our management and other personnel would need to devote a substantial amount of time to comply with our reporting obligations. Moreover, these reporting obligations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly.

We may lose our status as a foreign private Company in the United States, which would result in increased costs related to regulatory compliance under United States securities laws.