united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-23631 |

| Tactical Investment Series Trust |

| (Exact name of registrant as specified in charter) |

| 11726 Seven Gables Road, Cincinnati, OH | 45249 |

| (Address of principal executive offices) | (Zip code) |

| Capitol Services, Inc. |

| 1675 South State Street, Suite B, Dover, DE 19901 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | 833-974-3787 |

| Date of fiscal year end: | 12/31 |

| Date of reporting period: | 12/31/2021 |

ITEM 1. REPORTS TO SHAREHOLDERS.

| | | |

| | | |

| | | |

| |  | |

| | | |

| | | |

| | TFA Tactical Income Fund | |

| | (fka Tactical Conservative Allocation Fund) | |

| | Class A: TFALX | |

| | Class I: TFAZX | |

| | | |

| | | |

| | Tactical Moderate Allocation Fund | |

| | Class A: TFAMX | |

| | Class I: TFAUX | |

| | | |

| | | |

| | Tactical Growth Allocation Fund | |

| | Class A: TFAEX | |

| | Class I: TFAFX | |

| | | |

| | | |

| | TFA Quantitative Fund | |

| | Class I: TFAQX | |

| | | |

| | | |

| | TFA Multidimensional Tactical Fund | |

| | Class I: TFADX | |

| | | |

| | | |

| | TFA AlphaGen Growth Fund | |

| | Class I: TFAZX | |

| | | |

| | | |

| | TACTICAL INVESTMENT SERIES TRUST | |

| | | |

| | | |

| | | |

| | | |

| | Annual Report | |

| | | |

| | December 31, 2021 | |

| | | |

| | | |

| | | |

| | | |

| | 1-833-974-3787 | |

| | www.tfafunds.com | |

| | | |

| | | |

| | | |

SHAREHOLDER LETTER

DECEMBER 31, 2021 (UNAUDITED)

Dear Shareholders,

I am pleased to present you with the third annual report for the TFA family of tactically managed mutual funds, including the TFA Tactical Income Fund (formerly Tactical Conservative Allocation Fund), Tactical Moderate Allocation Fund, Tactical Growth Allocation Fund, TFA Multidimensional Tactical Fund, TFA Quantitative Fund, and TFA AlphaGen Growth Fund. This report covers the twelve months from January 1, 2021 through December 31, 2021.

We believe that every portfolio should include an allocation to actively managed mutual funds that seek to achieve their investment objectives by positioning portfolios to search out opportunities in the market while managing the risks of negative market environments. Such an approach carries a higher degree of management skills compared to a passive, buy-and-hold approach. Tactical Fund Advisors utilizes a flexible universe of tactical investing strategies and methodologies derived from a team of experienced and highly capable active investment managers.

For the year ending December 31, 2021, the TFA Tactical Income Fund Class I shares returned 5.82%, the Tactical Moderate Allocation Fund Class I shares returned 11.89%, while the Tactical Growth Allocation Fund Class I shares returned 16.18%. The TFA Multidimensional Tactical Fund Class I shares returned 11.02%, while the TFA Quantitative Fund Class I shares also returned 11.02%. The TFA AlphaGen Growth Fund Class I shares were launched on August 23, 2021 and returned 1.80% for the period.

In our prior letter to shareholders, we highlighted how multiple vaccine rollouts as well as ongoing monetary and fiscal support continued to push markets higher into the end of the 2020, despite slowing economic growth. During the first quarter of 2021, the transfer of power in Washington, the acceleration of Covid-19 vaccinations, a major stimulus/relief bill, significant economic improvement, and a surge in interest rates combined to push major stock indices higher and bond prices lower. Markets continued higher in the second quarter due to the continued re-opening of the economy and corresponding strong economic data and a dramatic decline in the spread of Covid-19 due to the global vaccination efforts. Interest rates continued moving lower despite inflation becoming one of the biggest issues during the quarter. During the third quarter, the stock market continued its relentless rise until September broke the market’s 8-month winning streak. In addition to being overdue and within the most difficult seasonal period, a series of previously ignored worries came to the fore, including the $20 billion Evergrande debt default in China, another US debt ceiling showdown, the rise of Covid-19 Delta variant and ever-present concerns over Federal Reserve policy and the attendant outlook on inflation and growth. Despite these worries, a stronger than expected earnings season pushed the S&P 500® Index to new highs in October despite ongoing supply chain issues. Markets cooled in November as inflation fears gripped the market and the Covid-19 Omicron variant caused a massive surge in Covid infections. As fears began to ebb about the seriousness of Omicron, the markets delivered a surge in time for the holidays.

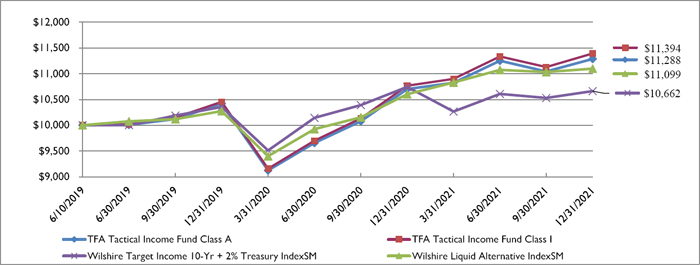

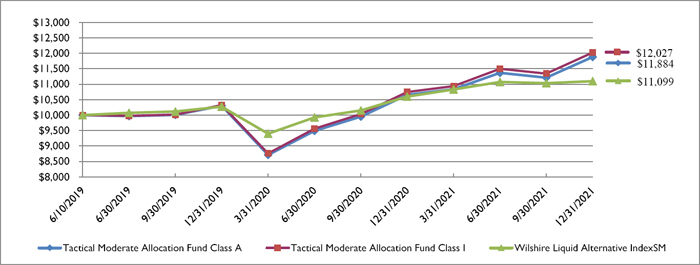

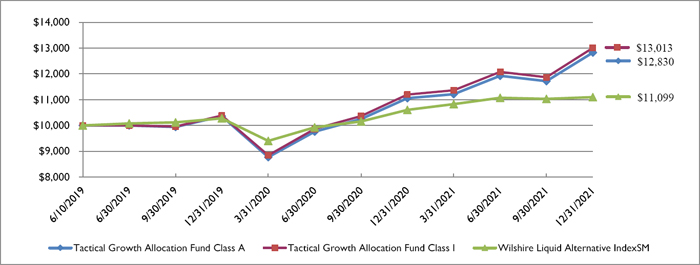

The TFA Tactical Income Fund’s 5.82% return for the year ending December 31, 2021 outperformed the -0.77% return of the benchmark Wilshire Target Income 10-yr Treasury +2% Index, as well as the 4.70% return of the prior benchmark Wilshire Liquid Alternatives Index. The 11.89% return of the Tactical Moderate Allocation Fund, and 16.18% return of the Tactical Growth Allocation Fund outperformed the 4.70% return of the benchmark Wilshire Liquid Alternatives Index. The outperformance of the funds can be attributed to the risk-targeted management approach, which provided exposure to class-leading equity and fixed-income holdings for the year, as well as the Funds’ strategy diversification approach that utilizes equities, fixed income and derivatives in order to achieve the desired exposure to specific asset classes for each fund.

SHAREHOLDER LETTER

DECEMBER 31, 2021 (UNAUDITED)

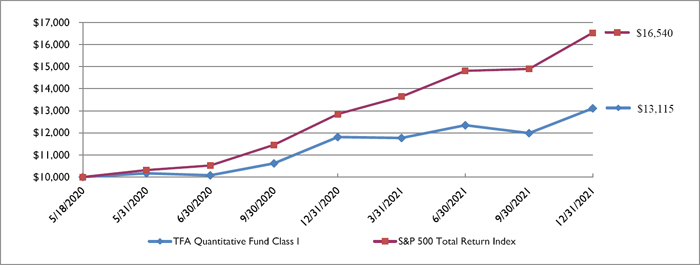

The TFA Quantitative Fund’s 11.02% return for the period ending December 31, 2021 underperformed the 28.71% return of the benchmark S&P 500 Total Return Index. The underperformance was largely the result of a deterioration in technical indicators causing the fund to remain underinvested while the markets marched forward. Changes to the management strategy made in the fourth quarter, allowing the fund to invest in 1.5x leveraged Russell 2000 and 2x leveraged Nasdaq 100 funds, contributed to its most successful quarter, but the fund still underperformed its S&P 500 Index for the year. At the end of December, the sub-adviser Potomac Advisor was notified that two additional sub-advisers were to be added to the fund and that Potomac’s percentage of assets it managed would be reduced. We look forward to 2022 with the two new sub-advisers.

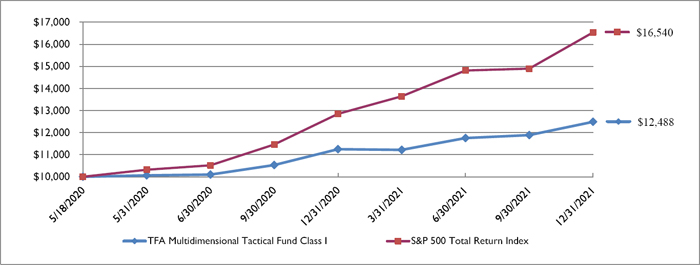

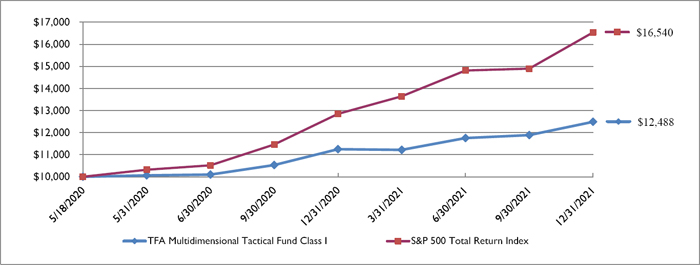

The TFA Multidimensional Tactical Fund’s 11.02% return for the period ending December 31, 2021 underperformed the 28.71% return of the benchmark S&P 500 Total Return Index, which is the fund’s primary benchmark. We believe it is important to recognize that the Multidimensional strategy maintains a constant allocation of approximately 15% to Fixed Income markets. In addition, it should be noted that the sub-advisor’s management strategy focuses on stock market segments outside of the S&P 500. Although such an approach has proved successful in the past, the management strategy did not keep pace with the S&P 500 Index benchmark for the year. We are working with the sub-advisor to upgrade the portfolio after the first of the year.

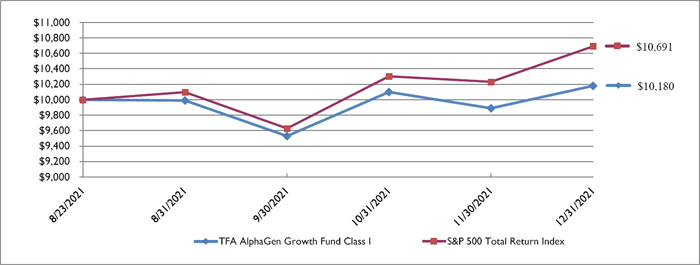

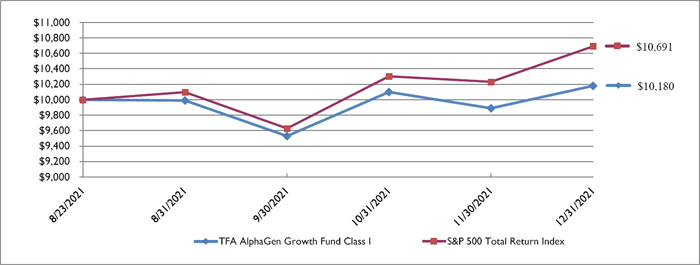

The TFA AlphaGen Growth Fund was launched in the third quarter of 2021. For the period August 23 through December 31, 2021, the fund’s 1.80% return underperformed the 6.91% return of the S&P 500 Total Return Index for the same period. The launch coincided with the start of the first meaningful correction in stock prices of the year, which lasted into early October. The risk mitigation strategies utilized by management resulted in the fund being underinvested during the brief rally that ensued. In addition, the fund’s global diversification and exposure to the fixed income market contributed to the fund lagging the S&P 500 Index for the four-month period.

Both the stock and bond markets have begun the new year in a corrective mode as investors appear to reprice assets for the higher inflation and interest rate environment expected to dominate 2022. Thus, we believe employing tactical strategies designed to not only participate in the upside but also to preserve capital during severely negative market cycles is more important than ever.

Thank you for being a shareholder in the TFA family of mutual funds and we wish you a healthy 2022.

Sincerely,

Drew K. Horter, President/CEO

Tactical Fund Advisors

SHAREHOLDER LETTER

DECEMBER 31, 2021 (UNAUDITED)

Performance figures represent past performance which is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The performance data quoted here represents past performance. For more current performance information, please call toll-free 1-800-869-1679 or visit our website, www.tfafunds.com. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment in the investment adviser has contractually agreed to reduce its fees and/or absorb expenses until at least April 30, 2023, to ensure that net annual, operating expenses of the Class A Shares and Class I Shares will not exceed 2.14% and 1.89% respectively, subject to the possible recoupment from the Fund within three years after the fees have been waived or reimbursed. Please review the Fund prospectus for more information regarding the Fund’s fees and expenses.

| TFA Tactical Income Fund (fka Tactical Conservative Allocation Fund) |

PORTFOLIO REVIEW (Unaudited)

December 31, 2021

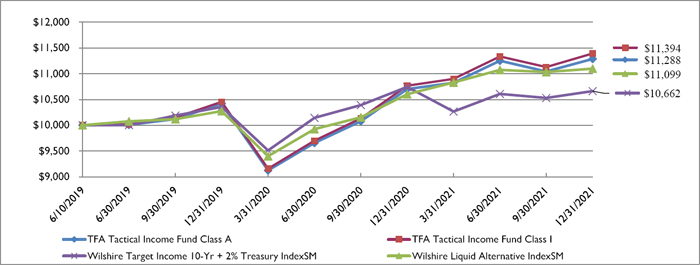

Average Annual Total Return through December 31, 2021*, as compared to its benchmark:

| | One | Since |

| | Year | Inception (a) |

| TFA Tactical Income Fund - Class A | 5.47% | 4.85% |

| TFA Tactical Income Fund - Class I | 5.82% | 5.23% |

| Wilshire Target Income 10-Yr + 2% Treasury IndexSM ** | -0.77% | 3.07% |

| Wilshire Liquid Alternative IndexSM *** | 4.70% | 4.16% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. The Fund’s manager has contractually agreed to waive fees and/or reimburse expenses of the Fund to the extent necessary to limit operating expenses (excluding front-end or contingent deferred loads, taxes, leverage interest, borrowing interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, dividend expenses on securities sold short, underlying fund fees and expenses or extraordinary expenses such as litigation) at 2.14% and 1.89% for Class A shares and Class I shares, respectively, through April 30, 2023. Per the Fund’s most recent prospectus, total annual Fund estimated expenses after waivers are 2.35% and 2.10% for Class A shares and Class I shares, respectively. Without waiver the expense ratios are 2.47%, and 2.22% for Class A shares and Class I shares, respectively. For performance information current to the most recent month-end, please call toll-free 1-833-974-3787. |

| ** | Effective October 26, 2021, the Fund’s primary benchmark was changed to the Wilshire Target Income 10-Year Treasury +2% Plus IndexSM. The Wilshire Target Income 10-Year Treasury +2% Plus IndexSM measures an investment strategy that provides broad exposure to income-producing asset classes, using a universe of ETFs with the goal of achieving an annualized target income yield in excess of the U.S. 1-Year Treasury plus two percent. The index uses an optimization approach which aims to minimize overall portfolio risk while meeting the stated yield target. Investors cannot invest directly in an index. |

| *** | The Wilshire Liquid Alternative IndexSM measures the collective performance of the five Wilshire Liquid Alternative strategies that make up the Wilshire Liquid Alternative Universe. The Wilshire Liquid Alternative Index (WLIQA) is designed to provide a broad measure of the liquid alternative market by combining the performance of the Wilshire Liquid Alternative Equity Hedge IndexSM (WLIQAEH), Wilshire Liquid Alternative Global Macro IndexSM (WLIQAGM), Wilshire Liquid Alternative Relative Value IndexSM (WLIQARV), Wilshire Liquid Alternative Multi-Strategy IndexSM (WLIQAMS), and Wilshire Liquid Alternative Event Driven IndexSM (WLIQAED). Investors cannot invest directly in an index. |

| (a) | Inception date June 10, 2019 |

Comparison of the Change in Value of a $10,000 Investment

| Holdings by Sector | | % of Net Assets | |

| Exchange-Traded Funds | | | | |

| Fixed Income | | | 89.2 | % |

| Equity | | | 2.6 | % |

| Short-Term Investments | | | 13.6 | % |

| Other / Cash & Cash Equivalents | | | -5.4 | % |

| | | | 100.0 | % |

Please refer to the Schedule of Investments in this annual report for a detailed listing of the Fund’s holdings.

| Tactical Moderate Allocation Fund |

PORTFOLIO REVIEW (Unaudited)

December 31, 2021

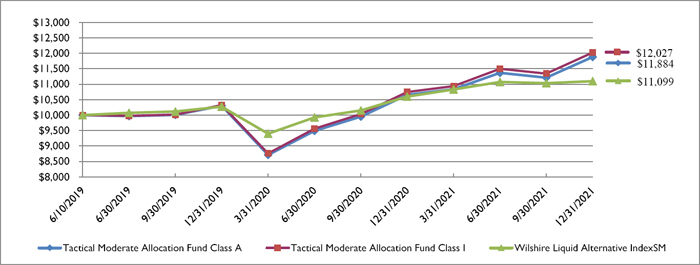

Average Annual Total Return through December 31, 2021*, as compared to its benchmark:

| | One | Since |

| | Year | Inception (a) |

| Tactical Moderate Allocation Fund - Class A | 11.50% | 6.98% |

| Tactical Moderate Allocation Fund - Class I | 11.89% | 7.48% |

| Wilshire Liquid Alternative IndexSM ** | 4.70% | 4.16% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. The Fund’s manager has contractually agreed to waive fees and/or reimburse expenses of the Fund to the extent necessary to limit operating expenses (excluding front-end or contingent deferred loads, taxes, leverage interest, borrowing interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, dividend expenses on securities sold short, underlying fund fees and expenses or extraordinary expenses such as litigation) at 2.14% and 1.89% for Class A shares and Class I shares, respectively, through April 30, 2023. Per the Fund’s most recent prospectus, total annual Fund estimated expenses after waivers are 2.31% and 2.06% for Class A shares and Class I shares, respectively. Without waiver the expense ratios are 2.38%, and 2.13% for Class A shares and Class I shares, respectively. For performance information current to the most recent month-end, please call toll-free 1-833-974-3787. |

| ** | The Wilshire Liquid Alternative IndexSM measures the collective performance of the five Wilshire Liquid Alternative strategies that make up the Wilshire Liquid Alternative Universe. The Wilshire Liquid Alternative Index (WLIQA) is designed to provide a broad measure of the liquid alternative market by combining the performance of the Wilshire Liquid Alternative Equity Hedge IndexSM (WLIQAEH), Wilshire Liquid Alternative Global Macro IndexSM (WLIQAGM), Wilshire Liquid Alternative Relative Value IndexSM (WLIQARV), Wilshire Liquid Alternative Multi-Strategy IndexSM (WLIQAMS), and Wilshire Liquid Alternative Event Driven IndexSM (WLIQAED). Investors cannot invest directly in an index. |

| (a) | Inception date June 10, 2019 |

Comparison of the Change in Value of a $10,000 Investment

| Holdings by Sector | | % of Net Assets | |

| Exchange-Traded Funds | | | | |

| Fixed Income | | | 37.0 | % |

| Mixed Allocation | | | 32.3 | % |

| Equity | | | 18.6 | % |

| Software | | | 0.3 | % |

| Insurance | | | 0.3 | % |

| Internet Media & Services | | | 0.3 | % |

| Retail-Consumer Staples | | | 0.2 | % |

| Semiconductors | | | 0.2 | % |

| Technology Hardware | | | 0.2 | % |

| Medical Equipment & Devices | | | 0.2 | % |

| Short-Term Investments | | | 14.9 | % |

| Other / Cash & Cash Equivalents | | | -4.5 | % |

| | | | 100.0 | % |

Please refer to the Schedule of Investments in this annual report for a detailed listing of the Fund’s holdings.

| Tactical Growth Allocation Fund |

PORTFOLIO REVIEW (Unaudited)

December 31, 2021

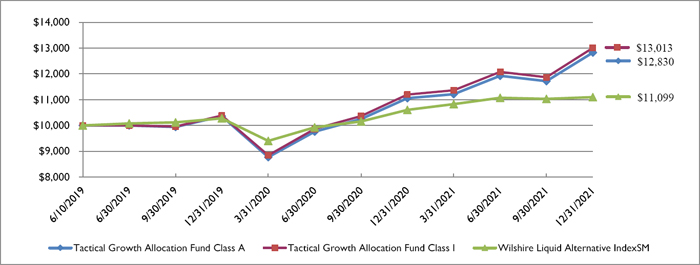

Average Annual Total Return through December 31, 2021*, as compared to its benchmark:

| | One | Since |

| | Year | Inception (a) |

| Tactical Growth Allocation Fund - Class A | 16.02% | 10.23% |

| Tactical Growth Allocation Fund - Class I | 16.18% | 10.84% |

| Wilshire Liquid Alternative IndexSM ** | 4.70% | 4.16% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. The Fund’s manager has contractually agreed to waive fees and/or reimburse expenses of the Fund to the extent necessary to limit operating expenses (excluding front-end or contingent deferred loads, taxes, leverage interest, borrowing interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, dividend expenses on securities sold short, underlying fund fees and expenses or extraordinary expenses such as litigation) at 2.14% and 1.89% for Class A shares and Class I shares, respectively, through April 30, 2023. Per the Fund’s most recent prospectus, total annual Fund estimated expenses are 2.30% and 2.05% for Class A shares and Class I shares, respectively. For performance information current to the most recent month-end, please call toll-free 1-833-974-3787. |

| ** | The Wilshire Liquid Alternative IndexSM measures the collective performance of the five Wilshire Liquid Alternative strategies that make up the Wilshire Liquid Alternative Universe. The Wilshire Liquid Alternative Index (WLIQA) is designed to provide a broad measure of the liquid alternative market by combining the performance of the Wilshire Liquid Alternative Equity Hedge IndexSM (WLIQAEH), Wilshire Liquid Alternative Global Macro IndexSM (WLIQAGM), Wilshire Liquid Alternative Relative Value IndexSM (WLIQARV), Wilshire Liquid Alternative Multi-Strategy IndexSM (WLIQAMS), and Wilshire Liquid Alternative Event Driven IndexSM (WLIQAED). Investors cannot invest directly in an index. |

| (a) | Inception date June 10, 2019 |

Comparison of the Change in Value of a $10,000 Investment

| Holdings by Sector | | % of Net Assets | |

| Exchange-Traded Funds | | | | |

| Equity | | | 48.0 | % |

| Fixed Income | | | 21.5 | % |

| Mixed Allocation | | | 8.5 | % |

| Software | | | 1.4 | % |

| Insurance | | | 1.3 | % |

| Internet Media & Services | | | 1.3 | % |

| Retail-Consumer Staples | | | 1.0 | % |

| Medical Equipment & Devices | | | 0.8 | % |

| Semiconductors | | | 0.8 | % |

| Technology Hardware | | | 0.8 | % |

| Short-Term Investments | | | 13.9 | % |

| Other / Cash & Cash Equivalents | | | 0.7 | % |

| | | | 100.0 | % |

Please refer to the Schedule of Investments in this annual report for a detailed listing of the Fund’s holdings.

PORTFOLIO REVIEW (Unaudited)

December 31, 2021

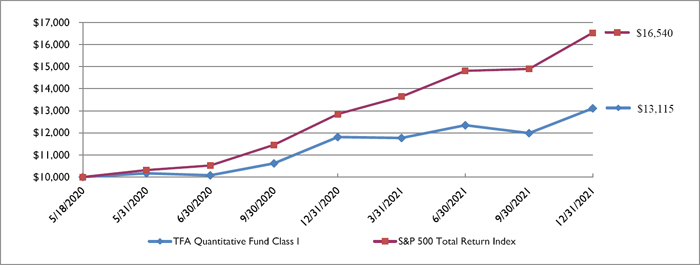

Average Annual Total Return through December 31, 2021*, as compared to its benchmark:

| | One | Since |

| | Year | Inception (a) |

| TFA Quantitative Fund - Class I | 11.02% | 18.20% |

| S&P 500 Total Return Index ** | 28.71% | 36.38% |

| Wilshire Liquid Alternative IndexSM *** | 4.70% | 8.66% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. The Fund’s manager has contractually agreed to waive fees and/or reimburse expenses of the Fund to the extent necessary to limit operating expenses (excluding front-end or contingent deferred loads, taxes, leverage interest, borrowing interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, dividend expenses on securities sold short, underlying fund fees and expenses or extraordinary expenses such as litigation) at 1.89% for Class I shares, through April 30, 2023. Per the Fund’s most recent prospectus, total annual Fund estimated expenses is 2.85% for Class I shares. For performance information current to the most recent month-end, please call toll-free 1-833-974-3787. |

| ** | The S&P 500 Total Return Index, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an index. |

| *** | The Wilshire Liquid Alternative IndexSM measures the collective performance of the five Wilshire Liquid Alternative strategies that make up the Wilshire Liquid Alternative Universe. The Wilshire Liquid Alternative Index (WLIQA) is designed to provide a broad measure of the liquid alternative market by combining the performance of the Wilshire Liquid Alternative Equity Hedge IndexSM (WLIQAEH), Wilshire Liquid Alternative Global Macro IndexSM (WLIQAGM), Wilshire Liquid Alternative Relative Value IndexSM (WLIQARV), Wilshire Liquid Alternative Multi-Strategy IndexSM (WLIQAMS), and Wilshire Liquid Alternative Event Driven IndexSM (WLIQAED). Investors cannot invest directly in an index. |

| (a) | Inception date May 18, 2020 |

Comparison of the Change in Value of a $10,000 Investment

| Holdings by Sector | | % of Net Assets | |

| Open End Funds | | | | |

| Mixed Allocation | | | 61.5 | % |

| Equity | | | 41.2 | % |

| Short-Term Investments | | | 14.7 | % |

| Other / Cash & Cash Equivalents | | | -17.4 | % |

| | | | 100.0 | % |

Please refer to the Schedule of Investments in this annual report for a detailed listing of the Fund’s holdings.

| TFA Multidimensional Tactical Fund |

PORTFOLIO REVIEW (Unaudited)

December 31, 2021

Average Annual Total Return through December 31, 2021*, as compared to its benchmark:

| | One | Since |

| | Year | Inception (a) |

| TFA Multidimensional Tactical Fund - Class I | 11.02% | 14.68% |

| S&P 500 Total Return Index ** | 28.71% | 36.38% |

| Wilshire Liquid Alternative IndexSM *** | 4.70% | 8.66% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. The Fund’s manager has contractually agreed to waive fees and/or reimburse expenses of the Fund to the extent necessary to limit operating expenses (excluding front-end or contingent deferred loads, taxes, leverage interest, borrowing interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, dividend expenses on securities sold short, underlying fund fees and expenses or extraordinary expenses such as litigation) at 1.89% for Class I shares, through April 30, 2023. Per the Fund’s most recent prospectus, total annual Fund estimated expenses is 1.79% for Class I shares. For performance information current to the most recent month-end, please call toll-free 1-833-974-3787. |

| ** | The S&P 500 Total Return Index, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an index. |

| *** | The Wilshire Liquid Alternative IndexSM measures the collective performance of the five Wilshire Liquid Alternative strategies that make up the Wilshire Liquid Alternative Universe. The Wilshire Liquid Alternative Index (WLIQA) is designed to provide a broad measure of the liquid alternative market by combining the performance of the Wilshire Liquid Alternative Equity Hedge IndexSM (WLIQAEH), Wilshire Liquid Alternative Global Macro IndexSM (WLIQAGM), Wilshire Liquid Alternative Relative Value IndexSM (WLIQARV), Wilshire Liquid Alternative Multi-Strategy IndexSM (WLIQAMS), and Wilshire Liquid Alternative Event Driven IndexSM (WLIQAED). Investors cannot invest directly in an index. |

| (a) | Inception date May 18, 2020 |

Comparison of the Change in Value of a $10,000 Investment

| Holdings by Sector | | % of Net Assets | |

| Exchange-Traded Funds | | | | |

| Fixed Income | | | 23.0 | % |

| Biotech & Pharma | | | 12.0 | % |

| Technology Hardware | | | 9.8 | % |

| Transportation & Logistics | | | 9.8 | % |

| Cable & Satellite | | | 7.3 | % |

| Internet Media & Services | | | 7.2 | % |

| Entertainment Content | | | 4.8 | % |

| Medical Equipment & Devices | | | 4.8 | % |

| Semiconductors | | | 4.8 | % |

| Technology Services | | | 4.8 | % |

| Short-Term Investments | | | 7.3 | % |

| Other / Cash & Cash Equivalents | | | 4.4 | % |

| | | | 100.0 | % |

Please refer to the Schedule of Investments in this annual report for a detailed listing of the Fund’s holdings.

PORTFOLIO REVIEW (Unaudited)

December 31, 2021

Average Annual Total Return through December 31, 2021*, as compared to its benchmark:

| | Since

Inception (a) |

| TFA AlphaGen Growth Fund - Class I | 1.80% |

| S&P 500 Total Return Index ** | 6.91% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. The Fund’s manager has contractually agreed to waive fees and/or reimburse expenses of the Fund to the extent necessary to limit operating expenses (excluding front-end or contingent deferred loads, taxes, leverage interest, borrowing interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, dividend expenses on securities sold short, underlying fund fees and expenses or extraordinary expenses such as litigation) at 1.89% for Class I shares, through April 30, 2023. Per the Fund’s most recent prospectus, total annual Fund estimated expenses is 2.16% for Class I shares. For performance information current to the most recent month-end, please call toll-free 1-833-974-3787. |

| ** | The S&P 500 Total Return Index, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an index. |

| (a) | Inception date August 23, 2021 |

Comparison of the Change in Value of a $10,000 Investment

| Holdings by Sector | | % of Net Assets | |

| Exchange-Traded Funds | | | | |

| Equity | | | 67.9 | % |

| Fixed Income | | | 12.5 | % |

| Short-Term Investments | | | 19.9 | % |

| Other / Cash & Cash Equivalents | | | -0.3 | % |

| | | | 100.0 | % |

Please refer to the Schedule of Investments in this annual report for a detailed listing of the Fund’s holdings.

| TFA TACTICAL INCOME FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2021 |

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 91.8% | | | | |

| | | | | EQUITY - 2.6% | | | | |

| | 20,400 | | | iShares Mortgage Real Estate ETF | | $ | 704,004 | |

| | | | | | | | | |

| | | | | FIXED INCOME - 89.2% | | | | |

| | 111,780 | | | Direxion Daily 20 Year Plus Treasury Bull 3x | | | 3,145,489 | |

| | 26,970 | | | Invesco Emerging Markets Sovereign Debt Portfolio | | | 710,660 | |

| | 8,160 | | | Invesco Senior Loan ETF | | | 180,336 | |

| | 12,830 | | | ISHARES 0-5 Year TIPS Bond ETF | | | 1,358,440 | |

| | 15,850 | | | iShares 1-3 Year Treasury Bond ETF | | | 1,355,809 | |

| | 10,000 | | | iShares 1-5 Year Investment Grade Corporate Bond ETF(a) | | | 538,800 | |

| | 6,815 | | | iShares 20+ Year Treasury Bond ETF | | | 1,009,915 | |

| | 42,010 | | | iShares 7-10 Year Treasury Bond ETF | | | 4,831,150 | |

| | 6,160 | | | iShares Agency Bond ETF | | | 721,767 | |

| | 9,380 | | | iShares Core International Aggregate Bond ETF | | | 511,491 | |

| | 17,890 | | | iShares Core U.S. Aggregate Bond ETF | | | 2,040,891 | |

| | 18,820 | | | iShares ESG Aware USD Corporate Bond ETF | | | 513,598 | |

| | 5,550 | | | iShares iBoxx $ High Yield Corporate Bond ETF | | | 482,906 | |

| | 3,600 | | | iShares iBoxx $ Investment Grade Corporate Bond ETF | | | 477,072 | |

| | 4,350 | | | iShares JPMorgan USD Emerging Markets Bond ETF | | | 474,411 | |

| | 600 | | | iShares Short Treasury Bond ETF(b) | | | 66,252 | |

| | 23,360 | | | iShares TIPS Bond ETF | | | 3,018,112 | |

| | 19,390 | | | iShares US Treasury Bond ETF | | | 517,325 | |

| | 31,000 | | | PGIM Ultra Short Bond ETF(a) | | | 1,534,190 | |

| | 8,350 | | | Vanguard Total International Bond Index Fund, ETF SHARES | | | 460,586 | |

| | | | | | | | 23,949,200 | |

| | | | | | | | | |

| | | | | TOTAL EXCHANGE-TRADED FUNDS (Cost $24,875,297) | | | 24,653,204 | |

| | | | | | | | | |

| Shares | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENTS — 13.6% | | | | |

| | | | | MONEY MARKET FUNDS - 13.6% | | | | |

| | 495 | | | Fidelity Government Portfolio, CLASS I, 0.01%(c) | | | 495 | |

| | 3,659,112 | | | First American Treasury Obligations Fund, Class X, 0.01%(c) | | | 3,659,112 | |

| | | | | TOTAL MONEY MARKET FUNDS (Cost $3,659,607) | | | 3,659,607 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS (Cost $3,659,607) | | | 3,659,607 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| TFA TACTICAL INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2021 |

| Contracts(d) | | | | | Counterparty | | Expiration Date | | Exercise Price | | | Notional Value | | | Fair Value | |

| | | | | INDEX OPTIONS PURCHASED - 1.1% | | | | | | | | | | | | | | | | |

| | | | | CALL OPTIONS PURCHASED - 1.1% | | | | | | | | | | | | | | | | |

| | 15 | | | SPDR S&P 500 ETF Trust | | StoneX | | 01/21/2022 | | $ | 415 | | | $ | 622,500 | | | $ | 91,635 | |

| | 25 | | | SPDR S&P 500 ETF Trust | | StoneX | | 03/18/2022 | | | 440 | | | | 1,100,000 | | | | 104,550 | |

| | 10 | | | SPDR S&P 500 ETF Trust | | StoneX | | 06/17/2022 | | | 434 | | | | 434,000 | | | | 53,175 | |

| | 10 | | | SPDR S&P 500 ETF Trust | | StoneX | | 09/16/2022 | | | 442 | | | | 442,000 | | | | 52,705 | |

| | | | | TOTAL CALL OPTIONS PURCHASED (Cost - $150,373) | | | | | 302,065 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL INDEX OPTIONS PURCHASED (Cost - $150,373) | | | | | 302,065 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 106.5% (Cost $28,685,277) | | | | $ | 28,614,876 | |

| | | | | CALL OPTIONS WRITTEN - (0.1)% (Proceeds - $10,910) | | | | | (33,200 | ) |

| | | | | PUT OPTIONS WRITTEN - (0.1)% (Proceeds - $143,308) | | | | | (35,250 | ) |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (6.3)% | | | | | (1,701,551 | ) |

| | | | | NET ASSETS - 100.0% | | | | | | | | | | | | | | $ | 26,844,875 | |

| | | | | | | | | | | | | | | | | | | | | |

| Contracts(d) | | | | | Counterparty | | Expiration Date | | Exercise Price | | | Notional Value | | | Fair Value | |

| | | | | WRITTEN INDEX OPTIONS - (0.2)% | | | | | | |

| | | | | CALL OPTIONS WRITTEN- (0.1)% | | | | | | |

| | 10 | | | SPDR S&P 500 ETF Trust | | StoneX | | 06/17/2022 | | $ | 484 | | | $ | 484,000 | | | $ | 16,980 | |

| | 10 | | | SPDR S&P 500 ETF Trust | | StoneX | | 09/16/2022 | | | 500 | | | | 500,000 | | | | 16,220 | |

| | | | | TOTAL CALL OPTIONS WRITTEN (Proceeds - $10,910) | | | | | 33,200 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | PUT OPTIONS WRITTEN - (0.1)% | | | | | | |

| | 15 | | | SPDR S&P 500 ETF Trust | | StoneX | | 01/21/2022 | | $ | 415 | | | $ | 622,500 | | | $ | 540 | |

| | 25 | | | SPDR S&P 500 ETF Trust | | StoneX | | 03/18/2022 | | | 440 | | | | 1,100,000 | | | | 14,100 | |

| | 10 | | | SPDR S&P 500 ETF Trust | | StoneX | | 06/17/2022 | | | 403 | | | | 403,000 | | | | 7,990 | |

| | 10 | | | SPDR S&P 500 ETF Trust | | StoneX | | 09/16/2022 | | | 400 | | | | 400,000 | | | | 12,620 | |

| | | | | TOTAL PUT OPTIONS WRITTEN (Proceeds - $143,308) | | | | | 35,250 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL INDEX OPTIONS WRITTEN (Proceeds - $154,218) | | | | $ | 68,450 | |

| ETF | - Exchange-Traded Fund |

| (a) | All or a portion of the security is held as collateral for written options. |

| (b) | Non-income producing security. |

| (c) | Rate disclosed is the seven day effective yield as of December 31, 2021. |

| (d) | Each option contract allows the holder of the option to purchase or sell 100 shares of the underlying security. |

See accompanying notes which are an integral part of these financial statements.

| TACTICAL MODERATE ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2021 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 2.7% | | | | |

| | | | | AEROSPACE & DEFENSE - 0.1% | | | | |

| | 135 | | | Lockheed Martin Corporation | | $ | 47,980 | |

| | | | | | | | | |

| | | | | BANKING - 0.1% | | | | |

| | 874 | | | Bank OZK | | | 40,667 | |

| | | | | | | | | |

| | | | | BIOTECH & PHARMA - 0.2% | | | | |

| | 329 | | | Johnson & Johnson | | | 56,282 | |

| | | | | | | | | |

| | | | | E-COMMERCE DISCRETIONARY - 0.2% | | | | |

| | 18 | | | Amazon.com, Inc.(a) | | | 60,018 | |

| | | | | | | | | |

| | | | | INSURANCE - 0.3% | | | | |

| | 293 | | | Assurant, Inc. | | | 45,667 | |

| | 204 | | | Berkshire Hathaway, Inc., Class B(a) | | | 60,996 | |

| | | | | | | | 106,663 | |

| | | | | INTERNET MEDIA & SERVICES - 0.3% | | | | |

| | 20 | | | Alphabet, Inc., Class A(a) | | | 57,941 | |

| | 134 | | | Meta Platforms, Inc., Class A(a) | | | 45,071 | |

| | | | | | | | 103,012 | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 0.2% | | | | |

| | 139 | | | ResMed, Inc. | | | 36,206 | |

| | 60 | | | West Pharmaceutical Services, Inc. | | | 28,141 | |

| | | | | | | | 64,347 | |

| | | | | OIL & GAS PRODUCERS - 0.1% | | | | |

| | 907 | | | Ovintiv, Inc. | | | 30,566 | |

| | | | | | | | | |

| | | | | RETAIL - CONSUMER STAPLES - 0.2% | | | | |

| | 55 | | | Costco Wholesale Corporation | | | 31,224 | |

| | 358 | | | Walmart, Inc. | | | 51,799 | |

| | | | | | | | 83,023 | |

| | | | | RETAIL - DISCRETIONARY - 0.1% | | | | |

| | 336 | | | Ross Stores, Inc. | | | 38,398 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| TACTICAL MODERATE ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2021 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 2.7% (Continued) | | | | |

| | | | | SEMICONDUCTORS - 0.2% | | | | |

| | 466 | | | Microchip Technology, Inc. | | $ | 40,570 | |

| | 90 | | | NVIDIA Corporation | | | 26,470 | |

| | | | | | | | 67,040 | |

| | | | | SOFTWARE - 0.3% | | | | |

| | 46 | | | Adobe, Inc.(a) | | | 26,085 | |

| | 247 | | | Microsoft Corporation | | | 83,071 | |

| | | | | | | | 109,156 | |

| | | | | TECHNOLOGY HARDWARE - 0.2% | | | | |

| | 374 | | | Apple, Inc. | | | 66,411 | |

| | | | | | | | | |

| | | | | TECHNOLOGY SERVICES - 0.2% | | | | |

| | 380 | | | Global Payments, Inc. | | | 51,368 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $747,444) | | | 924,931 | |

| | | | | | | | | |

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 88.0% | | | | |

| | | | | ALTERNATIVE - 0.1% | | | | |

| | 350 | | | First Trust ETF III-First Trust Long/Short Equity ETF | | | 18,260 | |

| | | | | | | | | |

| | | | | EQUITY - 18.6% | | | | |

| | 508 | | | Direxion Russell 1000 Value Over Growth ETF | | | 30,119 | |

| | 369 | | | First Trust Capital Strength ETF | | | 31,199 | |

| | 433 | | | First Trust NASDAQ Technology Dividend Index Fund | | | 27,214 | |

| | 226 | | | FlexShares Global Quality Real Estate Index Fund | | | 16,751 | |

| | 930 | | | Invesco DB Commodity Index Tracking Fund, N(a) | | | 19,325 | |

| | 162 | | | Invesco S&P 500 Equal Weight | | | 27,505 | |

| | 722 | | | Invesco S&P 500 Equal Weight Real Estate ETF | | | 30,505 | |

| | 239 | | | Invesco S&P 500 Equal Weight Utilities Portfolio | | | 27,285 | |

| | 402 | | | Invesco S&P 500 Low Volatility ETF | | | 27,589 | |

| | 137 | | | iShares DJ US Consumer | | | 27,425 | |

| | 645 | | | iShares MSCI Global Metals & Mining Producers ETF | | | 27,490 | |

| | 650 | | | iShares S&P 500 Growth ETF | | | 54,386 | |

See accompanying notes which are an integral part of these financial statements.

| TACTICAL MODERATE ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2021 |

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 88.0% (Continued) | | | | |

| | | | | EQUITY - 18.6% (Continued) | | | | |

| | 589 | | | O’Shares US Quality Dividend ETF | | $ | 27,430 | |

| | 1,080 | | | ProShares Ultra QQQ(a) | | | 96,142 | |

| | 1,320 | | | ProShares Ultra Russell2000(a) | | | 73,286 | |

| | 180 | | | ProShares Ultra S&P500 | | | 26,347 | |

| | 320 | | | SPDR Dow Jones Global Real Estate ETF | | | 18,090 | |

| | 920 | | | Vanguard FTSE All-World ex-US ETF | | | 56,378 | |

| | 710 | | | Vanguard FTSE Developed Markets ETF | | | 36,253 | |

| | 490 | | | Vanguard FTSE Emerging Markets ETF | | | 24,235 | |

| | 80 | | | Vanguard Growth ETF | | | 25,672 | |

| | 130 | | | Vanguard Large-Cap ETF | | | 28,733 | |

| | 20,461 | | | Vanguard Mega Cap Growth ETF(a) | | | 5,335,409 | |

| | 160 | | | Vanguard Mid-Cap ETF | | | 40,763 | |

| | 90 | | | Vanguard Real Estate ETF | | | 10,441 | |

| | 140 | | | Vanguard Russell 2000 ETF | | | 12,573 | |

| | 1,430 | | | Vanguard Total Stock Market ETF | | | 345,258 | |

| | 190 | | | Vanguard Value ETF | | | 27,951 | |

| | | | | | | | 6,531,754 | |

| | | | | FIXED INCOME - 37.0% | | | | |

| | 892 | | | First Trust Enhanced Short Maturity ETF | | | 53,342 | |

| | 899 | | | iShares 20+ Year Treasury Bond ETF | | | 133,223 | |

| | 39,801 | | | iShares Convertible Bond ETF(a) | | | 3,549,452 | |

| | 2,439 | | | iShares Core International Aggregate Bond ETF | | | 132,999 | |

| | 310 | | | iShares Core U.S. Aggregate Bond ETF | | | 35,365 | |

| | 4,895 | | | iShares ESG Aware USD Corporate Bond ETF | | | 133,585 | |

| | 1,400 | | | iShares TIPS Bond ETF | | | 180,880 | |

| | 5,043 | | | iShares US Treasury Bond ETF | | | 134,547 | |

| | 20,000 | | | PGIM Ultra Short Bond ETF(b) | | | 989,800 | |

| | 89,855 | | | SPDR Bloomberg Convertible Securities ETF | | | 7,454,370 | |

| | 110 | | | Vanguard Long-Term Bond | | | 11,321 | |

| | 240 | | | Vanguard Short-Term Bond ETF | | | 19,399 | |

| | 990 | | | Vanguard Total Bond Market ETF | | | 83,903 | |

| | 630 | | | Vanguard Total International Bond Index Fund, ETF SHARES | | | 34,751 | |

| | | | | | | | 12,946,937 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| TACTICAL MODERATE ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2021 |

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 88.0% (Continued) | | | | |

| | | | | MIXED ALLOCATION - 32.3% | | | | |

| | 107,904 | | | HCM Defender 100 Index ETF(a) | | $ | 6,082,548 | |

| | 113,041 | | | HCM Defender 500 Index ETF(a) | | | 5,221,364 | |

| | | | | | | | 11,303,912 | |

| | | | | | | | | |

| | | | | TOTAL EXCHANGE-TRADED FUNDS (Cost $30,156,450) | | | 30,800,863 | |

| | | | | | | | | |

| Shares | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENTS — 14.9% | | | | |

| | | | | MONEY MARKET FUNDS - 14.9% | | | | |

| | 25 | | | Fidelity Government Portfolio, CLASS I, 0.01%(c) | | | 25 | |

| | 5,220,769 | | | First American Treasury Obligations Fund, Class X, 0.01%(c) | | | 5,220,769 | |

| | | | | TOTAL MONEY MARKET FUNDS (Cost $5,220,794) | | | 5,220,794 | |

| | | | | | | | | |

| | | | | TOTAL SHORT-TERM INVESTMENTS (Cost $5,220,794) | | | 5,220,794 | |

| Contracts(d) | | | | | Counterparty | | Expiration Date | | Exercise Price | | | Notional Value | | | Fair Value | |

| | | | | INDEX OPTIONS PURCHASED - 0.4% | | |

| | | | | CALL OPTIONS PURCHASED - 0.4% | | |

| | 20 | | | SPDR S&P 500 ETF Trust | | StoneX | | 01/21/2022 | | $ | 466 | | | $ | 932,000 | | | $ | 24,540 | |

| | 15 | | | SPDR S&P 500 ETF Trust | | StoneX | | 06/17/2022 | | | 435 | | | | 652,500 | | | | 79,725 | |

| | 10 | | | SPDR S&P 500 ETF Trust | | StoneX | | 03/18/2022 | | | 457 | | | | 457,000 | | | | 27,370 | |

| | | | | TOTAL CALL OPTIONS PURCHASED (Cost - $83,769) | | | | | 131,635 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | PUT OPTIONS PURCHASED - 0.0%(e) | | | | | | |

| | 20 | | | SPDR S&P 500 ETF Trust | | StoneX | | 01/21/2022 | | $ | 415 | | | $ | 830,000 | | | $ | 720 | |

| | 10 | | | SPDR S&P 500 ETF Trust | | StoneX | | 03/18/2022 | | | 420 | | | | 420,000 | | | | 3,800 | |

| | | | | TOTAL PUT OPTIONS PURCHASED (Cost - $13,836) | | | | | 4,520 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL INDEX OPTIONS PURCHASED (Cost - $97,605) | | | | | 136,155 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS – 106.0% (Cost $36,222,293) | | | | $ | 37,082,743 | |

| | | | | CALL OPTIONS WRITTEN - (0.1)% (Proceeds - $17,599) | | | | | (28,680 | ) |

| | | | | PUT OPTIONS WRITTEN – (0.1)% (Proceeds - $71,144) | | | | | | (24,490 | ) |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (5.8)% | | | | | (2,033,352 | ) |

| | | | | NET ASSETS - 100.0% | | | | $ | 34,996,221 | |

| | | | | | | | | | | | | | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| TACTICAL MODERATE ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2021 |

| Contracts(d) | | | | | Counterparty | | Expiration Date | | Exercise Price | | | Notional Value | | | Fair Value | |

| | | | | WRITTEN INDEX OPTIONS - (0.1)% | | | |

| | | | | CALL OPTIONS WRITTEN- (0.1)% | | |

| | 15 | | | SPDR S&P 500 ETF Trust | | StoneX | | 06/17/2022 | | $ | 485 | | | $ | 727,500 | | | $ | 24,570 | |

| | 10 | | | SPDR S&P 500 ETF Trust | | StoneX | | 03/18/2022 | | | 499 | | | | 499,000 | | | | 3,010 | |

| | 20 | | | SPDR S&P 500 EFT Trust | | StoneX | | 01/21/2022 | | | 490 | | | | 980,000 | | | | 1,100 | |

| | | | | TOTAL CALL OPTIONS WRITTEN (Proceeds - $17,599) | | | | | 28,680 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | PUT OPTIONS WRITTEN - (0.1)% | | | | | | |

| | 15 | | | SPDR S&P 500 ETF Trust | | StoneX | | 06/17/2022 | | $ | 390 | | | $ | 585,000 | | | $ | 10,020 | |

| | 10 | | | SPDR S&P 500 ETF Trust | | StoneX | | 03/18/2022 | | | 457 | | | | 457,000 | | | | 8,390 | |

| | 20 | | | SPDR S&P 500 EFT Trust | | StoneX | | 01/21/2022 | | | 466 | | | | 932,000 | | | | 6,080 | |

| | | | | TOTAL PUT OPTIONS WRITTEN (Proceeds - $71,144) | | | | | 24,490 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL INDEX OPTIONS WRITTEN (Proceeds - $88,743) | | | | $ | 53,170 | |

| ETF | - Exchange-Traded Fund |

| (a) | Non-income producing security. |

| (b) | All or a portion of the security is held as collateral for written options. |

| (c) | Rate disclosed is the seven day effective yield as of December 31, 2021. |

| (d) | Each option contract allows the holder of the option to purchase or sell 100 shares of the underlying security. |

| (e) | Percentage rounds to less than 0.1%. |

See accompanying notes which are an integral part of these financial statements.

| TACTICAL GROWTH ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2021 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 11.4% | | | | |

| | | | | AEROSPACE & DEFENSE - 0.6% | | | | |

| | 992 | | | Lockheed Martin Corporation | | $ | 352,567 | |

| | | | | | | | | |

| | | | | BANKING - 0.5% | | | | |

| | 6,396 | | | Bank OZK | | | 297,606 | |

| | | | | | | | | |

| | | | | BIOTECH & PHARMA - 0.7% | | | | |

| | 2,413 | | | Johnson & Johnson | | | 412,792 | |

| | | | | | | | | |

| | | | | E-COMMERCE DISCRETIONARY - 0.7% | | | | |

| | 122 | | | Amazon.com, Inc.(a) | | | 406,790 | |

| | | | | | | | | |

| | | | | INSURANCE - 1.3% | | | | |

| | 2,150 | | | Assurant, Inc. | | | 335,099 | |

| | 1,499 | | | Berkshire Hathaway, Inc., Class B(a) | | | 448,200 | |

| | | | | | | | 783,299 | |

| | | | | INTERNET MEDIA & SERVICES - 1.3% | | | | |

| | 146 | | | Alphabet, Inc., Class A(a) | | | 422,968 | |

| | 985 | | | Meta Platforms, Inc., Class A(a) | | | 331,305 | |

| | | | | | | | 754,273 | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 0.8% | | | | |

| | 1,025 | | | ResMed, Inc. | | | 266,992 | |

| | 448 | | | West Pharmaceutical Services, Inc. | | | 210,116 | |

| | | | | | | | 477,108 | |

| | | | | OIL & GAS PRODUCERS - 0.4% | | | | |

| | 6,648 | | | Ovintiv, Inc. | | | 224,038 | |

| | | | | | | | | |

| | | | | RETAIL - CONSUMER STAPLES - 1.0% | | | | |

| | 408 | | | Costco Wholesale Corporation | | | 231,622 | |

| | 2,624 | | | Walmart, Inc. | | | 379,666 | |

| | | | | | | | 611,288 | |

| | | | | RETAIL - DISCRETIONARY - 0.5% | | | | |

| | 2,461 | | | Ross Stores, Inc. | | | 281,243 | |

See accompanying notes which are an integral part of these financial statements.

TACTICAL GROWTH ALLOCATION FUND

SCHEDULE OF INVESTMENTS (Continued)

December 31, 2021

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 11.4% (Continued) | | | | |

| | | | | SEMICONDUCTORS - 0.8% | | | | |

| | 3,414 | | | Microchip Technology, Inc. | | $ | 297,223 | |

| | 664 | | | NVIDIA Corporation | | | 195,289 | |

| | | | | | | | 492,512 | |

| | | | | SOFTWARE - 1.4% | | | | |

| | 342 | | | Adobe, Inc.(a) | | | 193,935 | |

| | 1,815 | | | Microsoft Corporation | | | 610,420 | |

| | | | | | | | 804,355 | |

| | | | | TECHNOLOGY HARDWARE - 0.8% | | | | |

| | 2,741 | | | Apple, Inc. | | | 486,719 | |

| | | | | | | | | |

| | | | | TECHNOLOGY SERVICES - 0.6% | | | | |

| | 2,785 | | | Global Payments, Inc. | | | 376,476 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $5,537,625) | | | 6,761,066 | |

| | | | | | | | | |

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 78.4% | | | | |

| | | | | ALTERNATIVE - 0.4% | | | | |

| | 4,900 | | | First Trust ETF III-First Trust Long/Short Equity | | | 255,633 | |

| | | | | | | | | |

| | | | | EQUITY – 48.0% | | | | |

| | 1,800 | | | Communication Services Select Sector SPDR Fund | | | 139,824 | |

| | 990 | | | Consumer Discretionary Select Sector SPDR Fund | | | 202,396 | |

| | 1,246 | | | Direxion Russell 1000 Value Over Growth ETF | | | 73,874 | |

| | 4,920 | | | Financial Select Sector SPDR Fund | | | 192,126 | |

| | 906 | | | First Trust Capital Strength ETF | | | 76,602 | |

| | 1,063 | | | First Trust NASDAQ Technology Dividend Index Fund | | | 66,810 | |

| | 529 | | | FlexShares Global Quality Real Estate Index Fund | | | 39,209 | |

| | 660 | | | Health Care Select Sector SPDR Fund | | | 92,987 | |

| | 740 | | | Industrial Select Sector SPDR Fund | | | 78,299 | |

| | 12,315 | | | Invesco DB Commodity Index Tracking Fund, N(a) | | | 255,905 | |

| | 398 | | | Invesco S&P 500 Equal Weight | | | 67,573 | |

| | 1,773 | | | Invesco S&P 500 Equal Weight Real Estate ETF | | | 74,910 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| TACTICAL GROWTH ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2021 |

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 78.4% (Continued) | | | | |

| | | | | EQUITY – 48.0% (Continued) | | | | |

| | 588 | | | Invesco S&P 500 Equal Weight Utilities Portfolio | | $ | 67,128 | |

| | 986 | | | Invesco S&P 500 Low Volatility ETF | | | 67,669 | |

| | 4,186 | | | iShares Core MSCI Emerging Markets ETF | | | 250,574 | |

| | 337 | | | iShares DJ US Consumer | | | 67,461 | |

| | 1,582 | | | iShares MSCI Global Metals & Mining Producers ETF | | | 67,425 | |

| | 12,140 | | | iShares S&P 500 Growth ETF | | | 1,015,754 | |

| | 5,499 | | | iShares Semiconductor ETF | | | 2,982,218 | |

| | 1,447 | | | O’Shares US Quality Dividend ETF | | | 67,387 | |

| | 74,723 | | | ProShares Ultra QQQ(a) | | | 6,651,841 | |

| | 27,040 | | | ProShares Ultra Russell2000(a) | | | 1,501,261 | |

| | 22,054 | | | ProShares Ultra S&P500 | | | 3,228,044 | |

| | 4,450 | | | SPDR Dow Jones Global Real Estate ETF | | | 251,559 | |

| | 2,000 | | | SPDR S&P 500 ETF Trust | | | 949,920 | |

| | 2,250 | | | Technology Select Sector SPDR Fund | | | 391,208 | |

| | 19,844 | | | Vanguard FTSE All-World ex-US ETF | | | 1,216,040 | |

| | 9,520 | | | Vanguard FTSE Developed Markets ETF | | | 486,091 | |

| | 11,303 | | | Vanguard FTSE Emerging Markets ETF | | | 559,046 | |

| | 1,800 | | | Vanguard Growth ETF | | | 577,620 | |

| | 2,650 | | | Vanguard Large-Cap ETF | | | 585,703 | |

| | 3,260 | | | Vanguard Mid-Cap ETF | | | 830,550 | |

| | 4,464 | | | Vanguard Russell 2000 ETF | | | 400,912 | |

| | 17,270 | | | Vanguard Total Stock Market ETF | | | 4,169,669 | |

| | 4,090 | | | Vanguard Value ETF | | | 601,680 | |

| | | | | | | | 28,347,275 | |

| | | | | FIXED INCOME - 21.5% | | | | |

| | 2,191 | | | First Trust Enhanced Short Maturity ETF | | | 131,022 | |

| | 56,261 | | | iShares 1-5 Year Investment Grade Corporate Bond ETF(b) | | | 3,031,343 | |

| | 2,206 | | | iShares 20+ Year Treasury Bond ETF | | | 326,907 | |

| | 5,988 | | | iShares Core International Aggregate Bond ETF | | | 326,526 | |

| | 4,320 | | | iShares Core U.S. Aggregate Bond ETF | | | 492,826 | |

| | 12,015 | | | iShares ESG Aware USD Corporate Bond ETF | | | 327,889 | |

| | 4,660 | | | iShares TIPS Bond ETF | | | 602,072 | |

| | 12,378 | | | iShares US Treasury Bond ETF | | | 330,245 | |

| | 72,000 | | | PGIM Ultra Short Bond ETF(b) | | | 3,563,280 | |

See accompanying notes which are an integral part of these financial statements.

| TACTICAL GROWTH ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2021 |

| Shares | | | | | | | | | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 78.4% (Continued) | | | | |

| | | | | FIXED INCOME - 21.5% (Continued) | | | | | | | | | | | | |

| | 41,400 | | | Vanguard Short-Term Corporate Bond ETF | | $ | 3,364,164 | |

| | 2,495 | | | Vanguard Total Bond Market ETF | | | 211,451 | |

| | | | | | | | | | | | | | | | 12,707,725 | |

| | | | | MIXED ALLOCATION - 8.5% | | | | |

| | 49,239 | | | HCM Defender 100 Index ETF(a) | | | 2,775,602 | |

| | 49,025 | | | HCM Defender 500 Index ETF(a) | | | 2,264,465 | |

| | | | | | | | | | | | | | | | 5,040,067 | |

| | | | | | | | | | | | | | | | | |

| | | | | TOTAL EXCHANGE-TRADED FUNDS (Cost $43,491,712) | | | 46,350,700 | |

| | | | | | | | | | | | | | | | | |

| Principal | | | | | Coupon Rate | | | | | | | |

| Amount ($) | | | | | (%) | | | Maturity | | | Fair Value | |

| | | | | CORPORATE BONDS — 0.5% | | | | | | | | | | | | |

| | | | | BANKING — 0.5% | | | | | | | | | | | | |

| | 300,000 | | | HSBC Holdings PLC | | | 2.6500 | | | | 01/05/22 | | | | 300,019 | |

| | | | | | | | | | | | | | | | | |

| | | | | TOTAL CORPORATE BONDS (Cost $300,015) | | | | | | | | | | | 300,019 | |

| | | | | | | | | | | | | | | | | |

| Shares | | | | | | | | | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENTS — 13.9% | | | | | | | | | | | | |

| | | | | MONEY MARKET FUNDS - 13.9% | | | | | | | | | | | | |

| | 738 | | | Fidelity Government Portfolio, CLASS I, 0.01%(c) | | | | | | | | | | | 738 | |

| | 8,207,507 | | | First American Treasury Obligations Fund, Class X, 0.01%(c) | | | | | | | | | | | 8,207,507 | |

| | | | | TOTAL MONEY MARKET FUNDS (Cost $8,208,245) | | | | | | | | | | | 8,208,245 | |

| | | | | | | | | | | | | | | | | |

| | | | | TOTAL SHORT-TERM INVESTMENTS (Cost $8,208,245) | | | | | | | | | | | 8,208,245 | |

| Contracts(d) | | | | | Counterparty | | Expiration Date | | Exercise Price | | | Notional Value | | | Fair Value | |

| | | | | INDEX OPTIONS PURCHASED - 2.2% | | | | | | | | | | | | | | | | |

| | | | | CALL OPTIONS PURCHASED - 2.1% | | | | | | | | | | | | | | | | |

| | 25 | | | SPDR S&P 500 ETF Trust | | StoneX | | 02/18/2022 | | $ | 447 | | | $ | 1,117,500 | | | $ | 81,950 | |

| | 25 | | | SPDR S&P 500 ETF Trust | | StoneX | | 03/18/2022 | | | 420 | | | | 1,050,000 | | | | 148,075 | |

| | 30 | | | SPDR S&P 500 ETF Trust | | StoneX | | 06/17/2022 | | | 423 | | | | 1,269,000 | | | | 187,155 | |

| | 20 | | | SPDR S&P 500 ETF Trust | | StoneX | | 06/17/2022 | | | 424 | | | | 848,000 | | | | 123,070 | |

| | 20 | | | SPDR S&P 500 ETF Trust | | StoneX | | 06/17/2022 | | | 434 | | | | 868,000 | | | | 106,350 | |

| | 20 | | | SPDR S&P 500 ETF Trust | | StoneX | | 01/21/2022 | | | 468 | | | | 936,000 | | | | 21,500 | |

| | 10 | | | SPDR S&P 500 ETF Trust | | StoneX | | 02/18/2022 | | | 446 | | | | 446,000 | | | | 33,370 | |

| | 15 | | | SPDR S&P 500 ETF Trust | | StoneX | | 02/18/2022 | | | 463 | | | | 694,500 | | | | 29,715 | |

See accompanying notes which are an integral part of these financial statements.

| TACTICAL GROWTH ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2021 |

| Contracts(d) | | | | | Counterparty | | | Expiration Date | | Exercise Price | | | Notional Value | | Fair Value | |

| | | | | INDEX OPTIONS PURCHASED - 2.2% (Continued) | | | | | | | | | | | |

| | | | | CALL OPTIONS PURCHASED - 2.1% (Continued) | | | | | | | | | | | |

| | 25 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 01/21/2022 | | $ | 469 | | | $ | 1,172,500 | | $ | 24,475 | |

| | 35 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 06/17/2022 | | | 468 | | | | 1,638,000 | | | 95,025 | |

| | 23 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 09/16/2022 | | | 433 | | | | 995,900 | | | 137,230 | |

| | 20 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 09/16/2022 | | | 434 | | | | 868,000 | | | 117,760 | |

| | 15 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 09/16/2022 | | | 435 | | | | 652,500 | | | 87,158 | |

| | 20 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 09/16/2022 | | | 470 | | | | 940,000 | | | 66,200 | |

| | | | | TOTAL CALL OPTIONS PURCHASED (Cost - $727,896) | | | | | | | | | 1,259,033 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | PUT OPTIONS PURCHASED - 0.1% | | | | | | | | | | |

| | 45 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 01/21/2022 | | $ | 420 | | | $ | 1,890,000 | | $ | 1,890 | |

| | 50 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 02/18/2022 | | | 425 | | | | 2,125,000 | | | 9,850 | |

| | 20 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 03/31/2022 | | | 445 | | | | 890,000 | | | 15,460 | |

| | 15 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 06/17/2022 | | | 410 | | | | 615,000 | | | 13,110 | |

| | 20 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 06/17/2022 | | | 415 | | | | 830,000 | | | 18,940 | |

| | | | | TOTAL PUT OPTIONS PURCHASED (Cost - $94,094) | | | | | | | | | | 59,250 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL INDEX OPTIONS PURCHASED (Cost - $821,990) | | | | | | | | | | 1,318,283 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 106.4% (Cost $58,359,587) | | | | | | | | | $ | 62,938,313 | |

| | | | | CALL OPTIONS WRITTEN - (0.3)% (Proceeds - $102,323) | | | | | | | | | | (172,969 | ) |

| | | | | PUT OPTIONS WRITTEN - (0.5)% (Proceeds - $639,326) | | | | | | | | | | (286,985 | ) |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (5.6)% | | | | | | | | | | (3,343,656 | ) |

| | | | | NET ASSETS - 100.0% | | | | | | | | | $ | 59,134,703 | |

| Contracts(d) | | | | | Counterparty | | | Expiration Date | | Exercise Price | | | Notional Value | | Fair Value | |

| | | | | WRITTEN INDEX OPTIONS - (0.8)% | | | | | | | | | | |

| | | | | CALL OPTIONS WRITTEN - (0.3)% | | | | | | | | | | |

| | 20 | | | SPDR S&P 500 ETF Trust | | StoneX | | | 06/17/2022 | | $ | 500 | | | $ | 1,000,000 | | $ | 18,600 | |

| | 45 | | | SPDR S&P 500 ETF Trust | | StoneX | | | 06/17/2022 | | | 505 | | | | 2,272,500 | | | 34,200 | |

| | 20 | | | SPDR S&P 500 ETF Trust | | StoneX | | | 06/17/2022 | | | 520 | | | | 1,040,000 | | | 7,580 | |

| | 45 | | | SPDR S&P 500 ETF Trust | | StoneX | | | 01/21/2022 | | | 496 | | | | 2,232,000 | | | 1,080 | |

| | 50 | | | SPDR S&P 500 ETF Trust | | StoneX | | | 02/18/2022 | | | 497 | | | | 2,485,000 | | | 6,750 | |

| | 20 | | | SPDR S&P 500 ETF Trust | | StoneX | | | 03/31/2022 | | | 484 | | | | 968,000 | | | 19,620 | |

| | 20 | | | SPDR S&P 500 ETF Trust | | StoneX | | | 06/17/2022 | | | 503 | | | | 1,006,000 | | | 16,260 | |

| | 23 | | | SPDR S&P 500 ETF Trust | | StoneX | | | 09/16/2022 | | | 510 | | | | 1,173,000 | | | 25,979 | |

| | 35 | | | SPDR S&P 500 ETF Trust | | StoneX | | | 09/16/2022 | | | 515 | | | | 1,802,500 | | | 34,720 | |

| | 20 | | | SPDR S&P 500 ETF Trust | | StoneX | | | 09/16/2022 | | | 540 | | | | 1,080,000 | | | 8,180 | |

| | | | | TOTAL CALL OPTIONS WRITTEN (Proceeds - $102,323) | | | | | | | | | 172,969 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | PUT OPTIONS WRITTEN - (0.5)% | | | | | | | | | | |

| | 25 | | | SPDR S&P 500 ETF Trust | | StoneX | | | 02/18/2022 | | $ | 447 | | | $ | 1,117,500 | | $ | 9,525 | |

| | 25 | | | SPDR S&P 500 ETF Trust | | StoneX | | | 03/18/2022 | | | 400 | | | | 1,000,000 | | | 6,150 | |

See accompanying notes which are an integral part of these financial statements.

| TACTICAL GROWTH ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2021 |

| Contracts(d) | | | | | | | | | | | | | | | | | |

| (continued) | | | | | Counterparty | | | Expiration Date | | Exercise Price | | | Notional Value | | | Fair Value | |

| | | | | WRITTEN INDEX OPTIONS - (0.8)% | | | | | | | | | | | | |

| | | | | PUT OPTIONS WRITTEN - (0.5)% (Continued) | | | | | | | | | | | | |

| | 20 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 06/17/2022 | | $ | 385 | | | $ | 770,000 | | | $ | 12,620 | |

| | 30 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 06/17/2022 | | | 390 | | | | 1,170,000 | | | | 20,040 | |

| | 20 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 06/17/2022 | | | 408 | | | | 816,000 | | | | 17,200 | |

| | 25 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 01/21/2022 | | | 469 | | | | 1,172,500 | | | | 8,950 | |

| | 20 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 01/21/2022 | | | 468 | | | | 936,000 | | | | 6,820 | |

| | 10 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 02/18/2022 | | | 446 | | | | 446,000 | | | | 3,650 | |

| | 15 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 02/18/2022 | | | 463 | | | | 694,500 | | | | 8,910 | |

| | 20 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 03/31/2022 | | | 375 | | | | 750,000 | | | | 3,860 | |

| | 35 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 06/17/2022 | | | 468 | | | | 1,638,000 | | | | 72,450 | |

| | 58 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 09/16/2022 | | | 405 | | | | 2,349,000 | | | | 78,010 | |

| | 20 | | | SPDR S&P 500 ETF Trust | | | StoneX | | | 09/16/2022 | | | 435 | | | | 870,000 | | | | 38,800 | |

| | | | | TOTAL PUT OPTIONS WRITTEN (Proceeds - $639,326) | | | | | | | | | | | 286,985 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL INDEX OPTIONS WRITTEN (Proceeds - $741,649) | | | | $ | 459,954 | |

ETF - Exchange-Traded Fund

PLC - Public Limited Company

| (a) | Non-income producing security. |

| (b) | All or a portion of the security is held as collateral for written options. |

| (c) | Rate disclosed is the seven day effective yield as of December 31, 2021. |

| (d) | Each option contract allows the holder of the option to purchase or sell 100 shares of the underlying security. |

See accompanying notes which are an integral part of these financial statements.

| TFA QUANTITATIVE FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2021 |

| Shares | | | | | Fair Value | |

| | | | | OPEN END FUNDS — 102.7% | | | | |

| | | | | EQUITY - 41.2% | | | | |

| | 21,348 | | | Rydex Nasdaq 100 2X Strategy Fund, Class H | | $ | 10,243,266 | |

| | 18,946 | | | Rydex Russell 2000 2x Strategy Fund, Class H (a) | | | 4,152,136 | |

| | | | | | | | 14,395,402 | |

| | | | | MIXED ALLOCATION - 61.5% | | | | |

| | 148,725 | | | Rydex Series Trust - Nova Fund, Investor Class (a) | | | 21,510,087 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | TOTAL OPEN END FUNDS (Cost $35,000,000) | | | 35,905,489 | |

| Shares | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENTS — 14.7% | | | | |

| | | | | MONEY MARKET FUNDS – 14.7% | | | | |

| | 2,092,108 | | | First American Treasury Obligations Fund, Class X, 0.01%(b) | | | 2,092,108 | |

| | 3,055,026 | | | Rydex U.S. Government Money Market Fund, Money Market Class, 0.00%(b) | | | 3,055,026 | |

| | | | | TOTAL MONEY MARKET FUNDS (Cost $5,147,134) | | | 5,147,134 | |

| | | | | | | | | |

| | | | | TOTAL SHORT-TERM INVESTMENTS (Cost $5,147,134) | | | 5,147,134 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 117.4% (Cost $40,147,134) | | $ | 41,052,623 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (17.4)% | | | (6,100,023 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 34,952,600 | |

| (a) | Affiliated Company – Tactical Growth Allocation Fund holds in excess of 5% of outstanding voting securities of this security. |

| (b) | Rate disclosed is the seven day effective yield as of December 31, 2021. |

See accompanying notes which are an integral part of these financial statements.

| TFA MULTIDIMENSIONAL TACTICAL FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2021 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 91.7% | | | | |

| | | | | BEVERAGES - 2.5% | | | | |

| | 4,130 | | | PepsiCo, Inc. | | $ | 717,423 | |

| | | | | | | | | |

| | | | | BIOTECH & PHARMA - 12.0% | | | | |

| | 12,080 | | | AstraZeneca plc - ADR | | | 703,660 | |

| | 7,857 | | | BioMarin Pharmaceutical, Inc.(a) | | | 694,166 | |

| | 9,820 | | | Gilead Sciences, Inc. | | | 713,030 | |

| | 7,695 | | | Sarepta Therapeutics, Inc.(a) | | | 692,935 | |

| | 53,660 | | | Viatris, Inc. | | | 726,020 | |

| | | | | | | | 3,529,811 | |

| | | | | CABLE & SATELLITE - 7.3% | | | | |

| | 1,112 | | | Charter Communications, Inc., Class A(a) | | | 724,990 | |

| | 14,400 | | | Comcast Corporation, Class A | | | 724,752 | |

| | 25,221 | | | Liberty Global plc, Class A(a) | | | 699,631 | |

| | | | | | | | 2,149,373 | |

| | | | | E-COMMERCE DISCRETIONARY - 2.4% | | | | |

| | 206 | | | Amazon.com, Inc.(a) | | | 686,874 | |

| | | | | | | | | |

| | | | | ENTERTAINMENT CONTENT - 4.8% | | | | |

| | 20,480 | | | Fox Corporation - Class B | | | 701,850 | |

| | 3,860 | | | Take-Two Interactive Software, Inc.(a) | | | 685,999 | |

| | | | | | | | 1,387,849 | |

| | | | | FOOD - 2.4% | | | | |

| | 10,701 | | | Mondelez International, Inc., Class A | | | 709,583 | |

| | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 2.4% | | | | |

| | 8,948 | | | Henry Schein, Inc.(a) | | | 693,738 | |

| | | | | | | | | |

| | | | | INTERNET MEDIA & SERVICES - 7.2% | | | | |

| | 246 | | | Alphabet, Inc., Class A(a) | | | 712,672 | |

| | 297 | | | Booking Holdings, Inc.(a) | | | 712,571 | |

| | 2,020 | | | Meta Platforms, Inc., Class A(a) | | | 679,427 | |

| | | | | | | | 2,104,670 | |

See accompanying notes which are an integral part of these financial statements.

| TFA MULTIDIMENSIONAL TACTICAL FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2021 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 91.7% (Continued) | | | | |

| | | | | LEISURE FACILITIES & SERVICES - 2.4% | | | | |

| | 7,476 | | | Caesars Entertainment, Inc.(a) | | $ | 699,230 | |

| | | | | | | | | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 4.8% | | | | |

| | 5,283 | | | Quidel Corporation(a) | | | 713,152 | |

| | 2,600 | | | Repligen Corporation(a) | | | 688,584 | |

| | | | | | | | 1,401,736 | |

| | | | | METALS & MINING - 2.4% | | | | |

| | 6,776 | | | Royal Gold, Inc. | | | 712,903 | |

| | | | | | | | | |

| | | | | PUBLISHING & BROADCASTING - 2.4% | | | | |

| | 30,939 | | | News Corporation, CLASS A | | | 690,249 | |

| | | | | | | | | |

| | | | | RENEWABLE ENERGY - 4.7% | | | | |

| | 3,687 | | | Enphase Energy, INC.(a) | | | 674,500 | |

| | 2,484 | | | SolarEdge Technologies, Inc.(a) | | | 696,936 | |

| | | | | | | | 1,371,436 | |

| | | | | SEMICONDUCTORS - 4.8% | | | | |

| | 10,049 | | | ON Semiconductor Corporation(a) | | | 682,528 | |

| | 3,900 | | | QUALCOMM, Inc. | | | 713,193 | |

| | | | | | | | 1,395,721 | |

| | | | | SOFTWARE - 2.4% | | | | |

| | 1,919 | | | Fortinet, Inc.(a) | | | 689,689 | |

| | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE - 9.8% | | | | |

| | 5,300 | | | Garmin Ltd. | | | 721,702 | |

| | 7,799 | | | NetApp, Inc. | | | 717,430 | |

| | 10,568 | | | Western Digital Corporation(a) | | | 689,139 | |

| | 1,212 | | | Zebra Technologies Corporation, Class A(a) | | | 721,383 | |

| | | | | | | | 2,849,654 | |

| | | | | TECHNOLOGY SERVICES - 4.8% | | | | |

| | 9,474 | | | Amdocs Ltd. | | | 709,034 | |

| | 2,854 | | | Automatic Data Processing, Inc. | | | 703,739 | |

| | | | | | | | 1,412,773 | |

See accompanying notes which are an integral part of these financial statements.

| TFA MULTIDIMENSIONAL TACTICAL FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2021 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 91.7% (Continued) | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 9.8% | | | | |

| | 18,596 | | | CSX Corporation | | $ | 699,210 | |

| | 5,276 | | | Expeditors International of Washington, Inc. | | | 708,514 | |

| | 3,512 | | | J.B. Hunt Transport Services, Inc. | | | 717,853 | |

| | 2,020 | | | Old Dominion Freight Line, Inc. | | | 723,927 | |

| | | | | | | | 2,849,504 | |

| | | | | WHOLESALE - DISCRETIONARY - 2.4% | | | | |

| | 1,283 | | | Pool Corporation | | | 726,178 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $25,911,557) | | | 26,778,394 | |

| | | | | | | | | |

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 23.0% | | | | |

| | | | | FIXED INCOME - 23.0% | | | | |

| | 8,300 | | | iShares 1-3 Year Treasury Bond ETF | | | 709,982 | |

| | 4,700 | | | iShares 20+ Year Treasury Bond ETF | | | 696,493 | |

| | 5,500 | | | iShares 3-7 Year Treasury Bond ETF | | | 707,685 | |

| | 6,100 | | | iShares 7-10 Year Treasury Bond ETF | | | 701,500 | |

| | 3,077 | | | iShares Agency Bond ETF | | | 360,532 | |

| | 8,300 | | | iShares iBoxx $ High Yield Corporate Bond ETF | | | 722,183 | |

| | 5,300 | | | iShares iBoxx $ Investment Grade Corporate Bond ETF | | | 702,356 | |

| | 6,600 | | | iShares JPMorgan USD Emerging Markets Bond ETF | | | 719,796 | |

| | 6,508 | | | iShares MBS ETF | | | 699,154 | |

| | 24,996 | | | SPDR Bloomberg Barclays International Treasury Bond ETF | | | 706,636 | |

| | | | | | | | 6,726,317 | |

| | | | | | | | | |

| | | | | TOTAL EXCHANGE-TRADED FUNDS (Cost $6,733,396) | | | 6,726,317 | |

| | | | | | | | | |

| Shares | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENTS — 7.3% | | | | |

| | | | | MONEY MARKET FUNDS - 7.3% | | | | |

| | 2,033,637 | | | Fidelity Government Portfolio, CLASS I, 0.01%(b) | | | 2,033,637 | |

See accompanying notes which are an integral part of these financial statements.

| TFA MULTIDIMENSIONAL TACTICAL FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2021 |

| Shares | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENTS — 7.3% (Continued) | | | | |

| | | | | MONEY MARKET FUNDS - 7.3% (Continued) | | | | |

| | 92,268 | | | First American Treasury Obligations Fund, Class X, 0.01%(b) | | $ | 92,268 | |

| | | | | TOTAL MONEY MARKET FUNDS (Cost $2,125,905) | | | 2,125,905 | |

| | | | | | | | | |

| | | | | TOTAL SHORT-TERM INVESTMENTS (Cost $2,125,905) | | | 2,125,905 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS – 122.0% (Cost $34,770,858) | | $ | 35,630,616 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (22.0)% | | | (6,418,164 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 29,212,452 | |

ADR - American Depositary Receipt

ETF - Exchange-Traded Fund

LTD - Limited Company

PLC - Public Limited Company

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of December 31, 2021. |

See accompanying notes which are an integral part of these financial statements.

| TFA ALPHAGEN GROWTH FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2021 |

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 80.4% | | | | |

| | | | | EQUITY - 67.9% | | | | |

| | 4,560 | | | Communication Services Select Sector SPDR Fund | | $ | 354,221 | |

| | 2,530 | | | Consumer Discretionary Select Sector SPDR Fund | | | 517,233 | |

| | 6,850 | | | Consumer Staples Select Sector SPDR Fund | | | 528,204 | |

| | 12,490 | | | Financial Select Sector SPDR Fund | | | 487,735 | |

| | 5,360 | | | Health Care Select Sector SPDR Fund | | | 755,170 | |

| | 1,860 | | | Industrial Select Sector SPDR Fund | | | 196,807 | |

| | 900 | | | Invesco QQQ Trust Series 1 | | | 358,065 | |

| | 22,590 | | | iShares India 50 ETF | | | 1,068,733 | |

| | 13,120 | | | iShares MSCI USA Min Vol Factor ETF | | | 1,061,408 | |

| | 4,660 | | | iShares U.S. Real Estate ETF | | | 541,212 | |

| | 58,410 | | | ProShares Ultra QQQ(a) | | | 5,199,658 | |

| | 69,130 | | | ProShares Ultra Russell2000(a) | | | 3,838,098 | |

| | 17,230 | | | ProShares Ultra S&P500 | | | 2,521,955 | |

| | 6,200 | | | SPDR S&P 500 ETF Trust | | | 2,944,752 | |

| | 8,360 | | | Technology Select Sector SPDR Fund | | | 1,453,553 | |

| | 48,890 | | | Ultra Dow30 Proshares | | | 3,911,200 | |

| | 34,800 | | | Vanguard FTSE All-World ex-US ETF | | | 2,132,544 | |

| | 20,500 | | | Vanguard FTSE Emerging Markets ETF | | | 1,013,930 | |

| | 3,500 | | | Vanguard Growth ETF | | | 1,123,150 | |

| | 5,200 | | | Vanguard Large-Cap ETF | | | 1,149,304 | |

| | 6,400 | | | Vanguard Mid-Cap ETF | | | 1,630,528 | |

| | 900 | | | Vanguard Real Estate ETF | | | 104,409 | |

| | 7,900 | | | Vanguard Russell 2000 ETF | | | 709,499 | |

| | 28,700 | | | Vanguard Total Stock Market ETF | | | 6,929,327 | |

| | 8,100 | | | Vanguard Value ETF | | | 1,191,591 | |

| | | | | | | | 41,722,286 | |

| | | | | FIXED INCOME - 12.5% | | | | |

| | 17,230 | | | iShares 20+ Year Treasury Bond ETF | | | 2,553,314 | |

| | 15,200 | | | iShares Short Treasury Bond ETF(a) | | | 1,678,384 | |

| | 19,380 | | | iShares TIPS Bond ETF | | | 2,503,896 | |

| | 600 | | | Vanguard Long-Term Bond | | | 61,752 | |

| | 1,200 | | | Vanguard Short-Term Bond ETF | | | 96,996 | |

| | 7,800 | | | Vanguard Total Bond Market ETF | | | 661,050 | |

See accompanying notes which are an integral part of this schedule of investments.

| TFA ALPHAGEN GROWTH FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2021 |

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 80.4% (Continued) | | | | |

| | | | | FIXED INCOME - 12.5% (Continued) | | | | |

| | 2,900 | | | Vanguard Total International Bond Index Fund, ETF SHARES | | $ | 159,964 | |

| | | | | | | | 7,715,356 | |

| | | | | | | | | |

| | | | | TOTAL EXCHANGE-TRADED FUNDS (Cost $48,211,953) | | | 49,437,642 | |

| | | | | | | | | |

| Shares | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENTS — 19.9% | | | | |

| | | | | MONEY MARKET FUNDS - 19.9% | | | | |

| | 1,767 | | | Fidelity Government Portfolio, CLASS I, 0.01%(b) | | | 1,767 | |

| | 12,209,649 | | | First American Treasury Obligations Fund, Class X, 0.01%(b) | | | 12,209,649 | |

| | | | | TOTAL MONEY MARKET FUNDS (Cost $12,211,416) | | | 12,211,416 | |

| | | | | | | | | |

| | | | | TOTAL SHORT-TERM INVESTMENTS (Cost $12,211,416) | | | 12,211,416 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 100.3% (Cost $60,423,369) | | $ | 61,649,058 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (0.3)% | | | (202,444 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 61,446,614 | |

ETF - Exchange-Traded Fund

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of December 31, 2021. |

See accompanying notes which are an integral part of this schedule of investments.

| Statements of Assets and Liabilities |

| December 31, 2021 |

| | | TFA Tactical

Income Fund | | | Tactical Moderate

Allocation Fund | | | Tactical Growth

Allocation Fund | |

| Assets: | | | | | | | | | |

| Investments in Securities: | | | | | | | | | | | | |

| Unaffiliated Investments at Value (Cost $28,685,277, $36,222,293 and $58,359,587, respectively) | | $ | 28,614,876 | | | $ | 37,082,743 | | | $ | 62,938,313 | |

| Cash held at custodian | | | 18,962 | | | | 1,560 | | | | 18,711 | |

| Deposits with broker for options | | | 19,004 | | | | 52,032 | | | | 126,820 | |