the Trust Account and thereafter to maintain the funds in the Trust Account in cash in an interest-bearing demand deposit account at a bank until the earlier of the consummation of our initial Business Combination and the liquidation of bleuacacia. Interest on such deposit account is currently approximately 4.5% per annum, but such deposit account carries a variable rate and bleuacacia cannot assure you that such rate will not decrease or increase significantly. Following such liquidation, we would likely receive minimal interest on the funds held in the Trust Account. However, interest previously earned on the funds held in the Trust Account still may be released to us to pay our taxes, if any. As a result, any decision to liquidate the investments held in the Trust Account and thereafter to hold all funds in the Trust Account in cash in an interest-bearing demand deposit account would reduce the dollar amount our public shareholders would receive upon any redemption or liquidation of bleuacacia.

In addition, even prior to the 24-month anniversary of the effective date of the IPO Registration Statement, we may be deemed to be an investment company. The longer that the funds in the Trust Account are held in short-term U.S. government treasury obligations or in money market funds invested exclusively in such securities, even prior to our 24-month anniversary, the greater the risk that we may be considered an unregistered investment company, in which case we may be required to liquidate bleuacacia. Accordingly, we may determine, in our discretion, to liquidate the securities held in the Trust Account, even prior to November 22, 2023, and instead hold all funds in the Trust Account in cash in an interest-bearing demand deposit account which would further reduce the dollar amount our public shareholders would receive upon any redemption or liquidation of bleuacacia. Were we to liquidate, our rights and warrants would expire worthless, and our securityholders would lose the investment opportunity associated with an investment in the combined company, including any potential price appreciation of our securities.

The Sponsor and our directors and executive officers represent in the aggregate approximately 20.0% of our voting power, and they have indicated they intend to vote in favor of the Extension Amendment Proposal.

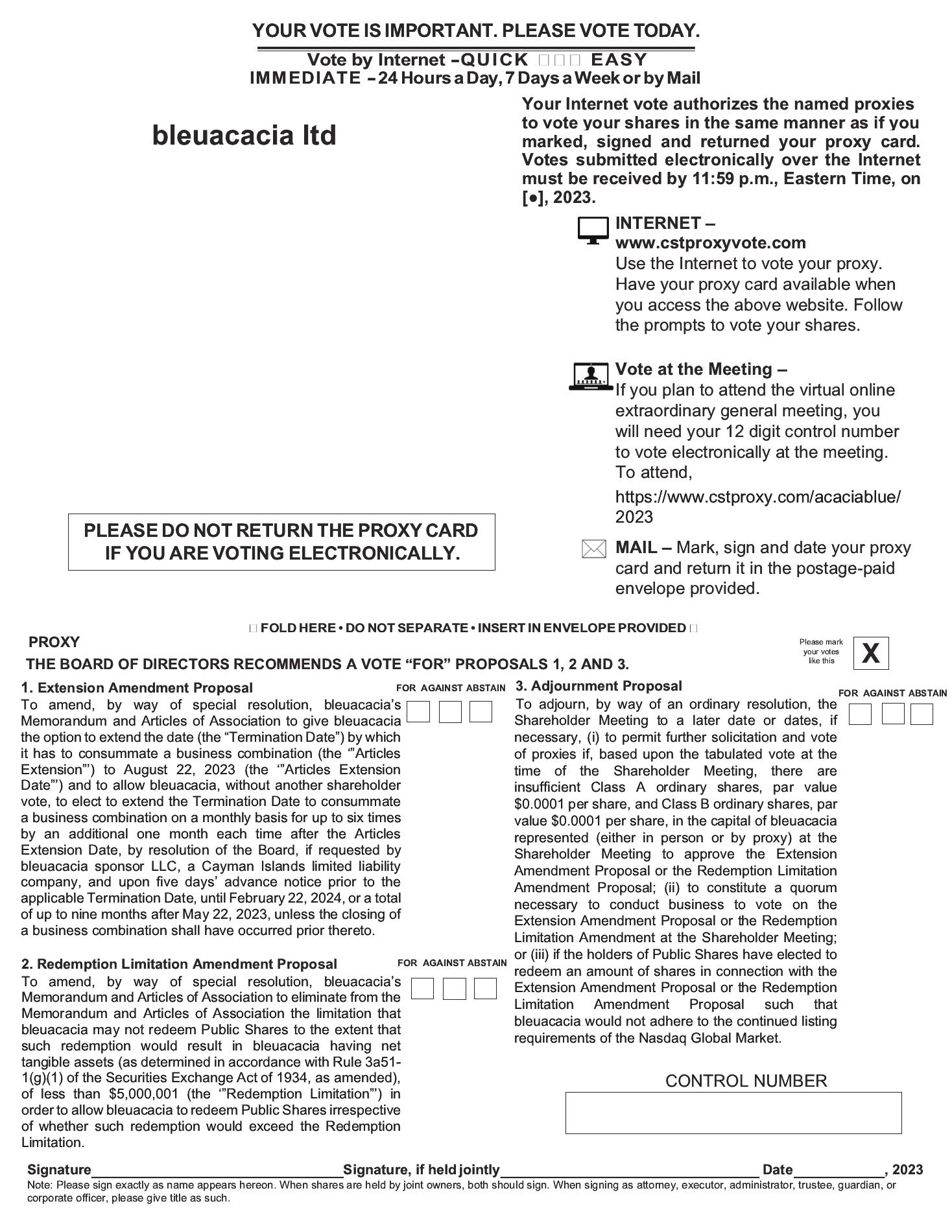

The Sponsor and all of our directors and executive officers are expected to vote any Ordinary Shares owned by them in favor of the Extension Amendment Proposal. On the Record Date, the Sponsor and our directors and executive officers beneficially owned and were entitled to vote an aggregate of 6,900,000 Class B Ordinary Shares, representing approximately 20.0% of the voting power of bleuacacia. The Extension Amendment Proposal must be approved by the affirmative vote of at least two-thirds (2/3) of the holders of the issued and outstanding Class A Ordinary Shares and Class B Ordinary Shares, voting as a single class, who, being entitled to do so, vote in person or by proxy at the Shareholder Meeting. When you consider the recommendation of the Board, bleuacacia shareholders should be aware that aside from their interests as shareholders, our Initial Shareholders, certain members of the Board and officers have interests that are different from, or in addition to, those of other shareholders generally (see “Proposal No. 1 - The Extension Amendment Proposal - Interests of the Sponsor and bleuacacia’s Directors and Officers” in this proxy statement).

To the extent that bleuacacia is deemed to be a “foreign person” under the regulations relating to CFIUS, it may be more difficult (or even impossible) to obtain any required approvals for our initial business combination within the requisite time period, which would require us to liquidate.

The Sponsor, bleuacacia sponsor, LLC, is a Cayman Islands limited liability company. The Sponsor currently owns 6.820,000 shares of our Class B Ordinary Shares acquired prior to our IPO, and 7,520,000 Private Placement Warrants that were purchased by the Sponsor in a private placement which occurred simultaneously with the completion of the IPO. The Sponsor is not controlled by a non-U.S. person. Approximately 11.5% of the total allocated membership interests in the Sponsor are owned by non-U.S. persons. To the best of the Company’s knowledge, other than the members holding an approximate 11.5% interest in the Sponsor, the Sponsor does not have substantial ties with any non-U.S. persons.

We do not believe that either we or our Sponsor constitute a “foreign person” under CFIUS rules and regulations. However, if CFIUS considers us to be a “foreign person” and believes that the business of a Business Combination target may affect national security, we could be subject to foreign ownership restrictions and/or CFIUS review. If a potential Business Combination falls within the scope of applicable foreign ownership restrictions, we may be unable to consummate a Business Combination. In addition, if a potential Business Combination falls within CFIUS’s jurisdiction, we may be required to make a mandatory filing or determine to submit a voluntary notice to CFIUS, or to proceed with a Business Combination without notifying CFIUS and risk CFIUS intervention, before or after closing the Business Combination.

Although we do not believe we or the Sponsor are a “foreign person”, CFIUS may take a different view and decide to block or delay a potential Business Combination, impose conditions to mitigate national security concerns