Exhibit 99.1

LETTER OF TRANSMITTAL AND CONSENT

Offer To Exchange Warrants to Acquire Class A Ordinary Shares

of

REE Automotive Ltd.

for

Class A Ordinary Shares

of

REE Automotive Ltd.

and

Consent Solicitation

| THE OFFER AND CONSENT SOLICITATION (AS DEFINED BELOW) AND WITHDRAWAL RIGHTS WILL EXPIRE AT MIDNIGHT (END OF DAY), EASTERN TIME, ON SEPTEMBER 22, 2022, OR SUCH LATER TIME AND DATE TO WHICH WE MAY EXTEND. PUBLIC WARRANTS (AS DEFINED BELOW) AND PRIVATE PLACEMENT WARRANTS (AS DEFINED BELOW) (COLLECTIVELY, THE “WARRANTS”) TENDERED PURSUANT TO THE OFFER AND CONSENT SOLICITATION MAY BE WITHDRAWN PRIOR TO THE EXPIRATION DATE (AS DEFINED BELOW). CONSENTS MAY BE REVOKED ONLY BY WITHDRAWING THE TENDER OF THE RELATED WARRANTS AND THE WITHDRAWAL OF ANY WARRANTS WILL AUTOMATICALLY CONSTITUTE A REVOCATION OF THE RELATED CONSENTS. THIS LETTER OF TRANSMITTAL AND CONSENT (AS DEFINED BELOW) ONLY RELATES TO TENDERS OF PRIVATE PLACEMENT WARRANTS IN THE OFFER AND CONSENTS OF HOLDERS OF PRIVATE PLACEMENT WARRANTS TO THE WARRANT AMENDMENT (AS DEFINED BELOW). HOLDERS OF PUBLIC WARRANTS MUST TRANSMIT INSTRUCTIONS WITH RESPECT TO TENDERS OF THEIR WARRANTS AND CONSENTS TO THE WARRANT AMENDMENT THROUGH ATOP (AS DEFINED BELOW). | |

The Exchange Agent for the Offer and Consent Solicitation is:

CONTINENTAL STOCK TRANSFER & TRUST COMPANY

By First Class Mail, Registered or

Certified Mail:

Continental Stock Transfer & Trust Company

1 State Street, 30th Floor,

New York, New York 10004 | | By Express or Overnight Delivery:

Continental Stock Transfer & Trust Company

1 State Street, 30th Floor,

New York, New York 10004 |

THE METHOD OF DELIVERY OF THIS LETTER OF TRANSMITTAL AND CONSENT, THE WARRANTS AND ALL OTHER REQUIRED DOCUMENTS, INCLUDING DELIVERY THROUGH BOOK-ENTRY TRANSFER, IS AT THE OPTION AND RISK OF THE TENDERING WARRANT HOLDER, AND EXCEPT AS OTHERWISE PROVIDED IN THE INSTRUCTIONS BELOW, THE DELIVERY WILL BE DEEMED MADE ONLY WHEN ACTUALLY RECEIVED BY THE EXCHANGE AGENT. IF DELIVERY IS BY MAIL, REGISTERED MAIL WITH RETURN RECEIPT REQUESTED, PROPERLY INSURED, IS RECOMMENDED. THE WARRANT HOLDER HAS THE RESPONSIBILITY TO CAUSE THIS LETTER OF TRANSMITTAL AND CONSENT, THE TENDERED WARRANTS AND ANY OTHER DOCUMENTS TO BE TIMELY DELIVERED. IN ALL CASES, SUFFICIENT TIME SHOULD BE ALLOWED TO ENSURE TIMELY DELIVERY. PLEASE READ THIS ENTIRE LETTER OF TRANSMITTAL AND CONSENT, INCLUDING THE INSTRUCTIONS, CAREFULLY BEFORE COMPLETING THIS LETTER OF TRANSMITTAL AND CONSENT.

REE Automotive Ltd., a company incorporated in Israel under registration number 51-455733-9 (the “Company,” “we,” “our” and “us”), has delivered to the undersigned a copy of the Prospectus/Offer to Exchange dated August 25, 2022 (the “Prospectus/Offer to Exchange”) of the Company and this letter of transmittal and consent (as it may be supplemented and amended from time to time, this “Letter of Transmittal and Consent”), which together set forth the

1

offer of the Company to each holder of the Company’s warrants to purchase the Company’s Class A ordinary shares, without par value (the “Class A ordinary shares”), to receive 0.20 Class A ordinary shares in exchange for each warrant tendered by the holder and exchanged pursuant to the offer (the “Offer”).

The Offer is being made to all holders of the Company’s warrants. The warrants (i) sold as part of the units in the initial public offering of units of 10X Capital, which closed on November 27, 2020 (the “IPO”) (whether they were purchased in the IPO or thereafter in the open market), or (ii) initially issued to certain parties in connection with the IPO that have been transferred to any person other than permitted transferees are referred to herein as the “public warrants.” The warrants issued to certain investors in a private placement in connection with the closing of the IPO that have not become public warrants under the Warrant Agreement (as defined below) as a result of being transferred to any person other than permitted transferees are referred to herein as the “private placement warrants.” The warrants are governed by the Warrant Assignment, Assumption and Amended & Restated Agreement, dated as of July 22, 2021 (the “Warrant Agreement”), by and between the Company, 10X Capital Venture Acquisition Corp. (“10X Capital”) and Continental Stock Transfer & Trust Company, as warrant agent (the “Warrant Agent”). Each warrant entitles the holder to purchase one Class A ordinary share at a price of $11.50 per share, subject to adjustment. The public warrants are listed on the Nasdaq Stock Market (“Nasdaq”) under the symbol “REEAW.” As of August 22, 2022, 15,562,500 warrants were outstanding, consisting of 10,062,500 public warrants and 5,500,000 private placement warrants. Pursuant to the Offer, the Company is offering up to an aggregate of 3,112,500 Class A ordinary shares in exchange for the warrants.

Concurrently with the Offer, the Company is also soliciting consents (the “Consent Solicitation”) from holders of the warrants (the “consent warrants”) to amend the Warrant Agreement, which governs all of the warrants, to permit the Company to require that each warrant that is outstanding upon the closing of the Offer be converted into 0.18 Class A ordinary shares, which is a ratio 10% less than the exchange ratio applicable to the Offer (the “Warrant Amendment”). Pursuant to the terms of the Warrant Agreement, all except certain specified modifications or amendments require the vote or written consent of holders of at least 50% of the number of the then outstanding public warrants and the vote or written consent of at least 50% of the number of the then outstanding private placement warrants.

As of the date of this Letter of Transmittal and Consent, a registration statement covering the resale of the underlying Class A ordinary shares has not been declared effective by the SEC. Accordingly, the adoption of the Warrant Amendment will require the consent of holders of at least 50% of the number of the then outstanding public warrants and at least 50% of the number of the then outstanding private placement warrants. Parties representing approximately 20.5% of the outstanding public warrants have agreed to tender their warrants in the Offer and to consent to the Warrant Amendment in the Consent Solicitation, pursuant to separate tender and support agreements. Accordingly, if holders of an additional approximately 29.5% of the outstanding public warrants consent to the Warrant Amendment in the Consent Solicitation, and the other conditions described herein are satisfied or waived, then the Warrant Amendment will be adopted with respect to the public warrants.

Holders of consent warrants may not consent to the Warrant Amendment without tendering consent warrants in the Offer, and holders may not tender such consent warrants without consent to the Warrant Amendment. The consent to the Warrant Amendment is a part of this Letter of Transmittal and Consent relating to the private placement warrants, and therefore by tendering consent warrants for exchange holders will be delivering to us consent. Holders of consent warrants may revoke consent at any time prior to the Expiration Date (as defined below) by withdrawing the consent warrants holders have tendered in the Offer.

Warrants not exchanged for Class A ordinary shares pursuant to the Offer will remain outstanding subject to their current terms or amended terms if the Warrant Amendment is approved. We reserve the right to redeem any of the warrants, as applicable, pursuant to their current terms at any time, including prior to the completion of the Offer and Consent Solicitation, and if the Warrant Amendment is approved, we intend to require the conversion of all outstanding warrants to Class A ordinary shares as provided in the Warrant Amendment.

The Offer and Consent Solicitation is made solely upon the terms and conditions in the Prospectus/Offer to Exchange and this Letter of Transmittal and Consent. The Offer and Consent Solicitation will be open until Midnight (end of day), Eastern Time, on September 22, 2022, or such later time and date to which we may extend (the period during which the Offer and Consent Solicitation is open, giving effect to any withdrawal or extension, is referred to as the “Offer Period,” and the date and time at which the Offer Period ends is referred to as the “Expiration Date”).

2

Each holder whose warrants are exchanged pursuant to the Offer and Consent Solicitation will receive 0.20 Class A ordinary shares for each warrant tendered by such holder and exchanged. Any warrant holder that participates in the Offer and Consent Solicitation may tender less than all of its warrants for exchange.

No fractional Class A ordinary shares will be issued pursuant to the Offer. In lieu of issuing fractional shares, any holder of warrants who would otherwise have been entitled to receive fractional shares pursuant to the Offer will, after aggregating all such fractional shares of such holder, receive such number of Class A ordinary shares rounded up to the nearest whole number of Class A ordinary shares. The Company’s obligation to complete the Offer is not conditioned on the receipt of a minimum number of tendered warrants.

We may withdraw the Offer and Consent Solicitation only if the conditions to the Offer and Consent Solicitation are not satisfied or waived prior to the Expiration Date. Promptly upon any such withdrawal, we will return the tendered warrants to the holders (and, in the case of any consent warrants, the consent to the Warrant Amendment will be revoked).

All holders of private placement warrants wishing to accept the Offer and Consent Solicitation should complete, execute and deliver this Letter of Transmittal and Consent to indicate the action they desire to take with respect to the Offer and Consent Solicitation.

Holders of public warrants must execute the tender through DTC’s Automated Tender Offer Program (“ATOP”), and therefore should not complete, execute and deliver this Letter of Transmittal and Consent.

As used in this Letter of Transmittal and Consent with respect to the tender procedures set forth herein, the term “registered holder” means any person in whose name warrants are registered on the books of the Company or who is listed as a participant in a clearing agency’s security position listing with respect to the warrants.

THE OFFER AND CONSENT SOLICITATION IS NOT MADE TO THOSE HOLDERS WHO RESIDE IN STATES OR OTHER JURISDICTIONS WHERE AN OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL.

PLEASE SEE THE INSTRUCTIONS TO THIS LETTER OF TRANSMITTAL AND CONSENT BEGINNING ON PAGE 12 FOR THE PROPER USE AND DELIVERY OF THIS LETTER OF TRANSMITTAL AND CONSENT.

3

DESCRIPTION OF WARRANTS TENDERED

List below the warrants to which this Letter of Transmittal and Consent relates. If the space below is inadequate, list the registered warrant certificate numbers on a separate signed schedule and affix the list to this Letter of Transmittal and Consent.

Name(s) and Address(es)

of Registered Holder(s)

of Warrants | |

Number of Warrants

Tendered

|

| | | |

| | | |

| | | |

| | | |

| | | Total: |

☐ | | CHECK HERE IF THE WARRANTS LISTED ABOVE ARE BEING DELIVERED BY BOOK-ENTRY TRANSFER MADE TO THE ACCOUNT MAINTAINED BY THE EXCHANGE AGENT WITH DTC AND COMPLETE THE FOLLOWING (FOR USE BY ELIGIBLE INSTITUTIONS ONLY): |

Name of Tendering Institution: | | |

| | | |

Account Number: | | |

| | | |

Transaction Code Number: | | |

4

NOTE: SIGNATURES MUST BE PROVIDED BELOW. PLEASE READ THE

ACCOMPANYING INSTRUCTIONS CAREFULLY.

REE Automotive Ltd.

Kibbutz Glil-Yam

4690500, Israel

c/o Continental Stock Transfer & Trust Company

1 State Street, 30th Floor,

New York, New York 10004

Attn: Voluntary Corporate Actions

Upon and subject to the terms and conditions set forth in the Prospectus/Offer to Exchange and in this Letter of Transmittal and Consent, receipt of which is hereby acknowledged, the undersigned hereby:

(i) tenders to the Company for exchange pursuant to the Offer and Consent Solicitation the number of private placement warrants indicated above under “Description of Warrants Tendered — Number of Warrants Tendered;”

(ii) subscribes for the Class A ordinary shares issuable upon the exchange of such tendered private placement warrants pursuant to the Offer and Consent Solicitation, being 0.20 Class A ordinary shares for each private placement warrant so tendered for exchange; and

(iii) if the private placement warrants indicated above under “Description of Warrants Tendered” include any consent warrants, consents to the Warrant Amendment.

Except as stated in the Prospectus/Offer to Exchange, the tender made hereby is irrevocable. The undersigned understands that this tender will remain in full force and effect unless and until such tender is withdrawn and revoked in accordance with the procedures set forth in the Prospectus/Offer to Exchange and this Letter of Transmittal and Consent. The undersigned understands that this tender may not be withdrawn after the Expiration Date, and that a notice of withdrawal will be effective only if delivered to the Exchange Agent in accordance with the specific withdrawal procedures set forth in the Prospectus/Offer to Exchange.

If the undersigned is not the registered holder of the warrants indicated under “Description of Warrants Tendered” above or such holder’s legal representative or attorney-in-fact (or, in the case of warrants held through DTC, the DTC participant for whose account such warrants are held), then the undersigned has obtained a properly completed irrevocable proxy that authorizes the undersigned (or the undersigned’s legal representative or attorney-in fact) to deliver a consent in respect of such warrants on behalf of the holder thereof, and such proxy is being delivered to the Exchange Agent with this Letter of Transmittal and Consent.

The undersigned understands that, upon and subject to the terms and conditions set forth in the Prospectus/Offer to Exchange and this Letter of Transmittal and Consent, any warrants properly tendered and not withdrawn which are accepted for exchange will be exchanged for Class A ordinary shares. The undersigned understands that, under certain circumstances, the Company may not be required to accept any of the warrants tendered (including any warrants tendered after the Expiration Date). If any warrants are not accepted for exchange for any reason or if tendered warrants are withdrawn, such unexchanged or withdrawn warrants will be returned without expense to the tendering holder, if applicable, and the related consent to the Warrant Amendment will be revoked.

The undersigned understands that, upon and subject to the terms and conditions set forth in the Prospectus/Offer to Exchange and this Letter of Transmittal and Consent, any consent warrants properly tendered and not validly withdrawn which are accepted for exchange constitute the holder’s validly delivered consent to the Warrant Amendment. A holder of consent warrants may not consent to the Warrant Amendment without tendering his or her consent warrants in the Offer and a holder of consent warrants may not tender his or her consent warrants without consenting to the Warrant Amendment. A holder may revoke his or her consent to the Warrant Amendment at any time prior to the Expiration Date by withdrawing the warrants he or she has tendered.

5

Subject to, and effective upon, the Company’s acceptance of the undersigned’s tender of warrants for exchange pursuant to the Offer and Consent Solicitation as indicated under “Description of Warrants Tendered—Number of Warrants Tendered” above, the undersigned hereby:

(i) assigns and transfers to, or upon the order of, the Company, all right, title and interest in and to, and any and all claims in respect of or arising or having arisen as a result of the undersigned’s status as a holder of, such warrants;

(ii) waives any and all rights with respect to such warrants;

(iii) releases and discharges the Company from any and all claims the undersigned may have now, or may have in the future, arising out of or related to such warrants;

(iv) acknowledges that the Offer is discretionary and may be extended, modified, suspended or terminated by the Company as provided in the Prospectus/Offer to Exchange; and

(v) acknowledges the future value of the warrants is unknown and cannot be predicted with certainty.

The undersigned understands that tenders of warrants pursuant to any of the procedures described in the Prospectus/Offer to Exchange and in the instructions in this Letter of Transmittal and Consent, if and when accepted by the Company, will constitute a binding agreement between the undersigned and the Company upon the terms and subject to the conditions of the Offer and Consent Solicitation.

Effective upon acceptance for exchange, the undersigned hereby irrevocably constitutes and appoints the Exchange Agent, acting as agent for the Company, as the true and lawful agent and attorney-in-fact of the undersigned with respect to the warrants tendered hereby, with full power of substitution (such power of attorney being deemed to be an irrevocable power coupled with an interest) to:

(i) transfer ownership of such warrants on the account books maintained by DTC together with all accompanying evidences of transfer and authenticity to or upon the order of the Company;

(ii) present such warrants for transfer of ownership on the books of the Company;

(iii) cause ownership of such warrants to be transferred to, or upon the order of, the Company on the books of the Company or its agent and deliver all accompanying evidences of transfer and authenticity to, or upon the order of, the Company;

(iv) receive all benefits and otherwise exercise all rights of beneficial ownership of such warrants; and

(v) sell Class A ordinary shares in accordance with the procedures described in Section 11 of the Instructions Forming Part of the Terms and Conditions of the Offer and Consent Solicitation;

all in accordance with the terms of the Offer and Consent Solicitation, as described in the Prospectus/Offer to Exchange and this Letter of Transmittal and Consent.

The undersigned hereby represents, warrants and agrees that:

(i) the undersigned has full power and authority to tender the warrants tendered hereby and to sell, exchange, assign and transfer all right, title and interest in and to such warrants;

(ii) the undersigned has full power and authority to subscribe for all of the Class A ordinary shares issuable pursuant to the Offer and Consent Solicitation in exchange for the warrants tendered hereby;

(iii) the undersigned has good, marketable and unencumbered title to the warrants tendered hereby, and upon acceptance of such warrants by the Company for exchange pursuant to the Offer and Consent Solicitation the Company will acquire good, marketable and unencumbered title to such warrants, in each case free and clear of any security interests, liens, restrictions, charges, encumbrances, conditional sales agreements or other obligations of any kind, and not subject to any adverse claim;

6

(iv) if the warrants tendered hereby include consent warrants, the undersigned has full power and authority to consent to the Warrant Amendment;

(v) the undersigned will, upon request, execute and deliver any additional documents deemed by the Company or the Exchange Agent to be necessary or desirable to complete and give effect to the transactions contemplated hereby;

(vi) the undersigned has received and reviewed the Prospectus/Offer to Exchange, this Letter of Transmittal and Consent and the Warrant Amendment;

(vii) the undersigned acknowledges that none of the Company, the information agent, the Exchange Agent, the dealer manager or any person acting on behalf of any of the foregoing has made any statement, representation or warranty, express or implied, to the undersigned with respect to the Company, the Offer and Consent Solicitation, the warrants, or the Class A ordinary shares, other than the information included in the Prospectus/Offer to Exchange (as amended or supplemented prior to the Expiration Date);

(viii) the terms and conditions of the Prospectus/Offer to Exchange shall be deemed to be incorporated in, and form a part of, this Letter of Transmittal and Consent, which shall be read and construed accordingly;

(ix) the undersigned understands that tenders of warrants pursuant to the Offer and Consent Solicitation and in the instructions hereto constitute the undersigned’s acceptance of the terms and conditions of the Offer and Consent Solicitation;

(x) the undersigned is voluntarily participating in the Offer; and

(xi) the undersigned agrees to all of the terms of the Offer and Consent Solicitation.

Unless otherwise indicated under “Special Issuance Instructions” below, the Company will issue in the name(s) of the undersigned as indicated under “Description of Warrants Tendered” above, the Class A ordinary shares to which the undersigned is entitled pursuant to the terms of the Offer and Consent Solicitation in respect of the warrants tendered and exchanged pursuant to this Letter of Transmittal and Consent. If the “Special Issuance Instructions” below are completed, the Company will issue such Class A ordinary shares in the name of the person or account indicated under “Special Issuance Instructions.”

The undersigned agrees that the Company has no obligation under the “Special Issuance Instructions” provision of this Letter of Transmittal and Consent to effect the transfer of any warrants from the holder(s) thereof if the Company does not accept for exchange any of the warrants tendered pursuant to this Letter of Transmittal and Consent.

The acknowledgments, representations, warranties and agreements of the undersigned in this Letter of Transmittal and Consent will be deemed to be automatically repeated and reconfirmed on and as of each of the Expiration Date and completion of the Offer and Consent Solicitation. The authority conferred or agreed to be conferred in this Letter of Transmittal and Consent shall not be affected by, and shall survive, the death or incapacity of the undersigned, and every obligation of the undersigned under this Letter of Transmittal and Consent shall be binding upon the heirs, executors, administrators, trustees in bankruptcy, personal and legal representatives, successors and assigns of the undersigned.

7

The undersigned acknowledges that the undersigned has been advised to consult with its own legal counsel and other advisors (including tax advisors) as to the consequences of participating or not participating in the Offer and Consent Solicitation.

SPECIAL ISSUANCE INSTRUCTIONS

(SEE INSTRUCTIONS, INCLUDING

INSTRUCTIONS 3, 4 AND 5) |

To be completed ONLY if the Class A ordinary shares issued pursuant to the Offer and Consent Solicitation in exchange for warrants tendered hereby and any warrants delivered to the Exchange Agent herewith but not tendered and exchanged pursuant to the Offer and Consent Solicitation, are to be issued in the name of someone other than the undersigned. Issue all such Class A ordinary shares and untendered warrants to: |

Name: | | |

Address: | | |

(PLEASE PRINT OR TYPE)

(INCLUDE ZIP CODE)

(TAX IDENTIFICATION OR SOCIAL SECURITY NUMBER) |

8

IMPORTANT: PLEASE SIGN HERE

(SEE INSTRUCTIONS AND ALSO COMPLETE ACCOMPANYING IRS FORM W-9 OR

APPROPRIATE IRS FORM W-8) |

By completing, executing and delivering this Letter of Transmittal and Consent, the undersigned hereby tenders the warrants indicated in the table above entitled “Description of Warrants Tendered.” SIGNATURES REQUIRED Signature(s) of Registered Holder(s) of Warrants |

Name: | | |

Address: | | |

Date: | | |

(The above lines must be signed by the registered holder(s) of warrants as the name(s) appear(s) on the warrants or on a security position listing, or by person(s) authorized to become registered holder(s) by a properly completed assignment from the registered holder(s), a copy of which must be transmitted with this Letter of Transmittal and Consent. If warrants to which this Letter of Transmittal and Consent relates are held of record by two or more joint holders, then all such holders must sign this Letter of Transmittal and Consent. If signature is by a trustee, executor, administrator, guardian, attorney-in-fact, officer of a corporation, or other person acting in a fiduciary or representative capacity, then such person must set forth his or her full title below and, unless waived by the Company, submit evidence satisfactory to the Company of such person’s authority so to act. See Instruction 3 regarding the completion and execution of this Letter of Transmittal and Consent.) |

Name: | | |

Capacity: | | |

Address: | | |

Area Code and Telephone Number: | | |

(PLEASE PRINT OR TYPE)

(INCLUDE ZIP CODE) |

9

GUARANTEE OF SIGNATURE(S) (IF REQUIRED)

(SEE INSTRUCTIONS, INCLUDING INSTRUCTION 4) Certain signatures must be guaranteed by an Eligible Institution.

Signature(s) guaranteed by an Eligible Institution: |

Authorized Signature |

| |

Title |

| |

Name of Firm |

| |

Address, Including Zip Code |

| |

Area Code and Telephone Number Date: |

10

IMPORTANT TAX

INFORMATION |

IMPORTANT NOTE FOR ALL SHAREHOLDERS, REGARDLESS OF PLACE OF RESIDENCE: 1. Please review the section of the Prospectus/Offer to Exchange entitled “Material U.S. Federal Income Tax Considerations — Information Reporting and Backup Withholding.” If you are a U.S. Person, you must complete the enclosed IRS Form W-9. If you are not a U.S. Person, you must provide an appropriate IRS Form W-8. The applicable IRS Form W-8 may be obtained from the IRS website at https://www.irs.gov. 2. Please review Instruction 11 (“Important Israeli Withholding Tax Information”) below and then check one (1) of the following boxes and complete, where applicable, the missing identity number: ☐ Check here if you have obtained a Valid Tax Certificate and have included a copy thereof with this Letter of Transmittal. ☐ Check here if you intend to obtain and submit to the Paying Agent a Valid Tax Certificate by September 22, 2022. ☐ Check here if you are not an Israeli Resident and have enclosed a signed “DECLARATION OF STATUS FOR ISRAELI INCOME TAX PURPOSES” with this Letter of Transmittal, together with the requisite supporting documents. ☐ Check here if you are an Israeli Bank, Broker or Financial Institution and have enclosed a signed “DECLARATION OF STATUS FOR ISRAELI INCOME TAX PURPOSES” with this Letter of Transmittal. ☐ Check here if you authorize the Paying Agent to arrange for the withholding of Israeli taxes (i.e., you do not qualify for any exemption from withholding described in the enclosed “DECLARATION OF STATUS FOR ISRAELI INCOME TAX PURPOSES”, do not have a Valid Tax Certificate or otherwise determined not to attempt to seek to qualify for such exemptions within the above timeframe) at the rate of (i) 25% for individuals and (ii) 23% for non-individuals. NOTE: If no box is checked, then Israeli tax at the rate of (i) 25% for individuals and (ii) 23% for non-individuals will be withheld. Individual residents of Israel – Please indicate your national identification or passport number: __________ Company or partnership organized under the laws of Israel – Please indicate the registration number: ____ ____ ____ |

11

INSTRUCTIONS

FORMING PART OF THE TERMS AND CONDITIONS OF THE OFFER AND

CONSENT SOLICITATION

1. Delivery of Letter of Transmittal and Consent and Warrants. This Letter of Transmittal and Consent only relates to tenders of private placement warrants in the Offer and consents of holders of private placement warrants to the Warrant Amendment. Holders of public warrants must transmit instructions with respect to tenders of their warrants and consents to the Warrant Amendment through ATOP.

Private placement warrants may be validly tendered pursuant to the procedures for book-entry transfer as described in the Prospectus/Offer to Exchange. In order for private placement warrants to be validly tendered by book-entry transfer, the Exchange Agent must receive the following prior to the Expiration Date, except as otherwise permitted by use of the procedures for guaranteed delivery as described below:

(i) timely confirmation of the transfer of such warrants to the Exchange Agent’s account at DTC (a “Book-Entry Confirmation”);

(ii) a properly completed and duly executed Letter of Transmittal and Consent; and

(iii) any other documents required by this Letter of Transmittal and Consent.

Delivery of a Letter of Transmittal and Consent to the Company or DTC will not constitute valid delivery to the Exchange Agent. No Letter of Transmittal and Consent should be sent to the Company or DTC.

THE METHOD OF DELIVERY OF THIS LETTER OF TRANSMITTAL AND CONSENT, TENDERED WARRANTS AND ALL OTHER REQUIRED DOCUMENTS, INCLUDING DELIVERY THROUGH DTC, IS AT THE OPTION AND RISK OF THE TENDERING WARRANT HOLDER, AND EXCEPT AS OTHERWISE PROVIDED IN THESE INSTRUCTIONS, THE DELIVERY WILL BE DEEMED MADE ONLY WHEN ACTUALLY RECEIVED BY THE EXCHANGE AGENT. IF DELIVERY IS BY MAIL, REGISTERED MAIL WITH RETURN RECEIPT REQUESTED, PROPERLY INSURED, IS RECOMMENDED. THE WARRANT HOLDER HAS THE RESPONSIBILITY TO CAUSE THIS LETTER OF TRANSMITTAL AND CONSENT, THE TENDERED WARRANTS AND ANY OTHER DOCUMENTS TO BE TIMELY DELIVERED. IN ALL CASES, SUFFICIENT TIME SHOULD BE ALLOWED TO ENSURE TIMELY DELIVERY.

Neither the Company nor the Exchange Agent is under any obligation to notify any tendering holder of the Company’s acceptance of tendered warrants.

2. Guaranteed Delivery. Warrant holders desiring to tender warrants pursuant to the Offer but whose warrants cannot otherwise be delivered with all other required documents to the Exchange Agent prior to the Expiration Date may nevertheless tender warrants, as long as all of the following conditions are satisfied:

(i) the tender must be made by or through an “Eligible Institution” (as defined in Instruction 4);

(ii) properly completed and duly executed Notice of Guaranteed Delivery in the form provided by the Company to the undersigned with this Letter of Transmittal and Consent (with any required signature guarantees) must be received by the Exchange Agent, at its address set forth in this Letter of Transmittal and Consent, prior to the Expiration Date; and

(iii) a confirmation of a book-entry transfer into the Exchange Agent’s account at DTC of all warrants delivered electronically, in each case together with a properly completed and duly executed Letter of Transmittal and Consent with any required signature guarantees, and any other documents required by this Letter of Transmittal and Consent, must be received by the Exchange Agent within two days that the Nasdaq Stock Market is open for trading after the date the Exchange Agent receives such Notice of Guaranteed Delivery, all as provided in the Prospectus/Offer to Exchange.

A warrant holder may deliver the Notice of Guaranteed Delivery by facsimile transmission or mail to the Exchange Agent.

12

Except as specifically permitted by the Prospectus/Offer to Exchange, no alternative or contingent exchanges will be accepted.

3. Signatures on Letter of Transmittal and Consent and other Documents. For purposes of the tender and consent procedures set forth in this Letter of Transmittal and Consent, the term “registered holder” means any person in whose name warrants are registered on the books of the Company or who is listed as a participant in a clearing agency’s security position listing with respect to the warrants.

If this Letter of Transmittal and Consent is signed by a trustee, executor, administrator, guardian, attorney-in-fact, officer of a corporation, or others acting in a fiduciary or representative capacity, such person must so indicate when signing and, unless waived by the Company, must submit to the Exchange Agent proper evidence satisfactory to the Company of the authority so to act.

4. Guarantee of Signatures. No signature guarantee is required if:

(i) this Letter of Transmittal and Consent is signed by the registered holder of the warrants and such holder has not completed the box entitled “Special Issuance Instructions”; or

(ii) such warrants are tendered for the account of an “Eligible Institution.” An “Eligible Institution” is a bank, broker dealer, credit union, savings association or other entity that is a member in good standing of the Securities Transfer Agents Medallion Program or a bank, broker, dealer, credit union, savings association or other entity which is an “eligible guarantor institution,” as that term is defined in Rule 17Ad-15 promulgated under the Securities Exchange Act of 1934, as amended.

IN ALL OTHER CASES, AN ELIGIBLE INSTITUTION MUST GUARANTEE ALL SIGNATURES ON THIS LETTER OF TRANSMITTAL AND CONSENT BY COMPLETING AND SIGNING THE TABLE ENTITLED “GUARANTEE OF SIGNATURE(S)” ABOVE.

5. Warrants Tendered. Any warrant holder who chooses to participate in the Offer and Consent Solicitation may exchange some or all of such holder’s warrants pursuant to the terms of the Offer and Consent Solicitation.

6. Inadequate Space. If the space provided under “Description of Warrants Tendered” is inadequate, the name(s) and address(es) of the registered holder(s), number of warrants being delivered herewith, and number of such warrants tendered hereby should be listed on a separate, signed schedule and attached to this Letter of Transmittal and Consent.

7. Transfer Taxes. The Company will pay all transfer taxes, if any, applicable to the transfer of warrants to the Company in the Offer and Consent Solicitation. If transfer taxes are imposed for any other reason, the amount of those transfer taxes, whether imposed on the registered holder or any other persons, will be payable by the tendering holder. Other reasons transfer taxes could be imposed include:

(i) if Class A ordinary shares are to be registered or issued in the name of any person other than the person signing this Letter of Transmittal and Consent; or

(ii) if tendered warrants are registered in the name of any person other than the person signing this Letter of Transmittal and Consent.

If satisfactory evidence of payment of or exemption from those transfer taxes is not submitted with this Letter of Transmittal and Consent, the amount of those transfer taxes will be billed directly to the tendering holder and/or withheld from any payment due with respect to the warrants tendered by such holder.

8. Validity of Tenders. All questions as to the number of warrants to be accepted, and the validity, form, eligibility (including time of receipt) and acceptance of any tender of warrants will be determined by the Company in its reasonable discretion, which determinations shall be final and binding on all parties. The Company reserves the absolute right to reject any or all tenders of warrants it determines not to be in proper form or to reject those warrants, the acceptance of which may, in the opinion of the Company’s counsel, be unlawful. The Company also reserves the absolute right to waive any defect or irregularity in the tender of any particular warrants, whether or not similar defects or irregularities are waived in the case of other tendered warrants. The Company’s interpretation of the terms and conditions of the Offer and Consent Solicitation (including this Letter of Transmittal and Consent and the instructions hereto) will be final and binding on all parties. Unless waived, any defects or irregularities in

13

connection with tenders of warrants must be cured within such time as the Company shall determine. None of the Company, the Exchange Agent, the information agent, the dealer manager or any other person is or will be obligated to give notice of any defects or irregularities in tenders of warrants, and none of them will incur any liability for failure to give any such notice. Tenders of warrants will not be deemed to have been validly made until all defects and irregularities have been cured or waived. Any warrants received by the Exchange Agent that are not validly tendered and as to which the defects or irregularities have not been cured or waived will be returned by the Exchange Agent to the holders, unless otherwise provided in this Letter of Transmittal and Consent, as soon as practicable following the Expiration Date. Warrant holders who have any questions about the procedure for tendering warrants in the Offer and Consent Solicitation should contact the information agent at the address and telephone number indicated herein. Consent warrants properly tendered and not validly withdrawn that are accepted for exchange constitute the holder’s validly delivered consent to the Warrant Amendment.

9. Waiver of Conditions. The Company reserves the absolute right to waive any condition, other than as described in the section of the Prospectus/Offer to Exchange entitled “The Offer and Consent Solicitation — General Terms — Conditions to the Offer and Consent Solicitation.”

10. Withdrawal. Tenders of warrants may be withdrawn only pursuant to the procedures and subject to the terms set forth in the section of the Prospectus/Offer to Exchange entitled “The Offer and Consent Solicitation — Withdrawal Rights.” Warrant holders can withdraw tendered warrants at any time prior to the Expiration Date, and warrants that the Company has not accepted for exchange by September 22, 2022 may thereafter be withdrawn at any time after such date until such warrants are accepted by the Company for exchange pursuant to the Offer and Consent Solicitation. Except as otherwise provided in the Prospectus/Offer to Exchange, in order for the withdrawal of warrants to be effective, a written notice of withdrawal satisfying the applicable requirements for withdrawal set forth in the section of the Prospectus/Offer to Exchange entitled “The Offer and Consent Solicitation — Withdrawal Rights” must be timely received from the holder by the Exchange Agent at its address stated herein, together with any other information required as described in such section of the Prospectus/Offer to Exchange. All questions as to the form and validity (including time of receipt) of any notice of withdrawal will be determined by the Company, in its reasonable discretion, and its determination shall be final and binding. None of the Company, the Exchange Agent, the information agent, the dealer manager or any other person is under any duty to give notification of any defect or irregularity in any notice of withdrawal or will incur any liability for failure to give any such notification. Any warrants properly withdrawn will be deemed not to have been validly tendered for purposes of the Offer and Consent Solicitation. However, at any time prior to the Expiration Date, a warrant holder may re-tender withdrawn warrants by following the applicable procedures discussed in the Prospectus/Offer to Exchange and this Letter of Transmittal and Consent. Consents may be revoked only by withdrawing the related consent warrants and the withdrawal of any consent warrants will automatically constitute a revocation of the related consents.

11. Important Israel Tax Withholding Information. Under Israeli law, any holder, including a holder who is not a resident of the State of Israel, is subject to withholding at source of Israeli tax at the fixed rate of 25% (for individual warrant holders) or 23% (for all other warrant holders) of the value of Class A ordinary shares issued to them in exchange for their warrants pursuant to the Offer, unless such shareholder provides the Exchange Agent (at the address specified above), prior to, or concurrently with submitting this Letter of Transmittal and Consent in accordance with the terms hereof, with a valid certificate issued by the Israel Tax Authority exempting such shareholder from Israeli withholding tax on the consideration in respect of any warrant certificate surrendered herewith and/or uncertificated warrant transferred, as applicable, or entitling such shareholder to a reduced rate of Israeli withholding tax on such payment in form and substance reasonably satisfactory to the Company (a “Valid Tax Certificate”). Please note that the payment of taxes, as relevant, shall be made in NIS and that I.B.I. Trust Management, acting as the Israeli tax withholding agent, shall convert the relevant portion of US dollars according to the applicable USD/NIS exchange rate at the time of such conversion and as required under Israeli law and the Ruling, if obtained.

Without derogating from the generality of the foregoing, we have requested a ruling from the Israel Tax Authority (the “Ruling”) providing, among things, that Israeli tax will not need to be withheld from a tendering warrant holder who certifies on the “Declaration of Status for Israeli Income Tax Purposes” attached hereto (a “Declaration Form”) that the holder (1) holds less than 5% of the outstanding shares of the Company (as applied to the warrants, the Israel Tax Authority may apply this test on an as-exercised basis); (2) is not a resident of Israel for tax purposes; and (3) acquired its warrants on or after the Company’s public registration on Nasdaq in July 2021 or that its warrants were issued in exchange for 10X Capital warrants which were acquired on or after 10X Capital’s initial public offering in November 2020.

14

There can be no assurance that the Israel Tax Authority will issue the Ruling or, if issued, what provisions it will contain. For example, the Ruling may approve the use of Declaration Forms for purposes of identifying warrant holders and determining their tax status, but may provide that the final classification of the exchange for Israeli tax purposes will be determined by the relevant tax assessors. In such case, we will take the position that the withholding of Israeli tax on the receipt of Class A ordinary shares pursuant to the Offer should generally be treated as a capital gains transaction for Israeli income tax purposes, in which a warrant holder will be treated as having sold the warrants, as further provided above. The relevant tax assessor may not accept this position and may determine a different, less favorable treatment.

If you do not submit to us a Declaration Form together with the applicable supporting documents before September 22, 2022 or a Valid Tax Certificate before September 22, 2022, Israeli tax will be automatically withheld at the applicable tax rate under Israeli law. Furthermore, if the Ruling is not obtained, Israeli tax will be withheld at the applicable tax rate under Israeli law. In such case, you will receive confirmation of such withholding for the purpose of presenting it to the Israeli tax authorities and you may be able to reclaim any withholding tax.

In order to fund any withholding tax obligation that may be imposed on the Company pursuant to the foregoing paragraph, the Exchange Agent will be entitled to sell an applicable number of Class A ordinary shares to satisfy such obligation, in which case the number of Class A ordinary shares that you will receive in exchange for your warrants will be reduced accordingly. If there are any fractional Class A ordinary shares resulting from the sale of Class A ordinary shares pursuant to this Instruction 12, after aggregating all such fractional shares owing to you, you will receive one additional whole Class A ordinary share in lieu of such fractional shares. The Company may refuse to deliver Class A ordinary shares upon settlement of tendered warrants to you if you fail to comply with your obligations in connection with the tax withholding as described in this Instruction.

12. Questions and Requests for Assistance and Additional Copies. Please direct questions or requests for assistance, or additional copies of the Prospectus/Offer to Exchange, Letter of Transmittal and Consent or other materials, in writing to the information agent for the Offer and Consent Solicitation at:

The Information Agent for the Offer and Consent Solicitation is:

Morrow Sodali LLC

333 Ludlow Street

5th Floor, South Tower

Stamford, Connecticut 06902

Individuals call toll-free: (800) 662-5200

Banks and Brokerage Firms, please call (203) 658-9400

Email: REE.info@investor.morrowsodali.com |

IMPORTANT: THIS LETTER OF TRANSMITTAL AND CONSENT, TOGETHER WITH THE TENDERED WARRANTS AND ALL OTHER REQUIRED DOCUMENTS, MUST BE RECEIVED BY THE EXCHANGE AGENT ON OR PRIOR TO MIDNIGHT (END OF DAY), EASTERN STANDARD TIME, ON THE EXPIRATION DATE, UNLESS A NOTICE OF GUARANTEED DELIVERY IS RECEIVED BY THE EXCHANGE AGENT BY SUCH DATE.

15

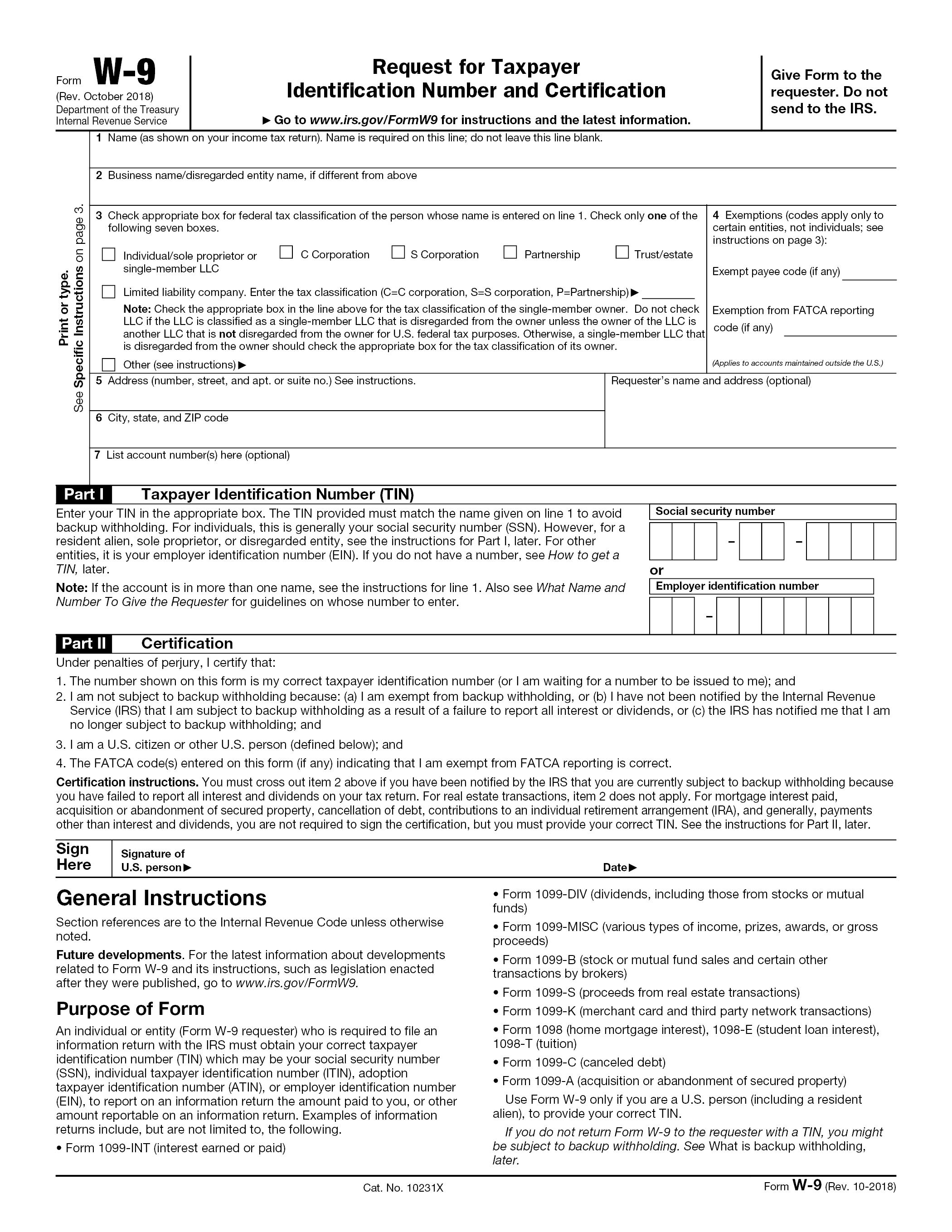

Form W-9

16

17

18

19

20

21

Declaration of Status for Israeli Tax Purposes

You are receiving this form of “Declaration of Status For Israeli Income Tax Purposes” as a holder of warrants to purchase Class A ordinary shares, without par value (the “Warrants”) of REE Automotive Ltd., a company organized under the laws of the State of Israel (the “Company”), in connection with (i) an offer (the “Exchange Offer”) by the Company to holders of its outstanding public warrants and private placement warrants (collectively, the “Warrants” and the holders of such Warrants, the “Warrantholders”) to exchange each Warrant for consideration consisting of 0.20 Class A ordinary shares, without par value (the “Shares”) and (ii) the solicitation of consents to amend that certain Warrant Assignment, Assumption and Amended & Restated Agreement dated as of July 22, 2021 by and among the Company, 10X Capital Venture Acquisition Corp. and Continental Stock Transfer & Trust Company, as warrant agent (the “Warrant Agreement”).

By completing this form in a manner that would substantiate your eligibility for an exemption from Israeli withholding tax, you will allow the Company, the Company’s paying agent, your broker or any other withholding agent, or their authorized representatives to refrain from applying Israeli withholding tax.

This form is relevant only if you certify that (A) you are NOT a “resident of Israel” (as defined under Section 1 of the Israeli Income Tax Ordinance [New Version], 5721-1961 (the “Ordinance”) (see Appendix A) for purposes of the Ordinance, (B) you acquired your Warrants on or after the Company’s initial public offering (i.e., on or after November 27, 2020), and (C) you hold less than 5% of the outstanding Shares. For the sake of clarity, this form is NOT relevant if you are a registered Warrantholder (i.e., you hold Warrants of the Company as a record holder in the Company’s share register).

PART I | Identification and details of Warrantholder (including Eligible Israeli Brokers) (see instructions) |

1. Name: | 2. Type of Warrantholder (more than one box may be applicable): |

(please print full name) | ☐ Corporation (or Limited Liability Company) ☐ Individual ☐ Trust ☐ Partnership ☐ Other: __________ | ☐ Bank ☐ Broker ☐ Other Financial Institution |

3. For individuals only: | 4. For all other Warrantholders: |

Date of birth: ______/_____/______ month / day / year | Country of incorporation or organization: |

Country of residence: | Registration number of entity (if applicable): |

Countries of citizenship (name all citizenships): |

Taxpayer Identification or

Social Security No. (if applicable): | Country of residence: |

5. Permanent Address (house number, street, apartment number, city, state, zip or postal code, country): |

22

6. Mailing Address (if different from above): | 7. Contact Details: Name: Capacity: Telephone Number (country code, area code and number): |

8. I hold the Warrants of the Company (mark X in the appropriate place): ☐ directly, as a registered holder ☐ through a Broker. If you marked this box, please state the name of your Broker: _________________ |

9. I am the beneficial owner (directly or indirectly) of less than 5% of the Company’s issued shares. Yes ☐ No ☐ |

PART II | Declaration by Non-Israeli Residents (see instructions) ►

Eligible Israeli Brokers should not complete this Part II |

A. To be completed only by Individuals. I hereby declare that: (if the statement is correct, mark X in the following box) |

A.1 ☐ I am NOT and at the date of purchase of my Warrants was not a an “resident of Israel” for tax purposes, as defined under Israeli law and provided in Appendix A attached hereto, which means, among other things, that: • The State of Israel is not my permanent place of residence; • The State of Israel is neither my place of residence nor that of my family; • The ordinary or permanent place of my business and financial activity is NOT in the State of Israel, and I do NOT have a permanent establishment in the State of Israel; • I do NOT engage in an occupation in the State of Israel, • I do NOT have any ownership rights in any business or any part of a business in the State of Israel; • I am NOT covered by the Israeli National Insurance Institution; • I was NOT present (nor am I planning to be present) in Israel for 183 days or more during this tax year; and • I was NOT present (nor am I planning to be present) in Israel for 30 days or more during this tax year, and the total period of my presence in Israel during this tax year and the two previous tax years is less than 425 days in total. A.2 ☐ I acquired the Warrants on or after the initial public offering of the Company (i.e., on or after November 27, 202), and while the Warrants were listed for trade. |

23

B. To be completed by corporations (except partnerships and trusts). I hereby declare that: (if correct, mark X in the following box) |

B.1 ☐ The corporation is NOT and at the date of purchase of its Warrants was not a an “resident of Israel” for tax purposes, as defined under Israeli law and provided in Appendix A attached hereto, which means, among other things, that: • The corporation is NOT registered with the Registrar of Companies in Israel; • The corporation is NOT registered with the Registrar of “Amutot” (non-profit organizations) in Israel; • The control of the corporation is NOT situated in Israel; • The management of the corporation is NOT located in Israel; • The corporation does NOT have a permanent establishment in Israel; and • No Israeli resident holds, directly or indirectly via shares or through a trust or in any other manner or with another who is an Israeli resident, 25.0% or more of any “means of control” in the corporation as specified below: • The right to participate in profits; • The right to appoint a director; • The right to vote; • The right to share in the assets of the corporation at the time of its liquidation; and • The right to direct the manner of exercising one of the rights specified above. B.2 ☐ The corporation acquired the Warrants on or after the initial public offering of the Company (i.e., on or after November 27, 2020), and while the Warrants were listed for trade. |

C. To be completed by Partnerships. I hereby declare that: (if correct, mark X in the following box) |

C.1 ☐ The partnership is NOT and at the date of purchase of its Warrants was not a an “resident of Israel” for tax purposes, as defined under Israeli law and provided in Appendix A attached hereto, which means, among other things, that: • The partnership is NOT registered with the Registrar of Partnerships in Israel; • The control of the partnership is NOT situated in Israel; • The management of the partnership is NOT located in Israel; • The partnership does NOT have a permanent establishment in Israel; • NO Israeli resident holds, directly or indirectly via shares or through a trust or in any other manner or with another who is an Israeli resident, 25.0% or more of any right in the partnership or, of the right to direct the manner of exercising any of the rights in the partnership; and • NO partner in the partnership is an Israeli resident; C.2 ☐ The partnership acquired the Warrants on or after the initial public offering of the Company (i.e., on or after November 27, 2020), and while the Warrants were listed for trade. |

D. To be completed by Trusts. I hereby declare that: (if correct, mark X in the following box) |

D.1 ☐ The trust is NOT and at the date of purchase of its Warrants was not a an “resident of Israel” for tax purposes, as defined under Israeli law and provided in Appendix A attached hereto, which means, among other things, that: • The trust is NOT registered in Israel; • NONE of the settlors of the trust are Israeli residents; • NONE of the beneficiaries of the trust are Israeli residents; and • The trustee of the trust is NOT an Israeli resident. D.2 ☐ The trust acquired the Warrants on or after the initial public offering of the Company (i.e., on or after November 27, 2020), and while the Warrants were listed for trade. |

24

PART III | Declaration by Israeli Bank, Broker or Financial Institution (see instructions) ►

Non-Israeli Residents should not complete this Part III |

I hereby declare that: (if correct, mark X in the following box) ☐ I am a bank, broker or financial institution that is a “resident of Israel” within the meaning of that term in Section 1 of the Ordinance (See Appendix A), I am holding the Warrants solely on behalf of beneficial holder(s) and I am subject to the provisions of the Ordinance and the regulations promulgated thereunder relating to the withholding of Israeli tax, including with respect to the cash payment (if any) made by me to such beneficial holder(s) with respect to Warrants in connection with the Exchange Offer. |

PART IV | Certification. By signing this form, I also declare that: |

• I understood this form and completed it correctly and pursuant to the instructions. • I provided accurate, full and complete details in this form. • I am aware that providing false details constitutes a criminal offense. • I am aware that this form may be provided to the Israel Tax Authority, in case the Israel Tax Authority so requests, for purposes of audit or otherwise. |

SIGN HERE ► | | ___________________ | | ___________________ | | _________________ |

| | | Signature of

Warrantholder | | Date | | Capacity in which acting |

| | | | | | | (or individual authorized to sign on your behalf) |

25

The Exchange Agent for the Offer and the Consent Solicitation is:

Continental Stock Transfer & Trust Company

By First Class, Registered or Certified Mail:

Continental Stock Transfer & Trust Company

1 State Street, 30th Floor,

New York, New York 10004

By Express or Overnight Delivery:

Continental Stock Transfer & Trust Company

1 State Street, 30th Floor,

New York, New York 10004

Questions or requests for assistance may be directed to the information agent at the address and telephone number listed below. Additional copies of the Prospectus/Offer to Exchange, this Letter of Transmittal and Consent and the Notice of Guaranteed Delivery may also be obtained from the information agent. Any warrant holder may also contact its broker, dealer, commercial bank or trust company for assistance concerning the Offer and Consent Solicitation.

The Information Agent for the Offer and Consent Solicitation is:

Morrow Sodali LLC

333 Ludlow Street

5th Floor, South Tower

Stamford, Connecticut 06902

Individuals call toll-free: (800) 662-5200

Banks and Brokerage Firms, please call (203) 658-9400

Email: REE.info@investor.morrowsodali.com

26