Liquidity and Capital Resources

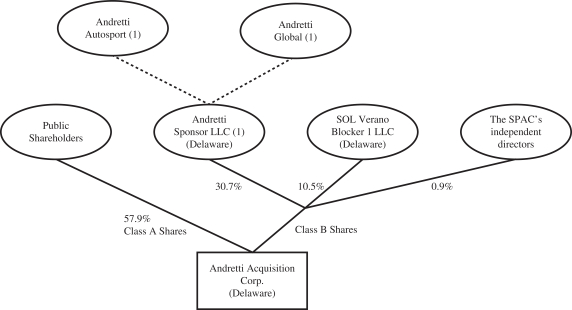

Until the consummation of the IPO, the SPAC’s only source of liquidity was an initial purchase of shares of SPAC Class B Common Stock and the Unsecured Promissory Note to the Sponsor entered on January 28, 2021, pursuant to which the SPAC was able to borrow up to an aggregate principal amount of $300,000.

On January 18, 2022, the SPAC consummated the IPO of 23,000,000 units, which includes the full exercise by the underwriters of the Over-Allotment Option, generating gross proceeds of $230,000,000. Simultaneously with the closing of the IPO, the SPAC consummated the sale of 13,550,000 SPAC Private Warrants at a price of $1.00 per Private Placement in a private placement to the Sponsor and the Sponsor Co-Investor, generating gross proceeds of $13,550,000.

Following the IPO, the full exercise of the over-allotment option, and the sale of SPAC Private Warrants, a total of $235,750,000 was placed in the Trust Account. The SPAC incurred $23,807,600 in IPO related costs, including $4,600,000 of underwriting fees and $754,790 of other offering costs.

In connection with the July 2023 Extraordinary General Meeting, shareholders holding an aggregate of 15,105,199 shares of SPAC Class A Common Stock exercised their right to redeem their shares prior to the redemption deadline on July 12, 2023. Following the withdrawals from the Trust Account in connection with such redemptions, approximately $84.2 million remained in the Trust Account (based on the redemption amount of $10.66 per share).

As of September 30, 2023, the SPAC had $157,413 in its operating bank account, $85,132,545 in marketable securities held in the Trust Account, which includes $4,210,835 of interest income, which is a result of $10,423,899 of interest income reduced by $6,213,064 of interest paid to redeeming shareholders and a working capital deficit of $510,271. The SPAC may withdraw interest from the Trust Account to pay taxes, if any. The SPAC intends to use substantially all of the funds held in the Trust Account, including any amounts representing interest earned on the Trust Account (less income taxes payable), to complete the Merger. To the extent that the SPAC’s share capital or debt is used, in whole or in part, as consideration to complete the Merger, the remaining proceeds held in the Trust Account will be used as working capital to finance the operations of the target business or businesses, make other acquisitions and pursue the SPAC’s growth strategies.

As of December 31, 2022, the SPAC had $616,120 in its operating bank account, $239,149,736 in marketable securities held in the Trust Account, including $3,399,736 of interest income, and working capital of $1,091,655. For the year ended December 31, 2022, cash used in operating activities was $1,932,401. Net income of $1,890,290 was affected by interest earned on marketable securities held in the Trust Account of $3,399,736. Changes in operating assets and liabilities used $422,955 of cash for operating activities. For the period from January 20, 2021 (inception) through December 31, 2021, cash used in operating activities was $7,910. Net loss of $10,861 was affected by formation cost paid by Sponsor of $5,000 and changes in operating assets and liabilities of $2,049.

For the nine months ended September 30, 2023, cash used in operating activities was $2,747,659. Net income of $705,617 was affected by interest earned on marketable securities held in the Trust Account of $7,024,163 and changes in related party convertible promissory notes of $38,199. Changes in operating assets and liabilities provided $3,532,688 of cash for operating activities.

For the nine months ended September 30, 2023, net cash provided by investing activities was $161,054,354 as a result of the redemption of ordinary shares.

For the nine months ended September 30, 2023, net cash used in financing activities was $158,752,402 as a result of the drawdowns on the related party convertible promissory notes partially offset by the payment of offering costs of $85,000 and redemption of ordinary shares of $161,041,354, offset by proceeds from convertible note - related party of $2,373,952.

258