Manager’s Commentary (Unaudited)

For the 12 months ended December 31, 2022, the investments held by Destiny Tech100 (the “Fund”) generated a return of -37.1%

1

. This compares to a -32.5% return for the Nasdaq Composite, a benchmark, over the same period.

2022 was a challenging year for owners of both public and private assets. Many domestic and global stock indexes faced declines on the order of fifteen to twenty percent while US bonds, also down double digits, failed to backstop the drawdown in equities. In turn, the “classic” portfolio of 60% U.S. stocks and 40% bonds produced its worst annual return since 1932

2

.

The tightening of monetary policy by the Federal Reserve has been particularly hard on high-growth technology businesses. With the 10-year treasury yield more than doubling amid the fastest rate-hiking cycle in four decades, once-cheap and abundant capital has evaporated, prompting a re-rating of forward-looking revenue multiples by market participants. Furthermore, as borrowing costs rise, operating losses have become a problem. The ARK Innovation ETF, AXS de-SPAC ETF, and Goldman Sachs Non Profitable Tech index - proxies for high-growth and low-profitability technology performance - returned -67.0%, -73.1%, and -62.3%, respectively, in 2022.

We believe the compression of multiples in the public markets will have a continuing impact on private company valuations. In Q4 2022, the median secondary trade price executed on the Forge platform represented an approximate 50% discount to a given company’s last fundraising round, as opposed to a 39% discount in Q3 and a 16% discount in Q2 2022

3

. Data from Pitchbook indicates that the median late-stage primary round post-money valuation declined 25.7% year-over-year

4

.

Adverse public and private market conditions may force private companies and shareholders with limited liquidity options to accept lower valuations moving forward, presenting more attractive risk-adjusted entry points. We believe these conditions could create great opportunities to purchase high-quality technology businesses at sensible prices. We will continue to utilize our investment targeting and screening process to identify and seek to take advantage of such opportunities in the coming year.

Thank you for your loyalty and continued support.

1. Performance represents the depreciation on investments for the one-year period of January 1, 2022 to December 31, 2022.

2. https://www.ft.com/content/c93f3660-821f-458b-ae0f-23ac05b8f03f

3. https://forgeglobal.com/insights/reports/investors-eye-next-wave-of-2023-unicorns/

4. Pitchbook data for the two-year period of January 1, 2021 to December 31, 2022

P

erformance and Graphical Illustrations (Unaudited)

The Fund’s performance figures* for the period ended December 31, 2022 compared to its benchmark:

| Fund/Index | | | |

| Destiny Tech100 Inc. - NAV | | | (33.27 | )% |

| | | | | |

| Fund Benchmark | | | | |

| | | | | |

NASDAQ Composite Index (b) | | | (7.95 | )% |

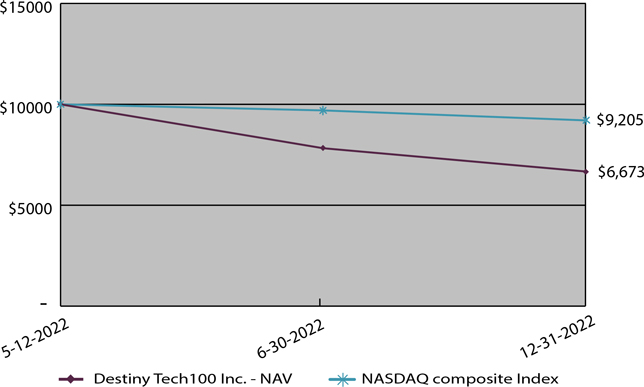

Comparison of Change in Value of $10,000 Initial Investment

| * | The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when sold may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the sale of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Returns are calculated using the traded net asset value or “NAV” on December 31, 2022. |

| (a) | The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. |

| (b) | The Nasdaq Composite is a market cap-weighted index, simply representing the value of all its listed stocks. The set of eligible securities includes common stocks, ordinary shares, and common equivalents such as ADRs. However, convertible debentures, warrants, Nasdaq-listed closed-end funds, exchange traded funds (ETFs), preferred stocks, and other derivative securities are excluded. |

The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

| | | For the Year | |

| | | Ended December 31, | |

| | | | |

| Net Asset Value, Beginning of Year | | $ | (1.60 | ) |

| | | | | |

| Income from Investment Operations | | | | |

| Net investment income/(loss) (3) | | | (0.27 | ) |

| Recognition of conversion of SAFE note liabilities to Common Shares | | | 2.33 | |

| Change in unrealized fair value on investments and warrants | | | (2.42 | ) |

| Total income/(loss) from investment operations and recognition of conversion of SAFE | | | | |

| Note liabilities to Common Shares | | | (0.36 | ) |

| | | | | |

| Distributions to Shareholders | | | | |

| From net investment income | | | - | |

| From return of capital | | | - | |

| Total distributions | | | - | |

| Effect of shares issued from SAFE note conversion to Common Shares | | | 7.18 | |

| Increase/(Decrease) in Net Asset Value | | | 6.82 | |

| Net Asset Value, End of Year | | $ | 5.22 | |

| | | | | |

| | | 426.08 | % (6) |

| | | | | |

| Supplemental Data and Ratios | | | | |

| Net assets attributable to common shares, end of period (000s) | | $ | 56,764 | |

| | | | | |

| Ratio of expenses to average net assets (5) | | | (5.13 | )% |

| Ratio of net investment income to average net assets (5) | | | (4.82 | )% |

| Portfolio turnover rate | | | 0.24 | % |

N

otes to the Financial Statements

Destiny Tech100 Inc. (the “Fund”) was formed on November 8, 2020 as a Maryland corporation and commenced operations on January 25, 2021. On May 13, 2022, the Fund registered with the Securities and Exchange Commission as an investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund is a-diversified, closed-end management investment company. The Fund intends to apply to have the common stock listed on the New York Stock Exchange (the “NYSE”) under the symbol “DXYZ”.

Destiny Advisors LLC, a Delaware limited liability company (the “Adviser”), serves as the investment adviser to the Fund. The Adviser is responsible for the overall management and affairs of the Fund and has full discretion to invest the assets of the Fund in a manner consistent with the Fund’s investment objective.

The Fund’s investment objective is to maximize the portfolio’s total return, principally by seeking capital gains on equity and equity-related investments. The Fund invests principally in the equity and equity-linked securities of what it believes to be rapidly growing venture-capital-backed emerging companies, primarily in the United States. The Fund may also invest on an opportunistic basis in select U.S. publicly traded equity securities or certain non-U.S. companies that otherwise meet the investment criteria.

The Adviser is a wholly-owned subsidiary of Destiny XYZ Inc. (the “Organizer”). The Organizer manages and controls the Adviser.

The Fund’s board of directors (the “Board”) has overall responsibility for monitoring and overseeing the Fund’s operations and investment program. A majority of the directors of the Board are not “interested persons” (as defined by the 1940 Act) of the Fund or the Adviser.

Summary of Significant Accounting Policies

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements. All accounts are stated in U.S. dollars unless otherwise noted. The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United State of America (“U.S. GAAP”). The Fund is an investment company and follows the accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946,

Financial Services - Investment Companies.

Investments in securities, including through SPVs, are recorded on the trade date, the date on which the Fund agrees to purchase or sell the securities.

The Fund may invest in SPVs that hold forward contracts. Forward contracts involve the future delivery of shares of a portfolio company upon such securities becoming freely transferable or the removal of restrictions on transfer. The counterparties are shareholders of the portfolio company. The Fund does not have information as to the identities of the shareholders; however, counterparty risk is mitigated by the fact that there is not a single counterparty on the opposite side of the forward contracts.

The Fund may invest in “forward contracts” that involve shareholders (each a “counterparty”) of a potential portfolio company whereby such counterparties promise future delivery of such securities upon transferability or other removal of restrictions. This may involve counterparty promises of future performance, including among other things transferring shares to us in the future, paying costs and fees associated with maintaining and transferring the shares, not transferring or encumbering their shares, and participating in further acts required of shareholders by the counterparty and their agreement with us. Should counterparties breach their agreement inadvertently, by operation of law, intentionally, or fraudulently, it could affect the Fund’s performance. The Fund’s ability and right to enforce transfer and payment obligations, and other obligations, against counterparties could be limited by acts of fraud or breach on the part of counterparties, operation of law, or actions of third parties. Measures the Fund takes to mitigate these risks, including powers of attorney, specific performance and damages provisions, any insurance policy, and legal enforcement steps, may prove ineffective, unenforceable, or economically impractical to enact.

Notes to the Financial Statements (continued)

The Fund recognizes interest and penalties related to unrecognized tax benefits, if any, on the income tax expense line in the accompanying statement of operations. As of December 31, 2022, no accrued interest or penalties are included on the related tax liability line in the balance sheet.

Cash and Cash Equivalents

Cash includes cash in bank accounts. Cash equivalents include short-term highly liquid investments that are readily convertible to cash and have original maturities of three months or less. The Fund maintains cash in the bank accounts which, at times, may exceed the United States Federal Deposit Insurance Corporation (FDIC) limit of $250,000.

Interest income is recognized on an accrual basis as earned. Dividend income is recorded on the ex-dividend date. Expenses are recognized on an accrual basis as incurred.

Organization costs include costs relating to the formation and incorporation of the business. These costs are expensed as incurred. From the commencement of the Fund’s operations, the Fund has incurred and expensed organization costs of $70,202, which were paid by the Organizer to be reimbursed by the Fund and are reflected as “Organizational costs payable to Organizer” on the Statement of Assets and Liabilities.

Pursuant to the terms of the investment advisory agreement while the Fund operated as a private fund (the “Prior Advisory Agreement”) entered into between the Fund and the Adviser that was in operation while the Fund operated as a private fund, the Fund is obligated to pay up to $150,000 of organizational costs and amounts in excess thereof will be borne by the Adviser. As of December 31, 2022, the Adviser has not borne any of the organizational expenses as the total amount incurred by the Fund has not historically exceeded $150,000. See note 5 for details on the reimbursable organizational costs to the Adviser.

Offering costs were accounted for as deferred costs until the Fund registered as an investment company under the 1940 Act and were then amortized to expense over twelve months on a straight-line basis. These costs consist of fees for the legal preparation and filing fees associated with the private offering. As of December 31, 2022, these costs amount to $216,510, which were paid by the Organizer to be reimbursed by the Fund. On the Statement of Assets and Liabilities, $72,170 remains as a deferred asset while $144,340 has been amortized to expense in the Statement of Operations.

Certain investments may have contractual payment-in-kind (“PIK”) interest. PIK represents accrued interest that is added to the principal of the investment on the respective interest payment dates rather than being paid in cash and generally becomes due at maturity or upon being called by the issuer. PIK is recorded as interest income.

The preparation of financial statements in conformity with GAAP requires the Fund’s management to make estimates and assumptions that affect the amounts reported in the financial statements. Because of the uncertainties associated with estimation, actual results could differ from those estimates used in preparing the accompanying financial statements.

Notes to the Financial Statements (continued)

Concentrations of Credit Risk

Financial instruments which potentially expose the Fund to concentrations of credit risk consist of cash and cash equivalents. The Fund maintains its cash and cash equivalents in financial institutions at levels that have historically exceeded federally-insured limits.

All investments are subject to certain risks. Changes in overall market movements, interest rates, or factors affecting a particular industry, can affect the ultimate value of the Fund’s investments. Investments are subject to a number of risks, including the risk that values will fluctuate as a result of changing expectations for the economy and individual investors.

Liquidity and Valuation Risk

- Liquidity risk is the risk that securities may be difficult or impossible to sell at the time the Adviser would like or at the price it believes the security is currently worth. Liquidity risk may be increased for certain Fund investments, including those investments in funds with gating provisions or other limitations on investor withdrawals and restricted or illiquid securities. Some SPVs in which the Fund invests may impose restrictions on when an investor may withdraw its investment or limit the amounts an investor may withdraw. To the extent that the Adviser seeks to reduce or sell out of its investment at a time or in an amount that is prohibited, the Fund may not have the liquidity necessary to participate in other investment opportunities or may need to sell other investments that it may not have otherwise sold.

The Fund may also invest in securities that, at the time of investment, are illiquid, as determined by using the Securities and Exchange Commission’s (the “SEC”) standard applicable to registered investment companies (i.e., securities that cannot be disposed of by the Fund within seven calendar days in the ordinary course of business at approximately the amount at which the Fund has valued the securities). Illiquid and restricted securities may be difficult to dispose of at a fair price at the times when the Fund believes it is desirable to do so. The market price of illiquid and restricted securities generally is more volatile than that of more liquid securities, which may adversely affect the price that the Fund pays for or recovers upon the sale of such securities. Investment of the Fund’s assets in illiquid and restricted securities may also restrict the Fund’s ability to take advantage of market opportunities.

Valuation risk is the risk that one or more of the securities in which the Fund invests are priced differently than the value realized upon such security’s sale. In times of market instability, valuation may be more difficult, in which case the Adviser’s judgment may play a greater role in the valuation process.

Market Disruption and Geopolitical Risk

- The Fund is subject to the risk that geopolitical events will disrupt securities markets and adversely affect global economies and markets. War, terrorism, and related geopolitical events (and their aftermath) have led, and in the future may lead, to increased short-term market volatility and may have adverse long-term effects on U.S. and world economies and markets generally. Likewise, natural and environmental disasters, such as, for example, earthquakes, fires, floods, hurricanes, tsunamis and weather-related phenomena generally, as well as the spread of infectious illness or other public health issues, including widespread epidemics or pandemics such as the COVID-19 outbreak, and systemic market dislocations can be highly disruptive to economies and markets. Those events as well as other changes in non-U.S. and domestic economic and political conditions also could adversely affect individual issuers or related groups of issuers, securities markets, interest rates, credit ratings, inflation, investor sentiment, and other factors affecting the value of Fund Investments.

Notes to the Financial Statements (continued)

The impact of the COVID-19 outbreak and any other epidemic or pandemic that may arise in the future could adversely affect the economies of many nations or the entire global economy, the financial performance of individual issuers, borrowers and sectors and the health of capital markets and other markets generally in potentially significant and unforeseen ways. This crisis or other public health crises may also exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty. The foregoing could lead to a significant economic downturn or recession, increased market volatility, a greater number of market closures, higher default rates and adverse effects on the values and liquidity of securities or other assets. Such impacts, which may vary across asset classes, may adversely affect the performance of the Fund’s investments, the Fund and a Shareholder’s investment in the Fund.

Restricted securities are securities of privately-held companies that may be resold only upon registration under federal securities laws or in transactions exempt from such registration. In some cases, the issuer of restricted securities has agreed to register such securities for resale, at the issuer’s expense, either upon demand by the Fund or in connection with another registered offering of the securities. Many restricted securities may be resold in the secondary market in transactions exempt from registration. Such restricted securities may be determined to be liquid under criteria established by the Adviser. The restricted securities may be valued at the price provided by dealers in the secondary market or, if no market prices are available, the fair value as determined in good faith using methods approved by the Adviser. As of the date of this report, there is no expected date for such restrictions to be removed from any of the Fund’s restricted securities.

Notes to the Financial Statements (continued)

Additional information on each restricted investment held by the Fund on December 31, 2022 is as follows:

| | | Initial | | | | | | | | | |

| | | Acquisition | | | | | | | | | |

| Investments | | Date | | Cost | | | Fair Value | | | % of Net Assets | |

| Automation Anywhere, Inc. | | 12/30/2021 | | | 2,609,219 | | | | 748,412 | | | | 1.32 | % |

| Axiom Space, Inc. | | 12/22/2021 | | | 3,090,000 | | | | 3,634,867 | | | | 6.41 | % |

| Bolt Financial, Inc., Series C Preferred Stock | | 3/7/2022 | | | 2,000,020 | | | | 1,136,375 | | | | 2.00 | % |

| Boom Technology, Inc. | | 2/11/2022 | | | 2,000,000 | | | | 2,000,000 | | | | 3.52 | % |

| Brex Inc. | | 3/2/2022 | | | 4,130,298 | | | | 2,358,820 | | | | 4.16 | % |

| CElegans Labs, Inc. | | 11/23/2021 | | | 2,999,977 | | | | 2,999,977 | | | | 5.28 | % |

| Chime Financial Inc. - Series A Preferred Stock | | 12/30/2021 | | | 5,150,748 | | | | 1,826,780 | | | | 3.22 | % |

| ClassDojo, Inc. | | 11/19/2021 | | | 3,000,018 | | | | 2,812,604 | | | | 4.95 | % |

| Discord, Inc. | | 3/1/2022 | | | 724,942 | | | | 395,530 | | | | 0.70 | % |

| Discord, Inc. - Series G Preferred Stock | | 3/1/2022 | | | 889,055 | | | | 485,070 | | | | 0.85 | % |

| Epic Games, Inc. | | 1/3/2022 | | | 6,998,590 | | | | 3,437,470 | | | | 6.06 | % |

| Flexport, Inc. | | 3/29/2022 | | | 520,000 | | | | 329,160 | | | | 0.58 | % |

| Impossible Foods - Series A Preferred Stock | | 6/17/2022 | | | 1,272,986 | | | | 538,720 | | | | 0.95 | % |

| Impossible Foods, Inc. - Series H Preferred Stock | | 11/4/2021 | | | 2,098,940 | | | | 857,616 | | | | 1.51 | % |

| Jeeves, Inc. - Series C Preferred Stock | | 4/5/2022 | | | 749,997 | | | | 749,997 | | | | 1.32 | % |

| Klarna Bank AB | | 3/16/2022 | | | 4,657,660 | | | | 793,866 | | | | 1.40 | % |

| Maplebear, Inc. | | 10/8/2021 | | | 3,556,000 | | | | 718,755 | | | | 1.27 | % |

| Maplebear, Inc. - Series B Preferred Stock | | 11/16/2021 | | | 2,863,400 | | | | 606,800 | | | | 1.07 | % |

| Plaid, Inc. | | 2/15/2022 | | | 1,110,340 | | | | 672,379 | | | | 1.18 | % |

| Public Holdings, Inc. | | 7/22/2021 | | | 999,990 | | | | 999,990 | | | | 1.76 | % |

| Relativity Space, LLC | | 12/28/2021 | | | 1,659,996 | | | | 1,329,912 | | | | 2.34 | % |

| Revolut Group Holdings Ltd | | 12/8/2021 | | | 5,275,185 | | | | 2,002,768 | | | | 3.53 | % |

| Space Exploration Technologies Corp., Class A | | 6/27/2022 | | | 10,009,990 | | | | 10,260,801 | | | | 18.08 | % |

| Space Exploration Technologies Corp., Class A and Class C | | 6/8/2022 | | | 3,390,000 | | | | 3,521,582 | | | | 6.20 | % |

| Space Exploration Technologies Corp., Class A | | 6/9/2022 | | | 618,618 | | | | 690,963 | | | | 1.22 | % |

| Stripe, Inc. | | 1/10/2022 | | | 3,478,813 | | | | 1,594,938 | | | | 2.81 | % |

| Superhuman Labs, Inc. | | 6/25/2021 | | | 2,999,996 | | | | 2,099,958 | | | | 3.70 | % |

| Total Investments | | | | $ | 78,854,778 | | | $ | 49,604,108 | | | | 87.39 | % |

The Fund’s Fair Valuation Procedures incorporate the principles found in Rule 2a-5 of the 1940 Act in conjunction with Topic 820 (“ASC 820”) of the Financial Accounting Standards Board (“FASB”). Rule 2a-5 was created to address valuation practices with respect to the investments of a registered investment company and the oversight role performed by the Board in the valuation process. The Board has appointed the Adviser to serve as the Valuation Designee to perform fair value determinations.

ASC 820 was created to establish a framework for measuring fair value through the use of certain methods and inputs and shall be used by the Adviser in combination with the directives of Rule 2a-5 of the 1940 Act. ASC 820 defines fair value as the price of an asset that one would observe in an orderly purchase and sale transaction between market participants at a specific point in time. Data inputs used to perform a valuation are categorized as follows:

Notes to the Financial Statements (continued)

Readily Available (Level I) - Investments that trade frequently, for which pricing quotations in active markets are easily accessible.

Limited Availability (Level II) - Investments lacking easily recognizable market data, but where certain other observable data points exist such as market quotes for similar investments, and other observable market conditions such as interest rates, yield curves, default rates, etc.

Unavailable (Level III) - Investments where there is virtually no market data available, with no observable market data points or inputs. Fair value may be derived from professional judgments and assumptions in the form of an analysis that considers relevant factors and criteria determined in good faith, using a methodology such as liquidation basis, present value of cash flows, income approach, etc. or an independent third-party appraisal, should the committee feel the need to engage one.

Investments in publicly traded securities are generally carried at the closing price on the last trading day of the reporting period, while private investments are carried at fair value, estimated using applicable methodologies or are valued at their NAV as a practical expedient. In instances where a public or private real estate market transaction is not sufficiently similar to the investment being valued, alternative valuation methodologies shall be utilized. The determined fair value may be discounted even further on account of factors including but not limited to capital and risk structure, restrictions on resale, and ownership structure.

The Fund is registered under the 1940 Act. The Fund’s investments will be fair valued on a monthly basis and the Fund will calculate its NAV as of the close of each business quarter. Fluctuations in an investment’s fair value may be caused by volatility in economic conditions, among other factors. Such fluctuations in the fair value are classified as unrealized gains or losses in the Fund’s statement of operations. Upon the disposition of an investment, the corresponding gain or loss is classified as realized and will also be noted in the statement of operations.

Investments in private financial instruments or securities for which no readily available pricing is available may be valued by an independent reputable third-party service provider on a quarterly basis or as needed. This includes securities for which the use of NAV as a practical expedient is permitted under U.S. GAAP because their value is not based on unadjusted quoted prices. In conjunction with input from the independent third-party valuation agent, the

Adviser, as the

Valuation Designee

,

shall value each Level III Investment on a monthly basis.

The methods commonly used to develop indications of value for an asset are the Income, Market, and Cost Approaches. Each valuation technique is detailed in ASC 820.

The Income Approach uses valuation techniques to convert future amounts (for example, cash flows or earnings) to a single present amount (discounted). The measurement is based on the value indicated by current market expectations about those future amounts. Those valuation techniques include present value techniques; option-pricing models, such as the Black-Scholes-Merton formula (a closed-form model) and a binomial model (a lattice model), which incorporate present value techniques.

The Market Approach uses prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities (including a business). For example, valuation techniques consistent with the market approach often use market multiples derived from a set of comparables. Multiples might lie in ranges with a different multiple for each comparable. The selection of where within the range the appropriate multiple falls requires judgment, considering factors specific to the measurement (qualitative and quantitative).

The Cost Approach is based on the amount that currently would be required to replace the service capacity of an asset (often referred to as current replacement cost). From the perspective of a market participant (seller), the price that would be received for the asset is determined based on the cost to a market participant (buyer) to acquire or construct a substitute asset of comparable utility, adjusted for obsolescence. Obsolescence encompasses physical deterioration, functional (technological) obsolescence, and economic (external) obsolescence and is broader than depreciation for financial reporting purposes (an allocation of historical cost) or tax purposes (based on specified service lives).

Notes to the Financial Statements (continued)

At various times, the Fund may utilize Special Purpose Vehicles (“SPV”)

and similar funds

in the investment process. The Fund advances money to these SPVs for the specific purpose of investing in securities of a single private issuer (an “SPV Investment”). When the Fund makes an SPV Investment, the investment is held through the Fund’s interest in the respective SPV. The Fund presents and fair values its SPV Investments in the financial statements as if they were owned directly by the Fund and

has

disregarded

the SPVs

for presentation purposes as a result of the following: (1) an SPV Investment is the sole activity of the SPV; (2) the Fund’s underlying ownership of

an

SPV

investment

is proportionate to the

contributions made

to

the SPV; and (3) the Fund will receive

its proportionate share of the

cash proceeds as the SPV Investment is monetized and distributed. The Schedule of Investments presents the direct investment of the SPVs with material positions in the Fund. The SPVs may incur a tax liability associated with distributions made by underlying portfolio investments. If an SPV charges management fees, those fees will adjust the cost of the SPV.

Investments in SPVs consist of an investment by the Fund in an entity that invests directly in the common or preferred stock of a Portfolio Company. Investments in SPVs are generally valued using the same fair value techniques for the securities held by the Fund once the investment has been made by the SPV into the underlying portfolio company and are categorized as Level 3 of the fair value hierarchy. The investments in an SPV that have yet to purchase the underlying securities are held at cost and are categorized in Level 3 of the fair value hierarchy.

The Warrants issued were fair valued by a valuation consultant. As of December 31, 2022, the valuation consultant used a valuation methodology that used a probability distribution of the common stock price at the forecast time of the public listing combined with the probability-weighted average formula for the value of a call option to value the Warrants.

The following table summarizes the levels within the fair value hierarchy for the Fund’s assets and liabilities measured at fair value as of December 31, 2022:

| Investments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Agreement for Future Delivery of Common Shares (a) | | $ | | | | $ | | | | $ | 2,267,317 | | | $ | 2,267,317 | |

| Common Stocks | | | — | | | | — | | | | 35,500,566 | | | $ | 35,500,566 | |

| Convertible Notes | | | — | | | | — | | | | 5,634,867 | | | | 5,634,867 | |

| Preferred Stocks | | | — | | | | — | | | | 6,201,358 | | | | 6,201,358 | |

| Total | | $ | — | | | $ | — | | | $ | 49,604,108 | | | $ | 49,604,108 | |

| Liabilities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Warrants | | | — | | | | — | | | | (3,571,824 | ) | | | (3,571,824 | ) |

| Total | | $ | — | | | $ | — | | | $ | (3,571,824 | ) | | $ | (3,571,824 | ) |

| (a) | Certain investments are held through SPV s that holds forward contracts. Forward contracts involve the future delivery of shares of a portfolio company upon such securities becoming freely transferable or the removal of restrictions on transfer. The counterparties are shareholders of the portfolio company. See Schedule of Investments. |

Notes to the Financial Statements (continued)

The changes in fair value of investments and liabilities for which the Fund has used Level 3 inputs to determine the fair value are as follows:

| | Balance as of

December 31, | | | | | | | | | | | | Appreciation (Depreciation) | | | | |

Agreement for Future Delivery of Common Shares (b) | | $ | — | | | $ | 4,589,153 | | | $ | — | | | $ | — | | | $ | (2,321,836 | ) | | $ | 2,267,317 | |

| | | 38,727,109 | | | | 25,208,683 | | | | (10,280,000 | ) | | | — | | | | (18,155,226 | ) | | $ | 35,500,566 | |

| | | 3,000,000 | | | | 2,000,000 | | | | — | | | | — | | | | 634,867 | | | | 5,634,867 | |

| | | 9,891,214 | | | | 7,980,997 | | | | (3,030,000 | ) | | | — | | | | (8,640,853 | ) | | | 6,201,358 | |

| | $ | 51,618,323 | | | $ | 39,778,833 | | | $ | (13,310,000 | ) | | $ | — | | | $ | (28,483,048 | ) | | $ | 49,604,108 | |

| (a) | Sale proceeds from investments is comprised entirely of returned funds held within an SPV. |

| (b) | Certain investments are held through SPV s that holds forward contracts. Forward contracts involve the future delivery of shares of a portfolio company upon such securities becoming freely transferable or the removal of restrictions on transfer. The counterparties are shareholders of the portfolio company. See Schedule of Investments. |

| | | | | | | | | Conversion of

SAFE Notes to

Common Stock | | | Net Realized

Gain (Loss) on

Conversion of

Liabilities | | | Net Change

in Unrealized

Appreciation

(Depreciation) on

Liabilities | | | Balance as of

December 31,

2022 | |

| | $ | (88,351,247 | ) | | $ | (2,398,501 | ) | | $ | 64,697,000 | | | $ | 25,375,657 | | | $ | 677,091 | | | $ | — | |

| | | (4,906,756 | ) | | | (106,529 | ) | | | — | | | | — | | | | 1,441,461 | | | | (3,571,824 | ) |

| | $ | (93,258,003 | ) | | $ | (2,505,030 | ) | | $ | 64,697,000 | | | $ | 25,375,657 | | | $ | 2,118,552 | | | $ | (3,571,824 | ) |

The following is a summary of quantitative information about significant unobservable valuation inputs for Level 3 Fair Value Measurements for investments held as of December 31, 2022:

| | | | | | | | Ranges of Inputs/(Average) |

|

Agreement for Future Delivery of Common Shares (a) | | $2,267,317 | | Market Approach | | Adjusted Recent Transaction Price | | $436.61 |

| | | | | Market Approach | | Indicative Broker Quote | | $32.50 |

| | $35,500,566 | | Market Approach | | Recent Transaction Price | | N/A |

| | | | | Market Approach | | Discount Factor | | 30%-65%/(52%) |

| | | | | Market Approach | | Volume Weighted Average Price | | $6.00-15.00/($10.63) |

| | | | | Market Approach | | Indicative Broker Quotes | | $20.00-$26.50/($22.44) |

| | $5,634,867 | | Market Approach | | Acquisition Price | | N/A |

Notes to the Financial Statements (continued)

| | Fair Value as of December 31, 2022 | | | | | | Ranges of Inputs/(Average) |

| | | | | Market Approach | | Recent Transaction Price | | N/A |

| | $6,201,358 | | Cost Approach | | Acquisition Price | | N/A |

| | | | | Market Approach | | Recent Transaction Price | | N/A |

| | | | | Market Approach | | Indicative Broker Quote | | $25.00 |

| | | | | Market Approach | | Volume Weighted Average Price | | $9.50-$34.95/($11.75) |

| | | | | Market Approach | | Discount Factor | | |

| | | | | | | | |

|

| | (3,571,824) | | Probability- Weighted Average | | Monte Carlo Simulation/Time to Public Listing Black-Scholes-Merton | | |

| | | | | Probability- Weighted Average | | Model/Estimated Volatility | | 32.5% |

| | | | | | | | |

| (a) | Certain investments are held through SPV that holds forward contracts. Forward contracts involve the future delivery of shares of a portfolio company upon such securities becoming freely transferable or the removal of restrictions on transfer. The counterparties are shareholders of the portfolio company. See Schedule of Investments. |

On January 25, 2021, the Organizer purchased 2,500,000 shares of the Fund’s common stock, par value $0.00001, for $25,000.

The securities offered and sold to investors in the Fund’s private offering were simple agreements for future equity in the Fund (the “SAFEs”). A SAFE is an investment instrument similar to a convertible promissory note. The SAFE document is not a debt instrument, but rather appears on the Fund’s capitalization table like other convertible securities such as options. Unlike a convertible note, the SAFE does not have a maturity date and contains provisions for conversion into shares of the Fund’s common stock or redemption upon the occurrences set forth therein. Additionally, a SAFE does not accrue interest.

The purchasers of SAFEs are referred to as “SAFE Investors.” As additional consideration of a SAFE Investor’s purchase of the SAFE, each SAFE Investor was granted a warrant to purchase the number of shares of the Fund’s common stock equal to the purchase amount of the SAFE divided by $10.00 per share (or such amount per share established pursuant to any amendment to the terms of the SAFE) multiplied by either 40% for Tranche 1 or 30% for Tranche 2 and Tranche 3, rounded down to the nearest whole share (the “Warrant Shares”) at a purchase price of $11.50 per Warrant Share, subject to such adjustments as set forth in the terms of the SAFE (the “Warrant”).

Immediately prior to the SAFE Conversion

(defined below)

,

and in accordance with the terms of the SAFE agreement, the Fund performed a reverse stock split of shares of the common stock to ensure that a sufficient amount of shares of the common stock not owned by the Organizer would be outstanding after the SAFE Conversion.

On April 27, 2022, the Fund obtained approval from a majority of the SAFE holders to amend the SAFE Agreement to provide for a mandatory conversion of the SAFEs to shares of our common stock at a conversion price of $10.00 per share (the “SAFE Conversion”). On May 11, 2022, each SAFE holder received from the Fund a number of shares of common stock equal to the total amount invested by such investor in the private offering divided by $10.00. Following the SAFE Conversion and the reverse stock split, the Fund has 10,879,905 shares of common stock issued and outstanding.

Notes to the Financial Statements (continued)

Selling Stockholders who acquired shares of the common stock in connection with the SAFE Conversion (the “Lock-Up Shares”) are subject to limitations on their ability to offer, sell or otherwise dispose of the Lock-Up Shares during the “Lock-Up Period”. Immediately following the date the shares are listed for trading on the NYSE, 25% of the Lock-Up Shares will be freely transferable and not subject to the lock-up provisions as defined in the Fund’s Registration Statement. The Lock-Up Period for the remaining Lock-Up Shares is:

| · | with respect to the first 33.33% of the remaining Lock-Up Shares, 60 days after the date our shares are listed for trading on the NYSE, |

| · | with respect to an additional 33.33% of the remaining Lock-Up Shares, 120 days after the date our shares are listed for trading on the NYSE, and |

| · | with respect to the last 33.33% of the remaining Lock-Up Shares, 180 days after the date our shares are listed for trading on the NYSE. |

The Warrants may only be exercised in full at any time until 5:00 P.M., Eastern Time, on January 1, 2026 (the “Expiration Date”) by the holders of the Warrants by surrendering the Warrant and providing an exercise notice with the information set forth in the Warrant Purchaser Agreement (the “Warrant Agreement”). As a result of the listing of common stock on the NYSE, the Fund may amend the Expiration Date at its sole discretion, provided that such amended Expiration Date will not be effective for at least ten (10) days after written notice is provided to the holder of the Warrants and that any such amendment will be identical among all outstanding Warrants.

If the exercise price of the Warrants is below the opening trading price when trading commences on the NYSE, the exercise price of the Warrants will be increased to an amount equal to the opening trading price when trading commences on the NYSE.

If at any time after the listing of common stock on the NYSE, the then-outstanding shares of common stock are subdivided (by stock split, reclassification or otherwise) or converted or exchange for a certain number of shares of any class or series of capital stock of the Fund (other than the common stock) or for other securities or property, then the exercise price will be adjusted pursuant to the terms of the Warrant Agreement.

A holder of the Warrants is not entitled to any voting rights or other rights as a stockholder of the Fund. In addition, the Warrants and the rights thereunder are not transferable without the written consent of the Fund.

If the Warrant Exercise Price is more than 115% of the SAFE Price at the time of any Public Listing, the Warrant Exercise Price will be reduced by such amount as is necessary to cause the Warrant Exercise Price to equal 115% of the SAFE Price. In addition, if the Warrant Exercise Price would be below the price of common stock offered in any Public Listing, the Warrant Exercise Price will be exercised to an amount equal to the price per share of common stock in the Public Listing.

The Fund evaluated the Warrants pursuant to ASC 480 to determine whether they represent an obligation requiring the Fund to classify the instruments as a liability. Management determined the Warrants do not meet the criteria to be classified as liabilities under ASC 480 and next evaluated them under ASC 815.

Notes to the Financial Statements (continued)

Management then determined the Warrants do not meet the definition of a derivative. It was thus determined to next evaluate them under the guidance in ASC 815-40-15-5 through 15-8 to determine whether they meet the criteria to be considered indexed to the Fund’s own stock. Management determined the Warrants do not meet the criteria to be considered indexed to the Fund’s own stock and are a liability classified pursuant to ASC 815-40-15-7D.

Related Party Transactions

On April 29, 2022, the Fund and the Adviser entered into an investment advisory agreement (the “Advisory Agreement”), whereby the Adviser received management fees in the amount of 2.00 percent per annum (the “Management Fee”) on the first business day of each month prior to a public listing of the Fund’s shares of common stock. The Management Fee is calculated based on the value of the invested capital. Under the Advisory Agreement, upon the listing of the Fund’s shares of common stock on a national securities exchange, the Adviser will receive a Management Fee, payable quarterly, in an amount equal to 2.50% of average gross assets, at the end of the two most recently completed calendar quarters. For purposes of the Advisory Agreement, the term “gross assets” includes assets purchased with borrowed amounts.

Prior to the execution of the Advisory Agreement, the Fund and the Adviser operated under a separate investment advisory agreement whereby the Adviser received management fees in the amount of 2.00 percent per annum on a monthly basis. Management fees under the prior investment advisory agreement were calculated based on (x) the aggregate amount of the SAFEs purchased by SAFE investors multiplied by (y) the management fee divided by (z) twelve.

Additionally, from time to time, the Fund will invest in SPVs that charge management fees in connection with the Fund’s investment. For the year ended

December 31, 2022

, the Fund paid $0 in management fees in connection with its investments in SPVs.

U.S. Bancorp Fund Services, LLC, d/b/a US Bank Global Fund Services (the “Administrator”), serves as administrator to the Fund. Under the Fund Administration Servicing Agreement and the Fund Accounting Servicing Agreement by and among the Fund and the Administrator, the Administrator maintains the Fund’s general ledger and is responsible for calculating the net asset value of the Shares, and generally managing the administrative affairs of the Fund. Under the Fund Administration Servicing Agreement, the Administrator is paid an administrative fee, computed and payable monthly at an annual rate based on the aggregate monthly total assets of the Fund.

U.S. Bancorp Fund Services, LLC, d/b/a US Bank Global Fund Services (“USBGFS”) serves as the Fund’s dividend paying agent, transfer agent and registrar. Under a transfer agency services agreement, USBFS is paid an administrative fee, computed and payable monthly at an annual rate based on the transactions processed.

U.S. Bank National Association (“USB N.A.”) serves as the custodian to the Fund. Under a custody agreement, USB N.A. is paid a custody fee monthly based on the average daily market value of any securities and cash held in the portfolio.

Notes to the Financial Statements (continued)

Employees of PINE Advisors LLC (“PINE”) serve as officers of the Fund. PINE receives a monthly fee for the services provided to the Fund. The Fund also reimburses PINE for certain out-of-pocket expenses incurred on the Fund’s behalf.

The Organizer has made payments of the Fund’s expenses and the Fund intends to reimburse the Organizer for these expenses. As of December 31, 2022, the reimbursable balance to the Organizer is $306,787 which consists of Offering costs payable, Organizational costs payable, and Operating Expenses Due to Organizer in the amounts of $216,510, $70,202 and $224,824, respectively as reported on the Statement of Assets and Liabilities.

As of December 31, 2022, Affiliates of the Fund owned 14.75% of shares of the Fund.

Commitments and Contingencies

In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

The Fund may be required to provide financial support in the form of investment commitments to certain investees as part of the conditions for entering into such investments. As of December 31, 2022, the Fund did not have any unfunded commitments and did not provide any financial support.

The Fund is not currently subject to any material legal proceedings, and to the Fund’s knowledge, no material legal proceedings are threatened against the Fund. From time to time, the Fund may be a party to certain legal proceedings in the ordinary course of business, including proceedings related to the enforcement of the Fund’s rights under contracts with its portfolio companies. While the outcome of any legal proceedings cannot be predicted with certainty, to the extent the Fund becomes party to such proceedings, the Fund would assess whether any such proceedings will have a material adverse effect upon its financial condition or results of operations.

The cost of purchases and the proceeds from sales of investment securities (excluding in-kind subscriptions and redemptions, US government securities, and short-term investments), for the year ended December 31, 2022, amounted to $39,778,833 and $13,310,000 respectively.

Any net operating losses arising in tax years beginning after December 31, 2017 will have an indefinite carry forward period. The TCJA also

established a limitation for any net operating losses generated in tax years beginning after December 31, 2017 to the lesser of the aggregate of

available net operating losses or 80% of taxable income before any net operating losses utilization.

As of December 31, 2022, the Fund had a federal net operating loss carryforward of

which may be carried forward indefinitely. As of December 31, 2021, the Fund had a federal and state net operating loss carryforward of

which may be carried forward indefinitely. The net operating loss carryforward is available to offset future taxable income

and subject to 80% of taxable income limitations.

.

Future realization of the tax benefits of existing temporary differences and net operating loss carryforwards ultimately depends on the existence of sufficient taxable income within the carryforward period. As of December 31, 2022, the Fund performed an evaluation to determine whether a valuation allowance was needed. The Fund considered all available evidence, both positive and negative, which included the results of operations for the current and preceding years. The Fund determined that it was not possible to reasonably quantify future taxable income and determined that it is more likely than not that all the deferred tax assets will not be realized. Accordingly, the Fund maintained a full valuation allowance as of December 31, 2022.

Under Internal Revenue Code Section 382, if a corporation undergoes an “ownership change,” the corporation’s ability to use its pre-change NOL carryforwards and other pre-change tax attributes to offset its post-change income may be limited. The Fund has not completed a study to assess whether an “ownership change” has occurred or whether there have been multiple ownership changes since the Fund became a “loss corporation” as defined in Section 382. Future changes in the Fund’s stock ownership, which may be outside of the Fund’s control, may trigger an “ownership change.” In addition, future equity offerings or acquisitions that have equity as a component of the purchase price could result in an “ownership change.” If an “ownership change” has occurred or does occur in the future, utilization of the NOL carryforwards or other tax attributes may be limited, which could potentially result in increased future tax liability to the Fund.

The calculation of the Fund’s tax liabilities involves dealing with uncertainties in the application of complex tax laws and regulations for both federal taxes and the many states in which we operate or do business in. ASC 740 states that a tax benefit from an uncertain tax position may be recognized when it is more likely than not that the position will be sustained upon examination, including resolutions of any related appeals or litigation processes, on the basis of the technical merits.

The Fund recognizes accrued interest and penalties related to unrecognized tax benefits as income tax expense. There were no unrecognized tax benefits and no amounts accrued for interest and penalties as of December 31, 2022. The Fund is currently not aware of any issues under review that could result in significant payments, accruals or material deviation from its position. The Fund is subject to income tax examinations by major taxing authorities since inception.

No current or deferred provision for federal or state income taxes has been recorded for the period ended December 31, 2022. A reconciliation of the Fund's statutory income tax rate to the Fund's effective income tax rate as of December 31, 2022 is as follows:

Income at U.S. statutory rate | | | | |

State taxes, net of federal benefit | | | | |

| | | | |

| | | | |

| | | | |

Income tax provision/(benefit) | | | | |

The net deferred income tax asset balance as of December 31, 2022 related to the following:

| | | | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

Total deferred tax assets | | | | |

| |

| | |

Net deferred tax assets (liability) | | | | |

At December 31, 2022 the tax cost basis of investments was $86,109,570 and gross unrealized depreciation was $29,345,531

.

The Company may elect to file an election to be treated for federal income tax purposes as a Regulated Investment company (“RIC”) effective for the 2023 tax year. If the Fund is unable to qualify as a RIC, the Fund will continue to be taxed as a C Corporation for the 2023 taxable year. In order to qualify as a RIC, among other things, the Fund is required to distribute to its stockholders on a timely basis at least 90% of investment company taxable income and must meet certain asset diversification requirements on a quarterly basis. As a RIC, the Fund generally will not pay corporate-level U.S. federal income taxes on any net ordinary income or capital gains that the Fund distributes to its stockholders as dividends and claims dividends paid deductions to compute taxable income. A RIC will not be eligible to utilize net operating losses. However, net operating losses may be available to offset any built in gain on the Fund’s conversion from a C Corporation to a RIC and would continue to be available if the Fund fails to qualify as a RIC for the 2023 tax year.

Recent Accounting Standards

From time to time, new accounting pronouncements are issued by the FASB or other standards setting bodies that are adopted by the Fund as of the specified effective date. The Fund believes that the impact of recently issued standards and any that are not yet effective will not

have a material impact on its financial statements upon adoption.

R

EPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Destiny Tech100 Inc. (the “Fund”) including the schedule of investments as of December 31, 2022, the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the related notes (collectively referred to as the “financial statements”) and the financial highlights for the year then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of December 31, 2022, the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for the year then ended in conformity with accounting principles generally accepted in the United States of America.

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of investments owned as of December 31, 2022, by correspondence with fund managers, custodians and portfolio companies or by other appropriate auditing procedures when replies were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2022.

D

irectors and Officers (Unaudited)

The business and affairs of the Fund are managed under the direction of the Board. The Board approves all significant agreements between the Fund and the persons or companies that furnish services to the Fund, including agreements with its investment adviser, administrator, custodian and transfer agent.

The name, age and principal occupations for the past five years of the Directors and officers of the Fund are listed below, along with the number of portfolios in the fund complex overseen by and the other directorships held by each Director. The business address for each Director and officer of the Fund is c/o Destiny Tech100 Inc., 1401 Lavaca Street, #144, Austin, Texas 78701. The Fund’s statement of additional information includes additional information about the Fund’s Directors and officers and is available without charge, upon request, by calling (415) 639-9966 or by visiting https://destiny.xyz/tech100.

| | | | | | | | | | |

| | | | | | | | | | |

| Sohail Prasad, 29 | | Director and Chief Executive Officer | | Director since November 2020; Term expires 2025 | | Founder, Chairman of the Board and Chief Executive Officer, Destiny XYZ (2020 present); Chief Executive Officer, Destiny Advisors LLC (2020 present); Chief Executive Officer, Forge (2014 2018); Founding Partner, S2 Capital (2012 – present) | | 1 | | None |

| | | | | | | | | | |

| Travis Mason, 38 | | Director | | Director since April 2022; Term expires 2023 | | Operating Partner, 776 Fund Management (2021 2022); Fellow, Massachusetts Institute of Technology (2020 – 2021); Vice President, Certification and Regulation, Airbus (2017 – 2020) | | 1 | | None |

| Eric Patterson, 39 | | Director | | Director since April 2022; Term expires 2024 | | Managing Member and Chief Investment Officer, Three Bell Capital LLC (2012 – present) | | 1 | | None |

| | | | | | | | | | |

A

pproval of Investment Advisory Agreement (unaudited)

At a meeting of the Board of Directors held on April 29, 2022, the Board, including a majority of the Directors who are not “interested persons” (as defined in the 1940 Act (the “Independent Directors”)), considered and approved the Investment Advisory Agreement (the “Advisory Agreement”) between Destiny Advisors LLC (the “Adviser”) and the Fund.

In making its determination, the Board relied upon the advice of legal counsel and its own business judgment in determining the material factors to be considered in evaluating the Advisory Agreement and the weight to be given to each factor considered. The Board’s conclusions were based on a comprehensive evaluation of all of the information provided and were not the result of any one factor. Moreover, each Director might have afforded different weight to the various factors in reaching conclusions with respect to the approval of the Advisory Agreement. Mr. Prasad and Mr. Silver provided an overview of the terms of the Advisory Agreement, including the fees to be paid by the Fund to the Adviser. Mr. Prasad noted that the base management fee is currently set at 2.00% annually of invested capital, payable on a monthly basis. When the Fund’s shares are listed on a national securities exchange, the management fee will be increased to 2.50% of the Fund’s average gross assets, at the end of the two most recently completed calendar quarters. While the management fee is higher than many other registered funds that have different investment strategies, management believes that the higher fee is reflective of the Fund’s strategy of investing in private equity securities that are difficult for retail investors to access. In addition, the proposed management fee is lower than the fee that investors would pay if they invested in a traditional private equity fund. In addition, since the Fund is registered under the 1940 Act, it is not able to take an incentive fee based on capital gains, which is a common feature of private equity funds.

Nature, Extent, and Quality of Services.

The Board considered that the Adviser was recently established and currently does not provide portfolio management services to any other private funds or registered investment companies. The Board reviewed the qualifications of the key personnel servicing the Fund, and considered the specialized knowledge required to implement the Fund’s strategy. The Board expressed satisfaction with the advisory personnel’s depth of experience and industry connections. The Board reviewed the Adviser’s compliance practices, noting that the Fund and the Adviser each utilize the services of a third-party chief compliance officer. The Board also considered an oral presentation of the financial condition of Destiny XYZ, the parent company of the Adviser. After discussion, the Board concluded that the Adviser had sufficient quality and depth of personnel, resources, and compliance policies and procedures essential to perform its duties under the Advisory Agreement and that the nature, overall quality and extent of the management services that it would provide to the Fund would be satisfactory.

Performance.

The Board considered that the Fund had a limited performance history and had not yet deployed all of the proceeds from its private offering. While the Fund did not present performance information, the Board received a presentation from management about the nature of the Fund’s investments and was satisfied that the investments made by the Fund were consistent with the Fund’s investment strategy. The Board concluded that the Adviser had potential to provide reasonable returns for the Fund.

Fees and Expenses.

The Board discussed the Adviser’s proposed management fee of 2.50% and the estimated expense structure for the Fund. The Board acknowledged that the proposed management fee was higher than many other registered closed-end funds, but also noted that the management fees were consistent with peers attempting to enter the market and were below the fees paid in a traditional private equity fund. Finally, the Board noted that, since the Fund is registered under the 1940 Act, it is not able to take incentive fees based on capital gains generated from the sale of investments. After further discussion, the Board concluded that the fees to be paid to the Adviser were not unreasonable.

Economies of Scale.

The Board considered that the Fund would benefit from economies of scale as it continued to grow, but that many of the Fund’s operating expenses, such as administration fees, transfer agency expenses, and audit fees, would increase as the Fund’s assets under management increased. The Board agreed to revisit the topic at a later date.