UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

DESTINY TECH100 INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Destiny Tech100 Inc.

1401 Lavaca Street, #144

Austin, TX 78701

August 19, 2024

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders of Destiny Tech100 Inc. (the “Company,” “we” or “us”) to be held on September 30, 2024 at 2:00 P.M., Eastern Time (the “Annual Meeting”). The Annual Meeting will be held virtually and conducted via live webcast. Participants must register at http://viewproxy.com/DXYZ/2024 to attend the event.

Your vote is important, regardless of the number of shares you own. Your immediate response will help avoid potential delays and may save the Company significant additional expenses associated with soliciting shareholder votes.

The attached Notice of Annual Meeting and Proxy Statement accompanying this letter provide an outline of the business to be conducted at the meeting. The Annual Meeting is being held for the following purposes:

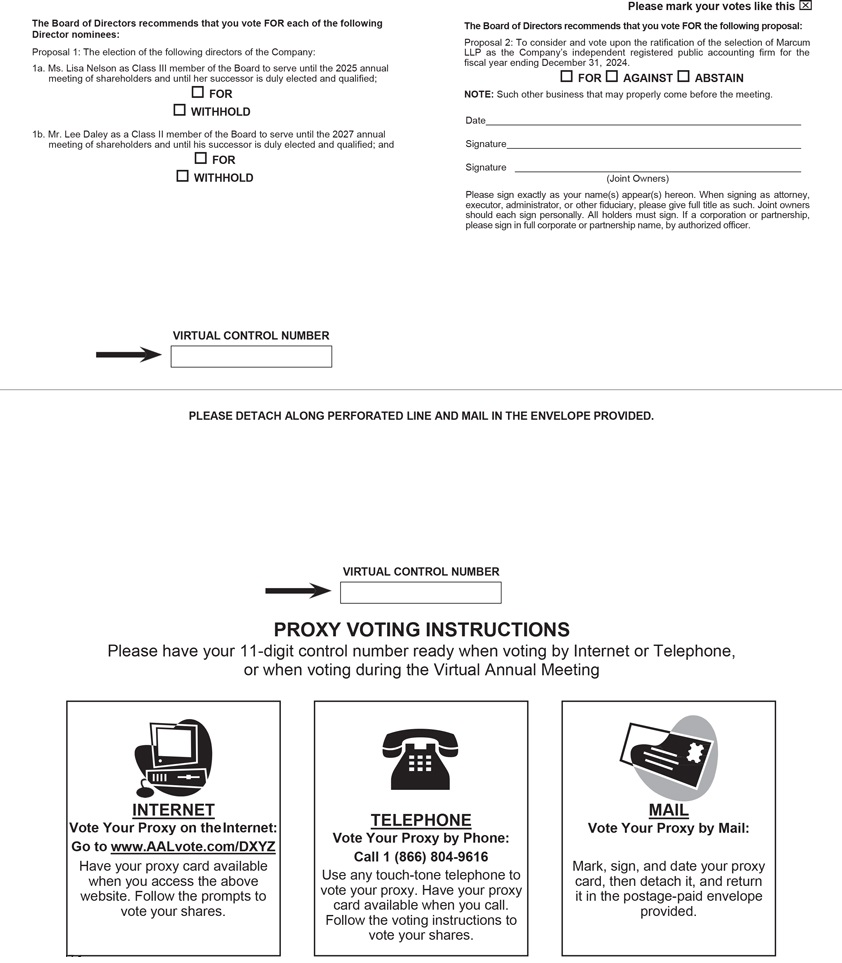

| (i) | The election of the following directors of the Company: |

| (a) | Ms. Lisa Nelson as Class III member of the board of directors of the Company (the “Board”) to serve until the 2025 annual meeting of shareholders and until her successor is duly elected and qualified; |

| (b) | Mr. Lee Daley as a Class II member of the Board to serve until the 2027 annual meeting of shareholders and until his successor is duly elected and qualified; and |

| | (ii) | To consider and vote upon the ratification of the selection of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; and |

| | | |

| | (ii) | To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. |

The Board unanimously recommends that you vote FOR each of the proposals to be considered and voted on at the Annual Meeting.

It is important that your shares of the Company’s common stock, par value $0.00001 per share, be represented at the Annual Meeting. If you are unable to attend the Annual Meeting virtually, I urge you to request, complete, date, sign and mail the enclosed proxy card or authorize your proxy through the Internet as soon as possible even if you currently plan to attend the Annual Meeting. This will not prevent you from voting at the meeting but will assure that your vote is counted if you are unable to attend the meeting.

This Proxy Statement, the Notice of Annual Meeting of Shareholders and the accompanying proxy card are first being released to shareholders on or about August 19, 2024. In addition, a Notice of Internet Availability of Proxy Materials is being sent to shareholders on or about August 19, 2024.

Your vote and participation in the governance of the Company are very important.

Sincerely yours,

Sohail Prasad

Chief Executive Officer, President and Director

Destiny Tech100 Inc.

1401 Lavaca Street, #144

Austin, TX 78701

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On September 30, 2024

To the Shareholders of Destiny Tech100 Inc.:

NOTICE IS HEREBY GIVEN THAT the annual meeting of shareholders of Destiny Tech100 Inc., a Maryland corporation (the “Company”), will be held on September 30, 2024 at 2:00 P.M., Eastern Time (the “Annual Meeting”). The Annual Meeting will be held virtually and conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting http://viewproxy.com/DXYZ/2024 and registering to attend. For instructions on how to attend and vote your shares at the Annual Meeting, see the information in the accompanying proxy statement under the heading “How may I attend the meeting and vote?” and the Notice of Internet Availability of Proxy Materials.

The Annual Meeting is being held for the following purposes:

| (i) | The election of the following directors of the Company: |

| (a) | Ms. Lisa Nelson as Class III member of the board of directors of the Company (the “Board”) to serve until the 2025 annual meeting of shareholders and until her successor is duly elected and qualified; |

| (b) | Mr. Lee Daley as a Class II member of the Board to serve until the 2027 annual meeting of shareholders and until his successor is duly elected and qualified; and |

| | (ii) | To consider and vote upon the ratification of the selection of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; and |

| | | |

| | (ii) | To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. |

The Board has fixed the close of business on August 9, 2024 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting and adjournments or postponements thereof.

Important notice regarding the availability of proxy materials for the Annual Meeting.

The Company’s proxy statement, the proxy card, and the Company’s N-CSR filing for the fiscal year ended December 31, 2023 (the “Annual Report”) are available at http://viewproxy.com/DXYZ/2024.

By Order of the Board of Directors,

Ethan Silver

Secretary

August 19, 2024

Shareholders are requested to follow the instructions on the Notice of Internet Availability of Proxy Materials to vote your proxy via the Internet or request, complete, sign, date and return a proxy card. Executing the proxy card is important to ensure a quorum at the Annual Meeting. Proxies may be revoked at any time before they are exercised by submitting a written notice of revocation or a subsequently executed proxy, or by virtually attending the Annual Meeting and voting.

Destiny Tech100 Inc.

1401 Lavaca Street, #144

Austin, TX 78701

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON SEPTEMBER 30, 2024

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

Q: What is the date of the Annual Meeting and where will it be held?

A: The Annual Meeting (the “Annual Meeting”) of shareholders of Destiny Tech100 Inc., which is sometimes referred to in this proxy statement as “we”, “us”, “our”, or the “Company,” will be held on September 30, 2024 at 2:00 P.M. Eastern Time. The Annual Meeting will be held virtually and conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting http://viewproxy.com/DXYZ/2024 and registering to attend.

This Proxy Statement, the Notice of Annual Meeting of Shareholders and the accompanying proxy card are first being released to shareholders on or about August 19, 2024. In addition, a Notice of Internet Availability of Proxy Materials is being sent to shareholders on or about August 19, 2024.

Q: What will I be voting on at the Annual Meeting?

A: At the Annual Meeting, shareholders will be asked the following:

| (i) | To consider and vote upon the election of the following directors of the Company: |

| (a) | Ms. Lisa Nelson as Class III member of the board of directors of the Company (the “Board”) to serve until the 2025 annual meeting of shareholders and until her successor is duly elected and qualified; |

| (b) | Mr. Lee Daley as a Class II member of the Board to serve until the 2027 annual meeting of shareholders and until his successor is duly elected and qualified; and |

| | (ii) | To consider and vote upon the ratification of the selection of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; and |

| | | |

| | (ii) | To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. |

Q: Who can vote at the Annual Meeting?

A: Only shareholders of record as of the close of business on August 9, 2024 (the “Record Date”) are entitled to notice of, and to vote at, the Annual Meeting and any postponements or adjournments thereof.

Q: How many votes do I have?

A: Shareholders are entitled to one vote for each share of the Company’s common stock, par value $0.00001, per share held as of the Record Date.

Q: How can I attend the Annual Meeting?

A: By voting virtually at the Annual Meeting. The Company will be hosting the Annual Meeting live via audio webcast. Any Shareholder can attend the Annual Meeting live online by visiting http://viewproxy.com/DXYZ/2024 and registering to attend. If you were a Shareholder as of the Record Date, or you hold a valid proxy for the Annual Meeting, you can vote at the Annual Meeting. A summary of the information you need to attend the Annual Meeting online is provided below:

| | · | Instructions on how to attend and participate via the Internet are set forth on the Notice of Internet Availability of Proxy Materials and posted at http://viewproxy.com/DXYZ/2024. |

| | · | Webcast starts at 2:00 P.M., Eastern Time. |

| | · | To attend and participate in the Annual Meeting, you will need to register in advance by 11:59 P.M. Eastern Time on September 27, 2024. |

| | · | Shareholders may submit questions while attending the Annual Meeting via the Internet. |

The Company will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call (415) 639-9966.

By Proxy through the Mail. When voting by proxy and mailing your proxy card, you are required to:

| | · | first follow the instructions set forth on the Notice of Internet Availability of Proxy Materials and request a hard copy of the proxy card; |

| | | |

| | · | indicate your instructions on the proxy card; |

| | · | date and sign the proxy card; |

| | · | mail the proxy card promptly in the envelope provided, which requires no postage if mailed in the United States; and |

| | · | allow sufficient time for the proxy card to be received on or before 11:59 p.m., Eastern Time, on September 29, 2024. |

By Proxy through the Internet. You may vote your shares over the Internet by following the instructions set forth on the accompanying proxy card and the Notice of Internet Availability of Proxy Materials.

Q: Does the Board recommend voting for each of the Proposals?

A: Yes. The Board unanimously recommends that you vote “FOR” each proposal below.

Q: Why does the Board recommend voting FOR the Proposal 1, the election of Lisa Nelson and Lee Daley?

A: Ms. Nelson is currently a member of the Board and has served in that capacity since 2023. Ms. Nelson has over 25 years of experience as a technology, financial and operational leader helping organizations across a variety of industries and stages execute their strategic priorities, including business, cultural and digital transformations. Ms. Nelson is an experienced board director for both private and public companies and has previously served as chair of the compensation committee and audit committees of various companies. The Board believes Ms. Nelson’s experience and expertise makes her well qualified to serve on the Board.

Mr. Daley is currently a member of the Board and has served in that capacity since 2024. Mr. Daley has 25 years of experience in international advertising and since 2011 has served as an advisor and/or board member for various start-up companies. The Board believes Mr. Daley’s industry experience and knowledge makes him well qualified to serve on the Board.

Q: Why does the Board recommend voting FOR Proposal 2, to ratify the appointment of Marcum LLP as the Company’s independent registered public accounting firm?

A: Marcum LLP has acted as the Company’s independent registered public accounting firm since inception through the end of its 2023 fiscal year, and has been appointed by the Board to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024. The Board has submitted the selection of Marcum LLP to shareholders for ratification as a matter of good corporate governance. Although action by the shareholders on this matter is not required, the Audit Committee and the Board believe it is appropriate to seek shareholder ratification of this selection in light of the role played by the independent registered public accounting firm in reporting on the Company’s financial statements.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

The accompanying proxy is solicited on behalf of the Board for use at the Annual Meeting to be held on September 30, 2024 at 2:00 P.M., Eastern Time. The Annual Meeting will be a held virtually and conducted via live webcast. Only holders of record of our common stock at the close of business on August 9, 2024, which is the Record Date, will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, we had 10,879,905 shares of common stock, par value $0.00001 per share (the “Shares”) outstanding and entitled to vote. This proxy statement, including the accompanying form of proxy (collectively, the “Proxy Statement”), containing instructions on how to access the Proxy Statement and annual N-CSR report for the fiscal year ended December 31, 2023 (the “Annual Report”), and how to submit proxies via the Internet or mail are first being sent to shareholders on or about August 19, 2024. The Proxy Statement and Annual Report can both be accessed online at http://viewproxy.com/DXYZ/2024. In addition, a Notice of Internet Availability of Proxy Materials is being sent to shareholders on or about August 19, 2024.

All proxies will be voted in accordance with the instructions contained therein. Unless contrary instructions are specified, if a proxy is properly executed and received by the Company (and not revoked) prior to the Annual Meeting, the Shares represented by the proxy will be voted FOR the election of Ms. Nelson to serve until the 2025 annual meeting of shareholders and Mr. Daley to serve until the 2027 annual meeting of shareholders and, each until his or her successor is duly elected and qualified. Should any matter not described above be properly presented at the Annual Meeting, the named proxies will vote in accordance with their best judgment as permitted.

Voting Rights

Holders of our common stock are entitled to one vote for each share held as of the Record Date.

The Annual Meeting is being held for the following purposes:

| (i) | The election of the following directors of the Company: |

| (a) | Ms. Lisa Nelson as Class III member of the Board to serve until the 2025 annual meeting of shareholders and until her successor is duly elected and qualified; |

| (b) | Mr. Lee Daley as a Class II member of the Board to serve until the 2027 annual meeting of shareholders and until his successor is duly elected and qualified; and |

| | (ii) | To consider and vote upon the ratification of the selection of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; and |

| | | |

| | (ii) | To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. |

Quorum Required

A majority of the outstanding Shares must be present or represented by proxy at the Annual Meeting in order to have a quorum. If you have properly voted by proxy via mail, you will be considered part of the quorum. We will count “abstain” and “withhold” votes as present for the purpose of establishing a quorum for the transaction of business at the Annual Meeting. If at any time Shares are held through brokers, we will count broker non-votes as present for the purpose of establishing a quorum. However, abstentions, “withhold” votes and broker non-votes are not counted as votes cast. A broker non-vote occurs when a broker holding Shares for a beneficial owner votes on some matters on the proxy card, but not on others, because the broker does not have instructions from the beneficial owner or discretionary authority (or declines to exercise discretionary authority) with respect to those other matters.

If a quorum is not present at the Annual Meeting, the person named as chair of the Annual Meeting may adjourn the meeting to permit further solicitation of proxies. The persons named as proxies will vote those proxies for such adjournment, unless marked to be voted against any proposal for which an adjournment is sought, to permit further solicitation of proxies. A stockholder vote may be taken on one or more of the proposals in this proxy statement prior to any such adjournment if there are sufficient votes for approval on such proposal(s).

Vote Required

| Proposal | | Vote Required | | Broker

Discretionary

Voting

Allowed | | Effect of

“Withhold”

Votes,

Abstentions

and Broker

Non-Votes |

Proposal 1—To elect directors of the Company as follows: (a) Ms. Lisa Nelson as Class III member of the Board to serve until the 2025 annual meeting of shareholders until her successor is duly elected and qualified; (b) Mr. Lee Daley as a Class II member of the Board to serve until the 2027 annual meeting of shareholders and until his successor is duly elected and qualified. | | Affirmative vote of a plurality of the votes cast on the matter. | | Yes | | “Withhold” votes and broker non-votes will have no effect on the result of the vote. |

| Proposal 2—To consider and vote upon the ratification of the selection of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024. | | Affirmative vote of a majority of the votes cast on the matter. | | Yes | | Abstentions and broker non-votes will have no effect on the result of the vote. |

You may vote “for”, “withhold” or “against,” or abstain from voting on each Proposal, as applicable. The inspector of elections appointed for the Annual Meeting will separately tabulate “for” votes, “withhold” votes, “against” votes, “abstain” votes, and broker non-votes.

Voting

You may vote by proxy or in person (virtually) at the Annual Meeting in accordance with the instructions provided in the Notice of Internet Availability of Proxy Materials and as set forth below.

Voting by Proxy

When voting by proxy and mailing your proxy card, you are required to:

| | · | first follow the instructions set forth on the Notice of Internet Availability of Proxy Materials and request a hard copy of the proxy card; |

| | | |

| | · | indicate your instructions on the proxy card; |

| | · | date and sign the proxy card; |

| | · | mail the proxy card promptly in the envelope provided, which requires no postage if mailed in the United States; and |

| | · | allow sufficient time for the proxy card to be received on or before 11:59 p.m. Eastern Time, on September 29, 2024. |

You may also vote your shares over the Internet by following the instructions set forth on the accompanying proxy card and the Notice of Internet Availability of Proxy Materials.

Voting at the Annual Meeting

The Company will be hosting the Annual Meeting live via audio webcast. Any shareholder can attend the Annual Meeting live online by visiting http://viewproxy.com/DXYZ/2024 and registering to attend. If you were a shareholder as of the Record Date, or you hold a valid proxy for the Annual Meeting, you can vote at the Annual Meeting. A summary of the information you need to attend the Annual Meeting online is provided below:

| | · | Instructions on how to attend and participate via the Internet are set forth on the Notice of Internet Availability of Proxy Materials and posted at http://viewproxy.com/DXYZ/2024. |

| | · | Webcast starts at 2:00 P.M., Eastern Time. |

| | · | To attend and participate in the Annual Meeting, you will need to register in advance. |

| | · | Shareholders may submit questions while attending the Annual Meeting via the Internet. |

The Company will have technicians ready to assist with any technical difficulties shareholders may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call (415) 639-9966.

Quorum and Adjournment

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, virtually or by proxy, of the holders of a majority of the shares outstanding on the Record Date will constitute a quorum.

If a quorum is not present at the Annual Meeting, the chairperson of the Annual Meeting may adjourn the Annual Meeting until a quorum is present.

Proxies for the Annual Meeting

The named proxies for the Annual Meeting are Sohail Prasad and Ethan Silver (or their duly authorized designees), who will follow submitted proxy voting instructions. They will vote as the Board recommends herein as to any submitted proxies that do not direct how to vote on any item, and will vote on any other matters properly presented at the Annual Meeting in their judgment.

Expenses of Soliciting Proxies

The Company will pay the expenses of soliciting proxies to be voted at the Annual Meeting, including the cost of preparing and posting this Proxy Statement and the Annual Report to the internet, and the cost of mailing the Notice of Internet Availability of Proxy Materials and any requested proxy materials to the shareholders. The Company has engaged the services of Alliance Advisors LLC (“Alliance”) for the purpose of assisting in the solicitation of proxies at an anticipated cost of approximately $25,895 plus reimbursement of certain out-of-pocket expenses and fees for additional services requested. Please note that Alliance may solicit stockholder proxies by telephone on behalf of the Company. They will not attempt to influence how you vote your shares, but only ask that you take the time to authorize your proxy. You may also be asked if you would like to authorize your proxy over the telephone and to have your voting instructions transmitted to the Company’s proxy tabulation firm.

Revocability of Proxies

You may revoke any proxy that is not irrevocable by attending the Annual Meeting and voting in person (virtually) or by delivering a proxy in accordance with applicable law bearing a later date to the Secretary of the Company.

Contact Information for Proxy Solicitation

You can contact us by mail sent to the attention of the Secretary of the Company, Ethan Silver, at our principal executive offices located at 1401 Lavaca Street, #144, Austin, TX 78701. You can call us by dialling (415) 639-9966.

Record Date

The Board has fixed the close of business on August 9, 2024 as the Record Date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting and adjournments or postponements thereof. As of the Record Date, there were 10,879,905 shares outstanding.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

Beneficial ownership is determined in accordance with the rules and regulations of the Securities and Exchange Commission (the “SEC”). These rules generally provide that a person is the beneficial owner of securities if such person has or shares the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof or has the right to acquire such powers within 60 days. The following table sets forth, as of the Record Date, the beneficial ownership according to information furnished to us by such persons or publicly available filings. Ownership information for those persons who beneficially own 5% or more of the outstanding shares of our common stock is based upon filings by such persons with the SEC and other information obtained from such persons of each current director, the nominees for director, the Company’s officers, the officers and directors as a group, and each person known to us to beneficially own 5% or more of the outstanding shares of our common stock.

The percentage ownership is based on 10,879,905 shares of our common stock outstanding as of the Record Date. To our knowledge, except as indicated in the footnotes to the table, each of the shareholders listed below has sole voting and/or investment power with respect to shares of our common stock beneficially owned by such shareholder.

| Name and Address3 | | Type of

Ownership | | | Shares Owned | | | Percentage1 | |

| 5% Owners | | | | | | | | | | | | |

| Destiny XYZ Inc. | | | | | | | 1,082,065 | | | | 9.95 | % |

| Interested Directors | | | | | | | | | | | | |

| Sohail Prasad | | | | | | | 1,119,565 | 2 | | | 10.29 | % |

| Independent Directors | | | | | | | | | | | | |

| Travis Mason | | | | | | | 0 | | | | - | |

| Lee Daley | | | | | | | | | | | - | |

| Lisa Nelson | | | | | | | 0 | | | | - | |

| Officers | | | | | | | | | | | | |

| Ethan Silver | | | | | | | 0 | | | | - | |

| Peter Sattelmair | | | | | | | 0 | | | | - | |

| Cory Gossard | | | | | | | 0 | | | | - | |

| All officers and directors as a group (7) persons | | | | | | | 1,119,565 | | | | 10.29 | % |

* Less than 1%

1 Percentage based on 10,879,905 shares issued and outstanding as of August 9, 2024.

2 Includes 37,500 shares held directly by Mr. Prasad and 1,082,065 shares held by Destiny XYZ Inc., an entity controlled by Mr. Prasad.

3 The addresses for each of the directors and officers is c/o Destiny Tech100 Inc., 1401 Lavaca Street, #144, Austin, TX 78701.

PROPOSAL 1: ELECTION OF DIRECTORS

At the Annual Meeting, shareholders are being asked to consider the election of two directors of the Company. Under the Company’s Articles of Incorporation, (the “Charter”), the number of directors on the Board may not be fewer than the minimum number required by the Maryland General Corporation Law. The directors are divided into three classes. Each class of directors holds office for a three-year term. The Board currently consists of four directors who serve in the following classes: Class I (term ending at the 2026 Annual Meeting) — Travis Mason; Class II (term ending at the Annual Meeting) — Lee Daley; and Class III (terms ending at the 2025 annual meeting of shareholders) — Sohail Prasad and Lisa Nelson. See “Corporate Governance — The Board” for more information regarding the composition of the Board.

Section 16 of the 1940 Act provides that vacancies on the Board may be filled only by a meeting of shareholders duly called for that purpose, except that vacancies occurring between such meetings may be filled in an otherwise legal manner so long as immediately after filling such vacancy, at least two thirds of the directors have been elected by shareholders of the Company. At this time, Mr. Prasad and Mr. Mason have been elected by shareholders. Accordingly, shareholders are being asked to approve the election of Ms. Nelson and Mr. Daley in order to comply with the requirements of Section 16 of the 1940 Act and to provide the Board with the maximum flexibility to fill vacancies in the future, if necessary, without incurring the expense of calling a special meeting of shareholders.

Lisa Nelson has been nominated for election by the Board to serve the remainder of her three-year term ending at the 2025 annual meeting of shareholders and Lee Daley has been nominated for election by the Board to serve a three year term ending at the 2027 annual meeting of shareholders, each until his/her successor is duly elected and qualified. The nominees have agreed to serve as in such capacities and have consented to being named as nominees.

A shareholder can vote for or withhold from voting for any or all of the director nominees. In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxy FOR the election of each of the director nominees named below. The Board has no reason to believe that the individuals named as director nominees will be unable or unwilling to serve.

Required Vote

The director nominees shall be elected by a plurality of the votes cast at the Annual Meeting in person (virtually) or by proxy, provided that a quorum is present. Abstentions and broker non-votes will not be included in determining the number of votes cast and, as a result, will not have any effect on the result of the vote with respect to this proposal on the election of directors.

Information about the Nominee and Directors

Set forth below is information, as of August 9, 2024, regarding Ms. Nelson, who is being nominated as a Class III Director, and Mr. Daley, who is being nominated for election as a Class II Director, as well as information about the Company’s other current directors whose terms of office will continue after the Annual Meeting. Neither Mr. Daley nor Ms. Nelson is being proposed for election pursuant to any agreement or understanding between him or her on the one hand, and the Company or any other person or entity, on the other hand.

The information below includes specific information about each director’s experience, qualifications, attributes or skills that led the Board to the conclusion that the individual is qualified to serve on the Board, in light of the Company’s business and structure.

There were no legal proceedings of the type described in Items 401(f) of Regulation S-K in the past 10 years against any of our directors, the director nominees or officers, and none are currently pending.

Nominee for Class II Director – To Be Elected at the Annual Meeting

Name and Age | | Position(s) held with the Company | | Principal Occupations(s) During the Past 5 Years | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Director | | Other Directorships Held by Director or Nominee for Director |

| Independent Directors |

| Lee Daley, 61 | | Director | | Co-Founder, Chairman and Chief Strategist, G3NiU7 Inc (learning technology company) (2018 – Present) | | Director since March 2024; term expires at the Annual Meeting | | 1 | | None |

Lee Daley. Lee Daley began his career with 25 years in international advertising. He served as the Global CEO of Red Cell Network for WPP, Executive Chairman of HHCL in London, Group Chairman and CEO of Saatchi & Saatchi UK, and Chief Strategy Officer of McCann World Group in Europe, the Middle East, and Africa and globally. Since 2011, Mr. Daley has worked as an advisor and board director with the founding teams of several successful Silicon Valley startups including Boxed.com, Equidate (now Forge Global), Twin Science, Revolution Solar, and Ronoc Asia, as well as mature tech businesses such as GlobalLogic and McLaren Applied and Advanced Technologies. With over 30 years of board experience, Mr. Daley continues to advise founders, boards, and clients around the world on business, marketing, and strategy issues. In 2018, Mr. Daley co-founded Hello Genius with former Microsoft, MIT, and McKinsey alumni and with the guidance of the late Sir Ken Robinson. Under Mr. Daley’s strategic leadership and chairmanship, Hello Genius has invested $5M in building a platform technology that harnesses AI and advanced machine learning algorithms to personalize users’ content experiences and develop sophisticated data and analytics. Mr. Daley studied Politics and Philosophy, graduating from the Victoria University of Manchester, before his postgraduate studies in Marketing at Kingston Business School in the UK. He has also undertaken executive studies at Harvard, Kellogg, MIT Sloan, Columbia, and the Yale School of Management. Mr. Daley is a fellow of the Royal Society of Arts, an active member of GBx (the society of Brits in Silicon Valley), a longstanding TED alumnus, and a strategic advisor to XPRIZE. Mr. Daley’s technology industry knowledge and broad experience serving on boards and as a strategic advisor qualifies him to serve on our Board and his independence from the Company, the Adviser and the Sponsor enhances his service as a member of our Audit, Compensation and Nominating and Corporate Governance Committees.

Nominee for Class III Director – To Be Elected at the Annual Meeting

Name and Age | | Position(s) held with the Company | | Principal Occupations(s) During the Past 5 Years | | Term of Office and Length of Time Served | | Number of

Portfolios in Fund Complex Overseen by Director | | Other Directorships Held by Director or Nominee for Director |

| Independent Directors | | |

| Lisa Nelson, 48 | | Director | | Director, Astra Space (2021-2024); Director, Limeade, Inc. (2022-2023); Director, Seattle Bank, Inc. (2021-present); Director, Spark, Inc. (2024-present); Director Envel, Inc. (2021-2023); Managing Director, Microsoft (2005-2019); Advisor, Brooks Running (2021-present); Advisor, Flying Fish (2020-present); Advisor, Movac (2020-present) | | Director since August 2023; Term expires 2025 | | 1 | | Director, Spark, Inc.; Director, Seattle Bank, Inc. |

Lisa Nelson. Ms. Nelson has over 25 years of experience as a technology, financial and operational leader helping organizations across a variety of industries and stages execute their strategic priorities, including business, cultural and digital transformations. Ms. Nelson currently serves as a full-time board director and advisor. Through her diverse experience with start-ups and Fortune 500 companies (including Microsoft where she served as a senior finance and business development executive for nearly 15 years), Ms. Nelson has developed expertise in business growth strategies, scaling businesses effectively, managing risks in complex environments and leading through change. Ms. Nelson currently serves on the audit committees of Seattle Bank and Spark, Inc. New Zealand and previously worked closely with Microsoft’s audit committee in her executive finance roles at the company. Ms. Nelson has also served as Chair of the Compensation Committee and as a member of the nominating and governance committee. Ms. Nelson also serves as a strategic advisor to Brooks Running (Berkshire Hathaway portfolio company with >$1B in sales) and several venture funds and start-ups around the world. We believe that Ms. Nelson’s extensive experience provides the Board with a valuable insight into the matters of business growth strategy, risk management and finance.

Ms. Nelson earned a Bachelors in Business Administration and a Certificate of Accounting from the University of Washington and is a Certified Public Accountant. Ms. Nelson’s knowledge of financial and accounting matters and broad experience working with public companies and in the investment management industry qualifies her to serve on our Board and her independence from the Company, the Adviser and the Sponsor enhances her service as a member of our Audit, Compensation and Nominating and Corporate Governance Committees.

Incumbent Class III Director – Term Expiring at the 2025 annual meeting

Name and Age | | Position(s) held with the Company | | Principal Occupations(s) During the Past 5 Years | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Director | | Other Directorships Held by Director or Nominee for Director |

| Sohail Prasad, 30 | | Director and Chief Executive Officer | | Founder, Chairman of the Board and Chief Executive Officer, Destiny XYZ (2020 – present); Chief Executive Officer, Destiny Advisors LLC (2020 – present); Chief Executive Officer, Forge (2014 – 2018); Founding Partner, S2 Capital (2012 – present) | | Director since November 2020; Term expires 2025 | | 1 | | None |

Sohail Prasad. Mr. Prasad is our Chairman of the Board and Chief Executive Officer and is Founder, Chairman, & Chief Executive Officer of DestinyXYZ Inc. Prior to founding Destiny, Mr. Prasad founded and served as CEO of Forge (NYSE:FRGE), a global private securities market place building trading, custody, and data infrastructure to meet the needs of high-growth unicorn companies, employees, and investors. In March 2022, Forge became the first dedicated trading platform for private shares to become a public company. As an eighteen-year-old, Mr. Prasad was among the youngest founders to go through Y Combinator, a start-up accelerator, and was later named a Thiel Fellow by the Thiel Foundation. Over the years, Mr. Prasad has advised and invested in over 200 start-ups, including as seed investor in notable start-ups such as Rippling, Rappi, Notion, Retool, Vise, Mercury, and Superhuman. He continues to invest in early stage technology companies through S2 Capital and serves as its Founding Partner. Prior to founding Forge, Mr. Prasad held roles in product management at Zynga, as an early engineer at mobile advertising firm Chartboost, and various other roles at Google and the MIT Media Lab. Mr. Prasad attended Carnegie Mellon University where he studied Electrical & Computer Engineering before dropping out. We believe Mr. Prasad is well qualified to serve as a director and Chairman of the Board due to his deep expertise with investments.

Incumbent Class I Director – Term Expiring at the 2026 annual meeting

Name and Age | | Position(s) held with the Company | | Principal Occupations(s) During the Past 5 Years | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Director | | Other Directorships Held by Director or Nominee for Director |

| Travis Mason, 40 | | Director | | Chief Policy and Regulatory Officer, Merlin Labs (2022-present); Operating Partner, 776 Fund Management (2021 – 2022); Fellow, Massachusetts Institute of Technology (2020 – 2021); Vice President, Certification and Regulation, Airbus (2017 – 2020) | | Director since April 2022; Term expires 2026 | | 1 | | None |

Travis Mason. Mr. Mason is the Chief Policy and Regulatory Officer at Merlin Labs and currently serves on the board of directors of the Maxwell School of Citizenship and Public Policy at Syracuse University, KinectAir and the BluPrint Collective. Mr. Mason previously served as Operating Partner of 776 Fund Management, a venture capital firm, from January 2021 to June 2022. Mr. Mason has 12 years of experience helping entrepreneurs navigate regulatory and public policy barriers to bring future technologies to market throughout North America, Europe, South America and Asia. Before Seven Six, Mr. Mason served as a Fellow at Massachusetts Institute of Technology, from 2020 to 2021. Prior to that, from 2017 to 2020, Mr. Mason served as Vice President, Certification and Regulation, at Airbus, leading global policy for the company’s emerging technology investments in autonomous air taxis, unmanned aircraft and urban air mobility. Prior to Airbus, Mr. Mason worked at Alphabet’s Google X and Google on the engineering and public policy teams to help bring technologies like drone delivery and autonomous vehicles to market. Mr. Mason received his Bachelor’s Degree at Syracuse University, where he was recognized as a Harry S. Truman Scholar, one of the country’s most prestigious undergraduate awards. He earned his Master’s Degree at the University of Michigan and also studied at Princeton University’s School of Public Policy and Harvard University’s Kennedy School of Government as a Galbraith Scholar.

Mr. Mason’s knowledge of financial matters and experience working with rapidly developing technology qualifies him to serve on our Board and his independence from the Company, the Adviser and the Sponsor enhances his service as a member of our Audit, Compensation and Nominating and Corporate Governance Committees.

Dollar Range of Equity Securities Beneficially Owned by Directors

The table below shows the dollar range of equity securities of the Company and the aggregate dollar range of equity securities of the Company that were beneficially owned by each director as of the Record Date stated as one of the following dollar ranges: None; $1-$10,000; $10,001- $50,000; $50,001-$100,000; or Over $100,000.

| Name of Director | | Dollar Range of Equity Securities in Destiny

Tech100 Inc.1,2 |

| Sohail Prasad | | Over $100,000 |

| Travis Mason | | None |

| Lee Daley | | None |

| Lisa Nelson | | None |

1 Beneficial ownership determined in accordance with Rule 16a-1(a)(2) promulgated under the Exchange Act.

2 The dollar range of equity securities of the Company beneficially owned by directors of the Company, if applicable, is calculated by multiplying our closing trading price per share as of August 16, 2024 of $11.38 times the number of shares beneficially owned.

Information about Officers Who Are Not Directors

The following sets forth certain information regarding the officers of the Company who are not directors of the Company.

| Name and Age | | Position(s) held with the Company | | Principal Occupations(s) During the Past 5 Years | | Officer Since |

| Peter Sattelmair, 46 | | Chief Financial Officer | | Director, PINE Advisor Solutions (2021– present); Director of Fund Operations and Assistant Treasurer, Transamerica Asset Management (2015 – 2021) | | April 2022 |

| Name and Age | | Position(s) held with the Company | | Principal Occupations(s) During the Past 5 Years | | Officer Since |

| Cory Gossard, 51 | | Chief Compliance Officer | | Managing Director, PINE Advisor Solutions (2021– present); Chief Compliance Officer, SS&C ALPS | | April 2022 |

| Ethan Silver, 48 | | Chief Operating Officer | | Partner, Lowenstein Sandler LLP (2016– present) | | May 2021 |

Peter Sattelmair. Mr. Sattelmair has served as our Chief Financial Officer since April 2022. He currently serves as a Director at PINE Advisor Solutions and has nearly 25 years in the financial services and asset management industries. Prior to PINE, he spent the previous 7 years at Transamerica Asset Management where he served as the Director of Fund Operations and Assistant Treasurer of a wide range of registered products with AUM of $80+ billion. In his roles at Transamerica Asset Management, Mr. Sattelmair was responsible for the oversight of all aspects of the funds including fund accounting, custody, fund administration, valuation, and oversight of third-party vendors. Prior to joining Transamerica Asset Management in July 2014, Mr. Sattelmair spent 15 years working at State Street Bank in various roles and locations including Boston, MA and Kansas City, MO. Mr. Sattelmair left State Street as a Vice President of Fund Administration. Mr. Sattelmair obtained his B.S. in Business Management from the University of Massachusetts, Dartmouth.

Cory Gossard. Mr. Gossard has served as our Chief Compliance Officer since April 2022 and currently serves as a Managing Director at PINE Advisor Solutions. Mr. Gossard is a seasoned Fund and Advisor Chief Compliance Officer with 25 years of experience in the asset management industry. Most recently, he was the Chief Compliance Officer for SS&C ALPS in which he held responsibilities for firm compliance, AML, risk management, portfolio compliance, internal audit, vendor oversight and outsourced CCO services. In addition to serving as the CCO for SS&C ALPS, Mr. Gossard also served as Fund CCO for SPDR S&P 500 ETF Trust, SPDR DJIA ETF Trust, and SPDR S&P MidCap400 ETF Trust with aggregate AUM in excess of $350 billion. Before ALPS, Mr. Gossard held an 18-year tenure at Citibank and a multitude of job titles making him a versatile compliance professional. Cory holds a degree from Heidelberg University and holds a FINRA Series 7 and ACAMS Certification.

Ethan Silver. Mr. Silver is our Chief Operating Officer. He is a leading lawyer in the FinTech industry, launching and representing many of the leading companies in the space across their offerings and operations in the broker-dealer, crypto and digital advisory businesses. This includes deep knowledge and understanding of the largest platforms operating in the private securities/late-stage pre-IPO investing space. He has also been an investor in many early stage pre-IPO companies. Mr. Silver started his career on the regulatory side as an Enforcement lawyer with the Bureau of Securities in the New Jersey Attorney General’s Office, as well as the Enforcement Division of the NYSE (which was later merged with the NASD to form FINRA). For the last 15 years, he has been on the private side as a Partner at a financial services boutique law firm as well as Lowenstein Sandler LLP. Mr. Silver received his Bachelor’s Degree from the University of Maryland and his J.D. from New York Law School.

CORPORATE GOVERNANCE

The Board

Board Composition

The Board currently consists of four directors and is divided into three classes as follows: Travis Mason serves as a Class I director (with term ending at the 2026 annual meeting of shareholders); Lee Daley serves as a Class II director (term ending at the Annual Meeting) and Sohail Prasad and Lisa Nelson serve as Class III directors (term ending at the 2025 annual meeting of shareholders).

The Board believes that a classified board of directors serves the best interests of the Company and its shareholders by promoting the continuity and stability of the Company and its business. A staggered election of directors means that over time the Company can ensure that, at any given time, at least a majority of the directors will have had prior experience on the Board. The Board also believes that classification may enhance the Company’s ability to attract and retain well-qualified directors who are able to commit the necessary time and resources to understand the Company, its business affairs and operations. The Board believes that the continuity and quality of leadership that results from a staggered Board enhances long-term planning and promotes the long-term value of the Company. Three-year terms provide the Company’s directors an appropriate amount of time to develop a deeper and more thorough understanding of the Company’s business, competitive environment and strategic goals. Experienced directors are better positioned to provide effective oversight and advice consistent with the best interests of the stockholders. Staggered terms for directors may also moderate the pace of change in the Board by extending the time required to elect a majority of directors from one to three annual meetings of shareholders.

Independent Directors

The Board consists of a majority of directors who are not “interested persons” of the Company, the Adviser, or any of their respective affiliates (“Independent Directors”). On an annual basis, each member of the Company’s Board is required to complete a questionnaire designed to provide information to assist the Board in determining whether the director is independent under NYSE corporate governance rules, the Exchange Act and the 1940 Act. The Board limits membership on the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee to Independent Directors.

Based on these independence standards and the recommendation of the Nominating Committee, after reviewing all relevant transactions and relationships between each director, or any of his family members, and the Company, the Adviser, or of any of their respective affiliates, the Board has determined that Messrs. Mason and Daley and Ms. Nelson qualify as Independent Directors. Each director who serves on the Audit Committee is an independent director for purposes of Rule 10A-3 under the Exchange Act.

Interested Directors

Mr. Prasad is considered an “interested person” of the Company since he has ownership interest in the Adviser.

Meetings and Attendance

The Board met 3 times during 2023 and acted on various occasions by unanimous written consent in lieu of a meeting. Each of the incumbent directors then in office attended all of the Board meetings held in 2023 as well as all committee meetings held in 2023.

Board Attendance at the Annual Meeting

The Company’s policy is to encourage its directors to attend each annual meeting; however, such attendance is not required at this time.

Board Leadership Structure and Oversight Responsibilities

Overall responsibility for the Company’s oversight rests with the Board. The Company has entered into an investment advisory agreement (the “Investment Advisory Agreement”), pursuant to which Destiny Advisors, LLC (the “Adviser”) manages the Company on a day-to-day basis. The Board is responsible for overseeing the Adviser and the Company’s other service providers in accordance with the provisions of the 1940 Act, applicable provisions of state and other laws and the Company’s charter. The Board is currently composed of four members, three of whom are Independent Directors.

The Board meets at regularly scheduled quarterly meetings each year. In addition, the Board may hold special in-person or telephonic meetings or informal conference calls to discuss specific matters that may arise or require action between regular meetings. Additionally, the Board has established an Audit Committee, Compensation Committee and a Nominating and Corporate Governance Committee and may establish ad hoc committees or working groups from time to time, to assist the Board in fulfilling its oversight responsibilities.

The Board has appointed Sohail Prasad to serve in the role of Chairman of the Board. Mr. Prasad is considered an interested director because he is an officer of the Company and controls the Adviser. The Chairman’s role is to preside at all meetings of the Board and to act as a liaison with the Adviser, counsel and other directors generally between meetings. The Chairman serves as a key point person for dealings between management and the directors. The Chairman also may perform such other functions as may be delegated by the Board from time to time. The Board reviews matters related to its leadership structure annually. The Board believes that Mr. Prasad’s history with the Company, familiarity with the Adviser’s investment platform and extensive experience investing in and managing early-stage investments qualifies him to serve as Chairman of the Board. The Board does not have a lead independent director. However, Ms. Nelson, the chair of the Audit Committee, is an independent director and acts as a liaison between the independent directors and management. The Board believes that its leadership structure is appropriate in light of the Company’s characteristics and circumstances because the structure allocates areas of responsibility among the individual directors and the committees in a manner that encourages effective oversight. The Board also believes that its size creates a highly efficient governance structure that provides ample opportunity for direct communication and interaction between the Adviser and the Board.

The Company is subject to a number of risks, including investment, compliance, operational and valuation risks, among others. Risk oversight forms part of the Board’s general oversight of the Company and is addressed as part of various Board and committee activities. Day-to-day risk management functions are subsumed within the responsibilities of the Adviser and other service providers (depending on the nature of the risk), which carry out our investment management and business affairs. The Adviser and other service providers employ a variety of processes, procedures and controls to identify various events or circumstances that give rise to risks, to lessen the probability of their occurrence and to mitigate the effects of such events or circumstances if they do occur. Each of the Adviser and other service providers has its own independent interest in risk management, and their policies and methods of risk management will depend on their functions and business models. The Board recognizes that it is not possible to identify all of the risks that may affect the Company or to develop processes and controls to eliminate or mitigate their occurrence or effects. As part of its regular oversight of the Company, the Board interacts with and reviews reports from, among others, the Adviser, our Chief Compliance Officer, our independent registered public accounting firm and counsel, as appropriate, regarding risks faced by the Company and applicable risk controls. The Board may, at any time and in its discretion, change the manner in which it conducts risk oversight.

Communications with Directors

Shareholders and other interested parties may contact any member (or all members) of the Board by mail. To communicate with the Board, any individual director(s) or any group or committee of directors, correspondence should be addressed to the Board or any such individual director(s) or group or committee of directors by either name or title. All such correspondence should be sent to Destiny Tech100 Inc., 1401 Lavaca Street, #144, Austin, TX 78701, Attention: Chair of the Audit Committee.

Committees of the Board

The Board has an Audit Committee, a Nominating and Corporate Governance Committee and a Compensation Committee, and may form additional committees in the future. A brief description of each committee is included in this Proxy Statement.

As of the date of this Proxy Statement, the members of each of the Board’s committees are as follows (the names of the respective committee chairperson are bolded):

| Audit Committee | | Nominating and Corporate

Governance Committee | | Compensation Committee |

| Lisa Nelson | | Travis Mason | | Lee Daley |

| Travis Mason | | Lee Daley | | Travis Mason |

| Lee Daley | | Lisa Nelson | | Lisa Nelson |

Audit Committee Governance, Responsibilities and Meetings

In accordance with its written charter adopted by the Board, the Audit Committee:

| | · | assists the Board’s oversight of the integrity of our financial statements, the independent registered public accounting firm’s qualifications and independence, our compliance with legal and regulatory requirements and the performance of our independent registered public accounting firm; |

| | · | prepares an Audit Committee report, if required by the SEC, to be included in our annual proxy statement; |

| | · | oversees the scope of the annual audit of our financial statements, the quality and objectivity of our financial statements, accounting and financial reporting policies and internal controls; |

| | · | determines the selection, appointment, retention and termination of our independent registered public accounting firm, as well as approving the compensation thereof; |

| | · | pre-approves all audit and non-audit services provided to us and certain other persons by such independent registered public accounting firm; and |

| | · | acts as a liaison between our independent registered public accounting firm and the Board. |

Our Board has determined that Messrs. Mason and Daley and Ms. Nelson meet the current independence and experience requirements of Rule 10A-3 of the Exchange Act. Messrs. Mason and Daley and Ms. Nelson are members of the Audit Committee and Ms. Nelson serves as Chair.

The Board has determined that Ms. Nelson qualifies as an “audit committee financial expert”, as that term is defined in Item 3 of Form N-CSR.

The Audit Committee met 4 times in 2023. The current charter of the Audit Committee is available on the Company’s website at https://d.xyz/proxy.

Nominating Committee Governance, Responsibilities and Meetings

In accordance with its written charter adopted by the Board, the Nominating and Corporate Governance Committee:

| | · | recommends to the Board persons to be nominated by the Board for re-election at the Company’s meetings of our shareholders, special or annual, if any, or to fill any vacancy on the Board that may arise between shareholder meetings; |

| | | |

| | · | makes recommendations with regard to the tenure of the directors; |

| | · | is responsible for overseeing an annual evaluation of the Board and its committee structure to determine whether the structure is operating effectively; and |

| | · | recommends to the Board the compensation to be paid to the independent directors of the Board. |

The Nominating and Corporate Governance Committee will consider for nomination to the Board candidates submitted by Company’s shareholders or from other sources, it deems appropriate. Messrs. Mason and Daley and Ms. Nelson are members of the Nominating and Corporate Governance Committee and Mr. Mason serves as Chair.

The Nominating and Corporate Governance Committee did not meet in 2023. The current charter of the Nominating Committee is available on the Company’s website at https://d.xyz/tech100.

Director Nominations

Nomination for election as a director may be made by, or at the direction of, the Nominating and Corporate Governance Committee or by shareholders in compliance with the procedures set forth in our bylaws. Our Nominating and Corporate Governance Committee will consider qualified director nominees recommended by shareholders when such recommendations are submitted in accordance with our bylaws and any applicable law, rule or regulation regarding director nominations. When submitting a nomination for consideration, a shareholder must provide certain information that would be required under applicable SEC rules, including the following minimum information for each director nominee: full name, age and address; principal occupation during the past five years; current directorships on publicly held companies and investment companies; number of our securities owned, if any; and, a written consent of the individual to stand for election if nominated by our Board and to serve if elected by our shareholders. Shareholder proposals or director nominations to be presented at the annual meeting of shareholders, other than shareholder proposals submitted pursuant to the SEC’s Rule 14a-8 under the Exchange Act, must be submitted in accordance with the advance notice procedures and other requirements set forth in our bylaws. These requirements are separate from the requirements discussed above to have the shareholder nomination or other proposal included in our proxy statement and form of proxy/voting instruction card pursuant to the SEC’s rules.

Our bylaws require that the proposal or recommendation for nomination must be delivered to, or mailed and received at, the principal executive offices of the Company not earlier than the 150th day prior to the one year anniversary of the date the Company’s proxy statement for the preceding year’s annual meeting, or later than the 120th day prior to the first anniversary of the date of the proxy statement for the preceding year’s annual meeting. If the date of the annual meeting has changed by more than 30 days from the first anniversary of the date of the preceding year’s annual meeting, shareholder proposals or director nominations must be so received not earlier than the 150th day prior to the date of such annual meeting and not later than the120th day prior to the date of such annual meeting or the tenth day following the day on which public announcement of the date of such meeting is first made.

In evaluating director nominees, the Nominating Committee considers, among others, the following factors:

| | · | whether the individual possesses high standards of character and integrity, relevant experience, a willingness to ask hard questions and the ability to work well with others; |

| | · | whether the individual is free of conflicts of interest that would violate applicable law or regulation or interfere with the proper performance of the responsibilities of a director; |

| | · | whether the individual is willing and able to devote sufficient time to the affairs of the Company and be diligent in fulfilling the responsibilities of a director and Board Committee member; |

| | · | whether the individual has the capacity and desire to represent the balanced, best interests of the shareholder as a whole and not a special interest group or constituency; and |

| | · | whether the individual possesses the skills, experiences (such as current business experience or other such current involvement in public service, academia or scientific communities), particular areas of expertise, particular backgrounds, and other characteristics that will help ensure the effectiveness of the Board and Board committees. |

The Nominating Committee’s goal is to assemble a board that brings to the Company a variety of perspectives and skills derived from high-quality business and professional experience.

Other than the foregoing, there are no stated minimum criteria for director nominees, although the Nominating Committee also may consider other factors as they may deem are in the best interests of the Company and its shareholders. The Board also believes it appropriate for certain key members of the Company’s management to participate as members of the Board.

The Nominating Committee identifies nominees by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to the Company’s business and who are willing to continue in service are considered for re-nomination. If any member of the Board does not wish to continue in service or if the Nominating Committee decides not to re-nominate a member for re-election, the Nominating Committee will identify the desired skills and experience of a new nominee in light of the criteria above. The members of the Board are polled for suggestions as to individuals meeting the aforementioned criteria. Research may also be performed to identify qualified individuals. To date, the Company has not engaged third parties to identify or evaluate or assist in identifying potential nominees, although the Company reserves the right in the future to retain a third-party search firm, if necessary.

The Board has not adopted a formal policy with regard to the consideration of diversity in identifying director nominees. In determining whether to recommend a director nominee, the Nominating Committee considers and discusses diversity, among other factors, with a view toward the needs of the Board as a whole. The Board generally conceptualizes diversity expansively to include, without limitation, concepts such as race, gender, national origin, differences of viewpoint, professional experience, education, skill and other qualities that contribute to the Board, when identifying and recommending director nominees. The Board believes that the inclusion of diversity as one of many factors considered in selecting director nominees is consistent with the Board’s goal of creating a Board that best serves the needs of the Company and the interests of its shareholders.

Compensation Committee, Responsibilities and Meetings

In accordance with its written charter adopted by the Board, the Compensation Committee:

| | · | oversee the Company’s compensation policies generally and make recommendations to the Board with respect to any incentive compensation and equity-based plans of the Company that are subject to Board approval; |

| | · | evaluate executive officer performance; |

| | · | review and approve the compensation, if any, by the Company for each of the Company’s executive officers, including reimbursement by the Company of the compensation of the Chief Financial Officer and Chief Compliance Officer; and |

| | · | prepare a report on executive officer compensation if the Securities and Exchange Commission rules require such a report to be included in the Company’s annual proxy statement. |

Messrs. Mason and Daley and Ms. Nelson are members of the Compensation Committee and Mr. Daley serves as Chair.

The Compensation Committee did not hold any meetings during 2023. The current charter of the Compensation Committee is available on the Company’s website at https://d.xyz/tech100.

Code of Ethics

The Company and the Adviser have each adopted a code of ethics pursuant to Rule 17j-1 under the 1940 Act that establishes procedures for personal investments and restricts certain personal securities transactions. Personnel subject to each code may invest in securities for their personal investment accounts, including securities that may be purchased or held by us, so long as such investments are made in accordance with the code’s requirements. Our code of ethics is available on the EDGAR Database on the SEC’s website at http://www.sec.gov.

Hedging, Speculative Trading, and Pledging of Securities

The Board has adopted, as part of the Company’s insider trading policy, prohibitions against directors and officers of the Company and any director, officer or employee of the Adviser or administrator buying or selling puts or calls or other derivative securities based on the Company’s securities (other than derivative securities issued by the Company, such as convertible notes). In addition, such persons are prohibited from (i) short-selling the Company’s securities or entering into hedging or monetization transactions or similar arrangements with respect to the Company’s securities, and (ii) pledging the Company’s securities in a margin account or as collateral for a loan.

Election of Officers

Officers hold their office until their successors have been duly elected and qualified, or until the earlier of their resignation or removal.

Director Compensation

No compensation will be paid to our directors considered to be “interested persons” as defined in the 1940 Act. Our Independent Directors who do not also serve in an executive officer capacity for us or the Adviser are entitled to receive annual cash retainer fees, fees for participating in in-person Board and committee meetings and annual fees for serving as a committee chairperson. These directors are Messrs. Mason and Daley and Ms. Nelson. We pay each Independent Director an annual fee of $100,000. They also receive reimbursements of reasonable out-of-pocket expenses incurred in connection with attending each regular Board meeting in person or telephonically. We also reimburse each of the directors for all reasonable and authorized business expenses in accordance with our policies as in effect from time to time, including reimbursement of reasonable out-of-pocket expenses incurred in connection with attending each committee meeting not held concurrently with a Board meeting.

The following table sets forth the compensation received by our directors for the year ended December 31, 2023.

| Name | | Aggregate Compensation From Fund1 | | | Pension or Retirement

Benefits

Accrued As Part of

Fund

Expenses2 | | | Total | |

| Interested Directors | | | | | | | | | | | | |

| Sohail Prasad | | | — | | | | — | | | | — | |

| Independent Directors | | | | | | | | | | | | |

| Travis Mason | | $ | 100,000 | | | | — | | | $ | 100,000 | |

| Eric Patterson3 | | $ | 96,739 | | | | — | | | $ | 96,739 | |

| Lisa Nelson4 | | $ | 34,239 | | | | — | | | $ | 34,239 | |

1 For discussion of the independent directors’ compensation, see above.

2 We do not maintain a stock or option plan, non-equity incentive plan or pension plan for our directors.

3 On December 19, 2023, Mr. Patterson announced his resignation from the Board. His resignation was not the result of any disagreement with management.

4 Ms. Nelson was appointed to the Board in August 2023.

Officer Compensation

None of our officers who are also officers or employees of our Adviser will receive direct compensation from us. We do not currently have any employees and do not expect to have any employees. Services necessary for our business are provided by individuals who are employees or officers of our Adviser or by individuals who were contracted by us or our Adviser to work on our behalf. We have outsourced the functions of our Chief Financial Officer and Chief Compliance Officer to employees of PINE Advisers LLC (“PINE”). PINE receives a monthly fee for services provided to us and we reimburse PINE for certain out-of-pocket expenses incurred on our behalf. For the fiscal year ended December 31, 2023, none of our officers received aggregate compensation from us in excess of $60,000.

Material Non-Public Information

The Company’s senior management, members of the Investment Committee and other investment professionals from the Adviser may serve as directors of, or in a similar capacity with, companies in which the Company invests or in which the Company is considering making an investment. Through these and other relationships with a company, these individuals may obtain material non-public information that might restrict the Company’s ability to buy or sell the securities of such company under the policies of the company or applicable law.

Required Vote

The affirmative vote of the plurality of votes cast on the proposal will determine the outcome of the proposal. For the proposal, “withhold” votes and broker non-votes, if any, will count as shares represented at the meeting for purpose of establishing a quorum but will have no effect on the outcome of the vote.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE

“FOR” EACH DIRECTOR NOMINEE.

PROPOSAL 2: RATIFICATION OF SELECTION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board, including the Audit Committee, which consists solely of Independent Directors, has selected Marcum LLP to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2024.

Marcum LLP has advised us that neither the firm nor any present member or associate of it have any material financial interest, direct or indirect, in us or our affiliates. It is expected that a representative of Marcum LLP will be present at the Annual Meeting and will have an opportunity to make a statement if he or she chooses and will be available to answer questions.

Principal Accountant Fees and Services

The following aggregate fees by Marcum LLP were billed for work attributable to audit, tax and other services provided to the Company the fiscal year ended December 31, 2023.

| | | Fiscal Year

Ended

December 31,

2023 | |

| Audit Fees1 | | $ | 250,000 | |

| Audit-Related Fees2 | | $ | 45,000 | |

| Tax Fees3 | | $ | 17,000 | |

| All Other Fees4 | | | - | |

| Total Fees: | | $ | 312,000 | |

1 Audit fees include fees for services that normally would be provided by the accountant in connection with statutory and regulatory filings or engagements and that generally only the independent accountant can provide. In addition to fees for the audit of our annual financial statements and the review of our quarterly financial statements in accordance with generally accepted auditing standards, this category contains fees for comfort letters, consents, and review of documents filed with the SEC.

2 Audit-related fees are assurance-related services that traditionally are performed by the independent accountant, such as attest services that are not required by statute or regulation.

3 Tax fees include professional fees for tax compliance and tax advice.

4 All other fees would include fees for products and services other than the services reported above.

During the fiscal year ended December 31, 2023, the non-audit fees billed by Marcum LLP to the Adviser, and any entity controlling, controlled by, or under common control with the Adviser that provides ongoing services to the Company was $0.

Pre-Approval Policy

The Audit Committee has established a pre-approval policy that describes the permitted audit, audit-related, tax and other services to be provided by Marcum LLP. The policy requires that the Audit Committee pre-approve all audit and non-audit services performed by the independent auditor in order to assure that the provision of such service does not impair the auditor’s independence. In accordance with the pre-approval policy, the Audit Committee includes every year a discussion and pre-approval of such services and the expected costs of such services for the year.

Any requests for audit, audit-related, tax and other services that have not received general pre-approval at the first Audit Committee meeting of the year must be submitted to the Audit Committee for specific pre-approval, irrespective of the amount, and cannot commence until such approval has been granted. Normally, pre-approval is provided at regularly scheduled meetings of the Audit Committee. However, the Audit Committee may delegate pre-approval authority to one or more of its members. The member or members to whom such authority is delegated shall report any pre-approval decisions to the Audit Committee at its next scheduled meeting. The Audit Committee does not delegate its responsibilities to pre-approve services performed by the independent registered public accounting firm to management.

During the fiscal year ended December 31, 2023, 100% of the non-audit services were approved pursuant to the pre-approval waiver requirement set forth in Rule 2-01(c)(7)(i)(C) of Regulation S-X.

AUDIT COMMITTEE REPORT

As part of its oversight of the Company’s financial statements, the Audit Committee reviewed and discussed with both management and Marcum LLP the Company’s financial statements to be filed with the SEC for the fiscal year ended December 31, 2023. Management advised the Audit Committee that all financial statements were prepared in accordance with U.S. GAAP, and reviewed significant accounting matters with the Audit Committee. The Audit Committee also discussed with Marcum LLP the matters required to be discussed by Public Company Accounting Oversight Board (“PCAOB”) Auditing Standard 1301: Communications with Audit Committees. PCAOB Auditing Standard 1301 requires our independent registered public accounting firm to discuss with our Audit Committee, among other things, the following:

| | · | methods used to account for significant unusual transactions; |

| | · | the effect of significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus; |

| | · | the process used by management in formulating particularly sensitive accounting estimates and the basis for the auditors’ conclusions regarding the reasonableness of those estimates; and |

| | · | disagreements with management over the application of accounting principles, the basis for management’s accounting estimates and the disclosures in the financial statements. |

Additionally, the Audit Committee has discussed with Marcum LLP the matters required to be discussed by PCAOB Auditing Standard 2410: Related Parties.

The Audit Committee received and reviewed the written disclosures from Marcum LLP required by the applicable PCAOB rule regarding the independent registered public accounting firm’s communications with audit committees concerning independence, and has discussed with Marcum LLP its independence. The Audit Committee has reviewed the audit fees paid by the Company to Marcum LLP. It has also reviewed non-audit services and fees to assure compliance with the Company’s and the Audit Committee’s policies restricting Marcum LLP from performing services that might impair its independence.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the Company’s financial statements as of and for the year ended December 31, 2023 be included in the Company’s Annual Report on Form N-CSR filed with the SEC. The Audit Committee also recommended the selection of Marcum LLP to serve as the Company’s independent registered public accounting firm for the year ending December 31, 2024 and the Board approved such recommendation.

Respectfully Submitted,

Audit Committee Members

Lisa Nelson

Travis Mason

Lee Daley

Required Vote

The affirmative vote of the majority of votes cast on the proposal will determine the outcome of the proposal. For the proposal, “abstain” votes and broker non-votes, if any, will count as shares represented at the meeting for purpose of establishing a quorum but will have no effect on the outcome of the vote.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE SELECTION OF MARCUM LLP AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE COMPANY FOR THE FISCAL YEAR ENDING DECEMBER 31, 2024.

OTHER MATTERS TO COME BEFORE THE ANNUAL MEETING

The Board is not aware of any matters that will be presented for action at the Annual Meeting other than the matters set forth herein. Should any other matters requiring a vote of shareholders arise, it is intended that the proxies that do not contain specific instructions to the contrary will be voted in accordance with the judgment of the persons named in the enclosed form of proxy.

SUBMISSION OF SHAREHOLDER PROPOSALS

Inclusion of Proposals in Our Proxy Statement and Proxy Card Under the SEC’s Rules