Exhibit 99.1

1 �ç©çÜã � ɸɶɸɺ :›ö�‚ � d›Âȼȩö � =›‚•›ØÜ¯Õ � (ÈØçÁ

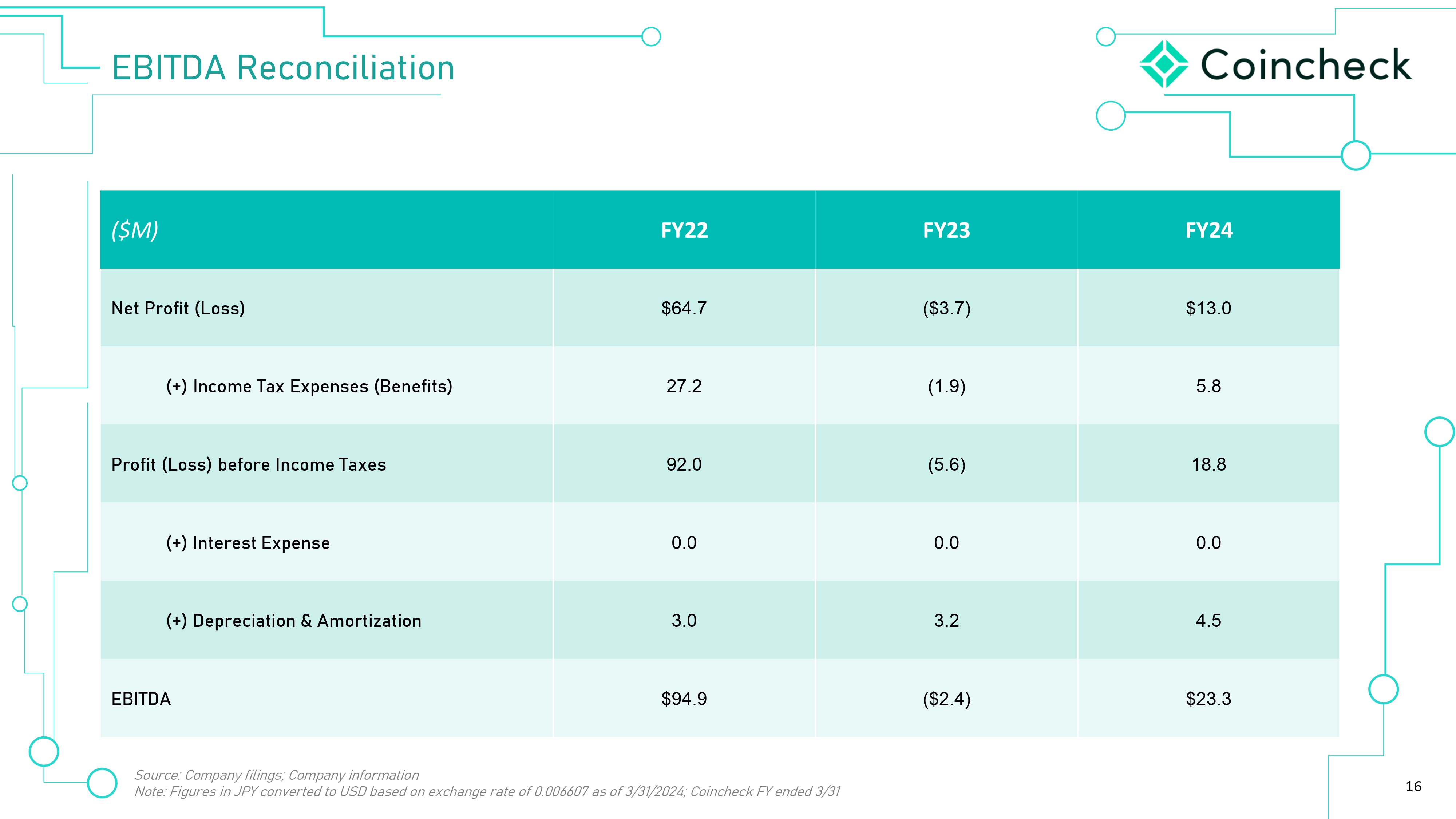

2 �¯Ü¼‚¯Á›Ø �••¯ã¯È‚¼ � 0¨ÈØÁ‚ã¯È � ‚• � w›Ø› � ãÈ � (¯Â• � 0ã 0 � È›ã¯È � ô¯ã � ã› � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯È � ‚©Ø››Á›Âãʍ � ‚Ü � ‚Á›Â•›•ʍ � ‚ÁÈ© � �ȯ›¹ʍ � 0Âʒ � ʞʪ�ȯ›¹ʫʟʍ � �ȯ›¹ � *ØÈçÕ � �ʒtʒ � ʞʪ��*ʫʟʍ � dç•›Ø � �د•©› � �‚կゼ � V‚Øã›ØÜ � 0tʍ � 0Âʒ � ʞʪdç•›Ø � �د•©› � 0tʫʟ � ‚• � Èã›ØÜ � ô¯ã � Ø›©‚Ø•Ü � ãÈ � ã›¯Ø � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʍ � ã› � Õ‚Øã¯›Ü �� ‚ó› � ¨¯¼›• � ‚ � Ø›©¯ÜãØ‚ã¯È � Üã‚ã›Á›Âã � È � (ÈØÁ � ( ʣ ɺ � ô¯ã � ã› � hʒ]ʒ � ]›çØ¯ã¯›Ü � ‚• � �õ‚©› � �ÈÁÁ¯ÜܯÈ � ʞʪ]��ʫʟʍ � ô¯ � ¯Â¼ç•›Ü � ‚ � ÕØÈõö � Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜ � Ȩ � dç•›Ø � �د•©› � 0tʍ � ‚• � Èã›Ø � •ÈçÁ›ÂãÜ � Ø›©‚Ø•¯Â© � ã› � ÕØÈÕÈÜ›• � ãØ‚ÂÜ‚ã¯ÈÂʒ � dç•›Ø � �د•©› � 0tʭÜ � Üãȹȼ•›ØÜ � ‚• � Èã›Ø � ¯Âã›Ø›Ü㛕 � Õ›ØÜÈÂÜ � ‚Ø› � ‚•ó¯Ü›• � ãÈ � Ø›‚• � ã› � ÕØ›¼¯Á¯Â‚Øö � ÕØÈõö � Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜ � ‚• � ã› � ‚Á›Â•Á›ÂãÜ � ã›Ø›ãÈ � ‚•ʍ � ô›Â � ‚󂯼‚Ž¼›ʍ � ã› � •›¨¯Â¯ã¯ó› � ÕØÈõö � Üã‚ã›Á›Âã � ‚• � •ÈçÁ›ÂãÜ � ¯ÂÈØÕÈ؂㛕 � Žö � Ø›¨›Ø›Â› � ã›Ø›¯Â � ¨¯¼›• � ¯Â � È›ã¯È � ô¯ã � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʍ � ‚Ü � ã›Ü› � Á‚ã›Ø¯‚¼Ü � ô¯¼¼ � ÈÂク � ¯ÁÕÈØã‚Âã � ¯Â¨ÈØÁ‚ã¯È � ‚ŽÈçã � ��*ʍ � �ȯ›¹ʍ � dç•›Ø � �د•©› � 0t � ‚• � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʒ � VØÈÁÕã¼ö � ‚¨ã›Ø � ã› � (ÈØÁ � ( ʣ ɺ � ¯Ü � •›¼‚Ø›• � ›¨¨›ã¯ó› � Žö � ã› � ]��ʍ � dç•›Ø � �د•©› � 0t � ô¯¼¼ � Á‚¯¼ � ã› � •›¨¯Â¯ã¯ó› � ÕØÈõö � Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜ � ‚• � ‚ � ÕØÈõö �� ‚Ø• � ãÈ � ›‚ � Üãȹȼ•›Ø � ›Âã¯ã¼›• � ãÈ � óÈã› � ‚ã � ã› � Á››ã¯Â© � Ø›¼‚ã¯Â© � ãÈ � ã› � ‚ÕÕØÈó‚¼ � Ȩ � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯È � ‚• � Èã›Ø � ÕØÈÕÈÜ‚¼Ü � Ü›ã � ¨ÈØã � ¯Â � ã› � ÕØÈõö � Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜʒ � �›¨ÈØ› � Á‚¹¯Â© � ‚Âö � óÈã¯Â© � ÈØ � ¯Âó›ÜãÁ›Âã � •›¯Ü¯ÈÂʍ � ¯Âó›ÜãÈØÜ � ‚• � Üãȹȼ•›ØÜ � Ȩ � dç•›Ø � �د•©› �� 0t � ‚Ø› � çØ©›• � ãÈ � ‚Ø›¨ç¼¼ö � Ø›‚• � ã› � ›Âã¯Ø› � Ø›©¯ÜãØ‚ã¯È � Üã‚ã›Á›Âã � ‚• � ÕØÈõö � Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜ � ‚• � ‚Âö � Èã›Ø � Ø›¼›ó‚Âã � •ÈçÁ›ÂãÜ � ¨¯¼›• � ô¯ã � ã› � ]��ʍ � ‚Ü � ô›¼¼ � ‚Ü � ‚Âö � ‚Á›Â•Á›ÂãÜ � ÈØ � ÜçÕÕ¼›Á›ÂãÜ � ãÈ � ã›Ü› � •ÈçÁ›ÂãÜʍ � Ž›‚çÜ› � ã›ö � ô¯¼¼ � ÈÂク � ¯ÁÕÈØã‚Âã � ¯Â¨ÈØÁ‚ã¯È � ‚ŽÈçã � ã› � ÕØÈÕÈÜ›• � ãØ‚ÂÜ‚ã¯ÈÂʒ � d› � •ÈçÁ›ÂãÜ � ¨¯¼›• � Žö � dç•›Ø � �د•©› � 0t � ô¯ã � ã› � ]�� � Á‚ö � Ž› � Ȏク›• � ¨Ø›› � Ȩ � ‚Ø©› � ‚ã � ã› � ]��ʭÜ � ô›ŽÜ¯ã› � ‚ã � ôôôʒÜ›ʒ©Èóʍ � ÈØ � Žö � •¯Ø›ã¯Â© � ‚ � Ø›×ç›Üã � ãÈ � dç•›Ø � �د•©› � �‚կゼ � V‚Øã›ØÜ � 0tʍ � 0Âʒʍ � ɿɿɷɸ � *›ÈØ©›ãÈô � V¯¹›ʍ � ]ç¯ã› � �ɸɶɹʍ � *Ø›‚ã � (‚¼¼Üʍ � t¯Ø©¯Â¯‚ � ɸɸɶɼɼʍ � �ãã›Âã¯ÈÂʌ � ]›Ø›ã‚Øöʍ � ʞɸɶɸʟ � ɺɹɷ ʣ ɶɻɶɽʒ V‚Ø㯯ՂÂãÜ � ¯Â � ã› � ]ȼ¯¯ã‚ã¯È dç•›Ø � �د•©› � 0t � ‚• � ¯ãÜ � •¯Ø›ãÈØÜ � ‚• � ›õ›çã¯ó› � Ȩ¨¯›ØÜ � Á‚ö � Ž› � •››Á›• � Õ‚Ø㯯ՂÂãÜ � ¯Â � ã› � Üȼ¯¯ã‚ã¯È � Ȩ � ÕØÈõ¯›Ü � ¨ØÈÁ � ¯ãÜ � Üãȹȼ•›ØÜ � ô¯ã � Ø›ÜÕ›ã � ãÈ � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʒ � � � ¼¯Üã � Ȩ � ã› � ‚Á›Ü � Ȩ � ãÈÜ› � •¯Ø›ãÈØÜ � ‚• � ›õ›çã¯ó› � Ȩ¨¯›ØÜ � ‚• � ‚ � •›ÜدÕã¯È � Ȩ � ã›¯Ø � ¯Âã›Ø›ÜãÜ � ¯Â � dç•›Ø � �د•©› � 0t � ô¯¼¼ � Ž› � ¯Â¼ç•›• � ¯Â � ã› � ÕØÈõö � Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜ � ¨ÈØ � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʒ � 0¨ÈØÁ‚ã¯È � ‚ŽÈçã � dç•›Ø � �د•©› � 0tʭÜ � •¯Ø›ãÈØÜ � ‚• � ›õ›çã¯ó› � Ȩ¨¯›ØÜ � ‚• � ã›¯Ø � Èô›ØÜ¯Õ � Ȩ � dç•›Ø � �د•©› � 0t � ÈÁÁÈ � Üãȹ � ¯Ü � Ü›ã � ¨ÈØã � ¯Â � dç•›Ø � �د•©› � 0tʭÜ � ¨¯Â‚¼ � ÕØÈÜÕ›ãçÜ � ¨ÈØ � ¯ãÜ � ¯Â¯ã¯‚¼ � Õ玼¯ � Ȩ¨›Ø¯Â©ʍ � •‚㛕 � 9ç› � ɸɿʍ � ɸɶɸɷʍ � ‚Ü � ÁÈ•¯¨¯›• � ÈØ � ÜçÕÕ¼›Á›Â㛕 � Žö � ‚Âö � (ÈØÁ � ɹ � ÈØ � (ÈØÁ � ɺ � ¨¯¼›• � ô¯ã � ã› � ]�� � ܯ› � ã› � •‚ã› � Ȩ � Üç � ¨¯¼¯Â©ʒ � Iã›Ø � ¯Â¨ÈØÁ‚ã¯È � Ø›©‚Ø•¯Â© � ã› � ¯Âã›Ø›ÜãÜ � Ȩ � ã› � Õ‚Ø㯯ՂÂãÜ � ¯Â � ã› � ÕØÈõö � Üȼ¯¯ã‚ã¯È � ô¯¼¼ � Ž› � ¯Â¼ç•›• � ¯Â � ã› � ÕØÈõö � Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜ � Õ›Øク¯© � ãÈ � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯È � ô›Â � ¯ã � Ž›ÈÁ›Ü � ‚󂯼‚Ž¼›ʒ � d›Ü› � •ÈçÁ›ÂãÜ � ‚ � Ž› � Ȏク›• � ¨Ø›› � Ȩ � ‚Ø©› � ¨ØÈÁ � ã› � ÜÈçØ› � ¯Â•¯‚㛕 � ‚ŽÈó›ʒ ��*ʍ � �ȯ›¹ � ‚• � ã›¯Ø � Ø›ÜÕ›ã¯ó› � •¯Ø›ãÈØÜ � ‚• � ›õ›çã¯ó› � Ȩ¨¯›ØÜ � Á‚ö � ‚¼ÜÈ � Ž› � •››Á›• � ãÈ � Ž› � Õ‚Ø㯯ՂÂãÜ � ¯Â � ã› � Üȼ¯¯ã‚ã¯È � Ȩ � ÕØÈõ¯›Ü � ¨ØÈÁ � ã› � Üãȹȼ•›ØÜ � Ȩ � dç•›Ø � �د•©› � 0t � ¯Â � È›ã¯È � ô¯ã � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʒ � � � ¼¯Üã � Ȩ � ã› � ‚Á›Ü � Ȩ � Üç � •¯Ø›ãÈØÜ � ‚• � ›õ›çã¯ó› � Ȩ¨¯›ØÜ � ‚• � ¯Â¨ÈØÁ‚ã¯È � Ø›©‚Ø•¯Â© � ã›¯Ø � ¯Âã›Ø›ÜãÜ � ¯Â � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯È � ô¯¼¼ � Ž› � ¯Â¼ç•›• � ¯Â � ã› � ÕØÈõö � Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜ � ¨ÈØ � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʒ (ÈØô‚Ø• � =Èȹ¯Â© � ]ã‚ã›Á›ÂãÜ d¯Ü � Õ؛ܛÂã‚ã¯È � ÈÂクÂÜ � ʪ¨ÈØô‚Ø• ʣ ¼Èȹ¯Â© � Üã‚ã›Á›ÂãÜʫ � ô¯ã¯Â � ã› � Á›‚¯© � Ȩ � ã› � Vدó‚ã› � ]›çØ¯ã¯›Ü � =¯ã¯©‚ã¯È � Y›¨ÈØÁ � �ã � Ȩ � ɷɿɿɻʒ � ]ç � Üã‚ã›Á›ÂãÜ � ¯Â¼ç•›ʍ � Žçã � ‚Ø› � ÂÈã � ¼¯Á¯ã›• � ãÈʍ � Üã‚ã›Á›ÂãÜ � ‚ŽÈçã � ¨çãçØ› � ¨¯Â‚¯‚¼ � ‚• � È՛؂ã¯Â© � Ø›Üç¼ãÜʍ � ÈçØ � Õ¼‚ÂÜʍ � ÈŽ¸›ã¯ó›Üʍ � ›õÕ›ã‚ã¯ÈÂÜ � ‚• � ¯Âã›Âã¯ÈÂÜ � ô¯ã � Ø›ÜÕ›ã � ãÈ � ¨çãçØ› � È՛؂ã¯ÈÂÜʍ � ÕØÈ•çãÜ � ‚• � Ü›Øó¯›Üʗ � ‚• � Èã›Ø � Üã‚ã›Á›ÂãÜ � ¯•›Â㯨¯›• � Žö � ôÈØ•Ü � Üç � ‚Ü � ʪô¯¼¼ � ¼¯¹›¼ö � Ø›Üç¼ãʍʫ � ʪ‚Ø› � ›õ՛㛕 � ãÈʍʫ � ʪô¯¼¼ � ÈÂã¯Âç›ʍʫ � ʪ¯Ü � ‚Â㯯Ղ㛕ʍʫ � ʪ›Üã¯Á‚㛕ʍʫ � ʪŽ›¼¯›ó›ʍʫ � ʪ¯Âã›Â•ʍʫ � ʪÕ¼‚Âʍʫ � ʪÕØȸ›ã¯ÈÂʍʫ � ʪÈçã¼Èȹʫ � ÈØ � ôÈØ•Ü � Ȩ � ܯÁ¯¼‚Ø � Á›‚¯©ʒ �� d›Ü› � ¨ÈØô‚Ø• ʣ ¼Èȹ¯Â© � Üã‚ã›Á›ÂãÜ � ¯Â¼ç•›ʍ � Žçã � ‚Ø› � ÂÈã � ¼¯Á¯ã›• � ãÈʍ � Üã‚ã›Á›ÂãÜ � Ø›©‚Ø•¯Â© � �ȯ›¹ʭÜ � ¯Â•çÜãØö � ‚• � Á‚ع›ã � ܯú›Üʍ � ¨çãçØ› � ÈÕÕÈØãçÂ¯ã¯›Ü � ¨ÈØ � ��*ʍ � �ȯ›¹ � ‚• � dç•›Ø � �د•©› � 0tʍ � �ȯ›¹ʭÜ � ›Üã¯Á‚㛕 � ¨çãçØ› � Ø›Üç¼ãÜ � ‚• � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯È � Ž›ãô››Â � dç•›Ø � �د•©› � 0t � ‚• � �ȯ›¹ʍ � ¯Â¼ç•¯Â© � ã› � ¯ÁÕ¼¯›• � ›Âã›ØÕدܛ � ó‚¼ç›ʍ � ã› � ›õ՛㛕 � ãØ‚ÂÜ‚ã¯È � ‚• � Èô›ØÜ¯Õ � ÜãØçãçØ› � ‚• � ã› � ¼¯¹›¼¯ÈÈ•ʍ � ã¯Á¯Â© � ‚• � ‚Ž¯¼¯ãö � Ȩ � ã› � Õ‚Øã¯›Ü � ãÈ � Üç›Üܨ缼ö � ÈÂÜçÁÁ‚ã› � ã› � ÕØÈÕÈÜ›• � ãØ‚ÂÜ‚ã¯ÈÂʒ � ]ç � ¨ÈØô‚Ø• ʣ ¼Èȹ¯Â© � Üã‚ã›Á›ÂãÜ � ‚Ø› � Ž‚Ü›• � çÕÈ � ã› � çØØ›Âã � Ž›¼¯›¨Ü � ‚• � ›õÕ›ã‚ã¯ÈÂÜ � Ȩ � ÈçØ � Á‚‚©›Á›Âã � ‚• � ‚Ø› � ¯Â›Ø›Âã¼ö � Ü玸›ã � ãÈ � ܯ©Â¯¨¯‚Âã � Žçܯ›ÜÜʍ � ›ÈÂÈÁ¯ � ‚• � ÈÁÕ›ã¯ã¯ó› � ç›ØクÂã¯›Ü � ‚• � ÈÂã¯Â©›Â¯›Üʍ � Á‚Âö � Ȩ � ô¯ � ‚Ø› � •¯¨¨¯ç¼ã � ãÈ � ÕØ›•¯ã � ‚• � ©›Â›Ø‚¼¼ö � Ž›öÈ• � ÈçØ � ÈÂãØȼʒ � �ã炼 � Ø›Üç¼ãÜ � ‚• � ã› � ã¯Á¯Â© � Ȩ � ›ó›ÂãÜ �� Á‚ö � •¯¨¨›Ø � Á‚ã›Ø¯‚¼¼ö � ¨ØÈÁ � ã› � Ø›Üç¼ãÜ � ‚Â㯯Ղ㛕 � ¯Â � ã›Ü› � ¨ÈØô‚Ø• ʣ ¼Èȹ¯Â© � Üã‚ã›Á›ÂãÜʒ 0 � ‚••¯ã¯È � ãÈ � ¨‚ãÈØÜ � ÕØ›ó¯Èçܼö � •¯Ü¼ÈÜ›• � ¯Â � dç•›Ø � �د•©› � 0tʭÜ � Ø›ÕÈØãÜ � ¨¯¼›• � ô¯ã � ã› � ]��ʍ � ã› � ¨È¼¼Èô¯Â© � ¨‚ãÈØÜʍ � ‚ÁÈ© � Èã›ØÜʍ � È缕 � ‚çÜ› � ‚ã炼 � Ø›Üç¼ãÜ � ‚• � ã› � ã¯Á¯Â© � Ȩ � ›ó›ÂãÜ � ãÈ � •¯¨¨›Ø � Á‚ã›Ø¯‚¼¼ö � ¨ØÈÁ � ã› � ‚Â㯯Ղ㛕 � Ø›Üç¼ãÜ � ÈØ � Èã›Ø � ›õÕ›ã‚ã¯ÈÂÜ � ›õÕØ›ÜÜ›• � ¯Â � ã› � ¨ÈØô‚Ø• ʣ � ¼Èȹ¯Â© � Üã‚ã›Á›ÂãÜʌ � ¯Â‚Ž¯¼¯ãö � ãÈ � Á››ã � ã› � ¼Èܯ© � È•¯ã¯ÈÂÜ � ãÈ � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʍ � ¯Â¼ç•¯Â© � ã› � ÈçØ؛› � Ȩ � ‚Âö � ›ó›Âãʍ � ‚©› � ÈØ � Èã›Ø � ¯ØçÁÜã‚Â›Ü � ã‚ã � È缕 � ©¯ó› � دܛ � ãÈ � ã› � ã›ØÁ¯Â‚ã¯È � Ȩ � ã› � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯È � ‚©Ø››Á›Âãʗ � ã› � ¯Â‚Ž¯¼¯ãö � ãÈ � ÈÁÕ¼›ã› � ã› � ãØ‚ÂÜ‚ã¯ÈÂÜ � ÈÂã›ÁÕ¼‚㛕 � Žö � ã› � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯È � ‚©Ø››Á›Âã � •ç› � ãÈ � ã› � ¨‚¯¼çØ› � ãÈ � Ȏク � ‚ÕÕØÈó‚¼ � Ȩ � dç•›Ø � �د•©› � 0tʭÜ � Üãȹȼ•›ØÜʍ � ã› � ¨‚¯¼çØ› � ãÈ � ‚¯›ó› � ã› � Á¯Â¯ÁçÁ � ‚ÁÈçÂã � Ȩ � ‚Ü � ‚󂯼‚Ž¼› � ¨È¼¼Èô¯Â© � ‚Âö � Ø›•›ÁÕã¯ÈÂÜ � Žö � dç•›Ø � �د•©› � 0t � Üãȹȼ•›ØÜʍ � Ø›•›ÁÕã¯ÈÂÜ � ›õ››•¯Â© � ‚ � Á‚õ¯ÁçÁ � ãØ›Üȼ• � ÈØ � ã› � ¨‚¯¼çØ› � ãÈ � Á››ã � C‚Ü•‚×ʭÜ � ¯Â¯ã¯‚¼ � ¼¯Üã¯Â© � Üã‚•‚Ø•Ü � ¯Â � È›ã¯È � ô¯ã � ã› � ÈÂÜçÁÁ‚ã¯È � Ȩ � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʗ � ÈÜãÜ � Ø›¼‚㛕 � ãÈ � ã› � ãØ‚ÂÜ‚ã¯ÈÂÜ � ÈÂã›ÁÕ¼‚㛕 � Žö � ã› � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯È � ‚©Ø››Á›Âãʗ � ‚ � •›¼‚ö � ÈØ � ¨‚¯¼çØ› � ãÈ �� Ø›‚¼¯ú› � ã› � ›õ՛㛕 � Ž›Â›¨¯ãÜ � ¨ØÈÁ � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʗ � Ø¯Ü¹Ü � Ø›¼‚㛕 � ãÈ � •¯ÜØçÕã¯È � Ȩ � Á‚‚©›Á›ÂãʭÜ � ã¯Á› � ¨ØÈÁ � È©ȯ© � Žçܯ›ÜÜ � È՛؂ã¯ÈÂÜ � •ç› � ãÈ � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʗ � ‚©›Ü � ¯Â � ã› � ØöÕãÈçØØ›Âö � ‚• � •¯©¯ã‚¼ � ‚ÜÜ›ã � Á‚ع›ãÜ � ¯Â � ô¯ � �ȯ›¹ � ÈÁÕ›ã›Üʍ � ¯Â¼ç•¯Â© � ô¯ã � Ø›ÜÕ›ã � ãÈ � ¯ãÜ � ÈÁÕ›ã¯ã¯ó› � ¼‚•܂՛ʍ � ã›Âȼȩö � ›óȼçã¯È � ÈØ � Ø›©ç¼‚ãÈØö � ‚©›Üʗ � ‚©›Ü � ¯Â � •ÈÁ›Ü㯠� ‚• � ©¼ÈŽ‚¼ � ©›Â›Ø‚¼ � ›ÈÂÈÁ¯ � È•¯ã¯ÈÂÜʗ � دܹ � ã‚ã � �ȯ›¹ � Á‚ö � ÂÈã � Ž› � ‚Ž¼› � ãÈ � ›õ›çã› � ¯ãÜ � ©ØÈôã � Üã؂㛩¯›Üʍ � ¯Â¼ç•¯Â© � ¯•›Â㯨ö¯Â© � ‚• � ›õ›çã¯Â© � ‚×ç¯Ü¯ã¯ÈÂÜʗ � دܹ � ã‚ã � �ȯ›¹ � Á‚ö � ÂÈã � Ž› � ‚Ž¼› � ãÈ � •›ó›¼ÈÕ � ‚• � Á‚¯Âク � ›¨¨›ã¯ó› � ¯Âã›Ø‚¼ � ÈÂãØȼÜʗ � ‚• � Èã›Ø � Ø¯Ü¹Ü � ‚• � ç›ØクÂã¯›Ü � ¯Â•¯‚㛕 � ¯Â � dç•›Ø � �د•©› � 0tʭÜ � ¨¯Â‚¼ � ÕØÈÜÕ›ãçÜ � ¨ÈØ � ¯ãÜ � ¯Â¯ã¯‚¼ � Õ玼¯ � Ȩ¨›Ø¯Â©ʍ � •‚㛕 � 9ç› � ɸɿʍ � ɸɶɸɷʍ � ‚• � ã› � ÕØÈõö � Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜ � Ø›¼‚ã¯Â© � ãÈ � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʍ � ¯Â¼ç•¯Â© � ãÈÜ› � ç•›Ø � ʪY¯Ü¹ � (‚ãÈØÜʫ � ã›Ø›¯Âʍ � ‚• � ¯Â � dç•›Ø � �د•©› � 0tʭÜ � Èã›Ø � ¨¯¼¯Â©Ü � ô¯ã � ã› � ]��ʒ � dç•›Ø � �د•©› � 0tʍ � ��* � ‚• � �ȯ›¹ � ‚çã¯È � ã‚ã � ã› � ¨ÈØ›©È¯Â© � ¼¯Üã � Ȩ � ¨‚ãÈØÜ � ¯Ü � ÂÈã � ›õ¼çܯó›ʒ �ã炼 � Ø›Üç¼ãÜʍ � ՛بÈØÁ‚› � ÈØ � ‚¯›ó›Á›ÂãÜ � Á‚ö � •¯¨¨›Ø � Á‚ã›Ø¯‚¼¼öʍ � ‚• � ÕÈã›Â㯂¼¼ö � ‚•ó›ØÜ›¼öʍ � ¨ØÈÁ � ‚Âö � ÕØȸ›ã¯ÈÂÜ � ‚• � ¨ÈØô‚Ø• ʣ ¼Èȹ¯Â© � Üã‚ã›Á›ÂãÜ � ‚• � ã› � ‚ÜÜçÁÕã¯ÈÂÜ � È � ô¯ � ãÈÜ› � ¨ÈØô‚Ø• ʣ ¼Èȹ¯Â© � Üã‚ã›Á›ÂãÜ � ‚Ø› � Ž‚Ü›•ʒ � d›Ø› � ‚ � Ž› � ÂÈ � ‚ÜÜç؂› � ã‚ã � ã› � •‚ã‚ � ÈÂク›• � ›Ø›¯Â � ¯Ü � Ø›¨¼›ã¯ó› � Ȩ � ¨çãçØ› � ՛بÈØÁ‚› � ãÈ � ‚Âö � •›©Ø››ʒ � yÈç � ‚Ø› � ‚çã¯È›• � ÂÈã � ãÈ � Õ¼‚› � çÂ•ç› � Ø›¼¯‚› � È � ¨ÈØô‚Ø• ʣ ¼Èȹ¯Â© � Üã‚ã›Á›ÂãÜ � ‚Ü � ‚ � ÕØ›•¯ãÈØ � Ȩ � ¨çãçØ› � ՛بÈØÁ‚› � ‚Ü � ÕØȸ›ã›• � ¨¯Â‚¯‚¼ � ¯Â¨ÈØÁ‚ã¯È � ‚• � Èã›Ø � ¯Â¨ÈØÁ‚ã¯È � ‚Ø› � Ž‚Ü›• � È � ›Üã¯Á‚ã›Ü � ‚• � ‚ÜÜçÁÕã¯ÈÂÜ � ã‚ã � ‚Ø› � ¯Â›Ø›Âã¼ö � Ü玸›ã � ãÈ � ó‚دÈçÜ � ܯ©Â¯¨¯‚Âã � دܹÜʍ � ç›ØクÂã¯›Ü � ‚• � Èã›Ø � ¨‚ãÈØÜʍ � Á‚Âö � Ȩ � ô¯ � ‚Ø› � Ž›öÈ• � ÈçØ � ÈÂãØȼʒ � �¼¼ � ¯Â¨ÈØÁ‚ã¯È � Ü›ã � ¨ÈØã � ›Ø›¯Â � ÜÕ›‚¹Ü � ȼö � ‚Ü � Ȩ � ã› � •‚ã› � ›Ø›È¨ � ¯Â � ã› � ‚Ü› � Ȩ � ¯Â¨ÈØÁ‚ã¯È � ‚ŽÈçã � dç•›Ø � �د•©› � 0tʍ � ��* � ‚• � �ȯ›¹ � ÈØ � ã› � •‚ã› � Ȩ � Üç � ¯Â¨ÈØÁ‚ã¯È � ¯Â � ã› � ‚Ü› � Ȩ � ¯Â¨ÈØÁ‚ã¯È � ¨ØÈÁ � Õ›ØÜÈÂÜ � Èã›Ø � ã‚ � dç•›Ø � �د•©› � 0tʍ � ��* � ‚• � �ȯ›¹ʍ � ‚• � ô› � •¯Ü¼‚¯Á � ‚Âö � ¯Âã›Âã¯È � ÈØ � ÈŽ¼¯©‚ã¯È � ãÈ � çÕ•‚ã› � ‚Âö � ¨ÈØô‚Ø• � ¼Èȹ¯Â© � Üã‚ã›Á›ÂãÜ � ‚Ü � ‚ � Ø›Üç¼ã � Ȩ � •›ó›¼ÈÕÁ›ÂãÜ � ÈçØد© � ‚¨ã›Ø � ã› � •‚ã› � Ȩ � ã¯Ü � Õ؛ܛÂã‚ã¯ÈÂʒ � (ÈØ›‚ÜãÜ � ‚• � ›Üã¯Á‚ã›Ü � Ø›©‚Ø•¯Â© � �ȯ›¹ʭÜ � ¯Â•çÜãØö � ‚• � ›Â• � Á‚ع›ãÜ � ‚Ø› � Ž‚Ü›• � È � ÜÈçØ›Ü � ô› � Ž›¼¯›ó› � ãÈ � Ž› � Ø›¼¯‚Ž¼›ʍ � Èô›ó›Ø � ã›Ø› � ‚ � Ž› � ÂÈ � ‚ÜÜç؂› � ã›Ü› � ¨ÈØ›‚ÜãÜ � ‚• � ›Üã¯Á‚ã›Ü � ô¯¼¼ � ÕØÈó› � ‚çØ‚ã› � ¯Â � ôȼ› � ÈØ � ¯Â � Õ‚Øãʒ � �ÂÂ炼¯ú›•ʍ � ÕØÈ � ¨ÈØÁ‚ʍ � ÕØȸ›ã›• � ‚• � ›Üã¯Á‚㛕 � ÂçÁŽ›ØÜ � ‚Ø› �� çÜ›• � ¨ÈØ � ¯¼¼çÜãØ‚ã¯ó› � ÕçØÕÈÜ› � ȼöʍ � ‚Ø› � ÂÈã � ¨ÈØ›‚ÜãÜ � ‚• � Á‚ö � ÂÈã � Ø›¨¼›ã � ‚ã炼 � Ø›Üç¼ãÜ CÈ � I¨¨›Ø � ÈØ � ]ȼ¯¯ã‚ã¯È d¯Ü � Õ؛ܛÂã‚ã¯È � Ü‚¼¼ � ÂÈã � ÈÂÜã¯ãçã› � ‚ � Üȼ¯¯ã‚ã¯È � Ȩ � ‚ � ÕØÈõöʍ � ÈÂÜ›Âãʍ � ÈØ � ‚çãÈدú‚ã¯È � ô¯ã � Ø›ÜÕ›ã � ãÈ � ‚Âö � Ü›çØ¯ã¯›Ü � ÈØ � ¯Â � Ø›ÜÕ›ã � Ȩ � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʒ � d¯Ü � Õ؛ܛÂã‚ã¯È � Ü‚¼¼ � ‚¼ÜÈ � ÂÈã � ÈÂÜã¯ãçã› � ‚ � Ȩ¨›Ø � ãÈ � Ü›¼¼ � ÈØ � ã› � Üȼ¯¯ã‚ã¯È � Ȩ � ‚ � Ȩ¨›Ø � ãÈ � Žçö � ‚Âö � Ü›çد㯛Üʍ � ÂÈØ � Ü‚¼¼ � ã›Ø› � Ž› � ‚Âö � Ü‚¼› � Ȩ � Ü›çØ¯ã¯›Ü � ¯Â � ‚Âö � Üã‚ã›Ü � ÈØ � ¸çدܕ¯ã¯ÈÂÜ � ¯Â � ô¯ � Üç � Ȩ¨›Øʍ � Üȼ¯¯ã‚ã¯ÈÂʍ � ÈØ � Ü‚¼› � ôÈ缕 � Ž› � 缂ô¨ç¼ � ÕدÈØ � ãÈ � Ø›©¯ÜãØ‚ã¯È � ÈØ � ×炼¯¨¯‚ã¯È � ç•›Ø � ã› � Ü›çØ¯ã¯›Ü � ¼‚ôÜ � Ȩ � ‚Âö � Üç � ¸çدܕ¯ã¯ÈÂʒ � CÈ � Ȩ¨›Ø¯Â© � Ȩ � Ü›çØ¯ã¯›Ü � Ü‚¼¼ � Ž› � Á‚•› � ›õ›Õã � Žö � Á›‚ÂÜ � Ȩ � ‚ � ÕØÈÜÕ›ãçÜ � Á››ã¯Â© � ã› � Ø›×ç¯Ø›Á›ÂãÜ � Ȩ � ]›ã¯È � ɷɶ � Ȩ � ã› � ]›çØ¯ã¯›Ü � �ã � Ȩ � ɷɿɹɹʍ � ‚Ü � ‚Á›Â•›•ʍ � ÈØ � ‚ � ›õ›ÁÕã¯È � ã›Ø›¨ØÈÁʒ CÈ ʣ 0(Y] � (¯Â‚¯‚¼ � B›‚ÜçØ›Ü d¯Ü � Õ؛ܛÂã‚ã¯È � ¯Â¼ç•›Ü � ›Øク � ¨¯Â‚¯‚¼ � Á›‚ÜçØ›Ü � ÂÈã � Õ؛Ղ؛• � ¯Â � ‚ÈØ•‚› � ô¯ã � 0(Y]ʍ � ô¯ � ÈÂÜã¯ãçã› � ʪÂÈ ʣ 0(Y] � ¨¯Â‚¯‚¼ � Á›‚ÜçØ›Üʫ � ‚Ü � •›¨¯Â›• � Žö � ã› � Øç¼›Ü � Ȩ � ã› � ]��ʒ � d› � ÂÈ ʣ 0(Y] � ¨¯Â‚¯‚¼ � Á›‚ÜçØ› � ¯Ü � ��0d��ʒ � d¯Ü � ÂÈ ʣ 0(Y] � ¨¯Â‚¯‚¼ � Á›‚ÜçØ› � ‚Ü � Ž››Â � ¯Â¼ç•›• �� Ž›‚çÜ› � �ȯ›¹ � Ž›¼¯›ó›Ü � ¯ã � ÕØÈó¯•›Ü � ‚ � ‚••¯ã¯È‚¼ � ãÈȼ � ¨ÈØ � ¯Âó›ÜãÈØÜ � ãÈ � çÜ› � ¯Â � ›ó‚¼ç‚ã¯Â© � ¯ãʭÜ � ¨¯Â‚¯‚¼ � ՛بÈØÁ‚› � ‚• � ÕØÈÜÕ›ãÜʒ � ��0d�� � ÜÈ缕 � ÂÈã � Ž› � ÈÂܯ•›Ø›• � ¯Â � ¯Üȼ‚ã¯È � ¨ØÈÁʍ � ÈØ � ‚Ü � ‚ � ‚¼ã›Ø‚ã¯ó› � ãÈʍ � ¨¯Â‚¯‚¼ � Á›‚ÜçØ›Ü � •›ã›ØÁ¯Â›• � ¯Â � ‚ÈØ•‚› � ô¯ã � 0(Y]ʒ � 0 � ‚••¯ã¯ÈÂʍ � ã¯Ü � ÂÈ ʣ 0(Y] � ¨¯Â‚¯‚¼ � Á›‚ÜçØ› � Á‚ö � •¯¨¨›Ø � ¨ØÈÁ � ÂÈ ʣ 0(Y] � ¨¯Â‚¯‚¼ � Á›‚ÜçØ›Ü � ô¯ã � ÈÁÕ‚Ø‚Ž¼› � ‚Á›Ü � çÜ›• � Žö � Èã›Ø � ÈÁՂ¯›Üʒ

3 �ȯ›¹ʍ � 0Âʒ � Ió›Øó¯›ô Mission : to increase the accessibility of new forms of investing and commerce for our highly - engaged customer base • =›‚•¯Â© � 9‚Ղ›ܛ � ØöÕãÈ � ›õ‚©› � ÈÁÕ‚Âö • I՛؂ã›Ü � È› � Ȩ � ã› � ¼‚Ø©›Üã � •ÈÁ›Ü㯠� Áç¼ã¯ ʣ � ØöÕãÈçØØ›Âö � Á‚ع›ãÕ¼‚›Ü � ‚• � ØöÕãÈ � ‚ÜÜ›ã� ›õ‚©›Ü � ¯Â � 9‚Õ‚Â • ]›Øó¯›Ü � ÜçÕÕÈØã¯Â© � ɸɿ � ØöÕãÈçØØ›Âö � ãȹ›ÂÜ� ‚ØÈÜÜ � ÈçØ � B‚ع›ãÕ¼‚› � ‚• � �õ‚©› � Õ¼‚ã¨ÈØÁÜ� ¨ÈØ � ãØ‚•¯Â© � ‚• � çÜãÈ•öʍ � ‚Ü � ô›¼¼ � ‚Ü � Èã›Ø � ØöÕãÈ� ‚ã¯ó¯ã¯›Ü � ¯Â¼ç•¯Â© � 0¯㯂¼ � �õ‚©› � I¨¨›Ø¯Â©Ü � ʞ0�IÜʟ� ‚• � C(dÜ • Y›©¯Üã›Ø›• � ØöÕãÈ � ‚ÜÜ›ã � ›õ‚©› � Ü›Øó¯› � ÕØÈó¯•›Ø ô¯ã � ã› � (¯Â‚¯‚¼ � ]›Øó¯›Ü � �©›Âö � Ȩ � 9‚Õ‚Â � ʞ9(]�ʟ • ]çŽÜ¯•¯‚Øö � Ȩ � BÈ›õ � *ØÈçÕʍ � ‚ � •¯ó›Øܯ¨¯›• � ¨¯Â‚¯‚¼�Ü›Øó¯›Ü � ÈÁÕ‚Âö � Õ玼¯¼ö � ¼¯Ü㛕 � È � ã› � dȹöÈ�]ãȹ � �õ‚©› =›‚•¯Â© � 9‚Ղ›ܛ � ØöÕãÈ � Žçܯ›ÜÜ � ¯Â � ÕØÈ›ÜÜ � Ȩ � ¼¯Üã¯Â© � Õ玼¯¼ö � ¯Â � ã› � hʒ]ʒ Who is Coincheck Process Update Coincheck is undergoing a business combination with Thunder Bridge Capital Partners IV (“Thunder Bridge”) to become publicly listed in the United States • �ÂÂÈ盕 � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯È � ô¯ã � ÜÕ›¯‚¼� ÕçØÕÈÜ› � ‚×ç¯Ü¯ã¯È � ÈÁÕ‚Âö � ʞ]V��ʟ � dç•›Ø� �د•©› � ¯Â � B‚Ø � ɸɶɸɸ � ãÈ � ¼¯Üã � Õ玼¯¼ö � È � ã› � C‚Ü•‚× • 0Âã›Â• � ãÈ � çÜ› � Õ玼¯ � ¼¯Üã¯Â© � ãÈ � ‚›ÜÜ � ©¼ÈŽ‚¼� ¯Âó›ÜãÈØ � Ž‚Ü› � ‚• � çÜ› � Õ玼¯ � Üãȹ � ‚Ü � ‚×ç¯Ü¯ã¯ÈÂ� çØØ›Âö • I©ȯ© � •¯‚¼È©ç› � ‚• � Áç¼ã¯Õ¼› � Ø›©ç¼‚ãÈØö� ÜçŽÁ¯ÜܯÈÂÜ � ãÈ � ã› � hʒ]ʒ � ]��ʍ � ÁÈÜã � Ø››Âã¼ö � ÈÂ� �ç©çÜã � ɸ • ʍ � ɸɶɸɺ • �õã›Â•›• � Èçãܯ•› � •‚ã› � ¨ÈØ � ã›ØÁ¯Â‚ã¯È � •‚ã› � Ȩ� �çܯ›ÜÜ � �ÈÁŽ¯Â‚ã¯È � �©Ø››Á›Âã � ô¯ã � dç•›Ø��د•©› � ãÈ � 9‚Âç‚Øö � ɸ • � ɸɶɸɻ

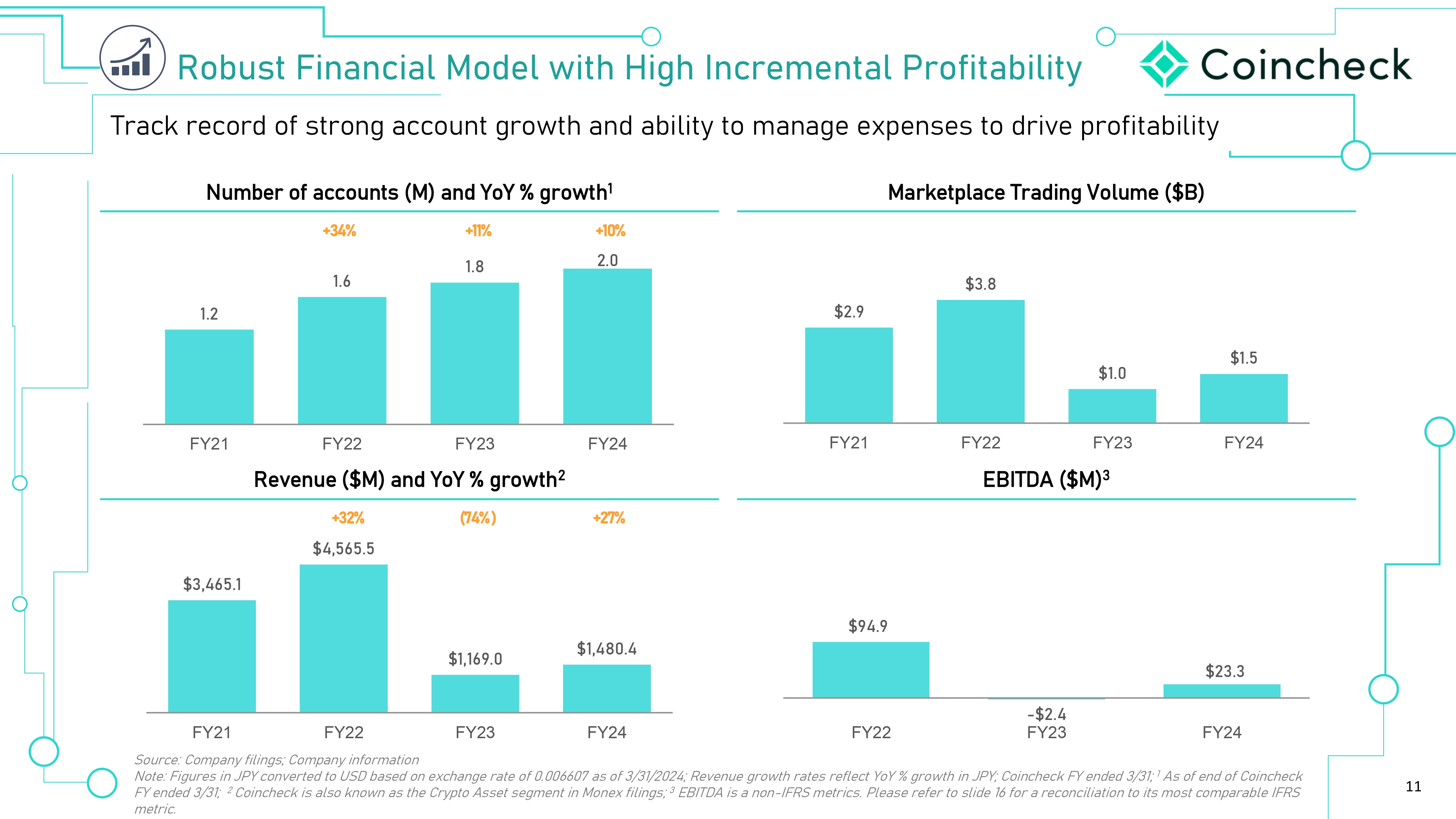

4 I› � Ȩ � ã› � =‚Ø©›Üã � �ØöÕãÈ � V¼‚ã¨ÈØÁÜ � ¯Â � 9‚Õ‚Â d› � �ȯ›¹ � IÕÕÈØãç¯ãö Providing Japanese Customers & Institutions with Direct Access to the Global Crypto Economy Source: Company filings Note: Figures in JPY converted to USD based on exchange rate of 0.006607 as of 3/31/2024; 1 As of Mar - 2024; Coincheck FY ended 3/31; Does not include NFTs; 2 Coincheck is also known as the Crypto Asset segment in Monex filings; 3 Represents J - GAAP accounting of customer assets which is calculated as the sum of crypto currencies deposited by customers and fiat currency deposited by customers Broad Product Set x �›•¯‚㛕 � ØöÕãÈ � ›õ‚©› � ¨ÈØ� ؛ク¼ � çÜãÈÁ›ØÜ x dØ‚•¯Â© � Õ¼‚ã¨ÈØÁ � ¨ÈØ� ÕØȨ›ÜܯÈ‚¼ � ãØ‚•›ØÜ x C(d � Á‚ع›ãÕ¼‚› x YÈŽçÜã � ÜÕØ›‚• ʣ Ž‚Ü›• � Žçܯ›ÜÜ� ÁÈ•›¼ � ô¯ã � ÕÈã›Â㯂¼ � ¨ÈØ � ¯©� ¯ÂØ›Á›Âゼ � ÕØȨ¯ã‚Ž¯¼¯ãö x dÈØÈç© � ö›ã � Ü›‚Á¼›ÜÜ � :y�� ‚• � �B= � ÕØÈ›•çØ›Ü � ‚•� ÈÂŽÈ‚Ø•¯Â© Strong track record of growth and “first crypto account” status ~2.0M accounts 1 29 supported crypto assets $4.7B customer assets 1, 3 $1.5B FY24 Marketplace trading value 1 27% FY24 YoY revenue growth 1, 2 $23mm FY24 EBITDA 1

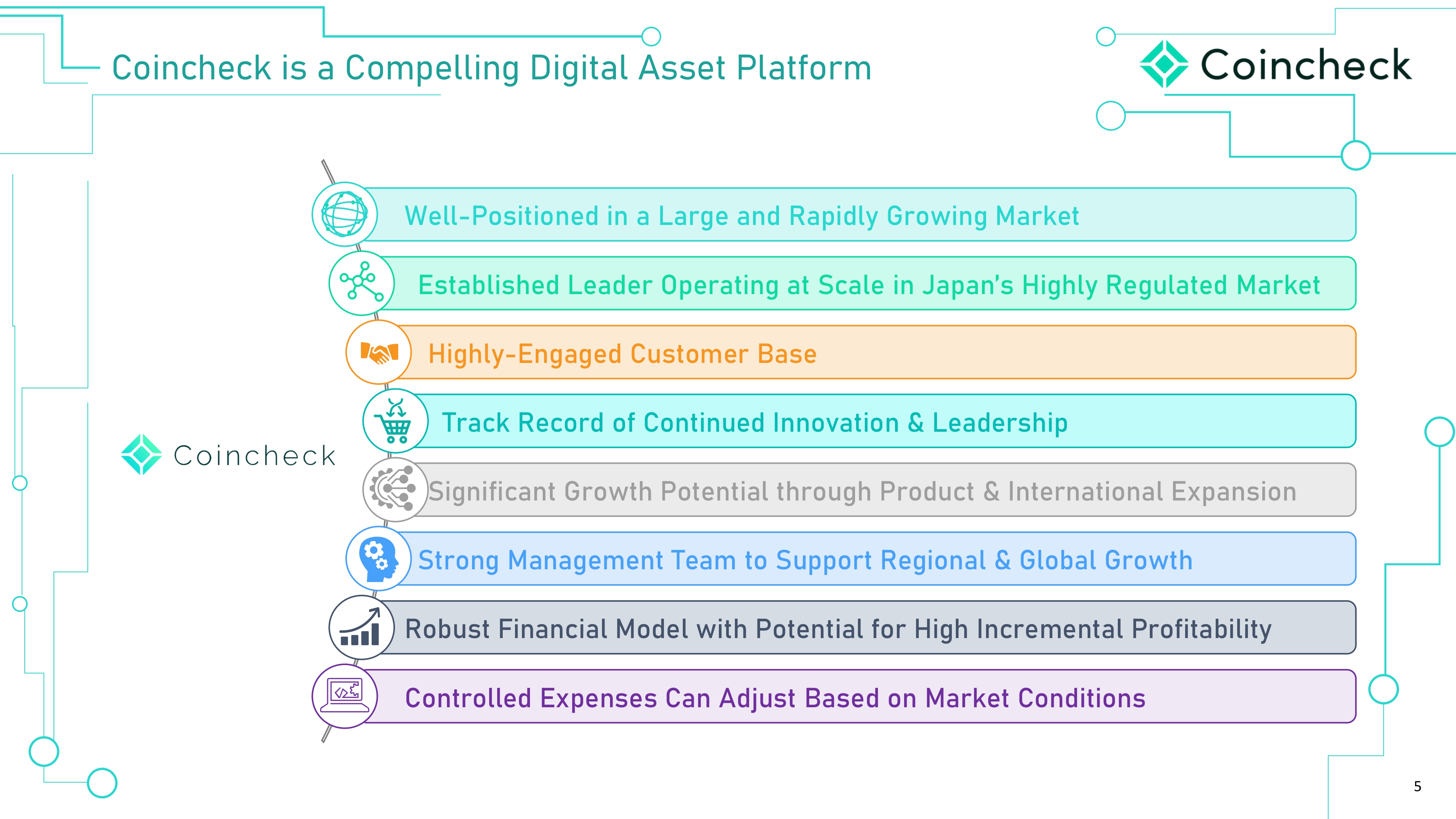

5 w›¼¼ ʣ VÈܯã¯È›• � ¯Â � ‚ � =‚Ø©› � ‚• � Y‚Õ¯•¼ö � *ØÈô¯Â© � B‚ع›ã �Üã‚Ž¼¯Ü›• � =›‚•›Ø � I՛؂ã¯Â© � ‚ã � ]‚¼› � ¯Â � 9‚Õ‚ÂʭÜ � .¯©¼ö � Y›©ç¼‚㛕 � B‚ع›ã .¯©¼ö ʣ �©‚©›• � �çÜãÈÁ›Ø � �‚Ü› dØ‚¹ � Y›ÈØ• � Ȩ � �ÈÂã¯Â盕 � 0ÂÂÈó‚ã¯È � ˬ � =›‚•›ØÜ¯Õ ]¯©Â¯¨¯‚Âã � *ØÈôã � VÈã›Â㯂¼ � ãØÈç© � VØÈ•çã � ˬ � 0Âã›Ø‚ã¯È‚¼ � �õÕ‚ÂܯÈ ]ãØÈ© � B‚‚©›Á›Âã � d›‚Á � ãÈ � ]çÕÕÈØã � Y›©¯È‚¼ � ˬ � *¼ÈŽ‚¼ � *ØÈôã� YÈŽçÜã � (¯Â‚¯‚¼ � BÈ•›¼ � ô¯ã � VÈã›Â㯂¼ � ¨ÈØ � .¯© � 0ÂØ›Á›Âゼ � VØȨ¯ã‚Ž¯¼¯ãö� �ÈÂãØȼ¼›• � �õÕ›ÂÜ›Ü � �‚ � �•¸çÜã � �‚Ü›• � È � B‚ع›ã � �È•¯ã¯ÈÂÜ �ȯ›¹ � ¯Ü � ‚ � �ÈÁÕ›¼¼¯Â© � �¯©¯ã‚¼ � �ÜÜ›ã � V¼‚ã¨ÈØÁ

6 =‚Ø©› � ‚• � �ããØ‚ã¯ó› � B‚ع›ã � ¯Â � �‚ؼö � ]ã‚©›Ü � Ȩ � �•ÈÕã¯È x 9‚Õ‚Â � ¯Ü � ã› � 4 th largest global economy ʞ˚ɺʒɸã � *�Vʟ ɻ ʍ � ô¯ã � ‚ � ©ØÈô¯Â© � ‚•�¯ÂØ›‚ܯ©¼ö � ÜÈÕ¯Ü㯂㛕 � ç¯ó›ØÜ› � Ȩ� ¯Âó›ÜãÈØÜ � Ü››¹¯Â© � ô›‚¼ã � ©›Â›Ø‚ã¯ÈÂ�ÈÕÕÈØãçÂ¯ã¯›Ü x I¼ö � ɽʒɽ˩ ɸ � Ȩ � 9‚Ղ›ܛ � ÕÈÕ缂ã¯È � ÈôÂÜ� ØöÕãÈ � ʞóÜʒ � ɷɽ˩ ɼ � Ȩ � h] � ÕÈÕ缂ã¯ÈÂʟʍ � Ø›¨¼›ã¯Â©� ã› � nascency Ȩ � ã› � 9‚Ղ›ܛ � Á‚ع›ã x w›¼¼ � ÕÈܯã¯È›• � ãÈ � Ü›Øó¯› � ‚ � ¼‚Ø©›¼ö� ç•›ØÜ›Øó›• � ¼È‚¼ � institutional investor base x 9‚Õ‚ÂʭÜ � thoughtful crypto regulation ÁÈ•›¼� ¯Ü � •›Ü¯©Â›• � ‚ØÈç• � ÕØÈã›ã¯Â© � ã›� ÈÂÜçÁ›Ø Crypto Penetration in Japan Massive Untapped Market Opportunity Note : 1 As of Mar - 2024 ; 2 As of March 2024 , according to data from the JVCEA ; 3 As of Jun - 2024 ; 4 Index of crypto adoption determined by rating 146 countries’ peer - to - peer exchange trade volume and on - chain cryptocurrency and retail value received at centralized exchanges and from DeFi protocols from 0 (lowest rank) to 1 (highest rank) by Chainalysis in September 2022 ; 5 Per Associated Press February 2024 article titled “Japan slips into a recession and loses its spot as the world’s third - largest economy” as of end of 2023 ; 6 As of January 2024 , according to Morning Consult Japan Germany United Kingdom China United States Source: Statistics Bureau of Japan; Japan Virtual and Crypto assets Exchange Association; The 2022 Geography of Cryptocurrency Report: Analysis of Geographic Trends in Cryptocurrency Adoption and Usage by Chainalysis, September 2022; Morning Consult; Associated Press 9.9M 2 124M 1 Japan Population Japan Crypto Community ~2.0M 3 Coincheck User Base Crypto Adoption by Market Snapshot 4 Today, Japan’s digital asset adoption is relatively low, representing an opportunity to ‘catch - up’ to countries of similar economic size 0.339 0.387 0.473 0.535 0.653

Stablecoins (used for payments) Travel rule Licensing / Registration Regulatory framework Jurisdiction 7 0•¯‚ 0ゼö =‚ãó¯‚ =çõ›ÁŽÈçØ© B‚¼ã‚ B‚çدã¯çÜ CÈØô‚ö Vȼ‚• VÈØãç©‚¼ X‚ã‚Ø ]¯Â©‚ÕÈØ› ]¼È󂹯‚ ]Èçã � �¨Ø¯‚ ]ô¯ãú›Ø¼‚• d‚¯ô‚ dçع›ö h¯㛕 � �Ø‚Ž � �Á¯Ø‚ã›Ü Stablecoins (used for payments) Travel rule Licensing / Registration Regulatory framework Jurisdiction Japan h¯㛕 � ]ã‚ã›Ü h¯㛕 � :¯Â©•ÈÁ �çÜãØ‚¼¯‚ �çÜãد‚ �‚‚Á‚Ü �‚Ø‚¯Â �‚‚•‚ �‚öÁ‚ � 0ܼ‚奆 �›ÂÁ‚ع �Üãȯ‚ (؂› *›ØÁ‚Âö *¯ŽØ‚¼ã‚Ø .È© � :È© .ç©‚Øö 9‚Õ‚Â � ]ã‚奆 � Içã � ‚Ü � ‚ � B‚ع›ã � ¨ÈØ � �ØöÕãÈ � �ã¯ó¯ãö =›©¯Ü¼‚ã¯È � ʘ � Y›©ç¼‚ã¯È � ¯Â � Õ¼‚› �ã¯ó› � Ø›©ç¼‚ãÈØö � ›Â©‚©›Á›Âã Y›©ç¼‚ãÈØö � ÕØÈ›ÜÜ � ÂÈã � ¯Â¯ã¯‚㛕 Source: PwC Global Crypto Regulation Report 2024 Note: Regulatory assessment is based on the analysis undertaken by individual PwC member firms �ØöÕãÈ � Ø›©ç¼‚ã¯È � ‚ã � ‚ � ©¼‚›

8 =›‚•›Ø � ¯Â � 9‚Õ‚ÂʭÜ � .¯©¼ö � Y›©ç¼‚㛕 � B‚ع›ã �ȯ›¹ � ¯Ü � ‚ � Ü‚Ø› � ‚ÜÜ›ãʍ � È՛؂ã¯Â© � ‚ã � Ü‚¼› =›‚•¯Â© � 9‚Ղ›ܛ � ØöÕãÈ � ‚ÕÕ ]‚Ø› � Ȩ � 9‚Õ‚Â � Á‚ع›ã � ʞŽö � ‚ÈçÂãÜʟ ɷ Strong market share driven by trusted and recognized brand, robust relative product offering, and strong customer experience Source: AppTweak; Japan Virtual and Crypto assets Exchange Association Note: Figures are approximate based on rounding; 1 As of Mar - 2024; 2 Based on downloads among Japanese crypto asset exchange apps between 2019 - 2023; 3 As of June. 30, 2024 ■ �ȯ›¹ ˛ Iã›Ø � 9‚Ղ›ܛ � ›õ‚©›Ü 20% 80% 9.9M No.1 domestic market share for 5 consecutive years 2 6.51 million downloads 3

9 19% 34% 27% 14% 6% .¯©¼ö ʣ �©‚©›• � �çÜãÈÁ›Ø � �‚Ü› Coincheck’s platform strongly aligns with its user base, offering products and services that cater towards a young demographic Note: Figures are approximate based on rounding; 1 As of Mar - 2024 ˛ ɸɶÜ � ˬ � ç•›Ø � ˛ ɹɶÜ � ˛ ɺɶÜ � ˛ ɻɶÜ � ˛ ɼɶÜ � ˬ � Èó›Ø Users by Age 1 Customer - Centric Product Strategy �ȯ›¹ʭÜ � ÕØÈ•çã � ‚• � Žçܯ›ÜÜ � Üã؂㛩ö � ¯Ü� ¯Â¨ÈØÁ›• � Žö � ¯ãÜ � çÜãÈÁ›Ø � •›ÁÈ©Ø‚Õ¯Üʍ � ô¯ã� ŽØÈ‚• � ãȹ›Â � Èó›Ø‚©›ʍ � C(d � ÜçÕÕÈØãʍ � ‚• � w›Žɹ � ‚¼¼� ‚ÕÕ›‚¼¯Â© � ãÈ � Á¯¼¼›Â¯‚¼ � ‚• � ¼‚ã›Ø � ©›Â›Ø‚ã¯ÈÂÜ x �›•¯‚㛕 � C(d � Á‚ع›ãÕ¼‚› x �õÕÈÜçØ› � ãÈ � Ø›©ç¼‚㛕 � •¯©¯ã‚¼ � ‚ÜÜ›ãÜ x BÈŽ¯¼› ʣ ‚ã¯ó› � çÜ›Ø � ¯Âã›Ø¨‚› � ʞ‚ÕÕʟ x ]›‚Á¼›ÜÜ � :y� � ÈÂŽÈ‚Ø•¯Â© � ó¯‚ � ÁÈŽ¯¼› � ‚ÕÕ 50%+ of users are in their 30s and younger 1

10 IçØ � Y›ó›Âç› � BÈ•›¼ Source: Company filings Note: Figures in JPY converted to USD based on exchange rate of 0.006607 as of 3/31/2024 Transaction Revenue 92.5% of Total Revenue Transaction Volume (Marketplace) Spread 3.42% Average Spread $1.5B Total FY24 Volume X Total Revenue Non - Transaction Revenue NFTs Initial Exchange Offering Wholesale services Cryptocurrency subscriptions Deposit and Withdrawal Fees (Crypto + Fiat) 7.5% of Total Revenue

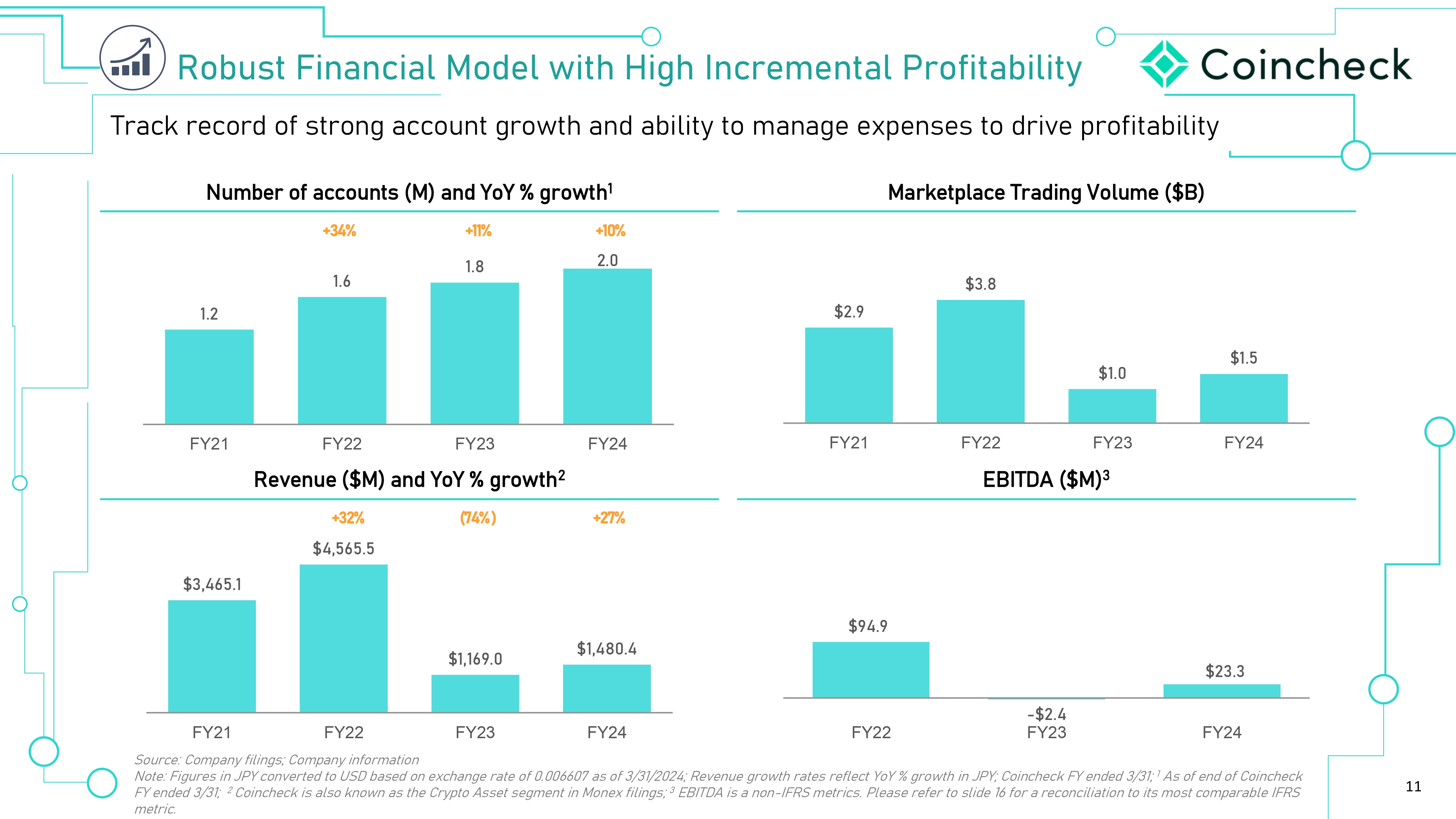

11 ˚ɿɺʒɿ ʣ ˚ɸʒɺ FY23 FY24 ˚ɸɹʒɹ FY21 FY22 FY23 FY24 FY22 ˚ɸʒɿ ˚ɹʒɾ ˚ɷʒɶ ˚ɷʒɻ FY21 FY22 FY23 ��0d�� � ʞ˚Bʟ ɹ FY24 ˚ɹʍɺɼɻʒɷ ˚ɷʍɷɼɿʒɶ ˚ɷʍɺɾɶʒɺ YÈŽçÜã � (¯Â‚¯‚¼ � BÈ•›¼ � ô¯ã � .¯© � 0ÂØ›Á›Âゼ � VØȨ¯ã‚Ž¯¼¯ãö dØ‚¹ � Ø›ÈØ• � Ȩ � ÜãØÈ© � ‚ÈçÂã � ©ØÈôã � ‚• � ‚Ž¯¼¯ãö � ãÈ � Á‚‚©› � ›õÕ›ÂÜ›Ü � ãÈ � •Ø¯ó› � ÕØȨ¯ã‚Ž¯¼¯ãö CçÁŽ›Ø � Ȩ � ‚ÈçÂãÜ � ʞBʟ � ‚• � yÈy � ˩ � ©ØÈôã ɷ B‚ع›ãÕ¼‚› � dØ‚•¯Â© � tȼçÁ› � ʞ˚�ʟ Source : Company filings ; Company information Note : Figures in JPY converted to USD based on exchange rate of 0 . 006607 as of 3 / 31 / 2024 ; Revenue growth rates reflect YoY % growth in JPY ; Coincheck FY ended 3 / 31 ; 1 As of end of Coincheck FY ended 3 / 31 ; 2 Coincheck is also known as the Crypto Asset segment in Monex filings ; 3 EBITDA is a non - IFRS metrics . Please refer to slide 16 for a reconciliation to its most comparable IFRS metric . +27% ɷʒɸ ɷʒɼ ɷʒɾ +10% ɸʒɶ FY22 FY23 Y›ó›Âç› � ʞ˚Bʟ � ‚• � yÈy � ˩ � ©ØÈôã ɸ +32% (74% ) ˚ɺʍɻɼɻʒɻ FY21 FY24 +34% +11%

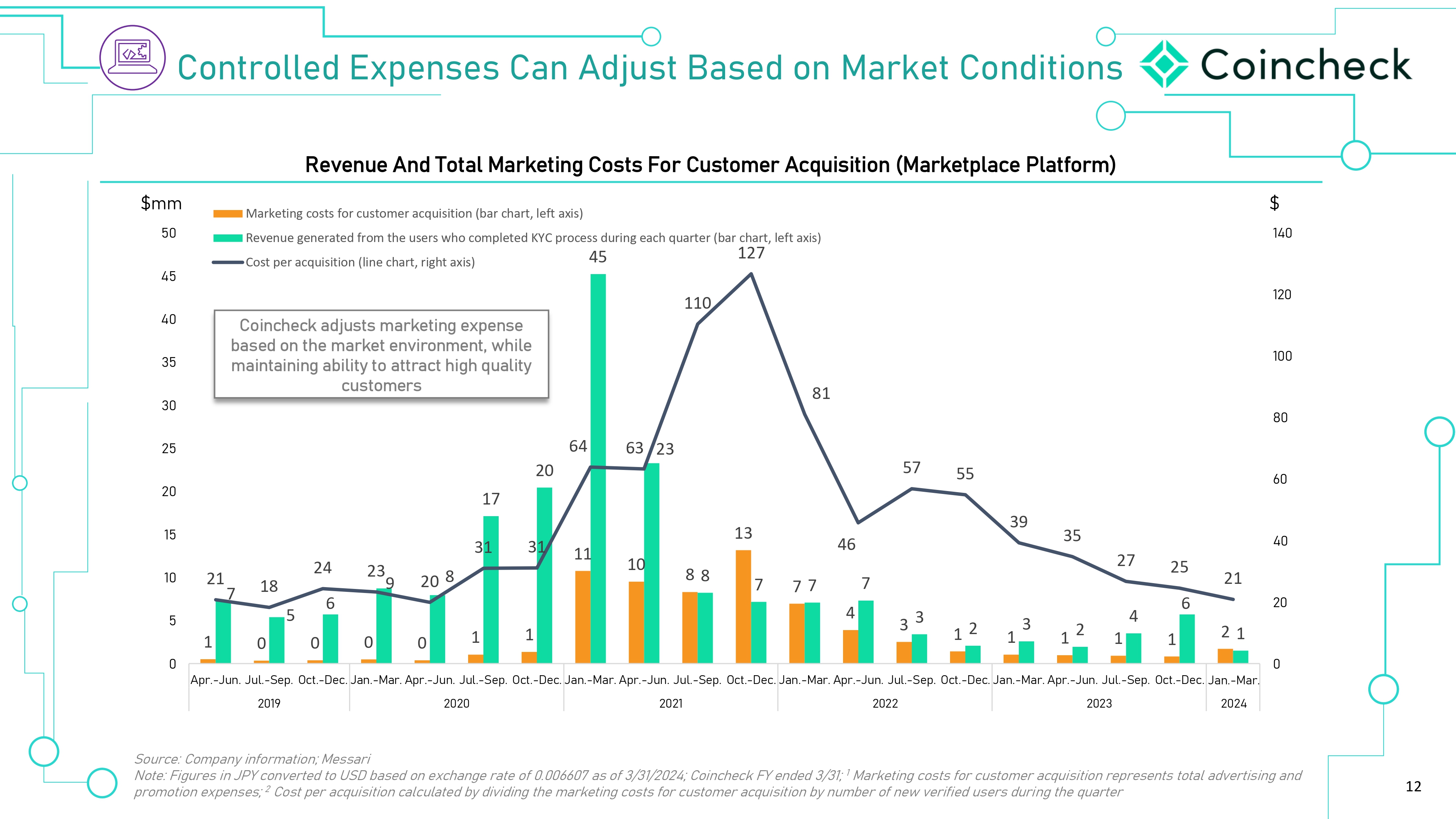

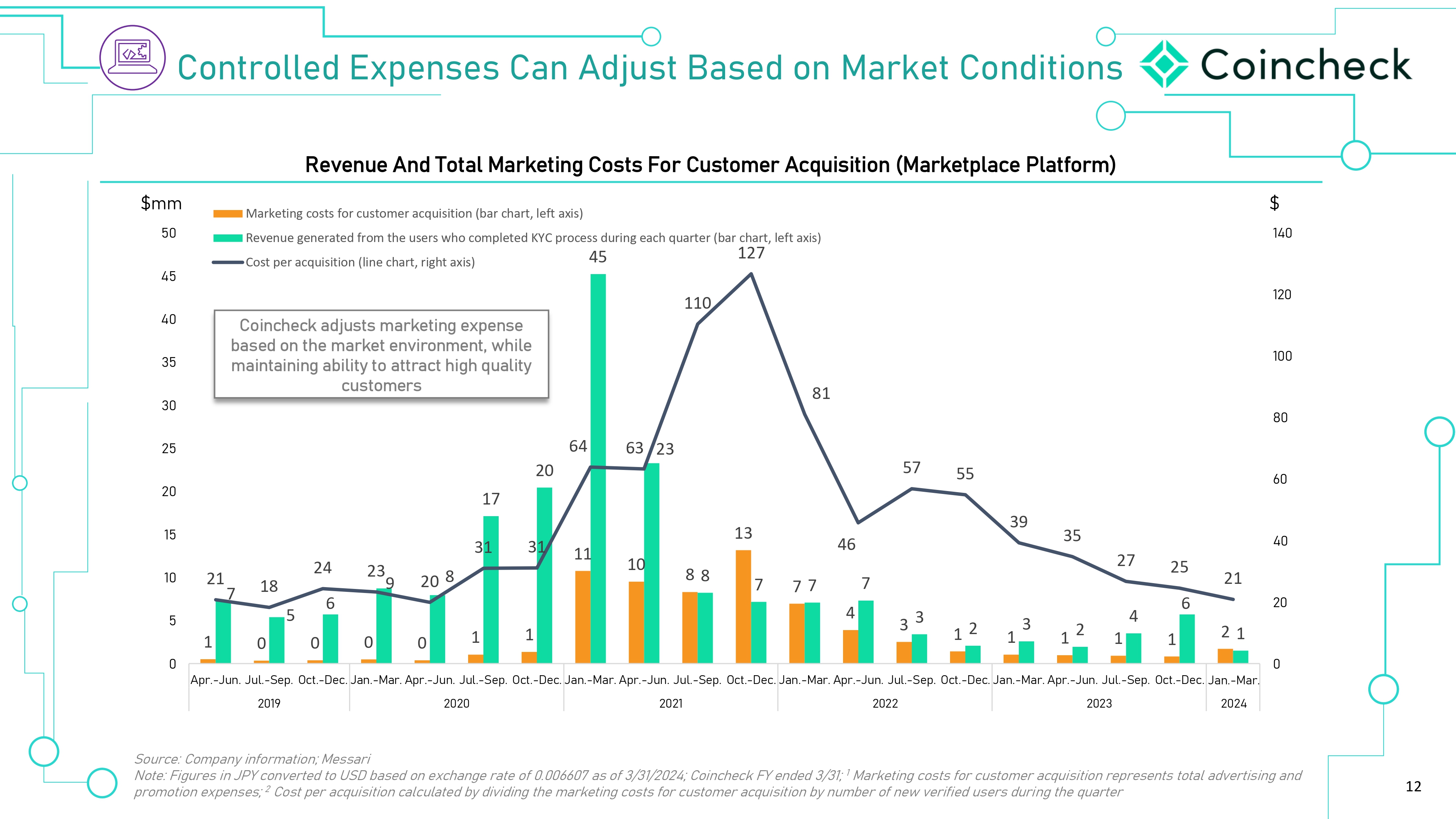

12 1 0 0 0 0 1 11 10 13 4 1 1 1 1 1 1 7 5 6 9 8 17 20 8 8 45 7 7 7 7 3 3 2 3 2 4 6 2 1 21 18 24 23 20 31 31 64 63 23 110 127 81 46 57 55 39 35 27 25 21 ɶ ɸɶ ɺɶ ɼɶ ɾɶ ɷɶɶ ɷɸɶ ˚ ɷɺɶ ɶ ɻ ɷɶ ɷɻ ɸɶ ɸɻ ɹɶ ɹɻ ɺɶ ɺɻ ˚ÁÁ ɻɶ �ÕØʒ ʣ 9çÂʒ � 9ç¼ʒ ʣ ]›Õʒ � Iãʒ ʣ �›ʒ � 9‚Âʒ ʣ B‚Øʒ � �ÕØʒ ʣ 9çÂʒ � 9ç¼ʒ ʣ ]›Õʒ � Iãʒ ʣ �›ʒ � 9‚Âʒ ʣ B‚Øʒ � �ÕØʒ ʣ 9çÂʒ � 9ç¼ʒ ʣ ]›Õʒ � Iãʒ ʣ �›ʒ � 9‚Âʒ ʣ B‚Øʒ � �ÕØʒ ʣ 9çÂʒ � 9ç¼ʒ ʣ ]›Õʒ � Iãʒ ʣ �›ʒ � 9‚Âʒ ʣ B‚Øʒ � �ÕØʒ ʣ 9çÂʒ � 9ç¼ʒ ʣ ]›Õʒ � Iãʒ ʣ �›ʒ � 9‚Âʒ ʣ B‚Øʒ ɸɶɷɿ ɸɶɸɶ ɸɶɸɷ ɸɶɸɸ ɸɶɸɹ ɸɶɸɺ Marketing costs for customer acquisition (bar chart, left axis) Revenue generated from the users who completed KYC process during each quarter (bar chart, left axis) Cost per acquisition (line chart, right axis) �ÈÂãØȼ¼›• � �õÕ›ÂÜ›Ü � �‚ � �•¸çÜã � �‚Ü›• � È � B‚ع›ã � �È•¯ã¯ÈÂÜ Source: Company information; Messari Note: Figures in JPY converted to USD based on exchange rate of 0.006607 as of 3/31/2024; Coincheck FY ended 3/31; 1 Marketing costs for customer acquisition represents total advertising and promotion expenses; 2 Cost per acquisition calculated by dividing the marketing costs for customer acquisition by number of new verified users during the quarter Y›ó›Âç› � �• � dÈゼ � B‚ع›ã¯Â© � �ÈÜãÜ � (ÈØ � �çÜãÈÁ›Ø � �×ç¯Ü¯ã¯È � ʞB‚ع›ãÕ¼‚› � V¼‚ã¨ÈØÁʟ �ȯ›¹ � ‚•¸çÜãÜ � Á‚ع›ã¯Â© � ›õÕ›ÂÜ› � Ž‚Ü›• � È � ã› � Á‚ع›ã � ›Âó¯ØÈÂÁ›Âãʍ � ô¯¼› � Á‚¯Âク¯© � ‚Ž¯¼¯ãö � ãÈ � ‚ããØ‚ã � ¯© � ×炼¯ãö � çÜãÈÁ›ØÜ

13 IçØ � *ØÈôã � ]ã؂㛩ö Solidify position as leading Japanese crypto exchange and deepen market penetration Advance the growth of the crypto ecosystem in both Japan and globally with growth in non - transaction - based offerings (e.g., IEOs, subscriptions) Introduce new digital asset - based products and capabilities, such as asset management Capitalize on longer - term Japanese institution opportunity in crypto by leveraging trusted brand Pursue strategically accretive investments and acquisitions in domestic exchange market and emerging crypto / blockchain technologies

14 �çܯ›ÜÜ � hÕ•‚ã› �ȯ›¹ � Üã‚Ø㛕 � ‚¯Ø¯Â© � dt� ÈÁÁ›Ø¯‚¼Ü � È � B‚ö � ɿʍ � ɸɶɸɺ � ãÈ� ‚×ç¯Ø› � ›ô � çÜãÈÁ›ØÜ � ‚• � ¨ÈÜã›Ø� ¯ãÜ � ŽØ‚• � ‚ô‚؛›ÜÜʒ ~2.0M accounts (+82K QoQ) =›‚•¯Â© � Á‚ع›ã � Ü‚Ø› � ô¯ã � ɸɶ˩ ɷ � Ü‚Ø› � Ȩ � ó›Ø¯¨¯›• � ‚ÈçÂãÜ CçÁŽ›Ø � Ȩ � ãȹ›ÂÜ � ÜçÕÕÈØ㛕 � ‚ØÈÜÜ � ÈçØ � B‚ع›ãÕ¼‚› � ‚• � �õ‚©› Õ¼‚ã¨ÈØÁÜ � ¨ÈØ � ãØ‚•¯Â© � ‚• � çÜãÈ•ö 29 coins �ȯ›¹ � ÈÂã¯Âç›Ü � ãÈ � ‚ããØ‚ã � çÜãÈÁ›ØÜ � ‚Ü � ‚ � ØöÕãÈ � ‚ÜÜ›ãÜ � ãØ‚•¯Â© � Õ¼‚ã¨ÈØÁ � ¯Â� 9‚Õ‚Â dt � ÈÁÁ›Ø¯‚¼Ü �ȯ›¹ � ÁÈŽ¯¼› � ‚ÕÕ �ȯ›¹ � ¨ÈØ � �çܯ›ÜÜ �ȯ›¹ � ‚Ü � ‚ � ©ØÈô¯Â© � Üç¯ã› � Ȩ� ¯ÂÜã¯ãçã¯È‚¼ � Ȩ¨›Ø¯Â©Üʍ � ÂÈã‚Ž¼ö � 0¯㯂¼� �õ‚©› � I¨¨›Ø¯Â©Ü � ʞ0�IÜʟʌ x 0 � ÈÁÕ¼¯‚› � ô¯ã � ©ç¯•›¼¯Â›Ü � •›ó›¼ÈÕ›• � Žö � ã› � 9t���ʍ � ô› � È•ç㛕 � ã› � ¨¯ØÜã � ‚ÕÕØÈó›• � 0�I � ¯Â � 9‚Õ‚Âʍ � ô¯ � ɼɹʍɾɻɹ � çÜ›ØÜ�‚ÕÕ¼¯›• � ãÈ � ‚• � ô‚Ü � Èó›ØÜçŽÜدŽ›• � Žö � ɸɺ � ã¯Á›Üʒ x Iã›Ø � ›õ‚ÁÕ¼›Ü � Ȩ � 0�IÜ � ô› � ‚ó› � ¨‚¯¼¯ã‚㛕 � ¯Â¼ç•› � �د¼¼¯‚Âã�ØöÕãÈʍ � ‚ � *‚Á›(¯ � Žçܯ›ÜÜ � ã‚ã � ç㯼¯ú›Ü � Ž¼È¹‚¯Â � ã›Âȼȩöʍ � ‚• � (‚ÂÕ¼‚ʍ � ‚ � ¨‚Â�¼çŽ� Üȯ‚¼ � Õ¼‚ã¨ÈØÁʒ Source: JVCEA Note: ¹ As of Mar - 2024; QoQ increase reflects change from number of verified accounts as of Dec - 23 to Mar - 24

15 �Õ՛•¯õ

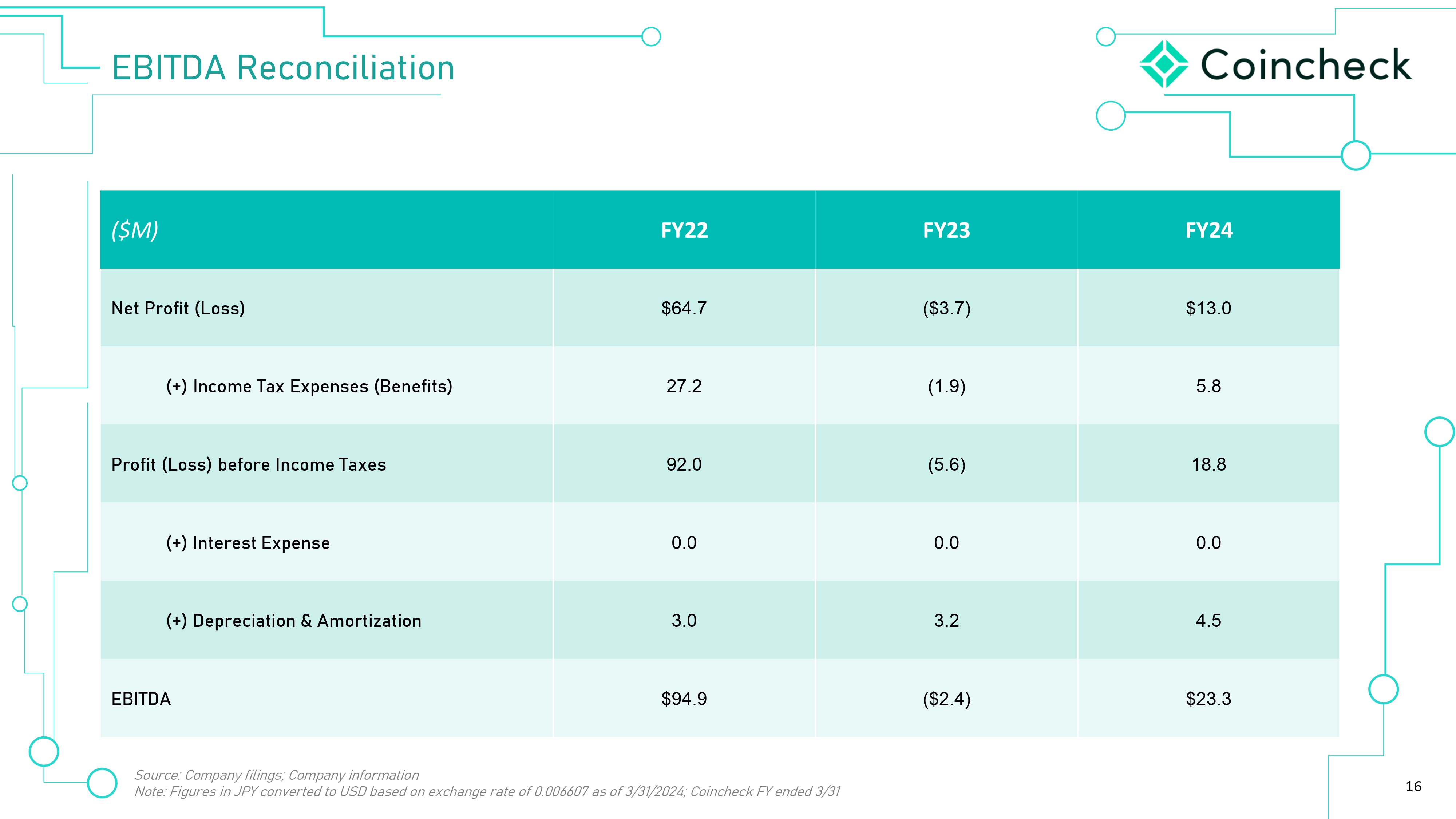

16 ��0d�� � Y›È¯¼¯‚ã¯È FY24 FY23 FY22 ($M) $13.0 ($3.7) $64.7 C›ã � VØȨ¯ã � ʞ=ÈÜÜʟ 5.8 (1.9) 27.2 ʞ˟ʟ � 0ÂÈÁ› � d‚õ � �õÕ›ÂÜ›Ü � ʞ�›Â›¨¯ãÜʟ 18.8 (5.6) 92.0 VØȨ¯ã � ʞ=ÈÜÜʟ � Ž›¨ÈØ› � 0ÂÈÁ› � d‚õ›Ü 0.0 0.0 0.0 ʞ˟ʟ � 0Âã›Ø›Üã � �õÕ›ÂÜ› 4.5 3.2 3.0 ʞ˟ʟ � �›ÕØ›¯‚ã¯È � ˬ � �ÁÈØã¯ú‚ã¯È $23.3 ($2.4) $94.9 ��0d�� Source: Company filings; Company information Note: Figures in JPY converted to USD based on exchange rate of 0.006607 as of 3/31/2024; Coincheck FY ended 3/31

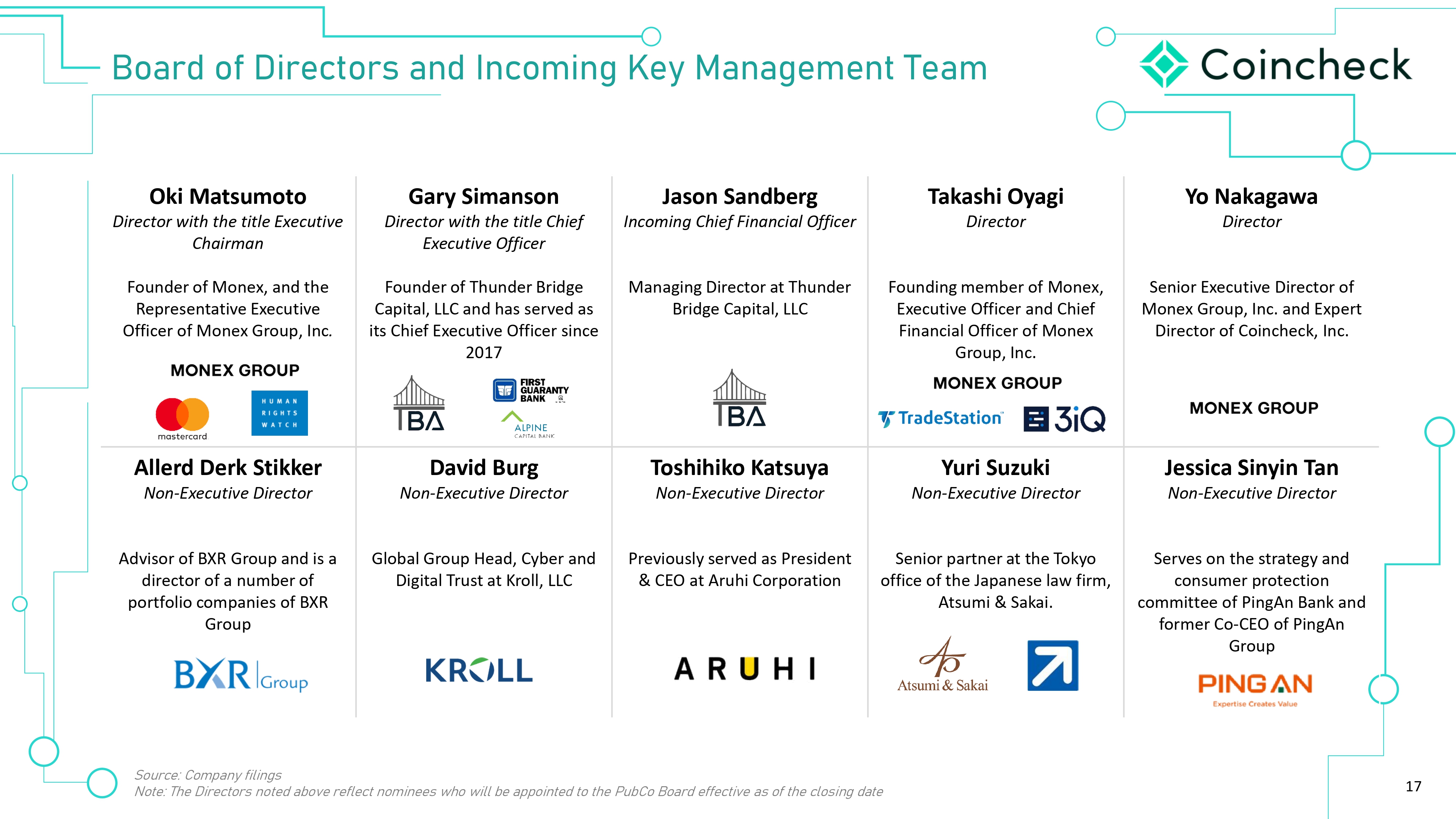

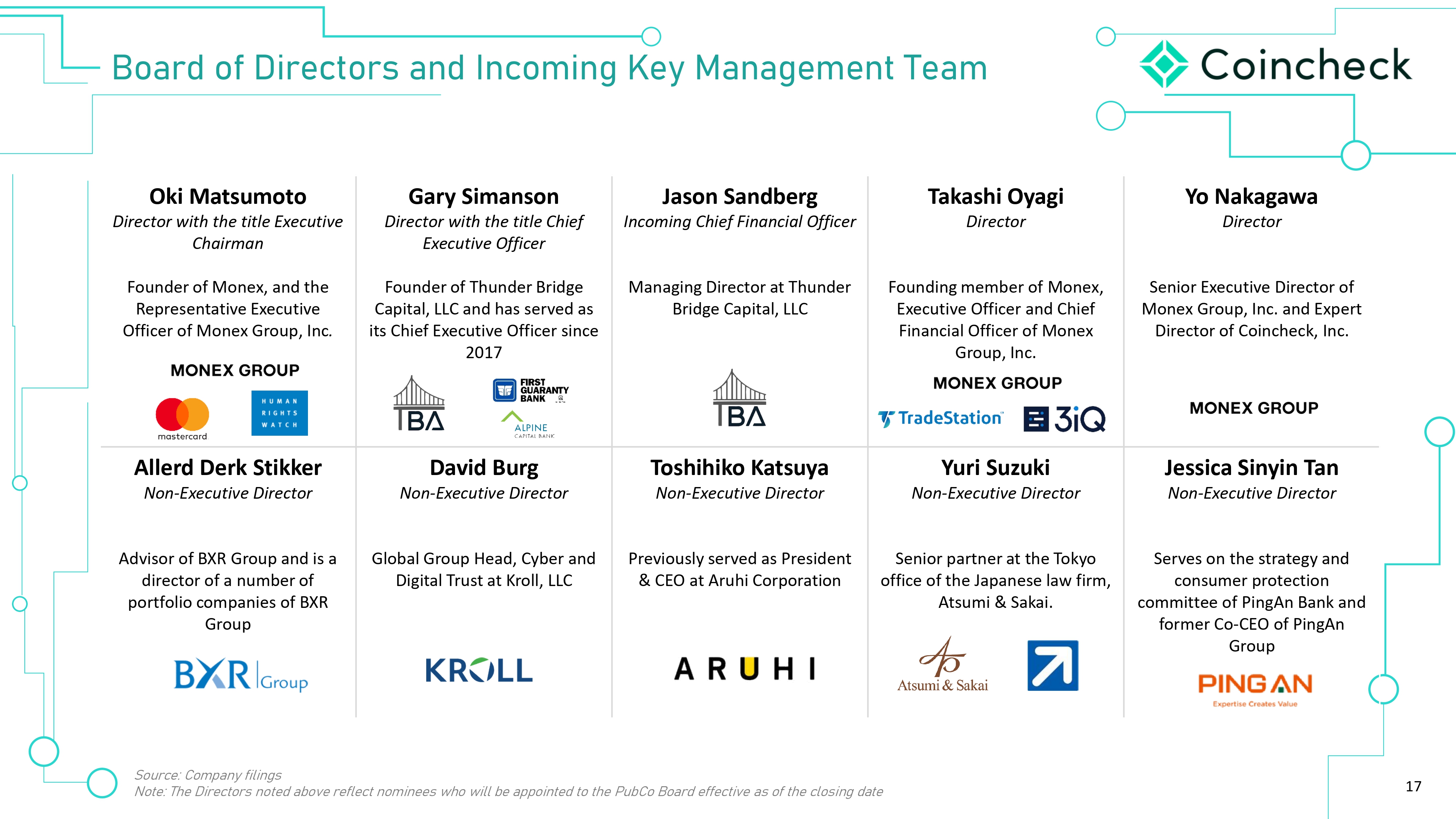

Yo Nakagawa Director Senior Executive Director of Monex Group, Inc. and Expert Director of Coincheck, Inc. Takashi Oyagi Director Founding member of Monex, Executive Officer and Chief Financial Officer of Monex Group, Inc. Jason Sandberg Incoming Chief Financial Officer Managing Director at Thunder Bridge Capital, LLC Gary Simanson Director with the title Chief Executive Officer Founder of Thunder Bridge Capital, LLC and has served as its Chief Executive Officer since 2017 Oki Matsumoto Director with the title Executive Chairman Founder of Monex, and the Representative Executive Officer of Monex Group, Inc .. Jessica Sinyin Tan Non - Executive Director Serves on the strategy and consumer protection committee of PingAn Bank and former Co - CEO of PingAn Group Yuri Suzuki Non - Executive Director Senior partner at the Tokyo office of the Japanese law firm, Atsumi & Sakai. Toshihiko Katsuya Non - Executive Director Previously served as President & CEO at Aruhi Corporation David Burg Non - Executive Director Global Group Head, Cyber and Digital Trust at Kroll, LLC Allerd Derk Stikker Non - Executive Director Advisor of BXR Group and is a director of a number of portfolio companies of BXR Group Source: Company filings Note: The Directors noted above reflect nominees who will be appointed to the PubCo Board effective as of the closing date 17 �È‚Ø• � Ȩ � �¯Ø›ãÈØÜ � ‚• � 0ÂÈÁ¯Â© � :›ö � B‚‚©›Á›Âã � d›‚Á