For the period from January 21, 2021 through December 31, 2021, we had a net loss of $313,274, which resulted from operating and formation costs of $316,021, partially offset by interest and dividend income on investments in Trust Account of $2,747.

Liquidity, Going Concern and Capital Resources

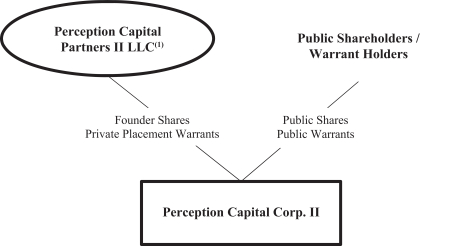

The IPO Registration Statement was declared effective on October 27, 2021. On November 1, 2021, we consummated the Initial Public Offering of 23,000,000 PCCT Units, including 3,000,000 PCCT Units issued pursuant to the exercise of the IPO Underwriters’ over-allotment option in full, generating gross proceeds of $230,000,000.

Simultaneously with the closing of the Initial Public Offering, we consummated the sale of 10,050,000 Private Placement Warrants at a price of $1.00 per Private Placement Warrant in a private placement to the Sponsor, including 1,050,000 Private Placement Warrants issued pursuant to the exercise of the IPO Underwriters’ over-allotment option in full, generating gross proceeds of $10,050,000.

For the three months ended March 31, 2023

For the three months ended March 31, 2023, net cash used in operating activities was $380,873 which was due to the net loss of $2,043,322 and interest income on investments held in Trust Account of $258,478, offset in part by changes in working capital of $1,730,927. For the three months ended March 31, 2022, net cash used in operating activities was $281,126, which was due to the net loss of $490,179 and interest income on investments held in Trust Account of $18,197, offset in part by changes in working capital of $227,250.

For the three months ended March 31, 2023, net cash used in investing activities was $294,947, which was due to cash deposits into the trust account of $294,947. For the three months ended March 31, 2022, there were no cash flows from investing activities.

For the three months ended March 31, 2023, net cash provided by financing activities was $719,947, which was due to proceeds from convertible promissory notes - related party of $719,947. For the three months ended March 31, 2022, net cash used in financing activities was $7,000, which was due to payments of offering costs of $7,000.

For the year ended December 31, 2022

For the period from January 1, 2022 through December 31, 2022, net cash used in operating activities was $839,103 which was due to our net loss of $1,763,793, changes in working capital of $2,955,073, and interest and dividend income on investments held in Trust Account of $2,030,383.

For the period from January 1, 2022 through December 31, 2022 net cash used in investing activities of $209,965,143 was the result of the initial pre-extension redemption of shares in the Trust Account.

For the period from January 1, 2022 through December 31, 2022, net cash used in financing activities was $209,940,143, which was comprised of payments to shareholder’s for the initial pre-extension redemption of shares in the Trust Account.

As of March 31, 2023, we had cash of $48,857 held outside the trust account. We intend to use the funds held outside the Trust Account primarily to identify and evaluate target businesses, perform business due diligence on prospective target businesses, travel to and from the offices, plants or similar locations of prospective target businesses or their representatives or owners, review corporate documents and material agreements of prospective target businesses, and structure, negotiate and complete a business combination.

138