Results of operations for the year ended December 31, 2022

For the period from January 1, 2022 through December 31, 2022, we had a net loss of $1,763,793, which resulted from operating and formation costs of $3,794,176, partially offset by interest and dividend income on investments in Trust Account of $2,030,383.

For the period from January 21, 2021 through December 31, 2021, we had a net loss of $313,274, which resulted from operating and formation costs of $316,021, partially offset by interest and dividend income on investments in Trust Account of $2,747.

Liquidity, Going Concern and Capital Resources

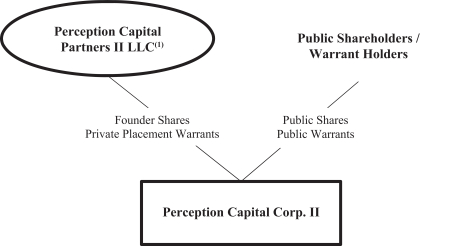

The IPO Registration Statement was declared effective on October 27, 2021. On November 1, 2021, we consummated the Initial Public Offering of 23,000,000 PCCT Units, including 3,000,000 PCCT Units issued pursuant to the exercise of the IPO Underwriters’ over-allotment option in full, generating gross proceeds of $230,000,000.

Simultaneously with the closing of the Initial Public Offering, we consummated the sale of 10,050,000 Private Placement Warrants at a price of $1.00 per Private Placement Warrant in a private placement to the Sponsor, including 1,050,000 Private Placement Warrants issued pursuant to the exercise of the IPO Underwriters’ over-allotment option in full, generating gross proceeds of $10,050,000.

For the six months ended June 30, 2023

For the six months ended June 30, 2023, net cash used in operating activities was $881,915 which was due to the net loss of $3,417,617 and interest income on investments held in Trust Account of $548,503, offset in part by changes in working capital of $2,624,205 and an unrealized loss on the change in fair value of forward purchase units of $460,000. For the six months ended June 30, 2022, net cash used in operating activities was $408,458, which was due to the net loss of $537,932 and interest income on investments held in Trust Account of $344,043, offset in part by changes in working capital of $473,517.

For the six months ended June 30, 2023, net cash provided by investing activities was $3,481,467, which was due to proceeds from Trust Account for payment to redeeming sharesholders of $4,041,203, offset by advances into the Trust Account of $559,736. For the six months ended June 30, 2022, there were no cash flows from investing activities.

For the six months ended June 30, 2023, net cash used in financing activities was $2,520,282, which was due to payment to redeeming shareholders of $4,041,203, offset by proceeds from convertible promissory notes - related party of $1,520,921. For the six months ended June 30, 2022, net cash used in financing activities was $7,000, which was due to payments of offering costs of $7,000.

For the year ended December 31, 2022

For the period from January 1, 2022 through December 31, 2022, net cash used in operating activities was $839,103 which was due to our net loss of $1,763,793, changes in working capital of $2,955,073, and interest and dividend income on investments held in Trust Account of $2,030,383.

For the period from January 1, 2022 through December 31, 2022 net cash used in investing activities of $209,965,143 was the result of the initial pre-extension redemption of shares in the Trust Account.

For the period from January 1, 2022 through December 31, 2022, net cash used in financing activities was $209,940,143, which was comprised of payments to shareholder’s for the initial pre-extension redemption of shares in the Trust Account.

142