Milliman Variable Insurance Trust

Milliman Hedged Equity Funds

Annual Report

December 31, 2023

The following series of Milliman Variable Insurance Trust are presented in this annual report:

Milliman – Capital Group Hedged U.S. Growth Fund

Milliman – Capital Group Hedged U.S. Income and Growth Fund

TABLE OF CONTENTS

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2023 (Unaudited)

About the Milliman Hedged Equity Funds

Investment Adviser: Milliman Financial Risk Management LLC (“Milliman”) serves as investment adviser to the Miliman - Capital Group Hedged U.S. Growth Fund and Milliman – Capital Group Hedged U.S. Income and Growth Fund (each a “Fund” and together, the “Funds”).

Investment Sub- Adviser: Capital International, Inc. (the “Sub-Adviser”) serves as investment sub-adviser to each Fund solely with respect to the provision of the Investable Universe. The Sub-Adviser does not have responsibility for the day-to-day management of the Fund’s portfolio nor review and oversight of the Fund’s investment strategy.

Market Environment

Despite investors’ fears of a recession, resilient corporate earnings and an apparent end to the Federal Reserve’s interest rate hikes led stocks to a strong rally in 2023. Uncertainty took over on several occasions throughout the year as a mix of concerns over the Fed’s policy, inflation, and potential softness in the job market took center stage. Equity markets tumbled as a response, but moved on to strong rallies immediately following these episodes, especially in Q4.

Overall, Growth stocks outperformed the broader market in 2023, producing large positive returns in response to an investor shift in focus from rising interest rates to increasingly confident expectations of rate cuts in 2024, as well as buzz fueled by the economic prospects of artificial intelligence (“AI”) technology. Meanwhile, Value stocks also performed strongly in 2023, but to a more moderate degree, boosted by resilient consumer spending and stable employment. Stock market indices rebounded from the 2022 bear market with Nasdaq 100 rising 54.97%, S&P 500 rising 25.97%, and the blue-chip Dow Jones Industrial Average (DJIA) trailing behind with a more modest return of 15.93% (all in total return terms and for 2023 full calendar year).

Milliman - Capital Group Hedged U.S. Growth Fund

Strategy and Benchmark Composition

The Fund seeks to achieve its investment objective by primarily investing its assets in a combination of common stocks (to provide long equity exposure) and derivatives (to create a hedge against the Fund’s downside equity exposure).

The Sub- Adviser provides to Milliman a weighted list of those common stocks of companies that the Sub-Adviser believes can provide long-term growth of capital (the “Investable Universe”). The Fund invests in some or all of the common stocks contained in the Investable Universe.

In seeking to create a hedge against the Fund’s downside equity exposure, Milliman purchases and sells over-the-counter (“OTC”) options on some or all of the common stocks contained in the Investable Universe (the “Buffer Hedging Strategy”). The Buffer Hedging Strategy is intended to provide a hedge against any losses that the Fund incurs that are greater than 5% but less than 20% of the Fund’s equity exposure (the “Buffer Range”). In addition, implementation of the Buffer Hedging Strategy could result in the Fund foregoing some of the upside returns on its long equity exposure because the options contracts used to effect the Buffer Hedging Strategy will limit the Fund’s potential upside returns, thus resulting in a “Cap.” The resulting Cap will impact the Fund until Milliman resets the options contracts (i.e., closes out existing options contracts and transacts in new options contracts) to achieve the Buffer Hedging Strategy, at which time a new Cap will result. Milliman typically resets

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2023 (Unaudited)

the options contracts and updates the Fund’s equity holdings quarterly.

Benchmark: S&P 500 Price Index – A market capitalization weighted benchmark index which tracks the price performance of 500 of the largest publicly traded stocks listed on U.S. exchanges. Please note that an investor cannot invest directly in an index.

Fund Performance

The Milliman - Capital Group Hedged U.S. Growth Fund returned 9.30% from its inception on February 10, 2023, to the end of the year. This underperformed the benchmark, the S&P 500 Price Index, which rose 16.61% during this same period. Stocks in the technology, communications, and consumer cyclical sectors were the largest contributors to the Fund’s positive return, reflecting resilient consumer spending in 2023. Option hedges detracted from performance in Q2 and Q4, when stock returns exceeded the Fund’s Cap.

Other contributors to the Fund’s return were stock selection in industrials and communication. Overweighting of healthcare stocks and financial services stock selection were detractors compared to the Fund’s benchmark.

Milliman - Capital Group Hedged U.S. Income and Growth Fund

Strategy and Benchmark Composition

The Fund seeks to achieve its investment objective by primarily investing its assets in a combination of common stocks (to provide long equity exposure) and derivatives (to create a hedge against the Fund’s downside equity exposure).

The Sub- Adviser provides to Milliman a weighted list of those common stocks of companies that the Sub-Adviser believes can provide long-term growth of capital (the “Investable Universe”). The Fund invests in some or all of the common stocks contained in the Investable Universe.

In seeking to create a hedge against the Fund’s downside equity exposure, Milliman purchases and sells over-the-counter (“OTC”) options on some or all of the common stocks contained in the Investable Universe (the “Buffer Hedging Strategy”). The Buffer Hedging Strategy is intended to provide a hedge against any losses that the Fund incurs that are greater than 5% but less than 20% of the Fund’s equity exposure (the “Buffer Range”). In addition, implementation of the Buffer Hedging Strategy could result in the Fund foregoing some of the upside returns on its long equity exposure because the options contracts used to effect the Buffer Hedging Strategy will limit the Fund’s potential upside returns, thus resulting in a “Cap.” The resulting Cap will impact the Fund until Milliman resets the options contracts (i.e., closes out existing options contracts and transacts in new options contracts) to achieve the Buffer Hedging Strategy, at which time a new Cap will result. Milliman typically resets the options contracts and updates the Fund’s equity holdings quarterly.

Benchmark: S&P 500 Price Index – A market capitalization weighted benchmark index which tracks the price performance of 500 of the largest publicly traded stocks listed on U.S. exchanges. Please note that an investor cannot invest directly in an index.

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2023 (Unaudited)

Fund Performance

The Milliman - Capital Group Hedged U.S. Income and Growth Fund returned 5.93% from its inception on February 10, 2023, to the end of the year. This underperformed the benchmark, the S&P 500 Price Index, which rose 16.61% during this same period. Stocks in the technology sector were the biggest contributor to the Fund’s positive return, along with communication and financial services sectors. Option hedges detracted from performance in Q2 and Q4, when stock returns exceeded the Fund’s Cap.

Other contributors to the Fund’s return were stock selection in the technology and financial services sectors, whereas consumer cyclical stock selection and technology sector underweighting were detractors compared to the benchmark.

Disclosures

The results shown are historical, for informational purposes only, and do not guarantee future results.

The analysis is prepared as of a particular date and time and does not reflect subsequent changes or variations in the market or changes in any and all other relevant factors.

The recipient should not construe any of the material contained herein as legal, regulatory, tax, accounting or other advice. The recipient should not act on any information in this document without consulting its legal, regulatory, tax, accounting and other advisors. Information herein has been obtained from sources we believe to be reliable but neither Milliman Financial Risk Management LLC (“Milliman FRM”) nor its parents, subsidiaries or affiliates warrant its completeness or accuracy. No responsibility can be accepted for errors of facts obtained from third parties.

The materials in this document represent the opinion of the authors at the time of authorship; they may change, and are not representative of the views of Milliman FRM or its parents, subsidiaries, or affiliates. Milliman FRM does not certify the information, nor does it guarantee the accuracy and completeness of such information. Use of such information is voluntary and should not be relied upon unless an independent review of its accuracy and completeness has been performed. Materials may not be reproduced without the express consent of Milliman FRM. Milliman Financial Risk Management LLC is an SEC-registered investment advisor and subsidiary of Milliman, Inc.

Milliman - Capital Group Hedged U.S. Growth Fund

Fund Performance

December 31, 2023 (Unaudited)

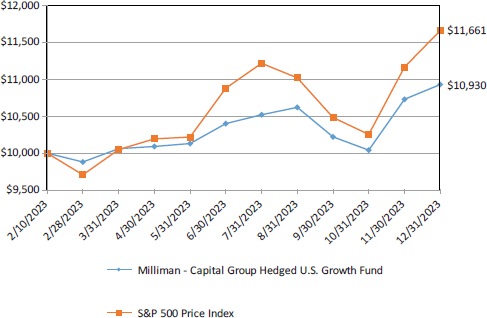

The following graph illustrates the value, as of December 31, 2023, of a hypothetical $10,000 investment made on February 10, 2023 (commencement of operations) in Class 3 Shares of the Milliman - Capital Group Hedged U.S. Growth Fund compared to the S&P 500 Price Index.

Growth of a Hypothetical $10,000 Investment

at December 31, 2023

| | | Total Returns as of December 31, 2023 | |

| | | Since Inception (a) | |

| Milliman - Capital Group Hedged U.S. Growth Fund | | | 9.30 | % |

| S&P 500 Price Index | | | 16.61 | % |

| (a) | Inception date is February 10, 2023. |

Performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The total return shown assumes the reinvestment of all distributions. Earnings from variable annuity contracts and variable life insurance policies compound tax-free until withdrawn, so no adjustments were made for income taxes. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and, in their absence, performance would have been lower. The performance information does not include insurance company separate account fees and variable annuity or variable life contract charges and if these fees and charges were included, then performance would have been lower. Current performance may be lower or higher than the performance shown above. For the most recent performance, please visit www. millimanfunds.com.

S&P 500 Price Index – A market capitalization weighted benchmark index which tracks the price performance of 500 of the largest publicly traded stocks listed on U.S. exchanges. Please note that an investor cannot invest directly in an index.

Milliman - Capital Group Hedged U.S. Income and Growth Fund

Fund Performance

December 31, 2023 (Unaudited)

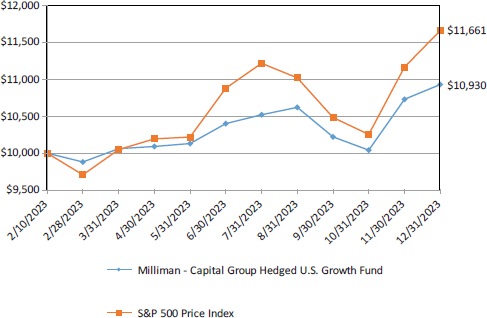

The following graph illustrates the value, as of December 31, 2023, of a hypothetical $10,000 investment made on February 10, 2023 (commencement of operations) in Class 3 Shares of the Milliman - Capital Group Hedged U.S. Income and Growth Fund compared to the S&P 500 Price Index.

Growth of a Hypothetical $10,000 Investment

at December 31, 2023

| | | Total Returns as of December 31, 2023 | |

| | | Since Inception (a) | |

| Milliman - Capital Group Hedged U.S. Income and Growth Fund | | | 5.93 | % |

| S&P 500 Price Index | | | 16.61 | % |

| (a) | Inception date is February 10, 2023. |

Performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The total return shown assumes the reinvestment of all distributions. Earnings from variable annuity contracts and variable life insurance policies compound tax-free until withdrawn, so no adjustments were made for income taxes. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and, in their absence, performance would have been lower. The performance information does not include insurance company separate account fees and variable annuity or variable life contract charges and if these fees and charges were included, then performance would have been lower. Current performance may be lower or higher than the performance shown above. For the most recent performance, please visit www. millimanfunds.com.

S&P 500 Price Index – A market capitalization weighted benchmark index which tracks the price performance of 500 of the largest publicly traded stocks listed on U.S. exchanges. Please note that an investor cannot invest directly in an index.

Milliman Variable Insurance Trust

Expense Example For the Period Ended

December 31, 2023 (Unaudited)

Each Fund sells its shares to insurance company separate accounts funding variable annuity contracts and variable life insurance policies and other qualified investors. The tables below do not include any fees or sales charges imposed by your variable product.

As a Fund shareholder, you incur ongoing costs, including management fees; distribution and/or service (“12b-1”) fees; and other Fund expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2023 to December 31, 2023.

Actual Expenses

The following table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 equals 8.6), then multiply the result by the number in the applicable line under the heading titled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only. The Funds do not charge transaction fees, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table below is useful in comparing the ongoing costs only and will not help you determine the relative total costs of owning different funds. The Funds’ expenses shown in the tables reflect fee waivers and reimbursements in effect.

| | Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period(a) |

|

| Milliman - Capital Group Hedged U.S. Growth Fund# | | | | | | |

| Actual | $1,000.00 | $1,051.00 | 1.09% | $ | 5.63 | |

| Hypothetical (assuming 5% return before expenses) | 1,000.00 | 1,019.71 | 1.09% | | 5.55 | |

| Milliman - Capital Group Hedged U.S. Income and Growth Fund# | | | | | | |

| Actual | 1,000.00 | 1,049.90 | 1.09% | | 5.63 | |

| Hypothetical (assuming 5% return before expenses) | 1,000.00 | 1,019.71 | 1.09% | | 5.55 | |

| (a) | Expenses are equal to the Funds’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the six-month period). |

Milliman - Capital Group Hedged U.S. Growth Fund

Schedule of Investments

December 31, 2023

| | Shares | | | Value | |

| COMMON STOCKS - 104.97% | |

| | |

| |

| Communication Services - 8.64% | | | | | | | | |

| Alphabet, Inc. - Class C (a) | | | 939 | | | $ | 132,334 | |

| Meta Platforms, Inc. - Class A (a) | | | 207 | | | | 73,270 | |

| Netflix, Inc. (a) | | | 121 | | | | 58,912 | |

| Take-Two Interactive Software, Inc. (a) | | | 118 | | | | 18,992 | |

| | | | | | | | 283,508 | |

| Consumer Discretionary - 20.84% | | | | | | |

| |

| Airbnb, Inc. - Class A (a) | | | 217 | | | | 29,542 | |

| Amazon.com, Inc. (a) | | | 795 | | | | 120,791 | |

| Burlington Stores, Inc. (a) | | | 249 | | | | 48,426 | |

| Caesars Entertainment, Inc. (a) | | | 466 | | | | 21,846 | |

| Churchill Downs, Inc. | | | 362 | | | | 48,845 | |

| Darden Restaurants, Inc. | | | 173 | | | | 28,424 | |

| DoorDash, Inc. - Class A (a) | | | 259 | | | | 25,613 | |

| DR Horton, Inc. | | | 220 | | | | 33,436 | |

| Floor & Decor Holdings, Inc. - Class A (a) | | | 311 | | | | 34,695 | |

| Hilton Worldwide Holdings, Inc. | | | 455 | | | | 82,851 | |

| Marriott International, Inc. - Class A | | | 168 | | | | 37,886 | |

| NIKE, Inc. - Class B | | | 291 | | | | 31,594 | |

| Starbucks Corp. | | | 282 | | | | 27,075 | |

| Tesla, Inc. (a) | | | 86 | | | | 21,369 | |

| TopBuild Corp. (a) | | | 109 | | | | 40,794 | |

| Williams-Sonoma, Inc. | | | 132 | | | | 26,635 | |

| YETI Holdings, Inc. (a) | | | 461 | | | | 23,871 | |

| | | | | | | | 683,693 | |

| Consumer Staples - 3.38% | | | | | | |

| |

| Costco Wholesale Corp. | | | 43 | | | | 28,383 | |

| Dollar Tree, Inc. (a) | | | 175 | | | | 24,859 | |

| Philip Morris International, Inc. | | | 611 | | | | 57,483 | |

| | | | | | | | 110,725 | |

| Energy - 1.38% | | | | | | | | |

| EOG Resources, Inc. | | | 375 | | | | 45,356 | |

| | | | | | | | | |

| Financials - 3.12% | | | | | | | | |

| First Republic Bank | | | 303 | | | | 12 | |

| LPL Financial Holdings, Inc. | | | 87 | | | | 19,803 | |

| MSCI, Inc. | | | 86 | | | | 48,646 | |

| S&P Global, Inc. | | | 77 | | | | 33,920 | |

| | | | | | | | 102,381 | |

| Health Care - 22.17% | | | | | | |

| |

| Abbott Laboratories | | | 976 | | | | 107,428 | |

| agilon health, Inc. (a) | | | 1,659 | | | | 20,820 | |

| Alnylam Pharmaceuticals, Inc. (a) | | | 210 | | | | 40,196 | |

| BioMarin Pharmaceutical, Inc. (a) | | | 374 | | | | 36,061 | |

| Dexcom, Inc. (a) | | | 173 | | | | 21,468 | |

| Edwards Lifesciences Corp. (a) | | | 259 | | | | 19,749 | |

| Eli Lilly & Co. | | | 131 | | | | 76,363 | |

| Insulet Corp. (a) | | | 116 | | | | 25,170 | |

| IQVIA Holdings, Inc. (a) | | | 125 | | | | 28,923 | |

| Penumbra, Inc. (a) | | | 97 | | | | 24,399 | |

| Revvity, Inc. | | | 411 | | | | 44,926 | |

| Stryker Corp. | | | 169 | | | | 50,609 | |

| Thermo Fisher Scientific, Inc. | | | 130 | | | | 69,003 | |

| UnitedHealth Group, Inc. | | | 215 | | | | 113,191 | |

| Zoetis, Inc. | | | 247 | | | | 48,750 | |

| | | | | | | | 727,056 | |

The accompanying notes are an integral part of these financial statements.

Milliman - Capital Group Hedged U.S. Growth Fund

Schedule of Investments (Continued)

December 31, 2023

| | Shares | | | Value | |

| Industrials - 15.38% | |

| | |

| |

| AMETEK, Inc. | | | 162 | | | $ | 26,712 | |

| Carrier Global Corp. | | | 883 | | | | 50,728 | |

| Ceridian HCM Holding, Inc. (a) | | | 501 | | | | 33,627 | |

| Copart, Inc. (a) | | | 1,171 | | | | 57,379 | |

| Old Dominion Freight Line, Inc. | | | 167 | | | | 67,690 | |

| RTX Corp. | | | 729 | | | | 61,338 | |

| Saia, Inc. (a) | | | 39 | | | | 17,091 | |

| TransDigm Group, Inc. | | | 111 | | | | 112,288 | |

| United Rentals, Inc. | | | 78 | | | | 44,727 | |

| Woodward, Inc. | | | 242 | | | | 32,943 | |

| | | | | | | 504,523 | |

| Information Technology - 27.08% (b) | | | | | | | | |

| Adobe, Inc. (a) | | | 77 | | | | 45,938 | |

| Apple, Inc. | | | 244 | | | | 46,977 | |

| Applied Materials, Inc. | | | 241 | | | | 39,059 | |

| Autodesk, Inc. (a) | | | 125 | | | | 30,435 | |

| Broadcom, Inc. | | | 117 | | | | 130,601 | |

| EPAM Systems, Inc. (a) | | | 83 | | | | 24,679 | |

| First Solar, Inc. (a) | | | 141 | | | | 24,291 | |

| Marvell Technology, Inc. | | | 537 | | | | 32,386 | |

| Micron Technology, Inc. | | | 731 | | | | 62,384 | |

| Microsoft Corp. | | | 646 | | | | 242,922 | |

| NVIDIA Corp. | | | 75 | | | | 37,142 | |

| Palo Alto Networks, Inc. (a) | | | 166 | | | | 48,950 | |

| Salesforce, Inc. (a) | | | 250 | | | | 65,785 | |

| ServiceNow, Inc. (a) | | | 80 | | | | 56,519 | |

| | | | | | | 888,068 | |

| Materials - 1.97% | | | | | | | | |

| Albemarle Corp. | | | 209 | | | | 30,196 | |

| Linde PLC | | | 84 | | | | 34,500 | |

| | | | | | | 64,696 | |

| Real Estate - 1.01% | | | | | | | | |

| Equinix, Inc. | | | 41 | | | | 33,021 | |

| TOTAL COMMON STOCKS (Cost$2,925,459) | | | | | | | 3,443,027 | |

| | | Contracts | | | Notional Amount | | | | |

| PURCHASED OPTIONS - 0.06% (c) | | | | | | | | | | | | |

| OVER-THE-COUNTER PUT OPTIONS - 0.06% | | | | | | | | | | | | |

| Milliman - Capital Group Growth Basket, Counterparty: Bank of America, Expires 2/12/2024, Strike Price $9,500.00 (a)(d) | | | 310 | | | $ | 3,422,662 | | | | 1,699 | |

| TOTAL PURCHASED OPTIONS (Cost$43,400) | | | | | | | | | | | 1,699 | |

| | | | | | | | | | | | | |

| Total Investments (Cost $2,968,859) - 105.03% | | | | | | | | | | | 3,444,726 | |

| Liabilities in Excess of Other Assets - (5.03)% | | | | | | | | | | | (164,803 | ) |

| TOTAL NET ASSETS - 100.00% | | | | | | | | | | $ | 3,279,923 | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

| (a) | Non-income producing security. |

| (b) | Amount represents investments in a particular sector. No industry within this sector represented more than 25% of the Fund’s total assets at the time of investment. |

| (c) | Purchased option contracts are held in connection with corresponding written option contracts. |

The accompanying notes are an integral part of these financial statements.

Milliman - Capital Group Hedged U.S. Growth Fund

Schedule of Investments (Continued)

December 31, 2023

| (d) | Comprised of a proprietary basket of securities. The underlying components of the basket as of December 31, 2023 are shown below: |

| Security Name | | Number of Shares | | | Notional Amount | | | % of Total Notional

Amount | |

| Microsoft Corp. | | | 642 | | |

| $241,487 | | | | 7.05 | % |

| Alphabet, Inc. – Class C | | | 935 | | | | 131,806 | | | | 3.85 | % |

| Broadcom, Inc. | | | 116 | | | | 129,657 | | | | 3.79 | % |

| Amazon.com, Inc. | | | 789 | | | | 119,858 | | | | 3.50 | % |

| UnitedHealth Group, Inc. | | | 214 | | | | 112,418 | | | | 3.28 | % |

| TransDigm Group, Inc. | | | 110 | | | | 111,625 | | | | 3.26 | % |

| Abbott Laboratories | | | 970 | | | | 106,817 | | | | 3.12 | % |

| Hilton Worldwide Holdings, Inc. | | | 452 | | | | 82,331 | | | | 2.41 | % |

| Eli Lilly & Co. | | | 130 | | | | 75,656 | | | | 2.21 | % |

| Meta Platforms, Inc. – Class A | | | 205 | | | | 72,718 | | | | 2.12 | % |

| Thermo Fisher Scientific, Inc. | | | 129 | | | | 68,631 | | | | 2.01 | % |

| Old Dominion Freight Line, Inc. | | | 166 | | | | 67,260 | | | | 1.97 | % |

| Salesforce, Inc. | | | 249 | | | | 65,531 | | | | 1.91 | % |

| Micron Technology, Inc. | | | 730 | | | | 62,258 | | | | 1.82 | % |

| RTX Corp. | | | 728 | | | | 61,226 | | | | 1.79 | % |

| Netflix, Inc. | | | 120 | | | | 58,272 | | | | 1.70 | % |

| Philip Morris International, Inc. | | | 608 | | | | 57,243 | | | | 1.67 | % |

| Copart, Inc. | | | 1,167 | | | | 57,174 | | | | 1.67 | % |

| ServiceNow, Inc. | | | 74 | | | | 51,938 | | | | 1.52 | % |

| Carrier Global Corp. | | | 880 | | | | 50,541 | | | | 1.48 | % |

| Stryker Corp. | | | 168 | | | | 50,457 | | | | 1.47 | % |

| Palo Alto Networks, Inc. | | | 165 | | | | 48,783 | | | | 1.43 | % |

| Zoetis, Inc. | | | 246 | | | | 48,506 | | | | 1.42 | % |

| Churchill Downs, Inc. | | | 359 | | | | 48,398 | | | | 1.42 | % |

| MSCI, Inc. | | | 85 | | | | 48,241 | | | | 1.41 | % |

| Burlington Stores, Inc. | | | 247 | | | | 48,012 | | | | 1.40 | % |

| Apple, Inc. | | | 242 | | | | 46,610 | | | | 1.36 | % |

| Adobe, Inc. | | | 77 | | | | 45,694 | | | | 1.34 | % |

| EOG Resources, Inc. | | | 374 | | | | 45,196 | | | | 1.32 | % |

| United Rentals, Inc. | | | 78 | | | | 44,579 | | | | 1.30 | % |

| Revvity, Inc. | | | 406 | | | | 44,419 | | | | 1.30 | % |

| TopBuild Corp. | | | 109 | | | | 40,659 | | | | 1.19 | % |

| Alnylam Pharmaceuticals, Inc. | | | 208 | | | | 39,866 | | | | 1.16 | % |

| Applied Materials, Inc. | | | 240 | | | | 38,915 | | | | 1.14 | % |

| Marriott International, Inc. – Class A | | | 167 | | | | 37,571 | | | | 1.10 | % |

| NVIDIA Corp. | | | 75 | | | | 37,291 | | | | 1.09 | % |

| BioMarin Pharmaceutical, Inc. | | | 371 | | | | 35,760 | | | | 1.04 | % |

| Floor & Decor Holdings, Inc. – Class A | | | 308 | | | | 34,409 | | | | 1.01 | % |

| Linde PLC | | | 83 | | | | 34,113 | | | | 1.00 | % |

| S&P Global, Inc. | | | 76 | | | | 33,571 | | | | 0.98 | % |

| Ceridian HCM Holding, Inc. | | | 497 | | | | 33,389 | | | | 0.98 | % |

| DR Horton, Inc. | | | 219 | | | | 33,330 | | | | 0.97 | % |

| Woodward, Inc. | | | 241 | | | | 32,817 | | | | 0.96 | % |

| Equinix, Inc. | | | 40 | | | | 32,617 | | | | 0.95 | % |

| Marvell Technology, Inc. | | | 536 | | | | 32,351 | | | | 0.95 | % |

| NIKE, Inc. – Class B | | | 290 | | | | 31,460 | | | | 0.92 | % |

| Autodesk, Inc. | | | 124 | | | | 30,150 | | | | 0.88 | % |

| Albemarle Corp. | | | 207 | | | | 29,880 | | | | 0.87 | % |

| Airbnb, Inc. – Class A | | | 216 | | | | 29,420 | | | | 0.86 | % |

| IQVIA Holdings, Inc. | | | 124 | | | | 28,733 | | | | 0.84 | % |

| Top 50 Holdings | | | | | | | 2,949,644 | | | | 86.18 | % |

| Other Securities | | | | | | | 473,018 | | | | 13.82 | % |

| Total Underlying Positions | | | | | |

| $3,422,662 | | | | 100.00 | % |

The accompanying notes are an integral part of these financial statements.

Milliman - Capital Group Hedged U.S. Growth Fund

Schedule of Investments (Continued)

December 31, 2023

SCHEDULE OF OPTIONS WRITTEN

December 31, 2023

| | | | | | Strike | | | | | | Notional | | | | |

| Description | | Expiration | | | Price | | | Contracts | | | Amount | | | Value | |

| Over-the-Counter Call Options | | | | | | | | | | | | | | | | | | |

| Milliman - Capital Group Growth Basket, Counterparty: Bank of America (a) | | 2/12/2024 | | | $ | 10,490.00 | | | 310 | | | $ | (3,422,662 | ) | | $ | (204,039 | ) |

| Over-the-Counter Put Options | | | | | | | | | | | | | | | | | | |

| Milliman - Capital Group Growth Basket, Counterparty: Bank of America (a) | | 2/12/2024 | | | | 8,000.00 | | | 310 | | | | (3,422,662 | ) | | | (164 | ) |

| TOTAL OPTIONS WRITTEN (Premiums Received $43,400) | | | $ | (204,203 | ) |

| (a) | Comprised of a proprietary basket of securities. The underlying components of the basket as of December 31, 2023 are shown in the Schedule of Investments. |

The accompanying notes are an integral part of these financial statements.

Milliman - Capital Group Hedged U.S. Growth Fund

Schedule of Investments (Concluded)

December 31, 2023

The following is a summary of the fair valuations according to the inputs used as of December 31, 2023 in valuing the Fund’s assets and liabilities (see Note 2 in Notes to Financial Statements):

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | |

| | |

| | |

| | |

| |

| Common Stocks | | $ | 3,443,027 | | | $ | – | | | $ | – | | | $ | 3,443,027 | |

| Purchased Options | | | – | | | | 1,699 | | | | – | | | | 1,699 | |

| Total Assets | | $ | 3,443,027 | | | $ | 1,699 | | | $ | – | | | $ | 3,444,726 | |

| | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Options Written | | $ | – | | | $ | 204,203 | | | $ | – | | | $ | 204,203 | |

| Total Liabilities | | $ | – | | | $ | 204,203 | | | $ | – | | | $ | 204,203 | |

Portfolio Holdings Summary

| | | % of Net | |

| Asset Type | | Assets | |

| Common Stocks | | | 104.97 | % |

| Purchased Options | | | 0.06 | |

| Total Investments | | | 105.03 | |

| Written Options | | | (6.23 | ) |

| Assets in Excess of Other Liabilities | | | 1.20 | |

| Net Assets | | | 100.00 | % |

The accompanying notes are an integral part of these financial statements.

Milliman - Capital Group Hedged U.S. Income and Growth Fund

Schedule of Investments

December 31, 2023

| | Shares | | | Value | |

| COMMON STOCKS - 103.18% | |

| | |

| |

| Communication Services - 7.34% | | | | | | | | |

| Alphabet, Inc. - Class A (a) | | | 603 | | | $ | 84,233 | |

| Comcast Corp. - Class A | | | 2,514 | | | | 110,239 | |

| Meta Platforms, Inc. - Class A (a) | | | 109 | | | | 38,582 | |

| | | | | | | 233,054 | |

| Consumer Discretionary - 8.61% | | | | | | | | |

| Darden Restaurants, Inc. | | | 310 | | | | 50,933 | |

| General Motors Co. | | | 952 | | | | 34,196 | |

| Home Depot, Inc. | | | 300 | | | | 103,964 | |

| Lennar Corp. - Class A | | | 271 | | | | 40,390 | |

| Yum! Brands, Inc. | | | 336 | | | | 43,902 | |

| | | | | | | 273,385 | |

| Consumer Staples - 5.91% | | | | | | | | |

| Archer-Daniels-Midland Co. | | | 690 | | | | 49,832 | |

| Keurig Dr Pepper, Inc. | | | 1,103 | | | | 36,752 | |

| Philip Morris International, Inc. | | | 777 | | | | 73,100 | |

| Target Corp. | | | 196 | | | | 27,914 | |

| | | | | | | 187,598 | |

| Energy - 6.48% | | | | | | | | |

| Baker Hughes Co. | | | 945 | | | | 32,300 | |

| Chevron Corp. | | | 313 | | | | 46,687 | |

| ConocoPhillips | | | 396 | | | | 45,964 | |

| EOG Resources, Inc. | | | 281 | | | | 33,987 | |

| Pioneer Natural Resources Co. | | | 208 | | | | 46,775 | |

| | | | | | | 205,713 | |

| Financials - 13.07% | | | | | | | | |

| BlackRock, Inc. | | | 72 | | | | 58,450 | |

| Capital One Financial Corp. | | | 265 | | | | 34,747 | |

| CME Group, Inc. | | | 301 | | | | 63,391 | |

| Discover Financial Services | | | 268 | | | | 30,123 | |

| Intercontinental Exchange, Inc. | | | 224 | | | | 28,768 | |

| JPMorgan Chase & Co. | | | 554 | | | | 94,235 | |

| Marsh & McLennan Cos., Inc. | | | 557 | | | | 105,535 | |

| | | | | | | 415,249 | |

| Health Care - 20.65% | | | | | | | | |

| Abbott Laboratories | | | 305 | | | | 33,571 | |

| AbbVie, Inc. | | | 283 | | | | 43,857 | |

| CVS Health Corp. | | | 807 | | | | 63,721 | |

| Danaher Corp. | | | 180 | | | | 41,641 | |

| Elevance Health, Inc. | | | 76 | | | | 35,839 | |

| Eli Lilly & Co. | | | 150 | | | | 87,438 | |

| Gilead Sciences, Inc. | | | 648 | | | | 52,494 | |

| Humana, Inc. | | | 82 | | | | 37,540 | |

| Johnson & Johnson | | | 425 | | | | 66,615 | |

| Pfizer, Inc. | | | 1,679 | | | | 48,338 | |

| UnitedHealth Group, Inc. | | | 275 | | | | 144,779 | |

| | | | | | | 655,833 | |

| Industrials - 11.10% | | | | | | | | |

| Boeing Co. (a) | | | 146 | | | | 38,056 | |

| Caterpillar, Inc. | | | 163 | | | | 48,194 | |

| CSX Corp. | | | 1,349 | | | | 46,770 | |

| Honeywell International, Inc. | | | 150 | | | | 31,457 | |

| L3Harris Technologies, Inc. | | | 145 | | | | 30,540 | |

| Lockheed Martin Corp. | | | 116 | | | | 52,576 | |

| Norfolk Southern Corp. | | | 112 | | | | 26,475 | |

| Northrop Grumman Corp. | | | 157 | | | | 73,497 | |

The accompanying notes are an integral part of these financial statements.

Milliman - Capital Group Hedged U.S. Income and Growth Fund

Schedule of Investments (Continued)

December 31, 2023

| | | Shares | | | Value | |

| Veralto Corp | | | 62 | | | $ | 5,100 | |

| | | | | | | | 352,665 | |

| Information Technology - 22.26% | | | | | | | | |

| Apple, Inc. | | | 403 | | | | 77,589 | |

| Applied Materials, Inc. | | | 272 | | | | 44,083 | |

| Broadcom, Inc. | | | 243 | | | | 271,249 | |

| Intel Corp. | | | 1,435 | | | | 72,109 | |

| Microsoft Corp. | | | 644 | | | | 242,170 | |

| | | | | | | | 707,200 | |

| Materials - 3.92% | | | | | | | | |

| Celanese Corp. | | | 297 | | | | 46,145 | |

| Linde PLC | | | 112 | | | | 46,000 | |

| LyondellBasell Industries NV - Class A | | | 343 | | | | 32,612 | |

| | | | | | | | 124,757 | |

| Real Estate - 1.21% | | | | | | | | |

| Extra Space Storage, Inc. | | | 240 | | | | 38,479 | |

| | | | | | | | | |

| Utilities - 2.63% | | | | | | | | |

| Constellation Energy Corp. | | | 324 | | | | 37,872 | |

| Sempra | | | 612 | | | | 45,735 | |

| | | | | | | | 83,607 | |

| TOTAL COMMON STOCKS (Cost $2,869,311) | | | | | | | 3,277,540 | |

| | | Contracts | | | Notional Amount | | | | |

| PURCHASED OPTIONS - 0.10% (b) | | | | | | | | | | | | |

| OVER-THE-COUNTER PUT OPTIONS - 0.10% | | | | | | | | | | | | |

| Milliman - Capital Group Income and Growth Basket: Counterparty: Bank of America, Expires 2/12/2024, Strike Price $9,500.00 (a)(c) | | | 301 | | | $ | 3,254,689 | | | | 3,242 | |

| TOTAL PURCHASED OPTIONS (Cost$24,381) | | | | | | | | | | | 3,242 | |

| | | | | | | | | | | | | |

| Total Investments (Cost $2,893,692) - 103.28% | | | | | | | | | | | 3,280,782 | |

| Liabilities in Excess of Other Assets - (3.28)% | | | | | | | | | | | (104,215 | ) |

| TOTAL NET ASSETS - 100.00% | | | | | | | | | | $ | 3,176,567 | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

| (a) | Non-income producing security. |

| (b) | Purchased option contracts are held in connection with corresponding written option contracts. |

The accompanying notes are an integral part of these financial statements.

Milliman - Capital Group Hedged U.S. Income and Growth Fund

Schedule of Investments (Continued)

December 31, 2023

(c) Comprised of a proprietary basket of securities. The underlying components of the basket as of December 31, 2023 are shown below:

| | | | | | | | | % of Total Notional | |

| Security Name | | Number of Shares | | | Notional Amount | | | Amount | |

| Broadcom, Inc. | | | 242 | | |

| $270,149 | | | | 8.31 | % |

| Microsoft Corp. | | | 640 | | | | 240,499 | | | | 7.39 | % |

| UnitedHealth Group, Inc. | | | 272 | | | | 143,460 | | | | 4.41 | % |

| Comcast Corp. – Class A | | | 2,498 | | | | 109,540 | | | | 3.37 | % |

| Marsh & McLennan Cos., Inc. | | | 553 | | | | 104,787 | | | | 3.23 | % |

| Home Depot, Inc. | | | 298 | | | | 103,285 | | | | 3.17 | % |

| JPMorgan Chase & Co. | | | 549 | | | | 93,402 | | | | 2.87 | % |

| Eli Lilly & Co. | | | 148 | | | | 86,191 | | | | 2.65 | % |

| Alphabet, Inc. – Class A | | | 600 | | | | 83,793 | | | | 2.57 | % |

| Apple, Inc. | | | 400 | | | | 76,994 | | | | 2.36 | % |

| Philip Morris International, Inc. | | | 773 | | | | 72,701 | | | | 2.24 | % |

| Northrop Grumman Corp. | | | 155 | | | | 72,652 | | | | 2.23 | % |

| Intel Corp. | | | 1,429 | | | | 71,827 | | | | 2.21 | % |

| Johnson & Johnson | | | 422 | | | | 66,151 | | | | 2.03 | % |

| CVS Health Corp. | | | 798 | | | | 63,006 | | | | 1.94 | % |

| CME Group, Inc. | | | 299 | | | | 62,883 | | | | 1.93 | % |

| BlackRock, Inc. | | | 71 | | | | 57,911 | | | | 1.78 | % |

| Lockheed Martin Corp. | | | 116 | | | | 52,427 | | | | 1.61 | % |

| Gilead Sciences, Inc. | | | 642 | | | | 52,014 | | | | 1.60 | % |

| Darden Restaurants, Inc. | | | 308 | | | | 50,607 | | | | 1.55 | % |

| Archer-Daniels-Midland Co. | | | 687 | | | | 49,625 | | | | 1.52 | % |

| Caterpillar, Inc. | | | 162 | | | | 47,817 | | | | 1.47 | % |

| Pfizer, Inc. | | | 1,663 | | | | 47,866 | | | | 1.47 | % |

| Chevron Corp. | | | 311 | | | | 46,424 | | | | 1.43 | % |

| CSX Corp. | | | 1,341 | | | | 46,499 | �� | | | 1.43 | % |

| Pioneer Natural Resources Co. | | | 206 | | | | 46,418 | | | | 1.42 | % |

| ConocoPhillips | | | 394 | | | | 45,778 | | | | 1.41 | % |

| Celanese Corp. | | | 294 | | | | 45,679 | | | | 1.40 | % |

| Linde PLC | | | 111 | | | | 45,666 | | | | 1.40 | % |

| Sempra | | | 606 | | | | 45,310 | | | | 1.39 | % |

| Applied Materials, Inc. | | | 271 | | | | 43,854 | | | | 1.35 | % |

| Yum! Brands, Inc. | | | 334 | | | | 43,583 | | | | 1.34 | % |

| AbbVie, Inc. | | | 280 | | | | 43,456 | | | | 1.34 | % |

| Danaher Corp. | | | 178 | | | | 41,270 | | | | 1.27 | % |

| Lennar Corp. | | | 269 | | | | 40,125 | | | | 1.23 | % |

| Meta Platforms, Inc. – Class A | | | 108 | | | | 38,341 | | | | 1.18 | % |

| Boeing Co. | | | 145 | | | | 37,835 | | | | 1.17 | % |

| Extra Space Storage, Inc. | | | 239 | | | | 38,242 | | | | 1.17 | % |

| Constellation Energy Corp. | | | 323 | | | | 37,723 | | | | 1.16 | % |

| Humana, Inc. | | | 82 | | | | 37,573 | | | | 1.15 | % |

| Keurig Dr Pepper, Inc. | | | 1,098 | | | | 36,585 | | | | 1.12 | % |

| Elevance Health, Inc. | | | 75 | | | | 35,441 | | | | 1.09 | % |

| Capital One Financial Corp. | | | 262 | | | | 34,401 | | | | 1.06 | % |

| General Motors Co. | | | 948 | | | | 34,063 | | | | 1.05 | % |

| EOG Resources, Inc. | | | 280 | | | | 33,916 | | | | 1.04 | % |

| Abbott Laboratories | | | 303 | | | | 33,356 | | | | 1.02 | % |

| LyondellBasell Industries NV – Class A | | | 340 | | | | 32,356 | | | | 0.99 | % |

| Baker Hughes Co. | | | 937 | | | | 32,012 | | | | 0.98 | % |

| Honeywell International, Inc. | | | 149 | | | | 31,232 | | | | 0.96 | % |

| L3Harris Technologies, Inc. | | | 144 | | | | 30,406 | | | | 0.93 | % |

| Top 50 Holdings | | | | | | | 3,137,131 | | | | 96.39 | % |

| Other Securities | | | | | | | 117,558 | | | | 3.61 | % |

| Total Underlying Positions | | | | | |

| $3,254,689 | | | | 100.00 | % |

The accompanying notes are an integral part of these financial statements.

Milliman - Capital Group Hedged U.S. Income and Growth Fund

Schedule of Investments (Continued)

December 31, 2023

SCHEDULE OF OPTIONS WRITTEN

December 31, 2023

| Description | | Expiration | | | Strike Price | | | Contracts | | | Notional Amount | | | Value | |

| Over-the-Counter Call Options | | | | | | | | | | | | | | | | | | |

| Milliman - Capital Group Income and Growth Basket: Counterparty: Bank of America (a) | | 2/12/2024 | | | $ | 10,410.00 | | | 301 | | | $ | (3,254,689 | ) | | $ | (148,363 | ) |

| Over-the-Counter Put Options | | | | | | | | | | | | | | | | | | |

| Milliman - Capital Group Income and Growth Basket: Counterparty: Bank of America (a) | | 2/12/2024 | | | | 8,000.00 | | | 301 | | | | (3,254,689 | ) | | | (114 | ) |

| TOTAL OPTIONS WRITTEN (Premiums Received $24,381) | | | $ | (148,477 | ) |

| (a) | Comprised of a proprietary basket of securities. The underlying components of the basket as of December 31, 2023 are shown in the Schedule of Investments. |

The accompanying notes are an integral part of these financial statements.

Milliman - Capital Group Hedged U.S. Income and Growth Fund

Schedule of Investments (Concluded)

December 31, 2023

The following is a summary of the fair valuations according to the inputs used as of December 31, 2023 in valuing the Fund’s assets and liabilities (see Note 2 in Notes to Financial Statements):

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | |

| | |

| | |

| | |

| |

| Common Stocks | | $ | 3,277,540 | | | $ | – | | | $ | – | | | $ | 3,277,540 | |

| Purchased Options | | | – | | | | 3,242 | | | | – | | | | 3,242 | |

| Total Assets | | $ | 3,277,540 | | | $ | 3,242 | | | $ | – | | | $ | 3,280,782 | |

| | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Options Written | | $ | – | | | $ | 148,477 | | | $ | – | | | $ | 148,477 | |

| Total Liabilities | | $ | – | | | $ | 148,477 | | | $ | – | | | $ | 148,477 | |

Portfolio Holdings Summary

| | | % of Net | |

| Asset Type | | Assets | |

| Common Stocks | | | 103.18 | % |

| Purchased Options | | | 0.10 | |

| Total Investments | | | 103.28 | |

| Written Options | | | (4.67 | ) |

| Assets in Excess of Other Liabilities | | | 1.39 | |

| Net Assets | | | 100.00 | % |

The accompanying notes are an integral part of these financial statements.

Milliman Variable Insurance Trust

Statements of Assets and Liabilities

December 31, 2023

| | | | Milliman - Capital Group Hedged U.S. Growth Fund | | | Milliman - Capital Group Hedged U.S. Income and Growth Fund | |

| | Assets: | | | | | | |

| | Investments, at value (a) | | $ | 3,444,726 | | | $ | 3,280,782 | |

| | Cash and cash equivalents | | | 69,965 | | | | 73,791 | |

| | Dividends and interest receivable | | | 2,474 | | | | 3,350 | |

| | Due from Advisor, net | | | 13,340 | | | | 13,131 | |

| | Deferred offering costs | | | 4,511 | | | | 4,502 | |

| | Total Assets | | | 3,535,016 | | | | 3,375,556 | |

| | | | | | | | | | |

| | Liabilities: | | | | | | | | |

| | Options written, at value (b) | | | 204,203 | | | | 148,477 | |

| | Distribution fees payable | | | 1,987 | | | | 1,937 | |

| | Payable to Trustees | | | 2,103 | | | | 2,085 | |

| | Professional fees payable | | | 25,028 | | | | 24,989 | |

| | Other liabilities | | | 21,772 | | | | 21,501 | |

| | Total Liabilities | | | 255,093 | | | | 198,989 | |

| | Commitments and Contingencies (Note 5) | | | — | | | | — | |

| | Net Assets | | $ | 3,279,923 | | | $ | 3,176,567 | |

| | | | | | | | | | |

| | Net Assets Consist of: | | | | | | | | |

| | Paid-in capital | | $ | 2,998,306 | | | $ | 3,036,593 | |

| | Total distributable earnings/(accumulated deficit) | | | 281,617 | | | | 139,974 | |

| | Net Assets | | $ | 3,279,923 | | | $ | 3,176,567 | |

| | | | | | | | | | |

| | Class 3 | | | | | | | | |

| | Net assets | | $ | 3,279,923 | | | $ | 3,176,567 | |

| | Shares of beneficial interest outstanding (unlimited shares authorized with par value of $0.001 per share) | | | 300,001 | | | | 303,527 | |

| | Net asset value, offering price and redemption price per share | | $ | 10.93 | | | $ | 10.47 | |

| | | | | | | | | | |

| (a) | Cost of investments | | $ | 2,968,859 | | | $ | 2,893,692 | |

| (b) | Premiums received | | | 43,400 | | | | 24,381 | |

The accompanying notes are an integral part of these financial statements.

Milliman Variable Insurance Trust

Statements of Operations

| | | Milliman - Capital Group Hedged U.S. Growth Fund | | | Milliman - Capital Group Hedged U.S. Income and Growth Fund | |

| | | Period February 10, 2023(a) to December 31, 2023 | �� | | Period February 10, 2023(a) to December 31, 2023 | |

| Investment Income: | |

| | | | | | |

| Dividends | | $ | 27,488 |

| | $ | 63,493 | |

| Interest | | | 1,717 | | | | 2,015 | |

| Total Investment Income | | | 29,205 | | | | 65,508 | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Investment advisory fees | | | 20,994 | | | | 20,433 | |

| Accounting and administration fees | | | 50,980 | | | | 50,377 | |

| Custody fees | | | 4,343 | | | | 2,833 | |

| Transfer agent fees | | | 5,353 | | | | 5,346 | |

| Distribution service fees | | | 6,816 | | | | 6,634 | |

| Professional fees and expenses | | | 32,797 | | | | 32,652 | |

| Trustees fees and expenses | | | 2,845 | | | | 2,846 | |

| Organizational costs | | | 3,573 | | | | 3,573 | |

| Offering costs | | | 35,653 | | | | 35,652 | |

| Other expenses | | | 6,778 | | | | 6,778 | |

| Total Expenses | | | 170,132 | | | | 167,124 | |

| Waivers/expense reimbursement by Advisor | | | (140,414 | ) | | | (138,199 | ) |

| Net Expenses | | | 29,718 | | | | 28,925 | |

| Net Investment Income/(Loss) | | | (513 | ) | | | 36,583 | |

| | | | | | | | | |

| Realized and Unrealized Gain/(Loss): | | | | | | | | |

| Net realized gain/(loss) on: | | | | | | | | |

| Investments | | | (85,416 | ) | | | (98,705 | ) |

| Options written | | | 51,969 | | | | (24,315 | ) |

| Net realized gain/(loss) | | | (33,447 | ) | | | (123,020 | ) |

| Net change in unrealized appreciation/(depreciation) on: | | | | | | | | |

| Investments | | | 475,867 | | | | 387,090 | |

| Options written | | | (160,803 | ) | | | (124,096 | ) |

| Net change in unrealized appreciation/(depreciation) | | | 315,064 | | | | 262,994 | |

| Net realized and unrealized gain/(loss) | | | 281,617 | | | | 139,974 | |

| Net Increase/(Decrease) in Net Assets From Operations | | $ | 281,104 |

| | $ | 176,557 | |

(a) Commencement of operations

The accompanying notes are an integral part of these financial statements.

Milliman Variable Insurance Trust

Statements of Changes in Net Assets

| | | Milliman - Capital Group Hedged U.S. Growth Fund | | | Milliman - Capital Group Hedged U.S. Income and Growth Fund | |

| | | Period February 10, 2023(a) to | | | Period February 10, 2023(a) to | |

| | | December 31, | | | December 31, | |

| | | 2023 | | | 2023 | |

| Operations: | | | | | | |

| Net Investment income/(loss) | | $ | (513 | ) | | $ | 36,583 | |

| Net realized gain/(loss) | | | (33,447 | ) | | | (123,020 | ) |

| Net change in unrealized appreciation/(depreciation) | | | 315,064 | | | | 262,994 | |

| Net Increase/(Decrease) in Net Assets Resulting from Operations | | | 281,104 | | | | 176,557 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Distributions to shareholders | | | – | | | | (36,583 | ) |

| Tax return of capital to shareholders | | | – | | | | (196 | ) |

| Total distributions to shareholders | | | – | | |

| (36,779 | ) |

| | | | | | | | | |

| Capital Share Transactions:(b) | | | | | | | | |

| Proceeds from shares sold | | | 3,053,804 | | | | 3,000,010 | |

| Reinvestments | | | – | | | | 36,779 | |

| Cost of shares redeemed | | | (54,985 | ) | | | – | |

| Net Increase/(Decrease) in Net Assets from Capital Share Transactions | | | 2,998,819 | | | | 3,036,789 | |

| Total Increase/(Decrease) in Net Assets | | | 3,279,923 | | | | 3,176,567 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of the period | | | – | | | | – | |

| End of the period | | $ | 3,279,923 | | | $ | 3,176,567 | |

| | | | | | | | | |

| Change in Shares Outstanding:(b) | | | | | | | | |

| Shares sold | | | 305,223 | | | | 300,001 | |

| Shares reinvested | | | – | | | | 3,526 | |

| Shares redeemed | | | (5,222 | ) | | | – | |

| Net Increase/(Decrease) | | | 300,001 | | | | 303,527 | |

| (a) | Commencement of Operations |

| (b) | Class 3 |

The accompanying notes are an integral part of these financial statements.

Milliman Variable Insurance Trust

Financial Highlights

| | | Per Share Operating Performance (for a share outstanding throughout each period) | | Ratios/Supplemental Data: | |

| | | | | | Investment Operations: | | Distributions: | | | | | | | | | | Ratio to Average Net Assets of: (a) | | | | |

| | | Net Asset

Value,

Beginning

of Period | | | Net

investment

income/

(loss) (b) | | | Net realized and unrealized gain/(loss) | | Total From Investment Operations | | From net

investment

income | | Total Distributions | | | Net Asset

Value, End

of Period | | Total return (c) | | | Net assets, end of

period

(000) | | Expenses,

gross | | | Expenses,

net (d) | | | Net

investment

income/

(loss) | | | Portfolio

turnover

rate (e) | |

| Milliman - Capital Group Hedged U.S. Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the period 2/10/23 (f) - 12/31/23 | | $ | 10.00 | | | (0.00 | )(g) | | 0.93 | | 0.93 | | – | | – | | | $ | 10.93 | | | 9.30 | % | | $ | 3,280 | | 6.24 | % | | 1.09 | % | | (0.02 | )% | | 32 | % |

| Milliman - Capital Group Hedged U.S. Income and Growth Fund | | |

| For the period 2/10/23 (f) - 12/31/23 | | $ | 10.00 | | | 0.12 | | | 0.47 | | 0.59 | | (0.12 | ) | (0.12 | )(h) | | $ | 10.47 | | | 5.93 | % | | $ | 3,177 | | 6.30 | % | | 1.09 | % | | 1.38 | % | | 22 | % |

| (a) | Annualized for periods less than one year. |

| (b) | Net investment income/(loss) per share has been calculated based on average shares outstanding during the period. |

| (c) | Total return is based on the change in net asset value of a share during the period, assumes reinvestment of dividends and distributions at net asset value and is not annualized for periods less than one year. Total return reflects waivers/reimbursements by the manager. Performance would have been lower had the waivers/reimbursements not been in effect. Total return does not include fees, charges, or expenses imposed by the variable annuity and life insurance contracts for which the Funds serve as an underlying investment vehicle. If total return had taken these into account, performance would have been lower. |

| (d) | Net expenses reflect fee waivers and expense reimbursements by the Advisor. |

| (e) | Not annualized for periods less than one year. |

| (f) | Commencement of operations. |

| (g) | Amount represents less than $0.005 per share. |

| (h) | A portion of total distributions amounting to less than $0.005 per share is return of capital. |

The accompanying notes are an integral part of these financial statements.

Milliman Variable Insurance Trust

Notes to Financial Statements

December 31, 2023

1. ORGANIZATION

Milliman Variable Insurance Trust (the “Trust”) was organized under the laws of the state of Delaware as a Delaware statutory trust on November 2, 2020, and is registered with the U.S. Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. As of December 31, 2023, the Trust consisted of 3 operational series, two of which are presented herein (each, a “Fund” and together, the “Funds”). The remaining series is presented in a separate report. Each of the Funds is classified as non-diversified under the 1940 Act. Each Fund offers shares only to insurance company separate accounts funding variable annuity contracts and variable life insurance policies and other qualified investors. All shares of the Funds have equal rights and privileges. As of December 31, 2023, only Class 3 shares were offered, which have no front-end sales load, deferred sales charge, or redemption fee.

The Funds and their respective commencement dates are as follows:

| | | Commencement of |

| Name | | Operations |

| Milliman - Capital Group Hedged U.S. Growth Fund | | February 10, 2023 |

| Milliman - Capital Group Hedged U.S. Income and Growth Fund | | February 10, 2023 |

The Milliman - Capital Group Hedged U.S. Growth Fund’s investment objective is to provide long-term growth of capital, while also seeking to provide a hedge against downside equity exposure.

The Milliman - Capital Group Hedged U.S. Income and Growth Fund's investment objective is to produce income and provide long-term growth of capital, while also seeking to provide a hedge against downside equity exposure.

Each Fund seeks to achieve its investment objective by primarily investing its assets in a combination of common stocks (to provide long equity exposure) and derivatives (to create a hedge against the Fund’s downside equity exposure).

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by each Fund in the preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles (“GAAP”). The Trust is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services – Investment Companies.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities, as well as reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Computation of Net Asset Value

The net asset values (“NAV”) of the Funds are determined as of the close of regular trading on the New York Stock Exchange (“NYSE”) (generally 4:00 p.m. ET) on each business day the NYSE is open for regular trading. If the NYSE closes early on a valuation day, the Funds shall determine NAV as of that time.

The Board of Trustees of the Trust (the “Board”) has adopted Pricing and Valuation Procedures (“Valuation Procedures”) to be used for valuing all securities and other assets held by the Funds, including those for which market quotations are not readily available or are deemed not be reliable. The Board has designated Milliman Financial Risk Management LLC (“Milliman”) as the valuation designee, which has established a pricing committee comprised of representatives of Milliman (the “Pricing Committee”) to provide input to Milliman in making fair value determinations in accordance with the Valuation Procedures.

Equity securities, including shares of exchange-traded Funds (“ETFs”), listed on any national or foreign exchange (excluding

Milliman Variable Insurance Trust

Notes to Financial Statements

December 31, 2023

the Nasdaq National Market (“Nasdaq”) and the London Stock Exchange Alternative Investment Market (“AIM”)) will be valued at the last sale price on the exchange on which they are principally traded, or, for Nasdaq and AIM securities, the official closing price. Securities traded on more than one securities exchange are valued at the last sale price or official closing price, as applicable, at the close of the exchange representing the principal market for such securities.

Exchange-traded options, including FLexible EXchange® Options (“FLEX Options”), are valued at a market-based price provided by the exchange on which the options contract is traded at the official close of that exchange’s trading date. If the exchange on which the options contract is traded is unable to provide a market price, exchange-traded options prices will be provided by a model-pricing provider. Over-the-counter options (“OTC Options”), including certain binary options, are valued at the mean of the most recent bid and asked price, if available, or otherwise at their closing bid price. Otherwise, the value of an options contract will be determined by the Pricing Committee in accordance with the Valuation Procedures.

Fixed income securities will generally be valued using a third-party pricing service vendor (a “Pricing Service”). Fixed income securities having a remaining maturity of 60 days or less when purchased will be valued at cost adjusted for amortization of premiums and accretion of discounts, provided the Pricing Committee has determined that the use of amortized cost is an appropriate reflection of fair value given market and issuer specific conditions existing at the time of the determination.

Open-end investment companies, with the exception of ETFs, are valued at their respective NAVs.

The Funds’ accounting agent may obtain all market quotations used in valuing securities from a Pricing Service. If no quotation can be obtained from a Pricing Service, then the Funds’ accounting agent will contact the Pricing Committee. The Pricing Committee will then attempt to obtain one or more broker quotes for the security or other asset daily and will value the security or other asset accordingly. If no quotation is available from either a Pricing Service, or one or more brokers, or if the Pricing Committee has reason to question the reliability or accuracy of a quotation supplied or the use of amortized cost, the value of any portfolio security or other asset held by a Fund for which reliable market quotations are not readily available will be determined by Milliman in a manner that most appropriately reflects fair market value of the security or other asset on the valuation date.

The Trust follows the authoritative guidance (GAAP) for fair value measurements, which established a framework for measuring fair value and a hierarchy for inputs and techniques used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs and techniques by requiring that the most observable inputs be used when available. The guidance established three tiers of inputs that may be used to measure fair value as follows:

| Level 1 - | Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access. |

| | |

| Level 2 - | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | |

| Level 3 - | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

| | |

The inputs used to value the Funds’ investments at December 31, 2023, are summarized at the end of each Fund’s Schedule of Investments. The inputs or techniques used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Milliman Variable Insurance Trust

Notes to Financial Statements

December 31, 2023

Cash and Cash Equivalents

Cash and cash equivalents include amounts held in interest-bearing demand deposit accounts with the Funds’ custodian.

Organizational and Offering Costs

Organizational and offering costs directly attributable to a series of the Trust are charged to that series, such as certain registration fees, while expenses which are attributable to more than one series are allocated among the respective series on a pro rata basis.

Organizational costs are expensed as incurred and include costs of forming the Funds and servicing agreements. Offering costs are recorded as a deferred asset and are amortized on a straight-line basis for a period of twelve months upon commencement of operations of each Fund. Offering costs include legal fees pertaining to the preparation, review and filing of each Fund’s initial registration statement with the SEC, and printing, mailing or other distribution charges related to each Fund’s prospectus and statement of additional information. Organizational costs and offering costs are subject to the Funds' Expense Limitation Agreement (See Note 5).

Investment Transactions, Investment Income and Expenses

Investment transactions are accounted for on a trade date basis for financial reporting purposes. Realized gains and losses from investment transactions are recorded on an identified cost basis. Dividend income, if any, is recognized on the ex-dividend date. Interest income, including accretion of discounts and amortization of premiums, is recognized on an accrual basis using the effective yield method.

Expenses are accrued daily. Expenses of the Trust, which are directly identifiable to a specific series, are applied to that series. Expenses which are not identifiable to a specific series are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense.

Distributions to Shareholders

Distributions to shareholders are recorded on the ex-dividend date. The Funds intend to pay out dividends from their net investment income, if any, annually. Distributions of net realized capital gains, if any, will be declared and paid at least annually by the Funds. The Funds may periodically make reclassifications among certain of its capital accounts as a result of the recognition and characterization of certain income and capital gain distributions determined annually in accordance with federal tax regulations which may differ from GAAP. Distributions that exceed earnings and profits for tax purposes are reported as a return of capital.

3. DERIVATIVES

Disclosures about derivative instruments are intended to improve financial reporting for derivative instruments by enabling investors to understand how and why an entity uses derivatives, how derivatives are accounted for, and how derivative instruments affect an entity’s results of operations and financial position.

In seeking to create a hedge against a Fund’s downside equity exposure, Milliman primarily intends to purchase and sell either OTC options and/or FLEX Options on common stocks and/or indices or ETFs representing those common stocks. OTC options are traded and privately negotiated in the OTC market and are subject to counterparty risk of the writer of the options contract. Many counterparties to OTC options are financial institutions, such as banks and broker-dealers, and their creditworthiness (and ability to pay or perform) may be negatively impacted by factors affecting financial institutions generally. FLEX Options are options contracts that trade on an exchange but provide an investor with the ability to customize key contract terms like strike price, style and expiration date, while achieving price discovery (i.e., determining market prices) in competitive, transparent auctions markets and avoiding the counterparty exposure of OTC options positions. Like traditional exchange-traded options, FLEX Options are guaranteed for settlement by the OCC, a market clearinghouse that guarantees performance by counterparties to certain derivatives contracts. Milliman is not restricted in its use of OTC or exchange-traded options and may use either type to achieve the Funds’ principal investment strategies.

Milliman Variable Insurance Trust

Notes to Financial Statements

December 31, 2023

The Funds will purchase and sell call and put options. In general, put options give the holder (i.e., the buyer) the right to sell an asset (or deliver the cash value of the underlying asset) and the seller (i.e., the writer) of the put has the obligation to buy the asset (or receive cash value of the underlying asset) at a certain defined price. Call options give the holder (i.e., the buyer) the right to buy an asset (or receive cash value of the underlying asset) and the seller (i.e., the writer) the obligation to sell the asset (or deliver cash value of the underlying asset) at a certain defined price.

When a Fund purchases an option, an amount equal to the premium paid by the Fund is recorded as an investment and is subsequently adjusted to the current value of the option purchased. If an option expires on the stipulated expiration date or if the Fund enters into a closing sale transaction, a gain or loss is realized. If a call option is exercised, the cost of the security acquired is increased by the premium paid for the call or, if cash-settled, a gain or loss is realized. If a put option is exercised, a gain or loss is realized from the sale of the underlying security, or the transfer of the relative cash amount if cash-settled, and the proceeds are decreased by the premium originally paid.

When a Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current value of the option written. Premiums received from writing options that expire unexercised are treated by the Fund on the expiration date as realized gain from written options. The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or if the premium is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option written by the Fund is exercised, the premium received is added to the proceeds from the sale of the underlying security, or the transfer of the relevant cash amount if cash-settled, in determining whether the Fund has a realized a gain or loss. If a put option written by the Fund is exercised, the premium received reduces the cost basis of the securities purchased by the Fund if physical delivery is required, or the corresponding cash amount if cash-settled. The Fund, as a writer of an option, bears the market risk of an unfavorable change in the price of the asset underlying the written option. Risk of loss on written options may exceed amounts recognized on the Statements of Assets and Liabilities.

The following tables summarize derivatives held by the Fund and their impact on the Funds’ results of operations.

The location and value of derivative instruments on the Statements of Assets and Liabilities as December 31, 2023, was as follows:

| | | Location | | Equity Risk | | | Total | |

| Milliman - Capital Group Hedged U.S. Growth Fund | | | | | | | | | | |

| Assets - Purchased options | | Investments, at value | | $ | 1,699 | | | $ | 1,699 | |

| Liabilities - Written options | | Options written, at value | | $ | 204,203 | | | $ | 204,203 | |

| Milliman - Capital Group Hedged U.S. Income and Growth Fund | | | | | | | | | | |

| Assets - Purchased options | | Investments, at value | | $ | 3,242 | | | $ | 3,242 | |

| Liabilities - Written options | | Options written, at value | | $ | 148,477 | | | $ | 148,477 | |

Milliman Variable Insurance Trust

Notes to Financial Statements

December 31, 2023

The location and effect of derivative instruments on the Statements of Operations for the period ended December 31, 2023 was as follows:

| | | Realized Gain/(Loss) on Derivatives Recognized in Income |

| Milliman - Capital Group Hedged U.S. Growth Fund | | Location | | | Equity Risk | | | | Total | |

| Purchased options | | Investments | | $ | (178,068 | ) | | $ | (178,068 | ) |

| Written options | | Written Options | | | 51,969 | | | | 51,969 | |

| | | | | $ | (126,099 | ) | | $ | (126,099 | ) |

| Milliman - Capital Group Hedged U.S. Income and Growth Fund | | | | | | | | | | |

| Purchased options | | Investments | | $ | (118,529 | ) | | $ | (118,529 | ) |

| Written options | | Written Options | | | (24,315 | ) | | | (24,315 | ) |

| | | | | $ | (142,844 | ) | | $ | (142,844 | ) |

| | | | | | | | | | | |

| | | Change in Unrealized Appreciation/(Depreciation) on Derivatives

Recognized in Income |

| Milliman - Capital Group Hedged U.S. Growth Fund | | Location | | | Equity Risk | | | | Total | |

| Purchased options | | Investments | | $ | (41,701 | ) | | $ | (41,701 | ) |

| Written options | | Written Options | | | (160,803 | ) | | | (160,803 | ) |

| | | | | $ | (202,504 | ) | | $ | (202,504 | ) |

| Milliman - Capital Group Hedged U.S. Income and Growth Fund | | | | | | | | |

| Purchased options | | Investments | | $ | (21,140 | ) | | $ | (21,140 | ) |

| Written options | | Written Options | | | (124,096 | ) | | | (124,096 | ) |

| | | | | $ | (145,236 | ) | | $ | (145,236 | ) |

The notional amounts of derivative instruments outstanding relative to each Fund’s net assets as of period end and the amounts of net realized gain (loss) and net change in unrealized appreciation (depreciation) on financial derivative instruments during the period, as disclosed in the Schedules of Investments, serve as indicators of the volume of financial derivative activity for the Funds.

Because OTC options are not guaranteed for settlement by a clearing broker, they are generally considered to have greater counterparty risk than exchange-traded options, such as FLEX Options, which are issued and guaranteed for settlement by the Options Clearing Corporation (“OCC”) and their clearing houses (“clearing members”) rather than a bank or a broker. To the extent the Fund uses FLEX Options, although clearing members guarantee performance of their clients’ obligations to the clearing house, there is a risk that the assets of the Fund might not be fully protected in the event of the clearing member’s bankruptcy, as the Fund would be limited to recovering only a pro rata share of all available funds segregated on behalf of the clearing member’s customers for the relevant account class. The use of certain derivatives involves leverage, which can cause the Fund’s portfolio to be more volatile than if the portfolio had not been leveraged. Leverage can significantly magnify the effect of price movements of the reference asset, disproportionately increasing the Fund’s losses and reducing the Fund’s opportunities for gains when the reference asset changes in unexpected ways. In some instances, such leverage could result in losses that exceed the original amount invested.

In order to better define its contractual rights and to secure rights to help the Funds mitigate their counterparty risk, the Funds may enter into International Swaps and Derivatives Association, Inc. Master Agreements (“ISDA Master Agreements”) or similar agreement with derivative contract counterparties. An ISDA Master Agreement is a bilateral agreement between the Fund and a counterparty that governs over-the-counter derivatives and foreign currency exchange contracts and typically contains, among other things, collateral posting items and netting provisions in the event of a default or termination event. Under an ISDA Master Agreement, the Fund may, under certain circumstances, offset with the counterparty certain derivative financial instrument payables and/or receivables with collateral held and/or posted and create one single net payment. The provisions of an ISDA Master Agreement typically permit a single net payment in the event of default (close-out) netting including the bankruptcy or insolvency of the counterparty. However, bankruptcy

Milliman Variable Insurance Trust

Notes to Financial Statements

December 31, 2023

or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against the right of offset in bankruptcy, insolvency or other events.

For financial reporting purposes, the Funds do not offset derivative assets and derivative liabilities that are subject to netting arrangements in the Statements of Assets and Liabilities.

At December 31, 2023, derivative assets and liabilities subject to offsetting provisions were as follows:

Milliman - Capital Group Hedged U.S. Growth Fund

| Counterparty | | | Gross Value of Derivative Assets | | | Derivatives Available for Offset(1) | | | Non-Cash Collateral Received(1) | | | Cash Collateral Received(1) | | | Net Exposure of Derivative Assets(2) | |

| Bank of America | | | $ | 1,699 | | | $ | (1,699 | ) | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | | Gross Value of Derivative Liabilities | | | Derivatives Available for Offset(1) | | | Non-Cash Collateral Received(1) | | | Cash Collateral Received(1) | | | Net Exposure of Derivative Liabilities(2) | |

| Bank of America | | | $ | 204,203 | | | $ | (1,699 | ) | | $ | - | | | $ | - | | | $ | 202,504 | |

| | | | | | | | | | | | | | | | | | | | | | |

Milliman - Capital Group Hedged U.S. Income and Growth Fund

| Counterparty | | | Gross Value of Derivative Assets | | | Derivatives Available for Offset(1) | | | Non-Cash Collateral Received(1) | | | Cash Collateral Received(1) | | | Net Exposure of Derivative Assets(2) | |

| Bank of America | | | $ | 3,242 | | | $ | (3,242 | ) | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | | Gross Value of Derivative Liabilities | | | Derivatives Available for Offset(1) | | | Non-Cash Collateral Received(1) | | | Cash Collateral Received(1) | | | Net Exposure of Derivative Liabilities(2) | |

| Bank of America | | | $ | 148,477 | | | $ | (3,242 | ) | | $ | - | | | $ | - | | | $ | 145,235 | |

| | | | | | | | | | | | | | | | | | | | | | |

| (1) | Excess of collateral is not shown for financial reporting purposes. |

| (2) | Net exposure represents the receivable due from or payable due to the counterparty in the event of default. |

4. FEDERAL TAXES INFORMATION

No provision for federal income taxes has been made, as it is each Fund’s policy to comply with the Subchapter M provision of the Internal Revenue Code of 1986, as amended, and to distribute to shareholders each year, all of its taxable income and realized gains.

Each Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the tax returns are filed. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Statements of Operations. The Funds do not have any unrecognized tax benefits or uncertain tax positions that would require a provision for income tax. Accordingly, the Funds did not incur any interest or penalties for the period ended December 31, 2023.

For financial reporting purposes, any permanent differences resulting from different book and tax treatment are reclassified between distributable earnings and paid-in capital in the period that the differences arise. These differences are primarily due to net operating losses. Results of operations and net assets are not affected by these reclassifications. As of December 31, 2023, the following reclassifications were made on the applicable Funds’ Statements of Assets and Liabilities for permanent differences:

Milliman Variable Insurance Trust

Notes to Financial Statements

December 31, 2023

| | | Distributable Earnings/ (Accumulated Deficit) | | | Paid-In Capital | |

| Milliman - Capital Group Hedged U.S. Growth Fund | | $ | 513 | | | $ | (513 | ) |

At December 31, 2023, the cost of investments, including derivatives, and unrealized appreciation/(depreciation) for federal income tax purposes for each Fund were as follows:

| | | Cost of Investments | | | Gross Unrealized Appreciation | | | Gross Unrealized Depreciation | | | Net Unrealized Appreciation/ (Depreciation) | |

| Milliman - Capital Group Hedged U.S. Growth Fund | | $ | 2,925,459 | | | $ | 642,842 | | | $ | (327,778 | ) | | $ | 315,064 | |

| Milliman - Capital Group Hedged U.S. Income and Growth Fund | | | 2,869,311 | | | | 484,556 | | | | (221,562 | ) | | | 262,994 | |

For the period ended December 31, 2023, the tax character of distributions by the applicable Funds, was as follows:

| | | Distributions paid from: | | | | | |

| | | Ordinary Income | | | | Long-Term Capital Gains | | | | Net Return of Capital | | | | Total Distributions Paid | |

| Milliman - Capital Group Hedged U.S. Income and Growth Fund | | $ | 36,583 | | | | – | | | $ | 196 | | | $ | 36,779 | |

As of December 31, 2023, the components of distributable earnings/(accumulated deficit) on a tax basis were as follows: