EXHIBIT 99.2

www.electrovaya.com

ELECTROVAYA INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE QUARTER ENDED MARCH 31, 2024

May 13, 2024

| 1| Page |

ELECTROVAYA INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

1. | OUR BUSINESS |

| 4 |

|

|

|

|

|

|

2. | OUR STRATEGY |

| 5 |

|

|

|

|

|

|

3. | RECENT DEVELOPMENTS |

| 5 |

|

|

|

|

|

|

4. | SELECTED QUARTERLY FINANCIAL INFORMATION |

| 7 |

|

|

|

|

|

|

5. | LIQUIDITY AND CAPITAL RESOURCES |

| 14 |

|

|

|

|

|

|

6. | OUTSTANDING SHARE DATA |

| 15 |

|

|

|

|

|

|

7. | OFF-BALANCE SHEET ARRANGEMENTS |

| 16 |

|

|

|

|

|

|

8. | RELATED PARTY TRANSACTIONS |

| 16 |

|

|

|

|

|

|

9. | CRITICAL ACCOUNTING ESTIMATES |

| 16 |

|

|

|

|

|

|

10. | CHANGES IN ACCOUNTING POLICIES AND RECENT ACCOUNTING PRONOUNCEMENTS |

| 16 |

|

|

|

|

|

|

11. | FINANCIAL AND OTHER INSTRUMENTS |

| 16 |

|

|

|

|

|

|

12. | DISCLOSURE CONTROLS |

| 17 |

|

|

|

|

|

|

13. | INTERNAL CONTROL OVER FINANCIAL REPORTING |

| 17 |

|

|

|

|

|

|

14. | QUALITATIVE AND QUANTITATIVE DISCLOSURES ABOUT RISKS AND UNCERTAINTIES |

| 18 |

|

|

|

|

|

|

15. | OTHER RISKS |

| 22 |

|

· | Introduction |

Management’s discussion and analysis (“MD&A”) provides our viewpoint on our Company, performance and strategy. “We,” “us,” “our,” “Company” and “Electrovaya” include Electrovaya Inc. and its wholly-owned or controlled subsidiaries, as the context requires.

Our Board of Directors, on the recommendation of its Audit Committee, approved the content of this MD&A on May 9, 2024 and it is, therefore, dated as at that date. This MD&A includes the operating and financial results for the quarters ending March 31, 2024 and 2023, and should be read in conjunction with our consolidated financial statements. It includes comments that we believe are relevant to an assessment of and understanding of the Company’s consolidated results of operations and financial condition. The financial information herein is presented in thousands of US dollars unless otherwise noted (except per share amounts, which are presented in US dollars unless otherwise noted), in accordance with International Financial Reporting Standards (“IFRS”). Additional information about the Company, including Electrovaya’s current annual information form, can be found on the SEDAR website for Canadian regulatory filings at www.sedar.com and the EDGAR website for SEC regulatory filings at sec.gov/EDGAR.

| 2| Page |

· | Forward-looking statements |

This MD&A contains forward-looking statements including statements with respect factors impacting revenue, the competitive position of the Company’s products, global trends in technology supply chains, the Company’s current and prospective Original Equipment Manufacturer (OEM) relationships, the Company’s strategic objectives and financial plans, including the operations and strategic direction of Electrovaya Labs, expectations with respect to increasing predictability of customer sales cycles in the future, the Company’s products, including electric bus, high voltages and electric lift truck and robotic applications and the potential for revenue from new applications , market conditions being favourable for the use of the Company’s shelf prospectus; the ability to draw on the Company’s shelf prospectus and favourable market conditions therefor, cost implications, continually increasing the Company’s intellectual property portfolio, additional capital raising activities, the adequacy of financial resources to continue as a going concern, and also with respect to the Company’s markets, objectives, goals, strategies, intentions, beliefs, expectations and estimates generally. Forward-looking statements can generally be identified by the use of words such as “may”, “will”, “could”, “should”, “would”, “likely”, “possible”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “plan”, “objective” and “continue” (or the negatives thereof) and words and expressions of similar import. Readers and investors should note that any announced estimated and forecasted orders and volumes provided by customers and potential customers to Electrovaya also constitute forward-looking information and Electrovaya does not have (a) knowledge of the material factors or assumptions used by the customers or potential customers to develop the estimates or forecasts or as to their reliability and (b) the ability to monitor the performance of the business its customers and potential customers in order to confirm that the forecasts and estimates initially represented by them to Electrovaya remain valid. If such forecasts and estimates do not remain valid, or if firm irrevocable orders are not obtained, the potential estimated revenues of Electrovaya could be materially and adversely impacted.

Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, the outcome of such statements involve and are dependent on risks and uncertainties, and undue reliance should not be placed on such statements. Certain material factors or assumptions are applied in making forward-looking statements, and actual results may differ materially from those expressed or implied in such statements. Material assumptions used to develop forward-looking information in this MD&A include, among other things, that current customers will continue to make and increase orders for the Company’s products; that the Company’s alternate supply chain will be adequate to replace material supply and manufacturing; that the Company’s products will remain competitive with currently-available alternatives in the market; that the alternative energy market will continue to grow and the impact of that market on the Company; the purchase orders actually placed by customers of Electrovaya; customers not terminating or renewing agreements; general business and economic conditions (including but not limited to currency rates and creditworthiness of customers); the relative effect of the global pandemics, geopolitics and supply chains on the Company’s business, its customers, and the economy generally; the Company’s liquidity and capital resources, including the availability of additional capital resources to fund its activities; the Company’s ability to raise sufficient non-dilutive capital to start up its US cell manufacturing operations; industry competition; changes in laws and regulations; legal and regulatory proceedings; the ability to adapt products and services to changes in markets; the ability to retain existing customers and attract new ones; the ability to attract and retain key executives and key employees; the granting of additional intellectual property protection; and the ability to execute strategic plans. Information about risks that could cause actual results to differ materially from expectations and about material factors or assumptions applied in making forward-looking statements may be found herein under the heading “Qualitative and Quantitative Disclosures About Risks and Uncertainties”, in the Company’s Annual Information Form (“AIF”) for the year ended September 30, 2023 under the heading “Risk Factors”, and in other public disclosure documents filed with Canadian securities regulatory authorities. The Company does not undertake any obligation to update publicly or to revise any of the forward-looking statements contained or incorporated by reference in this document, whether as a result of new information, future events or otherwise, except as required by law.

Revenue forecasts herein constitute future‐oriented financial information and financial outlooks (collectively, “FOFI”), and generally, are, without limitation, based on the assumptions and subject to the risks set out above under “Forward‐Looking Statements”. Although management believes such assumptions to be reasonable, a number of such assumptions are beyond the Company’s control and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. FOFI is provided for the purpose of providing information about management’s current expectations and plans relating to the Company’s future performance, and may not be appropriate for other purposes.

The FOFI does not purport to present the Company’s financial condition in accordance with IFRS, and it is expected that there may be differences between actual and forecasted results, and the differences may be material. The inclusion of the FOFI in this MD&A should not be regarded as an indication that the Company considers the FOFI to be a reliable prediction of future events, and the FOFI should not be relied upon as such.

| 3| Page |

ELECTROVAYA INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

1. | OUR BUSINESS |

Electrovaya Inc. designs, develops and manufactures directly or through out-sourced manufacturing lithium ion batteries for Material Handling Electric Vehicles (“MHEV”) and other electric transportation applications, as well for electric stationary storage and other battery markets. Our main businesses include:

| (a) | lithium ion battery systems to power MHEV including fork-lifts as well as accessories such as battery chargers to charge the batteries; |

|

|

|

| (b) | lithium ion batteries for robotic applications; |

|

|

|

| (c) | high voltage battery systems for electric bus, truck and defense applications; and, |

|

|

|

| (d) | industrial products for energy storage. |

The Company has a battery and battery systems research and manufacturing facility in Mississauga, Ontario. In December 2019, Electrovaya moved its corporate head office to 6688 Kitimat Road in Mississauga, Ontario. The location, which comprises approximately 62,000 square feet, is designed to enhance the Company’s productivity and efficiency. The Company also owns a 52 acre site including a 137,000 square foot manufacturing site at 1 Precision Way in Jamestown New York. This site is intended to be Electrovaya’s US headquarters and a key manufacturing hub. For further information, see “Liquidity and Capital Resources”. The Company has operating personnel in both Canada and the USA.

Electrovaya has a team of mechanical, electrical, electronic, battery, electrochemical, materials and system engineers able to give clients a “complete solution” for their energy and power requirements. Electrovaya also has substantial intellectual property in the lithium ion battery sector.

Management believes that our battery and battery systems contain a unique combination of characteristics that enable us to offer battery solutions that are competitive with currently available advanced lithium ion and non-lithium ion battery technologies. These characteristics include:

| · | Scalability and pouch cell geometry: We believe that large-format pouched prismatic (flat) cells represent the best long-term battery technology for use in large electro-motive and energy storage systems. |

|

|

|

| · | Safety: We believe our batteries provide a high level of safety in a lithium ion battery. Safety in lithium ion batteries is becoming an important performance factor and Original Equipment Manufacturers (“OEMs”) and users of lithium ion batteries prefer to have the highest level of safety possible in lithium ion batteries. |

|

|

|

| · | Cycle-life: Our cells are in the forefront of battery manufacturers with respect to cycle-life, with excellent rate capabilities. Cycle-life is generally controlled by the parasitic reactions inside the cell and these reactions have to be reduced in order to deliver industry leading cycle-life. Higher cycle-life is of importance in many intensive applications of lithium ion batteries. |

|

|

|

| · | Energy and Power: Our batteries give industry leading combination of energy and power and can be application specific. |

|

|

|

| · | Battery Management System: Our Battery Management System (“BMS”) has developed over the years, and provides excellent control and monitoring of the battery with advanced features as well as communication to many chargers, electric vehicles and other devices. |

| 4| Page |

2. | OUR STRATEGY |

We have developed a highly proprietary and specialized lithium ion technology that provides superior cycle life and safety. Given these advantages, the Company is focused on applications where those two performance differentiators provide the greatest benefits which has led to a focus on heavy duty and mission critical applications. These often require battery systems to provide around the clock operational capability, longer life and better safety and include material handling, robotics, transit, aerospace and other intensive electrified applications. We developed cells, modules, battery management systems, software and firmware necessary to deliver systems for these intensive applications. We also developed supply chains which can produce needed components including separators, electrolytes with appropriate additives, cells and cell assembly, modules, electronic boards, electrical and mechanical components as needed for our battery systems. Our goal is to utilize our battery and systems technology to develop and commercialize mass-production levels of battery systems for our targeted end markets.

To achieve these strategic objectives, we intend to:

| · | Establish global strategic relationships in order to broaden the market potential of our products and services; |

|

|

|

| · | Develop and commercialize leading-edge technology for heavy duty and mission critical electrified applications, as well as partnering with key large organizations to bring them to market; |

|

|

|

| · | Invest in research and development initiatives related to new technologies that reduce the costs of our products, but enhance the operating performance, of our current and future products; and, |

|

|

|

| · | Focus on intensive use and mission critical applications such as the logistics and e-commerce industry, automated guided vehicles, electric buses, energy storage and similar other applications. |

3. | RECENT DEVELOPMENTS |

3.1Business Highlights and 2024 Outlook

Business Highlights – Q1 and Q2 FY2024:

In October 2023, the Company established a relationship with one of the four largest Japanese trading houses or “sogo shosha”. Through this partnership, Electrovaya products are being marketed to a host of Japanese and international OEMs representing a significant boost to the Company’s sales reach. The trading house was identified as Sumitomo Corporation in a press release on April 29th, 2024.

On October 21, 2023, the Company announced the appointment of Steven Berkenfeld to the Company’s board of directors.

On November 2, 2023, the Company announced that it had executed a strategic supply agreement with two leading affiliated OEM partners for material handling vehicles and other affiliates for the supply of battery systems. The new agreement supersedes a preceding agreement from December 2020 with just one of the OEM partners and includes a longer term with larger minimum purchases to maintain exclusivity.

| 5| Page |

On November 7, 2023, the Company announced the receipt of a battery purchase order through one of its OEM sales channels valued at over US$8 million. The batteries will be used by a leading Fortune 100 company in the United States for material handling electric vehicles.

On December 20, 2023 the Company renewed its revolving facility and extended the term of the facility by three months to March 29, 2024, with the aim to refinance the facility by the end of Q2 FY2024. The Company retains the option to extend the existing facility by a further three months to June 29, 2024.

On December 26, 2023, the Company announced that it had made its first shipment of its Infinity-HV battery system.

On February 14, 2024, the Company announced that it had agreed an increase to its credit facility from C$16 million to C$22 million with uncommitted accordions up to C$4 million to increase the facility to C$26 million in the future.

On February 27, 2024, the Company announced that its latest generation of battery management system had been approved by UL.

On March 11, 2024, the Company announced that its latest generation of battery systems had been integrated and tested with two leading providers of wireless charges and had successfully demonstrated wireless charging capabilities that achieve performance metrics similar to that of wired chargers.

On April 19, 2024, the Company announced that it is hosting a battery technology and investor day on Wednesday June 12, 2024.

On April 29, 2024, the Company announced that it had established a supply agreement with Sumitomo Corporation Power & Mobility, a 100% owned subsidiary of Sumitomo Corporation. The supply agreement will initially cover the supply of battery modules to leading Japanese construction equipment manufacturers.

Notice to Reader:

The Company included with its financial results a notice to reader disclaimer due to the review engagement not being completed in time to meet the filing deadline. The reviewer identified an opening balance currency translation adjustment from fiscal year 2022 pertaining to the change in functional currency that requires further analysis. The Company expects to complete the review over the next few days.

Positive Financial Outlook:

The Company continues to anticipate revenue of approximately $65-75 million for the fiscal year ending September 30, 2024 (“FY 2024”). Approximately $20 million of this anticipated revenue is dependent on new distribution center sites. Any delays in the startup of these sites may lead to a proportion of revenue moving into the subsequent fiscal year. The Company expects to have further clarity on firm delivery dates for these sites over the next several months.

The revenue forecast takes into consideration the Company’s existing purchase order backlog, anticipated pipeline, additional demand from its key OEM partner and new products designed for new sectors. This guidance is subject to change and is made barry any unforeseen circumstances. See “Forward-Looking Statements”.

| 6| Page |

4. | SELECTED QUARTERLY FINANCIAL INFORMATION |

4.1 OPERATING SEGMENTS

The Company has reviewed its operations and determined that it operates in one business segment and has only one reporting unit. The Company develops, manufactures and markets power technology products.

4.2 Quarterly Financial Results

Our Q2 2024 Interim Financial Statements have been prepared in accordance with International Accounting Standard (IAS) 34, Interim Financial Reporting, as issued by the IASB and accounting policies we adopted in accordance with IFRS. The Q2 2024 Interim Financial Statements reflect all adjustments that are, in the opinion of management, necessary to present fairly our financial position as at March 31, 2024 and the financial performance, comprehensive income and cash flows for the three months ended March 31, 2024.

Results of Operations

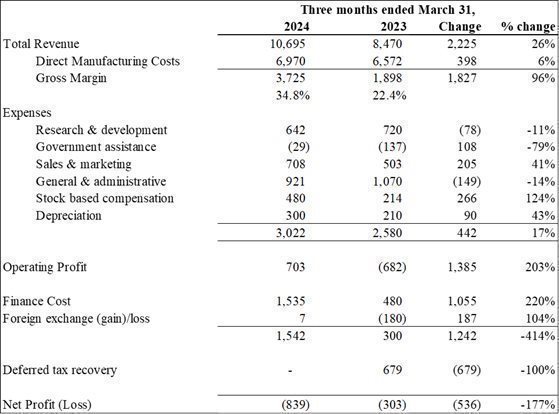

(Expressed in thousands of U.S. dollars)

| 7| Page |

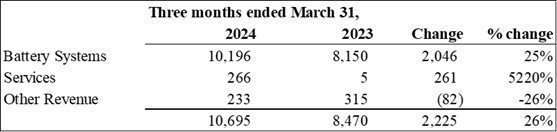

Revenue

Revenue increased to $10.7 million, compared to $8.5 million for the quarters ended March 31, 2024 and 2023 respectively, an increase of $2.2 million or 26%. The increase in year-over-year revenue was due to increased order and production volume. The Company had over $1.2 million within finished goods at the end of the quarter. This would represent completed units that were completed during the period and are either in transit to customers but have not yet been delivered or are awaiting transport.

Revenue was predominantly from the sale of batteries and battery systems for MHEVs. Batteries and battery systems accounted for $10.2 million or 95% of revenue for Q2 2024 and $8.2 million or 96% for Q2 2023. Sale of engineering services and other sources of revenue accounted for the remaining $0.5 million or 5% in Q2 2024 and $0.3 million or 4% in Q2 2023.

For the quarter ended March 31, 2024 revenue attributable to the United States accounted for $10.5 million 98% of total revenue while revenue attributed to Canada and other countries accounted for the remaining $0.2 million or 2%. For the quarter ended March 31, 2023 revenue attributable to the United States accounted for $8.0 million or 95%. This reflects the growing level of interest in our material handling batteries and an increased direct and indirect sales presence in the United States.

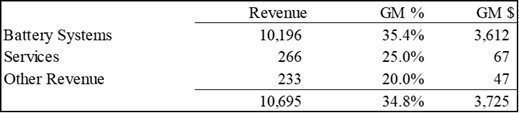

Direct Manufacturing Costs (variable costs) and Gross Margin

Direct manufacturing costs are comprised of materials, labour and manufacturing overhead, excluding amortization, associated with the production of batteries and battery packs for Electric Vehicles, stationary grid applications and research and engineering service revenues.

The gross margin increased to $3.7 million, compared to $1.9 million for the quarter ended March 31, 2024 and 2023 respectively, an increase of $1.8 million or 96%. The gross margin percentage was 34.8% for the quarter ended March 31, 2024, compared to 22.4% in the prior year. Prior year gross margin was affected by some orders being delivered at historical pricing with low margins. When reviewing gross margin by revenue stream, the main driver of revenue, Battery Systems, shows a gross margin of 35.4% for the quarter.

| 8| Page |

Our margin varies from period to period due to a number of factors including the product mix, special customer pricing, material cost, shipping costs and foreign exchange movement. In the current fiscal year we have seen some significant increases in costs due to inflationary pressures. The company has offset this by increasing sales prices and continues to work to improve gross margins going forward.

Operating Expenses

Operating expenses include:

| · | Research and Development (“R&D”) Research and development expenses consist primarily of compensation and premises costs for research and development personnel and activities, including independent contractors and consultants, and direct materials; |

| · | Government Assistance The company applied for and received funding from the Industrial Research Assistance Program during the year; |

| · | Sales and Marketing Sales and marketing expenses are comprised of the salaries and benefits of sales and marketing personnel, marketing activities, advertising and other costs associated with the sales of Electrovaya’s product lines; |

| · | General and Administrative General and administrative expenses include salaries and benefits for corporate personnel, insurance, professional fees, reserves for bad debts and facilities expenses. The Company’s corporate administrative staff includes its executive officers and employees engaged in business development, financial planning and control, legal affairs, human resources and information technology; |

| · | Stock based compensation Recognizes the value based on Black-Scholes option pricing model of stock based compensation expensed over the relevant vesting period; |

| · | Financing costs Financing costs includes the cost of debt, equity or other financing. This includes cash and non-cash interest, legal costs of financing, commissions and fees; and, |

| · | Patent and trademark costs Patent and trademark expense recognizes the cost of maintaining the Company’s patent and trademark portfolio. |

Total operating expenses increased to $3.0 million compared to $2.5 million for the quarters ended March 31, 2024 and 2023 respectively, an increase of $0.5 million or 17%. Within the quarter, Sales & Marketing increased by $0.2 million and Stock Based Compensation increased by $0.3 million due to the recognition of options with market conditions for vesting. Government assistance reduced by $0.1 million due to Government projects coming to an end and depreciation increased due to the additions to PPE. Other costs have not changed significantly from the prior year.

Operating Profit/(Loss) and Net Profit/(Loss)

The operating profit increased to $0.7 million from an operating loss of $0.7 million for the quarters ended March 31, 2024 and 2023 respectively, an increase of $1.4 million.

The net loss decreased to $0.8 million from a net loss of $0.3 million for the quarters ended March 31, 2024 and 2023 respectively, a decrease of $0.5 million. A significant driver of the net loss was the finance costs of $1.5 million in the quarter, which increased by $1.0 million compared to the same period in 2023. This is a result of increasing interest rates and the loan renewal costs of $0.2 million. Foreign exchange gain decreased by $0.2 million to a $0.0 million loss for the quarter ended March 31, 2024. The prior year also received the benefit of the deferred tax recovery from the revaluation of the land and buildings.

Key Performance Indicators

In addition to operating results and financial information described above, management reviews the following measures (which are not measures defined under IFRS):

| 9| Page |

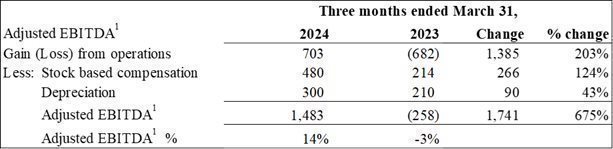

Adjusted EBITDA1

(Expressed in thousands of U.S. dollars)

1 Non-IFRS Measure: Adjusted EBITDA is defined as profit/loss from operations, plus stock-based compensation costs and depreciation. Adjusted EBITDA does not have a standardized meaning under IFRS. We believe that certain investors and analysts use Adjusted EBITDA to measure the performance of the business and is an accepted measure of financial performance in our industry. It is not a measure of financial performance under IFRS, and may not be defined and calculated in the same manner by other companies and should not be considered in isolation or as an alternative to Income (loss) from operations.

Adjusted EBITDA1 increased by $1.7 million primarily due to the increase in revenue and improvement in gross margin. Adjusted EBITDA1 percentage for the quarter improved to 14% compared to -3% for the quarter ended March 31, 2023. Management is focused on continuing the trend of positive Adjusted EBITDA1 in 2024 through an increase in sales, improving the gross margin and controlling cost of operations.

Adjusted EBITDA1 will improve primarily through increased sales, maintaining gross margin percentage and controlling operating expenses. We continue our efforts for sales growth, control of manufacturing costs and reduction operating expenses.

| 10| Page |

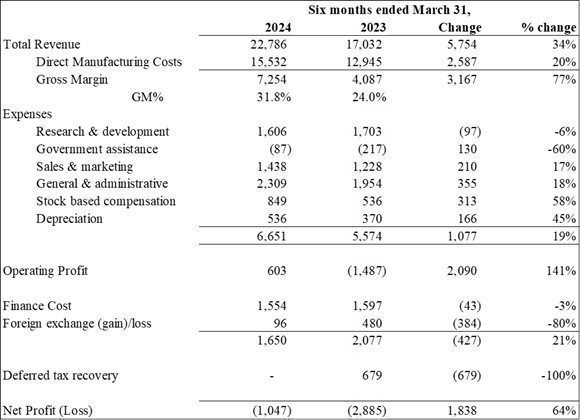

4.3 Summary Operating Results - Six Months Ended March 31, 2024 & 2023

Revenue was $22.8 million and $17.0 million for the six months ended March 31, 2024 and 2023. It is anticipated that sales will be higher for the second half of 2024 as customer site launches are skewed to our fiscal Q3 and Q4 periods. While the first half of fiscal year 2024 has been a record for the Company, we have experienced movement in orders due to customer delays. For example, approximately $3.5 million of orders were moved from Q2 to Q3 due to a customer site launch date delay.

The gross margin increased to 31.8% from 24% in the prior year. Management is working to increase the gross margin through increasing efficiency within the production facility and taking advantage of increased purchasing power.

Operating expenses increased by $1.1 million or 19% from Q2 FY2023 to Q2 FY 2024, due to increases in Sales & Marketing, General & Administrative costs by $0.2 million and $0.3 million respectively. Stock based compensation increased by $0.3 million and depreciation increased by $0.2 million. Finance costs are flat from year to year, while Foreign Exchange loss decreased by $0.4 million.

Operating profit increased by $2.1 million from a loss of $1.5 million to a profit of $0.6 million for the six month period ended March 31, 2024. Net loss decreased to $1.0 million from $2.9 million for the six month period ended March 31, 2024, an improvement of $1.8 million.

| 11| Page |

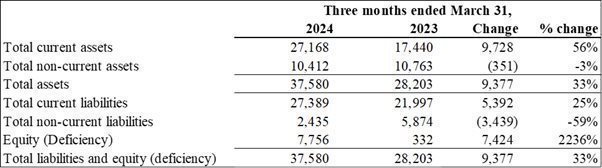

Quarterly Summary Financial Position and Cash Flow

Summary Financial Position

(Expressed in thousands of U.S. dollars)

Management is focused on continuing to improve the company’s financial position through the prudent use of debt and equity but most importantly achieving a profitable position and strong working capital management. The Company is also actively pursuing lower cost of capital lenders to refinance existing working capital facilities and reduce costs.

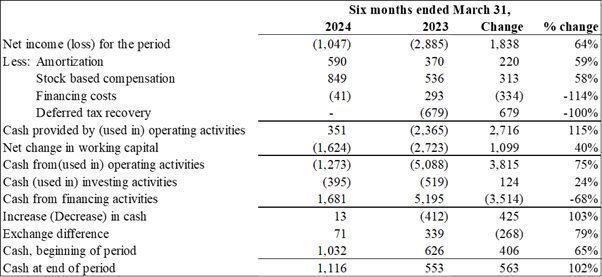

Summary Cash Flow

(Expressed in thousands of U.S. dollars)

| 12| Page |

The Company ended March 31, 2024 with $1.1 million of cash as compared to $0.6 million at March 31, 2023. The company is optimizing its cash position in order to reduce interest charges relating to the revolver.

For the six months ended March 31, 2024 the Company had cash provided by operating activities of $0.4 million, as compared to cash used in operating activities of $2.4 million for March 31, 2023, an improvement of $2.7 million year on year. Net change in working capital was $(1.6) million compared to $(2.7) million for the period ended March 31, 2023. Cash used in operating activities reduced to $1.3 million from $5.1 million in the prior year, an improvement of $3.8 million.

Quarterly Comparative Summaries

Quarterly revenue from continued operations are as follows:

(USD $ thousands) |

| Q1 |

|

| Q2 |

|

| Q3 |

|

| Q4 |

| ||||

2024 |

| $ | 12,091 |

|

| $ | 10,695 |

|

|

|

|

|

|

| ||

2023 |

| $ | 8,562 |

|

| $ | 8,470 |

|

| $ | 12,557 |

|

| $ | 14,470 |

|

2022 |

| $ | 1,250 |

|

| $ | 4,290 |

|

| $ | 4,305 |

|

| $ | 9,978 |

|

Quarterly net profits/(losses) from continued operations are as follows:

(USD $ thousands) |

| Q1 |

|

| Q2 |

|

| Q3 |

|

| Q4 |

| ||||

2024 |

| $ | (208 | ) |

| $ | (839 | ) |

|

|

|

|

|

| ||

2023 |

| $ | (2,581 | ) |

| $ | (303 | ) |

| $ | (166 | ) |

| $ | 1,610 |

|

2022 |

| $ | (2,155 | ) |

| $ | (2,251 | ) |

| $ | (1,461 | ) |

| $ | (680 | ) |

Quarterly net gains (losses) per common share from continued operations are as follows:

|

| Q1 |

|

| Q2 |

|

| Q3 |

|

| Q4 |

| ||||

2024 |

| $ | (0.00 | ) |

|

| (0.03 | ) |

|

|

|

|

|

| ||

2023 |

| $ | (0.08 | ) |

| $ | (0.01 | ) |

| $ | (0.01 | ) |

| $ | 0.05 |

|

2022 |

| $ | (0.01 | ) |

| $ | (0.02 | ) |

| $ | (0.01 | ) |

| $ | (0.00 | ) |

Quarterly Revenue and Seasonality

In recent periods, revenue has been weighted towards the second half of the fiscal year and management expects this trend to continue for the current fiscal year.

The lithium ion forklift battery has a long sales cycle as many customers are large companies, the technology is relatively new to the forklift market, and customers need time to familiarize themselves with and validate the benefits as compared to the incumbent technology of lead acid batteries. In some cases, the process involves receiving a demonstrator battery for testing and trial. This causes a somewhat long and “lumpy”, or uneven, sales cycle. As customers become more comfortable with the product and place repeat orders it is management's view that the sales will grow in a more predictable and consistent fashion.

| 13| Page |

5. | LIQUIDITY AND CAPITAL RESOURCES |

During the six months ended March 31, 2024, the Company had cash provided by operations of $351 (March 31, 2023: $(2.3) million). As of March 31, 2024 the company had negative working capital of $1.6 million (March 31, 2023: $(2.7) million) and a net loss of $(1.0) million (2023: $(2.8) million). The Company’s equity was in surplus of $7.7 million. As of March 31, 2024 the Company had cash and cash equivalents of $1.1 million. The Company is also anticipating the planned construction of its gigafactory in Jamestown, New York (the “Gigafactory”), which will need additional financing.

The first phase of construction is expected to take place within the existing 135,000 square foot manufacturing facility for the production of cells and batteries, with an estimated capital expenditure of approximately US$38 million. These material uncertainties raise significant doubt upon the Company's ability to continue as a going concern.

In assessing whether the going concern assumption was appropriate, management took into account all relevant information available about the future, which was at least, but not limited to, the twelve-month period following March 31, 2024. The Company and its Board of Directors have implemented various operating and financing strategies, including the following:

The Company plans on pursuing large scale investments in its planned Jamestown gigafactory only in the event that it closes a government backed debt facility that includes advantageous terms with minimal impacts to operating cash flow and equity dilution. If the Company is unable to secure such financing, it will delay or cancel these expansion plans with limited financial impact as the main investment made thus far is the land and building. which can be sold at a profit.

The Company has made improvements to its manufacturing process, equipment and facilities over the last several months. Furthermore, the Company also anticipates gross margins to improve in fiscal year 2024 due to decreasing costs of key materials including but not limited to cell materials, separators, and other high value items. These anticipated improved margins, when combined with expected overall sales growth should result in improved overall financial performance.

Finally, the Company is confident in securing additional working capital from either debt or equity. Since the Company listed on Nasdaq in July 2023, it has further increased liquidity and overall financing capabilities.

The Company believes that the cash on hand of $1.1 million, plus additional space on its revolving facility, $8.9 million of accounts receivable and $11.0 million of inventory, improved revenue levels, our strong relationship with our OEM partner, strong backlog and sales pipeline will provide adequate working capital to support its operating activities at the anticipated sales level for the 12 months ended March 31, 2025.

| 14| Page |

At March 31, 2024, we had the following contractual obligations:

Year of Payment Obligation |

| Debt Repayment |

| |

2024 |

|

| 2,813 |

|

2025 |

|

| 14,837 |

|

2026 |

|

| 57 |

|

2027 and thereafter |

|

| 86 |

|

Total |

| $ | 17,793 |

|

6. | OUTSTANDING SHARE DATA |

The authorized and issued capital stock of the Company consists of an unlimited authorized number of common shares as follows:

|

| Common Shares |

| |||||

|

| Number |

|

| Amount |

| ||

Balance, September 30, 2023 |

|

| 33,832,784 |

|

| $ | 115,041 |

|

Issued |

|

| 10,024 |

|

|

| 30 |

|

Issued |

|

| 42,157 |

|

|

| 169 |

|

Exercise of options |

|

| 249,200 |

|

|

| 1,161 |

|

Balance, March 31, 2024 |

|

| 34,134,165 |

|

| $ | 116,401 |

|

The following table reflects the quarterly stock option activities for the period from October 1, 2023 to March 31, 2024:

|

| Number outstanding |

|

| Weighted average exercise price |

| ||

Outstanding, September 30, 2023 |

|

| 4,714,388 |

|

| $ | 2.44 |

|

Exercised/Granted during the quarter |

|

| (249,200 | ) |

| $ | 2.65 |

|

Expired during the quarter |

|

| (16,200 | ) |

| $ | 2.87 |

|

Outstanding, Mar 31, 2024 |

|

| 4,448,988 |

|

| $ | 2.42 |

|

The following table reflects the outstanding warrant and Broker Compensation Option activities for the period from October 1, 2023 to March 31, 2024:

Details of Share Warrants |

|

|

|

|

|

| ||

|

| Number Outstanding |

|

| Exercise Price |

| ||

Outstanding, March 31, 2024 |

|

| 1,711,924 |

|

| $ | 2.38 |

|

Details of Compensation Options to Brokers |

|

|

|

|

|

| ||

|

| Number Outstanding |

|

| Exercise Price |

| ||

Outstanding, March 31, 2024 |

|

| 17,522 |

|

| $ | 4.95 |

|

As of March 31, 2024, the Company had 34,134,165 common shares outstanding, 4,714,388 options to purchase common shares outstanding, 17,522 compensation options outstanding and 1,711,924 warrants to purchase common shares outstanding.

| 15| Page |

7. | OFF-BALANCE SHEET ARRANGEMENTS |

The Company does not have any off-balance sheet arrangements for the quarter ended March 31, 2024.

8. | RELATED PARTY TRANSACTIONS |

Please refer to note 12 to the March 31, 2024 Financial Statements for details on related party transactions.

9. | CRITICAL ACCOUNTING ESTIMATES |

The Company’s management makes judgments in the process of applying the Company’s accounting policies in the preparation of its consolidated financial statements. In addition, the preparation of financial information requires that the Company’s management make assumptions and estimates of effects of uncertain future events on the carrying amounts of the Company’s assets and liabilities at the end of the reporting period and the reported amounts of revenue and expenses during the reporting period. Actual results may differ from those estimates as the estimation process is inherently uncertain. Estimates are reviewed on an ongoing basis based on historical experience and other factors that are considered to be relevant under the circumstances. Revisions to estimates and the resulting effects on the carrying amounts of the Company’s assets and liabilities are accounted for prospectively.

The critical judgments, estimates and assumptions applied in the preparation of Company’s financial information are reflected in Note 3 of the Company’s September 30, 2023 consolidated financial statements.

10. | CHANGES IN ACCOUNTING POLICIES AND RECENT ACCOUNTING PRONOUNCEMENTS |

Our accounting policies and information on the adoption and impact of new and revised accounting standards the Company was required to adopt effective January 1, 2015 are disclosed in Note 3 of our consolidated financial statements and their related notes for the year ended September 30, 2023.

11. | FINANCIAL AND OTHER INSTRUMENTS |

Please refer to note 16 of the March 31, 2024 Financial Statements for details of Financial and Other Instruments.

| 16| Page |

12. | DISCLOSURE CONTROLS |

We have established disclosure controls and procedures that are designed to ensure that the information required to be disclosed by the Company in the reports that it files or submits under securities legislation is recorded, processed, summarized, and reported within the time periods specified in such rules and forms and that such information is accumulated and communicated to management, including our principal executive officer and principal financial officer (who are our Chief Executive Officer and Chief Financial Officer, respectively) as appropriate to allow timely decisions regarding required disclosure. In designing and evaluating our disclosure controls and procedures, management recognized that disclosure controls and procedures can provide only reasonable, not absolute, assurance that the objectives of the disclosure controls and procedures are met.

Our management, including our Chief Executive Officer and Chief Financial Officer, evaluated the effectiveness of our disclosure controls and procedures. Based on this evaluation and as described below under “Internal Control over Financial Reporting”, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures were effective as of March 31, 2024.

13. | INTERNAL CONTROL OVER FINANCIAL REPORTING |

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is a process designed by, or under the supervision of, the CEO and the CFO and effected by the Board of Directors, management and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of consolidated financial statements for external purposes in accordance with IFRS.

Our management, including our CEO and CFO, believes that any disclosure controls and procedures or internal control over financial reporting, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, they cannot provide absolute assurance that all control issues and instances of fraud, if any, have been prevented or detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of a simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by unauthorized override of the control. The design of any system of controls is based in part on certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Accordingly, because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud might occur and not be detected.

Management assessed the effectiveness of the Company’s internal control over financial reporting on September 30, 2023, based on the criteria set forth in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission as published in 2013, and determined that the Company’s internal control over financial reporting was not effective in respect of the analysis and evaluation of certain technical accounting matters. In light of the material weakness, during the quarter ended December 31, 2023, management commenced a plan to add additional technical accounting resources to the financial reporting process. Management is committed to the implementation of remediation efforts to address the material weakness. Remediation is continuing and intended to address the material weakness and enhance the overall financial control environment, including steps to address the evaluation, applicability, and documentation of the impact of technical accounting matters on an ongoing basis. The material weakness will only be considered as remediated when the applicable control operates for a sufficient period of time and management has concluded through testing, that the control is operating effectively.

No assurance can be provided at this time that the actions and remediation efforts of the Company will effectively remediate the material weakness or prevent the occurrence of other significant deficiencies or material weaknesses in the Company’s internal controls over financial reporting in the future.

| 17| Page |

14. | QUALITATIVE AND QUANTITATIVE DISCLOSURES ABOUT RISKS AND UNCERTAINTIES |

The Company may be exposed to risks of varying degrees of significance which could affect its ability to achieve its strategic objectives. The main objectives of the Company’s risk management processes are to ensure that the risks are properly identified and that the capital base is adequate in relation to those risks. The principal risks to which the Company is exposed are described below.

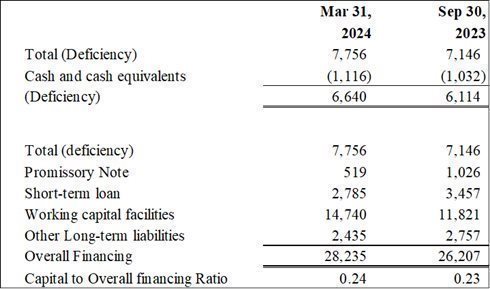

Capital risk

The Company manages its capital to ensure that there are adequate capital resources for the Company to maintain and develop its products. The capital structure of the Company consists of shareholders’ equity and depends on the underlying profitability of the Company’s operations.

The Company manages its capital structure and makes adjustments to it, based on the funds available to the Company, in order to support the development, manufacture and marketing of its products. The Board of Directors does not establish quantitative return on capital criteria for management, but rather relies on the expertise of the Company’s management to sustain future development of the business.

The Company's capital management objectives are:

| · | to ensure the Company's ability to continue as a going concern. |

| · | to provide an adequate return to shareholders by pricing products and services commensurately with the level of risk. |

The Company monitors capital on the basis of the carrying amount of equity plus its short-term debt comprised of the Promissory note, less cash and cash equivalents as presented on the face of the statement of financial position.

The Company sets the amount of capital in proportion to its overall financing structure, comprising equity and long-term debt. The Company manages the capital structure and makes adjustments to it in the light of changes in economic conditions and the risk characteristics of the underlying assets. In order to maintain or adjust the capital structure, the Company issues new shares or increases its long-term debt.

| 18| Page |

Capital for the reporting periods under review is summarized as follows:

Credit risk

Credit risk is the risk that the counterparty fails to discharge an obligation to the Company. The Company is exposed to this risk for various financial instruments, for example, by granting loans and receivables to customers, placing deposits, etc. The Company’s maximum exposure to credit risk is limited to the carrying amount of financial assets recognized at the reporting date, as summarized below:

|

| March 31, |

|

| September 30, |

| ||

|

| 2024 |

|

| 2023 |

| ||

Cash and cash equivalents |

| $ | 1,116 |

|

| $ | 1,032 |

|

Trade and other receivables |

|

| 8,875 |

|

|

| 10,611 |

|

Carrying amount |

| $ | 9,991 |

|

| $ | 11,643 |

|

Cash and cash equivalents are comprised of the following:

|

| March 31, |

|

| September 30, |

| ||

|

| 2024 |

|

| 2023 |

| ||

Cash |

| $ | 1,116 |

|

| $ | 1,032 |

|

Cash equivalents |

|

| - |

|

|

| - |

|

|

| $ | 1,116 |

|

| $ | 1,032 |

|

The Company's current portfolio consists of certain banker’s acceptance and high interest yielding savings accounts deposits. The majority of cash and cash equivalents are held with financial institutions, each of which had at March 31, 2024 a rating of R-1 mid or above.

The Company manages its credit risk by establishing procedures to establish credit limits and approval policies. The balance in trade and other receivables is primarily attributable to trade accounts receivables. In the opinion of management, the credit risk is moderate as some receivables are falling into arrears. Management is taking appropriate action to mitigate this risk by adjusting credit terms.

| 19| Page |

Liquidity risk

Liquidity risk is the risk that we may not have cash available to satisfy our financial obligations as they come due. The majority of our financial liabilities recorded in accounts payable, accrued and other current liabilities and provisions are due within 90 days. We manage liquidity risk by maintaining a portfolio of liquid funds and having access to a revolving credit facility. We believe that cash flow from operating activities, together with cash on hand, cash from our A/R, and borrowings available under the Revolver are sufficient to fund our currently anticipated financial obligations, and will remain available in the current environment.

Market risk

Market risk incorporates a range of risks. Movement in risk factors, such as market price risk and currency risk, affect the fair value of financial assets and liabilities. The Company is exposed to these risks as the ability of the Company to develop or market its products and the future profitability of the Company is related to the market price of its primary competitors for similar products.

Interest rate risk

The Company has floating and fixed interest-bearing debt ranging from prime plus 7% to 24%. The Company’s current policy is to invest excess cash in investment-grade short-term deposit certificates issued by its banking institutions.

Foreign currency risk

The Company is exposed to foreign currency risk. The Company’s functional currency is the US dollar and a majority of its revenue is derived in US dollars. Purchases are transacted in Canadian dollars, United States dollars and Euro. Management believes the foreign exchange risk derived from any currency conversions may have a material effect on the results of its operations. The financial instruments impacted by a change in exchange rates include our exposures to the above financial assets or liabilities denominated in non-functional currencies. Cash held by the Company in US dollars at March 31, 2024 was $189 (September 30, 2023 - $175).

If the US dollar to Canadian foreign exchange rate changed by 2% this would change the recorded Net gain by $119 (September 30, 2023 - $173).

Price risk

The Company is exposed to price risk. Price risk is the risk that the commodity prices that the Company charges are significantly influenced by its competitors and the commodity prices that the Company must charge to meet its competitors may not be sufficient to meet its expenses. The Company reduces the price risk by ensuring that it obtains information regarding the prices set by its competitors to ensure that its prices are appropriate to the unique attributes of our product. In the opinion of management, the price risk is low and is not material.

| 20| Page |

Disclosure control risks

The Company’s management, with the participation of the Chief Executive Officer and Chief Financial Officer of the Company, have designed disclosure controls and procedures (“DC&P”), or caused them to be designed under their supervision, to provide reasonable assurance that material information relating to the issuer, including its consolidated subsidiaries, is made known, particularly during the period in which interim or annual filings are being prepared, and information required to be disclosed by the Company in its annual filings, interim filings or other reports filed or submitted by it under securities legislation is recorded, processed, summarized and reported within the time periods specified in securities legislation. Although certain weaknesses have been identified, these items do not constitute a material weakness or a weakness in DC&P that are significant. A control system, no matter how well conceived or operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. DC&P are reviewed on an ongoing basis.

Internal control risks

The Company’s management, with the participation of the Chief Executive Officer and Chief Financial Officer of the Company, have designed such internal control over financial reporting (“ICFR”), or caused it to be designed under their supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with IFRS. Such design also uses the framework and criteria established in Internal Control over Financial Reporting - Guidance for Smaller Public Companies, issued by The Committee of Sponsoring Organizations of the Treadway Commission. The Company relies on entity-wide controls and programs including written codes of conduct and controls over initiating, recording, processing and reporting significant account balances and classes of transactions. Other controls include centralized processing controls, including a shared services environment and monitoring of operating results. Based on the evaluation of the design and operating effectiveness of the Company’s ICFR, the CEO and CFO concluded that the company’s ICFR was not effective as at March 31, 2024.

The Company does not believe that it has any material weakness or a weakness in ICFR that are significant, other than those reported in the September 30, 2023 audited financial statements. Control deficiencies have been identified within the Company’s accounting and finance departments and its financial information systems over segregation of duties and user access respectively. Specifically, certain duties within the accounting and finance departments were not properly segregated due to the small number of individuals employed in these areas. To our knowledge, none of the control deficiencies has resulted in a misstatement to the financial statements. However, these deficiencies may be considered a material weakness resulting in a more-than remote likelihood that a material misstatement of the Company’s annual or interim financial statements would not be prevented or detected.

As the Company incurs future growth, we plan to expand the number of individuals involved in the accounting function. At the present time, the CEO and CFO oversee all material transactions and related accounting records. In addition, the Audit Committee reviews on a quarterly basis the financial statements and key risks of the Company and queries management about significant transactions, there is a quarterly review of the company’s condensed interim unaudited financial statements by the Company’s auditors and daily oversight by the senior management of the Company.

| 21| Page |

15. | OTHER RISKS |

Other Risk Factors.

The risks described above are not the only risks and uncertainties that we face. Additional risks the Company faces are described under the heading “Risk Factors” in the Company’s AIF for the year ended September 30, 2023.

Other additional risks and uncertainties not presently known to us or that we currently consider immaterial may also impair our business operations. These risk factors could materially affect our future operating results and could cause actual events to differ materially from those described in our forward-looking statements.

Additional information relating to the Company, including our AIF for the year ended September 30, 2023, is available on SEDAR and EDGAR.

| 22| Page |