UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23818

NC SLF INC.

(Exact name of registrant as specified in charter)

430 Park Avenue, 14th Floor

New York, NY 10022

(Address of Principal Executive Offices)

John D. McCally, Esq.

General Counsel

Churchill Asset Management LLC

8500 Andrew Carnegie Blvd

Charlotte, NC 28262

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 478-9200

Date of fiscal year end: December 31, 2023

Date of reporting period: June 30, 2023

Item 1. Reports to Shareholders.

The semi-annual report to shareholders for the six months ended June 30, 2023 is filed herewith pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended.

NC SLF Inc.

Semi-Annual Report

June 30, 2023

TABLE OF CONTENTS

NC SLF INC.

Letter to Shareholders and Management’s Discussion of Company Performance

August 8, 2023

Dear Shareholders:

Company Overview

We are pleased to submit to you the report of NC SLF Inc. (“we”, “us”, “our” or the “Company”) for the six months ended June 30, 2023. The net asset value (“NAV”) of our shares at that date was $9.61 per share. The total return based on NAV for the six months ended June 30, 2023, as reflected in the Company’s financial highlights, was 4.96%. Please refer to “Note 8. Financial Highlights” for further details. Investment Objective

Our investment objective is to generate current income and capital appreciation primarily by investing in or originating first lien and unitranche leveraged loans made to private equity-owned U.S. middle market companies that require capital for growth, acquisitions, recapitalizations, refinancings and leveraged buyouts, which we define as companies with approximately $10 million to $200 million of earnings before interest, taxes, depreciation, and amortization. We expect to make investments through both primary originations and open-market secondary purchases. We focus on making loans that we directly originate to U.S. middle market companies that are meeting their financial obligations and operational targets, with a portfolio expected to comprise primarily of first lien senior secured debt and unitranche loans.

Portfolio Review

As of June 30, 2023, we had investments in 47 portfolio companies across 27 industries. Based on fair value as of June 30, 2023, 100.0% of our portfolio was invested in debt bearing a floating interest rate. As of June 30, 2023, our weighted average total annual yield of investments in debt securities at fair value was 11.32%. The weighted average yield was computed using the effective interest rates as of June 30, 2023, including accretion of original issue discount, but excluding investments on non-accrual status, if any.

For the six months ended June 30, 2023, net investment income was approximately $15.6 million, or $0.49 per weighted average common share.

For the six months ended June 30, 2023, we recorded a net increase in net assets resulting from operations of approximately $15.0 million, or $0.47 per weighted average common share (inclusive of realized and unrealized gains and losses).

For the six months ended June 30, 2023, we made additional investments of approximately $70.4 million, and received approximately $2.5 million from repayments of our investments.

Capital Markets Overview

The first half of 2023 was marked with continued positive momentum in the private credit industry. Leading private capital managers like Churchill Asset Management LLC, the Company’s investment adviser (“Churchill”) continue to benefit from the current investment environment, which many are calling the “Golden Age of Private Credit”. With reduced primary issuance in public credit markets, private equity sponsors are gravitating to scaled and trusted partners, whose long-term capital, large hold levels, and flexible terms make them extremely user friendly. In fact, the volume of LBOs financed in the direct lending market was 11.5x higher than the syndicated market in Q2 2023 – an all-time record.

While higher interest rates and macroeconomic uncertainty have led to lower M&A activity across the sponsored middle market in 2023, Churchill has seen deal flow increase quarter-over-quarter. In Q2 2023, Churchill’s overall platform level deal activity increased 12% from Q1 2023. This brought Churchill’s volume for the twelve months ended June 30, 2023 to $10.5 billion across over 385 transactions, just 5% below 2022’s record annual figures. Currently, there is a significant backlog of sell side mandates waiting for interest rate clarity from the Federal Reserve, after which Churchill believes a strong rebound in activity will materialize late this year.

Churchill believes the investment environment continues to be highly attractive. During the quarter, Churchill’s senior loan all-in yields remained at over 12%,1 while net senior and total leverage decreased to 3.9x and 4.2x, respectively. This brought Churchill’s all-in yield per unit of leverage to an all-time high of 2.98% during the quarter.2 Adding further support to the positive investment environment, average sponsor equity contributions were 56% during the quarter. The quality of deals coming to market also remains very strong, as companies impacted by today’s macroeconomic challenges are largely unable to transact.

U.S. Federal Reserve Chair Jerome Powell recently said the U.S. central bank’s staff economists were no longer forecasting recession given the resilience in the economic data. We believe Churchill’s $18.3 billion senior loan portfolio supports that thesis, with 96% of Churchill’s 230 investments rated a 5.0 or better on its portfolio management scale (4.0 being the initial rating assigned at origination). In Churchill’s view, it appears that a “soft landing” is becoming increasingly likely, and if that scenario plays out, it could promote an ideal environment for corporate credit and direct lending – attractive yields which are manageable for most borrowers and minimal defaults. In fact, Proskauer’s Private Credit Default Index recently defied expectations, and reported that defaults eased in Q2 2023, falling to 1.64% from 2.15% in Q1 2023.3

Sincerely,

Kenneth Kencel

President and Chief Executive Officer

This letter is intended to assist shareholders in understanding the Company’s performance during the six months ended June 30, 2023. The views and opinions in this letter were current as of August 8, 2023. Statements other than those of historical facts included herein may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors. See “Forward-Looking Statements” below for more information. The Company undertakes no duty to update any forward-looking statement made herein. Information contained on our website is not incorporated by reference into this stockholder letter and you should not consider information contained on our website to be part of this shareholder letter or any other report we file with the Securities and Exchange Commission (the “SEC”).

____________________________________________________________________________________________

1 Utilizes the greater of 3-month base rate, or base rate floor, if applicable for each respective transaction (SOFR 3M as of June 30, 2023 was 5.27%; LIBOR 3M as of June 30, 2023 was 5.55%).

2 Churchill’s all in yield (“AIY”) per unit of leverage was calculated on an investment-by-investment basis of AIY (spread + floor or base rate at the time of origination + OID/3) over first lien net leverage, the leverage applicable to each loan. These AIY/unit of leverage were then weighted by their committed capital on an annual basis. For 2023 data, AIY was calculated using June 30, 2023 Term SOFR 3M of 5.27% rather than the rate at the time of origination. This analysis does not incorporate credit spread adjustments, which can account for an additional approximately 15bps on average. Portfolio yield is only one component of expected performance and is not and should not be viewed as a statement of the future performance of the strategy. Metrics provided reflect the overall Churchill senior loan platform and do not reflect the Company’s standalone portfolio.

3 Source: Proskauer’s Private Credit Group - Q2 2023 Default Index. This index is presented for illustrative purposes and is not a benchmark or target return for the Company.

Important Information

This report is transmitted to the shareholders of the Company and is furnished pursuant to certain regulatory requirements. This report and the information and views herein do not constitute investment advice, or a recommendation or an offer to enter into any transaction with the Company or any of its affiliates. This report is provided for informational purposes only, does not constitute an offer to sell securities of the Company and is not a prospectus.

An investment in the Company is not appropriate for all investors. Shares of closed-end investment companies, such as the Company, frequently trade at a discount from their NAV, which may increase investors’ risk of loss. Past performance is not indicative of, or a guarantee of, future performance. The performance and certain other portfolio information quoted herein represents information as of June 30, 2023. Nothing herein should be relied upon as a representation as to the future performance or portfolio holdings of the Company. Investment return and principal value of an investment will fluctuate, and shares, when sold, may be worth more or less than their original cost. The Company’s performance is subject to change since the end of the period noted in this Annual Report and may be lower or higher than the performance data shown herein.

About NC SLF Inc.

NC SLF Inc. is a registered closed-end management investment company. Its investment objective is to generate current income and capital appreciation primarily by investing in or originating first lien and unitranche leveraged loans made to private equity-owned U.S. middle market companies that require capital for growth, acquisitions, recapitalizations, refinancings and leveraged buyouts.

Forward-Looking Statements

This report contains forward-looking statements that involve substantial risks and uncertainties. Such statements involve known and unknown risks, uncertainties and other factors and undue reliance should not be placed thereon. These forward-looking statements are not historical facts, but rather are based on our current expectations and estimates, our current and prospective portfolio investments, our industry, our beliefs and opinions, and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including, without limitation:

•our future operating results;

•our business prospects and the prospects of our portfolio companies;

•the dependence of our future success on the general economy and its impact on the industries in which we invest;

•the impact of a protracted decline in the liquidity of credit markets on our business;

•the impact of increased competition;

•an economic downturn and its impact on the ability of our portfolio companies to operate and the investment opportunities available to us;

•the impact of interest rate volatility, including the replacement of LIBOR with one or more alternate reference rates and rising interest rates, on our business and our portfolio companies;

•the impact of supply chain constraints and labor difficulties on our portfolio companies and the global economy;

•the elevated level of inflation, and its impact on our portfolio companies and on the industries in which we invest;

•the impact of geopolitical conditions, including the ongoing conflict between Ukraine and Russia, and its impact on financial market volatility, global economic markets, and various sectors, industries and markets for commodities globally, such as oil and natural gas;

•our contractual arrangements and relationships with third parties;

•the valuation of our investments in portfolio companies, particularly those having no liquid trading market;

•actual and potential conflicts of interest with Churchill Asset Management LLC, our investment adviser (“Churchill” or the “Investment Adviser”) and/or its affiliates;

•the ability of our portfolio companies to achieve their objectives;

•the use of borrowed money to finance a portion of our investments;

•the adequacy of our financing and working capital;

•the timing of cash flows, if any, from the operations of our portfolio companies;

•the ability of the Investment Adviser to locate suitable investments for us and to monitor and administer our investments;

•the ability of the Investment Adviser or its affiliates to attract and retain highly talented professionals;

•our ability to qualify and maintain our qualification as a regulated investment company (a “RIC”); and

•the impact of future legislation and regulation on our business and our portfolio companies.

Although we believe that the assumptions on which these forward-looking statements are based on are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. Important assumptions include our ability to originate new loans and investments, certain margins and levels of profitability and the availability of additional capital. In light of these and other uncertainties, the inclusion of a forward-looking statement in this report should not be regarded as a representation by us that our plans and objectives will be achieved. These forward-looking statements apply only as of the date of this report. Moreover, we assume no duty and do not undertake to update the forward-looking statements except as otherwise provided by law.

Strategy and Performance Overview

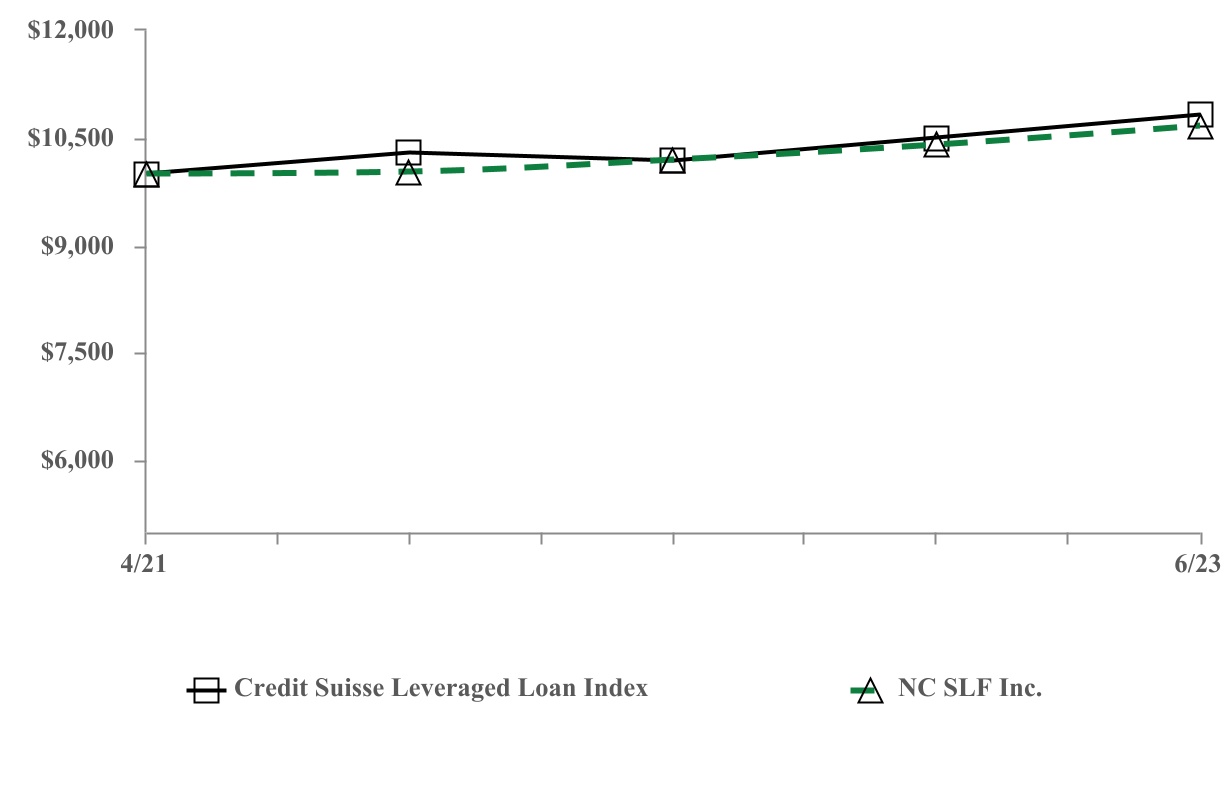

This graph compares the return on our common stock from April 16, 2021 (the inception date) to June 30, 2023 with that of Credit Suisse Leveraged Loan Index. Prior to its registration as a closed-end fund under the 1940 Act on August 12, 2022, the Company operated as a business development company (“BDC”) from June 2, 2021 until August 12, 2022, whereupon it withdrew its election to be regulated as a BDC pursuant to Section 54(c) of the 1940 Act. The graph assumes that, on April 16, 2021 a person invested $10,000 in each of our common stock and the Credit Suisse Leveraged Loan Index.

The graph measures total stockholder return, which takes into account changes in NAV and distributions. Distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Company’s distribution reinvestment plan (as applicable). Returns do not reflect the deduction of taxes that a shareholder would pay on Company distributions. Past performance is not indicative, or a guarantee, of future performance. Future results may vary and may be higher or lower than the data shown below.

COMPARISON OF INCEPTION TO DATE CUMULATIVE TOTAL RETURN*

NC SLF Inc. and the Credit Suisse Leveraged Loan Index

*$10,000 invested on April 16, 2021 (the inception date) in stock or index, including reinvestment of dividends through June 30, 2023. Returns for NC SLF Inc. reflect the impact of waived management fees for the period from July 1, 2021 through October 4, 2022 (Refer to Note 4 for additional information).

| | | | | | | | | | | | | | | | | |

| Returns | | 1 Year | | Since Inception (April 16, 2021) | |

NC SLF Inc. (1) | | 7.25 | % | | 6.65 | % | |

| Credit Suisse Leveraged Loan Index | | 10.10 | % | | 8.26 | % | |

(1) Return is calculated as the change in NAV per share during the period, plus distributions per share, if any, divided by the beginning NAV per share. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at the quarter end NAV per share preceding the distribution. Returns for NC SLF Inc. reflect the impact of waived management fees for the period from July 1, 2021 through October 4, 2022 (Refer to Note 4 for additional information). Portfolio Composition

As of June 30, 2023 , our investments consisted of the following (dollar amounts in thousands):

| | | | | | | | | | | | | | | | | |

| Amortized Cost | | Fair Value | | % of Fair Value |

| First Lien Term Loans | $ | 388,389 | | | $ | 377,959 | | | 100.0 | % |

| Total | $ | 388,389 | | | $ | 377,959 | | | 100.0 | % |

| Largest portfolio company investment | $ | 18,720 | | | $ | 19,257 | | | 5.09 | % |

| Average portfolio company investment | $ | 8,264 | | | $ | 8,042 | | | 2.13 | % |

The industry composition of our portfolio as a percentage of fair value as of June 30, 2023 was as follows:

| | | | | |

| Industry | |

| Air Freight & Logistics | 3.89 | % |

| Auto Components | 3.37 | % |

| Automobiles | 2.58 | % |

| Chemicals | 4.41 | % |

| Commercial Services & Supplies | 6.30 | % |

| Construction & Engineering | 1.43 | % |

| Construction Materials | 2.97 | % |

| Containers & Packaging | 7.90 | % |

| Distributors | 1.21 | % |

| Diversified Consumer Services | 5.58 | % |

| Electronic Equipment, Instruments & Components | 2.46 | % |

| Energy Equipment & Services | 1.82 | % |

| Gas Utilities | 3.08 | % |

| Health Care Providers & Services | 17.52 | % |

| Health Care Technology | 1.00 | % |

| Household Durables | 3.69 | % |

| Industrial Conglomerates | 1.48 | % |

| Insurance | 3.83 | % |

| Internet and Direct Marketing Retail | 2.58 | % |

| IT Services | 2.90 | % |

| Leisure Products | 1.99 | % |

| Machinery | 1.12 | % |

| Personal Products | 0.60 | % |

| Pharmaceuticals | 1.93 | % |

| Professional Services | 6.61 | % |

| Software | 3.98 | % |

| Transportation infrastructure | 3.77 | % |

| Total | 100.00 | % |

The weighted average yield of our portfolio as of June 30, 2023 was as follows:

| | | | | |

| Weighted average yield on debt and income producing investments, at cost | 11.02 | % |

| Weighted average yield on debt and income producing investments, at fair value | 11.32 | % |

| Percentage of debt investments bearing a floating rate | 100.00 | % |

| Percentage of debt investments bearing a fixed rate | — | % |

The weighted average yield of our debt and income producing securities is not the same as a return on investment for our shareholders, but rather relates to our investment portfolio and is calculated before deduction of all of our fees and expenses. The weighted average yield was computed using the effective interest rates as of the reporting date, including accretion of original issue discount, but excluding investments on non-accrual status, if any. There can be no assurance that the weighted average yield will remain at its current level.

Asset Quality

In addition to various risk management and monitoring tools, we use the Investment Adviser’s investment rating system to characterize and monitor the credit profile and expected level of returns on each investment in our portfolio. Each investment team utilizes a systematic, consistent approach to credit evaluation, with a particular focus on an acceptable level of debt repayment and deleveraging under a “base case” set of projections (the “Base Case”), which generally reflects a more conservative estimate than the set of projections provided by a prospective portfolio company, which the Investment Adviser refers to as the “Management Case.” The following is a description of the conditions associated with each investment rating:

1.Performing - Superior: Borrower is performing significantly above Management Case.

2.Performing - High: Borrower is performing at or near the Management Case (i.e., in a range slightly below to slightly above).

3.Performing - Low Risk: Borrower is operating well ahead of the Base Case to slightly below the Management Case.

4.Performing - Stable Risk: Borrower is operating at or near the Base Case (i.e., in a range slightly below to slightly above). This is the initial rating assigned to all new borrowers.

5.Performing - Management Notice: Borrower is operating below the Base Case. Adverse trends in business conditions and/or industry outlook are viewed as temporary. There is no immediate risk of payment default and only a low to moderate risk of covenant default.

6.Watch List - Low Maintenance: Borrower is operating below the Base Case, with declining margin of protection. Adverse trends in business conditions and/or industry outlook are viewed as probably lasting for more than a year. Payment default is still considered unlikely, but there is a moderate to high risk of covenant default.

7.Watch List - Medium Maintenance: Borrower is operating well below the Base Case, but has adequate liquidity. Adverse trends are more pronounced than in Internal Risk Rating 6 above. There is a high risk of covenant default, or it may have already occurred. Payments are current, although subject to greater uncertainty, and there is a moderate to high risk of payment default.

8.Watch List - High Maintenance: Borrower is operating well below the Base Case. Liquidity may be strained. Covenant default is imminent or may have occurred. Payments are current, but there is a high risk of payment default. Negotiations to restructure or refinance debt on normal terms may have begun. Further significant deterioration appears unlikely and no loss of principal is currently anticipated.

9.Watch List - Possible Loss: At the current level of operations and financial condition, the borrower does not have the ability to service and ultimately repay or refinance all outstanding debt on current terms. Liquidity is strained. Payment default may have occurred or is very likely in the short term unless creditors grant some relief. Loss of principal is possible.

10.Watch List - Probable Loss: At the current level of operations and financial condition, the borrower does not have the ability to service and ultimately repay or refinance all outstanding debt on current terms. Payment default is very likely or may have already occurred. Liquidity is extremely limited. The prospects for improvement in the borrower’s situation are sufficiently negative that loss of some or all principal is probable.

The Investment Adviser regularly monitors and, when appropriate, changes the investment rating assigned to each investment in our portfolio. Each investment team will review the investment ratings in connection with monthly or quarterly portfolio reviews. Based on a generally uncertain economic outlook in the United States (which includes a possible recession), we have increased oversight and analysis of credits in any vulnerable industries to mitigate any decline in loan performance and reduce credit risk.

The following table shows the investment ratings of the investments in our portfolio as of June 30, 2023 (dollar amounts in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | Fair Value | | % of Portfolio | | Number of Portfolio Companies |

| 1 | | $ | — | | | — | % | | — | |

| 2 | | — | | | — | % | | — | |

| 3 | | 7,270 | | | 1.92 | % | | 1 | |

| 4 | | 343,609 | | | 90.91 | % | | 43 |

| 5 | | 18,748 | | | 4.96 | % | | 2 | |

| 6 | | — | | | — | % | | — | |

| 7 | | 8,332 | | | 2.21 | % | | 1 | |

| 8 | | — | | | — | % | | — | |

| 9 | | — | | | — | % | | — | |

| 10 | | — | | | — | % | | — | |

| Total | | $ | 377,959 | | | 100.00 | % | | 47 |

As of June 30, 2023, the weighted average Internal Risk Rating of our investment portfolio was 4.1.

TOP TEN HOLDINGS

AS OF JUNE 30, 2023

(dollars in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| Investment | | Maturity | | Fair Value | | % of Net Assets |

| Sandlot Buyer, LLC | | 9/19/2028 | | $ | 19,257 | | | 6.14 | % |

| Phaidon International | | 8/22/2029 | | 18,858 | | | 6.01 | % |

| Kenco PPC Buyer LLC | | 11/15/2029 | | 14,737 | | | 4.70 | % |

| Olympic Buyer Inc. | | 6/30/2028 | | 13,683 | | | 4.36 | % |

| Randys Holdings, Inc. | | 11/1/2028 | | 12,819 | | | 4.09 | % |

| Excel Fitness Holdings, Inc. | | 4/27/2029 | | 11,417 | | | 3.64 | % |

| LSCS Safari Holdings, Inc. | | 12/16/2028 | | 10,789 | | | 3.44 | % |

| AG Group Holdings, Inc. | | 12/29/2028 | | 10,276 | | | 3.28 | % |

| American Auto Auction Group | | 12/30/2027 | | 9,761 | | | 3.11 | % |

| Sciens Building Solutions, LLC | | 12/15/2027 | | 9,670 | | | 3.08 | % |

| | | | | | 41.85 | % |

NC SLF INC.

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES (UNAUDITED)

(dollars in thousands, except share and per share data)

| | | | | |

| June 30, 2023 |

| Assets | |

| Investments, at fair value (amortized cost of $388,389) | $ | 377,959 | |

| Cash and cash equivalents | 28,146 | |

| Interest receivable | 2,698 | |

| Receivable for investment sold | 213 | |

| |

| Prepaid expenses | 101 | |

| Total assets | 409,117 |

| |

| Liabilities | |

| Secured borrowings (net of $1,430 deferred financing cost) | 86,070 | |

| |

| Interest Payable | 429 | |

| |

Management fees payable (See Note 4) | 453 |

| Distributions payable | 7,834 | |

Directors' fee payable (See Note 4) | 15 | |

| Accounts payable and accrued expenses | 702 | |

| Total liabilities | 95,503 | |

| |

Commitments and contingencies (See Note 6) | |

| |

| |

| Common shares, par value $0.01 per share, 500,000,000 shares authorized, 32,641,260 shares issued and outstanding as of June 30, 2023 | 326 | |

| Paid-in-capital in excess of par value | 323,266 | |

| Total distributable earnings (loss) | (9,978) | |

| Total net assets | $ | 313,614 | |

| |

Net asset value per share (See Note 8) | $ | 9.61 | |

The accompanying notes are an integral part of these consolidated financial statements.

11

NC SLF INC.

CONSOLIDATED STATEMENT OF OPERATIONS (UNAUDITED)

(dollars in thousands, except share and per share data)

| | | | | | | | | |

| Six Months Ended June 30, 2023 | |

| Investment income: | | | | | |

| Interest income | $ | 19,121 | | | | | |

| Other income | 30 | | | | | |

| Total investment income | 19,151 | | | | | |

| | | | | |

| Expenses: | | | | | |

| Interest and debt financing expenses | 1,794 | | | | | |

| | | | | |

| | | | | |

| 856 | | | | | |

| Professional fees | 447 | | | | | |

| 29 | | | | | |

Administration fees (See Note 4) | 317 | | | | | |

| Other general and administrative expenses | 61 | | | | | |

| Total expenses | 3,504 | | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net investment income (loss) | 15,647 | | | | |

| | | | | |

| Realized and unrealized gain (loss) on investments: | | | | | |

| Net realized gain (loss) on non-controlled/non-affiliated company investments | 78 | | | | | |

| Net change in unrealized appreciation (depreciation) on non-controlled/non-affiliated company investments | (680) | | | | | |

| Total net realized and unrealized gain (loss) on investments | (602) | | | | | |

| | | | | |

| Net increase (decrease) in net assets resulting from operations | $ | 15,045 | | | | | |

| | | | | |

| Per share data: | | | | | |

| Net investment income (loss) per share | $ | 0.49 | | | | | |

| Net increase (decrease) in net assets resulting from operations per share | $ | 0.47 | | | | | |

| Weighted average common shares outstanding | 32,161,961 | | | | | |

| | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

12

NC SLF INC.

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS

(dollars in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, | | Year Ended December 31, | | | | | | | | | | | |

| 2023

(Unaudited)

| | 2022 | | | | | | | | | | | |

| Increase (decrease) in net assets resulting from operations: | | | | | | | | | | | | | | |

| Net investment income (loss) | $ | 15,647 | | | $ | 13,281 | | | | | | | | | | | | |

| Net realized gain (loss) on investments | 78 | | | 78 | | | | | | | | | | | | |

| Net change in unrealized appreciation (depreciation) on investments | (680) | | | (9,944) | | | | | | | | | | | | |

| Net increase (decrease) in net assets resulting from operations | 15,045 | | | 3,415 | | | | | | | | | | | | |

| Shareholder distributions: | | | | | | | | | | | | | | |

| Distributions of investment income | (15,168) | | | (13,477) | | | | | | | | | | | | |

| Net increase (decrease) in net assets resulting from shareholder distributions | (15,168) | | | (13,477) | | | | | | | | | | | | |

| Capital share transactions: | | | | | | | | | | | | | | |

| Issuance of common shares | — | | | 250,000 | | | | | | | | | | | |

| Reinvestment of shareholder distributions | 13,602 | | | — | | | | | | | | | | | | |

| Net increase (decrease) in net assets resulting from capital share transactions | 13,602 | | | 250,000 | | | | | | | | | | | | |

| Total increase (decrease) in net assets | 13,479 | | | 239,938 | | | | | | | | | | | | |

| Net assets, at beginning of period | 300,135 | | | 60,197 | | | | | | | | | | | | |

| Net assets, at end of period | $ | 313,614 | | | $ | 300,135 | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

13

NC SLF INC.

CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED)

(dollars in thousands, except share and per share data) | | | | | | | |

| Six Months Ended June 30, 2023 |

| Cash flows from operating activities: | | | |

| Net increase (decrease) in net assets resulting from operations | $ | 15,045 | | | |

| Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided by (used in) operating activities | | | |

| Purchase of investments | (70,384) | | | |

| Proceeds from principal repayments of investments and sales of investments | 2,520 | | | |

| Amortization of premium/accretion of discount, net | (441) | | | |

| Net realized (gain) loss on investments | (78) | | | |

| Net change in unrealized (appreciation) depreciation on investments | 680 | | | |

| Amortization of deferred financing costs | 208 | | | |

| Changes in operating assets and liabilities: | | | |

| Interest receivable | (475) | | | |

| Receivable for investments sold | (33) | | | |

| Prepaid expenses | (101) | | | |

| | | |

| | | |

| | | |

| Interest payable | 343 | | | |

| Management fees payable | 106 | | | |

| | | |

| Accounts payable and accrued expenses | 197 | | | |

| Net cash provided by (used in) operating activities | (52,413) | | | |

| | | |

| Cash flows from financing activities: | | | |

| | | |

| Shareholder distributions | (135) | | | |

| Proceeds from secured borrowings | 82,500 | | | |

| Repayments of secured borrowings | (6,000) | | | |

| Payments of deferred financing costs | (1,325) | | | |

| Net cash provided by (used in) financing activities | 75,040 | | | |

| | | |

| Net increase (decrease) in cash and cash equivalents | 22,627 | | | |

| Cash and cash equivalents, beginning of period | 5,519 | | | |

| Cash and cash equivalents, end of period | $ | 28,146 | | | |

| | | |

| Supplemental disclosure of cash flow Information: | | | |

| Cash paid during the period for interest | $ | 1,929 | | | |

| | | |

| Supplemental disclosure of non-cash flow information: | | | |

| Reinvestment of shareholder distributions | $ | 13,602 | | | |

The accompanying notes are an integral part of these consolidated financial statements.

14

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| Investments | | | | | | | | | | | | | | | | | | |

| Debt Investments | | | | | | | | | | | | | | | | | | |

| Air Freight & Logistics | | | | | | | | | | | | | | | | | | |

| Kenco Group, Inc. | | (4) | | First Lien Term Loan | | S + 5.00% | | 10.27% | | 11/15/2029 | | $ | 14,946 | | | $ | 14,671 | | | $ | 14,737 | | | 4.70% |

| Kenco Group, Inc. (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 5.00% | | 10.27% | | 11/15/2029 | | 2,479 | | (45) | | | (35) | | | (0.01 | %) |

| Total Air Freight & Logistics | | | | | | | | | | | | | | 14,626 | | 14,702 | | 4.69 | % |

| | | | | | | | | | | | | | | | | | |

| Auto Components | | | | | | | | | | | | | | | | | | |

| Randys Holdings, Inc | | (4) (7) | | First Lien Term Loan | | S + 6.50% | | 11.77% | | 11/1/2028 | | 13,059 | | | 12,819 | | 12,819 | | 4.09 | % |

| Randys Holdings, Inc (Delayed Draw) | | (4) (6) (7) | | First Lien Term Loan | | S + 6.50% | | 11.77% | | 11/1/2028 | | 4,375 | | | — | | | (81) | | (0.03) | % |

| Total Auto Components | | | | | | | | | | | | | | 12,819 | | 12,738 | | 4.06 | % |

| | | | | | | | | | | | | | | | | | |

| Automobiles | | | | | | | | | | | | | | | | | | |

| American Auto Auction Group | | (4) | | First Lien Term Loan | | S + 5.00% | | 10.27% | | 12/30/2027 | | 10,573 | | | 10,489 | | 9,761 | | 3.11 | % |

| Total Automobiles | | | | | | | | | | | | | | 10,489 | | 9,761 | | 3.11 | % |

| | | | | | | | | | | | | | | | | | |

| Chemicals | | | | | | | | | | | | | | | | | | |

| Ascensus Specialties | | (4) (7) | | First Lien Term Loan | | S + 4.35% | | 9.49% | | 6/30/2028 | | 14,218 | | | 13,998 | | 13,683 | | 4.36 | % |

| Chroma Color Corporation (dba "Chroma Color) | | (4) | | First Lien Term Loan | | S + 6.00% | | 11.27% | | 4/21/2029 | | 3,068 | | | 3,008 | | 3,008 | | 0.96 | % |

| Chroma Color Corporation (dba "Chroma Color) (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.00% | | 11.27% | | 4/21/2029 | | 667 | | (6) | | | (13) | | | — | % |

| Total Chemicals | | | | | | | | | | | | | | 17,000 | | 16,678 | | 5.32 | % |

| | | | | | | | | | | | | | | | | | |

| Commercial Services & Supplies | | | | | | | | | | | | | | | | | | |

| Integrated Power Services | | (4) | | First Lien Term Loan | | S + 4.50% | | 9.64% | | 11/22/2028 | | 5,017 | | | 4,990 | | 4,937 | | 1.57 | % |

| Phaidon International | | (4) (8) | | First Lien Term Loan | | S + 5.50% | | 10.64% | | 8/22/2029 | | 19,013 | | | 18,846 | | 18,858 | | 6.02 | % |

| Total Commercial Services & Supplies | | | | | | | | | | | | | | 23,836 | | 23,795 | | 7.59 | % |

| | | | | | | | | | | | | | | | | | |

| Construction & Engineering | | | | | | | | | | | | | | | | | | |

| MEI Rigging & Crating | | (4) (11) | | First Lien Term Loan | | S + 6.50% | | 11.64% | | 6/29/2029 | | 5,540 | | | 5,429 | | 5,429 | | 1.73 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| MEI Rigging & Crating (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.50% | | 11.64% | | 6/29/2029 | | 877 | | | (4) | | | (18) | | | (0.01 | %) |

| Total Construction & Engineering | | | | | | | | | | | | | | 5,425 | | 5,411 | | 1.72 | % |

| | | | | | | | | | | | | | | | | | |

| Construction Materials | | | | | | | | | | | | | | | | | | |

| Sciens Building Solutions, LLC | | (4) (7) | | First Lien Term Loan | | S + 5.75% | | 11.02% | | 12/15/2027 | | 10,069 | | | 9,912 | | 9,670 | | 3.08 | % |

| Sciens Building Solutions, LLC (Delayed Draw) | | (4) (6) (7) | | First Lien Term Loan | | S + 5.75% | | 11.02% | | 12/15/2027 | | 5,302 | | | 1,710 | | 1,539 | | 0.49 | % |

| Total Construction Materials | | | | | | | | | | | | | | 11,622 | | 11,209 | | 3.57 | % |

| | | | | | | | | | | | | | | | | | |

| Containers & Packaging | | | | | | | | | | | | | | | | | | |

| Five Star Packing | | (4) (11) | | First Lien Term Loan | | S + 4.25% | | 9.64% | | 5/5/2029 | | 5,565 | | | 5,491 | | 5,471 | | 1.75 | % |

| Impact Parent Coproration (d/b/a Impact Environmental Group) | | (4) | | First Lien Term Loan | | S + 6.00% | | 11.39% | | 3/23/2029 | | 3,651 | | | 3,579 | | 3,582 | | 1.14 | % |

| Impact Parent Coproration (d/b/a Impact Environmental Group) (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.00% | | 11.39% | | 3/23/2029 | | 1,701 | | | (8) | | | (32) | | | (0.01 | %) |

| Pelican Products | | (7) (10) | | First Lien Term Loan | | S + 4.25% | | 9.52% | | 12/29/2028 | | 7,880 | | | 7,817 | | 7,195 | | 2.29 | % |

| Resource Label Group | | (7) (10) | | First Lien Term Loan | | S + 4.25% | | 9.39% | | 7/7/2028 | | 4,878 | | | 4,866 | | 4,652 | | 1.48 | % |

| Spartech | | (4) (7) | | First Lien Term Loan | | S + 4.75% | | 10.02% | | 5/8/2028 | | 9,874 | | | 9,874 | | 8,987 | | 2.87 | % |

| Total Containers & Packaging | | | | | | | | | | | | | | 31,619 | | 29,855 | | 9.52 | % |

| | | | | | | | | | | | | | | | | | |

| Distributors | | | | | | | | | | | | | | | | | | |

| RTH Buyer LLC (dba "Rhino Tool House) | | (4) | | First Lien Term Loan | | S + 6.25% | | 11.64% | | 4/4/2029 | | 4,701 | | | 4,610 | | 4,611 | | 1.47 | % |

| RTH Buyer LLC (dba "Rhino Tool House) (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.25% | | 11.64% | | 4/4/2029 | | 1,096 | | | (5) | | | (21) | | | (0.01 | %) |

| Total Distributors | | | | | | | | | | | | | | 4,605 | | 4,590 | | 1.46 | % |

| | | | | | | | | | | | | | | | | | |

| Diversified Consumer Services | | | | | | | | | | | | | | | | | | |

| Apex Services Partners, LLC (Delayed Draw) (Incremental) | | (4) (7) | | First Lien Term Loan | | S + 5.50% | | 10.77% | | 7/31/2025 | | 4,838 | | | 4,822 | | 4,838 | | 1.54 | % |

| Apex Services Partners, LLC (Incremental) | | (4) (7) (11) | | First Lien Term Loan | | S + 5.50% | | 10.77% | | 7/31/2025 | | 4,838 | | | 4,804 | | 4,838 | | 1.54 | % |

| Excel Fitness | | (4) (11) | | First Lien Term Loan | | S + 5.25% | | 10.52% | | 4/27/2029 | | 11,910 | | | 11,789 | | 11,417 | | 3.65 | % |

| Total Diversified Consumer Services | | | | | | | | | | | | | | 21,415 | | 21,093 | | 6.73 | % |

| | | | | | | | | | | | | | | | | | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| Electronic Equipment, Instruments & Components | | | | | | | | | | | | | | | | | | |

| Infinite Bidco LLC (Infinite Electronics) (Incremental) | | (4) (7) | | First Lien Term Loan | | S + 6.25% | | 11.64% | | 3/2/2028 | | 2,524 | | | 2,453 | | 2,454 | | 0.78 | % |

| INS Intermediate II, LLC (Ergotech Controls, Inc. – d/b/a INS) | | (4) | | First Lien Term Loan | | S + 6.50% | | 11.77% | | 1/19/2029 | | 7,001 | | | 6,872 | | 6,871 | | 2.20 | % |

| INS Intermediate II, LLC (Ergotech Controls, Inc. – d/b/a INS) (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.50% | | 11.77% | | 1/19/2029 | | 1,732 | | | (32) | | | (32) | | | (0.01 | %) |

| Total Electronic Equipment, Instruments & Components | | | | | | | | | | | | | | 9,293 | | 9,293 | | 2.97 | % |

| | | | | | | | | | | | | | | | | | |

| Energy Equipment & Services | | | | | | | | | | | | | | | | | | |

| Ovation Holdings, Inc. | | (4) | | First Lien Term Loan | | S + 6.25% | | 11.52% | | 2/3/2029 | | 7,066 | | | 6,919 | | 6,915 | | 2.20 | % |

| Ovation Holdings, Inc. (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.25% | | 11.52% | | 2/3/2029 | | 1,666 | | | (20) | | | (36) | | | (0.01 | %) |

| Total Energy Equipment & Services | | | | | | | | | | | | | | 6,899 | | 6,879 | | 2.19 | % |

| | | | | | | | | | | | | | | | | | |

| Gas Utilities | | | | | | | | | | | | | | | | | | |

| D&H United Fueling Solutions | | (4) (11) | | First Lien Term Loan | | S + 5.25% | | 10.52% | | 9/16/2028 | | 7,341 | | | 7,210 | | 7,050 | | 2.25 | % |

| D&H United Fueling Solutions (Delayed Draw) | | (4) | | First Lien Term Loan | | S + 5.25% | | 10.52% | | 9/16/2028 | | 2,336 | | | 2,316 | | 2,244 | | 0.72 | % |

| D&H United Fueling Solutions (Delayed Draw) (Incremental) | | (4) (6) | | First Lien Term Loan | | S + 5.25% | | 10.52% | | 9/16/2028 | | 1,090 | | | (5) | | | (22) | | | (0.01 | %) |

| D&H United Fueling Solutions (Incremental) | | (4) (11) | | First Lien Term Loan | | S + 5.25% | | 10.52% | | 9/16/2028 | | 2,423 | | | 2,374 | | 2,374 | | 0.76 | % |

| Total Gas Utilities | | | | | | | | | | | | | | 11,895 | | 11,646 | | 3.72 | % |

| | | | | | | | | | | | | | | | | | |

| Health Care Providers & Services | | | | | | | | | | | | | | | | | | |

| Forefront Dermatology | | (7) (10) (11) | | First Lien Term Loan | | S + 4.25% | | 9.39% | | 4/2/2029 | | 3,897 | | | 3,829 | | 3,859 | | 1.23 | % |

| Forefront Dermatology (Delayed Draw) | | (6) (7) (10) | | First Lien Term Loan | | S + 4.25% | | 9.39% | | 4/2/2029 | | 730 | | | 715 | | 707 | | 0.23 | % |

| Gastro Health | | (4) | | First Lien Term Loan | | S + 4.50% | | 9.64% | | 7/3/2028 | | 8,290 | | | 8,242 | | 7,901 | | 2.52 | % |

| PromptCare | | (4) (7) | | First Lien Term Loan | | S + 6.00% | | 11.14% | | 9/1/2027 | | 9,261 | | | 9,150 | | 9,062 | | 2.89 | % |

| PromptCare (Delayed Draw) | | (4) (6) (7) | | First Lien Term Loan | | S + 6.00% | | 11.14% | | 9/1/2027 | | 3,393 | | | 1,423 | | 1,370 | | 0.44 | % |

| Sandlot Buyer, LLC (Prime Time Healthcare) | | (4) | | First Lien Term Loan | | S + 5.75% | | 11.14% | | 9/19/2028 | | 19,250 | | | 18,720 | | 19,257 | | 6.14 | % |

| SCP Eye Care Holdco, LLC (DBA EyeSouth Partners) | | (4) | | First Lien Term Loan | | S + 5.75% | | 10.89% | | 10/5/2029 | | 7,804 | | | 7,649 | | 7,660 | | 2.44 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| SCP Eye Care Holdco, LLC (DBA EyeSouth Partners) (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 5.75% | | 10.89% | | 10/5/2029 | | 2,545 | | | 416 | | | 370 | | | 0.12 | % |

| Soliant Health | | (4) | | First Lien Term Loan | | S + 5.25% | | 10.39% | | 3/31/2028 | | 7,270 | | | 7,261 | | 7,270 | | 2.32 | % |

| Southern Veterinary Partners | | (4) (7) | | First Lien Term Loan | | S + 5.50% | | 10.64% | | 10/5/2027 | | 8,910 | | | 8,759 | | 8,762 | | 2.79 | % |

| Total Health Care Providers & Services | | | | | | | | | | | | | | 66,164 | | 66,218 | | 21.12 | % |

| | | | | | | | | | | | | | | | | | |

| Health Care Technology | | | | | | | | | | | | | | | | | | |

| Acclaim MidCo, LLC (dba ClaimLogiQ) | | (4) | | First Lien Term Loan | | S + 6.25% | | 11.52% | | 6/13/2029 | | 3,897 | | | 3,819 | | 3,820 | | 1.22 | % |

| Acclaim MidCo, LLC (dba ClaimLogiQ) (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 5.50% | | 10.77% | | 6/13/2029 | | 1,559 | | | (8) | | | (31) | | | (0.01 | %) |

| Total Health Care Technology | | | | | | | | | | | | | | 3,811 | | 3,789 | | 1.21 | % |

| | | | | | | | | | | | | | | | | | |

| Household Durables | | | | | | | | | | | | | | | | | | |

| All My Sons | | (4) (11) | | First Lien Term Loan | | S + 4.75% | | 9.89% | | 10/25/2028 | | 5,883 | | | 5,837 | | 5,619 | | 1.79 | % |

| Petmate | | (7) (10) | | First Lien Term Loan | | L + 5.50% | | 11.05% | | 9/15/2028 | | 12,818 | | | 12,718 | | 8,332 | | 2.66 | % |

| Total Household Durables | | | | | | | | | | | | | | 18,555 | | 13,951 | | 4.45 | % |

| | | | | | | | | | | | | | | | | | |

| Industrial Conglomerates | | | | | | | | | | | | | | | | | | |

| ISG Merger Sub, LLC (dba Industrial Service Group) | | (4) | | First Lien Term Loan | | S + 6.25% | | 11.52% | | 12/7/2028 | | 5,738 | | | 5,632 | | 5,633 | | 1.80 | % |

| ISG Merger Sub, LLC (dba Industrial Service Group) (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.25% | | 11.52% | | 12/7/2028 | | 2,983 | | | (14) | | | (55) | | | (0.02 | %) |

| Total Industrial Conglomerates | | | | | | | | | | | | | | 5,618 | | 5,578 | | 1.78 | % |

| | | | | | | | | | | | | | | | | | |

| Insurance | | | | | | | | | | | | | | | | | | |

| Patriot Growth Insurance Service (Delayed Draw) (Incremental) | | (4) (6) (7) | | First Lien Term Loan | | S + 5.75% | | 11.02% | | 10/14/2028 | | 8,981 | | | 4,634 | | 4,479 | | 1.43 | % |

| Risk Strategies (Delayed Draw) | | (4) (7) | | First Lien Term Loan | | S + 5.50% | | 10.77% | | 11/1/2026 | | 8,663 | | | 8,663 | | 8,467 | | 2.70 | % |

| Risk Strategies (Delayed Draw) | | (4) (6) (7) | | First Lien Term Loan | | S + 5.50% | | 10.77% | | 11/1/2026 | | 2,694 | | | 1,567 | | 1,526 | | 0.49 | % |

| Total Insurance | | | | | | | | | | | | | | 14,864 | | 14,472 | | 4.62 | % |

| | | | | | | | | | | | | | | | | | |

| Internet and Direct Marketing Retain | | | | | | | | | | | | | | | | | | |

| Xpressmyself.com LLC (a/k/a SmartSign) | | (4) | | First Lien Term Loan | | S + 5.75% | | 11.02% | | 9/7/2028 | | 2,693 | | | 2,639 | | 2,640 | | 0.84 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| Xpressmyself.com LLC (a/k/a SmartSign) | | (4) | | First Lien Term Loan | | S + 4.75% | | 10.02% | | 9/7/2028 | | 7,345 | | | 7,281 | | 7,127 | | 2.27 | % |

| Total Internet and Direct Marketing Retain | | | | | | | | | | | | | | 9,920 | | 9,767 | | 3.11 | % |

| | | | | | | | | | | | | | | | | | |

| IT Services | | | | | | | | | | | | | | | | | | |

| Evergreen Services Group | | (4) (7) | | First Lien Term Loan | | S + 6.15% | | 11.42% | | 6/15/2029 | | 9,140 | | | 8,979 | | 8,841 | | 2.82 | % |

| Evergreen Services Group (Delayed Draw) | | (4) (7) | | First Lien Term Loan | | S + 6.15% | | 11.42% | | 6/15/2029 | | 2,187 | | | 2,168 | | 2,115 | | 0.67 | % |

| Total IT Services | | | | | | | | | | | | | | 11,147 | | 10,956 | | 3.49 | % |

| | | | | | | | | | | | | | | | | | |

| Leisure Products | | | | | | | | | | | | | | | | | | |

| TouchTunes Interactive | | (4) | | First Lien Term Loan | | S + 5.00% | | 10.27% | | 4/2/2029 | | 7,594 | | | 7,528 | | 7,510 | | 2.39 | % |

| Total Leisure Products | | | | | | | | | | | | | | 7,528 | | 7,510 | | 2.39 | % |

| | | | | | | | | | | | | | | | | | |

| Machinery | | | | | | | | | | | | | | | | | | |

| Hyperion | | (10) | | First Lien Term Loan | | L + 4.25% | | 9.47% | | 8/28/2028 | | 4,272 | | | 4,258 | | 4,247 | | 1.35 | % |

| Total Machinery | | | | | | | | | | | | | | 4,258 | | 4,247 | | 1.35 | % |

| | | | | | | | | | | | | | | | | | |

| Personal Products | | | | | | | | | | | | | | | | | | |

| Protective Industrial Products ("PIP") | | (4) (7) | | First Lien Term Loan | | S + 5.00% | | 10.14% | | 12/29/2027 | | 2,355 | | | 2,262 | | | 2,263 | | | 0.72 | % |

| Total Personal Products | | | | | | | | | | | | | | 2,262 | | | 2,263 | | | 0.72 | % |

| | | | | | | | | | | | | | | | | | |

| Pharmaceuticals | | | | | | | | | | | | | | | | | | |

| Wellspring Pharmaceutical | | (4) | | First Lien Term Loan | | S + 5.75% | | 11.14% | | 8/22/2028 | | 3,395 | | | 3,337 | | | 3,296 | | | 1.05 | % |

| Wellspring Pharmaceutical (Delayed Draw) | | (4) | | First Lien Term Loan | | S + 5.75% | | 11.14% | | 8/22/2028 | | 1,579 | | | 1,569 | | | 1,533 | | | 0.49 | % |

| Wellspring Pharmaceutical (Delayed Draw) (Incremental) | | (4) (6) | | First Lien Term Loan | | S + 5.75% | | 11.14% | | 8/22/2028 | | 7,975 | | | (38) | | | (156) | | | (0.05 | %) |

| Wellspring Pharmaceutical (Incremental) | | (4) | | First Lien Term Loan | | S + 5.75% | | 11.14% | | 8/22/2028 | | 2,658 | | | 2,607 | | | 2,606 | | | 0.83 | % |

| Total Pharmaceuticals | | | | | | | | | | | | | | 7,475 | | | 7,279 | | | 2.32 | % |

| | | | | | | | | | | | | | | | | | |

| Professional Services | | | | | | | | | | | | | | | | | | |

| AG Group Holdings, Inc. | | (4) | | First Lien Term Loan | | S + 4.00% | | 9.14% | | 12/29/2028 | | 10,403 | | | 10,384 | | 10,276 | | 3.28 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| ALKU Intermediate Holdings, LLC | | (4) | | First Lien Term Loan | | S + 6.25% | | 11.39% | | 5/22/2029 | | 3,987 | | | 3,907 | | | 3,908 | | | 1.25 | % |

| LSCS Holdings Inc. | | (4) | | First Lien Term Loan | | L + 4.50% | | 9.72% | | 12/16/2028 | | 11,140 | | | 11,094 | | | 10,789 | | | 3.44 | % |

| Total Professional Services | | | | | | | | | | | | | | 25,385 | | | 24,973 | | | 7.97 | % |

| | | | | | | | | | | | | | | | | | |

| Software | | | | | | | | | | | | | | | | | | |

| BusinesSolver | | (4) (7) | | First Lien Term Loan | | S + 5.50% | | 10.77% | | 12/1/2027 | | 8,870 | | | 8,801 | | | 8,722 | | | 2.78 | % |

| BusinesSolver (Delayed Draw) | | (4) (6) (7) | | First Lien Term Loan | | S + 5.50% | | 10.77% | | 12/1/2027 | | 2,417 | | | 197 | | | 166 | | | 0.05 | % |

| Revalize (Delayed Draw) | | (4) (7) | | First Lien Term Loan | | S + 5.75% | | 10.89% | | 4/15/2027 | | 1,287 | | | 1,278 | | | 1,206 | | | 0.38 | % |

| Revalize (Delayed Draw) | | (4) (7) | | First Lien Term Loan | | S + 5.75% | | 10.89% | | 4/15/2027 | | 287 | | | 286 | | | 269 | | | 0.09 | % |

| Revalize (Delayed Draw) | | (4) (7) | | First Lien Term Loan | | S + 5.75% | | 10.89% | | 4/15/2027 | | 5,012 | | | 4,999 | | | 4,696 | | | 1.50 | % |

| Total Software | | | | | | | | | | | | | | 15,561 | | | 15,059 | | | 4.80 | % |

| | | | | | | | | | | | | | | | | | |

| Transportation Infrastructure | | | | | | | | | | | | | | | | | | |

| FSK Pallet Holding Corp. (DBA Kamps Pallets) | | (4) (11) | | First Lien Term Loan | | S + 5.50% | | 10.77% | | 12/23/2026 | | 8,684 | | | 8,534 | | | 8,486 | | | 2.71 | % |

| Transit Buyer LLC (dba“Propark”) | | (4) | | First Lien Term Loan | | S + 6.25% | | 11.64% | | 1/31/2029 | | 5,923 | | | 5,814 | | | 5,812 | | | 1.85 | % |

| Transit Buyer LLC (dba“Propark”) (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.25% | | 11.64% | | 1/31/2029 | | 2,699 | | | (50) | | | (51) | | | (0.02 | %) |

| Total Transportation Infrastructure | | | | | | | | | | | | | | 14,298 | | | 14,247 | | | 4.54 | % |

| | | | | | | | | | | | | | | | | | |

| Total Debt Investments | | | | | | | | | | | | | | 388,389 | | | 377,959 | | | 120.52 | % |

| | | | | | | | | | | | | | | | | | |

| Cash equivalents | | (9) | | | | | | | | | | | | 18,941 | | | 18,941 | | | 6.04 | % |

| Total Investments & Cash Equivalents | | | | | | | | | | | | | | $ | 407,330 | | | $ | 396,900 | | | 126.56 | % |

___________

(1)All investments are non-controlled/non-affiliated investments as defined by the Investment Company Act of 1940, as amended (the "1940 Act"). The 1940 Act classifies investments based on the level of control that the Company maintains in a particular portfolio company. As defined in the 1940 Act, a company is generally presumed to be “non-controlled” when the Company owns 25% or less of the portfolio company’s voting securities and “controlled” when the Company owns more than 25% of the portfolio company’s voting securities. The 1940 Act also classifies investments further based on the level of ownership that the Company maintains in a particular portfolio company. As defined in the 1940 Act, a company is generally deemed as “non-affiliated” when the Company owns less than 5% of a portfolio company’s voting securities and “affiliated” when the Company owns 5% or more of a portfolio company’s voting securities.

(2)The issuer of the debt investment held by the Company is domiciled in the United States unless otherwise noted.

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2023

(dollars in thousands)

(3)The majority of the investments bear interest at a rate that may be determined by reference to Secured Overnight Financing Rate (“SOFR” or “S”) and, to a lesser extent, London Interbank Offered Rate (“LIBOR” or “L”), which reset monthly or quarterly. For each such investment, the Company has provided the spread over SOFR and LIBOR and the current contractual interest rate in effect at June 30, 2023. As of June 30, 2023, rates for 1M S, 3M S and 6M S are 5.14%, 5.27% and 5.39%, respectively. As of June 30, 2023, rates for 1M L and 3M L are 5.22% and 5.55%, respectively. For portfolio companies with multiple interest rate contracts, the interest rate shown is a weighted average current interest rate in effect as of June 30, 2023. Certain investments are subject to a SOFR or LIBOR floor. For fixed loans, a spread above reference rate is not applicable.

(4)Investment valued using unobservable inputs (Level 3). See Note 3 “Fair Value Measurements” for more information. (5)Percentage is based on net assets of $313,614 as of June 30, 2023.

(6)Position or portion thereof is an unfunded loan commitment, and no interest is being earned on the unfunded portion. See Note 6. The investment may be subject to unused commitment fees. (7)Investment is a unitranche position.

(8)This portfolio company is not domiciled in the United States. The principal place of business for Phaidon International is the United Kingdom.

(9)Cash equivalents balance represents amounts held in an interest-bearing money market fund issued by U.S. Bank National Association.

(10)Investments valued using observable inputs (Level 2).

(11)Denotes that all or a portion of the assets are owned by SPV I (as defined in Note 1 “Organization”). SPV I entered into a loan and security agreement (the “ABL Facility”) on April 27, 2023. The lenders of the ABL Facility have a first lien security interest in substantially all of the assets of SPV I. Accordingly, such assets are not available to creditors of the Company. See Note 5 “Secured Borrowings” for more information.

NC SLF INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(dollars amounts in thousands, except per share data)

1.ORGANIZATION

NC SLF Inc. (the “Company”) is a Maryland corporation that registered under the Investment Company Act of 1940, as amended (the “1940 Act”), on August 12, 2022 as a non-diversified, closed-end management investment company. Prior to its registration as a closed-end fund under the 1940 Act, the Company was organized as a Maryland corporation on January 29, 2021 and operated as a business development company (“BDC”) from June 2, 2021 until August 12, 2022, whereupon it withdrew its election to be regulated as a BDC pursuant to Section 54(c) of the 1940 Act and filed a notice of registration under Section 8 of the 1940 Act in order to register as a closed-end fund (the “1940 Act Registration Statement”). The Company has elected, and intends to qualify annually, to be treated for U.S. federal income tax purposes as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (together with the rules and regulations promulgated thereunder, the “Code”).

Churchill Asset Management LLC (the “Investment Adviser” or “Churchill”) is a Delaware limited liability company registered as an investment adviser with the Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The Investment Adviser manages the Company’s day-to-day operations and provides it with investment advisory and management services. Nuveen Churchill Administration LLC (the “Administrator”) provides the administrative services necessary to conduct the Company's day-to-day operations. Teachers Insurance and Annuity Association of America (“TIAA”) is the ultimate parent company of the Investment Adviser and the Administrator.

The Company's investment objective is to generate current income and capital appreciation primarily by investing in or originating first lien and unitranche leveraged loans made to private equity-owned U.S. middle market companies that require capital for growth, acquisitions, recapitalizations, refinancings and leveraged buyouts, which the Investment Adviser believes have sustainable, leading positions in their respective markets with scalable revenues and operating cash flow, experienced management teams, and other positive business characteristics. The Company defines middle market companies as companies with approximately $10 million to $200 million of annual earnings before interest, taxes, depreciation, and amortization. The Company expects to make investments through both primary originations and open-market secondary purchases. The Company focuses on making loans that it directly originates to U.S. middle market companies that are meeting their financial and operational obligations, with a portfolio expected to comprise primarily of first lien senior secured debt and unitranche loans.

NC SLF SPV I, LLC (“SPV I”) is a Delaware limited liability company that was formed on August 10, 2021. SPV I is a wholly owned subsidiary of the Company and is consolidated in these consolidated financial statements commencing from the date of its formation. SPV I commenced operations on May 15, 2023, the date of its first investment transaction.

The Company has entered into separate subscription agreements (the “Subscription Agreements”) with one or more investors providing for the private placement of the Company’s common stock pursuant to a private offering (the “Private Offering”). Each investor makes a “Capital Commitment” (as such term is defined in the subscription agreements executed by each of the shareholders) to purchase shares pursuant to a Subscription Agreement. Each prospective investor in the Company is required to certify that it is an "accredited investor" within the meaning of Rule 501(a) of Regulation D promulgated under the Securities Act of 1933, as amended (the “Securities Act”). Prior to the filing of the 1940 Act Registration Statement, the Company completed its initial closing of capital commitments on June 21, 2021 (the “Initial Closing Date”) and subsequently commenced investment operations. The Company’s investment period (“Investment Period”) commenced on the Initial Closing Date and is set to continue through the 48-month anniversary of the Initial Closing Date, subject to automatic extensions thereafter, each for an additional one-year period, unless the holders of a majority of the Company’s outstanding shares elected to forego any such extension upon not less than ninety days’ prior written notice. Holders of a majority of the Company’s outstanding shares may also terminate the Investment Period as of any earlier anniversary of the Initial Closing Date upon not less than ninety days’ written notice. The Investment Adviser may also terminate the Investment Period of the Company as of an earlier date in its discretion.

NC SLF INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(dollars amounts in thousands, except per share data)

2.SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The consolidated financial statements have been prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”). The Company is an investment company for the purposes of accounting and financial reporting in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services—Investment Companies (“ASC Topic 946”), and pursuant to Regulation S-X. In the opinion of management, all adjustments, which are of a normal recurring nature, considered necessary for the fair statement of the consolidated financial statements for the periods presented, have been included. The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All significant intercompany balances and transactions have been eliminated. Certain prior period amounts have been reclassified to conform to the current period presentation. U.S. GAAP for an investment company requires investments to be recorded at fair value. The carrying value for all other assets and liabilities approximates their fair value, unless otherwise disclosed within.

Consolidation

As provided under ASC Topic 946, the Company will generally not consolidate its investment in a company other than an investment company subsidiary or a controlled operating company whose business consists of providing services to the Company. Accordingly, the consolidated financial statements include the accounts of the Company and its wholly owned subsidiary, SPV I.

Use of Estimates

The preparation of the consolidated financial statements in conformity with U.S. GAAP requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements, as well as the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Cash, Restricted Cash and Cash Equivalents

Cash and restricted cash represent cash deposits held at financial institutions, which at times may exceed U.S. federally insured limits. Cash equivalents include short-term highly liquid investments, such as money market funds, that are readily convertible to cash and have original maturities of three months or less. Cash, restricted cash and cash equivalents are carried at cost, which approximates fair value. As of June 30, 2023, the Company did not hold any restricted cash.

Valuation of Portfolio Investments

Investments are valued in accordance with the fair value principles established by FASB ASC Topic 820, Fair Value Measurement (“ASC Topic 820”) and in accordance with the 1940 Act. ASC Topic 820’s definition of fair value focuses on the amount that would be received to sell the asset or paid to transfer the liability in the principal or most advantageous market, and prioritizes the use of market-based inputs (observable) over entity-specific inputs (unobservable) within a measurement of fair value.

NC SLF INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(dollars amounts in thousands, except per share data)

ASC Topic 820 specifies a hierarchy of valuation techniques based on whether the inputs to those valuation techniques are observable or unobservable. ASC Topic 820 also provides guidance regarding a fair value hierarchy, which prioritizes information used to measure fair value and the effect of fair value measurements on earnings, and provides for enhanced disclosures determined by the level within the hierarchy of information used in the valuation. In accordance with ASC Topic 820, these inputs are summarized in the three levels listed below:

•Level 1 — Valuations are based on unadjusted, quoted prices in active markets for identical assets or liabilities that are accessible at the measurement date.

•Level 2 — Valuations are based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

•Level 3 — Valuations based on inputs that are unobservable and significant to the overall fair value measurement.

In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of observable input that is significant to the fair value measurement. The assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment.

Active, publicly traded instruments are classified as Level 1 and their values are generally based on quoted market prices, even if both the market’s normal daily trading volume is not sufficient to absorb the quantity held and placing orders to sell the position in a single transaction might affect the quoted price.

Fair value is generally determined as the price that would be received for an investment in a current sale, which assumes an orderly market is available for the market participants at the measurement date. If available, fair value of investments is based on directly observable market prices or on market data derived from comparable assets. The Company’s valuation policy considers the fact that no ready market may exist for many of the securities in which it invests and that fair value for its investments must be determined using unobservable inputs.

Pursuant to Rule 2a-5 under the 1940 Act, the Company's board of directors (the “Board”) has designated the Adviser as the Company's valuation designee (the “Valuation Designee”) to determine the fair value of the Company's investments that do not have readily available market quotations, which became effective for the fiscal quarter ended March 31, 2023. Pursuant to the Company's valuation policy approved by the Board, a valuation committee comprised of employees of the Adviser (the “Valuation Committee”) is responsible for determining the fair value of the Company’s assets for which market quotations are not readily available, subject to the oversight of the Board.

With respect to investments for which market quotations are not readily available (Level 3), the Valuation Designee, subject to the oversight of the Board as described below, defined further below in Note 4, undertakes a multi-step valuation process each quarter, as follows: i.the quarterly valuation process begins with each portfolio company or investment being initially valued by either the professionals of the applicable investment team that are responsible for the portfolio investment or an independent third-party valuation firm;

NC SLF INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(dollars amounts in thousands, except per share data)

ii.to the extent that an independent third-party valuation firm has not been engaged by, or on behalf of, the Company to value 100% of the portfolio, then at a minimum, an independent third-party valuation firm will be engaged by, or on behalf of, the Company will provide positive assurance of the portfolio each quarter (such that each investment is reviewed by a third-party valuation firm at least once on a rolling 12-month basis and each watch-list investment will be reviewed each quarter), including a review of management’s preliminary valuation and recommendation of fair value;

iii.the Valuation Committee then reviews and discusses the valuations with any input, where appropriate, from the independent third-party valuation firm(s), and determine the fair value of each investment in good faith based on the Company’s valuation policy, subject to the oversight of the Board; and

iv.the Valuation Designee provides the Board with the information relating to the fair value determination pursuant to the Company’s valuation policy in connection with each quarterly Board meeting, comply with the periodic board reporting requirements set forth in the Company’s valuation policy, and discuss with the Board its determination of the fair value of each investment in good faith.

The Valuation Designee makes this fair value determination on a quarterly basis and in such other instances when a decision regarding the fair value of the portfolio investments is required. Factors considered by the Valuation Designee as part of the valuation of investments include each portfolio company’s credit ratings/risk, current and projected earnings, current and expected leverage, ability to make interest and principal payments, liquidity, compliance with applicable loan covenants, and price to earnings (or other financial) ratios and those of other comparable companies, as well as the estimated remaining life of the investment and current market yields and interest rate spreads of similar securities as of the measurement date. Other factors taken into account include changes in the interest rate environment and the credit markets that may affect the price at which similar investments would trade. The Valuation Designee may also base its valuation of an investment on recent investments and securities with similar structure and risk characteristics. The Valuation Designee obtains market data from its ongoing investment purchase efforts, in addition to monitoring transactions that have closed or are disclosed in industry publications. External information may include (but is not limited to) observable market data derived from the U.S. loan and equity markets. As part of compiling market data as an indication of current market conditions, management may utilize third-party sources.

The values assigned to investments are based on available information and may fluctuate from period to period. In addition, such values do not necessarily represent the amount that ultimately might be realized upon a portfolio investment's sale. Due to the inherent uncertainty of valuation, the estimated fair value of an investment may differ from the value that would have been used had a ready market for the security existed, and the difference could be material.

The Board is responsible for overseeing the Valuation Designee’s process for determining the fair value of the Company’s assets for which market quotations are not readily available, taking into account the Company’s valuation risks. To facilitate the Board’s oversight of the valuation process, the Valuation Designee provides the Board with quarterly reports, annual reports, and prompt reporting of material matters affecting the Valuation Designee’s determination of fair value. As part of the Board’s oversight role, the Board may request and review additional information to be informed of the Valuation Designee’s process for determining the fair value of the Company's investments.

Investment Transactions and Revenue Recognition

Investment transactions are recorded on the applicable trade date. Any amounts related to purchases, sales and principal paydowns that have traded, but not settled, are reflected as either a receivable for investments sold or payable for investments purchased on the consolidated statement of assets and liabilities. Realized gains and losses on investment transactions are determined on a specific identification basis and are included as net realized gain (loss) on investments in the consolidated statement of operations. Net change in unrealized appreciation (depreciation) on investments is recognized in the consolidated statement of operations and reflects the period-to-period change in fair value and cost of investments.

NC SLF INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(dollars amounts in thousands, except per share data)

Interest income, including amortization of premium and accretion of discount on loans, and expenses are recorded on the accrual basis. The Company accrues interest income if it expects that ultimately it will be able to collect such income. Generally, when a payment default occurs on a loan in the portfolio, or if management otherwise believes that the issuer of the loan will not be able to make contractual interest payments or principal payments, the Investment Adviser will place the loan on non-accrual status and the Company will cease recognizing interest income on that loan until all principal and interest is current through receipt or until a restructuring occurs, such that the interest income is deemed to be collectible. Regardless, the Company remains contractually entitled to this interest. The Company may make exceptions to this policy if the loan has sufficient collateral value and is in the process of collection. Accrued interest is written off when it becomes probable that the interest will not be collected and the amount of uncollectible interest can be reasonably estimated. As of June 30, 2023, there were no loans in the Company's portfolio on non-accrual status.

From time to time, the Company may have loans in its portfolio that contain payment-in-kind (“PIK”) income provisions. PIK represents interest that is accrued and recorded as interest income at the contractual rates, increases the loan principal on the respective capitalization dates, and is generally due at maturity. As of June 30, 2023, no loans in the portfolio contained PIK income provisions.

Other income may include income such as consent, waiver, amendment, unused, and prepayment fees associated with the Company’s investment activities, as well as any fees for managerial assistance services rendered by the Company to its portfolio companies. Such fees are recognized as income when earned or the services are rendered. For the six months ended June 30, 2023, the Company earned other income of $30, primarily related to prepayment and amendment fees.

Deferred Financing Costs

Deferred financing costs include capitalized expenses related to the closing or amendments of borrowings. Amortization of deferred financing costs is computed on the straight-line basis over the term of the borrowings. The unamortized balance of such costs is included in deferred financing costs in the consolidated statement of assets and liabilities. The amortization of such costs is included in interest and debt financing expenses in the accompanying consolidated statement of operations.

Income Taxes

For U.S. federal income tax purposes, the Company has elected, and intends to qualify annually, to be treated as a RIC under the Code. In order to qualify as a RIC, the Company must meet certain minimum distribution, source-of-income and asset diversification requirements. If such requirements are met, then the Company is generally required to pay U.S. federal income taxes only on the portion of its taxable income and capital gains it does not distribute.

The minimum distribution requirements applicable to RICs require the Company to distribute to its shareholders at least 90% of its investment company taxable income (“ICTI”), as defined by the Code, each year. Depending on the level of ICTI earned in a tax year, the Company may choose to carry forward ICTI in excess of current year distributions into the next tax year. Any such carryover ICTI must be distributed before the end of that next tax year through a dividend declared prior to filing the final tax return related to the year which generated such ICTI.