UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23818

NC SLF INC.

(Exact name of registrant as specified in charter)

375 Park Avenue, 9th Floor

New York, NY 10152

(Address of Principal Executive Offices)

John D. McCally, Esq.

General Counsel

Churchill Asset Management LLC

8500 Andrew Carnegie Blvd

Charlotte, NC 28262

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 478-9200

Date of fiscal year end: December 31, 2023

Date of reporting period: December 31, 2023

Item 1. Reports to Shareholders.

The annual report to shareholders for the year ended December 31, 2023 is filed herewith pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended.

NC SLF Inc.

Annual Report

December 31, 2023

TABLE OF CONTENTS

NC SLF INC.

Letter to Shareholders and Management’s Discussion of Company Performance

February 28, 2024

Dear Shareholders:

Company Overview

We are pleased to submit to you the report of NC SLF Inc. (“we”, “us”, “our” or the “Company”) for the fiscal year ended December 31, 2023. The net asset value (“NAV”) of our shares at that date was $9.64 per share. The total return based on NAV for the fiscal year ended December 31, 2023, as reflected in the Company’s financial highlights, was 11.16%. Please refer to “Note 9. Financial Highlights” for further details. Investment Objective

Our investment objective is to generate current income and capital appreciation primarily by investing in or originating first lien and unitranche leveraged loans made to private equity-owned U.S. middle market companies that require capital for growth, acquisitions, recapitalizations, refinancings and leveraged buyouts, which we define as companies with approximately $10 million to $200 million of annual earnings before interest, taxes, depreciation, and amortization. We expect to make investments through both primary originations and open-market secondary purchases. We focus on making loans that we directly originate to U.S. middle market companies that are meeting their financial obligations and achieving their operational targets, with a portfolio expected to comprise primarily of first lien senior secured debt and unitranche loans.

Portfolio Review

As of December 31, 2023, we had investments in 65 portfolio companies across 34 industries. Based on fair value as of December 31, 2023, 100.0% of our portfolio was invested in debt bearing a floating interest rate. As of December 31, 2023, our weighted average total yield of investments in debt securities at fair value was 11.59%. The weighted average yield was computed using the effective interest rates as of December 31, 2023, including accretion of original issue discount, but excluding investments on non-accrual status, if any.

For the year ended December 31, 2023, net investment income was approximately $34.3 million, or $1.03 per weighted average common share.

For the year ended December 31, 2023, we recorded a net increase in net assets resulting from operations of approximately $34.3 million, or $1.03 per weighted average common share (inclusive of realized and unrealized gains and losses).

For the year ended December 31, 2023, we made additional investments of approximately $224.2 million, and received approximately $24.9 million from repayments of our investments.

Capital Markets Overview

Following a slow start in 2023, Churchill experienced a significant increase in attractive deal flow post Labor Day due to more certainty in the financial markets, and the second half was one of the most active periods in Churchill’s history. In particular, Q4 2023 was our second most active quarter ever. For the full year, Churchill closed or committed more than $11 billion in over 350 transactions across its platform, effectively equaling our 2022 all-time record.

Looking back, we believe 2023 validated the power and longevity of the Churchill platform and reaffirmed our belief that scaled private credit firms have a permanent seat at the table, notwithstanding the broadly syndicated loan market. Despite direct lending volume falling 32% year-over-year,1 Churchill’s traditional middle market senior lending business continued to outpace the industry and reached an all-time high of $7.0 billion in 2023. Specifically, in Q4 2023, Churchill closed or committed over $3.6 billion in 48 distinct investments, an increase of 13% from Q3 2023 and a 107% increase in closed/committed volume year-over-year. This led Churchill to be recognized for the first time as the #1 most active U.S. direct lender for the full calendar year by KBRA DLD, a true testament to the strength of our balance sheet, private equity relationships and flexible approach. Apart from the increased volume, credit metrics were highly attractive. Spreads were down modestly in Q4 2023 but remain at historically higher levels.

Sincerely,

Kenneth Kencel

President and Chief Executive Officer

This letter is intended to assist shareholders in understanding the Company’s performance during the fiscal year ended December 31, 2023. The views and opinions in this letter were current as of February 28, 2024. Statements other than those of historical facts included herein may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors. See “Forward-Looking Statements” below for more information. The Company undertakes no duty to update any forward-looking statement made herein. Information contained on our website is not incorporated by reference into this shareholder letter and you should not consider information contained on our website to be part of this shareholder letter or any other report we file with the Securities and Exchange Commission (the “SEC”).

_____________________________________________________________________________________________

1 LSEG LPC’s 4Q23 US Sponsored Middle Market Private Deals Analysis,.

2 Utilizes the greater of 3-month base rate, or base rate floor, if applicable for each respective transaction (SOFR as of December 31, 2023 was 5.33%).

3 Churchill, Private Capital Themes: Four for ‘24, available at www.churchillam.com/wp-content/uploads/2024/01/Churchill-Outlook_Four-themes-for-2024_.pdf.

Important Information

This report is transmitted to the shareholders of the Company and is furnished pursuant to certain regulatory requirements. This report and the information and views herein do not constitute investment advice, or a recommendation or an offer to enter into any transaction with the Company or any of its affiliates. This report is provided for informational purposes only, does not constitute an offer to sell securities of the Company and is not a prospectus.

An investment in the Company is not appropriate for all investors. Shares of closed-end investment companies, such as the Company, frequently trade at a discount from their NAV, which may increase investors’ risk of loss. Past performance is not indicative of, or a guarantee of, future performance. The performance and certain other portfolio information quoted herein represents information as of December 31, 2023. Nothing herein should be relied upon as a representation as to the future performance or portfolio holdings of the Company. Investment return and principal value of an investment will fluctuate, and shares, when sold, may be worth more or less than their original cost. The Company’s performance is subject to change since the end of the period noted in this Annual Report and may be lower or higher than the performance data shown herein.

About NC SLF Inc.

NC SLF Inc. is a registered closed-end management investment company. Its investment objective is to generate current income and capital appreciation primarily by investing in or originating first lien and unitranche leveraged loans made to private equity-owned U.S. middle-market companies that require capital for growth, acquisitions, recapitalizations, refinancings and leveraged buyouts.

Forward-Looking Statements

This report contains forward-looking statements that involve substantial risks and uncertainties. Such statements involve known and unknown risks, uncertainties and other factors and undue reliance should not be placed thereon. These forward-looking statements are not historical facts, but rather are based on our current expectations and estimates, our current and prospective portfolio investments, our industry, our beliefs and opinions, and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including, without limitation:

•our future operating results;

•our business prospects and the prospects of our portfolio companies;

•the dependence of our future success on the general economy and its impact on the industries in which we invest;

•the impact of a protracted decline in the liquidity of credit markets on our business;

•the impact of increased competition;

•an economic downturn and its impact on the ability of our portfolio companies to operate and the investment opportunities available to us;

•the impact of interest rate volatility, including the replacement of LIBOR with alternate rates and rising interest rates, on our business and our portfolio companies;

•the impact of supply chain constraints and labor difficulties on our portfolio companies and the global economy;

•the elevated level of inflation, and its impact on our portfolio companies and on the industries in which we invest;

•the impact of geopolitical conditions, including the ongoing conflict between Ukraine and Russia and ongoing war in the Middle East, and its impact on financial market volatility, global economic markets, and various sectors, industries and markets for commodities globally, such as oil and natural gas;

•our contractual arrangements and relationships with third parties;

•the valuation of our investments in portfolio companies, particularly those having no liquid trading market;

•actual and potential conflicts of interest with Churchill Asset Management LLC, our investment adviser (“Churchill” or the “Investment Adviser”) and/or its affiliates;

•the ability of our portfolio companies to achieve their objectives;

•the use of borrowed money to finance a portion of our investments;

•the adequacy of our financing sources and working capital;

•the timing of cash flows, if any, from the operations of our portfolio companies;

•the ability of the Investment Adviser to locate suitable investments for us and to monitor and administer our investments;

•the ability of the Investment Adviser or its affiliates to attract and retain highly talented professionals;

•our ability to qualify and maintain our qualification as a regulated investment company (a “RIC”); and

•the impact of future legislation and regulation on our business and our portfolio companies.

Although we believe that the assumptions on which these forward-looking statements are based on are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. Important assumptions include our ability to originate new loans and investments, certain margins and levels of profitability and the availability of additional capital. In light of these and other uncertainties, the inclusion of a forward-looking statement in this report should not be regarded as a representation by us that our plans and objectives will be achieved. These forward-looking statements apply only as of the date of this report. Moreover, we assume no duty and do not undertake to update the forward-looking statements except as otherwise provided by law.

Strategy and Performance Overview

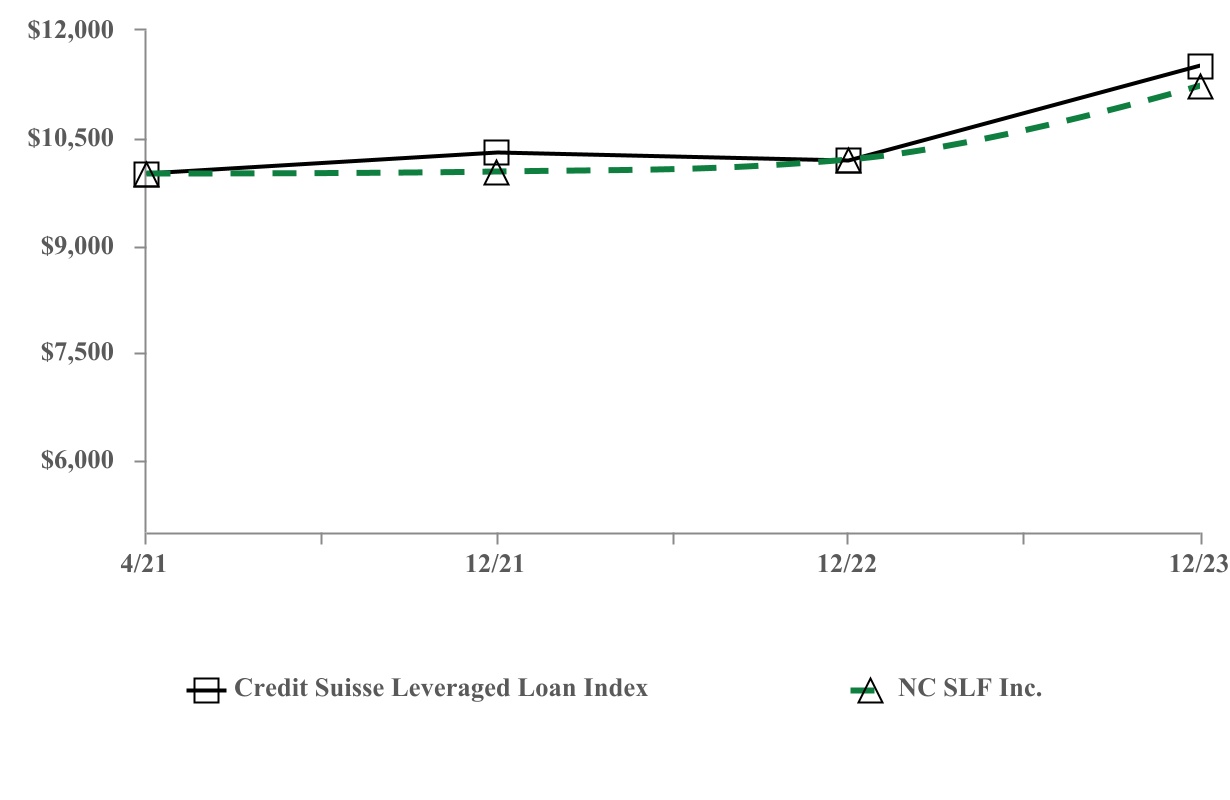

This graph compares the return on our common stock from April 16, 2021 (the inception date) to December 31, 2023 with that of Credit Suisse Leveraged Loan Index. Prior to its registration as a closed-end fund under the 1940 Act on August 12, 2022, the Company operated as a business development company (“BDC”) from June 2, 2021 until August 12, 2022, whereupon it withdrew its election to be regulated as a BDC pursuant to Section 54(c) of the 1940 Act. The graph assumes that, on April 16, 2021 a person invested $10,000 in each of our common stock and the Credit Suisse Leveraged Loan Index.

The graph measures total shareholder return, which takes into account changes in NAV and distributions. Distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Company’s distribution reinvestment plan (as applicable). Returns do not reflect the deduction of taxes that a shareholder would pay on Company distributions. Past performance is not indicative, or a guarantee, of future performance. Future results may vary and may be higher or lower than the data shown below.

COMPARISON OF INCEPTION TO DATE CUMULATIVE TOTAL RETURN*

NC SLF Inc. and the Credit Suisse Leveraged Loan Index

*$10,000 invested on April 16, 2021 (the inception date) in stock or index, including reinvestment of dividends through December 31, 2023. Returns for NC SLF Inc. reflect the impact of waived management fees for the period from July 1, 2021 through October 4, 2022 (Refer to Note 5 for additional information).

| | | | | | | | | | | | | | | | | | | | |

| Returns | | 1 Year | | 2 Year | | Since Inception

(April 16, 2021) |

NAV (1) | | 11.16 | % | | 11.91 | % | | 12.25 | % |

| Credit Suisse Leveraged Loan Index | | 13.04 | % | | 11.85 | % | | 15.10 | % |

(1) Return is calculated as the change in NAV per share during the period, plus distributions per share, if any, divided by the beginning NAV per share. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at the quarter end NAV per share preceding the distribution. Returns for NC SLF Inc. reflect the impact of waived management fees for the period from July 1, 2021 through October 4, 2022 (Refer to Note 5 for additional information). Portfolio Composition

As of December 31, 2023 , our investments consisted of the following (dollar amounts in thousands):

| | | | | | | | | | | | | | | | | |

| Amortized Cost | | Fair Value | | % of Fair Value |

| First-Lien Term Loans | $ | 520,490 | | | $ | 510,346 | | | 100.0 | % |

| Total | $ | 520,490 | | | $ | 510,346 | | | 100.0 | % |

| Largest portfolio company investment | $ | 18,060 | | | $ | 18,213 | | | 3.57 | % |

| Average portfolio company investment | $ | 8,008 | | | $ | 7,851 | | | 1.54 | % |

The industry composition of our portfolio as a percentage of fair value as of December 31, 2023 was as follows:

| | | | | |

| Industry | |

| Aerospace and Defense | 2.83 | % |

| Air Freight & Logistics | 2.91 | % |

| Auto Components | 2.50 | % |

| Automobiles | 2.01 | % |

| Beverages | 0.66 | % |

| Building Products | 0.64 | % |

| Chemicals | 3.09 | % |

| Commercial Services & Supplies | 4.55 | % |

| Construction & Engineering | 1.67 | % |

| Construction Materials | 2.60 | % |

| Containers & Packaging | 6.40 | % |

| Distributors | 3.68 | % |

| Diversified Consumer Services | 2.26 | % |

| Diversified Financial Services | 1.86 | % |

| Electronic Equipment, Instruments & Components | 1.84 | % |

| Energy Equipment & Services | 2.15 | % |

| Food Products | 3.46 | % |

| Gas Utilities | 2.30 | % |

| Health Care Equipment & Supplies | 3.63 | % |

| Health Care Providers & Services | 11.20 | % |

| Health Care Technology | 0.75 | % |

| Household Durables | 2.63 | % |

| Industrial Conglomerates | 1.92 | % |

| Insurance | 3.89 | % |

| Internet and Direct Marketing Retail | 1.93 | % |

| IT Services | 2.17 | % |

| Leisure Products | 1.47 | % |

| Machinery | 0.82 | % |

| Personal Products | 1.46 | % |

| Pharmaceuticals | 1.43 | % |

| Professional Services | 11.55 | % |

| Software | 3.00 | % |

| Transportation Infrastructure | 3.02 | % |

| Wireless Telecommunication Services | 1.72 | % |

| Total | 100.00 | % |

The weighted average yield of our portfolio as of December 31, 2023 was as follows:

| | | | | |

Weighted average yield on debt and income producing investments, at cost (1) | 11.37 | % |

Weighted average yield on debt and income producing investments, at fair value (1) | 11.59 | % |

| Percentage of debt investments bearing a floating rate | 100.00 | % |

| Percentage of debt investments bearing a fixed rate | — | % |

_____________

(1) There were no investments on non-accrual status as of December 31, 2023.

The weighted average yield of our debt and income producing securities is not the same as a return on investment for our shareholders, but rather relates to our investment portfolio and is calculated before deduction of all of our fees and expenses. The weighted average yield was computed using the effective interest rates as of the reporting date, including accretion of original issue discount, but excluding investments on non-accrual status, if any. There can be no assurance that the weighted average yield will remain at its current level.

Asset Quality

In addition to various risk management and monitoring tools, we use the Investment Adviser’s investment rating system to characterize and monitor the credit profile and expected level of returns on each investment in our portfolio. Each investment team utilizes a systematic, consistent approach to credit evaluation, with a particular focus on an acceptable level of debt repayment and deleveraging under a “base case” set of projections (the “Base Case”), which generally reflects a more conservative estimate than the set of projections provided by a prospective portfolio company (the “Management Case”). The following is a description of the conditions associated with each investment rating:

1.Performing - Superior: Borrower is performing significantly above Management Case.

2.Performing - High: Borrower is performing at or near the Management Case (i.e., in a range slightly below to slightly above).

3.Performing - Low Risk: Borrower is operating well ahead of the Base Case to slightly below the Management Case.

4.Performing - Stable Risk: Borrower is operating at or near the Base Case (i.e., in a range slightly below to slightly above). This is the initial rating assigned to all new borrowers.

5.Performing - Management Notice: Borrower is operating below the Base Case. Adverse trends in business conditions and/or industry outlook are viewed as temporary. There is no immediate risk of payment default and only a low to moderate risk of covenant default.

6.Watch List - Low Maintenance: Borrower is operating below the Base Case, with declining margin of protection. Adverse trends in business conditions and/or industry outlook are viewed as probably lasting for more than a year. Payment default is still considered unlikely, but there is a moderate to high risk of covenant default.

7.Watch List - Medium Maintenance: Borrower is operating well below the Base Case, but has adequate liquidity. Adverse trends are more pronounced than in Internal Risk Rating 6 above. There is a high risk of covenant default, or it may have already occurred. Payments are current, although subject to greater uncertainty, and there is a moderate to high risk of payment default.

8.Watch List - High Maintenance: Borrower is operating well below the Base Case. Liquidity may be strained. Covenant default is imminent or may have occurred. Payments are current, but there is a high risk of payment default. Negotiations to restructure or refinance debt on normal terms may have begun. Further significant deterioration appears unlikely and no loss of principal is currently anticipated.

9.Watch List - Possible Loss: At the current level of operations and financial condition, the borrower does not have the ability to service and ultimately repay or refinance all outstanding debt on current terms. Liquidity is strained. Payment default may have occurred or is very likely in the short term unless creditors grant some relief. Loss of principal is possible.

10.Watch List - Probable Loss: At the current level of operations and financial condition, the borrower does not have the ability to service and ultimately repay or refinance all outstanding debt on current terms. Payment default is very likely or may have already occurred. Liquidity is extremely limited. The prospects for improvement in the borrower’s situation are sufficiently negative that loss of some or all principal is probable.

The Investment Adviser regularly monitors and, when appropriate, changes the investment rating assigned to each investment in our portfolio. Each investment team will review the investment ratings in connection with monthly or quarterly portfolio reviews. Based on a generally uncertain economic outlook in the United States (which includes a possible recession), we have increased oversight and analysis of credits in any vulnerable industries to mitigate any decline in loan performance and reduce credit risk.

The following table shows the investment ratings of the investments in our portfolio as of December 31, 2023 (dollar amounts in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | Fair Value | | % of Portfolio | | Number of Portfolio Companies |

| 1 | | $ | — | | | — | % | | — | |

| 2 | | — | | | — | % | | — | |

| 3 | | 7,270 | | | 1.43 | % | | 1 | |

| 4 | | 474,795 | | | 93.03 | % | | 61 |

| 5 | | 20,673 | | | 4.05 | % | | 2 | |

| 6 | | — | | | — | % | | — | |

| 7 | | — | | | — | % | | — | |

| 8 | | 7,608 | | | 1.49 | % | | 1 | |

| 9 | | — | | | — | % | | — | |

| 10 | | — | | | — | % | | — | |

| Total | | $ | 510,346 | | | 100.00 | % | | 65 |

As of December 31, 2023, the weighted average Internal Risk Rating of our investment portfolio was 4.1.

Availability of Quarterly Portfolio Schedule

The Company files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Company’s filings on Form N-Port are available on the SEC’s website at www.sec.gov.

TOP TEN HOLDINGS

AS OF DECEMBER 31, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | |

| Investment | | Maturity | | Fair Value | | % of Net Assets |

| Phaidon International | | 8/22/2029 | | $ | 18,213 | | | 5.13 | % |

| Sandlot Buyer, LLC (Prime Time Healthcare) | | 9/19/2028 | | 17,708 | | | 4.99 | % |

| Kenco Group, Inc. | | 11/15/2029 | | 14,871 | | | 4.19 | % |

| Precision Aviation Group | | 12/21/2029 | | 14,519 | | | 4.09 | % |

| Randys Holdings, Inc | | 11/1/2028 | | 12,830 | | | 3.61 | % |

| Ascensus Specialties | | 6/30/2028 | | 12,758 | | | 3.59 | % |

| Excel Fitness | | 4/29/2029 | | 11,539 | | | 3.25 | % |

| Young Innovations | | 12/1/2029 | | 11,164 | | | 3.14 | % |

| Risk Strategies (Delayed Draw) | | 11/1/2026 | | 11,101 | | | 3.13 | % |

| LSCS Holdings Inc. | | 12/16/2028 | | 10,942 | | | 3.08 | % |

| | | | | | 38.20 | % |

NC SLF INC.

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES

(dollars in thousands, except share and per share data)

| | | | | |

| December 31, 2023 |

| |

| Assets | |

| Investments, at fair value (amortized cost of $520,490) | $ | 510,346 | |

| Cash and cash equivalents | 12,533 | |

| Interest receivable | 3,823 | |

| Receivable for investment sold | 90 | |

| |

| Prepaid expenses | 36 | |

| Total assets | 526,828 | |

| |

| Liabilities | |

| Secured borrowings (net of $1,605 deferred financing cost) | 157,895 | |

| |

| Interest Payable | 1,801 | |

| |

Management fees payable (See Note 5) | 587 |

| Distributions payable | 10,323 | |

Directors' fee payable (See Note 5) | 15 | |

| Accounts payable and accrued expenses | 999 | |

| Total liabilities | 171,620 | |

| |

Commitments and contingencies (See Note 7) | |

| |

| |

| Common stock, par value $0.01 per share, 500,000,000 shares authorized, 36,866,178 shares issued and outstanding as of December 31, 2023 | 369 | |

| Paid-in-capital in excess of par value | 364,269 | |

| Total distributable earnings (loss) | (9,430) | |

| Total net assets | $ | 355,208 | |

| |

Net asset value per share (See Note 9) | $ | 9.64 | |

The accompanying notes are an integral part of these consolidated financial statements.

NC SLF INC.

CONSOLIDATED STATEMENT OF OPERATIONS

(dollars in thousands, except share and per share data)

| | | | | | | | | |

| Year Ended December 31, 2023 | | | | |

| Income: | | | | | |

| Interest income | $ | 44,811 | | | | | |

| Other income | 65 | | | | | |

| Total investment income | 44,876 | | | | | |

| | | | | |

| Expenses: | | | | | |

| Interest and debt financing expenses | 7,008 | | | | | |

| | | | | |

| 1,945 | | | | | |

| Professional fees | 739 | | | | | |

| 59 | | | | | |

Administration fees (See Note 5) | 659 | | | | | |

| Other general and administrative expenses | 157 | | | | | |

| Total expenses | 10,567 | | | | | |

| Net investment income (loss) before excise taxes | 34,309 | | | | |

| Excise taxes | 6 | | | | | |

| Net investment income (loss) | 34,303 | | | | |

| | | | | |

| Realized and unrealized gain (loss) on investments: | | | | | |

| Net realized gain (loss) on non-controlled/non-affiliated company investments | 371 | | | | | |

| Net change in unrealized appreciation (depreciation) on non-controlled/non-affiliated company investments | (395) | | | | | |

| Total net realized and unrealized gain (loss) on investments | (24) | | | | | |

| | | | | |

| Net increase (decrease) in net assets resulting from operations | $ | 34,279 | | | | | |

| | | | | |

| Per share data: | | | | | |

| Net investment income (loss) per share | $ | 1.03 | | | | | |

| Net increase (decrease) in net assets resulting from operations per share | $ | 1.03 | | | | | |

| Weighted average common shares outstanding | 33,167,316 | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

NC SLF INC.

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS

(dollars in thousands, except share and per share data)

| | | | | | | | | | | | | | | | |

| Year Ended December 31 | | | | | |

| 2023 | | 2022 | | | | | |

| Increase (decrease) in net assets resulting from operations: | | | | | | | | |

| Net investment income (loss) | $ | 34,303 | | | $ | 13,281 | | | | | | |

| Net realized gain (loss) on investments | 371 | | | 78 | | | | | | |

| Net change in unrealized appreciation (depreciation) on investments | (395) | | | (9,944) | | | | | | |

| Net increase (decrease) in net assets resulting from operations | 34,279 | | | 3,415 | | | | | | |

| Shareholder distributions: | | | | | | | | |

| Distributions of investment income | (33,853) | | | (13,477) | | | | | | |

| Net increase (decrease) in net assets resulting from shareholder distributions | (33,853) | | | (13,477) | | | | | | |

| Capital share transactions: | | | | | | | | |

| Issuance of common shares | 25,000 | | | 250,000 | | | | | | |

| Reinvestment of shareholder distributions | 29,647 | | | — | | | | | | |

| Net increase (decrease) in net assets resulting from capital share transactions | 54,647 | | | 250,000 | | | | | | |

| Total increase (decrease) in net assets | 55,073 | | | 239,938 | | | | | | |

| Net assets, at beginning of period | 300,135 | | | 60,197 | | | | | | |

| Net assets, at end of period | $ | 355,208 | | | $ | 300,135 | | | | | | |

_

The accompanying notes are an integral part of these consolidated financial statements.

NC SLF INC.

CONSOLIDATED STATEMENT OF CASH FLOWS

(dollars in thousands, except share and per share data) | | | | | | | |

| Year Ended December 31, 2023 |

| Cash flows from operating activities: | | | |

| Net increase (decrease) in net assets resulting from operations | $ | 34,279 | | | |

| | | |

| Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided by (used in) operating activities | | | |

| Purchase of investments | (224,210) | | | |

| Proceeds from principal repayments of investments and sales of investments | 24,919 | | | |

| Amortization of premium/accretion of discount, net | (823) | | | |

| Net realized (gain) loss on investments | (371) | | | |

| Net change in unrealized (appreciation) depreciation on investments | 395 | | | |

| Amortization of deferred financing costs | 499 | | | |

| Changes in operating assets and liabilities: | | | |

| Interest receivable | (1,600) | | | |

| Receivable for investments sold | 90 | | | |

| Prepaid expenses | (36) | | | |

| | | |

| | | |

| | | |

| Interest payable | 1,715 | | | |

| Management fees payable | 240 | | | |

| | | |

| Accounts payable and accrued expenses | 494 | | | |

| Net cash provided by (used in) operating activities | (164,409) | | | |

| | | |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of common shares | 25,000 | | | |

| Shareholder distributions | (286) | | | |

| Proceeds from secured borrowings | 211,500 | | | |

| Repayments of secured borrowings | (63,000) | | | |

| Payments of deferred financing costs | (1,791) | | | |

| Net cash provided by (used in) financing activities | 171,423 | | | |

| | | |

| Net increase (decrease) in cash and cash equivalents | 7,014 | | | |

| Cash and cash equivalents, beginning of period | 5,519 | | | |

| Cash and cash equivalents, end of period | $ | 12,533 | | | |

| | | |

| Supplemental disclosure of cash flow Information: | | | |

| Cash paid during the period for interest | $ | 8,224 | | | |

| | | |

| Supplemental disclosure of non-cash flow information: | | | |

| Reinvestment of shareholder distributions | $ | 29,647 | | | |

| | | |

| | | |

| | | |

| | | |

The accompanying notes are an integral part of these consolidated financial statements.

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| | | | | | | | | | | | | | | | | | |

| Investments | | | | | | | | | | | | | | | | | | |

| Debt Investments | | | | | | | | | | | | | | | | | | |

| Aerospace & Defense | | | | | | | | | | | | | | | | | | |

| Precision Aviation Group | | (4) (11) | | First Lien Term Loan | | S + 5.75% | | 11.12% | | 12/21/2029 | | $ | 14,814 | | | $ | 14,519 | | | $ | 14,519 | | | 4.09 | % |

| Precision Aviation Group (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 5.75% | | 11.12% | | 12/21/2029 | | 4,886 | | | (49) | | (97) | | (0.03) | % |

| Total Aerospace & Defense | | | | | | | | | | | | | | 14,470 | | 14,422 | | 4.06 | % |

| | | | | | | | | | | | | | | | | | |

| Air Freight & Logistics | | | | | | | | | | | | | | | | | | |

| Kenco Group, Inc. | | (4) | | First Lien Term Loan | | S + 5.00% | | 10.39% | | 11/15/2029 | | 14,871 | | | 14,611 | | 14,871 | | 4.19 | % |

| Kenco Group, Inc. (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 5.00% | | 10.39% | | 11/15/2029 | | 2,479 | | | (42) | | — | | — | % |

| Total Air Freight & Logistics | | | | | | | | | | | | | | 14,569 | | 14,871 | | 4.19 | % |

| | | | | | | | | | | | | | | | | | |

| Auto Components | | | | | | | | | | | | | | | | | | |

| Randys Holdings, Inc | | (4) (7) | | First Lien Term Loan | | S + 6.50% | | 11.88% | | 11/1/2028 | | 12,994 | | | 12,767 | | 12,830 | | 3.62 | % |

| Randys Holdings, Inc (Delayed Draw) | | (4) (6) (7) | | First Lien Term Loan | | S + 6.50% | | 11.88% | | 11/1/2028 | | 4,375 | | | — | | (55) | | (0.02) | % |

| Total Auto Components | | | | | | | | | | | | | | 12,767 | | 12,775 | | 3.60 | % |

| | | | | | | | | | | | | | | | | | |

| Automobiles | | | | | | | | | | | | | | | | | | |

| American Auto Auction Group | | (4) | | First Lien Term Loan | | S + 5.00% | | 10.50% | | 12/30/2027 | | 10,520 | | | 10,443 | | 10,266 | | 2.89 | % |

| Total Automobiles | | | | | | | | | | | | | | 10,443 | | 10,266 | | 2.89 | % |

| | | | | | | | | | | | | | | | | | |

| Beverages | | | | | | | | | | | | | | | | | | |

| Sunny Sky Products | | (4) (11) | | First Lien Term Loan | | S + 5.25% | | 10.60% | | 12/23/2028 | | 3,425 | | | 3,392 | | 3,393 | | 0.95 | % |

| Sunny Sky Products (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 5.25% | | 10.60% | | 12/23/2028 | | 856 | | | — | | (8) | | — | % |

| Total Beverages | | | | | | | | | | | | | | 3,392 | | 3,385 | | 0.95 | % |

| | | | | | | | | | | | | | | | | | |

| Building Products | | | | | | | | | | | | | | | | | | |

| Vertex Service Partners | | (4) (11) | | First Lien Term Loan | | S + 5.50% | | 10.90% | | 11/8/2030 | | 2,269 | | | 2,235 | | 2,236 | | 0.63 | % |

| Vertex Service Partners (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 5.50% | | 10.90% | | 11/8/2030 | | 4,370 | | | 1,082 | | 1,029 | | 0.29 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| Total Building Products | | | | | | | | | | | | | | 3,317 | | 3,265 | | 0.92 | % |

| | | | | | | | | | | | | | | | | | |

| Chemicals | | | | | | | | | | | | | | | | | | |

| Ascensus Specialties | | (4) (7) | | First Lien Term Loan | | S + 4.25% | | 9.71% | | 6/30/2028 | | 14,145 | | | 13,939 | | 12,758 | | 3.59 | % |

| Chroma Color Corporation (dba Chroma Color) | | (4) | | First Lien Term Loan | | S + 6.00% | | 11.41% | | 4/21/2029 | | 3,052 | | | 2,996 | | 2,997 | | 0.84 | % |

| Chroma Color Corporation (dba Chroma Color) (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.00% | | 11.41% | | 4/21/2029 | | 667 | | | (6) | | (12) | | — | % |

| Total Chemicals | | | | | | | | | | | | | | 16,929 | | 15,743 | | 4.43 | % |

| | | | | | | | | | | | | | | | | | |

| Commercial Services & Supplies | | | | | | | | | | | | | | | | | | |

| Integrated Power Services | | (4) | | First Lien Term Loan | | S + 4.50% | | 9.97% | | 11/22/2028 | | 4,992 | | | 4,966 | | 4,992 | | 1.40 | % |

| Phaidon International | | (4) (8) | | First Lien Term Loan | | S + 5.50% | | 10.96% | | 8/22/2029 | | 18,213 | | | 18,060 | | 18,213 | | 5.13 | % |

| Total Commercial Services & Supplies | | | | | | | | | | | | | | 23,026 | | 23,205 | | 6.53 | % |

| | | | | | | | | | | | | | | | | | |

| Construction & Engineering | | | | | | | | | | | | | | | | | | |

| MEI Rigging & Crating | | (4) (11) | | First Lien Term Loan | | S + 6.50% | | 11.86% | | 6/30/2029 | | 5,526 | | | 5,420 | | 5,477 | | 1.54 | % |

| MEI Rigging & Crating (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.50% | | 11.86% | | 6/30/2029 | | 877 | | | (4) | | (8) | | — | % |

| WSB Engineering Holdings Inc. | | (4) (11) | | First Lien Term Loan | | S + 6.00% | | 11.39% | | 8/31/2029 | | 3,148 | | | 3,103 | | 3,102 | | 0.87 | % |

| WSB Engineering Holdings Inc. (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.00% | | 11.39% | | 8/31/2029 | | 2,104 | | | (15) | | (31) | | (0.01) | % |

| Total Construction & Engineering | | | | | | | | | | | | | | 8,504 | | 8,540 | | 2.40 | % |

| | | | | | | | | | | | | | | | | | |

| Construction Materials | | | | | | | | | | | | | | | | | | |

| Sciens Building Solutions, LLC | | (4) (7) | | First Lien Term Loan | | S + 5.75% | | 11.23% | | 12/15/2027 | | 10,018 | | | 9,876 | | 9,817 | | 2.76 | % |

| Sciens Building Solutions, LLC (Delayed Draw) | | (4) (6) (7) | | First Lien Term Loan | | S + 5.75% | | 11.23% | | 12/15/2027 | | 5,286 | | | 3,505 | | 3,434 | | 0.97 | % |

| Total Construction Materials | | | | | | | | | | | | | | 13,381 | | 13,251 | | 3.73 | % |

| | | | | | | | | | | | | | | | | | |

| Containers & Packaging | | | | | | | | | | | | | | | | | | |

| Five Star Packing | | (10) (11) | | First Lien Term Loan | | S + 4.25% | | 9.63% | | 5/6/2029 | | 5,536 | | | 5,468 | | 5,467 | | 1.53 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| Impact Environmental Group | | (4) | | First Lien Term Loan | | S + 6.00% | | 11.28% | | 3/23/2029 | | 3,633 | | | 3,565 | | 3,603 | | 1.01 | % |

| Impact Environmental Group (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.00% | | 11.28% | | 3/23/2029 | | 1,697 | | | 1,485 | | 1,479 | | 0.42 | % |

| Impact Environmental Group (Delayed Draw) (Incremental) | | (4) (6) | | First Lien Term Loan | | S + 6.00% | | 11.28% | | 3/23/2029 | | 3,294 | | | (16) | | (27) | | (0.01) | % |

| Impact Environmental Group (Incremental) | | (4) (11) | | First Lien Term Loan | | S + 6.00% | | 11.28% | | 3/23/2029 | | 745 | | | 731 | | 739 | | 0.21 | % |

| Online Labels Group | | (4) (11) | | First Lien Term Loan | | S + 5.25% | | 10.61% | | 12/19/2029 | | 1,607 | | | 1,591 | | 1,591 | | 0.45 | % |

| Online Labels Group (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 5.25% | | 10.61% | | 12/19/2029 | | 195 | | | — | | (2) | | — | % |

| Online Labels Group (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 5.25% | | 10.61% | | 12/19/2029 | | 195 | | | — | | (2) | | — | % |

| Pelican Products | | (7) (10) | | First Lien Term Loan | | S + 4.25% | | 9.75% | | 12/29/2028 | | 7,840 | | | 7,780 | | 7,304 | | 2.06 | % |

| Resource Label Group | | (7) (10) | | First Lien Term Loan | | S + 4.25% | | 9.72% | | 7/8/2028 | | 4,853 | | | 4,842 | | 4,577 | | 1.29 | % |

| Spartech | | (4) (7) | | First Lien Term Loan | | S + 4.75% | | 10.16% | | 5/6/2028 | | 9,824 | | | 9,824 | | 7,915 | | 2.23 | % |

| Total Containers & Packaging | | | | | | | | | | | | | | 35,270 | | 32,644 | | 9.19 | % |

| | | | | | | | | | | | | | | | | | |

| Distributors | | | | | | | | | | | | | | | | | | |

| Aramsco | | (4) (7) (11) | | First Lien Term Loan | | S + 4.75% | | 10.10% | | 10/10/2030 | | 2,980 | | | 2,921 | | 2,923 | | 0.82 | % |

| Aramsco (Delayed Draw) | | (4) (6) (7) | | First Lien Term Loan | | S + 4.75% | | 10.10% | | 10/10/2030 | | 520 | | | — | | (10) | | — | % |

| Motion & Control Enterprises | | (4) (11) | | First Lien Term Loan | | S + 5.50% | | 11.03% | | 6/1/2028 | | 4,042 | | | 3,993 | | 3,993 | | 1.12 | % |

| Motion & Control Enterprises (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 5.50% | | 11.03% | | 6/1/2028 | | 11,115 | | | 6,797 | | 6,677 | | 1.88 | % |

| RTH Buyer LLC (dba Rhino Tool House) | | (4) | | First Lien Term Loan | | S + 6.25% | | 11.97% | | 4/4/2029 | | 4,678 | | | 4,591 | | 4,639 | | 1.30 | % |

| RTH Buyer LLC (dba Rhino Tool House) (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.25% | | 11.97% | | 4/4/2029 | | 1,095 | | | 555 | | 551 | | 0.16 | % |

| Total Distributors | | | | | | | | | | | | | | 18,857 | | 18,773 | | 5.28 | % |

| | | | | | | | | | | | | | | | | | |

| Diversified Consumer Services | | | | | | | | | | | | | | | | | | |

| Excel Fitness | | (4) (11) | | First Lien Term Loan | | S + 5.25% | | 10.75% | | 4/29/2029 | | 11,850 | | | 11,734 | | 11,539 | | 3.25 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| Total Diversified Consumer Services | | | | | | | | | | | | | | 11,734 | | 11,539 | | 3.25 | % |

| | | | | | | | | | | | | | | | | | |

| Diversified Financial Services | | | | | | | | | | | | | | | | | | |

| KRIV Acquisition, Inc. | | (4) (11) | | First Lien Term Loan | | S + 6.50% | | 11.85% | | 7/6/2029 | | 9,824 | | | 9,562 | | 9,540 | | 2.68 | % |

| KRIV Acquisition Inc. (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.50% | | 11.85% | | 7/6/2029 | | 1,466 | | | (18) | | (42) | | (0.01) | % |

| Total Diversified Financial Services | | | | | | | | | | | | | | 9,544 | | 9,498 | | 2.67 | % |

| | | | | | | | | | | | | | | | | | |

| Electronic Equipment, Instruments & Components | | | | | | | | | | | | | | | | | | |

| Infinite Electronics (Incremental) | | (4) (7) | | First Lien Term Loan | | S + 6.25% | | 11.88% | | 3/2/2028 | | 2,511 | | | 2,447 | | 2,426 | | 0.68 | % |

| INS Intermediate II, LLC (Ergotech Controls, Inc. – dba INS) | | (4) | | First Lien Term Loan | | S + 6.50% | | 12.03% | | 1/20/2029 | | 6,966 | | | 6,844 | | 6,976 | | 1.97 | % |

| INS Intermediate II, LLC (Ergotech Controls, Inc. – dba INS) (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.50% | | 12.03% | | 1/20/2029 | | 1,732 | | | (29) | | 3 | | — | % |

| Total Electronic Equipment, Instruments & Components | | | | | | | | | | | | | | 9,262 | | 9,405 | | 2.65 | % |

| | | | | | | | | | | | | | | | | | |

| Energy Equipment & Services | | | | | | | | | | | | | | | | | | |

| National Power | | (4) (11) | | First Lien Term Loan | | S + 6.00% | | 11.36% | | 10/20/2029 | | 2,740 | | | 2,699 | | 2,701 | | 0.76 | % |

| National Power (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.00% | | 11.36% | | 10/20/2029 | | 1,473 | | | (4) | | (21) | | (0.01) | % |

| Ovation Holdings, Inc. | | (4) | | First Lien Term Loan | | S + 6.25% | | 11.78% | | 2/3/2029 | | 7,031 | | | 6,892 | | 6,955 | | 1.96 | % |

| Ovation Holdings, Inc. (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.25% | | 11.78% | | 2/3/2029 | | 1,661 | | | 1,343 | | 1,344 | | 0.38 | % |

| Total Energy Equipment & Services | | | | | | | | | | | | | | 10,930 | | 10,979 | | 3.09 | % |

| | | | | | | | | | | | | | | | | | |

| Food Products | | | | | | | | | | | | | | | | | | |

| Bakeovations Intermediate, LLC (d/b/a Commercial Bakeries) | | (4) (8) (11) | | First Lien Term Loan | | S + 6.25% | | 11.60% | | 9/25/2029 | | 7,413 | | | 7,274 | | 7,266 | | 2.04 | % |

| Sugar Foods | | (4) (7) (11) | | First Lien Term Loan | | S + 6.00% | | 11.34% | | 10/2/2030 | | 5,870 | | | 5,739 | | 5,742 | | 1.62 | % |

| Sugar Foods (Delayed Draw) | | (4) (6) (7) | | First Lien Term Loan | | S + 6.00% | | 11.34% | | 10/2/2030 | | 1,630 | | | (18) | | (35) | | (0.01) | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| Summit Hill Foods | | (4) (11) | | First Lien Term Loan | | S + 6.00% | | 11.39% | | 11/29/2029 | | 4,749 | | | 4,678 | | 4,679 | | 1.32 | % |

| Total Food Products | | | | | | | | | | | | | | 17,673 | | 17,652 | | 4.97 | % |

| | | | | | | | | | | | | | | | | | |

| Gas Utilities | | | | | | | | | | | | | | | | | | |

| D&H United Fueling Solutions | | (4) (11) | | First Lien Term Loan | | S + 5.50% | | 11.03% | | 9/16/2028 | | 7,304 | | | 7,184 | | 7,108 | | 2.00 | % |

| D&H United Fueling Solutions (Delayed Draw) | | (4) | | First Lien Term Loan | | S + 5.50% | | 11.03% | | 9/16/2028 | | 2,325 | | | 2,306 | | 2,262 | | 0.64 | % |

| D&H United Fueling Solutions (Delayed Draw) (Incremental) | | (4) (6) | | First Lien Term Loan | | S + 6.00% | | 11.50% | | 9/16/2028 | | 1,090 | | | (5) | | (9) | | — | % |

| D&H United Fueling Solutions (Incremental) | | (4) (11) | | First Lien Term Loan | | S + 6.00% | | 11.50% | | 9/16/2028 | | 2,411 | | | 2,366 | | 2,391 | | 0.67 | % |

| Total Gas Utilities | | | | | | | | | | | | | | 11,851 | | 11,752 | | 3.31 | % |

| | | | | | | | | | | | | | | | | | |

| Health Care Equipment & Supplies | | | | | | | | | | | | | | | | | | |

| TIDI Products | | (4) (7) (11) | | First Lien Term Loan | | S + 5.50% | | 10.86% | | 12/19/2029 | | 7,495 | | | 7,420 | | 7,421 | | 2.09 | % |

| TIDI Products (Delayed Draw) | | (4) (6) (7) | | First Lien Term Loan | | S + 5.50% | | 10.86% | | 12/19/2029 | | 1,972 | | | — | | (20) | | (0.01) | % |

| Young Innovations | | (4) (7) (11) | | First Lien Term Loan | | S + 5.75% | | 11.09% | | 12/1/2029 | | 11,274 | | | 11,161 | | 11,164 | | 3.15 | % |

| Young Innovations (Delayed Draw) | | (4) (6) (7) | | First Lien Term Loan | | S + 5.75% | | 11.09% | | 12/1/2029 | | 2,349 | | | — | | (23) | | (0.01) | % |

| Total Health Care Equipment & Supplies | | | | | | | | | | | | | | 18,581 | | 18,542 | | 5.22 | % |

| | | | | | | | | | | | | | | | | | |

| Health Care Providers & Services | | | | | | | | | | | | | | | | | | |

| Forefront Dermatology | | (7) (10) (11) | | First Lien Term Loan | | S + 4.25% | | 9.63% | | 4/1/2029 | | 4,605 | | | 4,541 | | 4,467 | | 1.26 | % |

| Gastro Health | | (4) | | First Lien Term Loan | | S + 4.50% | | 9.97% | | 7/1/2028 | | 8,259 | | | 8,213 | | 7,984 | | 2.25 | % |

| PromptCare | | (4) (7) | | First Lien Term Loan | | S + 6.00% | | 11.46% | | 9/1/2027 | | 9,214 | | | 9,121 | | 9,074 | | 2.54 | % |

| PromptCare (Delayed Draw) | | (4) (7) | | First Lien Term Loan | | S + 6.00% | | 11.46% | | 9/1/2027 | | 1,435 | | | 1,428 | | 1,413 | | 0.40 | % |

| Sandlot Buyer, LLC (Prime Time Healthcare) | | (4) | | First Lien Term Loan | | S + 6.00% | | 11.28% | | 9/19/2028 | | 17,917 | | | 17,458 | | 17,708 | | 4.99 | % |

| SCP Eye Care Holdco, LLC (DBA EyeSouth Partners) | | (4) | | First Lien Term Loan | | S + 5.75% | | 11.21% | | 10/7/2029 | | 7,764 | | | 7,617 | | 7,670 | | 2.16 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| SCP Eye Care Holdco, LLC (DBA EyeSouth Partners) (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 5.75% | | 11.21% | | 10/7/2029 | | 2,538 | | | 1,619 | | 1,588 | | 0.45 | % |

| Soliant Health | | (4) | | First Lien Term Loan | | S + 4.00% | | 9.47% | | 4/1/2028 | | 7,270 | | | 7,262 | | 7,270 | | 2.05 | % |

| Total Health Care Providers & Services | | | | | | | | | | | | | | 57,259 | | 57,174 | | 16.10 | % |

| | | | | | | | | | | | | | | | | | |

| Health Care Technology | | | | | | | | | | | | | | | | | | |

| Acclaim MidCo, LLC (dba ClaimLogiQ) | | (4) | | First Lien Term Loan | | S + 6.00% | | 11.35% | | 6/13/2029 | | 3,878 | | | 3,805 | | 3,844 | | 1.08 | % |

| Acclaim MidCo, LLC (dba ClaimLogiQ) (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.00% | | 11.35% | | 6/13/2029 | | 1,559 | | | (7) | | (14) | | — | % |

| Total Health Care Technology | | | | | | | | | | | | | | 3,798 | | 3,830 | | 1.08 | % |

| | | | | | | | | | | | | | | | | | |

| Household Durables | | | | | | | | | | | | | | | | | | |

| All My Sons | | (4) (11) | | First Lien Term Loan | | S + 4.75% | | 10.36% | | 10/25/2028 | | 5,852 | | | 5,808 | | 5,790 | | 1.63 | % |

| Petmate | | (4) (7) | | First Lien Term Loan | | S + 5.50% | | 11.23% | | 9/15/2028 | | 12,786 | | | 12,692 | | 7,608 | | 2.14 | % |

| Total Household Durables | | | | | | | | | | | | | | 18,500 | | 13,398 | | 3.77 | % |

| | | | | | | | | | | | | | | | | | |

| Industrial Conglomerates | | | | | | | | | | | | | | | | | | |

| ISG Merger Sub, LLC (dba Industrial Service Group) (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 5.75% | | 11.11% | | 12/7/2028 | | 10,996 | | | 1,157 | | 1,035 | | 0.29 | % |

| ISG Merger Sub, LLC (dba Industrial Service Group) | | (4) | | First Lien Term Loan | | S + 6.25% | | 11.60% | | 12/7/2028 | | 5,709 | | | 5,610 | | 5,748 | | 1.62 | % |

| ISG Merger Sub, LLC (dba Industrial Service Group) (Delayed Draw) | | (4) | | First Lien Term Loan | | S + 6.25% | | 11.60% | | 12/7/2028 | | 2,972 | | | 2,960 | | 2,993 | | 0.84 | % |

| Total Industrial Conglomerates | | | | | | | | | | | | | | 9,727 | | 9,776 | | 2.75 | % |

| | | | | | | | | | | | | | | | | | |

| Insurance | | | | | | | | | | | | | | | | | | |

| Patriot Growth Insurance Service (Delayed Draw) (Incremental) | | (4) (7) | | First Lien Term Loan | | S + 5.75% | | 11.25% | | 10/14/2028 | | 8,958 | | | 8,886 | | 8,754 | | 2.46 | % |

| Risk Strategies (Delayed Draw) | | (4) (7) | | First Lien Term Loan | | S + 5.50% | | 11.00% | | 11/2/2026 | | 11,300 | | | 11,300 | | 11,101 | | 3.13 | % |

| Total Insurance | | | | | | | | | | | | | | 20,186 | | 19,855 | | 5.59 | % |

| | | | | | | | | | | | | | | | | | |

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| Internet and Direct Marketing Retail | | | | | | | | | | | | | | | | | | |

| Xpressmyself.com LLC (a/k/a SmartSign) | | (4) | | First Lien Term Loan | | S + 5.50% | | 10.98% | | 9/7/2028 | | 7,308 | | | 7,249 | | 7,179 | | 2.02 | % |

| Xpressmyself.com LLC (a/k/a SmartSign) | | (4) | | First Lien Term Loan | | S + 5.75% | | 11.22% | | 9/7/2028 | | 2,680 | | | 2,630 | | 2,657 | | 0.75 | % |

| Total Internet and Direct Marketing Retail | | | | | | | | | | | | | | 9,879 | | 9,836 | | 2.77 | % |

| | | | | | | | | | | | | | | | | | |

| IT Services | | | | | | | | | | | | | | | | | | |

| Evergreen Services Group | | (4) (7) | | First Lien Term Loan | | S + 6.25% | | 11.70% | | 6/15/2029 | | 9,094 | | | 8,942 | | 8,917 | | 2.51 | % |

| Evergreen Services Group (Delayed Draw) | | (4) (7) | | First Lien Term Loan | | S + 6.25% | | 11.70% | | 6/15/2029 | | 2,176 | | | 2,158 | | 2,133 | | 0.60 | % |

| Total IT Services | | | | | | | | | | | | | | 11,100 | | 11,050 | | 3.11 | % |

| | | | | | | | | | | | | | | | | | |

| Leisure Products | | | | | | | | | | | | | | | | | | |

| TouchTunes Interactive | | (10) | | First Lien Term Loan | | S + 5.00% | | 10.35% | | 4/2/2029 | | 7,555 | | | 7,493 | | 7,517 | | 2.12 | % |

| Total Leisure Products | | | | | | | | | | | | | | 7,493 | | 7,517 | | 2.12 | % |

| | | | | | | | | | | | | | | | | | |

| Machinery | | | | | | | | | | | | | | | | | | |

| Hyperion | | (10) | | First Lien Term Loan | | S + 4.50% | | 10.15% | | 8/30/2028 | | 4,250 | | | 4,237 | | 4,197 | | 1.18 | % |

| Total Machinery | | | | | | | | | | | | | | 4,237 | | 4,197 | | 1.18 | % |

| | | | | | | | | | | | | | | | | | |

| Personal Products | | | | | | | | | | | | | | | | | | |

| Protective Industrial Products (“PIP”) | | (4) (7) | | First Lien Term Loan | | S + 5.00% | | 10.47% | | 12/29/2027 | | 2,349 | | | 2,264 | | 2,373 | | 0.67 | % |

| Thorne HealthTech | | (4) (11) | | First Lien Term Loan | | S + 5.75% | | 11.10% | | 10/16/2030 | | 5,143 | | | 5,093 | | 5,096 | | 1.43 | % |

| Total Personal Products | | | | | | | | | | | | | | 7,357 | | 7,469 | | 2.10 | % |

| | | | | | | | | | | | | | | | | | |

| Pharmaceuticals | | | | | | | | | | | | | | | | | | |

| Wellspring Pharmaceutical | | (4) | | First Lien Term Loan | | S + 5.75% | | 11.03% | | 8/22/2028 | | 3,378 | | | 3,323 | | 3,298 | | 0.93 | % |

| Wellspring Pharmaceutical (Delayed Draw) | | (4) | | First Lien Term Loan | | S + 5.75% | | 11.03% | | 8/22/2028 | | 1,571 | | | 1,561 | | 1,534 | | 0.43 | % |

| Wellspring Pharmaceutical (Delayed Draw) (Incremental) | | (4) (6) | | First Lien Term Loan | | S + 6.00% | | 11.18% | | 8/22/2028 | | 7,975 | | | (34) | | (116) | | (0.03) | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| Wellspring Pharmaceutical (Incremental) | | (4) | | First Lien Term Loan | | S + 6.00% | | 11.18% | | 8/22/2028 | | 2,645 | | | 2,597 | | 2,606 | | 0.73 | % |

| Total Pharmaceuticals | | | | | | | | | | | | | | 7,447 | | 7,322 | | 2.06 | % |

| | | | | | | | | | | | | | | | | | |

| Professional Services | | | | | | | | | | | | | | | | | | |

| AG Group Holdings, Inc. | | (4) | | First Lien Term Loan | | S + 4.00% | | 9.36% | | 12/29/2028 | | 10,350 | | | 10,334 | | 10,204 | | 2.87 | % |

| ALKU Intermediate Holdings, LLC | | (4) | | First Lien Term Loan | | S + 6.25% | | 11.61% | | 5/23/2029 | | 3,977 | | | 3,902 | | 3,943 | | 1.11 | % |

| ARMstrong | | (4) (11) | | First Lien Term Loan | | S + 6.25% | | 11.70% | | 10/6/2029 | | 5,527 | | | 5,446 | | 5,449 | | 1.53 | % |

| ARMstrong (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.25% | | 11.70% | | 10/6/2029 | | 1,857 | | | (13) | | (26) | | (0.01) | % |

| Evergreen Services Group II | | (4) (7) (11) | | First Lien Term Loan | | S + 6.00% | | 11.35% | | 10/4/2030 | | 10,475 | | | 10,320 | | 10,326 | | 2.92 | % |

| Evergreen Services Group II (Delayed Draw) | | (4) (6) (7) | | First Lien Term Loan | | S + 6.00% | | 11.35% | | 10/4/2030 | | 8,438 | | | 5,508 | | 5,409 | | 1.52 | % |

| Keng Acquisition, Inc. (Engage Group Holdings, LLC) | | (4) (7) (11) | | First Lien Term Loan | | S + 6.25% | | 11.60% | | 8/1/2029 | | 4,668 | | | 4,599 | | 4,600 | | 1.29 | % |

| Keng Acquisition, Inc. (Engage Group Holdings, LLC) (Delayed Draw) | | (4) (6) (7) | | First Lien Term Loan | | S + 6.25% | | 11.60% | | 8/1/2029 | | 4,497 | | | 569 | | 515 | | 0.14 | % |

| LSCS Holdings Inc. | | (10) | | First Lien Term Loan | | S + 4.50% | | 9.97% | | 12/16/2028 | | 11,083 | | | 11,040 | | 10,942 | | 3.08 | % |

| Orion Group FM Holdings, LLC (dba Leo Facilities Maintenance) | | (4) (11) | | First Lien Term Loan | | S + 6.25% | | 11.65% | | 7/1/2029 | | 7,752 | | | 7,639 | | 7,641 | | 2.16 | % |

| Orion Group FM Holdings, LLC (dba Leo Facilities Maintenance) (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.25% | | 11.65% | | 7/1/2029 | | 5,828 | | | (14) | | (83) | | (0.02) | % |

| Total Professional Services | | | | | | | | | | | | | | 59,330 | | 58,920 | | 16.59 | % |

| | | | | | | | | | | | | | | | | | |

| Software | | | | | | | | | | | | | | | | | | |

| BusinesSolver | | (4) (7) | | First Lien Term Loan | | S + 5.50% | | 10.96% | | 12/1/2027 | | 8,825 | | | 8,762 | | 8,821 | | 2.48 | % |

| BusinesSolver (Delayed Draw) | | (4) (6) (7) | | First Lien Term Loan | | S + 5.50% | | 10.96% | | 12/1/2027 | | 1,310 | | | 200 | | 204 | | 0.06 | % |

| Revalize (Delayed Draw) | | (4) (7) | | First Lien Term Loan | | S + 5.75% | | 11.21% | | 4/15/2027 | | 1,281 | | | 1,272 | | 1,227 | | 0.35 | % |

| Revalize (Delayed Draw) | | (4) (7) | | First Lien Term Loan | | S + 5.75% | | 11.25% | | 4/15/2027 | | 287 | | | 286 | | 275 | | 0.08 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| Revalize (Delayed Draw) | | (4) (7) | | First Lien Term Loan | | S + 5.75% | | 11.21% | | 4/15/2027 | | 4,986 | | | 4,974 | | 4,776 | | 1.34 | % |

| Total Software | | | | | | | | | | | | | | 15,494 | | 15,303 | | 4.31 | % |

| | | | | | | | | | | | | | | | | | |

| Transportation Infrastructure | | | | | | | | | | | | | | | | | | |

| FSK Pallet Holding Corp. (DBA Kamps Pallets) | | (4) (11) | | First Lien Term Loan | | S + 6.00% | | 11.53% | | 12/23/2026 | | 8,641 | | | 8,509 | | 8,414 | | 2.37 | % |

| Transit Buyer LLC (dba“Propark”) | | (4) | | First Lien Term Loan | | S + 6.25% | | 11.69% | | 1/31/2029 | | 5,894 | | | 5,791 | | 5,874 | | 1.65 | % |

| Transit Buyer LLC (dba“Propark”) (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.25% | | 11.69% | | 1/31/2029 | | 2,699 | | | 1,101 | | 1,138 | | 0.32 | % |

| Total Transportation Infrastructure | | | | | | | | | | | | | | 15,401 | | 15,426 | | 4.34 | % |

| | | | | | | | | | | | | | | | | | |

| Wireless Telecommunication Services | | | | | | | | | | | | | | | | | | |

| Mobile Communications America Inc | | (4) (11) | | First Lien Term Loan | | S + 6.00% | | 11.35% | | 10/16/2029 | | 8,935 | | | 8,803 | | 8,807 | | 2.48 | % |

| Mobile Communications America Inc (Delayed Draw) | | (4) (6) | | First Lien Term Loan | | S + 6.00% | | 11.35% | | 10/16/2029 | | 2,882 | | | (21) | | (41) | | (0.01) | % |

| Total Wireless Telecommunication Services | | | | | | | | | | | | | | 8,782 | | 8,766 | | 2.47 | % |

| | | | | | | | | | | | | | | | | | |

| Total Debt Investments | | | | | | | | | | | | | | 520,490 | | 510,346 | | 143.67 | % |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Interest Rate | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| Cash Equivalents | | | | | | | | | | | | | | | | | | |

| First American Government Obligations Fund | | (9) | | 5.19% | | 1 | | 1 | | | 1 | | | — | % |

| U.S. Bank National Association Money Market Deposit Account | | (9) | | 2.05% | | 11,377 | | | 11,377 | | 11,377 | | 3.20 | % |

| Total Cash Equivalents | | | | | | | | | | | | | | 11,378 | | | 11,378 | | | 3.20 | % |

| | | | | | | | | | | | | | | | | | |

| Total Investments & Cash Equivalents | | | | | | | | | | | | | | $ | 531,868 | | | $ | 521,724 | | | 146.87 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2023

(dollars in thousands)

________

(1)All investments are non-controlled/non-affiliated investments as defined by the Investment Company Act of 1940, as amended (the "1940 Act"). The 1940 Act classifies investments based on the level of control that the Company maintains in a particular portfolio company. As defined in the 1940 Act, a company is generally presumed to be “non-controlled” when the Company owns 25% or less of the portfolio company’s voting securities and “controlled” when the Company owns more than 25% of the portfolio company’s voting securities. The 1940 Act also classifies investments further based on the level of ownership that the Company maintains in a particular portfolio company. As defined in the 1940 Act, a company is generally deemed as “non-affiliated” when the Company owns less than 5% of a portfolio company’s voting securities and “affiliated” when the Company owns 5% or more of a portfolio company’s voting securities.

(2)The issuer of the debt investment held by the Company is domiciled in the United States unless otherwise noted.

(3)The majority of the investments bear interest at rates that may be determined by reference to Secured Overnight Financing Rate ("SOFR" or "S"), which reset monthly or quarterly. For each such investment, the Company has provided the spread over SOFR and the current contractual interest rate in effect at December 31, 2023. As of December 31, 2023, rate for 1M S, 3M S, 6M S are 5.35%, 5.33%, and 5.16% respectively. Certain investments are subject to a SOFR floor. For fixed rate loans, a spread above a reference rate is not applicable.

(4)Investment valued using unobservable inputs (Level 3). See Note 4 “Fair Value Measurements” for more information. (5)Percentage is based on net assets of $355,208 as of December 31, 2023.

(6)Position or portion thereof is an unfunded loan commitment, and no interest is being earned on the unfunded portion. See Note 7. The investment may be subject to unused commitment fees. (7)Investment is a unitranche position.

(8)This portfolio company is not domiciled in the United States. See Note 3 “Investments” for more information. (9)Cash equivalents balance represents amounts held in interest-bearing money market funds.

(10)Investments valued using observable inputs (Level 2).

(11)Denotes that all or a portion of the assets are owned by SPV I (as defined in Note 1 “Organization”). SPV I entered into a loan and security agreement (the “ABL Facility”) on April 27, 2023. The lenders of the ABL Facility have a first lien security interest in substantially all of the assets of SPV I. Accordingly, such assets are not available to creditors of the Company. See Note 6 “Secured Borrowings” for more information.

NC SLF INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars amounts in thousands, except per share data)

1.ORGANIZATION

NC SLF Inc. (the “Company”) is a Maryland corporation that registered under the Investment Company Act of 1940, as amended (the “1940 Act”), on August 12, 2022 as a non-diversified, closed-end management investment company. Prior to its registration as a closed-end fund under the 1940 Act, the Company was organized as a Maryland corporation on January 29, 2021 and was regulated as a business development company (“BDC”) from June 2, 2021 until August 12, 2022, whereupon it withdrew its election to be regulated as a BDC pursuant to Section 54(c) of the 1940 Act and filed a notice of registration under Section 8 of the 1940 Act in order to register as a closed-end fund (the “1940 Act Registration Statement”). The Company has elected, and intends to qualify annually, to be treated for U.S. federal income tax purposes as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (together with the rules and regulations promulgated thereunder, the “Code”).

Churchill Asset Management LLC (the “Investment Adviser” or “Churchill”) is a Delaware limited liability company registered as an investment adviser with the Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The Investment Adviser manages the Company’s day-to-day operations and provides it with investment advisory and management services. Churchill BDC Administration LLC (f/k/a Nuveen Churchill Administration LLC) (the “Administrator”) provides the administrative services necessary to conduct the Company's day-to-day operations. Teachers Insurance and Annuity Association of America (“TIAA”) is the ultimate parent company of the Investment Adviser and the Administrator.

The Company's investment objective is to generate current income and capital appreciation primarily by investing in or originating first lien and unitranche leveraged loans made to private equity-owned U.S. middle market companies that require capital for growth, acquisitions, recapitalizations, refinancings and leveraged buyouts, which the Investment Adviser believes have sustainable, leading positions in their respective markets with scalable revenues and operating cash flow, experienced management teams, and other positive business characteristics. The Company defines middle market companies as companies with approximately $10 million to $200 million of annual earnings before interest, taxes, depreciation, and amortization. The Company makes investments through both primary originations and open-market secondary purchases. The Company focuses on making loans that it directly originates to U.S. middle market companies that are meeting their financial and operational obligations, with a portfolio expected to comprise primarily of first lien senior secured debt and unitranche loans.

NC SLF SPV I, LLC (“SPV I”) was formed on August 10, 2021. SPV I is a wholly owned subsidiary of the Company and is consolidated in these consolidated financial statements commencing from the date of its formation. SPV I commenced operations on May 15, 2023, the date of its first investment transaction.

The Company has entered into separate subscription agreements (the “Subscription Agreements”) with one or more investors providing for the private placement of the Company’s common stock pursuant to a private offering (the “Private Offering”). Each investor makes a “Capital Commitment” (as such term is defined in the subscription agreements executed by each of the shareholders) to purchase shares pursuant to a Subscription Agreement. Each prospective investor in the Company is required to certify that it is an "accredited investor" within the meaning of Rule 501(a) of Regulation D promulgated under the Securities Act of 1933, as amended (the “Securities Act”). Prior to the filing of the 1940 Act Registration Statement, the Company completed its initial closing of capital commitments on June 21, 2021 (the “Initial Closing Date”) and subsequently commenced investment operations. The Company’s investment period (“Investment Period”) commenced on the Initial Closing Date and is set to continue through the 48-month anniversary of the Initial Closing Date, subject to automatic extensions thereafter, each for an additional one-year period, unless the holders of a majority of the Company’s outstanding shares elected to forego any such extension upon not less than ninety days’ prior written notice. Holders of a majority of the Company’s outstanding shares may also terminate the Investment Period as of any earlier anniversary of the Initial Closing Date upon not less than ninety days’ written notice. The Investment Adviser also may terminate the Investment Period of the Company as of an earlier date in its discretion.

NC SLF INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars amounts in thousands, except per share data)

2.SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The consolidated financial statements have been prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”). The Company is an investment company for the purposes of accounting and financial reporting in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services—Investment Companies (“ASC Topic 946”), and pursuant to Regulation S-X. In the opinion of management, all adjustments, which are of a normal recurring nature, considered necessary for the fair statement of the consolidated financial statements for the periods presented, have been included. The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All significant intercompany balances and transactions have been eliminated. Certain prior period amounts have been reclassified to conform to the current period presentation. U.S. GAAP for an investment company requires investments to be recorded at fair value. The carrying value for all other assets and liabilities approximates their fair value, unless otherwise disclosed within.

Consolidation

As provided under ASC Topic 946, the Company will generally not consolidate its investment in a company other than an investment company subsidiary or a controlled operating company whose business consists of providing services to the Company. Accordingly, the consolidated financial statements include the accounts of the Company and its wholly owned subsidiary, SPV I.

Use of Estimates

The preparation of the consolidated financial statements in conformity with U.S. GAAP requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements, as well as the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Cash, Restricted Cash and Cash Equivalents

Cash and restricted cash represent cash deposits held at financial institutions, which at times may exceed U.S. federally insured limits. Cash equivalents include short-term highly liquid investments, such as money market funds, that are readily convertible to cash and have original maturities of three months or less. Cash, restricted cash and cash equivalents are carried at cost, which approximates fair value. As of December 31, 2023, the Company did not hold any restricted cash.

Valuation of Portfolio Investments

Investments are valued in accordance with the fair value principles established by FASB ASC Topic 820, Fair Value Measurement (“ASC Topic 820”) and in accordance with the 1940 Act. ASC Topic 820’s definition of fair value focuses on the amount that would be received to sell the asset or paid to transfer the liability in the principal or most advantageous market, and prioritizes the use of market-based inputs (observable) over entity-specific inputs (unobservable) within a measurement of fair value.

NC SLF INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars amounts in thousands, except per share data)

ASC Topic 820 specifies a hierarchy of valuation techniques based on whether the inputs to those valuation techniques are observable or unobservable. ASC Topic 820 also provides guidance regarding a fair value hierarchy, which prioritizes information used to measure fair value and the effect of fair value measurements on earnings, and provides for enhanced disclosures determined by the level within the hierarchy of information used in the valuation. In accordance with ASC Topic 820, these inputs are summarized in the three levels listed below:

•Level 1 — Valuations are based on unadjusted, quoted prices in active markets for identical assets or liabilities that are accessible at the measurement date.

•Level 2 — Valuations are based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

•Level 3 — Valuations based on inputs that are unobservable and significant to the overall fair value measurement.

In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of observable input that is significant to the fair value measurement. The assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment.

Active, publicly traded instruments are classified as Level 1 and their values are generally based on quoted market prices, even if both the market’s normal daily trading volume is not sufficient to absorb the quantity held and placing orders to sell the position in a single transaction might affect the quoted price.

Fair value is generally determined as the price that would be received for an investment in a current sale, which assumes an orderly market is available for the market participants at the measurement date. If available, fair value of investments is based on directly observable market prices or on market data derived from comparable assets. The Company’s valuation policy considers the fact that no ready market may exist for many of the securities in which it invests and that fair value for its investments must be determined using unobservable inputs.

Pursuant to Rule 2a-5 under the 1940 Act, the Company's board of directors (the “Board”) has designated the Investment Adviser as the Company's valuation designee (the “Valuation Designee”) to determine the fair value of the Company's investments that do not have readily available market quotations, which became effective for the fiscal quarter ended March 31, 2023. Pursuant to the Company's valuation policy approved by the Board, a valuation committee comprised of employees of the Investment Adviser (the “Valuation Committee”) is responsible for determining the fair value of the Company’s assets for which market quotations are not readily available, subject to the oversight of the Board.

With respect to investments for which market quotations are not readily available (Level 3), the Valuation Designee, subject to the oversight of the Board as described below, defined further below in Note 4, undertakes a multi-step valuation process each quarter, as follows:

i.the quarterly valuation process begins with each portfolio company or investment being initially valued by either the professionals of the applicable investment team that are responsible for the portfolio investment or an independent third-party valuation firm;

ii.to the extent that an independent third-party valuation firm has not been engaged by, or on behalf of, the Company to value 100% of the portfolio, then at a minimum, an independent third-party valuation firm will be engaged by, or on behalf of, the Company will provide positive assurance of the portfolio each quarter (such that each investment is reviewed by a third-party valuation firm at least once on a rolling 12-month basis and each watch-list investment will be reviewed each quarter), including a review of management’s preliminary valuation and recommendation of fair value;

iii.the Valuation Committee then reviews and discusses the valuations with any input, where appropriate, from the independent third-party valuation firm(s), and determine the fair value of each investment in good faith based on the Company’s valuation policy, subject to the oversight of the Board; and

NC SLF INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars amounts in thousands, except per share data)

iv.the Valuation Designee provides the Board with the information relating to the fair value determination pursuant to the Company’s valuation policy in connection with each quarterly Board meeting, comply with the periodic board reporting requirements set forth in the Company’s valuation policy, and discuss with the Board its determination of the fair value of each investment in good faith.