Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This proxy statement/prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

PRELIMINARY—SUBJECT TO COMPLETION—DATED [*], 2021

PROXY STATEMENT FOR SPECIAL MEETING OF STOCKHOLDERS OF

and

PROSPECTUS FOR 2,998,261 SHARES OF CLASS A COMMON STOCK OF

MERGER PROPOSALS—YOUR VOTE IS VERY IMPORTANT

[ __ ], 2021

Dear Support Stockholder:

You are cordially invited to a special meeting of stockholders of Support.com, Inc. to be held on [ __ ], 2021 at 8:00 a.m., Pacific Time, at [ __ ]. At the special meeting, you will be asked to vote on the important matters described in detail in the notice of special meeting of stockholders and the proxy statement/prospectus accompanying this letter.

The proxy statement/prospectus is being provided to you as a stockholder of Support.com, Inc., which we refer to as “Support”, in connection with the proposed merger with a subsidiary of Greenidge Generation Holdings Inc., a Delaware corporation, which we refer to as “Greenidge”. These terms and others used in this introduction are defined in the proxy statement/prospectus under the caption “Frequently Used Terms”.

At the special meeting, you will be asked to vote on the adoption of an agreement and plan of merger, dated as of March 19, 2021 (the “Signing Date”), as it may be amended from time to time (the “Merger Agreement”), by and among Support, Greenidge and GGH Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of Greenidge (“Merger Sub”), pursuant to which Merger Sub will be merged with and into Support, with Support continuing as the surviving corporation and a wholly-owned subsidiary of Greenidge (such transaction, the “Merger”) as more fully described in the proxy statement/prospectus. The Merger Agreement is attached to the proxy statement/prospectus as Annex A.

Under the Merger Agreement, the aggregate consideration payable to holders of shares of Support common stock, Support options and Support awards consists of 2,998,261 shares of class A common stock of Greenidge.

If the Merger is completed, at the effective time of the Merger and subject to the terms and conditions set forth in the Merger Agreement, except for shares held in treasury by Support, each share of Support common stock that is issued and outstanding will be cancelled and automatically converted into the right to receive a number of shares of class A common stock equal to the Exchange Ratio.

The Exchange Ratio is a fraction, expressed as a decimal rounded to the nearest one-thousandth, equal to the quotient of (i) 2,998,261 shares of class A common stock divided by (ii) the fully diluted amount of outstanding shares of common stock of Support as calculated pursuant to the Merger Agreement.

Assuming a price per share of Support common stock of $[ __ ] (which is the VWAP for the ten-trading day period ending on [ __ ], 2021) and that the fully diluted amount of Support common stock is [ __ ], then the Exchange Ratio would be [ __ ]. Note that this is only an illustrative Exchange Ratio, and the final Exchange Ratio will be determined pursuant to the formulas in the Merger Agreement and announced immediately prior to the Closing.

Greenidge has applied to list its class A common stock on the Nasdaq Capital Market (“Nasdaq”) under the trading symbol “GREE.” The approval of such listing, including as to the shares of class A common stock issued in the Merger, subject only to official notice of issuance, is a condition to the obligations of Support and Greenidge to complete the Merger.

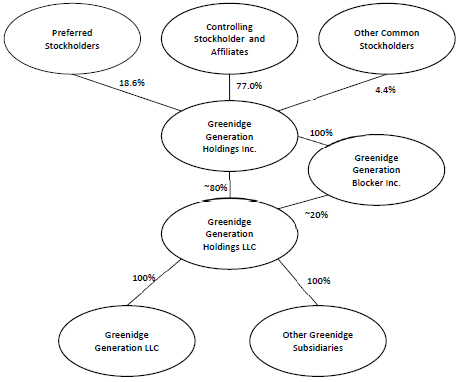

Shares of class A common stock, including the shares that will be issued to Support stockholders in connection with the Merger, are entitled to one vote per share. Shares of class B common stock, which are held by Greenidge’s existing shareholders or are issuable upon conversion of Greenidge’s existing series A preferred stock, have 10 votes per share. A description of the terms of Greenidge’s capital stock is described in more detail elsewhere in the proxy statement/prospectus under the caption “Description of Securities”.

In connection with the entry into the Merger Agreement, Support also entered into a subscription agreement with 210 Capital, LLC (the “Investor”). Pursuant to the subscription agreement, the Investor acquired 3,909,871 shares of Support common stock, representing approximately 16.6% of the issued and outstanding shares of Support common stock, pro forma for such issuance. In addition, in connection with the Merger Agreement, the Investor and the directors and certain executive officers of Support, who together with the Investor held an aggregate of approximately 30% of the outstanding shares of Support common stock as of the Signing Date, entered into a voting support agreement with Greenidge to, among other things, vote the shares of Support common stock that they beneficially own in favor of the Merger and grant Greenidge an irrevocable proxy to vote their shares in such manner if they fail to perform their obligations under this voting support agreement. Each of these agreements is described in more detail elsewhere in the proxy statement/prospectus. The voting support agreement is attached to the proxy statement/prospectus as Annex B and the subscription agreement is attached as Annex C.

The board of directors of Support has unanimously determined that the Merger and the other transactions contemplated by the Merger Agreement are fair to, advisable and in the best interests of Support and its stockholders, approved and declared advisable the Merger Agreement and recommends that Support stockholders vote “FOR” the adoption of the Merger Agreement.

At the special meeting, Support stockholders will also be asked to vote on (i) a proposal to approve, on an advisory (non-binding) basis, compensation that will or may be paid or provided to named executive officers of Support in connection with the Merger (the “Compensation Proposal”) and (ii) a proposal to approve the adjournment of the special meeting, if necessary, to permit further solicitation of proxies if there are not sufficient votes to approve the proposal to adopt the Merger Agreement (the “Adjournment Proposal”).

The board of directors of Support unanimously recommends that Support stockholders vote “FOR” the Compensation Proposal and “FOR” the Adjournment Proposal.

Support’s board of directors has fixed 5 p.m. Eastern Time on [ __ ], 2021 as the record date for determination of Support stockholders entitled to notice of, and to vote on, all matters presented at the special meeting, or any adjournment or postponement thereof.

The accompanying proxy statement/prospectus provides important information regarding the special meeting and a detailed description of the Merger Agreement, the Merger and the other proposals described above, as well as detailed business and financial information about Greenidge. You are urged to read carefully the accompanying proxy statement/prospectus, the annexes included with the proxy statement/prospectus and the documents incorporated by reference into the proxy statement/prospectus. Please pay particular attention to and read carefully the section “Risk Factors” beginning on page 35 of the accompanying proxy statement/prospectus. You can also obtain information about Support from documents that it has previously filed with the Securities and Exchange Commission.

Your vote is very important, regardless of the number of shares you own. Whether or not you expect to attend the special meeting in person, please vote or otherwise submit a proxy to vote your shares as promptly as possible so that your shares may be represented and voted at the special meeting. If your shares are held in the name of a bank, broker or other nominee holder of record, please follow the instructions on the voting instruction form furnished to you by such record holder.

If you have any questions or need assistance voting your shares, please contact our proxy solicitor:

Harkins Kovler, LLC

3 Columbus Circle, 15FL

New York, NY 10019

Toll: +1 (212) 468-5380

Toll Free: +1 (800) 326-5997

Email: SPRT@harkinskovler.com

Sincerely,

| | |

Lance Rosenzweig Chief Executive Officer, Support.com, Inc. | | Jeffrey Kirt Chief Executive Officer, Greenidge Generation Holdings Inc. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under the accompanying proxy statement/prospectus or determined that the accompanying proxy statement/prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

The accompanying proxy statement/prospectus is dated [ __ ], 2021 and is first being mailed or otherwise delivered to Support stockholders on or about [ __ ], 2021.