At December 31, 2020, the Company entered into an agreement to purchase miner equipment totaling $11,910 that required deposits of $5,959. At December 31, 2019, the Company entered into an agreement to purchase miner equipment totaling $7,860 that required deposits of $6,337.

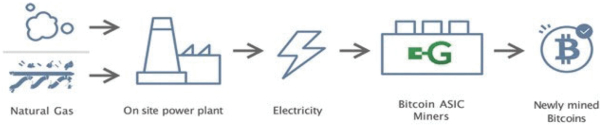

The Company entered into a contract with Empire Pipeline Inc. in September 2020 which provides for the transportation to its pipeline of 15,000 decatherms of natural gas per day, approximately $158 per month. The contract ends in September 2030 and may be terminated by either party with 12 months notice after the initial

10-year

period.

GREENIDGE GENERATION HOLDINGS LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2020 AND 2019

Amounts denoted in $000’s

The Company has one major power customer, the NYISO, that accounts for 35.7% and 90.8% of its revenue for the years ended December 31, 2020 and 2019, respectively. All amounts receivable were due from this customer at December 31, 2020 and 2019.

The Company has one major power vendor that accounted for approximately 56.8% and 55.6% of cost of revenue for the years ended December 31, 2020 and 2019, respectively.

Revenues from Greenidge’s largest pool operator customer comprised approximately 57% of total revenue for the year ended December 31, 2020.

| | OTHER RISKS AND CONSIDERATIONS |

The United States is presently in the midst of a national health emergency related to a virus, commonly known as Novel Coronavirus

(“COVID-19”).

The overall consequences of

COVID-19

on a national, regional and local level are unknown, but it has the potential to result in a significant economic impact.

COVID-19

did not have a material impact on the Company’s operations during the year ended December 31, 2020. The future impact of this situation on the Company and its results and financial position is not presently determinable.

In January 2021, GC merged into GG and GC was subsequently dissolved.

In January 2021, Greenidge Generation Holdings Inc. (“GGHI”) was formed in the state of Delaware. GGHI has the authority to issue 200,000,000 shares of common stock, $0.0001 par value per share, and 20,000,000 shares of preferred stock, $0.0001 par value per share.

After the formation of GGHI, the equity holders of GGH entered into an asset contribution and exchange agreement in which the holders’ equity interests and outstanding notes payable balances were contributed into GGHI in exchange for 7,000,000 shares of GGHI common stock (28,000,000 shares of GGHI Class B Common Stock after a 4-for-1 stock split that occurred in March 2021).

In January 2021, GGHI completed a private placement offering in which 1,620,000 shares of series A redeemable convertible preferred stock was sold at $25 per share. Total net proceeds from the private placement offering were $37,590.

In February 2021, GGHI adopted an equity incentive plan and reserved 957,778 shares of common stock (3,831,112 shares of Class A Common Stock after a 4-for-1 stock split that occurred in March 2021) for issuance under the plan.

On March 19, 2021, the Company entered into a definitive agreement and plan of merger for a business combination with Support.com, Inc., a Delaware corporation (NASDAQ: SPRT).

On March 19, 2021, the Company and the its largest equity member and its affiliates entered into an arrangement pursuant to which Greenidge agreed, upon request, to direct its bank to issue new letters of credit to replace all or a portion of the letters of credit provided by the largest equity member and certain of its affiliates, upon the consummation of a potential investment in, financing of, or sale of any assets or equity or debt securities of the Company, which results in net proceeds to the Company of at least $10,000,000.