- GREE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

-

Institutional

- Shorts

-

S-1 Filing

Greenidge Generation (GREE) S-1IPO registration

Filed: 17 Nov 21, 9:55pm

Delaware | 7374 | 86-1746728 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

Chris Zochowski Richard Alsop Kristina Trauger Shearman & Sterling LLP 401 9th Street, NW Suite 800 Washington, DC 20004 (202) 508-8000 | Dean M. Colucci Michelle Geller Alex Pherson Duane Morris LLP 1540 Broadway New York, NY 10036 (973) 424-2020 |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price (1)(2) | Amount of Registration Fee (3) | ||

8.50% Senior Notes due 2026 | $28,750,000 | $2,665.13 | ||

| (1) | Estimated solely for the purpose of computing the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Includes up to $3,750,000 in aggregate principal amount of additional Notes which may be issued upon the exercise of a 30-day option granted to the underwriters. |

| (3) | Pursuant to Rule 457(p) under the Securities Act, the registration fee for this registration statement is being offset in full by the unused portion of the registration fee ($12,546.50) previously paid by the Registrant in connection with the registration statement on Form S-1 (File No. 333-259678) filed with the SEC on September 20, 2021 (the “2021 Registration Statement”), of which $4,264.20 was used pursuant to the 2021 Registration Statement and $852.84 was used pursuant to a post-effective amendment (File No. 333-260177) to the 2021 Registration Statement filed with the SEC on October 8, 2021, and with the Registrant’s remaining balance in the amount of $4,764.33 to be applied to future filings. |

Per Note | Total (3)(4) | |||||||

Public offering price (1) | $ | $ | ||||||

Underwriting discount (2) | $ | $ | ||||||

Proceeds, before expenses, payable to us (3) | $ | $ | ||||||

| (1) | Plus accrued interest from October 13, 2021 to, but not including, , 2021, the settlement date. |

| (2) | See “ Underwriting |

| (3) | B. Riley Securities, Inc. (“B. Riley”), as representative of the underwriters, may exercise an option to purchase up to an additional $ aggregate principal amount of Notes offered hereby, within 30 days of the date of this prospectus. If this option is exercised in full, the total offering price will be $ , the total underwriting discount paid by us will be $ , and total proceeds to us, before expenses, will be approximately $ . |

| (4) | Total expenses of the offering payable by us, excluding underwriting discounts and commissions and the Structuring Fee (as defined in “Underwriting”), are estimated to be $ . |

B. Riley Securities | ||||

Page | ||||

| iii | ||||

| 1 | ||||

| 13 | ||||

| 16 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 50 | ||||

| 65 | ||||

| 71 | ||||

| 89 | ||||

| 109 | ||||

| 117 | ||||

| 123 | ||||

| 126 | ||||

| 130 | ||||

| 134 | ||||

| 134 | ||||

| 134 | ||||

| F-1 | ||||

| • | the ability to recognize the anticipated objectives and benefits of an expansion into multiple data centers in Texas or South Carolina |

| • | the ability to negotiate or execute definitive documentation with respect to potential expansion sites on terms and conditions that are acceptable to Greenidge, whether on a timely basis or at all; |

| • | the ability to recognize the anticipated objectives and any benefits of the Merger described in Note 1 of the Notes to Consolidated Financial Statements of Greenidge Generation Holdings Inc. herein, including the anticipated tax treatment of the Merger; |

| • | changes in applicable laws, regulations or permits affecting our operations or the industries in which we operate, including regulation regarding power generation, cryptocurrency usage and/or cryptocurrency mining; |

| • | any failure by us to obtain acceptable financing with regard to our growth strategies or operations; |

| • | fluctuations and volatility in the price of bitcoin and other cryptocurrencies; |

| • | loss of public confidence in, or use cases of, bitcoin and other cryptocurrencies; |

| • | the potential of cryptocurrency market manipulation; |

| • | the economics of mining cryptocurrency, including as to variables or factors affecting the cost, efficiency and profitability of mining; |

| • | the availability, delivery schedule and cost of equipment necessary to maintain and grow our business and operations, including mining equipment and equipment meeting the technical or other specifications required to achieve our growth strategy; |

| • | the possibility that we may be adversely affected by other economic, business or competitive factors, including factors affecting the industries in which we operate or upon which we rely and are dependent; |

| • | the ability to expand successfully to other facilities, mine other cryptocurrencies or otherwise expand our business; |

| • | changes in tax regulations applicable to us, our assets or cryptocurrencies, including bitcoin; |

| • | any litigation involving us; |

| • | costs and expenses relating to cryptocurrency transaction fees and fluctuation in cryptocurrency transaction fees; |

| • | the condition of our physical assets, including that our current single operating facility may realize material, if not total, loss and interference as a result of equipment malfunction or break-down, physical disaster, data security breach, computer malfunction or sabotage; and |

| • | the actual and potential impact of the COVID-19 pandemic. |

| • | Bitcoin-Mining |

| • | Independent Electric Generation |

| • | Capacity revenue: We receive capacity revenue for committing to sell power to the NYISO when dispatched. |

| • | Energy revenue: When dispatched by the NYISO, we receive energy revenue based on the hourly price of power. |

| • | Ancillary services revenue: When selected by the NYISO, we receive compensation for the provision of operating reserves. |

| • | Vertical integration |

| • | Low power costs |

| • | Bitcoin market upside |

| • | Power market upside |

| • | Self-reliance behind-the-meter |

| • | Relatively stable regulatory environment low-cost power environments. |

| • | Cryptocurrency experience low-cost ASIC mining computers of proven performance. |

| • | Blue-chip backing |

| • | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

| • | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| • | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay,” “say-on-frequency” |

| • | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the CEO’s compensation to median employee compensation. |

| • | We may be able to incur substantially more debt, which could have important consequences to you. |

| • | The Notes will be unsecured and therefore will be effectively subordinated to any secured indebtedness that we currently have or that we may incur in the future. |

| • | The Notes will be structurally subordinated to the indebtedness and other liabilities of our subsidiaries. |

| • | The indenture under which the Notes will be issued contains limited protection for holders of the Notes. |

| • | An increase in market interest rates could result in a decrease in the value of the Notes. |

| • | An active trading market for the Notes may not be sustained, which could limit the market price of the Notes or your ability to sell them. |

| • | We may redeem the Notes before maturity, and you may be unable to reinvest the proceeds at the same or a higher rate of return. |

| • | The rating for the Notes could at any time be revised downward or withdrawn entirely at the discretion of the issuing rating agency. |

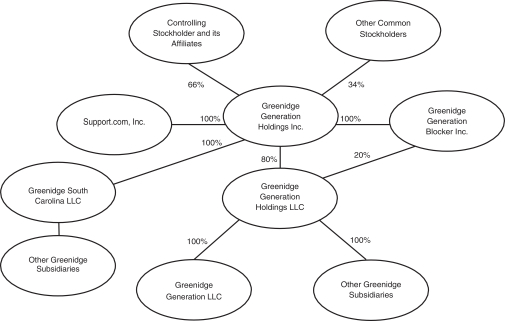

| • | Our subsidiaries conduct the substantial majority of our operations and own our operating assets. |

| • | Our business and operating plan may be altered due to several external factors, including market conditions, the ability to procure equipment in a quantity, cost and timeline consistent with our business plan, the ability to identify and acquire additional locations to replicate the operating model in place at our existing cryptocurrency mining and power generation facility and the ability to integrate the Support Services segment within our overall business plan. |

| • | It may take significant time, expenditure or effort for us to grow our business, including our bitcoin mining operations, through acquisitions, and our efforts may not be successful. |

| • | The loss of any of our management team, an inability to execute an effective succession plan, or an inability to attract and retain qualified personnel could adversely affect our results of operations, strategy and financial performance. |

| • | We have been, are currently, and may be in the future, the subject of legal proceedings, including governmental investigations, relating to our products or services. |

| • | We have a limited operating history, with operating losses as we have grown. If we are unable to sustain greater revenues than our operating costs of bitcoin mining and power generation, as well as expansion plans, we will resume operating losses, which could negatively impact our operations, strategy and financial performance. |

| • | While we have multiple sources of revenue from our business and operations, these sources of revenue currently all depend on the single natural gas power generation facility that we operate. Any disruption to our single power plant would have a material adverse effect on our business and operations, as well as our results of operations and financial condition. |

| • | As the aggregate amount of computing power, or hash rate, in the bitcoin network increases, the amount of bitcoin earned per unit of hash rate decreases; as a result, in order to maintain our market share, we may have to incur significant capital expenditures in order to expand our fleet of miners. |

| • | The properties utilized by us in our bitcoin mining operations may experience damage, including damage not covered by insurance. |

| • | Our bitcoin may be subject to loss, theft or restriction on access. |

| • | If bitcoin or other cryptocurrencies are determined to be investment securities, and we hold a significant portion of our assets in such cryptocurrency, investment securities or non-controlling equity interests of other entities, we may inadvertently violate the Investment Company Act. We could incur large losses to modify our operations to avoid the need to register as an investment company or could incur significant expenses to register as an investment company or could terminate operations altogether. |

| • | There has been limited precedent set for financial accounting of digital assets and so it is unclear how we will be required to account for digital asset transactions. |

| • | Regulatory changes or actions may alter the nature of an investment in us or restrict the use of bitcoin in a manner that adversely affects our business, prospects or operations. |

| • | We are subject to risks related to Internet disruptions, which could have an adverse effect on our ability to mine bitcoin. |

| • | Our future success will depend significantly on the price of bitcoin, which is subject to risk and has historically been subject to wide swings and significant volatility. |

| • | We may not be able to compete effectively against other companies, some of whom have greater resources and experience. |

| • | The impact of geopolitical and economic events on the supply and demand for bitcoin is uncertain. |

| • | Bitcoin miners and other necessary hardware are subject to malfunction, technological obsolescence, the global supply chain and difficulty and cost in obtaining new hardware. |

| • | We face risks and disruptions related to the COVID-19 pandemic and supply chain issues, including in semiconductors and other necessary mining components, which could significantly impact our operations and financial results. |

| • | We may not adequately respond to rapidly changing technology. |

| • | A failure to properly monitor and upgrade the bitcoin network protocol could damage the bitcoin network which could, in turn, have an adverse effect on our business. |

| • | Over time, incentives for bitcoin miners to continue to contribute processing power to the bitcoin network may transition from a set reward to transaction fees. If the incentives for bitcoin mining are not sufficiently high, we may not have an adequate incentive to continue to mine. |

| • | Incorrect or fraudulent cryptocurrency transactions may be irreversible. |

| • | We may not be able to realize the benefits of forks, and forks in a digital asset network may occur in the future which may affect the value of bitcoin held by us. |

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2021 | 2020 | 2021 | 2020 | |||||||||||||

Total revenue | $ | 35,754 | $ | 6,123 | $ | 62,993 | $ | 13,937 | ||||||||

Cost of revenue (exclusive of depreciation and amortization shown below) | 9,659 | 4,072 | 19,046 | 8,681 | ||||||||||||

Selling, general and administrative expenses | 5,446 | 1,493 | 12,017 | 4,131 | ||||||||||||

Merger and other costs | 29,847 | — | 31,095 | — | ||||||||||||

Depreciation and amortization | 2,667 | 1,064 | 5,531 | 3,227 | ||||||||||||

Loss from operations | (11,865 | ) | (506 | ) | (4,696 | ) | (2,102 | ) | ||||||||

Total other (expense) income, net | (1,020 | ) | 217 | (1,263 | ) | (364 | ) | |||||||||

Benefit for income taxes | (4,989 | ) | — | (2,860 | ) | — | ||||||||||

Net loss | $ | (7,896 | ) | $ | (289 | ) | $ | (3,099 | ) | $ | (2,466 | ) | ||||

Basic | $ | (0.28 | ) | $ | (0.13 | ) | ||||||||||

Diluted | $ | (0.28 | ) | $ | (0.13 | ) | ||||||||||

Year Ended December 31, | ||||||||

2020 | 2019 | |||||||

Total revenue | $ | 20,114 | $ | 4,439 | ||||

Cost of revenue (exclusive of depreciation and amortization shown below) | 12,600 | 4,900 | ||||||

Selling, general and administrative expenses | 5,581 | 5,833 | ||||||

Depreciation and amortization | 4,564 | 1,679 | ||||||

Loss from operations | (2,631 | ) | (7,973 | ) | ||||

Interest and other expense, net | (659 | ) | (502 | ) | ||||

Net loss | $ | (3,290 | ) | $ | (8,475 | ) | ||

September 30, 2021 | December 31, 2020 | |||||||

Current assets | $ | 64,425 | $ | 14,541 | ||||

Long-term assets | 193,886 | 50,834 | ||||||

Total assets | 258,311 | 65,375 | ||||||

Total liabilities | 52,509 | 21,015 | ||||||

Total stockholders’ equity | $ | 205,802 | $ | 44,360 | ||||

Year Ended December 31, | ||||||||

2020 | 2019 | |||||||

Total revenue | 43,864 | 63,333 | ||||||

Cost of revenue | 28,921 | 46,865 | ||||||

Gross profit | 14,943 | 16,468 | ||||||

Total operating expenses | 14,891 | 13,517 | ||||||

Income from operations | 52 | 2,951 | ||||||

Interest income and other, net | 496 | 1,049 | ||||||

Income taxes | (102 | ) | (154 | ) | ||||

Net income | $ | 446 | $ | 3,846 | ||||

Net income per share: Basic and Diluted | $ | 0.02 | $ | 0.20 | ||||

December 31, 2020 | ||||

Current assets | $ | 37,612 | ||

Long-term assets | 1,654 | |||

Total assets | $ | 39,266 | ||

Total liabilities | $ | 4,830 | ||

Total stockholders’ equity | $ | 34,436 | ||

Issuer: | Greenidge Generation Holdings Inc. |

Notes Offered: | $ aggregate principal amount of 8.50% Senior Notes due 2026 (or $ aggregate principal amount of 8.50% Senior Notes due 2026 if the underwriters’ option is exercised in full). |

Offering Price: | % of the principal amount plus accrued interest from October 13, 2021 to, but not including, , 2021, totaling $ , and any additional interest from , 2021 if settlement occurs after that date. |

Fungibility: | The Notes will be consolidated, form a single series, and be fully fungible with our outstanding 8.50% Notes due 2026 issued in an aggregate principal amount of $55.2 million on October 13, 2021. After giving effect to the offering of the Notes, the total amount outstanding of our 8.50% Notes due 2026 will be $ . |

Maturity Date: | The Notes will mature on October 31, 2026, unless redeemed prior to maturity. |

Interest Rate and Payment Dates: | 8.50% interest per annum on the principal amount of the Notes, payable quarterly in arrears on January 31, April 30, July 31 and October 31 of each year, beginning on January 31, 2022 and at maturity. |

Ranking: | The Notes will be our senior unsecured obligations and will rank: |

| • | senior to the outstanding shares of our common stock; |

| • | senior to any of our future subordinated debt; |

| • | pari passu |

| • | effectively subordinated to any existing or future secured indebtedness (including indebtedness that is initially unsecured to which we subsequently grant security), to the extent of the value of the assets securing such indebtedness; and |

| • | structurally subordinated to all existing and future indebtedness of our subsidiaries, financing vehicles or similar facilities. |

| The indenture governing the Notes does not limit the amount of indebtedness that we or our subsidiaries may incur or whether any such indebtedness can be secured by our assets. As of October 31, 2021, we had approximately $82.9 million of outstanding indebtedness, inclusive of $55.2 million of the Original Notes, which was unsecured, and approximately $0.8 million of outstanding capital lease obligations, which was secured. |

Guarantors: | The Notes will not be guaranteed by any of our subsidiaries or affiliates. |

Optional Redemption: | We may redeem the Notes for cash in whole or in part at any time at our option (i) on or after October 31, 2023 and prior to October 31, 2024, at a price equal to 102% of their principal amount, (ii) on or after October 31, 2024 and prior to October 31, 2025, at a price equal to 101% of their principal amount, and (iii) on or after October 31, 2025, at a price equal to 100% of their principal amount, plus (in each case noted above) accrued and unpaid interest to, but excluding, the date of redemption. See “ Description of Notes—Optional Redemption |

| In addition, we may redeem the Notes, in whole, but not in part, at any time at our option, at a redemption price equal to 100.5% of the principal amount plus accrued and unpaid interest to, but not including, the date of redemption, upon the occurrence of certain change of control events. See “ Description of Notes—Optional Redemption Upon Change of Control |

Sinking Fund: | The Notes will not be subject to any sinking funding (i.e., no amounts will be set aside by us to ensure repayment of the Notes at maturity). |

Use of Proceeds: | We anticipate using the net proceeds of this offering for general corporate purposes, including funding capital expenditures, future acquisitions, investments and working capital and repaying indebtedness. For additional information, see “ Use of Proceeds |

Events of Default: | Events of default generally will include failure to pay principal, failure to pay interest, failure to observe or perform any other covenant or warranty in the Notes, and the Original Notes, or in the indenture that governs the Notes, and the Original Notes, and certain events of bankruptcy, insolvency or reorganization. See “ Description of Notes—Events of Default |

No Financial Covenants: | The indenture governing the Notes does not contain financial covenants. |

Additional Notes: | We may create and issue additional Notes ranking equally and ratably with the Notes and the Original Notes in all respects, so that such further additional Notes will constitute and form a single series with the Notes and the Original Notes and will have the same terms as to |

status, redemption or otherwise (except the price to public, the issue date, and, if applicable, the initial interest accrual date and initial interest payment date) as the Notes and the Original Notes; provided that if any such further additional Notes are not fungible with the Notes initially offered hereby for U.S. federal income tax purposes, such further additional Notes will have one or more separate CUSIP numbers. |

Defeasance: | The Notes are subject to legal and covenant defeasance by us. See “ Description of Notes—Defeasance |

Listing: | The issued and outstanding Original Notes are listed on the Nasdaq Global Market and have been trading under the symbol “GREEL” since October 14, 2021. We intend to list the Notes on the Nasdaq Global Select Market under the same trading symbol. |

Form and Denomination: | The Notes will be issued in book-entry form in denominations of $25 and integral multiples thereof. The Notes will be represented by a permanent global certificate deposited with the trustee as custodian for DTC and registered in the name of a nominee of DTC. Beneficial interests in any of the Notes will be shown on, and transfers will be effected only through, records maintained by DTC and its direct and indirect participants and any such interest may not be exchanged for certificated securities, except in limited circumstances. |

Settlement: | Delivery of the Notes will be made against payment therefor on or about , 2021. |

Trustee: | Wilmington Savings Fund Society, FSB |

Governing Law: | The indenture is and the Notes will be governed by and construed in accordance with the laws of the State of New York. |

Risk factors: | Investing in the Notes involves a high degree of risk and purchasers may lose their entire investment. See “ Risk Factors |

| • | it could affect our ability to satisfy our financial obligations, including those relating to the Notes; |

| • | a substantial portion of our cash flows from operations would have to be dedicated to interest and principal payments and may not be available for operations, capital expenditures, expansion, acquisitions or general corporate or other purposes; |

| • | it may impair our ability to obtain additional debt or equity financing in the future; |

| • | it may limit our ability to refinance all or a portion of our indebtedness on or before maturity; |

| • | it may limit our flexibility in planning for, or reacting to, changes in our business and industry; and |

| • | it may make us more vulnerable to downturns in our business, our industry or the economy in general. |

| • | issue debt securities or otherwise incur additional indebtedness or other obligations, including (1) any indebtedness or other obligations that would be equal in right of payment to the Notes, (2) any indebtedness or other obligations that would be secured and therefore rank effectively senior in right of payment to the Notes to the extent of the values of the assets securing such debt, (3) indebtedness of ours that is guaranteed by one or more of our subsidiaries and which therefore is structurally senior to the Notes and (4) securities, indebtedness or obligations issued or incurred by our subsidiaries that would be senior to our equity interests in our subsidiaries and therefore rank structurally senior to the Notes with respect to the assets of our subsidiaries; |

| • | pay dividends on, or purchase or redeem or make any payments in respect of, capital stock or other securities subordinated in right of payment to the Notes; |

| • | sell assets (other than certain limited restrictions on our ability to consolidate, merge or sell all or substantially all of our assets); |

| • | enter into transactions with affiliates; |

| • | create liens (including liens on the shares of our subsidiaries) or enter into sale and leaseback transactions; |

| • | make investments; or |

| • | create restrictions on the payment of dividends or other amounts to us from our subsidiaries. |

| • | the presence of construction or repair defects or other structural or building damage; |

| • | any noncompliance with or liabilities under applicable environmental, health or safety regulations or requirements or building permit requirements; |

| • | any damage resulting from natural disasters, such as hurricanes, earthquakes, fires, floods and windstorms; |

| • | damage caused by criminal actors, such as cyberattacks, vandalism, sabotage or terrorist attacks; and |

| • | claims by employees and others for injuries sustained at our properties. |

| • | continued worldwide growth in the adoption and use of bitcoin as a medium to exchange; |

| • | governmental and quasi-governmental regulation of bitcoin and its use, or restrictions on or regulation of access to and operation of the bitcoin network or similar cryptocurrency systems; |

| • | changes in consumer demographics and public tastes and preferences; |

| • | the maintenance and development of the open-source software protocol of the network; |

| • | the increased consolidation of contributors to the bitcoin blockchain through bitcoin mining pools; |

| • | the availability and popularity of other cryptocurrencies and other forms or methods of buying and selling goods and services, including new means of using fiat currencies; |

| • | the use of the networks supporting cryptocurrencies for developing smart contracts and distributed applications; |

| • | general economic conditions and the regulatory environment relating to cryptocurrencies; |

| • | environmental restrictions on the use of electricity to mine bitcoin and a resulting decrease in global bitcoin mining operations; |

| • | an increase in bitcoin transaction costs and a resultant reduction in the use of and demand for bitcoin; and |

| • | negative consumer sentiment and perception of bitcoin specifically and cryptocurrencies generally. |

| • | changes in generation capacity in our markets, including the addition of new supplies of power as a result of the development of new plants, expansion of existing plants, the continued operation of uneconomic power plants due to state subsidies, or additional transmission capacity; |

| • | disruption to, changes in or other constraints or inefficiencies of electricity, fuel or natural gas transmission or transportation; |

| • | electric supply disruptions, including plant outages and transmission disruptions; |

| • | changes in market liquidity; |

| • | weather conditions, including extreme weather conditions and seasonal fluctuations, including the effects of climate change; |

| • | changes in commodity prices and the supply of commodities, including but not limited to natural gas and oil; |

| • | changes in the demand for power or in patterns of power usage, including the potential development of demand-side management tools and practices, distributed generation, and more efficient end-use technologies; |

| • | development of new fuels, new technologies and new forms of competition for the production of power; |

| • | fuel price volatility; |

| • | changes in capacity prices and capacity markets. |

| • | federal, state and foreign governmental environmental, energy and other regulation and legislation, including changes therein and judicial decisions interpreting such regulations and legislation; |

| • | the creditworthiness and liquidity of fuel suppliers and/or transporters and their willingness to do business with us; and |

| • | general economic and political conditions. |

| • | The performance of its partners, including the success of its partners in attracting end users of its products, which can impact the amount of revenue it derives; |

| • | Change, or reduction in or discontinuance of its programs with clients and partners; |

| • | Cancellations, rescheduling or deferrals of significant customer products or service programs; |

| • | Its reliance on a small number of partners for a substantial majority of its revenue; |

| • | Its ability to successfully license and grow revenue related to its SUPERAntiSpyware ® software, Guided Paths® , Support.com Cloud and its service offerings; |

| • | The timing of its sales to its clients and its partners’ resale of its products to end users and its ability to enter into new sales with partners and renew existing programs with its clients and partners; |

| • | The availability and cost-effectiveness of advertising placements for its software products and services and its ability to respond to changes in the advertising markets in which it participates; |

| • | The efficiency and effectiveness of its technology specialists; |

| • | Its ability to effectively match staffing levels with service volumes on a cost-effective basis; |

| • | Its ability to manage contract labor; |

| • | Its ability to hire, train, manage and retain its home-based customer support specialists and enhance the flexibility of its staffing model in a cost-effective fashion and in quantities sufficient to meet forecast requirements; |

| • | Its ability to manage costs under its self-funded health insurance program; |

| • | Usage rates on the subscriptions it offers; |

| • | Its ability to maintain a competitive cost structure for its organization; |

| • | The rate of expansion of its offerings and its investments therein; |

| • | Changes in the markets for computers and other technology devices relating to unit volume, pricing and other factors, including changes driven by declines in sales of personal computers and the growing popularity of tablets, and other mobile devices and the introduction of new devices into the connected home; |

| • | Its ability to adapt to its clients’ needs in a market space defined by frequent technological change; |

| • | Severe financial hardship or bankruptcy of one or more of its major clients; |

| • | The amount and timing of operating costs and capital expenditures in its business; |

| • | Failure to protect its intellectual property; and |

| • | Public health or safety concerns, medical epidemics or pandemics, such as COVID-19, and other natural- orman-made disasters. |

| • | the efficacy of our marketing efforts; |

| • | its ability to retain existing and obtain new customers and strategic partners; |

| • | the quality and perceived value of our services; |

| • | actions of its competitors, its strategic partners, and other third parties; |

| • | positive or negative publicity, including material on the Internet; |

| • | regulatory and other governmental related developments; and |

| • | litigation related developments. |

| • | Loss of or delay in market acceptance of its products; |

| • | Material recall and replacement costs; |

| • | Delay in revenue recognition or loss of revenue; |

| • | The diversion of the attention of its engineering personnel from product development efforts; |

| • | Support having to defend against litigation related to defective products; and |

| • | Damage to Support’s reputation in the industry that could adversely affect its relationships with its customers. |

| • | on an actual basis; |

| • | on an adjusted basis to give pro forma effect to our offering of $55.2 million of the Original Notes; and |

| • | on a further adjusted basis to give effect to this offering as if it occurred on that date, after deducting the underwriting discounts and commissions, the Structuring Fee and estimated offering expenses payable by us. |

As of September 30, 2021 | ||||||||||||

Actual | As adjusted for the Original Notes Offering | As further adjusted for this offering (1) (2) | ||||||||||

(in thousands) | ||||||||||||

Cash and cash equivalents | $ | 51,149 | $ | 103,854 | $ | |||||||

Long-term liabilities: | ||||||||||||

Deferred tax liability | 3,959 | 3,959 | ||||||||||

Notes payable, net of current portion (3) | 7,369 | 7,369 | ||||||||||

Finance lease obligation, net of current portion | 111 | 111 | ||||||||||

Asset retirement obligations | 2,380 | 2,380 | ||||||||||

Environmental trust liability | 4,994 | 4,994 | ||||||||||

Other long-term liabilities | 242 | 242 | ||||||||||

Original Notes (4) | — | 55,200 | 55,200 | |||||||||

Notes offered hereby (5) | — | — | ||||||||||

Total long-term liabilities | 19,055 | 74,255 | ||||||||||

Total Stockholders’ equity (deficit) | 202,029 | 202,029 | ||||||||||

Total capitalization | $ | 221,084 | $ | 276,284 | $ | |||||||

| (1) | Excludes up to an additional $ million aggregate principal amount of Notes issuable upon the exercise of the underwriters’ option to purchase additional Notes. |

| (2) | Excludes sales of shares of class A common stock in connection with the Purchase Agreement. |

| (3) | Excludes funding of additional notes payable associated with the purchase commitments subsequent to September 30, 2021 as disclosed below under “ Description of Other Indebtedness |

| (4) | Excludes unamortized debt issuance costs of approximately $2.6 million on the Original Notes. |

| (5) | Excludes unamortized debt issuance costs of approximately $ million on the Notes offered hereby. |

$ in thousands | Total | Less than 1 Year | 1-3 Years | |||||||||

Notes payable (1) | $ | 42,932 | $ | 25,229 | $ | 17,703 | ||||||

Leases (2) | $ | 943 | $ | 670 | $ | 273 | ||||||

Natural gas commitments (3) | $ | 9,187 | $ | 9,187 | $ | — | ||||||

Purchase commitments (4) | $ | 103,778 | $ | 103,778 | $ | — | ||||||

| (1) | The notes payable amounts presented in the above table include financed principal obligations plus estimated contractual future interest and risk premium payments. |

| (2) | Lease obligations include fixed monthly rental payments and exclude estimated revenue sharing payments. |

| (3) | Represents off balance sheet arrangements to purchase natural gas through March 1, 2022. |

| (4) | Represents miner purchase commitments as of September 30, 2021 reduced by deposits made as of September 30, 2021. |

| • | will be our general unsecured, senior obligations; |

| • | will be initially limited to an aggregate principal amount of $ (assuming no exercise of the underwriters’ option to purchase additional Notes described herein), and after giving effect to the offering, the total amount outstanding of our 8.50% Notes due 2026 will be $ ; |

| • | will mature on October 31, 2026 unless earlier redeemed or repurchased, and % of the aggregate principal amount will be paid at maturity; |

| • | will bear cash interest from October 13, 2021 at an annual rate of 8.50%, payable quarterly in arrears on January 31, April 30, July 31 and October 31 of each year, beginning on January 31, 2022, and at maturity; |

| • | be consolidated, form a single series, and be fully fungible with the Original Notes; |

| • | will be redeemable at our option, in whole or in part, at any time on or after October 31, 2023, at the prices and on the terms described under “ —Optional Redemption |

| • | will be issued in denominations of $25 and integral multiples of $25 in excess thereof; |

| • | will not have a sinking fund; |

| • | will be listed on the Nasdaq Global Select Market under the symbol “GREEL”; and |

| • | will be represented by one or more registered Notes in global form, but in certain limited circumstances may be represented by Notes in definitive form. |

| • | will be redeemable at our option, in whole, but not in part, at any time upon the occurrence of certain change of control events, at the prices and on the terms described under “ —Optional Redemption Upon Change of Control |

| (1) | any “Person” (as such term is used in Sections 13(d) and 14(d) of the Exchange Act) is or becomes the “Beneficial Owner” (as defined in Rules 13d-3 and13d-5 under the Exchange Act, except that for purposes of this clause (1) such Person shall be deemed to have “Beneficial Ownership” of all shares that any such Person has the right to acquire, whether such right is exercisable immediately or only |

| after the passage of time), directly or indirectly, of more than 50.0% of the total voting power of the Voting Stock of the Company; |

| (2) | the merger or consolidation of the Company with or into another Person or the merger of another Person with or into the Company, or the sale of all or substantially all the assets of the Company (determined on a consolidated basis) to another Person other than a transaction following which, in the case of a merger or consolidation transaction, holders of securities that represented 100.0% of the Voting Stock of the Company immediately prior to such transaction (or other securities into which such securities are converted as part of such merger or consolidation transaction) own directly or indirectly at least a majority of the voting power of the Voting Stock of the surviving Person in such merger or consolidation transaction immediately after such transaction and in substantially the same proportion as before the transaction; |

| (3) | “Continuing Directors” (as defined below) cease to constitute at least a majority of the Company’s board of directors; or |

| (4) | if after the Notes are initially listed on the Nasdaq Global Select Market or another national securities exchange, the Notes fail, or at any point cease, to be listed on the Nasdaq Global Select Market or such other national securities exchange. For the avoidance of doubt, it shall not be a Change of Control if after the Notes are initially listed on the Nasdaq Global Select Market or another national securities exchange, such Notes are subsequently listed on a different national securities exchange and the prior listing is terminated. |

| • | we do not pay interest on any Note, including the Original Notes, when due, and such default is not cured within 30 days; |

| • | we do not pay the principal of the Notes, including the Original Notes, when due and payable; |

| • | we breach any covenant or warranty in the indenture with respect to the Notes, including the Original Notes, and such breach continues for 60 days after we receive a written notice of such breach from the trustee or the holders of at least 25% of the principal amount of the Notes, including the Original Notes as a single series; and |

| • | certain specified events of bankruptcy, insolvency or reorganization occur and remain undischarged or unstayed for a period of 90 days. |

| • | such holder must give the trustee written notice that the Event of Default has occurred and remains uncured; |

| • | the holders of at least 25% of the outstanding principal of the Notes and Original Notes, as a single series, must have made a written request to the trustee to institute proceedings in respect of such Event of Default in its own name as trustee; |

| • | such holder or holders must have offered to the trustee indemnity satisfactory to the trustee against the costs, expenses and liabilities to be incurred in compliance with such request; |

| • | the trustee for 60 days after its receipt of such notice, request and offer of indemnity has failed to institute any such proceeding; and |

| • | no direction inconsistent with such written request has been given to the trustee during such 60-day period by holders of a majority of the outstanding principal of the Notes. |

| • | the direction so given by the holder is not in conflict with any law or the indenture, nor does it subject the trustee to a risk of personal liability in respect of which the trustee has not received indemnification satisfactory to it in its sole discretion against all losses, liabilities and expenses caused by taking or not taking such action; and |

| • | the trustee may take any other action deemed proper by the trustee which is not inconsistent with such direction. |

| • | the holder has given written notice to the trustee of a continuing Event of Default; |

| • | the holders of at least 25% in aggregate principal amount of the then-outstanding Notes and Original Notes, as a single series, have made written request to the trustee to institute proceedings in respect of such Event of Default in its own name as trustee under the indenture, and such holders have offered security or indemnity satisfactory to the trustee to institute the proceeding as trustee; and |

| • | the trustee does not institute the proceeding, and does not receive from the holders of a majority in aggregate principal amount of the outstanding Notes other conflicting directions within 60 days after the notice, request and offer. |

| • | we are the surviving entity or the entity (if other than us) formed by such merger or consolidation or to which such sale, transfer, lease, conveyance or disposition is made will be a corporation or limited liability company organized and existing under the laws of the United States of America, any state thereof or the District of Columbia; |

| • | the surviving entity (if other than us) expressly assumes, by supplemental indenture in form reasonably satisfactory to the trustee, executed and delivered to the trustee by such surviving entity, the due and punctual payment of the principal of, and premium, if any, and interest on, all the Notes outstanding, and the due and punctual performance and observance of all the covenants and conditions of the indenture to be performed by us; |

| • | immediately after giving effect to such transaction or series of related transactions, no default or Event of Default has occurred and is continuing; and |

| • | in the case of a merger where the surviving entity is other than us, we or such surviving entity will deliver, or cause to be delivered, to the trustee, an officers’ certificate and an opinion of counsel, each stating that such transaction and the supplemental indenture, if any, in respect thereto, comply with this covenant and that all conditions precedent in the indenture relating to such transaction have been complied with; provided that in giving an opinion of counsel, counsel may rely on an officers’ certificate as to any matters of fact, including as to the satisfaction of the preceding bullet. |

| • | to evidence the succession of another corporation, and the assumption by the successor corporation of our covenants, agreements and obligations under the indenture and the Notes; |

| • | to add to our covenants such new covenants, restrictions, conditions or provisions for the protection of the holders of the Notes, and to make the occurrence, or the occurrence and continuance, of a default in any of such additional covenants, restrictions, conditions or provisions an Event of Default; |

| • | to modify, eliminate or add to any of the provisions of the indenture to such extent as necessary to effect the qualification of the indenture under the Trust Indenture Act, and to add to the indenture such other provisions as may be expressly permitted by the Trust Indenture Act, excluding however, the provisions referred to in Section 316(a)(2) of the Trust Indenture Act; |

| • | to cure any ambiguity or to correct or supplement any provision contained in the indenture or in any supplemental indenture which may be defective or inconsistent with other provisions; |

| • | to secure the Notes; |

| • | to evidence and provide for the acceptance and appointment of a successor trustee and to add or change any provisions of the indenture as necessary to provide for or facilitate the administration of the trust by more than one trustee; and |

| • | to make provisions in regard to matters or questions arising under the indenture, so long as such other provisions do not materially affect the interest of any other holder of the Notes. |

| • | changing the stated maturity of the principal of, or any installment of interest on, any Note; |

| • | reducing the principal amount or rate of interest of any Note; |

| • | changing the place of payment where any Note or any interest is payable; |

| • | impairing the right to institute suit for the enforcement of any payment on or after the date on which it is due and payable; |

| • | reducing the percentage in principal amount of holders of the Notes whose consent is needed to modify or amend the indenture; and |

| • | reducing the percentage in principal amount of holders of the Notes whose consent is needed to waive compliance with certain provisions of the indenture or to waive certain defaults. |

| • | Notes and Original Notes, as a single series, cancelled by the trustee or delivered to the trustee for cancellation; |

| • | Notes and Original Notes, as a single series, for which we have deposited with the trustee or paying agent or set aside in trust money for their payment or redemption and, if money has been set aside for the redemption of the Notes, notice of such redemption has been duly given pursuant to the indenture to the satisfaction of the trustee; |

| • | Notes and Original Notes, as a single series, held by the Company, its subsidiaries or any other entity which is an obligor under the Notes, unless such Notes have been pledged in good faith and the pledgee is not the Company, an affiliate of the Company or an obligor under the Notes; |

| • | Notes and Original Notes, as a single series, which have undergone full defeasance, as described below; and |

| • | Notes and Original Notes, as a single series, which have been paid or exchanged for other Notes due to such Notes loss, destruction or mutilation, with the exception of any such Notes held by bona fide purchasers who have presented proof to the trustee that such Notes are valid obligations of the Company. |

| • | register the transfer or exchange of the Notes; |

| • | replace stolen, lost or mutilated Notes; |

| • | maintain paying agencies; and |

| • | hold monies for payment in trust. |

| • | we must irrevocably deposit or cause to be deposited with the trustee as trust funds for the benefit of all holders of the Notes cash, U.S. government obligations or a combination of cash and U.S. government obligations sufficient, without reinvestment, in the opinion of a nationally recognized firm of independent public accountants, investment bank or appraisal firm, to generate enough cash to make interest, principal and any other applicable payments on the Notes on their various due dates; |

| • | we must deliver to the trustee an opinion of counsel stating that under U.S. federal income tax law, we may make the above deposit and covenant defeasance without causing holders to be taxed on the Notes differently than if those actions were not taken; |

| • | we must deliver to the trustee an officers’ certificate stating that the Notes, if then listed on any securities exchange, will not be delisted as a result of the deposit; |

| • | no default or Event of Default with respect to the Notes has occurred and is continuing, and no defaults or Events of Defaults related to bankruptcy, insolvency or organization occurs during the 90 days following the deposit; |

| • | the covenant defeasance must not cause the trustee to have a conflicting interest within the meaning of the Trust Indenture Act; |

| • | the covenant defeasance must not result in a breach or violation of, or constitute a default under, the indenture or any other material agreements or instruments to which we are a party; |

| • | the covenant defeasance must not result in the trust arising from the deposit constituting an investment company within the meaning of the Investment Company Act of 1940, as amended (the “Investment Company Act”), unless such trust will be registered under the Investment Company Act or exempt from registration thereunder; and |

| • | we must deliver to the trustee an officers’ certificate and an opinion of counsel stating that all conditions precedent with respect to the covenant defeasance have been complied with. |

| • | we must irrevocably deposit or cause to be deposited with the trustee as trust funds for the benefit of all holders of the Notes cash, U.S. government obligations or a combination of cash and U.S. government obligations sufficient, without reinvestment, in the opinion of a nationally recognized firm, of independent public accountants, investment bank or appraisal firm, to generate enough cash to make interest, principal and any other applicable payments on the Notes on their various due dates; |

| • | we must deliver to the trustee an opinion of counsel confirming that there has been a change to the current U.S. federal income tax law or an Internal Revenue Service ruling that allows us to make the above deposit without causing holders to be taxed on the Notes any differently than if we did not make the deposit; |

| • | we must deliver to the trustee an officers’ certificate stating that the Notes, if then listed on any securities exchange, will not be delisted as a result of the deposit; |

| • | no default or Event of Default with respect to the Notes has occurred and is continuing and no defaults or Events of Defaults related to bankruptcy, insolvency or organization occurs during the 90 days following the deposit; |

| • | the full defeasance must not cause the trustee to have a conflicting interest within the meaning of the Trust Indenture Act; |

| • | the full defeasance must not result in a breach or violation of, or constitute a default under, the indenture or any other material agreements or instruments to which we are a party; |

| • | the full defeasance must not result in the trust arising from the deposit constituting an investment company within the meaning of the Investment Company Act unless such trust will be registered under the Investment Company Act or exempt from registration thereunder; and |

| • | we must deliver to the trustee an officers’ certificate and an opinion of counsel stating that all conditions precedent with respect to the full defeasance have been complied with. |

| • | DTC notified us at any time that it is unwilling or unable to continue as depositary for the Global Notes; |

| • | DTC ceases to be registered as a clearing agency under the Securities Exchange Act of 1934, as amended; or |

| • | an Event of Default with respect to such Global Note has occurred and is continuing. |

Greenidge | Reorganization Pro Forma Adjustments | Note 4 | Pro Forma Greenidge Post Reorganization | Support | Merger Pro Forma Adjustments | Note 4 | Pro Forma Combined | |||||||||||||||||||||||||

Revenues | $ | 20,114 | $ | — | $ | 20,114 | $ | 43,864 | — | $ | 63,978 | |||||||||||||||||||||

Cost of revenues (exclusive of depreciation and amortization shown below) | 12,600 | — | 12,600 | 28,921 | (247 | ) | (g | ) | 41,274 | |||||||||||||||||||||||

Engineering and IT | — | — | — | 3,655 | (5 | ) | (g | ) | 3,650 | |||||||||||||||||||||||

Selling, general and administrative | 5,581 | — | 5,581 | 11,236 | (67 | ) | (g | ) | 16,750 | |||||||||||||||||||||||

Depreciation and amortization | 4,564 | — | 4,564 | — | 319 | (g | ) | 9,312 | ||||||||||||||||||||||||

| 4,429 | (c | ) | ||||||||||||||||||||||||||||||

Income (loss) from operations | (2,631 | ) | — | (2,631 | ) | 52 | (4,429 | ) | (7,008 | ) | ||||||||||||||||||||||

Interest income (expense) and other | (659 | ) | 573 | (d) | (86 | ) | 496 | — | 410 | |||||||||||||||||||||||

Income (loss) before income taxes | (3,290 | ) | 573 | (2,717 | ) | 548 | (4,429 | ) | (6,598 | ) | ||||||||||||||||||||||

Income tax provision | — | 482 | (f | ) | 482 | 102 | (1,218 | ) | (e | ) | (634 | ) | ||||||||||||||||||||

Net income (loss) | $ | (3,290 | ) | $ | 91 | $ | (3,199 | ) | $ | 446 | $ | (3,211 | ) | $ | (5,964 | ) | ||||||||||||||||

Net income (loss) per common share: | ||||||||||||||||||||||||||||||||

Basic | ($ | 0.11 | ) | $ | 0.02 | ($ | 0.19 | ) | ||||||||||||||||||||||||

Diluted | ($ | 0.11 | ) | $ | 0.02 | ($ | 0.19 | ) | ||||||||||||||||||||||||

Weighted average common shares outstanding: | ||||||||||||||||||||||||||||||||

Basic | 28,000 | (b) | 28,000 | 19,192 | (19,192 | ) | (a | ) | 30,961 | |||||||||||||||||||||||

| 2,961 | (h | ) | ||||||||||||||||||||||||||||||

Diluted | 28,000 | (b) | 28,000 | 19,369 | (19,369 | ) | (a | ) | 30,961 | |||||||||||||||||||||||

| 2,961 | (h | ) | ||||||||||||||||||||||||||||||

$ in thousands, except per share amount | ||||

Support common stock exchanged | 25,745,487 | |||

Exchange ratio | 0.115 | |||

Greenidge Class A common stock exchanged | 2,960,731 | |||

Greenidge common stock value per share | $ | 31.71 | ||

Consideration paid | $ | 93,885 | ||

$ in thousands | ||||

Cash and cash equivalents | $ | 27,113 | ||

Short term investments | 496 | |||

Accounts receivable | 5,383 | |||

Prepaid expenses and other current assets | 713 | |||

Property and equipment | 1,349 | |||

Other long-term assets | 383 | |||

Accounts payable | (117 | ) | ||

Accrued expenses and other current liabilities | (3,328 | ) | ||

Other long-term liabilities | (242 | ) | ||

Intangible assets | 22,690 | |||

Deferred tax liability | (6,904 | ) | ||

Goodwill | 46,349 | |||

Total consideration | $ | 93,885 | ||

$ in thousands | ||||||||

Identifiable Intangible Asset | Useful Life | Fair Value | ||||||

Customer relationships | 5 years | $ | 21,600 | |||||

Tradename | 10 years | 1,090 | ||||||

Total identifiable intangible assets | $ | 22,690 | ||||||

| (a) | Represents the elimination of the historical equity of Support. |

| (b) | Reflects the March 16, 2021 amendments to the organizational documents of Greenidge whereby (i) Greenidge established its class A common stock (with one vote per share) and class B common stock (with ten votes per share), (ii) all then outstanding common stock of Greenidge was converted to class B common stock, and (iii) a forward split of 4 for 1 was effected for all outstanding common stock of Greenidge. In connection with this, the effective conversion rate for the series A preferred stock issued in the Series A Private Placement was adjusted to provide that each share of series A preferred stock will be converted into four shares of class B common stock upon the filing and effectiveness of a registration statement registering such underlying class B common stock for resale. These events eliminated the historical equity of GGH and established class A common stock and class B common stock at a par value of $0.0001 per share. |

| (c) | Reflects an adjustment for amortization of intangible assets, consisting of customer relationships and the Support.com trade name, recognized as a result of the transaction. The estimated value for the customer relationships is $21.6 million, which was determined by the present value of expected cash flows from such relationships. The estimated value of the customer relationships is assumed to be amortized over five years on a straight-line basis. The estimated value of the Support.com trade name is $1.3 million, which was based on the present value of discrete royalties avoided plus the present value of the tax amortization benefit. The estimated value of the trade name is assumed to be amortized over 10 years on a straight line basis. |

| (d) | Reflects the elimination of interest expense related to loans from Greenidge’s controlling shareholder that have been deemed fully satisfied. |

| (e) | Adjusts the tax provision to reflect the impact on the income tax provision resulting from the proforma adjustments, while assuming that the consolidated entity is a taxable entity due to the reorganization from an LLC to a corporation as of January 1, 2020. |

| (f) | Reflects an adjustment for the proforma effect of the reorganization from an LLC to a corporation, as if the reorganization occurred on January 1, 2020, to recognize a deferred tax liability for the differences between the recorded values and tax bases of assets and liabilities. |

| (g) | Adjusts Support’s results to present depreciation and amortization as a separate line item, consistent with Greenidge’s presentation. |

| (h) | Reflects the issuance of 2,960,731 shares of class A common stock to consummate the Merger, as if the Merger occurred on January 1, 2020. |

| • | Approximately 15,900 S19j Pro Bitmain Antminers scheduled for deployment beginning in the first quarter of 2022 and continuing through the third quarter of 2022; |

| • | Approximately 800 S19j Bitmain Antminers scheduled for deployment in the fourth quarter of 2021; and |

| • | Approximately 500 MicroBT M30 Whatsminers scheduled for deployment in the fourth quarter of 2021. |

Quarters Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||

$ in thousands | 2021 | 2020 | Variance | 2021 | 2020 | Variance | ||||||||||||||||||

Total revenue | $ | 35,754 | $ | 6,123 | 483.9 | % | $ | 62,993 | $ | 13,937 | 352.0 | % | ||||||||||||

Cost of revenue (exclusive of depreciation and amortization shown below) | 9,659 | 4,072 | 137.2 | % | 19,046 | 8,681 | 119.4 | % | ||||||||||||||||

Selling, general and administrative expenses | 5,446 | 1,493 | 264.8 | % | 12,017 | 4,131 | 190.9 | % | ||||||||||||||||

Merger and other costs | 29,847 | — | 31,095 | — | ||||||||||||||||||||

Depreciation and amortization | 2,667 | 1,064 | 150.7 | % | 5,531 | 3,227 | 71.4 | % | ||||||||||||||||

Loss from operations | (11,865 | ) | (506 | ) | N/A | (4,696 | ) | (2,102 | ) | N/A | ||||||||||||||

Other (expense) income: | ||||||||||||||||||||||||

Interest expense, net | (1,009 | ) | — | N/A | (1,377 | ) | — | N/A | ||||||||||||||||

Interest expense - related party | — | — | N/A | (22 | ) | (540 | ) | -95.9 | % | |||||||||||||||

Loss on sale of digital assets | 18 | 36 | -50.0 | % | 159 | 11 | N/A | |||||||||||||||||

Other (expense) income, net | (29 | ) | 181 | -116.0 | % | (23 | ) | 165 | N/A | |||||||||||||||

Total other (expense) income, net | (1,020 | ) | 217 | -570.0 | % | (1,263 | ) | (364 | ) | 247.0 | % | |||||||||||||

Loss before income taxes | (12,885 | ) | (289 | ) | N/A | (5,959 | ) | (2,466 | ) | 141.6 | % | |||||||||||||

(Benefit) provision for income taxes | (4,989 | ) | — | N/A | (2,860 | ) | — | N/A | ||||||||||||||||

Net loss | $ | (7,896 | ) | $ | (289 | ) | N/A | $ | (3,099 | ) | $ | (2,466 | ) | N/A | ||||||||||

Adjusted Amounts (a) | ||||||||||||||||||||||||

Income (loss) from operations | $ | 18,110 | $ | (506 | ) | $ | 26,527 | $ | (2,102 | ) | ||||||||||||||

Operating margin | 50.7 | % | -8.3 | % | 42.1 | % | -15.1 | % | ||||||||||||||||

Net income (loss) | $ | 12,166 | $ | (289 | ) | $ | 17,868 | $ | (2,466 | ) | ||||||||||||||

Other Financial Data (a) | ||||||||||||||||||||||||

EBITDA | $ | (9,209 | ) | $ | 775 | $ | 971 | $ | 1,301 | |||||||||||||||

as a percent of revenues | -25.8 | % | 12.7 | % | 1.5 | % | 9.3 | % | ||||||||||||||||

Adjusted EBITDA | $ | 21,177 | $ | 775 | $ | 33,668 | $ | 1,301 | ||||||||||||||||

as a percent of revenues | 59.2 | % | 12.7 | % | 53.4 | % | 9.3 | % | ||||||||||||||||

| (a) | Adjusted Amounts and Other Financial Data are non-GAAP performance measures. A reconciliation of reported amounts to adjusted amounts can be found in the “Non-GAAP Measures and Reconciliations |

Quarters Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||

$ in thousands | 2021 | 2020 | Variance | 2021 | 2020 | Variance | ||||||||||||||||||

Cryptocurrency mining | $ | 31,156 | $ | 3,043 | 923.9 | % | $ | 54,217 | $ | 8,673 | 525.1 | % | ||||||||||||

Power and capacity | 3,077 | 3,080 | -0.1 | % | 7,255 | 5,264 | 37.8 | % | ||||||||||||||||

Services and other | 1,521 | — | N/A | 1,521 | — | N/A | ||||||||||||||||||

Total revenue | $ | 35,754 | $ | 6,123 | 483.9 | % | $ | 62,993 | $ | 13,937 | 352.0 | % | ||||||||||||

Quarters Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2021 2020 | 2021 | 2020 | ||||||||||||||

Cryptocurrency mining | 87.1 | % | 49.7 | % | 86.1 | % | 62.2 | % | ||||||||

Power and capacity | 8.6 | % | 50.3 | % | 11.5 | % | 37.8 | % | ||||||||

Services and other | 4.3 | % | N/A | 2.4 | % | N/A | ||||||||||

Total revenue | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||

Quarters Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||

$ in thousands | 2021 | 2020 | Variance | 2021 | 2020 | Variance | ||||||||||||||||||

Cryptocurrency mining | $ | 5,974 | $ | 1,027 | 481.7 | % | $ | 11,504 | $ | 2,966 | 287.9 | % | ||||||||||||

Power and capacity | 2,831 | 3,045 | -7.0 | % | 6,688 | 5,715 | 17.0 | % | ||||||||||||||||

Services and other | 854 | — | N/A | 854 | — | N/A | ||||||||||||||||||

Total cost of revenue | $ | 9,659 | $ | 4,072 | 137.2 | % | $ | 19,046 | $ | 8,681 | 119.4 | % | ||||||||||||

As a percentage of total revenue | 27.0 | % | 66.5 | % | 30.2 | % | 62.3 | % | ||||||||||||||||

Quarters Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||

$ in thousands | 2021 | 2020 | Variance | 2021 | 2020 | Variance | ||||||||||||||||||

REVENUES | ||||||||||||||||||||||||

Cryptocurrency Mining and Power Generation | $ | 34,233 | $ | 6,123 | 459.1 | % | $ | 61,472 | $ | 13,937 | 341.1 | % | ||||||||||||

Support Services | 1,521 | — | N/A | 1,521 | — | N/A | ||||||||||||||||||

Total Revenues | $ | 35,754 | $ | 6,123 | 483.9 | % | $ | 62,993 | $ | 13,937 | 352.0 | % | ||||||||||||

SEGMENT ADJUSTED EBITDA | ||||||||||||||||||||||||

Cryptocurrency Mining and Power Generation | $ | 20,973 | $ | 775 | 2606.2 | % | $ | 33,464 | $ | 1,301 | 2472.2 | % | ||||||||||||

Support Services | 204 | — | N/A | 204 | — | N/A | ||||||||||||||||||

Total Adjusted EBITDA | $ | 21,177 | $ | 775 | 2632.5 | % | $ | 33,668 | $ | 1,301 | 2487.9 | % | ||||||||||||

Reconciliation to loss before income taxes: | ||||||||||||||||||||||||

Depreciation and amortization | (2,667 | ) | (1,064 | ) | (5,531 | ) | (3,227 | ) | ||||||||||||||||

Stock-based compensation | (411 | ) | — | (1,474 | ) | — | ||||||||||||||||||

Merger and other costs | (29,847 | ) | — | (31,095 | ) | — | ||||||||||||||||||

Expansion costs | (128 | ) | — | (128 | ) | — | ||||||||||||||||||

Interest expense, net | (1,009 | ) | — | (1,399 | ) | (540 | ) | |||||||||||||||||

Consolidated loss before income taxes | $ | (12,885 | ) | $ | (289 | ) | $ | (5,959 | ) | $ | (2,466 | ) | ||||||||||||

$ in thousands, except $ per MWh and average Bitcoin price | Quarters Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

2021 | 2020 | Variance | 2021 | 2020 | Variance | |||||||||||||||||||

Cryptocurrency mining | $ | 31,156 | $ | 3,043 | 923.9 | % | $ | 54,217 | $ | 8,673 | 525.1 | % | ||||||||||||

Power and capacity | 3,077 | 3,080 | -0.1 | % | 7,255 | 5,264 | 37.8 | % | ||||||||||||||||

Total revenue | $ | 34,233 | $ | 6,123 | 459.1 | % | $ | 61,472 | $ | 13,937 | 341.1 | % | ||||||||||||

MWh | ||||||||||||||||||||||||

Cryptocurrency mining | 87,111 | 41,960 | 107.6 | % | 199,200 | 90,746 | 119.5 | % | ||||||||||||||||

Power and capacity | 44,915 | 89,028 | -49.5 | % | 126,990 | 175,602 | -27.7 | % | ||||||||||||||||

Revenue per MWh | ||||||||||||||||||||||||

Cryptocurrency mining | $ | 358 | $ | 73 | 393.2 | % | $ | 272 | $ | 96 | 184.8 | % | ||||||||||||

Power and capacity | $ | 69 | $ | 35 | 98.0 | % | $ | 57 | $ | 30 | 90.6 | % | ||||||||||||

Cost of revenue (exclusive of depreciation and amortization) | ||||||||||||||||||||||||

Cryptocurrency mining | $ | 5,974 | $ | 1,027 | 481.7 | % | $ | 11,504 | $ | 2,966 | 287.9 | % | ||||||||||||

Power and capacity | $ | 2,831 | $ | 3,045 | -7.0 | % | $ | 6,688 | $ | 5,715 | 17.0 | % | ||||||||||||

Cost of revenue per MWh (exclusive of depreciation and amortization) | ||||||||||||||||||||||||

Cryptocurrency mining | $ | 69 | $ | 24 | 180.2 | % | $ | 58 | $ | 33 | 76.7 | % | ||||||||||||

Power and capacity | $ | 63 | $ | 34 | 84.3 | % | $ | 53 | $ | 33 | 61.8 | % | ||||||||||||

Cryptocurrency Mining Metrics | ||||||||||||||||||||||||

Bitcoins mined | 729 | 246 | 189.9 | % | 1,257 | 919 | 34.4 | % | ||||||||||||||||

Average Bitcoin price | $ | 41,937 | $ | 10,629 | 294.6 | % | $ | 44,614 | $ | 9,287 | 380.4 | % | ||||||||||||

Average hash rate (EH/s) | 188.3 | % | 86.4 | % | ||||||||||||||||||||

Average difficulty | -6.6 | % | 24.5 | % | ||||||||||||||||||||

Quarters Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

$ in thousands | 2021 | 2020 | 2021 | 2020 | ||||||||||||

Adjusted operating income (loss) | ||||||||||||||||

Loss from operations | $ | (11,865 | ) | $ | (506 | ) | $ | (4,696 | ) | $ | (2,102 | ) | ||||

Add: Merger and other costs | 29,847 | — | 31,095 | — | ||||||||||||

Add: Expansion costs | 128 | — | 128 | — | ||||||||||||

Adjusted income (loss) from operations | $ | 18,110 | $ | (506 | ) | $ | 26,527 | $ | (2,102 | ) | ||||||

Adjusted operating margin | 50.7 | % | -8.3 | % | 42.1 | % | -15.1 | % | ||||||||

Adjusted net income (loss) | ||||||||||||||||

Net loss | $ | (7,896 | ) | $ | (289 | ) | $ | (3,099 | ) | $ | (2,466 | ) | ||||

Add: Merger and other costs, after tax | 19,969 | — | 20,874 | — | ||||||||||||

Add: Expansion costs, after tax | 93 | — | 93 | — | ||||||||||||

Adjusted net income (loss) | $ | 12,166 | $ | (289 | ) | $ | 17,868 | $ | (2,466 | ) | ||||||

EBITDA and Adjusted EBITDA | ||||||||||||||||

Net loss | $ | (7,896 | ) | $ | (289 | ) | $ | (3,099 | ) | $ | (2,466 | ) | ||||

Provision for income taxes | (4,989 | ) | — | (2,860 | ) | — | ||||||||||

Interest expense, net | 1,009 | — | 1,399 | 540 | ||||||||||||

Depreciation and amortization | 2,667 | 1,064 | 5,531 | 3,227 | ||||||||||||

EBITDA | (9,209 | ) | 775 | 971 | 1,301 | |||||||||||

Stock-based compensation | 411 | — | 1,474 | — | ||||||||||||

Merger and other costs | 29,847 | — | 31,095 | — | ||||||||||||

Expansion costs | 128 | — | 128 | — | ||||||||||||

Adjusted EBITDA | $ | 21,177 | $ | 775 | $ | 33,668 | $ | 1,301 | ||||||||

$ in thousands | Total | Less than 1 Year | 1 - 3 Years | |||||||||

Notes payable (1) | $ | 42,932 | $ | 25,229 | $ | 17,703 | ||||||

Leases (2) | $ | 943 | $ | 670 | $ | 273 | ||||||

Natural gas commitments (3) | $ | 9,187 | $ | 9,187 | $ | — | ||||||

Purchase commitments (4) | $ | 103,778 | $ | 103,778 | $ | — | ||||||

| (1) | The Notes payable amounts presented in the above table include financed principal obligations plus estimated contractual future interest and risk premium payments. |

| (2) | Lease obligations include fixed monthly rental payments and exclude estimated revenue sharing payments. |

| (3) | Represents off balance sheet arrangements to purchase natural gas through March 1, 2022. |

| (4) | Represents miner purchase commitments as of September 30, 2021 reduced by deposits made as of September 30, 2021. |

Nine Months Ended September 30, | ||||||||

$ in thousands | 2021 | 2020 | ||||||

Net cash provided by operating activities | $ | 26,666 | $ | 788 | ||||

Net cash used in investing activities | (38,644 | ) | (9,302 | ) | ||||

Net cash provided by financing activities | 58,075 | — | ||||||

Net change in cash and cash equivalents | 46,097 | (8,514 | ) | |||||

Cash and cash equivalents at beginning of year | 5,052 | 11,750 | ||||||

Cash and cash equivalents at end of period | $ | 51,149 | $ | 3,236 | ||||

| • | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

| • | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| • | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay,” “say-on-frequency” |

| • | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the CEO’s compensation to median employee compensation. |

| • | Bitcoin-Mining |

| • | Independent Electric Generation |

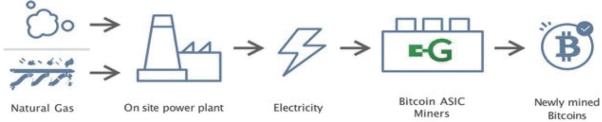

February 2014: | GGH acquired Greenidge Generation as an idled coal-fired facility. | |

October 2016: | Greenidge Generation received all required permits to restart the power plant as a natural gas facility after 2.5 years. | |

October 2016: | Commenced construction on an approximately 4.6 mile natural gas pipeline and coal-to-gas | |

March 2017: | Commenced commercial operations as a wholesale power generator. | |

April 2018: | Began test mining bitcoin. | |

May 2019: | Completed construction on an approximately 1 MW bitcoin mining pilot program. | |

July 2019: | Ordered 5,000 next-generation ASIC miners. | |

January 2020: | Commenced commercial bitcoin mining operations. | |

July 2020: | Launched full-service data center for blockchain services and added approximately 5 MW of customer-owned hosted mining. | |

November 2020: | Ordered and financed 6,000 additional next-generation ASIC miners. | |

March/April 2021: | Purchased and deployed approximately 745 miners and placed orders for an additional 4,200 miners to be deployed over the course of 2021 and 2022. | |

May 2021: | Ordered an additional 2,100 miners to be deployed over the course of 2021 and 2022 and committed to operate an entirely carbon neutral mining operation through the purchase of voluntary carbon offsets. | |

July 2021: | Purchased and deployed an additional 950 miners. | |

September 2021: | Acquisition of Support.com and public listing of our class A common stock. | |

October 2021: | Subsidiary of Greenidge entered into a Purchase and Sale Agreement for a property in Spartanburg, South Carolina, at which Greenidge intends to develop its next bitcoin mining operation, using existing electrical infrastructure at the location. Additionally, Greenidge entered into exclusive agreements regarding the potential construction of new data centers in Texas and an agreement giving it an exclusive right of first refusal at multiple power generation sites in the ERCOT market. | |

| • | Capacity revenue : We receive capacity revenue for committing to sell power to the NYISO when dispatched. |

| • | Energy revenue : When dispatched by the NYISO, we receive energy revenue based on the hourly price of power. |

| • | Ancillary services revenue : When selected by the NYISO, we receive compensation for the provision of operating reserves. |

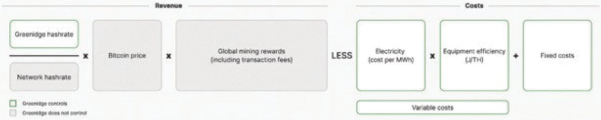

| • | the cost of electricity; |

| • | the efficiency of mining equipment; |

| • | fluctuations in the price of bitcoin; and |

| • | a miner’s proportionate share of the global hash rate. |

| • | Bitfarms Technologies Ltd. (formerly Blockchain Mining Ltd.); |

| • | DMG Blockchain Solutions Inc.; |

| • | Digihost International, Inc.; |

| • | Hive Blockchain Technologies Inc.; |

| • | Hut 8 Mining Corp.; |

| • | HashChain Technology, Inc.; |

| • | MGT Capital Investments, Inc.; |

| • | Layer1 Technologies, LLC; |

| • | Marathon Patent Group, Inc.; |

| • | Northern Data AG; |

| • | Riot BlockChain, Inc.; and |

| • | Cipher Mining / Good Works Acquisition Corp. |

| • | Vertical integration |

| • | Low power costs |

| • | Bitcoin market upside |

| • | Power market upside |

| • | Self-reliance behind-the-meter |

| • | Relatively stable regulatory environment low-cost power environments. |

| • | Cryptocurrency experience low-cost ASIC mining computers of proven performance. |

| • | Blue-chip backing |

| • | Customer Support Solutions |

| • | Technical Support Programs one-time purchase. Support also offers a subscription-based tech support servicedirect-to-consumers |

| • | End-User Software® software is a malware protection and removal software product available for the Windows OS on personal computers and tablets. The software is licensed on an annual basis, and is sold direct to consumers and businesses, or throughre-sellers. |

Department/Function | Employees | |||

Management | 8 | |||

Accounting/Finance | 2 | |||

Administration | 5 | |||

Operations | 30 | |||

TOTALS | 45 | |||

Name | Age | Position | ||||

Jeffrey Kirt | 48 | Chief Executive Officer and Director | ||||

Dale Irwin | 50 | President | ||||

Timothy Rainey | 35 | Chief Financial Officer | ||||

Timothy Fazio | 48 | Chairman | ||||

Ted Rogers | 51 | Vice Chairman | ||||

Andrew Bursky | 64 | Director | ||||

David Filippelli | 48 | Director | ||||

Jerome Lay | 32 | Director | ||||

Timothy Lowe | 62 | Director | ||||

Michael Neuscheler | 60 | Director | ||||

Daniel Rothaupt | 69 | Director | ||||

| • | been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offences); |

| • | had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time; |

| • | been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity; |

| • | been found by a court of competent jurisdiction in a civil action or by the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

| • | been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist |

| • | been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

| • | independent director representation on our audit, compensation and nominating and corporate governance committees, when we can no longer or choose not to take advantage of the “controlled company” exemption outlined below, and regular “executive session” meetings of our independent directors without the presence of our corporate officers or non-independent directors; |

| • | qualification of at least one of our directors as an “audit committee financial expert” as defined by the SEC; and |

| • | adoption of other corporate governance best practices, including limits on the number of directorships held by our directors to prevent “overboarding” and implementation a robust director education program. |

| • | appointing, compensating, retaining and oversighting the work of any registered public accounting firm engaged (including resolution of disagreements between management and the auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for Greenidge, and each such registered public accounting firm must report directly to the Audit Committee; |

| • | selection and oversight of the Internal Auditor; |

| • | reviewing and approving the appointment and replacement of the head of the internal auditing department; |