Filed Pursuant to Rule 424(b)(4)

File No. 333-261163

PROSPECTUS

$17,000,000

GREENIDGE GENERATION HOLDINGS INC.

8.50% Senior Notes due 2026

We are offering $17,000,000 aggregate principal amount of our 8.50% Senior Notes due 2026 (the “Notes”). The Notes will be a further issuance of, rank equally in right of payment with, be fully fungible with, and form a single series for all purposes under the indenture governing the Notes, including, without limitation, waivers, amendments, consents, redemptions and other offers to purchase, with the $55,200,000 aggregate principal amount of 8.50% Senior Notes due 2026 that we issued on October 13, 2021 (the “Original Notes”). Interest on the Notes will accrue from October 13, 2021, and will be paid quarterly in arrears on January 31, April 30, July 31 and October 31 of each year, commencing on January 31, 2022, and at maturity. The Notes will mature on October 31, 2026. We may redeem the Notes for cash in whole or in part at any time at our option (i) on or after October 31, 2023 and prior to October 31, 2024, at a price equal to 102% of their principal amount, (ii) on or after October 31, 2024 and prior to October 31, 2025, at a price equal to 101% of their principal amount, and (iii) on or after October 31, 2025, at a price equal to 100% of their principal amount, plus (in each case noted above) accrued and unpaid interest to, but excluding, the date of redemption. See “Description of Notes—Optional Redemption.” In addition, we may redeem the Notes, in whole, but not in part, at any time at our option, at a redemption price equal to 100.5% of the principal amount plus accrued and unpaid interest to, but not including, the date of redemption, upon the occurrence of certain change of control events, as described under “Description of Notes—Optional Redemption Upon Change of Control.” The Notes will be issued in denominations of $25 and in integral multiples thereof.

The Notes will be our senior unsecured obligations, will rank equally in right of payment with all of our existing and future senior unsecured indebtedness, including the Original Notes, and will be senior to any other indebtedness expressly made subordinate to the Notes. The Notes will be effectively subordinated to all of our existing and future secured indebtedness (to the extent of the value of the assets securing such indebtedness) and structurally subordinated to all existing and future liabilities of our subsidiaries, including trade payables.

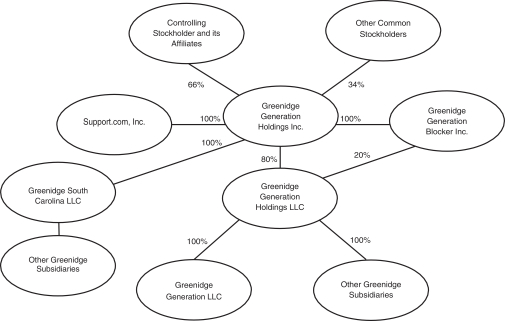

On September 14, 2021, we consummated the transactions contemplated by that certain Agreement and Plan of Merger, dated as of March 19, 2021, (the “Merger Agreement”), by and among Greenidge, Support.com, Inc. (“Support”) and GGH Merger Sub, Inc. (“Merger Sub”). As contemplated by the Merger Agreement, Merger Sub merged with and into Support, the separate corporate existence of Merger Sub ceased and Support survived as a wholly owned subsidiary of Greenidge (such transaction, the “Merger”).

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), and are subject to reduced public company reporting requirements.

We are also a “controlled company” under the rules of The Nasdaq Stock Market LLC (“Nasdaq”) and may take advantage of certain corporate governance exemptions afforded to a “controlled company” under the rules of Nasdaq.

Investing in the Notes involves a high degree of risk. See “Risk Factors” beginning on page 16 to read about factors you should consider before you make an investment decision.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Original Notes are listed on the Nasdaq Global Market and have been trading under the symbol “GREEL” since October 14, 2021. On December 2, 2021, the last reported sale price of the Original Notes on the Nasdaq Global Market was $24.50. We intend to list the Notes offered hereby on the Nasdaq Global Select Market under the same trading symbol. We have no obligation to maintain such listing, and we may delist the Notes at any time.

| | | | | | | | |

| | | Per Note | | | Total(3)(4) | |

Public offering price(1) | | $ | 24.50 | | | $ | 16,660,000 | |

Underwriting discount(2) | | $ | 0.8575 | | | $ | 583,100 | |

Proceeds, before expenses, payable to us(3) | | $ | 23.6425 | | | $ | 16,076,900 | |

| (1) | Plus accrued interest from October 13, 2021 to, but not including, December 7, 2021, the settlement date. |

| (2) | See “Underwriting” for a description of all underwriting compensation payable in connection with this offering. |

| (3) | B. Riley Securities, Inc. (“B. Riley”), as representative of the underwriters, may exercise an option to purchase up to an additional $2,550,000 aggregate principal amount of Notes offered hereby, within 30 days of the date of this prospectus. If this option is exercised in full, the total offering price will be $19,159,000, the total underwriting discount paid by us will be $670,565, and total proceeds to us, before expenses, will be approximately $18,488,435. |

| (4) | Total expenses of the offering payable by us, excluding underwriting discounts and commissions and the Structuring Fee (as defined in “Underwriting”), are estimated to be $475,000. |

The underwriters expect to deliver the Notes to purchasers in book-entry form through the facilities of The Depository Trust Company (“DTC”) for the accounts of its participants, including Euroclear Bank S.A./N.V., as operator of the Euroclear System, and Clearstream Banking, société anonyme, on or about December 7, 2021.

Book-Running Managers

| | | | |

B. Riley Securities | | Ladenburg Thalmann | | William Blair & Co. |

EF Hutton,

division of Benchmark Investments, LLC

Co-Managers

| | |

| Aegis Capital Corp. | | Colliers Securities LLC |

| Wedbush Securities | | Ziegler |

The date of this prospectus is December 2, 2021