“Issuing Entity Collateral” has the meaning defined in granting clause of the Indenture.

“Liquidation Proceeds” means, for any Collection Period and any Charged-Off Receivable, the amount (which will not be less than zero) received by the Servicer and deposited into the Collection Account after a Receivable becomes a Charged-Off Receivable, in connection with the attempted realization of the full amounts due or to become due under such Receivable, whether from the sale or other disposition of the related financed vehicle, the proceeds of repossession or any collection effort, the proceeds of recourse or similar payments payable under the related Receivable, receipt of Insurance Proceeds or otherwise, net of any amounts required by law to be remitted to the related obligor.

“Note Distribution Account” means the account, if applicable, designated as such, established and maintained pursuant to the Indenture.

“Noteholders” means the holders of record of the Notes pursuant to the Indenture and, with respect to any Class of Notes, holders of record of such Class of Notes pursuant to the Indenture.

“Pool Balance” means as of the last day of any Collection Period, the sum of the principal balances of the Receivables as of such last day; except that, that if the Receivables are purchased in connection with a clean-up call or are sold or otherwise liquidated by the Indenture Trustee following an Event of Default pursuant to the Indenture, the Pool Balance will be deemed to be zero as of the last day of the Collection Period during which such purchase, sale or other liquidation occurs.

“Principal Balance” means, with respect to any Receivable as of any date of determination, the outstanding principal balance of such Receivable as of such day, except that as of the date on which a Receivable becomes a Charged-Off Receivable, the Principal Balance of such Receivable will be zero.

“Rating Agency Condition” means, with respect to any action, the condition that (a) each Hired Rating Agency shall have been given at least ten (10) Business Days prior written notice of that action and that (b) none of the Sponsor, the Depositor, the Issuing Entity or the Indenture Trustee shall have received notice from any Hired Rating Agency that such action shall result in a downgrade or withdrawal of the then current rating of the Notes. Each entity listed above shall inform the other entities listed above of whether or not it has received notice from the Rating Agencies prior to the taking of the actions at issue.

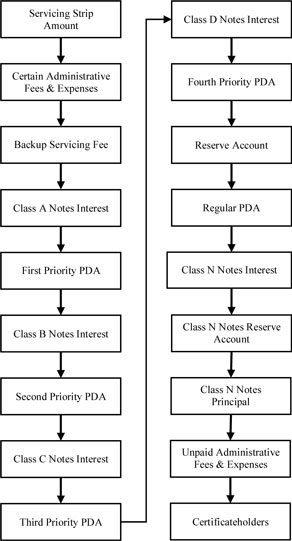

“Regular Principal Distributable Amount” or “Regular PDA” means, with respect to the Notes (other than the Class N Notes), for any Distribution Date, the lesser of: (A) the Aggregate Note Principal Amount (other than the Class N Notes) as of the close of the immediately preceding Distribution Date reduced by the Aggregate Priority PDA, if any, with respect to such Distribution Date; and (B) the remainder, if any, of: (1) the excess of the (x) sum of the Aggregate Note Principal Amount (other than the Class N Notes) as of the day preceding such Distribution Date and the Overcollateralization Target Amount for such Distribution Date over (y) the Pool Balance as of the close of business on the last day of the related Collection Period minus (2) the Aggregate Priority PDA, if any, with respect to such Distribution Date.

“Regulation AB” means Subpart 229.1100 – Asset Backed Securities (Regulation AB), 17 C.F.R. §§229.1100-229.1125, as such may be amended from time to time and subject to such clarification and interpretation as have been provided by the SEC in the adopting releases (Asset-Backed Securities, Securities Act Release No. 33-8518. 70 Fed. Reg. 1,506, 1,531 (January 7, 2005) and Asset-Backed Securities Disclosure and Registration, Securities Act Release No. 33-9638, 79 Fed. Reg. 57, 184 (September 24, 2014)) or by the staff of the SEC, or as may be provided by the SEC or its staff from time to time.

“Reserve Account” means the account designated as such, established and maintained pursuant to the Indenture.

“SEC” means the U.S. Securities and Exchange Commission.

“Second Priority Principal Distributable Amount” or “Second Priority PDA” means, with respect to any Distribution Date, an amount, not less than zero, equal to the difference between (i) the excess, if any, of (a) the aggregate outstanding principal amount of the Class A Notes and the Class B Notes as of, for the first Distribution Date, the Closing Date, and for subsequent Distribution Dates, the preceding Distribution Date (after giving effect to any principal payments made on the Class A Notes and the Class B Notes on such preceding Distribution Date) over (b) the Pool Balance as of the close of business on the last day of the related Collection Period, and (ii) the First Priority Principal Distributable Amount, if any, with respect to such Distribution Date; provided, however, that the Second Priority Principal Distributable Amount for each Distribution Date on and after the Final Scheduled Distribution Date for the Class B Notes will equal the greater of (i) the amount otherwise calculated pursuant to this definition and (ii) the outstanding principal amount of the Class B Notes as of the day preceding such Distribution Date.

“Securities Act” means the Securities Act of 1933, as amended.

“Short-Term Note” means any offered note that has a fixed maturity date of not more than one year from the issue date of that offered note.

“Third Priority Principal Distributable Amount” or “Third Priority PDA” means, with respect to any Distribution Date, an amount, not less than zero, equal to the difference between (i) the excess, if any, of (a) the aggregate outstanding principal amount of the Class A Notes, the Class B Notes and the Class C Notes as of, for the first Distribution Date, the Closing Date, and for subsequent Distribution Dates, the preceding Distribution Date (after giving effect to any principal payments made on the Class A Notes, the Class B Notes and the Class C Notes on such preceding Distribution Date) over (b) the Pool Balance as of the close of business on the last day of the related

110