Q2 2021�Earnings Presentation August 11, 2021 Exhibit 99.2

Forward-Looking Statements DISCLAIMERS Cautionary Note Regarding Forward-Looking Statements This presentation contains forward-looking statements about LifeStance Health Group, Inc. and its subsidiaries (“LifeStance”) and the industry in which LifeStance operates, including statements regarding future results of operations and financial position of LifeStance, which are subject to known and unknown uncertainties and contingencies outside of LifeStance’s control and which are largely based on our current expectations and projections about future events and financial trends that we believe may affect LifeStance’s financial condition, results of operations, business strategy, and prospects. LifeStance’s actual results, events, or circumstances may differ materially from these statements. Forward-looking statements include all statements that are not historical facts. Words such as “anticipate,” “believe,” “envision,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” “contemplate” and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties, factors and assumptions, including, among other things: we may not grow at the rates we historically have achieved or at all, even if our key metrics may imply future growth, including if we are unable to successfully execute on our growth initiatives and business strategies; if we fail to manage our growth effectively, our expenses could increase more than expected, our revenue may not increase proportionally or at all, and we may be unable to execute on our business strategy; if reimbursement rates paid by third-party payors are reduced or if third-party payors otherwise restrain our ability to obtain or deliver care to patients, our business could be harmed; we conduct business in a heavily regulated industry and if we fail to comply with these laws and government regulations, we could incur penalties or be required to make significant changes to our operations or experience adverse publicity, which could have a material adverse effect on our business, results of operations and financial condition; we are dependent on our relationships with affiliated practices, which we do not own, to provide health care services, and our business would be harmed if those relationships were disrupted or if our arrangements with these entities became subject to legal challenges; we operate in a competitive industry, and if we are not able to compete effectively, our business, results of operations and financial condition would be harmed; the impact of health care reform legislation and other changes in the healthcare industry and in health care spending on us is currently unknown, but may harm our business; if our or our vendors’ security measures fail or are breached and unauthorized access to our employees’ patients’ or partners’ data is obtained, our systems may be perceived as insecure, we may incur significant liabilities, including through private litigation or regulatory action, our reputation may be harmed, and we could lose patients and partners; our business depends on our ability to effectively invest in, implement improvements to and properly maintain the uninterrupted operation and data integrity of our information technology and other business systems; our existing indebtedness could adversely affect our business and growth prospects; and the other factors set forth in our filings with the Securities and Exchange Commission. The forward-looking statements, together with statements relating to our past performance, should not be regarded as a reliable indicator of our future performance. We undertake no obligation to update any forward-looking statements made in this presentation to reflect events or circumstances after the date of this presentation or to reflect new information or the occurrence of unanticipated events, except as may be required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments. Use of Non-GAAP Financial Measures In addition to financial measures presented in accordance with U.S. generally accepted accounting principles (“GAAP”), this presentation includes certain non-GAAP financial measures, including Center Margin and Adjusted EBITDA. These non-GAAP measures are in addition to, and not a substitute for, or superior to, measures of financial performance prepared in accordance with U.S. GAAP. The non-GAAP financial measures used by LifeStance may differ from the non-GAAP financial measures used by other companies. A reconciliation of these measures to the most directly comparable U.S. GAAP measure is included in the Appendix to these slides or as otherwise described in these slides. Market and Industry Data This presentation also contains information regarding our market and industry that is derived from third-party research and publications. This information involves a number of assumptions and limitations. While we believe the information in this presentation is generally reliable, forecasts, assumptions, expectations, beliefs, estimates and projections involve risk and uncertainties and are subject to change based on various factors.

Mike Lester President, Chief Executive Officer and Co-Founder

LifeStance Health – Successful IPO Trading Date June 10, 2021 Shares Offered 46M Offering Price�(upsized from $15-$17) $18 NASDAQ�Ticker LFST First Day Closing Price�(up 22%) $22 First Day Closing�Market Cap $8.2B

President, Chief Executive Officer �and Co-Founder Danish Qureshi Chief Growth Officer �and Co-Founder Mike Lester J. Michael Bruff Chief Financial Officer Today’s Presenters

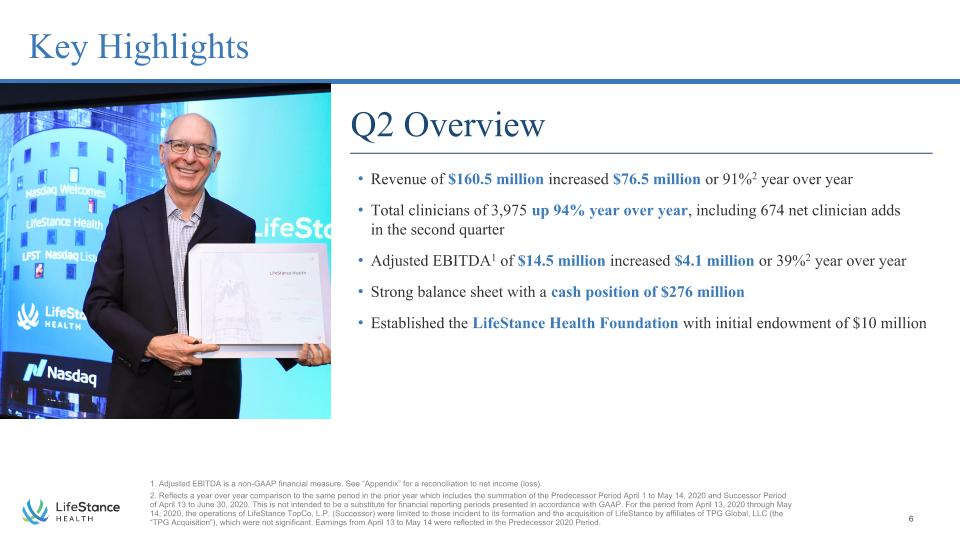

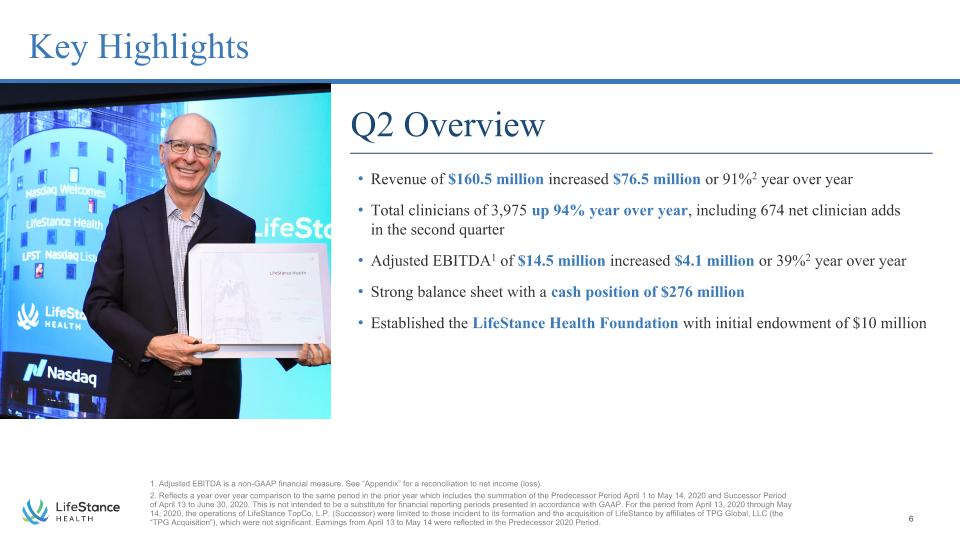

Key Highlights 1. Adjusted EBITDA is a non-GAAP financial measure. See “Appendix” for a reconciliation to net income (loss). 2. Reflects a year over year comparison to the same period in the prior year which includes the summation of the Predecessor Period April 1 to May 14, 2020 and Successor Period of April 13 to June 30, 2020. This is not intended to be a substitute for financial reporting periods presented in accordance with GAAP. For the period from April 13, 2020 through May 14, 2020, the operations of LifeStance TopCo, L.P. (Successor) were limited to those incident to its formation and the acquisition of LifeStance by affiliates of TPG Global, LLC (the “TPG Acquisition”), which were not significant. Earnings from April 13 to May 14 were reflected in the Predecessor 2020 Period. Revenue of $160.5 million increased $76.5 million or 91%2 year over year Total clinicians of 3,975 up 94% year over year, including 674 net clinician adds �in the second quarter Adjusted EBITDA1 of $14.5 million increased $4.1 million or 39%2 year over year Strong balance sheet with a cash position of $276 million Established the LifeStance Health Foundation with initial endowment of $10 million Q2 Overview

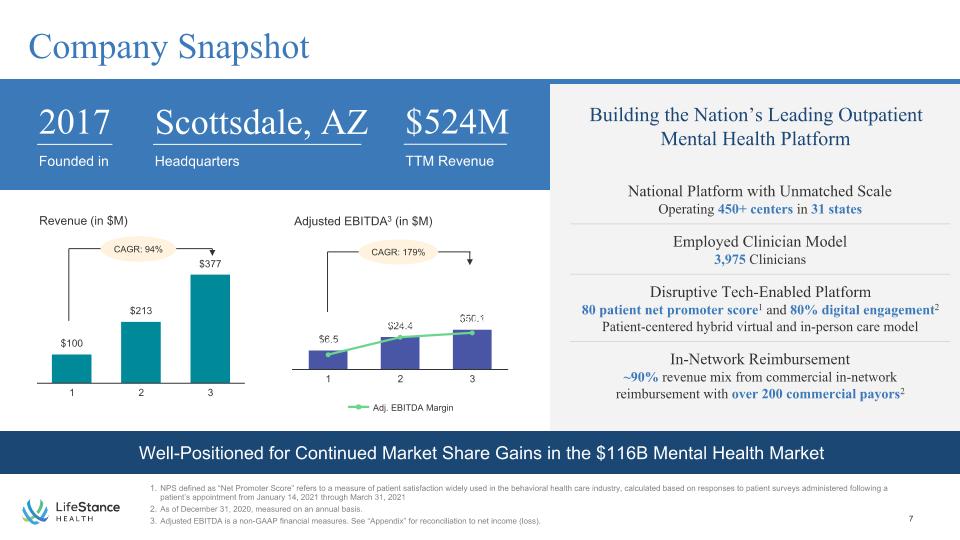

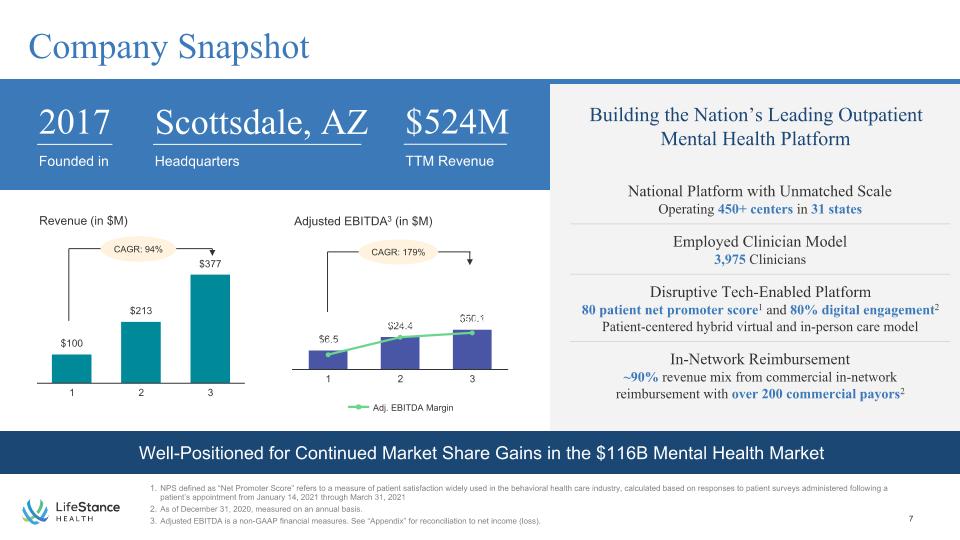

Company Snapshot NPS defined as “Net Promoter Score” refers to a measure of patient satisfaction widely used in the behavioral health care industry, calculated based on responses to patient surveys administered following a patient’s appointment from January 14, 2021 through March 31, 2021 As of December 31, 2020, measured on an annual basis. Adjusted EBITDA is a non-GAAP financial measures. See “Appendix” for reconciliation to net income (loss). Building the Nation’s Leading Outpatient �Mental Health Platform Well-Positioned for Continued Market Share Gains in the $116B Mental Health Market Revenue (in $M) Adjusted EBITDA3 (in $M) CAGR: 179% Adj. EBITDA Margin CAGR: 94% National Platform with Unmatched Scale�Operating 450+ centers in 31 states Employed Clinician Model�3,975 Clinicians Disruptive Tech-Enabled Platform�80 patient net promoter score1 and 80% digital engagement2 Patient-centered hybrid virtual and in-person care model In-Network Reimbursement�~90% revenue mix from commercial in-network �reimbursement with over 200 commercial payors2 Founded in 2017 Headquarters Scottsdale, AZ TTM Revenue $524M

We are Mission-Driven Our Vision Our Mission Our Values A truly healthy society �where mental and physical �healthcare are unified �to make lives better To help people lead healthier, more fulfilling lives by improving access to trusted, affordable, and personalized mental healthcare Delivering Compassion We care for people unconditionally �and act with empathy always Building Relationships We are collaborative, building enduring relationships to achieve more together Celebrating Difference We respect the diversity of every �individual’s lived experiences

We Remain Committed to Corporate Responsibility Note: Our efforts contribute to advancing several UN Sustainable Development Goals (SDGs), including SDG 3: Good Health and Well-Being; SDG 5: Gender Equality; SDG 8: Decent Work and Economic Growth; and SDG 10: Reduce Inequalities. Established National Diversity, Equity and Inclusion (DEI) Committee 50% of Executive Leadership �Team diverse by gender or race/ethnicity Majority of our clinicians �are female Diversity & �Inclusion Reducing work days and $ lost �due to mental illness Annual retention higher than industry benchmarks 97% of our clinicians feel they �are helping patients Investing in clinician education Social Good & Economic Growth Established the LifeStance Health Foundation in furtherance of our mission to improve patient access, enhance outcomes and lower overall health care costs $10 million initial endowment Corporate �Giving The work we do contributes �to greater societal health �and well-being, as well as �reduced inequalities Increasing access to high-quality, �affordable care Improving mental and �physical outcomes Improving �Health Care We are Reimagining Mental Health

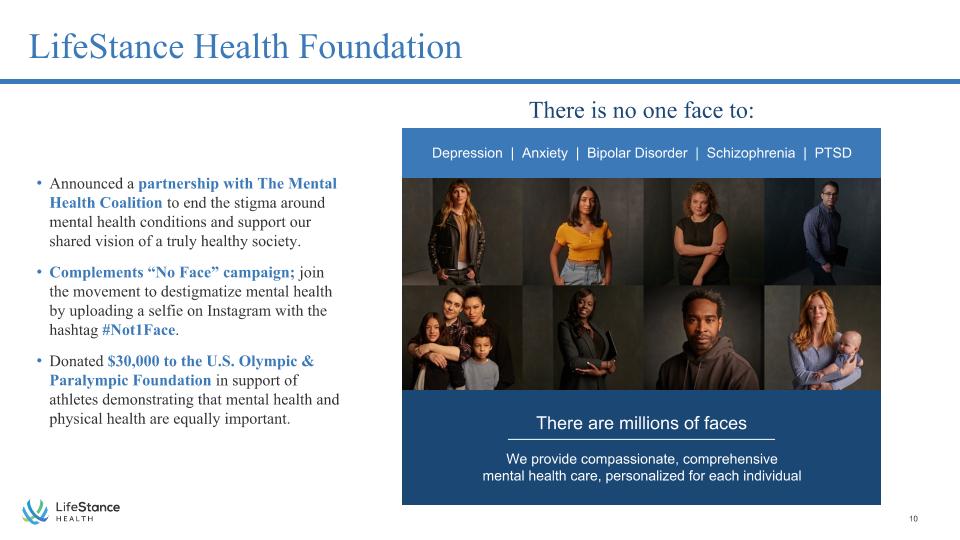

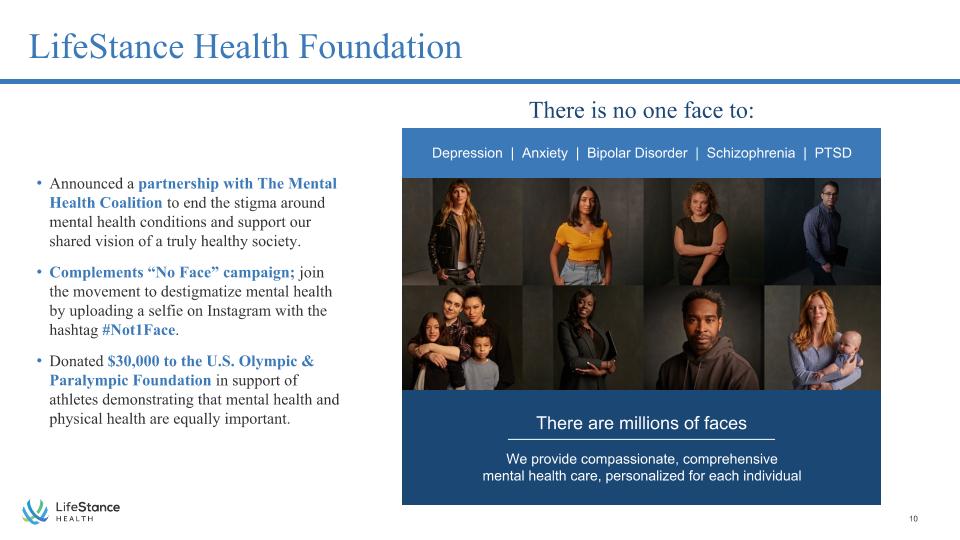

LifeStance Health Foundation There are millions of faces We provide compassionate, comprehensive mental health care, personalized for each individual Depression | Anxiety | Bipolar Disorder | Schizophrenia | PTSD There is no one face to: Announced a partnership with The Mental Health Coalition to end the stigma around mental health conditions and support our shared vision of a truly healthy society. Complements “No Face” campaign; join the movement to destigmatize mental health by uploading a selfie on Instagram with the hashtag #Not1Face. Donated $30,000 to the U.S. Olympic & Paralympic Foundation in support of athletes demonstrating that mental health and physical health are equally important.

Danish Qureshi Chief Growth Officer and Co-Founder

Our Growth Strategy A Powerful Growth Engine to Enable Market Share Gains Multiple Growth Opportunities 1 Expand into New Markets 31 states in total, operating as a leading national provider 5 states added in Q2’21 2 Build Market Density 3,975 clinicians in total (674 added in Q2’21) 183 de novos opened since inception (35 in Q2’21) 64 acquisitions completed since inception (10 in Q2’21) 3 Digital Services 80% digital patient engagement1, with virtual care offered in all 31 states to the entire statewide population Industry Tailwinds: $116B TAM in 2020 going to $215B by 2025, representing a 14% CAGR Significant White Space: Less than 1% penetration of a 650K clinician market; Less than 1% penetration in patient demand (350K+ patients in a market of 51M) Next Growth Horizons: Confidence in our long-term growth is reinforced by our investment today in innovative programs with value-based models, employer-based pilot programs, and integrated care As of December 31, 2020, measured on an annual basis.

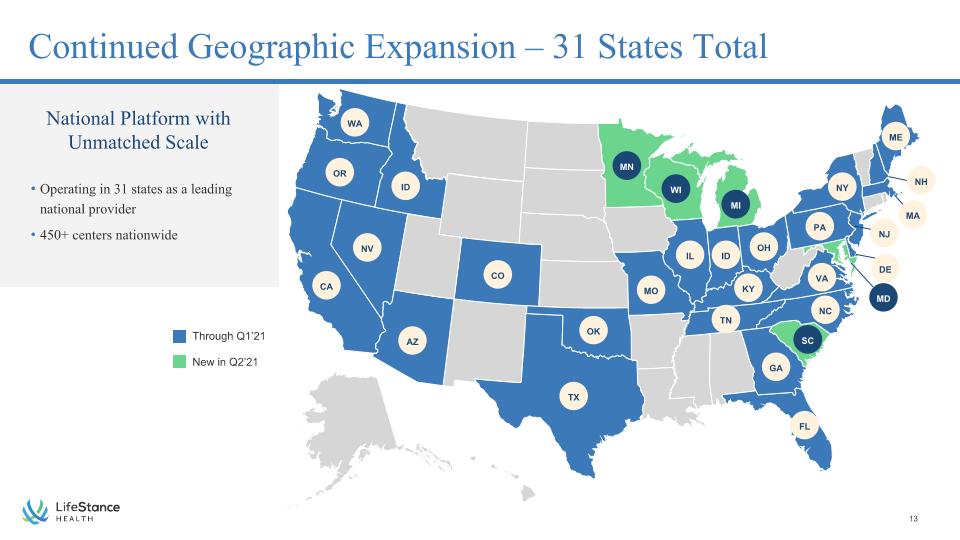

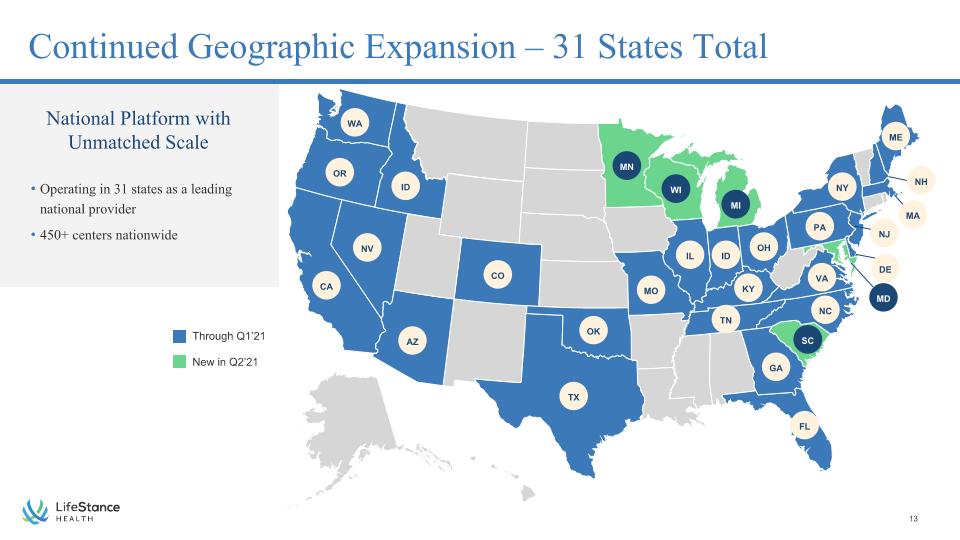

Continued Geographic Expansion – 31 States Total Operating in 31 states as a leading national provider 450+ centers nationwide National Platform with Unmatched Scale Through Q1’21 New in Q2’21 AZ CA CO DE FL GA ID IL ID KY TN TX VA PA OH NC OK NY MA NJ MD NH ME NV WA MO SC MN WI MI OR

Market Update

J. Michael Bruff Chief Financial Officer

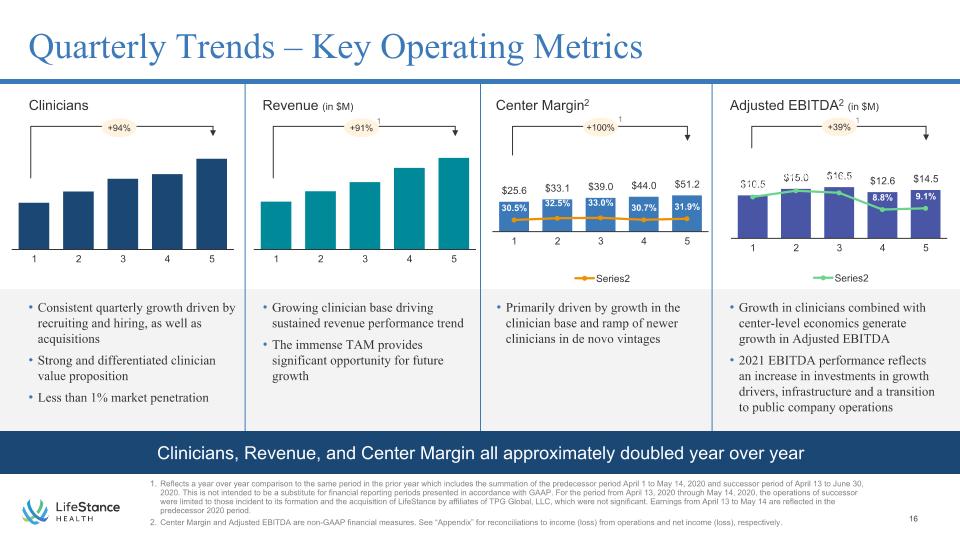

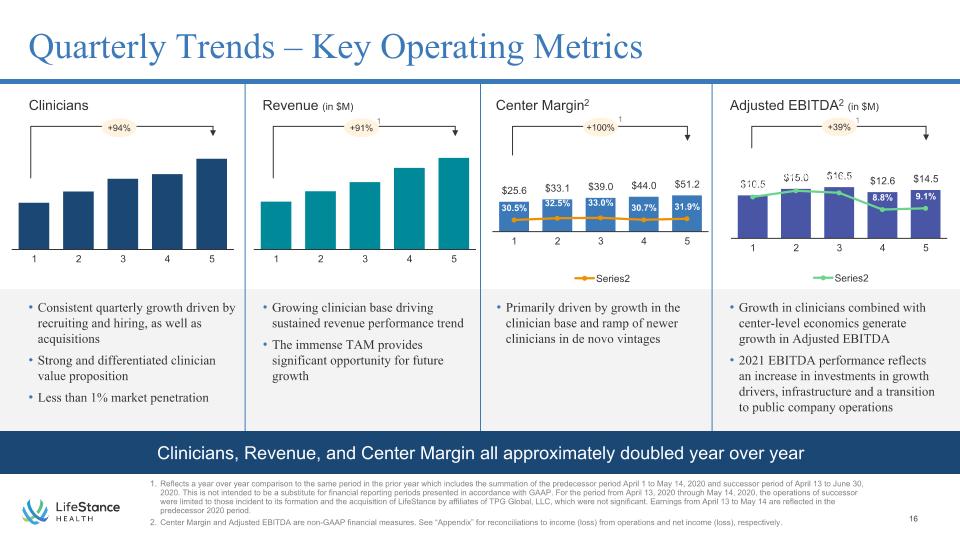

Clinicians Revenue (in $M) Center Margin2 Adjusted EBITDA2 (in $M) Consistent quarterly growth driven by recruiting and hiring, as well as acquisitions Strong and differentiated clinician value proposition Less than 1% market penetration Primarily driven by growth in the clinician base and ramp of newer clinicians in de novo vintages Growth in clinicians combined with center-level economics generate growth in Adjusted EBITDA 2021 EBITDA performance reflects an increase in investments in growth drivers, infrastructure and a transition to public company operations Growing clinician base driving sustained revenue performance trend The immense TAM provides significant opportunity for future growth Quarterly Trends – Key Operating Metrics +39% +100% +91% +94% 1 1 1 Reflects a year over year comparison to the same period in the prior year which includes the summation of the predecessor period April 1 to May 14, 2020 and successor period of April 13 to June 30, 2020. This is not intended to be a substitute for financial reporting periods presented in accordance with GAAP. For the period from April 13, 2020 through May 14, 2020, the operations of successor were limited to those incident to its formation and the acquisition of LifeStance by affiliates of TPG Global, LLC, which were not significant. Earnings from April 13 to May 14 are reflected in the predecessor 2020 period. Center Margin and Adjusted EBITDA are non-GAAP financial measures. See “Appendix” for reconciliations to income (loss) from operations and net income (loss), respectively. Clinicians, Revenue, and Center Margin all approximately doubled year over year

Balance Sheet Highlights and Operating Cash Flow Percentage description with ctetur ad ipisc ing elite 75% Cash and �Cash Equivalents $276.2M Percentage description with ctetur ad ipisc ing elite 75% Long-term Debt $158.7M Percentage description with ctetur ad ipisc ing elite 75% Operating Cash Flow (YTD 1) ($7.0)M Percentage description with ctetur ad ipisc ing elite 75% Capital Expenditures (YTD 1) $31.8M YTD is January 1, 2021 to June 30, 2021.

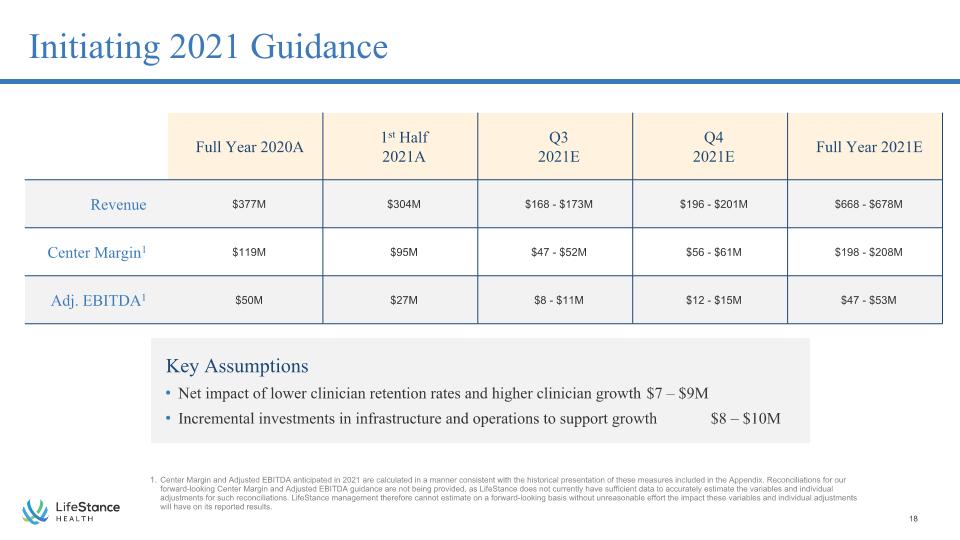

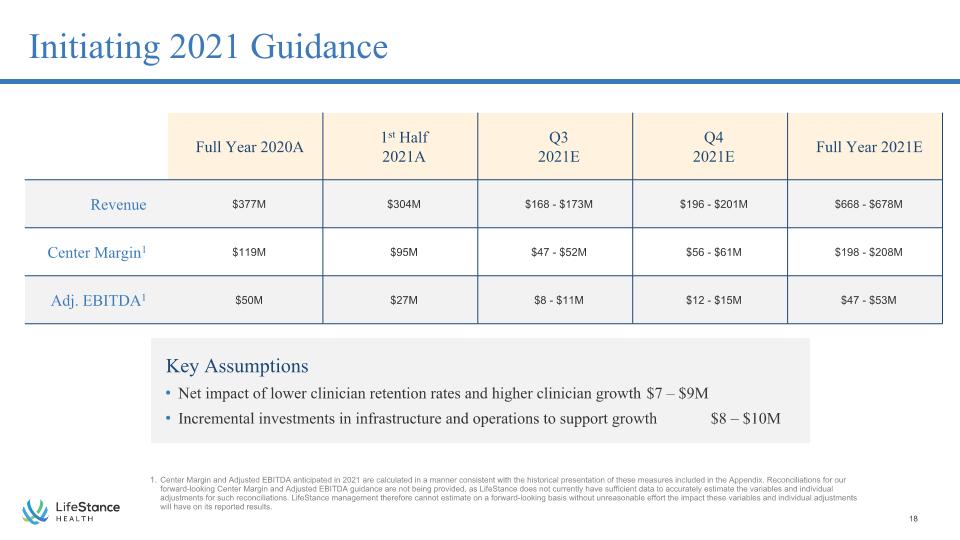

Full Year 2020A 1st Half �2021A Q3 �2021E Q4 �2021E Full Year 2021E Revenue $377M $304M $168 - $173M $196 - $201M $668 - $678M Center Margin1 $119M $95M $47 - $52M $56 - $61M $198 - $208M Adj. EBITDA1 $50M $27M $8 - $11M $12 - $15M $47 - $53M Initiating 2021 Guidance Key Assumptions Net impact of lower clinician retention rates and higher clinician growth $7 – $9M Incremental investments in infrastructure and operations to support growth $8 – $10M Center Margin and Adjusted EBITDA anticipated in 2021 are calculated in a manner consistent with the historical presentation of these measures included in the Appendix. Reconciliations for our forward-looking Center Margin and Adjusted EBITDA guidance are not being provided, as LifeStance does not currently have sufficient data to accurately estimate the variables and individual adjustments for such reconciliations. LifeStance management therefore cannot estimate on a forward-looking basis without unreasonable effort the impact these variables and individual adjustments will have on its reported results.

Closing Remarks

Appendix

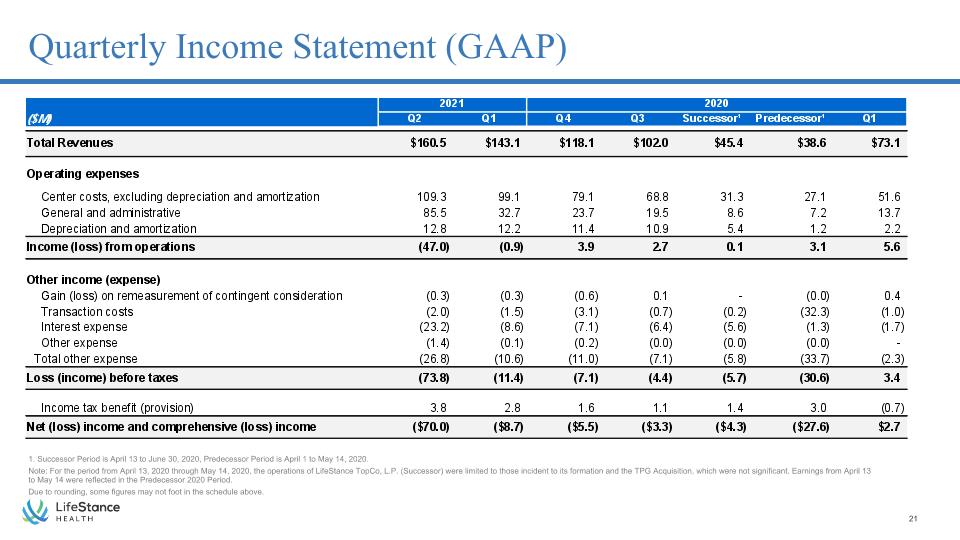

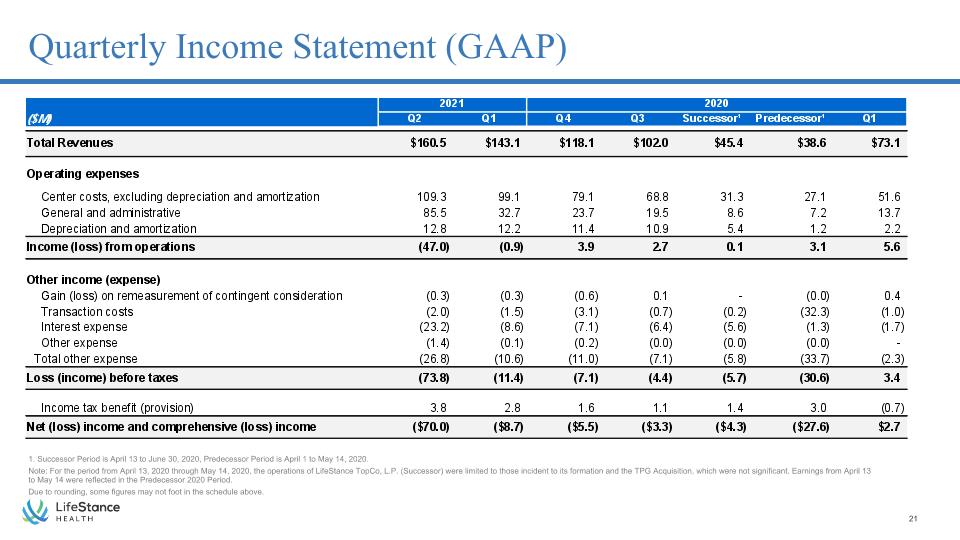

Quarterly Income Statement (GAAP) 1. Successor Period is April 13 to June 30, 2020, Predecessor Period is April 1 to May 14, 2020. Note: For the period from April 13, 2020 through May 14, 2020, the operations of LifeStance TopCo, L.P. (Successor) were limited to those incident to its formation and the TPG Acquisition, which were not significant. Earnings from April 13 to May 14 were reflected in the Predecessor 2020 Period. Due to rounding, some figures may not foot in the schedule above. 2021 2020 ($M) Q2 Q1 Q4 Q3 Successor¹ Predecessor¹ Q1 Total Revenues $160.5 $143.1 $118.1 $102.0 $45.4 $38.6 $73.1 Operating expenses Center costs, excluding depreciation and amortization 109.3 99.1 79.1 68.8 31.3 27.1 51.6 General and administrative 85.5 32.7 23.7 19.5 8.6 7.2 13.7 Depreciation and amortization 12.8 12.2 11.4 10.9 5.4 1.2 2.2 Income (loss) from operations (47.0) (0.9) 3.9 2.7 0.1 3.1 5.6 Other income (expense) Gain (loss) on remeasurement of contingent consideration (0.3) (0.3) (0.6) 0.1 - - 0.4 Transaction costs (2.0) (1.5) (3.1) (0.7) (0.2) (32.3) (1.0) Interest expense (23.2) (8.6) (7.1) (6.4) (5.6) (1.3) (1.7) Other expense (1.4) (0.1) (0.2) - - - - Total other expense (26.8) (10.6) (11.0) (7.1) (5.8) (33.7) (2.3) Loss (income) before taxes (73.8) (11.4) (7.1) (4.4) (5.7) (30.6) 3.4 Income tax benefit (provision) 3.8 2.8 1.6 1.1 1.4 3.0 (0.7) Net (loss) income and comprehensive (loss) income ($70.0) ($8.7) ($5.5) ($3.3) ($4.3) ($27.6) $2.7

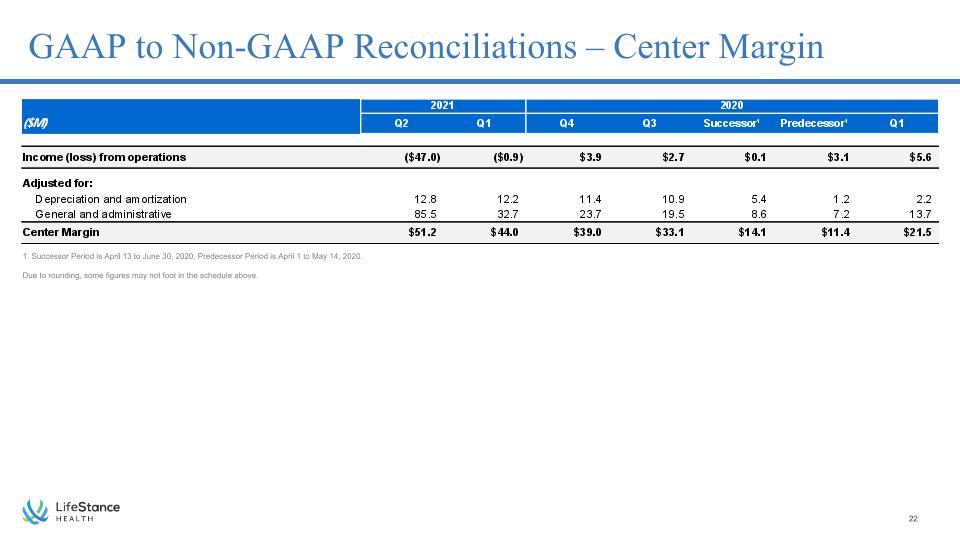

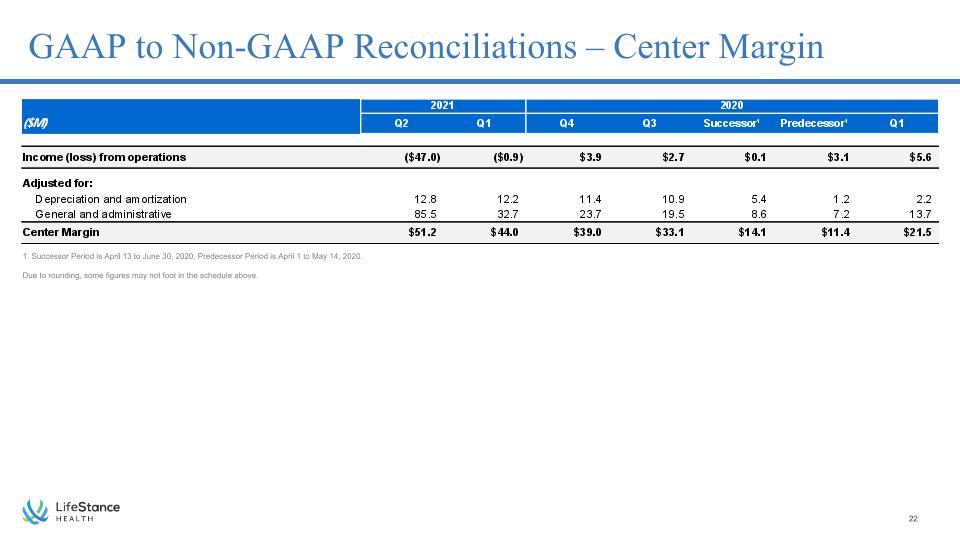

GAAP to Non-GAAP Reconciliations – Center Margin 1. Successor Period is April 13 to June 30, 2020, Predecessor Period is April 1 to May 14, 2020. Due to rounding, some figures may not foot in the schedule above. 2021 2020 ($M) Q2 Q1 Q4 Q3 Successor¹ Predecessor¹ Q1 Income (loss) from operations ($47.0) ($0.9) $3.9 $2.7 $0.1 $3.1 $5.6 Adjusted for: Depreciation and amortization 12.8 12.2 11.4 10.9 5.4 1.2 2.2 General and administrative 85.5 32.7 23.7 19.5 8.6 7.2 13.7 Center Margin $51.2 $44.0 $39.0 $33.1 $14.1 $11.4 $21.5

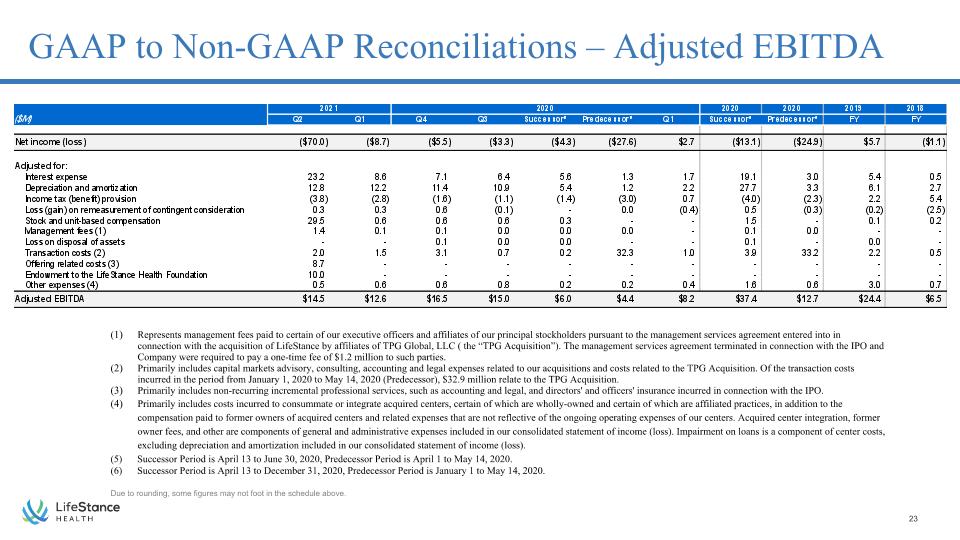

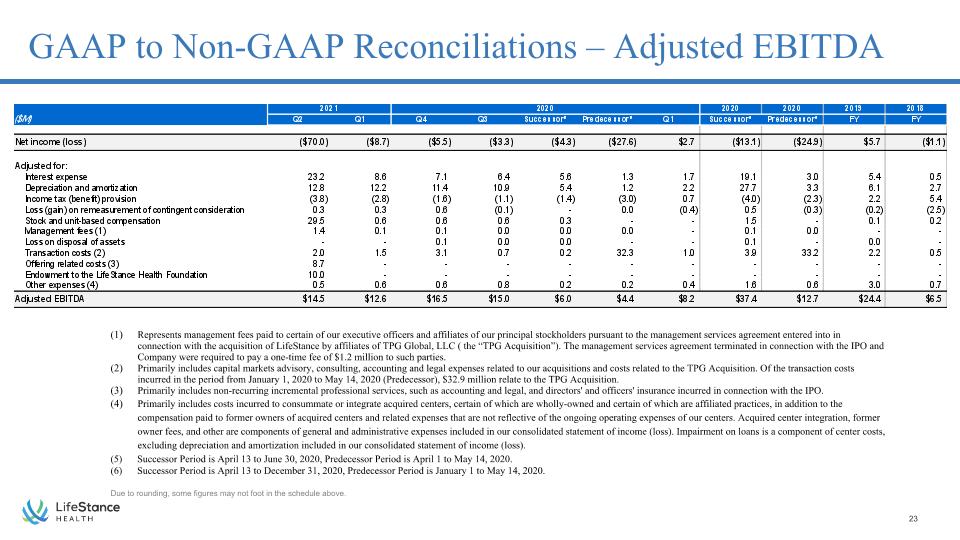

GAAP to Non-GAAP Reconciliations – Adjusted EBITDA Represents management fees paid to certain of our executive officers and affiliates of our principal stockholders pursuant to the management services agreement entered into in connection with the acquisition of LifeStance by affiliates of TPG Global, LLC ( the “TPG Acquisition”). The management services agreement terminated in connection with the IPO and Company were required to pay a one-time fee of $1.2 million to such parties. Primarily includes capital markets advisory, consulting, accounting and legal expenses related to our acquisitions and costs related to the TPG Acquisition. Of the transaction costs incurred in the period from January 1, 2020 to May 14, 2020 (Predecessor), $32.9 million relate to the TPG Acquisition. Primarily includes non-recurring incremental professional services, such as accounting and legal, and directors' and officers' insurance incurred in connection with the IPO. Primarily includes costs incurred to consummate or integrate acquired centers, certain of which are wholly-owned and certain of which are affiliated practices, in addition to the compensation paid to former owners of acquired centers and related expenses that are not reflective of the ongoing operating expenses of our centers. Acquired center integration, former owner fees, and other are components of general and administrative expenses included in our consolidated statement of income (loss). Impairment on loans is a component of center costs, excluding depreciation and amortization included in our consolidated statement of income (loss). (5) Successor Period is April 13 to June 30, 2020, Predecessor Period is April 1 to May 14, 2020. (6) Successor Period is April 13 to December 31, 2020, Predecessor Period is January 1 to May 14, 2020. Due to rounding, some figures may not foot in the schedule above. 2021 2020 2020 2020 2019 2018 ($M) Q2 Q1 Q4 Q3 Successor¹ Predecessor¹ Q1 Successor² Predecessor² FY FY Net income (loss) ($70.0) ($8.7) ($5.5) ($3.3) ($4.3) ($27.6) $2.7 ($13.1) ($24.9) $5.7 ($1.1) Adjusted for: Interest expense 23.2 8.6 7.1 6.4 5.6 1.3 1.7 19.1 3.0 5.4 0.5 Depreciation and amortization 12.8 12.2 11.4 10.9 5.4 1.2 2.2 27.7 3.3 6.1 2.7 Income tax (benefit) provision (3.8) (2.8) (1.6) (1.1) (1.4) (3.0) 0.7 (4.0) (2.3) 2.2 5.4 Loss (gain) on remeasurement of contingent consideration 0.3 0.3 0.6 (0.1) - - (0.4) 0.5 (0.3) (0.2) (2.5) Share/unit-based compensation 29.5 0.6 0.6 0.6 0.3 - - 1.5 - 0.1 0.2 Management fees (1) 1.4 0.1 0.1 - - - - 0.1 - - - Loss on disposal of assets - - 0.1 - - - - 0.1 - - - Transaction costs (2) 2.0 1.5 3.1 0.7 0.2 32.3 1.0 3.9 33.2 2.2 0.5 Offering related costs (3) 8.7 - - - - - - - - - - Endowment to the LifeStance Health Foundation 10.0 - - - - - - - - - - Other expenses (4) 0.5 0.6 0.6 0.8 0.2 0.2 0.4 1.6 0.6 3.0 0.7 Adjusted EBITDA $14.5 $12.6 $16.5 $15.0 $6.0 $4.4 $8.2 $37.4 $12.7 $24.4 $6.5

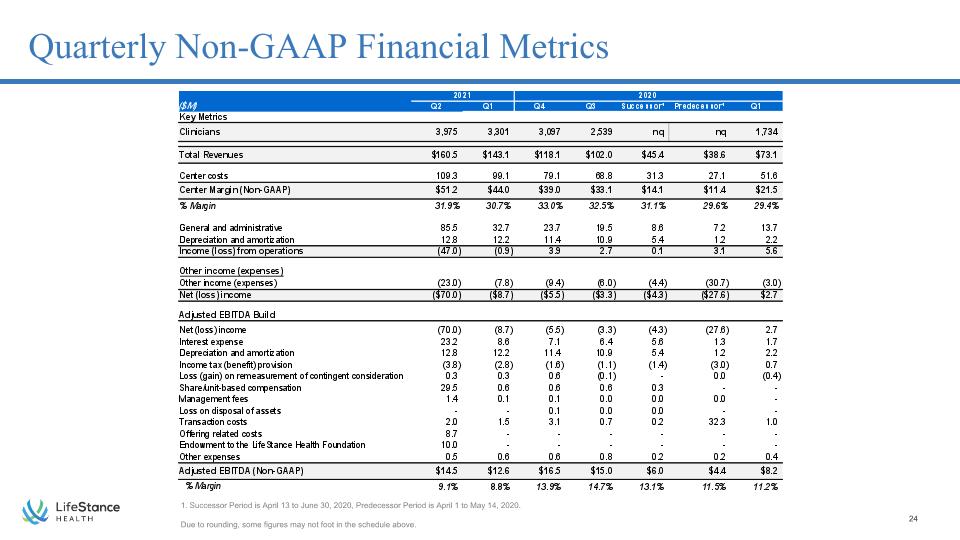

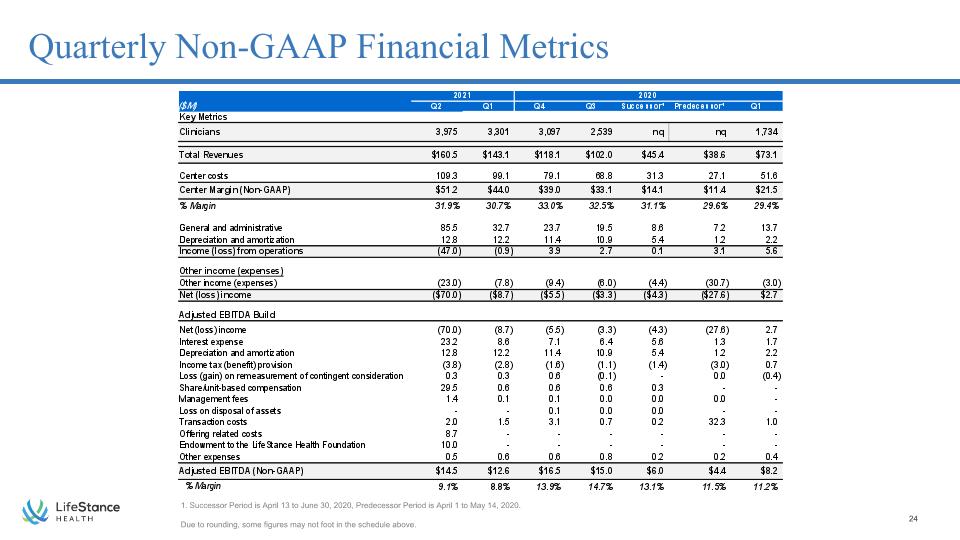

Quarterly Non-GAAP Financial Metrics 1. Successor Period is April 13 to June 30, 2020, Predecessor Period is April 1 to May 14, 2020. Due to rounding, some figures may not foot in the schedule above. 2021 2020 ($M) Q2 Q1 Q4 Q3 Successor¹ Predecessor¹ Q1 Key Metrics Clinicians 3,975 3,301 3,097 2,539 nq nq 1,734 Total Revenues $160.5 $143.1 $118.1 $102.0 $45.4 $38.6 $73.1 Center costs 109.3 99.1 79.1 68.8 31.3 27.1 51.6 Center Margin (Non-GAAP) $51.2 $44.0 $39.0 $33.1 $14.1 $11.4 $21.5 % Margin 31.9% 30.7% 33.0% 32.5% 31.1% 29.6% 29.4% General and administrative 85.5 32.7 23.7 19.5 8.6 7.2 13.7 Depreciation and amortization 12.8 12.2 11.4 10.9 5.4 1.2 2.2 Income (loss) from operations (47.0) (0.9) 3.9 2.7 0.1 3.1 5.6 Other income (expenses) Other income (expenses) (23.0) (7.8) (9.4) (6.0) (4.4) (30.7) (3.0) Net (loss) income ($70.0) ($8.7) ($5.5) ($3.3) ($4.3) ($27.6) $2.7 Adjusted EBITDA Build Net (loss) income (70.0) (8.7) (5.5) (3.3) (4.3) (27.6) 2.7 Interest expense 23.2 8.6 7.1 6.4 5.6 1.3 1.7 Depreciation and amortization 12.8 12.2 11.4 10.9 5.4 1.2 2.2 Income tax (benefit) provision (3.8) (2.8) (1.6) (1.1) (1.4) (3.0) 0.7 Loss (gain) on remeasurement of contingent consideration 0.3 0.3 0.6 (0.1) - - (0.4) Share/unit-based compensation 29.5 0.6 0.6 0.6 0.3 - - Management fees 1.4 0.1 0.1 - - - - Loss on disposal of assets - - 0.1 - - - - Transaction costs 2.0 1.5 3.1 0.7 0.2 32.3 1.0 Offering related costs 8.7 - - - - - - Endowment to the LifeStance Health Foundation 10.0 - - - - - - Other expenses 0.5 0.6 0.6 0.8 0.2 0.2 0.4 Adjusted EBITDA (Non-GAAP) $14.5 $12.6 $16.5 $15.0 $6.0 $4.4 $8.2 % Margin 9.1% 8.8% 13.9% 14.7% 13.1% 11.5% 11.2%

Quarterly Balance Sheet Due to rounding, some figures may not foot in the schedule above. 2021 2020 ($M) Q2 Q1 Q4 Q3 Q2 Q1 Cash and cash equivalents 276.2 39.5 18.8 25.1 13.8 20.3 Patient accounts receivable 60.1 47.8 43.7 34.3 31.0 25.2 Prepaid expenses and other current assets 27.8 22.3 13.7 16.1 14.0 9.0 Total current assets 364.1 109.6 76.3 75.4 58.8 54.5 Property and equipment, net 91.8 70.8 59.3 47.5 39.7 31.2 Intangible assets, net 316.5 323.3 332.8 334.0 342.8 15.8 Goodwill 1,138.7 1,099.7 1,098.7 963.0 951.3 224.3 Deposits 3.3 2.9 2.6 2.1 2.0 1.7 Total noncurrent assets 1,550.4 1,496.7 1,493.5 1,346.5 1,335.8 273.0 Total assets $1,914.4 $1,606.3 $1,569.7 $1,422.0 $1,394.6 $327.5 Accounts payable 10.0 5.9 7.7 4.4 4.3 3.5 Accrued payroll expenses 50.4 45.4 38.0 30.5 23.9 21.4 Other accrued expenses 38.8 25.7 14.7 12.5 12.4 13.5 Current portion of contingent consideration 10.9 14.9 10.6 8.1 7.1 23.5 Other current liabilities 2.6 4.9 5.0 2.8 2.8 1.0 Total current liabilities 112.6 96.8 75.9 58.2 50.5 62.9 Long-term debt, net 157.1 387.3 362.5 227.1 227.4 113.5 Other noncurrent liabilities 15.7 14.2 11.4 12.9 11.1 9.0 Contingent consideration, net of current portion 3.2 1.1 5.9 3.7 3.9 3.0 Deferred tax liability, net 81.2 81.2 81.2 85.4 85.4 0.9 Total noncurrent liabilities 257.2 483.8 461.0 329.1 327.8 126.4 Total liabilities $369.8 $580.5 $536.9 $387.3 $378.3 $189.3 Redeemable units - 71.8 35.0 35.0 35.0 - Stockholders' / Members' equity 3.7 1,010.5 1,009.5 1,006.4 985.4 302.4 Additional paid-in capital 1,669.5 2.1 1.5 0.9 0.3 - Accumulated deficit (128.6) (58.6) (13.1) (7.6) (4.3) (164.2) Total stockholders'/members’ equity 1,544.6 954.0 997.8 999.6 981.4 138.2 Total liabilities, redeemable units and stockholders’/members’ equity $1,914.4 $1,606.3 $1,569.7 $1,422.0 $1,394.6 $327.5

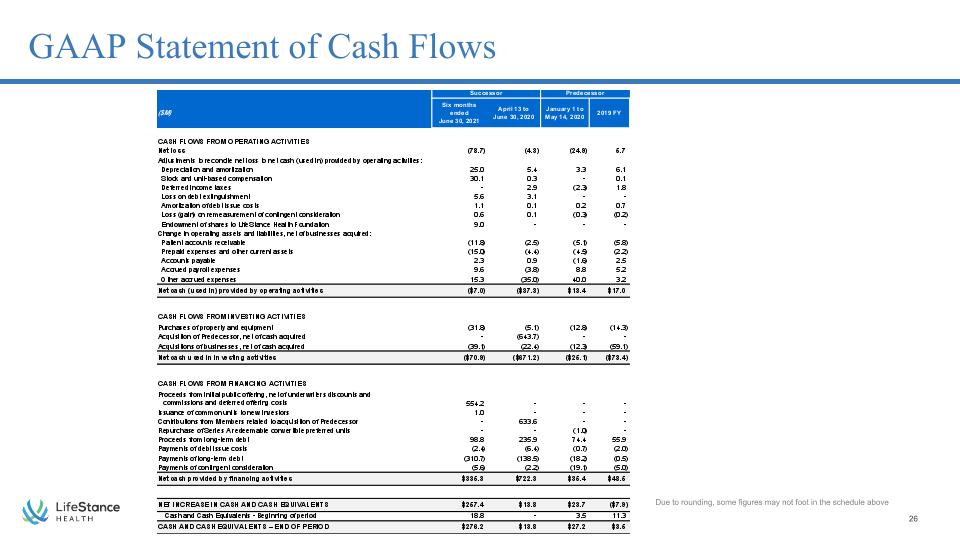

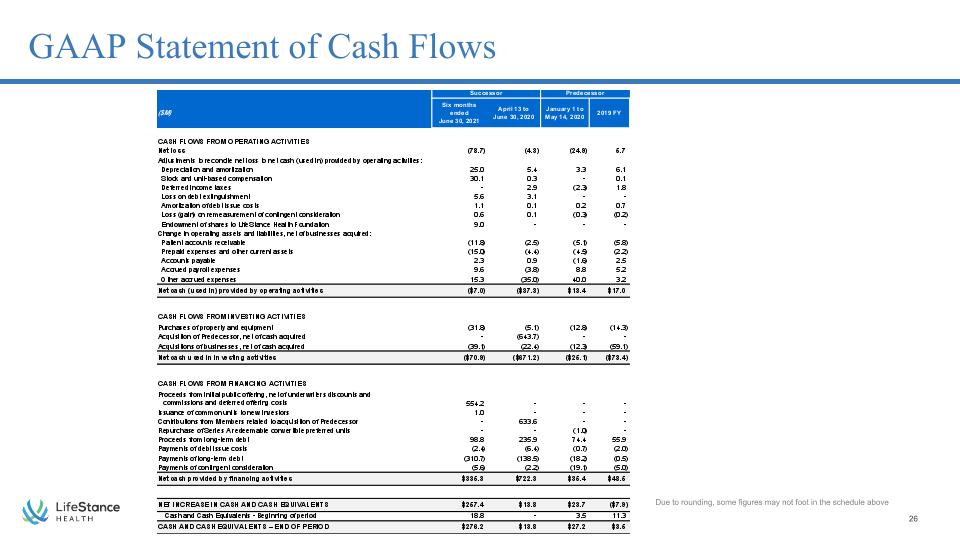

GAAP Statement of Cash Flows Due to rounding, some figures may not foot in the schedule above Successor Predecessor ($M) "Six months ended June 30, 2021" "April 13 to June 30, 2020" "January 1 to May 14, 2020" 2019 FY CASH FLOWS FROM OPERATING ACTIVITIES Net loss (78.7) (4.3) (24.9) 5.7 Adjustments to reconcile net loss to net cash (used in) provided by operating activities: Depreciation and amortization 25.0 5.4 3.3 6.1 Stock and unit-based compensation 30.1 0.3 - 0.1 Deferred income taxes - 2.9 (2.3) 1.8 Loss on debt extinguishment 5.6 3.1 - - Amortization of debt issue costs 1.1 0.1 0.2 0.7 Loss (gain) on remeasurement of contingent consideration 0.6 0.1 (0.3) (0.2) Endowment of shares to LifeStance Health Foundation 9.0 - - - Change in operating assets and liabilities, net of businesses acquired: Patient accounts receivable (11.8) (2.5) (5.1) (5.8) Prepaid expenses and other current assets (15.0) (4.4) (4.5) (2.2) Accounts payable 2.3 0.9 (1.6) 2.5 Accrued payroll expenses 9.6 (3.8) 8.8 5.2 Other accrued expenses 15.3 (35.0) 40.0 3.2 Net cash (used in) provided by operating activities ($7.0) ($37.3) $13.4 $17.0 CASH FLOWS FROM INVESTING ACTIVITIES Purchases of property and equipment (31.8) (5.1) (12.8) (14.3) Acquisition of Predecessor, net of cash acquired - (643.7) - - Acquisitions of businesses, net of cash acquired (39.1) (22.4) (12.3) (59.1) Net cash used in investing activities ($70.9) ($671.2) ($25.1) ($73.4) CASH FLOWS FROM FINANCING ACTIVITIES "Proceeds from initial public offering, net of underwriters discounts and commissions and deferred offering costs" 554.2 - - - Issuance of common units to new investors 1.0 - - - Contributions from Members related to acquisition of Predecessor - 633.6 - - Repurchase of Series A redeemable convertible preferred units - - (1.0) - Proceeds from long-term debt 98.8 235.9 74.4 55.9 Payments of debt issue costs (2.4) (6.4) (0.7) (2.0) Payments of long-term debt (310.7) (138.5) (18.2) (0.5) Payments of contingent consideration (5.6) (2.2) (19.1) (5.0) Net cash provided by financing activities $335.3 $722.3 $35.4 $48.5 NET INCREASE IN CASH AND CASH EQUIVALENTS $257.4 $13.8 $23.7 ($7.9) Cash and Cash Equivalents - Beginning of period 18.8 - 3.5 11.3 CASH AND CASH EQUIVALENTS – END OF PERIOD $276.2 $13.8 $27.2 $3.5