Q4 2021�Earnings Presentation March 10, 2022 Exhibit 99.2

Forward-Looking Statements DISCLAIMERS Cautionary Note Regarding Forward-Looking Statements This presentation and related oral statements contain forward-looking statements about LifeStance Health Group, Inc. and its subsidiaries (“LifeStance”) and the industry in which LifeStance operates, including statements regarding full-year and first quarter guidance, future results of operations and financial position of LifeStance, which are subject to known and unknown uncertainties and contingencies outside of LifeStance's control and which are largely based on our current expectations and projections about future events and financial trends that we believe may affect LifeStance's financial condition, results of operations, business strategy, and prospects. LifeStance's actual results, events, or circumstances may differ materially from these statements. Forward-looking statements include all statements that are not historical facts. Words such as “anticipate,” “believe,” “envision,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” “contemplate” and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties, factors and assumptions, including, among other things: we may not grow at the rates we historically have achieved or at all, even if our key metrics may imply future growth, including if we are unable to successfully execute on our growth initiatives and business strategies; if we fail to manage our growth effectively, our expenses could increase more than expected, our revenue may not increase proportionally or at all, and we may be unable to execute on our business strategy; our ability to recruit new clinicians and retain existing clinicians; if reimbursement rates paid by third-party payors are reduced or if third-party payors otherwise restrain our ability to obtain or deliver care to patients, our business could be harmed; we conduct business in a heavily regulated industry and if we fail to comply with these laws and government regulations, we could incur penalties or be required to make significant changes to our operations or experience adverse publicity, which could have a material adverse effect on our business, results of operations and financial condition; we are dependent on our relationships with affiliated practices, which we do not own, to provide health care services, and our business would be harmed if those relationships were disrupted or if our arrangements with these entities became subject to legal challenges; we operate in a competitive industry, and if we are not able to compete effectively, our business, results of operations and financial condition would be harmed; the impact of health care reform legislation and other changes in the healthcare industry and in health care spending on us is currently unknown, but may harm our business; if our or our vendors' security measures fail or are breached and unauthorized access to our employees' patients' or partners' data is obtained, our systems may be perceived as insecure, we may incur significant liabilities, including through private litigation or regulatory action, our reputation may be harmed, and we could lose patients and partners; our business depends on our ability to effectively invest in, implement improvements to and properly maintain the uninterrupted operation and data integrity of our information technology and other business systems; our existing indebtedness could adversely affect our business and growth prospects; and the other factors set forth in our filings with the Securities and Exchange Commission. The forward-looking statements, together with statements relating to our past performance, should not be regarded as a reliable indicator of our future performance. We undertake no obligation to update any forward-looking statements made in this presentation to reflect events or circumstances after the date of this presentation or to reflect new information or the occurrence of unanticipated events, except as may be required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future mergers, dispositions, joint ventures, or investments. Use of Non-GAAP Financial Measures In addition to financial measures presented in accordance with U.S. generally accepted accounting principles (“GAAP”), this presentation includes certain non-GAAP financial measures, including Center Margin and Adjusted EBITDA. These non-GAAP measures are in addition to, and not a substitute for, or superior to, measures of financial performance prepared in accordance with U.S. GAAP. The non-GAAP financial measures used by LifeStance may differ from the non-GAAP financial measures used by other companies. A reconciliation of these measures to the most directly comparable U.S. GAAP measure is included in the Appendix to these slides or as otherwise described in these slides. Market and Industry Data This presentation also contains information regarding our market and industry that is derived from third-party research and publications. This information involves a number of assumptions and limitations. Forecasts, assumptions, expectations, beliefs, estimates and projections involve risk and uncertainties and are subject to change based on various factors.

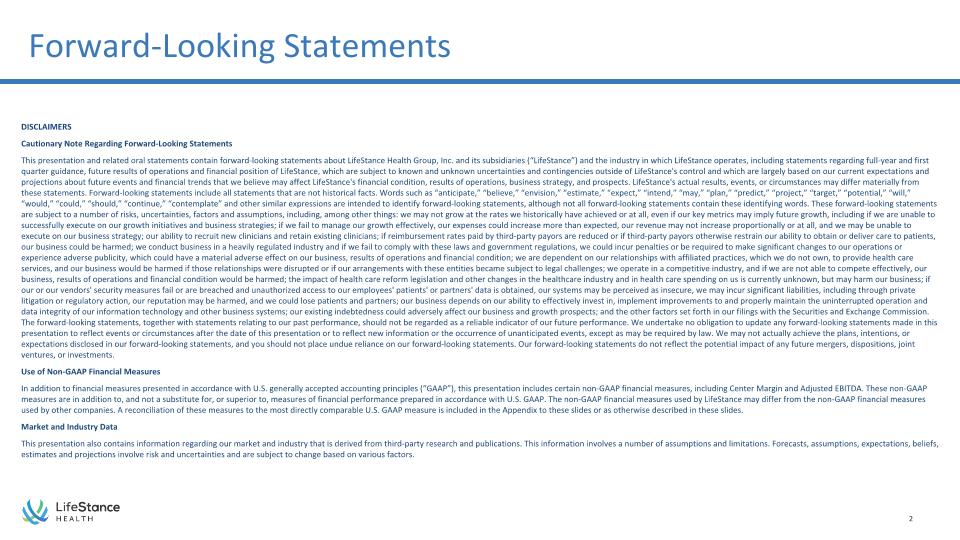

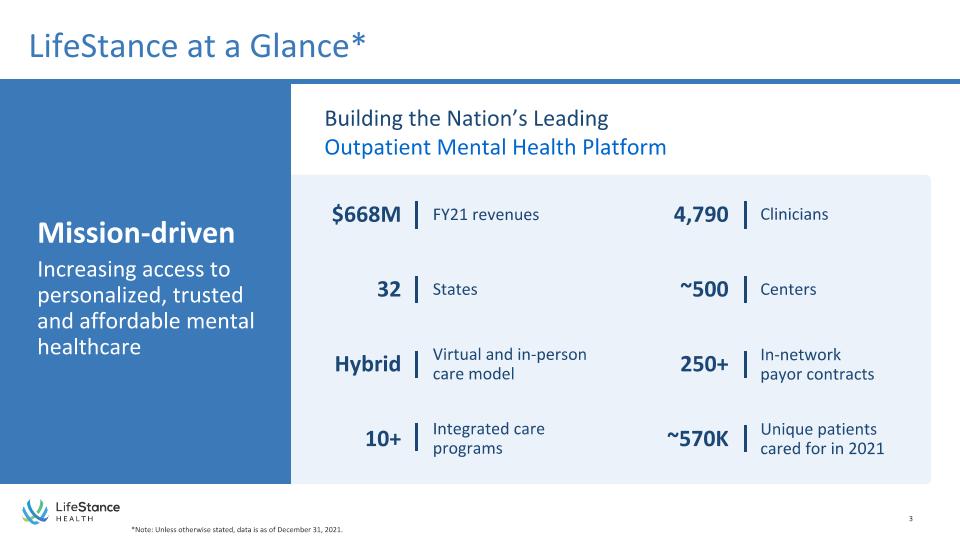

Mission-driven Increasing access to personalized, trusted and affordable mental healthcare LifeStance at a Glance* Hybrid Virtual and in-person �care model 250+ In-network �payor contracts 10+ Integrated care �programs ~570K Unique patients cared for in 2021 32 States ~500 Centers 4,790 Clinicians $668M FY21 revenues Building the Nation’s Leading �Outpatient Mental Health Platform *Note: Unless otherwise stated, data is as of December 31, 2021.

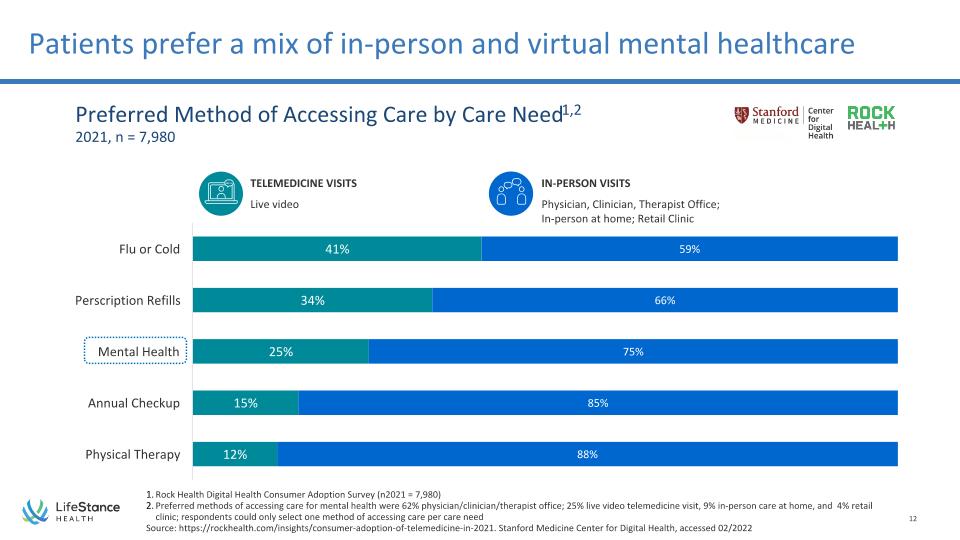

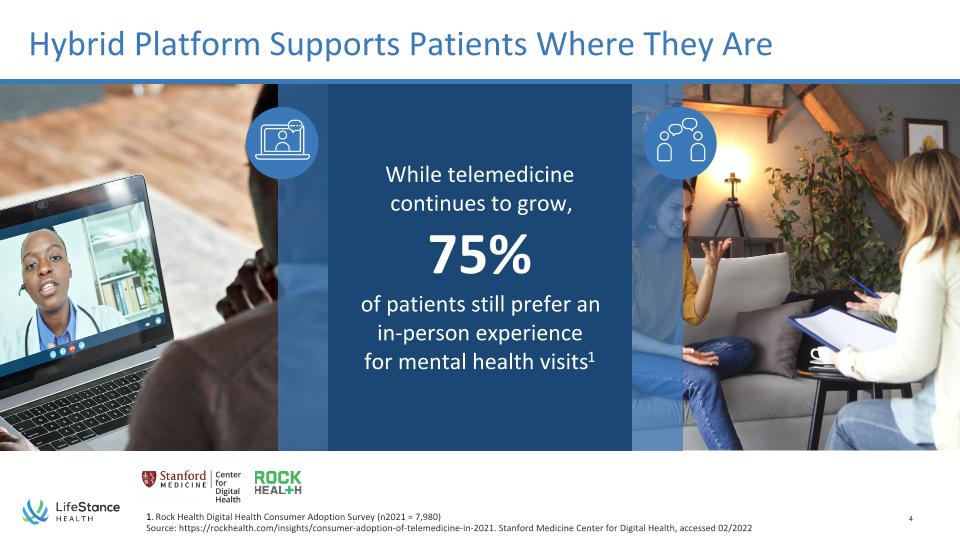

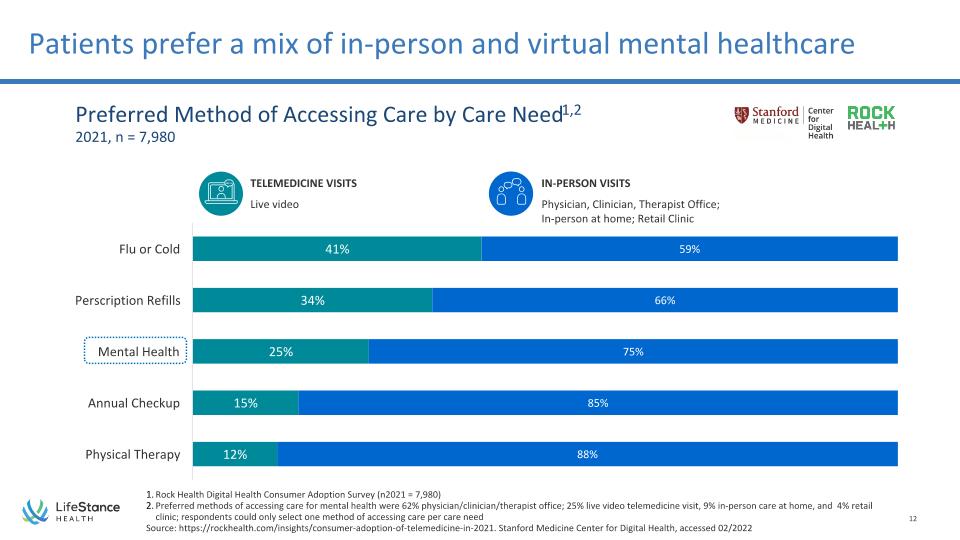

Hybrid Platform Supports Patients Where They Are While telemedicine �continues to grow, 75% of patients still prefer an �in-person experience for mental health visits1 Rock Health Digital Health Consumer Adoption Survey (n2021 = 7,980) Source: https://rockhealth.com/insights/consumer-adoption-of-telemedicine-in-2021. Stanford Medicine Center for Digital Health, accessed 02/2022

Q4 and FY 2021 Financial Highlights Q4 Revenue of $190 million increased 61% year-over-year�FY Revenue of $668 million increased 77%1 year-over-year Q4 Center Margin of $54 million, or 28.5% as a percentage of revenue�FY Center Margin of $202 million, or 30.2% as a percentage of revenue Q4 Adjusted EBITDA of $11 million, or 6.0% as a percentage of revenue�FY Adjusted EBITDA of $49 million, or 7.4% as a percentage of revenue Strong balance sheet ending Q4 with a cash position of $148 million Note: See reconciliation of GAAP to non-GAAP measures in the Appendix to this presentation. 1 Reflects a year-over-year comparison to the same period in the prior year which includes the summation of the Predecessor Period January 1, 2020 to May 14, 2020 and Successor Period of April 13 to December 31, 2020. This is not intended to be a substitute for financial reporting periods presented in accordance with GAAP. For the period from April 13, 2020 through May 14, 2020, the operations of LifeStance TopCo, L.P. (Successor) were limited to those incident to its formation and the acquisition of LifeStance Health, LLC by affiliates of TPG Inc., which were not significant. Earnings from April 13 to May 14 were reflected in the Predecessor 2020 Period.

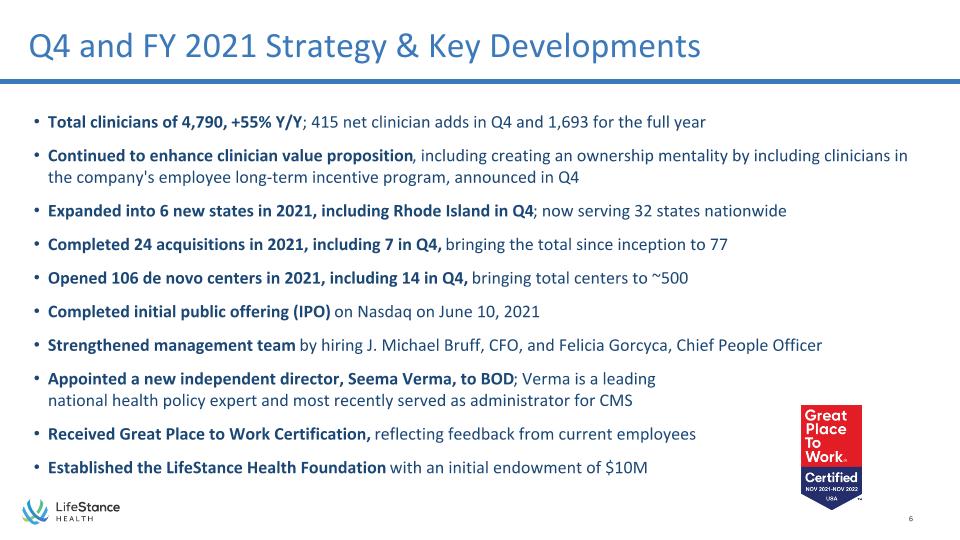

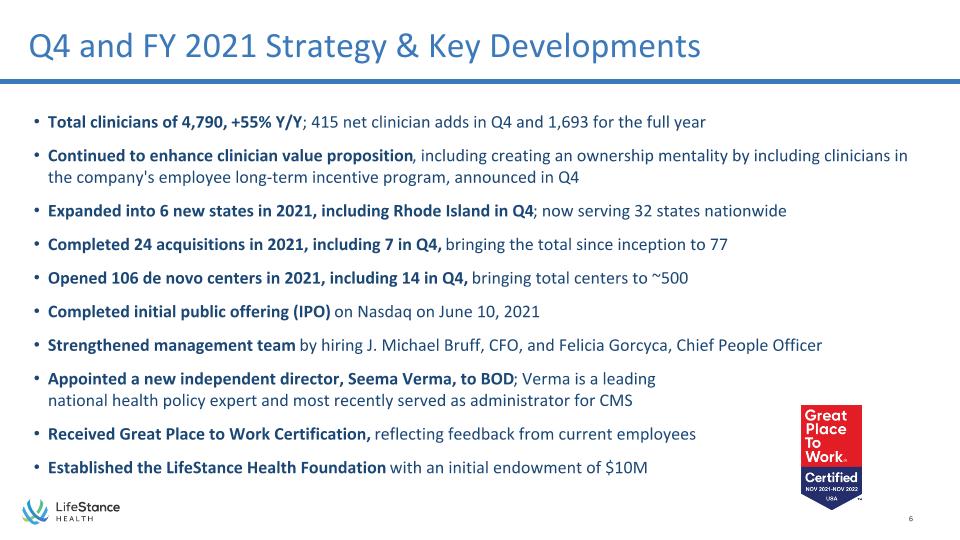

Q4 and FY 2021 Strategy & Key Developments Total clinicians of 4,790, +55% Y/Y; 415 net clinician adds in Q4 and 1,693 for the full year Continued to enhance clinician value proposition, including creating an ownership mentality by including clinicians in the company's employee long-term incentive program, announced in Q4 Expanded into 6 new states in 2021, including Rhode Island in Q4; now serving 32 states nationwide Completed 24 acquisitions in 2021, including 7 in Q4, bringing the total since inception to 77 Opened 106 de novo centers in 2021, including 14 in Q4, bringing total centers to ~500 Completed initial public offering (IPO) on Nasdaq on June 10, 2021 Strengthened management team by hiring J. Michael Bruff, CFO, and Felicia Gorcyca, Chief People Officer Appointed a new independent director, Seema Verma, to BOD; Verma is a leading �national health policy expert and most recently served as administrator for CMS Received Great Place to Work Certification, reflecting feedback from current employees Established the LifeStance Health Foundation with an initial endowment of $10M

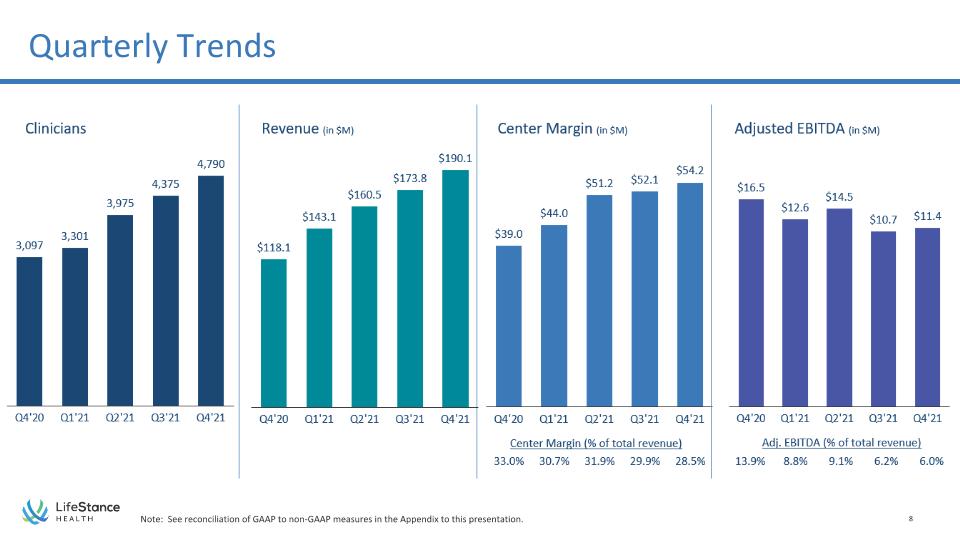

Adjusted EBITDA (in $M) Center Margin (in $M) Clinicians Revenue (in $M) Q4 2021 Results Note: See reconciliation of GAAP to non-GAAP measures in the Appendix to this presentation. 13.9% 6.0% Adj. EBITDA (% of total revenue) 33.0% 28.5% Center Margin (% of total revenue) +39% +61% +55%

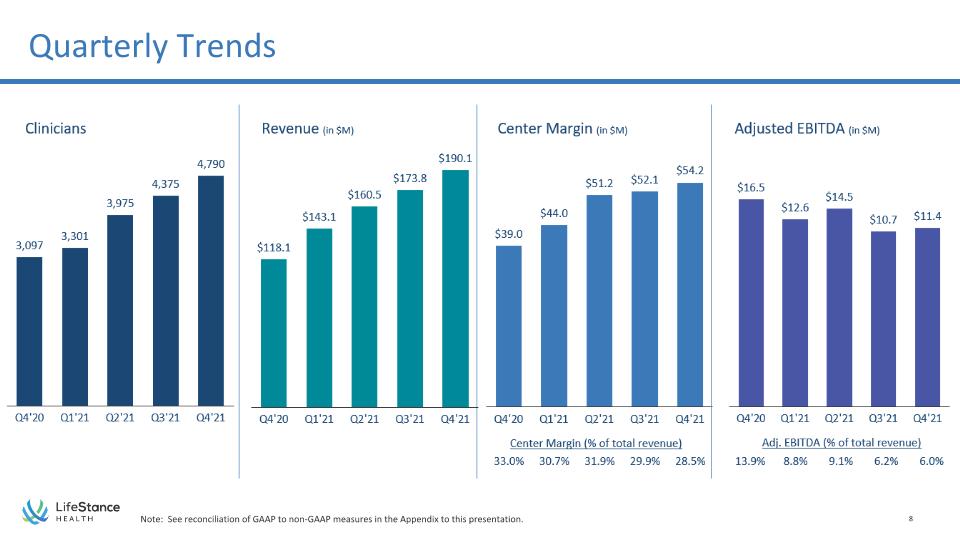

Clinicians Adjusted EBITDA (in $M) 13.9% 8.8% 9.1% 6.2% 6.0% Adj. EBITDA (% of total revenue) Center Margin (in $M) Revenue (in $M) Quarterly Trends Note: See reconciliation of GAAP to non-GAAP measures in the Appendix to this presentation. 33.0% 30.7% 31.9% 29.9% 28.5% Center Margin (% of total revenue)

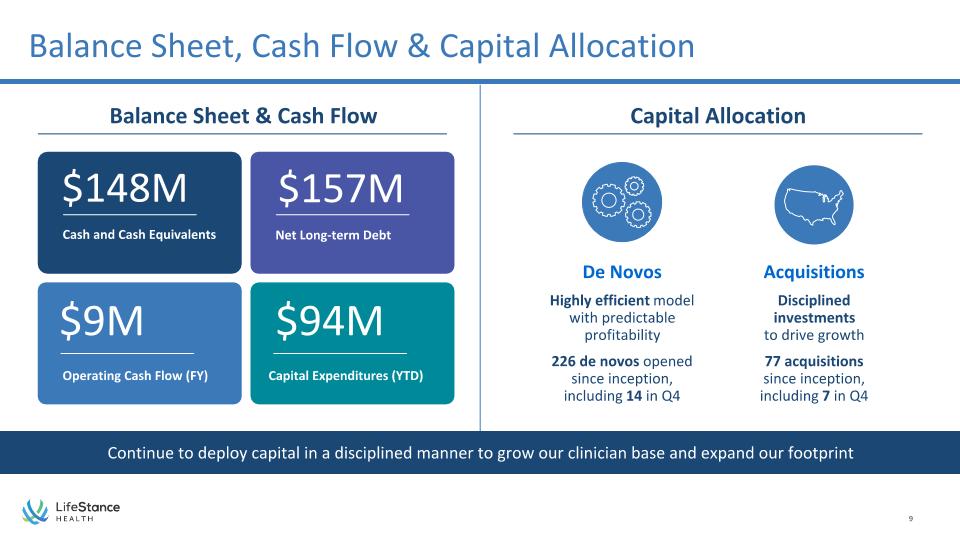

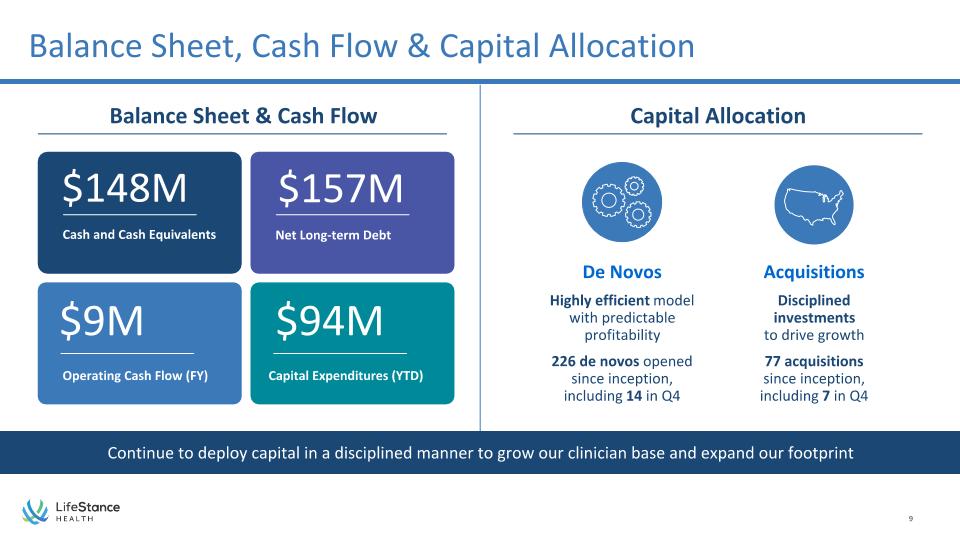

Balance Sheet, Cash Flow & Capital Allocation Percentage description with ctetur ad ipisc ing elite 75% Cash and Cash Equivalents $148M Percentage description with ctetur ad ipisc ing elite 75% Net Long-term Debt $157M Percentage description with ctetur ad ipisc ing elite 75% Operating Cash Flow (FY) $9M Percentage description with ctetur ad ipisc ing elite 75% Capital Expenditures (YTD) $94M Continue to deploy capital in a disciplined manner to grow our clinician base and expand our footprint De Novos Highly efficient model with predictable profitability 226 de novos opened since inception, including 14 in Q4 Capital Allocation Acquisitions Disciplined �investments �to drive growth 77 acquisitions�since inception, including 7 in Q4 Balance Sheet & Cash Flow

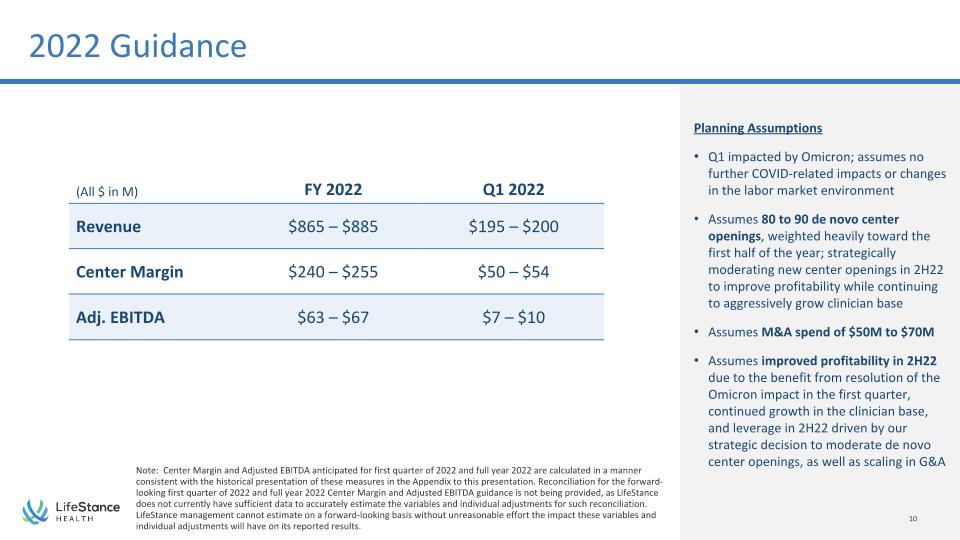

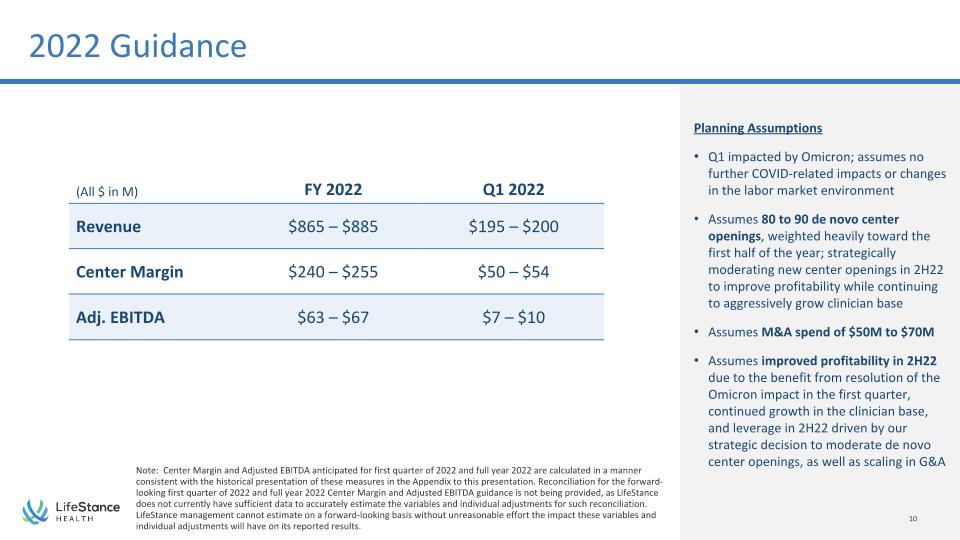

2022 Guidance (All $ in M) FY 2022 Q1 2022 Revenue $865 – $885 $195 – $200 Center Margin $240 – $255 $50 – $54 Adj. EBITDA $63 – $67 $7 – $10 Note: Center Margin and Adjusted EBITDA anticipated for first quarter of 2022 and full year 2022 are calculated in a manner consistent with the historical presentation of these measures in the Appendix to this presentation. Reconciliation for the forward-looking first quarter of 2022 and full year 2022 Center Margin and Adjusted EBITDA guidance is not being provided, as LifeStance does not currently have sufficient data to accurately estimate the variables and individual adjustments for such reconciliation. LifeStance management cannot estimate on a forward-looking basis without unreasonable effort the impact these variables and individual adjustments will have on its reported results. Planning Assumptions Q1 impacted by Omicron; assumes no further COVID-related impacts or changes in the labor market environment Assumes 80 to 90 de novo center openings, weighted heavily toward the first half of the year; strategically moderating new center openings in 2H22 to improve profitability while continuing to aggressively grow clinician base Assumes M&A spend of $50M to $70M Assumes improved profitability in 2H22 due to the benefit from resolution of the Omicron impact in the first quarter, continued growth in the clinician base, and leverage in 2H22 driven by our strategic decision to moderate de novo center openings, as well as scaling in G&A

Appendix

Patients prefer a mix of in-person and virtual mental healthcare Rock Health Digital Health Consumer Adoption Survey (n2021 = 7,980) Preferred methods of accessing care for mental health were 62% physician/clinician/therapist office; 25% live video telemedicine visit, 9% in-person care at home, and 4% retail clinic; respondents could only select one method of accessing care per care need Source: https://rockhealth.com/insights/consumer-adoption-of-telemedicine-in-2021. Stanford Medicine Center for Digital Health, accessed 02/2022 TELEMEDICINE VISITS Live video IN-PERSON VISITS Physician, Clinician, Therapist Office; In-person at home; Retail Clinic Preferred Method of Accessing Care by Care Need1,2 2021, n = 7,980

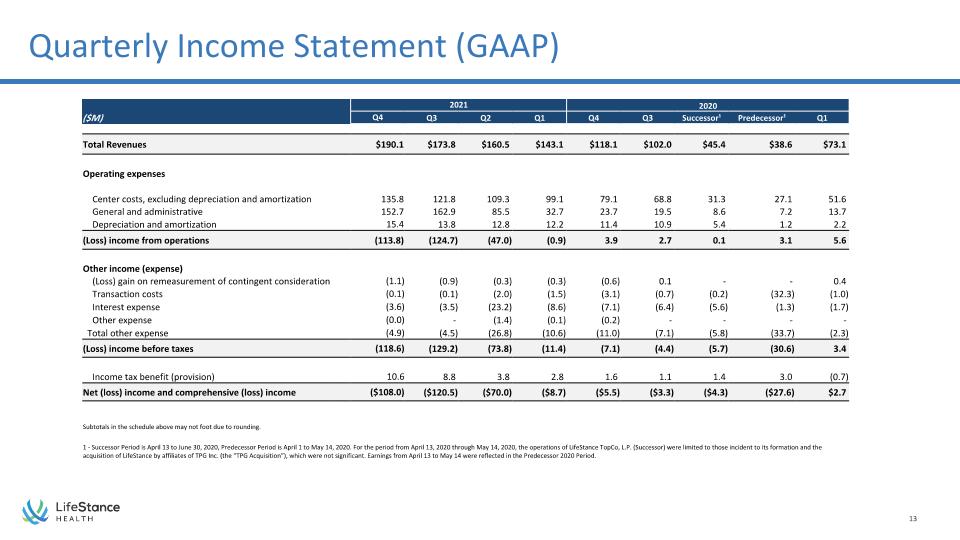

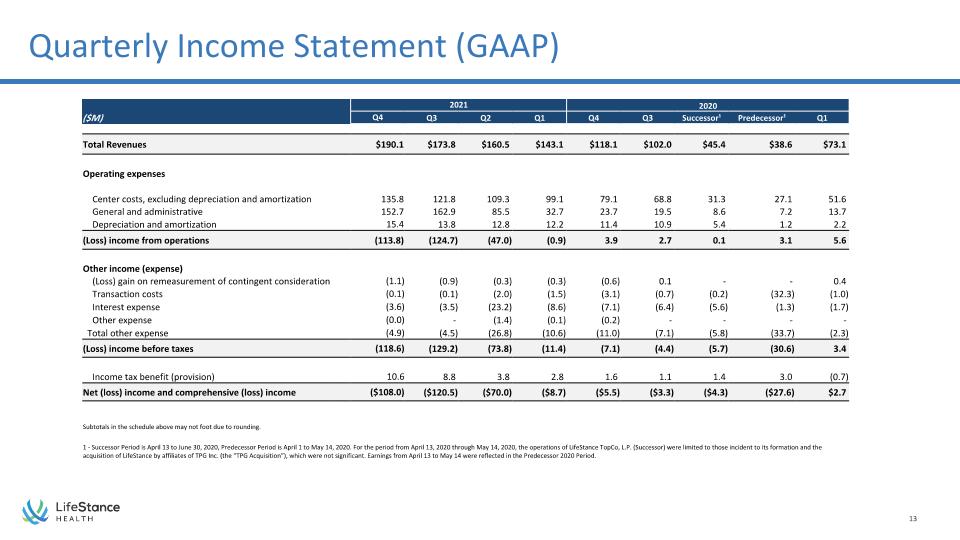

Quarterly Income Statement (GAAP) 2021 2020 ($M) Q4 Q3 Q2 Q1 Q4 Q3 Successor¹ Predecessor¹ Q1 Total Revenues $190.1 $173.8 $160.5 $143.1 $118.1 $102.0 $45.4 $38.6 $73.1 Operating expenses Center costs, excluding depreciation and amortization 135.8 121.8 109.3 99.1 79.1 68.8 31.3 27.1 51.6 General and administrative 152.7 162.9 85.5 32.7 23.7 19.5 8.6 7.2 13.7 Depreciation and amortization 15.4 13.8 12.8 12.2 11.4 10.9 5.4 1.2 2.2 (Loss) income from operations (113.8) (124.7) (47.0) (0.9) 3.9 2.7 0.1 3.1 5.6 Other income (expense) (Loss) gain on remeasurement of contingent consideration (1.1) (0.9) (0.3) (0.3) (0.6) 0.1 - - 0.4 Transaction costs (0.1) (0.1) (2.0) (1.5) (3.1) (0.7) (0.2) (32.3) (1.0) Interest expense (3.6) (3.5) (23.2) (8.6) (7.1) (6.4) (5.6) (1.3) (1.7) Other expense (0.0) - (1.4) (0.1) (0.2) - - - - Total other expense (4.9) (4.5) (26.8) (10.6) (11.0) (7.1) (5.8) (33.7) (2.3) (Loss) income before taxes (118.6) (129.2) (73.8) (11.4) (7.1) (4.4) (5.7) (30.6) 3.4 Income tax benefit (provision) 10.6 8.8 3.8 2.8 1.6 1.1 1.4 3.0 (0.7) Net (loss) income and comprehensive (loss) income ($108.0) ($120.5) ($70.0) ($8.7) ($5.5) ($3.3) ($4.3) ($27.6) $2.7 Subtotals in the schedule above may not foot due to rounding. 1 - Successor Period is April 13 to June 30, 2020, Predecessor Period is April 1 to May 14, 2020. For the period from April 13, 2020 through May 14, 2020, the operations of LifeStance TopCo, L.P. (Successor) were limited to those incident to its formation and the acquisition of LifeStance by affiliates of TPG Inc. (the “TPG Acquisition”), which were not significant. Earnings from April 13 to May 14 were reflected in the Predecessor 2020 Period.

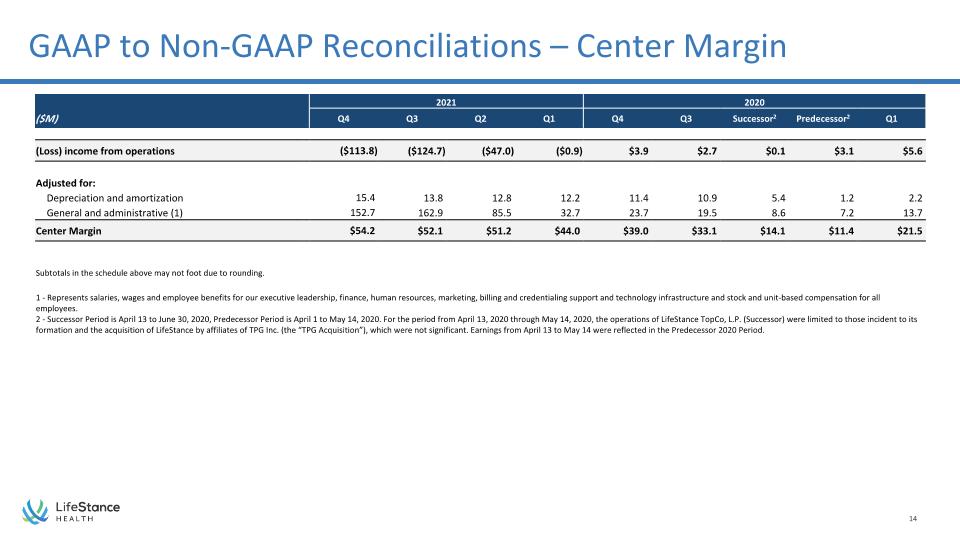

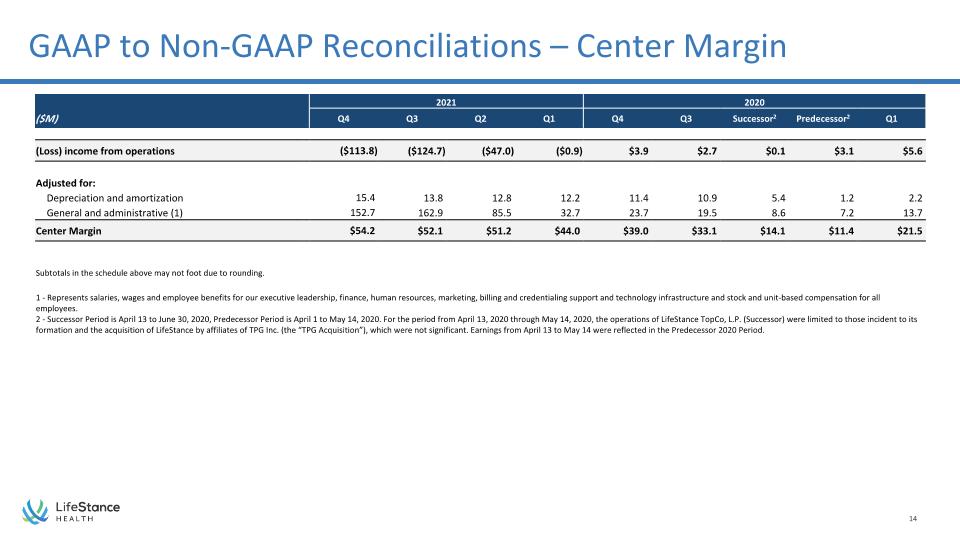

GAAP to Non-GAAP Reconciliations – Center Margin 2021 2021 2020 ($M) Q4 Q3 Q2 Q1 Q4 Q3 Successor2 Predecessor2 Q1 (Loss) income from operations ($113.8) ($124.7) ($47.0) ($0.9) $3.9 $2.7 $0.1 $3.1 $5.6 Adjusted for: Depreciation and amortization 15.4 13.8 12.8 12.2 11.4 10.9 5.4 1.2 2.2 General and administrative (1) 152.7 162.9 85.5 32.7 23.7 19.5 8.6 7.2 13.7 Center Margin $54.2 $52.1 $51.2 $44.0 $39.0 $33.1 $14.1 $11.4 $21.5 Subtotals in the schedule above may not foot due to rounding. 1 - Represents salaries, wages and employee benefits for our executive leadership, finance, human resources, marketing, billing and credentialing support and technology infrastructure and stock and unit-based compensation for all employees. 2 - Successor Period is April 13 to June 30, 2020, Predecessor Period is April 1 to May 14, 2020. For the period from April 13, 2020 through May 14, 2020, the operations of LifeStance TopCo, L.P. (Successor) were limited to those incident to its formation and the acquisition of LifeStance by affiliates of TPG Inc. (the “TPG Acquisition”), which were not significant. Earnings from April 13 to May 14 were reflected in the Predecessor 2020 Period.

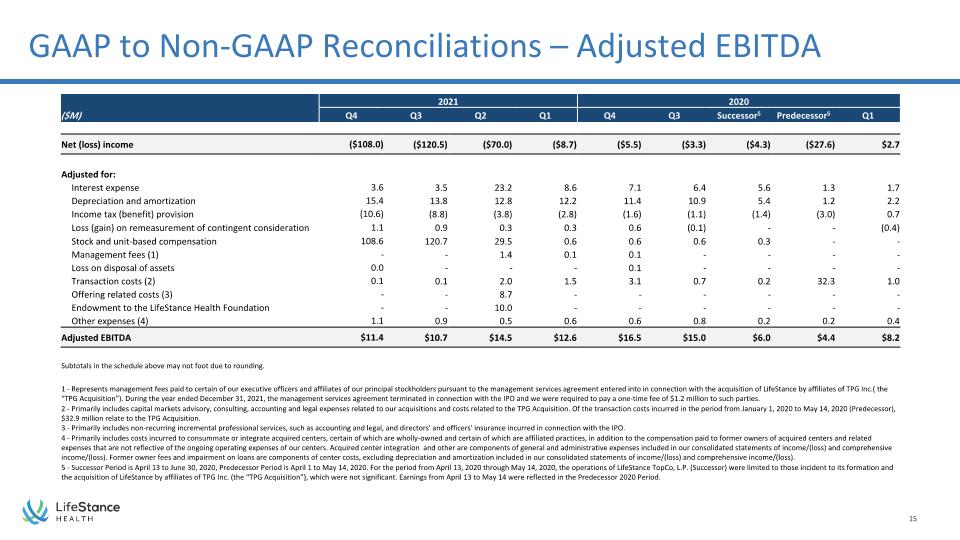

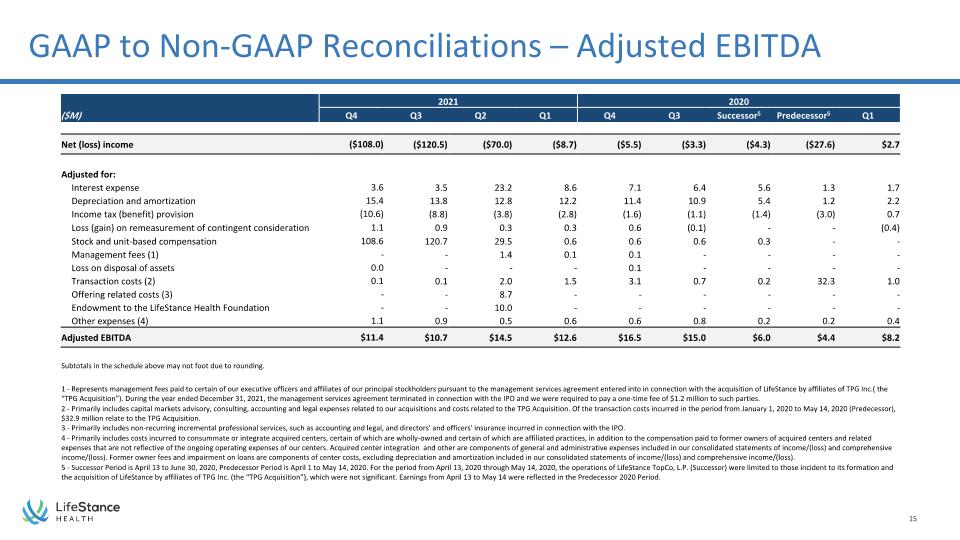

GAAP to Non-GAAP Reconciliations – Adjusted EBITDA 2021 2021 2020 ($M) Q4 Q3 Q2 Q1 Q4 Q3 Successor5 Predecessor5 Q1 Net (loss) income ($108.0) ($120.5) ($70.0) ($8.7) ($5.5) ($3.3) ($4.3) ($27.6) $2.7 Adjusted for: Interest expense 3.6 3.5 23.2 8.6 7.1 6.4 5.6 1.3 1.7 Depreciation and amortization 15.4 13.8 12.8 12.2 11.4 10.9 5.4 1.2 2.2 Income tax (benefit) provision (10.6) (8.8) (3.8) (2.8) (1.6) (1.1) (1.4) (3.0) 0.7 Loss (gain) on remeasurement of contingent consideration 1.1 0.9 0.3 0.3 0.6 (0.1) - - (0.4) Stock and unit-based compensation 108.6 120.7 29.5 0.6 0.6 0.6 0.3 - - Management fees (1) - - 1.4 0.1 0.1 - - - - Loss on disposal of assets 0.0 - - - 0.1 - - - - Transaction costs (2) 0.1 0.1 2.0 1.5 3.1 0.7 0.2 32.3 1.0 Offering related costs (3) - - 8.7 - - - - - - Endowment to the LifeStance Health Foundation - - 10.0 - - - - - - Other expenses (4) 1.1 0.9 0.5 0.6 0.6 0.8 0.2 0.2 0.4 Adjusted EBITDA $11.4 $10.7 $14.5 $12.6 $16.5 $15.0 $6.0 $4.4 $8.2 Subtotals in the schedule above may not foot due to rounding. 1 - Represents management fees paid to certain of our executive officers and affiliates of our principal stockholders pursuant to the management services agreement entered into in connection with the acquisition of LifeStance by affiliates of TPG Inc.( the “TPG Acquisition”). During the year ended December 31, 2021, the management services agreement terminated in connection with the IPO and we were required to pay a one-time fee of $1.2 million to such parties. 2 - Primarily includes capital markets advisory, consulting, accounting and legal expenses related to our acquisitions and costs related to the TPG Acquisition. Of the transaction costs incurred in the period from January 1, 2020 to May 14, 2020 (Predecessor), $32.9 million relate to the TPG Acquisition. 3 - Primarily includes non-recurring incremental professional services, such as accounting and legal, and directors' and officers' insurance incurred in connection with the IPO. 4 - Primarily includes costs incurred to consummate or integrate acquired centers, certain of which are wholly-owned and certain of which are affiliated practices, in addition to the compensation paid to former owners of acquired centers and related expenses that are not reflective of the ongoing operating expenses of our centers. Acquired center integration and other are components of general and administrative expenses included in our consolidated statements of income/(loss) and comprehensive income/(loss). Former owner fees and impairment on loans are components of center costs, excluding depreciation and amortization included in our consolidated statements of income/(loss) and comprehensive income/(loss). 5 - Successor Period is April 13 to June 30, 2020, Predecessor Period is April 1 to May 14, 2020. For the period from April 13, 2020 through May 14, 2020, the operations of LifeStance TopCo, L.P. (Successor) were limited to those incident to its formation and the acquisition of LifeStance by affiliates of TPG Inc. (the “TPG Acquisition”), which were not significant. Earnings from April 13 to May 14 were reflected in the Predecessor 2020 Period.

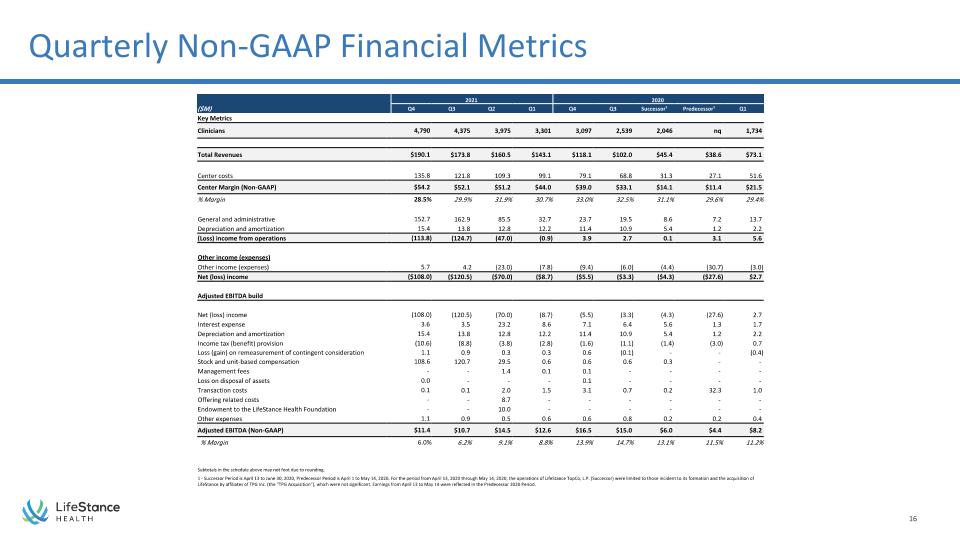

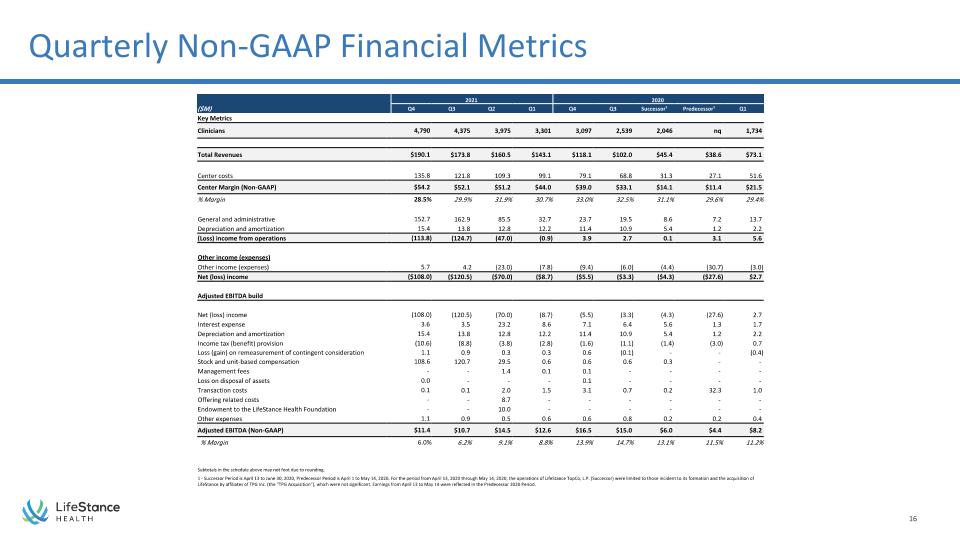

Quarterly Non-GAAP Financial Metrics 2021 2021 2020 ($M) Q4 Q3 Q2 Q1 Q4 Q3 Successor¹ Predecessor¹ Q1 Key Metrics Clinicians 4,790 4,375 3,975 3,301 3,097 2,539 2,046 nq 1,734 Total Revenues $190.1 $173.8 $160.5 $143.1 $118.1 $102.0 $45.4 $38.6 $73.1 Center costs 135.8 121.8 109.3 99.1 79.1 68.8 31.3 27.1 51.6 Center Margin (Non-GAAP) $54.2 $52.1 $51.2 $44.0 $39.0 $33.1 $14.1 $11.4 $21.5 % Margin 28.5% 29.9% 31.9% 30.7% 33.0% 32.5% 31.1% 29.6% 29.4% General and administrative 152.7 162.9 85.5 32.7 23.7 19.5 8.6 7.2 13.7 Depreciation and amortization 15.4 13.8 12.8 12.2 11.4 10.9 5.4 1.2 2.2 (Loss) income from operations (113.8) (124.7) (47.0) (0.9) 3.9 2.7 0.1 3.1 5.6 Other income (expenses) Other income (expenses) 5.7 4.2 (23.0) (7.8) (9.4) (6.0) (4.4) (30.7) (3.0) Net (loss) income ($108.0) ($120.5) ($70.0) ($8.7) ($5.5) ($3.3) ($4.3) ($27.6) $2.7 Adjusted EBITDA build Net (loss) income (108.0) (120.5) (70.0) (8.7) (5.5) (3.3) (4.3) (27.6) 2.7 Interest expense 3.6 3.5 23.2 8.6 7.1 6.4 5.6 1.3 1.7 Depreciation and amortization 15.4 13.8 12.8 12.2 11.4 10.9 5.4 1.2 2.2 Income tax (benefit) provision (10.6) (8.8) (3.8) (2.8) (1.6) (1.1) (1.4) (3.0) 0.7 Loss (gain) on remeasurement of contingent consideration 1.1 0.9 0.3 0.3 0.6 (0.1) - - (0.4) Stock and unit-based compensation 108.6 120.7 29.5 0.6 0.6 0.6 0.3 - - Management fees - - 1.4 0.1 0.1 - - - - Loss on disposal of assets 0.0 - - - 0.1 - - - - Transaction costs 0.1 0.1 2.0 1.5 3.1 0.7 0.2 32.3 1.0 Offering related costs - - 8.7 - - - - - - Endowment to the LifeStance Health Foundation - - 10.0 - - - - - - Other expenses 1.1 0.9 0.5 0.6 0.6 0.8 0.2 0.2 0.4 Adjusted EBITDA (Non-GAAP) $11.4 $10.7 $14.5 $12.6 $16.5 $15.0 $6.0 $4.4 $8.2 % Margin 6.0% 6.2% 9.1% 8.8% 13.9% 14.7% 13.1% 11.5% 11.2% Subtotals in the schedule above may not foot due to rounding. 1 - Successor Period is April 13 to June 30, 2020, Predecessor Period is April 1 to May 14, 2020. For the period from April 13, 2020 through May 14, 2020, the operations of LifeStance TopCo, L.P. (Successor) were limited to those incident to its formation and the acquisition of LifeStance by affiliates of TPG Inc. (the “TPG Acquisition”), which were not significant. Earnings from April 13 to May 14 were reflected in the Predecessor 2020 Period.

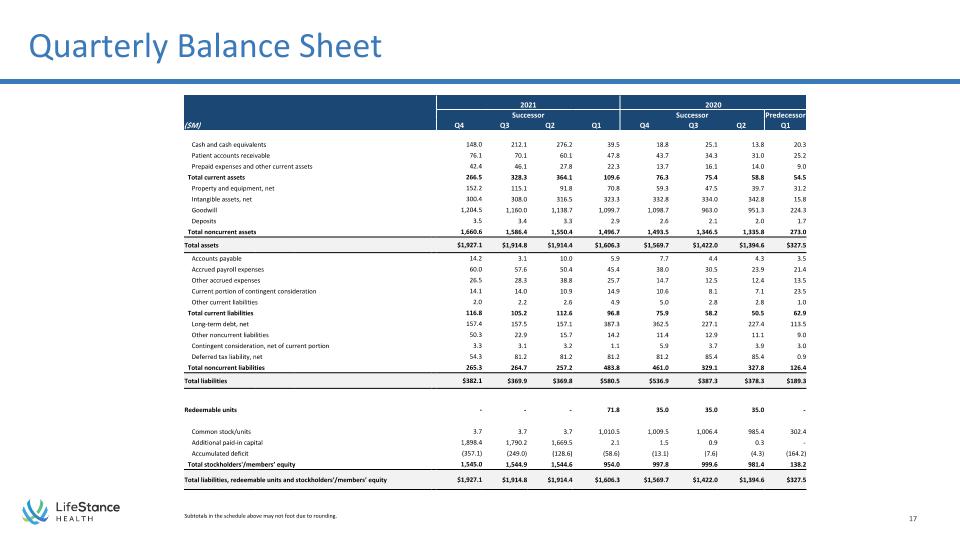

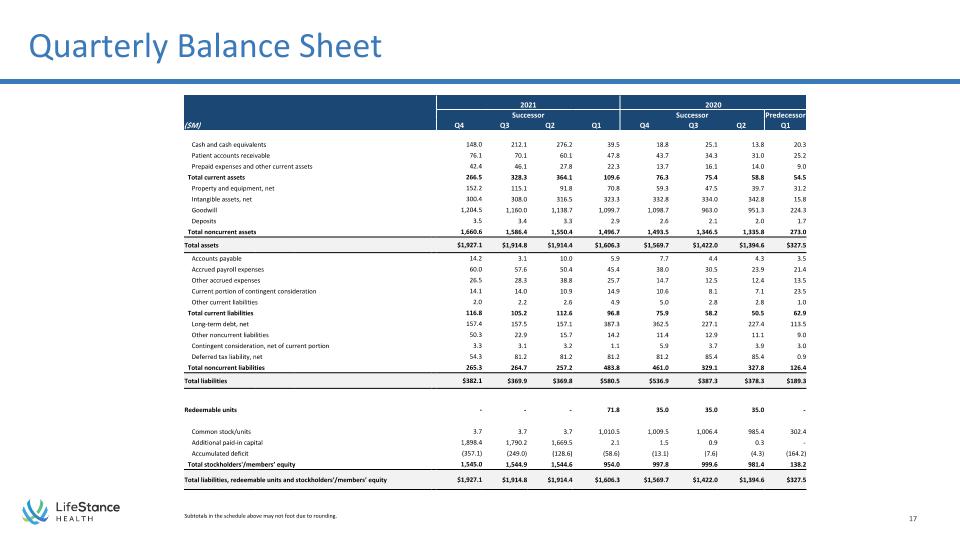

Quarterly Balance Sheet 2021 2021 2020 Successor Successor Predecessor ($M) Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Cash and cash equivalents 148.0 212.1 276.2 39.5 18.8 25.1 13.8 20.3 Patient accounts receivable 76.1 70.1 60.1 47.8 43.7 34.3 31.0 25.2 Prepaid expenses and other current assets 42.4 46.1 27.8 22.3 13.7 16.1 14.0 9.0 Total current assets 266.5 328.3 364.1 109.6 76.3 75.4 58.8 54.5 Property and equipment, net 152.2 115.1 91.8 70.8 59.3 47.5 39.7 31.2 Intangible assets, net 300.4 308.0 316.5 323.3 332.8 334.0 342.8 15.8 Goodwill 1,204.5 1,160.0 1,138.7 1,099.7 1,098.7 963.0 951.3 224.3 Deposits 3.5 3.4 3.3 2.9 2.6 2.1 2.0 1.7 Total noncurrent assets 1,660.6 1,586.4 1,550.4 1,496.7 1,493.5 1,346.5 1,335.8 273.0 Total assets $1,927.1 $1,914.8 $1,914.4 $1,606.3 $1,569.7 $1,422.0 $1,394.6 $327.5 Accounts payable 14.2 3.1 10.0 5.9 7.7 4.4 4.3 3.5 Accrued payroll expenses 60.0 57.6 50.4 45.4 38.0 30.5 23.9 21.4 Other accrued expenses 26.5 28.3 38.8 25.7 14.7 12.5 12.4 13.5 Current portion of contingent consideration 14.1 14.0 10.9 14.9 10.6 8.1 7.1 23.5 Other current liabilities 2.0 2.2 2.6 4.9 5.0 2.8 2.8 1.0 Total current liabilities 116.8 105.2 112.6 96.8 75.9 58.2 50.5 62.9 Long-term debt, net 157.4 157.5 157.1 387.3 362.5 227.1 227.4 113.5 Other noncurrent liabilities 50.3 22.9 15.7 14.2 11.4 12.9 11.1 9.0 Contingent consideration, net of current portion 3.3 3.1 3.2 1.1 5.9 3.7 3.9 3.0 Deferred tax liability, net 54.3 81.2 81.2 81.2 81.2 85.4 85.4 0.9 Total noncurrent liabilities 265.3 264.7 257.2 483.8 461.0 329.1 327.8 126.4 Total liabilities $382.1 $369.9 $369.8 $580.5 $536.9 $387.3 $378.3 $189.3 Redeemable units - - - 71.8 35.0 35.0 35.0 - Common stock/units 3.7 3.7 3.7 1,010.5 1,009.5 1,006.4 985.4 302.4 Additional paid-in capital 1,898.4 1,790.2 1,669.5 2.1 1.5 0.9 0.3 - Accumulated deficit (357.1) (249.0) (128.6) (58.6) (13.1) (7.6) (4.3) (164.2) Total stockholders'/members’ equity 1,545.0 1,544.9 1,544.6 954.0 997.8 999.6 981.4 138.2 Total liabilities, redeemable units and stockholders’/members’ equity $1,927.1 $1,914.8 $1,914.4 $1,606.3 $1,569.7 $1,422.0 $1,394.6 $327.5 Subtotals in the schedule above may not foot due to rounding.

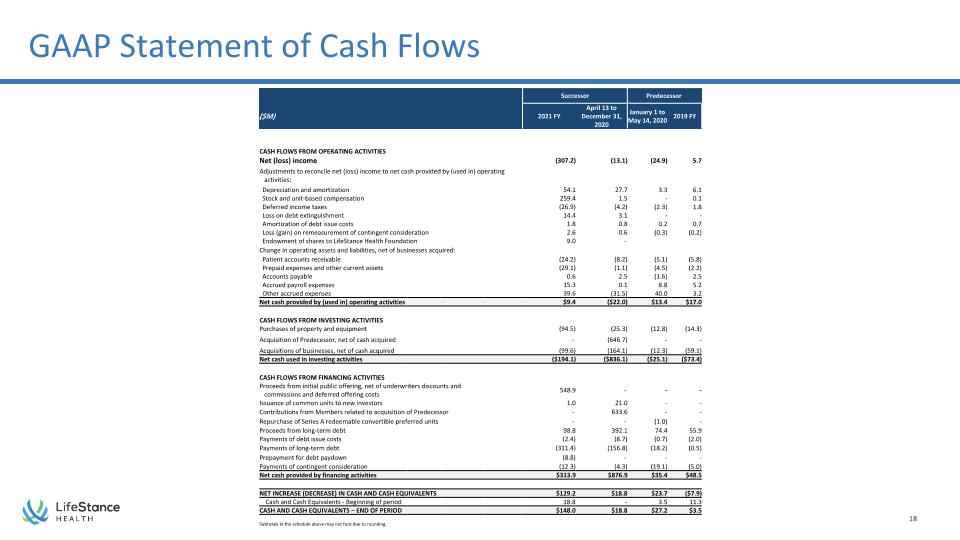

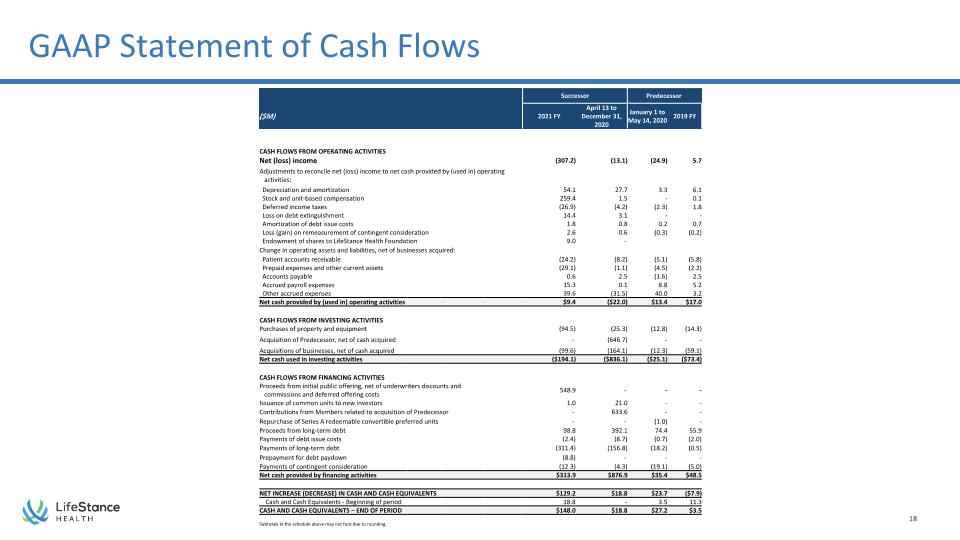

Successor Predecessor ($M) 2021 FY April 13 to�December 31, 2020 January 1 to�May 14, 2020 2019 FY CASH FLOWS FROM OPERATING ACTIVITIES Net (loss) income (307.2) (13.1) (24.9) 5.7 Adjustments to reconcile net (loss) income to net cash provided by (used in) operating� activities: Depreciation and amortization 54.1 27.7 3.3 6.1 Stock and unit-based compensation 259.4 1.5 - 0.1 Deferred income taxes (26.9) (4.2) (2.3) 1.8 Loss on debt extinguishment 14.4 3.1 - - Amortization of debt issue costs 1.8 0.8 0.2 0.7 Loss (gain) on remeasurement of contingent consideration 2.6 0.6 (0.3) (0.2) Endowment of shares to LifeStance Health Foundation 9.0 - Change in operating assets and liabilities, net of businesses acquired: Patient accounts receivable (24.2) (8.2) (5.1) (5.8) Prepaid expenses and other current assets (29.1) (1.1) (4.5) (2.2) Accounts payable 0.6 2.5 (1.6) 2.5 Accrued payroll expenses 15.3 0.1 8.8 5.2 Other accrued expenses 39.6 (31.5) 40.0 3.2 Net cash provided by (used in) operating activities $9.4 ($22.0) $13.4 $17.0 CASH FLOWS FROM INVESTING ACTIVITIES Purchases of property and equipment (94.5) (25.3) (12.8) (14.3) Acquisition of Predecessor, net of cash acquired - (646.7) - - Acquisitions of businesses, net of cash acquired (99.6) (164.1) (12.3) (59.1) Net cash used in investing activities ($194.1) ($836.1) ($25.1) ($73.4) CASH FLOWS FROM FINANCING ACTIVITIES Proceeds from initial public offering, net of underwriters discounts and� commissions and deferred offering costs 548.9 - - - Issuance of common units to new investors 1.0 21.0 - - Contributions from Members related to acquisition of Predecessor - 633.6 - - Repurchase of Series A redeemable convertible preferred units - - (1.0) - Proceeds from long-term debt 98.8 392.1 74.4 55.9 Payments of debt issue costs (2.4) (8.7) (0.7) (2.0) Payments of long-term debt (311.4) (156.8) (18.2) (0.5) Prepayment for debt paydown (8.8) - - - Payments of contingent consideration (12.3) (4.3) (19.1) (5.0) Net cash provided by financing activities $313.9 $876.9 $35.4 $48.5 NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS $129.2 $18.8 $23.7 ($7.9) Cash and Cash Equivalents - Beginning of period 18.8 - 3.5 11.3 CASH AND CASH EQUIVALENTS – END OF PERIOD $148.0 $18.8 $27.2 $3.5 GAAP Statement of Cash Flows Subtotals in the schedule above may not foot due to rounding.