| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-23643) |

| | |

| Exact name of registrant as specified in charter: | Putnam ETF Trust |

| | |

| Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

| | |

| Name and address of agent for service: | Stephen Tate, Vice President

100 Federal Street

Boston, Massachusetts 02110 |

| | |

| Copy to: | Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, New York 10036 |

| | |

| | James E. Thomas, Esq.

Ropes & Gray LLP

800 Boylston Street

Boston, Massachusetts 02199 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | April 30, 2023 |

| | |

| Date of reporting period: | January 19, 2023 (commencement of operations) – April 30, 2023 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam

ESG Ultra Short

ETF

Annual report

4 | 30 | 23

Message from the Trustees

June 14, 2023

Dear Shareholder:

Stocks and bonds have generally advanced since the start of the year despite market ups and downs. Inflation has fallen but remains a concern for the Federal Reserve. U.S. interest rates have risen to their highest level since 2007, which is putting pressure on corporate earnings and causing stress in the banking system.

Fortunately, a strong pulse of innovation in the broader economy is gaining investor attention. International markets are becoming increasingly dynamic, in part because China’s economy is reopening after years of pandemic-related restrictions.

While remaining alert to market risks, your investment team is finding new and attractive opportunities across sectors, industries, and global markets. This report offers an update about their efforts in managing your fund.

Thank you for investing with Putnam.

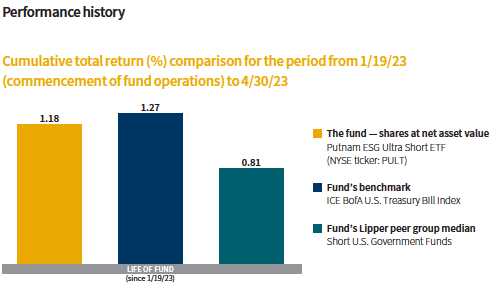

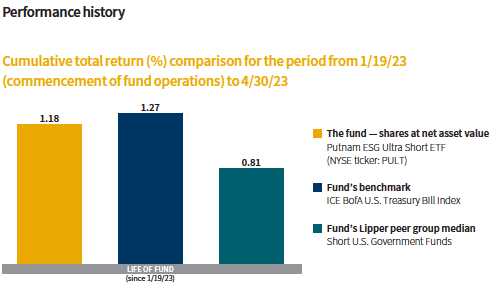

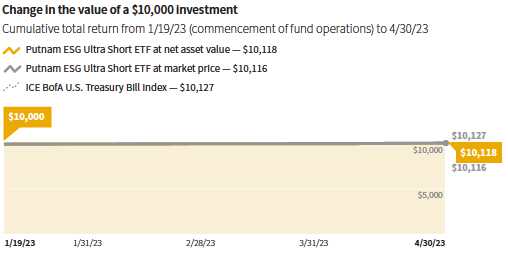

Data are historical. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of fund shares assumes reinvestment of distributions and does not account for taxes. The fund return in the bar chart is at net asset value (NAV). See below and pages 7–8 for additional performance information, including fund returns at market price. For a portion of the period, the fund had expense limitations, without which the return would have been lower. Index results should be compared with fund performance at NAV. The short-term results of a relatively new fund are not necessarily indicative of its long-term prospects. To obtain the most recent month-end performance, please visit putnam.com or call 1-833-228-5577 (toll free).

Lipper peer group median is provided by Lipper, a Refinitiv company.

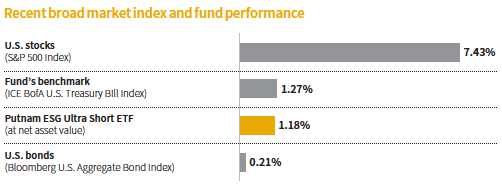

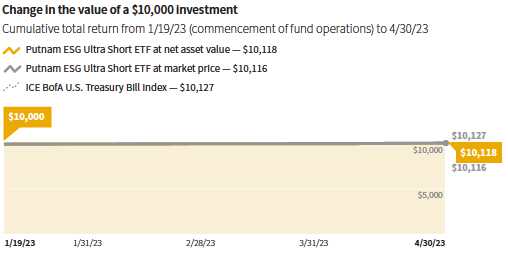

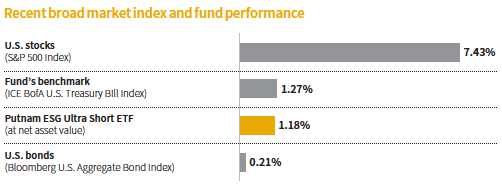

This comparison shows your fund’s performance in the context of broad market indexes for the period from 1/19/23 (commencement of fund operations) to 4/30/23. See above and pages 7–8 for additional fund performance information. Index descriptions can be found on page 11.

All Bloomberg indices are provided by Bloomberg Index Services Limited.

How were market conditions during the reporting period?

Short-term fixed income delivered positive performance amid considerable market volatility. Rising interest rates and persistent inflation weighed on investor sentiment. The ICE BofA U.S. Treasury Bill Index, the fund’s benchmark, returned 1.27% for the period.

After a strong start in January, markets reversed course in February. This was due, in part, to fears that the Federal Reserve might increase interest rates higher than anticipated following the release of rising inflation data and continued labor market tightness in January.

Volatility persisted into March, as markets sold off due to high-profile failures of regional banks in California and New York as well as a liquidity crisis and forced merger for a bank in Switzerland. Quick actions by global central banks to minimize systemic risk, including shoring up bank deposits, prevented contagion across the global financial system. While the turmoil stirred recession concerns, it also led to changing expectations about the future path of Fed monetary policy. Investors hoped that a continued economic slowdown might give the Fed room to ease monetary policy.

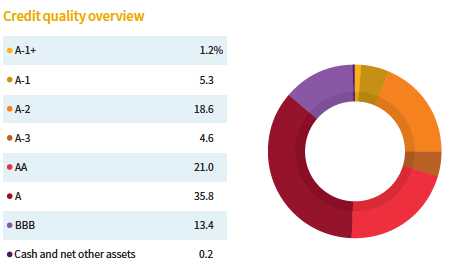

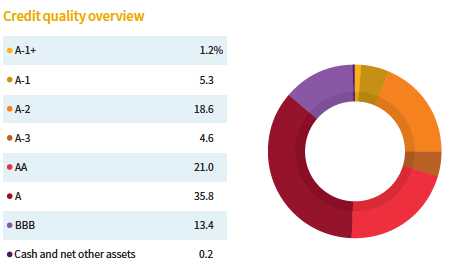

Credit qualities are shown as a percentage of the fund’s net assets as of 4/30/23. A bond rated BBB or higher (A-3/SP-3 or higher, for short-term debt) is considered investment grade. This chart reflects the highest security rating provided by one or more of Standard & Poor’s, Moody’s, and Fitch. Ratings may vary over time. Due to rounding, percentages may not equal 100%.

Cash and net other assets, if any, represent the market value weights of cash and derivatives and may show a negative market value as a result of the timing of trade versus settlement date transactions. The fund itself has not been rated by an independent rating agency.

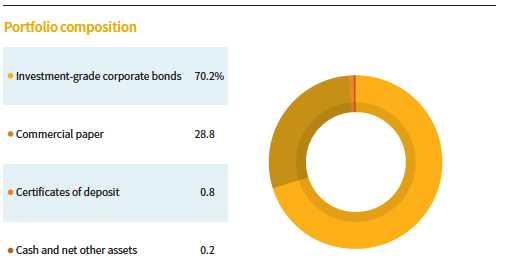

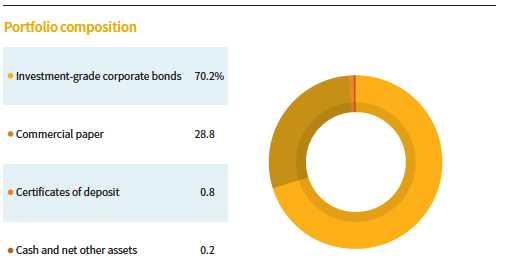

Allocations are shown as a percentage of the fund’s net assets as of 4/30/23. Cash and net other assets, if any, represent the market value weights of cash, derivatives, and other unclassified assets in the portfolio. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the use of different classifications of securities for presentation purposes, and rounding. Holdings and allocations may vary over time. Due to rounding, percentages may not equal 100%.

With signs that inflation was moderating but still high, the Fed pivoted to lower interest-rate increases of 0.25% in February and March. Yields fell in sync with changing monetary policy expectations. The yield on the 2-year U.S. Treasury note began the period at 4.09% and peaked at 5.05% on March 8 before falling to 4.04% at period-end.

How did the fund perform in this environment?

For the period from its commencement of operations on January 19, 2023, through April 30, 2023, the fund gained 1.18%, marginally underperforming the 1.27% return for the benchmark.

What were the drivers of performance during the period?

Corporate credit was the largest contributor to the fund’s relative performance during the period, despite 1–3 year investment-grade corporate spreads widening. [Spreads are the yield advantage credit-sensitive bonds offer over comparable-maturity U.S. Treasuries. Bond prices rise as yield spreads tighten and decline as spreads widen.] After beginning the quarter at 73 basis point [bps], spreads widened out to 132 bps by March 15 amid concerns over the stability of U.S. regional and European banks. Spreads subsequently retraced following government and central bank intervention, ending the period 16 bps wider at 92 bps. Issuer selection within financials, which is the largest sector allocation within the fund, was strong, especially among high-quality bank issuers that represent most of the fund’s financials exposure. Many of these high-quality bank issuers held up much better in March compared with regional banks. To a lesser extent, the fund’s smaller allocation to industrials and utilities also contributed.

Our allocations to commercial paper contributed to returns as well. The fund keeps a balance of short-maturity commercial paper for liquidity. As interest rates increased, we have been able to reinvest the maturing paper at higher rates.

What is your near-term outlook for shorter-term fixed income markets?

We have a constructive outlook for strategies that focus on the short end of the curve, as they continue to benefit from elevated yields and the expectation that rates will remain high for the foreseeable future, in our view. The London Interbank Offered Rate [LIBOR] and Secured Overnight Financing Rate [SOFR] rose for much of the period amid the Fed’s continued rate hiking. Regarding interest-rate expectations, there remains a relatively high level of uncertainty around the ultimate terminal federal funds rate, as the expected terminal rate adjusted downward meaningfully in March. Market expectations for future rate hikes have come down, with the thought that the recent bank turmoil may cause the Fed to pause sooner than previously expected.

Where our view generally differs from the market is the timing of Fed cuts. The market is once again pricing in Fed cuts in the second half of 2023 following March’s notable banking events. Currently, the market is pricing in at least one Fed interest-rate cut by the December 2023 meeting. Our view is that, with the policy rate at 5.00%–5.25%, the Fed will likely pause for longer given the continued resilience of the U.S. consumer and tight labor market. We believe Fed interest-rate reductions in 2023 remain unlikely.

In a sustained higher-rate environment, we believe our fund, and ultrashort strategies in general, will continue to capture these higher yields. Additionally, short-term corporate credit spreads [as measured by the Bloomberg U.S. 1-3 Year Corporate Bond Index] widened meaningfully during the first calendar quarter of 2023, making valuations on the short end

of the yield curve more attractive than in prior months, in our view. With interest rates likely to remain elevated, we believe investors can reap the benefits of higher income in ultrashort strategies without taking the same level of interest-rate risk as longer-term bond fund investors.

What are the fund’s strategies going forward?

We have positioned the fund to take advantage of a sustained higher interest-rate environment, given our view that interest-rate cuts are unlikely in 2023. The fund continues to hold a meaningful allocation to securities with a floating-rate coupon tied to either LIBOR or SOFR. These securities’ coupons reset on a daily, 1-month, or 3-month basis to reflect current short-term rates and provide a very short duration [interest-rate sensitivity]. Given our belief that we are nearing a pause in the Fed’s hiking cycle, the portfolio’s duration is currently neutral, at 0.36 years. We manage the duration posture of the fund through the maturity profile and coupon type of the underlying securities.

Within investment-grade corporate bonds, we continue to have a high level of confidence in the creditworthiness of the fund’s banking exposure despite the banking turmoil experienced in March. We believe the names owned by the fund can hold up well, even in a deteriorating economic environment. We expect balance sheets for the banking sector to remain stable, particularly within the larger “national champion” banks that dominate exposure in the fund. Most banks will continue to maintain levels of capitalization at or above long-term targets, while current asset quality profiles remain on solid footing, helping these institutions to weather this potentially more challenging period, in our view.

We continue to structure the portfolio with a combination of lower-tier investment-grade securities [BBB or equivalent], generally maturing in one year or less, and upper-tier investment-grade securities [A or AA rated], generally maturing in a range of 1 to 4 years. Overall, the Ultra Short Duration Income team is actively monitoring portfolio exposures as market events evolve and continues to structure the portfolio with capital preservation and liquidity as the primary objectives. We do not try to “stretch for yield” in the strategy.

Thank you, Joanne, for sharing this update about the fund.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for the period from January 19, 2023 (commencement of fund operations) through April 30, 2023, the end of its fiscal year. We also include performance information as of the most recent calendar quarter-end. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return, net asset value, and market price will fluctuate, and you may have a gain or a loss when you sell your shares. For the most recent month-end performance, please visit putnam.com or call 1-833-228-5577 (toll free).

Fund performance Total return for the period ended 4/30/23

| |

| | Life of fund |

| | (since 1/19/23) |

| Net asset value | 1.18% |

| Market price | 1.16 |

Performance assumes reinvestment of distributions and does not account for taxes. The short-term results of a relatively new fund are not necessarily indicative of its long-term prospects.

Performance includes the deduction of management fees.

For a portion of the period, the fund had expense limitations, without which the return would have been lower.

Comparative index returns For the period ended 4/30/23

| |

| | Life of fund |

| | (since 1/19/23) |

| ICE BofA U.S. Treasury Bill Index | 1.27% |

| Lipper Short U.S. Government Funds category median* | 0.81 |

Index and Lipper results should be compared with fund performance at net asset value.

Lipper peer group median is provided by Lipper, a Refinitiv company.

* Over the life-of-fund period ended 4/30/23, there were 69 funds in this Lipper category.

Past performance does not indicate future results.

Fund price and distribution information For the period ended 4/30/23

| | |

| Distributions | | |

| Number | 3 |

| Income | $0.3801 |

| Capital gains | — |

| Total | $0.3801 |

| Share value | Net asset value | Market price |

| 1/19/23* | $50.00 | $50.00 |

| 4/30/23 | 50.21 | 50.20 |

| Current rate (end of period) | Net asset value | Market price |

| Current dividend rate1 | 4.99% | 4.99% |

| Current 30-day SEC yield2 | 5.38 | — |

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

* Inception date of the ETF.

1 Most recent distribution, including any return of capital and excluding capital gains, annualized and divided by NAV or market price at period-end.

2 Based only on investment income and calculated in accordance with SEC guidelines.

Fund performance as of most recent calendar quarter

Total return for the period ended 3/31/23

| |

| | Life of fund |

| | (since 1/19/23) |

| Net asset value | 0.53% |

| Market price | 0.56 |

See the discussion following the fund performance table on page 7 for information about the calculation of fund performance.

Your fund’s expenses

As an investor, you pay ongoing expenses, such as management fees, and other expenses (with certain exceptions). In the most recent six-month period, your fund’s expenses were limited; had expenses not been limited, they would have been higher. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay brokerage commissions in connection with your purchase or sale of shares of the fund, which are not shown in this section and would have resulted in higher total expenses. The expenses shown in the example also do not reflect transaction costs, which would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | |

| Estimated total annual operating expenses for the fiscal year ended 4/30/23* | 0.25% |

| Annualized expense ratio for the period from 1/19/23 (commencement of operations) | |

| to 4/30/23† | 0.25% |

Estimated fiscal year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report.

Expenses are shown as a percentage of average net assets.

* Based on estimated amounts for the current fiscal year.

† Expense ratio is for the fund’s most recent fiscal period. As a result of this, ratio may differ from the expense ratio in the financial highlights.

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in the fund from 1/19/23 (commencement of operations) to 4/30/23. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | |

| Expenses paid per $1,000*† | $0.70 |

| Ending value (after expenses) | $1,011.80 |

* Expenses are calculated using the fund’s annualized expense ratio, which represents the ongoing expenses as a percentage of average net assets for the period from 1/19/23 (commencement of operations) to 4/30/23.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period (102); and then dividing that result by the number of days in the year (365).

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the period from 1/19/23 (commencement of operations) to 4/30/23, use the following calculation method. To find the value of your investment on 1/19/23, call 1-833-228-5577.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | |

| Expenses paid per $1,000*† | $1.25 |

| Ending value (after expenses) | $1,023.55 |

* Expenses are calculated using the fund’s annualized expense ratio, which represents the ongoing expenses as a percentage of average net assets for the period from 1/19/23 (commencement of operations) to 4/30/23.

† Expenses are calculated by multiplying the expense ratio by the average account value for the six month period; then multiplying the result by the number of days in the six-month period (181); and then dividing that result by the number of days in the year (365).

Comparative index definitions

Bloomberg U.S. 1–3 Year Corporate Bond Index is an unmanaged index that tracks the performance of U.S. dollar-denominated, investment-grade, fixed-rate, taxable corporate bonds with 1- to 3-year maturities.

Bloomberg U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed income securities.

ICE BofA (Intercontinental Exchange Bank of America) U.S. Treasury Bill Index is an unmanaged index that tracks the performance of U.S. dollar-denominated U.S. Treasury bills publicly issued in the U.S. domestic market. Qualifying securities must have a remaining term of at least one month to final maturity and a minimum amount outstanding of $1 billion.

S&P 500® Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approve or endorse this material, or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom, and to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

ICE Data Indices, LLC (“ICE BofA”), used with permission. ICE BofA permits use of the ICE BofA indices and related data on an “as is” basis; makes no warranties regarding same; does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA indices or any data included in, related to, or derived therefrom; assumes no liability in connection with the use of the foregoing; and does not sponsor, endorse, or recommend Putnam Investments, or any of its products or services.

Lipper, a Refinitiv company, is a third-party industry-ranking entity that ranks funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category medians reflect performance trends for funds within a category.

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single notice of internet availability, or a single printed copy, of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581 or, for exchange-traded funds only, 1-833-228-5577. We will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures are available in the Individual Investors section of putnam.com and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581 or, for exchange-traded funds only, 1-833-228-5577.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT within 60 days of the end of such fiscal quarter. Shareholders may obtain the fund’s Form N-PORT on the SEC’s website at www.sec.gov.

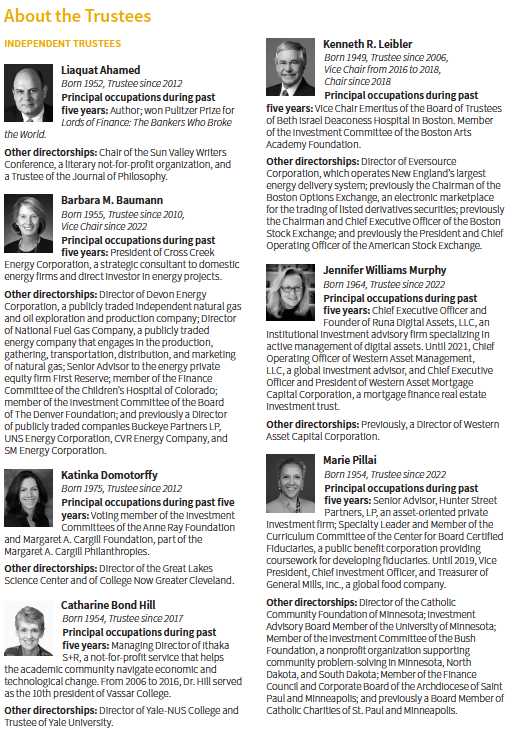

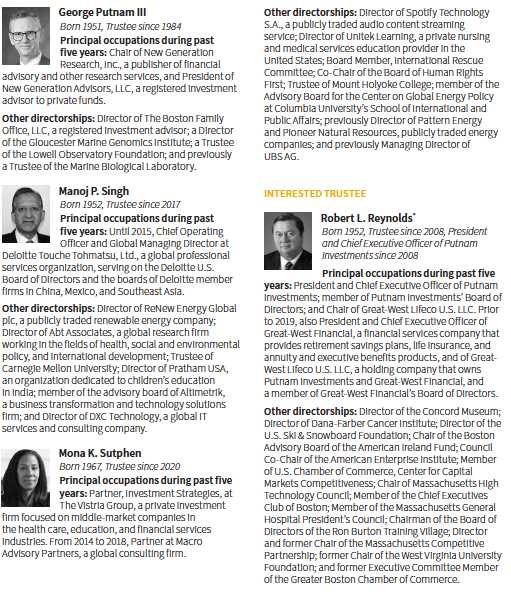

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam funds. As of April 30, 2023, Putnam employees had approximately $467,000,000 and the Trustees had approximately $66,000,000 invested in Putnam funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

Important notice regarding Putnam’s privacy policy

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ names, addresses, Social Security numbers, and dates of birth. Using this information, we are able to maintain accurate records of accounts and transactions.

It is our policy to protect the confidentiality of our shareholder information, whether or not a shareholder currently owns shares of our funds. In particular, it is our policy not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use.

Under certain circumstances, we must share account information with outside vendors who provide services to us, such as mailings and proxy solicitations. In these cases, the service providers enter into confidentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. Finally, it is our policy to share account information with your financial representative, if you’ve listed one on your Putnam account.

Audited financial statements

These sections of the report, as well as the accompanying Notes, preceded by the Report of Independent Registered Public Accounting Firm, constitute the fund’s audited financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover (not required for money market funds) in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Putnam ETF Trust and Shareholders of

Putnam ESG Ultra Short ETF:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the fund’s portfolio, of Putnam ESG Ultra Short ETF (one of the funds constituting Putnam ETF Trust, referred to hereafter as the “Fund”) as of April 30, 2023, and the related statement of operations and changes in net assets, including the related notes, and the financial highlights for the period of January 19, 2023 (commencement of operations) through April 30, 2023 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of April 30, 2023, and the results of its operations, changes in its net assets and the financial highlights for the period January 19, 2023 (commencement of operations) through April 30, 2023, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of April 30, 2023 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audit provides a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

June 14, 2023

We have served as the auditor of one or more investment companies in the Putnam Investments family of funds since at least 1957. We have not been able to determine the specific year we began serving as auditor.

| | |

| The fund’s portfolio 4/30/23 | | |

|

| | | |

| CORPORATE BONDS AND NOTES (70.2%)* | Principal

amount | Value |

| Banking (38.6%) |

| ANZ New Zealand Int’l, Ltd./London 144A company guaranty sr. unsec. FRN (US SOFR + 0.60%), 5.336%, 2/18/25 (United Kingdom) | | $1,005,000 | $998,598 |

| Bank of America Corp. sr. unsec. FRN (US SOFR + 1.10%), 5.938%, 4/25/25 | | 665,000 | 662,948 |

| Bank of America Corp. sr. unsec. FRN 5.08%, 1/20/27 | | 565,000 | 563,922 |

| Bank of America Corp. sr. unsec. FRN Ser. GMTN, (ICE LIBOR USD 3 Month + 0.96%), 6.233%, 7/23/24 | | 100,000 | 100,014 |

| Bank of America Corp. sr. unsec. FRN Ser. MTN, (US SOFR + 0.73%), 5.568%, 10/24/24 | | 250,000 | 249,366 |

| Bank of America Corp. sr. unsec. unsub. FRN Ser. MTN, 3.458%, 3/15/25 | | 100,000 | 98,005 |

| Bank of Montreal sr. unsec. unsub. FRN Ser. MTN, (US SOFR Compounded Index + 0.71%), 5.502%, 3/8/24 (Canada) | | 100,000 | 99,762 |

| Bank of Montreal sr. unsec. unsub. FRN Ser. MTN, (US SOFR Compounded Index + 0.32%), 5.157%, 7/9/24 (Canada) | | 1,620,000 | 1,610,243 |

| Bank of New York Mellon Corp. (The) sr. unsec. unsub. FRN (US SOFR + 0.62%), 5.458%, 4/25/25 | | 725,000 | 724,227 |

| Bank of New York Mellon Corp. (The) sr. unsec. unsub. FRN (US SOFR + 0.20%), 5.038%, 10/25/24 | | 669,000 | 661,935 |

| Bank of Nova Scotia (The) sr. unsec. notes 1.625%, 5/1/23 (Canada) | | 500,000 | 500,000 |

| Bank of Nova Scotia (The) sr. unsec. unsub. FRN (US SOFR + 0.38%), 5.219%, 7/31/24 (Canada) | | 1,810,000 | 1,799,590 |

| Banque Federative du Credit Mutuel SA 144A sr. unsec. FRN (US SOFR Compounded Index + 0.41%), 5.105%, 2/4/25 (France) | | 692,000 | 683,836 |

| Banque Federative du Credit Mutuel SA 144A sr. unsec. notes 3.75%, 7/20/23 (France) | | 850,000 | 846,401 |

| Barclays PLC sr. unsec. unsub. FRN 1.007%, 12/10/24 (United Kingdom) | | 250,000 | 241,366 |

| BNP Paribas SA 144A sr. unsec. FRN 4.705%, 1/10/25 (France) | | 1,160,000 | 1,149,890 |

| BPCE SA 144A sr. unsec. FRN (ICE LIBOR USD 3 Month + 1.24%), 6.394%, 9/12/23 (France) | | 780,000 | 780,502 |

| BPCE SA 144A sr. unsec. unsub. FRN 5.975%, 1/18/27 (France) | | 1,000,000 | 1,007,899 |

| Canadian Imperial Bank of Commerce sr. unsec. unsub. FRN (US SOFR + 0.94%), 5.777%, 4/7/25 (Canada) | | 535,000 | 536,099 |

| Canadian Imperial Bank of Commerce sr. unsec. unsub. FRN (US SOFR Compounded Index + 0.42%), 5.257%, 10/18/24 (Canada) | | 872,000 | 866,468 |

| Canadian Imperial Bank of Commerce sr. unsec. unsub. notes 5.144%, 4/28/25 (Canada) | | 380,000 | 380,191 |

| Commonwealth Bank of Australia 144A sr. unsec. unsub. FRN (US SOFR + 0.74%), 5.545%, 3/14/25 (Australia) | | 545,000 | 544,357 |

| Commonwealth Bank of Australia/New York, NY sr. unsec. notes 5.079%, 1/10/25 | | 545,000 | 548,650 |

| Cooperatieve Rabobank UA sr. unsec. FRN (US SOFR Compounded Index + 0.30%), 5.137%, 1/12/24 (Netherlands) | | 517,000 | 515,355 |

| Cooperatieve Rabobank UA 144A sr. unsec. unsub. notes 3.875%, 9/26/23 (Netherlands) | | 250,000 | 248,193 |

| Cooperative Rabobank UA company guaranty unsec. sub. notes 4.625%, 12/1/23 (Netherlands) | | 1,000,000 | 992,259 |

| Credit Agricole SA/London 144A sr. unsec. unsub. notes 3.25%, 10/4/24 (United Kingdom) | | 1,540,000 | 1,493,057 |

| | | |

| CORPORATE BONDS AND NOTES (70.2%)* cont. | Principal

amount | Value |

| Banking cont. |

| DNB Bank ASA 144A sr. unsec. FRN 5.896%, 10/9/26 (Norway) | | $735,000 | $739,274 |

| Fifth Third Bank/Cincinnati, OH sr. unsec. FRN 5.852%, 10/27/25 | | 665,000 | 660,748 |

| Huntington National Bank (The) sr. unsec. FRN 5.699%, 11/18/25 | | 990,000 | 966,640 |

| ING Groep NV sr. unsec. FRN (US SOFR Compounded Index + 1.64%), 6.481%, 3/28/26 (Netherlands) | | 665,000 | 668,600 |

| ING Groep NV sr. unsec. notes 4.10%, 10/2/23 (Netherlands) | | 200,000 | 198,769 |

| Intesa Sanpaolo SpA company guaranty sr. unsec. notes 5.25%, 1/12/24 (Italy) | | 1,375,000 | 1,369,118 |

| JPMorgan Chase & Co. sr. unsec. unsub. FRN (ICE LIBOR USD 3 Month + 0.89%), 6.163%, 7/23/24 | | 100,000 | 100,012 |

| JPMorgan Chase & Co. sr. unsec. unsub. FRN 5.546%, 12/15/25 | | 1,000,000 | 1,004,391 |

| KeyBank NA sr. unsec. notes 4.70%, 1/26/26 | | 255,000 | 246,187 |

| Lloyds Banking Group PLC sr. unsec. unsub. FRN 3.87%, 7/9/25 (United Kingdom) | | 200,000 | 195,197 |

| Lloyds Banking Group PLC sr. unsec. unsub. notes 4.45%, 5/8/25 (United Kingdom) | | 560,000 | 549,993 |

| Lloyds Banking Group PLC sr. unsec. unsub. notes 4.05%, 8/16/23 (United Kingdom) | | 608,000 | 604,782 |

| Macquarie Bank, Ltd. 144A sr. unsec. notes 2.30%, 1/22/25 (Australia) | | 255,000 | 244,052 |

| Mitsubishi UFJ Financial Group, Inc. sr. unsec. FRN (ICE LIBOR USD 3 Month + 0.86%), 6.128%, 7/26/23 (Japan) | | 100,000 | 100,056 |

| Mitsubishi UFJ Financial Group, Inc. sr. unsec. FRN 5.719%, 2/20/26 (Japan) | | 200,000 | 201,048 |

| Mitsubishi UFJ Financial Group, Inc. sr. unsec. FRN 4.788%, 7/18/25 (Japan) | | 415,000 | 411,259 |

| Mizuho Financial Group, Inc. sr. unsec. FRN 1.241%, 7/10/24 (Japan) | | 200,000 | 198,266 |

| Mizuho Financial Group, Inc. sr. unsec. unsub. FRN (ICE LIBOR USD 3 Month + 0.61%), 5.618%, 9/8/24 (Japan) | | 1,660,000 | 1,653,833 |

| National Australia Bank, Ltd. 144A sr. unsec. FRN (US SOFR + 0.38%), 5.217%, 1/12/25 (Australia) | | 1,015,000 | 1,009,935 |

| National Bank of Canada company guaranty sr. unsec. FRN (US SOFR + 0.49%), 5.189%, 8/6/24 (Canada) | | 1,525,000 | 1,517,358 |

| Nordea Bank ABP 144A sr. unsec. notes 3.75%, 8/30/23 (Finland) | | 200,000 | 198,763 |

| PNC Financial Services Group, Inc. (The) sr. unsec. unsub. FRN 4.758%, 1/26/27 | | 100,000 | 98,858 |

| Royal Bank of Canada sr. unsec. unsub. FRN Ser. GMTN, (US SOFR Compounded Index + 0.34%), 5.177%, 10/7/24 (Canada) | | 1,445,000 | 1,434,386 |

| Royal Bank of Canada sr. unsec. unsub. FRN Ser. GMTN, (US SOFR Compounded Index + 0.00%), 5.138%, 1/19/24 (Canada) | | 500,000 | 498,619 |

| Santander Holdings USA, Inc. sr. unsec. notes 3.50%, 6/7/24 | | 1,000,000 | 973,586 |

Skandinaviska Enskilda Banken AB 144A sr. unsec. notes

(ICE LIBOR USD 3 Month + 0.32%), 5.282%, 9/1/23 (Sweden) | | 1,720,000 | 1,720,201 |

| Societe Generale SA 144A unsec. sub. notes 5.00%, 1/17/24 (France) | | 1,802,000 | 1,774,833 |

| Sumitomo Mitsui Financial Group, Inc. sr. unsec. FRN (ICE LIBOR USD 3 Month + 0.80%), 6.06%, 10/16/23 (Japan) | | 100,000 | 100,163 |

| Sumitomo Mitsui Financial Group, Inc. 144A unsec. sub. bonds 4.436%, 4/2/24 (Japan) | | 1,500,000 | 1,479,875 |

| Sumitomo Mitsui Trust Bank, Ltd. 144A sr. unsec. unsub. FRN (US SOFR + 0.44%), 5.245%, 9/16/24 (Japan) | | 1,425,000 | 1,416,184 |

| | | |

| CORPORATE BONDS AND NOTES (70.2%)* cont. | Principal

amount | Value |

| Banking cont. |

| Svenska Handelsbanken AB 144A sr. unsec. FRN (US SOFR Compounded Index + 0.91%), 5.708%, 6/10/25 (Sweden) | | $800,000 | $799,844 |

| Svenska Handelsbanken AB 144A sr. unsec. notes 0.625%, 6/30/23 (Sweden) | | 621,000 | 616,020 |

| Toronto-Dominion Bank (The) sr. unsec. FRN (US SOFR + 0.36%), 5.135%, 3/4/24 (Canada) | | 500,000 | 498,155 |

| Toronto-Dominion Bank (The) sr. unsec. FRN Ser. MTN, (US SOFR + 0.35%), 5.148%, 9/10/24 (Canada) | | 590,000 | 585,478 |

| Toronto-Dominion Bank (The) sr. unsec. unsub. FRN Ser. MTN, (US SOFR + 0.91%), 5.702%, 3/8/24 (Canada) | | 600,000 | 600,179 |

| Truist Financial Corp. sr. unsec. unsub. FRN Ser. MTN, (US SOFR + 0.40%), 5.195%, 6/9/25 | | 1,065,000 | 1,024,881 |

| UBS Group AG 144A sr. unsec. FRN 4.49%, 8/5/25 (Switzerland) | | 200,000 | 196,048 |

| UBS Group AG 144A sr. unsec. FRN 1.008%, 7/30/24 (Switzerland) | | 1,081,000 | 1,065,908 |

| UniCredit SpA 144A sr. unsec. unsub. notes 7.83%, 12/4/23 (Italy) | | 350,000 | 351,948 |

| Westpac Banking Corp. sr. unsec. unsub. FRN (US SOFR + 0.30%), 5.035%, 11/18/24 (Australia) | | 1,525,000 | 1,518,028 |

| | | 48,494,608 |

| Capital goods (3.0%) |

| Daimler Trucks Finance North America, LLC 144A company guaranty sr. unsec. FRN (US SOFR + 1.00%), 5.836%, 4/5/24 | | 750,000 | 749,046 |

| Daimler Trucks Finance North America, LLC 144A company guaranty sr. unsec. FRN (US SOFR + 0.75%), 5.562%, 12/13/24 | | 500,000 | 495,392 |

| Daimler Trucks Finance North America, LLC 144A company guaranty sr. unsec. FRN (US SOFR + 0.60%), 5.415%, 12/14/23 | | 545,000 | 544,667 |

| Waste Management, Inc. company guaranty sr. unsec. notes 2.40%, 5/15/23 | | 1,946,000 | 1,944,011 |

| | | 3,733,116 |

| Communication services (2.8%) |

| American Tower Corp. sr. unsec. notes 0.60%, 1/15/24 R | | 1,885,000 | 1,821,590 |

| AT&T, Inc. sr. unsec. FRN (ICE LIBOR USD 3 Month + 1.18%), 6.334%, 6/12/24 | | 1,095,000 | 1,101,694 |

| Verizon Communications, Inc. sr. unsec. unsub. FRN (ICE LIBOR USD 3 Month + 1.10%), 5.964%, 5/15/25 | | 605,000 | 608,946 |

| | | 3,532,230 |

| Conglomerates (0.3%) |

| Siemens Financieringsmaatschappij NV 144A company guaranty sr. unsec. FRN (US SOFR + 0.43%), 5.23%, 3/11/24 (Netherlands) | | 336,000 | 335,748 |

| | | 335,748 |

| Consumer cyclicals (3.4%) |

| BMW US Capital, LLC 144A company guaranty sr. unsec. FRN (US SOFR + 0.84%), 5.65%, 4/1/25 | | 1,795,000 | 1,789,807 |

| Mercedes-Benz Finance North America, LLC 144A company guaranty sr. unsec. FRN (ICE LIBOR USD 3 Month + 0.84%), 5.646%, 5/4/23 | | 150,000 | 150,002 |

| Mercedes-Benz Finance North America, LLC 144A company guaranty sr. unsec. notes 0.75%, 3/1/24 | | 235,000 | 226,561 |

| Toyota Motor Credit Corp. sr. unsec. unsub. FRN Ser. MTN, (US SOFR + 0.75%), 5.56%, 12/11/23 | | 200,000 | 200,241 |

| Toyota Motor Credit Corp. sr. unsec. unsub. FRN Ser. MTN, (US SOFR Compounded Index + 0.33%), 5.167%, 1/11/24 | | 326,000 | 325,145 |

| | | |

| CORPORATE BONDS AND NOTES (70.2%)* cont. | Principal

amount | Value |

| Consumer cyclicals cont. |

| Toyota Motor Credit Corp. sr. unsec. unsub. FRN Ser. MTN, (US SOFR + 0.32%), 5.157%, 1/13/25 | | $300,000 | $297,382 |

| Volkswagen Group of America Finance, LLC 144A company guaranty sr. unsec. notes 0.875%, 11/22/23 | | 200,000 | 195,174 |

| Volkswagen Group of America Finance, LLC 144A company guaranty sr. unsec. notes 3.35%, 5/13/25 | | 200,000 | 193,691 |

| Walmart, Inc. sr. unsec. unsub. notes 4.00%, 4/15/26 | | 110,000 | 110,031 |

| Warnermedia Holdings, Inc. 144A company guaranty sr. unsec. FRN (US SOFR Compounded Index + 1.78%), 6.592%, 3/15/24 | | 750,000 | 754,234 |

| | | 4,242,268 |

| Consumer finance (4.6%) |

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust company guaranty sr. unsec. notes 4.875%, 1/16/24 (Ireland) | | 1,180,000 | 1,170,333 |

| Air Lease Corp. sr. unsec. sub. notes 3.875%, 7/3/23 | | 1,747,000 | 1,741,502 |

| American Express Co. sr. unsec. unsub. FRN (US SOFR + 0.93%), 5.71%, 3/4/25 | | 1,135,000 | 1,134,830 |

| American Express Co. sr. unsec. unsub. FRN (US SOFR Compounded Index + 0.72%), 5.409%, 5/3/24 | | 359,000 | 359,108 |

| American Express Co. sr. unsec. unsub. notes 4.90%, 2/13/26 | | 81,000 | 81,565 |

| American Honda Finance Corp. sr. unsec. FRN Ser. MTN, (ICE LIBOR USD 3 Month + 0.28%), 5.478%, 1/12/24 | | 905,000 | 903,505 |

| General Motors Financial Co., Inc. company guaranty sr. unsec. notes 4.25%, 5/15/23 | | 100,000 | 99,941 |

| General Motors Financial Co., Inc. sr. unsec. sub. FRN (US SOFR + 0.76%), 5.552%, 3/8/24 | | 250,000 | 248,877 |

| | | 5,739,661 |

| Consumer staples (1.1%) |

| General Mills, Inc. sr. unsec. unsub. FRN (ICE LIBOR USD 3 Month + 1.01%), 6.27%, 10/17/23 | | 475,000 | 476,395 |

| Kenvue, Inc. 144A company guaranty sr. unsec. notes 5.50%, 3/22/25 | | 400,000 | 406,756 |

| Keurig Dr Pepper, Inc. company guaranty sr. unsec. notes 0.75%, 3/15/24 | | 425,000 | 409,175 |

| Netflix, Inc. sr. unsec. notes 5.75%, 3/1/24 | | 96,000 | 96,355 |

| | | 1,388,681 |

| Financial (1.0%) |

| Macquarie Group, Ltd. 144A sr. unsec. FRN (US SOFR + 0.71%), 5.547%, 10/14/25 (Australia) | | 1,160,000 | 1,141,220 |

| Macquarie Group, Ltd. 144A sr. unsec. unsub. notes 6.207%, 11/22/24 (Australia) | | 100,000 | 101,219 |

| | | 1,242,439 |

| Health care (1.6%) |

| Amgen, Inc. sr. unsec. unsub. notes 5.25%, 3/2/25 | | 33,000 | 33,312 |

| Cigna Corp. company guaranty sr. unsec. unsub. FRN (ICE LIBOR USD 3 Month + 0.89%), 6.15%, 7/15/23 | | 144,000 | 144,056 |

| Thermo Fisher Scientific, Inc. sr. unsec. FRN (US SOFR Compounded Index + 0.53%), 5.367%, 10/18/24 | | 1,420,000 | 1,419,657 |

| Thermo Fisher Scientific, Inc. sr. unsec. FRN (US SOFR Compounded Index + 0.39%), 5.227%, 10/18/23 | | 455,000 | 454,375 |

| | | 2,051,400 |

| | | |

| CORPORATE BONDS AND NOTES (70.2%)* cont. | Principal

amount | Value |

| Insurance (5.0%) |

| Athene Global Funding 144A FRN (ICE LIBOR USD 3 Month + 0.73%), 5.941%, 1/8/24 | | $245,000 | $242,843 |

| Athene Global Funding 144A FRN (US SOFR Compounded Index + 0.56%), 5.296%, 8/19/24 | | 250,000 | 245,510 |

| Athene Global Funding 144A notes 1.716%, 1/7/25 | | 835,000 | 778,414 |

| MassMutual Global Funding II 144A FRN (US SOFR + 0.87%), 5.692%, 3/21/25 | | 1,500,000 | 1,497,546 |

| MassMutual Global Funding II 144A FRN (US SOFR + 0.36%), 5.197%, 4/12/24 | | 200,000 | 199,563 |

| Metropolitan Life Global Funding I 144A sr. unsub. FRN (US SOFR Compounded Index + 0.91%), 5.732%, 3/21/25 | | 1,000,000 | 999,653 |

| Pacific Life Global Funding II 144A FRN (US SOFR Compounded Index + 0.80%), 5.64%, 3/30/25 | | 587,000 | 580,900 |

| Principal Life Global Funding II 144A FRN (US SOFR + 0.45%), 5.287%, 4/12/24 | | 810,000 | 808,233 |

| Principal Life Global Funding II 144A FRN (US SOFR + 0.38%), 5.137%, 8/23/24 | | 500,000 | 497,327 |

| Protective Life Global Funding 144A notes 0.631%, 10/13/23 | | 500,000 | 488,541 |

| | | 6,338,530 |

| Investment banking/Brokerage (4.3%) |

| Charles Schwab Corp. (The) sr. unsec. unsub. FRN (US SOFR Compounded Index + 0.50%), 5.32%, 3/18/24 | | 480,000 | 474,956 |

| Deutsche Bank AG sr. unsec. unsub. FRN 3.961%, 11/26/25 (Germany) | | 475,000 | 454,015 |

| Deutsche Bank AG sr. unsec. unsub. notes 3.70%, 5/30/24 (Germany) | | 705,000 | 683,728 |

| Deutsche Bank AG sr. unsec. unsub. notes Ser. E, 0.962%, 11/8/23 (Germany) | | 150,000 | 145,241 |

| Goldman Sachs Group, Inc. (The) sr. unsec. unsub. FRN (US SOFR + 0.70%), 5.538%, 1/24/25 | | 1,088,000 | 1,082,374 |

| Goldman Sachs Group, Inc. (The) sr. unsec. unsub. FRN (US SOFR + 0.49%), 5.328%, 10/21/24 | | 11,000 | 10,895 |

| Goldman Sachs Group, Inc. (The) sr. unsec. unsub. FRN (US SOFR + 0.50%), 5.298%, 9/10/24 | | 100,000 | 99,409 |

| Goldman Sachs Group, Inc. (The) sr. unsec. unsub. FRN 1.757%, 1/24/25 | | 233,000 | 226,147 |

| Goldman Sachs Group, Inc. (The) sr. unsec. unsub. FRN 0.925%, 10/21/24 | | 350,000 | 341,579 |

| Morgan Stanley sr. unsec. FRN (US SOFR + 1.17%), 6.002%, 4/17/25 | | 475,000 | 475,369 |

| Morgan Stanley sr. unsec. FRN 5.05%, 1/28/27 | | 665,000 | 666,762 |

| Morgan Stanley sr. unsec. FRN Ser. MTN, (US SOFR + 0.47%), 5.185%, 11/10/23 | | 500,000 | 499,404 |

| Morgan Stanley sr. unsec. unsub. FRN Ser. GMTN, (ICE LIBOR USD 3 Month + 1.22%), 6.063%, 5/8/24 | | 100,000 | 100,006 |

| Morgan Stanley sr. unsec. unsub. FRN Ser. MTN, 2.72%, 7/22/25 | | 200,000 | 192,927 |

| | | 5,452,812 |

| Real estate (1.5%) |

| Boston Properties, LP sr. unsec. notes 3.20%, 1/15/25 R | | 1,000,000 | 954,099 |

| Boston Properties, LP sr. unsec. unsub. notes 3.80%, 2/1/24 R | | 100,000 | 97,811 |

| Public Storage sr. unsec. FRN (US SOFR + 0.47%), 5.308%, 4/23/24 | | 728,000 | 725,735 |

| Realty Income Corp. sr. unsec. unsub. notes 5.05%, 1/13/26 R | | 100,000 | 100,016 |

| | | 1,877,661 |

| | | |

| CORPORATE BONDS AND NOTES (70.2%)* cont. | Principal

amount | Value |

| Utilities and power (3.0%) |

| American Electric Power Co., Inc. jr. unsec. sub. notes 2.031%, 3/15/24 | | $1,665,000 | $1,612,607 |

| Enbridge, Inc. company guaranty sr. unsec. notes 0.55%, 10/4/23 (Canada) | | 100,000 | 97,835 |

| Enbridge, Inc. company guaranty sr. unsec. notes 5.969%, 3/8/26 (Canada) | | 200,000 | 200,501 |

| Eversource Energy sr. unsec. unsub. FRN (US SOFR Compounded Index + 0.25%), 4.974%, 8/15/23 | | 100,000 | 99,907 |

| NextEra Energy Capital Holdings, Inc. company guaranty sr. unsec. unsub. FRN (US SOFR Compounded Index + 0.40%), 5.089%, 11/3/23 | | 1,520,000 | 1,516,161 |

| Southern Co. (The) sr. unsec. FRN (US SOFR Compounded Index + 0.37%), 5.083%, 5/10/23 | | 200,000 | 199,978 |

| | | 3,726,989 |

| Total corporate bonds and notes (cost $88,438,478) | $88,156,143 |

|

| | | | |

| COMMERCIAL PAPER (28.8%)* | Yield (%) | Maturity

date | Principal

amount | Value |

| Alexandria Real Estate Equities, Inc. | 5.110 | 5/4/23 | $1,000,000 | $999,170 |

| Amcor Finance (USA), Inc. | 5.282 | 5/25/23 | 600,000 | 597,561 |

| American Honda Finance Corp. | 5.250 | 5/22/23 | 400,000 | 398,646 |

| Arrow Electronics, Inc. | 5.617 | 5/4/23 | 1,250,000 | 1,248,888 |

| AT&T, Inc. | 5.562 | 10/19/23 | 400,000 | 389,096 |

| Autonation, Inc. | 5.402 | 5/1/23 | 1,250,000 | 1,249,449 |

| Aviation Capital Group, LLC | 5.503 | 5/1/23 | 1,250,000 | 1,249,468 |

| Baker Hughes Holdings, LLC | 5.174 | 5/15/23 | 625,000 | 623,494 |

| Banco Santander SA (Spain) | 5.399 | 11/10/23 | 600,000 | 582,393 |

| Bell Canada (Canada) | 5.274 | 5/5/23 | 1,250,000 | 1,248,770 |

| Berkshire Hathaway Energy Co. | 5.115 | 5/3/23 | 650,000 | 649,546 |

| Cabot Corp. | 5.065 | 5/10/23 | 1,250,000 | 1,247,907 |

| Conagra Brands, Inc. | 5.302 | 5/1/23 | 725,000 | 724,676 |

| Constellation Brands, Inc. | 5.398 | 5/1/23 | 1,300,000 | 1,299,427 |

| Crown Castle, Inc. | 5.871 | 5/9/23 | 650,000 | 648,938 |

| Crown Castle, Inc. | 5.828 | 5/4/23 | 600,000 | 599,470 |

| Dollar General Corp. | 5.064 | 5/9/23 | 1,250,000 | 1,248,064 |

| EIDP, Inc. | 5.514 | 6/1/23 | 250,000 | 248,766 |

| EIDP, Inc. | 5.463 | 6/20/23 | 675,000 | 669,919 |

| Enbridge US, Inc. | 5.063 | 5/1/23 | 950,000 | 949,587 |

| General Motors Financial Co., Inc. | 5.400 | 6/20/23 | 750,000 | 743,856 |

| General Motors Financial Co., Inc. | 5.390 | 6/8/23 | 250,000 | 248,424 |

| Haleon UK Capital PLC (United Kingdom) | 5.430 | 6/1/23 | 825,000 | 820,785 |

| Haleon UK Capital PLC (United Kingdom) | 5.423 | 5/24/23 | 425,000 | 423,348 |

| Humana, Inc. | 5.679 | 5/1/23 | 540,000 | 539,762 |

| Humana, Inc. | 5.479 | 5/22/23 | 650,000 | 647,671 |

| Humana, Inc. | 5.476 | 5/15/23 | 700,000 | 698,234 |

| Hyundai Capital America (South Korea) | 5.303 | 5/26/23 | 725,000 | 722,050 |

| International Flavors & Fragrances, Inc. | 6.034 | 6/1/23 | 600,000 | 597,020 |

| Intesa Sanpaolo Funding, LLC (Spain) | 5.690 | 11/7/23 | 250,000 | 242,490 |

| Keurig Dr Pepper, Inc. | 5.208 | 5/12/23 | 800,000 | 798,473 |

| Marriott International, Inc./MD | 5.095 | 5/8/23 | 750,000 | 748,906 |

| | | | |

| COMMERCIAL PAPER (28.8%)* cont. | Yield (%) | Maturity

date | Principal

amount | Value |

| Mondelez International, Inc. | 5.140 | 5/9/23 | $625,000 | $624,038 |

| Mondelez International, Inc. | 5.051 | 5/3/23 | 750,000 | 749,476 |

| National Australia Bank, Ltd. (Australia) | 5.310 | 11/30/23 | 500,000 | 500,265 |

| National Grid PLC (United Kingdom) | 5.249 | 5/23/23 | 600,000 | 597,833 |

| NatWest Markets PLC (United Kingdom) | 5.641 | 2/9/24 | 1,500,000 | 1,435,246 |

| Nordea Bank ABP (Finland) | 5.230 | 10/10/23 | 1,000,000 | 1,000,425 |

| Oracle Corp. | 5.141 | 5/11/23 | 600,000 | 598,900 |

| Ovintiv, Inc. | 6.085 | 6/1/23 | 600,000 | 596,850 |

| Ovintiv, Inc. | 5.810 | 5/9/23 | 650,000 | 648,934 |

| Penske Truck Leasing Co. | 5.166 | 5/5/23 | 1,250,000 | 1,248,758 |

| Protective Life Corp. | 5.222 | 5/10/23 | 750,000 | 748,717 |

| Targa Resources Corp. | 5.604 | 5/2/23 | 1,250,000 | 1,249,347 |

| VW Credit, Inc. | 5.262 | 5/25/23 | 800,000 | 796,867 |

| Walt Disney Co. (The) | 5.248 | 9/6/23 | 275,000 | 269,682 |

| WPP CP, LLC | 5.378 | 5/31/23 | 1,000,000 | 995,181 |

| Total commercial paper (cost $36,180,246) | $36,164,773 |

|

| | | | |

| CERTIFICATES OF DEPOSIT (0.8%)* | Yield (%) | Maturity

date | Principal

amount | Value |

| MUFG Bank Ltd./New York, NY FRN (Japan) | 5.180 | 11/14/23 | $1,000,000 | $999,590 |

| Total certificates of deposit (cost $999,991) | $999,590 |

|

| | | |

| ASSET-BACKED SECURITIES (—%)* | Principal

amount | Value |

| Ford Credit Auto Owner Trust Ser. 20-C, Class A3, 0.41%, 7/15/25 | | $30,731 | $29,975 |

| Total asset-backed securities (cost $29,785) | $29,975 |

|

| |

| TOTAL INVESTMENTS |

| Total investments (cost $125,648,500) | $125,350,481 |

|

| |

| Key to holding’s abbreviations |

| DAC | Designated Activity Company |

| FRN | Floating Rate Notes: The rate shown is the current interest rate or yield at the close of the reporting period. Rates may be subject to a cap or floor. For certain securities, the rate may represent a fixed rate currently in place at the close of the reporting period. |

| GMTN | Global Medium Term Notes |

| ICE | Intercontinental Exchange |

| LIBOR | London Interbank Offered Rate |

| MTN | Medium Term Notes |

| SOFR | Secured Overnight Financing Rate |

|

| | | |

| Notes to the fund’s portfolio |

| Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from January 19, 2023 (commencement of operations) through April 30, 2023 (the reporting period). Within the following notes to the portfolio, references to “Putnam Management” represent Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Putnam Investments, LLC and references to “ASC 820” represent Accounting Standards Codification 820 Fair Value Measurements and Disclosures. |

| * | Percentages indicated are based on net assets of $125,536,412. |

| R | Real Estate Investment Trust. |

| Debt obligations are considered secured unless otherwise indicated. |

| | | |

| 144A after the name of an issuer represents securities exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| The dates shown on debt obligations are the original maturity dates. |

|

| | | | |

| DIVERSIFICATION BY COUNTRY | | | | |

| Distribution of investments by country of risk at the close of the reporting period, excluding collateral received, if any (as a percentage of Portfolio Value): |

| United States | 57.9% | | Germany | 1.0% |

| Canada | 10.0 | | Switzerland | 1.0 |

| United Kingdom | 5.9 | | Finland | 0.9 |

| Japan | 5.2 | | Ireland | 0.9 |

| France | 5.0 | | Spain | 0.7 |

| Australia | 4.0 | | Norway | 0.6 |

| Sweden | 2.5 | | South Korea | 0.6 |

| Netherlands | 2.4 | | Total | 100.0% |

| Italy | 1.4 | | | |

|

| ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows: |

Level 1: Valuations based on quoted prices for identical securities in active markets.

Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement.

| The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period: |

|

| | | |

| | Valuation inputs |

| Investments in securities: | Level 1 | Level 2 | Level 3 |

| Asset-backed securities | $— | $29,975 | $— |

| Certificates of deposit | — | 999,590 | — |

| Commercial paper | — | 36,164,773 | — |

| Corporate bonds and notes | — | 88,156,143 | — |

| Totals by level | $— | $125,350,481 | $— |

The accompanying notes are an integral part of these financial statements.

Statement of assets and liabilities 4/30/23

| |

| ASSETS | |

| Investment in securities, at value (Note 1): | |

| Unaffiliated issuers (identified cost $125,648,500) | $125,350,481 |

| Cash | 14,083 |

| Interest and other receivables | 709,661 |

| Receivable for investments sold | 343,555 |

| Total assets | 126,417,780 |

| |

| LIABILITIES | |

| Payable for investments purchased | 855,628 |

| Payable for compensation of Manager (Note 2) | 25,740 |

| Total liabilities | 881,368 |

| | |

| Net assets | $125,536,412 |

| |

| REPRESENTED BY | |

| Paid-in capital (Unlimited shares authorized) (Notes 1, 4 and 5) | $125,348,440 |

| Total distributable earnings (Note 1) | 187,972 |

| Total — Representing net assets applicable to capital shares outstanding | $125,536,412 |

| |

| COMPUTATION OF NET ASSET VALUE | |

| Net asset value per share ($125,536,412 divided by 2,500,000 shares) | $50.21 |

The accompanying notes are an integral part of these financial statements.

Statement of operations For the period 1/19/23 (commencement of operations) to 4/30/23

| |

| INVESTMENT INCOME | |

| Interest (including interest income of $277 from investments in affiliated issuers) (Note 6) | $1,439,185 |

| Total investment income | 1,439,185 |

| |

| EXPENSES | |

| Compensation of Manager (Note 2) | 67,897 |

| Fees waived and reimbursed by Manager (Note 2) | (21) |

| Total expenses | 67,876 |

| | |

| Net investment income | 1,371,309 |

| |

| REALIZED AND UNREALIZED GAIN (LOSS) | |

| Net realized gain (loss) on: | |

| Securities from unaffiliated issuers (Notes 1 and 3) | (55,238) |

| Total net realized loss | (55,238) |

| Change in net unrealized appreciation (depreciation) on: | |

| Securities from unaffiliated issuers | (298,019) |

| Total change in net unrealized depreciation | (298,019) |

| | |

| Net loss on investments | (353,257) |

| |

| Net increase in net assets resulting from operations | $1,018,052 |

The accompanying notes are an integral part of these financial statements.

Statement of changes in net assets

| | |

| | | For the period |

| | | 1/19/23 |

| | | (commencement |

| | | of operations) |

| INCREASE IN NET ASSETS | | to 4/30/23 |

| Operations | | |

| Net investment income | | $1,371,309 |

| Net realized loss on investments | | (55,238) |

| Change in net unrealized depreciation of investments | | (298,019) |

| Net increase in net assets resulting from operations | | 1,018,052 |

| Distributions to shareholders (Note 1): | | |

| From ordinary income | | |

| Net investment income | | (830,080) |

| Proceeds from shares sold (Note 4) | | 145,236,935 |

| Decrease from shares redeemed (Note 4) | | (25,058,791) |

| Other capital (Note 4) | | 170,296 |

| Total increase in net assets | | 120,536,412 |

| |

| NET ASSETS | | |

| Beginning of period (Note 5) | | 5,000,000 |

| End of period | | $125,536,412 |

| |

| NUMBER OF FUND SHARES | | |

| Shares outstanding at beginning of period (Note 5) | | 100,000 |

| Shares sold (Note 4) | | 2,900,000 |

| Shares redeemed (Note 4) | | (500,000) |

| Shares outstanding at end of period | | 2,500,000 |

The accompanying notes are an integral part of these financial statements.

Financial highlights

(For a common share outstanding throughout the period)

| |

| PER-SHARE OPERATING PERFORMANCE | |

| | For the period |

| | 1/19/23 |

| | (commencement |

| | of operations) |

| | to 4/30/23 |

| Net asset value, beginning of period | $50.00 |

| Investment operations: | |

| Net investment income (loss) a | .71 |

| Net realized and unrealized | |

| gain (loss) on investments | (.21) |

| Total from investment operations | .50 |

| Less distributions: | |

| From net investment income | (.38) |

| Total distributions | (.38) |

| Other capital | .09 |

| Net asset value, end of period | $50.21 |

| Total return at net asset value (%) b | 1.18* |

| RATIOS AND SUPPLEMENTAL DATA | |

| Net assets, end of period (in thousands) | $125,536 |

| Ratio of expenses to average | |

| net assets (%) c,d | .07* |

| Ratio of net investment income | |

| (loss) to average net assets (%) d | 1.41* |

| Portfolio turnover (%) e | 26* |

* Not annualized.

a Per share net investment income (loss) has been determined on the basis of the weighted average number of shares outstanding during the period.

b Total return assumes dividend reinvestment.

c Excludes acquired fund fees and expenses, if any.

d Reflects waivers of certain fund expenses in connection with investments in Putnam Government Money Market Fund during the period. As a result of such waivers, the expenses of the fund reflect a reduction of less than 0.01% as a percentage of average net assets (Note 2).

e Portfolio turnover excludes securities received or delivered in-kind, if any.

The accompanying notes are an integral part of these financial statements.

Notes to financial statements 4/30/23

Within the following Notes to financial statements, references to “ETF” represent exchange-traded fund, references to “State Street” represent State Street Bank and Trust Company, references to “the SEC” represent the Securities and Exchange Commission, references to “Putnam Management” represent Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Putnam Investments, LLC. Additionally, references to “OTC”, if any, represent over-the-counter and references to “ESG”, if any, represent environmental, social and governance. Unless otherwise noted, the “reporting period” represents the period from January 19, 2023 (commencement of operations) through April 30, 2023.

Putnam ESG Ultra Short ETF (the fund) is a diversified, open-end series of Putnam ETF Trust (the Trust), a Delaware statutory trust organized under the Investment Company Act of 1940, as amended. The fund is an actively managed ETF. The fund’s investment objective is to seek as high a rate of current income as Putnam Management believes is consistent with preservation of capital and maintenance of liquidity. The fund invests in a diversified short duration portfolio of fixed-income securities comprised of investment-grade money market and other fixed-income securities, including U.S. dollar-denominated foreign securities of these types, with a focus on companies or issuers that Putnam Management believes meet relevant environmental, social or governance (“ESG”) criteria on a sector-specific basis (“ESG criteria”).

The fund’s investments may include obligations of the U.S. government, its agencies and instrumentalities, which are backed by the full faith and credit of the United States (e.g., U.S. Treasury bonds and Ginnie Mae mortgage-backed bonds) or by only the credit of a federal agency or government-sponsored entity (e.g., Fannie Mae or Freddie Mac) mortgage-backed bonds), domestic corporate debt obligations, taxable municipal debt securities, securitized debt instruments (such as mortgage- and asset-backed securities), repurchase agreements, certificates of deposit, bankers acceptances, commercial paper (including asset-backed commercial paper), time deposits, Yankee Eurodollar securities and other money market instruments. The fund may also invest in U.S. dollar-denominated foreign securities of these types. Under normal circumstances, the effective duration of the fund’s portfolio will generally not be greater than one year. Effective duration provides a measure of a fund’s interest-rate sensitivity. The longer a fund’s duration, the more sensitive the fund is to shifts in interest rates. Under normal circumstances, the dollar-weighted average portfolio maturity of the fund is not expected to exceed four years.

The fund may consider, among other factors, a company’s or issuer’s ESG criteria (as described below), credit, interest rate, liquidity and prepayment risks, as well as general market conditions, when deciding whether to buy or sell investments.

Under normal circumstances, the fund invests at least 80% of the value of its net assets in fixed-income securities that meet Putnam Management’s ESG criteria. This policy is non-fundamental and may be changed only after 60 days’ notice to shareholders. Putnam Management may not apply ESG criteria to investments that are not subject to the fund’s 80% policy and such investments may not meet Putnam Management’s ESG criteria.

In evaluating investments for the fund, Putnam Management identifies relevant ESG criteria on a sector-specific basis using an internally developed materiality map, which is informed by the ESG issues identified by the Sustainability Accounting Standards Board as material to companies or issuers within a particular industry. A materiality map provides a guide to understanding which ESG criteria are more or less important for a given sector or subsector; it includes those ESG criteria that may be reasonably likely to influence investment decision-making. Putnam Management constructs the materiality map by evaluating the significance of specified ESG criteria (i.e., board structure and composition, diversity, equity and inclusion, or climate change risk, among others) in specific industries (i.e., consumer, healthcare, financials, etc.), subsectors, or countries. Putnam Management then categorizes the relevance of each ESG criteria for each industry, subsector, or country. As part of this analysis, Putnam Management may utilize metrics and information such as emissions data, carbon intensity, sources of energy used for operations, water use and re-use, water generation, waste diversion from landfill, employee safety and diversity data, supplier audits, product safety, board composition, and incentive compensation structures. After evaluating these criteria, Putnam Management will assign each company or issuer, as applicable, a proprietary ESG rating ranging from 1 to 4 (1 indicating the highest (best) ESG rating and 4 indicating the lowest (worst) ESG rating). In order to meet Putnam Management’s ESG criteria for purposes of the above-referenced non-fundamental investment policy, a company or issuer must be rated 2 or 1 by Putnam Management. While Putnam Management may consider independent third-party data as a part of its analytical process, the portfolio management team performs its own independent analysis of issuers and does not rely solely on third-party screens.

The fund’s approach to ESG investing incorporates fundamental research together with consideration of ESG criteria which may include, but are not limited to, those included in the following descriptions. Environmental criteria include, for example, a company’s or issuer’s carbon intensity and use of resources like water or minerals. ESG measures in this area might include plans to reduce waste, increase recycling, raise the proportion of energy supply from renewable sources, or improve product design to be less resource intensive. Social criteria include, for example, labor practices and supply chain management. ESG measures in this area might include programs to improve employee well-being, commitment to workplace equality and diversity, or improved stewardship of supplier relationships and working conditions. Corporate governance criteria include, for example, board composition and executive compensation, as well as bondholders’ rights. ESG measures in this area might include improvements in board independence or diversity, or alignment of management incentives with the company’s or issuer’s strategic ESG objectives.

Putnam Management uses a sector-specific approach in evaluating investments. In the corporate credit sector, Putnam Management combines fundamental analysis with relevant ESG insights with a forward-looking perspective. Putnam Management believes that this approach contributes to a more nuanced assessment of an issuer’s credit profile which offers potential opportunity to limit tail risk in credit portfolios (i.e., the risk that the price of a portfolio may decrease by more than three standard deviations from its current price) and ratings volatility. Putnam Management believes that securitized debt instruments present unique challenges in applying ESG criteria due to the presence of various asset types, counterparties involved, and the complex structure of the securitized debt market along with a lack of available ESG-related data. In evaluating securitized debt instruments for potential investment, Putnam Management takes a broad approach, analyzing both the terms of the transaction, including the asset type being securitized and structure of the securitization, as well as key counterparties. Opportunities are analyzed at the asset level within each securitization and each subsector to identify assets that meet relevant ESG thresholds. Additionally, in evaluating securitized debt instruments, Putnam Management analyzes relevant ESG criteria regarding the originator, servicers, or other relevant counterparties. In the sovereign debt sector, Putnam Management uses quantitative modeling and fundamental research to evaluate countries across a variety of ESG criteria (i.e., natural resource dependence and level of public corruption) and non-ESG criteria (i.e., global economic conditions, market valuations and technicals). Putnam Management believes that sovereign issuers with better ESG scores generally benefit from lower borrowing costs and that ESG criteria may influence the perception of the credit risk of a country’s debt. Countries are evaluated both on current ESG metrics and the extent of recent progress.

Putnam Management evaluates ESG considerations using independent third-party data (where available), and also uses company or issuer disclosures and public data sources. Putnam Management believes that ESG considerations are best analyzed in combination with a company’s or issuer’s fundamentals, including a company’s or issuer’s industry, location, strategic position, and key relationships.

In addition to bonds, the fund may also invest in other fixed-income instruments. In addition to the main investment strategies described above, the fund may make other types of investments, such as investments in hybrid and structured bonds and notes, and preferred securities that would be characterized as debt securities under applicable accounting standards and tax laws. The fund may also use derivatives, such as futures, options, certain foreign currency transactions and swap contracts, for both hedging and non-hedging purposes.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund’s management team expects the risk of material loss to be remote.

The fund has entered into contractual arrangements with an investment adviser, administrator, distributor, transfer agent and custodian, who each provide services to the fund. Unless expressly stated otherwise, shareholders are not parties to, or intended beneficiaries of these contractual arrangements, and these contractual arrangements are not intended to create any shareholder right to enforce them against the service providers or to seek any remedy under them against the service providers, either directly or on behalf of the fund.

Under the fund’s Amended and Restated Agreement and Declaration of Trust, any claims asserted against or on behalf of the Putnam Funds, including claims against Trustees and Officers, must be brought in courts of the State of Delaware.

Note 1: Significant accounting policies

The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations. Actual results could differ from those estimates. Subsequent events after the Statement of assets and liabilities date through the date that the financial statements were issued have been evaluated in the preparation of the financial statements.

Security valuation Portfolio securities and other investments are valued using policies and procedures adopted by the Board of Trustees. The Trustees have formed a Pricing Committee to oversee the implementation of these procedures and have delegated responsibility for valuing the fund’s assets in accordance with these procedures to Putnam Management. Putnam Management has established an internal Valuation Committee that is responsible for making fair value determinations, evaluating the effectiveness of the pricing policies of the fund and reporting to the Pricing Committee.

Market quotations are not considered to be readily available for certain debt obligations (including short-term investments with remaining maturities of 60 days or less) and other investments; such investments are valued on the basis of valuations furnished by an independent pricing service approved by the Trustees or dealers selected by Putnam Management. Such services or dealers determine valuations for normal institutional-size trading units of such securities using methods based on market transactions for comparable securities and various relationships, generally recognized by institutional traders, between securities (which consider such factors as security prices, yields, maturities and ratings). These securities will generally be categorized as Level 2. Securities quoted in foreign currencies, if any, are translated into U.S. dollars at the current exchange rate.

Investments in open-end investment companies (excluding exchange-traded funds), if any, which can be classified as Level 1 or Level 2 securities, are valued based on their net asset value. The net asset value of such investment companies equals the total value of their assets less their liabilities and divided by the number of their outstanding shares.

To the extent a pricing service or dealer is unable to value a security or provides a valuation that Putnam Management does not believe accurately reflects the security’s fair value, the security will be valued at fair value by Putnam Management in accordance with policies and procedures approved by the Trustees. Certain investments, including certain restricted and illiquid securities and derivatives, are also valued at fair value following procedures approved by the Trustees. These valuations consider such factors as significant market or specific security events such as interest rate or credit quality changes, various relationships with other securities, discount rates, U.S. Treasury, U.S. swap and credit yields, index levels, convexity exposures, recovery rates, sales and other multiples and resale restrictions. These securities are classified as Level 2 or as Level 3 depending on the priority of the significant inputs.

To assess the continuing appropriateness of fair valuations, the Valuation Committee reviews and affirms the reasonableness of such valuations on a regular basis after considering all relevant information that is reasonably available. Such valuations and procedures are reviewed periodically by the Trustees. Certain securities may be valued on the basis of a price provided by a single source. The fair value of securities is generally determined as the amount that the fund could reasonably expect to realize from an orderly disposition of such securities over a reasonable period of time. By its nature, a fair value price is a good faith estimate of the value of a security in a current sale and does not reflect an actual market price, which may be different by a material amount.

Security transactions and related investment income Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Gains or losses on securities sold are determined on the identified cost basis.

Interest income, net of any applicable withholding taxes, if any, is recorded on the accrual basis. Amortization and accretion of premiums and discounts on debt securities, if any, is recorded on the accrual basis.

Master agreements The fund is a party to ISDA (International Swaps and Derivatives Association, Inc.) Master Agreements that govern OTC derivative and foreign exchange contracts and Master Securities Forward Transaction Agreements that govern transactions involving mortgage-backed and other asset-backed securities that may result in delayed delivery (Master Agreements) with certain counterparties entered into from time to time. The Master Agreements may contain provisions regarding, among other things, the parties’ general obligations, representations, agreements, collateral requirements, events of default and early termination. With respect to certain counterparties, in accordance with the terms of the Master Agreements, collateral pledged to the fund is held in a

segregated account by the fund’s custodian and, with respect to those amounts which can be sold or repledged, are presented in the fund’s portfolio.

Collateral pledged by the fund is segregated by the fund’s custodian and identified in the fund’s portfolio. Collateral can be in the form of cash or debt securities issued by the U.S. Government or related agencies or other securities as agreed to by the fund and the applicable counterparty. Collateral requirements are determined based on the fund’s net position with each counterparty.