ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1: Valuations based on quoted prices for identical securities in active markets.

Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

|

| | | |

| | Valuation inputs |

| Investments in securities: | Level 1 | Level 2 | Level 3 |

| Common stocks*: | | | |

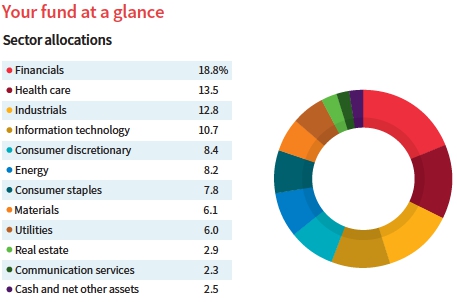

| Communication services | $6,967,518 | $— | $— |

| Consumer discretionary | 25,991,239 | — | — |

| Consumer staples | 24,038,929 | — | — |

| Energy | 25,215,874 | — | — |

| Financials | 57,953,431 | — | — |

| Health care | 41,536,099 | — | — |

| Industrials | 39,611,728 | — | — |

| Information technology | 33,149,061 | — | — |

| Materials | 18,803,993 | — | — |

| Real Estate | 8,968,231 | — | — |

| Utilities | 18,622,292 | — | — |

| Total common stocks | 300,858,395 | — | — |

| Short-term investments | 7,159,378 | — | — |

| Totals by level | $308,017,773 | $— | $— |

* Common stock classifications are presented at the sector level, which may differ from the fund’s portfolio presentation.

The accompanying notes are an integral part of these financial statements.

| |

Focused Large Cap Value ETF 11 |

Statement of assets and liabilities 2/29/24 (Unaudited)

| |

| ASSETS | |

| Investment in securities, at value (Note 1): | |

| Unaffiliated issuers (identified cost $262,909,619) | $300,858,395 |

| Affiliated issuers (identified cost $7,159,378) (Note 5) | 7,159,378 |

| Dividends, interest and other receivables | 470,254 |

| Receivable for shares of the fund sold | 4,198,635 |

| Receivable for investments sold | 305,043 |

| Total assets | 312,991,705 |

| |

| LIABILITIES | |

| Payable for investments purchased | 4,367,399 |

| Payable for compensation of Manager (Note 2) | 119,173 |

| Total liabilities | 4,486,572 |

| | |

| Net assets | $308,505,133 |

| |

| REPRESENTED BY | |

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $266,220,534 |

| Total distributable earnings (Note 1) | 42,284,599 |

| Total — Representing net assets applicable to capital shares outstanding | $308,505,133 |

| |

| COMPUTATION OF NET ASSET VALUE | |

| Net asset value per share | |

| ($308,505,133 divided by 9,179,000 shares) | $33.61 |

The accompanying notes are an integral part of these financial statements.

|

| 12 Focused Large Cap Value ETF |

Statement of operations Six months ended 2/29/24 (Unaudited)

| |

| INVESTMENT INCOME | |

| Dividends (net of foreign tax of $7,590) | $2,173,344 |

| Interest (including interest income of $195,204 from investments in affiliated issuers) (Note 5) | 195,204 |

| Total investment income | 2,368,548 |

| |

| EXPENSES | |

| Compensation of Manager (Note 2) | 648,515 |

| Fees waived and reimbursed by Manager (Note 2) | (10,734) |

| Total expenses | 637,781 |

| | |

| Net investment income | 1,730,767 |

| |

| REALIZED AND UNREALIZED GAIN (LOSS) | |

| Net realized gain (loss) on: | |

| Securities from unaffiliated issuers (Notes 1 and 3) | (1,050,733) |

| Securities from in-kind transactions (Notes 1 and 3) | 8,578,361 |

| Total net realized gain | 7,527,628 |

| Change in net unrealized appreciation (depreciation) on: | |

| Securities from unaffiliated issuers | 24,609,324 |

| Total change in net unrealized appreciation | 24,609,324 |

| | |

| Net gain on investments | 32,136,952 |

| |

| Net increase in net assets resulting from operations | $33,867,719 |

The accompanying notes are an integral part of these financial statements.

|

| Focused Large Cap Value ETF 13 |

Statement of changes in net assets

| | |

| INCREASE IN NET ASSETS | Six months ended 2/29/24* | Year ended 8/31/23 |

| Operations | | |

| Net investment income | $1,730,767 | $2,340,234 |

| Net realized gain on investments | 7,527,628 | 6,138,372 |

| Change in net unrealized appreciation of investments | 24,609,324 | 14,443,202 |

| Net increase in net assets resulting from operations | 33,867,719 | 22,921,808 |

| Distributions to shareholders (Note 1): | | |

| From ordinary income | | |

| Net investment income | (2,473,201) | (1,326,803) |

| Proceeds from shares sold (Note 4) | 117,800,453 | 172,319,170 |

| Decrease from shares redeemed (Note 4) | (46,360,623) | (35,608,503) |

| Total increase in net assets | 102,834,348 | 158,305,672 |

| |

| NET ASSETS | | |

| Beginning of period | 205,670,785 | 47,365,113 |

| End of period | $308,505,133 | $205,670,785 |

| |

| NUMBER OF FUND SHARES | | |

| Shares outstanding at beginning of period | 6,904,000 | 1,829,000 |

| Shares sold (Note 4) | 3,800,000 | 6,325,000 |

| Shares redeemed (Note 4) | (1,525,000) | (1,250,000) |

| Shares outstanding at end of period | 9,179,000 | 6,904,000 |

*Unaudited.

The accompanying notes are an integral part of these financial statements.

|

| 14 Focused Large Cap Value ETF |

Financial highlights

(For a common share outstanding throughout the period)

| | | | |

| PER-SHARE OPERATING PERFORMANCE | | | | |

| | | | | For the period |

| | Six | | | 5/25/21 |

| | months | Year | Year | (commencement |

| | ended | ended | ended | of operations) |

| | 2/29/24** | 8/31/23 | 8/31/22 | to 8/31/21 |

| Net asset value, beginning of period | $29.79 | $25.90 | $26.30 | $25.00 |

| Investment operations: | | | | |

| Net investment income (loss)a | .22 | .46 | .35 | .09 |

| Net realized and unrealized | | | | |

| gain (loss) on investments | 3.92 | 3.69 | (.62) | 1.21 |

| Total from investment operations | 4.14 | 4.15 | (.27) | 1.30 |

| Less distributions: | | | | |

| From net investment income | (.32) | (.26) | (.13) | — |

| From net realized gain on investments | — | — | — | — |

| Total distributions | (.32) | (.26) | (.13) | — |

| Net asset value, end of period | $33.61 | $29.79 | $25.90 | $26.30 |

| Total return at net asset value (%)b | 14.05* | 16.10 | (1.04) | 5.20* |

| |

| RATIOS AND SUPPLEMENTAL DATA | | | | |

| Net assets, end of period | | | | |

| (in thousands) | $308,505 | $205,671 | $47,365 | $9,312 |

| Ratio of expenses to average | | | | |

| net assets (%)c | .27*d | .55d | .55 | .15* |

| Ratio of net investment income | | | | |

| (loss) to average net assets (%) | .73*d | 1.65d | 1.32 | .34* |

| Portfolio turnover (%)e | 14* | 37 | 48 | 27* |

* Not annualized.

** Unaudited.

a Per share net investment income has been determined on the basis of the weighted average number of shares outstanding during the period.

b Total return assumes dividend reinvestment.

c Excludes acquired fund fees and expenses, if any.

d Reflects waivers of certain fund expenses in connection with investments in Putnam Government Money Market Fund during the period. As a result of such waivers, the expenses of the fund reflect a reduction of the following amounts (Note 2):

| |

| | Percentage of average net assets |

| February 29, 2024 | 0.01% |

| August 31, 2023 | 0.01 |

e Portfolio turnover excludes securities received or delivered in-kind.

The accompanying notes are an integral part of these financial statements.

|

| Focused Large Cap Value ETF 15 |

Notes to financial statements 2/29/24 (Unaudited)

Unless otherwise noted, the “reporting period” represents the period from September 1, 2023 through February 29, 2024. The following table defines commonly used references within the Notes to financial statements:

| |

| References to | Represent |

| ETF | Exchange-traded fund |

| Franklin Templeton | Franklin Resources, Inc. |

| JPMorgan | JPMorgan Chase Bank, N.A. |

| OTC | Over-the-counter |

| PIL | Putnam Investments Limited, an affiliate of Putnam Management |

| Putnam Management | Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned |

| | subsidiary of Franklin Templeton |

| SEC | Securities and Exchange Commission |

| State Street | State Street Bank and Trust Company |

Putnam Focused Large Cap Value ETF (the fund) is a non-diversified, open-end series of Putnam ETF Trust (the Trust), a Delaware statutory trust organized under the Investment Company Act of 1940, as amended. The fund is an actively managed ETF that operates pursuant to an exemptive order from the SEC. The fund’s investment objective is to seek capital growth and current income. The fund invests mainly in common stocks of U.S. companies, with a focus on value stocks that offer the potential for capital growth, current income, or both. Under normal circumstances, the fund invests at least 80% of the fund’s net assets in large-cap companies, which, for purposes of this policy, are of a size similar to those in the Russell 1000 Value Index (the Index). This policy may be changed only after 60 days’ notice to shareholders. As of September 30, 2023, the Index was composed of companies having market capitalizations of between approximately $1.1 billion to $764.0 billion. The fund may also invest in midsize companies. Value stocks are issued by companies that the fund’s investment manager, Putnam Investment Management, LLC (Putnam Management) believes are currently undervalued by the market. If Putnam Management is correct and other investors ultimately recognize the value of the company, the price of its stock may rise. Putnam Management may consider, among other factors, a company’s valuation, financial strength, growth potential, competitive position in its industry, projected future earnings, cash flows and dividends when deciding whether to buy or sell investments.

The fund is “non-diversified,” which means it may invest a greater percentage of its assets in fewer issuers than a “diversified” fund. The fund expects to invest in a limited number of issuers.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund’s management team expects the risk of material loss to be remote.

The fund has entered into contractual arrangements with an investment adviser, administrator, distributor, transfer agent and custodian, who each provide services to the fund. Unless expressly stated otherwise, shareholders are not parties to, or intended beneficiaries of these contractual arrangements, and these contractual arrangements are not intended to create any shareholder right to enforce them against the service providers or to seek any remedy under them against the service providers, either directly or on behalf of the fund.

Under the Trust’s Agreement and Declaration of Trust, any claims asserted by a shareholder against or on behalf of the Trust (or its series), including claims against Trustees and Officers, must be brought in courts of the State of Delaware.

Note 1: Significant accounting policies

The fund follows the accounting and reporting guidance in Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (ASC 946) and applies the specialized accounting and reporting guidance in U.S. Generally Accepted Accounting Principles (U.S. GAAP), including, but not limited to, ASC 946. The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in

|

| 16 Focused Large Cap Value ETF |

the financial statements and the reported amounts of increases and decreases in net assets from operations. Actual results could differ from those estimates. Subsequent events after the Statement of assets and liabilities date through the date that the financial statements were issued have been evaluated in the preparation of the financial statements.

Security valuation Portfolio securities and other investments are valued using policies and procedures adopted by the Board of Trustees. The Trustees have formed a Pricing Committee to oversee the implementation of these procedures and have delegated responsibility for valuing the fund’s assets in accordance with these procedures to Putnam Management. Putnam Management has established an internal Valuation Committee that is responsible for making fair value determinations, evaluating the effectiveness of the pricing policies of the fund and reporting to the Pricing Committee.

Investments for which market quotations are readily available are valued at the last reported sales price on their principal exchange, or official closing price for certain markets, and are classified as Level 1 securities under Accounting Standards Codification 820 Fair Value Measurements and Disclosures (ASC 820). If no sales are reported, as in the case of some securities that are traded OTC, a security is valued at its last reported bid price and is generally categorized as a Level 2 security.

Investments in open-end investment companies (excluding exchange-traded funds), if any, which can be classified as Level 1 or Level 2 securities, are valued based on their net asset value. The net asset value of such investment companies equals the total value of their assets less their liabilities and divided by the number of their outstanding shares.

Many securities markets and exchanges outside the U.S. close prior to the scheduled close of the New York Stock Exchange and therefore the closing prices for securities in such markets or on such exchanges may not fully reflect events that occur after such close but before the scheduled close of the New York Stock Exchange. Accordingly, on certain days, the fund will fair value certain foreign equity securities taking into account multiple factors including movements in the U.S. securities markets, currency valuations and comparisons to the valuation of American Depository Receipts, exchange-traded funds and futures contracts. The foreign equity securities, which would generally be classified as Level 1 securities, will be transferred to Level 2 of the fair value hierarchy when they are valued at fair value. The number of days on which fair value prices will be used will depend on market activity and it is possible that fair value prices will be used by the fund to a significant extent. Securities quoted in foreign currencies, if any, are translated into U.S. dollars at the current exchange rate. Short-term securities with remaining maturities of 60 days or less are valued using an independent pricing service approved by the Trustees, and are classified as Level 2 securities.

To the extent a pricing service or dealer is unable to value a security or provides a valuation that Putnam Management does not believe accurately reflects the security’s fair value, the security will be valued at fair value by Putnam Management, which has been designated as valuation designee pursuant to Rule 2a–5 under the Investment Company Act of 1940, in accordance with policies and procedures approved by the Trustees. Certain investments, including certain restricted and illiquid securities and derivatives, are also valued at fair value following procedures approved by the Trustees. These valuations consider such factors as significant market or specific security events such as interest rate or credit quality changes, various relationships with other securities, discount rates, U.S. Treasury, U.S. swap and credit yields, index levels, convexity exposures, recovery rates, sales and other multiples and resale restrictions. These securities are classified as Level 2 or as Level 3 depending on the priority of the significant inputs.

To assess the continuing appropriateness of fair valuations, the Valuation Committee reviews and affirms the reasonableness of such valuations on a regular basis after considering all relevant information that is reasonably available. Such valuations and procedures are reviewed periodically by the Trustees. The fair value of securities is generally determined as the amount that the fund could reasonably expect to realize from an orderly disposition of such securities over a reasonable period of time. By its nature, a fair value price is a good faith estimate of the value of a security in a current sale and does not reflect an actual market price, which may be different by a material amount.

Security transactions and related investment income Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Gains or losses on securities sold are determined on the identified cost basis.

Interest income, net of any applicable withholding taxes, if any, is recorded on the accrual basis. Amortization and accretion of premiums and discounts on debt securities, if any, is recorded on the accrual basis.

Dividend income, net of any applicable withholding taxes, is recognized on the ex-dividend date except that certain dividends from foreign securities, if any, are recognized as soon as the fund is informed of the ex-dividend

|

| Focused Large Cap Value ETF 17 |

date. Non-cash dividends, if any, are recorded at the fair value of the securities received. Dividends representing a return of capital or capital gains, if any, are reflected as a reduction of cost and/or as a realized gain.

Lines of credit The fund participates, along with other Putnam funds, in a $320 million syndicated unsecured committed line of credit, provided by State Street ($160 million) and JPMorgan ($160 million), and a $235.5 million unsecured uncommitted line of credit, provided by State Street. Borrowings may be made for temporary or emergency purposes, including the funding of shareholder redemption requests and trade settlements. Interest is charged to the fund based on the fund’s borrowing at a rate equal to 1.25% plus the higher of (1) the Federal Funds rate and (2) the Overnight Bank Funding Rate for the committed line of credit and 1.30% plus the higher of (1) the Federal Funds rate and (2) the Overnight Bank Funding Rate for the uncommitted line of credit. A closing fee equal to 0.04% of the committed line of credit and 0.04% of the uncommitted line of credit has been paid by the participating funds and a $75,000 fee has been paid by the participating funds to State Street as agent of the syndicated committed line of credit. In addition, a commitment fee of 0.21% per annum on any unutilized portion of the committed line of credit is allocated to the participating funds based on their relative net assets and paid quarterly. During the reporting period, the fund had no borrowings against these arrangements.

Federal taxes It is the policy of the fund to distribute all of its taxable income within the prescribed time period and otherwise comply with the provisions of the Internal Revenue Code of 1986, as amended (the Code), applicable to regulated investment companies. It is also the intention of the fund to distribute an amount sufficient to avoid imposition of any excise tax under Section 4982 of the Code.

The fund is subject to the provisions of Accounting Standards Codification 740 Income Taxes (ASC 740). ASC 740 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The fund did not have a liability to record for any unrecognized tax benefits in the accompanying financial statements. No provision has been made for federal taxes on income, capital gains or unrealized appreciation on securities held nor for excise tax on income and capital gains. Each of the fund’s federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service.

Under the Regulated Investment Company Modernization Act of 2010, the fund will be permitted to carry forward capital losses incurred for an unlimited period and the carry forwards will retain their character as either short-term or long-term capital losses. At August 31, 2023, the fund had the following capital loss carryovers available, to the extent allowed by the Code, to offset future net capital gain, if any:

| | |

| | Loss carryover | |

| Short-term | Long-term | Total |

| $1,652,709 | $559,495 | $2,212,204 |

Tax cost of investments includes adjustments to net unrealized appreciation (depreciation) which may not necessarily be final tax cost basis adjustments, but closely approximate the tax basis unrealized gains and losses that may be realized and distributed to shareholders. The aggregate identified cost on a tax basis is $271,556,153, resulting in gross unrealized appreciation and depreciation of $38,096,713 and $1,635,093, respectively, or net unrealized appreciation of $36,461,620.

Distributions to shareholders Distributions to shareholders from net investment income, if any, are recorded by the fund on the ex-dividend date. Distributions from capital gains, if any, are recorded on the ex-dividend date and paid at least annually. The amount and character of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year. Reclassifications are made to the fund’s capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations.

Expenses of the Trust Expenses directly charged or attributable to any fund will be paid from the assets of that fund. Generally, expenses of the Trust will be allocated among and charged to the assets of each fund on a basis that the Trustees deem fair and equitable, which may be based on the relative assets of each fund or the nature of the services performed and relative applicability to each fund.

Note 2: Management fee, administrative services and other transactions

The fund pays the Manager an annual all-inclusive management fee of 0.55% based on the fund’s average daily net assets computed and paid monthly. The management fee covers investment management services and all of the fund’s organizational and other operating expenses with certain exceptions, including but not limited to: payments

|

| 18 Focused Large Cap Value ETF |

under distribution plans, interest and borrowing expenses, taxes, brokerage commissions and other transaction costs, fund proxy expenses, litigation expenses, extraordinary expenses and acquired fund fees and expenses.

For the reporting period, the management fee represented an effective rate (excluding the impact from any expense waivers in effect) of 0.274% of the fund’s average net assets.

The fund invests in Putnam Government Money Market Fund, an open-end management investment company managed by Putnam Management. Management fees paid by the fund are reduced by an amount equal to the management fees paid by Putnam Government Money Market Fund with respect to assets invested by the fund in Putnam Government Money Market Fund. During the reporting period, management fees paid were reduced by $10,734 relating to the fund’s investment in Putnam Government Money Market Fund.

PIL is authorized by the Trustees to manage a separate portion of the assets of the fund as determined by Putnam Management from time to time. PIL did not manage any portion of the assets of the fund during the reporting period. If Putnam Management were to engage the services of PIL, Putnam Management would pay a quarterly sub-management fee to PIL for its services at an annual rate of 0.25% of the average net assets of the portion of the fund managed by PIL.

On January 1, 2024, a subsidiary of Franklin Templeton acquired Putnam U.S. Holdings I, LLC (“Putnam Holdings”), the parent company of Putnam Management and PIL, in a stock and cash transaction (the “Transaction”). As a result of the Transaction, Putnam Management and PIL became indirect, wholly-owned subsidiaries of Franklin Templeton. The Transaction also resulted in the automatic termination of the investment management contract between the fund and Putnam Management and the sub-management contract for the fund between Putnam Management and PIL that were in place for the fund before the Transaction (together, the “Previous Advisory Contracts”). However, for the period from January 1, 2024 until February 14, 2024, Putnam Management and PIL continued to provide uninterrupted services with respect to the fund pursuant to interim investment management and sub-management contracts (together, the “Interim Advisory Contracts”) that were approved by the Board of Trustees. The terms of the Interim Advisory Contracts were identical to those of the Previous Advisory Contracts, except for the term of the contracts and those provisions required by regulation. On February 14, 2024, new investment management and sub-management contracts were approved by fund shareholders at a shareholder meeting held in connection with the Transaction (together, the “New Advisory Contracts”). The New Advisory Contracts took effect on February 14, 2024 and replaced the Interim Advisory Contracts. The terms of the New Advisory Contracts are substantially similar to those of the Previous Advisory Contracts, and the fee rates payable under the New Advisory Contracts are the same as the fee rates under the Previous Advisory Contracts.

The fund has adopted a distribution and service plan pursuant to Rule 12b–1 under the 1940 Act that authorizes the fund to pay distribution fees in connection with the sale and distribution of its shares and service fees in connection with the provision of ongoing shareholder support services. No Rule 12b–1 fees are currently paid by the fund.

Note 3: Purchases and sales of securities

During the reporting period, the cost of purchases and the proceeds from sales, excluding short-term investments and in-kind transactions, were as follows:

| | |

| | Cost of purchases | Proceeds from sales |

| Investments in securities (Long-term) | $33,335,607 | $107,179,682 |

| U.S. government securities (Long-term) | — | — |

| Total | $33,335,607 | $107,179,682 |

Portfolio securities received or delivered through in-kind transactions were $105,084,823 and $40,561,523, respectively.

The fund may purchase or sell investments from or to other Putnam funds in the ordinary course of business, which can reduce the fund’s transaction costs, at prices determined in accordance with SEC requirements and policies approved by the Trustees. During the reporting period, purchases or sales of long-term securities from or to other Putnam funds, if any, did not represent more than 5% of the fund’s total cost of purchases and/or total proceeds from sales.

Note 4: Capital shares

Shares of the fund are listed and traded on NYSE Arca, Inc., and individual fund shares may only be bought and sold in the secondary market through a broker or dealer at market price. These transactions, which do not involve

|

| Focused Large Cap Value ETF 19 |

the fund, are made at market prices that may vary throughout the day, rather than at net asset value (NAV). Shares of the fund may trade at a price greater than the fund’s NAV (premium) or less than the fund’s NAV (discount). An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase shares (bid) and the lowest price a seller is willing to accept for shares (ask) when buying or selling fund shares in the secondary market (the “bid-ask spread”). The fund will issue and redeem shares in large blocks of 25,000 shares called “Creation Units” on a continuous basis, at NAV, with authorized participants who have entered into agreements with the fund’s distributor. The fund will generally issue and redeem Creation Units in return for a designated portfolio of securities (and an amount of cash) that the fund specifies each day. The fund generally imposes a transaction fee on investors purchasing or redeeming Creation Units. Investors transacting in Creation Units for cash may also pay an additional variable charge to compensate the fund for certain transaction costs and market impact expenses relating to investing in portfolio securities. Such variable charges, if any, are included in Other capital in the Statement of changes in net assets.

Note 5: Affiliated transactions

Transactions during the reporting period with any company which is under common ownership or control were as follows:

| | | | | |

| | | | | | Shares |

| | | | | | outstanding |

| | | | | | and fair |

| | Fair value as | Purchase | Sale | Investment | value as |

| Name of affiliate | of 8/31/23 | cost | proceeds | income | of 2/29/24 |

| Short-term investments | | | | | |

| Putnam Government | | | | | |

| Money Market Fund | | | | | |

| Class P* | $8,435,273 | $11,717,280 | $12,993,175 | $195,204 | $7,159,378 |

| Total Short-term | | | | | |

| investments | $8,435,273 | $11,717,280 | $12,993,175 | $195,204 | $7,159,378 |

* Management fees incurred through investment in Putnam Government Money Market Fund have been waived by the fund (Note 2). There were no realized or unrealized gains or losses during the period.

Note 6: Market, credit and other risks

In the normal course of business, the fund trades financial instruments and enters into financial transactions where risk of potential loss exists due to changes in the market (market risk) or failure of the contracting party to the transaction to perform (credit risk). The fund may be exposed to additional credit risk that an institution or other entity with which the fund has unsettled or open transactions will default. Investments in foreign securities involve certain risks, including those related to economic instability, unfavorable political developments, and currency fluctuations.

Shareholder meeting results (Unaudited)

February 14, 2024 special meeting

At the meeting, a new Management Contract for your fund with Putnam Investment Management, LLC was approved, as follows:

| | |

| Votes for | Votes against | Abstentions/Votes withheld |

| 2,414,703 | 38,910 | 762,382 |

At the meeting, a new Sub-Management Contract for your fund between Putnam Investment Management, LLC and Putnam Investments Limited was approved, as follows:

| | |

| Votes for | Votes against | Abstentions/Votes withheld |

| 2,410,975 | 46,612 | 758,408 |

All tabulations are rounded to the nearest whole number.

|

| 20 Focused Large Cap Value ETF |

Fund information

| | |

| Investment Manager | Trustees | Jonathan S. Horwitz |

| Putnam Investment | Kenneth R. Leibler, Chair | Executive Vice President, |

| Management, LLC | Barbara M. Baumann, Vice Chair | Principal Executive Officer, |

| 100 Federal Street | Liaquat Ahamed | and Compliance Liaison |

| Boston, MA 02110 | Katinka Domotorffy | |

| | Catharine Bond Hill | Kelley Hunt |

| Investment Sub-Advisor | Jennifer Williams Murphy | AML Compliance Officer |

| Putnam Investments Limited | Marie Pillai | |

| 16 St James’s Street | George Putnam III | Martin Lemaire |

| London, England SW1A 1ER | Robert L. Reynolds | Vice President and |

| Manoj P. Singh | Derivatives Risk Manager |

| Distribution Services | Mona K. Sutphen | |

| Foreside Fund Services, LLC | Jane E. Trust | Alan G. McCormack |

| Three Canal Plaza, Suite 100 | | Vice President and |

| Portland, ME 04101 | Officers | Derivatives Risk Manager |

| Robert L. Reynolds | |

| Custodian | President, The Putnam Funds | Denere P. Poulack |

| State Street Bank | | Assistant Vice President, |

| and Trust Company | Kevin R. Blatchford | Assistant Clerk, and |

| Vice President and | Assistant Treasurer |

| Legal Counsel | Assistant Treasurer | |

| Ropes & Gray LLP | | Janet C. Smith |

| James F. Clark | Vice President, |

| | Vice President and | Principal Financial Officer, |

| | Chief Compliance Officer | Principal Accounting Officer, |

| | | and Assistant Treasurer |

| | Michael J. Higgins | |

| | Vice President, Treasurer, | Stephen J. Tate |

| | and Clerk | Vice President and |

| | | Chief Legal Officer |

Call 1-833-228-5577 (toll free) Monday through Friday between 9:00 a.m. and 5:00 p.m. Eastern Time or visit putnam.com anytime for up-to-date information about the fund’s NAV.

| |

| Item 3. Audit Committee Financial Expert: |

| |

| Item 4. Principal Accountant Fees and Services: |

| |

| Item 5. Audit Committee of Listed Registrants |

| |

| Item 6. Schedule of Investments: |

| |

| The registrant’s schedule of investments in unaffiliated issuers is included in the report to shareholders in Item 1 above. |

| |

| Item 7. Disclosure of Proxy Voting Policies and Procedures For Closed-End Management Investment Companies: |

| |

| Item 8. Portfolio Managers of Closed-End Investment Companies |

| |

| Item 9. Purchases of Equity Securities by Closed-End Management Investment Companies and Affiliated Purchasers: |

| |

| Item 10. Submission of Matters to a Vote of Security Holders: |

| |

| Item 11. Controls and Procedures: |

| |

| (a) The registrant’s principal executive officer and principal financial officer have concluded, based on their evaluation of the effectiveness of the design and operation of the registrant’s disclosure controls and procedures as of a date within 90 days of the filing date of this report, that the design and operation of such procedures are generally effective to provide reasonable assurance that information required to be disclosed by the registrant in this report is recorded, processed, summarized and reported within the time periods specified in the Commission’s rules and forms. |

| |

| (b) Changes in internal control over financial reporting: Not applicable |

| |

| Item 12. Disclosures of Securities Lending Activities for Closed-End Investment Companies: |

| |

| Item 13. Recovery of Erroneously Awarded Compensation. |

| |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. |

| |

| By (Signature and Title): |

| |

| /s/ Janet C. Smith

Janet C. Smith

Principal Accounting Officer

|

| |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. |

| |

| By (Signature and Title): |

| |

| /s/ Jonathan S. Horwitz

Jonathan S. Horwitz

Principal Executive Officer

|

| |

| By (Signature and Title): |

| |

| /s/ Janet C. Smith

Janet C. Smith

Principal Financial Officer

|