| |

| SECURITIES AND EXCHANGE COMMISSION |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| |

| MANAGEMENT INVESTMENT COMPANIES |

| | |

| Investment Company Act file number: | (811-23643) |

| | |

| Exact name of registrant as specified in charter: | Putnam ETF Trust |

| | |

| Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

| | |

| Name and address of agent for service: | Stephen Tate, Vice President |

| | |

| | Boston, Massachusetts 02110 |

| | |

| Copy to: | Bryan Chegwidden, Esq. |

| | |

| | 1211 Avenue of the Americas |

| | |

| | Boston, Massachusetts 02199 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | April 30, 2025 |

| | |

| Date of reporting period: | May 1, 2024 – October 31, 2024 |

| |

| Item 1. Report to Stockholders: |

| |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: |

| | |

Putnam ESG Ultra Short ETF | |

PULT | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Putnam ESG Ultra Short ETF for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Putnam ESG Ultra Short ETF | $13 | 0.25% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $106,294,483 |

Total Number of Portfolio Holdings* | 324 |

Portfolio Turnover Rate | 25% |

| * | Includes derivatives, if applicable. |

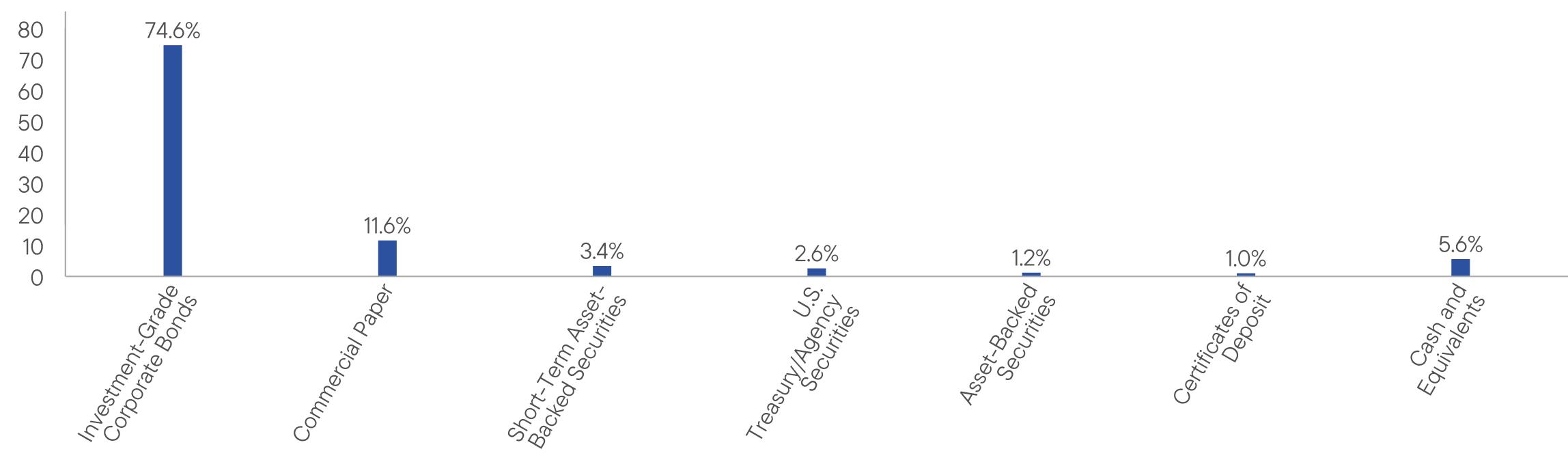

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition (% of Total Net Assets)

| Cash and Equivalents, if any, represent the market value weights of cash, derivatives, and other unclassified assets in the portfolio and may show a negative market value percentage as a result of the timing of trade-date and settlement-date transactions. Holdings and allocations may vary over time. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Putnam ESG Ultra Short ETF | PAGE 1 | 39497-STSR-1224 |

74.611.63.42.61.21.05.6

| |

| Item 3. Audit Committee Financial Expert: |

| |

| Item 4. Principal Accountant Fees and Services: |

| |

| Item 5. Audit Committee of Listed Registrants |

| |

| The registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements and Other Important Information in Item 7 below. |

| |

| Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies. |

Putnam

ESG Ultra Short ETF

Financial Statements and Other Important Information

Semiannual | October 31, 2024

Table of Contents

| | Financial Statements and Other Important Information—Semiannual | franklintempleton.com |

The fund’s portfolio 10/31/24 (Unaudited) |

| | CORPORATE BONDS AND NOTES (74.7%)* | | Principal amount | Value |

| | Banking (37.5%) | | | | |

| | ABN AMRO Bank NV 144A sr. unsec. FRN 6.575%, 10/13/26 (Netherlands) | | | $400,000 | $404,831 |

| | ABN AMRO Bank NV 144A sr. unsec. FRN 6.339%, 9/18/27 (Netherlands) | | | 300,000 | 307,821 |

| | ANZ New Zealand Int’l, Ltd./London 144A company guaranty sr. unsec. FRN (US SOFR + 0.60%), 5.659%, 2/18/25 (United Kingdom) | | | 603,000 | 603,696 |

| | Australia and New Zealand Banking Group, Ltd. 144A sr. unsec. FRN (US SOFR + 0.65%), 5.508%, 9/30/27 (Australia) | | | 250,000 | 250,651 |

| | Australia and New Zealand Banking Group, Ltd. 144A sr. unsec. unsub. FRN (US SOFR + 0.68%), 5.532%, 7/16/27 (Australia) | | | 482,000 | 484,104 |

| | Banco Bilbao Vizcaya Argentaria SA sr. unsec. unsub. FRN 5.862%, 9/14/26 (Spain) | | | 800,000 | 804,181 |

| | Banco Bilbao Vizcaya Argentaria SA sr. unsec. unsub. notes 1.125%, 9/18/25 (Spain) | | | 200,000 | 193,859 |

| | Banco Santander SA sr. unsec. unsub. FRN 6.527%, 11/7/27 (Spain) | | | 200,000 | 206,777 |

| | Banco Santander SA sr. unsec. unsub. FRN 5.552%, 3/14/28 (Spain) | | | 200,000 | 202,192 |

| | Banco Santander SA sr. unsec. unsub. notes 2.746%, 5/28/25 (Spain) | | | 365,000 | 360,445 |

| | Bank of America Corp. sr. unsec. FRN 5.08%, 1/20/27 | | | 250,000 | 250,689 |

| | Bank of America Corp. sr. unsec. FRN Ser. MTN, (US SOFR + 1.05%), 6.19%, 2/4/28 | | | 135,000 | 135,918 |

| | Bank of America Corp. sr. unsec. notes 5.933%, 9/15/27 | | | 753,000 | 769,194 |

| | Bank of America Corp. unsec. sub. FRN Ser. L, 3.95%, 4/21/25 | | | 400,000 | 398,237 |

| | Bank of Montreal sr. unsec. FRN (US SOFR Compounded Index + 0.88%), 5.81%, 9/10/27 (Canada) | | | 302,000 | 302,661 |

| | Bank of Montreal sr. unsec. unsub. notes Ser. MTN, 1.85%, 5/1/25 (Canada) | | | 96,000 | 94,606 |

| | Bank of New York Mellon (The) sr. unsec. FRN Ser. BKNT, 5.148%, 5/22/26 | | | 250,000 | 250,407 |

| | Bank of New York Mellon Corp. (The) sr. unsec. unsub. FRN (US SOFR Compounded Index + 0.83%), 5.672%, 7/21/28 | | | 102,000 | 102,402 |

| | Bank of New York Mellon Corp. (The) sr. unsec. unsub. FRN (US SOFR + 0.62%), 5.46%, 4/25/25 | | | 661,000 | 662,192 |

| | Bank of Nova Scotia/The sr. unsec. unsub. FRN (US SOFR + 1.00%), 5.914%, 9/8/28 (Canada) | | | 402,000 | 402,950 |

| | Bank of Nova Scotia/The sr. unsec. unsub. FRN (US SOFR Compounded Index + 0.78%), 5.747%, 6/4/27 (Canada) | | | 421,000 | 422,005 |

| | Banque Federative du Credit Mutuel SA 144A sr. unsec. FRN (US SOFR Compounded Index + 1.07%), 6.131%, 2/16/28 (France) | | | 405,000 | 407,019 |

| | Banque Federative du Credit Mutuel SA 144A sr. unsec. FRN (US SOFR Compounded Index + 0.41%), 5.55%, 2/4/25 (France) | | | 702,000 | 702,364 |

| | Banque Federative du Credit Mutuel SA 144A sr. unsec. notes 5.896%, 7/13/26 (France) | | | 200,000 | 203,881 |

| | Barclays PLC sr. unsec. unsub. FRN 6.496%, 9/13/27 (United Kingdom) | | | 630,000 | 647,243 |

| | Barclays PLC sr. unsec. unsub. FRN 7.325%, 11/2/26 (United Kingdom) | | | 287,000 | 293,039 |

| | Barclays PLC sr. unsec. unsub. FRN 5.304%, 8/9/26 (United Kingdom) | | | 200,000 | 200,134 |

| | BNP Paribas SA 144A sr. unsec. notes 3.375%, 1/9/25 (France) | | | 765,000 | 762,438 |

| | BPCE SA 144A sr. unsec. FRN (US SOFR + 0.96%), 5.819%, 9/25/25 (France) | | | 250,000 | 251,278 |

| | BPCE SA 144A sr. unsec. unsub. FRN 5.975%, 1/18/27 (France) | | | 719,000 | 725,982 |

| | Canadian Imperial Bank of Commerce sr. unsec. notes 5.926%, 10/2/26 (Canada) | | | 28,000 | 28,664 |

| | Canadian Imperial Bank of Commerce sr. unsec. unsub. FRN (US SOFR Compounded Index + 0.93%), 5.842%, 9/11/27 (Canada) | | | 402,000 | 403,373 |

| | Canadian Imperial Bank of Commerce sr. unsec. unsub. FRN (US SOFR + 0.94%), 5.792%, 6/28/27 (Canada) | | | 320,000 | 321,457 |

| | Canadian Imperial Bank of Commerce sr. unsec. unsub. notes 5.144%, 4/28/25 (Canada) | | | 409,000 | 409,829 |

| | Citizens Bank NA sr. unsec. unsub. FRN 5.284%, 1/26/26 | | | 505,000 | 504,540 |

| | Commonwealth Bank of Australia 144A sr. unsec. unsub. FRN (US SOFR + 0.74%), 5.64%, 3/14/25 (Australia) | | | 158,000 | 158,332 |

| | Commonwealth Bank of Australia 144A unsec. sub. notes 4.50%, 12/9/25 (Australia) | | | 200,000 | 198,694 |

| | Commonwealth Bank of Australia/New York, NY sr. unsec. notes 5.079%, 1/10/25 | | | 544,000 | 544,156 |

| | Cooperatieve Rabobank UA sr. unsec. FRN (US SOFR Compounded Index + 0.62%), 5.613%, 8/28/26 (Netherlands) | | | 250,000 | 250,488 |

| | Cooperatieve Rabobank UA sr. unsec. notes 4.85%, 1/9/26 (Netherlands) | | | 300,000 | 301,283 |

| | Cooperatieve Rabobank UA sr. unsec. unsub. notes 1.375%, 1/10/25 (Netherlands) | | | 650,000 | 645,645 |

| | Credit Agricole SA 144A unsec. sub. notes 4.375%, 3/17/25 (France) | | | 200,000 | 199,220 |

| | Credit Agricole SA/London 144A sr. unsec. FRN (US SOFR + 1.21%), 6.122%, 9/11/28 (France) | | | 290,000 | 292,651 |

| | Credit Agricole SA/London 144A sr. unsec. FRN 4.631%, 9/11/28 (France) | | | 352,000 | 349,296 |

| | | | | | |

| | CORPORATE BONDS AND NOTES (74.7%)* cont. | | Principal amount | Value |

| | Banking cont. | | | | |

| | Credit Suisse Group AG 144A sr. unsec. FRN 6.373%, 7/15/26 (Switzerland) | | | $645,000 | $650,084 |

| | DNB Bank ASA 144A sr. unsec. FRN 5.896%, 10/9/26 (Norway) | | | 963,000 | 970,971 |

| | Fifth Third Bancorp sr. unsec. sub. notes 2.375%, 1/28/25 | | | 354,000 | 351,718 |

| | Goldman Sachs Bank USA/New York, NY sr. unsec. FRN (US SOFR + 0.75%), 5.782%, 5/21/27 | | | 543,000 | 543,564 |

| | Huntington Bancshares, Inc. sr. unsec. unsub. notes 4.00%, 5/15/25 | | | 111,000 | 110,395 |

| | Huntington National Bank (The) sr. unsec. FRN 5.699%, 11/18/25 | | | 834,000 | 833,991 |

| | ING Groep NV sr. unsec. FRN (US SOFR Compounded Index + 1.64%), 6.492%, 3/28/26 (Netherlands) | | | 601,000 | 603,952 |

| | ING Groep NV sr. unsec. FRN 3.869%, 3/28/26 (Netherlands) | | | 200,000 | 198,899 |

| | ING Groep NV sr. unsec. unsub. FRN (US SOFR Compounded Index + 1.56%), 6.472%, 9/11/27 (Netherlands) | | | 200,000 | 202,982 |

| | Intesa Sanpaolo SpA 144A sr. unsec. notes 7.00%, 11/21/25 (Italy) | | | 200,000 | 204,010 |

| | JPMorgan Chase & Co. sr. unsec. FRN (US SOFR + 0.86%), 5.701%, 10/22/28 | | | 195,000 | 195,468 |

| | JPMorgan Chase & Co. sr. unsec. unsub. FRN 2.083%, 4/22/26 | | | 215,000 | 212,030 |

| | JPMorgan Chase & Co. sr. unsec. unsub. FRN 2.005%, 3/13/26 | | | 250,000 | 247,172 |

| | JPMorgan Chase & Co. sr. unsec. unsub. FRN Ser. ., (US SOFR + 0.92%), 5.761%, 4/22/28 | | | 92,000 | 92,419 |

| | JPMorgan Chase & Co. sr. unsec. unsub. FRN 4.08%, 4/26/26 | | | 730,000 | 726,465 |

| | KeyCorp sr. unsec. unsub. FRN Ser. MTN, (US SOFR Compounded Index + 1.25%), 6.271%, 5/23/25 | | | 150,000 | 150,456 |

| | Lloyds Banking Group PLC sr. unsec. unsub. FRN (US SOFR Compounded Index + 1.56%), 6.703%, 8/7/27 (United Kingdom) | | | 200,000 | 202,853 |

| | Lloyds Banking Group PLC sr. unsec. unsub. FRN 5.985%, 8/7/27 (United Kingdom) | | | 200,000 | 203,767 |

| | Lloyds Banking Group PLC sr. unsec. unsub. FRN 4.716%, 8/11/26 (United Kingdom) | | | 200,000 | 199,275 |

| | Lloyds Banking Group PLC sr. unsec. unsub. notes 4.45%, 5/8/25 (United Kingdom) | | | 756,000 | 754,445 |

| | Macquarie Bank, Ltd. 144A sr. unsec. notes 5.391%, 12/7/26 (Australia) | | | 80,000 | 81,355 |

| | Macquarie Bank, Ltd. 144A sr. unsec. notes 3.231%, 3/21/25 (Australia) | | | 590,000 | 586,354 |

| | Macquarie Bank, Ltd. 144A sr. unsec. notes 2.30%, 1/22/25 (Australia) | | | 134,000 | 133,199 |

| | Mitsubishi UFJ Financial Group, Inc. sr. unsec. notes 2.193%, 2/25/25 (Japan) | | | 200,000 | 198,350 |

| | Mitsubishi UFJ Financial Group, Inc. sr. unsec. notes 1.412%, 7/17/25 (Japan) | | | 200,000 | 195,416 |

| | Mitsubishi UFJ Financial Group, Inc. sr. unsec. unsub. FRN 5.541%, 4/17/26 (Japan) | | | 618,000 | 618,809 |

| | Mizuho Financial Group, Inc. sr. unsec. unsub. FRN (US SOFR + 0.96%), 6.017%, 5/22/26 (Japan) | | | 641,000 | 642,897 |

| | National Australia Bank, Ltd. 114A sr. unsec. FRN (US SOFR + 0.62%), 5.537%, 6/11/27 (Australia) | | | 250,000 | 250,645 |

| | National Australia Bank, Ltd. 144A sr. unsec. FRN (US SOFR + 0.38%), 5.231%, 1/12/25 (Australia) | | | 588,000 | 588,017 |

| | National Bank of Canada company guaranty sr. unsec. FRN (US SOFR Compounded Index + 1.03%), 5.88%, 7/2/27 (Canada) | | | 250,000 | 251,030 |

| | Nationwide Building Society 144A sr. unsec. notes 6.557%, 10/18/27 (United Kingdom) | | | 200,000 | 206,170 |

| | Nationwide Building Society 144A sr. unsec. unsub. FRN (US SOFR + 1.29%), 6.351%, 2/16/28 (United Kingdom) | | | 200,000 | 201,493 |

| | NatWest Group PLC sr. unsec. unsub. FRN 5.847%, 3/2/27 (United Kingdom) | | | 851,000 | 861,213 |

| | NatWest Group PLC sr. unsec. unsub. FRN 5.583%, 3/1/28 (United Kingdom) | | | 324,000 | 329,075 |

| | Nordea Bank ABP 144A sr. unsec. FRN (US SOFR + 0.74%), 5.606%, 3/19/27 (Finland) | | | 200,000 | 200,904 |

| | PNC Financial Services Group, Inc. (The) sr. unsec. unsub. FRN 5.812%, 6/12/26 | | | 367,000 | 368,722 |

| | PNC Financial Services Group, Inc. (The) sr. unsec. unsub. FRN 4.758%, 1/26/27 | | | 786,000 | 785,522 |

| | Royal Bank of Canada sr. unsec. FRN Ser. GMTN, (US SOFR Compounded Index + 0.72%), 5.563%, 10/18/27 (Canada) | | | 255,000 | 255,383 |

| | Royal Bank of Canada sr. unsec. FRN Ser. GMTN, (US SOFR + 0.79%), 5.632%, 7/23/27 (Canada) | | | 455,000 | 455,874 |

| | Santander Holdings USA, Inc. sr. unsec. unsub. notes 3.45%, 6/2/25 | | | 434,000 | 429,466 |

| | Santander UK Group Holdings PLC sr. unsec. unsub. FRN 6.833%, 11/21/26 (United Kingdom) | | | 200,000 | 203,252 |

| | Skandinaviska Enskilda Banken AB 144A sr. unsec. notes 5.125%, 3/5/27 (Sweden) | | | 400,000 | 405,120 |

| | Societe Generale SA 144A company guaranty sr. unsec. unsub. FRN (US SOFR + 1.05%), 5.892%, 1/21/26 (France) | | | 700,000 | 700,908 |

| | Societe Generale SA 144A sr. unsec. notes 2.625%, 1/22/25 (France) | | | 763,000 | 758,546 |

| | State Street Corp. sr. unsec. unsub. FRN (US SOFR + 0.85%), 5.985%, 8/3/26 | | | 97,000 | 97,666 |

| | | | | | |

| | CORPORATE BONDS AND NOTES (74.7%)* cont. | | Principal amount | Value |

| | Banking cont. | | | | |

| | State Street Corp. sr. unsec. unsub. FRN (US SOFR + 0.64%), 5.509%, 10/22/27 | | | $172,000 | $172,699 |

| | State Street Corp. sr. unsec. unsub. FRN 5.104%, 5/18/26 | | | 631,000 | 630,974 |

| | Sumitomo Mitsui Financial Group, Inc. sr. unsec. notes 1.474%, 7/8/25 (Japan) | | | 475,000 | 464,846 |

| | Sumitomo Mitsui Trust Bank, Ltd. 144A sr. unsec. FRN (US SOFR + 0.98%), 5.914%, 9/10/27 (Japan) | | | 200,000 | 201,806 |

| | Toronto-Dominion Bank (The) sr. unsec. FRN Ser. GMTN, (US SOFR + 0.48%), 5.324%, 10/10/25 (Canada) | | | 200,000 | 200,295 |

| | Toronto-Dominion Bank (The) sr. unsec. FRN Ser. MTN, (US SOFR + 1.08%), 5.923%, 7/17/26 (Canada) | | | 530,000 | 534,370 |

| | Toronto-Dominion Bank (The) sr. unsec. notes 5.103%, 1/9/26 (Canada) | | | 134,000 | 134,550 |

| | Toronto-Dominion Bank (The) sr. unsec. FRN Ser. GMTN, 5.55%, 8/29/25 (Canada) | | | 395,000 | 395,298 |

| | Toronto-Dominion Bank (The) sr. unsec. unsub. notes Ser. MTN, 1.15%, 6/12/25 (Canada) | | | 135,000 | 132,062 |

| | Truist Bank sr. unsec. notes Ser. BKNT, 1.50%, 3/10/25 | | | 415,000 | 410,172 |

| | Truist Financial Corp. sr. unsec. unsub. FRN Ser. MTN, 4.26%, 7/28/26 | | | 100,000 | 99,405 |

| | Truist Financial Corp. sr. unsec. unsub. FRN Ser. MTN, 5.90%, 10/28/26 | | | 360,000 | 363,350 |

| | Truist Financial Corp. sr. unsec. unsub. notes Ser. MTN, 3.70%, 6/5/25 | | | 190,000 | 188,825 |

| | U.S. Bank NA/Cincinnati, OH sr. unsec. FRN 4.507%, 10/22/27 | | | 510,000 | 508,119 |

| | UBS Group AG 144A sr. unsec. FRN 4.488%, 5/12/26 (Switzerland) | | | 405,000 | 403,440 |

| | UBS Group AG 144A sr. unsec. notes 4.282%, 1/9/28 (Switzerland) | | | 250,000 | 245,133 |

| | Westpac Banking Corp. sr. unsec. unsub. FRN (US SOFR + 0.30%), 5.359%, 11/18/24 (Australia) | | | 769,000 | 769,213 |

| | Westpac Banking Corp. sr. unsec. unsub. FRN (US SOFR + 0.72%), 5.779%, 11/17/25 (Australia) | | | 206,000 | 206,866 |

| | | | | | 39,932,549 |

| | Basic materials (0.4%) | | | | |

| | Sherwin-Williams Co. (The) sr. unsec. unsub. notes 4.25%, 8/8/25 | | | 143,000 | 142,556 |

| | Sherwin-Williams Co. (The) sr. unsec. unsub. notes 3.45%, 8/1/25 | | | 237,000 | 234,681 |

| | | | | | 377,237 |

| | Capital goods (1.8%) | | | | |

| | Caterpillar Financial Services Corp. sr. unsec. FRN (US SOFR + 0.69%), 5.534%, 10/16/26 | | | 145,000 | 145,946 |

| | Daimler Trucks Finance North America, LLC 144A company guaranty sr. unsec. FRN (US SOFR + 0.75%), 5.68%, 12/13/24 | | | 209,000 | 209,142 |

| | Daimler Trucks Finance North America, LLC 144A company guaranty sr. unsec. notes (US SOFR + 0.96%), 5.819%, 9/25/27 | | | 300,000 | 300,769 |

| | Daimler Trucks Finance North America, LLC 144A company guaranty sr. unsec. FRN 5.60%, 8/8/25 | | | 150,000 | 151,008 |

| | Daimler Trucks Finance North America, LLC 144A company guaranty sr. unsec. notes 1.625%, 12/13/24 | | | 624,000 | 621,406 |

| | John Deere Capital Corp. sr. unsec. unsub. FRN Ser. MTN, (US SOFR + 0.60%), 5.512%, 6/11/27 | | | 310,000 | 310,876 |

| | RTX Corp. sr. unsec. notes 5.00%, 2/27/26 | | | 121,000 | 121,474 |

| | | | | | 1,860,621 |

| | Communication services (1.0%) | | | | |

| | American Tower Corp. sr. unsec. notes 1.30%, 9/15/25 | | | 55,000 | 53,340 |

| | American Tower Corp. sr. unsec. notes 2.40%, 3/15/25 | | | 88,000 | 87,174 |

| | Rogers Communications, Inc. company guaranty sr. unsec. unsub. notes 2.95%, 3/15/25 (Canada) | | | 255,000 | 253,015 |

| | T-Mobile USA, Inc. company guaranty sr. notes 3.50%, 4/15/25 | | | 500,000 | 496,759 |

| | Verizon Communications, Inc. sr. unsec. unsub. notes 3.376%, 2/15/25 | | | 209,000 | 208,031 |

| | | | | | 1,098,319 |

| | Consumer cyclicals (6.4%) | | | | |

| | BMW US Capital, LLC 144A company guaranty sr. unsec. FRN (US SOFR Compounded Index + 0.92%), 6.012%, 8/13/27 | | | 387,000 | 389,358 |

| | BMW US Capital, LLC 144A company guaranty sr. unsec. FRN (US SOFR Compounded Index + 0.80%), 5.892%, 8/13/26 | | | 145,000 | 145,785 |

| | BMW US Capital, LLC 144A company guaranty sr. unsec. FRN (US SOFR Compounded Index + 0.84%), 5.692%, 4/1/25 | | | 647,000 | 648,518 |

| | Dollar Tree, Inc. sr. unsec. notes 4.00%, 5/15/25 | | | 50,000 | 49,693 |

| | Home Depot, Inc./The sr. unsec. unsub. FRN (US SOFR + 0.33%), 5.196%, 12/24/25 | | | 155,000 | 155,045 |

| | Hyatt Hotels Corp. sr. unsec. notes 5.75%, 1/30/27 | | | 156,000 | 159,098 |

| | | | | | |

| | CORPORATE BONDS AND NOTES (74.7%)* cont. | | Principal amount | Value |

| | Consumer cyclicals cont. | | | | |

| | Hyatt Hotels Corp. sr. unsec. notes 5.375%, 4/23/25 | | | $70,000 | $70,056 |

| | Hyatt Hotels Corp. sr. unsec. unsub. notes 4.85%, 3/15/26 | | | 46,000 | 46,006 |

| | Hyundai Capital America 144A sr. unsec. FRN (US SOFR + 1.04%), 5.906%, 3/19/27 (South Korea) | | | 260,000 | 260,616 |

| | Hyundai Capital America 144A sr. unsec. FRN (US SOFR + 1.03%), 5.882%, 9/24/27 (South Korea) | | | 249,000 | 249,304 |

| | Hyundai Capital America 144A sr. unsec. FRN (US SOFR + 1.04%), 5.893%, 6/24/27 (South Korea) | | | 528,000 | 528,848 |

| | Hyundai Capital America 144A sr. unsec. notes 5.30%, 3/19/27 (South Korea) | | | 369,000 | 373,107 |

| | Hyundai Capital America 144A sr. unsec. notes 1.65%, 9/17/26 (South Korea) | | | 116,000 | 109,370 |

| | Lennar Corp. company guaranty sr. unsec. unsub. notes 4.75%, 5/30/25 | | | 381,000 | 380,489 |

| | Marriott International, Inc./MD 5.75%, 5/1/25 | | | 418,000 | 419,166 |

| | Mercedes-Benz Finance North America, LLC 144A company guaranty sr. unsec. notes 4.90%, 1/9/26 | | | 360,000 | 360,926 |

| | Mercedes-Benz Finance North America, LLC 144A company guaranty sr. unsec. notes 4.75%, 8/1/27 | | | 150,000 | 150,426 |

| | Netflix, Inc. sr. unsec. notes 5.875%, 2/15/25 | | | 310,000 | 310,905 |

| | Netflix, Inc. sr. unsec. unsub. notes 4.375%, 11/15/26 | | | 55,000 | 54,953 |

| | Netflix, Inc. 144A sr. unsec. notes 3.625%, 6/15/25 | | | 430,000 | 426,747 |

| | Owens Corning sr. unsec. notes 5.50%, 6/15/27 | | | 70,000 | 71,409 |

| | Toyota Motor Credit Corp. sr. unsec. unsub. FRN (US SOFR + 0.77%), 5.877%, 8/7/26 | | | 97,000 | 97,564 |

| | Toyota Motor Credit Corp. sr. unsec. unsub. FRN Ser. MTN, (US SOFR + 0.60%), 5.41%, 6/9/25 | | | 132,000 | 132,294 |

| | Toyota Motor Credit Corp. sr. unsec. unsub. FRN Ser. MTN, (US SOFR Compounded Index + 0.45%), 5.294%, 4/10/26 | | | 149,000 | 149,106 |

| | Toyota Motor Credit Corp. sr. unsec. unsub. FRN Ser. MTN, (US SOFR + 0.32%), 5.163%, 1/13/25 | | | 219,000 | 219,065 |

| | Volkswagen Group of America Finance, LLC 144A company guaranty sr. unsec. FRN (US SOFR + 0.83%), 5.689%, 3/20/26 | | | 265,000 | 265,342 |

| | Volkswagen Group of America Finance, LLC 144A company guaranty sr. unsec. notes 4.90%, 8/14/26 | | | 400,000 | 398,897 |

| | Volkswagen Group of America Finance, LLC 144A company guaranty sr. unsec. notes 3.35%, 5/13/25 | | | 200,000 | 198,445 |

| | | | | | 6,820,538 |

| | Consumer finance (5.6%) | | | | |

| | AerCap Ireland Capital DAC/AerCap Global Aviation Trust company guaranty sr. unsec. notes 6.50%, 7/15/25 (Ireland) | | | 460,000 | 464,166 |

| | AerCap Ireland Capital DAC/AerCap Global Aviation Trust company guaranty sr. unsec. notes 3.50%, 1/15/25 (Ireland) | | | 325,000 | 323,866 |

| | AerCap Ireland Capital DAC/AerCap Global Aviation Trust company guaranty sr. unsec. sub. notes 1.75%, 1/30/26 (Ireland) | | | 150,000 | 144,277 |

| | Air Lease Corp company guaranty sr. unsec. sub. notes Ser. MTN, 5.30%, 6/25/26 | | | 137,000 | 138,276 |

| | Air Lease Corp sr. unsec. notes 3.375%, 7/1/25 | | | 340,000 | 336,659 |

| | Air Lease Corp. sr. unsec. notes 3.25%, 3/1/25 | | | 127,000 | 126,232 |

| | Air Lease Corp. sr. unsec. sub. notes Ser. MTN, 2.30%, 2/1/25 | | | 444,000 | 440,836 |

| | American Express Co. sr. unsec. unsub. notes 6.338%, 10/30/26 | | | 156,000 | 158,202 |

| | American Express Co. sr. unsec. unsub. FRN (US SOFR Compounded Index + 1.35%), 6.189%, 10/30/26 | | | 8,000 | 8,062 |

| | American Express Co. sr. unsec. unsub. FRN (US SOFR Compounded Index + 1.00%), 6.061%, 2/16/28 | | | 102,000 | 102,493 |

| | American Express Co. sr. unsec. unsub. FRN (US SOFR Compounded Index + 0.93%), 5.897%, 3/4/25 | | | 668,000 | 669,196 |

| | American Express Co. sr. unsec. unsub. FRN (US SOFR + 0.76%), 5.852%, 2/13/26 | | | 19,000 | 19,081 |

| | American Express Co. sr. unsec. unsub. FRN (US SOFR Compounded Index + 0.97%), 5.81%, 7/28/27 | | | 80,000 | 80,505 |

| | American Express Co. sr. unsec. unsub. FRN (US SOFR + 0.93%), 5.77%, 7/26/28 | | | 144,000 | 144,829 |

| | American Express Co. sr. unsec. unsub. notes 4.90%, 2/13/26 | | | 43,000 | 43,198 |

| | American Honda Finance Corp. sr. unsec. FRN Ser. MTN, (US SOFR + 0.55%), 5.648%, 2/12/25 | | | 264,000 | 264,036 |

| | American Honda Finance Corp. sr. unsec. FRN Ser. GMTN, (US SOFR + 0.72%), 5.559%, 10/22/27 | | | 257,000 | 257,119 |

| | American Honda Finance Corp. sr. unsec. FRN Ser. MTN, (US SOFR + 0.60%), 5.673%, 8/14/25 | | | 248,000 | 248,594 |

| | | | | | |

| | CORPORATE BONDS AND NOTES (74.7%)* cont. | | Principal amount | Value |

| | Consumer finance cont. | | | | |

| | American Honda Finance Corp. sr. unsec. unsub. FRN (US SOFR Compounded Index + 0.78%), 5.621%, 4/23/25 | | | $173,000 | $173,449 |

| | Capital One Financial Corp. sr. unsec. unsub. FRN 4.985%, 7/24/26 | | | 644,000 | 643,448 |

| | Capital One Financial Corp. sr. unsec. unsub. notes 3.20%, 2/5/25 | | | 88,000 | 87,570 |

| | Capital One Financial Corp. unsec. sub. notes 4.20%, 10/29/25 | | | 150,000 | 148,932 |

| | General Motors Financial Co., Inc. sr. unsec. bonds 5.40%, 4/6/26 | | | 102,000 | 102,822 |

| | General Motors Financial Co., Inc. company guaranty sr. unsec. unsub. notes 4.30%, 7/13/25 | | | 351,000 | 349,385 |

| | General Motors Financial Co., Inc. sr. unsec. FRB (US SOFR Compounded Index + 1.05%), 5.894%, 7/15/27 | | | 180,000 | 180,075 |

| | General Motors Financial Co., Inc. sr. unsec. sub. notes 2.75%, 6/20/25 | | | 264,000 | 260,212 |

| | | | | | 5,915,520 |

| | Consumer staples (2.3%) | | | | |

| | Campbell Soup Co. sr. unsec. unsub. notes 5.30%, 3/20/26 | | | 321,000 | 323,624 |

| | Haleon UK Capital PLC company guaranty sr. unsec. unsub. notes 3.125%, 3/24/25 (United Kingdom) | | | 615,000 | 610,850 |

| | Kenvue, Inc. company guaranty sr. unsec. notes Ser. REGS, 5.50%, 3/22/25 | | | 488,000 | 488,943 |

| | Keurig Dr Pepper, Inc. company guaranty sr. unsec. unsub. notes 4.417%, 5/25/25 | | | 36,000 | 35,931 |

| | Kroger Co. (The) sr. unsec. notes 4.70%, 8/15/26 | | | 240,000 | 240,840 |

| | PepsiCo, Inc. sr. unsec. unsub. FRN (US SOFR Compounded Index + 0.40%), 5.498%, 11/12/24 | | | 161,000 | 161,025 |

| | Starbucks Corp. sr. unsec. sub. notes 3.80%, 8/15/25 | | | 555,000 | 551,254 |

| | | | | | 2,412,467 |

| | Energy (0.4%) | | | | |

| | ONEOK, Inc. company guaranty sr. unsec. sub. notes 5.55%, 11/1/26 | | | 182,000 | 184,539 |

| | Sabine Pass Liquefaction, LLC sr. notes 5.875%, 6/30/26 | | | 230,000 | 232,571 |

| | | | | | 417,110 |

| | Financial (0.6%) | | | | |

| | Jefferies Financial Group, Inc. sr. unsec. notes Ser. MTN, 5.15%, 9/15/25 | | | 390,000 | 390,044 |

| | Macquarie Group, Ltd. 144A sr. unsec. unsub. notes 6.207%, 11/22/24 (Australia) | | | 63,000 | 63,041 |

| | Macquarie Group, Ltd. 144A sr. unsec. unsub. FRN 5.108%, 8/9/26 (Australia) | | | 199,000 | 199,032 |

| | | | | | 652,117 |

| | Health care (2.4%) | | | | |

| | Amgen, Inc. sr. unsec. unsub. notes 5.25%, 3/2/25 | | | 28,000 | 28,033 |

| | CVS Health Corp. sr. unsec. notes 5.00%, 12/1/24 | | | 398,000 | 397,890 |

| | GE Healthcare Holding, LLC sr. unsec. notes 5.60%, 11/15/25 | | | 145,000 | 146,221 |

| | GE HealthCare Technologies, Inc. company guaranty sr. unsec. notes 5.55%, 11/15/24 | | | 407,000 | 407,059 |

| | HCA, Inc. company guaranty sr. unsec. unsub. notes 5.375%, 2/1/25 | | | 452,000 | 452,057 |

| | Illumina, Inc. sr. unsec. sub. notes 4.65%, 9/9/26 | | | 202,000 | 201,582 |

| | Pfizer Investment Enterprises PTE, Ltd. company guaranty sr. unsec. notes 4.65%, 5/19/25 (Singapore) | | | 208,000 | 207,887 |

| | Pfizer Investment Enterprises PTE, Ltd. company guaranty sr. unsec. notes 4.45%, 5/19/26 (Singapore) | | | 502,000 | 501,422 |

| | UnitedHealth Group, Inc. sr. unsec. unsub. FRN (US SOFR + 0.50%), 5.344%, 7/15/26 | | | 192,000 | 192,762 |

| | | | | | 2,534,913 |

| | Insurance (6.8%) | | | | |

| | AEGON Funding Co., LLC 144A company guaranty sr. unsec. notes 5.50%, 4/16/27 | | | 360,000 | 363,538 |

| | Athene Global Funding 144A notes 5.349%, 7/9/27 | | | 240,000 | 241,756 |

| | Athene Global Funding 144A notes 2.50%, 1/14/25 | | | 64,000 | 63,650 |

| | Athene Global Funding 144A notes 1.716%, 1/7/25 | | | 726,000 | 721,510 |

| | Athene Global Funding 144A sr. notes 4.86%, 8/27/26 | | | 292,000 | 291,558 |

| | Athene Global Funding 144A sr. FRN (US SOFR Compounded Index + 0.85%), 5.957%, 5/8/26 | | | 335,000 | 334,537 |

| | Corebridge Financial, Inc. sr. unsec. notes 3.50%, 4/4/25 | | | 340,000 | 337,934 |

| | Corebridge Global Funding 144A company guaranty sr. unsec. unsub. notes 5.35%, 6/24/26 | | | 225,000 | 227,384 |

| | Corebridge Global Funding 144A sr. unsub. FRN (US SOFR + 1.30%), 6.153%, 9/25/26 | | | 390,000 | 394,354 |

| | Marsh & McLennan Cos., Inc. sr. unsec. FRN (US SOFR Compounded Index + 0.70%), 5.539%, 11/8/27 | | | 155,000 | 155,856 |

| | MassMutual Global Funding II 144A FRN (US SOFR + 0.87%), 5.723%, 3/21/25 | | | 912,000 | 914,361 |

| | | | | | |

| | CORPORATE BONDS AND NOTES (74.7%)* cont. | | Principal amount | Value |

| | Insurance cont. | | | | |

| | Metropolitan Life Global Funding I 144A notes 5.00%, 1/6/26 | | | $150,000 | $150,680 |

| | Metropolitan Life Global Funding I 144A sr. unsub. FRN (US SOFR Compounded Index + 0.91%), 5.763%, 3/21/25 | | | 935,000 | 937,472 |

| | Metropolitan Life Global Funding I 144A sr. unsub. notes 2.80%, 3/21/25 | | | 199,000 | 197,542 |

| | New York Life Global Funding 144A sr. FRN (US SOFR + 0.67%), 5.52%, 4/2/27 | | | 655,000 | 656,586 |

| | New York Life Global Funding 144A sr. unsub. FRN (US SOFR Compounded Index + 0.33%), 5.173%, 1/14/25 | | | 184,000 | 184,074 |

| | Northwestern Mutual Global Funding 144A notes 5.07%, 3/25/27 | | | 114,000 | 115,614 |

| | Pacific Life Global Funding II 144A FRN (US SOFR Compounded Index + 0.80%), 5.652%, 3/30/25 | | | 318,000 | 318,680 |

| | Principal Life Global Funding II 144A notes 4.60%, 8/19/27 | | | 97,000 | 97,151 |

| | Protective Life Global Funding 144A FRN (US SOFR + 0.70%), 5.544%, 4/10/26 | | | 233,000 | 233,698 |

| | Protective Life Global Funding 144A notes 4.335%, 9/13/27 | | | 300,000 | 297,483 |

| | | | | | 7,235,418 |

| | Investment banking/Brokerage (3.7%) | | | | |

| | Deutsche Bank AG sr. unsec. unsub. FRN 3.961%, 11/26/25 (Germany) | | | 512,000 | 511,336 |

| | Deutsche Bank AG/New York, NY sr. unsec. unsub. FRN 2.129%, 11/24/26 (Germany) | | | 265,000 | 256,776 |

| | Deutsche Bank AG/New York, NY sr. unsec. unsub. FRN 6.119%, 7/14/26 (Germany) | | | 280,000 | 281,636 |

| | Goldman Sachs Group, Inc. (The) sr. unsec. unsub. FRN (US SOFR + 1.07%), 6.163%, 8/10/26 | | | 195,000 | 195,785 |

| | Goldman Sachs Group, Inc. (The) sr. unsec. unsub. FRN Ser. GMTN, (CME Term SOFR 3 Month + 2.01%), 6.629%, 10/28/27 | | | 11,000 | 11,270 |

| | Goldman Sachs Group, Inc. (The) sr. unsec. unsub. FRN 5.798%, 8/10/26 | | | 314,000 | 316,006 |

| | Goldman Sachs Group, Inc. (The) sr. unsec. unsub. notes 3.85%, 1/26/27 | | | 161,000 | 157,914 |

| | Mizuho Markets Cayman LP company guaranty sr. unsec. FRN Ser. MTN, (US SOFR + 0.50%), 5.493%, 9/23/25 (Cayman Islands) | | | 293,000 | 293,266 |

| | Mizuho Markets Cayman LP 144A company guaranty sr. unsec. unsub. FRN Ser. MTN, (US SOFR + 0.60%), 5.445%, 10/6/25 (Cayman Islands) | | | 301,000 | 301,094 |

| | Morgan Stanley sr. unsec. FRN 6.138%, 10/16/26 | | | 117,000 | 118,366 |

| | Morgan Stanley sr. unsec. FRN Ser. MTN, 5.652%, 4/13/28 | | | 950,000 | 969,145 |

| | Morgan Stanley sr. unsec. unsub. FRN 2.63%, 2/18/26 | | | 115,000 | 114,119 |

| | Morgan Stanley sr. unsec. unsub. notes Ser. MTN, 3.125%, 7/27/26 | | | 49,000 | 47,804 |

| | Morgan Stanley Bank NA sr. unsec. FRN Ser. BKNT, (US SOFR + 0.94%), 5.783%, 7/14/28 | | | 384,000 | 385,561 |

| | | | | | 3,960,078 |

| | Real estate (2.5%) | | | | |

| | Alexandria Real Estate Equities, Inc. company guaranty sr. unsec. notes 3.45%, 4/30/25 | | | 175,000 | 173,811 |

| | Boston Properties, LP sr. unsec. notes 3.20%, 1/15/25 R | | | 509,000 | 506,959 |

| | Boston Properties, LP sr. unsec. unsub. notes 3.65%, 2/1/26 R | | | 241,000 | 236,568 |

| | Camden Property Trust sr. unsec. unsub. notes 5.85%, 11/3/26 R | | | 335,000 | 343,463 |

| | Essex Portfolio LP company guaranty sr. unsec. notes 3.50%, 4/1/25 | | | 533,000 | 529,930 |

| | Kimco Realty OP, LLC company guaranty sr. unsec. unsub. notes 3.85%, 6/1/25 | | | 42,000 | 41,691 |

| | Public Storage sr. unsec. FRN (US SOFR Compounded Index + 0.60%), 5.44%, 7/25/25 R | | | 197,000 | 197,538 |

| | Public Storage Operating Co. company guaranty sr. unsec. FRN (US SOFR Compounded Index + 0.70%), 5.544%, 4/16/27 | | | 349,000 | 350,678 |

| | Realty Income Corp. sr. unsec. unsub. notes 5.05%, 1/13/26 R | | | 84,000 | 83,850 |

| | Simon Property Group LP sr. unsec. unsub. notes 3.50%, 9/1/25 | | | 195,000 | 193,137 |

| | | | | | 2,657,625 |

| | Technology (0.8%) | | | | |

| | Broadcom, Inc. sr. unsec. notes 5.05%, 7/12/27 | | | 206,000 | 208,102 |

| | Hewlett Packard Enterprise Co. sr. unsec. unsub. notes 4.90%, 10/15/25 | | | 399,000 | 399,339 |

| | VMWare, LLC sr. unsec. notes 4.50%, 5/15/25 | | | 231,000 | 230,482 |

| | | | | | 837,923 |

| | Utilities and power (2.5%) | | | | |

| | Constellation Energy Generation, LLC sr. unsec. notes 3.25%, 6/1/25 | | | 238,000 | 235,596 |

| | DTE Energy Co. sr. unsec. unsub. notes 4.95%, 7/1/27 | | | 60,000 | 60,344 |

| | DTE Energy Co. sr. unsec. unsub. notes Ser. F, 1.05%, 6/1/25 | | | 159,000 | 155,608 |

| | Electricite De France SA 144A sr. unsec. unsub. notes 3.625%, 10/13/25 (France) | | | 90,000 | 88,926 |

| | Energy Transfer LP sr. unsec. notes 4.05%, 3/15/25 | | | 196,000 | 195,217 |

| | Eversource Energy sr. unsec. unsub. notes 4.75%, 5/15/26 | | | 162,000 | 162,084 |

| | | | | | |

| | CORPORATE BONDS AND NOTES (74.7%)* cont. | | Principal amount | Value |

| | Utilities and power cont. | | | | |

| | Kinder Morgan, Inc. company guaranty sr. unsec. unsub. notes 4.30%, 6/1/25 | | | $328,000 | $326,881 |

| | NextEra Energy Capital Holdings, Inc. company guaranty sr. unsec. unsub. notes 5.749%, 9/1/25 | | | 370,000 | 372,737 |

| | NextEra Energy Capital Holdings, Inc. company guaranty sr. unsec. unsub. notes 3.55%, 5/1/27 | | | 75,000 | 73,152 |

| | NiSource, Inc. sr. unsec. notes 0.95%, 8/15/25 | | | 181,000 | 175,465 |

| | ONEOK Partners LP company guaranty sr. unsec. notes 4.90%, 3/15/25 | | | 336,000 | 335,937 |

| | Pacific Gas and Electric Co. sr. FRN (US SOFR Compounded Index + 0.95%), 5.899%, 9/4/25 | | | 200,000 | 200,470 |

| | WEC Energy Group, Inc. sr. unsec. unsub. notes 5.60%, 9/12/26 | | | 262,000 | 266,286 |

| | | | | | 2,648,703 |

| | Total corporate bonds and notes (cost $79,089,676) | $79,361,138 |

| | COMMERCIAL PAPER (16.3%)* | Yield (%) | Maturity date | Principal amount | Value |

| | Alexandria Real Estate Equities, Inc. | 5.000 | 11/8/24 | $387,000 | $386,572 |

| | Alexandria Real Estate Equities, Inc. | 4.970 | 11/1/24 | 494,000 | 493,932 |

| | Alimentation Couche-Tard, Inc. (Canada) | 4.952 | 11/8/24 | 575,000 | 574,362 |

| | Alimentation Couche-Tard, Inc. (Canada) | 4.939 | 11/1/24 | 473,000 | 472,935 |

| | American Honda Finance Corp. | 5.229 | 12/12/24 | 340,000 | 338,077 |

| | Boston Properties LP | 5.003 | 11/25/24 | 276,000 | 275,061 |

| | Conagra Brands, Inc. | 5.216 | 11/13/24 | 255,000 | 254,528 |

| | Conagra Brands, Inc. | 5.151 | 11/1/24 | 731,000 | 730,896 |

| | Constellation Brands, Inc. | 5.114 | 11/18/24 | 250,000 | 249,355 |

| | Constellation Brands, Inc. | 5.088 | 11/8/24 | 250,000 | 249,711 |

| | Constellation Brands, Inc. | 5.087 | 11/4/24 | 250,000 | 249,855 |

| | Crown Castle, Inc. | 5.246 | 11/20/24 | 250,000 | 249,284 |

| | Crown Castle, Inc. | 5.276 | 11/14/24 | 271,000 | 270,454 |

| | Enbridge US, Inc. | 4.945 | 11/12/24 | 525,000 | 524,124 |

| | Enbridge US, Inc. | 4.946 | 11/8/24 | 525,000 | 524,414 |

| | Energy Transfer LP | 4.951 | 11/1/24 | 867,000 | 866,882 |

| | Eversource Energy | 4.941 | 11/1/24 | 584,000 | 583,920 |

| | Huntington Ingalls Industries, Inc. | 5.344 | 11/4/24 | 642,000 | 641,628 |

| | Huntington Ingalls Industries, Inc. | 5.322 | 11/1/24 | 443,000 | 442,936 |

| | Intercontinental Exchange, Inc. | 4.943 | 11/6/24 | 525,000 | 524,563 |

| | Intercontinental Exchange, Inc. | 4.933 | 11/4/24 | 250,000 | 249,861 |

| | Microchip Technology, Inc. | 5.400 | 11/4/24 | 525,000 | 524,704 |

| | Mid-America Apartments LP | 4.970 | 11/4/24 | 510,000 | 509,721 |

| | Mid-America Apartments LP | 4.970 | 11/1/24 | 540,000 | 539,926 |

| | Nutrien, Ltd. (Canada) | 4.955 | 12/6/24 | 250,000 | 248,780 |

| | Nutrien, Ltd. (Canada) | 4.954 | 12/5/24 | 250,000 | 248,813 |

| | Nutrien, Ltd. (Canada) | 4.966 | 11/8/24 | 535,000 | 534,410 |

| | Ovintiv, Inc. | 5.389 | 11/20/24 | 500,000 | 498,454 |

| | Ovintiv, Inc. | 5.455 | 11/15/24 | 339,000 | 338,204 |

| | Penske Truck Leasing Co. | 5.391 | 11/6/24 | 250,000 | 249,792 |

| | Penske Truck Leasing Co. | 4.961 | 11/4/24 | 300,000 | 299,833 |

| | PPG Industries, Inc. | 4.900 | 12/19/24 | 500,000 | 496,726 |

| | PPG Industries, Inc. | 4.959 | 11/14/24 | 500,000 | 499,046 |

| | Protective Life Corp. | 4.934 | 11/20/24 | 530,000 | 528,479 |

| | Targa Resources Corp. | 5.060 | 11/7/24 | 273,000 | 272,718 |

| | Targa Resources Corp. | 4.951 | 11/1/24 | 831,000 | 830,878 |

| | TransCanada PipeLines, Ltd. (Canada) | 4.954 | 11/5/24 | 476,000 | 475,675 |

| | UDR, Inc. | 4.923 | 12/3/24 | 485,000 | 482,844 |

| | UDR, Inc. | 4.941 | 11/22/24 | 571,000 | 569,298 |

| | Total commercial paper (cost $17,304,011) | $17,301,651 |

| | ASSET-BACKED SECURITIES (4.5%)* | | Principal amount | Value |

| | Bank of America Auto Trust 144A Ser. 23-2A, Class A2, 5.85%, 8/17/26 | | | $151,939 | $152,446 |

| | CarMax Auto Owner Trust | | | | |

| | Ser. 24-2, Class A3, 5.50%, 1/16/29 | | | 408,000 | 415,287 |

| | Ser. 22-2, Class A3, 3.49%, 2/16/27 | | | 114,120 | 113,334 |

| | Chase Auto Owner Trust 144A Ser. 24-3A, Class A2, 5.53%, 9/27/27 | | | 466,000 | 468,320 |

| | | | | | |

| | ASSET-BACKED SECURITIES (4.5%)* cont. | | Principal amount | Value |

| | Citizens Auto Receivables Trust 144A | | | | |

| | Ser. 23-2, Class A2A, 6.09%, 10/15/26 | | | $115,403 | $115,763 |

| | FRB Ser. 24-2, Class A2B, (US 30 Day Average SOFR + 0.54%), 5.55%, 11/16/26 | | | 168,000 | 168,117 |

| | GM Financial Consumer Automobile Receivables Trust | | | | |

| | Ser. 24-2, Class A3, 5.10%, 3/16/29 | | | 353,000 | 356,722 |

| | Ser. 23-1, Class A3, 4.66%, 2/16/28 | | | 285,000 | 285,158 |

| | Ser. 22-2, Class A3, 3.10%, 2/16/27 | | | 145,738 | 144,522 |

| | Harley-Davidson Motorcycle Trust | | | | |

| | Ser. 23-B, Class A2, 5.92%, 12/15/26 | | | 111,773 | 112,094 |

| | Ser. 23-B, Class A3, 5.69%, 8/15/28 | | | 120,000 | 121,421 |

| | Ser. 24-A, Class A2, 5.65%, 2/16/27 | | | 402,193 | 403,603 |

| | Honda Auto Receivables Owner Trust | | | | |

| | Ser. 23-4, Class A2, 5.87%, 6/22/26 | | | 162,598 | 163,264 |

| | Ser. 23-1, Class A3, 5.04%, 4/21/27 | | | 371,000 | 372,157 |

| | Huntington Auto Trust 144A Ser. 24-1A, Class A2, 5.50%, 3/15/27 | | | 90,436 | 90,683 |

| | Hyundai Auto Receivables Trust | | | | |

| | Ser. 23-C, Class A2A, 5.80%, 1/15/27 | | | 158,373 | 159,037 |

| | Ser. 23-A, Class A3, 4.58%, 4/15/27 | | | 470,000 | 469,648 |

| | Tesla Auto Lease Trust 144A Ser. 23-A, Class A2, 5.86%, 8/20/25 | | | 75,271 | 75,327 |

| | Toyota Auto Receivables Owner Trust | | | | |

| | FRB Ser. 24-D, Class A2B, (US 30 Day Average SOFR + 0.39%), 5.417%, 8/16/27 | | | 200,000 | 200,120 |

| | Ser. 22-C, Class A3, 3.76%, 4/15/27 | | | 204,418 | 203,406 |

| | Volkswagen Auto Loan Enhanced Trust | | | | |

| | Ser. 23-2, Class A2A, 5.72%, 3/22/27 | | | 169,191 | 170,011 |

| | Ser. 21-1, Class A3, 1.02%, 6/22/26 | | | 73,046 | 72,369 |

| | Total asset-backed securities (cost $4,799,042) | $4,832,809 |

| | U.S. TREASURY OBLIGATIONS (2.6%)* | | Principal amount | Value |

| | U.S. Treasury Notes | | | | |

| | 5.00%, 9/30/25 | | | $583,000 | $586,290 |

| | 4.875%, 4/30/26 | | | 2,105,000 | 2,124,899 |

| | Total U.S. treasury obligations (cost $2,684,120) | $2,711,189 |

| | CERTIFICATES OF DEPOSIT (1.0%)* | Yield (%) | Maturity date | Principal amount | Value |

| | Intesa Sanpaolo SPA/New York, NY | 5.680 | 1/13/25 | $520,000 | $520,460 |

| | Intesa Sanpaolo SPA/New York, NY FRN | 5.770 | 8/18/25 | 250,000 | 250,590 |

| | Mizuho Bank, Ltd./New York, NY | 4.750 | 2/4/25 | 305,000 | 304,996 |

| | Total certificates of deposit (cost $1,075,000) | $1,076,046 |

| | SHORT-TERM INVESTMENTS (1.6%)* | Shares | Value |

| | Putnam Government Money Market Fund Class P 4.62% L | 1,750,100 | $1,750,100 |

| | Total short-term investments (cost $1,750,100) | $1,750,100 |

| | TOTAL INVESTMENTS |

| | Total investments (cost $106,701,949) | $107,032,933 |

| | Key to holding’s abbreviations |

| | BKNT | Bank Note |

| | CME | Chicago Mercantile Exchange |

| | DAC | Designated Activity Company |

| | FRB | Floating Rate Bonds: The rate shown is the current interest rate at the close of the reporting period. Rates may be subject to a cap or floor. For certain securities, the rate may represent a fixed rate currently in place at the close of the reporting period. |

| | FRN | Floating Rate Notes: The rate shown is the current interest rate or yield at the close of the reporting period. Rates may be subject to a cap or floor. For certain securities, the rate may represent a fixed rate currently in place at the close of the reporting period. |

| | GMTN | Global Medium Term Notes |

| | MTN | Medium Term Notes |

| | REGS | Securities sold under Regulation S may not be offered, sold or delivered within the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933. |

| | SOFR | Secured Overnight Financing Rate |

| | Notes to the fund’s portfolio |

| | Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from May 1, 2024 through October 31, 2024 (the reporting period). Within the following notes to the portfolio, references to “Franklin Advisers” represent Franklin Advisers, Inc., the fund’s investment manager, a direct wholly-owned subsidiary of Franklin Resources, Inc., and references to “ASC 820” represent Accounting Standards Codification 820 Fair Value Measurements and Disclosures. |

| * | Percentages indicated are based on net assets of $106,294,483. |

| L | Affiliated company (Note 5). The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period. |

| R | Real Estate Investment Trust. |

| | Debt obligations are considered secured unless otherwise indicated. |

| | 144A after the name of an issuer represents securities exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| | The dates shown on debt obligations are the original maturity dates. |

| | DIVERSIFICATION BY COUNTRY |

| | Distribution of investments by country of risk at the close of the reporting period, excluding collateral received, if any (as a percentage of Portfolio Value): |

| | United States | 65.1% | | Switzerland | 1.2% |

| | Canada | 7.1 | | Germany | 1.0 |

| | United Kingdom | 5.2 | | Norway | 0.9 |

| | France | 5.1 | | Ireland | 0.9 |

| | Australia | 3.7 | | Singapore | 0.7 |

| | Netherlands | 2.7 | | Cayman Islands | 0.6 |

| | Japan | 2.2 | | Other | 0.5 |

| | Spain | 1.7 | | Total | 100.0% |

| | South Korea | 1.4 | | | |

| | ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows: |

| | Level 1: Valuations based on quoted prices for identical securities in active markets. |

| | Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly. |

| | Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement. |

| | The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period: |

| | | Valuation inputs |

| | Investments in securities: | Level 1 | Level 2 | Level 3 |

| | Asset-backed securities | $— | $4,832,809 | $— |

| | Certificates of deposit | — | 1,076,046 | — |

| | Commercial paper | — | 17,301,651 | — |

| | Corporate bonds and notes | — | 79,361,138 | — |

| | U.S. treasury obligations | — | 2,711,189 | — |

| | Short-term investments | 1,750,100 | — | — |

| | Totals by level | $1,750,100 | $105,282,833 | $— |

The accompanying notes are an integral part of these financial statements.

Financial Statements

Statement of assets and liabilities

10/31/24 (Unaudited)

| ASSETS | |

| Investment in securities, at value (Note 1): | |

| Unaffiliated issuers (identified cost $104,951,849) | $105,282,833 |

| Affiliated issuers (identified cost $1,750,100) (Note 5) | 1,750,100 |

| Cash | 60 |

| Interest and other receivables | 787,925 |

| Total assets | 107,820,918 |

| | |

| LIABILITIES | |

| Payable for investments purchased | 1,504,394 |

| Payable for compensation of Manager (Note 2) | 22,041 |

| Total liabilities | 1,526,435 |

| Net assets | $106,294,483 |

| | |

| Represented by | |

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $105,474,233 |

| Total distributable earnings (Note 1) | 820,250 |

| Total — Representing net assets applicable to capital shares outstanding | $106,294,483 |

| | |

| COMPUTATION OF NET ASSET VALUE | |

| Net asset value per share ($106,294,483 divided by 2,100,000 shares) | $50.62 |

The accompanying notes are an integral part of these financial statements.

Statement of operations

Six months ended 10/31/24 (Unaudited)

| Investment income | |

| Interest (including interest income of $19,375 from investments in affiliated issuers) (Note 5) | $2,737,104 |

| Total investment income | 2,737,104 |

| | |

| EXPENSES | |

| Compensation of Manager (Note 2) | 122,931 |

| Fees waived and reimbursed by Manager (Note 2) | (756) |

| Total expenses | 122,175 |

| Net investment income | 2,614,929 |

| | |

| REALIZED AND UNREALIZED GAIN (LOSS) | |

| Net realized gain (loss) on: | |

| Securities from unaffiliated issuers (Notes 1 and 3) | 41,446 |

| Total net realized gain | 41,446 |

| Change in net unrealized appreciation (depreciation) on: | |

| Securities from unaffiliated issuers | 327,869 |

| Total change in net unrealized appreciation | 327,869 |

| Net gain on investments | 369,315 |

| Net increase in net assets resulting from operations | $2,984,244 |

The accompanying notes are an integral part of these financial statements.

Statement of changes in net assets

| | Six months ended 10/31/24* | Year ended 4/30/24 |

| Increase (decrease) in net assets | | |

| Operations | | |

| Net investment income | $2,614,929 | $5,557,204 |

| Net realized gain on investments | 41,446 | 47,992 |

| Change in net unrealized appreciation of investments | 327,869 | 301,134 |

| Net increase in net assets resulting from operations | 2,984,244 | 5,906,330 |

| Distributions to shareholders (Note 1): | | |

| From ordinary income | | |

| Net investment income | (2,513,658) | (5,744,638) |

| Proceeds from shares sold (Note 4) | 22,708,123 | 56,561,279 |

| Decrease from shares redeemed (Note 4) | — | (99,322,200) |

| Other capital (Note 4) | 22,708 | 155,883 |

| Total increase (decrease) in net assets | 23,201,417 | (42,443,346) |

| Net assets | | |

| Beginning of period | 83,093,066 | 125,536,412 |

| End of period | $106,294,483 | $83,093,066 |

| Number of fund shares | | |

| Shares outstanding at beginning of period | 1,650,000 | 2,500,000 |

| Shares sold (Note 4) | 450,000 | 1,125,000 |

| Shares redeemed (Note 4) | — | (1,975,000) |

| Shares outstanding at end of period | 2,100,000 | 1,650,000 |

| *Unaudited. |

The accompanying notes are an integral part of these financial statements.

Financial highlights

(For a common share outstanding throughout the period)

| PER-SHARE OPERATING PERFORMANCE | | | |

| | Six months ended 10/31/24** | Year ended 4/30/24 | For the period 1/19/23 (commencement of operations) to 4/30/23 |

| Net asset value, beginning of period | $50.36 | $50.21 | $50.00 |

| Investment operations: | | | |

| Net investment income (loss)a | 1.35 | 2.73 | .71 |

| Net realized and unrealized gain (loss) on investments | .21 | .18 | (.21) |

| Total from investment operations | 1.56 | 2.91 | .50 |

| Less distributions: | | | |

| From net investment income | (1.31) | (2.84) | (.38) |

| Total distributions | (1.31) | (2.84) | (.38) |

| Other capital | .01 | .08 | .09 |

| Net asset value, end of period | $50.62 | $50.36 | $50.21 |

| Total return at net asset value (%)b | 3.15* | 6.14 | 1.18* |

| RATIOS AND SUPPLEMENTAL DATA | | | |

| Net assets, end of period (in thousands) | $106,294 | $83,093 | $125,536 |

| Ratio of expenses to average net assets (%)c,d | .13* | .25 | .07* |

| Ratio of net investment income (loss) to average net assets (%)d | 2.68* | 5.44 | 1.41* |

| Portfolio turnover (%)e | 25* | 84 | 26* |

| a | Per share net investment income (loss) has been determined on the basis of the weighted average number of shares outstanding during the period. |

| b | Total return assumes dividend reinvestment. |

| c | Excludes acquired fund fees and expenses, if any. |

| d | Reflects waivers of certain fund expenses in connection with investments in Putnam Government Money Market Fund during the period. As a result of such waivers, the expenses of the fund reflect a reduction of the following amounts (Notes 2 and 5): |

| | Percentage of average net assets |

| October 31, 2024 | <0.01% |

| April 30, 2024 | <0.01 |

| April 30, 2023 | <0.01 |

| e | Portfolio turnover excludes securities received or delivered in-kind, if any. |

The accompanying notes are an integral part of these financial statements.

Notes to financial statements 10/31/24 (Unaudited)

Unless otherwise noted, the “reporting period” represents the period from May 1, 2024 through October 31, 2024. The following table defines commonly used references within the Notes to financial statements:

| References to | Represent |

| 1940 Act | Investment Company Act of 1940, as amended |

| ESG | Environmental, social and/or corporate governance |

| ETF | Exchange-traded fund |

| Franklin Advisers | Franklin Advisers, Inc., a direct wholly-owned subsidiary of Franklin Templeton, and the fund’s investment manager for periods on or after July 15, 2024 |

| Franklin Templeton | Franklin Resources, Inc. |

| Franklin Templeton Services | Franklin Templeton Services, LLC, a wholly-owned subsidiary of Franklin Templeton |

| JPMorgan | JPMorgan Chase Bank, N.A. |

| OTC | Over-the-counter |

| PIL | Putnam Investments Limited, an indirect wholly-owned subsidiary of Franklin Templeton |

| Putnam Management | Putnam Investment Management, LLC, an indirect wholly-owned subsidiary of Franklin Templeton, and the fund’s investment manager for periods prior to July 15, 2024 |

| SEC | Securities and Exchange Commission |

| State Street | State Street Bank and Trust Company |

Putnam ESG Ultra Short ETF (the fund) is a diversified, open-end series of Putnam ETF Trust (the Trust), a Delaware statutory trust organized under the 1940 Act. The fund is an actively managed ETF. The fund’s investment objective is to seek as high a rate of current income as Franklin Advisers believes is consistent with preservation of capital and maintenance of liquidity. The fund invests in a diversified short duration portfolio of fixed-income securities comprised of investment-grade money market and other fixed-income securities, including U.S. dollar-denominated foreign securities of these types, with a focus on companies or issuers that Franklin Advisers believes meet ESG criteria on a sector-specific basis (“ESG criteria”).

The fund’s investments may include obligations of the U.S. government, its agencies and instrumentalities, which are backed by the full faith and credit of the United States (e.g., U.S. Treasury bonds and Ginnie Mae mortgage-backed bonds) or by only the credit of a federal agency or government-sponsored entity (e.g., Fannie Mae or Freddie Mac) mortgage-backed bonds), domestic corporate debt obligations, taxable municipal debt securities, securitized debt instruments (such as mortgage- and asset-backed securities), repurchase agreements, certificates of deposit, bankers acceptances, commercial paper (including asset-backed commercial paper), time deposits, Yankee Eurodollar securities and other money market instruments. The fund may also invest in U.S. dollar-denominated foreign securities of these types. Under normal circumstances, the effective duration of the fund’s portfolio will generally not be greater than one year. Effective duration provides a measure of a fund’s interest-rate sensitivity. The longer a fund’s duration, the more sensitive the fund is to shifts in interest rates. Under normal circumstances, the dollar-weighted average portfolio maturity of the fund is not expected to exceed four years.

Franklin Advisers may consider, among other factors, a company’s or issuer’s ESG criteria (as described below), credit, interest rate, liquidity and prepayment risks, as well as general market conditions, when deciding whether to buy or sell investments.

Under normal circumstances, the fund invests at least 80% of the value of its net assets in fixed-income securities that meet Franklin Advisers’ ESG criteria. This policy is non-fundamental and may be changed only after 60 days’ notice to shareholders. Franklin Advisers may not apply ESG criteria to investments that are not subject to the fund’s 80% policy and such investments may not meet Franklin Advisers’ ESG criteria. The fund will not necessarily sell an investment if it no longer meets Franklin Advisers’ ESG criteria after purchase, subject to compliance with the 80% policy.

In evaluating investments for the fund, Franklin Advisers identifies relevant ESG criteria for specific sectors, subsectors or countries using an internally developed framework, which may take into account independent third party ESG data. Franklin Advisers identifies specific ESG criteria (i.e., quality of board, product safety and quality, workforce relations, lending criteria, emissions and waste management, energy efficiency, or governmental corruption, among others) and assigns a percentage weighting to those criteria based on Franklin Advisers’ assessment of which criteria are more or less important. Franklin Advisers then categorizes the relevance of each ESG criteria and assigns each criterion a percentage weighting. As part of this analysis, Franklin Advisers may utilize metrics and information such as emissions data, carbon intensity, sources of energy used for operations, renewable energy consumption, water use and re-use, waste diversion from landfill, employee safety and diversity data, FICO credit scores and income statistics for borrowers, supplier audits, product safety, board composition, or the Global Peace Index. After evaluating these criteria and applying the established weightings, Franklin Advisers will assign each company, issuer or country, as applicable, a proprietary ESG rating ranging from a 5.0 to a 1.0 with 5.0 indicating the highest (best) ESG rating and 1.0 indicating the lowest (worst) ESG rating. In order to meet Franklin Advisers’ ESG criteria for purposes of the above-referenced non-fundamental investment policy, a company or issuer must generally be rated 2.5 or above by Franklin Advisers.

For corporate credit (i.e., investment grade-rated and below investment grade-rated securities), Franklin Advisers also applies a momentum factor in determining the ESG rating of a company or issuer based on Franklin Advisers’ view of whether the performance of the company or issuer under the relevant ESG criteria is expected to improve or decline. If an issuer is rated 2.0 or above and has a positive momentum factor, a company or issuer will be viewed as meeting Franklin Advisers’ criteria for purposes of the above-referenced non-fundamental policy. Conversely, if an issuer has a negative momentum factor, it will be viewed as meeting Franklin Advisers’ criteria for purposes of the above-referenced non-fundamental policy only if it’s rated a 3.0 or above.

While Franklin Advisers may consider independent third-party data as a part of its analytical process, the portfolio management team performs its own independent analysis of issuers and does not rely solely on third-party screens.

The fund’s approach to ESG investing incorporates fundamental research together with consideration of ESG criteria which may include, but are not limited to, those included in the following descriptions. Environmental criteria include, for example, a company’s or issuer’s carbon intensity and use of resources like water or minerals. ESG measures in this area might include plans to reduce waste, increase recycling, raise the proportion of energy supplied from renewable sources, greenhouse gas emissions per capita or improve product design to be less resource intensive. Social criteria include, for example, labor practices, supply chain management, and community relations. ESG measures in this area might include programs to improve employee well-being, commitment to workplace equality and diversity, or improved stewardship of supplier relationships and working conditions, lending to underserved populations, or the degree of universal health coverage. Governance criteria include, for example, board composition, executive compensation, debt structures that improve transparency and bondholders’ rights. ESG measures in this area might include improvements in board independence or diversity, alignment of governmental or management incentives with appropriate strategic ESG objectives, and disclosure of operating and ESG metrics to bondholders.

In the corporate credit sector, Franklin Advisers combines fundamental analysis with relevant ESG insights with a forward-looking perspective. Franklin Advisers believes that this approach contributes to a more nuanced assessment of an issuer’s credit profile.

Franklin Advisers believes that securitized debt instruments present unique challenges in applying ESG criteria due to the presence of various asset types, counterparties involved, and the complex structure of the securitized debt market along with a lack of available ESG-related data. In evaluating securitized debt instruments for potential investment, Franklin Advisers takes a broad approach, analyzing both the terms of the transaction, including the asset type being securitized, the terms of the transaction, structure of the securitization, as well as key counterparties. Opportunities are analyzed at the asset level within each securitization and each subsector to identify assets that meet relevant ESG thresholds. Additionally, in evaluating securitized debt instruments, Franklin Advisers analyzes relevant ESG criteria regarding the originator, servicers, or other relevant counterparties

In the sovereign debt sector, Franklin Advisers uses quantitative modeling and fundamental research to evaluate countries across a variety of ESG criteria (i.e., natural resource dependence and level of public corruption) and non-ESG criteria (i.e., global economic conditions, market valuations, and technical factors.

Franklin Advisers believes that sovereign issuers with better ESG scores generally benefit from lower borrowing costs and that ESG criteria may influence the perception of the credit risk of a country’s debt.

Franklin Advisers evaluates ESG considerations using independent third-party data (where available), and also uses company or issuer disclosures and public data sources. Franklin Advisers believes that ESG considerations are best analyzed in combination with a company’s or issuer’s fundamentals, including a company’s or issuer’s industry, location, strategic position, and key relationships.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund’s management team expects the risk of material loss to be remote.

The fund has entered into contractual arrangements with an investment adviser, administrator, distributor, transfer agent and custodian, who each provide services to the fund. Unless expressly stated otherwise, shareholders are not parties to, or intended beneficiaries of these contractual arrangements, and these contractual arrangements are not intended to create any shareholder right to enforce them against the service providers or to seek any remedy under them against the service providers, either directly or on behalf of the fund.

Under the Trust’s Agreement and Declaration of Trust, any claims asserted by a shareholder against or on behalf of the Trust (or its series), including claims against Trustees and Officers, must be brought in courts of the State of Delaware.

Note 1: Significant accounting policies

The fund follows the accounting and reporting guidance in Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (ASC 946) and applies the specialized accounting and reporting guidance in U.S. Generally Accepted Accounting Principles (U.S. GAAP), including, but not limited to, ASC 946. The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations. Actual results could differ from those estimates. Subsequent events after the Statement of assets and liabilities date through the date that the financial statements were issued have been evaluated in the preparation of the financial statements.

Security valuation Portfolio securities and other investments are valued using policies and procedures adopted by the Board of Trustees (Trustees). The Trustees have formed a Pricing Committee to oversee the implementation of these procedures. Under compliance policies and procedures approved by the Trustees, the Trustees have designated the fund’s investment manager as the valuation designee and has responsibility for oversight of valuation. The investment manager is assisted by the fund’s administrator in performing this responsibility, including leading the cross-functional Valuation Committee (VC). The VC is responsible for making fair value determinations, evaluating the effectiveness of the pricing policies of the fund and reporting to the Trustees.

Market quotations are not considered to be readily available for certain debt obligations (including short-term investments with remaining maturities of 60 days or less) and other investments; such investments are valued on the basis of valuations furnished by an independent pricing service approved by the Trustees or dealers selected by the fund’s investment manager. Such services or dealers determine valuations for normal institutional-size trading units of such securities using methods based on market transactions for comparable securities and various relationships, generally recognized by institutional traders, between securities (which consider such factors as security prices, yields, maturities and ratings). These securities will generally be categorized as Level 2. Securities quoted in foreign currencies, if any, are translated into U.S. dollars at the current exchange rate.

Investments in open-end investment companies (excluding exchange-traded funds), if any, which can be classified as Level 1 or Level 2 securities, are valued based on their net asset value. The net asset value of such investment companies equals the total value of their assets less their liabilities and divided by the number of their outstanding shares.

To the extent a pricing service or dealer is unable to value a security or provides a valuation that the fund’s investment manager does not believe accurately reflects the security’s fair value, the security will be valued at fair value by the fund’s investment manager, which has been designated as valuation designee pursuant to Rule 2a–5 under the 1940 Act, in accordance with policies and procedures approved by the Trustees. Certain investments, including certain restricted and illiquid securities and derivatives, are also valued at fair value following procedures approved by the Trustees. These valuations consider such factors as significant market or specific security events such as interest rate or credit quality changes, various relationships with other securities, discount rates, U.S. Treasury, U.S. swap and credit yields, index levels, convexity exposures, recovery rates, sales and other multiples and resale restrictions. These securities are classified as Level 2 or as Level 3 depending on the priority of the significant inputs.

To assess the continuing appropriateness of fair valuations, the Valuation Committee reviews and affirms the reasonableness of such valuations on a regular basis after considering all relevant information that is reasonably available. Such valuations and procedures are reviewed periodically by the Trustees. Certain securities may be valued on the basis of a price provided by a single source. The fair value of securities is generally determined as the amount that the fund could reasonably expect to realize from an orderly disposition of such securities over a reasonable period of time. By its nature, a fair value price is a good faith estimate of the value of a security in a current sale and does not reflect an actual market price, which may be different by a material amount.

Security transactions and related investment income Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Gains or losses on securities sold are determined on the identified cost basis.

Interest income, net of any applicable withholding taxes, if any, is recorded on the accrual basis. Amortization and accretion of premiums and discounts on debt securities, if any, is recorded on the accrual basis.

Master agreements The fund is a party to ISDA (International Swaps and Derivatives Association, Inc.) Master Agreements that govern OTC derivative and foreign exchange contracts and Master Securities Forward Transaction Agreements that govern transactions involving mortgage-backed and other asset-backed securities that may result in delayed delivery (Master Agreements) with certain counterparties entered into from time to time. The Master Agreements may contain provisions regarding, among other things, the parties’ general obligations, representations, agreements, collateral requirements, events of default and early termination. With respect to certain counterparties, in accordance with the terms of the Master Agreements, collateral pledged to the fund is held in a segregated account by the fund’s custodian and, with respect to those amounts which can be sold or repledged, are presented in the fund’s portfolio.

Collateral pledged by the fund is segregated by the fund’s custodian and identified in the fund’s portfolio. Collateral can be in the form of cash or debt securities issued by the U.S. Government or related agencies or other securities as agreed to by the fund and the applicable counterparty. Collateral requirements are determined based on the fund’s net position with each counterparty.

With respect to ISDA Master Agreements, termination events applicable to the fund may occur upon a decline in the fund’s net assets below a specified threshold over a certain period of time. Termination events applicable to counterparties may occur upon a decline in the counterparty’s long-term or short-term credit ratings below a specified level. In each case, upon occurrence, the other party may elect to terminate early and cause settlement of all derivative and foreign exchange contracts outstanding, including the payment of any losses and costs resulting from such early termination, as reasonably determined by the terminating party. Any decision by one or more of the fund’s counterparties to elect early termination could impact the fund’s future derivative activity.

At the close of the reporting period, the fund did not have a net liability position on open derivative contracts subject to the Master Agreements .

Lines of credit The fund participates, along with other Putnam funds, in a $320 million syndicated unsecured committed line of credit, provided by State Street ($160 million) and JPMorgan ($160 million), and a $235.5 million unsecured uncommitted line of credit, provided by State Street. Borrowings may be made for temporary or emergency purposes, including the funding of shareholder redemption requests and trade settlements. Interest is charged to the fund based on the fund’s borrowing at a rate equal to 1.25% plus the higher of (1) the Federal Funds rate and (2) the Overnight Bank Funding Rate for the committed line of credit and 1.30% plus the higher of (1) the Federal Funds rate and (2) the Overnight Bank Funding Rate for the uncommitted line of credit. A closing fee equal to 0.04% of the committed line of credit and 0.04% of the uncommitted line of credit has been paid by the participating funds and a $75,000 fee has been paid by the participating funds to State Street as agent of the syndicated committed line of credit. In addition, a commitment fee of 0.21% per annum on any unutilized portion of the committed line of credit is allocated to the participating funds based on their

relative net assets and paid quarterly. During the reporting period, the fund had no borrowings against these arrangements.

Federal taxes It is the policy of the fund to distribute all of its taxable income within the prescribed time period and otherwise comply with the provisions of the Internal Revenue Code of 1986, as amended (the Code), applicable to regulated investment companies. It is also the intention of the fund to distribute an amount sufficient to avoid imposition of any excise tax under Section 4982 of the Code.

The fund is subject to the provisions of Accounting Standards Codification 740 Income Taxes (ASC 740). ASC 740 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The fund did not have a liability to record for any unrecognized tax benefits in the accompanying financial statements. No provision has been made for federal taxes on income, capital gains or unrealized appreciation on securities held nor for excise tax on income and capital gains. Each of the fund’s federal tax returns for the prior periods remains subject to examination by the Internal Revenue Service.

Under the Regulated Investment Company Modernization Act of 2010, the fund will be permitted to carry forward capital losses incurred for an unlimited period and the carry forwards will retain their character as either short-term or long-term capital losses. At April 30, 2024, the fund had the following capital loss carryovers available, to the extent allowed by the Code, to offset future net capital gain, if any:

| Loss carryover |

| Short-term | Long-term | Total |

| $— | $769 | $769 |

Tax cost of investments includes adjustments to net unrealized appreciation (depreciation) which may not necessarily be final tax cost basis adjustments, but closely approximate the tax basis unrealized gains and losses that may be realized and distributed to shareholders. The aggregate identified cost on a tax basis is $106,708,426, resulting in gross unrealized appreciation and depreciation of $345,699 and $21,192, respectively, or net unrealized appreciation of $324,507.

Distributions to shareholders Distributions to shareholders from net investment income, if any, are recorded by the fund on the ex-dividend date. Distributions from capital gains, if any, are recorded on the ex-dividend date and paid at least annually. The amount and character of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year. Reclassifications are made to the fund’s capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations.

Expenses of the Trust Expenses directly charged or attributable to any fund will be paid from the assets of that fund. Generally, expenses of the Trust will be allocated among and charged to the assets of each fund on a basis that the Trustees deem fair and equitable, which may be based on the relative assets of each fund or the nature of the services performed and relative applicability to each fund.

Note 2: Management fee, administrative services and other transactions

Effective July 15, 2024, Putnam Management transferred its management contract with the fund to Franklin Advisers. As a result of the transfer, Franklin Advisers replaced Putnam Management as the investment adviser of the fund. In connection with the transfer, the fund’s portfolio managers, along with supporting research analysts and certain other investment staff of Putnam Management, also became employees of Franklin Advisers.

In addition, Putnam Management transferred to Franklin Advisers the sub-management contract between Putnam Management and PIL in respect of the fund.

The fund pays its investment manager an annual all-inclusive management fee of 0.25% based on the fund’s average daily net assets computed and paid monthly. The management fee covers investment management services and all of the fund’s organizational and other operating expenses with certain exceptions, including but not limited to: payments under distribution plans, interest, taxes, brokerage commissions and other transaction costs, fund proxy expenses, litigation expenses, extraordinary expenses and acquired fund fees and expenses.

For the reporting period, the management fee represented an effective rate (excluding the impact from any expense waivers in effect) of 0.126% of the fund’s average net assets.

The fund invests in Putnam Government Money Market Fund, an open-end management investment company managed by Franklin Advisers. Management fees paid by the fund are reduced by an amount equal to the management fees paid by Putnam Government Money Market Fund with respect to assets invested by the fund in Putnam Government Money Market Fund. During the reporting period, management fees paid were reduced by $756 relating to the fund’s investment in Putnam Government Money Market Fund.

During the reporting period, PIL was authorized by the Trustees to manage a separate portion of the assets of the fund as determined by Franklin Advisers from time to time. PIL did not manage any portion of the assets of the fund during the reporting period. Effective November 1, 2024, PIL, and its investment professionals, merged into Franklin Templeton Investment Management Limited (FTIML), an affiliate of the investment manager, and FTIML became a sub-advisor to the fund. If Franklin Advisers were to engage the services of FTIML or PIL, Franklin Advisers would pay a monthly sub-management fee to FTIML or PIL for its services at an annual rate of 0.20% of the average net assets of the portion of the fund managed by FTIML or PIL.

Effective June 1, 2024, Franklin Templeton Services provides certain administrative services to the fund. The fee for those services is paid by the fund’s investment manager based on the costs incurred by Franklin Templeton Services and is not an additional expense of the fund.

The fund has adopted a distribution and service plan pursuant to Rule 12b–1 under the 1940 Act that authorizes the fund to pay distribution fees in connection with the sale and distribution of its shares and service fees in connection with the provision of ongoing shareholder support services. No Rule 12b–1 fees are currently paid by the fund.

Note 3: Purchases and sales of securities

During the reporting period, the cost of purchases and the proceeds from sales, excluding short-term investments and in-kind transactions, were as follows:

| | Cost of purchases | Proceeds from sales |

| Investments in securities (Long-term) | $37,376,567 | $15,008,539 |

| U.S. government securities (Long-term) | — | — |

| Total | $37,376,567 | $15,008,539 |