SMX Warranties means the representations and warranties of SMX set out in clause 13.1 of the Scheme Implementation Deed;

Soreq means the Soreq Nuclear Research Center, an Israeli government research and development institute for nuclear and photonic technologies under the Israeli Atomic Energy Commission;

Source IP means the commercialization of the initial technology of tracking and tracing materials by observing and identifying markers.

SPAC means special purpose acquisition company;

Sponsor means the founding shareholder of the Company and is Lionheart Equities, LLC;

Standby Facility means the standby facility entered into by SMX in August 2022 to raise up to US $1,400,000 (AU$ 2,000,000) for the period until October 31, 2022;

Subscription Agreements has the meaning given to such term in the Business Combination Agreement;

Subsidiary of an entity means another entity which:

| | (a) | is a subsidiary of the first entity within the meaning of the Corporations Act; and; |

| | (b) | is part of a consolidated entity constituted by the first entity and the entities it is required to include in the consolidated financial statements it prepares, or would be if the first entity was required to prepare consolidated financial statements. |

Takeovers Panel means the Australian Takeovers Panel;

Tax means any tax, levy, charge, excise, GST, impost, rates, Duty, fee, deduction, compulsory loan or withholding, which is assessed, levied, imposed or collected by any fiscal Governmental Authority and includes any interest, fine, penalty, charge, fee, expenses or other statutory charges or any other such amount imposed by any fiscal Governmental Authority on or in respect of any of the above;

Tax Act means the Income Tax Assessment Act 1936 (Cth) or the Income Tax Assessment Act 1997 (Cth), or both as the context requires;

Tax Law means a law with respect to or imposing any Tax;

Tax Return means any computation, return or document relating to Tax including any which must be lodged with a Governmental Authority or which a taxpayer must prepare and retain under a Tax Law (such as an activity statement, amended return, schedule or election and any attachment);

Timetable means the timetable set out in Schedule 1 of the Scheme Implementation Deed, subject to any amendments agreed by the parties in writing;

Transactions has the meaning given to such term in the Business Combination Agreement;

Transaction Documents means the Business Combination Agreement and the Ancillary Agreements (as defined in the BCA);

Transfer Tax means any sales, use, value-added, business, goods and services, transfer (including any stamp duty or other similar Tax chargeable in respect of any instrument transferring property), documentary, conveyancing or similar Tax or expense or any recording fee, in each case that is imposed as a result of the Transactions, together with any penalty, interest and addition to any such item with respect to such item; provided, however, for the avoidance of doubt, the term Transfer Tax shall not include any income Tax or similar Tax imposed on any direct or indirect equity holder of Lionheart, Empatan, or SMX;

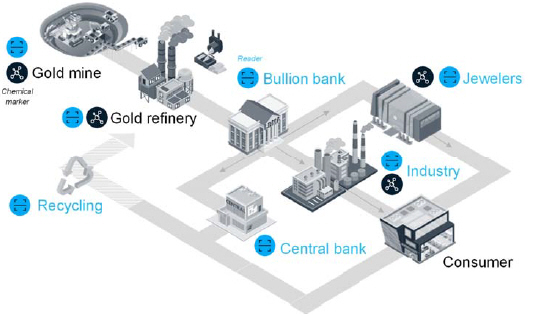

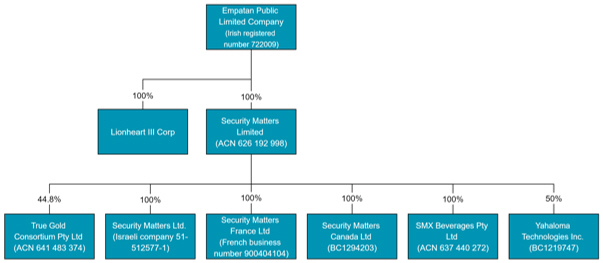

trueGold means True Gold Consortium Pty Ltd ACN 641 483 374;

Trust Account has the meaning given to it in the definition of Trust Fund;

Trust Fund means the trust account maintained pursuant to that certain Investment Management Trust Agreement, by and between Continental Stock Transfer & Trust Company (the “Trustee”) and Lionheart, dated as of November 3, 2021 (such agreement, the “Trust Agreement”);

US Securities Act means the Securities Act of 1933 of the United States of America;

US Treasury means the executive agency responsible for promoting economic prosperity and ensuring the financial security of the United States;

Voting Agreement means the Voting Agreement entered between Empatan and Empatan shareholders pursuant to which, among other things, during the Term (as defined in the Voting Agreement) Empatan and the Empatan shareholders have agreed to take all such action within its power as may be necessary or appropriate.

179

@secmattersltd

@secmattersltd