August 12, 2021 Exhibit 99.1

Disclaimer This Presentation (together with oral statements made in connection herewith, the “Presentation”) relates to the proposed business combination (the “Business Combination”) between Khosla Ventures Acquisition Co. II (“Khosla”) and Nextdoor, Inc. (“Nextdoor”). This Presentation does not constitute an offer, or a solicitation of an offer, to buy or sell any securities, investment or other specific product, or a solicitation of any vote or approval, nor shall there be any sale of securities, investment or other specific product in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The information contained herein does not purport to be all-inclusive and none of Khosla or Nextdoor nor any of their respective subsidiaries, stockholders, affiliates, representatives, control persons, partners, members, managers, directors, officers, employees, advisers or agents make any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. You should consult with your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, you confirm that you are not relying solely upon the information contained herein to make any investment decision. The recipient shall not rely upon any statement, representation or warranty made by any other person, firm or corporation in making its investment decision to subscribe for securities of Khosla in connection with the Business Combination. To the fullest extent permitted by law, in no circumstances will Khosla, Nextdoor or any of their respective subsidiaries, stockholders, affiliates, representatives, control persons, partners, members, managers, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. In addition, this Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of Khosla, Nextdoor or the Business Combination. The general explanations included in this Presentation cannot address, and are not intended to address, your specific investment objectives, financial situations or financial needs. Forward-Looking Statements Certain statements in this Presentation may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995 with respect to the Business Combination. Forward-looking statements herein generally relate to future events or the future financial or operating performance of Khosla, Nextdoor or the combined company expected to result from the Business Combination (the “Combined Company”). For example, projections of future financial performance of Nextdoor and the Combined Company, the Combined Company’s business plan, other projections concerning key performance metrics, the proceeds of the Business Combination and the Combined Company’s expected cash runway, and the potential effects of the Business Combination on Khosla and the Combined Company, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “ may,”“ should,”“ expect,”“ intend,”“ will,” “estimate,”“ anticipate,”“ believe,”“ predict,” “project,” “target,” “plan,” or “potentially” or the negatives of these terms or variations of them or similar terminology. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Khosla, Nextdoor and its management, as the case may be, are inherently uncertain and subject to material change. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risk and uncertainties. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, various factors beyond management’s control, including general economic conditions and other risks, uncertainties and factors set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in Khosla’s final prospectus relating to its initial public offering, dated March 23, 2021, the registration statement on S-4 relating to the business combination, and other filings with the Securities and Exchange Commission (“SEC”), as well as factors associated with companies, such as Nextdoor, including anticipated trends, growth rates, and challenges in those businesses and in the markets in which they operate. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements in this Presentation, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements in this Presentation, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein and the risk factors of Khosla and Nextdoor described above. Neither Khosla nor Nextdoor undertakes any duty to update these forward-looking statements. Use of Projections This Presentation contains projected financial information with respect to Nextdoor. Such projected financial information constitutes forward-looking information, is for illustrative purposes only and should not be relied upon as being predictive of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in such prospective financial information, including without limitation, assumptions regarding Khosla’s and Nextdoor’s ability to consummate the Business Combination, the failure of which to materialize could cause actual results to differ materially from those contained in the prospective financial information. Khosla and Nextdoor caution that their assumptions may not materialize and that current economic conditions render such assumptions, although believed reasonable at the time they were made, subject to greater uncertainty. See the section above titled “Forward-Looking Statements”. The inclusion of financial forecast information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. Neither Khosla’s nor Nextdoor’s independent auditors have audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation or any other purpose, and accordingly, none of such independent auditors has expressed any opinion or provided any other form of assurance with respect to such projections. Financial Information and Use of Non-GAAP Financial Measures The financial information contained in this Presentation has been taken from or prepared based on the historical financial statements of Nextdoor for the periods presented. A review of Nextdoor’s financial statements for the three months ended June 30, 2021 is in process. Accordingly, such financial information and data may be adjusted in or may be presented differently in future filings of the registration statement on Form S-4 filed with the SEC by Khosla in connection with the Business Combination. Nextdoor has not yet completed its closing procedures for the three months ended June 30, 2021. This Presentation contains certain estimated preliminary financial results and key operating metrics for the three months ended June 30, 2021. This information is preliminary and subject to change. As such, our actual results may differ from the estimated preliminary results presented here and will not be finalized until we complete of our quarter-end accounting procedures.

Disclaimer This presentation includes certain non-GAAP financial measures (including on a forward-looking basis). These non-GAAP measures are an addition, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to their nearest GAAP equivalent or any other performance measures derived in accordance with GAAP. A reconciliation of the non-GAAP financial measures used in this Presentation to their nearest GAAP equivalent is included in the appendix to this Presentation. Nextdoor believes that these non-GAAP measures of financial results (including on a forward-looking basis) provide useful supplemental information to investors about Nextdoor. Nextdoor’s management uses forward-looking non-GAAP measures to evaluate Nextdoor’s projected financials and operating performance. However, there are a number of limitations related to the use of these non-GAAP measures and their nearest GAAP equivalents, including that they exclude significant expenses that are required by GAAP to be recorded in Nextdoor’s financial measures. In addition, other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore, Nextdoor’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies. Additionally, to the extent that forward-looking non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Additional Information In connection with the proposed Business Combination, Khosla has filed with the SEC a registration statement on Form S-4 containing a preliminary proxy statement/prospectus of Khosla and consent solicitation statement of Nextdoor. The registration statement is not yet effective. After the registration statement is declared effective, Khosla and Nextdoor will mail a definitive proxy statement/prospectus/consent solicitation statement relating to the proposed Business Combination to their respective stockholders. This Presentation does not contain any information that should be considered by Khosla’s or Nextdoor’s stockholders and other interested persons concerning the proposed Business Combination and is not intended to constitute the basis of any voting or investment decision in respect of the Business Combination or the securities of Khosla. Khosla’s and Nextdoor’s stockholders and other interested persons are advised to read the preliminary proxy statement/prospectus/consent solicitation statement and the amendments thereto and the definitive proxy statement/prospectus/consent solicitation statement and other documents filed in connection with the proposed Business Combination, as these materials will contain important information about Khosla, Nextdoor and the Business Combination. When available, the definitive proxy statement/prospectus/consent solicitation statement and other relevant materials for the proposed Business Combination will be mailed to stockholders of Khosla and Nextdoor as of a record date to be established for voting on the proposed Business Combination. Stockholders will also be able to obtain copies of the preliminary proxy statement/prospectus/consent solicitation statement, the definitive proxy statement/ prospectus/consent solicitation statement and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: Khosla Ventures Acquisition Co. II, 2128 Sand Hill Road, Menlo Park, CA 94025. Participants in the Solicitation Khosla, Nextdoor and their respective directors and executive officers may be deemed participants in the solicitation of proxies from Khosla’s stockholders with respect to the proposed Business Combination. A list of the names of Khosla’s directors and executive officers and a description of their interests in Khosla is contained in Khosla’s registration statement on Form S-4, which was filed with the SEC and is available free of charge at the SEC’s web site at www.sec.gov, or by directing a request to Khosla Ventures Acquisition Co. II, 2128 Sand Hill Road, Menlo Park, CA 94025. To the extent that holdings of Khosla’s securities have changed since the amounts printed in Khosla’s registration statement on Form S-4, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. A list of the names of Nextdoor's directors and executive officers and a description of their interests in the proposed Business Combination is contained in Khosla's registration statement on Form S-4, which was filed with the SEC and is available free of charge at the SEC's web site at www.sec.gov, or by directing a request to Khosla Ventures Acquisition Co. II, 2128 Sand Hill Road, Menlo Park, CA 94025. You may obtain free copies of these documents as described in the preceding paragraphs. No Offer or Solicitation This Presentation shall not constitute a “solicitation” as defined in Section 14 of the Securities Exchange Act of 1934, as amended. This Presentation does not constitute an offer, or a solicitation of an offer, to buy or sell any securities, investment or other specific product, or a solicitation of any vote or approval, nor shall there be any sale of securities, investment or other specific product in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No public offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption therefrom. Neither Nextdoor nor Khosla is making an offer of the Securities in any state or jurisdiction where the offer is not permitted. NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE. Industry and Market Data Certain information contained in this Presentation relates to or is based on studies, publications, surveys and Nextdoor’s own internal estimates and research. In addition, all of the market data included in this Presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while Nextdoor believes its internal research is reliable, such research has not been verified by any independent source and none of Nextdoor, nor any of its affiliates nor any of its control persons, officers, directors, employees or representatives make any representation or warranty with respect to the accuracy of such information. Trademarks This Presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM © or ® symbols, but Khosla and Nextdoor will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. No Relationship or Joint Venture Nothing contained in this Presentation will be deemed or construed to create the relationship of partnership, association, principal and agent or joint venture. This Presentation does not create any obligation on the part of either Nextdoor, Khosla or the recipient to enter into any further agreement or arrangement. Unless and until a definitive agreement has been fully executed and delivered, no contract or agreement providing for a transaction will be deemed to exist and none of Khosla, Nextdoor or the recipient will be under any legal obligation of any kind whatsoever. Accordingly, this Presentation is not intended to create for any party a right of specific performance or a right to seek any payment or damages for failure, for any reason, to complete the proposed transactions contemplated herein.

Welcome to the Neighborhood Sarah Friar Chief Executive Officer Mike Doyle Chief Financial Officer David Weiden Founding Partner and Managing Director Vinod Khosla Founder Nextdoor Khosla Ventures Acquisition Co. II

Connecting neighborhoods one neighbor at a time

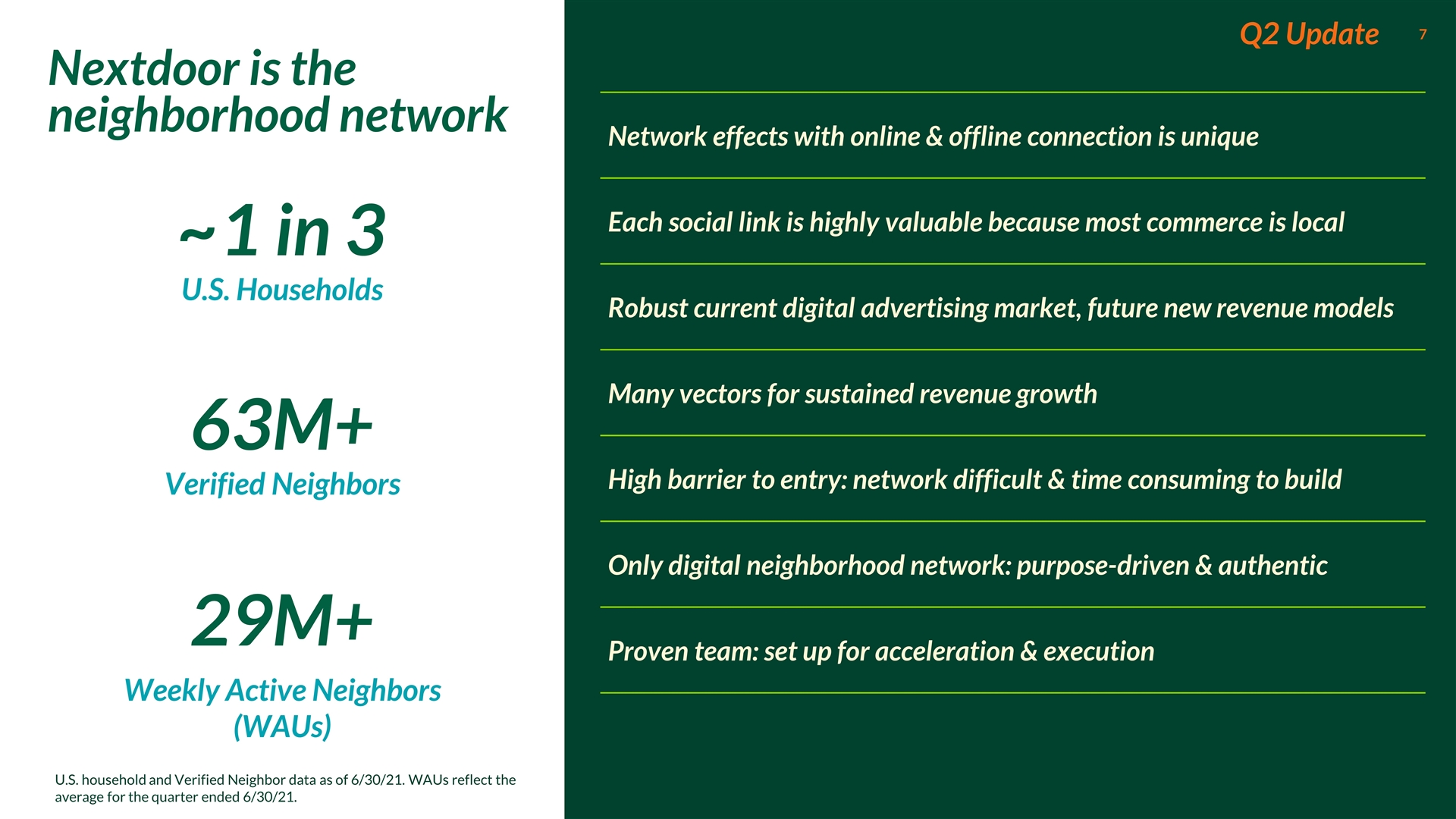

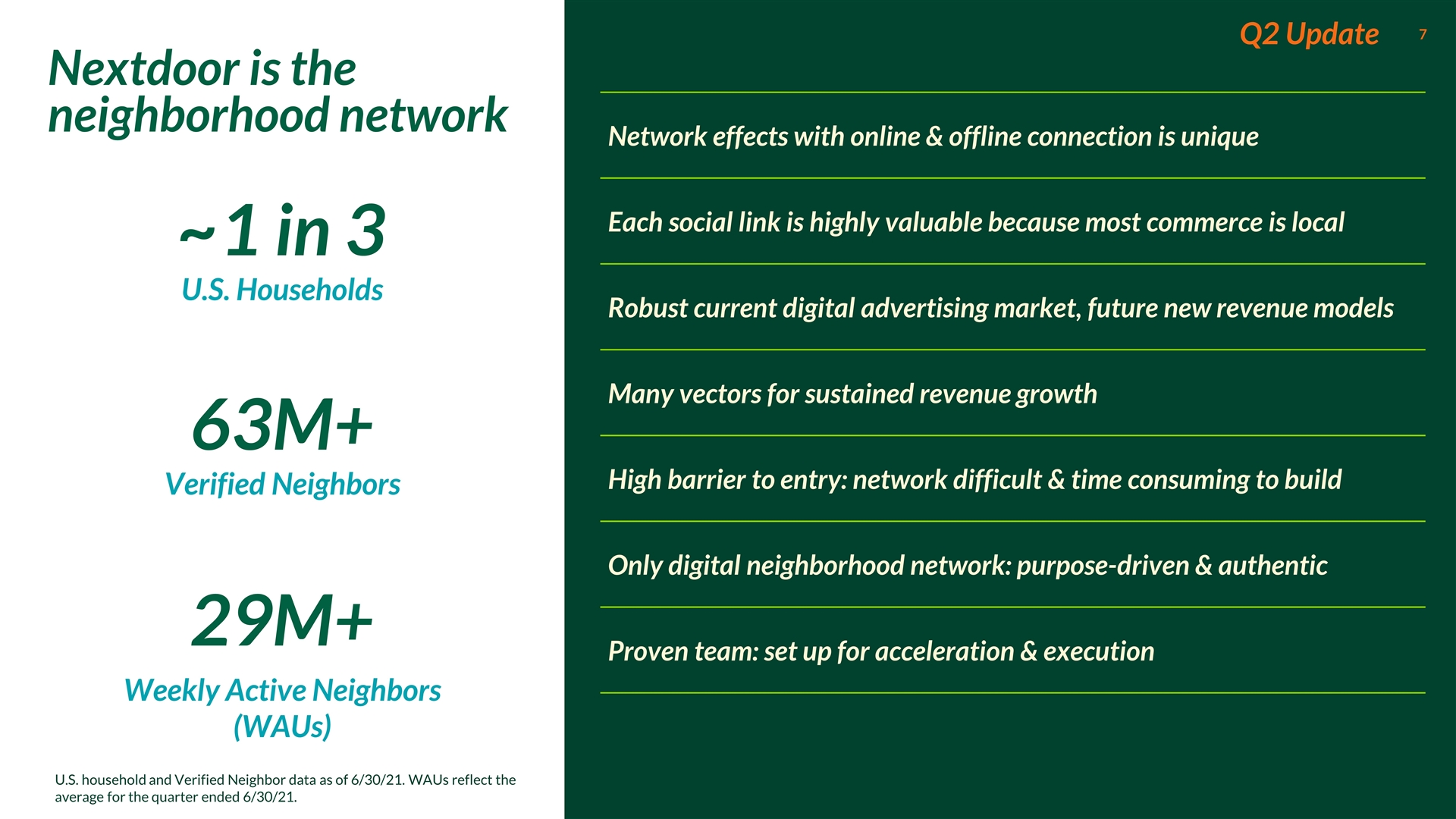

Network effects with online & offline connection is unique Each social link is highly valuable because most commerce is local Robust current digital advertising market, future new revenue models Many vectors for sustained revenue growth High barrier to entry: network difficult & time consuming to build Only digital neighborhood network: purpose-driven & authentic Proven team: set up for acceleration & execution ~1 in 3 U.S. Households 63M+ Verified Neighbors 29M+ Weekly Active Neighbors (WAUs) U.S. household and Verified Neighbor data as of 6/30/21. WAUs reflect the average for the quarter ended 6/30/21. Q2 Update Nextdoor is the neighborhood network

(1) Open Mind Strategy 2020; (2) Nextdoor Global Loneliness Study (3) Brightpearl, 2021; (4) Owl Labs October, 2020; (5) Statista, 2021. 73% say neighbors are one of the most important communities in their lives(1) Knowing at least 6 neighbors can reduce loneliness(2) 75% plan to shop more locally(3) 80% expect to work from home at least 3x per week(4) 2x expected growth of sharing economy(5) Building back community

To cultivate a kinder world where everyone has a neighborhood they can rely on Our purpose

Groups Recommendations Businesses Connections People interact with and rely on their neighborhoods every day... Local Perspectives Toddler/baby playground meetup community. Hey Neighbourhood, We are new here and seeking community! We have two small children — 3 and 1 and would love to meet other families in the neighbourhood. Is anyone interested? BTW — also looking for a pack and play if anyone has one that their kids have outgrown... Hello all! My name is Jonathan and I am a commercial fisherman out of Cape Cod! I created this group to notify everyone when I will be going fishing and when we will have crab or fish for sale! We are bringing fresh I... Cape Cod Jericho, Oxford, UK Posted in General to 26 neighbourhoods

Searches for school tutor A day in the life of a parent: meet Abraham Kingstowne Thompson Center, VA 7AM Borrows neighbor’s pasta machine Meets neighbors for coffee Recommends a local restaurant Hosts Dads group 6PM Drops kids off at school, remembers to search for an after-school tutor Reaches out to neighbors for a pasta machine, to make his favorite chef’s 24-layer lasagna Hosts 30 coffees in 30 days to meet people nearby Schedules Zoom Session to connect with local parents 10AM 12PM Gives rave review for the local burger place where he had lunch 4PM

Updates her business page A week in the life of a small business owner: meet Dawn Grant Park, GA Checks her dashboard Responds to neighbors Checks in with her business group Promotes new job listing Updates with new spring time hours, and adds a few new photos Checks her Local Deal dashboard to see how its performing and re-ups for another month Notices new recommendations from neighbors and quickly replies to thank them for their support Responds to a question about payroll software from her local small business owner group Looks to hire a new social media expert and creates an ad for the job MON FRI SAT TUE THU

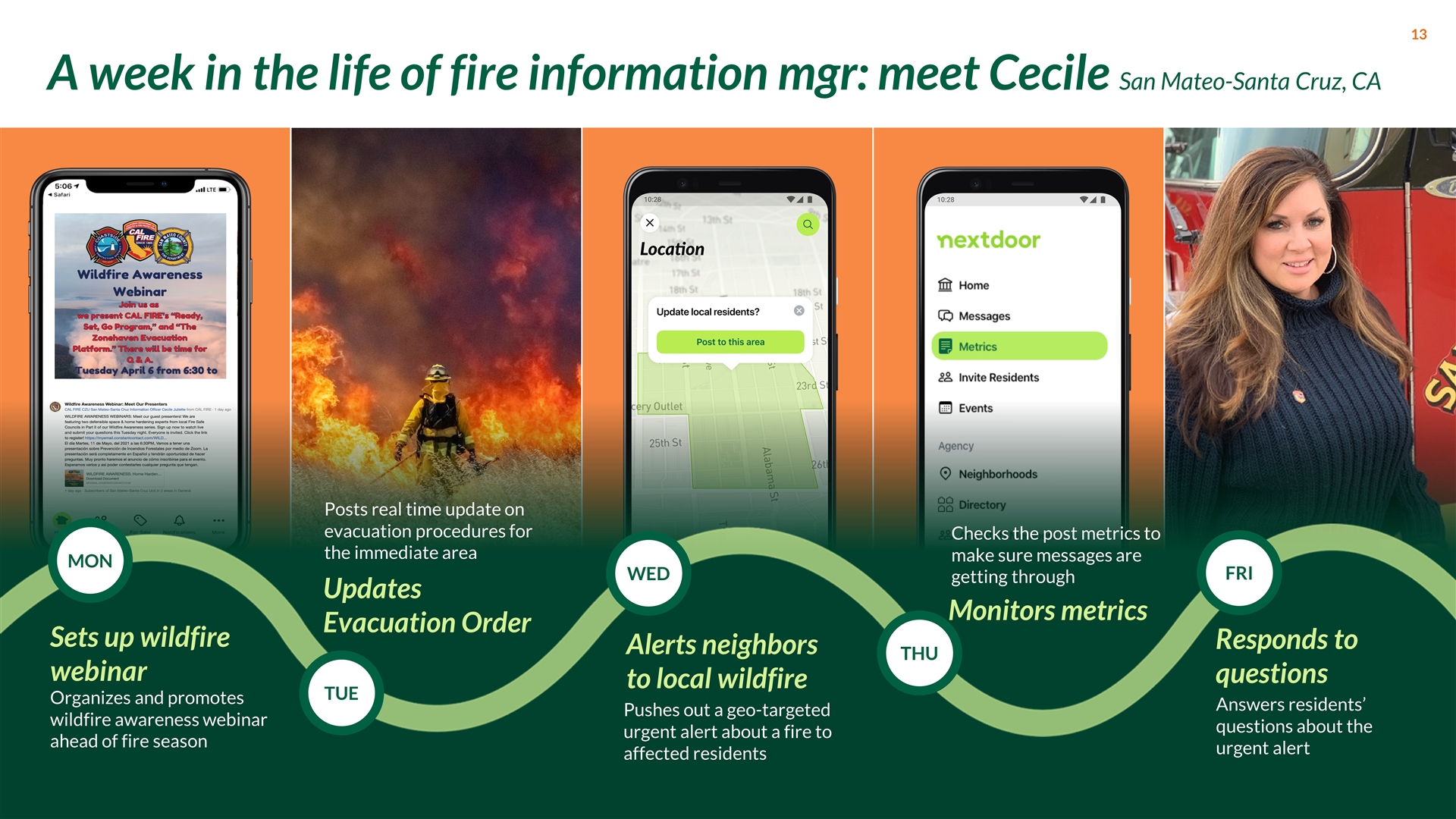

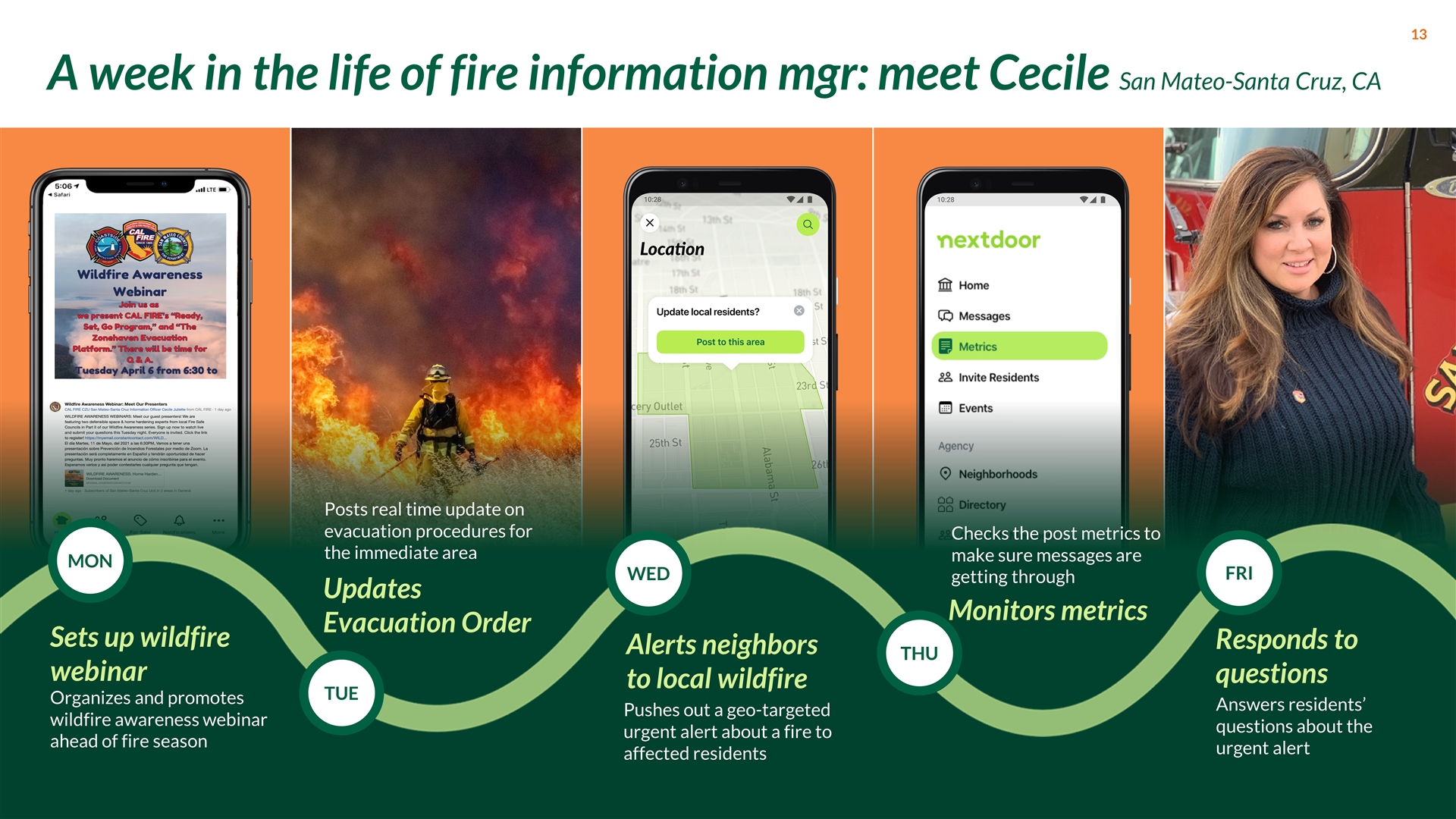

Sets up wildfire webinar A week in the life of fire information mgr: meet Cecile San Mateo-Santa Cruz, CA MON Alerts neighbors to local wildfire Monitors metrics Responds to questions THU FRI Organizes and promotes wildfire awareness webinar ahead of fire season Posts real time update on evacuation procedures for the immediate area Pushes out a geo-targeted urgent alert about a fire to affected residents Checks the post metrics to make sure messages are getting through Answers residents’ questions about the urgent alert TUE WED Updates Evacuation Order

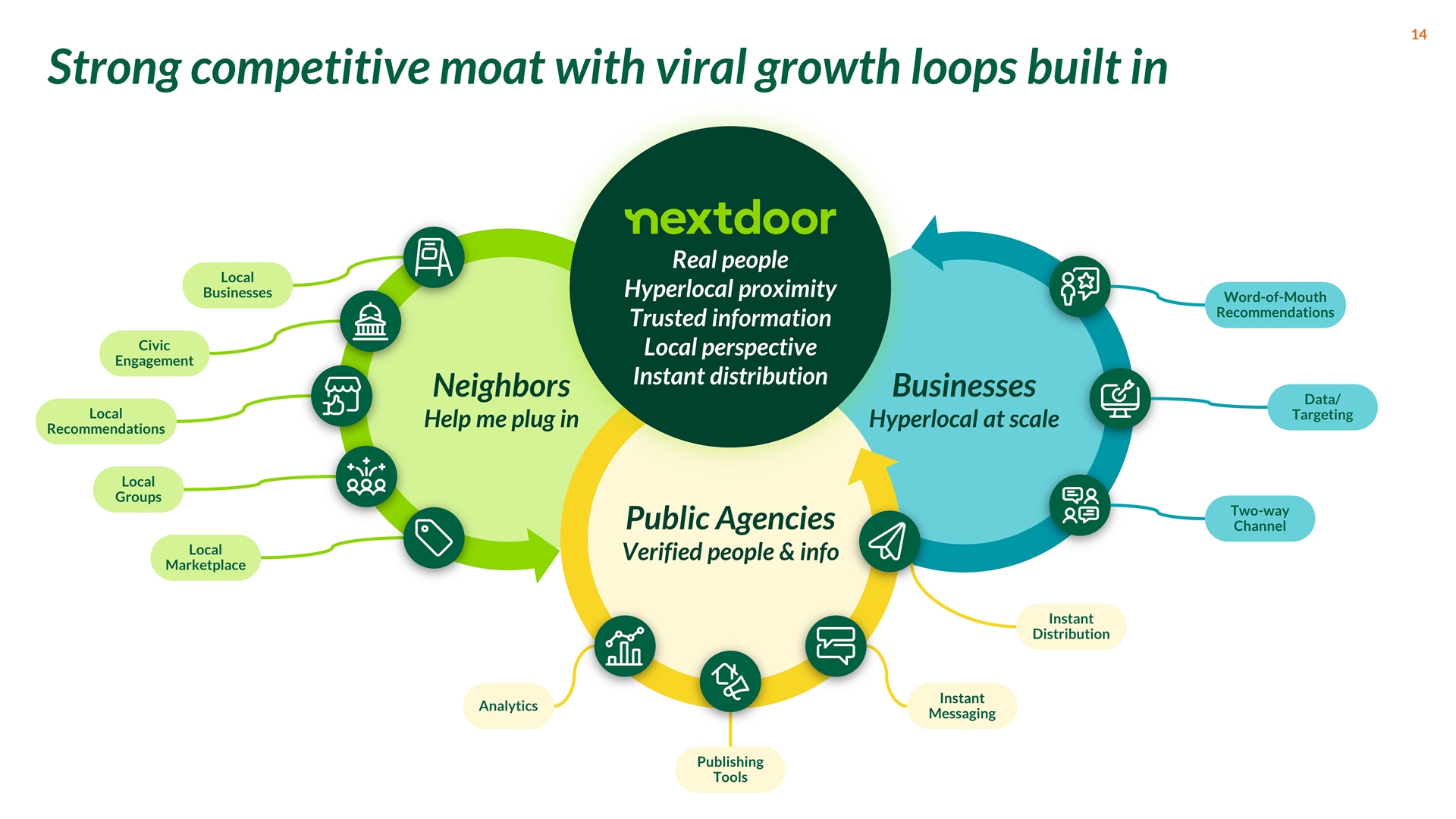

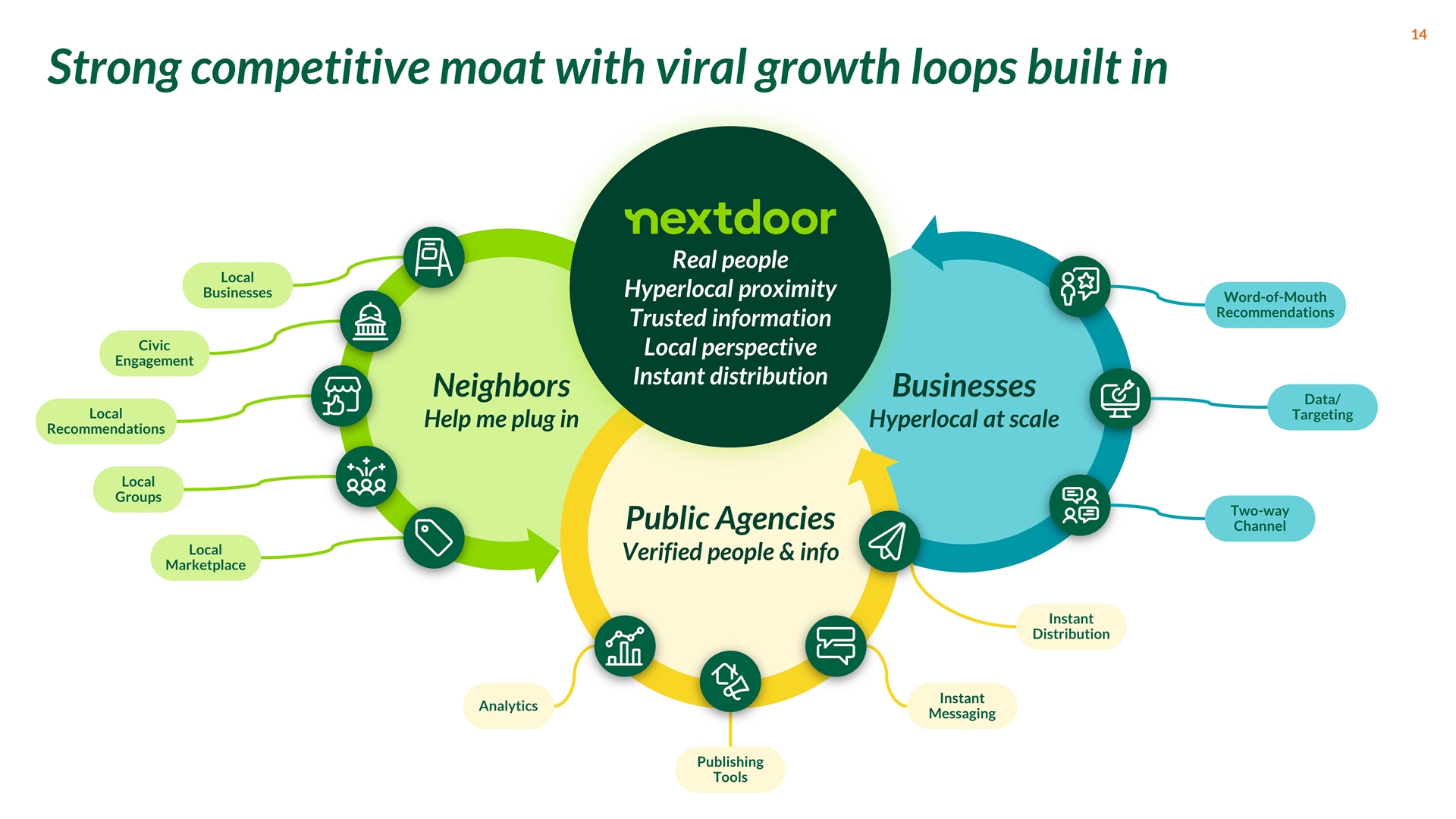

Neighbors Help me plug in Businesses Hyperlocal at scale Strong competitive moat with viral growth loops built in Local Groups Local Marketplace Public Agencies Verified people & info Local Recommendations Local Businesses Civic Engagement Analytics Publishing Tools Instant Messaging Instant Distribution Word-of-Mouth Recommendations Data/ Targeting Two-way Channel Real people Hyperlocal proximity Trusted information Local perspective Instant distribution

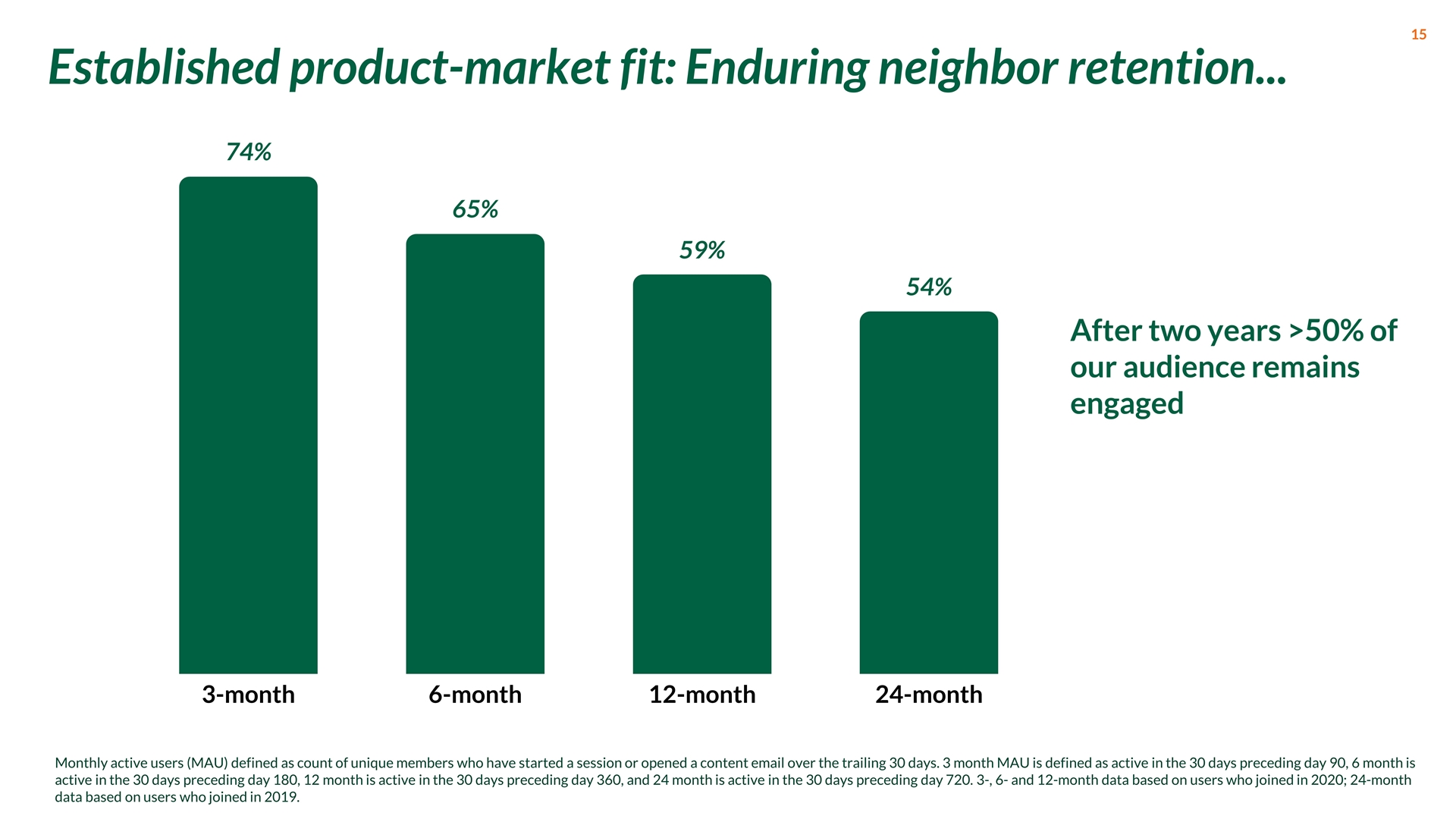

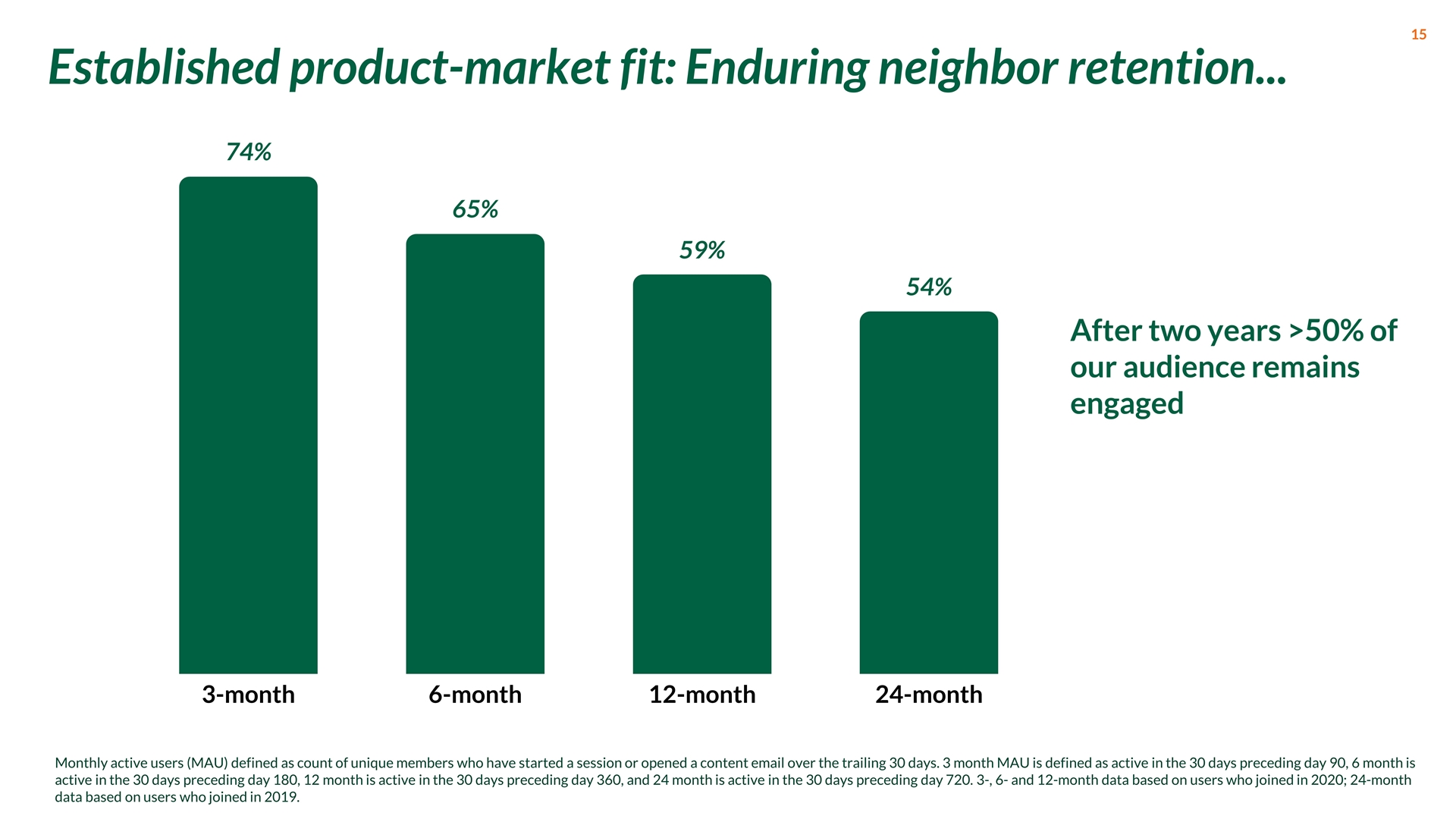

Established product-market fit: Enduring neighbor retention... Monthly active users (MAU) defined as count of unique members who have started a session or opened a content email over the trailing 30 days. 3 month MAU is defined as active in the 30 days preceding day 90, 6 month is active in the 30 days preceding day 180, 12 month is active in the 30 days preceding day 360, and 24 month is active in the 30 days preceding day 720. 3-, 6- and 12-month data based on users who joined in 2020; 24-month data based on users who joined in 2019. 3-month 74% 6-month 65% 12-month 59% 24-month 54% After two years >50% of our audience remains engaged

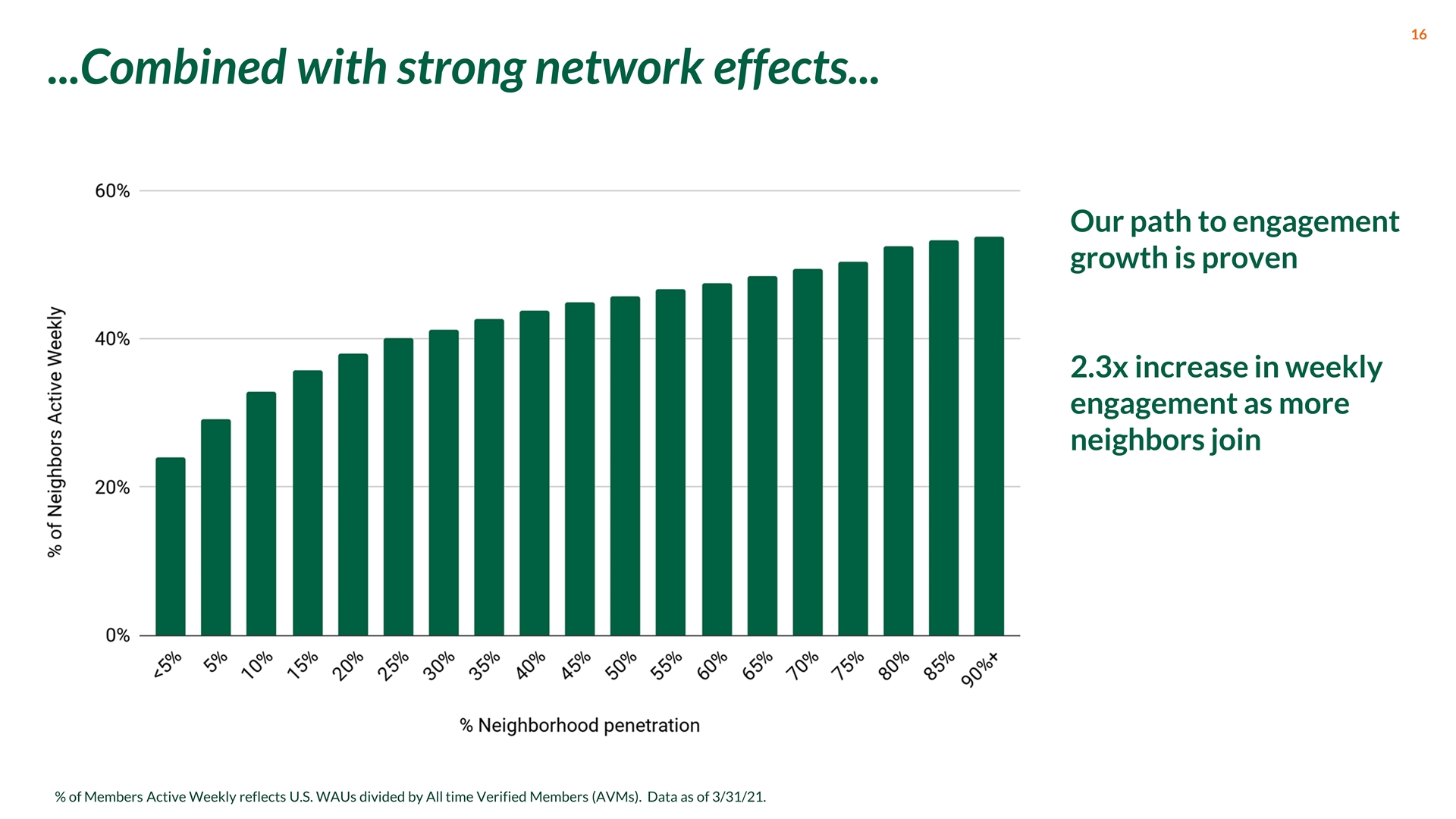

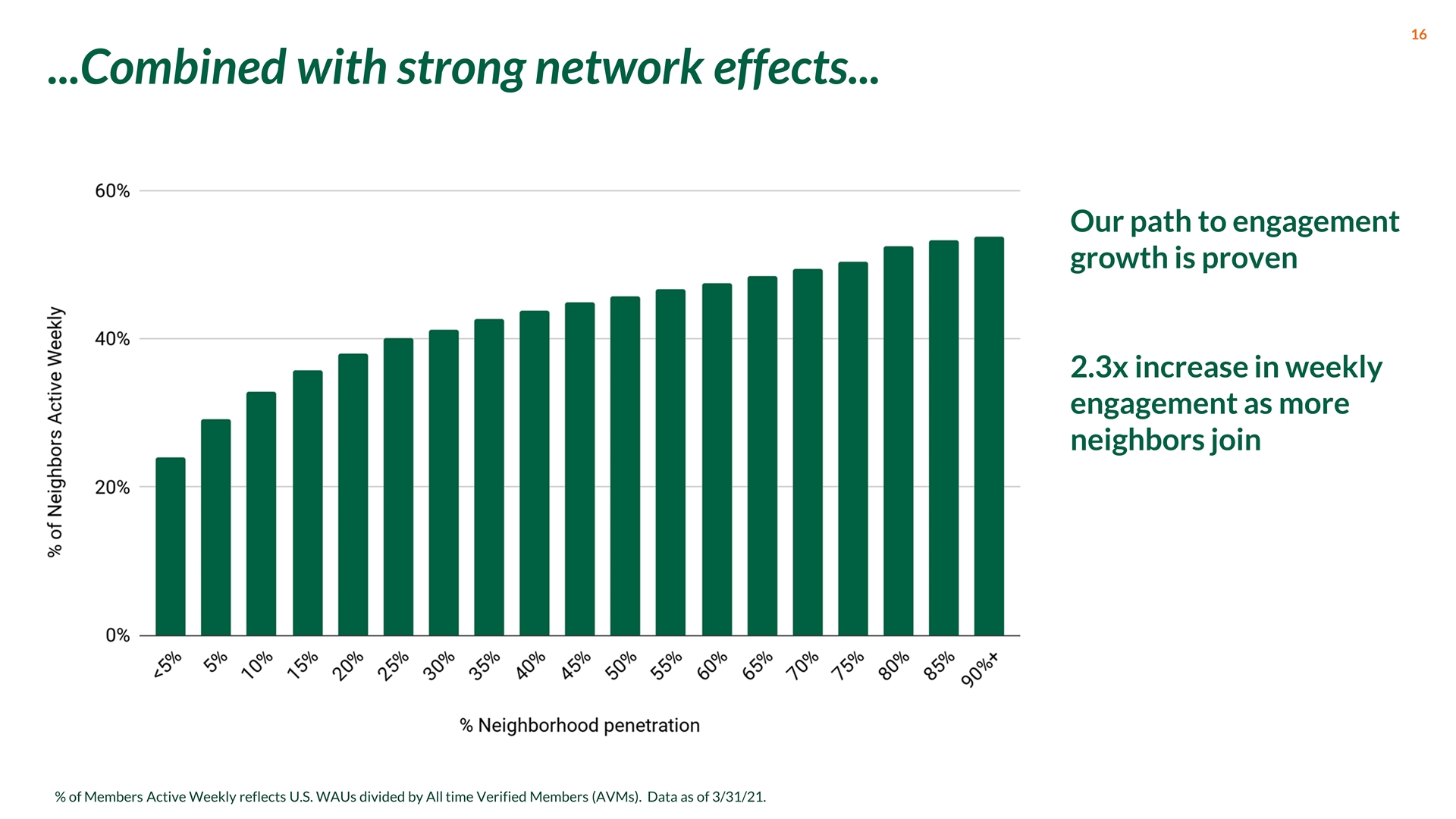

Our path to engagement growth is proven 2.3x increase in weekly engagement as more neighbors join % of Members Active Weekly reflects U.S. WAUs divided by All time Verified Members (AVMs). Data as of 3/31/21. ...Combined with strong network effects...

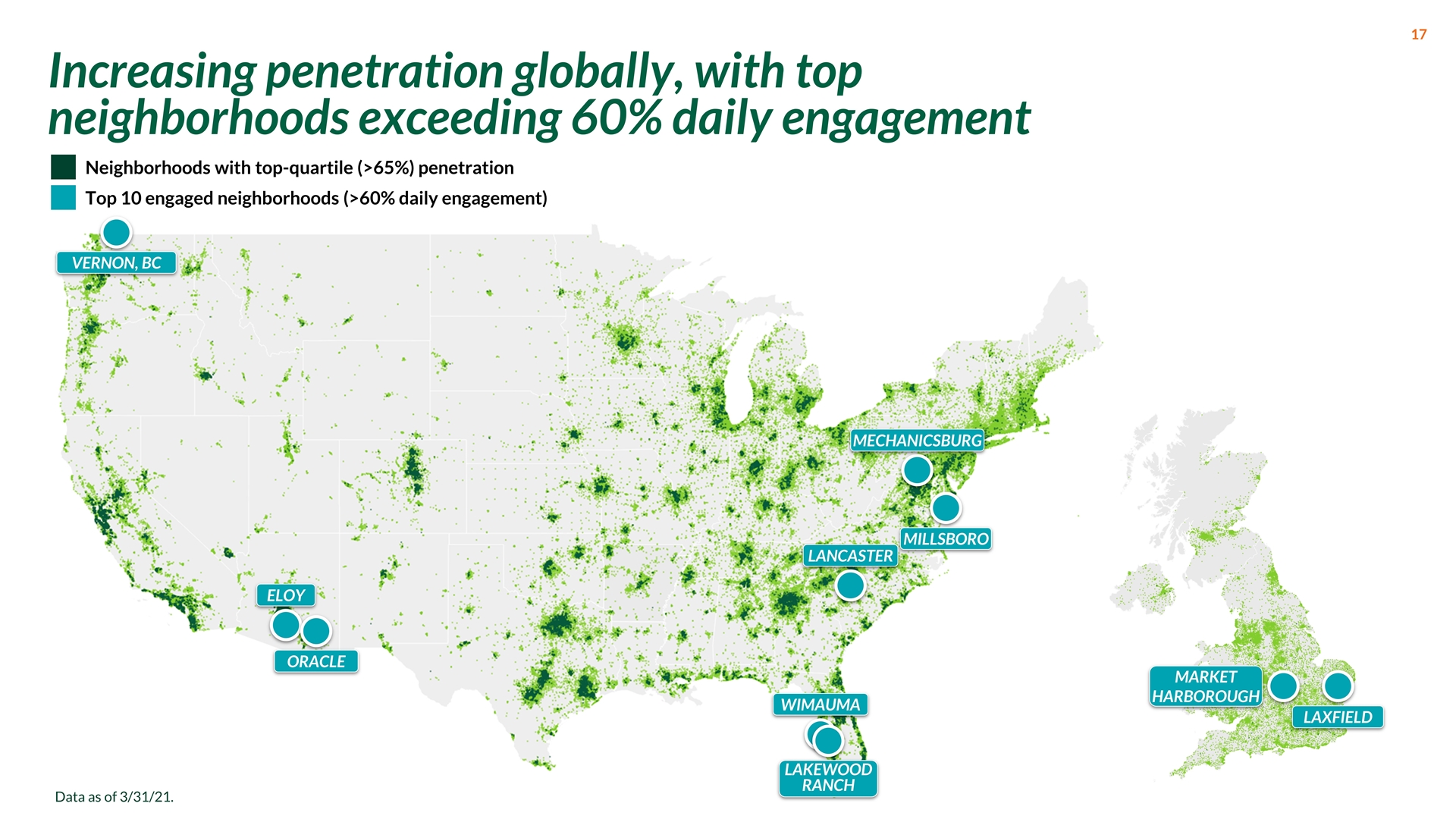

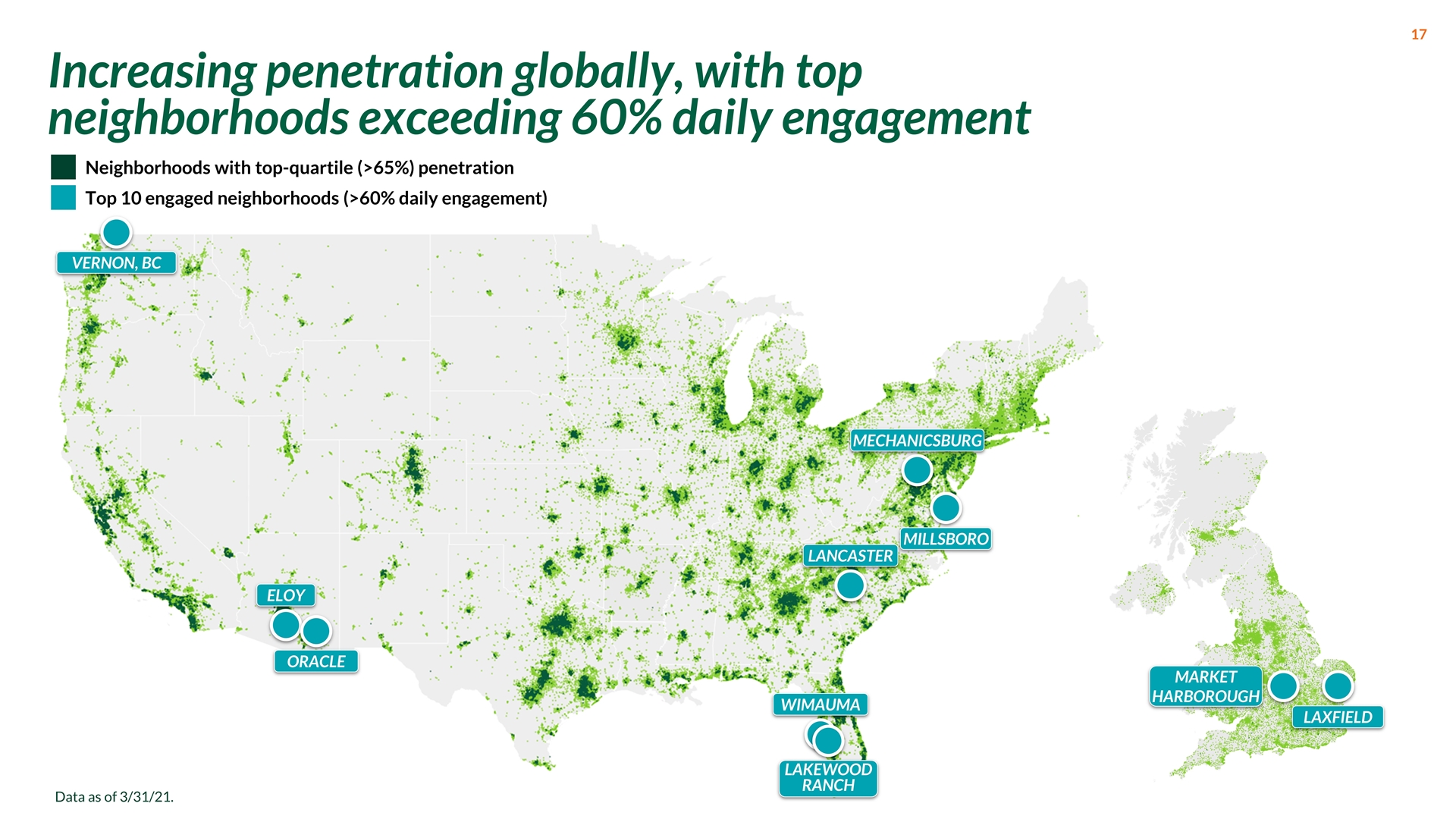

Increasing penetration globally, with top neighborhoods exceeding 60% daily engagement Neighborhoods with top-quartile (>65%) penetration Top 10 engaged neighborhoods (>60% daily engagement) ELOY MILLSBORO ORACLE LANCASTER VERNON, BC MECHANICSBURG WIMAUMA LAKEWOOD RANCH LAXFIELD MARKET HARBOROUGH Data as of 3/31/21.

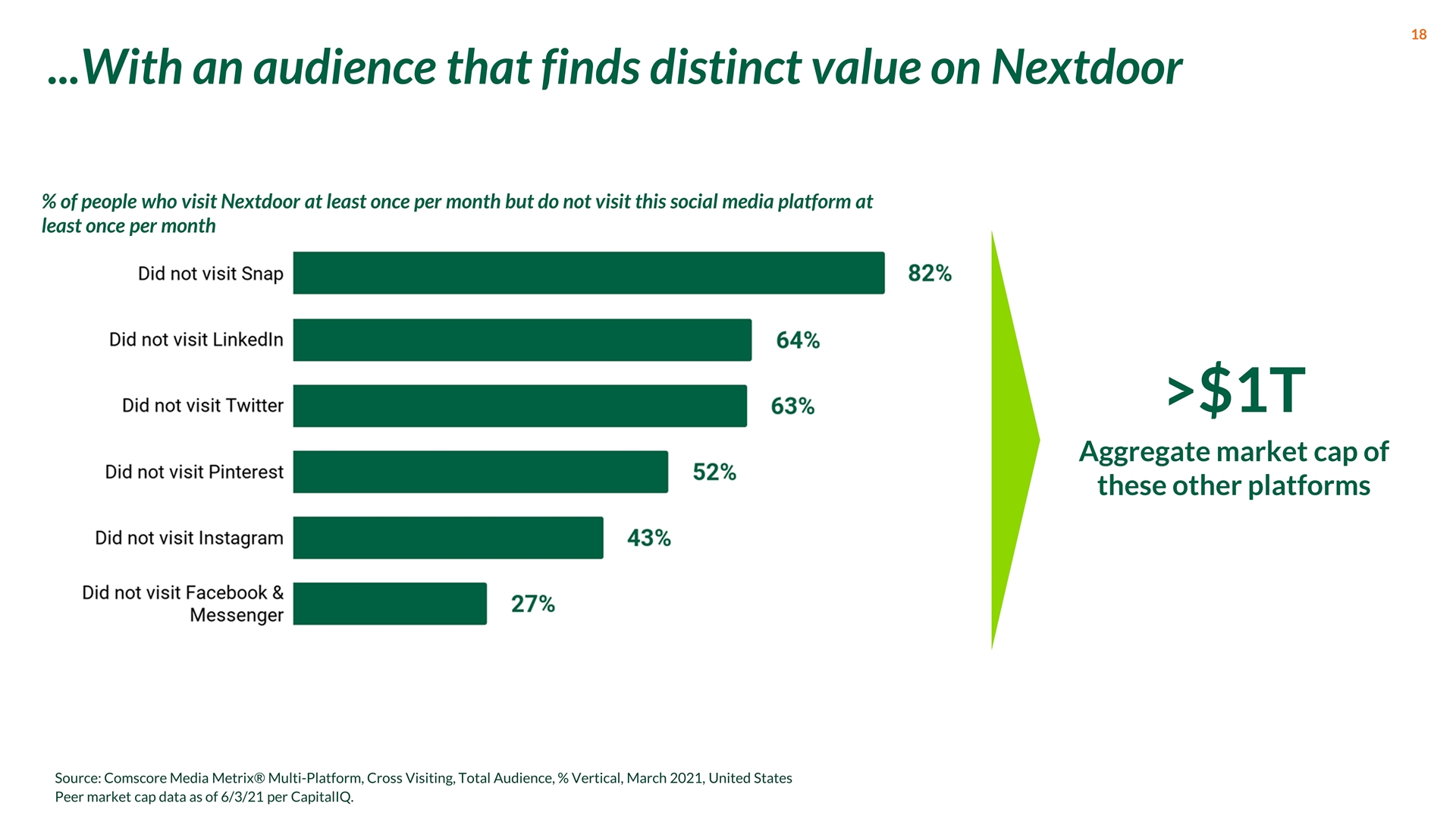

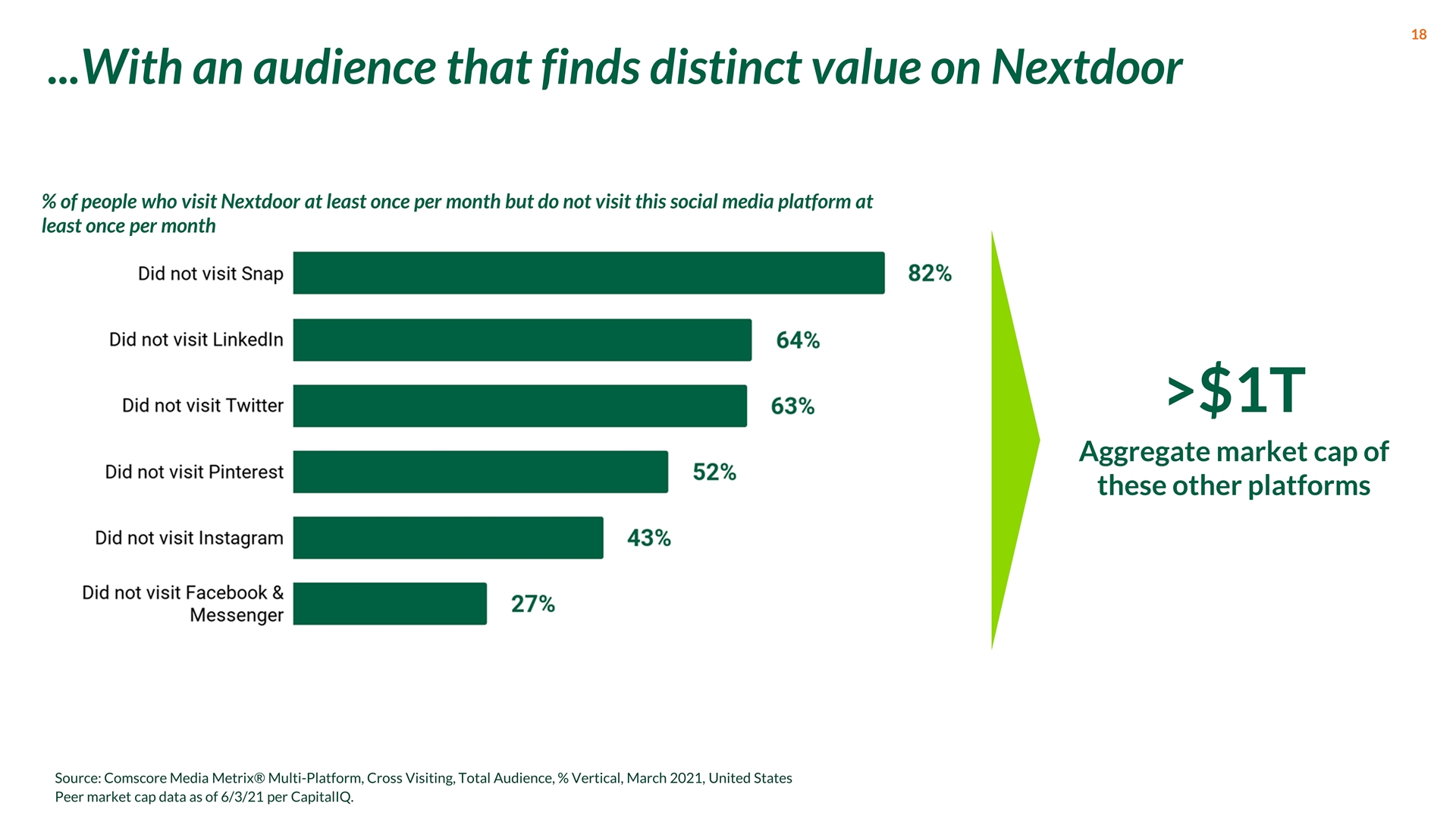

...With an audience that finds distinct value on Nextdoor % of people who visit Nextdoor at least once per month but do not visit this social media platform at least once per month >$1T Aggregate market cap of these other platforms Source: Comscore Media Metrix® Multi-Platform, Cross Visiting, Total Audience, % Vertical, March 2021, United States Peer market cap data as of 6/3/21 per CapitalIQ.

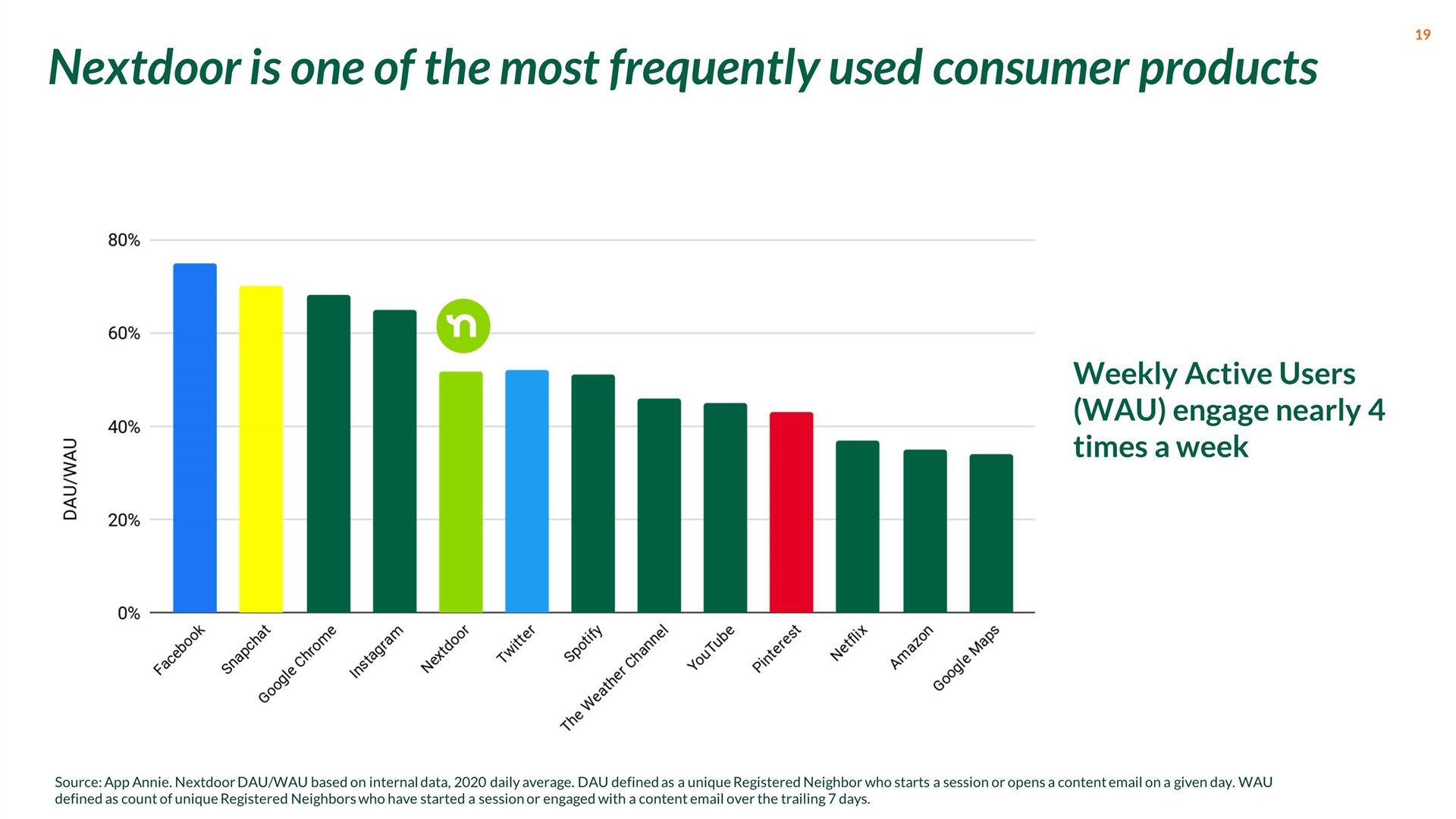

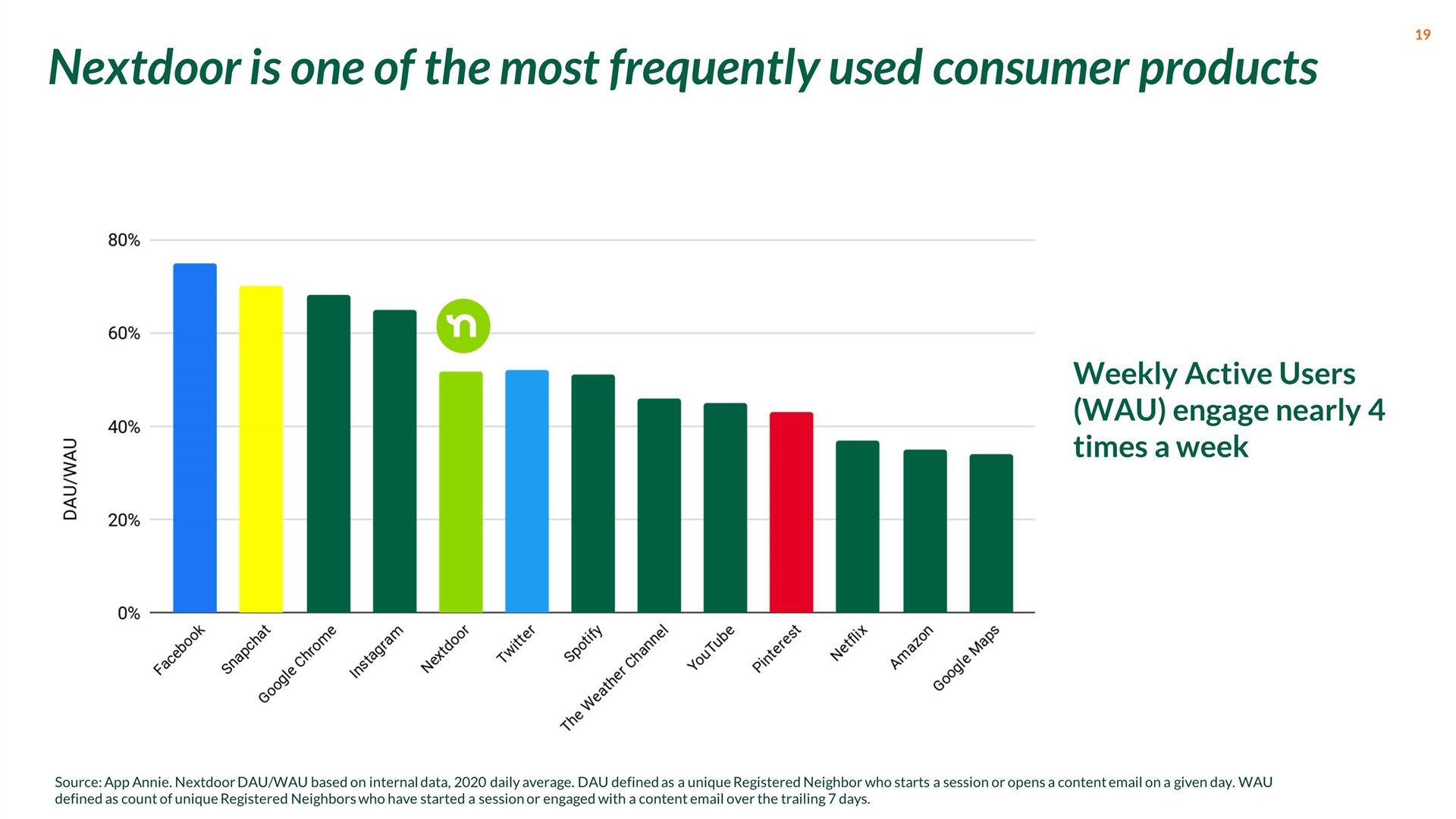

Weekly Active Users (WAU) engage nearly 4 times a week Nextdoor is one of the most frequently used consumer products Source: App Annie. Nextdoor DAU/WAU based on internal data, 2020 daily average. DAU defined as a unique Registered Neighbor who starts a session or opens a content email on a given day. WAU defined as count of unique Registered Neighbors who have started a session or engaged with a content email over the trailing 7 days.

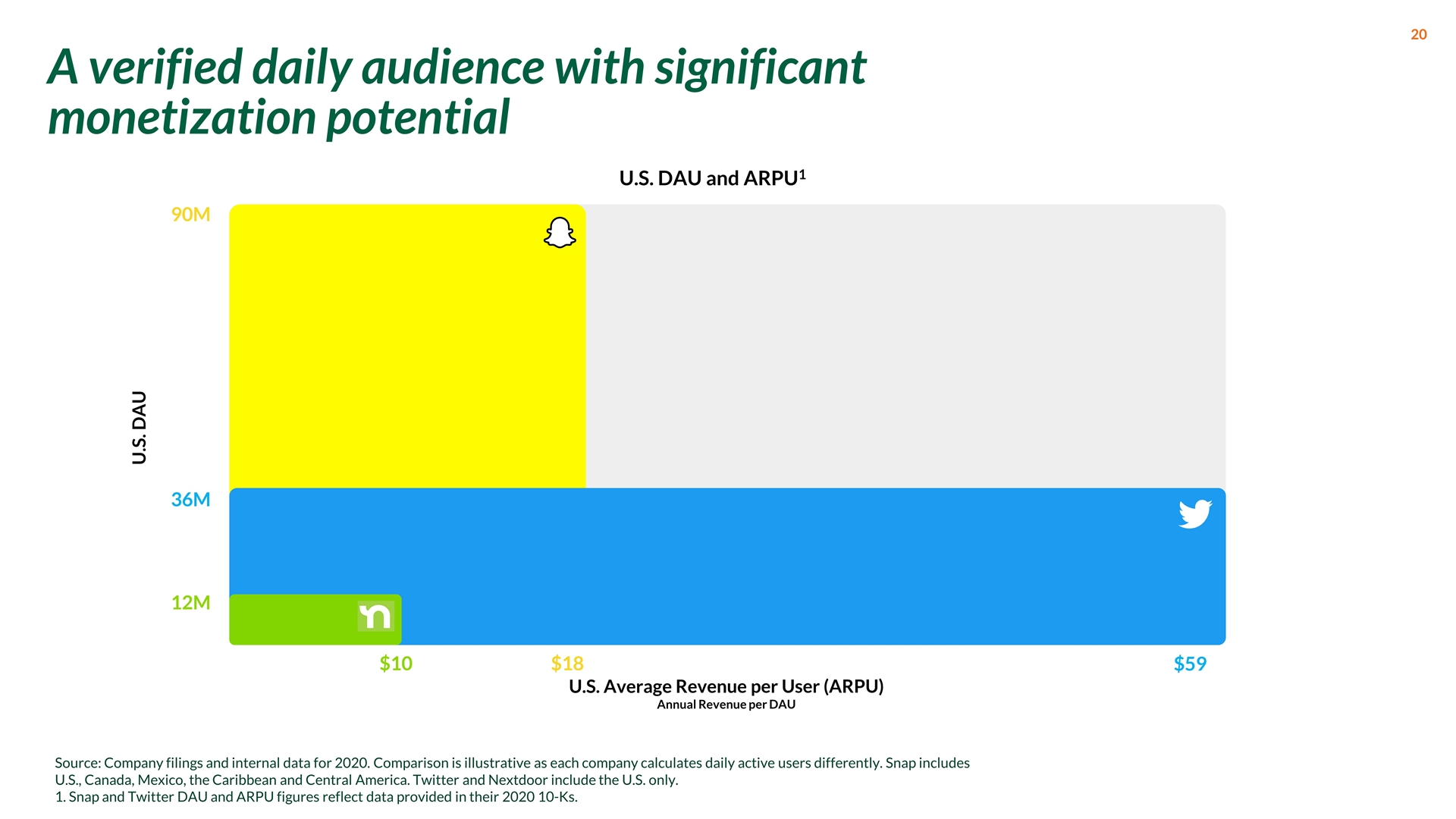

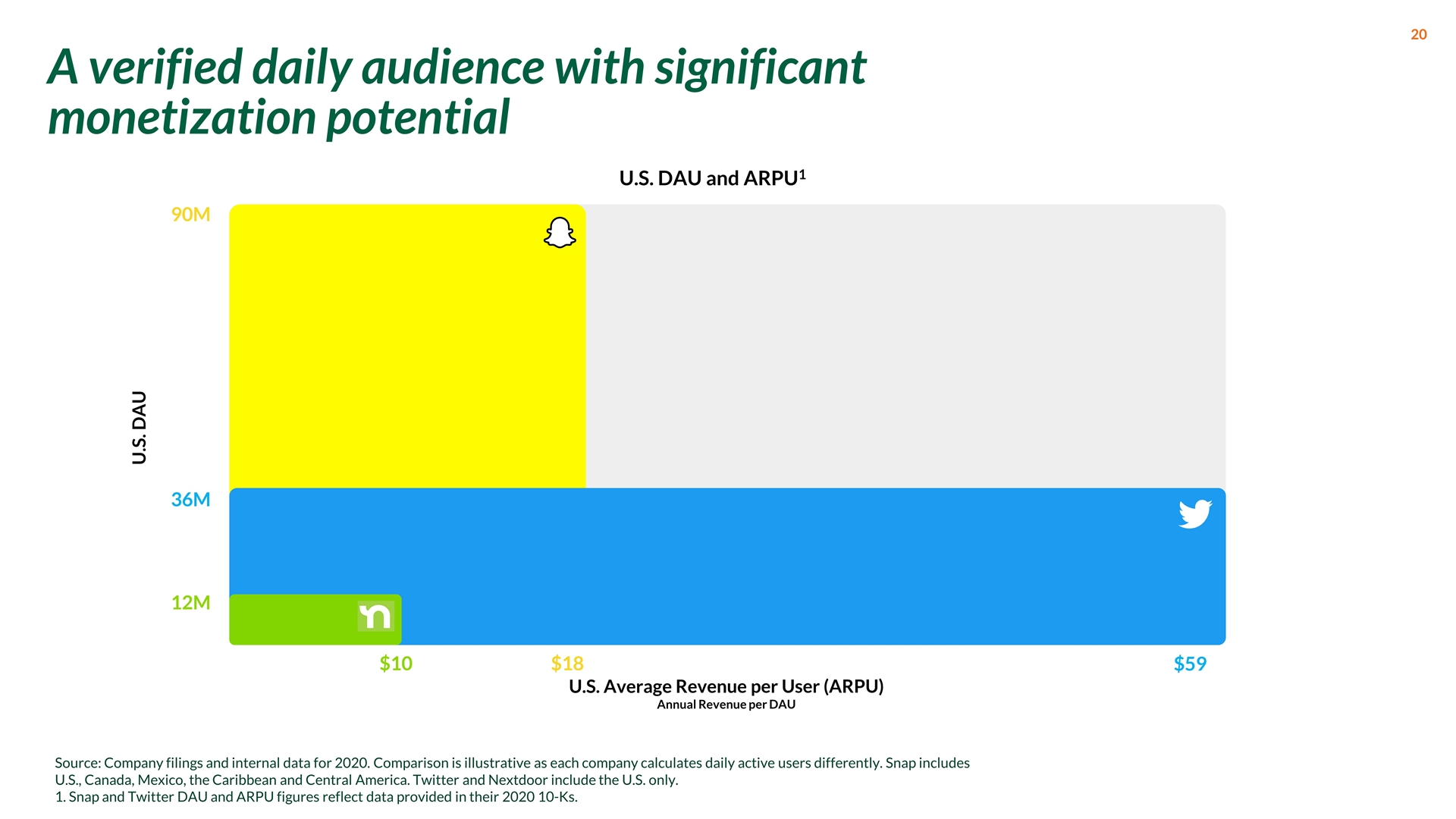

Source: Company filings and internal data for 2020. Comparison is illustrative as each company calculates daily active users differently. Snap includes U.S., Canada, Mexico, the Caribbean and Central America. Twitter and Nextdoor include the U.S. only. 1. Snap and Twitter DAU and ARPU figures reflect data provided in their 2020 10-Ks. A verified daily audience with significant monetization potential U.S. DAU 90M 36M 12M $59 $18 $10 U.S. Average Revenue per User (ARPU) Annual Revenue per DAU U.S. DAU and ARPU1

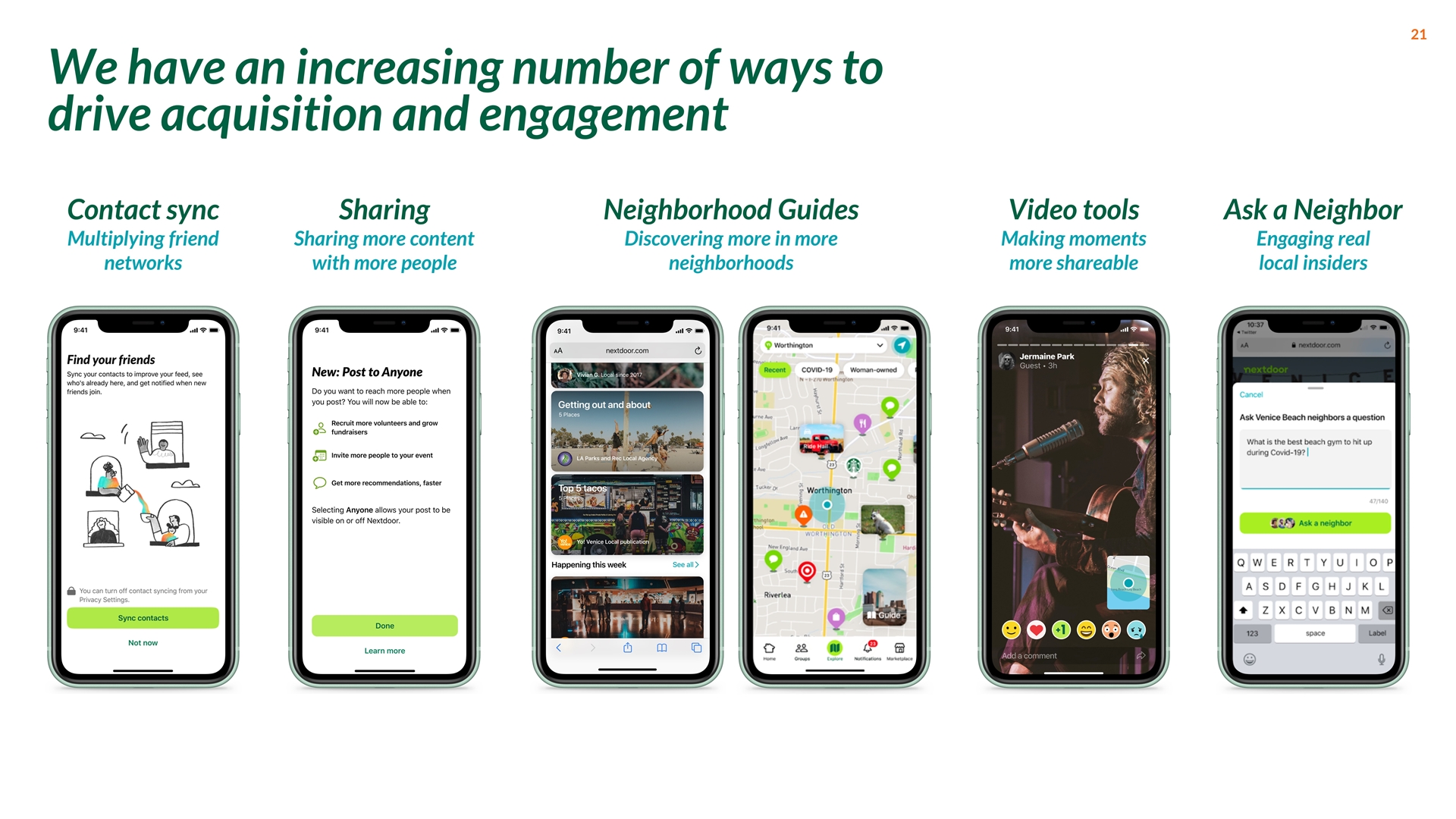

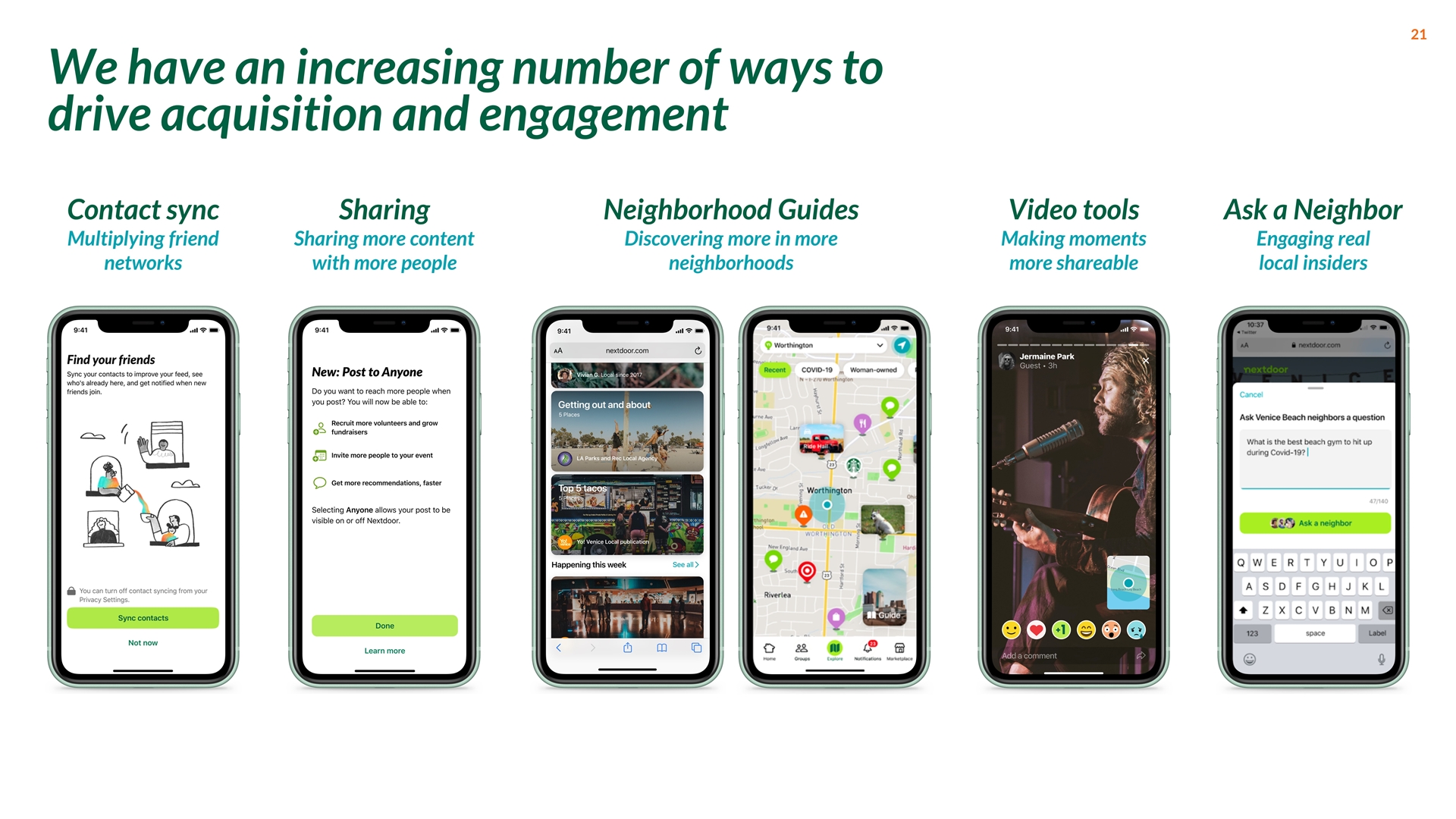

Sharing Sharing more content with more people Neighborhood Guides Discovering more in more neighborhoods Contact sync Multiplying friend networks Ask a Neighbor Engaging real local insiders Video tools Making moments more shareable We have an increasing number of ways to drive acquisition and engagement

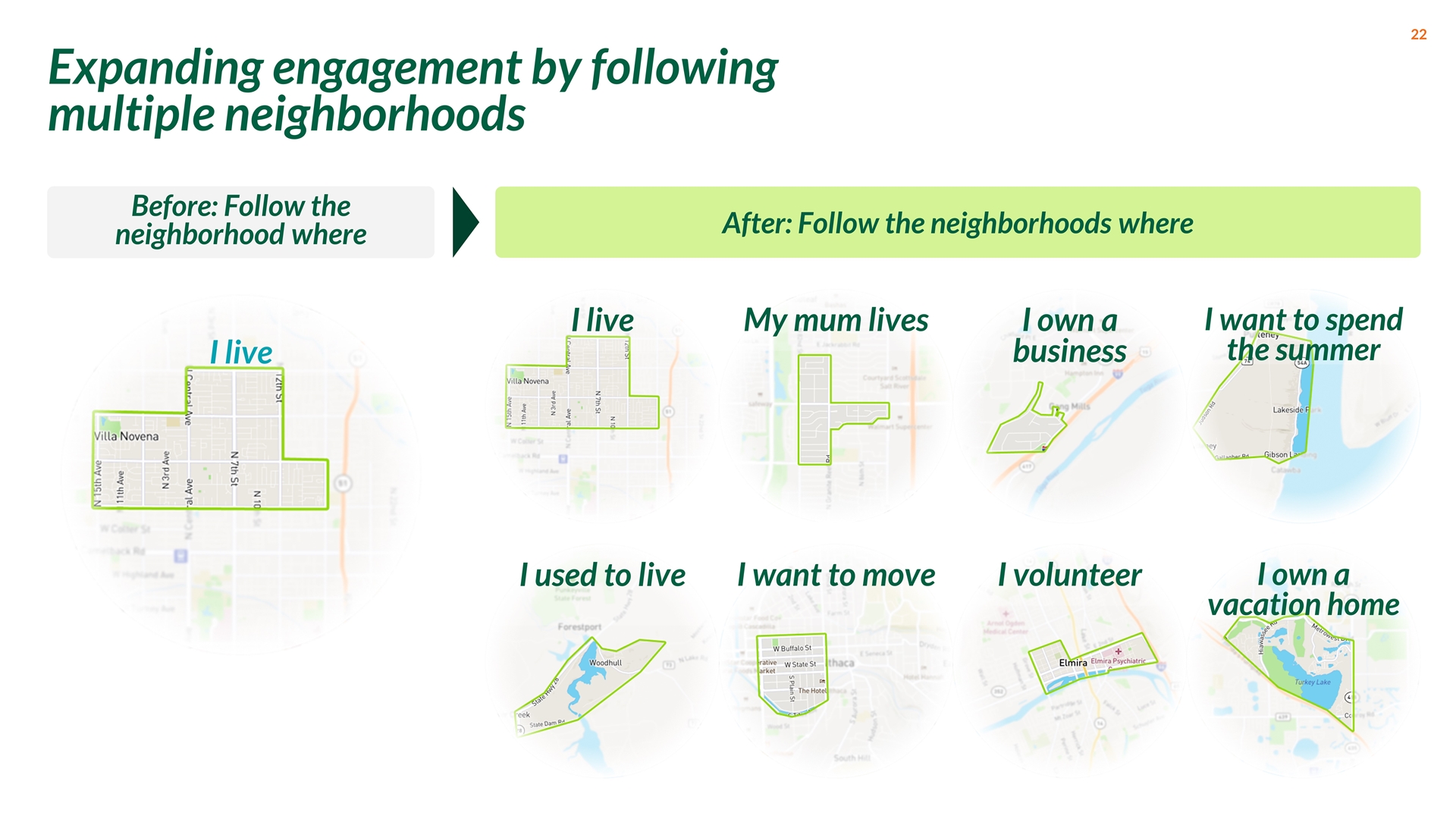

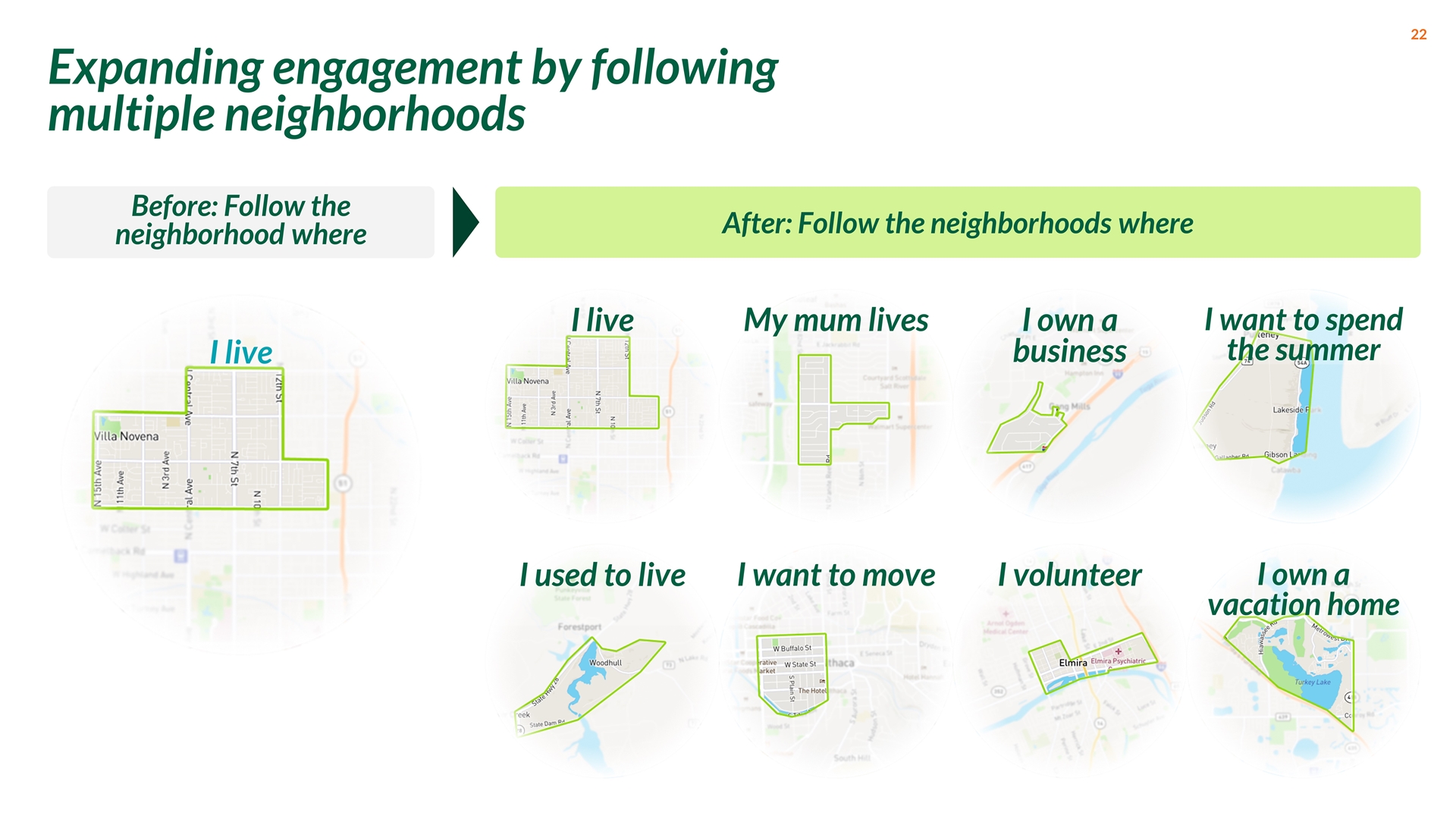

Expanding engagement by following multiple neighborhoods Before: Follow the neighborhood where After: Follow the neighborhoods where I live I live My mum lives I own a business I want to spend the summer I used to live I want to move I volunteer I own a vacation home

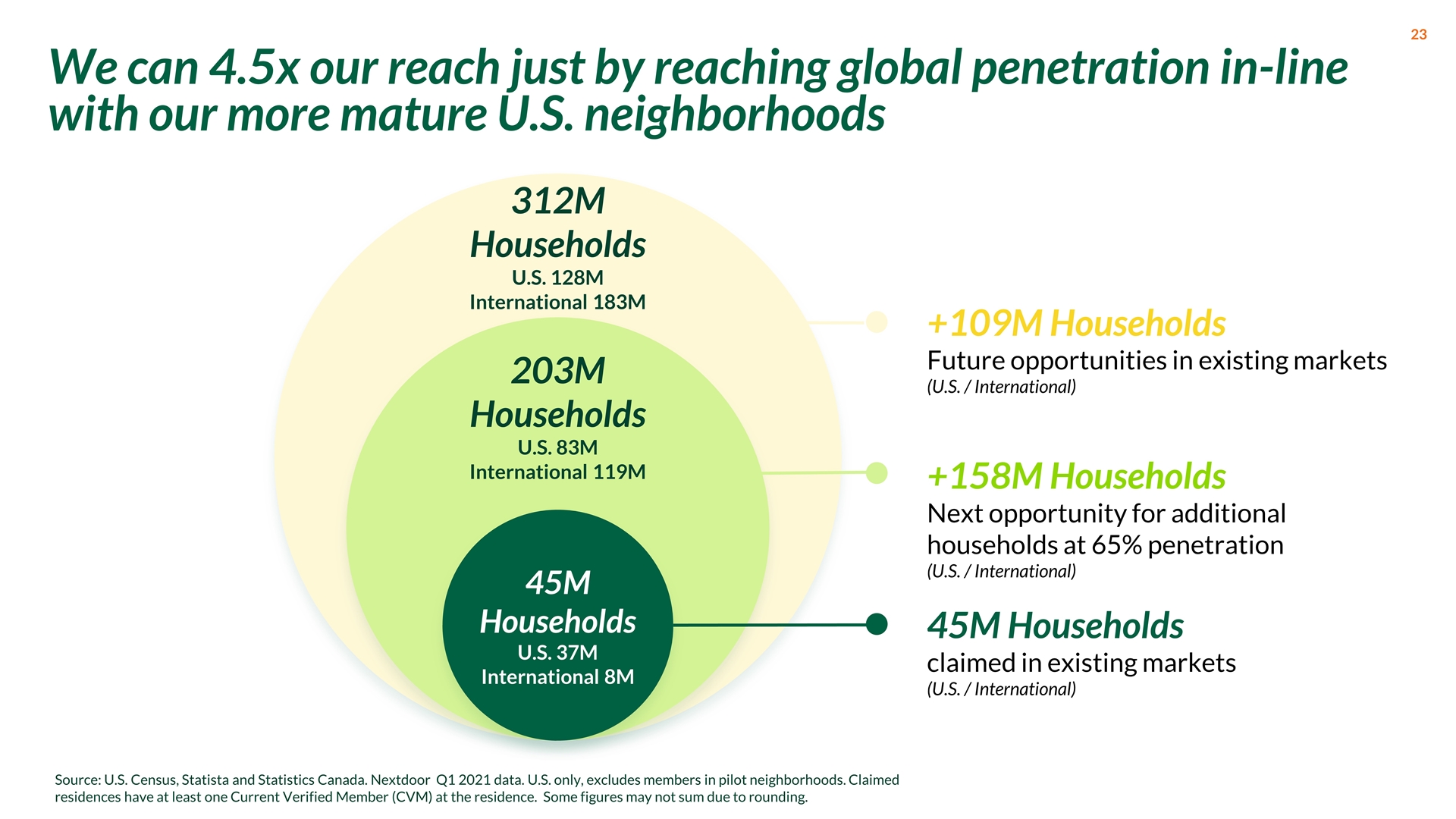

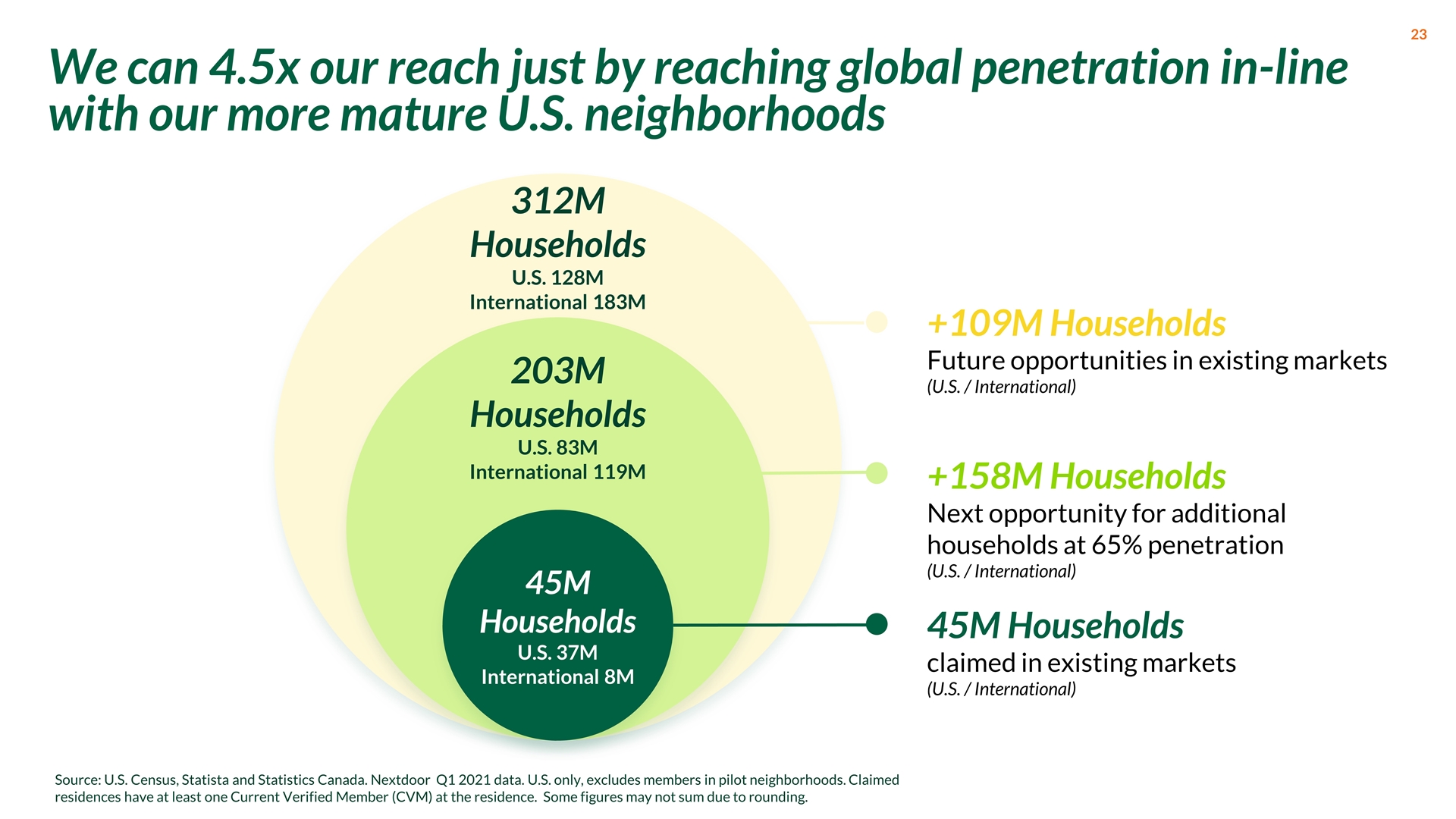

45M Households U.S. 37M International 8M We can 4.5x our reach just by reaching global penetration in-line with our more mature U.S. neighborhoods 45M Households claimed in existing markets (U.S. / International) +158M Households Next opportunity for additional households at 65% penetration (U.S. / International) +109M Households Future opportunities in existing markets (U.S. / International) 312M Households U.S. 128M International 183M 203M Households U.S. 83M International 119M Source: U.S. Census, Statista and Statistics Canada. Nextdoor Q1 2021 data. U.S. only, excludes members in pilot neighborhoods. Claimed residences have at least one Current Verified Member (CVM) at the residence. Some figures may not sum due to rounding.

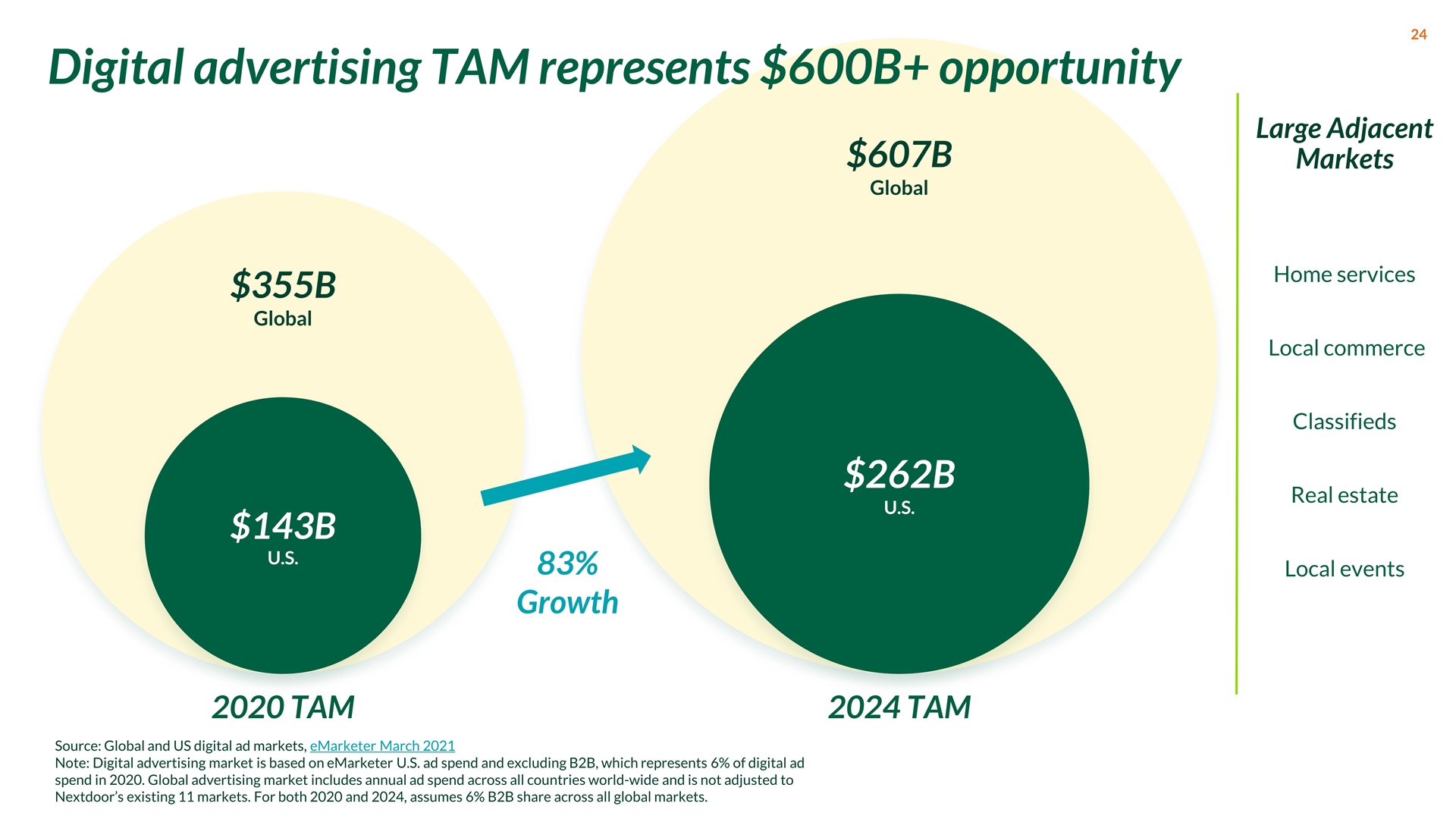

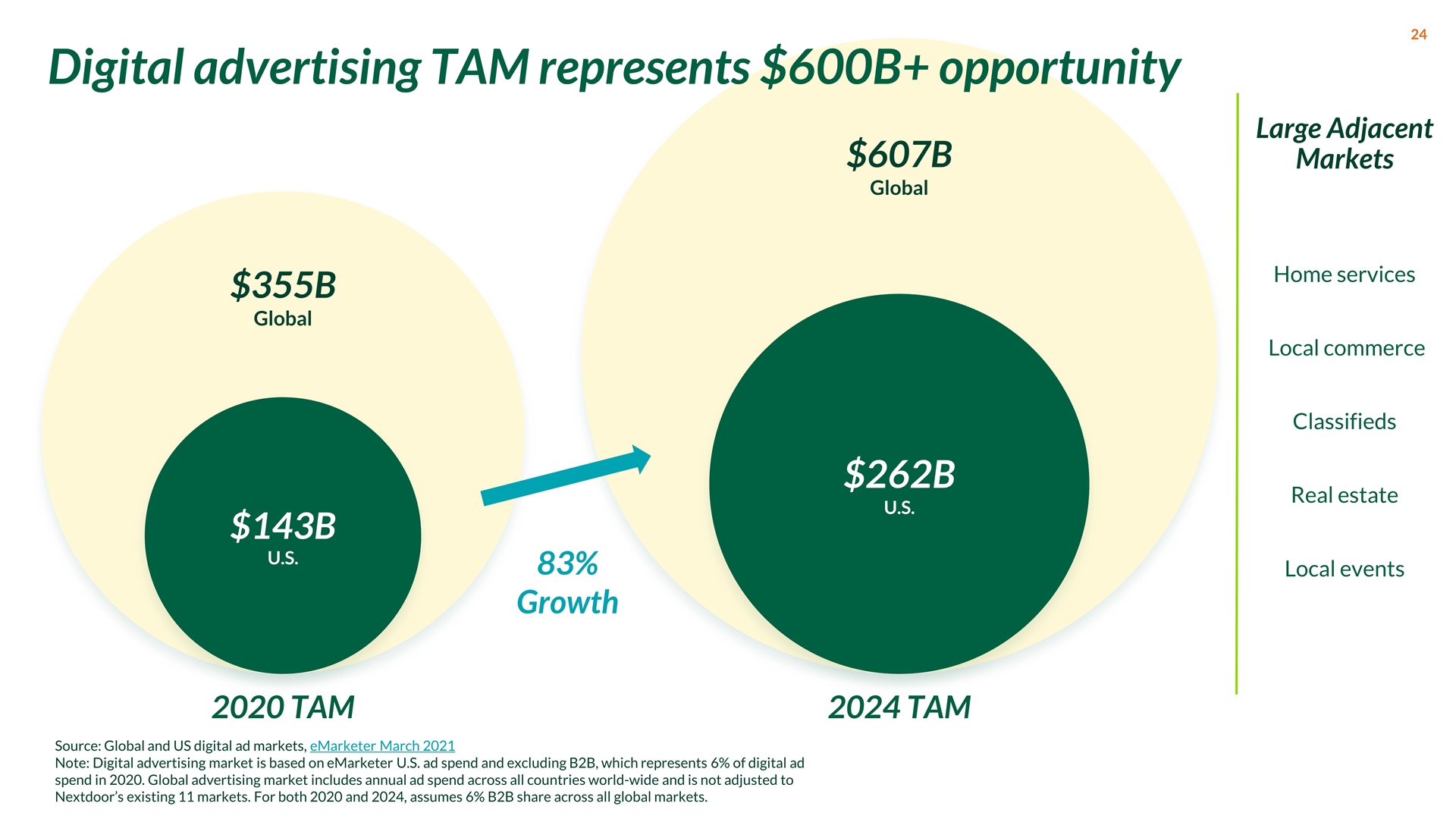

$607B Global $355B Global 2020 TAM 2024 TAM Large Adjacent Markets Home services Local commerce Classifieds Real estate Local events Source: Global and US digital ad markets, eMarketer March 2021 Note: Digital advertising market is based on eMarketer U.S. ad spend and excluding B2B, which represents 6% of digital ad spend in 2020. Global advertising market includes annual ad spend across all countries world-wide and is not adjusted to Nextdoor’s existing 11 markets. For both 2020 and 2024, assumes 6% B2B share across all global markets. 83% Growth $143B U.S. $262B U.S. Digital advertising TAM represents $600B+ opportunity

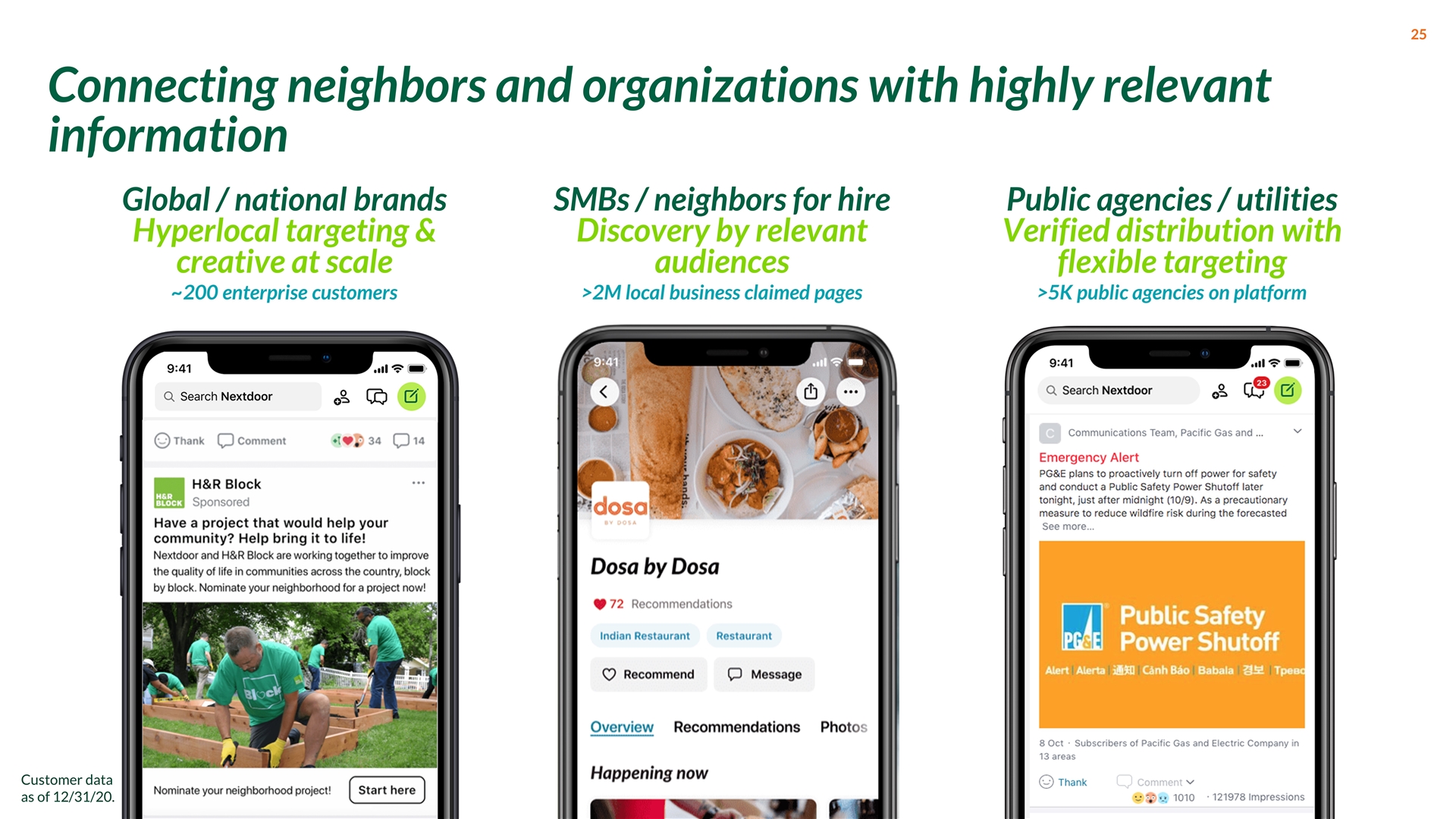

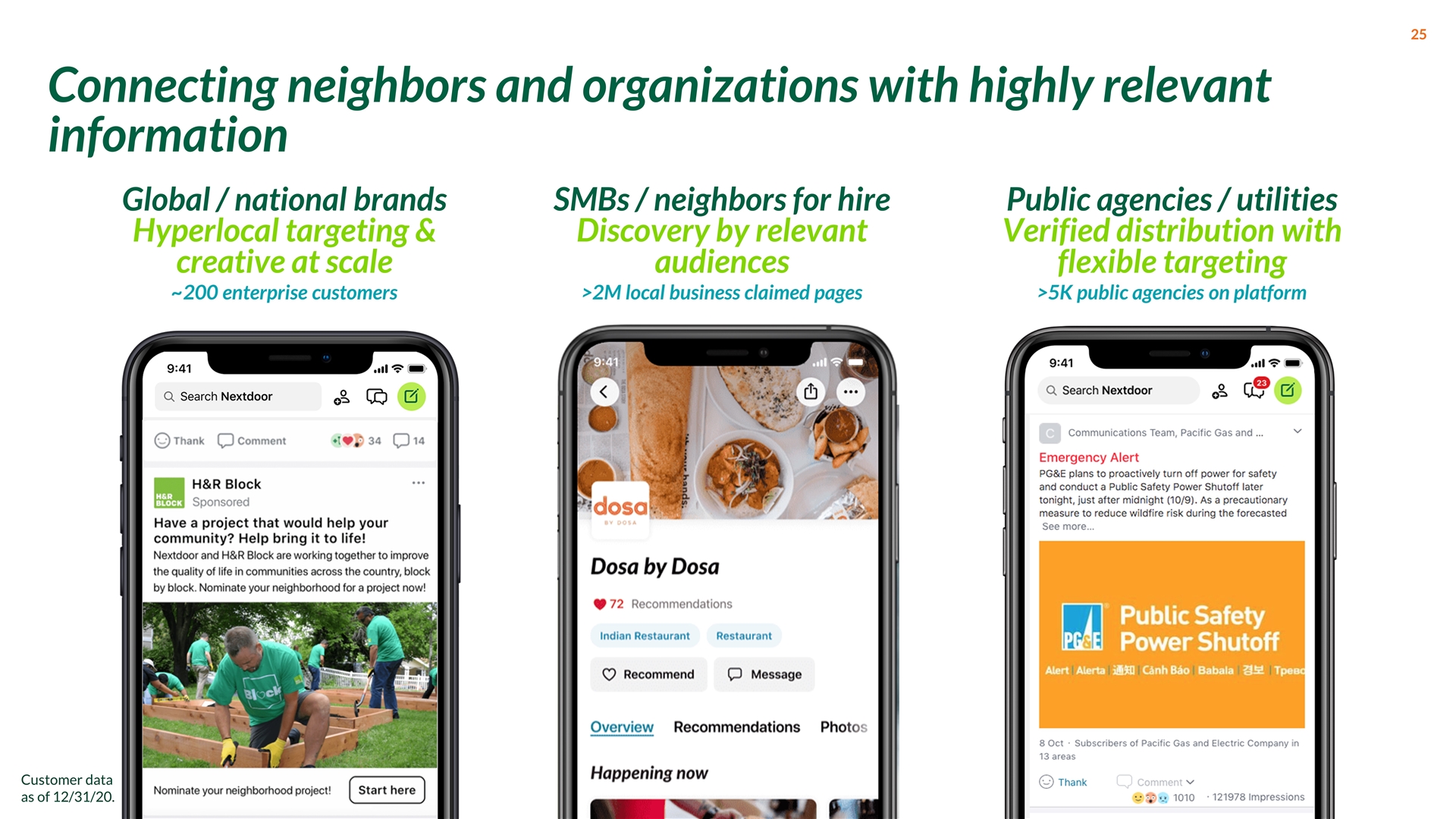

Public agencies / utilities Verified distribution with flexible targeting >5K public agencies on platform SMBs / neighbors for hire Discovery by relevant audiences >2M local business claimed pages Global / national brands Hyperlocal targeting & creative at scale ~200 enterprise customers Customer data as of 12/31/20. Connecting neighbors and organizations with highly relevant information

Intent & Influence First-party data creates efficient targeting Action Opportunities to purchase and act with ease Awareness & Discovery Local context means Nextdoor content is relevant Full funnel approach helping neighbors from awareness to action Dynamic Local Ads Local Deals Finds Sponsorships Maps Sponsored Posts South Star Real Estate Sponsored by

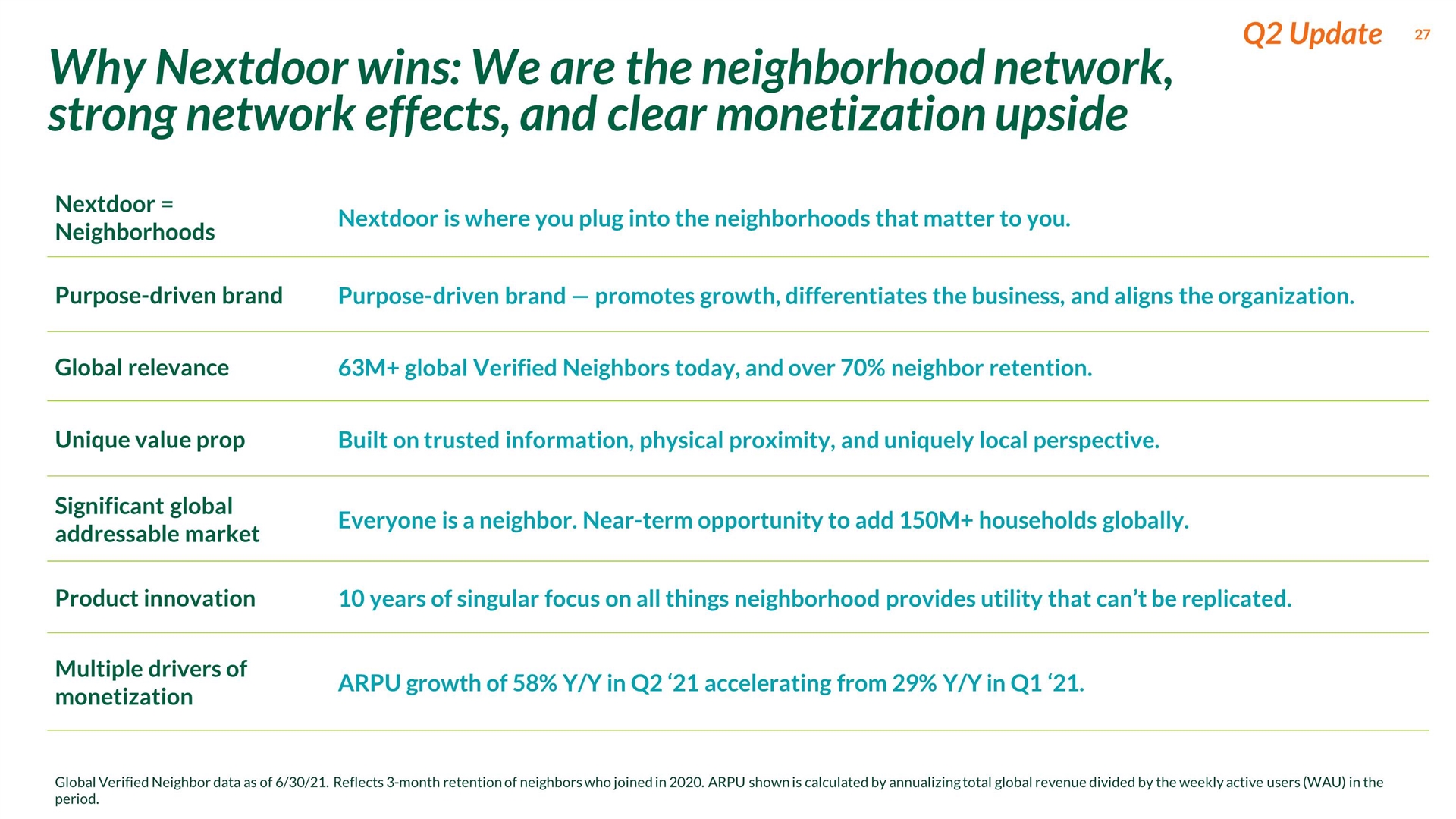

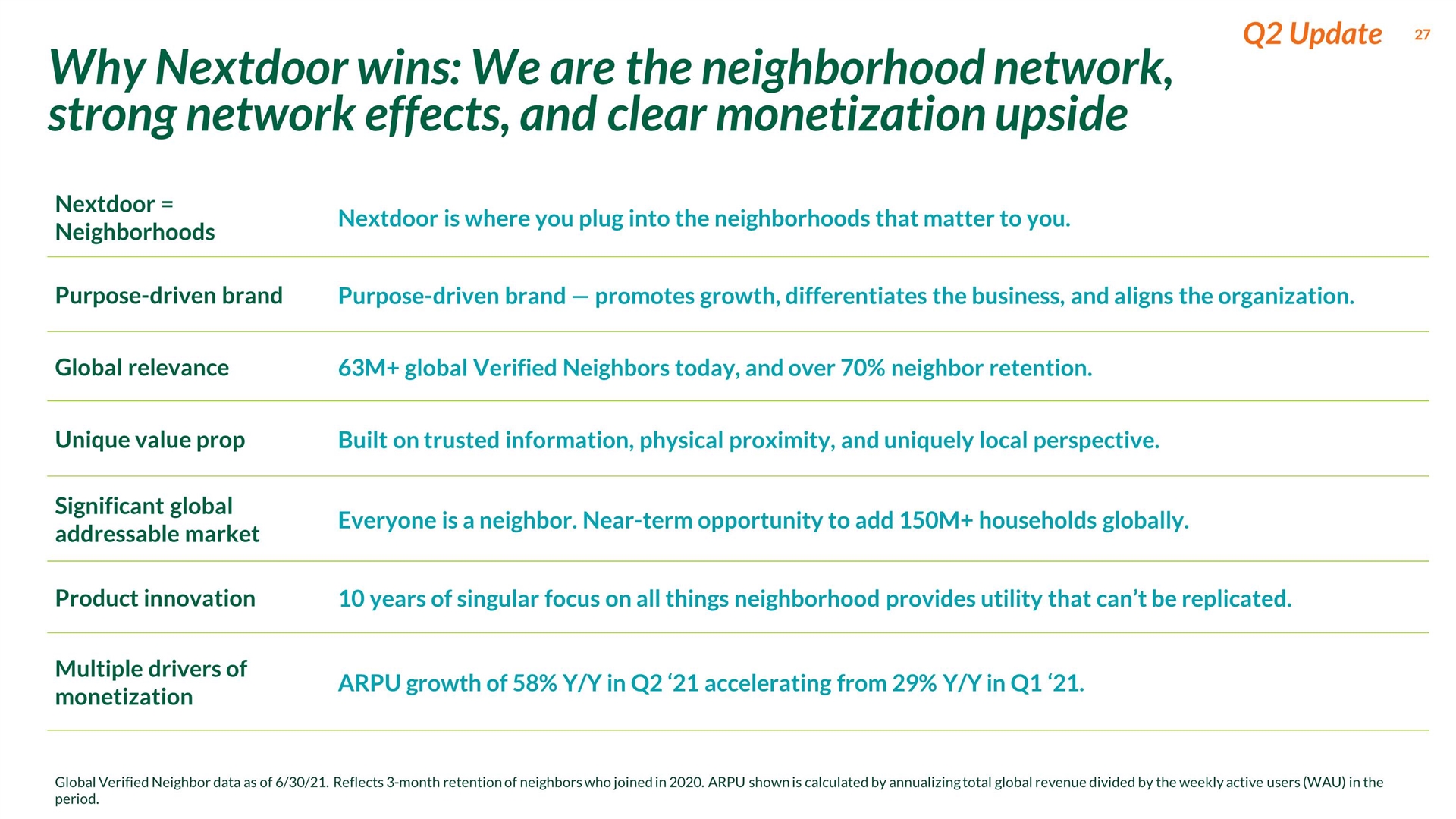

Why Nextdoor wins: We are the neighborhood network, strong network effects, and clear monetization upside Nextdoor = Neighborhoods Nextdoor is where you plug into the neighborhoods that matter to you. Purpose-driven brand Purpose-driven brand — promotes growth, differentiates the business, and aligns the organization. Global relevance 63M+ global Verified Neighbors today, and over 70% neighbor retention. Unique value prop Built on trusted information, physical proximity, and uniquely local perspective. Significant global addressable market Everyone is a neighbor. Near-term opportunity to add 150M+ households globally. Product innovation 10 years of singular focus on all things neighborhood provides utility that can’t be replicated. Multiple drivers of monetization ARPU growth of 58% Y/Y in Q2 ‘21 accelerating from 29% Y/Y in Q1 ‘21. Global Verified Neighbor data as of 6/30/21. Reflects 3-month retention of neighbors who joined in 2020. ARPU shown is calculated by annualizing total global revenue divided by the weekly active users (WAU) in the period. Q2 Update

Sarah Friar Chief Executive Officer Mike Doyle Chief Financial Officer Prakash Janakiraman Co-Founder, Chief Architect John Orta Chief Legal Officer & Head of Corp Dev Heidi Andersen Head of Revenue Antonio Silveira Head of Engineering Bryan Power Head of People Craig Lisowski Head of Data, Information, Systems and Trust Maryam Banikarim Head of Marketing Kiran Prasad Head of Product Turbocharged leadership team in last 24 months

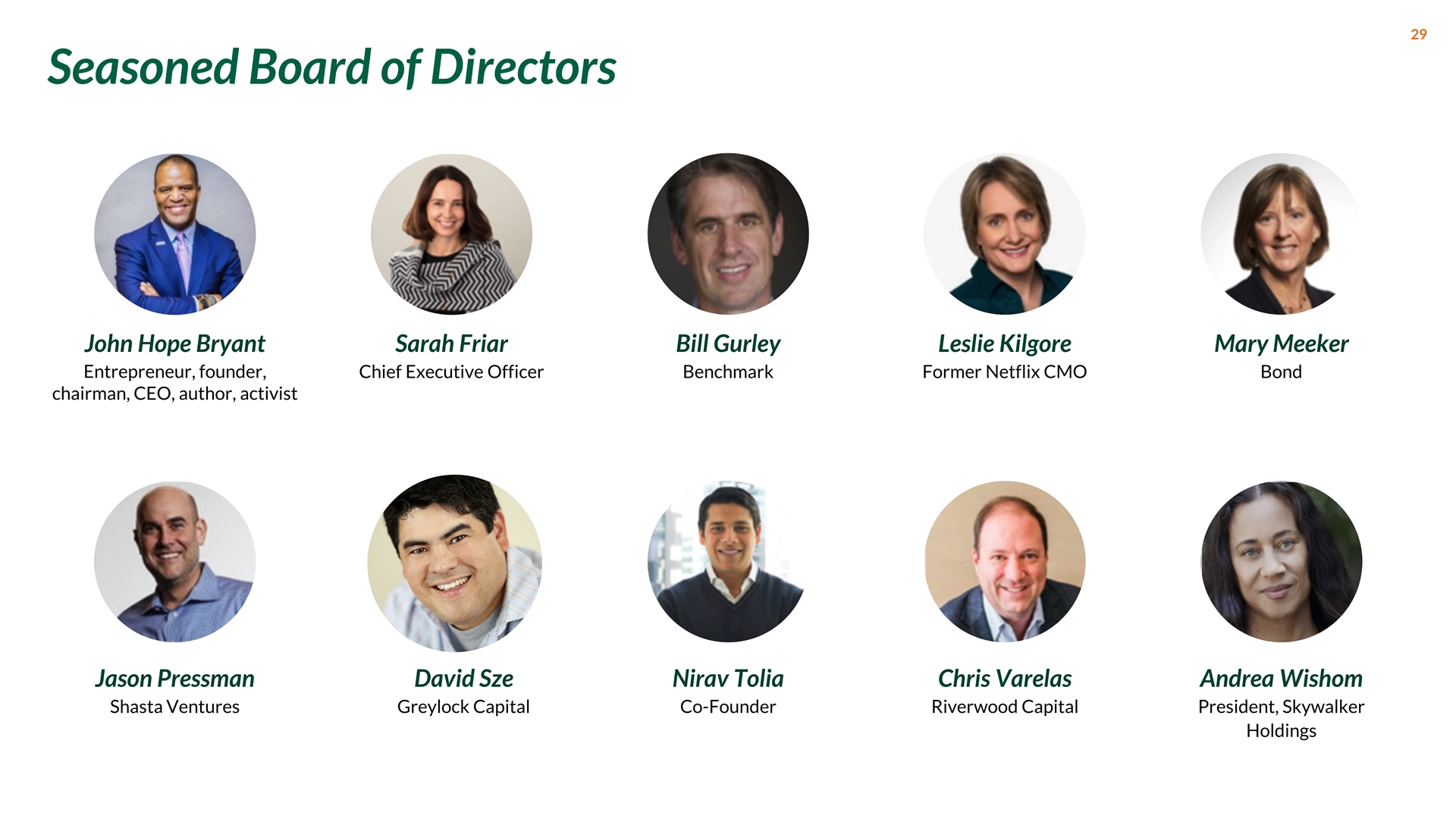

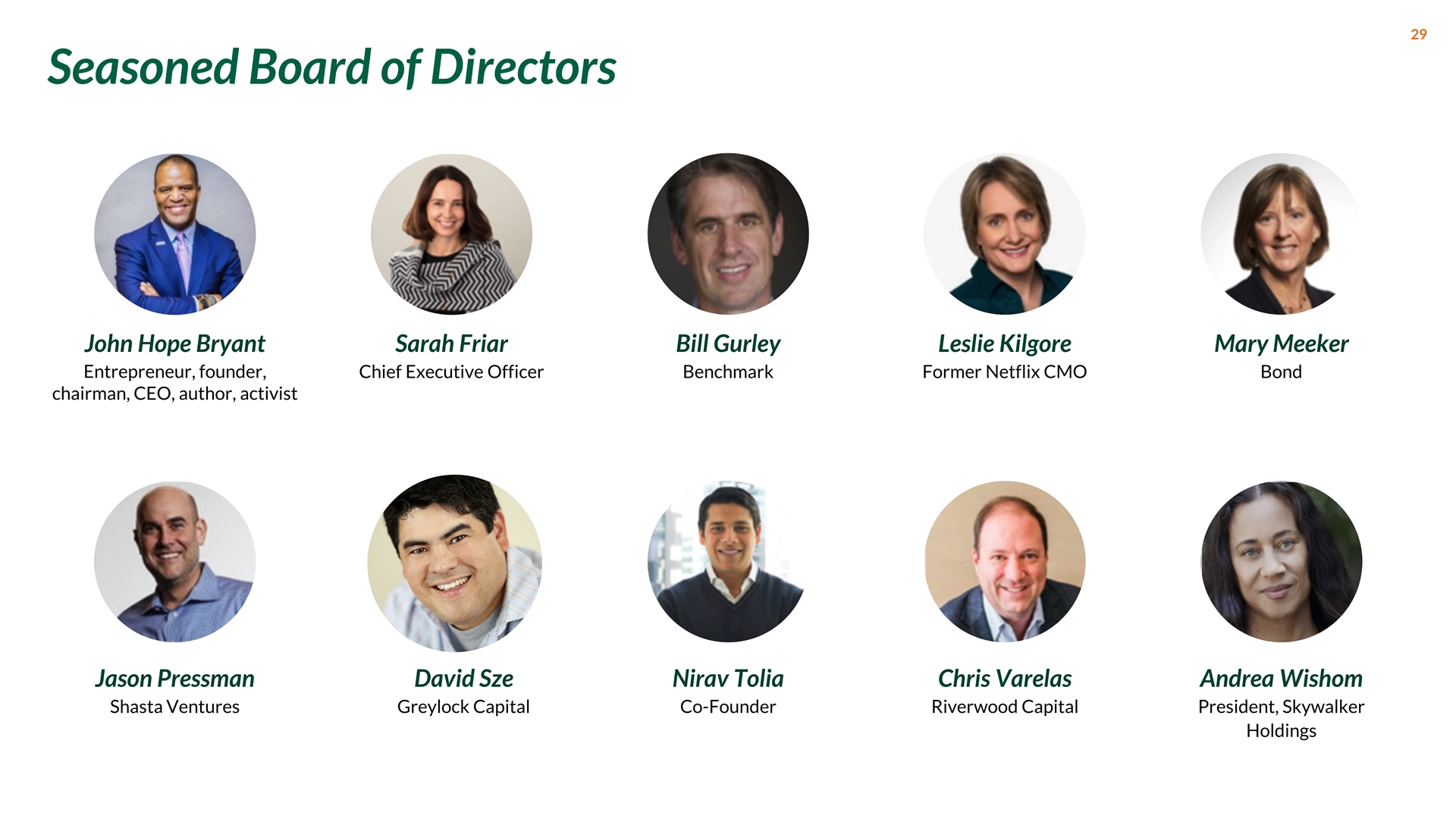

Leslie Kilgore Former Netflix CMO Bill Gurley Benchmark Mary Meeker Bond John Hope Bryant Entrepreneur, founder, chairman, CEO, author, activist Sarah Friar Chief Executive Officer Seasoned Board of Directors Chris Varelas Riverwood Capital Nirav Tolia Co-Founder David Sze Greylock Capital Jason Pressman Shasta Ventures Andrea Wishom President, Skywalker Holdings

Monetization and Outlook

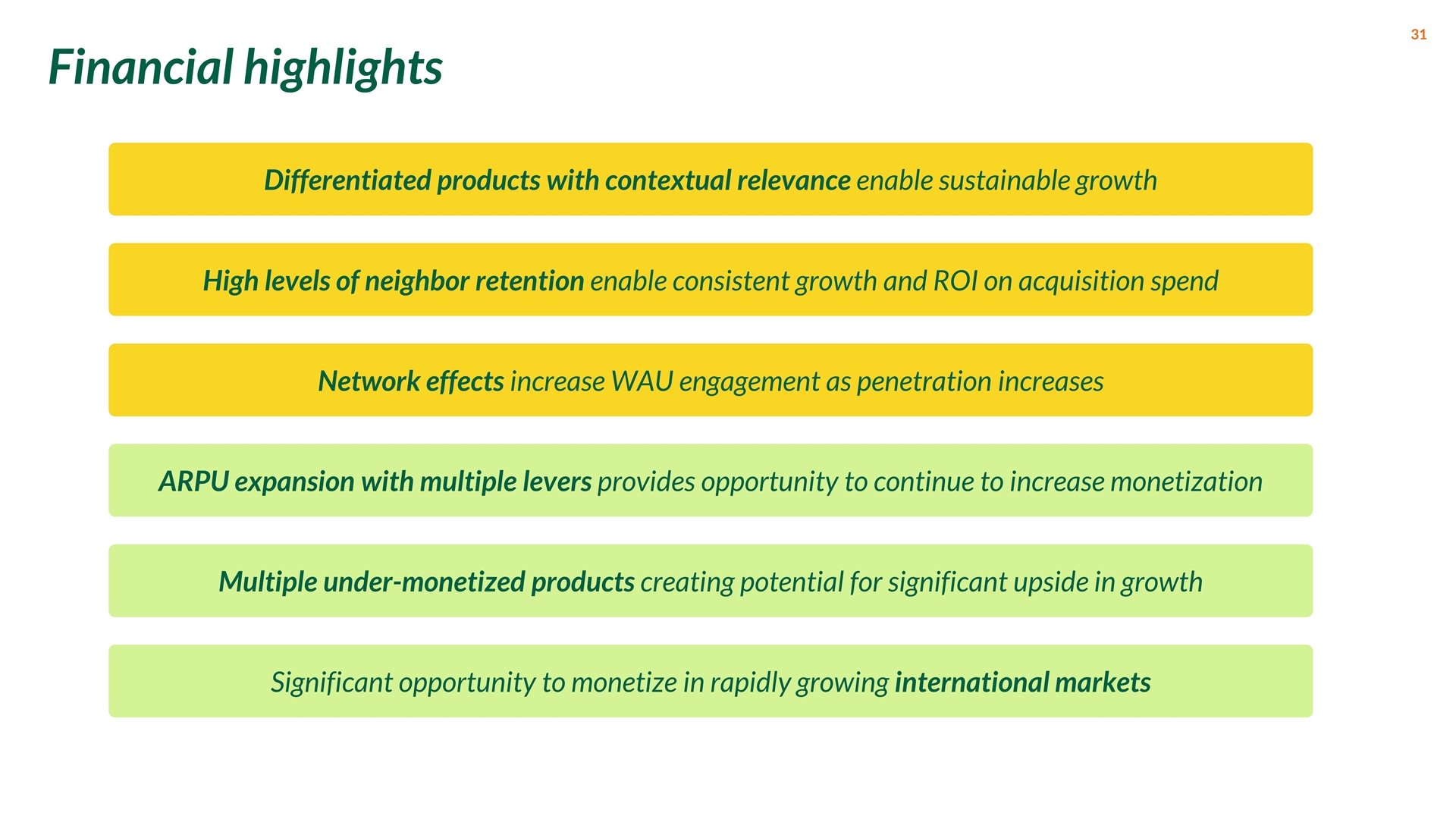

Financial highlights Differentiated products with contextual relevance enable sustainable growth High levels of neighbor retention enable consistent growth and ROI on acquisition spend ARPU expansion with multiple levers provides opportunity to continue to increase monetization Network effects increase WAU engagement as penetration increases Multiple under-monetized products creating potential for significant upside in growth Significant opportunity to monetize in rapidly growing international markets

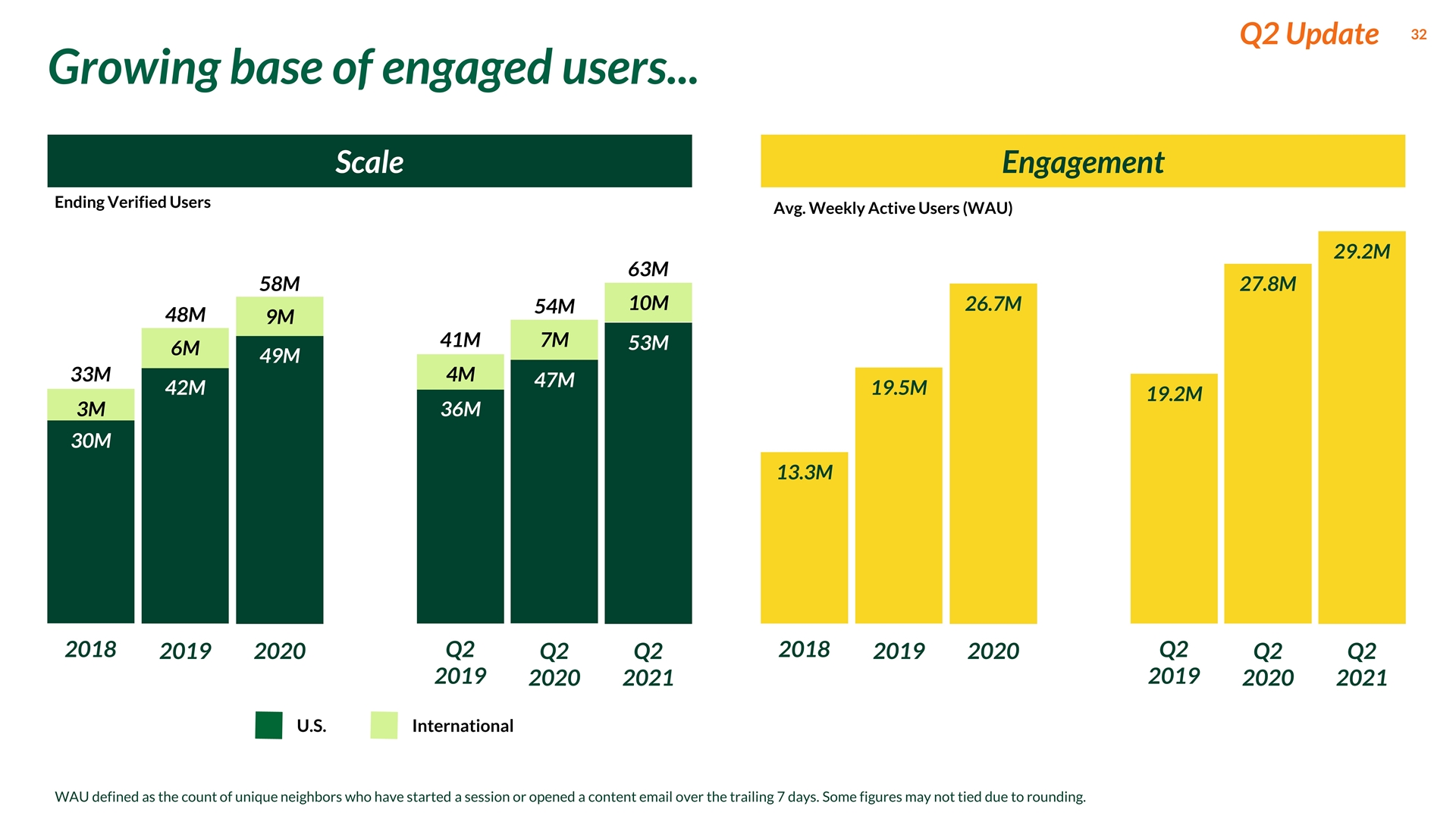

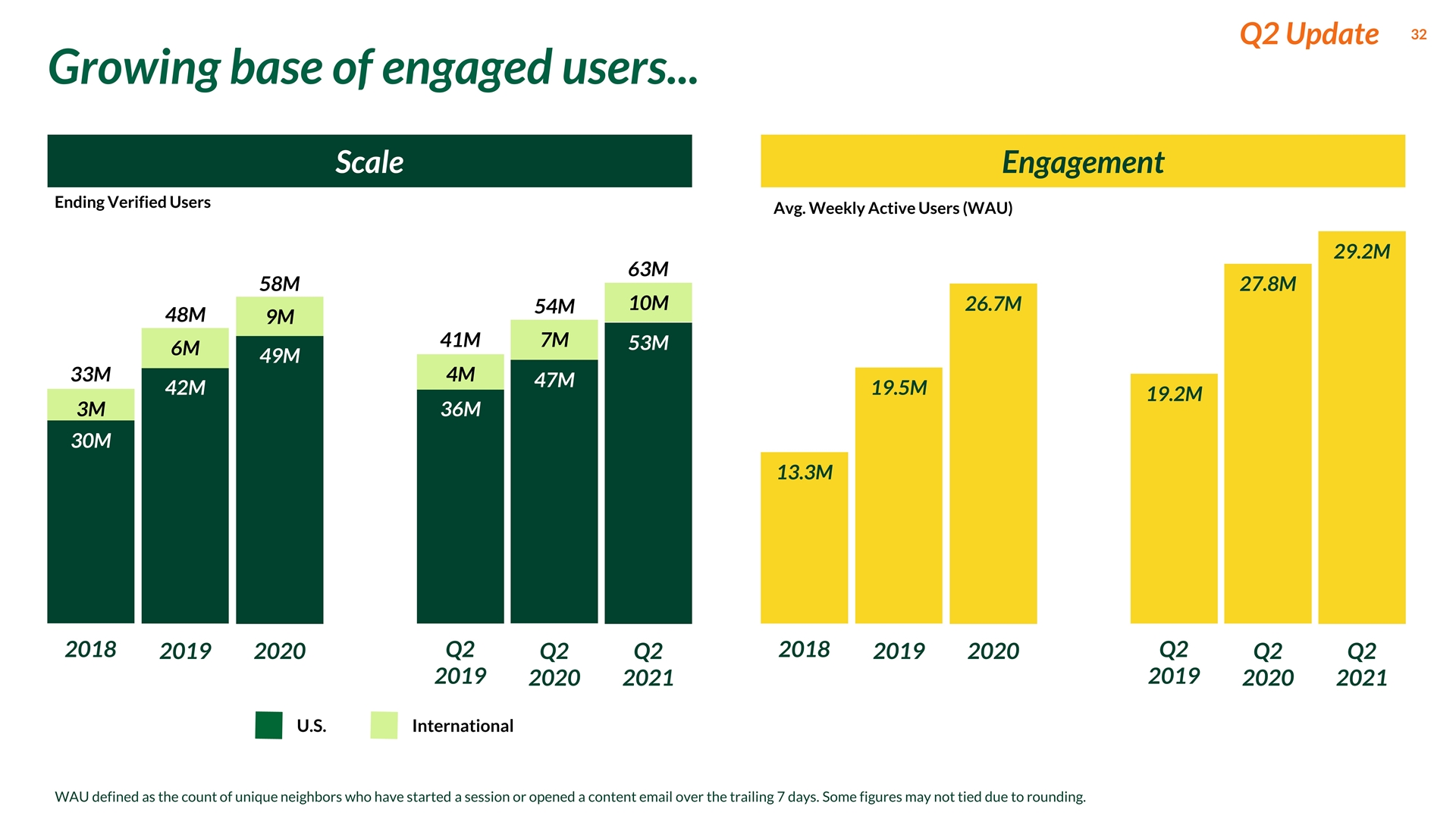

Growing base of engaged users... 32 WAU defined as the count of unique neighbors who have started a session or opened a content email over the trailing 7 days. Some figures may not tied due to rounding. Scale Engagement Avg. Weekly Active Users (WAU) Ending Verified Users U.S. International Q2 2020 47M 7M 54M Q2 2019 36M 4M 41M 53M 10M 63M Q2 2021 2019 42M 6M 48M 2018 30M 3M 33M 49M 9M 58M 2020 Q2 2020 27.8M Q2 2019 19.2M 29.2M Q2 2021 2019 19.5M 2018 13.3M 26.7M 2020 Q2 Update

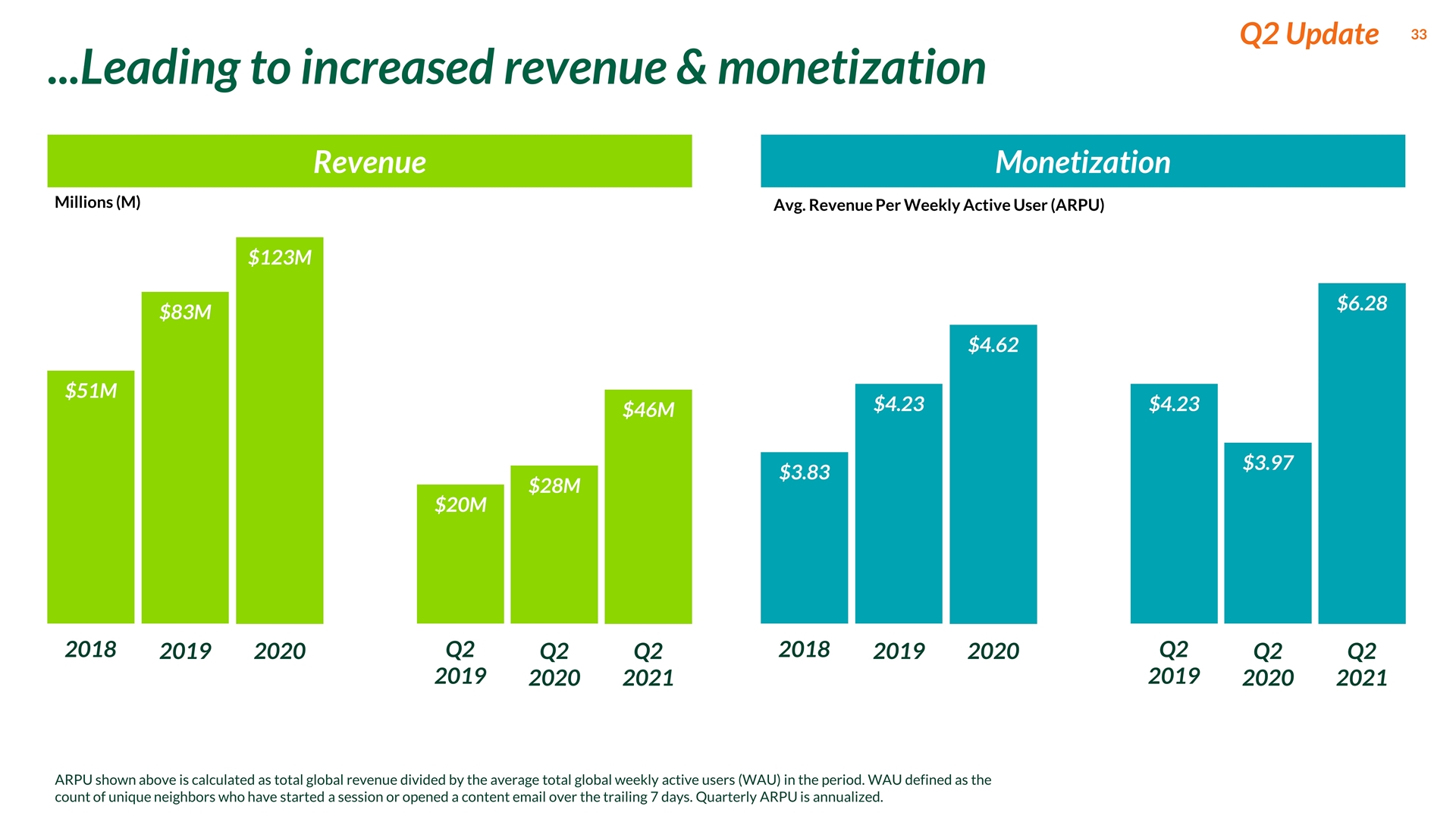

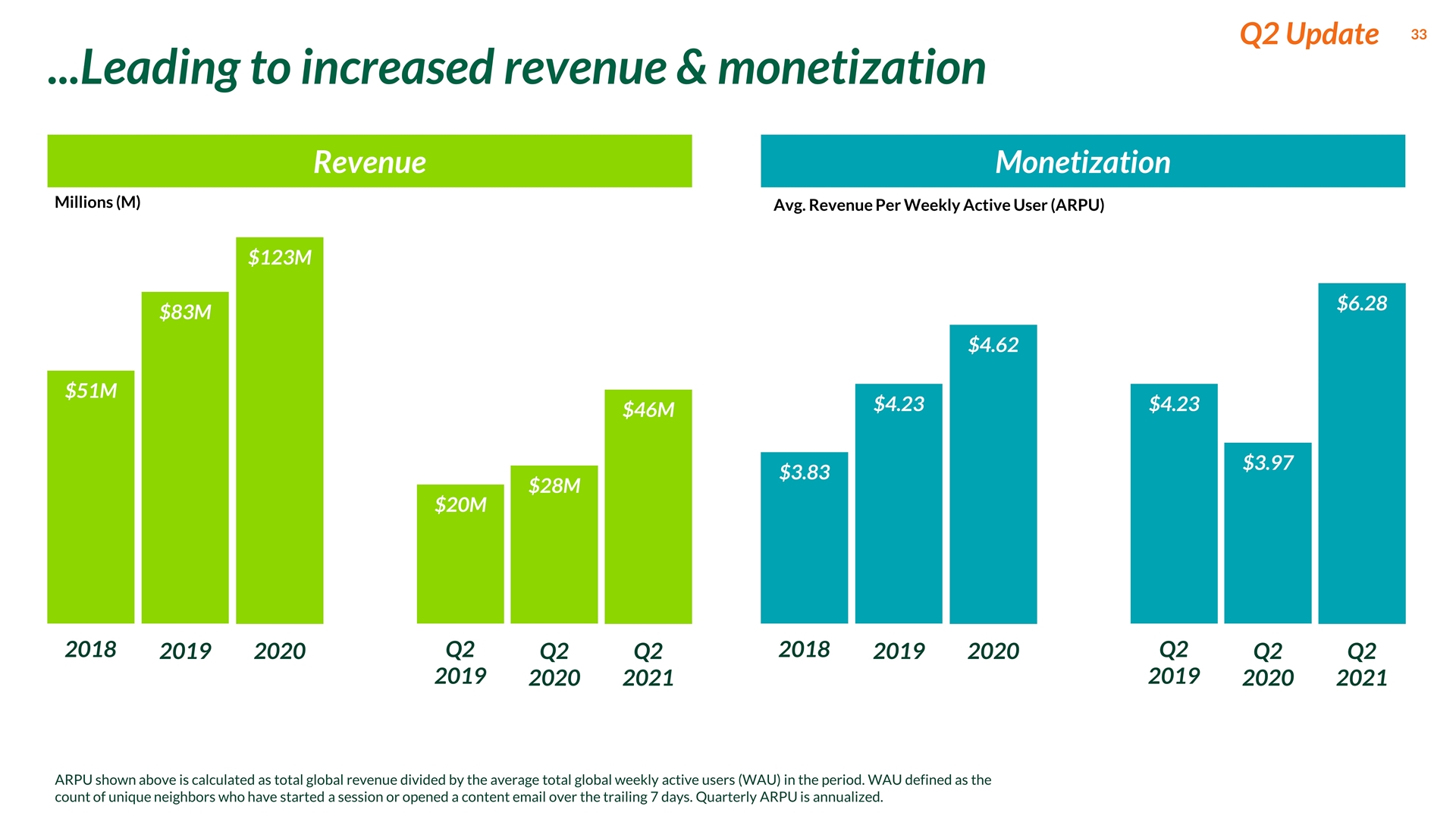

...Leading to increased revenue & monetization 33 Revenue Monetization Avg. Revenue Per Weekly Active User (ARPU) Millions (M) Q2 2020 $28M Q2 2019 $20M $46M Q2 2021 2019 $83M 2018 $51M $123M 2020 Q2 2020 $3.97 Q2 2019 $4.23 $6.28 Q2 2021 2019 $4.23 2018 $3.83 $4.62 2020 ARPU shown above is calculated as total global revenue divided by the average total global weekly active users (WAU) in the period. WAU defined as the count of unique neighbors who have started a session or opened a content email over the trailing 7 days. Quarterly ARPU is annualized. Q2 Update

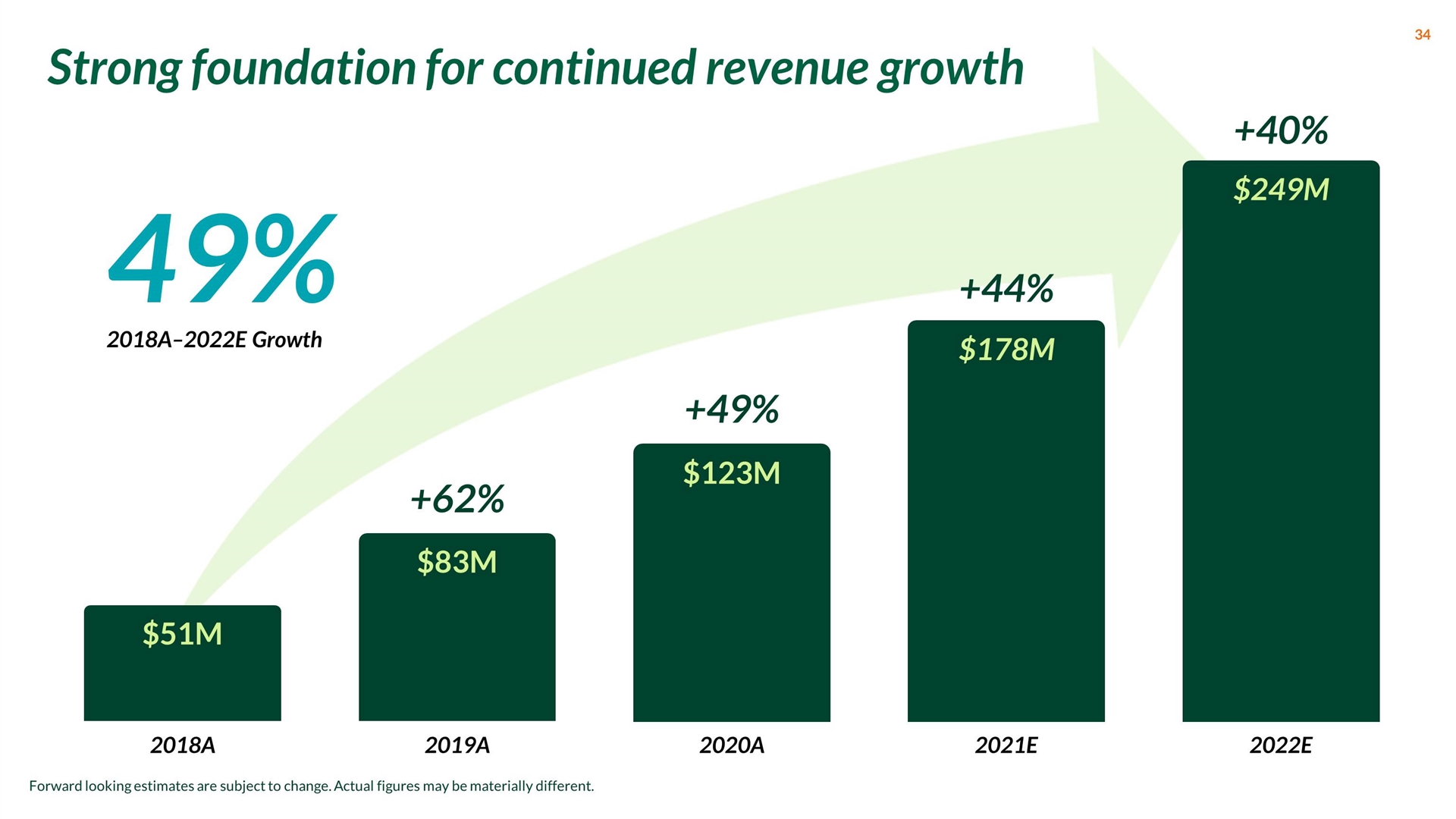

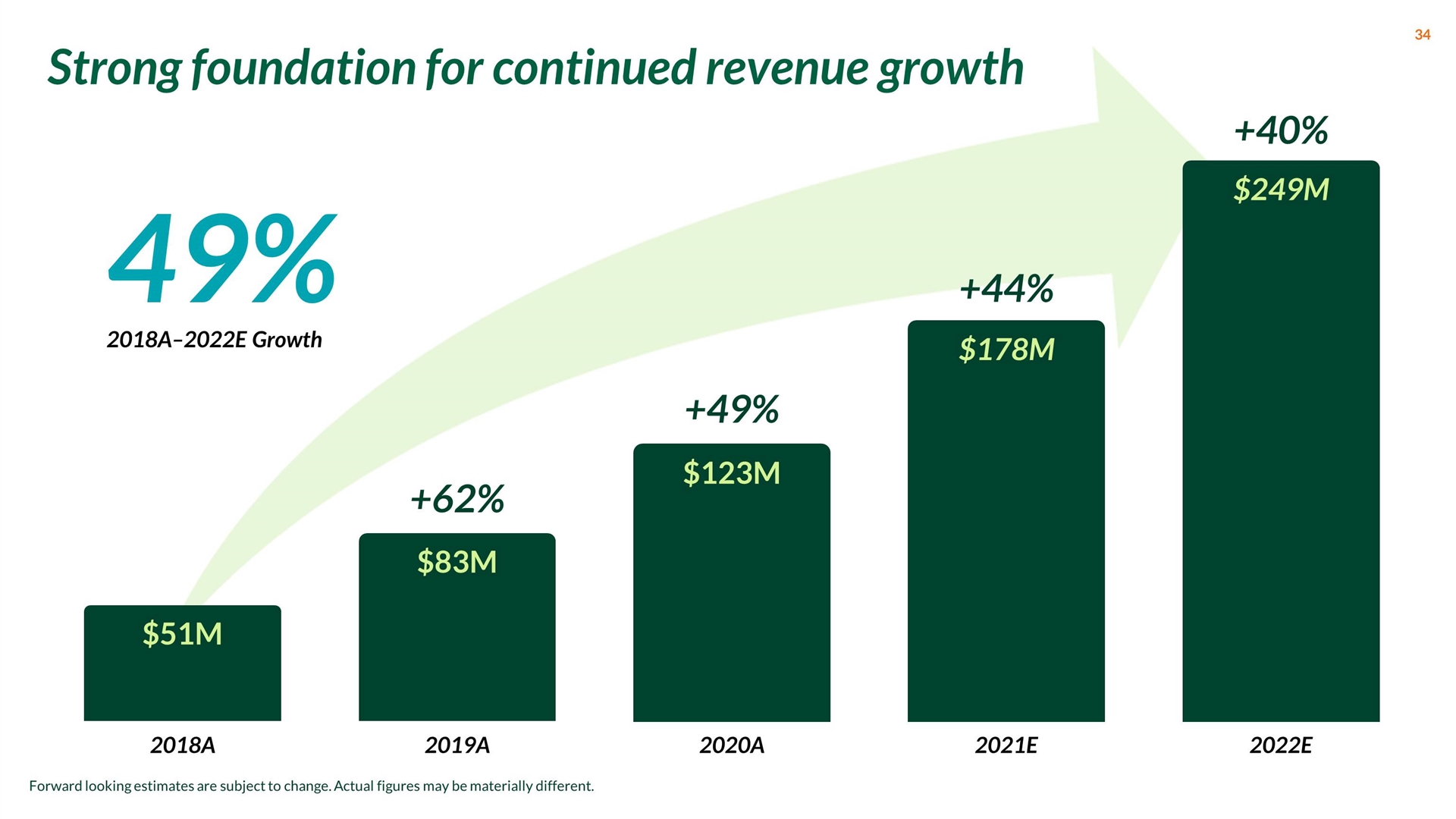

$51M $83M $123M $178M $249M Strong foundation for continued revenue growth 49% 2018A–2022E Growth 2018A 2019A 2020A 2021E 2022E +62% +49% +44% +40% 34 Forward looking estimates are subject to change. Actual figures may be materially different.

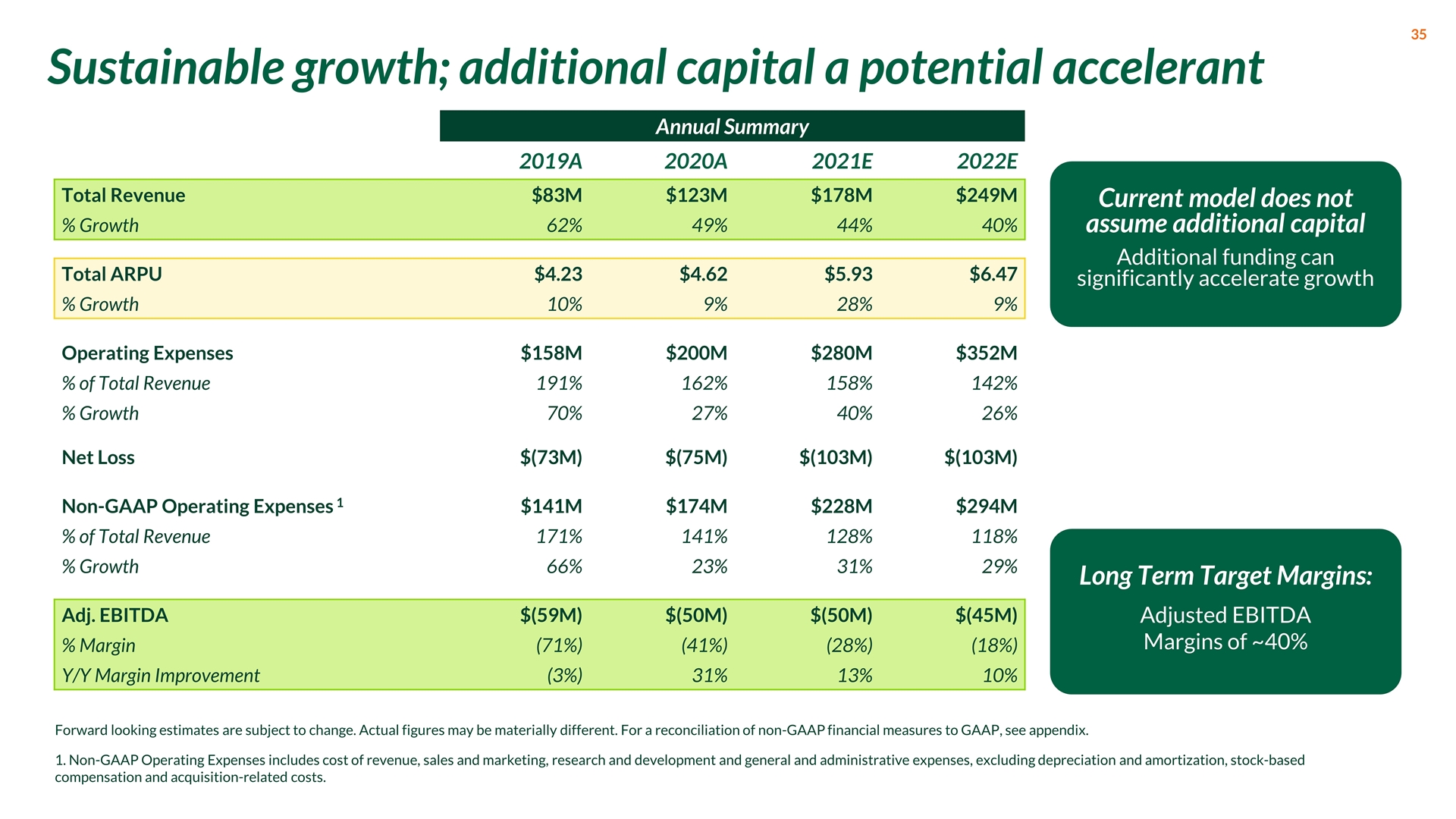

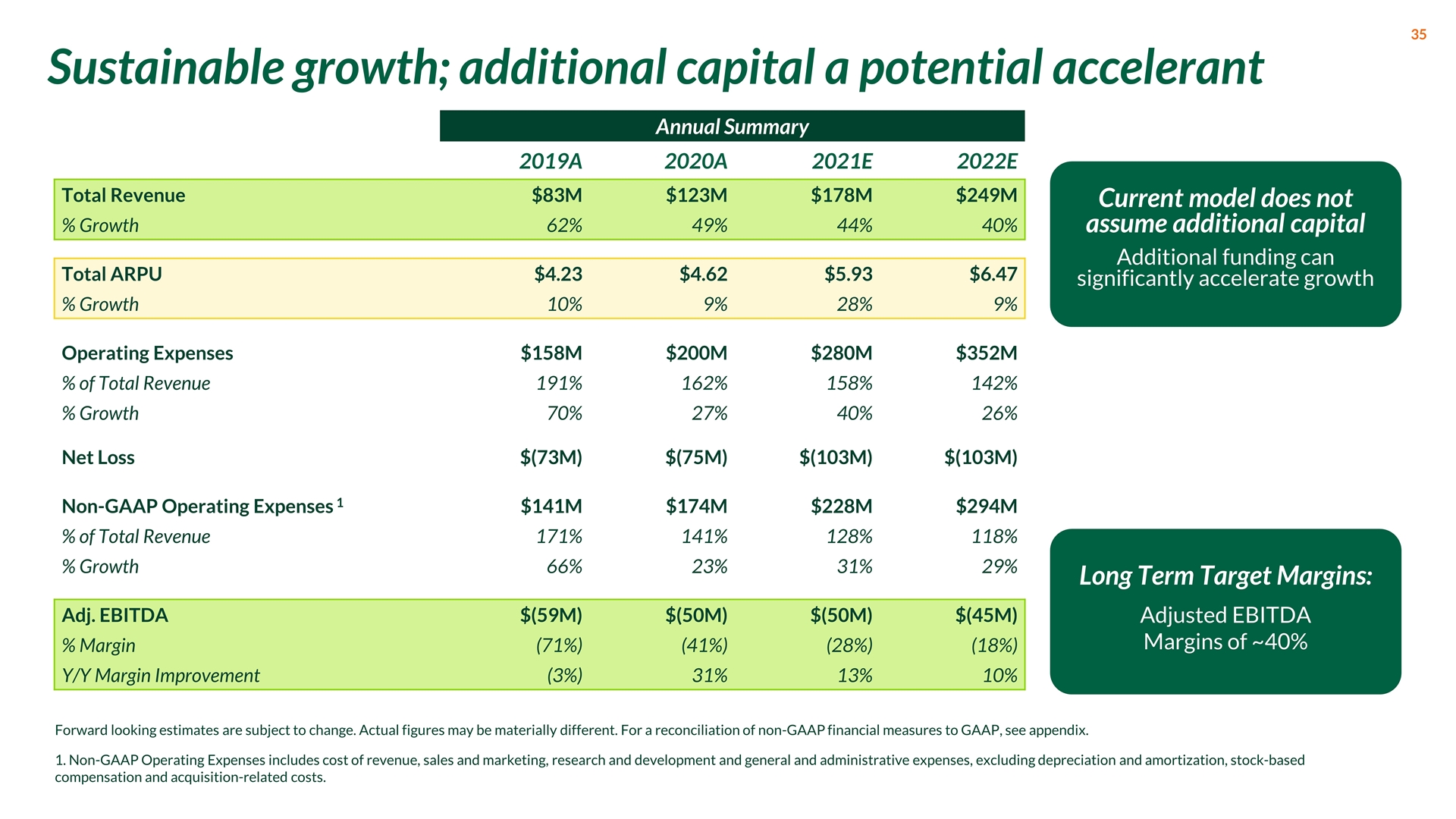

Sustainable growth; additional capital a potential accelerant 5 Forward looking estimates are subject to change. Actual figures may be materially different. For a reconciliation of non-GAAP financial measures to GAAP, see appendix. Current model does not assume additional capital Additional funding can significantly accelerate growth Long Term Target Margins: Adjusted EBITDA Margins of ~40% Annual Summary 2019A 2020A 2021E 2022E Total Revenue $83M $123M $178M $249M % Growth 62% 49% 44% 40% Total ARPU $4.23 $4.62 $5.93 $6.47 % Growth 10% 9% 28% 9% Operating Expenses $158M $200M $280M $352M % of Total Revenue 191% 162% 158% 142% % Growth 70% 27% 40% 26% Net Loss $(73M) $(75M) $(103M) $(103M) Non-GAAP Operating Expenses 1 $141M $174M $228M $294M % of Total Revenue 171% 141% 128% 118% % Growth 66% 23% 31% 29% Adj. EBITDA $(59M) $(50M) $(50M) $(45M) % Margin (71%) (41%) (28%) (18%) Y/Y Margin Improvement (3%) 31% 13% 10% 1. Non-GAAP Operating Expenses includes cost of revenue, sales and marketing, research and development and general and administrative expenses, excluding depreciation and amortization, stock-based compensation and acquisition-related costs.

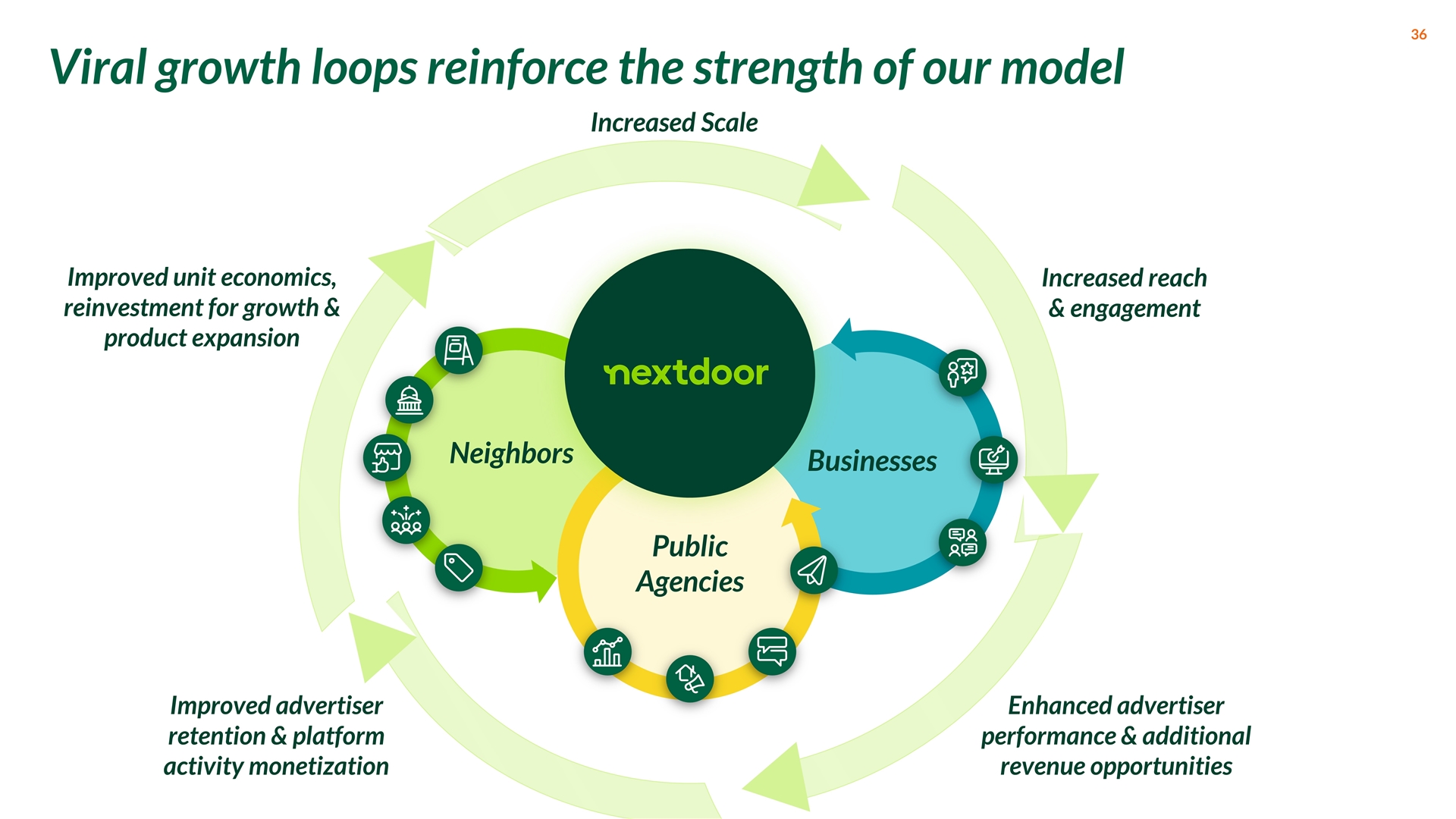

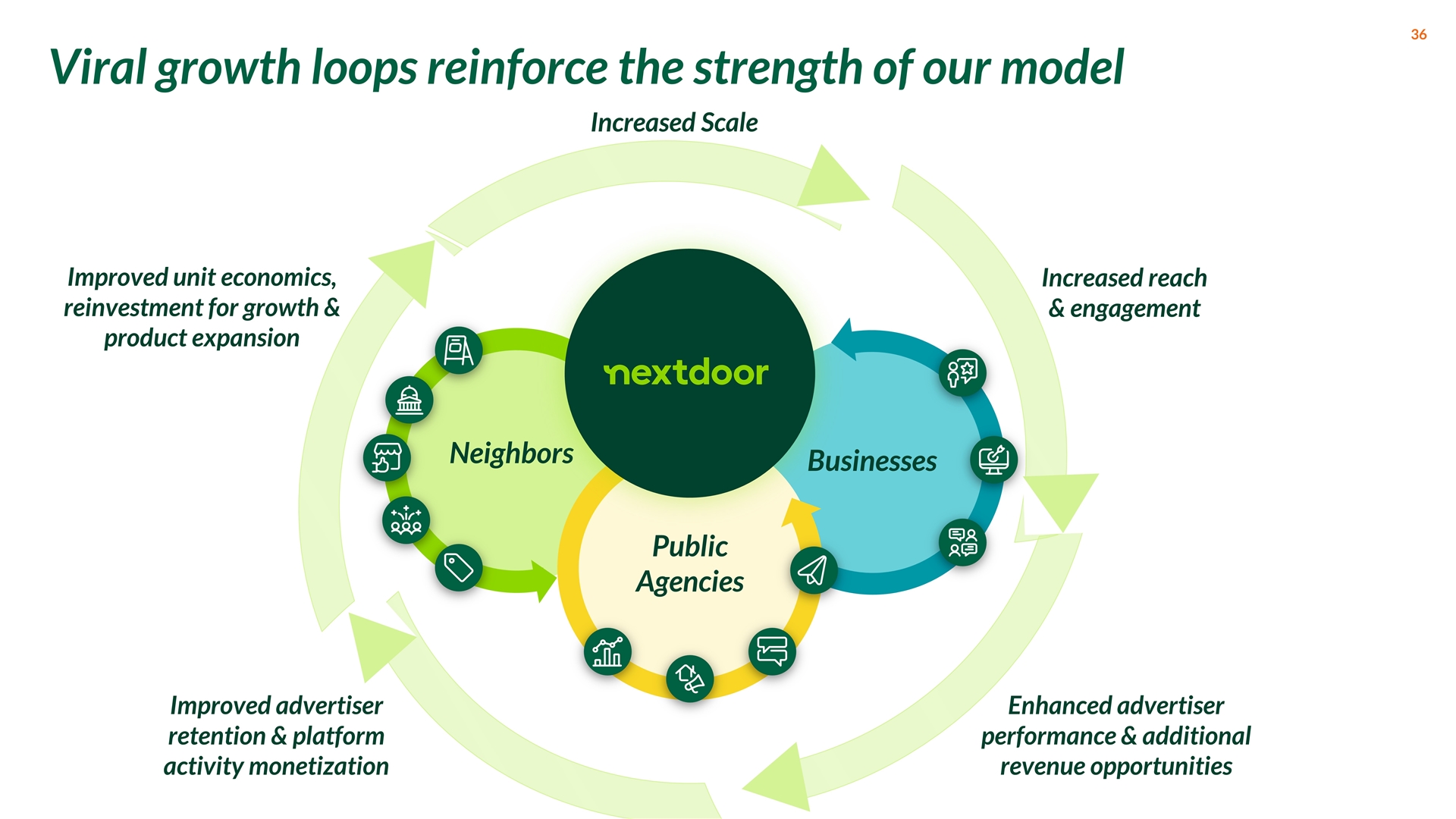

36 Increased reach & engagement Increased Scale Enhanced advertiser performance & additional revenue opportunities Improved advertiser retention & platform activity monetization Improved unit economics, reinvestment for growth & product expansion Neighbors Businesses Public Agencies Viral growth loops reinforce the strength of our model

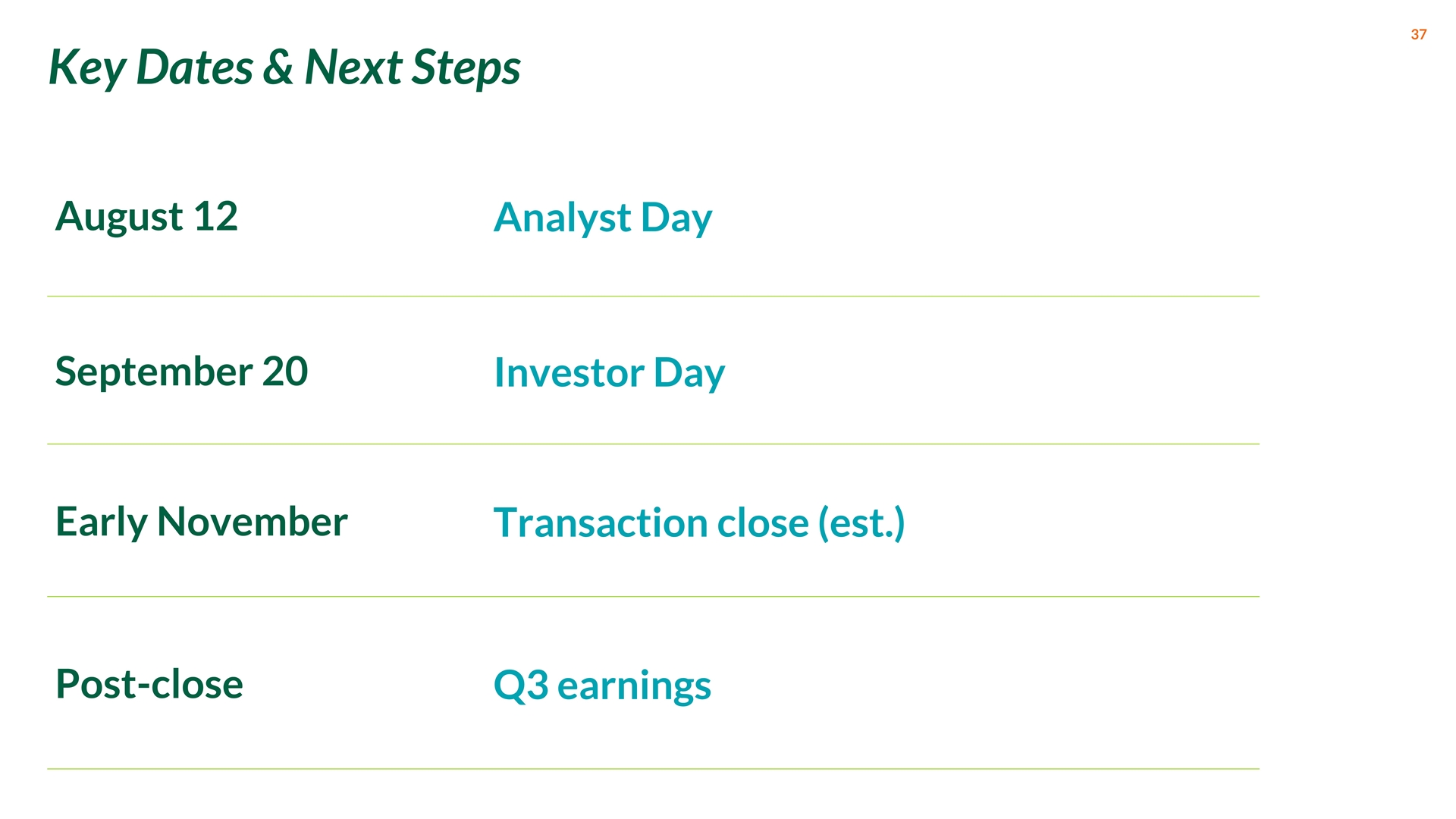

37 Key Dates & Next Steps August 12 Analyst Day September 20 Investor Day Early November Transaction close (est.) Post-close Q3 earnings

Appendix

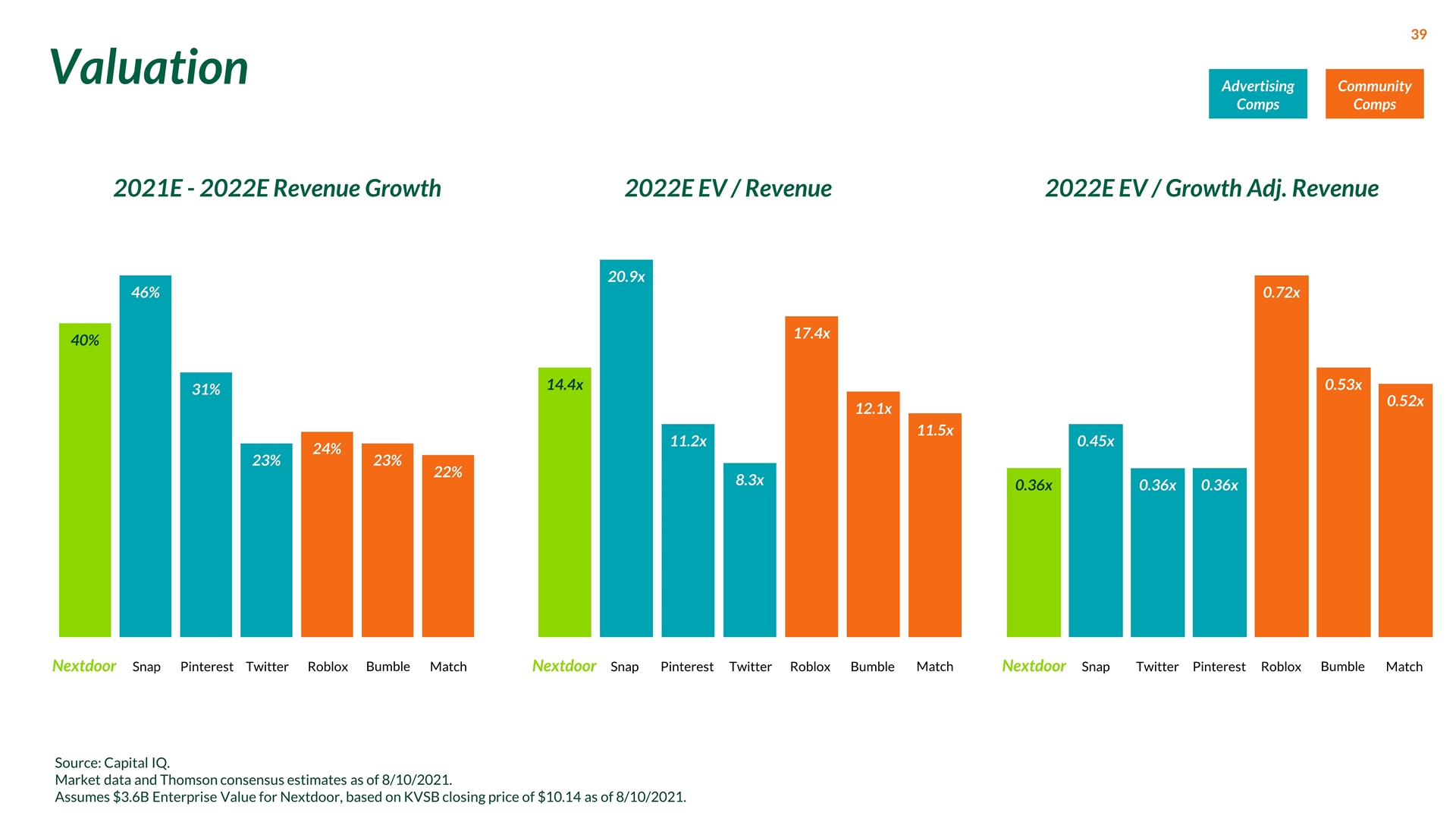

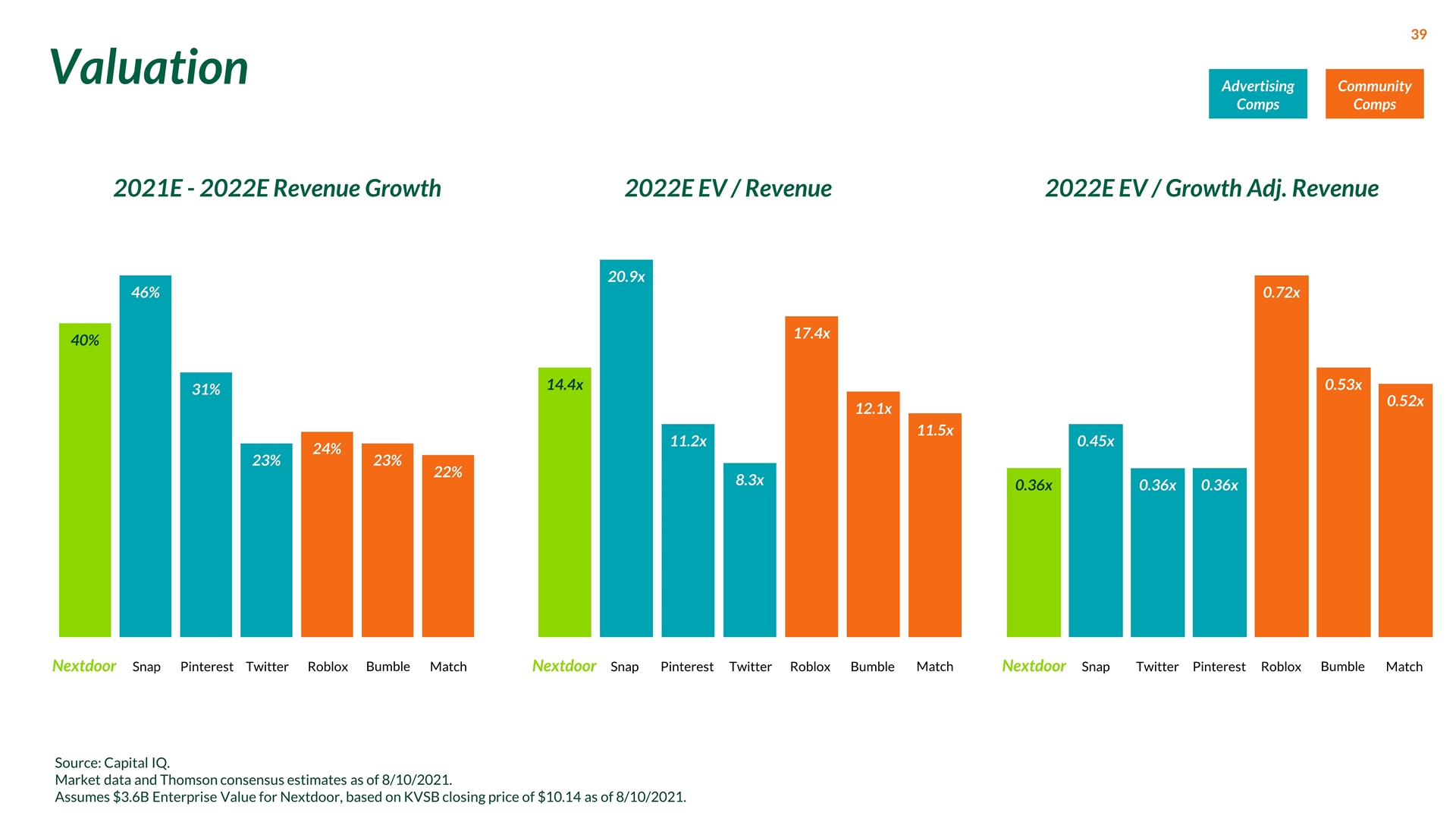

Valuation 2021E - 2022E Revenue Growth 2022E EV / Revenue 2022E EV / Growth Adj. Revenue 40% 46% 31% 24% 23% 22% Nextdoor Snap Pinterest Match Roblox Bumble Nextdoor Bumble Pinterest Match Advertising Comps Community Comps 23% Twitter 14.4x 20.9x 11.2x 17.4x 12.1x 11.5x 8.3x Snap Twitter Roblox 0.36x 0.45x 0.36x 0.72x 0.53x 0.52x Nextdoor Snap Twitter Match Roblox Bumble 0.36x Pinterest Source: Capital IQ. Market data and Thomson consensus estimates as of 8/10/2021. Assumes $3.6B Enterprise Value for Nextdoor, based on KVSB closing price of $10.14 as of 8/10/2021. 39

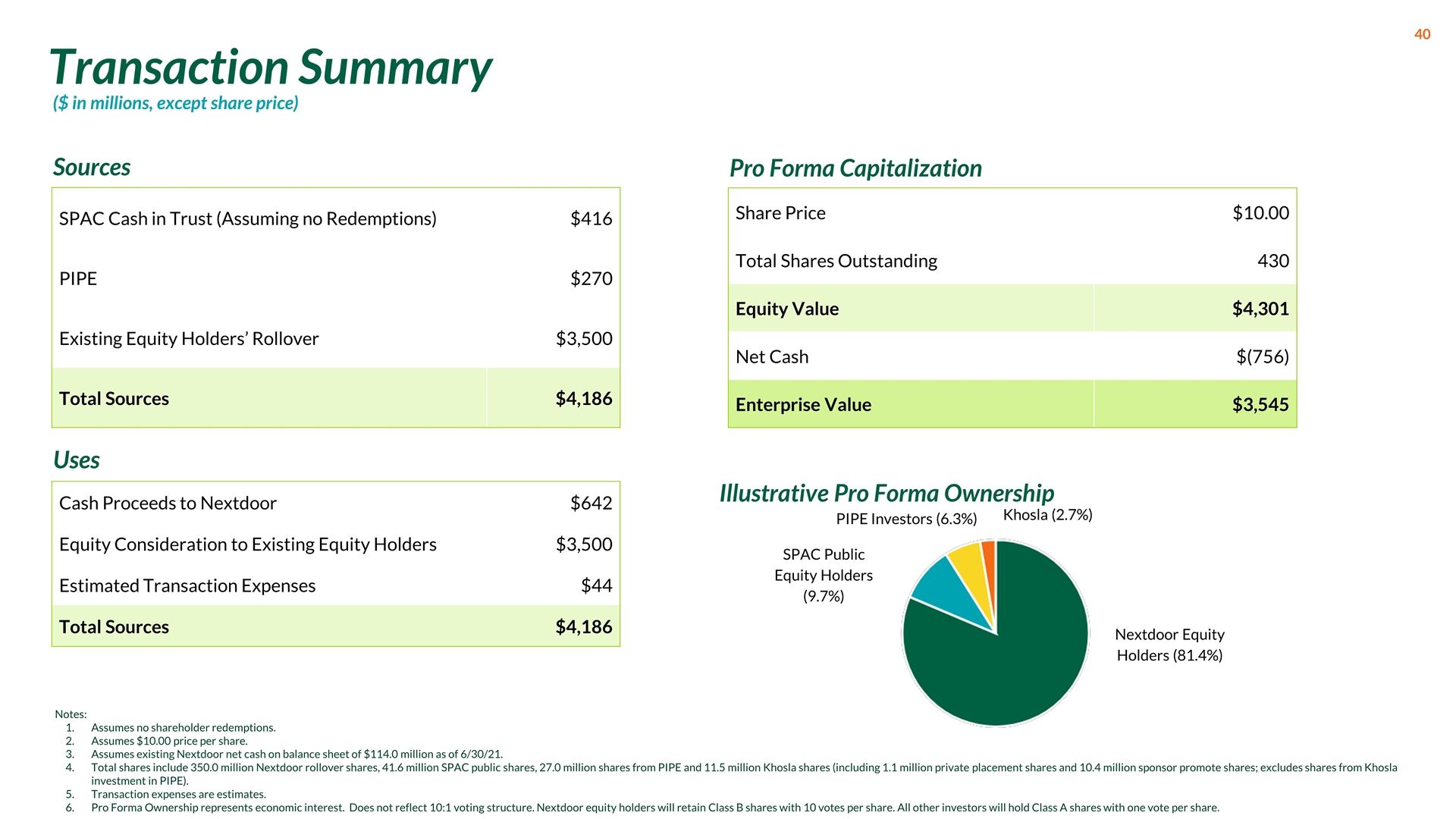

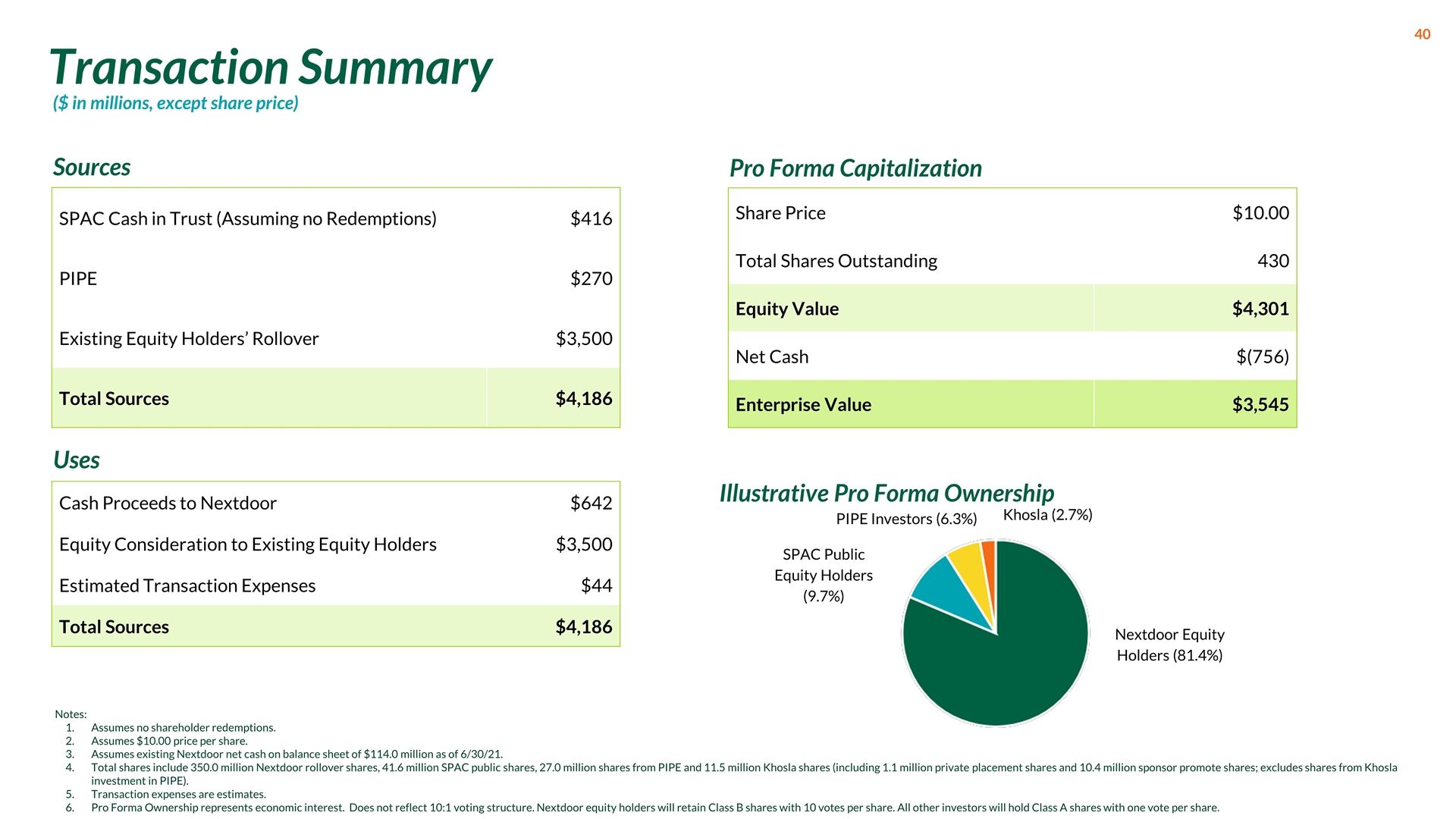

Transaction Summary SPAC Cash in Trust (Assuming no Redemptions) $416 PIPE $270 Existing Equity Holders’ Rollover $3,500 Total Sources $4,186 Cash Proceeds to Nextdoor $642 Equity Consideration to Existing Equity Holders $3,500 Estimated Transaction Expenses $44 Total Sources $4,186 Share Price $10.00 Total Shares Outstanding 430 Equity Value $4,301 Net Cash $(756) Enterprise Value $3,545 ($ in millions, except share price) Sources Uses Pro Forma Capitalization Illustrative Pro Forma Ownership Nextdoor Equity Holders (81.4%) SPAC Public Equity Holders (9.7%) PIPE Investors (6.3%) Khosla (2.7%) Notes: Assumes no shareholder redemptions. Assumes $10.00 price per share. Assumes existing Nextdoor net cash on balance sheet of $114.0 million as of 6/30/21. Total shares include 350.0 million Nextdoor rollover shares, 41.6 million SPAC public shares, 27.0 million shares from PIPE and 11.5 million Khosla shares (including 1.1 million private placement shares and 10.4 million sponsor promote shares; excludes shares from Khosla investment in PIPE). Transaction expenses are estimates. Pro Forma Ownership represents economic interest. Does not reflect 10:1 voting structure. Nextdoor equity holders will retain Class B shares with 10 votes per share. All other investors will hold Class A shares with one vote per share. 40

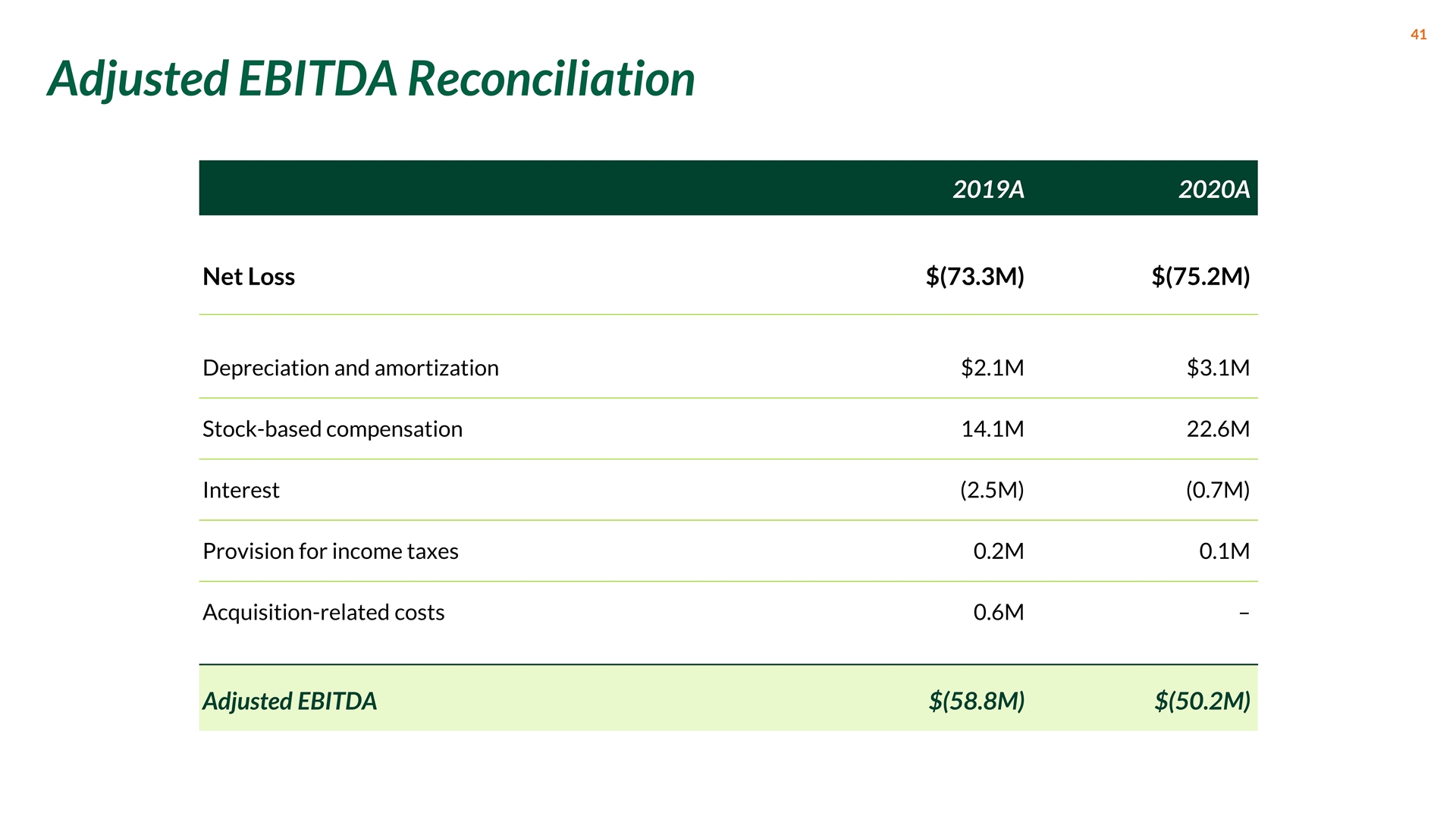

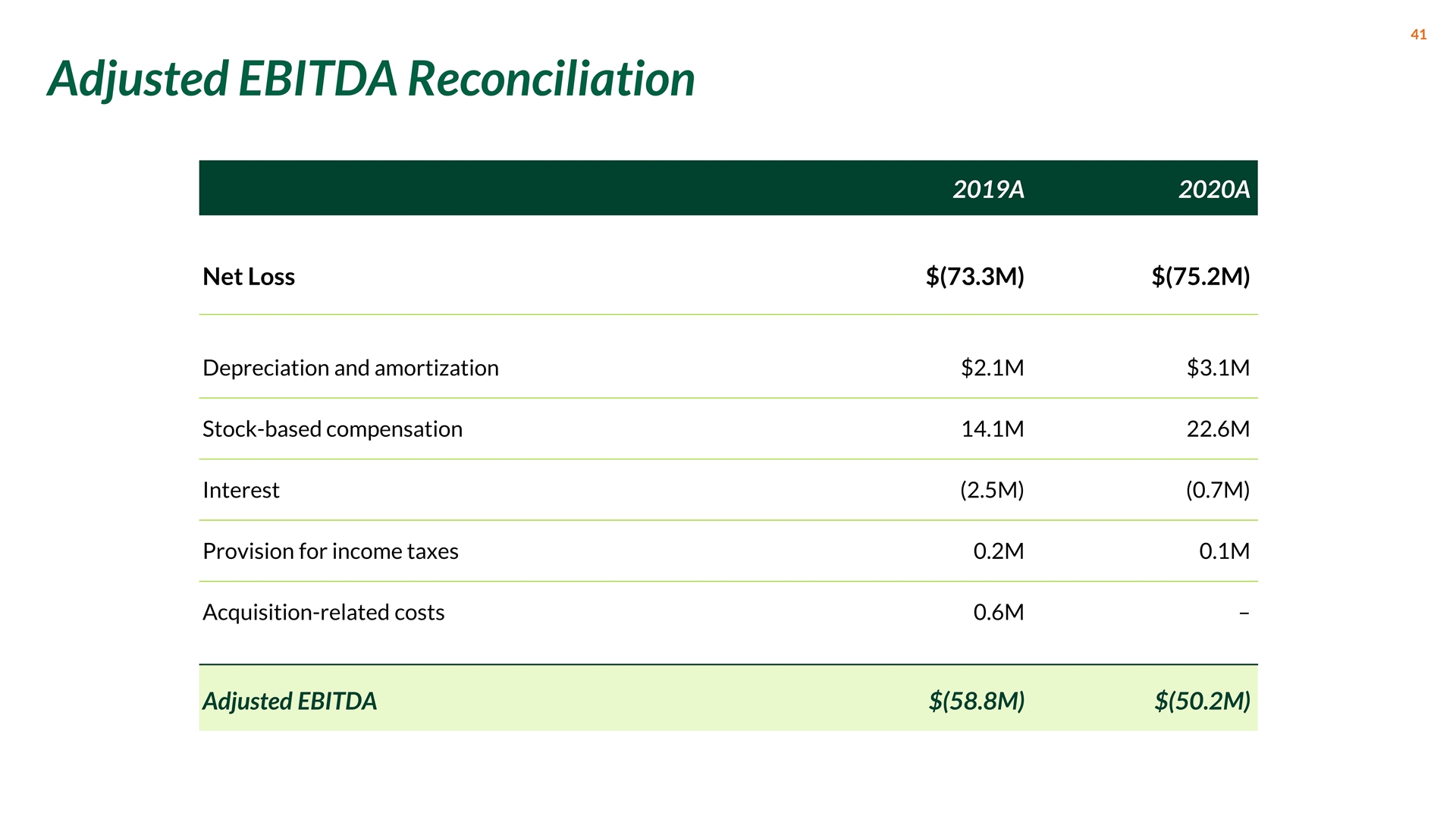

Adjusted EBITDA Reconciliation 41 2019A 2020A Net Loss $(73.3M) $(75.2M) Depreciation and amortization $2.1M $3.1M Stock-based compensation 14.1M 22.6M Interest (2.5M) (0.7M) Provision for income taxes 0.2M 0.1M Acquisition-related costs 0.6M – Adjusted EBITDA $(58.8M) $(50.2M)

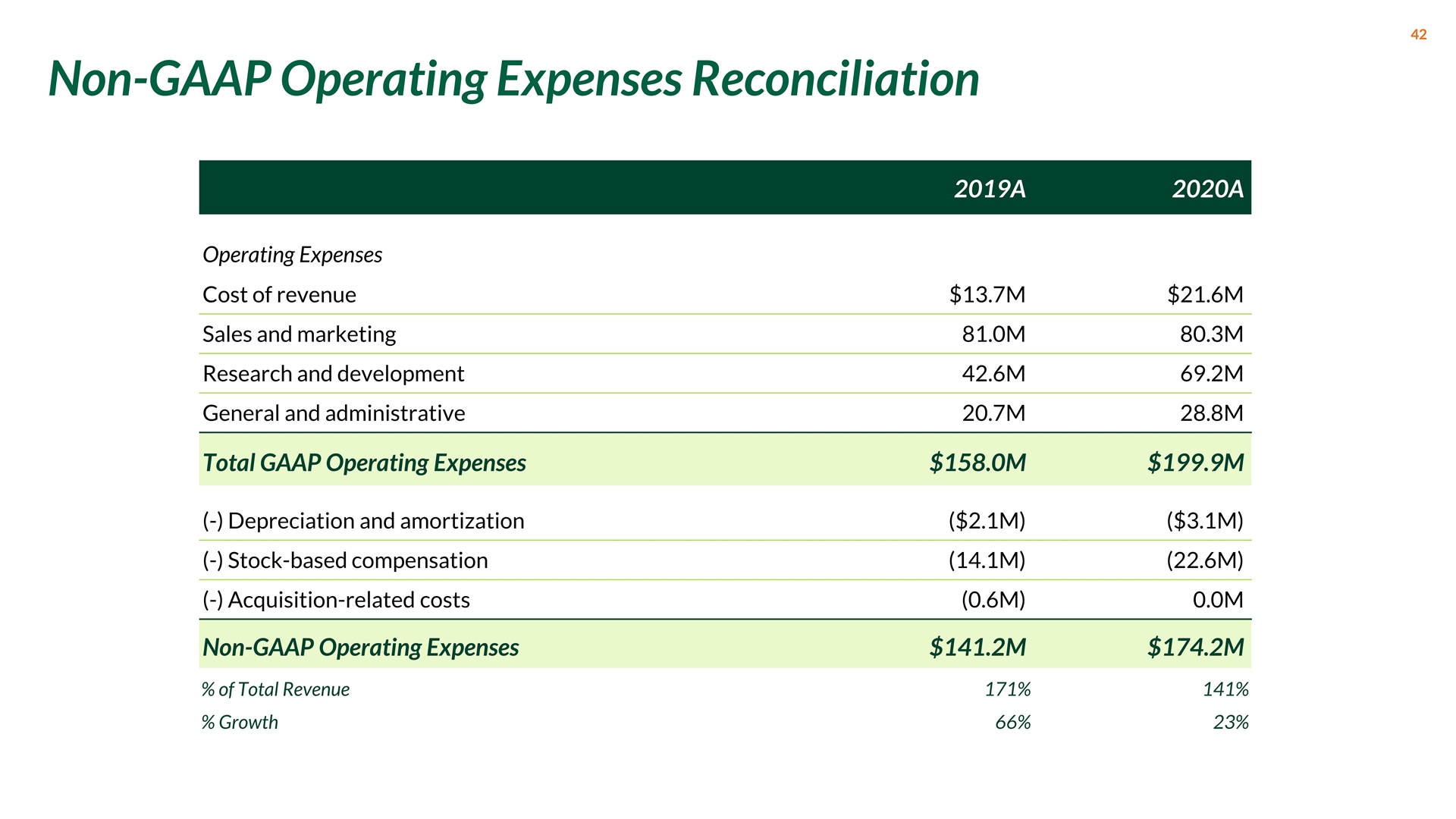

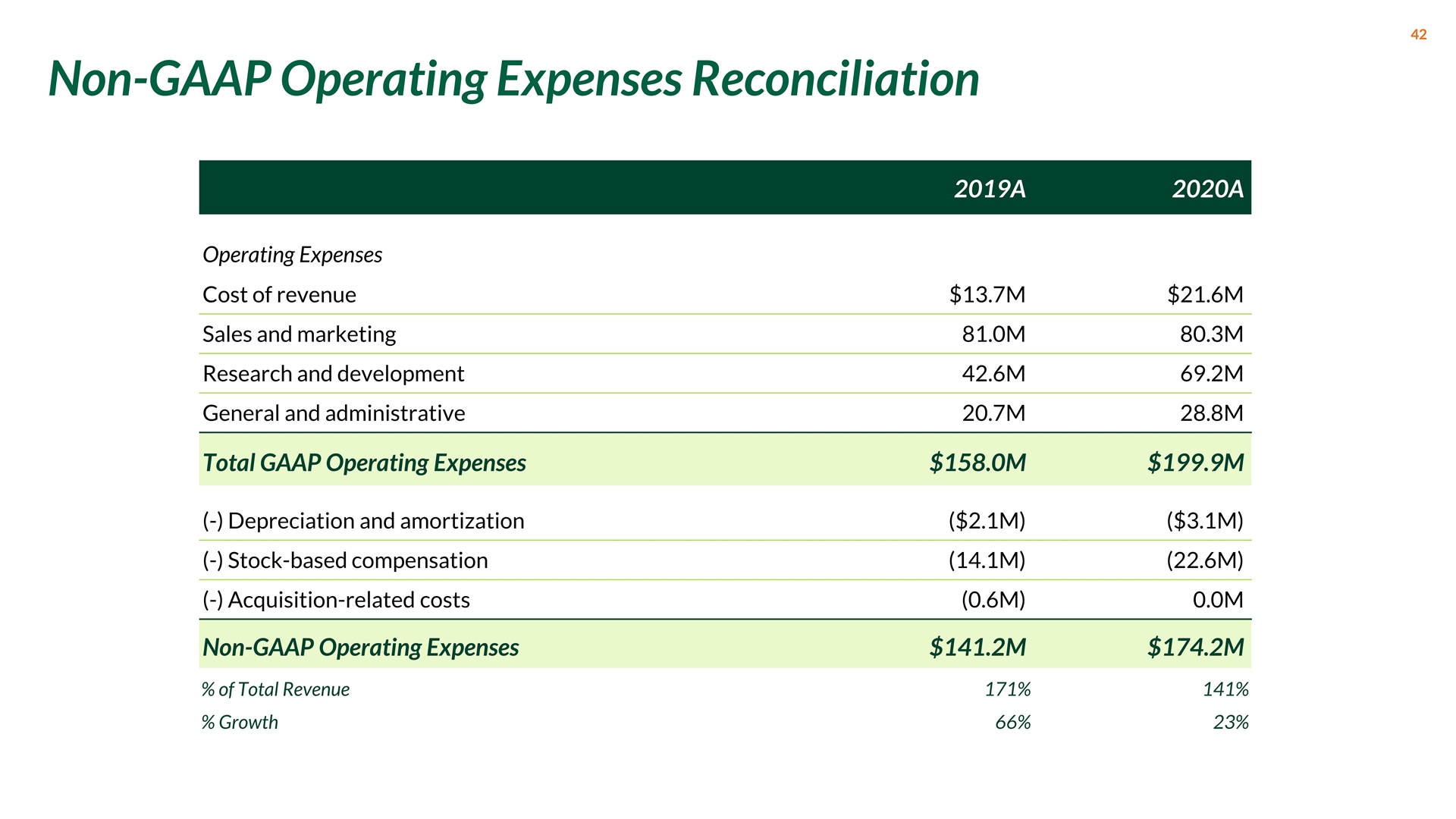

42 Non-GAAP Operating Expenses Reconciliation 2019A 2020A Operating Expenses Cost of revenue $13.7M $21.6M Sales and marketing 81.0M 80.3M Research and development 42.6M 69.2M General and administrative 20.7M 28.8M Total GAAP Operating Expenses $158.0M $199.9M (-) Depreciation and amortization ($2.1M) ($3.1M) (-) Stock-based compensation (14.1M) (22.6M) (-) Acquisition-related costs (0.6M) 0.0M Non-GAAP Operating Expenses $141.2M $174.2M % of Total Revenue 171% 141% % Growth 66% 23%

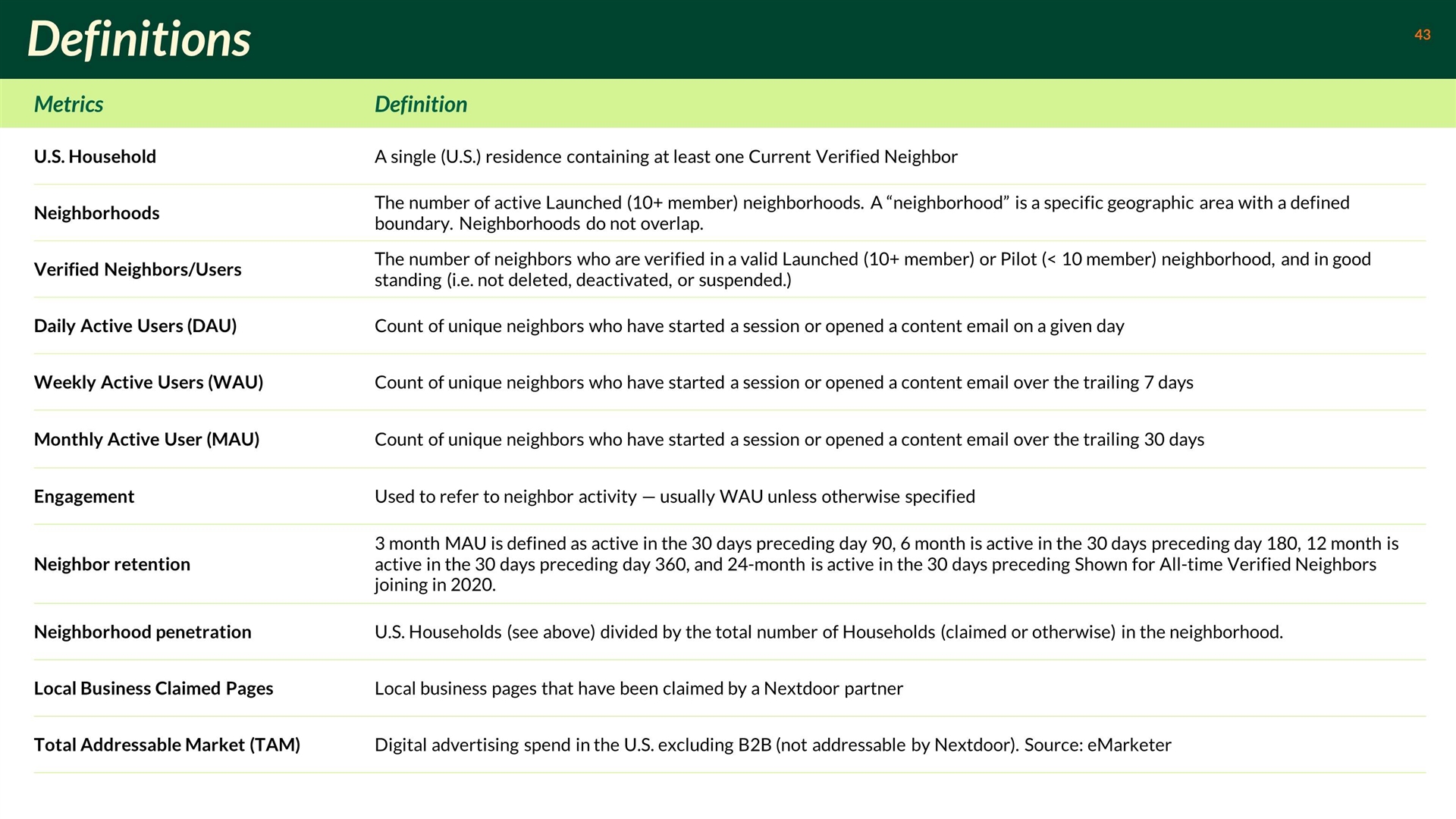

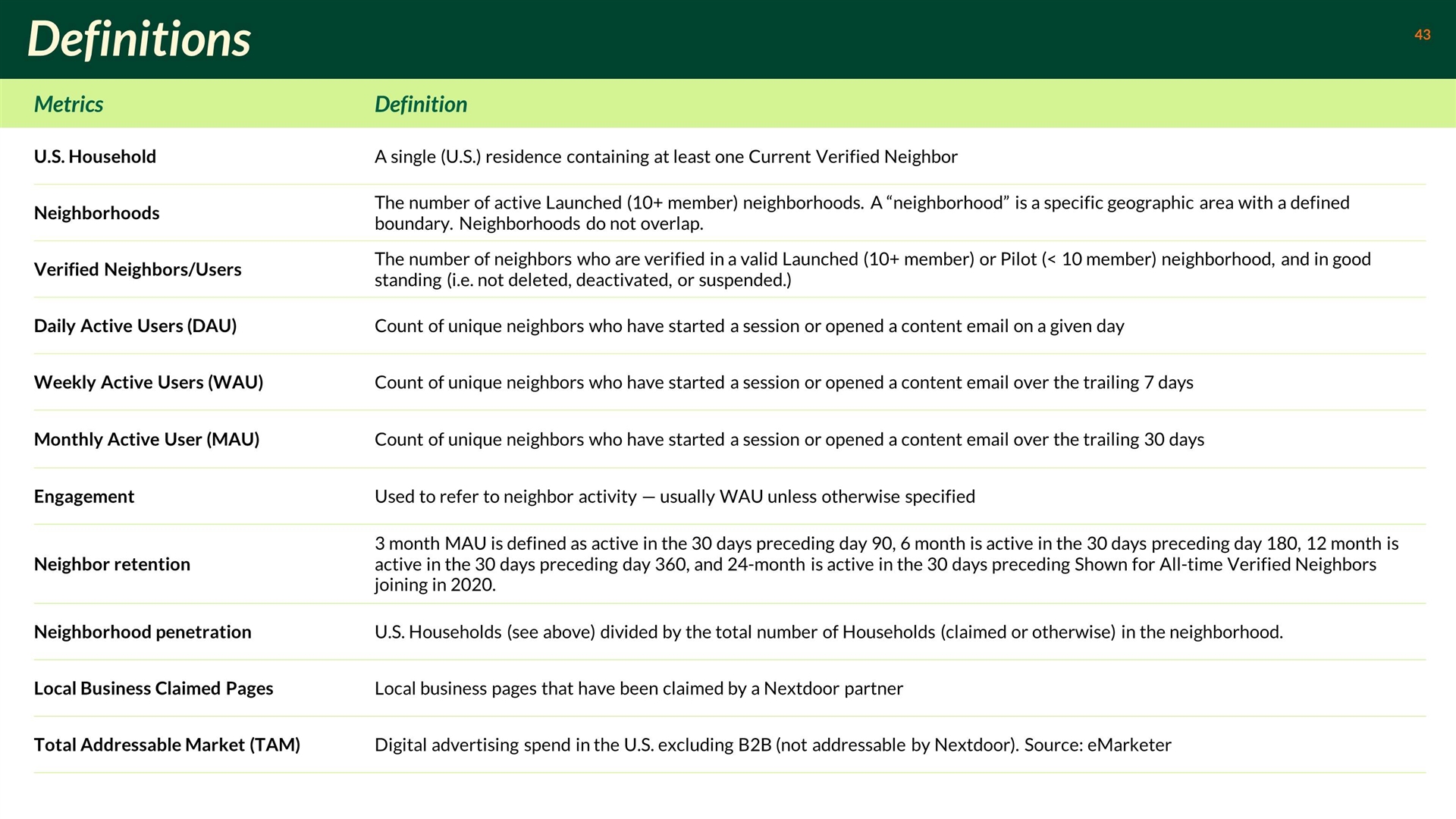

Definitions 43 Metrics Definition U.S. Household A single (U.S.) residence containing at least one Current Verified Neighbor Neighborhoods The number of active Launched (10+ member) neighborhoods. A “neighborhood” is a specific geographic area with a defined boundary. Neighborhoods do not overlap. Verified Neighbors/Users The number of neighbors who are verified in a valid Launched (10+ member) or Pilot (< 10 member) neighborhood, and in good standing (i.e. not deleted, deactivated, or suspended.) Daily Active Users (DAU) Count of unique neighbors who have started a session or opened a content email on a given day Weekly Active Users (WAU) Count of unique neighbors who have started a session or opened a content email over the trailing 7 days Monthly Active User (MAU) Count of unique neighbors who have started a session or opened a content email over the trailing 30 days Engagement Used to refer to neighbor activity — usually WAU unless otherwise specified Neighbor retention 3 month MAU is defined as active in the 30 days preceding day 90, 6 month is active in the 30 days preceding day 180, 12 month is active in the 30 days preceding day 360, and 24-month is active in the 30 days preceding Shown for All-time Verified Neighbors joining in 2020. Neighborhood penetration U.S. Households (see above) divided by the total number of Households (claimed or otherwise) in the neighborhood. Local Business Claimed Pages Local business pages that have been claimed by a Nextdoor partner Total Addressable Market (TAM) Digital advertising spend in the U.S. excluding B2B (not addressable by Nextdoor). Source: eMarketer