UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 5, 2021

Nextdoor Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40246 | | 86-1776836 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

| 420 Taylor Street | | |

San Francisco, | California | | 94102 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (415) 344-0333

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A common stock, par value $0.0001 per share | | KIND | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Introductory Note

Terms used in this Current Report on Form 8-K (this “Report”) but not defined herein, or for which definitions are not otherwise incorporated by reference herein, shall have the meaning given to such terms in the prospectus and definitive proxy statement dated October 21, 2021 (the “Proxy Statement/Prospectus”), filed by the Company with the Securities and Exchange Commission (the “SEC”), in the section entitled “Selected Definitions” beginning on page v thereof, and such definitions are incorporated herein by reference.

This Report incorporates by reference certain information from reports and other documents that were previously filed with the SEC, including certain information from the Proxy Statement/Prospectus. To the extent there is a conflict between the information contained in this Report and the information contained in such prior reports and other documents, the information in this Report controls.

Overview

On November 5, 2021 (the “Closing Date”), Nextdoor, Inc., a Delaware corporation (“Nextdoor”), Khosla Ventures Acquisition Co. II, a Delaware corporation (“KVSB”), and Lorelei Merger Sub Inc., a Delaware corporation and a direct, wholly owned subsidiary of KVSB (“Merger Sub”), consummated the closing of the transactions contemplated by the Agreement and Plan of Merger, dated July 6, 2021, as amended on September 30, 2021, by and among KVSB, Nextdoor and Merger Sub (the “Merger Agreement”), following approval at a special meeting of the stockholders of KVSB held on November 2, 2021 (the “Special Meeting”).

Pursuant to the terms of the Merger Agreement, a merger of Nextdoor and KVSB was effected by the merger of Merger Sub with and into Nextdoor, with Nextdoor surviving the merger as a wholly owned subsidiary of KVSB (the “Merger,” and, collectively with the other transactions described in the Merger Agreement, the “Business Combination” or “Transactions”). Following the consummation of the Merger on the Closing Date, KVSB changed its name from Khosla Ventures Acquisition Co. II to Nextdoor Holdings, Inc. (“New Nextdoor” or the “Company”).

In connection with the Special Meeting and the Business Combination, the holders of 1,222,040 shares of KVSB Class A common stock, par value $0.0001 per share (“KVSB Class A common stock”), or approximately 3% of the shares with redemption rights, exercised their right to redeem their shares for cash at a redemption price of approximately $10.00 per share, for an aggregate redemption amount of approximately $12.2 million.

Conversion and Exchange of Equity in the Business Combination

After the Proxy Statement/Prospectus was declared effective under the Securities Act of 1933, as amended (the “Securities Act”), Nextdoor obtained and delivered to KVSB a written consent approving and adopting the Merger Agreement and the ancillary documents thereto to which Nextdoor was a party or would be a party and the transactions contemplated therein (including the Merger) that was duly executed by Nextdoor Stockholders that held at least the requisite number of issued and outstanding shares of Nextdoor common stock required to approve and adopt such matters in accordance with the Delaware General Corporation Law (the “DGCL”), Nextdoor’s governing documents and Nextdoor’s stockholders agreements (the “Nextdoor Stockholder Written Consent”). Promptly following the receipt of the Nextdoor Stockholder Written Consent, Nextdoor prepared and delivered to each Nextdoor Stockholder who did not execute and deliver the Nextdoor Stockholder Written Consent an information statement, in the form and substance required under the DGCL in connection with the Merger and otherwise reasonably satisfactory to KVSB.

In connection with the Merger, KVSB amended and restated its certificate of incorporation to implement a new dual-class capital structure with: (i) shares of the Company’s Class A common stock, par value $0.0001 per share (“New Nextdoor Class A common stock”) carrying voting rights in the form of one vote per share, and (ii) shares of the Company’s Class B common stock, par value $0.0001 per share (“New Nextdoor Class B common stock” and, together with the New Nextdoor Class A common stock, the “common stock”) carrying voting rights in the form of ten votes per share. Pursuant to the amended and restated certificate of incorporation, the Nextdoor Stockholders have the right to convert their New Nextdoor Class B common stock received (or to be received, following exercise

of the applicable options or settlement of restricted stock unit awards) as a result of the Business Combination into New Nextdoor Class A common stock. Moreover, the amended and restated certificate of incorporation provides that each share of New Nextdoor Class B common stock will convert automatically into one share of New Nextdoor Class A common stock upon certain transfers and upon the earlier of (i) the date specified by a vote of the holders of two-thirds of the then outstanding shares of New Nextdoor Class B common stock and (ii) ten years from the Closing Date.

In connection with the Merger:

•all outstanding shares of KVSB Class K common stock, par value $0.0001 per share, and KVSB Class B common stock, par value $0.0001 per share, were converted into shares of New Nextdoor Class A common stock,

•each share of Nextdoor common stock that was issued and outstanding immediately prior to the Effective Time, after giving effect to the conversion of all shares of Nextdoor preferred stock into shares of Nextdoor common stock immediately prior to the Effective Time, (other than (A) shares of Nextdoor common stock subject to Nextdoor Awards, (B) shares of Nextdoor common stock held as treasury shares, (C) shares of Nextdoor common stock held by stockholders who have perfected and not withdrawn a demand for appraisal rights pursuant to the applicable provisions of the DGCL and (D) certain entitlements to receive Nextdoor common stock pursuant to the terms of the Pixel Labs Merger Agreement) was canceled and converted into the right to receive a number of shares of New Nextdoor Class B common stock equal to the Exchange Ratio multiplied by the number of shares of Nextdoor common stock held by such holder immediately prior to the Effective Time (with fractional shares otherwise issuable to holders rounded down to the nearest whole share),

•each Nextdoor Option that was outstanding and unexercised as of immediately prior to the Effective Time was converted into a New Nextdoor Option to purchase a number of shares of New Nextdoor Class B common stock equal to the number of shares of Nextdoor common stock subject to such Nextdoor Option as of immediately prior to the Effective Time, multiplied by the Exchange Ratio (rounded down to the nearest whole share), at an exercise price per share equal to the exercise price per share of such Nextdoor Option in effect immediately prior to the Effective Time, divided by the Exchange Ratio (rounded up to the nearest whole cent),

•each entitlement to receive Nextdoor common stock pursuant to the terms of the Pixel Labs Merger Agreement that was outstanding (upon and subject to completion and delivery of the exchange documentation required under the Pixel Labs Merger Agreement) as of immediately prior to the Effective Time was converted into the right to receive a number of shares of New Nextdoor Class B common stock equal to the number of Consideration Shares (as defined in the Pixel Labs Merger Agreement) to which such holder was entitled (upon and subject to completion and delivery of the exchange documentation required under the terms of the Pixel Labs Merger Agreement) as of immediately prior to the Effective Time, multiplied by the Exchange Ratio (rounded down to the nearest whole share),

•each Nextdoor Restricted Stock Award that was outstanding as of immediately prior to the Effective Time was converted into the right to receive restricted shares of New Nextdoor Class B common stock covering a number of shares of New Nextdoor Class B common stock equal to the number of shares of Nextdoor common stock subject to such Nextdoor Restricted Stock Award immediately prior to the Effective Time, multiplied by the Exchange Ratio (rounded down to the nearest whole share), and

•each Nextdoor RSU that was outstanding as of immediately prior to the Effective Time was converted into the right to receive restricted stock units covering a number of shares of New Nextdoor Class B common stock equal to the number of shares of Nextdoor common stock subject to such Nextdoor RSU immediately prior to the Effective Time, multiplied by the Exchange Ratio (rounded down to the nearest whole share).

A description of the Business Combination and the terms of the Merger Agreement are included in the Proxy Statement/Prospectus in the section titled “BCA Proposal—The Merger Agreement” beginning on page 88 of the Proxy Statement/Prospectus. The foregoing description of the Merger Agreement is a summary only and is qualified in its entirety by the full text of the Merger Agreement, a copy of which is attached hereto as Exhibit 2.1, which is incorporated herein by reference.

PIPE Subscription Agreements

In connection with the Business Combination and substantially concurrent with the execution of the Merger Agreement, KVSB entered into subscription agreements (each, a “Subscription Agreement”) with each of the investors in the PIPE Investment (as defined below) (including with certain of KVSB’s directors and officers and affiliates of Khosla Ventures SPAC Sponsor II LLC (the “Sponsor”), affiliates of Nextdoor and other third parties) (collectively, the “PIPE Investors”), pursuant to which the PIPE Investors agreed to subscribe for and purchase, and KVSB agreed to issue and sell to the PIPE Investors, an aggregate of 27,000,000 shares of New Nextdoor Class A common stock at a price of $10.00 per share (the “PIPE Shares”), for aggregate gross proceeds of $270,000,000, which we refer to as the “PIPE Investment.” KVSB granted the PIPE Investors certain registration rights in connection with the PIPE Investment. The issuance and sale of the PIPE Shares was consummated concurrently with the closing of the Business Combination (the “Closing”).

A description of the Subscription Agreements is included in the Proxy Statement/Prospectus in the section titled “BCA Proposal—Related Agreements—PIPE Subscription Agreements” beginning on page 105 of the Proxy Statement/Prospectus. The foregoing description of the Subscription Agreements is a summary only and is qualified in its entirety by the full text of the form of PIPE Subscription Agreement, a copy of which is attached hereto as Exhibit 10.1, which is incorporated herein by reference. Sponsor Support Agreement

In connection with the execution of the Merger Agreement, KVSB, the Sponsor, Nextdoor and the persons set forth on Schedule I thereto entered into the Sponsor Support Agreement (the “Sponsor Support Agreement”), pursuant to which the Sponsor and each director and officer of KVSB agreed to, among other things, (i) vote in favor of the Merger Agreement and the transactions contemplated thereby, (ii) waive their redemption rights in connection with the consummation of the Business Combination with respect to any shares of KVSB common stock held by them, (iii) vote for any amendments to the governing documents as are necessary to convert all shares of KVSB Class K common stock and KVSB Class B common stock into an aggregate of 10,408,603 shares of New Nextdoor Class A common stock at the Closing, and (iv) waive any adjustments to the conversion ratio that would otherwise have been applicable for a conversion into any amount in excess of such amount, in each case, subject to the terms and conditions contemplated by the Sponsor Support Agreement.

A description of the Sponsor Support Agreement is included in the Proxy Statement/Prospectus in the section titled “BCA Proposal—Related Agreements—Sponsor Support Agreement” beginning on page 104 of the Proxy Statement/Prospectus. The foregoing description of the Sponsor Support Agreement is a summary only and is qualified in its entirety by the full text of the Sponsor Support Agreement, a copy of which is attached hereto as Exhibit 10.2 and incorporated herein by reference. Nextdoor Stockholder Support Agreement

In connection with the execution of the Merger Agreement, KVSB entered into a support agreement with certain stockholders and each director and executive officer of Nextdoor (the “Nextdoor Stockholder Support Agreement”). Pursuant to the Nextdoor Stockholder Support Agreement, certain stockholders and each director and executive officer of Nextdoor agreed to, among other things, vote to adopt and approve, upon the effectiveness of the Registration Statement, the Merger Agreement and all other documents and transactions contemplated thereby, subject to the terms and conditions of the Nextdoor Stockholder Support Agreement.

A description of the Nextdoor Stockholder Support Agreement is included in the Proxy Statement/Prospectus in the section titled “BCA Proposal—Related Agreements—Nextdoor Stockholder Support Agreement” beginning on page 104 of the Proxy Statement/Prospectus. The foregoing description of the Nextdoor Stockholder Support Agreement is a summary only and is qualified in its entirety by the full text of the Nextdoor Stockholder Support Agreement, a copy of which is attached hereto as Exhibit 10.3 and incorporated herein by reference. Lock-Up Agreements

Following the Closing Date and pursuant to the Bylaws (as defined below), certain of the former holders of Nextdoor common stock, Nextdoor Options, Nextdoor Restricted Stock, Nextdoor RSUs or other equity awards outstanding immediately prior to the Effective Time will not be permitted to sell, pledge, transfer or otherwise dispose of, or grant any option or purchase right with respect to, any shares of New Nextdoor Class A common stock or New Nextdoor Class B common stock issued to such holders pursuant to the Business Combination (such shares, the “Lock-Up Shares”), or engage in any short sale, hedging transaction or other derivative security transaction involving the Lock-Up Shares during the period commencing on the Closing Date until 180 days following the Closing Date, subject to certain customary exceptions; including if New Nextdoor completes a transaction that results in a change of control, the Lock-Up Shares are released from restriction immediately prior to such change of control.

A description of the restrictions applicable to the Lock-Up Shares is included in the Proxy Statement/Prospectus in the section titled “BCA Proposal—Lock-Up Agreements—Proposed Bylaws” beginning on page 105 of the Proxy Statement/Prospectus. The foregoing description of the restrictions applicable to the Lock-Up Shares is a summary only and is qualified in its entirety by the full text of the Bylaws, a copy of which is attached hereto as Exhibit 3.2 and incorporated herein by reference. Sponsor Lock-Up Agreements

Following the Closing Date, the Sponsor and certain affiliated individuals (the “Sponsor Holders”) will enter into Sponsor Lock-Up Agreements which contain restrictions on transfer with respect to the shares of KVSB common stock held by the Sponsor Holders immediately following the Closing Date (other than shares purchased in the public market, shares purchased in the PIPE Investment or shares purchased pursuant to the Forward Purchase Agreement) (the “Sponsor Holders Lock-Up Shares”). The Sponsor Holders have agreed not to transfer the Sponsor Holders Lock-up Shares during the period commencing on the Closing Date until one year after the Closing Date, subject to certain customary exceptions, including if, after the Closing Date, New Nextdoor completes a transaction that results in a change of control, the Sponsor Holders Lock-up Shares are released from restriction immediately prior to such change of control.

The foregoing description of the Sponsor Lock-Up Agreements is qualified in its entirety by reference to the full text of the Sponsor Lock-Up Agreements, a copy of which is attached hereto as Exhibit 10.4 and incorporated herein by reference.

Item 1.01 Entry into a Material Definitive Agreement.

Amended and Restated Registration Rights Agreement

On the Closing Date, KVSB, the Sponsor and certain former stockholders of Nextdoor entered into an amended and restated registration rights agreement, pursuant to which, among other things, the Sponsor and such other stockholders were granted certain customary registration rights pursuant to which New Nextdoor will agree to register for resale certain shares of New Nextdoor common stock (the “Registration Rights Agreement”).

A description of the Registration Rights Agreement is included in the Proxy Statement/Prospectus in the section titled “BCA Proposal—Related Agreements—Registration Rights Agreement” beginning on page 105 of the Proxy Statement/Prospectus. Following the Closing, the holders of 229,733,048 shares of New Nextdoor common stock are entitled to certain registration rights.

The foregoing description of the Registration Rights Agreement is qualified in its entirety by reference to the full text of the Registration Rights Agreement, a copy of which is attached hereto as Exhibit 10.5 and incorporated herein by reference.

Indemnification Agreements

Effective as of the Closing Date, the Company entered into indemnification agreements with each of its directors and executive officers. These indemnification agreements, among other things, require the Company to indemnify its directors and executive officers for certain expenses, including attorneys’ fees, judgments, fines, and settlement amounts incurred by a director or executive officer in any action or proceeding arising out of their services as one of the Company’s directors or executive officers of any other company or enterprise to which the person provides services at the Company’s request.

The foregoing description of the indemnification agreements is qualified in its entirety by the full text of the form of Indemnity Agreement, a copy of which is attached hereto as Exhibit 10.6 and incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The disclosure set forth in the “Introductory Note” above is incorporated by reference into this Item 2.01 of this Report.

As of the Closing Date and following the completion of the Business Combination, the Company had the following outstanding securities:

•78,953,663 shares of New Nextdoor Class A common stock; and

•304,003,976 shares of New Nextdoor Class B common stock; and

•59,616,898 New Nextdoor Options; and

•2,691,577 New Nextdoor RSUs.

FORM 10 INFORMATION

Item 2.01(f) of this Report states that if the predecessor registrant was a shell company, as KVSB was immediately before the Business Combination, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10. Accordingly, the Company, as the successor registrant to KVSB, is providing the information below that would be included in a Form 10 if it were to file a Form 10. Please note that the information provided below relates to the combined company after the consummation of the Business Combination unless otherwise specifically indicated or the context otherwise requires.

Forward-Looking Statements

The Company makes forward-looking statements in this Report and in documents incorporated herein by reference. All statements, other than statements of present or historical fact included in or incorporated by reference in this Report, regarding the Company’s future financial performance, as well as the Company’s strategy, future operations, financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this Report, the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “future,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “will,” “would” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations, assumptions, hopes, beliefs, intentions and strategies regarding future events and are based on currently available information as to the outcome and timing

of future events. The Company cautions you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of the Company.

These forward-looking statements are based on information available as of the date of this Report, and current expectations, forecasts and assumptions, and involve a number of risks and uncertainties. Accordingly, forward-looking statements in this Report and in any document incorporated herein by reference should not be relied upon as representing the Company’s views as of any subsequent date, and the Company does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, the Company’s actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include:

•the Company’s ability to scale its business and monetization efforts;

•the Company’s ability to expand its business operations abroad by opening new and expanding within existing neighborhoods outside of the United States;

•the Company’s ability to respond to general economic conditions;

•the Company’s ability to manage its growth effectively;

•the Company’s ability to achieve and maintain profitability in the future;

•the Company’s ability to access sources of capital to finance operations and growth;

•the success of strategic relationships with third parties;

•the impact of the COVID-19 pandemic;

•the Company’s ability to realize the benefits of the Business Combination;

•the Company’s ability to protect its intellectual property rights from unauthorized use by third parties;

•cybersecurity risks to the Company’s various systems and software; and

•risks associated with the dual-class structure of the common stock which has the effect of concentrating voting control with the former Nextdoor Stockholders.

Please see the other risks and uncertainties set forth in the Proxy Statement/Prospectus in the section titled “Risk Factors” beginning on page 34 of the Proxy Statement/Prospectus, which is incorporated herein by reference. In addition, statements that the “Company believes” or “New Nextdoor believes” and similar statements reflect the Company’s beliefs and opinions on the relevant subject. These statements are based upon information available to the Company as of the date of the Proxy Statement/Prospectus or the date of this Report, as the case may be, and while the Company believes such information forms a reasonable basis for such statements, such information may be limited or incomplete, and such statements should not be read to indicate that the Company has conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

Business and Properties

The business and properties of the Company are described in the Proxy Statement/Prospectus in the sections titled “Information About KVSB” and “Information About Nextdoor” beginning on pages 172 and 184, respectively, of the Proxy Statement/Prospectus, and such descriptions are incorporated herein by reference. Risk Factors

The risks associated with the Company’s business are described in the Proxy Statement/Prospectus in the section titled “Risk Factors” beginning on page 34 of the Proxy Statement/Prospectus and are incorporated herein by reference. Selected Historical Financial Information

The selected historical financial information and other data as of and for the years ended December 31, 2020 and 2019 and as of June 30, 2021 and for the six months ended June 30, 2021 and 2020 for Nextdoor is included in the section titled “Selected Historical Financial Information of Nextdoor” beginning on page 28 of the Proxy Statement/Prospectus and in the section titled “Nextdoor’s Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 222 of the Proxy Statement/Prospectus are incorporated herein by reference. The selected historical financial information and other data for the period from January 29, 2021 (KVSB’s inception) through June 30, 2021 for KVSB is included in the section titled “Selected Historical Financial Information of KVSB” beginning on page 26 of the Proxy Statement/Prospectus and in the section titled “KVSB’s Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 179 of the Proxy Statement/Prospectus are incorporated herein by reference. The historical financial information and other data as of September 30, 2021 and for the nine months ended September 30, 2021 and 2020 for Nextdoor are set forth in Exhibit 99.2 attached hereto and are incorporated herein by reference.

The historical financial information and other data as of September 30, 2021 and for the period from January 29, 2021 (date of inception) through September 30, 2021 for KVSB is described in KVSB’s Quarterly Report on Form 10-Q filed with the SEC on November 3, 2021.

Unaudited Pro Forma Condensed Combined Financial Information

The unaudited pro forma condensed combined financial information of the Company as of and for the nine months ended September 30, 2021 and for the year ended December 31, 2020 is set forth in Exhibit 99.3 attached hereto and is incorporated herein by reference.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Unless the context otherwise requires, all references in this section to “we,” “us” or “our” refer to the combined business of Nextdoor, Inc. and its consolidated subsidiaries (collectively, “Nextdoor”) prior to the Closing.

The following discussion and analysis provides information which Nextdoor’s management believes is relevant to an assessment and understanding of Nextdoor’s consolidated results of operations and financial condition (following the Closing, Nextdoor’s management became New Nextdoor’s management). The discussion should be read together with the unaudited interim condensed consolidated financial statements as of September 30, 2021 and for the three and nine months ended September 30, 2021 and 2020, and the related notes that are included as Exhibit 99.2 to this Report. The discussion and analysis should also be read together with the pro forma financial information as of and for the nine months ended September 30, 2021 and for the year ended December 31, 2020 that is included as Exhibit 99.3 to this Report. This discussion may contain forward-looking statements based upon current expectations that

involve risks and uncertainties. New Nextdoor’s actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth under “Risk Factors” or in other parts of this Report.

Overview

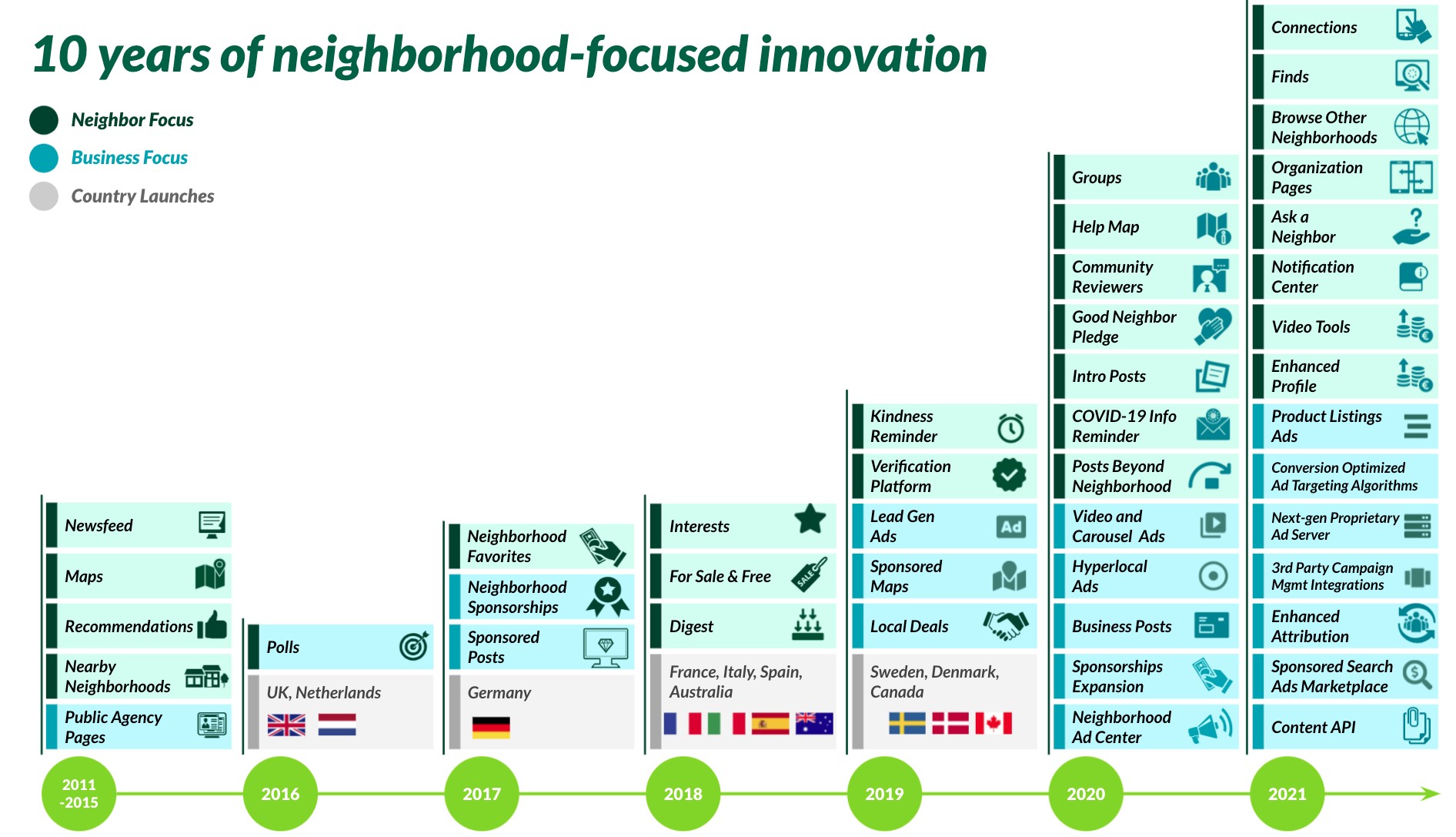

Since our founding, we have had a singular focus on developing our neighborhood network. As of September 30, 2021, Nextdoor was in more than 285,000 neighborhoods around the world. In the United States, nearly 1 in 3 households turn to Nextdoor to receive trusted information, give and get help, and build real-world connections with people and organizations nearby — including neighbors, small and mid-sized businesses, large brands, public agencies, and nonprofits. Nextdoor is the neighborhood network that brings all of these stakeholders together to get things done locally and build thriving communities.

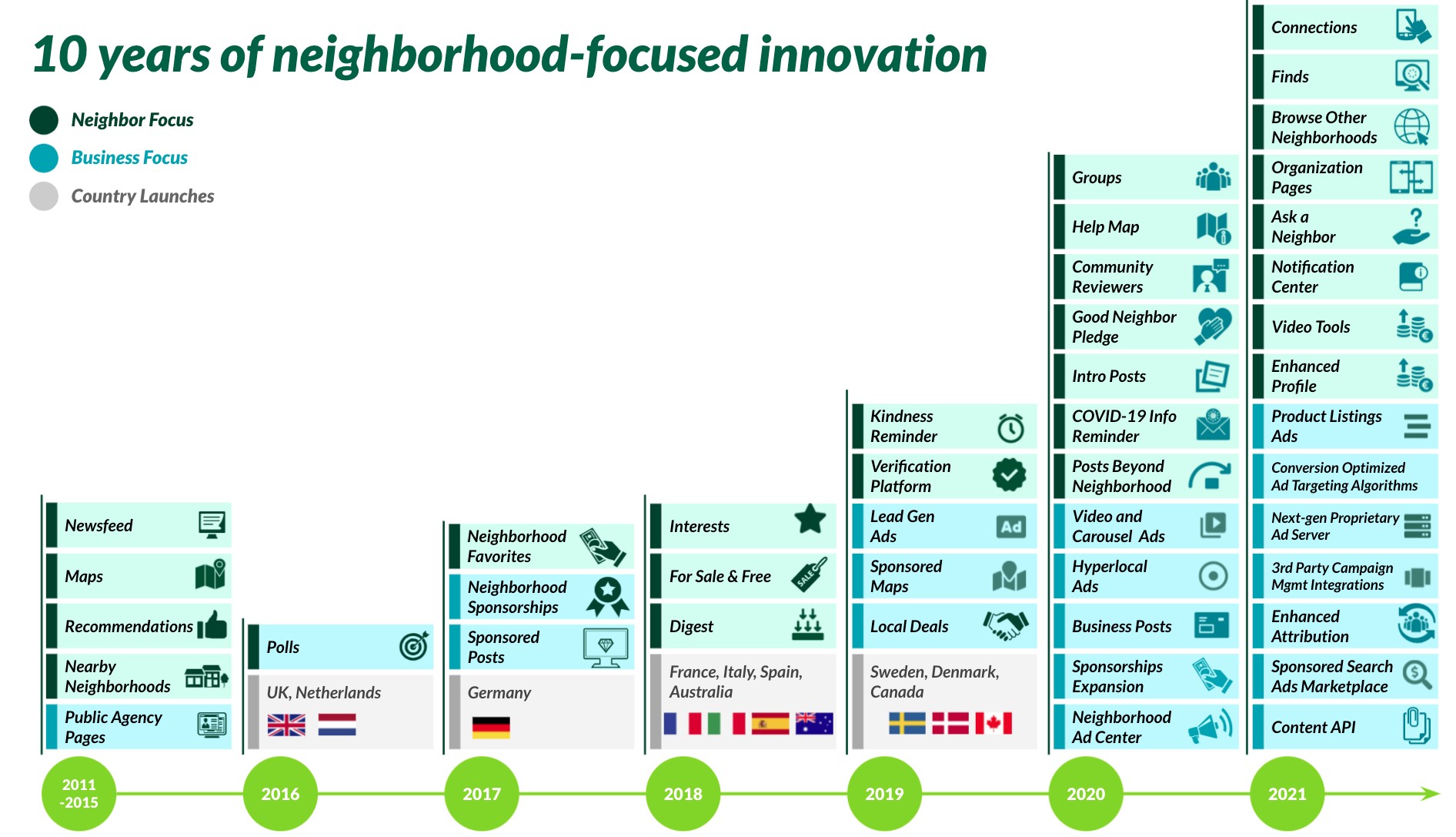

Nextdoor began in the United States, and as of September 30, 2021, our platform was available in 11 countries. Beyond the United States, Nextdoor supports neighborhoods in the United Kingdom, Canada, Australia, Netherlands, France, Spain, Italy, Germany, Sweden, and Denmark. Our sole focus on neighborhoods has allowed us to introduce a range of innovative products and features that drive continuous neighbor acquisition and growth in engagement. As a result, we are increasing neighborhood penetration, and increasingly becoming a weekly and even daily use case. In top neighborhoods across the world we see more than 60% of total neighbors engaging daily on our platform.

Nextdoor is a community built on trust and genuine connections. Initially, our priority was to grow our neighborhood network across the United States by adding users that we define as Verified Neighbors, who are individuals who join Nextdoor and have their address verified by us. By requiring neighbors to use their real name and address, we ensure that conversations and interactions on Nextdoor are between real people creating trust and mutual accountability.

To date, we have primarily attracted new neighbors through word-of-mouth, earned media, and through mailed invitations, and kept our content accessible only to Verified Neighbors. While we believe this approach was critical to develop our trusted platform, it also constrained our user growth relative to the total market opportunity. More

recently, we have begun investing in new features to inspire neighbors to increase engagement, such as the ability to follow multiple neighborhoods, join interest groups, and make moments more engaging and shareable with enhanced video capabilities.

We took a similarly deliberate approach to our monetization efforts. We serve customers who consist of large brands and small and mid-sized businesses seeking to provide hyperlocal, engaging advertising content to our large and engaged base of neighbors. In 2016, we started to build a sales force to target large brands. We have since developed a range of advertising products that allow our customers to reach neighbors at every stage of the advertising funnel, starting with discovery, onto consideration, and ending with purchase. In 2017, we started to offer Neighborhood Sponsorships to allow businesses to build a reputation, drive awareness, and keep their business top of mind by advertising in the Nextdoor Newsfeed. Our first customers for this product were real estate agents who created automated ad placements to post to the Nextdoor Newsfeed in targeted postal codes. We have since introduced Neighborhood Sponsorships across a range of verticals and have further expanded our offering to include Local Deals and Local Search. In 2020, we launched a self-serve advertising platform to allow all businesses to procure advertisements in the same manner and continued to invest in building new advertising products and measurement capabilities that allow us to further deliver value to our customers. More recently, as we have focused on growing revenue and driving increased yield from advertisement sales, regardless of customer type, we are in the process of further unifying our neighborhood sponsorships and local deals self-serve platform and our self-serve advertising platform so that all customers (including large brands, small and mid-sized businesses, and public agencies) will have access to the same inventory. While we have historically not tracked the amount of revenue by customer category, we were historically able to estimate what portion of our revenue came from large brands versus small and mid-sized businesses based on the way that a customer procured an advertisement, as it has been our experience that large brands had generally procured advertisements through our sales force and small and mid-sized businesses had generally procured advertisements through our neighborhood sponsorships and local deals self-serve platform. However, as a result of our move towards unifying our neighborhood sponsorships and local deals self-serve platform and our self-serve advertising platform, our ability to accurately estimate revenue by customer category has diminished and will continue to diminish. As a result, we are not able to accurately estimate and report revenue by customer category of large brands, small and mid-sized businesses, and public agencies.

Our advertising customers that procured ads through our sales force have historically made up our largest share of revenue and have spanned a wide variety of industry verticals. For the nine months ended September 30, 2021, Cable, Technology, and Communications, Financial Services, Home Improvement, Home Security, and Home Services represented our five largest verticals of customers that procured ads through our sales force and, in the aggregate, represented approximately 33% of our revenue, with the remainder of our revenue during the period coming from a wide range of other verticals. For the nine months ended September 30, 2021, no such vertical of customers that procured ads through our sales force contributed more than 10% of our revenue.

For the nine months ended September 30, 2020, Cable, Technology, and Communications, Financial Services, Home Security, Home Services, and Retail represented our five largest verticals of customers that procured ads through our sales force and, in the aggregate, represented approximately 46% of our revenue, with the remainder of our revenue during the period coming from a wide range of other verticals. For the nine months ended September 30, 2020, revenue from the Home Security, Retail, and Home Services verticals of customers that procured ads through our sales force contributed approximately 12%, 12%, and 11%, respectively, of our revenue. No other vertical of customers that procured ads through our sales force contributed more than 10% of our revenue during such period.

We have historically not tracked the industry verticals of our customers that procure ads through our self-serve platforms and, as a result, the industry vertical information presented is only with respect to customers that have procured ads through our sales force.

As our base of neighbors and customers has grown, we have benefited from powerful network effects. As neighborhood penetration increases, engagement also increases through additional relevant local content that is generated by neighbors on Nextdoor, prompting more engagement from other neighbors, which then leads to higher retention and increasing value for all who are in our network. Once a neighbor joins and experiences the value of

Nextdoor, they are very likely to stay and engage with our platform. Historically, we have enjoyed strong user retention, with 77% of Verified Neighbors remaining active on our platform after 3 months, 71% after 6 months, 60% after 12 months, and 57% after 24 months. Our retention rate only includes neighbors who were active in the last 30 days of the period for which our retention rate is calculated. We believe that this strong user retention is due to the utility and community connections that our platform offers neighbors who come to our platform to access trusted information, build real-world connections with those nearby, and get things done locally. Additionally, increases in neighbor reach and engagement enhance the value we offer to customers, leading to improved retention and additional revenue opportunities for us.

We have grown rapidly since our inception. For the three months ended September 30, 2021 and September 30, 2020, we generated revenue of $52.7 million and $31.8 million, respectively, representing year-over-year growth of 66%. For the nine months ended September 30, 2021 and September 30, 2020, we generated revenue of $132.9 million and $83.2 million, respectively, representing year-over-year growth of 60%. We have made significant investments in our platform. Accordingly, we have a history of generating net losses. For the three months ended September 30, 2021, we generated a net loss of $(19.4) million and Adjusted EBITDA of $(7.7) million, as compared to a net loss of $(19.2) million and Adjusted EBITDA of $(12.2) million, respectively, for the three months ended September 30, 2020. For the nine months ended September 30, 2021, we generated a net loss of $(66.0) million and Adjusted EBITDA of $(35.8) million, as compared to a net loss of $(60.3) million and Adjusted EBITDA of $(42.6) million, respectively, for the nine months ended September 30, 2020. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Business Metrics and Non-GAAP Financial Measure” below for more information and for a reconciliation of net loss, the most directly comparable financial measure calculated and presented in accordance with U.S. generally accepted accounting principles (“GAAP”), to Adjusted EBITDA.

Recent Developments

Closing of Transactions

On July 6, 2021, Nextdoor entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Lorelei Merger Sub Inc. (“Merger Sub”), a wholly owned subsidiary of Khosla Ventures Acquisition Co. II (“KVSB”), a special purpose acquisition company and KVSB. Pursuant to the Merger Agreement, Merger Sub merged with and into Nextdoor, with Nextdoor surviving the merger (the “Merger” or “Transactions”). Nextdoor became a wholly owned subsidiary of KVSB and KVSB was immediately renamed Nextdoor Holdings, Inc. (“New Nextdoor”) upon completion of the Merger on November 5, 2021 (the “Closing”). Each share of Nextdoor common stock that was issued and outstanding immediately prior to Closing, after giving effect to the conversion of all issued and outstanding shares of Nextdoor preferred stock to Nextdoor common stock, was canceled and converted into the right to receive a number of shares of New Nextdoor Class B common stock equal to the Exchange Ratio multiplied by the number of shares of Nextdoor common stock.

The Transactions will be accounted for as a reverse recapitalization in accordance with GAAP. Under this method of accounting, KVSB is expected to be treated as the “acquired” company for financial reporting purposes. Accordingly, the Transactions will be reflected as the equivalent of Nextdoor issuing common stock for the net assets of KVSB, accompanied by a recapitalization. The net assets of KVSB will be stated at historical cost, with no goodwill or other intangible assets recorded. Operations prior to the Transactions will be those of Nextdoor in future reports of New Nextdoor.

Key Business Metrics and Non-GAAP Financial Measure

In addition to the measures presented in our consolidated financial statements, we use the following key business metrics to evaluate our business, measure our performance, develop financial forecasts, and make strategic decisions.

Key Business Metrics

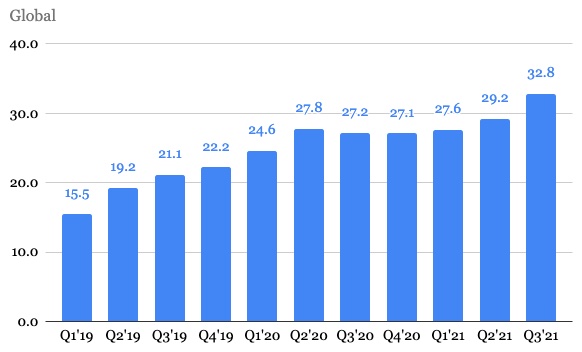

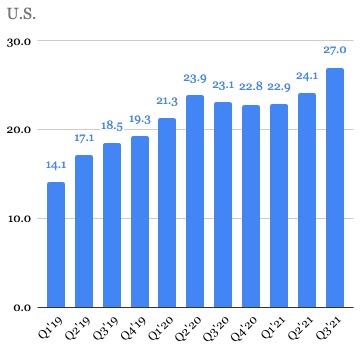

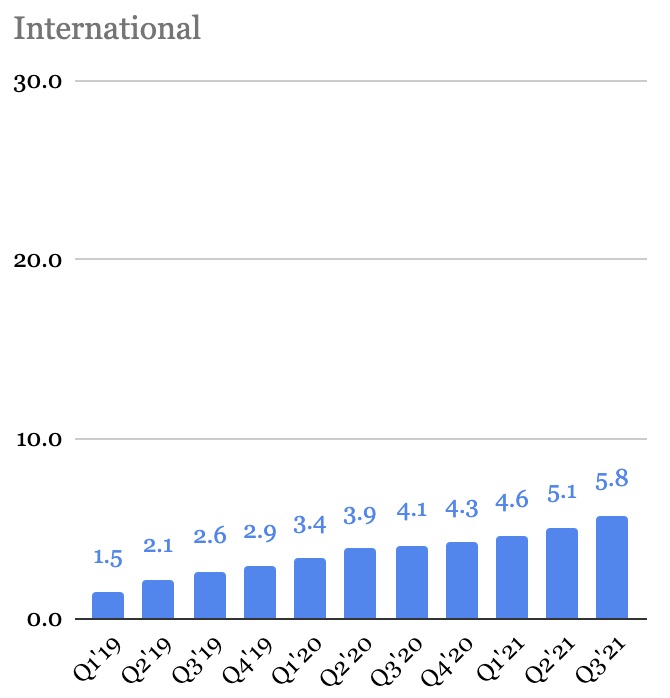

Weekly Active Users (WAUs)

We define a Weekly Active User, or WAU, as a Nextdoor user who opens our application, logs on to our website, or engages with an email with monetizable content at least once during a defined 7-day period1. We calculate average WAUs for a particular period by calculating the count of unique users, on a rolling basis for the past seven days, for each day of that period, and dividing that sum by the number of days in that period. We assess the health of our business by measuring WAUs because we believe that weekly usage best captures the cadence at which we expect a healthy user base to engage with, and derive the most utility from our platform, and by extension their neighborhood. We also present WAUs by geography because we are more advanced in engagement and monetization in the United States than internationally.

In September 2021, Apple released changes to the Apple email client available on its operating systems, including iOS 15 and iPadOS 15, which limit our ability to measure user engagement with emails containing monetizable content for users that use the Apple email client. The introduction of these changes impacts our ability to accurately calculate a portion of WAUs for periods following the adoption of the updated operating systems. Following this introduction, we use estimates for these user engagement numbers based on historical data sets, as well as data from users who engage with Nextdoor’s monetizable content on email clients other than Apple email.

Our WAU for the three months ended September 30, 2021 and 2020 was 32.8 million and 27.2 million, respectively. In 2021 engagement as measured by WAUs has grown steadily as users have turned to our platform for the utility that it offers them. As illustrated below, our international WAUs have grown at a faster rate than our U.S. WAUs, and we expect this international growth to continue to outpace U.S. growth in the near term.

1 Emails with monetizable content are emails with a primary purpose to regularly inform users about topics that are relevant to them, and are therefore appropriate for delivering ads to users. These emails comprise almost all of the emails that we send our users and include, but are not limited to, new, trending and top posts, weekly and anytime digests, welcome emails and urgent and emergency alerts. We earn revenue from delivery of ad impressions in emails with monetizable content on either a CPM or CPC basis or, with respect to local sponsorships and local deals, on a fixed-fee basis. While we have the ability to serve ads in all emails with monetizable content, we currently only do so on a portion of the total.

Quarterly Average Weekly Active Users

(in millions)

A portion of our WAUs visit Nextdoor on a daily basis. We define a daily active user (“DAU”) as a Nextdoor user who opens our application, logs on to our website, or engages with an email with monetizable content at least once during a defined 24 hour period. The proportion of DAUs to WAUs has generally increased over time as our users have increased their engagement with our platform. For the three and nine months ended September 30, 2021, the proportion of global DAUs to WAUs was 51% and 52%, respectively, consistent with the three and nine months ended September 30, 2020.

While included herein, the proportion of DAUs to WAUs is not a key metric utilized by our management in order to manage the business and, further, the ratio of DAUs to WAUs has not historically been a focus of our management. Rather, our management uses WAUs because, while the frequency of user engagement with our platform varies, a weekly cadence represents what management believes to be a representative use case on a neighborhood platform such as Nextdoor and helps to inform our management on the number of impressions that we are able to provide our advertisers. The proportion of DAUs to WAUs, as discussed above, is intended to provide further context on the historical trend of increasing engagement over time. Nextdoor does not currently intend to regularly disclose the proportion of DAUs to WAUs in future periodic filings for New Nextdoor.

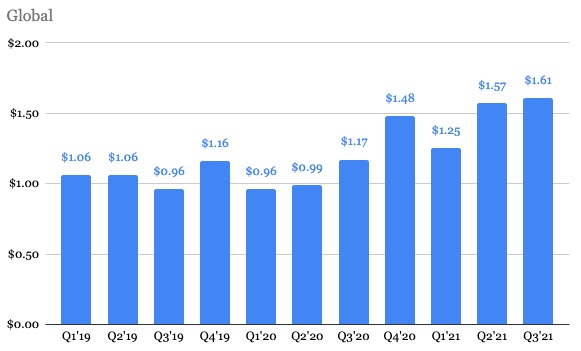

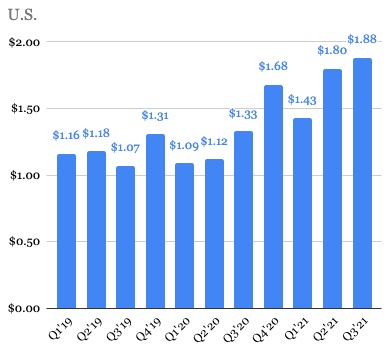

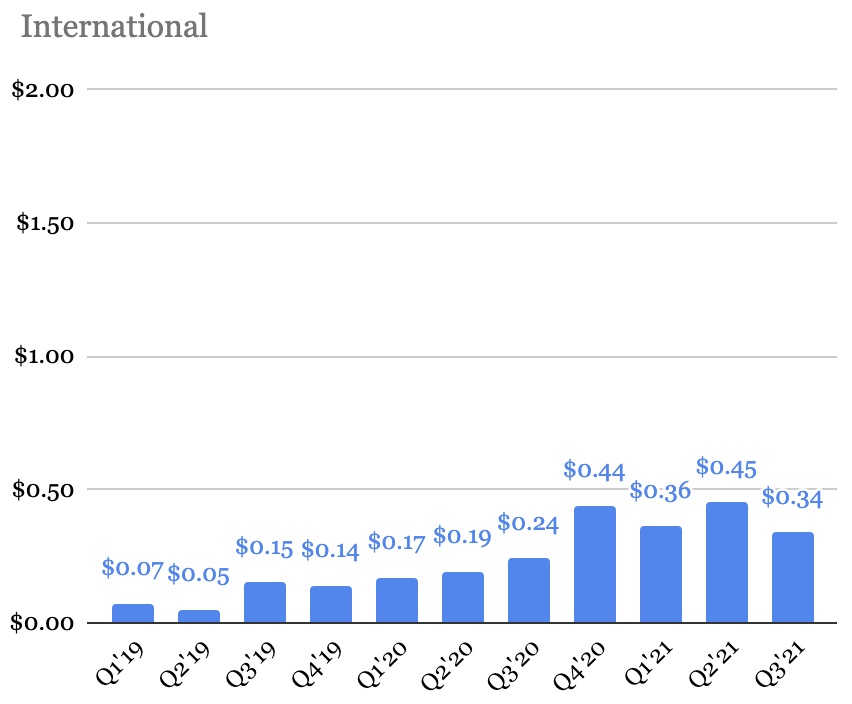

Average Revenue per Weekly Active User (ARPU)

We generate revenue primarily from advertising. We measure monetization of our platform through our average revenue per weekly active user, or ARPU, metric. We define ARPU as our total revenue in that geography during a period divided by the average of the number of WAUs in that geography during the same period. We present ARPU on a U.S. and international basis because we are more advanced in our monetization in the United States than internationally.

U.S. ARPU is higher primarily due to our decision to focus our earliest monetization efforts there, the size and maturity of our audience in the United States, as well the size of the U.S. advertising market. For purposes of calculating ARPU, revenue by user geography is apportioned to each region based on a determination of the location of the account where the revenue-generating activities occur. Our ARPU for the nine months ended September 30, 2021 and 2020 was $4.44 and $3.12, respectively. Our ARPU reflects the seasonality of our advertising revenue, with the fourth quarter typically being the strongest quarter of each year.

Quarterly Average Revenue per User

Non-GAAP Financial Measure

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure that represents our net loss adjusted for depreciation and amortization, stock-based compensation, net interest income, provision for income taxes, and acquisition-related costs.

We use Adjusted EBITDA in conjunction with GAAP measures as part of our overall assessment of our performance, including the preparation of our annual operating budget and quarterly forecasts, to evaluate the effectiveness of our business strategies and to communicate with our board of directors concerning our financial performance. We believe Adjusted EBITDA is also helpful to investors, analysts, and other interested parties because it can assist in providing a more consistent and comparable overview of our operations across our historical financial periods. Adjusted EBITDA has limitations as an analytical tool, however, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Because of these limitations, you should consider Adjusted EBITDA alongside other financial performance measures, including net loss and our other GAAP results. In evaluating Adjusted EBITDA, you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed to imply that our future results will be unaffected by the types of items excluded from the calculation of Adjusted EBITDA. Adjusted EBITDA is not presented in accordance with GAAP and the use of this term varies from others in our industry.

The following is a reconciliation of net loss, the most comparable GAAP measure, to Adjusted EBITDA:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands) | 2021 | | 2020 | | 2021 | | 2020 |

| Net loss | $ | (19,363) | | | $ | (19,166) | | | $ | (66,002) | | | $ | (60,298) | |

| Depreciation and amortization | 1,047 | | | 830 | | | 3,202 | | | 2,084 | |

| Stock-based compensation | 10,592 | | | 6,163 | | | 26,971 | | | 16,210 | |

| Interest income | (21) | | | (61) | | | (86) | | | (682) | |

| Provision for income taxes | 27 | | | 34 | | | 96 | | | 122 | |

| Adjusted EBITDA | $ | (7,718) | | | $ | (12,200) | | | $ | (35,819) | | | $ | (42,564) | |

Factors Affecting Our Performance

Growth in and Engagement of Users. We measure growth in, and engagement of, users by tracking WAUs and Verified Users (which we also refer to as Verified Neighbors). As the size and engagement of our user base grows, we believe the potential to increase our revenue grows.

We attract users through several channels including word-of-mouth, mailed invitations, email and text invitations, and our contact sync feature. We complement our organic growth with paid marketing, which primarily focuses on newer neighborhoods where we have lower levels of penetration and are focused on growing our user base. This includes neighborhoods in international countries where we are in earlier stages of growth.

We may face challenges increasing the size and engagement of our user base due to a number of factors including competition, challenges in acquiring and engaging users, or changes in regulations.

Growth in Monetization. Monetization trends, which are reflected in our ARPU, are a key factor that affects our revenue and financial results. We are in the early stages of our monetization efforts. To increase monetization, we are focused on serving more national brands by building out our salesforce, and enhancing our self-serve tools for our customers. We are also focused on increasing our user base and engagement in the United States and internationally, which will increase the opportunities for businesses to advertise on Nextdoor.

There are many variables that impact ARPU, including the number of ad impressions shown on our platform and the price per ad, which depends on a number of factors including the engagement of our user base, the number and diversity of our customers, seasonality of advertising spend, our customers’ advertising objectives, advertising performance, the effectiveness of our advertising products, our ability to measure that effectiveness for our customer, and the effect of geographic differences on each of these factors.

Due to our decision to focus our earliest monetization efforts in the United States, we have less experience monetizing international markets and therefore may experience challenges scaling and monetizing these markets. The international advertising market is also less mature than the U.S. digital advertising market.

Investment for Growth. We intend to continue to invest in technology that we believe will enhance user and customer experiences. We also intend to continue to invest heavily in our advertising products, including our self-serve advertising platform and first-party and third-party ad measurement tools, as well as our sales team. Our ability to grow our user base, attract new advertisers, increase our revenue, and expand our total addressable market will depend, in part, on our ability to continue innovating.

International Expansion. Our early proof points from launches in 10 countries outside of the United States show user engagement across international markets on par with the U.S. market. We believe that increased international monetization presents an important opportunity for growth, and we are working on localizing our product and expanding our operations to better serve our international user and customer base. We are still in the early stages of global expansion and will continue to evaluate expansion opportunities in our current international markets, and also in additional geographies. Over time, we believe that international WAUs can grow rapidly. We also believe that we can increase the monetization of users in international markets and that we can increase long-term ARPU for international WAUs from current levels. While we expect to grow ARPU for international WAUs, we still expect this to be lower than ARPU for U.S. WAUs. We expect that our international expansion will require significant investment. Although our investments in international expansion may adversely affect our operating results in the near term, we believe that they will contribute to our long-term growth. If our near-term investments do not lead to increased international WAUs and ARPU and expected revenue growth over time, we may not achieve or, if achieved, maintain profitability and our growth rates may slow or decline.

Seasonality. Industry advertising spend tends to be strongest in the fourth quarter, and we observe a similar pattern in our historical revenue. Our significant growth has partially masked these trends in historical periods, and we expect seasonality to become more pronounced in the future.

Components of Results of Operations

Revenue

We generate substantially all of our revenue from the delivery of advertisements on our platform which includes the delivery of advertising impressions sold on a cost per thousand, or CPM, basis and cost per click, or CPC, basis, as well as local sponsorships and local deals which are sold on a fixed-fee basis. The majority of our revenue is generated in the United States.

Cost of Revenue

Cost of revenue consists primarily of expenses associated with the delivery of our revenue generating activities, including the third-party cost of hosting our platform and allocated personnel-related costs, which include salaries, benefits, and stock-based compensation for employees engaged in development of our revenue generating products. Cost of revenue also includes third-party costs associated with delivering and supporting our advertising products and credit card transaction fees related to processing customer transactions.

We expect cost of revenue will increase on an absolute dollar basis as neighbor activity on our platform increases. While we expect to realize scale benefits over time, our cost of revenue as a percentage of revenue may vary from period-to-period and is expected to increase modestly over the near and medium term as we invest in new products and features to further increase platform engagement.

Operating Expenses

Research and Development

Research and development expenses consist primarily of personnel-related costs, including salaries, benefits, and stock-based compensation for our employees engaged in research and development, as well as costs for consultants, contractors and third-party software. In addition, allocated overhead costs, such as facilities, information technology, and depreciation are included in research and development expenses.

We expect research and development expenses will increase on an absolute dollar basis due to investments that we are making in our platform. We expect that research and development expenses as a percentage of revenue will vary from period-to-period over the short term and decrease over the long term.

Sales and Marketing

Sales and marketing expenses consist of personnel-related and other costs which include salaries, commissions, benefits, and stock-based compensation for employees engaged in sales and marketing activities as well as other costs including third-party consulting, public relations, allocated overhead costs, and amortization of acquired intangible assets. Sales and marketing expenses also include brand and performance marketing for both user and small and mid-sized customer acquisition, and neighbor services, which includes personnel-related costs for our neighbor support team, our outsourced neighbor support function, and verification costs.

Performance marketing costs related to user acquisition largely consist of the distribution of mailed invitations and, to a lesser extent, digital advertising. Performance marketing costs related to small and mid-sized customer acquisition largely consists of digital advertising and, to a lesser extent, direct mail campaigns. Fluctuations in our performance marketing expenses are driven by a variety of factors, including but not limited to: our target geographies, whether we are acquiring users or businesses, assessment of return on investment of marketing spend, strategic priorities, and seasonal factors.

We expect sales and marketing expenses will increase on an absolute dollar basis due to continued investment in sales activities, increased investment in marketing to acquire users, small and mid-sized customers, and further investment in international expansion. We expect sales and marketing expenses as a percentage of revenue will vary from period-to-period over the short term and decrease over the long term.

General and Administrative

General and administrative expenses consist primarily of personnel-related costs, including salaries, benefits, and stock-based compensation for certain executives, finance, legal, information technology, human resources, and other administrative employees. In addition, general and administrative expenses include fees and costs for professional services, including consulting, third-party legal and accounting services, and allocated overhead costs.

We expect general and administrative expenses will increase on an absolute dollar basis for the foreseeable future to support our growth as well as due to additional costs associated with legal, accounting, compliance, investor relations, and other costs as we become a public company. We expect general and administrative expenses as a percentage of revenue will vary from period-to-period over the short term and decrease over the long term.

Interest Income

Interest income consists of interest earned on our cash, cash equivalents, and marketable securities.

Other Income (Expense), Net

Other income (expense), net consists primarily of unrealized gains and losses from the re-measurement of monetary assets and liabilities denominated in non-functional currencies, and foreign currency transaction gains and losses.

Provision for Income Taxes

The provision for income taxes consists primarily of income taxes related to foreign and state jurisdictions in which we conduct business. We maintain a full valuation allowance on our U.S. federal and state deferred tax assets as we have concluded that it is more likely than not that the deferred tax assets will not be realized.

Results of Operations

The results of operations presented below should be reviewed in conjunction with our condensed consolidated financial statements and related notes thereto included in Exhibit 99.2 to this Report. The following table sets forth our consolidated results of operations for the periods presented.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands) | 2021 | | 2020 | | 2021 | | 2020 |

| Revenue | $ | 52,705 | | | $ | 31,826 | | | $ | 132,870 | | | $ | 83,167 | |

Costs and expenses(1): | | | | | | | |

| Cost of revenue | 7,371 | | | 5,346 | | | 20,308 | | | 15,177 | |

| Research and development | 25,461 | | | 18,759 | | | 69,612 | | | 50,570 | |

| Sales and marketing | 27,448 | | | 20,111 | | | 76,698 | | | 58,136 | |

| General and administrative | 11,505 | | | 7,087 | | | 31,793 | | | 20,539 | |

| Total costs and expenses | 71,785 | | | 51,303 | | | 198,411 | | | 144,422 | |

| Loss from operations | (19,080) | | | (19,477) | | | (65,541) | | | (61,255) | |

| Interest income | 21 | | | 61 | | | 86 | | | 682 | |

| Other income (expense), net | (277) | | | 284 | | | (451) | | | 397 | |

| Loss before income taxes | (19,336) | | | (19,132) | | | (65,906) | | | (60,176) | |

| Provision for income taxes | 27 | | | 34 | | | 96 | | | 122 | |

| Net loss | $ | (19,363) | | | $ | (19,166) | | | $ | (66,002) | | | $ | (60,298) | |

__________________(1)Includes stock-based compensation expense as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands) | 2021 | | 2020 | | 2021 | | 2020 |

| Cost of revenue | $ | 383 | | | $ | 247 | | | $ | 981 | | | $ | 680 | |

| Research and development | 5,680 | | | 2,839 | | | 13,954 | | | 7,373 | |

| Sales and marketing | 1,711 | | | 1,072 | | | 4,461 | | | 2,190 | |

| General and administrative | 2,818 | | | 2,005 | | | 7,575 | | | 5,967 | |

| Total | $ | 10,592 | | | $ | 6,163 | | | $ | 26,971 | | | $ | 16,210 | |

The following table sets forth the components of our consolidated statements of operations as a percentage of revenue for each of the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (as a percentage of total revenue) | 2021 | | 2020 | | 2021 | | 2020 |

| Revenue | 100 | % | | 100 | % | | 100 | % | | 100 | % |

| Costs and expenses: | | | | | | | |

| Cost of revenue | 14 | | | 17 | | | 15 | | | 18 | |

| Research and development | 48 | | | 59 | | | 52 | | | 61 | |

| Sales and marketing | 52 | | | 63 | | | 58 | | | 70 | |

| General and administrative | 22 | | | 22 | | | 24 | | | 25 | |

| Total costs and expenses | 136 | | | 161 | | | 149 | | | 174 | |

| Loss from operations | (36) | | | (61) | | | (49) | | | (74) | |

| Interest income | — | | | — | | | — | | | 1 | |

| Other income (expense), net | (1) | | | 1 | | | — | | | — | |

| Loss before income taxes | (37) | | | (60) | | | (50) | | | (72) | |

| Provision for income taxes | — | | | — | | | — | | | — | |

| Net loss | (37) | % | | (60) | % | | (50) | % | | (73) | % |

Note: Certain figures may not sum due to rounding.

Comparison of the Three and Nine Months Ended September 30, 2021 and 2020

Revenue

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Change | | Nine Months Ended September 30, | | Change |

| (in thousands, except percentages) | 2021 | | 2020 | | $ | | % | | 2021 | | 2020 | | $ | | % |

| Revenue | $ | 52,705 | | | $ | 31,826 | | | $ | 20,879 | | | 66 | % | | $ | 132,870 | | | $ | 83,167 | | | $ | 49,703 | | | 60 | % |

Revenue increased by $20.9 million, or 66%, for the three months ended September 30, 2021 compared to the three months ended September 30, 2020, primarily due to increased advertiser demand across our product offerings, our growing sales team, and increased user engagement as measured by a 21% increase in WAUs. ARPU increased 38% primarily due to a 20% increase in the number of impressions delivered and a 22% increase in the price per delivered impression.

Revenue increased by $49.7 million, or 60%, for the nine months ended September 30, 2021 compared to the nine months ended September 30, 2020, primarily due to increased advertiser demand across our product offerings, our growing sales team, and increased user engagement as measured by a 12% increase in WAUs. ARPU increased 42% primarily due to a 26% increase in the number of impressions delivered and a 15% increase in the price per delivered impression, both of which outpaced WAU growth during the period.

Cost of revenue

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Change | | Nine Months Ended September 30, | | Change |

| (in thousands, except percentages) | 2021 | | 2020 | | $ | | % | | 2021 | | 2020 | | $ | | % |

| Cost of revenue | $ | 7,371 | | | $ | 5,346 | | | $ | 2,025 | | | 38 | % | | $ | 20,308 | | | $ | 15,177 | | | $ | 5,131 | | | 34 | % |

Cost of revenue increased by $2.0 million, or 38%, for the three months ended September 30, 2021 compared to the three months ended September 30, 2020. The increase was primarily due to $1.2 million higher third-party hosting costs due to increased user growth and engagement and a $0.4 million increase in credit card transaction fees related to processing customer transactions.

Cost of revenue increased by $5.1 million, or 34%, for the nine months ended September 30, 2021 compared to the nine months ended September 30, 2020. The increase was primarily due to $3.1 million higher third-party hosting

costs due to increased user growth and engagement, a $1.0 million increase in credit card transaction fees related to processing customer transactions and a $0.5 million increase in costs associated with delivering advertisements on our platform.

Research and development

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Change | | Nine Months Ended September 30, | | Change |

| (in thousands, except percentages) | 2021 | | 2020 | | $ | | % | | 2021 | | 2020 | | $ | | % |

| Research and development | $ | 25,461 | | | $ | 18,759 | | | $ | 6,702 | | | 36 | % | | $ | 69,612 | | | $ | 50,570 | | | $ | 19,042 | | | 38 | % |

Research and development expenses increased by $6.7 million, or 36%, for the three months ended September 30, 2021 compared to the three months ended September 30, 2020. The increase was primarily due to a $5.7 million increase in personnel-related costs and a $0.6 million increase in third-party software costs.

Research and development expenses increased by $19.0 million, or 38%, for the nine months ended September 30, 2021 compared to the nine months ended September 30, 2020. The increase was primarily due to a $14.8 million increase in personnel-related costs and a $2.0 million increase in third-party software costs.

Sales and marketing

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Change | | Nine Months Ended September 30, | | Change |

| (in thousands, except percentages) | 2021 | | 2020 | | $ | | % | | 2021 | | 2020 | | $ | | % |

| Personnel-related and other | $ | 14,709 | | | $ | 13,054 | | | $ | 1,655 | | | 13 | % | | $ | 41,571 | | | $ | 33,271 | | | $ | 8,300 | | | 25 | % |

| Brand and performance marketing | 9,831 | | | 4,071 | | | 5,760 | | | 141 | % | | 26,281 | | | 16,626 | | | 9,655 | | | 58 | % |

| Neighbor services | 2,908 | | | 2,986 | | | (78) | | | (3) | % | | 8,846 | | | 8,239 | | | 607 | | | 7 | % |

| Total sales and marketing | $ | 27,448 | | | $ | 20,111 | | | $ | 7,337 | | | 36 | % | | $ | 76,698 | | | $ | 58,136 | | | $ | 18,562 | | | 32 | % |

Sales and marketing expenses increased by $7.3 million, or 36%, for the three months ended September 30, 2021 compared to the three months ended September 30, 2020. The increase was primarily due to a $2.9 million increase in performance marketing costs to acquire small and mid-sized customers, a $2.9 million increase in performance marketing costs for user acquisition, and a $1.7 million increase in personnel-related and other costs which was primarily driven by growth in sales activities.

Sales and marketing expenses increased by $18.6 million, or 32%, for the nine months ended September 30, 2021 compared to the nine months ended September 30, 2020. The increase was primarily due to a $8.3 million increase in personnel-related and other costs which was primarily driven by growth in sales activities, a $8.1 million increase in performance marketing costs to acquire small and mid-sized customers, and a $1.5 million increase in performance marketing costs for user acquisition.

General and administrative

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Change | | Nine Months Ended September 30, | | Change |

| (in thousands, except percentages) | 2021 | | 2020 | | $ | | % | | 2021 | | 2020 | | $ | | % |

| General and administrative | $ | 11,505 | | | $ | 7,087 | | | $ | 4,418 | | | 62 | % | | $ | 31,793 | | | $ | 20,539 | | | $ | 11,254 | | | 55 | % |

General and administrative expenses increased by $4.4 million, or 62%, for the three months ended September 30, 2021 compared to the three months ended September 30, 2020, primarily due to a $1.9 million increase in personnel-related costs and a $2.1 million increase in professional fees.

General and administrative expenses increased by $11.3 million, or 55%, for the nine months ended September 30, 2021 compared to the nine months ended September 30, 2020, primarily due to a $4.8 million increase in professional fees and a $4.7 million increase in personnel-related costs.

Interest income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Change | | Nine Months Ended September 30, | | Change |

| (in thousands, except percentages) | 2021 | | 2020 | | $ | | % | | 2021 | | 2020 | | $ | | % |

| Interest income | $ | 21 | | | $ | 61 | | | $ | (40) | | | (66) | % | | $ | 86 | | | $ | 682 | | | $ | (596) | | | (87) | % |

Interest income decreased by $0.1 million, or 66%, for the three months ended September 30, 2021 compared to the three months ended September 30, 2020 and decreased by $0.6 million, or 87%, for the nine months ended September 30, 2021 compared to the nine months ended September 30, 2020 primarily due to a decline in effective market yields on our marketable securities.

Other income (expense), net

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Change | | Nine Months Ended September 30, | | Change |

(in thousands, except percentages)

(NM = Not Meaningful) | 2021 | | 2020 | | $ | | % | | 2021 | | 2020 | | $ | | % |

| Other income (expense), net | $ | (277) | | | $ | 284 | | | $ | (561) | | | NM | | $ | (451) | | | $ | 397 | | | $ | (848) | | | NM |

Other income (expense), net decreased by $0.6 million for the three months ended September 30, 2021 compared to the three months ended September 30, 2020 and decreased by $0.8 million for the nine months ended September 30, 2021 compared to the nine months ended September 30, 2020. The decrease was primarily due to the periodic re-measurement of monetary assets and liabilities denominated in non-functional currencies.

Provision for income taxes

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Change | | Nine Months Ended September 30, | | Change |

(in thousands, except percentages)

(NM = Not Meaningful) | 2021 | | 2020 | | $ | | % | | 2021 | | 2020 | | $ | | % |

| Provision for income taxes | $ | 27 | | | $ | 34 | | | $ | (7) | | | NM | | $ | 96 | | | $ | 122 | | | $ | (26) | | | NM |

Provision for income taxes decreased by $0.1 million for the three months ended September 30, 2021 compared to the three months ended September 30, 2020. The decrease was primarily due to taxes related to our foreign subsidiaries.

Provision for income taxes decreased by $0.1 million for the nine months ended September 30, 2021 compared to the nine months ended September 30, 2020. The decrease was primarily due to taxes related to our foreign subsidiaries.

Liquidity and Capital Resources

Since inception, we have generated negative cash flows from operations and have primarily financed our operations from net proceeds received from the sale of equity securities and payments received from our customers. As of September 30, 2021, we had raised an aggregate of $470.9 million, net of issuance costs, through the sales of redeemable convertible preferred stock and issuance of restricted stock. We currently have no debt outstanding.

We have generated losses from our operations, as reflected in our accumulated deficit of $451.0 million as of September 30, 2021. We incurred operating losses and cash outflows from operations by supporting the growth of our business. We expect these losses and operating cash outflows to continue for the foreseeable future. We also

expect to incur significant research and development, sales and marketing, and general and administrative expenses over the next several years in connection with the continued development and expansion of our business.

As of September 30, 2021, we had $106.6 million in cash, cash equivalents, and marketable securities. We believe that our existing cash, cash equivalents, and marketable securities will be sufficient to meet our working capital and capital expenditure needs for at least the next 12 months.

Our future capital requirements will depend on many factors, including the rate of our revenue growth, the timing and extent of spending on research and development efforts and other business initiatives, the expansion of sales and marketing activities, the introduction of new and enhanced product offerings and features, and the continuing market adoption of our platform. We may in the future enter into arrangements to acquire or invest in complementary companies, products or technologies. We may be required to seek additional equity or debt financing. In the event that additional financing is required from outside sources, we may not be able to secure timely additional financing on favorable terms, if at all. If we are unable to raise additional capital or generate cash flows necessary to expand our operations and invest in new technologies, it could reduce our ability to compete successfully and harm our business, results of operations, and financial condition.

Cash Flows

The following table summarizes our cash flows for the periods presented:

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| (in thousands) | 2021 | | 2020 |

| Net cash used in operating activities | $ | (33,280) | | | $ | (35,279) | |

| Net cash provided by investing activities | $ | 4,716 | | | $ | 44,359 | |

| Net cash provided by financing activities | $ | 9,863 | | | $ | 3,207 | |

Operating activities

Cash used in operating activities during the nine months ended September 30, 2021 was $33.3 million which resulted from a net loss of $(66.0) million, adjusted for non-cash charges of $30.5 million and net cash inflows of $2.2 million from changes in operating assets and liabilities. Non-cash charges primarily consisted of $27.0 million of stock-based compensation expense and $3.2 million of depreciation and amortization expense. The net cash inflow from changes in operating assets and liabilities was primarily the result of a $5.5 million increase in accrued expenses and other current liabilities, a $4.9 million decrease in operating lease right-of-use assets due to normal amortization, and a $0.2 million increase in accounts payable. These amounts were partially offset by a $5.0 million increase in accounts receivable, net and a $4.1 million decrease in operating lease liabilities due to lease payments.

Cash used in operating activities during the nine months ended September 30, 2020 was $35.3 million, which resulted from a net loss of $(60.3) million, adjusted for non-cash charges of $18.5 million and net cash inflows of $6.5 million from changes in operating assets and liabilities. Non-cash charges primarily consisted of $16.2 million of stock-based compensation expense and $2.1 million of depreciation and amortization expense. The net cash inflow from changes in operating assets and liabilities was primarily the result of a $4.8 million increase in accrued expenses and other current liabilities, a $3.3 million decrease in operating lease right-of-use assets due to normal amortization, a $1.2 million increase in accounts payable, and a $1.1 million decrease in prepaid expenses and other current assets. These amounts were partially offset by a $3.0 million decrease in operating lease liabilities due to lease payments.

Investing activities

Cash provided by investing activities for the nine months ended September 30, 2021 was $4.7 million, which consisted of proceeds from maturities of marketable securities of $50.6 million and proceeds from sales of marketable securities of $2.4 million. This was offset by the purchases of marketable securities of $40.3 million and the purchase of property and equipment of $8.1 million.

Cash provided by investing activities for the nine months ended September 30, 2020 was $44.4 million, which consisted of maturities of marketable securities of $81.4 million and proceeds from sales of marketable securities of $21.8 million, partially offset by the purchases of marketable securities of $55.7 million and the purchase of property and equipment of $3.2 million.

Financing activities

Cash provided by financing activities for the nine months ended September 30, 2021 was $9.9 million, which reflect $12.8 million of proceeds from the exercise of stock options, net of repurchases. This was offset by the payment of deferred transaction costs of $3.0 million.

Cash provided by financing activities for the nine months ended September 30, 2020 was $3.2 million, which reflect proceeds from the exercise of stock options, net of repurchases.

Contractual Obligations and Commitments

The following table summarizes our contractual obligations as of September 30, 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Payments Due By Period |

| (in thousands) | Total | | Less Than 1 Year | | 1-3 Years | | 3-5 Years | | More Than 5 Years |