Business Highlights

| | | | | | | | |

| Q4 revenue declined 10% year-over-year to $53M, driven by reduced advertising spend from the financial services, home services and real estate verticals. An overall reduction in spend per customer was mitigated in part by stable customer retention and a growing base of mid-market advertisers. | Q4 Weekly Active Users (WAU) grew 11% year-over-year to 40 million, driven by growth in U.S. neighbor engagement. Quarter-over-quarter WAU grew by 1.7 million, or 4%. | Q4 ARPU1 of $1.33 declined 19% year-over-year as a result of sustained WAU growth in relatively less-monetized international markets and lower average spend per customer. |

______________________________

1 ARPU is defined as average revenue per WAU.

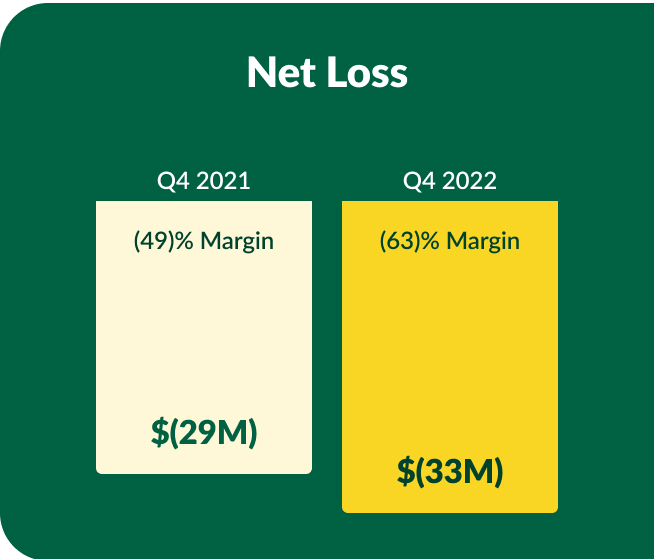

2 Net Loss margin is calculated as Net Loss divided by Revenue.

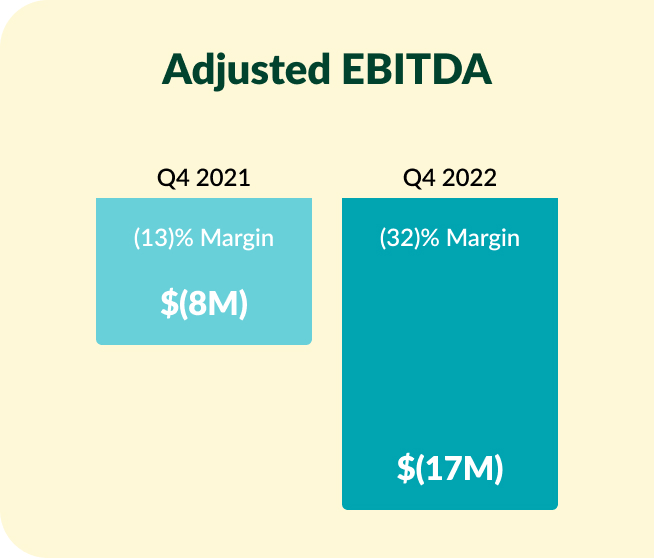

3 Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by Revenue. A reconciliation of non-GAAP metrics used in this letter to their most comparable GAAP measures is provided at the end of the letter.

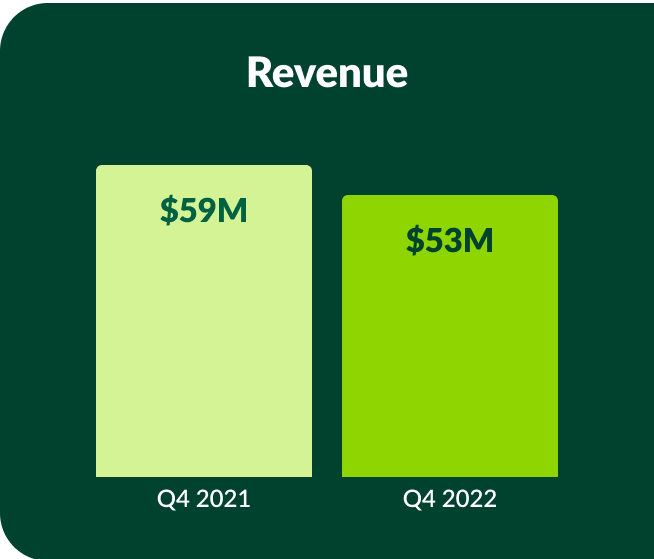

To Our Shareholders

In 2022, advertisers spent with increased caution, resulting in slowing growth that was most pronounced in the second half of the year. While 2022 revenue grew by 11% year-over-year, first half growth of 32% year-over-year shifted to a 4% year-over-year decline in the second half of the year as the economic environment worsened and advertisers paused to recalibrate. Q4 revenue declined 10% year-over-year to $53M, driven in large part by reduced advertising spend in key verticals such as financial services, home services, and real estate. This was partially offset by our expanding base of mid-market customers and resilience in other verticals, including telecommunications & technology. Importantly, during 2022, we retained 90% of our top 50 customers, highlighting that even in light of lower customer spend, advertisers are still finding value on Nextdoor.

Despite a difficult operating environment, we are driving results in the areas we can more directly control — most notably, the growth of neighbors who are active weekly. We are focused on enabling viral growth and increasingly deep and frequent engagement, monetized through our local advertising platform. The utility and community that Nextdoor offers provides durable value to neighbors and advertisers of all types.

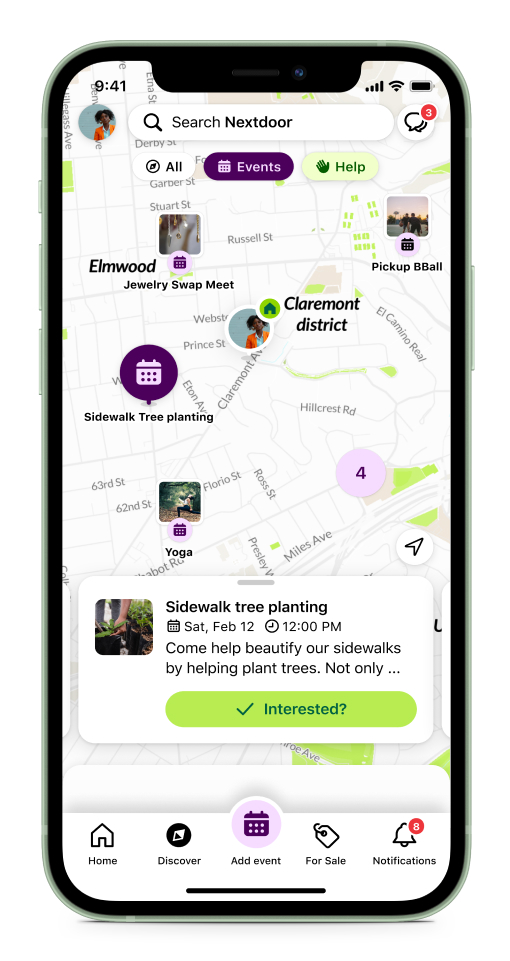

With our focus on creating an Active Valued Community, we are continually increasing the relevance of our platform. In Q4, we launched the updated Events function and Events Map, introduced new machine learning models designed to increase neighbor engagement, and advanced our multi-year ad platform development. Q4 WAU grew 11% year-over-year to 40 million. Building on the WAU momentum from Q3, in Q4 we added more WAU sequentially than in any other quarter this year. This Q4 growth included over 1 million neighbors in the United States, where our monetization opportunity is most developed today. Over the past two years, we have grown WAU by 42%, continuing to build off the record high engagement we experienced in 2020, with increasing momentum throughout 2022.

In Q4, we remained focused on operational efficiency, holding operating expenses constant year-over-year. We have held headcount approximately flat over the last three quarters, actively managing performance and selectively hiring in only the most critical areas: product, engineering, data science, design, and sales. We are balancing spend reductions with continued investments in initiatives that are designed to grow the base of neighbors and organizations on Nextdoor, increase engagement, and drive sustained revenue growth. We believe that these efforts will enable us to return to revenue growth and margin improvement in the full year 2023.

Building an Active Valued Community

Our product strategy is to build an Active Valued Community where neighbors and organizations can join, connect, contribute, and transact with one another. In Q4, we grew WAU sequentially for the 8th consecutive quarter, with 21% year-over-year WAU growth in 2022. In the quarter, our most consistently engaged base of neighbors grew 41% year-over-year4. We have also been successfully driving increased engagement in the form of sessions, which continue to outpace WAU growth year-over-year, and by driving more neighbors to become daily users.

______________________________

4 We define our most engaged neighbors as those who visit Nextdoor at least 4 times a week for 4 weeks in a row.

Driving engagement through valuable neighbor experiences

| | | | | | | | |

| 2022 was a year of increasing product velocity. A major achievement was launching the Discover surface as part of a broader app redesign in order to help neighbors more easily access core products and discover new ones. In Q4, we built upon Discover by launching the revamped Events function. Now, neighbors are able to create local events to share in their communities. Helping get the word out and ensuring that everyone knows what is happening nearby is key for neighbor engagement, providing unique local utility at scale. With Events, we are further increasing our value proposition as a local platform that drives online to offline interactions. In Q4, neighbors used Events to highlight moving sales, farmers markets, yoga workshops, and restaurant openings, to name a few. Since Q4, we have expanded Events to both public agencies and small businesses, increasing the ways neighbors and organizations can interact, engage, and share relevant, local information. | |

| The Discover surface seeks to provide a map-based way to find everything local — from groups, to businesses, to seasonal events like the Treat Map for Halloween. In Q4, we launched an Events Map overlay, which enables neighbors to visualize where events are taking place. The Events Map is an important milestone because it is the first nativized and evergreen map surface on Nextdoor, meaning it will be present all year round.

|

Neighbors and organizations now benefit from Nextdoor becoming the go-to place to discover all local events and activities, and are able to deepen engagement in ways that are uniquely local. An evergreen maps surface can also drive more revenue by allowing us to support more advertisers beyond seasonal campaigns.

Driving engagement through machine learning Building out our machine learning team was a top priority in 2022, and we have already seen meaningful returns from this investment. In Q4, improved notifications, which are powered by our machine learning capabilities, were a leading driver of both sessions and year-over-year and sequential WAU growth. In the quarter, we advanced our email notifications by optimizing for long-term engagement. We did this by targeting the recipients who are most likely to turn into WAU. |

Taking a step further, we started to optimize push notifications for the first time in Q4. This is a meaningful engagement driver for neighbors, and when combined with email notifications, represents an important milestone in using machine learning to personalize the experience of neighbors on Nextdoor.

We also laid the groundwork for personalization within the Newsfeed in Q4 by incorporating signals from neighbor interactions across Nextdoor to capture their intent. These signals include neighbor search objectives, post content understanding, and interactions and Connections between neighbors. We plan to continue expanding the signals we use for personalization, and over time, this will help us recommend more relevant notifications and customize the Newsfeed for the posts with which neighbors most want to engage. As with notifications, this foundational effort will take time to deliver results, but will be an integral part of the neighbor experience in the long-term.

Our machine learning efforts are becoming more sophisticated and will continue to be a top focus area in 2023.

Driving engagement through encouraging conversations and community

A primary way in which we deepen engagement is by driving posting, which creates conversations, content, and ultimately, community. In Q4, we deployed several initiatives to increase posts. For example, we made it easier to post and share content by enabling neighbors to post to both the Newsfeed and Groups at the same time, and to post media without text, thus driving more conversations. We also launched post insights to show neighbors how engaging their posts are. This has driven an increase in activity by creating a positive feedback loop for neighbors who post.

Another way that we encourage neighborhood vitality and neighbor retention is through our work to facilitate kind conversations. Over the course of 2022, we released several features and systems to support this objective, including the Constructive Conversations Reminder. In Q4, we launched the comment filter, which hides potentially hurtful or harmful comments5. Since the launch, we have seen a decrease in views of comments that were reported as hurtful or harmful, as well as, importantly, a decrease in creation of potentially hurtful or harmful comments6. Our community moderation, supported by over 210,000 volunteer moderators, remains a key competitive differentiator, incorporating local context into timely moderation decisions, with industry-leading speeds of 5.1 hours from time of report to removal7. More information about the positive impact of our focus on neighborhood vitality and our unique approach to moderation can be found in our recently released 2022 Transparency Report.

Scaling our platform for advertisers

While 2022 revenue grew 11% year-over-year, Q4 revenue decreased 10% year-over-year, reflecting continued headwinds in historically strong verticals including financial services, home services, and real estate. We saw emerging softness in retail in the quarter as some advertisers continued to experience uncertainty in their own businesses and consequently pulled back on marketing budgets. Against these headwinds, we are focused on bringing more advertisers to Nextdoor to broaden our customer base across an increasing variety of industry verticals, and in Q4 we saw continued growth in our advertiser count.

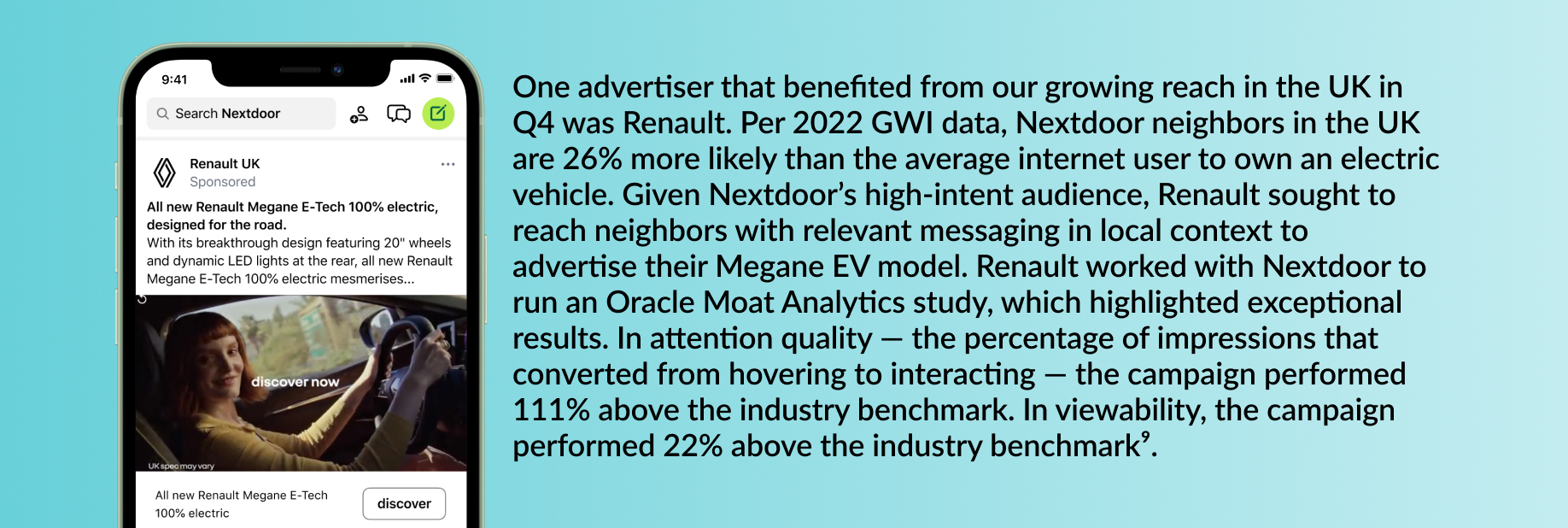

The telecommunications & technology vertical remained resilient in the quarter. Newer verticals like government and healthcare continued to grow year-over-year and sequentially. In our international markets, we also saw growth in revenue, primarily from the UK, where WAU grew 23% year-over-year. In the UK, continued growth in the size of our audience is driving improved performance for advertisers.

______________________________

5 Hurtful is defined as content that neighbors consider uncivil, including personal attacks. Harmful is defined as content that neighbors consider fraudulent, unsafe, or unwelcoming, including misinformation and discrimination.

6 Across the U.S. and tested international markets.

7 Data from our 2022 Transparency Report; based on median time to removal.

In Q4, we also saw relative strength from mid-market advertisers. Growth in mid-market customers helped us reach the highest ever number of managed accounts, which grew 18% year-over-year in Q4. This growth largely reflects the continued maturation of our go-to-market strategy.

The percent of advertising spend that came from evergreen advertisers held fairly constant year-over-year in Q48. This evergreen spend remains the majority of our revenue from managed advertisers, reaffirming that Nextdoor’s high-intent audience and locally relevant advertising consistently deliver strong results.

In 2022, despite lower per-advertiser spend levels, we retained 90% of our top 50 customers. This reflects our broader Q4 revenue dynamic: advertisers are still finding value on Nextdoor, even as they adjust their budgets.

Developing Nextdoor’s advertising platform

Our objective to build a must-buy local advertising solution for customers of all sizes means focusing on delivering advertiser value, reducing advertiser effort, and enabling businesses to thrive on Nextdoor.

In 2022, we made progress toward enabling our ad platform to drive better advertiser outcomes. We completed the foundation for our proprietary ad server by building out the capabilities to store first-party data and the machine learning models that will allow us to seamlessly deploy the data to deliver advertiser results. This data includes demographic and geographic information as well as actions neighbors take on the platform.

We also expanded our self-serve options to small and mid-sized businesses (SMBs) in 2022 to provide them with an easy-to-use, intuitive, hands-on solution for ad creation. In Q4, we started to unify our self-serve workflow so that we can serve customers of all sizes on the same platform. By creating one self-serve option for all advertisers, we are simplifying our products and more efficiently enabling customers of all sizes to succeed on Nextdoor as they grow. All customers will have access to a single campaign creation and campaign management tool that will reduce and streamline the effort needed to use our advertising solutions, cementing customer confidence in the decision to sign up.

______________________________

8 We define evergreen advertisers as advertisers that have spent with Nextdoor in each of the last 5 quarters.

9 Viewability is defined as the percentage of impressions where at least 50% of an ad was in view for at least one continuous second.

Enhancing advertiser performance and measurement capabilities

Measurement is key to unlocking customer growth and improving retention by demonstrating advertiser value. In 2022, we made significant improvements to our measurement capabilities through increasing customer adoption of Nextdoor’s pixel, developing deeper third-party vendor relationships, and integrating with new measurement partners such as Neustar. In Q4, we leveraged this work to help customers understand their performance. This is one of the reasons advertisers continue to spend on Nextdoor even as they decrease their overall budget in the current environment.

| | | | | |

| One large national retailer aimed to increase sales online and in-store in Q4. We used proprietary data and our predictive intent algorithms to reach a unique audience that lived within a 5–10 mile radius of store locations. The campaign resulted in a return on ad spend 26% above the retailer’s goal. Additionally, we leveraged our relationship with Foursquare to determine that the cost per store visit was 78% more efficient than Foursquare’s category benchmarks. As a result of the strong performance we delivered, the retailer scaled its spend on Nextdoor from Q3 to Q4. | |

A big box retailer partnered with Nextdoor to promote their early Black Friday deals by running a one-day takeover using video advertisements. The campaign performed better than goal across multiple metrics, with a video completion rate 103% above Nextdoor’s benchmark, a click through rate 44% above Nextdoor’s benchmark, and a cost per click 27% below the advertiser’s goal. Moreover, exposing neighbors to the brand’s video advertisements changed their behaviors and led them to search for and recommend the brand to other neighbors, amplifying the brand’s organic presence on the platform. The retailer experienced a 25% increase in platform searches and a 28% increase in platform mentions compared to mentions of the retailer in the year-ago period. This advertiser is continuing to spend on multiple campaigns in 2023.

Unique and localized advertising delivers customer value

Nextdoor offers hyperlocal advertising solutions to customers of all sizes in neighborhoods everywhere.

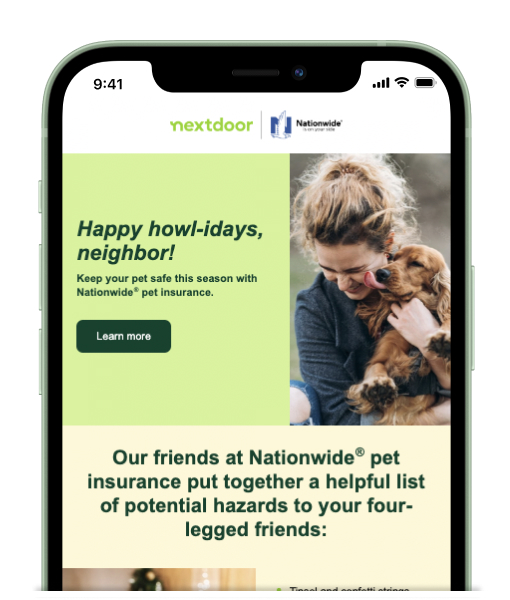

| | | | | |

| One advertiser that saw success across U.S. neighborhoods in Q4 was Nationwide® pet insurance, which benefited from Nextdoor’s passionate community of pet lovers to reach pet owners in a way that only Nextdoor can. In December, Nationwide® sent sponsored emails to neighbors, encouraging them to keep pets safe over the holiday season with their pet insurance. The advertiser shared one national message, but leveraged hyperlocal customization in the form of links to neighborhood specific Nextdoor Groups for pet owners. This approach provides utility for neighbors and quality engagement for advertisers. | |

Thumbtack took a similar approach to local personalization at national scale. In Q4, Thumbtack welcomed new neighbors to the neighborhood as a sponsor for our quarterly New Mover Kit. The Neighborhood Welcome Guide featured tips to get settled along with locally relevant neighborhood favorite small businesses and top-rated service pros to help make moving a little easier. The New Mover Kit has been so successful that we have run it for 8 consecutive quarters, attracting interest from multiple advertisers in every period.

Q4 2022 Financial Discussion

| | | | | |

Revenue Q4 revenue was $53M, a decrease of 10% year-over-year. We saw continued softness in advertising spend, particularly in the financial services, home services, and real estate verticals. This was partially offset by strength in other verticals and growth in the number of mid-market customers. Global ARPU declined 19% year-over-year to $1.33, as WAU growth sustained even as revenue declined.

| |

| |

Operating expenses In Q4, operating expenses were $90M. We held operating expenses roughly constant year-over-year and quarter-over-quarter. This was largely a result of headcount remaining stable over the last 3 quarters and a year-over-year reduction in marketing expenses, offset by an increase in cost of revenue.

Cost of revenue was $10M, up 16% year-over-year. The increase was primarily driven by third-party cloud hosting costs, which increase with neighbor growth and engagement. Hosting costs increased by less than the equivalent growth in sessions as a result of operational efficiencies in how we optimize for traffic. | |

| |

Research and development expenses were $32M, or 60% of revenue, up 16% year-over-year. The growth was driven primarily by increased headcount and personnel costs related to our engineering, data science, and product management teams. Sales and marketing expenses were $30M, or 57% of revenue, up 3% year-over-year. We held costs roughly constant as headcount growth in key sales roles was offset by decreased paid marketing spend for both neighbor and business acquisition. General and administrative expenses were $17M, or 32% of revenue, a decrease of 25% year-over-year. This decrease reflects a normalization relative to Q4 2021, which included costs related to our public offering, including a one-time $8.5M stock-based compensation expense. Total non-GAAP operating expenses were $71M, or 133% of revenue, up 5% year-over-year10. Stock based compensation expense remained roughly constant sequentially due to flat headcount. |

______________________________ 10 A reconciliation of non-GAAP metrics used in this letter to their most comparable GAAP measures is provided at the end of this letter.

| | | | | |

Earnings Net loss was $33M in Q4 representing a (63)% margin, compared to $29M and a (49)% margin in the year-ago period. The increase in net loss and decrease in margin primarily reflects the in-period deleveraging effect from the year-over-year reduction in revenue and year-over-year growth in personnel costs and hosting costs as neighbor engagement continues to grow. These effects were offset in part by a year-over-year reduction in stock based compensation expense and increase in interest income. | |

Q4 adjusted EBITDA loss was $17M representing a (32)% margin, compared to $8M and a (13)% margin in the year-ago period. As with net loss, the increase in adjusted EBITDA loss and decrease in adjusted EBITDA margin reflects the in-period deleveraging effect from the year-over-year reduction in revenue and year-over-year growth in personnel costs and hosting costs. | |

Balance sheet and cash flows In Q4, we ended the period with $583M in cash and cash equivalents and marketable securities. Cash used in operations for the year ended December 31, 2022 was $61M compared to $51M in the year-ago period. |

FY 2022 Financial Discussion

2022 revenue was $213M, an increase of 11% year-over-year. 2022 Global ARPU declined 9% year-over-year to $5.60, reflecting progress made in growing sessions and supply of impressions, which outpaced advertiser demand in 2022.

In 2022, GAAP operating expenses were $357M, an increase of 24% year-over-year. Year-over-year operating expense growth of 40% in the first half of 2022 decreased to 12% in the second half of the year as we moderated expenses while maintaining our long-term product and go-to-market initiatives.

Net loss was $138M in 2022, representing a (65)% margin, compared to $95M and a (50)% margin in the prior year.

2022 adjusted EBITDA loss was $75M, representing a (35)% margin, compared to $44M and a (23)% margin in the prior year. In the first half of 2022, our adjusted EBITDA margin was nearly constant year-over-year, as revenue growth supported early hiring for critical new roles. The year-over-year revenue decline in the second half of 2022 led to margin contraction despite the 28 point reduction in operating expense growth from the first half to second half of 2022.

Outlook

In 2023, our focus remains on growing our base of neighbors and organizations, increasing engagement on the platform, and returning to strong revenue growth to support our path to profitability.

Q1 2023 Outlook

•Revenue is expected to be $46M–$47M.

•Adjusted EBITDA loss is expected to be $27M–$26M.

For the full year 2023, we expect to return to revenue growth and adjusted EBITDA margin improvement.

We have not reconciled our adjusted EBITDA to GAAP net loss because certain items that impact GAAP net loss are uncertain or out of our control and cannot be reasonably predicted. In particular, stock-based compensation expense is impacted by the future fair market value of our common stock and other factors, all of which are difficult to predict, subject to frequent change, or not within our control. The actual amount of these expenses during 2023 will have a significant impact on our future GAAP financial results. Accordingly, a reconciliation of adjusted EBITDA outlook to net loss is not available without unreasonable efforts.

Q4 Conference Call and Webcast

We will host a Q&A webcast at 2:00 pm PT/5:00 pm ET today, February 28, 2023, to discuss these results and outlook. An audio webcast archive will be available following the live webcast for approximately one year on Nextdoor’s Investor Relations website at www.investors.nextdoor.com. Thank you for your support in building stronger neighborhoods across the globe and for being active neighbors in your neighborhood. We look forward to your questions and comments this afternoon.

We use our Investor Relations website (investors.nextdoor.com), our Twitter handle (twitter.com/Nextdoor), our LinkedIn Home Page (linkedin.com/company/nextdoor-com), and Sarah Friar’s LinkedIn posts (linkedin.com/in/sarah-friar-922b044) as a means of disseminating or providing notification of, among other things, news or announcements regarding our business or financial performance, investor events, press releases, and earnings releases and as a means of disclosing material nonpublic information and for complying with our disclosure obligations under Regulation FD. The content of our websites and information that we may post on or provide to online and social media channels, including those mentioned above, and information that can be accessed through our websites or these online and social media channels are not incorporated by reference into this press release or in any report or document we file with the SEC, and any references to our websites or these online and social media channels are intended to be inactive textual references only.

Safe Harbor Statement

This shareholder letter includes forward-looking statements, which are statements other than statements of historical facts and statements in the future tense. These statements include, but are not limited to, statements regarding our future performance and our market opportunity, including expected financial results for the first quarter of 2023 and full year 2023, our business strategy and plans, and our objectives and future operations, including our expansion into new markets.

Forward-looking statements are based upon various estimates and assumptions, as well as information known to us as of the date of this shareholder letter, and are subject to risks and uncertainties. Accordingly, actual results could differ materially due to a variety of factors, including: our ability to scale our business and monetization efforts; our ability to expand business operations abroad; our limited operating history; risks associated with managing our growth; our ability to achieve and maintain profitability in the future; the effects of the highly competitive market in which we operate; our ability to attract new and retain existing customers and users, or renew and expand our relationships with them; our ability to anticipate and satisfy customer preferences; market acceptance of our platform; our ability to successfully develop and timely introduce new products and services; our ability to achieve our objectives of strategic and operational initiatives; cybersecurity risks to our various systems and software; the impact of privacy and data security laws; and other general market, political, economic, and business conditions, including those related to inflation, rising interest rates and the ongoing COVID-19 pandemic.

Additional risks and uncertainties that could affect our financial results and business are more fully described in our Annual Report on Form 10-K for the period ended December 31, 2022, which is expected to be filed with the SEC on or about February 28, 2023, and our other SEC filings, which are available on the Investor Relations page of our website at www.investors.nextdoor.com and on the SEC’s website at www.sec.gov.

All forward-looking statements contained herein are based on information available to us as of the date hereof and you should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance, or achievements. We undertake no obligation to update any of these forward-looking statements for any reason after the date of this shareholder letter or to conform these statements to actual results or revised expectations, except as required by law. Undue reliance should not be placed on the forward-looking statements in this shareholder letter.

Consolidated Balance Sheets

in thousands, except per share data (unaudited)

| | | | | | | | | | | |

| As of December 31, |

| 2022 | | 2021 |

| | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 55,236 | | | $ | 521,812 | |

| Marketable securities | 528,067 | | | 193,999 | |

| Accounts receivable, net of allowance of $422 and $425 as of December 31, 2022 and 2021, respectively | 29,770 | | | 29,673 | |

| Prepaid expenses and other current assets | 12,185 | | | 16,259 | |

| Total current assets | 625,258 | | | 761,743 | |

| Property and equipment, net | 11,818 | | | 12,545 | |

| Operating lease right-of-use assets | 52,555 | | | 59,422 | |

| Intangible assets, net | 3,067 | | | 4,835 | |

| Goodwill | 1,211 | | | 1,211 | |

| Other assets | 5,653 | | | 330 | |

| Total assets | $ | 699,562 | | | $ | 840,086 | |

| | | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 4,535 | | | $ | 6,163 | |

| Operating lease liabilities, current | 7,766 | | | 7,131 | |

| Liability for unvested restricted stock | — | | | 4,765 | |

| Accrued expenses and other current liabilities | 22,362 | | | 15,444 | |

| Total current liabilities | 34,663 | | | 33,503 | |

| Operating lease liabilities, non-current | 53,831 | | | 61,598 | |

| Total liabilities | 88,494 | | | 95,101 | |

| | | |

| Stockholders' equity: | | | |

| Preferred stock, $0.0001 par value; 50,000 shares authorized; no shares issued or outstanding as of December 31, 2022 and 2021 | — | | | — | |

| Class A Common stock, $0.0001 par value; 2,500,000 shares authorized; 153,693 and 78,954 shares issued and outstanding as of December 31, 2022 and 2021, respectively | 15 | | | 8 | |

| Class B Common stock, $0.0001 par value; 500,000 shares authorized; 218,029 and 304,701 shares issued and outstanding as of December 31, 2022 and 2021, respectively | 22 | | | 30 | |

| Additional paid-in capital | 1,231,482 | | | 1,225,815 | |

| Accumulated other comprehensive loss | (2,196) | | | (529) | |

| Accumulated deficit | (618,255) | | | (480,339) | |

| Total stockholders' equity | 611,068 | | | 744,985 | |

| | | |

| Total liabilities and stockholders' equity | $ | 699,562 | | | $ | 840,086 | |

Consolidated Statements of Operations

in thousands, except per share data (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2022 | | 2021 | | 2022 | | 2021 |

| | | | | | | |

| Revenue | $ | 53,270 | | | $ | 59,327 | | | $ | 212,765 | | | $ | 192,197 | |

| Costs and expenses: | | | | | | | |

| Cost of revenue | 9,857 | | | 8,505 | | | 38,981 | | | 28,813 | |

| Research and development | 32,016 | | | 27,484 | | | 127,073 | | | 97,096 | |

| Sales and marketing | 30,494 | | | 29,732 | | | 123,182 | | | 106,430 | |

| General and administrative | 17,234 | | | 22,871 | | | 67,733 | | | 54,664 | |

| Total costs and expenses | 89,601 | | | 88,592 | | | 356,969 | | | 287,003 | |

| Loss from operations | (36,331) | | | (29,265) | | | (144,204) | | | (94,806) | |

| Interest income | 3,957 | | | 91 | | | 9,304 | | | 177 | |

| Other income (expense), net | 259 | | | (88) | | | (1,343) | | | (539) | |

| Loss before income taxes | (32,115) | | | (29,262) | | | (136,243) | | | (95,168) | |

| Provision for income taxes | 1,293 | | | 61 | | | 1,673 | | | 157 | |

| Net loss | $ | (33,408) | | | $ | (29,323) | | | $ | (137,916) | | | $ | (95,325) | |

| | | | | | | |

| Net loss per share attributable to Class A and Class B common stockholders, basic and diluted | $ | (0.09) | | | $ | (0.11) | | | $ | (0.36) | | | $ | (0.65) | |

| Weighted average shares used in computing net loss per share attributable to Class A and Class B common stockholders, basic and diluted | 370,305 | | | 276,368 | | | 378,731 | | | 146,337 | |

Consolidated Statements of Cash Flows

in thousands (unaudited)

| | | | | | | | | | | | | |

| Year Ended December 31 |

| 2022 | | 2021 | | |

| | | | | |

| Cash flows from operating activities: | | | | | |

| Net loss | $ | (137,916) | | | $ | (95,325) | | | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | |

| Depreciation and amortization | 5,656 | | | 4,172 | | | |

| Stock-based compensation | 64,420 | | | 47,514 | | | |

| Bad debt expense | 71 | | | 317 | | | |

| Other | (2,171) | | | 3 | | | |

| Changes in operating assets and liabilities: | | | | | |

| Accounts receivable, net | (168) | | | (8,172) | | | |

| Prepaid expenses and other current assets | 4,074 | | | (4,087) | | | |

| Operating lease right-of-use assets | 6,867 | | | 6,605 | | | |

| Other assets | (323) | | | 370 | | | |

| Accounts payable | (1,578) | | | 2,759 | | | |

| Operating lease liabilities | (7,132) | | | (5,844) | | | |

| Accrued expenses and other current liabilities | 7,697 | | | 420 | | | |

| Net cash used in operating activities | (60,503) | | | (51,268) | | | |

| Cash flows from investing activities: | | | | | |

| Purchases of property and equipment | (3,161) | | | (8,846) | | | |

| Purchases of marketable securities | (711,887) | | | (199,832) | | | |

| Sales of marketable securities | 10,789 | | | 2,411 | | | |

| Maturities of marketable securities | 366,811 | | | 56,745 | | | |

| Loan to Opportunity Finance Network | (5,000) | | | — | | | |

| Net cash provided by (used in) investing activities | (342,448) | | | (149,522) | | | |

| Cash flows from financing activities: | | | | | |

| Proceeds from exercise of stock options, net of repurchases | 12,463 | | | 15,334 | | | |

| Proceeds from issuance of common stock under employee stock purchase plan | 1,430 | | | — | | | |

| Proceeds from the Reverse Recapitalization | — | | | 628,489 | | | |

| Payment of transaction costs related to the Reverse Recapitalization | (314) | | | (5,384) | | | |

| Tax withholdings on release of restricted stock units | (695) | | | (863) | | | |

| Repurchase of common stock | (77,232) | | | — | | | |

| Net cash provided by (used in) financing activities | (64,348) | | | 637,576 | | | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | 723 | | | 283 | | | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | (466,576) | | | 437,069 | | | |

| Cash, cash equivalents, and restricted cash at beginning of period | 521,812 | | | 84,743 | | | |

| Cash, cash equivalents, and restricted cash at end of period | 55,236 | | | 521,812 | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are prepared in accordance with GAAP, we present non-GAAP cost of revenue, non-GAAP research and development, non-GAAP sales and marketing, non-GAAP general and administrative, adjusted EBITDA and adjusted EBITDA Margin in this shareholder letter. Our use of non-GAAP financial measures has limitations as an analytical tool, and these measures should not be considered in isolation or as a substitute for analysis of financial results as reported under GAAP.

We use these non-GAAP financial measures in conjunction with financial measures prepared in accordance with GAAP for planning purposes, including in the preparation of our annual operating budget, as a measure of our core operating results and the effectiveness of our business strategy, and in evaluating our financial performance. These measures provide consistency and comparability with past financial performance, facilitate period-to-period comparisons of core operating results, and also facilitate comparisons with other peer companies, many of which use similar non-GAAP financial measures to supplement their GAAP results. In addition, adjusted EBITDA is widely used by investors and securities analysts to measure a company's operating performance. We exclude the following items from one or more of our non-GAAP financial measures: stock-based compensation expense (non-cash expense calculated by companies using a variety of valuation methodologies and subjective assumptions), depreciation and amortization (non-cash expense), interest income, provision for income taxes, and, if applicable, acquisition-related costs.

Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In particular, (1) stock-based compensation expense has recently been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy, (2) although depreciation and amortization expense are non-cash charges, the assets subject to depreciation and amortization may have to be replaced in the future, and our non-GAAP measures do not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements, and (3) adjusted EBITDA does not reflect: (a) changes in, or cash requirements for, our working capital needs; (b) interest expense, or the cash requirements necessary to service interest or principal payments on our debt, which reduces cash available to us; or (c) tax payments that may represent a reduction in cash available to us. The non-GAAP measures we use may be different from non-GAAP financial measures used by other companies, limiting their usefulness for comparison purposes. We compensate for these limitations by providing specific information regarding the GAAP items excluded from these non-GAAP financial measures. A reconciliation of these non-GAAP measures has been provided below:

Non-GAAP Financial Measures

in thousands (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31 | | Year Ended December 31 |

| 2022 | | 2021 | | 2022 | | 2021 |

| | | | | | | |

| Net loss | $ | (33,408) | | | $ | (29,323) | | | $ | (137,916) | | | $ | (95,325) | |

| % Margin | (63 | %) | | (49 | %) | | (65 | %) | | (50 | %) |

| Depreciation and amortization | $ | 1,487 | | | $ | 970 | | | $ | 5,656 | | | $ | 4,172 | |

| Stock-based compensation | 17,463 | | | 20,543 | | | 64,420 | | | 47,514 | |

| Interest income | (3,957) | | | (91) | | | (9,304) | | | (177) | |

| Provision for income taxes | 1,293 | | | 61 | | | 1,673 | | | 157 | |

| Adjusted EBITDA | $ | (17,122) | | | $ | (7,840) | | | $ | (75,471) | | | $ | (43,659) | |

| % Margin | (32 | %) | | (13 | %) | | (35 | %) | | (23 | %) |

| Cost of Revenue Reconciliation: | | | | | | | |

| Cost of Revenue, GAAP | $ | 9,857 | | | $ | 8,505 | | | $ | 38,981 | | | $ | 28,813 | |

| Stock-based compensation | (721) | | | (485) | | | (2,627) | | | (1,466) | |

| Cost of Revenue, Non-GAAP | $ | 9,136 | | | $ | 8,020 | | | $ | 36,354 | | | $ | 27,347 | |

| % of revenue, GAAP | 19 | % | | 14 | % | | 18 | % | | 15 | % |

| % of revenue, Non-GAAP | 17 | % | | 14 | % | | 17 | % | | 14 | % |

| Research and Development Reconciliation: | | | | | | | |

| Research and Development, GAAP | $ | 32,016 | | | $ | 27,484 | | | $ | 127,073 | | | $ | 97,096 | |

| Stock-based compensation | (9,653) | | | (6,736) | | | (35,567) | | | (20,690) | |

| Depreciation and amortization | (508) | | | (271) | | | (1,951) | | | (1,062) | |

| Research and Development, Non-GAAP | $ | 21,855 | | | $ | 20,477 | | | $ | 89,555 | | | $ | 75,344 | |

| % of revenue, GAAP | 60 | % | | 46 | % | | 60 | % | | 51 | % |

| % of revenue, Non-GAAP | 41 | % | | 35 | % | | 42 | % | | 39 | % |

| Sales and Marketing Reconciliation: | | | | | | | |

| Sales and Marketing, GAAP | $ | 30,494 | | | $ | 29,732 | | | $ | 123,182 | | | $ | 106,430 | |

| Stock-based compensation | (2,543) | | | (1,927) | | | (10,160) | | | (6,388) | |

| Depreciation and amortization | (782) | | | (618) | | | (3,001) | | | (2,794) | |

| Sales and Marketing, Non-GAAP | $ | 27,169 | | | $ | 27,187 | | | $ | 110,021 | | | $ | 97,248 | |

| % of revenue, GAAP | 57 | % | | 50 | % | | 58 | % | | 55 | % |

| % of revenue, Non-GAAP | 51 | % | | 46 | % | | 52 | % | | 51 | % |

| General and Administrative Reconciliation: | | | | | | | |

| General and Administrative, GAAP | $ | 17,234 | | | $ | 22,871 | | | $ | 67,733 | | | $ | 54,664 | |

| Stock-based compensation | (4,546) | | | (11,395) | | | (16,066) | | | (18,970) | |

| Depreciation and amortization | (197) | | | (81) | | | (704) | | | (316) | |

| General and Administrative, Non-GAAP | $ | 12,491 | | | $ | 11,395 | | | $ | 50,963 | | | $ | 35,378 | |

| % of revenue, GAAP | 32 | % | | 39 | % | | 32 | % | | 28 | % |

| % of revenue, Non-GAAP | 23 | % | | 19 | % | | 24 | % | | 18 | % |

| Total Operating Expenses Reconciliation: | | | | | | | |

| Operating Expenses, GAAP | $ | 89,601 | | | $ | 88,592 | | | $ | 356,969 | | | $ | 287,003 | |

| Stock-based compensation | (17,463) | | | (20,543) | | | (64,420) | | | (47,514) | |

| Depreciation and amortization | (1,487) | | | (970) | | | (5,656) | | | (4,172) | |

| Total Operating Expenses, Non-GAAP | $ | 70,651 | | | $ | 67,079 | | | $ | 286,893 | | | $ | 235,317 | |

| % of revenue, GAAP | 168 | % | | 149 | % | | 168 | % | | 149 | % |

| % of revenue, Non-GAAP | 133 | % | | 113 | % | | 135 | % | | 122 | % |