- SHCO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

FWP Filing

Soho House & Co (SHCO) FWPFree writing prospectus

Filed: 6 Jul 21, 5:19pm

Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration No. 333-257206

July 6, 2021

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it.

The foregoing statement does not form part of the prospectus approved by the FCA (as defined below) for the purposes of the U.K. Prospectus Regulation.

This document comprises a prospectus for the purposes of Article 3 of the UK version of Regulation (EU) No 2017/1129 as amended by The Prospectus (Amendment etc.) (EU Exit) Regulations 2019, which is part of UK law by virtue of the European Union (Withdrawal) Act 2018 (the “UK Prospectus Regulation”) as amended relating to Membership Collective Group Inc (“MCG Inc.”), prepared in accordance with the prospectus regulation rules (the “UK Prospectus Regulation Rules”) of the Financial Conduct Authority (the “FCA”) made under section 73A of the Financial Services and Markets Act 2000 (the “FSMA”). This prospectus has been approved by the FCA in accordance with section 87A of the FSMA and has been made available to the public in accordance with Prospectus Rule 3.2.1. The FCA, as the competent authority under the UK Prospectus Regulation, only approves this prospectus as meeting the standards of completeness, comprehensibility and consistency imposed by the UK Prospectus Regulation and such approval should not be considered as an endorsement of MCG Inc. or the quality of its shares of Class A common stock (as defined below) that are the subject of this prospectus. Prospective investors should make their own assessment as to the suitability of investing in the Class A common stock of MCG Inc. of US$0.01 par value per share (the “Class A common stock”) offered to eligible employees of Soho House Holdings Limited and its affiliates (“Eligible Employees”) and eligible members of certain membership brands of the Membership Collective Group (“Eligible Members”) in each case who are resident and located in the United Kingdom (such persons, “UK Eligible Employees” and “UK Eligible Members”, respectively, and together, “Eligible UK Participants”) pursuant to, and subject to the terms of, the offer described in this prospectus (the “UK Community Offer”).

An application has been made for the shares of Class A common stock to be listed on the New York Stock Exchange (the “NYSE”) with the ticker symbol ‘MCG’. No application has been or will be made for the shares of Class A common stock to be admitted to listing on or by any other stock exchange, including any stock exchange in the United Kingdom. It is expected that conditional dealings of the shares of Class A common stock on the NYSE will commence at 9:30 a.m. (New York time) on or about July 15, 2021, being the New York business day following the Pricing Date (as defined herein). The shares of Class A common stock will only be traded on the NYSE as dematerialised shares and, accordingly, no documents of title will be issued to successful applicants who wish to apply for shares of Class A common stock. Eligible UK Participants who acquire shares of Class A common stock and are successful will have the option of holding their shares of Class A common stock directly or through a participant in CREST (as defined below). Any Eligible UK Participant who holds their shares of Class A common stock in CREST will be subject to additional requirements in order to settle trades in their shares of Class A common stock following completion and settlement of the sale and purchase of the shares of Class A common stock pursuant to the Combined Offers (“Completion”), which may delay their ability to do so. See Part 6 (Details of the UK Community Offer) for a description of these requirements. No Eligible UK Participant will be able to deal in their shares of Class A common stock prior to commencement of conditional dealings of the shares on the NYSE.

The directors of MCG Inc., whose names appear on page 46 of this prospectus (the “Directors”), and MCG Inc. accept responsibility for the information contained in this prospectus. To the best of the knowledge of the Directors and MCG Inc., the information contained in this prospectus is in accordance with the facts and makes no omission likely to affect the import of such information.

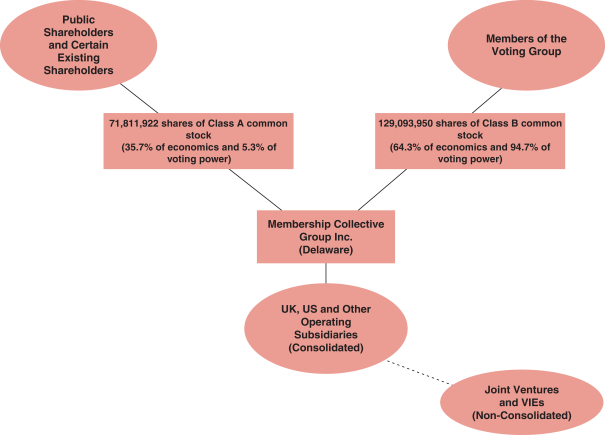

On Completion, MCG Inc. will have two classes of authorised common stock. The holders of MCG Inc.’s shares of Class A common stock will be entitled to one vote per share of Class A common stock, and the holders of the shares of Class B common stock will be entitled to ten votes per share of Class B common stock. Certain of MCG Inc.’s existing equity owners (and their affiliates) comprise the Voting Group (as described herein) that will hold all of its issued and outstanding Class B common stock and will have the right to convert Class B common stock held by them into shares of Class A common stock on a one-for-one basis. On Completion, the Voting Group will own Class B common stock representing 94.7% of the combined voting power of MCG Inc.’s common stock (assuming the Offer Price is set at the mid-point of the Expected Price Range and no exercise of the over-allotment option described herein). As a result, members of the Voting Group, when voting together as a group, will be able to control any action requiring approval of MCG Inc.’s stockholders so long as the Voting Group owns a requisite percentage of MCG Inc.’s total outstanding common stock. Accordingly, MCG Inc. will be a ‘controlled company’ within the meaning of the corporate governance rules of the NYSE. See “Management—Director independence” of Part 10 (Relevant Information extracted from the Registration Statement relating to the International Offer).

Prospective investors in the shares of Class A common stock should read this prospectus in its entirety before making any decision as to whether to purchase shares of Class A common stock. See Part 2 (Risk Factors) for a discussion of certain risks and other factors that should be considered prior to any investment in the shares of Class A common stock.

Class A Common Stock

MEMBERSHIP COLLECTIVE GROUP INC.

(Incorporated in the State of Delaware, United States of America (file number 4945249))

Offer of shares of Class A common stock par value US$ 0.01 each

to Eligible UK Participants

at an Offer Price expected to be between US$14.00 and US$16.00 per share of Class A common stock(1) (payable in equivalent pounds Sterling)

EXPECTED SHARE CAPITAL IMMEDIATELY FOLLOWING COMPLETION OF THE

COMBINED OFFERS AND COMMENCEMENT OF CONDITIONAL DEALINGS OF THE SHARES ON THE NYSE AND ASSUMING NO EXERCISE OF THE OVER-ALLOTMENT OPTION

| Issued and fully paid | ||||||||

| Number | Nominal Value | |||||||

Shares of Class A common stock | 71,811,922 | US$ | 0.01 | |||||

Shares of Class B common stock | 129,110,352 | US$ | 0.01 | |||||

The contents of this prospectus are not to be construed as legal, business or tax advice. None of MCG Inc. or any of its representatives, is making any representation to any offeree or purchaser of the shares of Class A common stock regarding the legality of an investment in the shares of Class A common stock by such offeree or purchaser under the laws applicable to such offeree or purchaser. Each prospective investor should consult his or her own lawyer, independent adviser or tax adviser for legal, financial or tax advice in relation to any subscription for Class A common stock. Prospective investors should be aware that an investment in MCG Inc. involves a degree of risk and that, if certain of the risks described in this prospectus occur, they may find their investment materially and adversely affected. Accordingly, an investment in the shares of Class A common stock is only suitable for prospective investors who are particularly knowledgeable in investment matters and who are able to bear the loss of the whole or part of their investment.

MCG Inc. is offering up to a maximum of 34,500,000 of its shares of Class A common stock pursuant to its initial public offering. MCG Inc’s shares of Class A common stock are being offered to certain institutional, professional and other investors (the “International Offer”) and in addition MCG Inc. has reserved up to 3.5% of its shares of Class A common stock to be sold in the Combined Offers (as defined below) for sale to Eligible UK Participants pursuant to the UK Community Offer described in this prospectus, and has also reserved up to 3.5% of the shares of Class A common stock to be sold in the Combined Offers for sale to Eligible Employees and Eligible Members located in the United States of America and to Eligible Employees located in certain jurisdictions other than the United States of America or the United Kingdom. In addition, MCG Inc. has reserved a number of its shares of Class A common stock for sale to certain members of MCG Inc.’s Board and related persons. The offer of shares of Class A common stock to Eligible Employees and Eligible Members located in the United States of America, and to Eligible Employees located in jurisdictions other than the United Kingdom and to certain members of MCG Inc.’s Board and related persons are, together, referred to as the “DSP Offer”. MCG Inc. may increase or decrease the size of the UK Community Offer and the DSP Offer in its discretion, however the aggregate number of shares of MCG Inc.’s Class A common stock to be sold pursuant to the UK Community Offer and the DSP Offer will not exceed 7% of the shares of MCG Inc.’s Class A common stock to be sold in the Combined Offers.

This prospectus relates solely to the offer of shares of Class A common stock to Eligible UK Participants resident and located in the United Kingdom and in connection with the UK Community Offer which is being made to such persons pursuant to this prospectus. This prospectus does not relate to the International Offer or the DSP Offer. The International Offer, the DSP Offer and the UK Community Offer are together referred to in this

| (1) | Subject to adjustment as contemplated herein. |

(i)

prospectus as the “Combined Offers”. The UK Community Offer is not being made to and cannot be accepted by the general public in the United Kingdom nor is it being made to and cannot be accepted by or

on behalf of any person other than Eligible UK Participants.

Completion of the UK Community Offer is subject to, and conditional upon, the International Offer and the DSP Offer proceeding. See “Background” in Part 6 (Details of the UK Community Offer).

As used in this prospectus, unless the context otherwise indicates, any reference to MCG Inc. is a reference to Membership Collective Group Inc., the entity making the UK Community Offer described herein and the issuer of the shares of Class A common stock offered pursuant to the Combined Offers. References to ‘Membership Collective Group,’ ‘MCG Group,’ ‘our company,’ ‘the company,’ ‘us,’ ‘we’ and ‘our’ refer: (i) prior to the exchange of equity interests by equity holders in Soho House Holdings Limited for shares of Class A common stock or Class B common stock (as applicable) in MCG Inc. as described in “Prospectus overview - our structure” in Part 10 (Relevant Information extracted from the Registration Statement relating to the International Offer), to Soho House Holdings Limited and its consolidated subsidiaries; and (ii) following such exchange, to MCG Inc. together with its consolidated subsidiaries.

None of the joint bookrunners acting in connection with the International Offer (the “Joint Bookrunners”) is acting in any capacity, or makes any representation or warranty, express or implied, in connection with the UK Community Offer or this prospectus and accordingly none of the Joint Bookrunners accepts any responsibility or liability whatsoever in respect of the UK Community Offer or the contents of this prospectus (including as to the accuracy, completeness or verification of this prospectus), or for any other statement made or purported to be made by it, or on its behalf, in connection with MCG Inc., the MCG Group, the shares of Class A common stock or the UK Community Offer, and nothing in this prospectus is, or shall be relied upon as, a promise or representation in this respect, whether as to the past or the future. Save for the responsibilities, if any, which may be imposed under the regulatory regime of any jurisdiction where exclusion of liability would be illegal, void or unenforceable, each of the Joint Bookrunners accordingly disclaims all and any responsibility or liability, whether arising in tort, contract or otherwise, which it might otherwise have in respect of this prospectus or any such statement or otherwise in connection with the UK Community Offer.

The UK Community Offer will be open for applications as described in this prospectus from the date of this prospectus until 23:59 p.m. (London time) on July 12, 2021 (the “UK Community Offer Closing Time”). The number of shares of Class A common stock to be sold by MCG Inc. pursuant to the Combined Offers (the “Offer Size”) will be determined by reference to and will be a function of, amongst other things, the offer price for the shares of Class A common stock determined on or about July 14, 2021 (the “Pricing Date”) in connection with the International Offer (the “Offer Price”). The number of shares of Class A common stock to be sold by MCG Inc. pursuant to the UK Community Offer (the “UK Community Offer Size”) will be set out in the Pricing Statement (as defined below) to be published by MCG Inc. as soon as practicable on or after the Pricing Date, which will also set out the Offer Price (in US dollars) which Eligible UK Participants will be required to pay for shares of Class A common stock which they acquire. Whilst the Offer Price will be a price per Share in US dollars, Eligible UK Participants will be required to pay for any shares of Class A common stock allocated to them pursuant to the UK Community Offer in pounds Sterling, converted at the Specified Exchange Rate. Further details of how the Offer Price is to be determined are set out in paragraph 3 (The Offer Price and the Offer Size) of Part 6 (Details of the UK Community Offer).

The range within which the Offer Price is currently expected to be set (the “Expected Price Range”) is between US$14.00 and US$16.00 per share of Class A common stock, although MCG Inc. reserves the right to set an Offer Price up to a maximum of 20% higher than the top of, or 20% lower than the bottom of, the Expected Price Range (i.e., between US$10.80 and US$19.20) (such, modified range, the “Maximum Price Range”).

The range within which the Offer Size is currently expected to be set (the “Expected Offer Size Range”) is between 30,000,000 and 34,500,000 shares of Class A common stock, although MCG Inc. reserves the right to modify that range to allow for the issuance of up to a maximum number of shares of Class A common stock 20% higher than the top, of or 20% lower than the bottom of, the Expected Offer Size Range (i.e., between 24,000,000 and 41,400,000 shares of Class A common stock) (such, modified range, the “Maximum Offer Size Range”).

The range within which the UK Community Offer Size is currently expected to be set (the “Expected UK Community Offer Size Range”) is up to 1,207,500 shares of Class A common stock, although MCG Inc. reserves the right to modify that range to allow for the issuance of up to a maximum number of shares of Class A common stock 20% higher than the top of the Expected UK Community Offer Size Range (i.e., up to 1,449,500 shares of Class A common stock) (such, modified range, the “Maximum UK Community Offer Size Range”).

(ii)

It is currently expected that the UK Community Offer Size will be set within the Maximum UK Community Offer Size Range and the Offer Price will be set within the Maximum Price Range. However, the UK Community Offer Size and the Offer Price, may be within or outside of the Expected Price Range or Expected UK Community Offer Size Range, as applicable. A number of factors will be considered in determining the Offer Price and the UK Community Offer Size, including the level and nature of demand for the shares of Class A common stock during the bookbuilding process for the International Offer and the DSP Offer, prevailing market conditions and the objective of establishing an orderly after-market in the shares of Class A common stock. Further details of how the Offer Price and the UK Community Offer Size are to be determined are set out in paragraph 3 (The Offer Price and the Offer Size) of Part 6 (Details of the UK Community Offer). Unless required to do so by law or regulation, MCG Inc. does not envisage publishing a supplementary prospectus or an announcement triggering a right to withdraw applications for shares of Class A common stock pursuant to Article 17 of the UK Prospectus Regulation on determination of the Offer Price or the UK Community Offer Size. If the Offer Price is set within the Maximum Price Range, and the UK Community Offer Size is set within the Maximum UK Community Offer Size Range, a pricing statement containing the Offer Price, the UK Community Offer Size, the total number of shares of Class A common stock comprised in the Combined Offers and related disclosures (the “Pricing Statement”) is expected to be published as soon as practicable on or after the Pricing Date and will be available on MCG Inc.’s website at www.membershipcollectivegroup.com. If the Offer Price is set outside of the Maximum Price Range or the Maximum Price Range is revised higher, or the UK Community Offer Size is set outside of the Maximum UK Community Offer Size Range, then we will make an announcement to such effect via a Regulatory Information Service and prospective investors will have a statutory right to withdraw their application for shares of Class A common stock pursuant to Article 17 of the UK Prospectus Regulation. In such circumstances, the Pricing Statement would not be published until the period for exercising such withdrawal rights has ended and the expected date of publication of the Pricing Statement would be extended. The arrangements for withdrawing offers to subscribe for shares of Class A common stock pursuant to the UK Community Offer would be made clear in the announcement.

Eligible UK Participants who wish to participate in the UK Community Offer can do so by applying through PrimaryBid Limited (“PrimaryBid”) at www.primarybid.com/mcg. Eligible UK Participants who are existing retail customers of financial intermediaries authorised by the FCA or the Prudential Regulatory Authority in the United Kingdom (each, an “Intermediary” and, together, the “Intermediaries”), and who wish to hold any shares of Class A common stock which may be allotted to them in an Individual Savings Account (“ISA”) or Self Invested Personal Pension (“SIPP”) may be able to request their Intermediary to submit an application on their behalf. See “Participation, allocation and pricing” in Part 6 (Details of the UK Community Offer) herein.

This prospectus does not constitute or form part of any offer or invitation to sell or issue, or any solicitation of any offer to subscribe for any securities other than the shares of Class A common stock to which it relates and which are being offered pursuant to the UK Community Offer or any offer or invitation to sell or issue, or any solicitation of any offer to subscribe for shares of Class A common stock by any person in any circumstances in which such offer or solicitation is unlawful.

If prospective investors are in any doubt about the contents of this prospectus they should consult their stockbroker, bank manager, lawyer, accountant or other financial adviser. It should be remembered that the price of securities can go down as well as up.

This document does not constitute an offer to sell or the solicitation of an offer to subscribe for shares of Class A common stock in any jurisdiction other than the United Kingdom. In particular, this document does not constitute an offer to sell or the solicitation of an offer to subscribe for shares of Class A common stock in the United States of America, pursuant to the International Offer or the DSP Offer or in any jurisdiction in which any such offer or solicitation is unlawful. The distribution of this document in jurisdictions other than the United Kingdom may be restricted by law and therefore persons into whose possession this document comes should inform themselves about and observe any such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities law of any such jurisdiction.

Prospective investors should only rely on the information in this prospectus. No person has been authorised to give any information or to make any representations in connection with the UK Community Offer, other than any information or representations contained in this prospectus and, if given or made, such information or representations must not be relied upon as having been authorised by MCG Inc. or on its behalf or on behalf of the Directors or any other person.

(iii)

None of MCG Inc., the Directors or any of their representatives is making any representation to any offeree or purchaser of the shares of Class A common stock regarding the legality of an investment by such offeree or purchaser.

In making an investment decision, each prospective investor must rely on their own examination, analysis and enquiry of MCG Inc. and the terms of the UK Community Offer, including the merits and risks involved, based on the information in this prospectus.

Prospective investors will be deemed to have acknowledged that they have relied solely on the information contained in this prospectus and that no person has been authorised to give any information or to make any representation concerning MCG Inc. or the shares of Class A common stock (other than as contained in this prospectus) and, if given or made, any such other information or representation should not be relied upon as having been authorised by MCG Inc., the Directors or any other person.

The information contained in this prospectus is correct only as at the date of this prospectus (or as the context indicates), subject to the requirements of the UK Prospectus Regulation Rules and any other legal and regulatory requirements. Neither any delivery of this prospectus nor the offering, sale or delivery of any shares of Class A common stock will, in any circumstances, create any implication that the information contained in this prospectus is true and accurate subsequent to the date hereof or (as the case may be) the date upon which this prospectus has been most recently supplemented, or that there has been no adverse change in MCG Inc.’s or the MCG Group’s financial situation since such date. The working capital statement at paragraph 3 “Working capital” of Part 8 (Additional Information) of this prospectus shall, notwithstanding the foregoing, relate to the period of 12 months from the date of this prospectus. This prospectus shall not incorporate by reference any information other than as expressly stated herein, nor shall it incorporate by reference any information published by us after its date.

The contents of this prospectus are not to be construed as legal, business or tax advice. Each prospective investor should consult his or her own lawyer, independent adviser or tax adviser for legal, financial or tax advice. In making an investment decision, each prospective investor must rely on their own examination, analysis and enquiry of MCG Inc. and the terms of the UK Community Offer, including the merits and risks involved.

Withdrawals

In the event that we are required to publish a supplementary prospectus, applicants who have applied to subscribe for shares of Class A common stock in the UK Community Offer will have at least two business days commencing on the first business day after the date of the publication of the supplementary prospectus within which to withdraw their offer to subscribe for shares of Class A common stock in the UK Community Offer.

In addition, in the event that the Offer Price is set outside of the Maximum Price Range or the Maximum Price Range is revised higher, or the UK Community Offer Size is set outside of the Maximum UK Community Offer Size Range, then applicants who have applied to subscribe for shares of Class A common stock in the UK Community Offer would have a statutory right to withdraw their offer to subscribe for shares of Class A common stock in the UK Community Offer in its entirety pursuant to Article 17 of the UK Prospectus Regulation before the end of a period of two business days commencing on the first business day after the date on which an announcement of this is published via a Regulatory Information Service announcement (or such later date as may be specified in that announcement).

If the application is not withdrawn within the stipulated period, any offer to apply for shares of Class A common stock in the UK Community Offer will remain valid and binding. Details of how to withdraw an application will be made available if a supplementary prospectus or a relevant announcement is published. In such circumstances, Eligible UK Participants who have submitted an application to apply for shares of Class A common stock in the UK Community Offer will also receive an email from PrimaryBid notifying them of the fact that the supplementary prospectus has been published and where such supplementary prospectus can be accessed and informing them of how they can withdraw their application through the PrimaryBid website. The email will also set out the period during which Eligible UK Participants may withdraw their application. Notice of withdrawal of an application given by any other means or which is submitted through the PrimaryBid website after the expiry of such period will not constitute a valid withdrawal and any such application to apply for shares of Class A common stock in the UK Community Offer will remain valid and binding.

This prospectus should not be considered as a recommendation by us that any recipient of this prospectus should subscribe for any shares of Class A common stock. Each recipient of this prospectus will be taken to have made

(iv)

their own investigation and appraisal of the condition (financial or otherwise) of MCG Inc., the MCG Group and of the shares of Class A common stock. Prior to making any decision as to whether to purchase the shares of Class A common stock, prospective investors should read this prospectus. Prospective investors should ensure that they read the whole of this prospectus carefully and not just rely on key information or information summarised within it.

UK Product Governance Requirements

No target market assessment has been made for the purposes of the product governance requirements of Chapter 3 of the FCA Handbook Product Intervention and Product Governance Sourcebook (the “UK Product Governance Requirements”). Accordingly, any distributor (if any) for the purposes of the UK Product Governance Requirements is responsible for undertaking its own target market assessment in respect of the shares of Class A common stock and determining appropriate distribution channels.

This prospectus is dated July 6, 2021.

(v)

| 1 | ||||

| 8 | ||||

| 41 | ||||

| 46 | ||||

PART 5 EXPECTED TIMETABLE OF PRINCIPAL EVENTS AND OFFER STATISTICS | 47 | |||

| 49 | ||||

| 60 | ||||

| 68 | ||||

| 76 | ||||

| 81 | ||||

| 244 | ||||

1

SUMMARY

SECTION A — INTRODUCTION AND WARNINGS

A.1. — Name, identity, contact details and date of approval

Shares of Class A common stock of US$0.01 par value each (the “Class A common stock”) of MCG Inc. (the “Shares”). When admitted to trading on the NYSE, the Shares will be registered with ISIN US5860011098 and trade under the ticker symbol ‘MCG’ using the CUSIP 586001 109.

The registered address of MCG Inc. is 1209 Orange Street, Wilmington, 19801 Delaware, United States of America and its principal executive offices are located at 180 Strand, London WC2R 1EA, United Kingdom. MCG Inc.’s legal entity identifier (LEI) is 213800XNSPPBRF2E5A41.

This prospectus has been approved on July 6, 2021 by the Financial Conduct Authority (the “FCA”) having its head office at 12 Endeavour Square, London, E20 1JN, United Kingdom and telephone number +44 (0)20 7066 1000. The FCA only approves this prospectus as meeting the standards of completeness, comprehensibility and consistency imposed by the UK Prospectus Regulation, and such approval should not be considered as an endorsement of MCG Inc., or of the quality of the Shares. Prospective investors should make their own assessment as to the suitability of investing in the Shares.

A.2. — Warning

This summary has been prepared in accordance with Article 7 of the UK Prospectus Regulation and should be read as an introduction to this prospectus. Any decision to invest in the Shares should be based on consideration of this prospectus as a whole by the prospective investor. Prospective investors could lose all or part of their invested capital.

Civil liability attaches only to those persons who have tabled this summary including any translation thereof, but only if the summary is misleading, inaccurate or inconsistent when read together with the other parts of the prospectus or it does not provide, when read together with the other parts of the prospectus, key information in order to aid prospective investors when considering whether to invest in such securities.

SECTION B — KEY INFORMATION ON THE ISSUER

Section B-1 — Who is the issuer of the securities?

B.1.1 — Domicile, legal form, applicable legislation and country of incorporation

MCG Inc. was incorporated on February 10, 2021 in the State of Delaware, United States of America, with file number 4945249 under the Delaware General Corporation Law and subordinate legislation thereunder.

B.1.2 — Principal activities

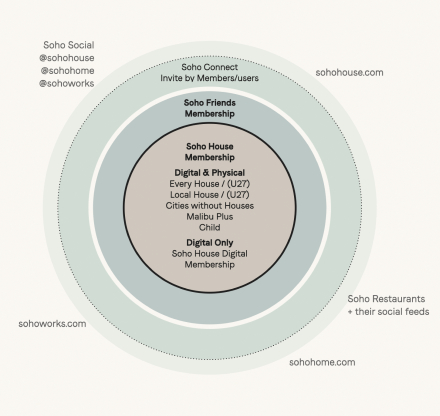

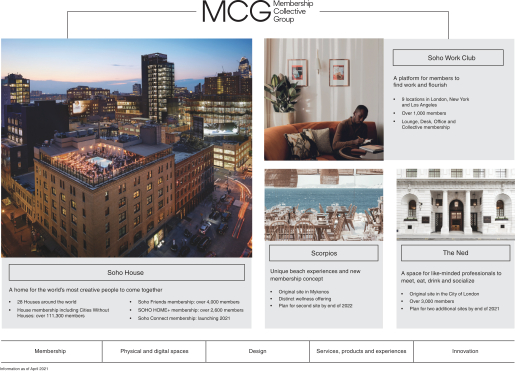

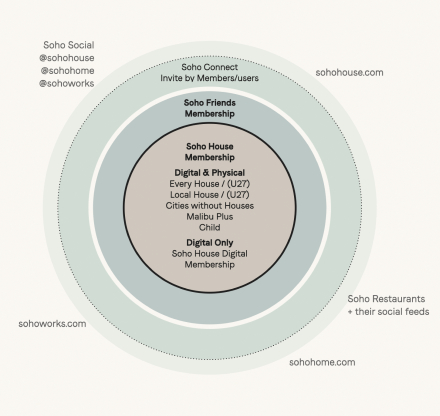

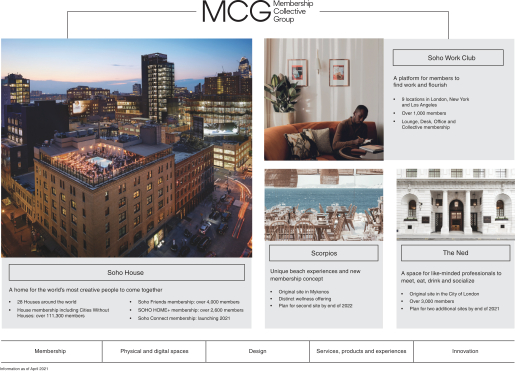

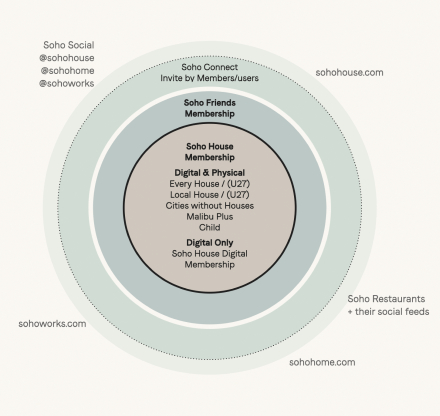

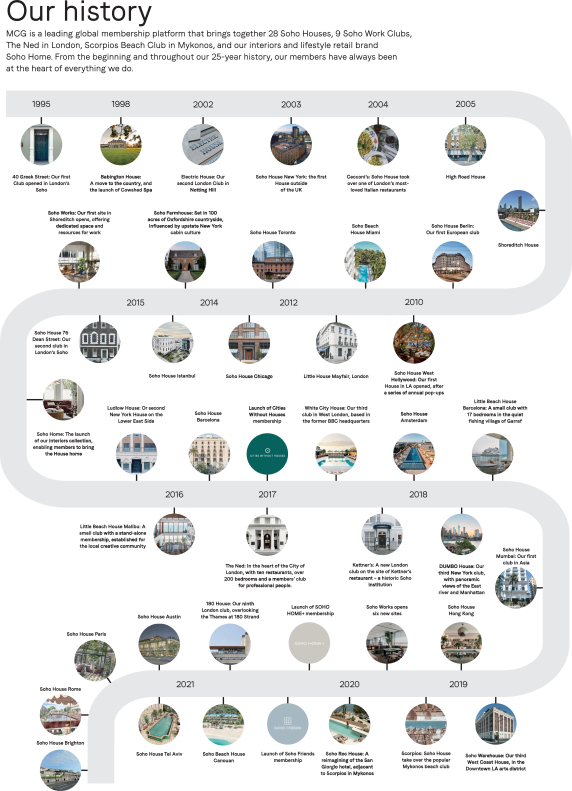

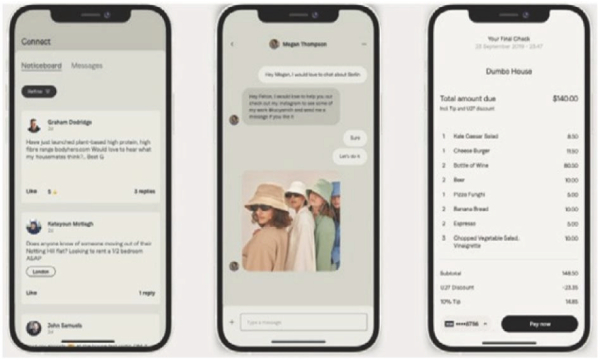

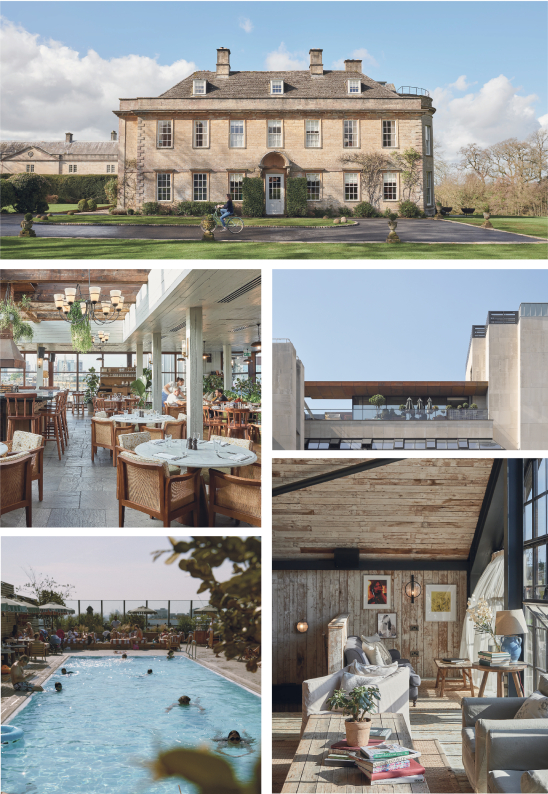

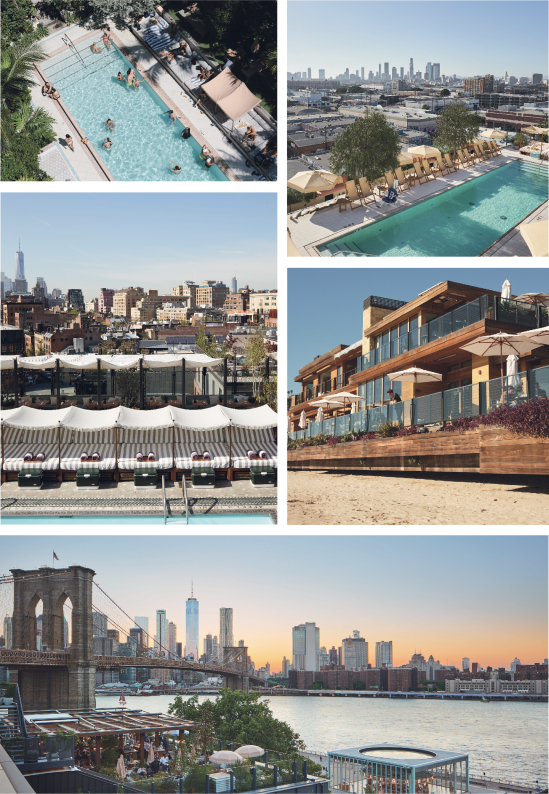

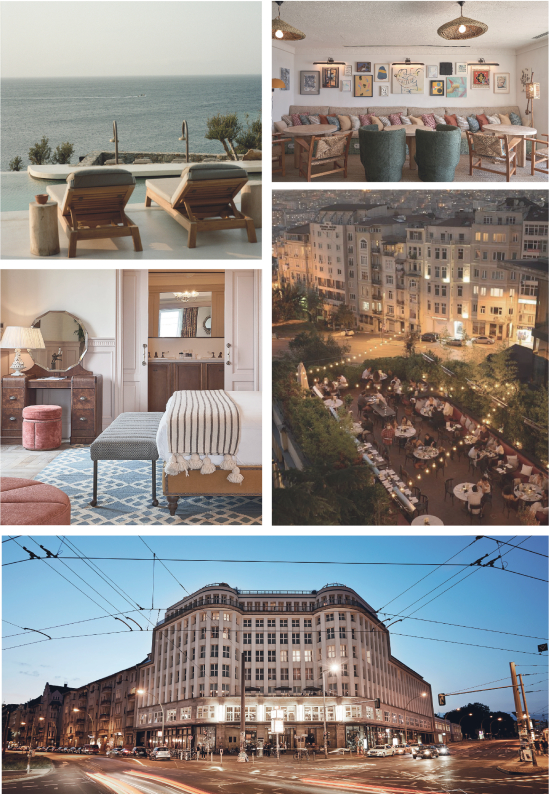

MCG Inc. will, on Completion, be the holding company of Soho House Holdings Limited and its affiliated membership clubs and platforms, known as The Membership Collective Group. The Membership Collective Group is a global membership platform of physical and digital spaces that connects a vibrant, diverse group of members from across the world. As of April 4, 2021, it had over 119,000 members who engage with it through its global portfolio of 30 Soho Houses, 9 Soho Work Clubs, The Ned in London, Scorpios Beach Club in Mykonos, Soho Home (its interiors and lifestyle retail brand), and its digital channels.

B.1.3 — Major stockholders

On Completion, MCG Inc. will have two classes of authorised common stock, the Shares and shares of Class B common stock. Holders of the Shares will have one vote per share of Class A common stock held, and for so long as the Voting Group hold Class B common stock, the holders of such shares of Class B common stock will be entitled to ten votes per share of Class B common stock held. Once the Voting Group owns less than 15% of MCG Inc.’s total outstanding shares of common stock, all remaining shares of Class B common stock will automatically convert on a one-for-one basis into Shares.

1

In so far as is known to the Directors, the following persons will on Completion be directly or indirectly interested in 5% or more of MCG Inc.’s share capital:

| Shares of Class A common stock beneficially owned before this offering | Shares of Class A common stock beneficially owned after giving effect to this offering (no option) | Shares of Class A common stock beneficially owned after giving effect to this offering (with option) | ||||||||||||||||||||||

Name of beneficial owner | Number of shares | Percentage | Number of shares | Percentage | Number of shares | |||||||||||||||||||

>5% Stockholders | ||||||||||||||||||||||||

Yucaipa Companies, LLC | 79,221,823 | 46.3 | % | 79,221,823 | 39.4 | % | 79,221,823 | 38.6 | % | |||||||||||||||

Global Joint Venture Investment Partners LP | 10,864,097 | 6.4 | % | 10,864,097 | 5.4 | % | 10,864,097 | 5.3 | % | |||||||||||||||

Nick Jones | 12,063,062 | 7.1 | % | 12,063,062 | 6.0 | % | 12,063,062 | 5.9 | % | |||||||||||||||

Richard Caring | 41,128,251 | 24.1 | % | 41,128,251 | 20.5 | % | 41,128,251 | 20.0 | % | |||||||||||||||

Directors, Director Nominees and Executive Officers | ||||||||||||||||||||||||

Nick Jones | 12,063,062 | 7.1 | % | 12,063,062 | 6.0 | % | 12,063,062 | 5.9 | % | |||||||||||||||

Ron Burkle | 90,085,920 | 52.7 | % | 90,085,920 | 44.8 | % | 90,085,920 | 43.9 | % | |||||||||||||||

Richard Caring | 41,128,251 | 24.1 | % | 41,128,251 | 20.5 | % | 41,128,251 | 20.0 | % | |||||||||||||||

All Directors, Director Nominees and Executive Officers as a group | 149,644,372 | 87.6 | % | 149,644,372 | 74.5 | % | 149,644,372 | 72.8 | % | |||||||||||||||

* Represents beneficial ownership of less than 1%.

| Shares of Class B common stock beneficially owned | ||||||||||||||||

| Shares of Class B common stock beneficially owned before this offering | Shares of Class B common stock beneficially owned after giving effect to this offering | |||||||||||||||

Name of beneficial owner | Number of shares | % | Number of shares | % | ||||||||||||

>5% Stockholders | ||||||||||||||||

Yucaipa Companies, LLC | 79,221,823 | 61.4 | % | 79,221,823 | 61.4 | % | ||||||||||

Nick Jones | 8,760,278 | 6.8 | % | 8,760,278 | 6.8 | % | ||||||||||

Richard Caring | 41,128,251 | 31.9 | % | 41,128,251 | 31.9 | % | ||||||||||

B.1.4 — Key executive directors

The Directors of MCG Inc. as at the date of this prospectus are Ron Burkle (aged 68), Nick Jones (aged 57) and Andrew Carnie (aged 47).

Each of the following director nominees are expected to become directors of MCG Inc. on Completion: Her Excellency Sheikha Al Mayassa Hamad (aged 39), Nicole Avant (aged 53), Richard Caring (aged 73), Alice Delahunt (aged 34), Mark Ein (aged 56), Joseph Hage (aged 58), Yusef D. Jackson (aged 50), Ben Schwerin (aged 42), Bippy Siegal (aged 53), and Dasha Zhukova (aged 39).

MCG Inc.’s Chief Financial Officer is Humera Afzal (aged 44).

B.1.5 — Statutory auditors

MCG Inc.’s statutory auditor is BDO LLP of 55 Baker Street, London W1U 7EU, United Kingdom. BDO LLP is a member firm of the Institute of Chartered Accountants in England and Wales.

Section B.2 — What is the key financial information regarding the issuer?

Selected historical key financial information

MCG Inc. is a newly incorporated entity that, immediately prior to Completion, will become the parent company of Soho House Holdings Limited and its consolidated subsidiaries (the “MCG Group”). The tables below set out the summary financial information of the MCG Group for the three years ended December 30, 2018, December 29, 2019 and January 3, 2021 and the 13-weeks ended April 4, 2021. The information has been prepared in accordance with GAAP. The selected financial information set out below has been extracted without material adjustment from the MCG Group’s consolidated historical financial information set out in the prospectus.

2

Consolidated statements of operations data

| As of and For the 13-Weeks Ended | As of and For the Fiscal Year Ended | |||||||||||||||||||

| April 4, 2021 | March 29, 2020 | January 3, 2021 | December 29, 2019 | December 30, 2018 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (Dollar amounts in thousands, except per share data) | ||||||||||||||||||||

Consolidated statements of operations data | ||||||||||||||||||||

Revenues | ||||||||||||||||||||

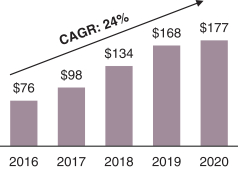

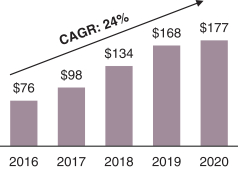

Membership revenues | $ | 40,493 | $ | 47,752 | $ | 176,910 | $ | 167,582 | $ | 134,060 | ||||||||||

In-House revenues | 16,259 | 67,871 | 126,774 | 312,330 | 271,392 | |||||||||||||||

Other revenues | 15,649 | 25,929 | 80,692 | 162,123 | 169,853 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total revenues | 72,401 | 141,552 | 384,376 | 642,035 | 575,305 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Operating expenses | ||||||||||||||||||||

In-House operating expenses (exclusive of depreciation and amortisation)(1)(2) | (45,809 | ) | (95,469 | ) | (220,036 | ) | (379,985 | ) | (310,923 | ) | ||||||||||

Other operating expenses (exclusive of depreciation and amortisation)(3) | (28,193 | ) | (26,129 | ) | (109,251 | ) | (144,455 | ) | (147,776 | ) | ||||||||||

General and administrative expenses | (16,505 | ) | (24,147 | ) | (74,954 | ) | (75,506 | ) | (62,443 | ) | ||||||||||

Pre-opening expenses | (4,825 | ) | (5,687 | ) | (21,058 | ) | (23,437 | ) | (20,323 | ) | ||||||||||

Depreciation and amortisation | (17,845 | ) | (14,949 | ) | (69,802 | ) | (57,139 | ) | (48,387 | ) | ||||||||||

Other | (22,784 | ) | (2,323 | ) | (44,005 | ) | (20,371 | ) | (17,838 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total operating expenses | $ | (135,961 | ) | $ | (168,704 | ) | $ | (539,106 | ) | $ | (700,893 | ) | $ | (607,690 | ) | |||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Operating loss | $ | (63,560 | ) | $ | (27,152 | ) | $ | (154,730 | ) | $ | (58,858 | ) | $ | (32,385 | ) | |||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Business interruption income | — | — | — | — | 650 | |||||||||||||||

Interest expense, net | (29,604 | ) | (17,756 | ) | (77,792 | ) | (64,108 | ) | (57,700 | ) | ||||||||||

Gain (loss) on sale of property and other, net | — | 1 | 98 | (1,340 | ) | (639 | ) | |||||||||||||

Share of (loss) profit of equity method investments | (696 | ) | (176 | ) | (3,627 | ) | 774 | 270 | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total other expense, net | (30,300 | ) | (17,931 | ) | (81,321 | ) | (64,674 | ) | (57,419 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Loss before income taxes | (93,860 | ) | (45,083 | ) | (236,051 | ) | (123,532 | ) | (89,804 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Income tax benefit (expense) | 823 | 103 | 776 | (4,468 | ) | (43 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net loss | $ | (93,037 | ) | $ | (44,980 | ) | (235,275 | ) | (128,000 | ) | (89,847 | ) | ||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net loss attributable to Soho House Holdings Limited | (90,479 | ) | (43,631 | ) | (228,461 | ) | (127,742 | ) | (91,356 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net loss per share (basic and diluted) | $ | (0.49 | ) | $ | (0.26 | ) | $ | (1.24 | ) | $ | (0.76 | ) | $ | (0.56 | ) | |||||

Consolidated balance sheet data

Consolidated balance sheet data | ||||||||||||||||||||

Cash and cash equivalents | $ | 71,674 | $ | 46,250 | $ | 52,887 | $ | 44,050 | $ | 47,748 | ||||||||||

Restricted cash | $ | 7,029 | $ | 7,694 | $ | 7,083 | $ | 12,265 | $ | 23,709 | ||||||||||

Total assets | $ | 2,122,162 | $ | 1,198,641 | $ | 2,104,445 | $ | 1,964,977 | $ | 1,435,107 | ||||||||||

Total liabilities | $ | 2,186,750 | $ | 2,035,041 | $ | 2,303,333 | $ | 2,064,830 | $ | 1,512,921 | ||||||||||

Redeemable preferred shares | $ | 176,274 | $ | 14,700 | $ | 14,700 | 14,700 | $ | 29,700 | |||||||||||

Redeemable C ordinary shares | $ | 207,405 | $ | 67,416 | $ | 160,405 | $ | 67,416 | — | |||||||||||

Total non-current liabilities | $ | 1,806,135 | $ | 1,721,615 | $ | 1,950,375 | $ | 1,762,191 | $ | 1,176,010 | ||||||||||

Total shareholders’ deficit | $ | (448,267 | ) | $ | (198,516 | ) | $ | (373,993 | ) | $ | (181,969 | ) | $ | (107,514 | ) | |||||

Total liabilities, redeemable preferred and ordinary shares and shareholders’ deficit | $ | 2,122,162 | $ | 1,198,641 | $ | 2,104,445 | $ | 1,964,977 | $ | 1,435,107 |

Other operating data

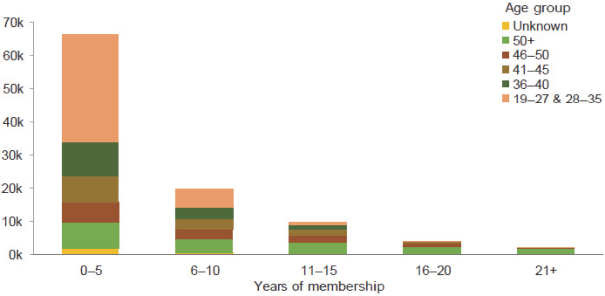

Other operating data (unaudited) | ||||||||||||||||||||

Number of Houses | 28 | 26 | 27 | 26 | 23 | |||||||||||||||

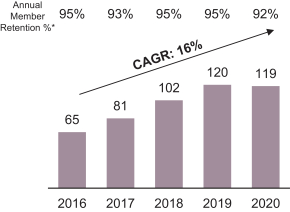

Number of Soho House | 111,311 | 123,357 | 113,509 | 119,832 | 101,968 | |||||||||||||||

Number of Other Members | 7,874 | 586 | 5,252 | 424 | 241 | |||||||||||||||

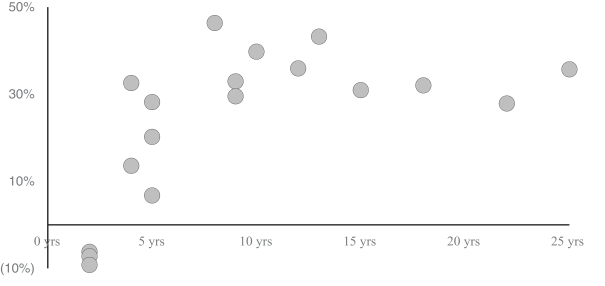

Soho House Member Retention | n/a | n/a | 92 | % | 95 | % | 95 | % | ||||||||||||

House-Level Contribution(4) | $ | 10,123 | $ | 19, 352 | $ | 81,159 | $ | 97,946 | $ | 94,529 | ||||||||||

As a percentage of House Revenues | 18 | % | 17 | % | 27 | % | 20 | % | 23 | % | ||||||||||

Total Other Contribution | $ | (11,724 | ) | $ | 602 | $ | (26,070 | ) | $ | 19,649 | $ | 22,077 | ||||||||

Adjusted EBITDA(5) | $ | (22,792 | ) | $ | (8,943 | ) | $ | (44,080 | ) | $ | 17,650 | $ | 37,288 | |||||||

As a percentage of Total Revenues | (31 | )% | (6 | )% | (11 | )% | 3 | % | 6 | % | ||||||||||

Number of Active App Users | 76,308 | 79,184 | 77,226 | 90,885 | 76,021 | |||||||||||||||

| (1) | In-House operating expenses includes our rent expense of $29,155 and $26,382 for the 13-weeks period ended April 4, 2021 and March 29, 2020, respectively, and $110,707, $88,761 and $61,097 for the fiscal years ended January 3, 2021, December 29, 2019 and December 30, 2018, respectively. Rent expense under ASC 842 includes an amount related to future rent increases and free-rent periods of $10,423 and $7,896 for the 13-weeks period ended April 4, 2021 and March 29, 2020, respectively, and $15,627, $33,128 and $9,434 for the fiscal years ended January 3, 2021, December 29, 2019 and December 30, 2018, respectively. These amounts are not related to the total contractual rent cashflows for the periods presented in “Consolidated Statements of Operations” above. |

| (2) | In-House operating expenses excludes depreciation and amortisation of $10,862 and $10,037 for the 13-week periods ended April 4, 2021 and March 29, 2020, respectively; and $46,386, $36,278 and $33,192 for the fiscal years ended January 3, 2021, December 29, 2019 and December 30, 2018, respectively. |

| (3) | Other operating expenses excludes depreciation and amortisation of $6,983 and $4,912 for the 13-week periods ended April 4, 2021 and March 29, 2020, respectively; and $23,416, $20,861 and $15,195 for the fiscal years ended January 3, 2021, December 29, 2019 and December 30, 2018, respectively. |

| (4) | ‘House-Level Contribution’ is defined as House Revenues (which we define as Membership Revenues as well as In-House Revenues, less ‘Non-House Membership Revenue’) less ‘In-House Operating Expenses,’ which includes expense items such as food and beverage costs, labor costs, variable overheads and fixed costs, such as rent. It does not reflect the impact of depreciation, amoritsation, |

3

| impairment, gain or loss on sale of property, business interruption income or general and administrative expenses. Our management considers House-Level Contribution to be an important management measure to evaluate the performance and profitability of each House, and growth in aggregate House-Level Contribution allows us to leverage our general and administrative costs and improve overall profitability. |

| (5) | ‘Adjusted EBITDA’ is defined as net income (loss) before depreciation and amortisation, interest expense, net, provision (benefit) for income taxes, adjusted to take account of the impact of certain non-cash and other items that we do not consider in our evaluation of ongoing operating performance. These items include, but are not limited to, loss (gain) on sale of property and other, net, share of loss (profit) from equity method investments, foreign exchange, pre-opening expenses, non-cash rent, deferred registration fees, share of equity method investments adjusted EBITDA, share-based compensation expense as well as certain other expenses, net. |

Section B.3 — What are the key risks that are specific to the issuer?

| • | The current outbreak of COVID-19, or the future outbreak of any other highly infectious or contagious diseases, has caused, and will continue to cause, disruption to MCG Inc.’s business, financial condition, liquidity, results of operations, cash flows or prospects. Further, the spread of the COVID-19 outbreak has caused severe disruptions in the global economy and financial markets and could potentially create widespread business continuity issues of an as yet unknown magnitude and duration. |

| • | The MCG Group has incurred net losses in each year since its inception, and may not be able to achieve profitability. |

| • | Restrictions imposed by the MCG Group’s outstanding indebtedness and any future indebtedness may limit MCG Inc.’s ability to operate its business and to finance its future operations or capital needs or to engage in other business activities. |

| • | The MCG Group has substantial debt, and may incur additional indebtedness, which may negatively affect MCG Inc.’s business and financial results as well as limit its ability to pursue its growth strategy. |

| • | The MCG Group will require a significant amount of cash to service its indebtedness. The ability to generate cash or refinance indebtedness as it becomes due depends on many factors, some of which are beyond its control. |

| • | MCG Inc.’s success depends on the strength of its name, image and brands, and if the value of its name, image or brands diminishes, its business and operations would be adversely affected. |

| • | Changes in consumer discretionary spending and general economic factors may adversely affect MCG Inc.’s results of operation. |

| • | As MCG Inc. expands its footprint internationally outside of the US and Europe, it is exposed to additional risks, including increased complexity and costs of managing projects and international operations and geopolitical instability. |

| • | MCG Inc.’s intellectual property rights are valuable, and any failure to obtain, maintain, protect, defend and enforce its intellectual property, including due to ‘brand squatting,’ could have a negative impact on the value of its brand names and adversely affect its business. |

| • | MCG Inc. identified material weaknesses in connection with internal controls over financial reporting. Although the MCG Group is taking steps to remediate these material weaknesses, there is no assurance it will be successful in doing so in a timely manner, or at all, and it may identify other material weaknesses. |

| • | A cybersecurity attack, ‘data breach’ or other security incident experienced by the MCG Group or its third-party service providers may result in negative publicity, claims, investigations and litigation and adversely affect its business, results of operation and financial condition. |

| • | If MCG Inc. fails to properly maintain the confidentiality and integrity of its data, including member and customer credit or debit card and bank account information and other personally identifiable information, or if it fails to comply with applicable laws, rules, regulations, industry standards and contractual obligations relating to data privacy, protection and security, it may adversely affect its reputation, business and operations. |

SECTION C—KEY INFORMATION ON THE SECURITIES

Section C.1 — What are the main features of the securities?

C.1.1 — Description of type and class of securities being offered

Only the Shares are being offered. When admitted to trading on the NYSE the shares of Class A common stock will be registered with ISIN US5860011098 and trade under the ticker symbol ‘MCG’ using the CUSIP 586001 109. The shares of Class A common stock will only be admitted to trading on the NYSE.

Eligible UK Participants who apply for Shares and are successful will have the option of holding their Shares directly on the register of members in the United States maintained by Computershare Trust Company, N.A., or in the form of CREST depository interests (the “MCG CDIs”) to be held through a participant in CREST.

4

C.1.2 — Currency, denomination, par value, number of securities issued and term of the securities

The Shares are shares of Class A common stock of US$0.01 par value each. The Shares are priced in US dollars and will only be quoted and traded on the NYSE in US dollars.

On Completion there will be up to 71,811,922 Shares in issue (all of which will be fully paid or credited as fully paid), depending on determination of the Offer Price and assuming no exercise of the over-allotment option, and up to 129,110,352 shares of Class B common stock in issue. The Class B common stock are not part of the UK Community Offer and will not be admitted to listing or trading on any stock exchange.

The UK Community Offer Size is expected to be up to a maximum of 1,207,500 Shares out of an expected maximum number of 34,500,000 Shares being offered by MCG Inc. The Offer Price is expected to be between US$14.00 and US$16.00. The UK Community Offer Size and the Offer Price will be set out in a pricing statement (the “Pricing Statement”) which is expected to be published on or about July 14, 2021 and will be available on MCG Inc.’s website at www.membershipcollectivegroup.com. Notwithstanding that the Offer Price will be a price in US dollars, Eligible UK Participants who wish to subscribe for Shares must pay for such Shares in pounds Sterling.

C.1.3 — Rights attached to the securities

The rights attaching to the Shares will be uniform in all respects and they will form a single class for all purposes, including with respect to voting and for all dividends and other distributions. The holders of the Shares are entitled to one vote per Share. The holders of the shares of Class B common stock will be entitled to ten votes per share of Class B common stock. Holders of Shares and shares of Class B common stock will vote together as a single class on all matters requiring approval by stockholders unless otherwise required by law. Each holder of shares of Class B common stock has the right to convert its shares of Class B common stock into Shares, at any time, upon notice to us, on a one-for-one basis.

On Completion, the shares of Class B common stock will be held by MCG Inc.’s Chief Executive Officer and MCG Inc. Board member Nick Jones, MCG Inc. Board member Mr. Richard Caring, and certain affiliates of MCG Inc.’s sponsor, The Yucaipa Companies, LLC (“Yucaipa”) and its Founder and MCG Inc.’s Executive Chairman and Director, Ron Burkle (and, in each case, certain affiliates and family members), acting together as a group (the “Voting Group”) pursuant to the provisions of a Stockholders’ Agreement. The Voting Group will be able to control any action requiring the approval of MCG’s Inc.’s stockholders.

C.1.4 — Seniority of securities

The Shares and the shares of Class B common stock will rank equally in all matters except for voting rights, as described above. The Shares and the shares of Class B common stock will not carry any rights to participate in a distribution (including on a winding-up) other than those that exist as a matter of law.

C.1.5 — Restrictions on free transferability of the securities

There will be no restrictions on the free transferability of the Shares or any MCG CDIs by Eligible UK Participants (subject, in the case of MCG CDIs, to meeting all requirements to facilitate the settlement and trading of the underlying shares of Class A common stock).

C.1.6 — Dividend policy

MCG Inc. intends to retain any earnings to expand the growth and development of its business and, therefore, does not anticipate paying dividends in the foreseeable future.

C.2. — Where will the securities be traded?

The Shares will be listed on the NYSE. No application has been or will be made for the Shares to be admitted to the Official List of the FCA or admitted to trading on the London Stock Exchange plc.

C.3. — What are the key risks that are specific to the securities?

| • | The dual class structure of MCG Inc.’s common stock has the effect of concentrating voting control with the Voting Group, including control over decisions that require the approval of stockholders; this will limit or preclude your ability to influence corporate matters submitted to a stockholder vote. |

| • | MCG Inc. has never paid dividends on MCG Inc.’s share capital and does not anticipate paying cash dividends in the foreseeable future. |

| • | It is likely that no active or liquid trading market will develop for the Shares in the United Kingdom, and holders of the Shares or MCG CDIs may not be able to easily realise their investment. |

5

SECTION D—KEY INFORMATION ON THE OFFER

D.1. — Under which conditions and timetable can I invest in this security?

D.1.1 — Terms and conditions of the offer

The UK Community Offer will be open for applications from the date of this prospectus until 11:59 p.m. (London time) on July 12, 2021.

The UK Community Offer consists of an offer solely to Eligible Employees and Eligible Members who are resident and located in the United Kingdom (“Eligible UK Participants”). Eligible UK Participants wishing to participate in the UK Community Offer can do so by applying through PrimaryBid at www.primarybid.com/mcg. Eligible UK Participants who are existing retail customers of any Intermediary and who wish to hold any Shares in an Individual Savings Account (“ISA”) or Self Invested Personal Pension (“SIPP”) may be able to request their relevant Intermediary to submit an application on their behalf. PrimaryBid will not charge Eligible UK Participants who wish to subscribe for Shares any commission for this service. Intermediaries may charge their customers a fee for submitting an application on their behalf.

The UK Community Offer is subject to, and conditional upon, the consummation of the International Offer and the DSP Offer. If the International Offer and the DSP Offer do not proceed for any reason, the UK Community Offer will be cancelled and withdrawn.

Eligible UK Participants who wish to subscribe for Shares pursuant to the UK Community Offer may only apply for a fixed number of 100 Shares. Prospective investors may not apply for more than 100 Shares, nor may they apply for fewer shares.

All Shares subject to the UK Community Offer will be sold at the Offer Price which will be a price in US dollars. Eligible UK Participants must pre-pay for 100 Shares in the amount of £1465.00, being the price of 100 Shares at an assumed Offer Price at the top of the Maximum Price Range, converted into pounds Sterling at a fixed exchange rate of US$1.00: £0.763 (the “Assumed Sterling Price”). The Offer Price is expected to be announced on or around July 14, 2021. If the Offer Price as eventually determined and converted into pounds Sterling at the prevailing rate of exchange on the Pricing Date (the “Final Sterling Price”) is higher than the Assumed Sterling Price, allocations will be scaled down and each applicant will be allotted only such whole number of Shares as can be purchased at the Final Sterling Price with the amount pre-paid at the time of application. Applicants will be refunded in pounds Sterling the difference between the amount pre-paid by them at the time of application and the actual aggregate price for such number of Shares as are allotted to them on the basis of the Final Sterling Price as eventually determined.

Eligible UK Participants will be required to elect whether to receive their Shares directly on the register of members maintained by Computershare Trust Company, N.A, with legal entitlement to such Shares being evidenced through The Direct Registration System (“DRS”), or to hold their entitlement to Shares through CREST, the UK-based system for the paperless settlement of trades in securities, of which Euroclear UK and Ireland Limited is the operator (“CREST”). DRS is a method of holding legal title to securities without the need to be issued with and retain a physical share certificate.

Eligible UK Participants who elect to hold their Shares through CREST (directly or through a broker or other nominee with a CREST account) will not be issued with Shares directly through DRS but will be issued with MCG CDIs through an unsponsored depositary interest programme administered through CREST in respect of the Shares. The MCG CDIs will, to the extent possible, reflect the economic rights attached to the Shares.

D.1.2 — Expected timetable

Event (1)(2) | Date | |

| 2021 | ||

UK Community Offer opens | July 6 | |

Last time and date for applications to be submitted via PrimaryBid (UK Community Offer closes) | 11:59 p.m. (London time) on July 12 | |

Pricing Date | on or about July 14 | |

Publication of the Pricing Statement (3) | on or about July 14 | |

Commencement of conditional dealings of Shares on the NYSE | 9:30 a.m. on or about July 15 | |

Completion of the Combined Offers | 8:00 a.m. on or about July 19 |

Notes:

| (1) | Times and dates set out in the timetable above are indicative only and subject to change without further notice. In particular, it should be noted that the UK Community Offer is subject to, and conditional upon, consummation of the International Offer and the DSP Offer. Furthermore, the dates and times of the announcement of the Offer Price and commencement of trading of the Shares on the NYSE may be accelerated or extended by agreement between us and the Joint Bookrunners in respect of the International Offer. |

6

| (2) | All times are New York time, unless otherwise stated. The time in New York will be five (5) hours behind London time. |

| (3) | The Pricing Statement will not automatically be sent to persons who receive this prospectus but it will be available free of charge at MCG Inc.’s principal executive office at 180 Strand, London WC2R 1EA, United Kingdom. In addition, the Pricing Statement will be published (subject to certain restrictions) in electronic form and available on www.membershipcollectivegroup.com. If the Offer Price is set outside of the Maximum Price Range or the Maximum Price Range is revised higher, or the UK Community Offer Size is set outside of the Maximum UK Community Offer Size Range, then MCG Inc. would make an announcement via a Regulatory Information Service and prospective investors would have a statutory right to withdraw their application for Shares pursuant to Article 17 of the Prospectus Regulation. The arrangements for withdrawing offers to subscribe for Shares would be made clear in the announcement. |

D.1.3 — Admission

Commencement of conditional dealings of the Shares on the NYSE is expected to become effective at 9:30 a.m. (New York time) on or about July 15, 2021. No application has been or will be made for the Shares to be admitted to trading on the London Stock Exchange plc. Prospective investors who subscribe for Shares in the UK Community Offer will not be able to trade the Shares on a conditional basis.

D.1.4 — Dilution

The Combined Offers will, together, result in an immediate dilution in adjusted net tangible book value (deficit) per share of Class A common stock of US$14.96 to new investors who purchase the shares of Class A common stock in the Combined Offers (assuming the Offer Size and Offer Price are set at the mid-point of the Maximum Offer Size Range and Maximum Price Range, respectively, and exercise of the over-allotment option).

D.1.5 — Net proceeds and expenses

Assuming the Offer Price is set at the mid-point of the Maximum Price Range, and assuming exercise of the over-allotment option, the net proceeds receivable by MCG Inc. pursuant to the Combined Offers are expected to be US$405.0 million, after deducting underwriting discounts and commissions, and other estimated offering expenses of US$15.8 million. If the Underwriters exercise in full their option to purchase an additional 4,500,000 Shares, the estimated net proceeds of the Combined Offers will be $468.1 million.

No expenses will be charged to Eligible UK Participants who decide to participate in connection with UK Community Offer by MCG Inc. or by PrimaryBid. Intermediaries may charge their customers a fee for submitting an application on their behalf. All other expenses in relation to the UK Community Offer will be borne by the MCG Group.

D.2. — Who is the offeror and/or the person asking for admission to trading?

The Shares are being offered by MCG Inc.

D.3. — Why is this prospectus being produced?

D.3.1 — Reasons for the offer and use of proceeds

This prospectus is being produced solely in connection with the UK Community Offer. The Directors believe that the initial public offering and listing of the Shares will support the MCG Group’s growth plans and help to enhance the membership experience for customers, give the MCG Group access to a wider range of capital-raising options and further improve the ability to recruit, retain and incentivise key management and employees. MCG Inc. is conducting the UK Community Offer for the specific purpose of enabling Eligible UK Participants to participate directly in the initial public offering of the Shares. MCG Group intends to use the net proceeds from the Combined Offers to repay outstanding indebtedness, to pay the redemption price of the outstanding preferred shares of Soho House & Co Limited and to use the remainder for general corporate purposes, including for working capital.

D.3.2 — Underwriting

The UK Community Offer is a direct offer by MCG Inc. and the Shares offered pursuant to the UK Community Offer are not being underwritten. Any portion of the Shares being offered pursuant to the UK Community Offer which are not purchased by UK Eligible Participants will not be resold and will remain unissued. All Shares to be offered pursuant to the International Offer and the DSP Offer, will be fully underwritten, subject to certain customary conditions, by the Joint Bookrunners in accordance with an underwriting agreement to be entered into on the Pricing Date. The Underwriting Agreement will only be entered into if the International Offer proceeds.

D.3.3 — Conflicts of interest

Following the Combined Offers, one of MCG Inc.’s directors, the Executive Chairman, Mr. Burkle, will remain affiliated with Yucaipa, as its Founder. Mr. Burkle has fiduciary duties to MCG Inc. and, in addition, has duties to Yucaipa. As a result, Mr. Burkle may face actual or potential conflicts of interest with respect to matters affecting both MCG Inc. and Yucaipa, whose interests may be adverse to MCG Inc.’s in some circumstances. None of the other directors of MCG Inc., nor any of the director nominees or any senior manager has any actual or potential conflicts of interest between any duties they owe to MCG Inc. and any private interests or other duties he or she may also have.

7

RISK FACTORS

Any investment in the shares of Class A common stock is subject to a number of risks. Prior to investing in the shares of Class A common stock, prospective investors should carefully consider the risk factors associated with any investment in the shares of Class A common stock, the MCG Group’s business and the industry in which it operates, together with all other information contained in this prospectus including, in particular, the risk factors described below.

Prospective investors should note that the risks relating to the MCG Group, its industry and the shares of Class A common stock summarised in the section of this prospectus headed “Summary” are the risks that MCG Inc. and the Directors believe to be the most essential to an assessment by a prospective investor of whether to consider an investment in the shares of Class A common stock. However, as the risks which the MCG Group faces relate to events and depend on circumstances that may or may not occur in the future, prospective investors should consider not only the information on the key risks summarised in the section of this prospectus headed “Summary” but also, among other things, the risks and uncertainties described below.

The risk factors described below are not an exhaustive list or explanation of all risks which prospective investors may face when making an investment in the shares of Class A common stock and prospective investors should use them as guidance only. The risk factors detailed below and additional risks and uncertainties relating to the MCG Group that are not currently known to MCG Group, or that MCG Inc. currently deems to be immaterial, may individually or cumulatively also have a material adverse effect on the MCG Group’s business, results of operations, financial condition, prospects and/or ability to pay dividends and, if any such risk should occur, the price of the shares of Class A common stock may decline and prospective investors could lose all or part of their investment. Prospective investors should consider carefully whether an investment in the shares of Class A common stock is suitable for them in the light of the information in this prospectus and their personal circumstances.

None of the statements made in this Part 2 (Risk Factors) in any way constitutes a qualification of the working capital statement contained in paragraph 3 (Working capital) of Part 8 (Additional Information) of this prospectus.

In this Part 2 (Risk Factors), references to “we”, “us” or “our” are to MCG Inc. and the MCG Group.

| 1. | Risks relating to our business |

1.1 The current outbreak of COVID-19, or the future outbreak of any other highly infectious or contagious diseases, has caused, and will continue to cause, disruption to our business, financial condition, liquidity, results of operations, cash flows or prospects. Further, the spread of the COVID-19 outbreak has caused severe disruptions in the global economy and financial markets and could potentially create widespread business continuity issues of an as yet unknown magnitude and duration.

In December 2019, COVID-19 was reported to have surfaced in Wuhan, China. COVID-19 has since spread to over 100 countries, including every state in the United States. On March 11, 2020 the World Health Organisation declared COVID-19 to be a pandemic.

The outbreak of COVID-19 has severely impacted global economic activity and caused significant volatility and negative pressure in financial markets. The global impact of the outbreak has evolved rapidly and many countries, including the United Kingdom and the United States, reacted by instituting quarantines, mandating business and school closures, and restricting travel. Many experts predict that the outbreak will trigger a period of global economic slowdown or a global recession.

The COVID-19 pandemic has adversely affected our near-term operating and financial results and will continue to adversely impact our long-term operating and financial results. As a result of the imposition of government-imposed lockdowns in many of the territories in which our properties are located, a majority of our sites have been forced to close or operate under restricted hours and with social distancing regulations in place throughout much of 2020 and into 2021. As a result of the forced closures, our In-House Revenues declined significantly.

The forced closure of many of our Houses for extended periods of time has also resulted in an increase in attrition among existing members as well as an increase in the number of members freezing their memberships.

8

Each member may request a temporary freeze to their membership on a six, nine or twelve month basis during which time the member will not be required to pay membership fees but will not have access to the Houses or any of our membership apps, and will not receive any communications from us. At the end of the freeze period the member will either resume his or her membership and continue paying membership fees, or his or her membership will be cancelled. As of April 4, 2021, we had over 16,500 Frozen Members. Due to the uncertainty of the COVID-19 pandemic, we may continue to see higher than average levels of attrition, increasing delinquencies in the payment of member dues, or we may encounter difficulties in attracting new members, any of which may materially and adversely affect our business, financial condition, liquidity, results of operation, cash flows or prospects.

In light of the evolving nature of COVID-19 and the uncertainty it has caused around the world, we do not believe it is possible to predict the COVID-19 pandemic’s cumulative and ultimate impact on our future business, results of operation, financial condition and cash flows. The extent of the impact of the COVID-19 pandemic on our business financial results and cash flows will depend largely on future developments, including the duration and extent of the spread of COVID-19 globally, the prevalence of local hospitality restrictions, the availability and adoption of effective vaccines, local, global and international travel restrictions, the impact on capital and financial markets and on the US and global economies, foreign currencies exchange, and governmental or regulatory orders that impact our business, all of which are highly uncertain and cannot be predicted. Moreover, even after restrictions are lifted, demand for our offerings may remain depressed for a significant length of time, and we cannot predict if and when demand will return to pre-COVID-19 levels. In addition, we cannot predict the impact the COVID-19 pandemic has had and will have on our business partners and third-party vendors and service providers, and we may continue to be materially adversely impacted as a result of the material adverse impact our business partners and third-party vendors suffer now and in the future.

In response to the economic challenges and uncertainty resulting from the COVID-19 pandemic and its impact on our business, we accelerated our cost efficiencies programs. During fiscal 2020, we implemented four rounds of redundancies; which reduced ‘Group Head Office’ employee headcount by 19%. This reduction in headcount has resulted in the loss of institutional knowledge, relationships, and expertise for certain critical roles, which may not have been effectively transferred to continuing employees and may divert attention away from operating our business, create personnel capacity constraints, and hamper our ability to grow, develop innovative products or membership platforms, and compete. Any of these impacts could materially adversely impact our business and reputation and impede our ability to operate or meet strategic objectives. This has led to increased attrition and could lead to reduced employee morale and productivity, as well as problems with retaining existing employees and recruiting future employees, all of which could have a material adverse impact on our business, results of operation, and financial condition.

To the extent the COVID-19 pandemic continues to materially adversely affect our business, results of operation, financial condition and cash flows, it may also have the effect of heightening many of the other risks described in these “Risk Factors” or elsewhere in this prospectus. Any of the foregoing factors, or other knock-on effects of the COVID-19 pandemic that are not currently foreseeable, will materially adversely impact our business, results of operation, and financial condition.

1.2 We have incurred net losses in each year since our inception, and we may not be able to achieve profitability.

We incurred net losses of $93 million for first quarter 2020 and net losses of $235 million for fiscal 2020. As of April 4, 2021, we had an accumulated deficit of $848 million and as of January 3, 2021, we had an accumulated deficit of $757 million. Historically, we have invested significantly in efforts to open new Houses, launch and grow complimentary businesses, hire additional employees, and enhance our membership experience. Beginning in the second quarter of 2020, as a response to the COVID-19 pandemic we significantly reduced our fixed and variable costs including by reducing discretionary capital spend. Nevertheless, we have continued to make significant investments in our membership platforms, including through our digital platforms and in new Houses. These efforts may prove more expensive than we currently anticipate, and we may not succeed in increasing our revenue from these investments or otherwise sufficiently offset these expenses. While we have enacted measures to reduce our expenses, we expect to continue to incur a net loss in fiscal 2021, and we are utilising a significant portion of our cash to support our operations in fiscal 2021 as a consequence of suffering a material decrease in revenues.

1.3 Restrictions imposed by our outstanding indebtedness and any future indebtedness may limit our ability to operate our business and to finance our future operations or capital needs or to engage in other business activities.

The terms of our outstanding indebtedness restrict us from engaging in specified types of transactions. These covenants restrict our ability, among other things, to:

| • | incur indebtedness or guarantees or engage in sale and leaseback transactions; |

9

| • | incur liens; |

| • | engage in mergers, acquisitions and asset sales; |

| • | alter the business conducted today by the MCG Group and its restricted subsidiaries; |

| • | make investments and loans; |

| • | declare dividends or other distributions; |

| • | enter into agreements limiting restricted subsidiary distributions; and |

| • | engage in certain transactions with affiliates. |

Our indebtedness limits our ability to engage in these types of transactions even if we believe that a specific transaction would contribute to our future growth or improve our results of operation. We believe that we will be able to operate our business without breaching the terms of our indebtedness. In addition, the credit agreements governing our credit facilities require us to meet specified financial and operating results and maintain compliance with specified financial covenants and ratios. In particular, under a senior revolving facility agreement (the “Revolving Credit Facility”) entered into with HSBC Bank PLC (“HSBC”) on December 5, 2019, from March 31, 2020 we are required to maintain a Consolidated Obligor EBITDA (as defined in the Revolving Credit Facility) at or above a certain level. This level is £5 million ($7 million) at April 4, 2021 and scales up to £32 million ($44 million) from December 31, 2021 in line with the anticipated recovery from the pandemic. We are currently in compliance with such covenants and have not breached any such terms in the past. We do not anticipate that we will be in breach of any such covenants in the short term, that is, for at least the twelve months from the date of publication of this prospectus, being the period covered by the working capital statement in this prospectus.

A breach of any of the restrictive covenants in our credit facilities or senior secured notes could result in an event of default, which could trigger acceleration of our indebtedness and may result in the acceleration of, or default under, any other debt we have incurred or we may incur in the future to which a cross-acceleration or cross-default provision applies, which could have a material adverse effect on our business and operations. In the event of any default under our credit facilities or senior secured notes, the applicable lenders or note purchasers could elect to terminate borrowing commitments and declare all borrowings and loans outstanding, together with accrued and unpaid interest and any fees and other obligations, to be immediately due and payable. In addition, or in the alternative, the applicable lenders or agents could exercise their rights under the security documents, entered into in connection with our credit facilities and our senior secured notes. We have pledged a significant portion of our assets as collateral under our credit facilities and our senior secured notes.

If we were unable to repay or otherwise refinance these borrowings and loans when due, the applicable lenders or agents could proceed against the collateral granted to them to secure that indebtedness, which could force us into bankruptcy or liquidation. In the event the applicable lenders or agents accelerate the repayment of our borrowings, we and our subsidiaries may not have sufficient assets to repay that indebtedness. Any acceleration of amounts due under the agreements governing our credit facilities or senior secured notes or the exercise by the applicable lenders or agents of their rights under the security documents would likely have a material adverse effect on our business and operations. As a result of these restrictions, we may be limited in how we conduct our business, unable to raise additional debt or equity financing on terms acceptable to us, or at all, to operate during general economic or business downturns, or unable to compete effectively or to take advantage of new business opportunities. These restrictions may affect our ability to grow in accordance with our strategy.

1.4 Anticipated changes in effective tax rates or adverse outcomes resulting from our exposure to various tax regimes in the countries in which we operate.

Net operating losses and excess interest deductions to offset future taxable income may be subject to certain limitations or forfeiture.