Exhibit 99.1

SAI Digital Summit Presentation

Disclaimer 2 Important Information About the Business Combination and Where to Find It : This presentation may be deemed solicitation material in respect of the proposed business combination (the “Business Combin ati on”) between TradeUP Global Corporation (“ TradeUP Global”), TGC Merger Sub and SAITECH Limited (“ SAITECH ” or the “Company”). This communication does not constitute a solicitation of any vote or approval. This communication does n ot constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed business combination, effective October 22, 2021 TradeUP Global filed a Registration Statement on Form F - 4 (Registration No. 333 - 260418)(the “Registration Statement”) with the U.S. Sec urities and Exchange Commission’s (“SEC”), which includes a preliminary prospectus and preliminary proxy statement. TradeUP Global may also file other documents with the SEC regarding the proposed business combination. TradeUP Global will mail a definitive proxy statement/prospectus and other relevant documents to its shareholders. This communication is not a substitute for the Registr ati on Statement, the definitive proxy statement/prospectus or any other document that TradeUP Global will send to its shareholders in connection with the proposed business combination. Investors and security holders of TradeUP Global are advised to read, when available, the proxy statement/prospectus in connection with TradeUP Global’s solicitation of proxies for its extraordinary general meeting of shareholders to be held to approve the proposed business combination (and related matters) because the proxy statement/prospectus will contain important informa tio n about the proposed business combination and the parties to the proposed business combination. The definitive proxy statement/prospectus will be mailed to shareholders of TradeUP Global as of a record date to be established for voting on the proposed business combination. Shareholders will also be able t o obtain copies of the proxy statement/prospectus and other documents filed with the SEC that will be incorporated by reference in the proxy statement/prospectus, without charge, once available, at the SEC’ s w eb site at www.sec.gov, or by directing a request to: TradeUP Global Corporation, 437 Madison Avenue, 27th Floor, New York, New York 10022, Attention: Jianwei Li, (732) 910 - 9692. Participants in the Solicitation : TradeUP Global and its directors and executive officers may be deemed participants in the solicitation of proxies from TradeUP Global’s shareholders with respect to the business combination. A list of the names of those directors and executive officers and a description of their interests in TradeUP Global is contained in TradeUP Global’s final prospectus filed with the SEC on April 30, 2021, and is available free of charge at the SEC’s web site at sec.gov, or b y directing a request to TradeUP Global Corporation, 437 Madison Avenue, 27th Floor, New York, New York 10022, Attention: Jianwei Li, (732) 910 - 9692. Additional infor mation regarding the interests of such participants is included in the proxy statement/prospectus contained the Registration Sta tement. SAITECH and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from th e s hareholders of TradeUP Global in connection with the business combination. A list of the names of such directors and executive officers and information regarding their interests in the proposed business combination is included in the proxy statement/prospectus cont ain ed the Registration Statement. No Representations or Warranties : No representations or warranties, express or implied are given in, or in respect of, this presentation or as to the accurac y, reasonableness or completeness of the information contained in or incorporated by reference herein. To the fullest extent permitted by law, in no circumstances will TradeUP Global, the Company or any of their respective affiliates, directors, officers, employees, members, partners, shareholders, a dv isors or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this presentation, its contents (including the internal economic models), its omissions, re lia nce on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connectio n t herewith. Certain information contained herein has been derived from sources prepared by third parties. While such information is believed to b e r eliable for the purposes used herein, none of the Company, TradeUP Global or any of their respective affiliates, directors, officers, employees, members, partners, shareholders, advisors or agents has independently verified the data obtained from these sources or makes any representation or warranty with respect to the accuracy of such information. Recipients of this presentation are not to const ru e its contents, or any prior or subsequent communications from or with TradeUP Global, the Company or their respective representatives as investment, legal or tax advice. In addition, this presentation do es not purport to be all inclusive or to contain all of the information that may be required to make a full analysis of the Company, TradeUP Global or the Proposed Transaction. Recipients of this presentation should each make their own evaluation of the Company, TradeUP Global or the Proposed Transaction and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Recipients are not entitled to rely on the accuracy or comp let eness of this presentation and are entitled to rely solely on only those particular representations and warranties, if any, w hic h may be made by TradeUP Global or the Company to a recipient of this presentation or other third party in a definitive written agreement, when, and i f executed, and subject to the limitations and restrictions as may be specified therein. The information contained herein and t he parties involved in the Proposed Transaction, any representations, warranties, agreements or covenants between the recipient and any parties i nvo lved in the Proposed Transaction set forth in definitive agreements by and among such persons. The Company and TradeUP Global disclaim any duty to update the information contained in this presentation. Forward - Looking Statements : This presentation includes “forward - looking statements” within the meaning of the “safe harbor” provisions of the Private Secu rities Litigation Reform Act of 1995. TradeUP Global’s and SAITECH’s actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward looking statements as predicti ons of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “ will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward - looking statement s. These forward - looking statements include, without limitation, TradeUP Global’s and SAITECH’s expectations with respect to future performance and anticipated financial impacts of the proposed business combination, the satisfaction of the closing conditions to the propose d b usiness combination and the timing of the closing. These forward - looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside TradeUP Global’s and SAITECH’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the outcom e of any legal proceedings that may be instituted against TradeUP Global and SAITECH following the announcement of the Business Combination Agreement and the transactions contemplated therein; (2) the inability t o complete the proposed business combination, including due to failure to obtain approval of the shareholders of TradeUP Global, approvals or other determinations from certain regulatory authorities, or other conditions to closing in the proposed b usiness combination; (3) the occurrence of any event, change or other circumstance that could give rise to the termination of the Business Combination Agreement or could otherwise cause the transactions contemplated therein to fail to close; (4) the risk that the proposed business combination disrupts current plans and operations as a result of the announcem ent and consummation of the proposed business combination; (5) the ability to recognize the anticipated benefits of the business comb ina tion, which may be affected by, among other things, competition and the ability of the combined company to grow and manage gr owt h profitably and retain its key employees; (6) costs related to the business combination; (7) changes in applicable laws or regulations; ( 8) the possibility that SAITECH or the combined company may be adversely affected by other economic, business, and/or competitive factors; (10) the impact of COVID - 19 on SAITECH’s business and/or the ability of the parties to complete the business combination; and (11) other risks and uncertainties indic at ed from time to time in the proxy statement/prospectus relating to the business combination, including those under “Risk Factors” in the Registration Statement and in TradeUP Global’s other filings with the SEC. TradeUP Global cautions that the foregoing list of factors is not exclusive. TradeUP Global cautions readers not to place undue reliance upon any forward - looking statements, which speak only as of the date made. TradeUP Global does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward - l ooking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Trademarks : This presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the prope rty of their respective owners, and the Company’s and TradeUP Global’s use thereof does not imply an affiliation with, or endorsement by, the owners of such trademarks, service marks, trade names and copyrights. Solely for convenience, some of the tr ademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, © or ® sym bol s, but the Company, TradeUP Global and their affiliates will assert, to the fullest extent under applicable law, the rights of the applicable owners, if an y, to these trademarks, service marks, trade names and copyrights.

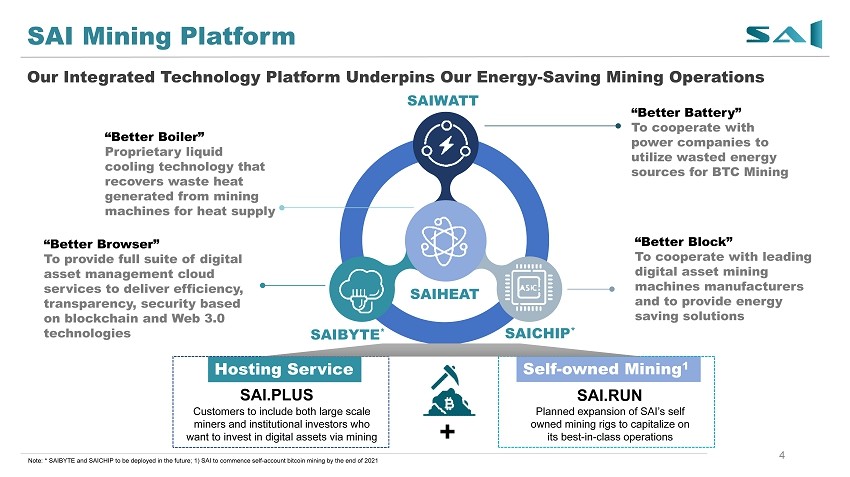

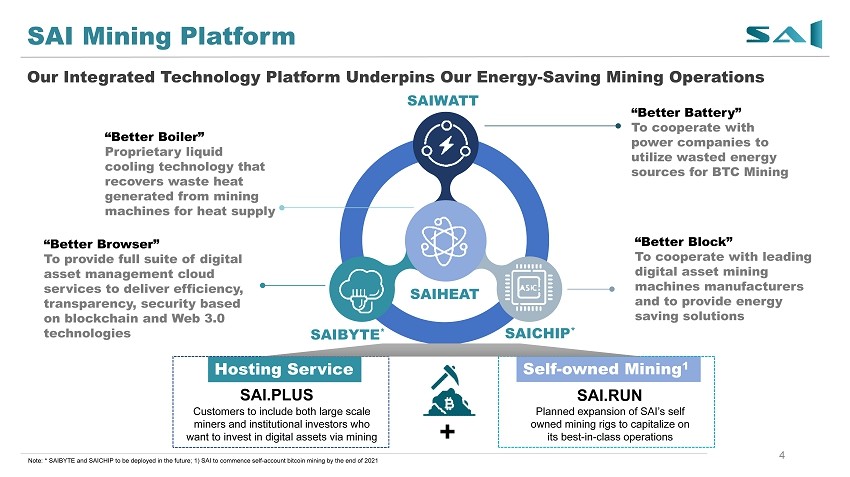

Introduction • Founded in 2019, SAITECH Limited (“SAI”) is a Eurasia - based energy saving bitcoin mining operator that provides integrated tech solutions to optimize mining’s total cost of operation (“TCO”) and is committed to carbon neutrality • SAI intends to become a publicly traded company via merger with TradeUP Global Corporation • Core technology sectors SAIHEAT (chip waste heat utilization) SAIWATT (clean power consumption) SAIBYTE (computing cloud network system) SAICHIP (new computing chip) Building an ecosystem with clean computing power as the core, providing the optimal solution with higher energy efficiency and less carbon emissions to benefit human society

SAI Mining Platform 4 Our Integrated Technology Platform Underpins Our Energy - Saving Mining Operations SAIHEAT SAIWATT SAIBYTE * SAICHIP * “Better Battery” To cooperate with power companies to utilize wasted energy sources for BTC Mining “Better Block” To cooperate with leading digital asset mining machines manufacturers and to provide energy saving solutions “Better Browser” To provide full suite of digital asset management cloud services to deliver efficiency, transparency, security based on blockchain and Web 3.0 technologies + Self - owned Mining 1 SAI .RUN Planned expansion of SAI’s self owned mining rigs to capitalize on its best - in - class operations Hosting Service SAI .PLUS Customers to include both large scale miners and institutional investors who want to invest in digital assets via mining “Better Boiler” Proprietary liquid cooling technology that recovers waste heat generated from mining machines for heat supply Note: * SAIBYTE and SAICHIP to be deployed in the future; 1) SAI to commence self - account bitcoin mining by the end of 2021

5 SAI is Dedicated to Carbon Neutrality x Seek long - term agreements with renewable energy power sources Renewable Energy x Recover excess heat from SAI’s data center and crypto mining centers to provide local heating for the community Heat Recovery Sustainability & carbon neutrality is key to our business x Prioritize water stewardship by investing in circular systems Water Stewardship x Purchase carbon offsets and compensate for carbon emitted (e.g. from forestry) Carbon Offset SAI is the first bitcoin mining company to release a Carbon Footprint report

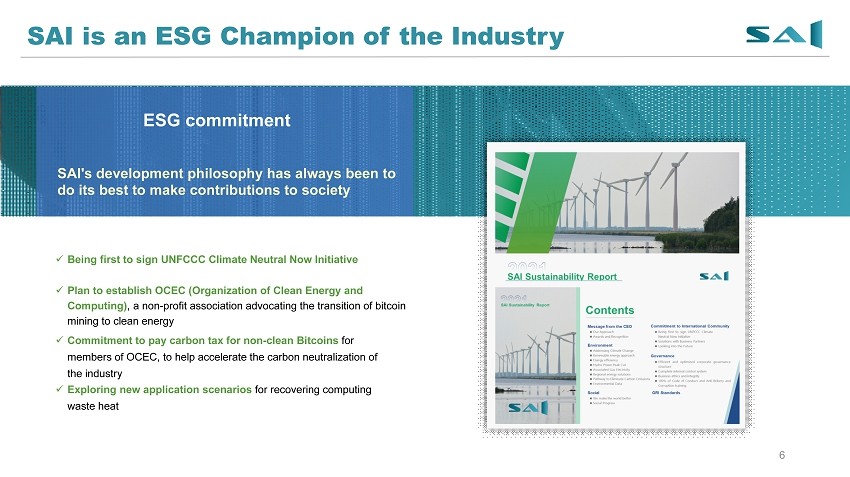

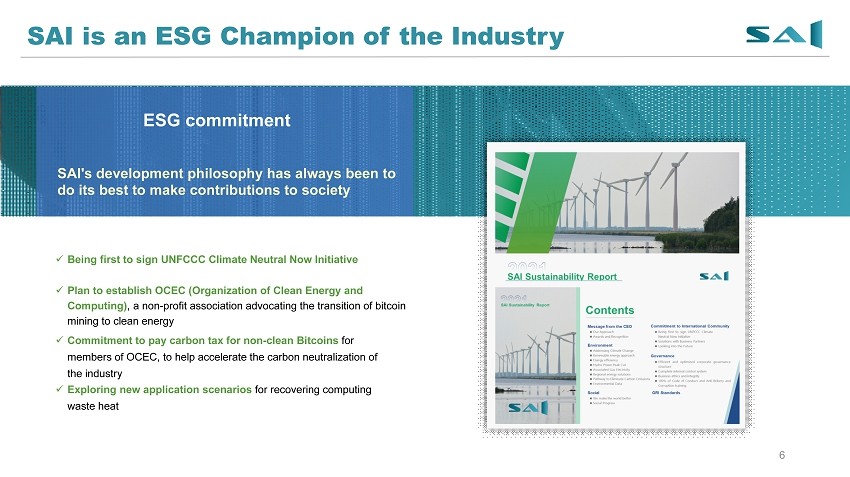

6 SAI is an ESG Champion of the Industry x Being first to sign UNFCCC Climate Neutral Now Initiative x Plan to establish OCEC (Organization of Clean Energy and Computing) , a non - profit association advocating the transition of bitcoin mining to clean energy x Commitment to pay carbon tax for non - clean Bitcoins for members of OCEC, to help accelerate the carbon neutralization of the industry x Exploring new application scenarios for recovering computing waste heat ESG commitment SAI's development philosophy has always been to do its best to make contributions to society

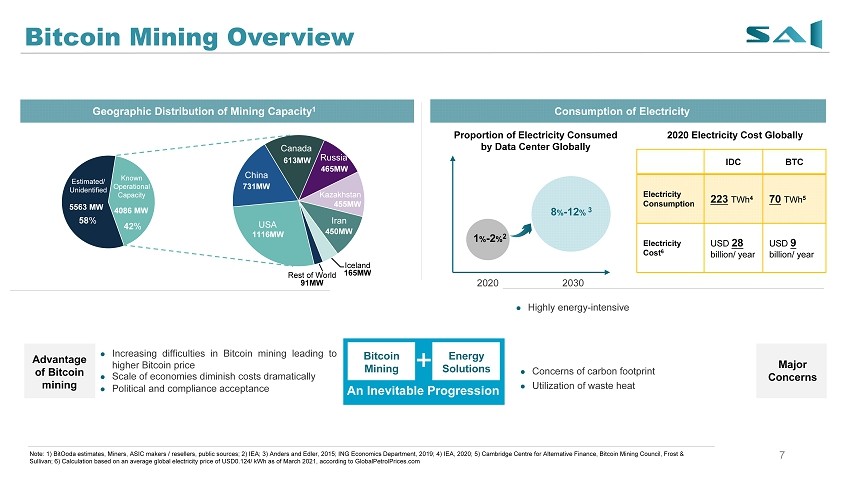

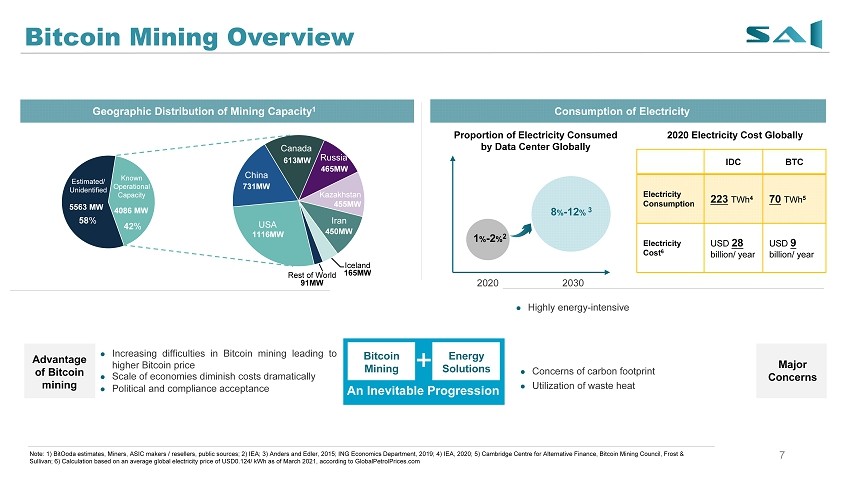

Proportion of Electricity Consumed by Data Center Globally Geographic Distribution of Mining Capacity 1 1 % - 2 % 2 2020 2030 8 % - 12 % 3 2020 Electricity Cost Globally Advantage of Bitcoin mining An Inevitable Progression Increasing difficulties in Bitcoin mining leading to higher Bitcoin price Scale of economies diminish costs dramatically Political and compliance acceptance Bitcoin Mining Energy Solutions Highly energy - intensive Concerns of carbon footprint Utilization of waste heat Major Concerns Consumption of Electricity Known Operational Capacity 4086 MW 42 % USA 1116MW China 731MW Canada 613MW Russia 465MW Kazakhstan 455MW Iran 450MW Iceland 165MW Rest of World 91MW Estimated/ Unidentified 5563 MW 58 % IDC BTC Electricity Consumption 223 TWh 4 70 TWh 5 Electricity Cost 6 USD 28 billion/ year USD 9 billion/ year Bitcoin Mining Overview Note: 1) BitOoda estimates, Miners, ASIC makers / resellers, public sources; 2) IEA; 3) Anders and Edler , 2015; ING Economics Department, 2019; 4) IEA, 2020; 5) Cambridge Centre for Alternative Finance, Bitcoin Mining Council, Fr ost & Sullivan; 6) Calculation based on an average global electricity price of USD0.124/ kWh as of March 2021, according to GlobalP etr olPrices.com 7

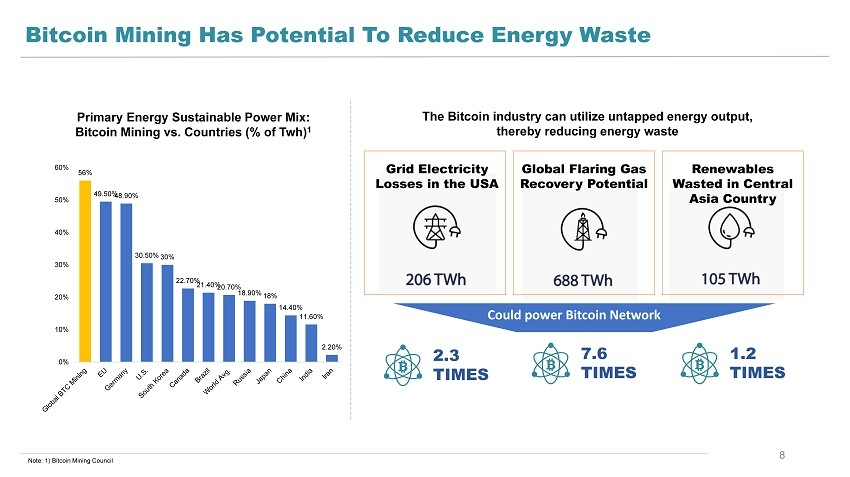

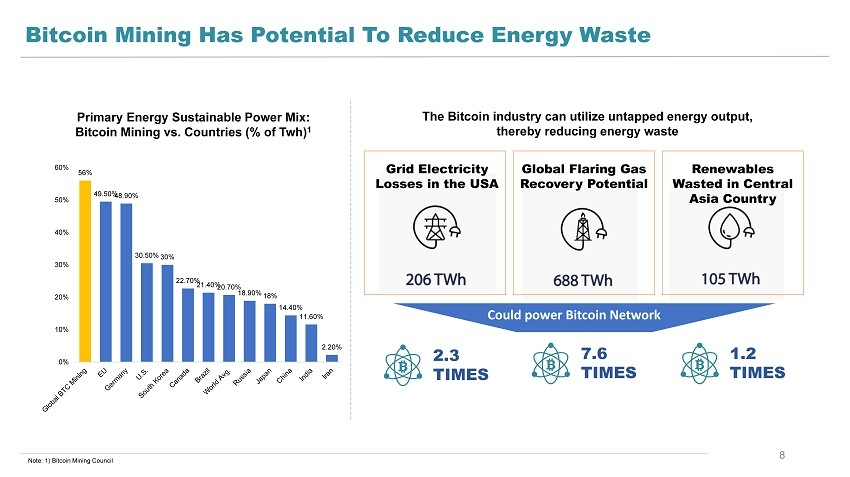

8 Note: 1) Bitcoin Mining Council Bitcoin Mining Has Potential To Reduce Energy Waste The Bitcoin industry can utilize untapped energy output, thereby reducing energy waste 56% 49.50% 48.90% 30.50% 30% 22.70% 21.40% 20.70% 18.90% 18% 14.40% 11.60% 2.20% 0% 10% 20% 30% 40% 50% 60% Grid Electricity Losses in the USA Global Flaring Gas Recovery Potential Renewables Wasted in Central Asia Country 2.3 TIMES 7.6 TIMES 1.2 TIMES Primary Energy Sustainable Power Mix: Bitcoin Mining vs. Countries (% of Twh ) 1 Could power Bitcoin Network

Key Points ▪ Bitcoin mining can promote the transition into renewable energy, as a complementary demand for clean energy production, storage and consumption with ancillary benefits ▪ Renewable energy such as solar and wind are low in cost but have intermittency and grid congestion issues, leading to deployment bottlenecks ▪ Bitcoin mining, with its flexibility as a storage and load option, could potentially help solve renewable energy’s problems of intermittency and congestion, allowing grids to deploy substantially more renewable energy ▪ As renewable energy capacity and production increase, renewable energy costs decrease even further, bringing lower marginal cost in production, thus in turn attracting more attention to clean energy utilization 1 Note: 1) Bitcoin Clean Energy Initiative Memorandum, Square; More in favor of carbon neutrality More consistent with the ESG concept & Growing Clean Energy Adoption in Bitcoin Mining 9

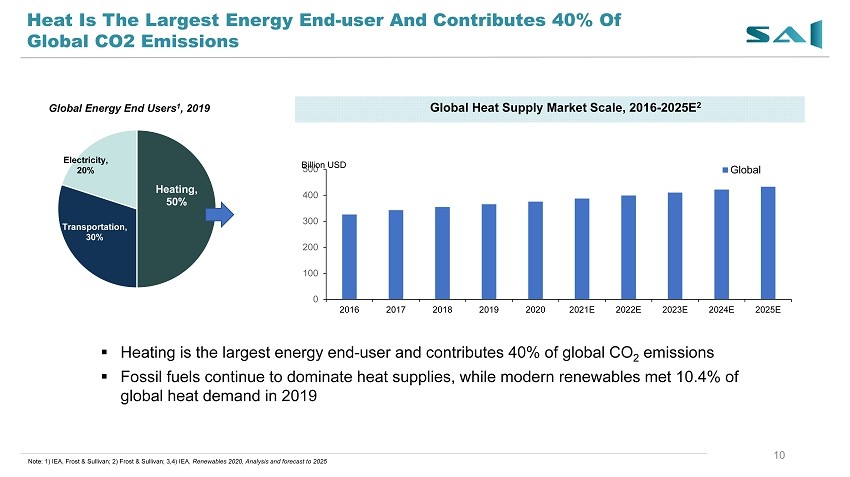

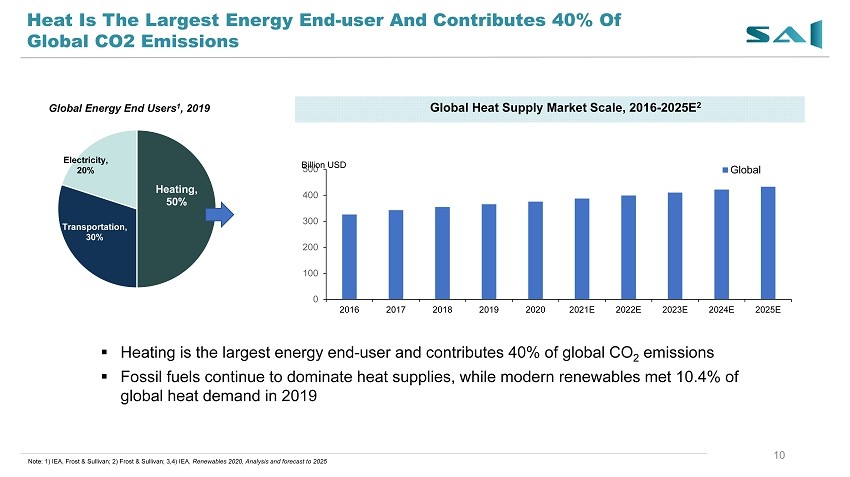

Global Heat Supply Market Scale, 2016 - 2025E 2 Global Energy End Users 1 , 2019 0 100 200 300 400 500 2016 2017 2018 2019 2020 2021E 2022E 2023E 2024E 2025E Global Billion USD Note: 1) IEA, Frost & Sullivan; 2) Frost & Sullivan; 3,4) IEA, Renewables 2020, Analysis and forecast to 2025 Heating, 50% Transportation, 30% Electricity, 20% Heat Is The Largest Energy End - user And Contributes 40% Of Global CO2 Emissions 10 ▪ Heating is the largest energy end - user and contributes 40% of global CO 2 emissions ▪ Fossil fuels continue to dominate heat supplies, while modern renewables met 10.4% of global heat demand in 2019

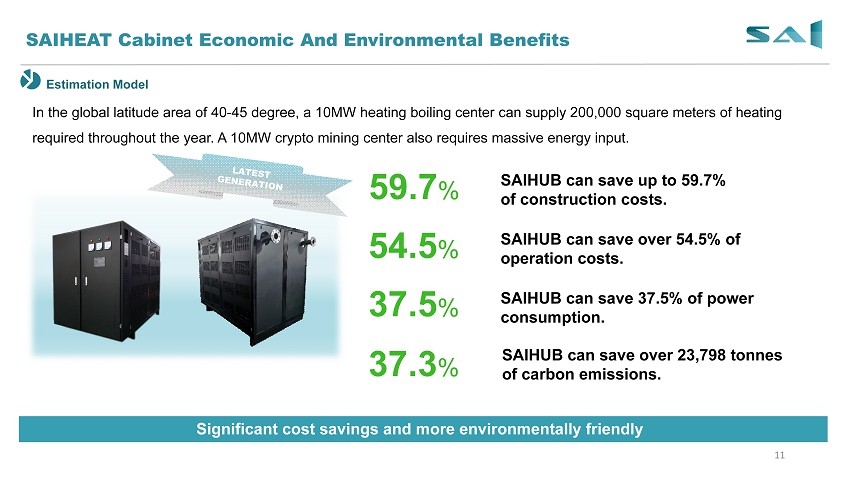

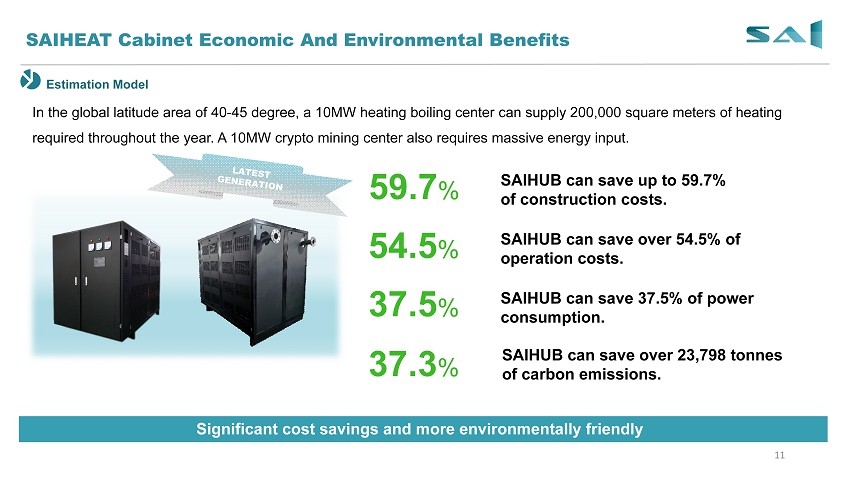

In the global latitude area of 40 - 45 degree, a 10MW heating boiling center can supply 200,000 square meters of heating required throughout the year. A 10MW crypto mining center also requires massive energy input. Estimation Model SAIHEAT Cabinet Economic And Environmental Benefits 11 Significant cost savings and more environmentally friendly SAIHUB can save up to 59.7% of construction costs. 59.7 % SAIHUB can save 37.5% of power consumption. 37.5 % SAIHUB can save over 54.5% of operation costs. 54.5 % SAIHUB can save over 23,798 tonnes of carbon emissions. 37.3 %

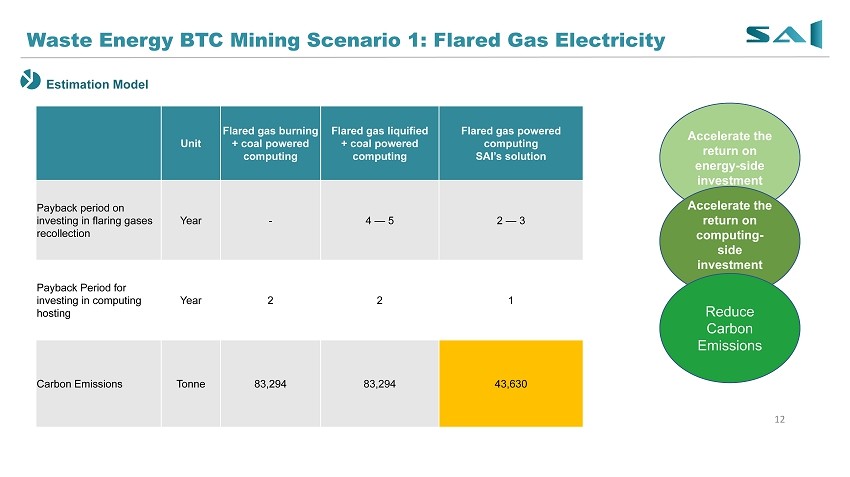

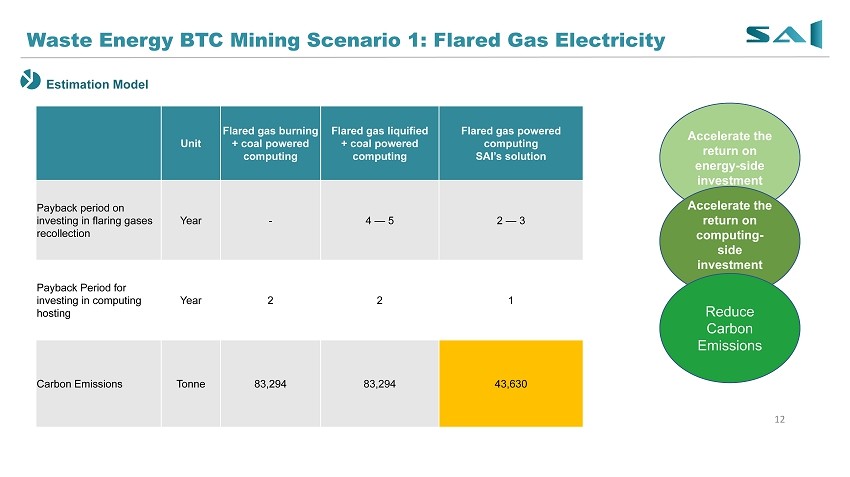

Unit Flared gas burning + coal powered computing Flared gas liquified + coal powered computing Flared gas powered computing SAI’s solution Payback period on investing in flaring gases recollection Year - 4 — 5 2 — 3 Payback Period for investing in computing hosting Year 2 2 1 Carbon Emissions Tonne 83,294 83,294 43,630 Waste Energy BTC Mining Scenario 1: Flared Gas Electricity 12 Accelerate the return on energy - side investment Accelerate the return on computing - side investment Reduce Carbon Emissions Estimation Model

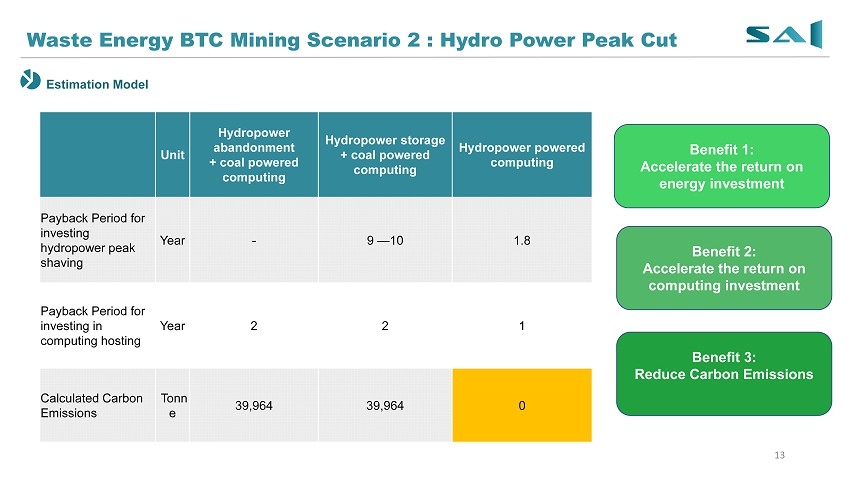

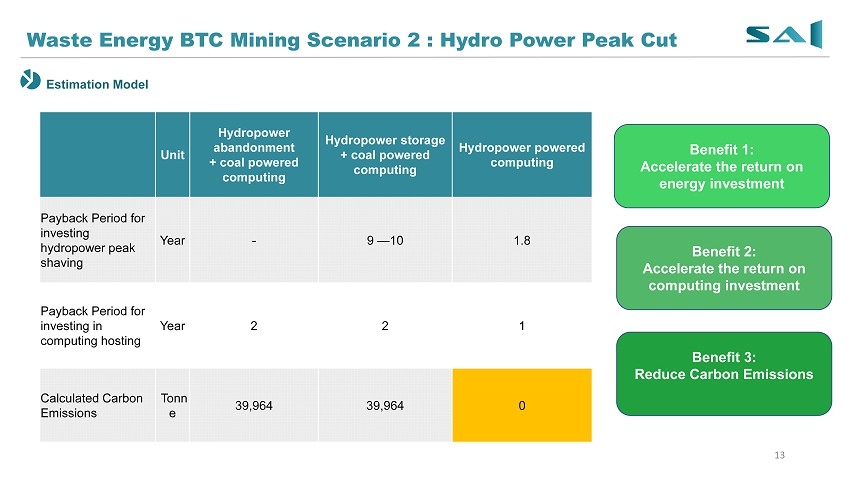

Unit Hydropower abandonment + coal powered computing Hydropower storage + coal powered computing Hydropower powered computing Payback Period for investing hydropower peak shaving Year - 9 — 10 1.8 Payback Period for investing in computing hosting Year 2 2 1 Calculated Carbon Emissions Tonn e 39,964 39,964 0 Waste Energy BTC Mining Scenario 2 : Hydro Power Peak Cut 13 Benefit 1: Accelerate the return on energy investment Benefit 2: Accelerate the return on computing investment Benefit 3: Reduce Carbon Emissions Estimation Model

Conclusion ▪ Bitcoin mining can produce lower carbon emissions while being more efficient compared to gold mining, financial system and traditional calculations. ▪ Bitcoin mining can be aligned with ESG and help promote carbon neutrality. ▪ Use the renewable energies to power the mining chips, reuse the heat generated by the chips , to further reduce the carbon emissions through the whole supply chain. ▪ As the clean computing industry becomes more mature, Bitcoin mining can be aligned with reducing total carbon emissions and help achieve the goal of carbon neutrality. ▪ SAI, the leading crypto mining and hosting operator who actively engages with international organizations, urges our peers to join us – Join OCEC, together we act green today ! 14

Closing Note SAI's development philosophy has always been to do its best to make contributions to society. If you have any questions or concerns, please contact us: ESG@SAI.TECH Thank you! 15