Exhibit 99.1

November 10, 2022

2 The material that follows is a confidential presentation that has been prepared by Lavoro Agro Limited and its subsidiaries ( the “Company” or “Lavoro”) and is being delivered to persons considering investing in TPB Acquisition Corporation I (“TPB”) with respect to a potential business combination and related transactions (th e “Business Combination”) between TPB and Lavoro and for no other purpose. This presentation is intended solely for investors that are qualified institutional buyers or institutional accredited invest ors solely for the purposes of familiarizing such investors with the Company and TPB, and determining whether such investors might have an interest investing in TPB. This material has been prepared solely for inform ati onal purposes and is not to be construed as a solicitation, an invitation, or an offer to buy or sell any securities, or any solicitation of any offer to purchase or subscribe for any shares of TPB or Lavor o, and should not be treated as giving investment advice. You should not definitively rely upon this material or use it to form the definitive basis for any decision, contract, commitment or action whatsoever, w ith respect to any proposed transaction or otherwise. You should consult your own legal, regulatory, tax, business, financial and accounting advisors to the extent you deem necessary, and you must make your own investment decision and perform your own independent investigation and analysis of an investment in Lavoro or TPB and the transactions contemplated in this presentation. Neither this material nor anything contained herein shall form the basis of any contract or commitment whatsoever. This presentation is not targeted to the specific investment objectives, financial situation or particular needs of any recip ien t. It contains statements and analyses based on information from third - party sources, which have not been independently verified. Accordingly, the Company and TPB make no representations or warranty, ex pre ss or implied, as to the accuracy or completeness of such data, and such data involves risks and uncertainties and is subject to change based on various factors. The information contained h ere in is in summary form and does not purport to be complete. It is not intended to be relied upon as advice to potential investors. Lavoro, TPB and their respective affiliates, officers, directors , e mployees, representatives, advisors and agents expressly disclaim any and all liability which may be based on this document and any errors therein or omissions therefrom. By accepting this presentation, you confirm that you are not relying upon the information contained herein to make any decision. This material does not constitute a prospectus or form part of any offer or invitation to sell or issue, or any solicitation of any offer to purchase or subscribe for, or any offer to underwrite or otherwise acquire any shares in the Company or TPB or any other securities issued involving the Company or TPB, nor shall they or any p art of them nor the fact of their distribution or communication form the basis of, or be relied on in connection with, any contract, commitment or investment decision in relation thereto, nor does it cons tit ute a recommendation regarding any securities issued involving the Company or TPB. This presentation is strictly confidential and may not be disclosed to any other person and its contents are proprietary info rma tion and may not be reproduced or otherwise disseminated in whole or in part without the prior written consent of the Company or TPB. No representation or warranty either express or implied is made as to, and no reliance should be placed on future financial performance, or the fairness, validity, accuracy, or completeness of the information, statements or opinions contained herein including in re lat ion to, statistical data, predictions, estimates or projections contained in this presentation, which are used for informational purposes only. Additionally, you acknowledge that you are (a) aware that the U nit ed States securities laws prohibit any person who has material, non - public information concerning a company from purchasing or selling securities of such company or from communicating such info rma tion to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and (b) familiar with the Securities E xch ange Act of 1934, as amended, and the rules and regulations promulgated thereunder (collectively, the "Exchange Act"), and that the recipient will neither use, nor cause any third party to use, thi s d ocument or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10b - 5 thereunder. Certain statements in this presentation may be considered forward - looking statements and forward - looking information within the meaning of applicable United States securities legislation (collectively herein referred to as “forward - looking statements”). Forward - looking statements generally relate to future events or future fina ncial or operating performance of Lavoro or TPB. Forward - looking statements in this presentation, may include, for example, statements about: the growth of Lavoro’s business and its ability to realize expected results, including with respect to its revenue, gross profit, EBITDA, EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin, Pro Forma revenue, Pro Forma gross profit, Pro Forma Adjusted EB ITDA, Pro Forma Adjusted EBITDA margin, and Free Cash Flow; the viability of its growth strategy, including with respect to its ability to grow market share in Brazil, Latin America and glo bal ly, grow revenue from existing customers, and consummate acquisitions; opportunities, trends and developments in the agricultural input industry, including with respect to future financial perform anc e in the industry; the size of Lavoro’s total addressable market; the expected benefits of the Business Combination; the satisfaction of closing conditions to the Business Combination, the amount of redem pti on requests made by TPB’s public stockholders and the completion of the Business Combination, including the use of the cash proceeds therefrom; ; and the pro forma ownership of the resulting issuer . Legal Disclaimer

3 In some cases, you can identify forward looking statements by terminology such as “believe,” “intend,” “target,” “expect,” “e sti mate,” “may,” “should,” “plan,” “project,” “contemplate,” “anticipate,” “predict” or similar expressions, but the absence of these words does not mean that a statement is not forward - looking. Such for ward - looking statements are only predictions and are not guarantees of future performance. Investors are cautioned not to rely on forward - looking statements and that any such forward - looking statements are and will be, as the case may be, subject to several risks, uncertainties and factors relating to, among others: general economic, financial, political, demographic and business conditions in Brazil and Latin Am eri ca, as well as in any other countries Lavoro may serve in the future, and their impact on its business; factors associated with companies, such as Lavoro, that are engaged in the agricultural input i ndu stry, including the impact of the COVID - 19 pandemic, competitive pressures in the industry, the rapid pace of technological change, the impact of governmental regulation, the inability to re tai n skilled employees, changes in consumer demand, and a wide variety of other significant business, economic and competitive risks and uncertainties; the ability to obtain approval of the stockhold ers of TPB; legal or regulatory developments (such as any SEC statements or enforcement or other actions relating to special purpose acquisition companies); the ability to maintain the listing of the c omb ined company’s securities on a U.S. exchange; the inability to complete the proposed PIPE financing; the risk that the Business Combination disrupts current plans and operations of TPB or Lavoro as a result of the announcement and consummation of the transaction described herein; the risk that any of the conditions to closing the Business Combination are not satisfied in the anticipate d m anner or on the anticipated timeline; the failure to realize the anticipated benefits of the Business Combination; risks relating to the uncertainty of the projected financial information with respect t o L avoro and costs related to the Business Combination; the outcome of any legal proceedings or regulatory action that may be instituted against TPB or Lavoro, or any of their respective directors or off icers, following the announcement of the potential transaction; the amount of redemption requests made by TPB’s public stockholders; and those factors discussed in this presentation, TPB’s final prosp ect us dated August 12, 2021 and any Quarterly Report on Form 10 - Q or Annual Report on Form 10 - K, in each case, under the heading “Risk Factors,” and other documents of TPB filed, or to be filed, with the SEC. If any of these risks materialize or TPB or Lavoro’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements. Although the Company believes that the expectations and assumptions reflected in the forward - looking statements are reasonable b ased on information currently available to the management of the Company and TPB, the Company and TPB cannot guarantee future results or events. There can be no assurance that (i) the Compan y h as correctly measured or identified all of the factors affecting its business or the extent of their likely impact, (ii) the publicly available information with respect to these factors on which th e Company’s analysis is based is complete or accurate, (iii) the Company’s analysis is correct or (iv) the Company’s strategy, which is based in part on this analysis, will be successful. Forward - looking statements involve numerous risks and uncertainties that could cause actual results to differ materially from expected results. In addition, the Company and TPB do not undertake any obligation to updat e a ny information or forward - looking statement, or to update the reasons why actual results could differ materially from those anticipated herein, even if new information becomes available in the fu tur e. Certain information contained in this presentation relates to or is based on third - party studies, publications, surveys and Lavo ro’s or TPB’s own internal estimates and research. In addition, all of the market data included in this presentation involves a number of assumptions and limitations, and there can be no guarantee as to the acc uracy or reliability of such assumptions. Finally, while Lavoro and TPB believe their internal research is reliable, such research has not been verified by any independent source and Lavoro and TPB ca nnot guarantee and make no representation or warranty, express or implied, as to its accuracy and completeness. Nothing in this presentation should be regarded as a representation by any person that the forward - looking statements set forth herein will be achieved or that any of the contemplated results of such forward - looking statements will be achieved. You should not place undue reliance on forward - looking statements in this presentat ion, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein. This presentation also contains certain financial forecast i nfo rmation of Lavoro. Such financial forecast information constitutes forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of f utu re results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and oth er risks and uncertainties. Actual results may differ materially from the results contemplated by the financial forecast information contained in this presentation, and the inclusion of such information in t his presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. Any opinions expressed in this material are subject to change without notice and the Company and TPB are not under obligation to update or keep current the information contained herein. The Company and TPB, as well as their respective affiliates, agents, directors, partners and employees, accept no liability whats oev er for any loss or damage of any kind arising out of the use of all or any part of this material. Neither Lavoro nor TPB undertakes any obligation to update this presentation unless otherwise required by law. Legal Disclaimer (continued)

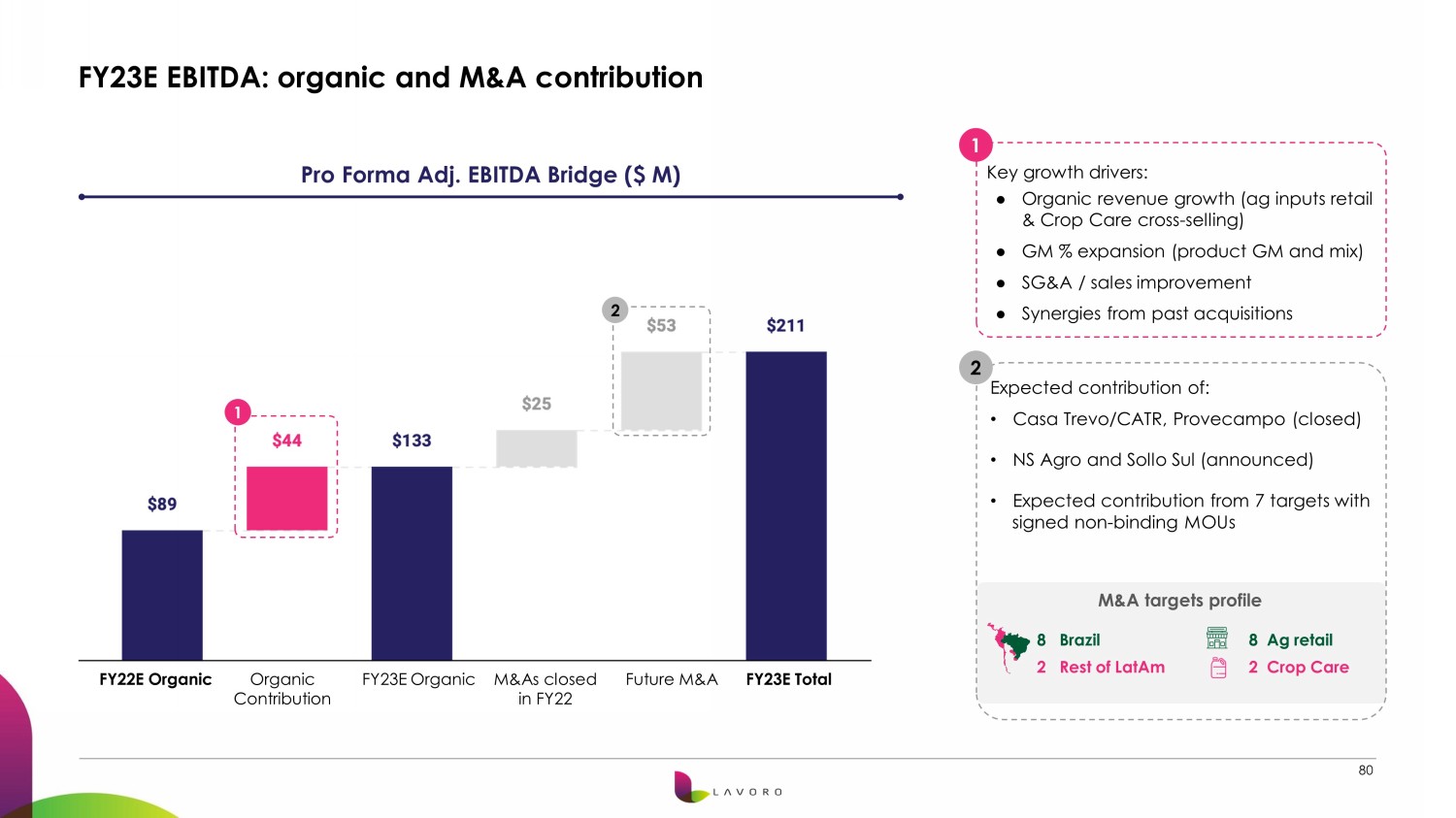

4 Use of Projections This presentation contains projected financial information with respect to the Company, namely EBITDA margin, Adjusted EBITDA , A djusted EBITDA margin, Pro Forma revenue, Pro Forma gross profit, Pro Forma Adjusted EBITDA, Pro Forma Adjusted EBITDA margin, Free Cash Flow, retention rates and sales representative productivit y. Such projected financial information constitutes forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future re sul ts. The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and oth er risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. See the description of forward - looking statements above. Actual r esults may differ materially from the results contemplated by the projected financial information contained in this presentation, and the inclusion of such information in this presentation sh oul d not be regarded as a representation by any person that the results reflected in such projections will be achieved. Neither the independent registered public accounting firm of the Company nor the independent registered public accounting firm of TPB, audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this pr ese ntation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. Financial Information; Non - IFRS Financial Measures Certain financial information and data contained in this presentation is unaudited and does not conform to Regulation S - X. Accor dingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any proxy statement, registration statement, or prospectus to be filed by Lav oro with the SEC. Some of the financial information and data contained in this presentation, such as EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Pro Forma revenue, Pro Forma Adjusted EBITDA, Pro Form a A djusted EBITDA margin, Enterprise Value and Net Debt, and Free Cash Flow (“FCF”), have not been prepared in accordance with International Financial Reporting Standards (“IFRS”). EBITDA is defin ed as operating profit (loss), plus depreciation & amortization (as defined by IFRS), and includes non - controlling interests for minority shareholders of certain Lavoro subsidiaries. Adjusted EBITDA is defin ed as EBITDA, plus M&A related expenses, which primarily include M&A team compensation expenses and accounting and tax due diligence expenses, plus (minus) any other expenses (income) that Lavoro man age ment considers as non - recurring and/or non - cash. Net Debt is defined as debt (calculated using current and noncurrent borrowings), less pro forma cash and cash equivalents. Enterprise Va lue is defined as market capitalization pro forma for the potential business combination, plus Net Debt, plus lease liabilities, plus non - controlling interest on the balance sheet. Pro Forma financials (i. e. revenue, gross profit and Adjusted EBITDA) are calculated assuming the full year financial contribution for companies acquired in a given year (rather than the partial “stub period” contribution). FCF is defined as net cash flows from operating activities, less capital expenditures defined as additions to property, plant and equipment and intangible assets. TPB and the Company believe EBITDA, Adjusted EBI TDA , Adjusted EBITDA margin, Enterprise Value, Net Debt, and FCF provide useful information to management and investors regarding certain financial and business trends relating to the Compan y’s financial condition and results of operations. TPB and the Company believe that the use of EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Enterprise Value, Net Debt, and FCF provides an addi tio nal tool for investors to use in evaluating projected operating results and trends in and in comparing the Company’s financial measures with other similar companies, many of which present similar non - IFRS financial measures to investors. Management does not consider EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Enterprise Value, Net Debt, or FCF in isolation or as an alternative to fina nci al measures determined in accordance with IFRS. The principal limitation of EBITDA is that it excludes significant expenses and income that are required by IFRS to be recorded in the Company’s financia l s tatements. The principal limitation of FCF is that it may be calculated differently by other companies in Lavoro’s industry, limiting its usefulness as a comparative measure. In order to compensate fo r these limitations, management presents non - IFRS financial measures in connection with IFRS results. The Company is not providing a reconciliation of its projected EBITDA, Adjusted EBITDA, Enterpr ise Value, Net Debt, or FCF for the 2022 to 2024 fiscal years to the most directly comparable measures prepared in accordance with IFRS because the Company is unable to provide this reconciliation without unr eas onable effort due to the uncertainty and inherent difficulty of predicting the occurrence, the financial impact, and the periods in which the adjustments may be recognized. For the same rea son s, the Company is unable to address the probable significance of the unavailable information, which could be material to future results. You should review the Company’s audited financial stateme nts , which will be included in the proxy statement/registration statement relating to the Business Combination. In addition, with the exception of the Company’s historical financial information as of June 30, 2021 and 2020 and for the fi sca l years then ended, which are derived from its audited combined financial statements, all other historical financial information of the Company included herein, including any financial information as of June 30, 2022 and for the fiscal year then ended, is unaudited, preliminary and subject to change. Legal Disclaimer (continued)

5 Additional Information In connection with the Business Combination, Lavoro filed with the SEC a registration statement on Form F - 4, containing a prelim inary proxy statement/prospectus of TPB, and after the registration statement is declared effective, Lavoro expects that TPB will mail a definitive proxy statement/prospectus relating to the Bu sin ess Combination to TPB’s shareholders. This presentation does not contain all the information that should be considered concerning the Business Combination and is not intended to form the basis of any in ves tment decision or any other decision in respect of the Business Combination. Shareholders of TPB and other interested persons are advised to read, when available, the preliminary proxy stat eme nt/prospectus and the amendments thereto and the definitive proxy statement/prospectus and other documents filed by TPB or Lavoro in connection with the Business Combination, as these materia ls will contain important information about Lavoro, TPB, and the Business Combination. When available, the definitive proxy statement/prospectus and other relevant materials for the Business Combinat ion will be mailed to shareholders of TPB as of a record date to be established for voting on the Business Combination. Shareholders will also be able to obtain copies of the preliminary proxy sta tement/prospectus, the definitive proxy statement/prospectus and other documents filed by Lavoro with the SEC, without charge, once available, at the SEC’s website at www.sec.gov. NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESE NTA TION IS TRUTHFUL OR COMPLETE. TPB, Lavoro, and their respective directors and executive officers may be deemed participants in the solicitation of proxies fro m TPB’s stockholders with respect to the Business Combination. A list of the names of TPB’s directors and executive officers and a description of their interests in TPB is contained in TPB’s final prosp ect us relating to its initial public offering, which was filed with the SEC on August 12, 2021 and is available free of charge at the SEC’s web site at www sec gov, or by directing a request to TPB. Additional infor mat ion regarding the interests of the participants in the solicitation of proxies from the shareholders of TPB with respect to the Business Combination will be contained in the proxy statement/prospectus for th e Business Combination filed by Lavoro when available. Trademarks This presentation contains trademarks, service marks, trade names and copyrights of the Company, TPB and other companies, whi ch are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade name or products in this presentation is not intended to, and does not imply, a relationship with TPB or Lavoro, or an endorsement of sponsorship by or of TPB or Lavoro. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear wit h the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that TPB or Lavoro will not assert, to the fullest extent under applicable law, their rights or the rig ht of the applicable licensor to these trademarks, service marks and trade names. BY ATTENDING THIS PRESENTATION YOU AGREE TO BE BOUND BY THE FOREGOING RESTRICTIONS. PLEASE RETURN ANY PHYSICAL COPIES OF THIS SLIDE PRESENTATION AT THE END OF THE MEETING. Unless otherwise noted, data in this presentation is as of November 10, 2022. Legal Disclaimer (continued)

6 All references to “Lavoro,” the “Company,” “we,” “us” or “our” refer to the business of Lavoro Agro Limited and its subsidiar ies . The risks presented below are certain of the general risks related to the business of the Company, and such list is not exhaustive. The list below has been prepared solely for purposes of the propose d p rivate placement transaction, and solely for potential private placement investors, and not for any other purpose. The occurrence of any of the following risks or additional risks and uncertainties not presently known to us or that we currently believe to be immaterial could materially and adversely affect our business, financial condition or results of operations. You should carefully consider the se risks and uncertainties, and should carry out your own diligence and consult with your own financial and legal advisors concerning the risks and suitability of an investment in this offering before maki ng an investment decision. Risks relating to the business of the Company will be disclosed in future documents filed or furnished by the Company and TPB Acquisition Corporation I (“TPB”) with the United Sta tes Securities and Exchange Commission (“SEC”), including the documents filed or furnished in connection with the proposed transactions between the Company and TPB. The risks presented in such fili ngs will be consistent with those that would be required for a public company in its SEC filings, including with respect to the business and securities of the Company and TPB and the proposed tra nsa ctions between the Company and TPB, and may differ significantly from, and be more extensive than, those presented below. Risks Related to TPB’s Securities ● If the benefits of the potential business combination do not meet the expectations of investors or securities analysts, the m ark et price of TPB’s securities may decline, either before or after the closing of the potential business combination. ● Unlike some other similarly structured blank check companies, TPB’s sponsor will receive additional Class A ordinary shares i f T PB issues shares to consummate an initial business combination. ● An active trading market for TPB’s Class A ordinary shares may not be available on a consistent basis to provide stockholders wi th adequate liquidity. The stock price may be extremely volatile, and stockholders could lose a significant part of their investment. ● TPB Class A ordinary shares may fail to meet the continued listing standards of the Nasdaq Capital Market (“Nasdaq”), and add iti onal shares may not be approved for listing on Nasdaq. General Risks ● TPB may require additional capital to support Lavoro’s growth, and such capital might not be available on terms acceptable to TP B, if at all. Failure to obtain additional capital on acceptable terms, or at all, could hamper Lavoro’s growth and adversely affect its business. Risks Related to TPB and the Business Combination ● TPB’s officers and directors presently have, and any of them in the future may have, additional, fiduciary or contractual obl iga tions to other entities, including another blank check company, and, accordingly, may have conflicts of interest in approving the potential business combination. ● If you hold public warrants of TPB, TPB may, in accordance with their terms, redeem your unexpired TPB warrants prior to thei r e xercise at a time that is disadvantageous to you. ● If TPB seeks shareholder approval of the potential business combination with Lavoro, its sponsor and members of its managemen t t eam have agreed to vote in favor of such business combination, regardless of how its public shareholders vote. ● If TPB seeks shareholder approval of the potential business combination with Lavoro, TPB’s founders, directors, officers, adv iso rs and their affiliates may elect to purchase TPB Class A ordinary shares or TPB warrants from public shareholders, which may influence the vote on such business combination and reduce the pub lic “float” of TPB’s Class A ordinary shares. ● TPB does not have a specified maximum redemption threshold. The absence of such a redemption threshold and the potential for TPB ’s public shareholders to exercise redemption rights with respect to a large number of outstanding TPB Class A ordinary shares may make it impossible for TPB to complete the potential bu siness combination. ● TPB does not have a specified maximum redemption threshold. In the event the aggregate cash consideration TPB would be requir ed to pay for all Class A ordinary shares that are validly submitted for redemption exceeds the aggregate amount of cash available to TPB, the combined company may not have sufficient cas h to grow as currently contemplated. ● The potential business combination is subject to conditions, including certain conditions that may not be satisfied on a time ly basis, if at all. ● The TPB board has not obtained and may not obtain a third - party valuation or financial opinion in determining whether to proceed with the potential business combination. ● The SEC is considering new rules which would impose a variety of new requirements on special purpose acquisition companies, s uch as TPB, which may adversely affect the potential business combination, including our ability to complete the potential business combination. Risk Factor Summary

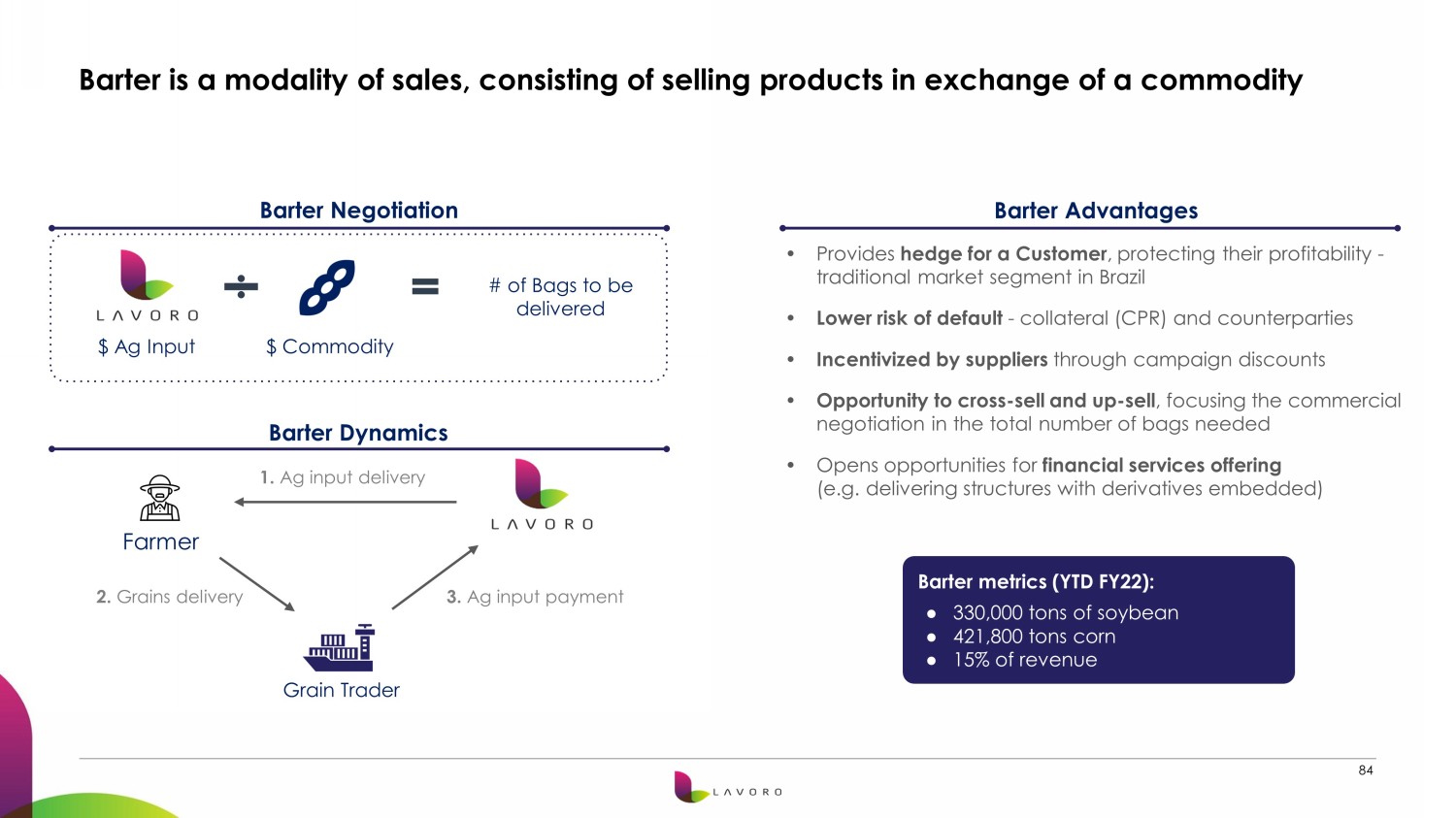

7 Risks Relating to Our Business and Industry ● We may be adversely affected by global market and economic conditions. ● Our operating results are highly dependent upon and fluctuate based upon business and economic conditions and governmental po lic ies affecting the agricultural industry in which we or our customers operate. These factors are outside of our control and may significantly affect our profitability. ● Our business is highly seasonal and affected by adverse weather conditions and other factors beyond our control, which may ca use our sales and operating results to fluctuate significantly. ● We do not control the activities of our farmer customers, and facts or circumstances that may occur as a result of their acti ons or omissions could harm our reputation and sales. ● We operate in a competitive market. If we are unable to compete effectively, our financial results will suffer. ● We may not be successful in selling or marketing the agricultural products that we offer in the markets in which we operate. ● If we are unable to retain our existing customers or attract new customers, including through opening new stores and geograph ic expansion, our business, financial condition and results of operations will be adversely affected. ● Our business depends on a well - regarded and widely known brand, and any failure to maintain, protect and enhance our brand would harm our business, financial condition and results of operations. ● If we fail to manage our growth effectively, our business could be harmed. ● Our continued international expansion efforts may not be successful, or may subject our business to increased risks. ● Our results of operations and operating metrics may fluctuate and we may generate losses in the future, which may cause the m ark et price of our common shares to decline. ● Our results of operations may be adversely affected if our customers are unable to repay trade receivables from us. ● We may incur significant losses if our customers do not meet their obligations under the barter transactions entered into wit h t rading companies. ● If we fail to identify, develop and maintain relationships with a sufficient number of qualified suppliers, our ability to ti mel y and efficiently access products that meet our standards for quality could be adversely affected, or we may experience an increase in the costs of our products that could reduce our overall prof ita bility. ● Shortfalls or disruptions in the supply of agricultural inputs by our current suppliers may adversely affect us until we are abl e to procure a replacement supplier for certain categories of the agricultural products we sell. ● We may be adversely affected by the ongoing armed conflict between Russia and Ukraine. ● Disruptions of the supply or reliability of transportation services and/or changes in transportation service costs can affect ou r sales volumes and selling prices. ● Interruptions in the production or transportation of certain agricultural inputs we sell could adversely affect our operation s a nd profitability. ● Our failure to accurately forecast and manage inventory could result in an unexpected shortfall or surplus of products, which co uld harm our business. ● We cannot guarantee that our suppliers will not engage in improper practices, including inappropriate labor or manufacturing pra ctices. ● If we are unable to effectively develop the Lavoro Connected Farm platform, our operating results may be affected. ● We are dependent on third - party service providers in our Lavoro Connected Farm platform. ● We may require additional capital in the future, which may not be available on acceptable terms or at all. ● We may not be successful in developing biological agricultural products that we offer in the markets in which we operate. ● The complexity of the approval processes for in the production of our private label products may negatively affect our busine ss and results of operations. ● The COVID - 19 pandemic could impact our business, key metrics and results of operations in volatile and unpredictable ways. ● Consumer and government resistance to genetically modified organisms may negatively affect our public image and reduce sales of the genetically modified seeds that we commercialize. ● If our products become adulterated, misbranded, or mislabeled, we might need to recall, relabel or repackage those items and may experience product liability claims; food safety and foodborne illness concerns could materially and adversely affect us. ● The incorrect or off - label use of our private label products may damage our reputation or negatively impact our results. ● Our insurance policies may not be sufficient to cover all claims. ● We depend on key management, as well as our experienced and capable employees, and any failure to attract, motivate and retai n o ur employees could harm our ability to maintain and grow our business. Risk Factor Summary (continued)

8 Risks Relating to Our Business and Industry (Continued) ● Our holding company structure makes us dependent on the operations of our subsidiaries. ● We have a limited operating history as a consolidated company with financial results that may not be indicative of future per for mance, and our revenue growth rate is likely to slow as our business matures. ● We and our independent registered public accounting firm have identified material weaknesses in our internal control over fin anc ial reporting and, if we fail to implement and maintain effective internal controls over financial reporting, we may be unable to accurately report our results of operations, meet o ur reporting obligations or prevent fraud. ● Disclosure controls and procedures over financial reporting may not prevent or detect all errors or acts of fraud. ● We may not be able to renew or maintain all our stores and facilities’ leases. Risks Relating to Acquisitions and Pro Forma Financial Information ● Any acquisition, partnership or joint venture we make or enter into could disrupt our business and harm our financial conditi on. ● Our recent acquisitions and the comparability of our results may make it difficult for investors to evaluate our business, fi nan cial condition, results of operations and prospects. ● The unaudited Pro Forma financial information included herein is presented for illustrative purposes only and may not be indi cat ive of our combined financial condition or results of operations after giving effect to our pro forma transactions. Risks Relating to Regulatory Matters, Privacy, Litigation, and Cybersecurit y ● Our business and the commercialization of our products are subject to various government regulations and environmental, healt h a nd safety authorities and industry standards, and we or our collaborators may be unable to obtain, or may face delays in obtaining, necessary regulatory approvals. ● Our operations are subject to various health and environmental risks associated with our production, handling and transportat ion . ● Environmental, health and safety and food and agricultural inputs laws and regulations to which we are subject may become mor e s tringent over time. This could increase the effects on us of these laws and regulations, and the increased effects could be materially adverse to our business, operations, liquidity and/ or results of operations. ● We may be liable for labor charges and disbursements if our sales representatives are considered to be our employees. ● Changes in tax laws, incentives, benefits and regulations may adversely affect us. ● We are subject to anti - corruption, anti - bribery and anti - money laundering laws and regulations. ● Requirements associated with being a public company in the United States will require significant company resources and manag eme nt attention. ● Adverse outcomes in legal proceedings could subject us to substantial damages and adversely affect our results of operations and profitability. ● We are subject to costs and risks associated with increased or changing laws and regulations affecting our business, includin g t hose relating to data privacy, security and protection. ● We may face restrictions and penalties under Brazilian and Colombian consumer protection laws. ● Unauthorized disclosure of sensitive or confidential customer information or our failure or the perception by our customers t hat we failed to comply with privacy laws or properly address privacy concerns could harm our business and standing with our customers. ● Unauthorized disclosure of, improper access to, or destruction or modification of data, through cybersecurity breaches, compu ter viruses or otherwise, or disruptions to our systems or services could expose us to liability, protracted and costly litigation and damage our reputation. ● Interruption or failure of our infrastructure, information technology and communications systems could impair our operations, wh ich could also damage our reputation and harm our results of operations. ● We depend on data centers operated by third parties and third - party Internet hosting providers, and any disruption in the operat ion of these facilities or access to the Internet could adversely affect our business. Risk Factor Summary (continued)

9 Risks Relating to Latin America ● We are subject to risks relating to our significant presence in Latin American countries. ● Latin America has experienced, and may continue to experience, adverse economic or political conditions that may impact our b usi ness, financial condition and results of operations. ● The Brazilian federal government has exercised, and continues to exercise, significant influence over the Brazilian economy. Thi s influence, as well as Brazil’s political and economic conditions, could harm us and the price of our common shares. ● Any further downgrading of Brazil’s credit rating could reduce the trading price of our common shares. ● Inflation and certain measures by the Brazilian government to curb inflation have historically harmed the Brazilian economy a nd Brazilian capital markets, and high levels of inflation in the future could harm our business and the price of our common shares. ● Exchange rate instability may impact our ability to hedge exchange rate risk, which may lead to interest rate volatility and hav e a material adverse effect on the price of our common shares. ● Disruption or volatility in global financial and credit markets could have a material adverse effect on us. ● Infrastructure and workforce deficiency in Brazil may impact economic growth and have a material adverse effect on us. Risk Factor Summary (continued)

10 Today’s Presenters David Friedberg CEO, TPB Acquisition Corporation I Ruy Cunha CEO, Lavoro Gustavo Modenesi Chief Strategy Officer, Lavoro Luiz Spinardi Head of M&A, Lavoro Marcos Freire Head of Strategy, Lavoro Crop Care Rob Hranac CEO, Pattern Ag Daniel Fisberg Board Member, Lavoro; Managing Director, Patria Investments

11 Today’s Agenda 3:40PM Cocktails Room: Acquisition David Friedberg, Daniel Fisberg, Ruy Cunha Breakout Sessions 4:00PM Room: Supply Suite Gustavo Modenesi, Marcos Freire, Luiz Henrique Spinardi 1:30PM Introduction & Macro 1:50PM LatAm Ag Retail 101 Daniel Fisberg Board Member, Lavoro; Managing Director, Patria Investments Ruy Cunha Chief Executive Officer, Lavoro 2:10PM Lavoro’s M&A Opportunity Luiz Henrique Spinardi Head of M&A, Lavoro 2:25PM Crop Care: Lavoro's Private Label Marcos Freire Chief Strategy Officer, Lavoro Crop Care 2:45PM Digital Ag & Services Opportunities Rob Hranac CEO of Pattern Ag 3:20PM Financial Overview Gustavo Modenesi Chief Strategy Officer, Lavoro 4:30PM Room: Supply Suite David Friedberg, Daniel Fisberg, Ruy Cunha Room: Acquisition Gustavo Modenesi, Marcos Freire, Luiz Henrique Spinardi 2:40PM BREAK Gustavo Modenesi Chief Strategy Officer, Lavoro 3:35PM Concluding Remarks David Friedberg Chief Executive Officer, TPB Acquisition Corporation I David Friedberg Chief Executive Officer, TPB Acquisition Corporation I

12 Looking Ahead: Why we are excited about LatAm agriculture David Friedberg CEO and Chairman, TPB Acquisition Corporation I

13 No public market pureplay Lavoro will become the first US - listed LatAm ag retail pureplay equity TPB Investment Thesis Large growing TAM for ag inputs across LatAm $38B growing 16% CAGR between 2017 and 2021 in Brazil LatAm small farmer productivity an essential part of the solution 65% of Brazilian farmland managed by farmers with 250 - 25,000 of acres under production Ag retail is the key to unlocking technology adoption across farms 41% of total ag inputs sold through independent retailers in Brazil Global food supply chains increasingly unstable Climate change, COVID - 19, and global conflict underscore vulnerabilities Latin America key to global food security Fastest growing and largest global agriculture export market Current Lavoro footprint Expected near - term entry Urgent need for improved technology adoption to drive productivity Digital agronomy & biologics increase yield with less cost, land, water, and carbon Source: Company analysis

14 We believe Latin American agriculture market growth is at an inflection point New technologies are transforming global agriculture 1 We believe Latin American farmers are poised to adopt, and are already benefiting from, emerging agricultural technologies 2 We believe Latin American agricultural service providers will offer more integrated services than in the North American market 3

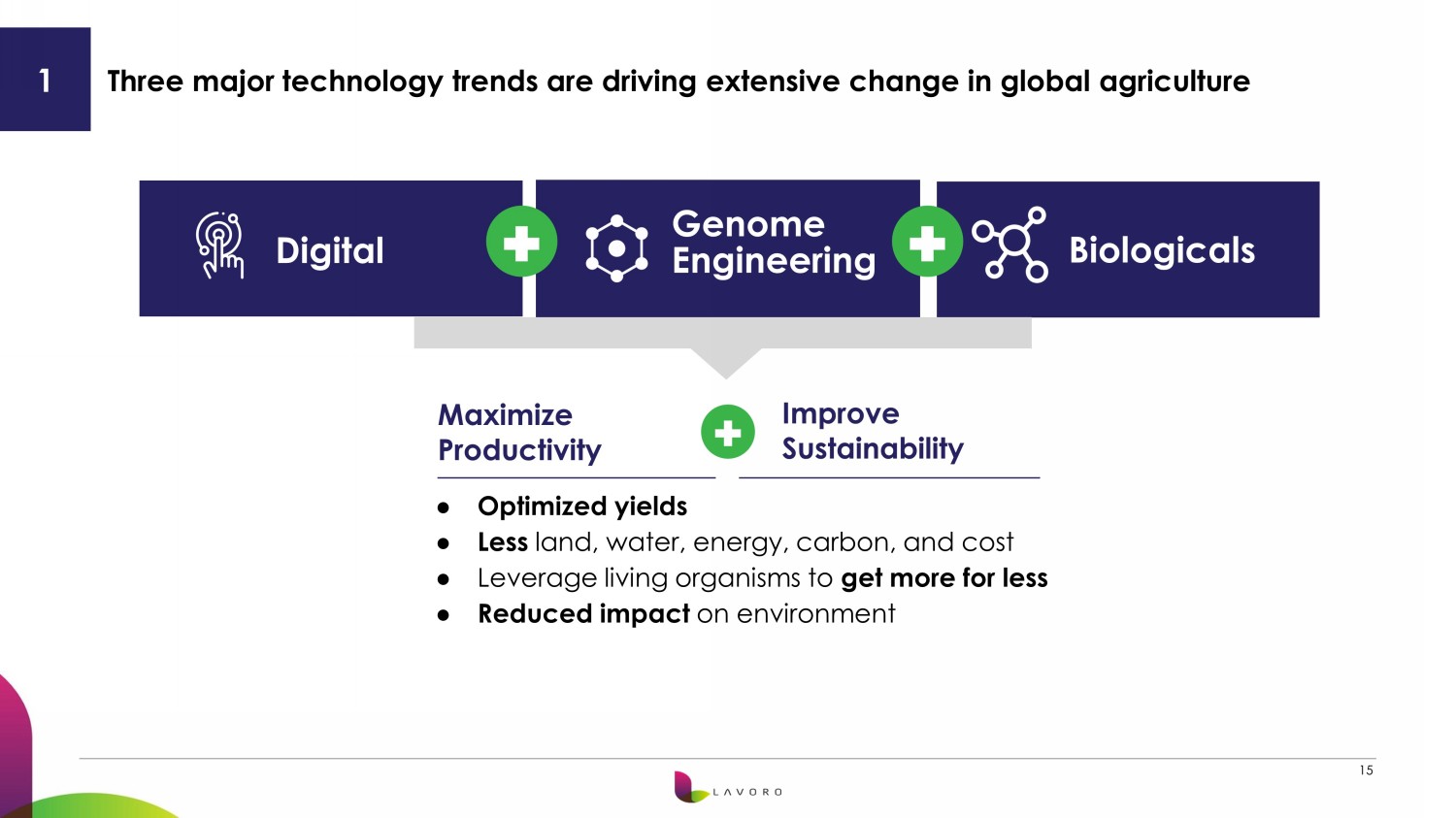

15 Three major technology trends are driving extensive change in global agriculture 1 ● Optimized yields ● Less land, water, energy, carbon, and cost ● Leverage living organisms to get more for less ● Reduced impact on environment Maximize Productivity Improve Sustainability Digital Genome Engineering Biologicals

16 Delivering Driving •••••••••••••••••• Several key technologies are driving digital predictions and prescriptions in agriculture Agriculture is being digitized DIGITAL | GENOME ENGINEERING | BIOLOGICALS 1 Wireless sensors everywhere Ubiquitous wireless internet Cheap data transmission, storage, computing Higher yields to farmers ● Predictive models ● Precision agronomic recommendations Enabled by

17 Execute with Equipment ● Digital, connected farm equipment ● Variable Rate Planters, Sprayers, Applicators The full technology stack is already in place to deliver digital productivity gains Improved Yield per Acre Lower Cost per Unit of Production Deliver Recommendations ● Digital Agronomy ● Crop Inputs Selection ● Variable Rate Prescriptions: Seed, Fertilizers, Pesticides Generate Data ● Planting/Yield Monitors ● Soil Testing ● Scouting ● Remote Sensing DIGITAL | GENOME ENGINEERING | BIOLOGICALS Predict Outcomes ● Data Integration ● Data Science & Machine Learning 1

18 We are at the cusp of an accelerated transition from analog to digital breeding Source: National Human Genome Research Institute; www.yourgenome.org ; McKinsey Global Institute analysis; U.S. GAO, “ Science & Tech Spotlight: CRISPR Gene Editing” (April 7, 2020); DeepMind - Alp haFold Manual / Analog Breeding Molecular Breeding Targeted Edits Precision Gene Editing Technologies Computational Biology DIGITAL | GENOME ENGINEERING | BIOLOGICALS Low - Cost DNA Sequencing Plant Breeding Evolution 1 Enabled By: $ Cost per genome (log scale)

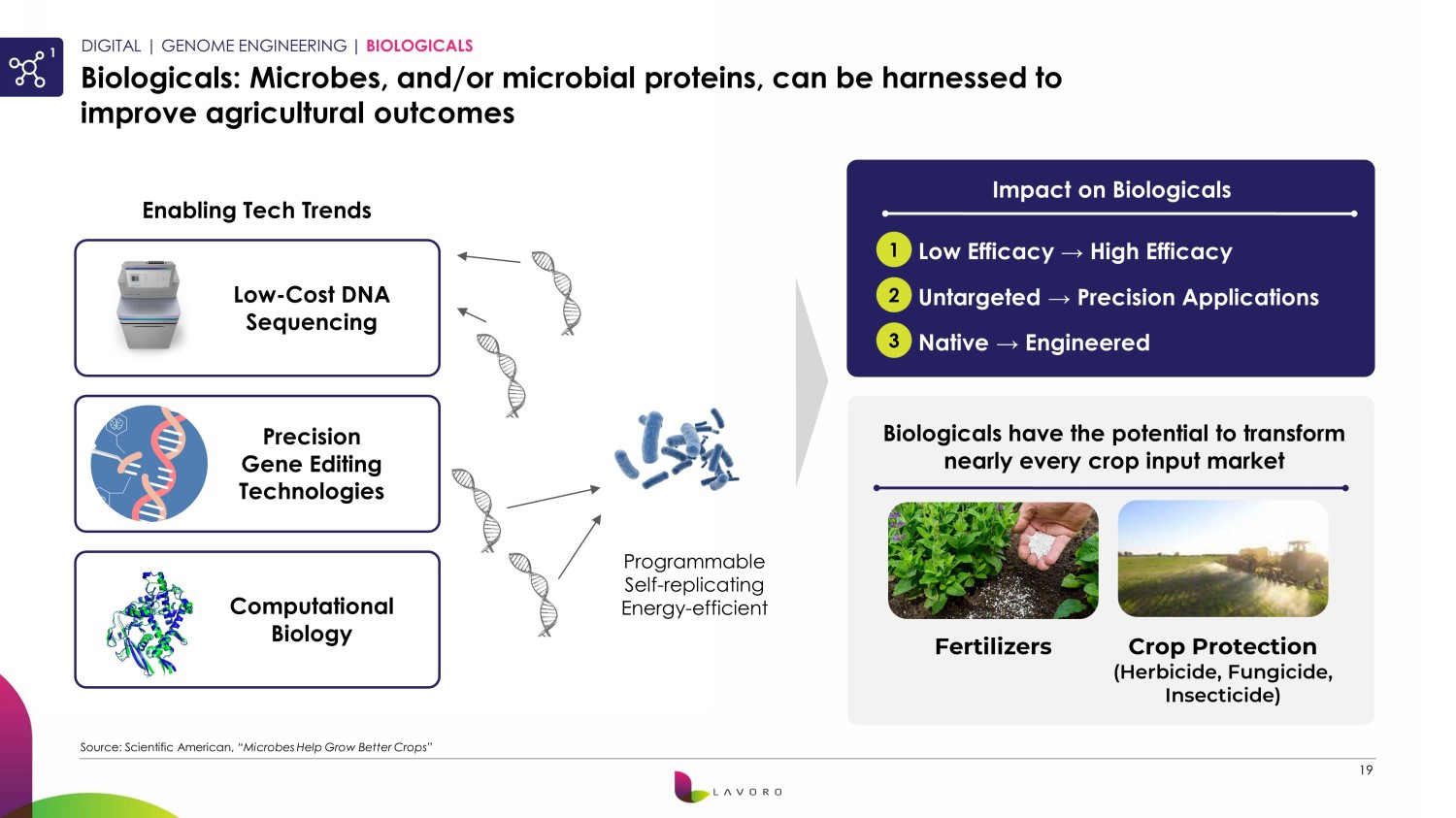

19 Biologicals: Microbes, and/or microbial proteins, can be harnessed to improve agricultural outcomes DIGITAL | GENOME ENGINEERING | BIOLOGICALS Biologicals have the potential to transform nearly every crop input market Low - Cost DNA Sequencing Precision Gene Editing Technologies Computational Biology Programmable Self - replicating Energy - efficient Fertilizers Crop Protection (Herbicide, Fungicide, Insecticide) 1 Enabling Tech Trends Impact on Biologicals 1 2 3 Low Efficacy → High Efficacy Untargeted → Precision Applications Native → Engineered Source: Scientific American, “ Microbes Help Grow Better Crops ”

20 We believe Latin American farmers are poised to adopt, and are already benefiting from, these transformational technologies Strong Investment Cycle Strong Demographics 2

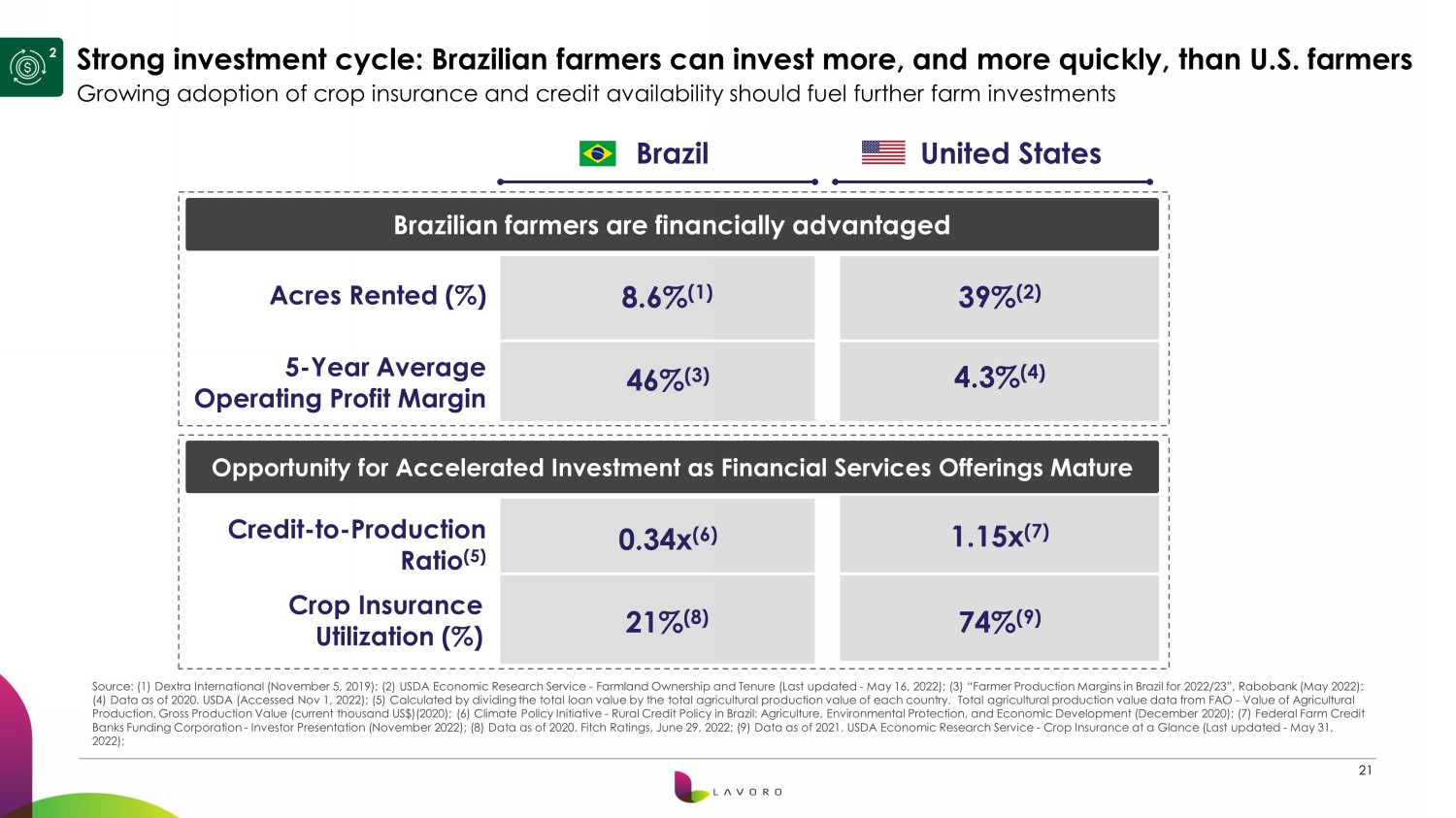

21 Strong investment cycle: Brazilian farmers can invest more, and more quickly, than U.S. farmers Source: (1) Dextra International (November 5, 2019); (2) USDA Economic Research Service - Farmland Ownership and Tenure (Last up dated - May 16, 2022); (3) “Farmer Production Margins in Brazil for 2022/23”, Rabobank (May 2022); (4) Data as of 2020. USDA (Accessed Nov 1, 2022); (5) Calculated by dividing the total loan value by the total agricultural p rod uction value of each country. Total agricultural production value data from FAO - Value of Agricultural Production, Gross Production Value (current thousand US$)(2020); (6) Climate Policy Initiative - Rural Credit Policy in Brazil: Agriculture, Environmental Protection, and Economic Development (December 2020); (7) Federal Farm Credit Banks Funding Corporation - Investor Presentation (November 2022); (8) Data as of 2020. Fitch Ratings, June 29, 2022; (9) Data a s of 2021. USDA Economic Research Service - Crop Insurance at a Glance (Last updated - May 31, 2022); Growing adoption of crop insurance and credit availability should fuel further farm investments 2 Crop Insurance Utilization (%) Acres Rented (%) Credit - to - Production Ratio (5) 5 - Year Average Operating Profit Margin 74% (9) 21% (8) 1.15x (7) 0.34x (6) 4.3% (4) 46% (3) 39% (2) 8.6% (1) Brazilian farmers are financially advantaged Opportunity for Accelerated Investment as Financial Services Offerings Mature United States Brazil

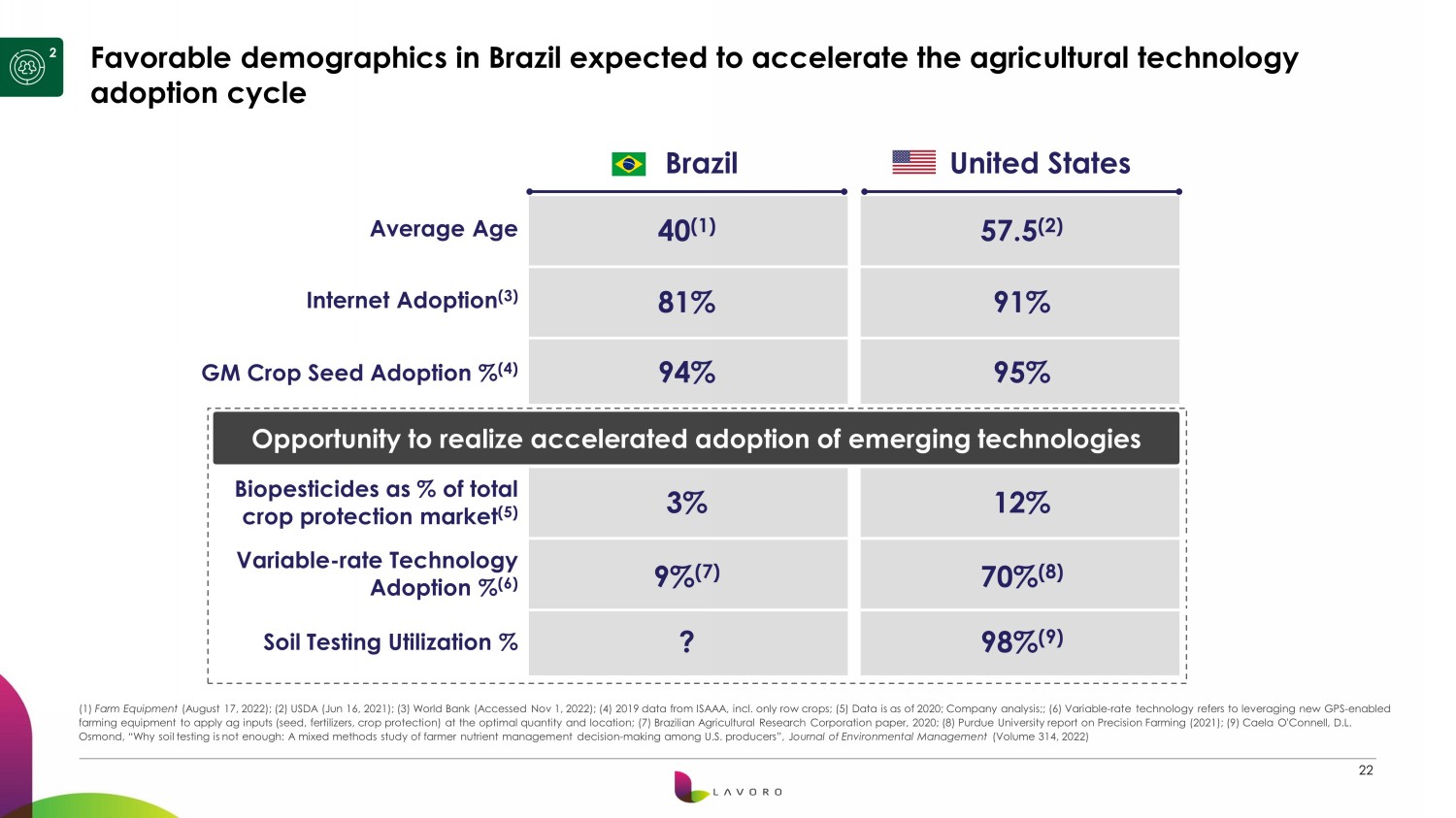

22 (1) Farm Equipment (August 17, 2022); (2) USDA (Jun 16, 2021); (3) World Bank (Accessed Nov 1, 2022); (4) 2019 data from ISAAA, incl. only row c rop s; (5) Data is as of 2020; Company analysis;; (6) Variable - rate technology refers to leveraging new GPS - enabled farming equipment to apply ag inputs (seed, fertilizers, crop protection) at the optimal quantity and location; (7) Brazilian Ag ricultural Research Corporation paper, 2020; (8) Purdue University report on Precision Farming (2021); (9) Caela O'Connell, D .L. Osmond, “Why soil testing is not enough: A mixed methods study of farmer nutrient management decision - making among U.S. producer s”, J ournal of Environmental Management (Volume 314, 2022) Favorable demographics in Brazil expected to accelerate the agricultural technology adoption cycle 2 United States Brazil Opportunity to realize accelerated adoption of emerging technologies Biopesticides as % of total crop protection market (5) 12% 3% Variable - rate Technology Adoption % (6) 70% (8) 9% (7) 98% (9) ? Soil Testing Utilization % Internet Adoption (3) Average Age 57.5 (2) 40 (1) 91% 81% 95% 94% GM Crop Seed Adoption % (4)

23 Due to its unique history and the role of the federal government, the market for service providers to farmers is highly fractured in the U.S. 7,000+ independent farm equipment dealers (6) 10,000+ Crop Insurance agents (1) 70+ local Farm Credit institutions (4) $362B in total loans outstanding (5) ● ~60% of insurance cost covered by US govt (2) ● $121B value insured in 2020 (3) 4,500+ retail outlets, owned by co - ops and independent retailers (7) Federal Govt support & oversight Source: (1) U.S. Department of Agriculture - Risk Management Agency - “Agent Locator”; (2) Environmental Working Group - “Crop Insurance in the United States”; (3) USDA Economic Research Service - Crop Insurance at a Glance (Last updated - May 31, 2022); (4) Farm Credit System - All Locations; (5) Federal Farm Credit Banks Funding Corporation - Investor Presentation (November 2022); (6) Ag Equipment Intelligence , “Big Dealers Own 33% of All Ag Stores in 2021” (April 15, 2021); (7) CropLife - “Top 10 Ag Retailers With the Most Facilities in 2021 (January 12, 2022) Farmers US farmers typically depend on these 5+ “trusted advisors” to support their needs 3 Crop Insurance Credit Ag Inputs & Agronomy Grain Trading Equipment

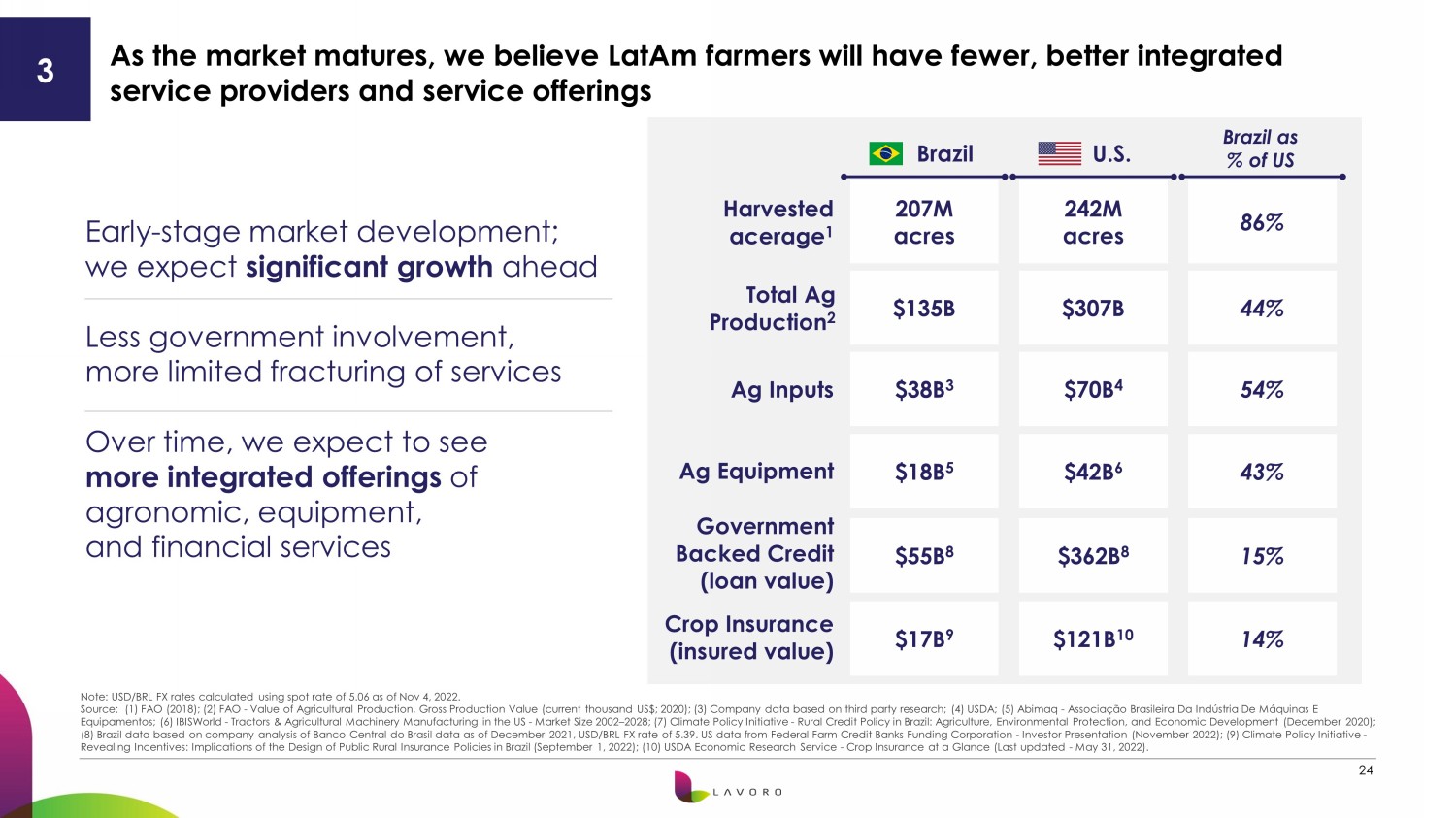

24 Note: USD/BRL FX rates calculated using spot rate of 5.06 as of Nov 4, 2022. Source: (1) FAO (2018); (2) FAO - Value of Agricultural Production, Gross Production Value (current thousand US$; 2020); (3) Co mpany data based on third party research; (4) USDA; (5) Abimaq - Associação Brasileira Da Indústria De Máquinas E Equipamentos; (6) IBISWorld - Tractors & Agricultural Machinery Manufacturing in the US - Market Size 2002 – 2028; (7) Climate Pol icy Initiative - Rural Credit Policy in Brazil: Agriculture, Environmental Protection, and Economic Development (December 2020); (8) Brazil data based on company analysis of Banco Central do Brasil data as of December 2021, USD/BRL FX rate of 5.39. US da ta from Federal Farm Credit Banks Funding Corporation - Investor Presentation (November 2022); (9) Climate Policy Initiative - Revealing Incentives: Implications of the Design of Public Rural Insurance Policies in Brazil (September 1, 2022); (10) USDA Eco nomic Research Service - Crop Insurance at a Glance (Last updated - May 31, 2022). Brazil U.S. As the market matures, we believe LatAm farmers will have fewer, better integrated service providers and service offerings Early - stage market development; we expect significant growth ahead Less government involvement, more limited fracturing of services Over time, we expect to see more integrated offerings of agronomic, equipment, and financial services 3 Harvested acerage 1 207M acres 242M acres 86% Total Ag Production 2 $135B $307B 44% Government Backed Credit (loan value) $55B 8 $362B 8 15% Brazil as % of US Ag Equipment $18B 5 $42B 6 43% Crop Insurance (insured value) $17B 9 $121B 10 14% Ag Inputs $38B 3 $70B 4 54%

25 Why Lavoro? Multiple opportunities for upside beyond plan, including services, digital agronomy, and biologics #1 Ag input retailer in Brazil 53,000+ farmers 3 ~$1.6B FY22E 1 PF 2 revenue Highly fragmented market ripe for consolidation 22 acquisitions closed 5 ~10% Brazil Market share 4 High growth business with expanding EBITDA margins 7.6% CY22E PF 2 Adj. EBITDA mgn 41% growth FY22E 1 PF 2 revenue Compelling transaction dynamics 4.3x CY23E PF 2 Adj. EBITDA 7 7.1x CY22E PF 2 Adj. EBITDA 7 Note: Financials in USD calculated using actual USD/BRL FX rates up to Nov 4, 2022, and spot rate of 5.06 as of Nov 4, 2022 t her eafter (CY21 5.39, CY22E 5.13, CY23E 5.06; FY21 5.39, FY22E 5.24, FY23E 5.13, FY24E 5.06) (1) Lavoro Fiscal Year ends on June 30; (2) Pro Forma (PF) financials are calculated assuming full year financial contributio n f or companies acquired in a given year (rather than just the partial “stub period” contribution); (3) As of March 2022; (4) Company analysis based on third - party research, additional information available later in this presentation; (5) As of Nov 4, 2022; (6) Pro Forma gross margin for Crop Care segment (Crop Care) for FY22E; (7) PF Adj. EBITDA represents fully consolidated EBITDA, which includes EBITDA from non - controlling minority shareholders (estimated at ~13% of tot al for FY22E). See F - 4 filing for more details on Lavoro's shareholding structure. Portfolio of proprietary biologics, providing sustainable alternatives to traditional synthetic crop inputs ~43% PF 2 gross margin 6 10 biologics today 5 Nascent digital commerce, already largest omnichannel in Brazil $81M FY22E 1 revenue Launched May 2020

26 LatAm Ag Retail 101 Ruy Cunha CEO, Lavoro

27 ● Increased preponderance in 2nd and 3rd crops driven by improved farmer profitability ● Higher yields driven by technology adoption ● Acreage expansion: ~116M acres of potential to convert pasture land to agriculture use Brazil ag inputs growth driven by secular factors that we expect are here to stay Brazil corn & soybean production (M tons) Brazil share of global production (%) Brazil today: ● 35% of soybean ● 9% of corn Key growth drivers Source: OECD - FAO Agricultural Outlook 2022 - 2031 report

28 Growth Catalysts • Farming profitability at very high levels • Ongoing modernization of ag equipment fleet • Improving logistics infrastructure and access to technology Small - mid size farmers will play a major role in the future growth of Brazil ag inputs Small & mid size farmers represent ~65% of agricultural land in Brazil… ...with strong growth drivers Large Farmer Small/Mid Farmer Micro Farmer % of Agricultural Land > 25,000 Acres 250 to 25,000 Acres <250 Acres 65% 15% 20% Source: IBGE 2017 census and company analysis.

29 Ag retailers are the critical link in the agribusiness value chain for small - mid sized farmers Source: Company analysis based on third party research and IBGE 2017 census. Corn / Oilseed Processing Grain / Oilseed Exports Biologics & other Specialty Products Seeds & Crop Protection products Small & Medium (250 - 25,000 acres) 65% of arable land Micro (up to 250 acres) 20% of arable land Fertilizers Co - operatives 26% Ag Retailers 41% Direct Sales 33% of Brazil ag inputs market Large (25,000+ acres) 15% of Brazil arable land Suppliers / Service Providers Channel Farmers Grain mkt & processing

30 1980 - 1990s 2000 - 2010s 2015 - 2020 2022 The retail segment is now passing through a consolidation wave Beginnings Multinational crop protection suppliers encourage their salespeople to start distribution businesses focused on small/mid - sized farmers Expansion ● Ag inputs retailers add fertilizers and seeds to their product portfolio ● Brazil ag growth leads to higher level of professionalism, and emergence of larger retailers with 5+ stores Consolidation wave ● Lavoro, AgroGalaxy, Nutrien, Bunge, and others begin the consolidation in Brazil ● ~65 meaningful M&A transactions have occurred between 2016 and 2022 in Brazil Top 51 - 100 Top 11 - 50 101 - 1,000+ Top 10 companies Top 51 - 100 Top 11 - 50 101 - 1,000+ Top 10 companies Fragmentation: % of total Brazil ag inputs retail market sales 1 FY16 FY22 Source: Company analysis based on third party research (1) Chart represents the sales % share in crop protection and seeds market. Excludes co - operatives, and global suppliers, which sell directly to large farmers

31 Source: Company Analysis based on third party sources: Spark (BIC Survey), Agrogalaxy and Três Tentos investor relations webs ite s; (1) Data excludes direct sales to large farmers from certain global inputs suppliers (e.g., Bayer, Corteva, etc.), and sales fro m co - operatives (which cater to smaller farmers present mainly in the South of Brazil) (2) Represents the share of sales for the soybean/corn crop protection and seeds markets, for crop year ending June 2022; cal cul ation does not include sales of fertilizers & specialties, as data from third party research for these product categories is not available. (3) Market share does not consider Ihara due to lack of available data A new model of retail is developing: scaled, fully independent retailers are leading Small independent ag retailers Retail arms of ag inputs suppliers Scaled fully independent ag retailers 1 JV JV Market Share 2,3 : ~55 - 65% Market Share 2,3 : ~10 - 15% Profile of a typical small retailer: • 1 - 5 stores, 3 - 15 RTVs • <R$100M revenue • Carrying only one input supplier brand (Bayer, Corteva, BASF, Syngenta, etc.) • Focused on marketing their own branded crop protection and seed products to small/mid - sized farmers • Scaled operations, but ag retail operations small % of P&L for these multinational companies • Complete product portfolio • Stores in multiple states • Ag retail a core business • May or may not do M&As • Scale enables investment in digital ag, financial and other services Market Share 2 : ~25 - 30%

32 Lavoro is leading a new generation of retailers, helping farmers make better decisions throughout the crop cycle Planting ● Seed Depth ● Planting Speed Through the FIeld ● Plant Population ● Starter Fertilizer ● Herbicide Application ● Soil Insecticides ● Fungicide Application - In - Furrow ● Variety / Hybrid Selection In - Field ● Etc. Pre - planting ● Pre - Plant Irrigation ● Fertility Program ● pH Management ● Burn - Down Program ● Tillage Level ● Primary Tillage Program ● Etc. In - Season ● Keep Stand or Replant ● Post - Emergent Herbicide Application ● Foliar Insect Control ● Foliar Disease Control ● Fertility Program ● Irrigation Application In - Season ● Micronutrients / Fertility Management ● Crop Diagnostics ● Etc. Harvest ● Equipment ● Timing ● Storage ● Post - Harvest Assessment ● Crop Marketing Support ● Etc. Planning ● Production Planning ● Crop Rotation ● Weed Control Program ● Row Spacing ● Variety / Hybrid Selection ● Refuge Options ● Seed Treatment ● Soil Insecticides ● Soil Nematicides ● Etc. Each year farmers put their net worth at risk investing in ag inputs Farming is a complex operation, with 70+ critical decisions per growing season Lavoro technical salespeople ( RTVs ) are trusted advisors , helping farmers optimize agronomic and operational decisions: ● Deep knowledge of clients’ agronomic history ● Technical advice specific to client’s needs, and local growing conditions ● Scouting and monitoring of pests With its scale and investments in training and technology, Lavoro is pioneering a new breed of RTVs 32

33 What makes Lavoro’s RTVs more effective in their role as trusted advisors ● RTV is attached to a store; 3 - 5 RTVs per store ● Services 20 - 40 farmers ● Majority of time spent visiting clients on farm, developing relationships Education, training, and toolkit Responsibilities Incentives alignment ● Typically, university degree in agronomy or related field ● In - depth knowledge of local farming ● Trainee program to hire and train grads; 2 - 3 years to become a fully - fledged RTV ● Proprietary digital and technology tools (Minha Lavoro Super App & CRM) ● Dedicated specialized RTVs for seeds and specialty products ● Base salary + variable pay ● Variable pay reflects ag input sales (~1% of sales), realized gross margin, and cash flow metrics

34 Lavoro’s retail stores serve a warehousing, logistical and administrative role ● Retail stores primarily used as warehouse/distribution points ● Vast majority of RTV - farmer meetings occur on the client’s farm ● Capital required to open a new store is ~$100K per store ● Lavoro’s capex - to - sales ratio has averaged under ~1% of sales Lavoro GP Produtec store Unaí, Minas Gerais Lavoro Impacto store Matupá, Mato Grosso Lavoro shelf at agribusiness fair Canarana, Mato Grosso Inventory warehousing Rondonopolis, Mato Grosso Source: Company analysis.Company data as of June 2021.

35 We have a built a retail footprint of ~200 stores, covering ~120M of acres in LatAm CROP CARE Agrobiólogica Union Agro Perterra Deragro Agrozap Agrovenci (MS) Cultivar Floema Integra Nova Geração Produtec Produttiva Qualicitrus EAST Agrovenci (MT) América Central Agrícola Impacto Lavoro NORTH Futuragro Pitangueiras Plenafértil Realce Casa Trevo Denorpi Deragro SOUTH Grupo Gral AgSe Cenagro Provecampo LATAM BRAZIL ● 159 stores in Brazil across 10 states ● 40 stores in Colombia ● Emergent trading operations in Uruguay ● Announced acquisition to enter Chile & Peru (subject to closing conditions)

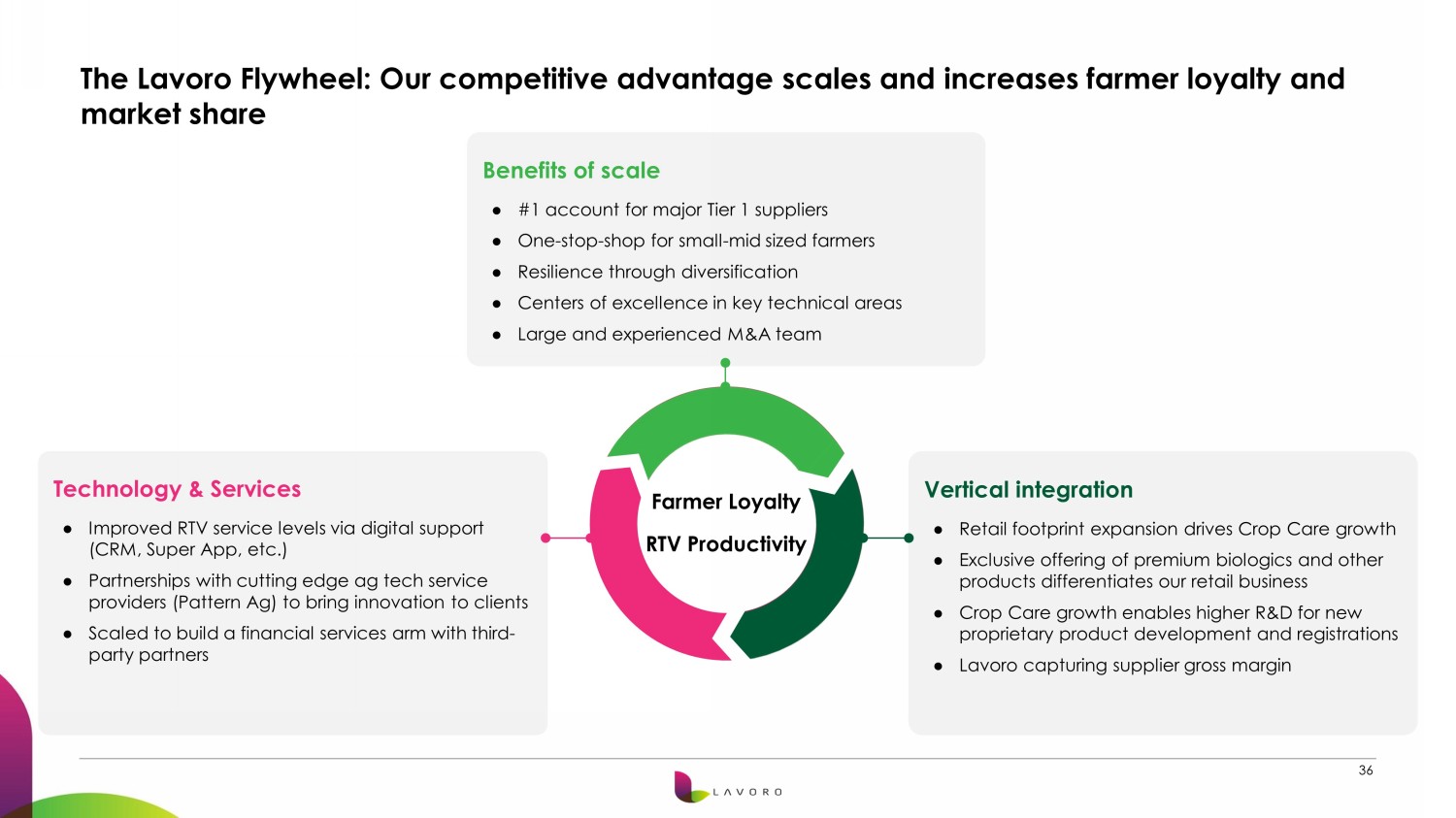

36 The Lavoro Flywheel: Our competitive advantage scales and increases farmer loyalty and market share Benefits of scale ● #1 account for major Tier 1 suppliers ● One - stop - shop for small - mid sized farmers ● Resilience through diversification ● Centers of excellence in key technical areas ● Large and experienced M&A team Vertical integration ● Retail footprint expansion drives Crop Care growth ● Exclusive offering of premium biologics and other products differentiates our retail business ● Crop Care growth enables higher R&D for new proprietary product development and registrations ● Lavoro capturing supplier gross margin Technology & Services ● Improved RTV service levels via digital support (CRM, Super App, etc.) ● Partnerships with cutting edge ag tech service providers (Pattern Ag) to bring innovation to clients ● Scaled to build a financial services arm with third - party partners Farmer Loyalty RTV Productivity

37 Lavoro’s M&A Opportunity Luiz Henrique Spinardi Head of M&A, Lavoro

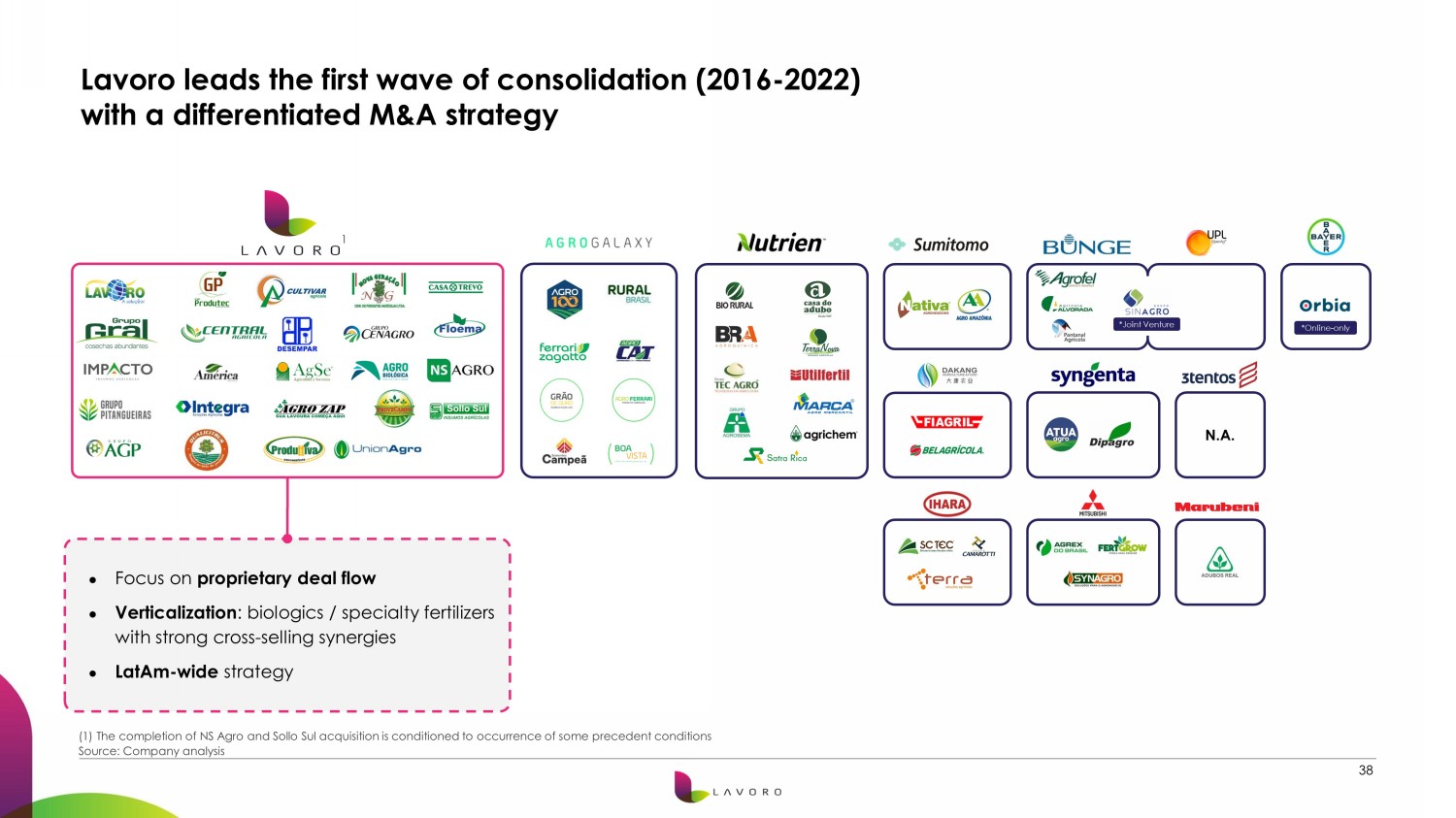

38 (1) The completion of NS Agro and Sollo Sul acquisition is conditioned to occurrence of some precedent conditions Source: Company analysis Lavoro leads the first wave of consolidation (2016 - 2022) with a differentiated M&A strategy ● Focus on proprietary deal flow ● Verticalization : biologics / specialty fertilizers with strong cross - selling synergies ● LatAm - wide strategy *Joint Venture N.A. 1 *Online - only

39 The Lavoro Way: Key drivers behind our success Through the experience of more than 20 acquisitions, we have built and honed a set of M&A core capabilities , resulting in a strong competitive advantage Dedicated M&A Team 15 individuals with investment banking & PE backgrounds; scouting, negotiating, and diligencing companies across LatAm Proprietary Deal Flow Relationships with 200+ Brazilian retailers, 40+ specialty input manufacturers, and dozens throughout LatAm Associative Approach Reputation as friendly acquirer for sellers, who often retain minority stakes post - close, participating in upside/value creation Structured Process Disciplined execution; 5 - stage M&A process with clear milestones Disciplined Execution Detailed analysis of market landscape for each region & country Integration Expertise Team with experience accumulated through 22 milestones dedicated to post - close integration Our advantage: unique capabilities that enable a proprietary deal pipeline, exceptional diligence and deal execution, system for alignment with sellers, and value - enhancing integration post - close

40 Desempar revenue 1 (R$ M) Case study: Desempar, the simultaneous acquisition of 5 companies Context ● Desempar consisted of five companies with 18 different legal entities, operated independently, with minimal scale and integration M&A process ● Conducted operational and financial due diligence for all 5 companies simultaneously, and developed business plan for each ● MOU signed June 2020; binding SPA signed December 2020, deal closed March 2021 Value creation ● Post - close, renegotiated supplier agreements to match Lavoro terms ● Companies continued operating as business units, but with centralized management, procurement, treasury and HR (1) Combined figures of unaudited financial statements of all five operating companies (Futuragro, Realce, Deragro, Denorpi a nd Plenafertil) Retailers Wholesalers Close

41 Lavoro follows a structured process to acquire small/mid size players • In - person scouting • Industry interviews • Database analysis • Site visits and NDA • Management presentation • Due diligence requests Deal structure and negotiation • Background checks • Finance & accounting • Legal & environmental • Ops (IT, HR, barter book, etc) • Synergies estimations • Financial modeling and growth plans • Integration plan Key Activities MOU signing • Market sizing and landscape analysis • Targets list • Adjusted financial statements • IC presentation • Due diligence reports • Risk assessment • Company Understanding presentation • In - depth business plan Output Ongoing 2 to 3 months 1 to 3 months 2 to 5 months 2 to 5 months Execution Timelines Screening Deal Alert MOU Due Diligence Business Plan 1 2 3 4 5 Active Targets +40 +25 5 4 3 +80 Active Targets

42 Our integration playbook balances a fast pace of synergy capture, while minimizing disruption to the acquired company Phase I: Takeover Phase II: Initial Synergies Capture Phase III: Full Business Integration Taking control of new operations • Cash flow/payments/receivables are internalized by Lavoro’s team • Detailed budget definition aligned with business plan • Hiring of new key personnel (e.g., finance manager) • Implementation of “phase 1” controls, reports and governance model New stores openings, hiring of RTVs, and centralization of procurement • Ensure retention and alignment of local leadership and RTVs • Local brand kept intact • First wave of processes integration (e.g., credit & collection, barter) • Investment in compliance and controls Full processes, systems and organizational integration implementation • SAP and salesforce roll - out • Phased SG&A synergies capture • Observed increase in voluntary turnover • Lavoro brand associated with local brand • Consistent monitoring of pace of integration efforts vs. disruption in the existing business 1 2 3 First 90 days 101 st to 360 th day 2 nd and 3 rd years

43 Our M&A plan in Brazil follows a well defined strategy for each key state Establish foothold 1 Strengthen our position 2 Acquire a well - run retailer in a new state where Lavoro is not present Case: Acquisition of Agrozap Deal Rationale : Expand in “Triângulo Mineiro” (eastern Minas Gerais), representing 45% of the harvest area Lavoro’s share in the state after acquisition : 2nd Target acquisitions in regions adjacent to our existing footprint to further expand and densify our coverage area MT MA 21 % 11 % 11 % SP MG 13 % PR RS 8% 2% GO BA 7% MS 7% 5% PA 2% Others 13 % % of Brazil Harvest Area Future priorities MG MG Case study of Minas Gerais (MG) Case: Acquisition of Floema Deal Rationale : Expand further our market share in Triaângulo Mineiro Lavoro’s position in the state after acquisition : 1st MG Case: Acquisition of Produttiva Deal Rationale : Enter in Minas Gerais (MG), 7 th largest in Brazil Lavoro’s share in MG after acquisition : 6th 2a 2b Source: Company analysis of third party information.

44 Market Size : ~$650M Main crops: Soy, wheat, sorghum and corn Uruguay 4 Market size : ~$650M Main crops: Cocoa, corn, rice and banana Ecuador 3 Market Size : ~$570M Main crops: Corn, coffee, beans and sugar cane 5 • Acquisition of NS Agro, the 2nd largest ag inputs retailer in Chile (~18% market share) and a foothold in Peru. Transaction subject to customary closing conditions. • Chile is a $1.2B ag inputs market (growing at 3% CAGR), with fruits (berries, grapes, etc) representing ~45% of planted acres • Peru is a $930M market (growing at 9% CAGR) with a focus on corn, rice, potatoes • Market size : ~$2.0B • Main crops are soy (3.6M ha), corn (1.1M ha) and wheat (500k ha), representing ~85% of cultivated land • Paraguay is the 6th largest soybean producer worldwide, and the 4th largest exporter • Crop protection market is fragmented: 5 largest suppliers account for only 38% of the market • Private label products represent 68% of the market Paraguay Chile and Peru 1 Our expansion plans focus on productive ag regions, and diverse crops and climates 1 1 2 4 3 5 Central America Source: Company analysis of third party information. 2

45 (1) Company analysis based on third - party sources We intend to replicate our M&A playbook to expand Crop Care Biologics 1 Specialty fertilizers 2 M&A Strategy: targets with products and R&D pipeline complementary to Agrobiológica & Lavoro, with strong revenue synergies potential M&A Strategy: companies with premium specialty fertilizers & adjuvants complementary to UnionAgro Market Size 1 $0.4B Market Size 1 $2.0B Deal Rationale : cross - sell newly acquired companies through our extensive Ag retail footprint in Brazil and LatAm

46 Crop Care: Lavoro’s Private Label Company Marcos Freire Chief Strategy Officer, Lavoro Crop Care

47 Crop Care offers a wide variety of product categories to support farmers Biologicals Specialty Fertilizers Microorganisms applied to the soil, seeds or the plant leaves: ● Biopesticides: reduce pest, disease, or weed pressure ● Biofertilizers: improve soil health and NPK uptake Macro and micronutrients applied on the leaf and soil that supply nutrient deficiencies to increase productivity ● Foliar fertilizers ● Adjuvants ● Soil conditioning Agrochemicals Post patent, generic pesticides to combat pest and disease ● Fungicides ● Herbicides ● Insecticides

48 We believe Crop Care is well positioned to take advantage of the growing adoption of specialties and access to the market through Brazil’s main ag input retailer Companies ● Improved COGS ● Supply risk mitigation Strategic fit with Lavoro Brazil market size Post - Patent Agrochemicals ~$11.2B 1 +14% CAGR (‘19 - ’21) 2 Specialty Fertilizers ~$2.0B 1 +17% CAGR (‘19 - ’21) 2 Biologicals ~$0.4B 1 +44% CAGR (‘19 - ’21) 2 ● High margin & growth ● Cross - selling via Lavoro ● Sustainable ● High farmer ROI Gross margin 43% Pro Forma Revenue ($ M) 3 (1) Company analysis based on third - party sources; (2) CAGR measured in local currency) (3) Incl. organic & inorganic contributions. Financials in USD calculated using actual USD/BRL FX rates up to Nov 4, 2022, an d s pot rate of 5.06 as of Nov 4, 2022 thereafter (FY22E 5.24, FY23E 5.13, FY24E 5.06); 45% +77% CAGR

49 • Nutrien, has the world’s largest ag inputs retailer business ($17B worldwide revenue as of FY21) • Loveland is Nutrien’s private label² brand (pesticides, fertilizers, seeds and specialties) • All Nutrien’s major competitors in the US (Helena, Land O’Lakes and Pinnacle) also have meaningful private label products businesses Case study: Nutrien invests in verticalization to achieve higher margins Financials Nutrien’s Private Label Private Label Gross Profit share Gross Margin¹ % Source: Nutrien public earnings and investor day presentations (1) 2018; (2) Segments: Seeds, Agrochemicals and Crop Protection 2023E 2021 23% 29% Third Party Products Private Label 37% 21%

50 Pro Forma Gross Profit ($ M) Crop Care’s Gross profit bridge FY22E - FY24E 2 3 1 +81% CAGR FY22E FY24E Note: Financials in USD calculated using actual USD/BRL FX rates up to Nov 4, 2022, and spot rate of 5.06 as of Nov 4, 2022 t her eafter (FY21 5.39, FY22E 5.24, FY23E 5.13, FY24E 5.06)

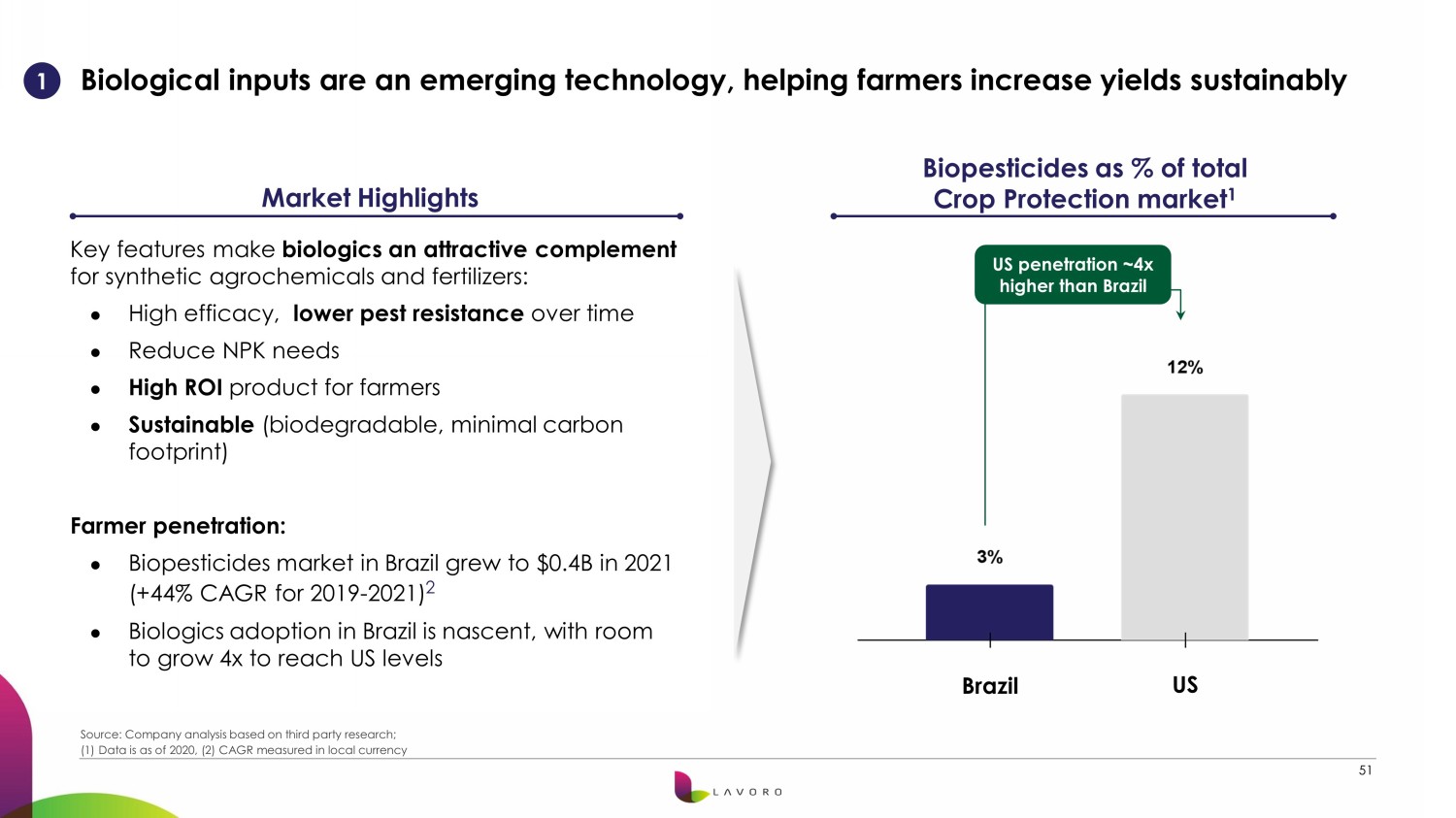

51 Source: Company analysis based on third party research; (1) Data is as of 2020, (2) CAGR measured in local currency Biological inputs are an emerging technology, helping farmers increase yields sustainably Biopesticides as % of total Crop Protection market 1 Key features make biologics an attractive complement for synthetic agrochemicals and fertilizers: ● High efficacy, lower pest resistance over time ● Reduce NPK needs ● High ROI product for farmers ● Sustainable (biodegradable, minimal carbon footprint) Farmer penetration: ● Biopesticides market in Brazil grew to $0.4B in 2021 (+44% CAGR for 2019 - 2021) 2 ● Biologics adoption in Brazil is nascent, with room to grow 4x to reach US levels 1 Market Highlights Brazil US US penetration ~4x higher than Brazil

52 Source: Crop Care (1) Agrochemical pesticides use has a side effect of reducing the microorganisms in the soil. Biological products, on the oth er hand, enables microorganisms to expand Agrobiológica is well set up to be a leading biologics player in Brazil for years to come Growing product portfolio Current portfolio of 10 products cover 72% of biopesticides' active ingredients; R&D focused on new products driving productivity and soil regeneration¹ 1 Growth Drivers Main Products Cross - selling through Lavoro retail channel Share of Lavoro biological inputs sales expected to increase via RTV training and new product introductions Manufacturing capacity expansion Current facilities operating at 100% capacity (sold out for FY23E) New plant under development: 121 acres to be one of the largest biopesticides facilities in Brazil

53 1 We believe biologics adoption will further increase with capacity and R&D expansion • Footprint: 121 acres footprint, one of the largest biomanufacturing facilities in LatAm • Start of production: October 2023 • Strategic location : Itápolis, SP - near large cities and agricultural hubs Overview Purpose • R&D center for new product development, and field trials • Training hub in biologics for technical sales reps biologics

54 Perterra offers more than 100 off - patent agrochemicals to Lavoro, through direct sourcing from Asia Strategic portfolio definition Company offers 106 products with similar or better costs, and high volume to Lavoro Supply chain risk mitigation Company’s strategic relationship with 10+ key suppliers in Asia support reducing the risk of sourcing disruptions Capture supplier gross margin Improved Lavoro crop protection gross margin via substituting Tier 3 suppliers 3 Main Products Growth Drivers

55 Union Agro has an extensive portfolio, resilient business model and attractive margins Extensive product portfolio 87 products including specialty foliar, soil, fertilizers, adjuvants, that restore nutrients and boost yields Specialty fertilizers one - stop shop Portfolio spans premium to budget solutions, offering farmers what they need Large and growing TAM Specialty fertilizers market grew to $2.0B in 2021 (+17% CAGR 2019 - 2021) 1 2 Main Products Key Highlights Source: Company analysis based on third party research; (1) CAGR measured in local currency

56 Wrap - up: We have rapidly integrated acquisitions into Crop Care, with headroom to grow Crop Care share of Lavoro’s Specialty Products 1 Private Label’s Share of Total Gross Profit 2 Source: Company analysis performed by third party research and data; Crop Care, Lavoro (1) Based on Lavoro’s specialty products COGS (2) Organic and Inorganic, Crop Protection and Specialties (3) Loveland (Nutrien’s Private Label) projected gross profit share of total Nutrien’s Gross Profit FY21A FY22E FY23E FY21A Crop Care Nutrien’s Private Label 3 Other Suppliers Crop Care - Agrobiologica and Union Agro

57 Digital Ag & Services Opportunities Gustavo Modenesi, Chief Strategy Officer, Lavoro Rob Hranac, CEO, Pattern Ag

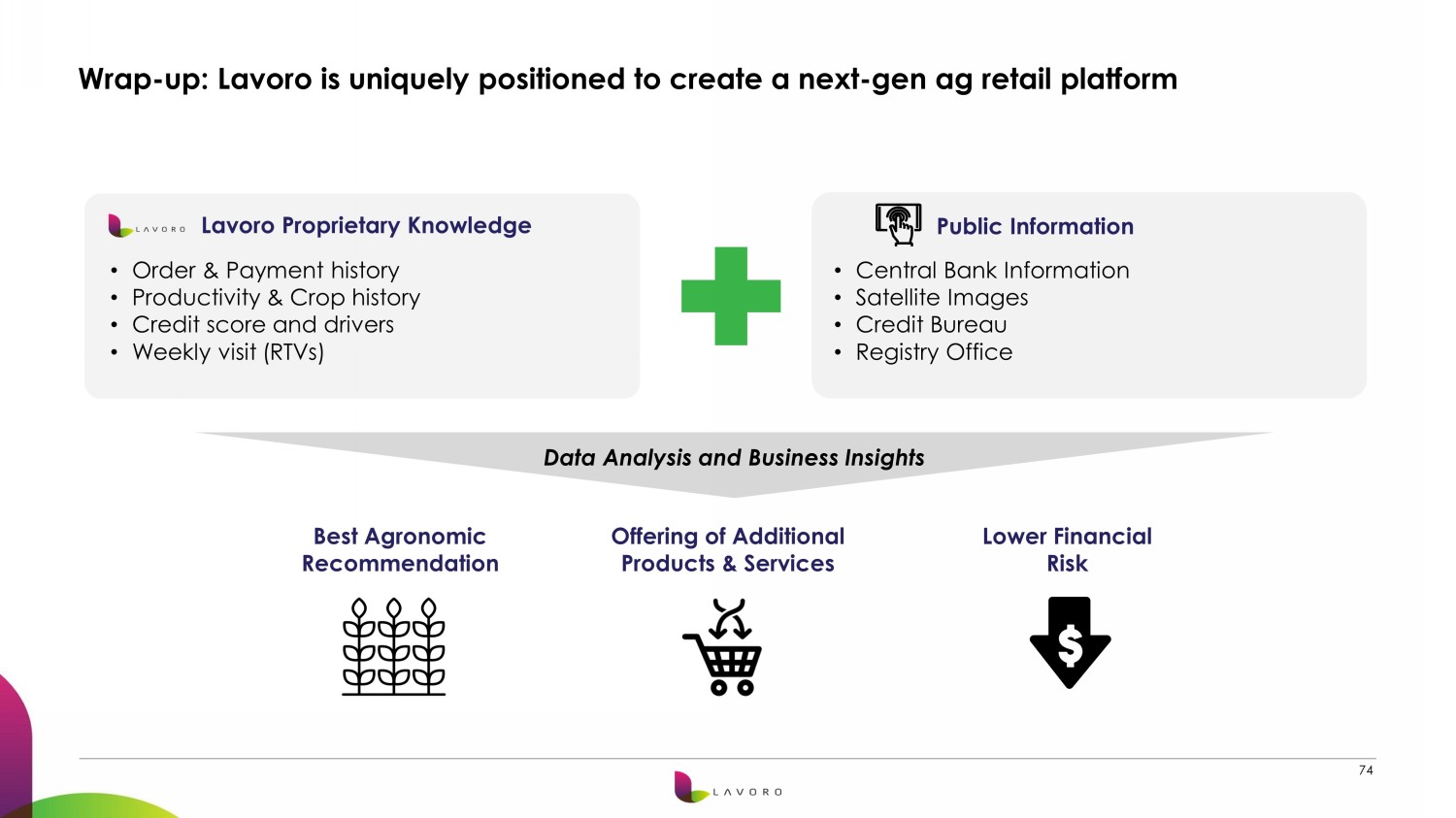

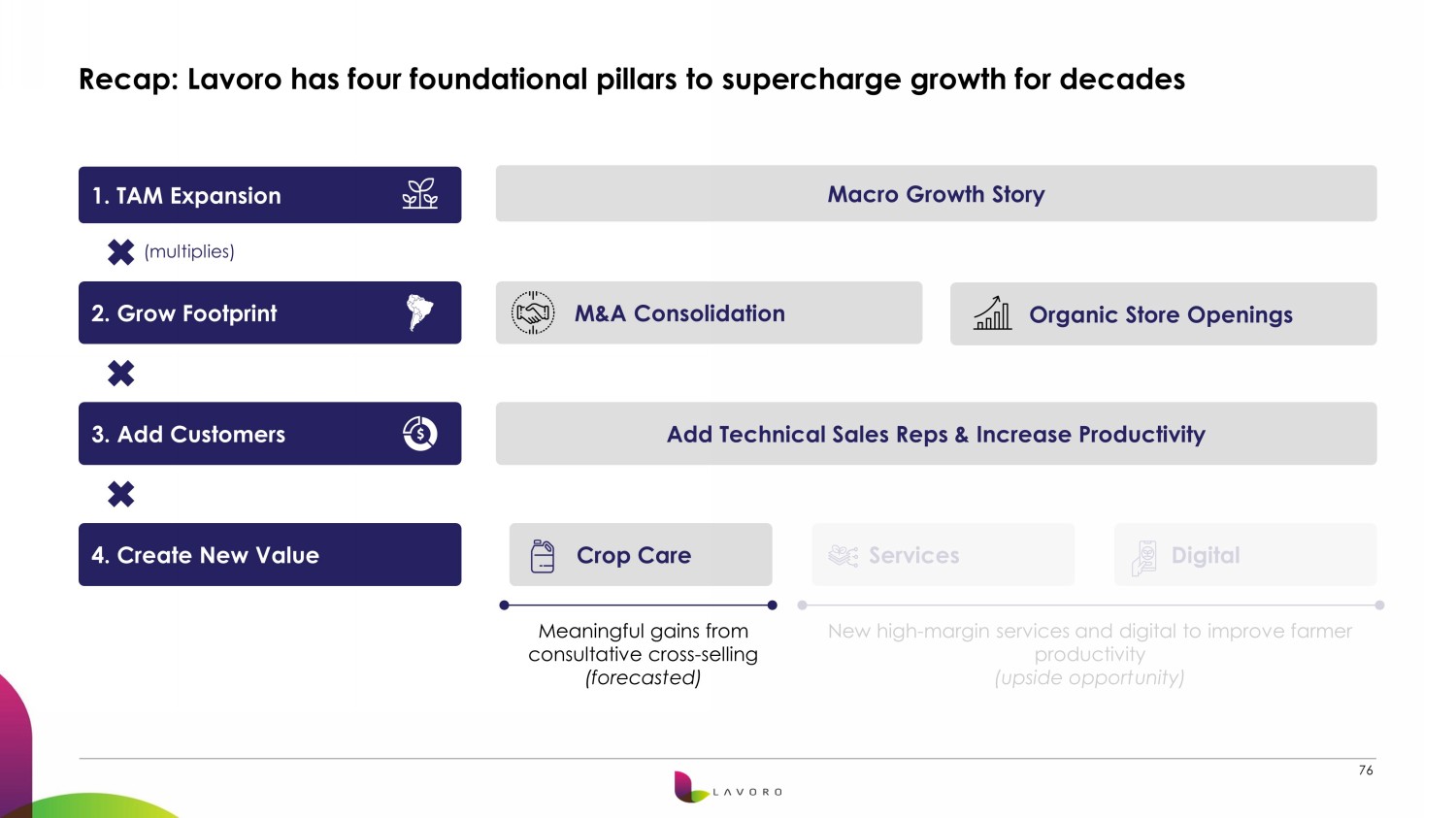

58 Organic Store Openings M&A Consolidation Recap: Lavoro has four foundational pillars to supercharge growth for decades Meaningful gains from consultative cross - selling (forecasted) 3. Add Customers 4. Create New Value 1. TAM Expansion 2. Grow Footprint Macro Growth Story Add Technical Sales Reps & Increase Productivity New high - margin services and digital to improve farmer productivity (upside opportunity) (multiplies) Services Crop Care Digital

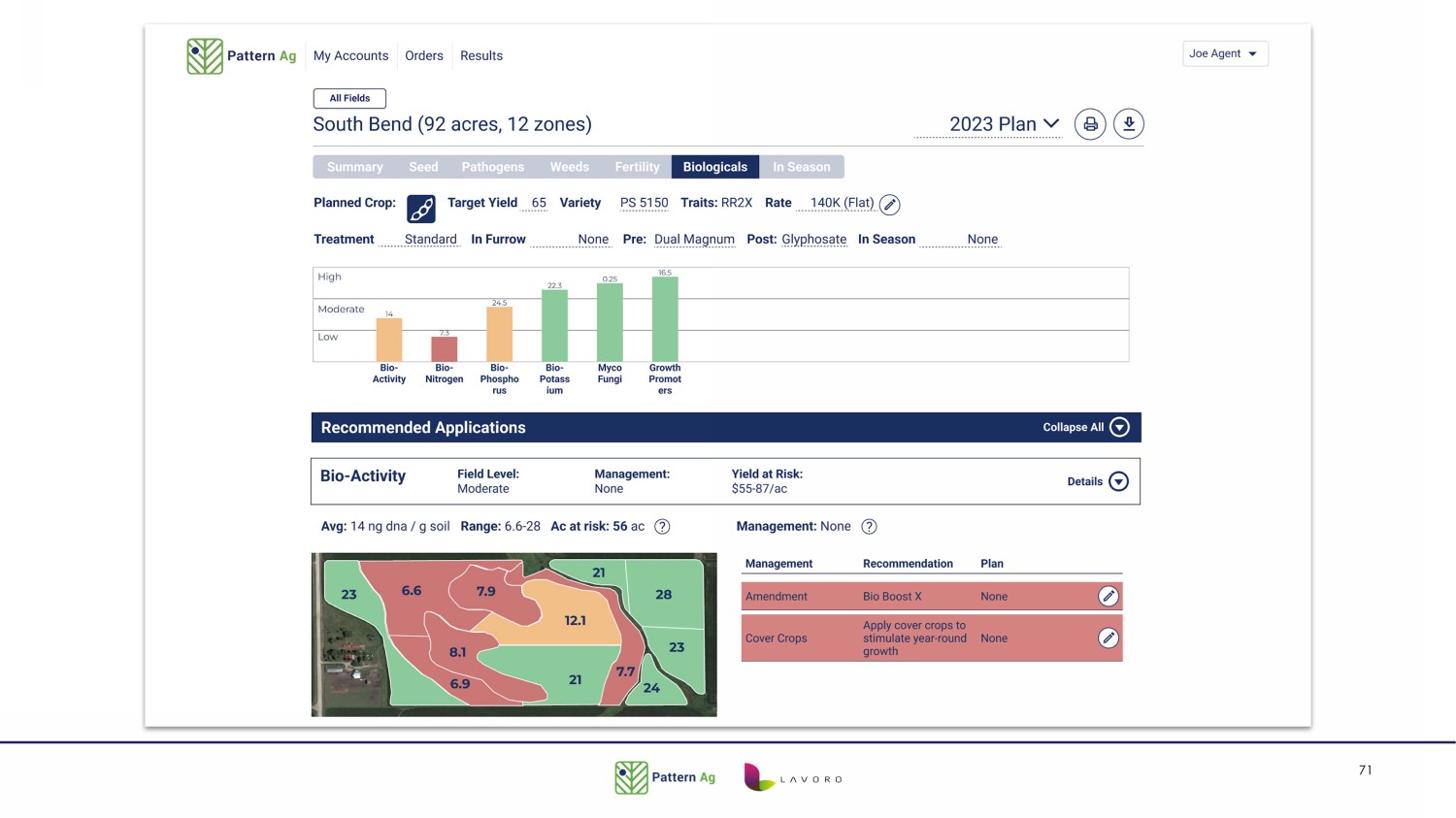

59 Lavoro and Pattern Ag partnership aims to bring cutting - edge services to Brazil Sales Partner Agreement ▪ Exclusivity Period until June 2024 (Retail Channel) with extension options ▪ Full integration with Minha Lavoro’s App ▪ More than 50k samples already purchased Services: ▪ The service will be fully operational in August 2023 ▪ Initially service will be available in the Southeast and Midwest regions to Crop Care customers Underserved by the market Suppliers aren’t professionalized and extremely fragmented The Soil Analysis Opportunity Market still with low adoption Soil testing adoption in the US at 98% 1 High sales and service potential for Lavoro RTVs could sell service and collect samples (1) Caela O'Connell, D.L. Osmond, “Why soil testing is not enough: A mixed methods study of farmer nutrient management decisi on - making among U.S. producers”, J ournal of Environmental Management (Volume 314, 2022)

60 Pattern Ag: The Power of Predictive Agronomy Rob Hranac, CEO, Pattern Ag

61 100 billion + 10 thousand + 10 million organisms / lb. of soil DNA sequencing tech surfaces hidden soil biology species / lb. of soil data points / lb. of soil SCIENCE Partnership Source: Ohio State University, “Understanding Soil Microbes and Nutrient Recycling”; Company Analysis

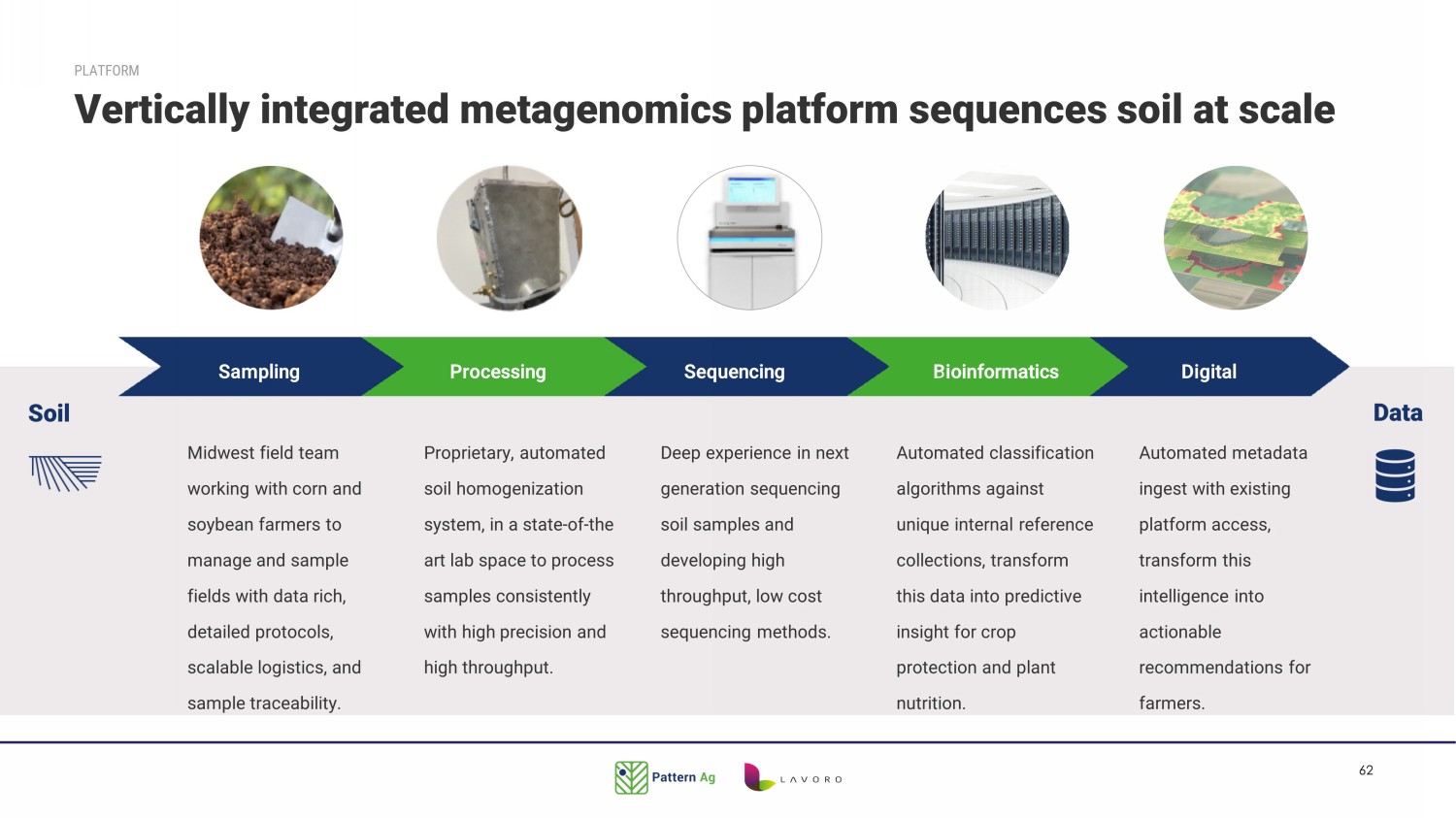

62 Midwest field team working with corn and soybean farmers to manage and sample fields with data rich, detailed protocols, scalable logistics, and sample traceability. Proprietary, automated soil homogenization system, in a state - of - the art lab space to process samples consistently with high precision and high throughput. Deep experience in next generation sequencing soil samples and developing high throughput, low cost sequencing methods. Automated classification algorithms against unique internal reference collections, transform this data into predictive insight for crop protection and plant nutrition. Automated metadata ingest with existing platform access, transform this intelligence into actionable recommendations for farmers. Vertically integrated metagenomics platform sequences soil at scale PLATFORM Soil Data Sampling Processing Sequencing Bioinformatics Digital

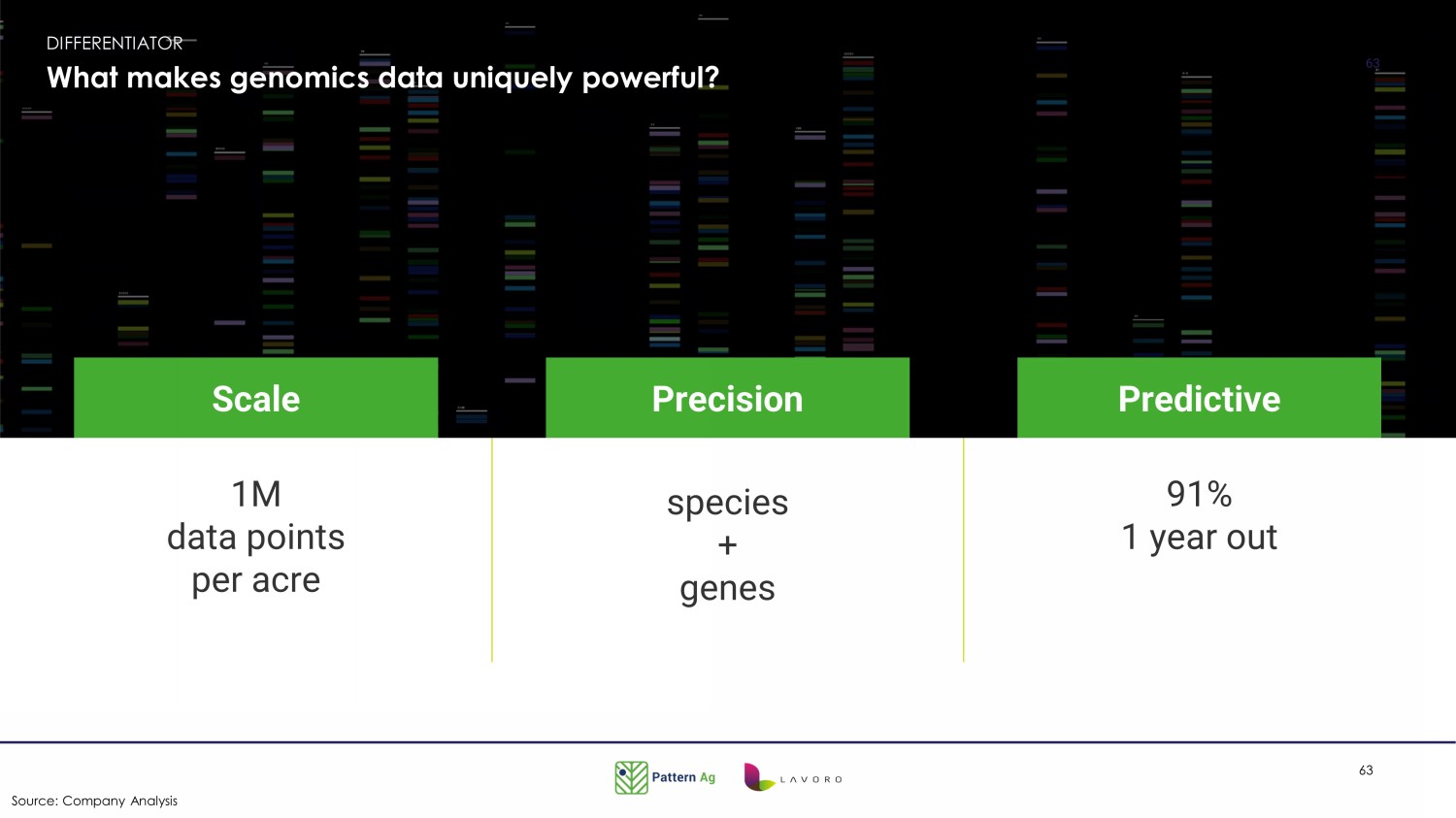

63 1M data points per acre species + genes 91% 1 year out What makes genomics data uniquely powerful? DIFFERENTIATOR 63 Scale Precision Predictive Source: Company Analysis

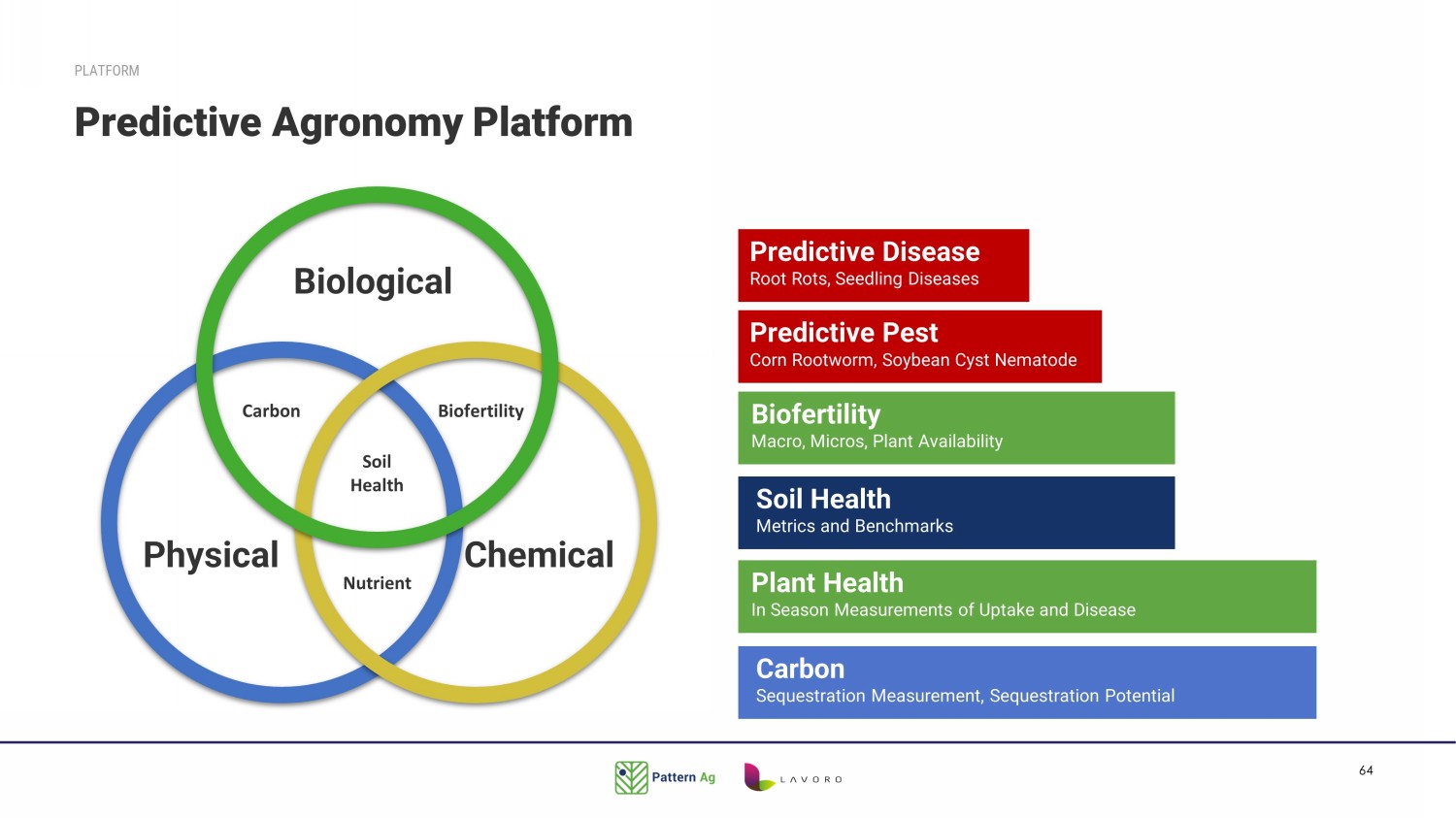

64 PLATFORM © 2022 confidential Accelerating the transition to biological solutions Predictive Agronomy Platform Predictive Disease Root Rots, Seedling Diseases Predictive Pest Corn Rootworm, Soybean Cyst Nematode Biofertility Macro, Micros, Plant Availability Plant Health In Season Measurements of Uptake and Disease Carbon Sequestration Measurement, Sequestration Potential Soil Health Metrics and Benchmarks Chemical Soil Health Nutrient Biofertility Carbon Biological Physical

65 VALUE PROPOSITION US farmers without our service underspend or overspend on inputs $9 / acre / year 50% of a farmer’s annual per acre spend is on agronomic inputs (in green, above). Pattern’s biological analytics helps farmers spend on inputs with new levels of precision impossible without our technology platform. US pricing Less than 20% of Corn Fields are at risk for Corn Rootworm , but 80% of farmers spend on traits and insecticide at a cost of: 60% overspend $50 - $150 / acre profit increase 60% of untreated Soybean Fields lose 3 - 5 bu. of yield, due to undetected levels of Soybean Cyst Nematode , costing: 60% underspend $50 - $80 / acre revenue increase Source: Company Analysis

66

67

68

69

70

71

72 Minha Lavoro App designed to streamline relationships between farmers and Lavoro Functionalities Real - time news on agriculture - related topics Lavoro’s Marketplace - integration with our e - commerce Purchase Orders - history and upcoming deliveries Credit - pre - approved limit for clients Real - time grains pricing with trading possibility Contracts - document status and digital signature Payment dates and possibility of anticipation Direct Contact with your sales rep Access to other services - Pattern Ag (and others) Our vision ● Automate the more transactional points of contact of farmers with Lavoro ● Free up valuable RTV time to focus on value creation activities for their clients ● Create hub for placing adjacent products and services

73 We see an attractive opportunity to develop integrated financial services Why Financial Services? Credit ▪ Government subsidized credit (“Plano Safra”) far below real farmers’ needs ▪ Private banks lack capillarity / access (“deep Brazil”) ▪ Traditional financial institutions suffer from high information asymmetry and, as a result, are over - cautious to provide credit ▪ Farmers end up accessing informal lines at high costs Crop Insurance ▪ Small penetration (18% of TAM)¹ ▪ Asymmetry of information by insurer, and high adverse selection Grain Derivatives ▪ Small and medium producers don’t have access and knowledge to use contract grain derivative structures (1) IBGE, July 2022 Lower Priority Higher Priority Credit Crop Insurance Grain Derivatives Credit Card Bank Account Investments