UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23694

PUERTO RICO RESIDENTS TAX-FREE FUND VI, INC.

(Exact name of registrant as specified in charter)

270 Muñoz Rivera Avenue, Suite 1110

San Juan, Puerto Rico 00918

(Address of principal executive offices)

Liana Loyola, Esq.

270 Muñoz Rivera Avenue, Suite 1110

San Juan, PR 00918

(Name and Address of Agent for Service)

| Copy to: |

| Jesse C. Kean, Esq. |

| Sidley Austin LLP |

| 787 Seventh Avenue |

| New York, NY 10019 |

| |

| Owen T. Meacham, Esq. |

| UBS Asset Management – Legal Department |

| One North Wacker Drive |

| Chicago, IL 60606 |

Registrant’s telephone number, including area code: (787) 764-1788

| Date of fiscal year end: | June 30 |

| | |

| Date of reporting period: | July 1, 2023 – June 30, 2024 |

Item 1. Reports to Shareholders.

| (a) | | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”): |

TABLE OF CONTENTS

| Portfolio Update | 1 |

| Schedule of Investments | 8 |

| Statement of Assets and Liabilities | 11 |

| Statement of Operations | 12 |

| Statements of Changes in Net Assets | 13 |

| Statement of Cash Flows | 14 |

| Financial Highlights | 15 |

| Notes to Financial Statements | 17 |

| Report of Independent Registered Public Accounting Firm | 31 |

| Other Information | 32 |

| Management of the Fund | 35 |

| Statement Regarding Basis for Approval of Investment Advisory Contract | 40 |

| Privacy Policy | 44 |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Portfolio Update |

| | June 30, 2024 (Unaudited) |

LETTER TO SHAREHOLDERS

July 15, 2024

Dear Shareholder:

Puerto Rico Residents Tax-Free Fund VI, Inc. (the “Fund”) is pleased to present this Letter to Shareholders for the fiscal year ended June 30, 2024.

The Federal Reserve Board (the “Fed”) raised the Fed funds rate a total of 0.25% during the Fund’s fiscal year. This was considerably slower than the increase of 3.50% during the fiscal year ended June 30, 2023. The Fed funds rate closed the fiscal year at 5.25% to 5.50%.

The Fed did not raise rates at any of the last seven meetings during the fiscal year, and in its statement after the June 2024 meeting it cited strong job gains, a low unemployment rate, and inflation, although lower, that remains elevated, (i.e., higher than the Fed’s 2% target) as reasons for leaving the Fed funds rates untouched. The Fed does not believe it would be appropriate to reduce the Fed funds range until it has more confidence inflation continues to move towards its long-term goal.

The Fed Board members’ updated summary of economic projections published after the June meeting, projected lower Fed funds rates and inflation for the remainder of calendar year 2024 and 2025. Market participants have adjusted their expectations for Fed funds rate cuts. One rate cut is now expected beginning in September 2024, versus the two or three cuts projected after the March 2024 projections were released. The pace and timing of any cuts would still depend on future inflation indicators. Recent economic indicators have been mixed.

After trading briefly at a yield of 5% during October 2023, the yield on the 10-year U.S. Treasury Note dropped for the rest of the fiscal year. It closed the year at 4.40% versus 3.84% at the beginning of the Fund’s fiscal year. The 2-year U.S. Treasury Note also decreased in yield after the October 2023 highs to close at 4.75%. Although the yield curve remains inverted, the spread between the 2-year and 10-year Note decreased to negative 0.35% from negative 1.06% at the beginning of the year. Thus, the yield curve flattened during the year. Major equity indexes are trading at or close to their all-time highs. The best performing index for the first six months of 2024 was the technology heavy Nasdaq 100, followed closely by the S&P 500.

The combination of higher inflation, an inverted yield curve, the timing of the end of the tightening cycle, and elevated geopolitical risks continue to present a challenging environment for the management of the Fund. Notwithstanding, the Investment Adviser remains committed to seeking investment opportunities within the allowed parameters while providing professional management services to the Fund for the benefit of its shareholders.

Sincerely,

| /s/ Enrique Vila del Corral | |

| Enrique Vila del Corral, CPA | |

| Chairman of the Board | |

This letter is intended to assist shareholders in understanding how the Fund performed during the year ended June 30, 2024. The views and opinions in the letter were current as of July 15, 2024. They are not guarantees of future performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and we reserve the right to change our views about individual securities, sectors, and markets at any time. As a result, the views expressed should not be relied upon as a forecast of the Fund's future investment intent. We encourage you to consult your financial advisor regarding your personal investment program.

| Annual Report | June 30, 2024 | 1 |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Portfolio Update |

| | June 30, 2024 (Unaudited) |

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

REGISTRATION UNDER THE INVESTMENT COMPANY ACT OF 1940

The Fund is a non-diversified closed-end management investment company organized under the laws of the Commonwealth of Puerto Rico (“Puerto Rico”) and is registered as an investment company under the Investment Company Act of 1940, as amended (the “1940 Act”), as of May 21, 2021. Prior thereto, the Fund was registered under the Puerto Rico Investment Companies Act of 1954, as amended.

On May 24, 2018, the Economic Growth, Regulatory Relief, and Consumer Protection Act (Pub. L. No. 115-174) was signed into law and amended the 1940 Act to repeal the exemption from its registration of investment companies created under the laws of Puerto Rico, the U.S. Virgin Islands, or any other U.S. possession under Section 6(a)(1) thereof. The repeal of the exemption took effect on May 24, 2021. Upon the Fund’s registration under the 1940 Act, it must now register its future offerings of securities under the Securities Act of 1933, as amended (the “1933 Act”), absent an available exception. The Fund has suspended its current offerings of securities pending its registration under the 1933 Act.

FUND PERFORMANCE

The following table shows the Fund’s performance for the fiscal year ended June 30, 2024, as compared to the Bloomberg Municipal Bond Index. Past performance is not predictive of future results.

Performance calculations do not reflect any deduction of taxes that a shareholder may have to pay on Fund distributions or any commissions payable on the sale of Fund shares. The return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Total returns for periods of less than one year have not been annualized. Current performance may be higher or lower than the performance data quoted.

| | Average Annual Total Returns as of June 30, 2024 |

| | 1-Year | Since Inception* |

| Puerto Rico Residents Tax-Free Fund VI, Inc. - NAV | 4.53% | -2.68% |

| Puerto Rico Residents Tax-Free Fund VI, Inc. - Market | 21.54% | -13.13% |

| Bloomberg Municipal Bond Index | 3.21% | -0.77% |

| 2 | (787) 764-1788 | www.ubs.com/prfunds |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Portfolio Update |

| | June 30, 2024 (Unaudited) |

Growth of an assumed $10,000 investment as of June 30, 2024*

| * | While the Fund commenced operations on September 29, 1995, it did not register with the SEC under the 1940 Act until May 21, 2021. |

The following table provides summary data on the Fund’s dividends, net asset value ("NAV"), and market prices as of June 30, 2024:

| Dividend yield based on market at fiscal year end | 6.82% |

| Dividend yield based on NAV at fiscal year end | 3.16% |

| NAV as of June 30, 2024 | $4.17 |

| Market Price as of June 30, 2024 | $1.93 |

| Premium (discount) to NAV | (53.7%) |

The Fund seeks to pay monthly dividends out of its net investment income. To allow the Fund to maintain a more stable monthly dividend, the Fund may pay dividends that are more or less than the amount of net income earned during the year. The Fund’s dividend distribution of $2,535,783 included all of the Fund’s net investment income for the year plus approximately $323,000 net investment income from prior years. The basis of the distributions is the Fund's net investment income for tax purposes. See Note 10 to the Financial Statements for a reconciliation of book and taxable income.

| Annual Report | June 30, 2024 | 3 |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Portfolio Update |

| | June 30, 2024 (Unaudited) |

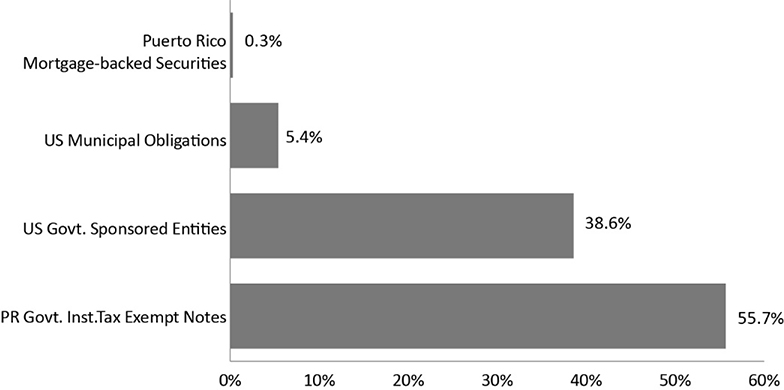

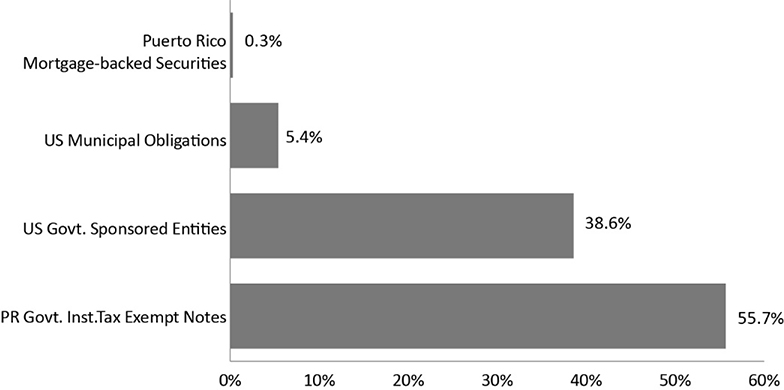

Figure 1 below reflects the breakdown of the Fund's investment portfolio as of June 30, 2024. For details of the security categories below, please refer to the enclosed Schedule of Investments.

Figure 1. Asset allocation as of June 30, 2024

Asset Allocation, as a % of the Total Portfolio

The largest Puerto Rico municipal bond holdings in the portfolio, representing 55.3%, are the new-issue Puerto Rico Sales Tax Financing Corporation (“COFINA”) bonds. The newly exchanged bonds are secured by 53.65% of the pledged sales and use tax through 2058, which amounts to $531.7 million for fiscal year 2025, and a 4% increase each year, capping out at $992.5 million in fiscal year 2041. Even though interest rates were higher during the year, the valuation of the COFINA bonds increased during the year. The COFINA collection report as of June 30, 2024, reported a 6.9% increase in the collections of the pledged sales and use tax (IVU) versus last year. The debt service reserve for fiscal year 2023-2024 was fully funded during October 2023.

The Fund owns several mortgage-backed securities (“MBS”) representing 0.3% of its portfolio. The MBS consist of Puerto Rico mortgage pools issued or guaranteed by U.S. agencies and certain notes collateralized with U. S. agency mortgage pools. The balance of the MBS decreased mostly as a result of repayments of the underlying mortgages.

The remaining Puerto Rico security consists of a contingent value instrument (“CVI”) representing 0.4% of the portfolio. The CVI was received as part of the re-structuring of the debt of the Puerto Rico Highway Authority. The CVI pays yearly distributions, if any, based on rum excise tax collections above a pre-determined base. The last CVI distribution was during November 2023.

The Fund’s U.S. holdings are comprised of U.S. agencies and U.S. municipal bonds representing 38.6% and 5.4%, respectively of the portfolio. The U.S. agencies decreased in value during the year in response to higher interest rates across the yield curve.

The Fund's NAV increased $0.05 during the year from $4.12 at the beginning of the year to $4.17 at fiscal year-end. There was a net increase in the valuation of the portfolio. As discussed above, the portfolio of Puerto Rico securities, led by the COFINA bonds, increased in value. This increase was partly offset by the decrease in the U.S. agencies. At year-end the Fund's indicated market value was a 53.7% discount to its NAV, a decrease from the discount of 60.2% at fiscal year-end 2023.

| 4 | (787) 764-1788 | www.ubs.com/prfunds |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Portfolio Update |

| | June 30, 2024 (Unaudited) |

FUND HOLDINGS SUMMARY

The following tables show the Fund’s portfolio allocation using various metrics as of fiscal year-end. It should not be construed as a measure of performance for the Fund itself. The portfolio is actively managed, and holdings are subject to change.

| Portfolio Composition (% of Total Portfolio) |

| Sales and Use Tax (PR) | 55.3% |

| U.S. Agencies | 38.6% |

| U.S. Municipal Bonds | 5.4% |

| Other P.R. Municipal Bonds | 0.4% |

| Mortgage-Backed Securities | 0.3% |

| Total | 100.0% |

| Geographic Allocation (% of Total Portfolio) |

| Puerto Rico | 56.0% |

| U.S. | 44.0% |

| Total | 100.0% |

The following table shows the Fund’s security portfolio ratings as of June 30, 2024. The ratings used are the highest rating given by one of the three nationally recognized rating agencies, Fitch Ratings (Fitch), Moody's Investors Service (Moody's), and S&P Global Ratings (S&P). Ratings are subject to change.

| Rating | Percent (% of Total Portfolio) |

| AAA | 38.9% |

| AA | 0.0% |

| A | 5.4% |

| BBB | 0.0% |

| Below BBB | 0.0% |

| Not Rated | 55.7% |

| Total | 100.0% |

The "Not-Rated" category is comprised of restructured COFINA bonds issued in 2019 and a minor position in a Puerto Rico Commonwealth GO/Highway & Transportation Authority revenue bond. The restructured COFINA bonds were issued without a rating from any of the rating agencies, pending a determination of the Board of Directors of COFINA on the appropriate timing to apply for such rating. As of June 30, 2024, the COFINA Board had not applied for a rating.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell, or hold a security or an investment strategy and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her financial advisers. The views expressed herein are those of the portfolio manager as of the date of this report. The Fund disclaims any obligation to update publicly the views expressed herein.

| Annual Report | June 30, 2024 | 5 |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Portfolio Update |

| | June 30, 2024 (Unaudited) |

FUND LEVERAGE

THE BENEFITS AND RISKS OF LEVERAGE

As its fundamental policy, the Fund may only issue senior securities, as defined in the 1940 Act (“Senior Securities”), representing indebtedness to the extent that immediately after their issuance, the value of its total assets, less all the Fund’s liabilities and indebtedness that are not represented by Senior Securities being issued or already outstanding, is equal to or greater than the total of 300% of the aggregate par value of all outstanding indebtedness issued by the Fund. The Fund may only issue Senior Securities representing preferred stock to the extent that immediately after any such issuance, the value of its total assets, less all the Fund’s liabilities and indebtedness that are not represented by Senior Securities being issued or already outstanding, is equal to or greater than the total of 200% of the aggregate par value of all outstanding preferred stock (not including any accumulated dividends or other distributions attributable to such preferred stock) issued by the Fund. These asset coverage requirements must also be met any time the Fund pays a dividend or makes any other distribution on its issued and outstanding shares of common stock or any shares of its preferred stock (other than a dividend or other distribution payable in additional shares of common stock) as well as any time the Fund repurchases any shares of common stock, in each case after giving effect to such repurchase of shares of common stock or issuance of preferred stock, debt securities, or other forms of leverage. To the extent necessary, the Fund may purchase or redeem preferred stock, debt securities, or other forms of leverage in order to maintain asset coverage at the required levels. In such instances, the Fund will redeem Senior Securities, as needed, to maintain the required asset coverage.

Subject to the above percentage limitations, the Fund may also engage in certain additional borrowings from banks or other financial institutions through reverse repurchase agreements. In addition, the Fund may also borrow for temporary or emergency purposes in an amount of up to an additional 5% of its total assets.

Leverage can produce additional income when the income derived from investments financed with borrowed funds exceeds the cost of such borrowed funds. In such an event, the Fund's net income will be greater than it would be without leverage. On the other hand, if the income derived from securities purchased with borrowed funds is not sufficient to cover the cost of such funds, the Fund's net income will be less than it would be without leverage.

To obtain leverage, the Fund enters into collateralized reverse repurchase agreements with major institutions in the U.S. and/or issues Tax Exempt Secured Obligations ("TSOs") in the Puerto Rico market. Both are accounted for as collateralized borrowings in the financial statements. Typically, the Fund borrows for approximately 30-90 days at a variable borrowing rate based on short-term rates. The TSO program was suspended in May 2021 pending registration under the 1933 Act.

| 6 | (787) 764-1788 | www.ubs.com/prfunds |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Portfolio Update |

| | June 30, 2024 (Unaudited) |

As of June 30, 2024, the Fund had the following leverage outstanding:

| Reverse Repurchase Agreements | $20,700,000 |

| Leverage Ratio1 | 20.1% |

Please refer to the Schedule of Investments for details of the securities pledged as collateral and to Note 6 to the Financial Statements for further details on outstanding leverage during the year.

| 1 | Asset Leverage ratio: The sum of (i) the aggregate principal amount of outstanding TSOs plus (ii) the aggregate principal amount of other borrowings by the Fund, including borrowings resulting from the issuance of any other series and other forms of leverage, and from the compliance date of Rule 18f-4 going forward, including borrowings in the form of reverse repurchase agreements, divided by the fair market value of the assets of the Fund on any given day. |

| Annual Report | June 30, 2024 | 7 |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Schedule of Investments |

| | June 30, 2024 |

| Principal Amount/Description | | Rate | | | Maturity | | | Fair Value | |

| Government Bonds (47.73%) | | | | | | | | | |

| US Government and Agency Obligations (6.80%) | | | | | | | | | | | | |

| $ | 5,625,000 | | | Federal Home Loan Bank(a) | | | 5.200 | % | | | 09/28/37 | | | $ | 5,463,782 | |

| | | | | | | | | | | | | | | | | |

| US Government Sponsored Entities (40.93%) | | | | | | | | | | | | |

| | 1,650,000 | | | Federal Farm Credit Banks Funding Corp. | | | 5.200 | % | | | 02/06/26 | | | | 1,658,433 | |

| | 17,385,000 | | | Federal Home Loan Bank(a) | | | 5.500 | % | | | 07/15/36 | | | | 18,925,676 | |

| | 2,365,000 | | | Federal Farm Credit Banks Funding Corp. | | | 5.700 | % | | | 10/25/27 | | | | 2,444,828 | |

| | 8,300,000 | | | Federal Farm Credit Banks Funding Corp. | | | 6.180 | % | | | 11/06/28 | | | | 8,876,295 | |

| | 1,000,000 | | | Federal Home Loan Bank | | | 6.500 | % | | | 09/13/38 | | | | 997,104 | |

| | | | | | | | | | | | | | | | 32,902,336 | |

| | | | | | | | | | | | | | | | | |

| Total Government Bonds | | | | | | | | | | | | |

| (Cost $38,905,184) | | | | | | | | | | | 38,366,118 | |

| | | | | | | | | | | | | | | | | |

| Municipal Bonds (75.70%) | | | | | | | | | | | | |

| Illinois (6.73%) | | | | | | | | | | | | |

| | 5,000,000 | | | State of Illinois, General Obligation Unlimited Bonds | | | 7.100 | % | | | 07/01/35 | | | | 5,415,250 | |

| Puerto Rico Government Instrumentalities (68.88%) | | | | | | | | | | | | |

| | 632,152 | | | Puerto Rico Commonwealth CVI - Highway 1998, Revenue Bonds(c) | | | 0.000 | % | | | 11/01/51 | | | | 398,256 | |

| | 1,735,000 | | | Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Restructured Series A-1, Revenue Bonds(b) | | | 4.500 | % | | | 07/01/34 | | | | 1,737,520 | |

| | 880,000 | | | Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Restructured Series A-1, Revenue Bonds(b) | | | 4.550 | % | | | 07/01/40 | | | | 883,288 | |

| | 6,452,000 | | | Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Restructured Series A-1, Revenue Bonds(b) | | | 4.750 | % | | | 07/01/53 | | | | 6,358,043 | |

| | 19,690,000 | | | Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Restructured Series A-1, Revenue Bonds(b) | | | 5.000 | % | | | 07/01/58 | | | | 19,613,347 | |

| | 18,507,000 | | | Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Capital Appreciation Restructured Series A-1, Revenue Bonds(b)(c) | | | 0.000 | % | | | 07/01/46 | | | | 5,951,561 | |

| | 17,923,000 | | | Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Capital Appreciation Restructured Series A-1, Revenue Bonds(b)(c) | | | 0.000 | % | | | 07/01/51 | | | | 4,193,785 | |

See Notes to Financial Statements.

| 8 | (787) 764-1788 | www.ubs.com/prfunds |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Schedule of Investments |

| | June 30, 2024 |

| Principal Amount/Description | | Rate | | | Maturity | | | Fair Value | |

| Puerto Rico Government Instrumentalities (68.88%) (continued) | | | | | | | | | | | | |

| $ | 8,930,000 | | | Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Restructured Series A-2, Revenue Bonds(b) | | | 4.329 | % | | | 07/01/40 | | | $ | 8,810,276 | |

| | 268,000 | | | Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Restructured Series A-2, Revenue Bonds(b) | | | 4.536 | % | | | 07/01/53 | | | | 255,212 | |

| | 7,281,000 | | | Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Restructured Series A-2, Revenue Bonds(b) | | | 4.784 | % | | | 07/01/58 | | | | 7,165,571 | |

| | | | | | | | | | | | | | | | 55,366,859 | |

| Puerto Rico Tax Exempt Notes (0.09%)(d) | | | | | | | | | | | | |

| | 1,491 | | | Community Endowment, Inc - collateralized by FN536042 | | | 8.000 | % | | | 09/01/30 | | | | 1,552 | |

| | 35,934 | | | Community Endowment, Inc - collateralized by GN514609 | | | 7.000 | % | | | 09/15/29 | | | | 36,013 | |

| | 27,091 | | | Community Endowment, Inc - collateralized by GN514615 | | | 7.000 | % | | | 09/15/29 | | | | 27,216 | |

| | 6,082 | | | Community Endowment, Inc – collateralized by FN536024 | | | 8.500 | % | | | 05/01/30 | | | | 6,087 | |

| | | | | | | | | | | | | | | | 70,868 | |

| | | | | | | | | | | | | | | | | |

| Total Municipal Bonds | | | | | | | | | | | | |

| (Cost $59,768,996) | | | | | | | | | | | 60,852,977 | |

| | | | | | | | | | | | | |

| Mortgage-Backed Securities (0.25%) | | | | | | | | | | | | |

| Puerto Rico GNMA Bonds(e) (0.03%) | | | | | | | | | | | | |

| | 22,786 | | | GNMA Pool 487554 | | | 7.000 | % | | | 07/15/29 | | | | 22,873 | |

| | 3,659 | | | GNMA Pool 508646 | | | 7.000 | % | | | 07/15/29 | | | | 3,674 | |

| | | | | | | | | | | | | | | | 26,547 | |

| Puerto Rico Fannie Mae Bonds(f) (0.22%) | | | | | | | | | | | | |

| | 106,098 | | | FNMA Pool 504143 | | | 8.000 | % | | | 07/01/29 | | | | 107,920 | |

| | 64,456 | | | FNMA Pool 504156 | | | 8.000 | % | | | 08/01/29 | | | | 64,785 | |

| | | | | | | | | | | | | | | | 172,705 | |

| | | | | | | | | | | | | | | | | |

| Total Mortgage-Backed Securities | | | | | | | | | | | | |

| (Cost $196,999) | | | | | | | | | | | 199,252 | |

| | | | | | | | | | | | | |

| Total Investments (123.68%) | | | | | | | | | | | | |

| (Cost $98,871,179) | | | | | | | | | | $ | 99,418,347 | |

| | | | | | | | | | | | | |

| Liabilities in Excess of Other Assets (-23.68%) | | | | | | | | | | | (19,036,010 | ) |

| NET ASSETS (100.00%) | | | | | | | | | | $ | 80,382,337 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2024 | 9 |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Schedule of Investments |

| | June 30, 2024 |

| (a) | A portion or all of the security has been pledged as collateral for reverse repurchase agreements. |

| (b) | Security may be called before its maturity date. |

| (c) | Issued with a zero coupon. Income is recognized through the accretion of discount. |

| (d) | Community Endowment - These obligations are collateralized by mortgage-backed securities and the only source of repayment is the collateral. They are subject to principal paydowns as a result of prepayments or refinancing of the underlying mortgage instruments. As a result, the average life may be substantially less than the original maturity. |

| (e) | Puerto Rico GNMA - Represents mortgage-backed obligations guaranteed by the Government National Mortgage Association. They are subject to principal paydowns as a result of prepayments or refinancing of the underlying mortgage instruments. As a result, the average life may be substantially less than the original maturity. |

| (f) | Puerto Rico Fannie Mae Taxable - Represents mortgage-backed obligations guaranteed by the Federal National Mortgage Association. They are subject to principal paydowns as a result of prepayments or refinancing of the underlying mortgage instruments. As a result, the average life may be substantially less than the original maturity. |

Reverse Repurchase Agreements

| Counterparty | | Interest Rate | | | Acquisition Date | | Maturity Date | | Amount | |

| J.P. Morgan Chase & Co.(a) | | | 5.55% | | | 6/20/2024 | | 07/18/2024 | | $ | 20,700,000 | |

| | | | | | | | | | | $ | 20,700,000 | |

| (a) | Reverse Repurchase Agreement with JPMorgan Chase & Co $20,700,000 5.55% dated June 20, 2024, due July 18, 2024 (Collateralized by US Government, Agency, and Instrumentalities with a face amount of $20,150,000 and a fair value of $21,276,002 5.20% - 5.50%, with maturity dates from July 15, 2036, to September 28, 2037). |

See Notes to Financial Statements.

| 10 | (787) 764-1788 | www.ubs.com/prfunds |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Statement of Assets and Liabilities |

| | June 30, 2024 |

| ASSETS: | | | |

| Investments in securities: | | | | |

| Securities pledged as collateral under reverse repurchase agreements, at fair value (cost $21,672,093) | | $ | 21,276,002 | |

| Other securities, at fair value (cost $77,199,086) | | | 78,142,345 | |

| | | $ | 99,418,347 | |

| Cash and cash equivalents | | | 93,008 | |

| Interest receivable | | | 1,930,682 | |

| Prepaid and other assets | | | 125,855 | |

| Total Assets | | | 101,567,892 | |

| | | | | |

| LIABILITIES: | | | | |

| Reverse repurchase agreements (cost $20,700,000) | | | 20,700,000 | |

| Interest payable | | | 35,104 | |

| Dividends payable | | | 200,678 | |

| Payable to Investment Adviser | | | 20,923 | |

| Payable to fund accounting and administration | | | 45,276 | |

| Payable to Transfer agency | | | 2,943 | |

| Payable for Compliance fees | | | 926 | |

| Payable for Custodian fees | | | 165 | |

| Payable for Audit fees | | | 63,058 | |

| Other payables | | | 116,482 | |

| Total Liabilities | | | 21,185,555 | |

| Net Assets | | $ | 80,382,337 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital $0.01 par value, – shares authorized 19,258,965 issued and outstanding | | $ | 215,383,439 | |

| Accumulated deficit | | | (135,001,102 | ) |

| Net Assets | | $ | 80,382,337 | |

| | | | | |

| PRICING OF SHARES: | | | | |

| Net Assets | | $ | 80,382,337 | |

| Shares of common stock outstanding (98,000,000 of shares authorized, at $0.01 par value per share) | | | 19,258,965 | |

| Net asset value per share | | $ | 4.17 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2024 | 11 |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Statement of Operations |

| | For the year ended June 30, 2024 |

| INVESTMENT INCOME: | | | |

| Interest | | $ | 4,821,015 | |

| Total Investment Income | | | 4,821,015 | |

| | | | | |

| EXPENSES: | | | | |

| Investment Adviser fee | | | 744,818 | |

| Accounting and Administration fees | | | 194,213 | |

| Compliance expense | | | 6,662 | |

| Transfer agent expenses | | | 9,424 | |

| Interest expense | | | 1,130,302 | |

| Audit expenses | | | 66,473 | |

| Legal expenses | | | 571,758 | |

| Custodian fees | | | 6,808 | |

| Director expenses | | | 50,487 | |

| Printing expenses | | | 135,437 | |

| Insurance fee | | | 143,758 | |

| Other expenses | | | 34,049 | |

| Total expenses before waiver | | | 3,094,189 | |

| Less fees waived by Investment Adviser | | | (496,545 | ) |

| Total Expenses | | | 2,597,644 | |

| Net Investment Income | | | 2,223,371 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS): | | | | |

| Net realized gain on: | | | | |

| Investments | | | 18,616 | |

| Net realized gain | | | 18,616 | |

| Net change in unrealized appreciation on: | | | | |

| Investments | | | 1,406,774 | |

| Net change in unrealized appreciation | | | 1,406,774 | |

| Net Realized and Unrealized Gain on Investments | | | 1,425,390 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 3,648,761 | |

See Notes to Financial Statements.

| 12 | (787) 764-1788 | www.ubs.com/prfunds |

| Puerto Rico Residents | |

| Tax-Free Fund VI, Inc. | Statements of Changes in Net Assets |

| | | For the

Year Ended

June 30, 2024 | | | For the

Year Ended

June 30, 2023 | |

| NET INCREASE/(DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 2,223,371 | | | $ | 2,545,124 | |

| Net realized gain/(loss) on investments | | | 18,616 | | | | (375,434 | ) |

| Net change in unrealized appreciation/(depreciation) | | | 1,406,774 | | | | (2,070,755 | ) |

| Net increase in net assets resulting from operations | | | 3,648,761 | | | | 98,935 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Dividends | | | (2,535,783 | ) | | | (2,639,759 | ) |

| Net decrease in net assets from dividends | | | (2,535,783 | ) | | | (2,639,759 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Reinvestment of dividends | | | 5,114 | | | | 8,046 | |

| Net increase in net assets from capital share transactions | | | 5,114 | | | | 8,046 | |

| | | | | | | | | |

| Net Increase/(Decrease) in Net Assets | | | 1,118,092 | | | | (2,532,778 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 79,264,245 | | | | 81,797,023 | |

| End of year | | $ | 80,382,337 | | | $ | 79,264,245 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2024 | 13 |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Statement of Cash Flows |

For the year ended June 30, 2024

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net increase in net assets resulting from operations | | $ | 3,648,761 | |

| Adjustments to reconcile net decrease in net assets from operations to net cash provided by operating activities: | | | | |

| Purchases of investment securities | | | (1,000,000 | ) |

| Proceeds from disposition of investment securities | | | 273,867 | |

| Amortization of premium and accretion of discount on investments, net | | | (248,584 | ) |

| Net realized gain on: | | | | |

| Investments | | | (18,616 | ) |

| Net change in unrealized appreciation on: | | | | |

| Investments | | | (1,406,774 | ) |

| (Increase)/Decrease in assets: | | | | |

| Interest receivable | | | (16,484 | ) |

| Prepaid and other assets | | | 17,788 | |

| Increase/(Decrease) in liabilities: | | | | |

| Payable for interest expense | | | (45,273 | ) |

| Payable to Investment Adviser | | | 648 | |

| Payable to fund accounting and administration fees | | | 17,044 | |

| Payable to Transfer agency | | | (576 | ) |

| Payable to Directors | | | (9,381 | ) |

| Payable for Compliance fees | | | 466 | |

| Payable for Custodian fees | | | (7,843 | ) |

| Payable for Audit fees | | | (15,330 | ) |

| Other payables | | | 29,442 | |

| Net cash provided by operating activities | | $ | 1,219,155 | |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Securities purchased under reverse repurchase agreements | | $ | (647,805,000 | ) |

| Securities sold under reverse repurchase agreements | | | 649,102,000 | |

| Cash distributions paid to common shareholders - net of distributions reinvested | | | (2,546,640 | ) |

| Net cash used in financing activities | | $ | (1,249,640 | ) |

| | | | | |

| Net decrease in cash and cash equivalents | | $ | (30,485 | ) |

| Cash and cash equivalents, beginning of year | | $ | 123,493 | |

| Cash and cash equivalents, end of year | | $ | 93,008 | |

| | | | | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | | |

| Cash paid during the year for interest expense on reverse repurchase agreements | | $ | 1,175,575 | |

| | | | | |

| NON-CASH ACTIVITIES: | | | | |

| Reinvestment of dividends | | $ | 5,114 | |

See Notes to Financial Statements.

| 14 | (787) 764-1788 | www.ubs.com/prfunds |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Financial Highlights |

For a share outstanding during the period presented

| | | Year Ended June 30, 2024 | | | Year Ended June 30, 2023 | | | Year Ended June 30, 2022 | | | Year Ended June 30, 2021 | |

| Net asset value - beginning of period | | $ | 4.12 | | | $ | 4.25 | | | $ | 5.12 | | | $ | 4.92 | |

| Income/(loss) from investment operations: | | | | | | | | | | | | | | | | |

| Net investment income(a) | | | 0.12 | | | | 0.13 | | | | 0.15 | | | | 0.19 | |

| Net realized and unrealized gain/(loss) | | | 0.06 | | | | (0.12 | ) | | | (0.84 | ) | | | 0.19 | |

| Total income/(loss) from investment operations | | | 0.18 | | | | 0.01 | | | | (0.69 | ) | | | 0.38 | |

| Less distributions: | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.13 | ) | | | (0.14 | ) | | | (0.18 | ) | | | (0.18 | ) |

| Total distributions | | | (0.13 | ) | | | (0.14 | ) | | | (0.18 | ) | | | (0.18 | ) |

| Net increase/(decrease) in net asset value | | | 0.05 | | | | (0.13 | ) | | | (0.87 | ) | | | 0.20 | |

| Net asset value - end of period | | $ | 4.17 | | | $ | 4.12 | | | $ | 4.25 | | | $ | 5.12 | |

| Market value per share - end of period(b) | | $ | 1.93 | | | $ | 1.64 | | | $ | 1.77 | | | $ | 3.44 | |

| Total Return - Net Asset Value(c) | | | 4.53 | % | | | 0.29 | % | | | (13.88 | %) | | | 10.26 | % |

| Total Return - Market Price(c) (d) | | | 21.54 | % | | | (4.14 | %) | | | (46.63 | %) | | | 15.34 | % |

| Supplemental Data: | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 80,382 | | | $ | 79,264 | | | $ | 81,797 | | | $ | 98,564 | |

| Ratios to Average Net Assets(e) | | | | | | | | | | | | | | | | |

| Ratio of gross expenses to average net assets(f) | | | 3.92 | % | | | 3.22 | % | | | 1.94 | % | | | 1.68 | % |

| Ratio of net expenses to average net assets(f)(g) | | | 3.29 | % | | | 2.60 | % | | | 1.33 | % | | | 0.96 | % |

| Ratio of gross operating expenses to average net assets(h) | | | 2.49 | % | | | 2.27 | % | | | 1.88 | % | | | 1.62 | % |

| Interest and leverage related expenses to average net assets | | | 1.43 | % | | | 0.95 | % | | | 0.06 | % | | | 0.06 | % |

| Ratio of net investment income to average net assets(g) | | | 2.82 | % | | | 3.26 | % | | | 3.17 | % | | | 3.70 | % |

| Portfolio turnover rate | | | 0 | % | | | 1 | % | | | 0 | % | | | 0 | % |

| (a) | Based on weekly average outstanding common shares of 19,258,458 for the year ended June 30, 2024, 19,256,597 for the year ended June 30, 2023, 19,255,051 for the year ended June 30, 2022, and 19,254,024 for the year ended June 30, 2021. |

See Notes to Financial Statements.

| Annual Report | June 30, 2024 | 15 |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Financial Highlights |

For a share outstanding during the period presented

| (b) | End of year market values are provided by UBS Financial Services Inc., a dealer of the Fund's shares and an affiliated party. The market values shown may reflect limited trading in shares of the Fund in an over-the-counter market. |

| (c) | Dividends are assumed to be reinvested at the per share net asset value as defined in the dividend reinvestment plan. |

| (d) | The return is calculated based on market values provided by UBS Financial Services Inc., a dealer of the Fund's shares and an affiliated party. |

| (e) | Based on average net assets attributable to common shares of $78,693,525 for the year ended June 30, 2024, $78,240,060 for the year ended June 30, 2023, $93,450,869 for the year ended June 30, 2022, and 96,621,591 for the year ended June 30, 2021. |

| (f) | Expenses include both operating and interest and leverage related expenses. |

| (g) | The effect of the expenses waived for the year ended June 30, 2024, for the year ended June 30, 2023, for the year ended June 30, 2022, for the year ended June 30, 2021, and was to decrease the expense ratio, thus increasing the net investment income ratio to average net assets applicable to common shareholders by 0.63%, 0.62%, 0.61%, and 0.72%, respectively. |

| (h) | Operating expenses represent total expenses excluding interest and leverage related expenses. |

See Notes to Financial Statements.

| 16 | (787) 764-1788 | www.ubs.com/prfunds |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Notes to Financial Statements |

June 30, 2024

NOTE 1. REPORTING ENTITY AND SIGNIFICANT ACCOUNTING POLICIES

Puerto Rico Residents Tax-Free Fund VI, Inc. (the "Fund") is a non-diversified closed-end management investment company. The Fund is a corporation organized under the laws of the Commonwealth of Puerto Rico (the "Commonwealth" or "Puerto Rico") and is registered as an investment company under the 1940 Act as of May 21, 2021. The Fund was incorporated on July 31, 1995, and commenced operations on September 29, 1995.

The Fund’s investment objective is to achieve a high level of current income that, for Puerto Rico residents, is exempt from federal and Puerto Rico income taxes, consistent with the preservation of capital. There is no assurance that the Fund will achieve its investment objective.

On May 24, 2018, the Economic Growth, Regulatory Relief, and Consumer Protection Act (Pub. L. No. 115-174) was signed into law and amended the 1940 Act to repeal the exemption from its registration of investment companies created under the laws of Puerto Rico, the U.S. Virgin Islands, or any other U.S. possession under Section 6(a)(1) thereof. The repeal of the exemption took effect on May 24, 2021. Subsequent to its registration under the 1940 Act, the Fund must now register its future offering of securities under the 1933 Act, absent an available exception. The Fund has suspended its current offering of securities pending its registration under the 1933 Act.

The Fund is an investment company that applies the accounting and reporting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (ASC 946). The financial statements are prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), which requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

| (a) | Cash and Cash Equivalents – Cash and cash equivalents consist of demand deposits and funds invested in short-term investments with original maturities of 90 days or less. Cash and cash equivalents are valued at amortized cost, which approximates fair value. At June 30, 2024, cash and cash equivalents consisted of a time deposit open account amounting to $93,008 with JPMorgan Chase Bank, N.A. |

| (b) | Valuation of Investments – Investments included in the Fund’s financial statements have been stated at fair value as determined by the Fund, with the assistance of UBS Asset Managers of Puerto Rico, a division of UBS Trust Company of Puerto Rico (the "Investment Adviser") (refer to Note 3 for details on the investment advisory agreement), on the basis of valuations provided by dealers or by pricing services which are approved by Fund management and the Fund's Board of Directors (the "Board") in accordance with the valuation methods set forth in the governing documents and related policies and procedures. See Note 2 for further discussions regarding fair value disclosures. See Note 2 for further discussions regarding fair value disclosures. |

| Annual Report | June 30, 2024 | 17 |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Notes to Financial Statements |

June 30, 2024

| (c) | Taxation – The Fund has elected to be treated as a registered investment company under the Puerto Rico Internal Revenue Code of 2011, as amended, and the regulations and administrative pronouncements promulgated thereunder. As a registered investment company under the 1940 Act, the Fund will not be subject to Puerto Rico income tax for any taxable year if it distributes at least 90% of its taxable net investment income for such year, as determined for these purposes pursuant to the provisions of section 1112.01(a)(2) of the Puerto Rico Internal Revenue Code of 2011, as amended. Accordingly, as the Fund intends to meet this distribution requirement, the income earned by the Fund is not subject to Puerto Rico income tax at the Fund level. The Fund has never been subject to taxation. |

In addition, the fixed income and equity investments of the Fund are exempt from Puerto Rico personal property taxes. The Fund does not intend to qualify as a Regulated Investment Company ("RIC") under Subchapter M of the U.S. Internal Revenue Code of 1986, as amended, and consequently an investor that is not (i) an individual who has his or her principal residence in Puerto Rico, or (ii) a person, other than an individual, that has its principal office and principal place of business in Puerto Rico will not receive the tax benefits of an investment in typical U.S. mutual funds (such as RIC tax treatment, i.e., availability of pass-through tax status for non-Puerto Rico residents) and may have adverse tax consequences for U.S. federal income tax purposes. The Fund is exempt from United States income taxes, except for dividends received from United States sources, which are subject to a 10% United States withholding tax if certain requirements are met. In the opinion of the Fund's legal counsel, the Fund is not required to file a U.S. federal income tax return.

FASB Accounting Standards Codification Topic 740, Income Taxes (ASC 740) requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund's tax return to determine whether the tax positions are “more likely than not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the “more likely than not” threshold are recorded as a tax expense in the current year. Management has analyzed the Fund's tax positions taken on its Puerto Rico income tax returns for all open tax years (the current and prior three tax years) and has concluded that there are no uncertain tax positions. On an ongoing basis, management will monitor the Fund's tax position to determine if adjustments to this conclusion are necessary. The Fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expenses in the Statement of Operations. During the year ended June 30, 2024, the Fund did not incur any interest or penalties.

| (d) | Statement of Cash Flows – The Fund invests in securities and distributes dividends from net investment income, which are paid in cash or are reinvested at the discretion of common shareholders. These activities are reported in the Statement of Changes in Net Assets. Additional information on cash receipts and payments is presented in the Statement of Cash Flows. |

Accounting practices that do not affect the reporting of activities on a cash basis include carrying investments at fair value and amortizing premiums or discounts on debt obligations.

| (e) | Dividends and Distributions to Shareholders – Dividends from substantially all of the Fund’s net investment income are declared and paid monthly. The Fund may at times pay out more or less than the entire amount of net investment income earned in any particular period and may at times pay out such accumulated undistributed income earned in other periods in order to permit the Fund a more stable level of distribution. The Fund records dividends to its shareholders on the ex-dividend date. The Fund does not expect to make distributions of net realized capital gains, although the Fund’s Board reserves the right to do so in its sole discretion. |

| 18 | (787) 764-1788 | www.ubs.com/prfunds |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Notes to Financial Statements |

June 30, 2024

| (f) | Reverse Repurchase Agreements – Under these agreements, the Fund sells portfolio securities, receives cash in exchange, and agrees to repurchase the securities at a mutually agreed upon date and price. Ordinarily, those counterparties with which the Fund enters into these agreements require delivery of collateral, nevertheless, the Fund retains ownership of the collateral through the agreement that requires the repurchase and return of such collateral. These transactions are treated as financings and recorded as liabilities. Therefore, no gain or loss is recognized on the transaction and the securities pledged as collateral remain recorded as assets of the Fund. The Fund enters into reverse repurchase agreements that do not have third-party custodians, with the collateral delivered directly to the counterparty. Pursuant to the terms of the standard SIFMA Master Repurchase Agreement, the counterparty is free to repledge or rehypothecate the collateral, provided it is delivered to the Fund upon maturity of the reverse repurchase agreement. This arrangement allows the Fund to receive better interest rates and pricing on the reverse repurchase agreements. While the Fund cannot monitor the rehypothecation of collateral, it does monitor the market value of the collateral versus the repurchase amount, that the income from the collateral is paid to the Fund on a timely basis, and that the collateral is returned at the end of the reverse repurchase agreement. These agreements involve the risk that the market value of the securities purchased with the proceeds from the sale of securities received by the Fund may decline below the price of the securities that the Fund is obligated to repurchase and that the value of the collateral posted by the Fund increases in value and the counterparty does not return it. Because the Fund borrows under reverse repurchase agreements based on the estimated fair value of the pledged assets, the Fund’s ongoing ability to borrow under its reverse repurchase facilities may be limited, and its lenders may initiate margin calls in the event of adverse changes in the market. A decrease in market value of the pledged assets may require the Fund to post additional collateral or otherwise sell assets at a time when it may not be in the best interest of the Fund to do so (See Note 6). |

| (g) | Short- and Medium-term Notes – The Fund has a short- and medium-term notes payable program as a funding vehicle to increase the amount available for investment. The short- and medium-term notes are issued from time to time in denominations of at least $1,000 and maturing in periods of up to 270 days and over 270 days, respectively. The notes are collateralized by the pledge of certain securities of the Fund. The pledged securities are held by JPMorgan Chase Bank, N.A. (the Custodian), as collateral agent, for the benefit of the holders of the notes. Selling fees related to the issuance of medium-term notes are amortized throughout the term of the note or until its first call date. There were no short- or medium-term notes outstanding for the year ended June 30, 2024. |

| (h) | Paydowns – Realized gains and losses on mortgage-backed securities paydowns are recorded as an adjustment to interest income as required by GAAP. For purposes of dividend distributions, net investment income excludes the effect of mortgage-backed securities paydowns gains and losses. For the year ended June 30, 2024, losses on mortgage-backed securities paydowns decreased interest income in the amount of $11,256 (See Note 10). |

| Annual Report | June 30, 2024 | 19 |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Notes to Financial Statements |

June 30, 2024

| (i) | Restructuring Expenses – Legal expenses incurred by the Fund related to Puerto Rico bond restructurings have been accounted for as a realized loss. |

| (j) | Other – Security transactions are accounted for on the trade date (the date the order to buy or sell is executed). Realized gains and losses on security transactions are determined based on the identified cost method. Premiums and discounts on securities purchased are amortized over the life or the expected life of the respective securities using the effective interest method. Interest income on preferred equity securities is accrued daily except when collection is not expected. Dividend income on preferred equity securities is recorded on the ex-dividend date. |

NOTE 2. FAIR VALUE MEASUREMENTS

Under GAAP, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. A fair value measurement assumes that the transaction to sell the asset or transfer the liability occurs in the principal market for the asset or liability or, in the absence of a principal market, the most advantageous market for the asset or liability.

GAAP establishes a fair value hierarchy that prioritizes the inputs and valuation techniques used to measure fair value into three levels in order to increase consistency and comparability in fair value measurements and disclosures. The classification of assets and liabilities within the hierarchy is based on whether the inputs to the valuation methodology used for the fair value measurement are observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from independent sources. Unobservable inputs reflect the Fund’s estimates about assumptions that market participants would use in pricing the asset or liability based on the best information available. The hierarchy is broken down into three levels based on the reliability of inputs as follows:

| Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities at the measurement date. Valuation on these instruments does not need a significant degree of judgment since valuations are based on quoted prices that are readily available in an active market. |

| Level 2 – | Quoted prices other than those included in Level 1 that are observable either directly or indirectly. Level 2 inputs include quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active or other inputs that are observable or that can be corroborated by observable market data for substantially the full term of the financial instrument. |

| Level 3 – | Unobservable inputs are significant to the fair value measurement. Unobservable inputs reflect the Fund’s own assumptions about assumptions that market participants would use in pricing the asset or liability. |

The Fund maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the observable inputs be used when available. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Fair value is based upon quoted market prices when available. If listed prices or quotes are not available, the Fund employs internally developed models that primarily use market-based inputs including yield curves, interest rates, volatilities, and credit curves, among others. Valuation adjustments are limited to those necessary to ensure that the financial instrument’s fair value is adequately representative of the price that would be received or paid in the marketplace. These adjustments include amounts that reflect counterparty credit quality, constraints on liquidity, and unobservable parameters that are applied consistently.

| 20 | (787) 764-1788 | www.ubs.com/prfunds |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Notes to Financial Statements |

June 30, 2024

The estimated fair value may be subjective in nature and may involve uncertainties and matters of significant judgment for certain financial instruments. Changes in the underlying assumptions used in calculating fair value could significantly affect the results. In addition, the fair value estimates are based on outstanding balances without attempting to estimate the value of anticipated future business. Therefore, the estimated fair value may materially differ from the value that could actually be realized in a sale. The Fund monitors the portfolio securities to ensure they are in the correct hierarchy level.

The Board has delegated to the Valuation Committee, comprised of voting members of the Investment Adviser, certain procedures and functions related to the valuation of portfolio securities for the purpose of determining the NAV of the Fund. The Valuation Committee is generally responsible for determining the fair value of the following types of portfolio securities:

| ● | Portfolio instruments for which no price or value is available at the time the Fund’s NAV is calculated on a particular day; |

| ● | Portfolio instruments for which the prices or values available do not, in the judgment of the Investment Adviser, represent the fair value of the portfolio instruments; |

| ● | A price of a portfolio instrument that has not changed for four consecutive weekly pricing periods, except for Puerto Rico taxable securities and U.S. portfolio instruments; |

| ● | Puerto Rico taxable securities and the U.S. portfolio instruments whose value has not changed from the previous weekly pricing period. |

Following is a description of the Fund’s valuation methodologies used for assets and liabilities measured at fair value:

Mortgage and other asset-backed securities: Certain agency mortgage and other assets-backed securities (“MBS”) are priced based on a bond’s theoretical value derived from the prices of similar bonds; “similar” being defined by credit quality and market sector. Their fair value incorporates an option adjusted spread. The agency MBS and GNMA Puerto Rico Serials are classified as Level 2.

Obligations of Puerto Rico and political subdivisions: Obligations of Puerto Rico and political subdivisions are segregated, and the like characteristics divided into specific sectors. Market inputs used in the evaluation process include all or some of the following: trades, bid price or spread, quotes, benchmark curves including but not limited to Treasury benchmarks, LIBOR and swap curves and discount and capital rates. These bonds are classified as Level 2.

Puerto Rico Tax Exempt Notes: Prices for these securities are obtained from broker quotes. These securities trade in over-the-counter markets. Quoted prices are based on recent trading activity for similar instruments and do not trade in highly liquid markets. Community endowments are generally classified as Level 2 and the pricing is based on their collateral.

| Annual Report | June 30, 2024 | 21 |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Notes to Financial Statements |

June 30, 2024

Obligations of U.S. government sponsored entities and state and municipal obligations: The fair value of obligations of U.S. government sponsored entities and state and municipal obligations are obtained from third-party pricing service providers that use a pricing methodology based on an active exchange market and quoted market prices for similar securities. These securities are classified as Level 2. U.S. agency structured notes are priced based on a bond’s theoretical value from similar bonds defined by credit quality and market sector, and for which the fair value incorporates an option adjusted spread in deriving their fair value. These securities are classified as Level 2.

The following is a summary of the levels within the fair value hierarchy in which the Fund invests based on inputs used to determine the fair value of such securities:

| Investments in Securities at Value* | | Level 1 -Quoted Prices | | | Level 2 -Other Significant Observable Inputs | | | Level 3 -Significant Unobservable Inputs | | | Total | |

| Government Bonds | | $ | – | | | $ | 38,366,118 | | | $ | – | | | $ | 38,366,118 | |

| Municipal Bonds | | | – | | | | 60,852,977 | | | | – | | | | 60,852,977 | |

| Mortgage-Backed Securities | | | – | | | | 199,252 | | | | – | | | | 199,252 | |

| Total | | $ | – | | | $ | 99,418,347 | | | $ | – | | | $ | 99,418,347 | |

There were no purchases, sales, or transfers into or out of level 3 securities during the fiscal year-end June 30, 2024.

Temporary cash investments, if any, are valued at amortized cost, which approximates fair value. As of fiscal year end there were no temporary cash investments.

NOTE 3. INVESTMENT ADVISORY, ADMINISTRATIVE, CUSTODY, AND TRANSFER AGENCY ARRANGEMENTS AND OTHER TRANSACTIONS WITH AFFILIATES

Pursuant to an Investment Advisory Agreement with the Investment Adviser, the Fund receives advisory services in exchange for a fee. The investment advisory fee is calculated at an annual rate of 0.375% of the Fund’s average weekly gross assets, including the liquidation value of all outstanding debt securities of the Fund, as defined in the agreement. For the year ended June 30, 2024, the gross investment advisory fees amounted to $744,818. Total voluntarily waived fees amounted to $496,545 for a net fee of $248,273, of which $20,923 remains payable at fiscal year-end. There will be no recoupment of these voluntarily waived fees. Effective June 17, 2024, Popular Asset Management LLC resigned as co-investment adviser to Fund. UBS Asset Managers of Puerto Rico will continue as sole investment adviser to the Fund per its existing Amended and Restated Investment Advisory Contract. Prior to its resignation, Popular Asset Management LLC provided advisory services in exchange for a fee calculated at an annual rate of 0.375% of the Fund’s average weekly gross assets, including the liquidation value of all outstanding debt securities of the Fund, as defined in a separate investment advisory agreement with the Fund. Popular Asset Management LLC will continue to provide certain ancillary administration services to the Fund under a Transitional Ancillary Services Agreement through December 31, 2024.

| 22 | (787) 764-1788 | www.ubs.com/prfunds |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Notes to Financial Statements |

June 30, 2024

ALPS Fund Services, Inc., together with certain affiliated entities, has been retained to serve as the Fund’s administrator and provides various administration, fund accounting, and investor accounting services to the Fund. Banco Popular de Puerto Rico serves as transfer agent, registrar, dividend disbursing agent, and shareholder servicing agent to the Fund. For the year ended June 30, 2024, the administrative fees and transfer agent fees amounted to $194,213 and $45,276, respectively.

JPMorgan Chase Bank, N.A. has been retained to provide custody services to the Fund. For the year ended June 30, 2024, the custody fees amounted to $6,808.

Certain officers and directors of the Fund are also officers and directors of the Investment Adviser and/or its affiliates. The six independent directors of the Fund's Board are paid based upon an agreed fee of $1,000 per meeting. Three of the independent directors of the Fund also serve on the Fund's audit committee and are paid based upon an agreed fee of $1,000 per committee meeting. For the year ended June 30, 2024, the compensation expense for the six independent directors of the Fund was $50,487, of which $0 remains payable at year-end.

Prior to May 21, 2021, the Fund was not registered under the 1940 Act, and therefore, was not subject to the restrictions contained therein regarding, among other things, transactions between the Fund, Banco Popular de Puerto Rico, and UBS Financial Services Inc. (“UBS Puerto Rico”), or their affiliates (“Affiliated Transactions”). In that regard, the Board had adopted a set of Procedures for Affiliated Transactions in an effort to address potential conflicts of interest that could arise prior to registration under the 1940 Act. See Note 13 for further information on recent events.

NOTE 4. CAPITAL SHARE TRANSACTIONS

Capital share transactions for the fiscal years ended June 30, 2024 and June 30, 2023, were as follows:

| | | For the Year Ended June 30, 2024 | | | For the Year Ended June 30, 2023 | |

| Common shares outstanding - beginning of year | | | 19,257,706 | | | | 19,255,723 | |

| Common shares issued as reinvestment of dividends | | | 1,259 | | | | 1,983 | |

| Common shares outstanding - end of fiscal year | | | 19,258,965 | | | | 19,257,706 | |

NOTE 5. INVESTMENT TRANSACTIONS

The cost of securities purchased for the year ended June 30, 2024, was $1,000,000. Proceeds from sales, maturities/calls, and paydowns of portfolio securities, excluding short-term transactions, for the year ended June 30, 2024, were $285,124. Reverse repurchase agreements entered into for the fiscal year ended June 30, 2024, were $20,700,000.

| Annual Report | June 30, 2024 | 23 |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Notes to Financial Statements |

June 30, 2024

NOTE 6. REVERSE REPURCHASE AGREEMENTS

The Fund enters into reverse repurchase agreements that do not have third-party custodians, with the collateral delivered directly to the counterparty. Pursuant to the terms of the standard SIFMA Master Repurchase Agreement, the counterparty is free to repledge or rehypothecate the collateral, provided it is delivered to the Fund upon maturity of the reverse repurchase agreement. This arrangement allows the Fund to receive better interest rates and pricing on the reverse repurchase agreements. While the Fund cannot monitor the rehypothecation of collateral, it does monitor the market value of the collateral versus the repurchase amount, that the income from the collateral is paid to the Fund on a timely basis, and that the collateral is returned at the end of the reverse repurchase agreement.

| Weighted average interest rate at end of the year | | | 5.55 | % |

| Maximum aggregate balance outstanding at any time during the year | | $ | 36,138,000 | |

| Average balance outstanding during the year | | $ | 19,939,631 | |

| Average interest rate during the year | | | 5.67 | % |

At June 30, 2024, interest rates on reverse repurchase agreements ranged was 5.5% and the maturity was July 18, 2024. Interest rates on collateral ranged from 5.2% to 5.5% and maturity dates ranged from July 15, 2036, to September 28, 2037. Some of the outstanding agreements to repurchase as of fiscal year-end may be called by the counterparty before their maturity date.

At June 30, 2024, investment securities with fair values amounting to $21,276,002 are pledged as collateral for reverse repurchase agreements. The counterparties have the right to sell or repledge the assets during the term of the reverse repurchase agreement with the Fund. Interest payable on reverse repurchase agreements amounted to $35,104 at June 30, 2024.

At June 30, 2024, the total value of reverse repurchase agreements were as follows:

| Counterparty | | Gross Amount of Securities Sold Under Reverse Repurchase Agreements Presented in the Statement of Assets and Liabilities | | | Securities Sold Under Reverse Repurchase Agreements Available for Offset | | | Collateral Posted (a) | | | Net Amount Due to Counterparty (not less than zero) | |

| JPMorgan Chase & Co, New York | | $ | 20,700,000 | | | $ | - | | | $ | 20,700,000 | | | $ | - | |

| (a) | Collateral received or posted is limited to the net securities sold under reverse repurchase agreements liability amounts. See above for actual collateral received and posted |

NOTE 7. SHORT-TERM AND LONG-TERM FINANCIAL INSTRUMENTS

The fair market value of short-term financial instruments, which include $20,700,000 in reverse repurchase agreements, are substantially the same as the carrying amounts reflected in the Statement of Assets and Liabilities as these are reasonable estimates of fair value, given the relatively short period of time between origination of the instrument and their expected realization. Securities sold under agreements to repurchase are classified as Level 2 securities under the Fair Value hierarchy. There are no long-term financial debt instruments outstanding at June 30, 2024.

| 24 | (787) 764-1788 | www.ubs.com/prfunds |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Notes to Financial Statements |

June 30, 2024

NOTE 8. CONCENTRATION OF CREDIT RISK

Concentrations of credit risk (whether on or off-balance sheet) that arise from financial instruments exist for groups of customers or counterparties when they have similar economic characteristics that would cause their ability to meet contractual obligations to be similarly affected by changes in economic or other conditions. For this purpose, management has determined to disclose any investment whose fair value is over 5% of net assets, both individually and in the aggregate. Moreover, collateralized investments have been excluded from this disclosure.

The major concentration of credit risk arises from the Fund's investment securities in relation to the location of issuers. For calculation of concentration, all fixed-income securities guaranteed by the U.S. government are excluded. At June 30, 2024, the Fund had investments with an aggregate market value of $55,366,859 which were issued by entities located in Puerto Rico and are not guaranteed by the U.S. government nor the Puerto Rico government. Also, at June 30, 2024, the Fund had an investment with a market value of $6,087, which was issued by one issuer located in the United States and is not guaranteed by the U.S. government.

As stated in the prospectus, the Fund will ordinarily invest at least 67% of its total assets in Puerto Rico obligations (“the 67% Investment Requirement”). Therefore, to the extent the securities are not guaranteed by the U.S. government or any of its subdivisions, the Fund is more susceptible to factors adversely affecting issuers of Puerto Rico obligations than an investment company that is not concentrated in Puerto Rico obligations to such degree.

NOTE 9. INVESTMENT AND OTHER REQUIREMENTS AND LIMITATIONS

The Fund is subject to certain requirements and limitations related to investments and leverage. Some of these requirements and limitations are imposed statutorily or by regulation while others are by procedures established by the Board. The most significant requirements and limitations are discussed below.

The Fund invests under normal circumstances at least 67% of its total assets, including borrowings for investment purposes, in securities issued by Puerto Rico entities. A “Puerto Rico entity” or a “Puerto Rico security” is any entity or security that satisfies one or more of the following criteria: (i) securities of issuers that are organized under the laws of Puerto Rico or that maintain their principal place of business in Puerto Rico; (ii) securities that are traded principally in Puerto Rico; or (iii) securities of issuers that, during the issuer’s most recent fiscal year, derived at least 20% of their revenues or profits from goods produced or sold, investments made, or services performed in Puerto Rico or that have at least 20% of their assets in Puerto Rico. While the Fund intends to comply with the above 67% Investment Requirement as market conditions permit, the Fund’s ability to procure sufficient Puerto Rico securities which meet the Fund’s investment criteria may be constrained due to the volatility affecting the Puerto Rico bond market since 2013 and the fact that the Puerto Rico government is currently in the process of restructuring its outstanding debt under Title III of the Puerto Rico Oversight, Management, and Economic Stability Act. To the extent that the Fund is unable to procure sufficient amounts of such Puerto Rico securities, the Fund may acquire investments in securities of non-Puerto Rico issuers which satisfy the Fund’s investment criteria, provided its ability to comply with its tax-exempt policy is not affected, but the Fund will ensure that its investments in Puerto Rico securities will constitute at least 20% of its assets.

| Annual Report | June 30, 2024 | 25 |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Notes to Financial Statements |

June 30, 2024

The Fund invests, except where the Fund is unable to procure sufficient Puerto Rico Securities that meet the Fund’s investment criteria, in the opinion of the Investment Adviser, or other extraordinary circumstances, up to 33% of its total assets in securities issued by non-Puerto Rico entities. These include securities issued or guaranteed by the U.S. government, its agencies and instrumentalities, non-Puerto Rico mortgage-backed and asset-backed securities, corporate obligations and preferred stock of non-Puerto Rico entities, municipal securities of issuers within the U.S., and other non-Puerto Rico securities that the Investment Adviser may select, consistent with the Fund’s investment objectives and policies.

The Fund may increase amounts available for investment through the issuance of preferred stock, debt securities, or other forms of leverage (“Senior Securities”). The Fund may only issue Senior Securities representing indebtedness to the extent that immediately after their issuance, the value of its total assets, less all the Fund’s liabilities and indebtedness that are not represented by Senior Securities being issued or already outstanding, is equal to or greater than the total of 300% of the aggregate par value of all outstanding indebtedness issued by the Fund. The Fund may only issue Senior Securities representing preferred stock to the extent that immediately after any such issuance, the value of its total assets, less all the Fund’s liabilities and indebtedness that are not represented by Senior Securities being issued or already outstanding, is equal to or greater than the total of 200% of the aggregate par value of all outstanding preferred stock (not including any accumulated dividends or other distributions attributable to such preferred stock) issued by the Fund. This asset coverage requirement must also be met any time the Fund pays a dividend or makes any other distribution on its issued and outstanding shares of common stock or any shares of its preferred stock (other than a dividend or other distribution payable in additional shares of common stock) as well as any time the Fund repurchases any shares of common stock, in each case after giving effect to such repurchase of shares of common stock or issuance of preferred stock, debt securities, or other forms of leverage in order to maintain asset coverage at the required levels. To the extent necessary, the Fund may purchase or redeem preferred stock, debt securities, or other forms of leverage in order to maintain asset coverage at the required levels. In such instances, the Fund will redeem Senior Securities as needed to maintain the required asset coverage.

The Fund, subject to the above percentage limitations, may also engage in certain additional borrowings from banks or other financial institutions through reverse repurchase agreements. In addition, the Fund may also borrow for temporary or emergency purposes in an amount of up to an additional 5% of its total assets.

| 26 | (787) 764-1788 | www.ubs.com/prfunds |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Notes to Financial Statements |

June 30, 2024

NOTE 10. RECONCILIATION BETWEEN NET INVESTMENT INCOME AND DISTRIBUTABLE NET INVESTMENT INCOME FOR TAX PURPOSES AND NET REALIZED LOSS ON INVESTMENTS AND NET REALIZED LOSS ON INVESTMENTS FOR INCOME TAX PURPOSES

As a result of certain reclassifications made for financial statement presentation, the Fund’s net investment income and net realized loss on investments reflected in the financial statements differ from distributable net investment income and net realized loss on investments for tax purposes, respectively, as follows:

| Net investment income | | $ | 2,223,371 | |

| Reclassification of realized gain (loss) on securities’ paydowns | | | (11,256 | ) |

| Distributable net investment income for tax purposes | | $ | 2,212,115 | |

| Net realized gain on investments | | $ | 18,616 | |

| Reclassification of realized gain (loss) on securities’ paydowns | | | 11,256 | |

| Net realized loss on investments, for tax purposes | | $ | 29,872 | |

The amount of net unrealized appreciation/(depreciation) and the cost of investment securities for tax purposes was as follows:

| Cost of investments for tax purposes | | $ | 98,871,179 | |

| Gross appreciation | | | 1,382,844 | |

| Gross depreciation | | | (835,676 | ) |

| Net appreciation/(depreciation) | | $ | 547,168 | |

For the year ended June 30, 2024, the Fund distributed $2,535,783 from ordinary income. The undistributed net investment income and accumulated net realized loss on investments (for tax purposes) at June 30, 2024, were as follows:

| Undistributed net investment income, beginning of the year | | $ | 1,985,632 | |

| Distributable net investment income for the year | | | 2,212,115 | |

| Dividends | | | (2,535,783 | ) |

| Undistributed net investment income, end of the year | | $ | 1,661,964 | |

| Accumulated net realized loss on investments, beginning of the year | | $ | (137,240,106 | ) |

| Net realized gain on investments for the year | | | 29,872 | |

| Accumulated net realized loss on investments, end of the year | | $ | (137,210,234 | ) |

| Annual Report | June 30, 2024 | 27 |

| Puerto Rico Residents Tax-Free Fund VI, Inc. | Notes to Financial Statements |

June 30, 2024

NOTE 11. INDEMNIFICATIONS

In the normal course of business, the Fund enters into contracts that contain a variety of indemnifications. The Fund’s maximum exposure under these agreements is unknown. However, the Fund has not paid prior claims or losses pursuant to these contracts and expects the risk of losses to be remote.

NOTE 12. RISKS AND UNCERTAINTIES

The Fund is exposed to various types of risks, such as geographic concentration, industry concentration, non-diversification, interest rate, and credit risks, and pandemic or other public health threats, among others. This list is qualified by reference to the more detailed information provided in the prospectus for the securities issued by the Fund.

The Fund’s assets are invested primarily in securities of Puerto Rico issuers. As a result, the Fund has greater exposure to adverse economic, political, or regulatory changes in Puerto Rico than a more geographically diversified fund, particularly with regard to municipal bonds issued by the Commonwealth and its related instrumentalities, which are currently experiencing significant price volatility and low liquidity. Also, the Fund’s NAV and its yield may increase or decrease more than that of a more diversified investment company as a result of changes in the market’s assessment of the financial condition and prospects of such Puerto Rico issuers.