UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23693

| PUERTO RICO RESIDENTS TAX-FREE FUND V, INC. |

| (Exact name of registrant as specified in charter) |

| |

| Banco Popular Center |

| 209 Muñoz Rivera Avenue, Suite 1112 |

| San Juan, Puerto Rico 00918 |

| (Address of principal executive offices)(Zip code) |

| Luis A. Avilés |

| Banco Popular Center |

| 209 Muñoz Rivera Avenue, Suite 1112 |

| San Juan, Puerto Rico 00918 |

| (Name and Address of Agent for Service) |

Copy to:

Jesse C. Kean

Jesse C. Kean

Sidley Austin LLP

787 Seventh Avenue

New York, NY 10019

Registrant’s telephone number, including area code: (787) 781-5452

| Date of fiscal year end: | January 31 |

| | |

| Date of reporting period: | May 21, 2021 – July 31, 2021 |

Item 1. Report of Shareholders.

| (a) | The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”): |

Beginning on January 1, 2022, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund, or financial intermediary, such as broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically.

You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the fund complex or your financial intermediary.

LETTER TO SHAREHOLDERS

Dear Shareholder:

The Puerto Rico Residents Tax Free Fund V, Inc. (formerly known as Puerto Rico Investors Tax Free Fund V, Inc. and hereinafter referred to as the “Fund”) is pleased to present its Letter to Shareholders for the six-month period ending on July 31, 2021.

The U.S. economy remains solid and stable, with a positive outlook for continued economic expansion. Economists expect that the massive vaccination efforts together with strong consumer demand will lead to higher spending. Officials from the Federal Reserve Board (the “Fed”) have remained steady in their view that recent upticks in inflation should be “transitory”, or short-lived. It remains to be seen whether the inflation headwinds are indeed a temporary situation or become something more. So far, the Fed has mitigated any concerns of a sudden or significant policy shift.

At its July 27-28 meeting, the Fed decided to maintain short-term interest rates at 0.00% to 0.25%. The Fed also indicated that it is planning to scale back the pace of its $120 billion per month bond purchase program, likely before the end of 2021. Fed officials emphasized that the tapering was not a precursor to an imminent rate hike. It is also worth noting that although the economic outlook is positive, uncertainty is quite high, with the Covid-19 delta variant representing a wildcard.

With a near-zero interest rate environment and elevated valuations in nearly all asset classes, current market conditions present a challenging environment for the management of the Fund. Notwithstanding, Popular Asset Management LLC and UBS Asset Managers of Puerto Rico remain committed to looking for investment opportunities within the allowed parameters while providing professional asset management services to the Fund for the benefit of its shareholders.

Sincerely,

| /s/ Enrique Vila del Corral | |

| | |

| Enrique Vila del Corral, CPA | |

| Chairman of the Board | |

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

REGISTRATION UNDER THE INVESTMENT COMPANY ACT OF 1940

The Fund is a non-diversified, closed-end management investment company organized under the laws of the Commonwealth of Puerto Rico (“Puerto Rico”) and registered as an investment company under the U.S. Investment Company Act of 1940, as amended (the “1940 Act”), as of May 21, 2021. Prior thereto, it was registered under the Puerto Rico Investment Companies Act of 1954, as amended.

On May 24, 2018, the Economic Growth, Regulatory Relief, and Consumer Protection Act (Pub. L. No. 115-174) was signed into law and amended the 1940 Act, to repeal the exemption from its registration of investment companies created under the laws of Puerto Rico, the U.S. Virgin Islands, or any other U.S. possession under Section 6(a)(1) thereof. The repeal of the exemption took effect on May 24, 2021. Upon the Fund’s registration under the 1940 Act, it must now register its future offerings of securities under the U.S. Securities Act of 1933, as amended, absent any available exception. In connection with the process required for registration of the Fund’s securities, it was required to change its corporate name and implement certain operational changes including, without limitation, a reduction in the types and/or amount of leverage, as well as a prohibition against engaging in principal transactions with affiliates. The Fund also suspended its current offerings of securities, pending its registration under the U.S. Securities Act of 1933, as amended, absent an applicable exception.

FUND PERFORMANCE*

The following table shows performance for the period from February 1, 2021 to July 31, 2021:

| | Six-Month Period |

| Based on market price | 12.02% |

| Based on NAV | 2.15% |

Past performance is not predictive of future results. Performance calculations do not reflect any deduction of taxes that a shareholder may have to pay on Fund distributions or any commissions payable on the sale of Fund shares.

The following table provides summary data on the Fund’s dividends, net asset value ("NAV") and market prices as of July 31, 2021:

| Dividend yield-based on $10 IPO | 1.10% |

| Dividend yield based on market at year-end | 4.53% |

| NAV as of July 31, 2021 | $3.66 |

| Market Price as of July 31, 2021 | $2.43 |

| Premium (discount) to NAV | (33.6%) |

| * | The following discussion contains financial terms that are defined in the attached Glossary of Fund Terms. |

The Fund seeks to pay monthly dividends out of its net investment income. To permit the Fund to maintain a more stable monthly dividend, the Fund may pay dividends that are more or less than the amount of net income earned during the year. All monthly dividends paid by the Fund during the fiscal year were paid from net investment income. The basis of the distributions is the Fund's net investment income for tax purposes. See Note 11 to the Financial Statements for a reconciliation of book and taxable income.

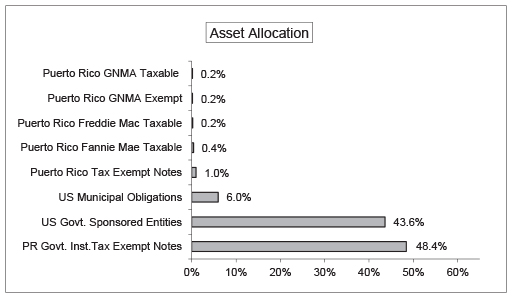

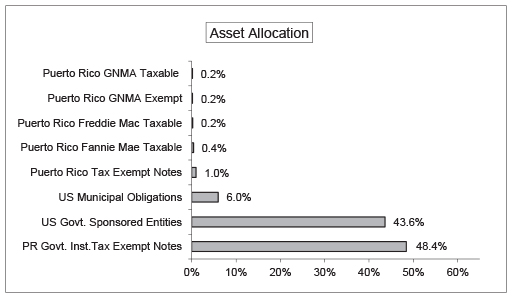

Figure 1 below reflects the breakdown of the investment portfolio as of July 31, 2021. For details of the security categories below, please refer to the enclosed Schedule of Investments.

Figure 1. Asset allocation as of July 31, 2021

The largest Puerto Rico municipal bond holdings in the portfolio are newly-issued Puerto Rico Sales Tax Financing Corporation (“COFINA”) bonds exchanged on or about February 2019, pursuant to a plan of adjustment approved by the U.S. District Court for the District of Puerto Rico under Title III of the Puerto Rico Oversight, Management, and Economic Stability Act. These newly-issued COFINA bonds, which are secured by 53.65% of the pledged sales and use tax through 2058 (which amount to $420 million for fiscal year 2019 and increase by 4% each year thereafter, capping out at $992.5 million in fiscal year 2041), and represent 44.7% of the Fund’s total assets, had a positive performance (income and price appreciation) during the six-month period. Sales and Use Tax (“IVU”) collections exceeded the fiscal plan projections. The bond debt service reserve was fully funded during October.

On the other hand, Employee Retirement System Pension Obligation Bonds ("POB") in the portfolio, representing 3.7% of total assets, had negative performance. POB bonds decreased in value during the six-month period ending July 31, 2021, based on the expected recovery from a settlement stipulation entered into on or about April 2021. As a signatory of the stipulation, the Fund will receive its pro-rata share of the consummation costs contemplated therein, when the stipulation is deemed effective.

U.S. holdings in the portfolio, representing 49.6% of total assets, consist primarily of U.S. Government Agency Bonds, mostly Federal Home Loan Bank, and U.S. Municipal Bonds. During the six-month period, the performance for this segment of the portfolio was generally in line with the flat performance of the overall U.S. investment-grade fixed income market. One notable exception was the Illinois municipal bonds in the portfolio, representing 2.7% of total assets. These bonds benefitted from significant improvements in the state’s finances, including a balanced budget for the third straight year. In addition, Standard & Poor’s upgraded the bonds’ credit rating and outlook, from BBB Negative at the beginning of the period to BBB+ Stable as of July 31, 2021.

The NAV of the Fund increased $0.01 from $3.65 at the beginning of the period to $3.66 at the end of the six-month period. The indicated market price for shares of the Fund continued to reflect a discount to NAV, although the discount narrowed to 33.6% as of July 31, 2021, compared to 39.5% as of January 31, 2021.

FUND HOLDINGS SUMMARY

The following tables show the allocation of the portfolio using various metrics as of the end of the fiscal year. It should not be construed as a measure of performance for the Fund itself. The portfolio is actively managed, and holdings are subject to change.

Portfolio Composition (% of Total Portfolio) | | | Geographic Allocation (% of Total Portfolio) | |

| COFINA (PR) | 44.7% | | Puerto Rico | 50.4% |

| U.S. Agencies | 43.6% | | U.S. | 49.6% |

| U.S. Municipal Bonds | 6.0% | | Total | 100% |

| Pension Obligation Bonds (PR) | 3.7% | | | |

| Mortgage-Backed Securities | 2.0% | | | |

| Total | 100% | | | |

The following table shows the ratings of the Fund’s security portfolio as of July 31, 2021. The ratings used are the highest rating given by one of the three nationally recognized rating agencies, Fitch Ratings ("Fitch"), Moody's Investors Service ("Moody's"), and S&P Global Ratings ("S&P"). Ratings are subject to change.

(% of Total Portfolio)

| Rating | Percent | |

| AAA | 45.6% | |

| AA | 3.3% | |

| BBB | 2.7% | |

| Below BBB | 3.7% | |

| Not Rated | 44.7% | (COFINA) |

| Total | 100% | |

The Not-Rated category is comprised of the newly-issued COFINA bonds issued in 2019. The bonds were issued without a rating from any of the agencies, pending a determination of the Board of Directors of COFINA on the appropriate timing to apply for such rating. As of July 31, 2021, the COFINA Board had not applied for a rating.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors. The views expressed herein are those of the portfolio manager as of the date of this report. The Fund disclaims any obligations to update publicly the views expressed herein.

FUND LEVERAGE

THE BENEFITS AND RISKS OF LEVERAGE

As its fundamental policy, the Fund may not (i) issue senior securities, as defined in the Investment Company Act, except to the extent permitted under the Investment Company Act and except as otherwise described in the prospectus, or (ii) borrow money from banks or other entities, in excess of 33⅓% of its total assets (including the amount of borrowings and debt securities issued); except that, the Fund may borrow from banks or other financial institutions for temporary or emergency purposes (including, among others, financing repurchases of the Notes and tender offers), in an amount of up to an additional 5% of its total assets.

Leverage can produce additional income when the income derived from investments financed with borrowed funds exceeds the cost of such borrowed funds. In such an event, the Fund's net income will be greater than it would be without leverage. On the other hand, if the income derived from securities purchased with borrowed funds is not sufficient to cover the cost of such funds, the Fund's net income will be less than it would be without leverage.

To obtain leverage, the Fund enters into collateralized repurchase agreements with major institutions in the U.S. and/or issues Tax Exempt Secured Obligations ("TSO") in the local market. Both are accounted for as collateralized borrowings in the financial statements. Typically, the Fund borrows for approximately 30-90 days; the borrowing rate is variable and based on short-term rates. The TSOs are rated F-1 in accordance with Fitch Ratings published rating guidelines. As stated above, the TSO program was discontinued in May 2021 pending registration to the 1940 Act.

As of July 31, 2021, the Fund had the following leverage outstanding:

| Repurchase Agreements | $ 12,471,000 |

| Leverage Ratio | 20.0% |

Refer to the Schedule of Investments for a detail of the pledged securities and to Note 6 to the Financial Statements for further details on outstanding leverage during the year.

FUND REPURCHASE PROGRAM

REPURCHASE PROGRAM

The Fund's Board of Directors authorized the repurchase of the Fund's shares of common stock in the open market when such shares are trading at or below NAV of the shares, up to 25% of the aggregate number of shares of common stock issued by the Fund. During the current fiscal year, the Shares continued to experience a period of limited liquidity and/or trading at a discount to their net asset value. Although the holders of the Shares do not have the right to redeem their Shares inasmuch as the Fund is closed-ended, the Fund may, at its sole discretion, effect repurchases of Shares in the open market, in an attempt to increase the liquidity of the Shares as well as reduce any market discount from their corresponding net asset value. There is no assurance that, if such action is undertaken, it will result in the improvement of the Shares' liquidity or reducing any such market discount. Moreover, while such undertaking may have a favorable effect on the market price of the Shares, the repurchase of the Shares by the Fund will decrease the Fund's total assets and therefore, have the effect of increasing the Fund's expense ratio. Upon registration under the 1940 Act, any repurchases of Shares by the Fund must be conducted in accordance therewith and rules and regulations issued thereunder.

Prior to May 21, 2021, repurchases of Shares by the Fund were conducted in accordance with the terms and conditions contained in Article 10 of Regulation No. 8469 issued by the Office of the Commissioner of Financial Institutions ("OCFI") and procedures adopted by the Fund's Board of Directors to address potential conflicts of interest with affiliated broker-dealers Popular Securities and UBS Financial Services Incorporated of Puerto Rico. Among other things, such regulation and procedures require that to the extent that various sellers indicate interest in selling shares of the Fund, it will purchase such shares starting with the lowest offered price and in the following order of priority for each price: (1) individual and corporate investors, irrespective of the broker-dealer that serves as record owner of the shares to be repurchased; (2) the trading desks of Puerto Rico broker-dealers which are unaffiliated with the Fund; and (3) the trading desks of Popular Securities and UBS Financial Services Incorporated of Puerto Rico. If sellers offer more shares for repurchase than the Fund is able to accept at any particular price for a particular level of priority, repurchase offers will be accepted on a pro-rata basis within that particular level of priority. Additionally, to the extent that Popular Securities or UBS Financial Services Incorporated of Puerto Rico elects to offer the Fund's shares of Common Stock for repurchase from its respective securities inventory, it must do so at its corresponding offer price per share reported to the public.

The Fund's Share Repurchase Program is implemented on a discretionary basis, under the direction of the Investment Adviser. All repurchase activity, if any, during the fiscal year is disclosed in the Semi-Annual Report to Shareholders attached hereto (see Note 4). The undertaking of a repurchase program does not obligate the Fund to purchase specific amounts of shares. Future share repurchases must now be conducted in accordance with the provisions of the 1940 Act.

For the six-month period ended July 31, 2021, the Fund did not repurchase any shares. Since the program's inception, the Fund has repurchased 7,320,437 shares of common stock in the open market with a net asset value of $29,667,236 and a cost of $26,272,434, which represent 19.03% of the total assets of the Fund as of January 31, 2014 (net of shares acquired for dividend reinvestment purposes and which remain outstanding).

GLOSSARY OF MUTUAL FUND TERMS

Bond - Security issued by a government or corporation to those from whom it has borrowed money. A bond usually promises to pay interest income to the bondholder at regular intervals and to repay the entire amount borrowed at maturity date.

Realized Gain (Loss) - The profit (loss) from the sale of securities. Realized gains are paid to fund shareholders on a per share basis. When a gain distribution is made, the fund's net asset value drops by the amount of the distribution because the distribution is no longer considered part of the fund's assets.

Dividend - A per share distribution of the income earned from the fund's portfolio holdings. When a dividend distribution is made, the fund's net asset value drops by the amount of the distribution because the distribution is no longer considered part of the fund's assets.

Interest Rate Swap - An agreement to exchange one interest rate stream for another. No principal changes hands.

Investment Adviser - An investment professional who is responsible for managing a portfolio's assets prudently and making appropriate investment decisions, such as which securities to buy, hold and sell, based on the investment objectives of the portfolio.

Leverage - Vehicle used by the Fund to increase the amounts available for investment through the issuance of commercial paper or repurchase agreements transactions.

Long-Term - An investment with a maturity greater than one year.

Mutual Fund - A company which combines the investment money of many people whose financial goals are similar, and invests that money in a variety of securities. A mutual fund allows the smaller investor the benefits of diversification, professional management and constant supervision usually available only to large investors.

Net Asset Value (NAV) Per Share - The NAV per share is determined by subtracting a fund's total liabilities from its total assets, and dividing that amount by the number of fund shares outstanding.

Offering Price - The offering price of a share of a mutual fund is the price at which the share is sold to the public.

Repurchase Agreements - Transactions in which the Fund sells securities to a bank or dealer, and agrees to repurchase them at a mutually agreed date and price.

Short-Term - An investment with a maturity of one year or less.

Total Investment Return - The change in value of a fund investment over a specified period of time, taking into account the change in a fund's market price and the reinvestment of all fund distributions.

Turnover Ratio - The turnover ratio represents the fund's level of trading activity. A fund divides the lesser of purchases or sales (expressed in dollars and excluding all securities with maturities of less than one year) by the fund's average monthly assets.

Yield - The annualized rate of income as measured against the current net asset value of fund shares.

Puerto Rico Residents Tax-Free Fund V, Inc.

The following table includes selected data for a share outstanding throughout the period and other performance information derived from the financial statements.

| | | | | | For the period from February 1, 2021 to July 31, 2021 (Unaudited) | |

| Increase (Decrease) in Net Asset Value: | | | | |

| Per Share | | | Net asset value, beginning of period | | $ | 3.65 | |

| Operating | (a) | | Net investment income | | | 0.06 | |

| Performance: | (a) | | Net realized gain and unrealized appreciation on investments | | | 0.01 | |

| | | | Total from investment operations | | | 0.07 | |

| | | | Less: dividends from net investment income applicable to common shareholders | | | (0.06 | ) |

| | | | Net asset value, end of period | | $ | 3.66 | |

| | (h) | | Market value, end of period | | $ | 2.43 | |

| | | | | | | | |

| Total Investment | | | | | | | |

| Return: (g) | (b) | | Based on market value per share | | | 12.02 | % |

| | | | Based on net asset value per share | | | 2.15 | % |

| | | | | | | | |

| Ratios: (c) | (d) (f) | | Gross expenses to average net assets applicable to common shareholders | | | 2.28 | % |

| | (d) (f) | | Expenses to average net assets applicable to common shareholders - net of waived fees | | | 1.52 | % |

| | (e) (f) | | Gross operating expenses to average net assets applicable to common shareholders | | | 2.20 | % |

| | | | Interest and leverage related expenses to average net assets applicable to common shareholders | | | 0.08 | % |

| | (f) | | Gross net investment income to average net assets appliacable to common shareholders | | | 2.51 | % |

| | (f) | | Net investment income to average net assets applicable to common shareholders - net of waived fees | | | 3.27 | % |

| | | | | | | | |

| Supplemental | | | Net assets applicable to common shares, end of period (in thousands) | | $ | 49,637 | |

| Data: | (i) | | Portfolio turnover | | | - | |

| | (i) | | Portfolio turnover excluding the proceeds from calls and maturities of portfolio securities and the proceeds from mortgage backed securities paydowns | | | - | |

| | | | | | | | |

| | (a) | | Based on weekly average outstanding common shares of 13,554,743 for the period from February 1, 2021 to July 31, 2021. | | | | |

| | (b) | | The return is calculated based on market values provided by UBS Financial Services Incorporated of Puerto Rico, a dealer of the Fund's shares and an affiliated party. | | | | |

| | (c) | | Based on average net assets applicable to common shareholders of $48,286,486 for the period from February 1, 2021 to July 31, 2021. | | | | |

| | (d) | | "Expenses" represent both operating and interest and leverage related expenses. | | | | |

| | (e) | | "Operating expenses" represent total expenses excluding interest and leverage related expenses. | | | | |

| | (f) | | The effect of the expenses waived for the period from Frebruary 1, 2021 to July 31, 2021 was to decrease the expense ratios, thus increasing the net investment income ratio to average net assets applicable to common shareholders by 0.76%. | | | | |

| | (g) | | Dividends are assumed to be reinvested at the per share net asset value as defined in the dividend reinvestment plan. | | | | |

| | | | Investment return is not annualized for the period from February 1, 2021 to July 31, 2021. | | | | |

| | (h) | | End of period market values are provided by UBS Financial Services Incorporated of Puerto Rico, a dealer of the Fund's shares and an affiliated party. | | | | |

| | | | The market values shown may reflect limited trading in the shares of the Fund in the over-the-counter market. | | | | |

| | (i) | | Portfolio turnover is not annualized for the period from February 1, 2021 to July 31, 2021. | | | | |

The accompanying notes are an integral part of these financial statements.

Puerto Rico Residents Tax-Free Fund V, Inc.

| SCHEDULE OF INVESTMENTS | July 31, 2021 (Unaudited) |

| Principal Outstanding Amount | | | | | | | | Issuer | | Coupon | | | Maturity Date | | Fair Value | |

| Puerto Rico Freddie Mac Taxable - 0.28% of net assets applicable to common shares, total cost of $122,694 | |

| | | | | | | | | | | | | | | | | |

| | 4,041 | | + | | | | | | FGLMC (POOL C 18249) | | | 7.00 | % | | 11/01/28 | | $ | 4,461 | |

| | 79,031 | | + | | | | | | FGLMC (POOL C 59579) | | | 6.50 | % | | 10/01/31 | | | 88,887 | |

| | 37,489 | | + | | | | | | FGLMC (POOL C 63329) | | | 6.50 | % | | 12/01/31 | | | 42,164 | |

| | 2,091 | | + | | | | | | FGLMC (POOL D 75620) | | | 7.50 | % | | 02/01/23 | | | 2,098 | |

| | 122,652 | | | | | | | | | | | | | | | | | 137,610 | |

| | | | | | | | | | | | | | | | | | | | |

| Puerto Rico Fannie Mae Taxable - 0.48% of net assets applicable to common shares, total cost of $212,926 |

| | | | | | | | | | | | | | | | | | | | |

| | 18,485 | | ++ | | | | | | FNMA (POOL 445330) | | | 7.00 | % | | 07/01/28 | | | 18,550 | |

| | 28,843 | | ++ | | | | | | FNMA (POOL 580540) | | | 6.00 | % | | 06/01/31 | | | 32,381 | |

| | 24,784 | | ++ | | | | | | FNMA (POOL 627603) | | | 6.50 | % | | 11/01/31 | | | 27,862 | |

| | 140,814 | | ++ | | | | | | FNMA (POOL 849999) | | | 5.00 | % | | 01/01/36 | | | 160,322 | |

| | 212,926 | | | | | | | | | | | | | | | | | 239,115 | |

| | | | | | | | | | | | | | | | | | | | |

| Puerto Rico GNMA Taxable - 0.22% of net assets applicable to common shares, total cost of $103,629 |

| | | | | | | | | | | | | | | | | | | | |

| | 64,513 | | * | | | | | | GNMA P/I (POOL 515366) | | | 7.50 | % | | 04/15/30 | | | 67,505 | |

| | 11,733 | | * | | | | | | GNMA P/I (POOL 515442) | | | 8.00 | % | | 07/15/30 | | | 11,783 | |

| | 5,799 | | * | | | | | | GNMA P/I (POOL 531461) | | | 8.00 | % | | 05/15/30 | | | 5,937 | |

| | 15,999 | | * | | | | | | GNMA P/I (POOL 548493) | | | 7.50 | % | | 05/15/31 | | | 16,518 | |

| | 5,584 | | * | | | | | | GNMA P/I (POOL 548495) | | | 7.00 | % | | 05/15/31 | | | 5,606 | |

| | 103,628 | | | | | | | | | | | | | | | | | 107,349 | |

| | | | | | | | | | | | | | | | | | | | |

| Puerto Rico GNMA Exempt - 0.25% of net assets applicable to common shares, total cost of $113,559 |

| | | | | | | | | | | | | | | | | | | | |

| | 110,313 | | * | | | | | | GNMA SERIAL (POOL 556254) | | | 6.50 | % | | 08/15/31 | | | 122,004 | |

| | | | | | | | | | | | | | | | | | | | |

Face

Amount | | | | | | | | | | | | | | | | | | |

| Puerto Rico Government Instrumentalities Tax Exempt Notes - 60.39% of net assets applicable to common shares, total cost of $41,723,872 |

| | | | | | | | | | | | | | | | | | | | |

| $ | 550,000 | | @ | | ** | | (1) (2) | | EMPLOYEES RETIREMENT SYSTEM - SENIOR PENSION FUNDING BONDS (SERIES B) | | | 6.30 | % | | 07/01/36 | | | 69,438 | |

| | 1,550,000 | | @ | | ** | | (1) (2) | | EMPLOYEES RETIREMENT SYSTEM - SENIOR PENSION FUNDING BONDS (SERIES B) | | | 6.30 | % | | 07/01/38 | | | 195,688 | |

| | 1,835,000 | | @ | | ** | | (1) (2) | | EMPLOYEES RETIREMENT SYSTEM - SENIOR PENSION FUNDING BONDS (SERIES A) | | | 6.20 | % | | 07/01/39 | | | 231,669 | |

| | 9,990,000 | | @ | | ** | | (1) (2) | | EMPLOYEES RETIREMENT SYSTEM - SENIOR PENSION FUNDING BONDS (SERIES A) | | | 6.20 | % | | 07/01/40 | | | 1,261,238 | |

| | 2,210,000 | | @ | | ** | | (1) (2) | | EMPLOYEES RETIREMENT SYSTEM - SENIOR PENSION FUNDING BONDS (SERIES B) | | | 6.55 | % | | 07/01/55 | | | 279,012 | |

| | 2,210,000 | | @ | | ** | | (1) (2) | | EMPLOYEES RETIREMENT SYSTEM - SENIOR PENSION FUNDING BONDS (SERIES B) | | | 6.55 | % | | 07/01/56 | | | 279,012 | |

| | 767,000 | | @ | | | | (1) (4) | | PUERTO RICO SALES TAX FINANCING CORPORATION - RESTRUCTURED SERIES A-1 | | | 4.50 | % | | 07/01/34 | | | 849,723 | |

| | 390,000 | | @ | | | | (1) (4) | | PUERTO RICO SALES TAX FINANCING CORPORATION - RESTRUCTURED SERIES A-1 | | | 4.55 | % | | 07/01/40 | | | 448,723 | |

| | 3,942,000 | | @ | | | | (1) (4) | | PUERTO RICO SALES TAX FINANCING CORPORATION - RESTRUCTURED SERIES A-2 | | | 4.33 | % | | 07/01/40 | | | 4,479,921 | |

| | 8,172,000 | | @ | | | | (1) (4) | | PUERTO RICO SALES TAX FINANCING CORPORATION - CAPITAL APPRECIATION RESTRUCTURED SERIES A-1 | | | 0.00 | % | | 07/01/46 | | | 2,739,320 | |

| | 7,915,000 | | @ | | | | (1) (4) | | PUERTO RICO SALES TAX FINANCING CORPORATION - CAPITAL APPRECIATION RESTRUCTURED SERIES A-1 | | | 0.00 | % | | 07/01/51 | | | 1,916,783 | |

| | 118,000 | | @ | | | | (1) (4) | | PUERTO RICO SALES TAX FINANCING CORPORATION - RESTRUCTURED SERIES A-2 | | | 4.54 | % | | 07/01/53 | | | 133,797 | |

| | 2,847,000 | | @ | | | | (1) (4) | | PUERTO RICO SALES TAX FINANCING CORPORATION - RESTRUCTURED SERIES A-1 | | | 4.75 | % | | 07/01/53 | | | 3,266,682 | |

| | 8,684,000 | | @ | | | | (1) (4) | | PUERTO RICO SALES TAX FINANCING CORPORATION - RESTRUCTURED SERIES A-1 | | | 5.00 | % | | 07/01/58 | | | 10,125,805 | |

| | 3,212,000 | | @ | | | | (1) (4) | | PUERTO RICO SALES TAX FINANCING CORPORATION - RESTRUCTURED SERIES A-2 | | | 4.78 | % | | 07/01/58 | | | 3,701,271 | |

| | | | | | | | | | | | | | | | | | | 29,978,082 | |

The accompanying notes are an integral part of these financial statements.

Puerto Rico Residents Tax-Free Fund V, Inc.

| SCHEDULE OF INVESTMENTS (concluded) | | July 31, 2021 (Unaudited) |

| Principal Outstanding Amount | | | | | | | | Issuer | | Coupon | | | Maturity Date | | Fair Value | |

| Puerto Rico Tax Exempt Notes - 1.22% of net assets applicable to common shares, total cost of $552,266 |

| | | | | | | | | | | | | | | | | | | | |

| | 21,712 | | | | | | (3) | | COMMUNITY ENDOWMENT, INC. - Collateralized by FN362600 | | | 7.50 | % | | 10/01/26 | | $ | 21,795 | |

| | 26,503 | | | | | | (3) | | COMMUNITY ENDOWMENT, INC. - Collateralized by FN372184 | | | 7.50 | % | | 01/01/27 | | | 26,884 | |

| | 102,831 | | | | | | (3) | | COMMUNITY ENDOWMENT, INC. - Collateralized by FN372183 | | | 7.00 | % | | 02/01/27 | | | 111,917 | |

| | 20,491 | | | | | | (3) | | COMMUNITY ENDOWMENT, INC. - Collateralized by GN448307 | | | 7.00 | % | | 09/15/27 | | | 20,571 | |

| | 140,975 | | | | | | (3) | | COMMUNITY ENDOWMENT, INC. - Collateralized by GN445571 | | | 7.50 | % | | 09/15/27 | | | 155,973 | |

| | 20,937 | | | | | | (3) | | COMMUNITY ENDOWMENT, INC. - Collateralized by GN453529 | | | 7.50 | % | | 09/15/27 | | | 21,026 | |

| | 22,298 | | | | | | (3) | | COMMUNITY ENDOWMENT, INC. - Collateralized by GN470940 | | | 7.00 | % | | 06/15/28 | | | 22,575 | |

| | 15,558 | | | | | | (3) | | COMMUNITY ENDOWMENT, INC. - Collateralized by FN536020 | | | 8.50 | % | | 05/01/30 | | | 18,029 | |

| | 4,101 | | | | | | (3) | | COMMUNITY ENDOWMENT, INC. - Collateralized by FN536024 | | | 8.50 | % | | 05/01/30 | | | 4,437 | |

| | 10,001 | | | | | | (3) | | COMMUNITY ENDOWMENT, INC. - Collateralized by FN536042 | | | 8.00 | % | | 09/01/30 | | | 11,451 | |

| | 166,861 | | | | | | (3) | | COMMUNITY ENDOWMENT, INC. - Collateralized by FN536045 | | | 8.00 | % | | 10/01/30 | | | 191,456 | |

| | 552,268 | | | | | | | | | | | | | | | | | 606,114 | |

Face

Amount | | | | | | | | | | | | | | | | | | |

| US Government Sponsored Entities - 54.43% of net assets applicable to common shares, total cost of $20,344,461 |

| | | | | | | | | | | | | | | | | | | | |

| $ | 2,442,000 | | | | # | | | | FANNIE MAE NOTE | | | 6.63 | % | | 11/15/30 | | | 3,571,271 | |

| | 250,000 | | | | # | | | | FEDERAL FARM CREDIT BANK | | | 6.18 | % | | 11/06/28 | | | 337,821 | |

| | 15,360,000 | | | | # | | | | FEDERAL HOME LOAN BANK BONDS | | | 5.50 | % | | 07/15/36 | | | 23,107,261 | |

| | 18,052,000 | | | | | | | | | | | | | | | | | 27,016,353 | |

| | | | | | | | | | | | | | | | | | | | |

| US Municipal Obligations - 7.44% of net assets applicable to common shares, total cost of $2,767,509 | |

| | | | | | | | | | | | | | | | | | | | |

| | 1,100,000 | | @ | | | | | | STATE OF ILLINOIS - VARIOUS PURPOSE GENERAL OBLIGATION BONDS - 2012 SERIES B | | | 5.00 | % | | 01/01/23 | | | 1,153,453 | |

| | 450,000 | | @ | | | | | | STATE OF ILLINOIS - VARIOUS PURPOSE GENERAL OBLIGATION BONDS - 2012 SERIES B | | | 5.15 | % | | 01/01/24 | | | 486,333 | |

| | 1,200,000 | | @ | | | | | | STATE OF CALIFORNIA - VARIOUS PURPOSE GENERAL OBLIGATION BONDS | | | 7.63 | % | | 03/01/40 | | | 2,055,412 | |

| | | | | | | | | | | | | | | | | | | 3,695,198 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Total investments (124.71% of net assets applicable to common shares) | | | | | | | | | 61,901,825 | |

| | | | | | | | | | Liabilities minus other assets (-24.71% of net assets applicable to common shares) | | | | | | | | | (12,264,399 | ) |

| | | | | | | | | | Net assets attributable to common shares - 100% | | | | | | | | $ | 49,637,426 | |

| | | | | | | | | | | | | | | | | | | | |

| Securities sold under agreements to repurchase - 25.12% of net assets applicable to common shares | |

| | | | | | | | | | | | | | | | | | | | |

| $ | 10,171,000 | | | | | | | | REPURCHASE AGREEMENT WITH JPMORGAN- Collateralized by: | | | 0.12 | % | | 08/04/21 | | $ | 10,171,000 | |

| | | | | | | | | | US Government Sponsored entity with a fair value of $3,158,864; 6.63% with a matuirty date of 11/15/30 | | | | | | | | | | |

| | | | | | | | | | US Government Sponsored entity with a fair value of $7,627,201; 5.50% with a maturity date of 7/15/36 | | | | | | | | | | |

| | | | | | | | | | US Government Sponsored entity with a fair value of $74,321; 6.18% with a matuirty date of 11/06/28 | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | 2,300,000 | | | | | | | | REPURCHASE AGREEMENT WITH SOUTH STREET- Collateralized by: | | | 0.28 | % | | 08/10/21 | | | 2,300,000 | |

| | | | | | | | | | US Government Sponsored entity with a fair value of $2,482,225; 5.50% with a maturity date of 7/15/36 | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Total securities sold under agreements to repurchase | | | | | | | | $ | 12,471,000 | |

| | | | | | | | | | | | | | | | | | | | |

| * | Puerto Rico GNMA - Represents mortgage-backed obligations guaranteed by the Government National Mortgage Association. They are subject to principal paydowns as a result of prepayments or refinancing of the underlying mortgage instruments. As a result, the average life may be substantially less than the original maturity. |

| + | Puerto Rico Freddie Mac Taxable - Represents mortgage-backed obligations guaranteed by the Federal Home Loan Mortgage Corporation. They are subject to principal paydowns as a result of prepayments or refinancing of the underlying mortgage instruments. As a result, the average life may be substantially less than the original maturity. |

| ++ | Puerto Rico Fannie Mae Taxable - Represents mortgage-backed obligations guaranteed by the Federal National Mortgage Association. They are subject to principal paydowns as a result of prepayments or refinancing of the underlying mortgage instruments. As a result, the average life may be substantially less than the original maturity. |

| # | A portion or all of the security has been pledged as collateral for securities sold under agreements to repurchase. |

| @ | Security may be called before its maturity date. |

| (1) | Revenue Bonds - issued by agencies and payable from revenues and other sources of income of the agency as specified in the applicable prospectus. These obligations are not an obligation of the Commonwealth of Puerto Rico. |

| (2) | The bonds are limited, non-recourse obligations of the Employees Retirement System payable solely from, and secured solely by, employer contributions made after the date of issuance of the bonds. |

| (3) | Community Endowment - These obligations are collateralized by Mortgage-Backed Securities and the only source of repayment is the collateral. They are subject to principal paydowns as a result of prepayments or refinancing of the underlying mortgage instruments. As a result, the average life may be substantially less than the original maturity. |

| (4) | These securities are the exchanged bonds under the COFINA's Third Amended Plan of Adjustment (the "Plan"). |

| ** | Employees Retirement System ("ERS") securities are not accruing interest income. These bonds are under Title III of the Puerto Rico Oversight, Management, and Economic Stability Act ("PROMESA"). |

The accompanying notes are an integral part of these financial statements.

Puerto Rico Residents Tax-Free Fund V, Inc.

| STATEMENT OF ASSETS AND LIABILITIES | July 31, 2021 (Unaudited) |

| Assets: | | Investment in securities: | | | | | | | | |

| | | Securities pledged as collateral under repurchase agreements, at fair value (cost $10,121,748) | | $ | 13,342,611 | | | | | |

| | | Other securities, at fair value (cost $55,819,168) | | | 48,559,214 | | | $ | 61,901,825 | |

| | | Cash and cash equivalents | | | | | | | 211,193 | |

| | | Interest receivable | | | | | | | 208,854 | |

| | | Other assets | | | | | | | 80,052 | |

| | | Total assets | | | | | | | 62,401,924 | |

| | | | | | | | | | | |

| Liabilities: | | Securities sold under repurchase agreements - unaffiliated (cost - $12,471,000) | | | | | | | 12,471,000 | |

| | | Payables: | | | | | | | | |

| | | Interest | | | 700 | | | | | |

| | | Investment advisory fees | | | 13,198 | | | | | |

| | | Administration fees | | | 7,918 | | | | | |

| | | Dividend payable | | | 124,258 | | | | 146,074 | |

| | | Accrued expenses and other liabilities | | | | | | | 147,424 | |

| | | Total liabilities | | | | | | | 12,764,498 | |

| | | | | | | | | | | |

| Net Assets Applicable to Common Shares: | | | | | | $ | 49,637,426 | |

| | | | | | | | | | | |

| Net Assets | | Paid-in capital - $0.01 par value, 98,000,000 shares authorized, 13,555,362 issued and outstanding | | | | | | $ | 163,119,465 | |

| Consist of: | | Accumulated deficit | | | | | | | (113,482,039 | ) |

| | | Net assets applicable to common shares | | | | | | $ | 49,637,426 | |

| | | | | | | | | | | |

| | | Net asset value applicable to common shares - per share; 13,555,362 shares outstanding | | | | | | $ | 3.66 | |

| | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Puerto Rico Residents Tax-Free Fund V, Inc.

| | | | | For the period from February 1, 2021 to July 31, 2021 (Unaudited) | |

| Investment income: | | Interest | | $ | 1,147,132 | |

| | | | | | | |

| Expenses: | | Interest and leverage related expenses | | | 19,818 | |

| | | Investment advisory fees | | | 227,173 | |

| | | Administration fees | | | 45,435 | |

| | | Custodian and transfer agent fees | | | 30,290 | |

| | | Professional fees | | | 93,400 | |

| | | Insurance expense | | | 34,161 | |

| | | Directors' fees and expenses | | | 45,099 | |

| | | Printing and shareholder reports | | | 9,783 | |

| | | Other | | | 41,531 | |

| | | Total expenses | | | 546,690 | |

| | | Waived investment advisory, custodian, and transfer agent fees | | | (181,739 | ) |

| | | Net expenses after waived fees | | | 364,951 | |

| | | | | | | |

| | | | | | | |

| Net investment income: | | | | | 782,181 | |

| | | | | | | |

| Realized Gain (Loss) & Unrealized | | Net realized loss on investments | | | (40,582 | ) |

| Appreciation (Depreciation) on | | Change in net unrealized depreciation on investments | | | 147,894 | |

| Investments: | | Total net gain on investments | | | 107,312 | |

| | | | | | | |

| | | | | | | |

| | | Net increase in net assets resulting from operations | | $ | 889,493 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Puerto Rico Residents Tax-Free Fund V, Inc.

| STATEMENTS OF CHANGES IN NET ASSETS |

| Increase (Decrease) in Net Assets: | | For the period from February 1, 2021 to July 31, 2021 (Unaudited) | | | For the year ended January 31, 2021 | |

| Operations: | | Net investment income | | $ | 782,181 | | | $ | 1,755,349 | |

| | | Net realized loss on investments | | | (40,582 | ) | | | (136,313 | ) |

| | | Change in net unrealized depreciation on investments | | | 147,894 | | | | 355,290 | |

| | | Net increase in net assets resulting from operations | | | 889,493 | | | | 1,974,326 | |

| | | | | | | | | | | |

| Distributions to Common | | | | | | | | | | |

| Shareholders From: | | Net investment income | | | (745,539 | ) | | | (1,428,837 | ) |

| | | | | | | | | | | |

| Capital Share | | Reinvestment of dividends on common shares | | | 3,865 | | | | 2,519 | |

| Transactions: | | Increase in net assets derived from common shares transactions | | | 3,865 | | | | 2,519 | |

| | | | | | | | | | | |

| Net Assets: | | Net increase in net assets attributable to common shares | | | 147,819 | | | | 548,008 | |

| | | Balance at beginning of the period | | | 49,489,607 | | | | 48,941,599 | |

| | | Balance at end of the period | | $ | 49,637,426 | | | $ | 49,489,607 | |

| | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Puerto Rico Residents Tax-Free Fund V, Inc.

| Increase (Decrease) in Cash: | | For the period from February 1, 2021 to July 31, 2021 (Unaudited) | |

| Cash Provided by | | Net increase in net assets resulting from operations | | $ | 889,493 | |

| Operating Activities: | | | | | | |

| | | Adjusted by: | | | | |

| | | Proceeds from mortgage-backed securities paydowns | | | 76,253 | |

| | | Restructuring expenses | | | (40,582 | ) |

| | | Net realized gain on paydowns | | | (229 | ) |

| | | Net realized loss on investments | | | 40,582 | |

| | | Change in net unrealized depreciation on investments | | | (147,894 | ) |

| | | Amortization and accretion of premiums and discounts on investments | | | (35,954 | ) |

| | | Decrease in interest and dividends receivable | | | 432 | |

| | | Increase in other assets | | | (55,601 | ) |

| | | Decrease in interest payable | | | (932 | ) |

| | | Decrease in investment advisory fees payable | | | (31 | ) |

| | | Decrease in administration fees payable | | | (18 | ) |

| | | Increase in accrued expenses and other liabilities | | | 50,498 | |

| | | Total cash provided by operating activities | | | 776,017 | |

| | | | | | | |

| Cash Used in | | Repurchase agreements related issuances | | | 106,038,601 | |

| Financing Activities: | | Repurchase agreements related repayments | | | (106,044,251 | ) |

| | | Dividends to common shareholders paid in cash | | | (741,664 | ) |

| | | Total cash used in financing activities | | | (747,314 | ) |

| | | | | | | |

| Cash: | | Net increase in cash and cash equivalents | | | 28,703 | |

| | | Cash and cash equivalents at beginning of period | | | 182,490 | |

| | | Cash and cash equivalents at end of period | | $ | 211,193 | |

| | | | | | | |

| Cash Flow | | Cash paid for interest and leverage related expenses | | $ | 20,750 | |

| Information: | | | | | | |

| | | Non-cash activities: | | | | |

| | | | | | | |

| | | Dividends reinvested by common shareholders | | $ | 3,865 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

PUERTO RICO RESIDENTS TAX-FREE FUND V, INC.

NOTES TO FINANCIAL STATEMENTS

For the six month period from February 1, 2021 to July 31, 2021 (Unaudited)

Note 1 - Reporting Entity and Significant Accounting Policies:

Puerto Rico Residents Tax-Free Fund V, Inc (formerly known as Puerto Rico Investors Tax-Free Fund V, Inc. and hereinafter referred to as the "Fund") is a non-diversified, closed-end management investment company. The Fund is a corporation organized under the laws of the Commonwealth of Puerto Rico and is registered as an investment company under the Investment Companies Act of 1940, as amended (the “1940 Act”), as of May 21, 2021. Prior to such date and since inception, the Fund was registered and operated under the Puerto Rico Investment Companies Act of 1954, as amended (the "Puerto Rico Investment Companies Act"). The Fund was incorporated on May 15, 1996 and started operations on February 28, 1997.

The Fund’s investment objective is to achieve a high level of current income that, for the Puerto Rico investors, is exempt from Federal and Puerto Rico income taxes, consistent with the preservation of capital. There is no assurance that the Fund will achieve its investment objective.

On May 24, 2018, the Economic Growth, Regulatory Relief, and Consumer Protection Act (Pub. L. No. 115-174) was signed into law and amended the 1940 Act, to repeal the exemption from its registration of investment companies created under the laws of Puerto Rico, the U.S. Virgin Islands, or any other U.S. possession under Section 6(a)(1) thereof. The repeal of the exemption took effect on May 24, 2021. The Fund registered as an investment company under the Investment Company Act of 1940, as amended (the “1940 Act”), by filing the corresponding Notification of Registration on Form N-8A on May 21, 2021. Upon its registration under the 1940 Act, the Fund must now register its future offering of securities under the U.S. Securities Act of 1933, as amended, absent any available exception, by filing Registration Statement on Form N-2 with the Securities and Exchange Commission (the “SEC”). In connection with the process required for registration of these securities, the Fund has suspended its current offering of securities, pending their registration or an exception therefrom, in connection with any such offering. The Fund was required to change its corporate name and is now implementing certain operational changes including, without limitation, a reduction in the types and/or amount of leverage, as well as a prohibition against engaging in principal transactions with affiliates. The new name of the Fund is Puerto Rico Residents Tax-Free Fund V, Inc.

The Fund is an investment company that applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (“ASC 946”). The financial statements are prepared in accordance with United States (“US”) generally accepted accounting principles (“GAAP”), which requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

(a) Cash and Cash Equivalents – Cash and cash equivalents consist of all demand deposits and funds invested in short-term investments with original maturities of 90 days or less. Cash and cash equivalents are valued at amortized cost, which approximates fair value. At July 31, 2021, cash and cash equivalents consisted of a time deposit open account amounting to $211,193 with Banco Popular de Puerto Rico, which is an affiliated entity.

(b) Valuation of Investments - Investments included in the Fund’s financial statements have been stated at fair values as determined by Banco Popular de Puerto Rico, as the Fund's administrator, with the assistance of the Investment Advisers (Refer to Note 3 for details on investment agreements), on the basis of valuations provided by dealers or by pricing services, which are approved by the Fund’s management and the Board of Directors, in accordance with the valuation methods set forth in the Governing Documents (Prospectus and Valuation Committee) and related policies and procedures. See Note 2 for further discussions regarding fair value disclosures.

PUERTO RICO RESIDENTS TAX-FREE FUND V, INC.

NOTES TO FINANCIAL STATEMENTS

For the six month period from February 1, 2021 to July 31, 2021 (Unaudited)

(c) Taxation – As a registered investment company under the 1940 Act, the Fund will not be subject to Puerto Rico (“PR”) income tax for any taxable year if it distributes at least 90% of its taxable net investment income for such year, as determined for these purposes pursuant to the provisions of section 1112.01(a)(2) of the Puerto Rico Internal Revenue Code of 2011, as amended. Accordingly, as the Fund intends to meet this distribution requirement, the income earned by the Fund is not subject to Puerto Rico income tax at the Fund level. The Fund has never been subject to taxation.

In addition, the fixed income and equity investments of the Fund are exempt from Puerto Rico personal property taxes. The Fund is exempt from United States income taxes, except for dividends received from United States sources, which are subject to a 10% United States withholding tax, if certain requirements are met. In the opinion of the Fund's legal counsel, the Fund is not required to file a U.S. federal income tax return.

GAAP requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax return to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the “more-likely-than-not” threshold are recorded as a tax benefit or expense in the current year. Management has analyzed the Fund’s tax positions taken on its Puerto Rico income tax returns for all open tax years (the current and prior three tax years). Management concluded that no liability should be recorded as the Fund has not taken any uncertain tax positions on returns filed for open tax years.

The balance of undistributed net investment income and of accumulated net realized loss on investments and derivatives reflect the reclassification of permanent differences and of temporary differences between book and tax balances that become permanent (See Note 11).

(d) Statement of Cash Flows - The Fund invests in securities and distributes dividends from net investment income, which are paid in cash or are reinvested at the discretion of common shareholders. These activities are reported on the Statement of Changes in Net Assets. Additional information on cash receipts and payments is presented in the Statement of Cash Flows.

Accounting practices that do not affect the reporting of activities on a cash basis include carrying investments at fair value and amortizing premiums or discounts on debt obligations.

(e) Dividends and Distributions to Shareholders - Dividends from net investment income are declared and paid monthly. The Fund may at times pay out less than the entire amount of net investment income earned in any particular period and may at times pay out such accumulated undistributed income earned in other periods in order to permit a more stable level of distribution. The Fund records dividends to its shareholders on the ex-dividend date. The Fund does not expect to make distributions of net realized capital gains, although the Fund’s Board of Directors reserves the right to do so in its sole discretion.

(f) Securities Sold Under Agreements to Repurchase - Under these agreements, the Fund sells securities, receives cash in exchange and agrees to repurchase the securities at a mutually agreed date and price. Ordinarily, those counterparties with which the Fund enters into these agreements require delivery of collateral, nevertheless, the Fund retains ownership of the collateral through the agreement that requires the repurchase and return of such collateral. These transactions are treated as financings and recorded as liabilities. Therefore, no gain or loss is recognized on the transaction and the securities pledged as collateral remain recorded as assets of the Fund. These agreements involve the risk that the market value of the securities purchased with the proceeds from the sale of securities received by the Fund may decline below the price of the securities that the Fund is obligated to repurchase and that the value of the collateral posted by the Fund increases in value and the counterparty does not return it. Because the Fund borrows under repurchase agreements based on the estimated fair value of the pledged assets, the Fund’s ongoing ability to borrow under its repurchase facilities may be limited and its lenders may initiate margin calls in the event of adverse changes in the market. A decrease in market value of the pledged assets may require the Fund to post additional collateral or otherwise sell assets at a time when it may not be in the best interest of the Fund to do so (See Note 6).

PUERTO RICO RESIDENTS TAX-FREE FUND V, INC.

NOTES TO FINANCIAL STATEMENTS

For the six month period from February 1, 2021 to July 31, 2021 (Unaudited)

(g) Short and medium-term notes - The Fund has a short and medium-term notes payable program as a funding vehicle to increase the amount available for investment. The short and medium-term notes are issued from time to time in denominations of at least $1,000 maturing in periods of up to 270 days and over 270 days, respectively. The notes are collateralized by the pledge of certain securities of the Fund. The pledged securities are held by Banco Popular de Puerto Rico (the Custodian), as collateral agent, for the benefit of the holders of the notes. Selling fees related to the issuance of medium-term notes are amortized throughout the term of the note or until its first call date. There were no short-term or medium-term notes outstanding for the period from February 1, 2021 to July 31, 2021. The Fund suspended the current offerings of its securities, pending the registration of the securities under the U.S. Securities Act of 1933, as amended, absent an exception.

(h) Paydowns - Realized gains and losses on mortgage-backed securities paydowns are recorded as an adjustment to interest income as required by GAAP. For the period from February 1, 2021 to July 31, 2021, the Fund increased interest income in the amount of $229 related to realized gain on mortgage-backed securities paydowns. For purpose of dividend distributions, net investment income excludes the effect of mortgage-backed securities paydowns gains and losses (See Note 11).

(i) Restructuring Expenses - Legal expenses incurred by the Fund related to Puerto Rico bond restructurings have been accounted for as a realized loss.

(j) Other - Security transactions are accounted for on the trade date (the date the order to buy or sell is executed). Realized gains and losses on security transactions are determined based on the identified cost method. Premiums and discounts on securities purchased are amortized over the life or the expected life of the respective securities using the effective interest method. Interest and dividend income on preferred equity securities are accrued daily except when collection is not expected.

Note 2 – Fair Value Measurements:

Under GAAP, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. A fair value measurement assumes that the transaction to sell the asset or transfer the liability occurs in the principal market for the asset or liability or, in the absence of a principal market, the most advantageous market for the asset or liability.

GAAP establishes a fair value hierarchy that prioritizes the inputs and valuation techniques used to measure fair value into three levels in order to increase consistency and comparability in fair value measurements and disclosures. The classification of assets and liabilities within the hierarchy is based on whether the inputs to the valuation methodology used for the fair value measurement are observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from independent sources. Unobservable inputs reflect the Fund’s estimates about assumptions that market participants would use in pricing the asset or liability based on the best information available. The hierarchy is broken down into three levels based on the reliability of inputs as follows:

PUERTO RICO RESIDENTS TAX-FREE FUND V, INC.

NOTES TO FINANCIAL STATEMENTS

For the six month period from February 1, 2021 to July 31, 2021 (Unaudited)

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities at the measurement date. Valuation of these instruments does not need a significant degree of judgment since valuations are based on quoted prices that are readily available in an active market.

Level 2 – Quoted prices other than those included in Level 1 that are observable either directly or indirectly. Level 2 inputs include quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, or other inputs that are observable or that can be corroborated by observable market data for substantially the full term of the financial instrument.

Level 3 – Unobservable inputs are significant to the fair value measurement. Unobservable inputs reflect the Fund’s own assumptions about assumptions that market participants would use in pricing the asset or liability.

The Fund maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the observable inputs be used when available. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Fair value is based upon quoted market prices when available. If listed prices or quotes are not available, the Fund employs internally developed models that primarily use market-based inputs including yield curves, interest rates, volatilities, and credit curves, among others. Valuation adjustments are limited to those necessary to ensure that the financial instrument’s fair value is adequately representative of the price that would be received or paid in the marketplace. These adjustments include amounts that reflect counterparty credit quality, constraints on liquidity, and unobservable parameters that are applied consistently.

The estimated fair value may be subjective in nature and may involve uncertainties and matters of significant judgment for certain financial instruments. Changes in the underlying assumptions used in calculating fair value could significantly affect the results. In addition, the fair value estimates are based on outstanding balances without attempting to estimate the value of anticipated future business. Therefore, the estimated fair value may materially differ from the value that could actually be realized on a sale.

The Board of Directors of the Fund delegated to the Valuation Committee, comprised of voting members of Popular Asset Management, a division of Banco Popular, and UBS Asset Managers of PR, a division of UBS Trust Company of PR, certain procedures and functions related to the valuation of portfolio securities for the purpose of determining the Net Asset Value of the Fund. The Valuation Committee is generally responsible for determining the fair value of the following types of portfolio securities:

| - | Portfolio instruments for which no price or value is available at the time the Fund’s NAV is calculated on a particular day; |

| - | Portfolio instruments for which the prices or values available do not, in the judgment of the Investment Advisers, represent the fair value of the portfolio instruments; |

| - | A price of a portfolio instrument that has not changed for four consecutive weekly pricing periods, except for Puerto Rico taxable securities and U.S. portfolio instruments; |

| - | Any PR taxable securities and the U.S. portfolio instruments whose value has not changed from the previous weekly pricing period. |

PUERTO RICO RESIDENTS TAX-FREE FUND V, INC.

NOTES TO FINANCIAL STATEMENTS

For the six month period from February 1, 2021 to July 31, 2021 (Unaudited)

Following is a description of the Fund’s valuation methodologies used for assets and liabilities measured at fair value:

Mortgage and other asset-backed securities: Certain agency mortgage-backed securities (“MBS”) are priced based on a bond’s theoretical value derived from the prices of similar bonds; “similar” being defined by credit quality and market sector. Their fair value incorporates an option adjusted spread. GNMA Puerto Rico Serials are priced using a pricing matrix with quoted prices from local broker dealers, based on trade activity in local markets and is compared with data from exchange platforms where similar instruments regularly trade. The agency MBS and GNMA Puerto Rico Serials are classified as Level 2.

Obligations of Puerto Rico and political subdivisions: Obligations of Puerto Rico and political subdivisions are segregated and the like characteristics divided into specific sectors. Market inputs used in the evaluation process include all or some of the following: trades, bid price or spread, quotes, benchmark curves including but not limited to Treasury benchmarks, LIBOR and swap curves, and discount and capital rates. These bonds are classified as Level 2.

Puerto Rico Tax Exempt Notes: Prices for these securities are obtained from broker quotes. These securities trade in over-the-counter markets. Quoted prices are based on recent trading activity for similar instruments and do not trade in highly liquid markets. Community Endowments are generally classified as Level 2 and the pricing is based on their collateral.

Obligations of U.S. Government Sponsored Entities, State, and Municipal Obligations: The fair value of Obligations of U.S. Government sponsored entities, state and municipal obligations is obtained from third-party pricing service providers that use a pricing methodology based on an active exchange market and based on quoted market prices for similar securities. These securities are classified as Level 2. U.S. agency structured notes are priced based on a bond’s theoretical value from similar bonds defined by credit quality and market sector, and for which the fair value incorporates an option adjusted spread in deriving their fair value. These securities are classified as Level 2.

The following is a summary of the levels within the fair value hierarchy in which the Fund invests based on inputs used to determine the fair value of such securities:

| | | | | | Hierarchy | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Balance at 7/31/2021 | |

| Assets: | | | | | | | | | | | | |

| Mortgage-Backed Securities: | | | | | | | | | | | | |

| Puerto Rico Freddie Mac Taxable | | $ | - | | | $ | 137,610 | | | $ | - | | | $ | 137,610 | |

| Puerto Rico Fannie Mae Taxable | | | - | | | | 239,115 | | | | - | | | | 239,115 | |

| Puerto Rico GNMA Taxable | | | - | | | | 107,349 | | | | - | | | | 107,349 | |

| Puerto Rico GNMA Exempt | | | - | | | | 122,004 | | | | - | | | | 122,004 | |

| Puerto Rico Govt. Instrumentalities Tax Exempt Notes | | | - | | | | 29,978,082 | | | | - | | | | 29,978,082 | |

| Puerto Rico Tax Exempt Notes | | | - | | | | 606,114 | | | | - | | | | 606,114 | |

| US Government Sponsored Entities | | | - | | | | 27,016,353 | | | | - | | | | 27,016,353 | |

| US Municipal Obligations | | | - | | | | 3,695,198 | | | | - | | | | 3,695,198 | |

| Total | | $ | - | | | $ | 61,901,825 | | | $ | - | | | $ | 61,901,825 | |

Temporary cash investments, if any, are valued at amortized cost, which approximates fair value. As of period-end there were no temporary cash investments.

PUERTO RICO RESIDENTS TAX-FREE FUND V, INC.

NOTES TO FINANCIAL STATEMENTS

For the six month period from February 1, 2021 to July 31, 2021 (Unaudited)

Note 3 - Investment Advisory, Administrative, Custodian, Transfer Agency Arrangements, and Other Transactions with Affiliates:

Pursuant to separate Investment Advisory Agreements with UBS Asset Managers of Puerto Rico, a division of UBS Trust Company of Puerto Rico, and Popular Asset Management LLC, a subsidiary of Popular, Inc. (collectively, the "Investment Advisers"), the Fund receives advisory services in exchange for a fee. The investment advisory fee is calculated at an annual rate of 0.75% of the Fund’s average weekly net assets, as defined in the agreement. For these calculations, average net assets include the liquidation value of all outstanding debt securities of the Fund. For the period from February 1, 2021 to July 31, 2021, gross investment advisory fee amounted to $227,173. Total waived fees amounted to $151,449 for a net fee of $75,724.

Banco Popular also provides administrative, custody, and transfer agency services pursuant to separate Administration, Custodian, and Transfer Agency Agreements. Under the terms of the Administration Agreement, Banco Popular provides facilities and personnel to the Fund for the performance of the administrator duties. The fees related to these services are calculated at an annual rate of 0.15% of the Fund’s average weekly net assets, as defined above. For the period from February 1, 2021 to July 31, 2021, the fee for such services amounted to $45,435. The fees related to Custody and Transfer Agency are calculated at an annual rate of 0.05%, each, of the Fund’s average weekly net assets and amounted to $30,290 for the period from February 1, 2021 July 31, 2021. Custody and Transfer Agency fees were waived in their entirety.

Certain officers and directors of the Fund are also officers and directors of the Investment Advisers and/or their affiliates. The six independent directors of the Fund's Board are paid based upon an agreed fee of $1,000 per meeting. Three of the independent directors of the Fund also serve on the Fund's audit committee and are paid based upon an agreed fee of $1,000 per committee meeting. For the period from February 1, 2021 to July 31, 2021, the compensation expense for the six independent directors of the Fund was $45,099.

Prior to May 21, 2021, the Fund was not registered under the 1940 Act, and therefore, was not subject to the restrictions contained therein regarding, among other things, transactions between the Fund, Banco Popular and UBS Financial Services Incorporated of Puerto Rico (“UBS Puerto Rico”), or their affiliates (“Affiliated Transactions”). In that regard, the Board of Directors of the Fund had adopted a set of Procedures for Affiliated Transactions (“Procedures”) in an effort to address potential conflicts of interest that could arise prior to registration under the 1940 Act. See Note 1 for further information on recent events.

The total amount (in thousands) of other affiliated and unaffiliated transactions, listed by counterparty, during the period were as follows:

| | | Purchases | | | % | | | Sales of Portfolio Securities | | | % | | | Securities Sold under Agreements to Repurchase | | | % | |

| UBS Puerto Rico | | $ | - | | | | - | % | | $ | - | | | | - | % | | $ | 460 | | | | 5 | % |

| Unaffiliated | | | - | | | | - | % | | | - | | | | - | % | | | 105,579 | | | | 95 | % |

| Total | | $ | - | | | | - | % | | $ | - | | | | - | % | | $ | 106,039 | | | | 100 | % |

PUERTO RICO RESIDENTS TAX-FREE FUND V, INC.

NOTES TO FINANCIAL STATEMENTS

For the six month period from February 1, 2021 to July 31, 2021 (Unaudited)

Note 4 – Capital Share Transactions:

Capital share transactions for the period from February 1,2021 to July 31, 2021 and for the fiscal year ended January 31, 2021, were as follows:

| | | Dollar Amount | |

| Common shares: | | 7/31/2021 | | | 1/31/2021 | |

| Dividends reinvested by common shareholders | | $ | 3,865 | | | $ | 2,519 | |

| Increase in net assets derived from common shares transactions | | $ | 3,865 | | | $ | 2,519 | |

| | | | | | | | | |

| | | | Shares Amount | |

| Common shares: | | | 7/31/2021 | | | | 1/31/2021 | |

| Beginning balance | | | 13,554,280 | | | | 13,553,576 | |

| Shares issued due to reinvestment of dividends at net asset value | | | 1,082 | | | | 704 | |

| Ending balance | | | 13,555,362 | | | | 13,554,280 | |

Note 5 - Investment Transactions:

The cost of securities purchased and proceeds from sales, maturities/calls and paydowns of portfolio securities (in thousands), excluding short-term transactions, for the period ended July 31, 2021 were as follows:

| | | Purchases | | | Sales | | | Maturities / Calls | | | Paydowns | |

| AFICA Bonds | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Puerto Rico Freddie Mac Taxable | | | - | | | | - | | | | - | | | | 7 | |

| Puerto Rico Fannie Mae Taxable | | | - | | | | - | | | | - | | | | 30 | |

| Puerto Rico GNMA Taxable | | | - | | | | - | | | | - | | | | 5 | |

| Puerto Rico GNMA Exempt | | | - | | | | - | | | | - | | | | - | |

| Puerto Rico Govt. Instrumentalities Tax Exempt Notes | | | - | | | | - | | | | - | | | | - | |

| Puerto Rico Tax Exempt Notes | | | - | | | | - | | | | - | | | | 34 | |

| US Government Sponsored Entities | | | - | | | | - | | | | - | | | | - | |

| US Municipal Obligations | | | - | | | | - | | | | - | | | | - | |

| Total | | $ | - | | | $ | - | | | $ | - | | | $ | 76 | |

Note 6 – Securities Sold under Agreements to Repurchase:

| Weighted average interest rate at end of period | | | 0.15 | % |

| Maximum aggregate balance outstanding at any time during the period | | $ | 13,114,000 | |

| Average balance outstanding during the period | | $ | 12,814,254 | |

| Average interest rate during the period | | | 0.18 | % |

At July 31, 2021, the interest rates on securities sold under agreements to repurchase ranged from 0.12% to 0.28% with maturities up to August 10, 2021. Some of the outstanding agreements to repurchase as of period end may be called by the counterparty before their maturity date.

PUERTO RICO RESIDENTS TAX-FREE FUND V, INC.

NOTES TO FINANCIAL STATEMENTS

For the six month period from February 1, 2021 to July 31, 2021 (Unaudited)

At July 31, 2021, investment securities amounting to $13,342,611 are pledged as collateral for securities sold under agreements to repurchase. The counterparties have the right to sell or repledge the assets during the term of the repurchase agreements with the Fund. Interest payable on securities sold under agreements to repurchase amounted to $700 at July 31, 2021.

At July 31, 2021, the total value (in thousands) of securities sold to affiliates and non-affiliates under agreements to repurchase were as follows:

| Counterparty | | Amount | | | % | |

| Unaffiliated | | $ | 12,471 | | | | 100 | % |

| Total | | $ | 12,471 | | | | 100 | % |

Note 7 - Short-Term and Long-Term Financial Instruments:

The fair market value of short-term financial instruments, which include $12,471,000 of securities sold under agreements to repurchase, are substantially the same as the carrying amount reflected in the Statement of Assets and Liabilities as these are reasonable estimates of fair value, given the relatively short period of time between origination of the instrument and their expected realization. There are no long-term financial debt instruments outstanding at July 31, 2021. The securities sold under agreements to repurchase are classified as Level 2.

Note 8 – Credit Facility:

The Fund has available with Banco Popular (an affiliate of the Investment Advisers) an uncommitted line of credit that is part of a credit facility extended to the Puerto Rico Residents Family of Funds and the Popular Family of Funds. The proceeds of the credit advances will be exclusively used by the Fund for short term funding needs arising from failed repurchase agreement transactions or cash shortfalls due to the non-receipt by the Fund of payments in the settlement process of transactions to which the Fund is a party. The Fund can obtain credit advances not to exceed the lesser of $35,000,000 or ten percent (10%) of Banco Popular’s capital stock and surplus, provided that the aggregate sum of all outstanding balances under all credit facilities never exceed $200,000,000. Interest on the unpaid balance of each credit advance accrues at a rate of 2.25% over the one week LIBOR Rate and will be payable on the dates set forth in each credit facility note. As of July 31, 2021, the Fund had no outstanding balance and had the complete credit facility available for drawing, subject to the limitations described above.

Note 9 - Concentration of Credit Risk:

Concentrations of credit risk (whether on or off-balance sheet) that arise from financial instruments exist for groups of customers or counterparties when they have similar economic characteristics that would cause their ability to meet contractual obligations to be similarly affected by changes in economic or other conditions. For this purpose, Management has determined to disclose any investment whose fair value is over 5% of Net Assets, both individually or in the aggregate. Moreover, collateralized investments have been excluded for this disclosure.

PUERTO RICO RESIDENTS TAX-FREE FUND V, INC.

NOTES TO FINANCIAL STATEMENTS

For the six month period from February 1, 2021 to July 31, 2021 (Unaudited)

The major concentration of credit risk arises from the Fund's investment securities in relation to the location of issuers. For calculation of concentration, all fixed-income securities guaranteed by the U.S. Government are excluded. At July 31, 2021, the Fund had investments with an aggregate market value of $29,978,082 which were issued by entities located in the Commonwealth of Puerto Rico and are not guaranteed by the U.S. Government nor the PR Government. Also, at July 31, 2021, the Fund had investments with market values of $3,571,271 and $23,107,261 which were each issued by one issuer located in the United States of America and not guaranteed by the U.S. Government.

As stated in the Prospectus, the Fund will ordinarily invest at least 67% of its total assets in Puerto Rico obligations (the “67% Investment Requirement”). Therefore, to the extent the securities are not guaranteed by the U.S. Government or any of its subdivisions, the Fund is more susceptible to factors adversely affecting issuers of Puerto Rico obligations than an investment company that is not concentrated in Puerto Rico obligations to such degree.

Note 10 - Investment and Other Requirements and Limitations:

The Fund is subject to certain requirements and limitations related to investments and leverage. Some of these requirements and limitations are imposed statutorily or by regulation while others are imposed by procedures established by the Board of Directors. The most significant requirements and limitations are discussed below.

The Fund invests under normal circumstances at least 67% of its total assets, including borrowings for investment purposes, in securities issued by Puerto Rico entities. A “Puerto Rico entity” or a “Puerto Rico security” is any entity or security that satisfies one or more of the following criteria: (i) securities of issuers that are organized under the laws of Puerto Rico or that maintain their principal place of business in Puerto Rico; (ii) securities that are traded principally in Puerto Rico; or (iii) securities of issuers that, during the issuer’s most recent fiscal year, derived at least 20% of their revenues or profits from goods produced or sold, investments made, or services performed in Puerto Rico or that have at least 20% of their assets in Puerto Rico. While the Fund intends to comply with the above 67% investment requirement as market conditions permit, the Fund’s ability to procure sufficient Puerto Rico securities which meet the Fund’s investment criteria may be constrained, due to the volatility affecting the Puerto Rico bond market since 2013 and the fact that the Puerto Rico Government is currently in the process of restructuring its outstanding debt under Title III of the Puerto Rico Oversight, Management, and Economic Stability Act. To the extent that the Fund is unable to procure sufficient amounts of such Puerto Rico securities, the Fund may acquire investments in securities of non-Puerto Rico issuers which satisfy the Fund’s investment criteria, provided its ability to comply with its tax-exempt policy is not affected, but the Fund will ensure that its investments in Puerto Rico securities will constitute at least 20% of its assets.