UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

TAX-FREE FIXED INCOME FUND III

FOR PUERTO RICO RESIDENTS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

On October 8, 2021, Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc. (the “Fund”) began distributing a letter to shareholders in connection with the Fund’s 2021 Annual Meeting of Shareholders. Copies of the letter in English and Spanish can be found below.

* * * * *

| | | | |

| | Puerto Rico Family of Funds | | UBSPRFunds.com |

October 4, 2021

To Shareholders of Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc.:

At this year’s annual meeting, to be held virtually on October 28, 2021, at 2:00 pm, you will have an important decision to make about the future of your investment in the Fund. Your Board urges you to vote on the WHITE proxy card “FOR ALL” to elect the three current directors up for re-election and to support the stability and continuity of the Fund. The current Board has a long history overseeing the Fund on behalf of shareholders and is committed to ensuring the Fund’s long-term viability, so that it continues to generate valuable dividend income for Puerto Rican residents like you.

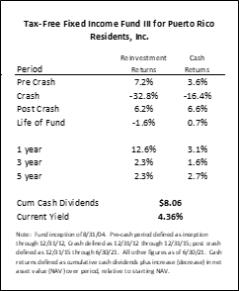

The Fund’s Performance as of June 30, 2021

The Fund’s investment objective is to provide its shareholders with current income, while preserving capital. In fact, as noted in the table below, the Fund has distributed significant cumulative dividends to its shareholders since inception.

| | |

Measured according to its investment objectives – i.e., cumulative dividends and preservation of the Fund’s net asset value (NAV)1 – the Fund has delivered positive returns over the past one-, three- and five-year periods, as well as since inception. The Board’s Oversight of the Fund’s Lifetime Performance As a result of prudent investment management, overseen by its Board, the Fund has delivered positive cash returns over its lifetime, in spite of significant market challenges. In fact, the Fund performed well from its inception through 2012. The crash of the Puerto Rico municipal bond market beginning in 2013 through the end of 2015 affected all investors in these markets, as reflected in the Fund’s returns during that period. However, under the Board’s leadership, the Fund continued to deliver monthly tax-advantaged income, conducting share repurchases to provide liquidity to selling shareholders while accreting value to those who held their investment. | |  |

Though the Puerto Rico bond markets have not yet fully recovered, the Fund has performed strongly since the end 2015, as it has continued to provide its shareholders with consistent monthly income. Today, the Fund delivers a very compelling, tax-advantaged yield, that shareholders are unlikely to find elsewhere at a similar risk profile.

The Board believes the outlook for the Fund is positive. As the Puerto Rico bond market emerges, both the income and liquidity of the Fund can be expected to improve. At the current Board’s direction, the Fund continues to work tirelessly to maximize shareholder returns, including a registration with the U.S. Securities and Exchange Commission under the Investment Company Act of 1940, which may contribute to increased liquidity and reduced market discount to NAV, paving the way for further positive returns. The Board is keenly aware of the need for liquidity in the Fund shares and will continue to make this a strategic priority.

Your Fund’s Nominees

As members of the current Board, the Fund’s nominees for re-election at the Annual Meeting are highly qualified financial professionals with deep roots in Puerto Rico and a long-standing commitment to the Fund and its shareholders. They understand Puerto Rico’s financial markets:

| • | | Carlos V. Ubiñas has served as Chief Executive Officer of UBS Financial Services Incorporated of Puerto Rico since 2009, in addition to other senior roles at UBS Financial Services Incorporated of Puerto Rico since 1989. With decades of experience in the local municipal market, which included a senior role at the Government Development Bank, he has an unparalleled understanding of the Puerto Rico financial markets. |

1 Annual returns based on cumulative dividends and NAV preservation defined as cumulative cash dividends plus increase (decrease) in net asset value (NAV) over period, relative to starting NAV.

1

| | | | |

| | Puerto Rico Family of Funds | | UBSPRFunds.com |

| • | | Jose J. Villamil is Chairman of the Board and Chief Executive Officer of Estudios Técnicos, Inc.; a long-time member of the Board of Governors of United Way of Puerto Rico; Economic Advisor to the Puerto Rico Manufacturer’s Association and the Associated General Contractors of America (Puerto Rico Chapter); as well as Chairman of the Board of BBVA-PR from 2000 to 2012, among his many private, public and non-profit leadership roles in Puerto Rico. |

| • | | Vicente León has developed deep experience in finance and accounting since 1962, including as a former Member and Audit Committee Chairman of the Board of Directors of Triple S Management Corp. from 2000 to 2012; former Audit Partner at KPMG LLP; and former President of the Puerto Rico Society of CPA. |

The Board urges shareholders to support the Fund’s continued positive momentum and plan for long-term stability and viability of the Fund as a source of current income for its shareholders by voting “FOR ALL” to elect these three nominees on the WHITE card.

If You Receive a Blue Proxy from Ocean Capital, Please Discard It

The Fund has received a notice from Ocean Capital, stating its intention to nominate director candidates and submit a proposal at the Annual Meeting.

Please note that Ocean Capital is an investment vehicle, affiliated with Georgia-based First Southern and led by First Southern’s founder William Heath Hawk. Ocean Capital apparently targets Puerto Rico bond funds with the goal of liquidating them and extracting short-term profits at the expense of funds’ long-term shareholders’ income and interests. In fact, Mr. Hawk and First Southern have a long history of “distressed bond investing,” facilitating the liquidation of Santander Puerto Rico’s bond funds.2 Notably, key executives associated with both Ocean Capital and First Southern appear to have moved to Puerto Rico in order avoid capital gains taxes pursuant to Puerto Rico’s Act 22, including Ben Eiler, as reported by the Associated Press3 and multiple outlets.

PLEASE VOTE “FOR” THE BOARD’S NOMINEES ON THE WHITE PROXY CARD NOW

As your Board, we are honored to serve as your fiduciaries and ask that you continue to place your trust in us by voting FOR the Board’s nominees on the WHITE proxy card. For more information, please visit UBSPRFunds.com.

Very truly yours,

The Board of Directors of Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc.

|

If you have any questions, or need assistance voting your WHITE proxy card, please contact:

|

2 First Southern, LLC, First Puerto Rico Family of Funds, https://fssec.com/first-puerto-rico-family-of-funds/.

3 Danica Otto, As middle class flees, Puerto Rico tries luring rich people, Associated Press (Feb. 6, 2015), https://apnews.com/article/91114c2f7cf64516bbcc3c8f7af27adc.

2

| | | | |

| | Puerto Rico Family of Funds | | UBSPRFunds.com |

Important Additional Information and Where to Find It

Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc. (the “Fund”) has filed a definitive proxy statement on Schedule 14A (the “Proxy Statement”), an accompanying WHITE proxy card and other relevant documents with the SEC in connection with such solicitation of proxies from the Fund’s stockholders for its 2021 annual meeting of stockholders. STOCKHOLDERS OF THE FUND ARE STRONGLY ENCOURAGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders may obtain a copy of the Proxy Statement, an accompanying WHITE proxy card, any amendments or supplements to the Proxy Statement and other documents that the Fund files with the SEC at no charge at the SEC’s website at www.sec.gov. In addition, a stockholder who wishes to receive a copy of the Fund’s definitive proxy materials, without charge, should submit this request to: UBS Trust Company of Puerto Rico, c/o Claudio Ballester, 250 Muñoz Rivera Avenue, American International Plaza, Tenth Floor, San Juan, Puerto Rico 00918.

3

| | | | |

| | Puerto Rico Family of Funds | | UBSPRFunds.com |

4 de octubre de 2021

A los accionistas del Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc.:

En la reunión anual de accionistas de este año, que se llevará a cabo virtualmente el 28 de octubre de 2021 a las 2:00 p.m., usted tendrá una decisión importante que tomar sobre el futuro de su inversión en el Fondo. Su Junta de Directores lo exhorta a votar en la tarjeta de poder de votación (Proxy Card) BLANCA “POR TODOS” para reelegir a los tres directores actuales postulados para la reelección y para asegurar la estabilidad y continuidad del Fondo. Su Junta de Directores tiene una larga trayectoria supervisando el Fondo para el beneficio de sus accionistas y está comprometida con asegurar la viabilidad a largo plazo del Fondo, de modo que continúe generando ingresos de dividendos para los residentes puertorriqueños como usted.

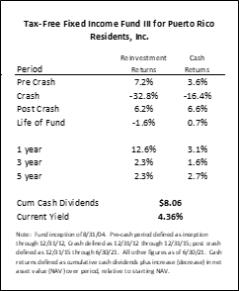

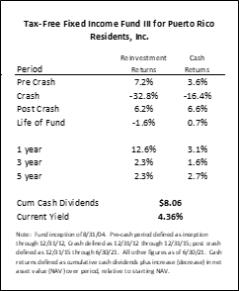

Rendimiento del Fondo al 30 de junio de 2021

El objetivo de la inversión del Fondo es generar ingresos corrientes para sus accionistas, preservando al mismo tiempo el capital. De hecho, como se ve en la tabla abajo, el Fondo ha distribuido a sus accionistas una gran cantidad de dividendos acumulados desde su creación.

| | |

Medido de acuerdo con sus objetivos de inversión, es decir, dividendos acumulados y preservación del valor neto de los activos (net asset value, NAV) del Fondo1, el Fondo ha generado rendimientos positivos en los perĺodos más recientes de uno, tres y cinco años, asĺ como desde su creación. La supervisión de la Junta de Directores y el rendimiento del Fondo por su vida operacional Como resultado de la administración prudente y acertada de las inversiones, según supervisada por su Junta de Directores, el Fondo ha generado rendimientos en efectivo positivos a lo largo de su vida operacional, a pesar de importantes retos del mercado. De hecho, tuvo un desempeño bueno desde su creación hasta 2012. La caída del mercado de bonos municipales de Puerto Rico desde su inicio en 2013 hasta fines de 2015 afectó a todos los inversionistas en estos mercados, como se refleja en los rendimientos del Fondo durante este período. Sin embargo, bajo el liderazgo de la Junta de Directores, el Fondo continuó generando ingresos mensuales con beneficios contributivos y realizó recompras de acciones para proporcionar liquidez a los accionistas, mientras se acrecía el valor para los accionistas que mantuvieron su inversión. | |

|

Aunque los mercados de bonos de Puerto Rico aún no se han recuperado completamente, el Fondo ha tenido un rendimiento sólido desde finales de 2015 y ha continuado brindando a sus accionistas ingresos mensuales uniformes. Hoy en día, el Fondo ofrece tasas de rendimientos muy atractivas y con ventajas contributivas, las cuales es poco probable que los accionistas puedan encontrar en otro lugar a un perfil de riesgo similar.

La Junta de Directores considera que la perspectiva para el Fondo es positiva. A medida que se estabilizan los mercados de bonos de Puerto Rico, tanto los ingresos como la liquidez del Fondo se espera que mejore. Bajo la dirección actual de la Junta de Directores, el Fondo continúa trabajando incansablemente para maximizar los rendimientos de los accionistas, incluyendo el registrar el Fondo con el U.S. Securities and Exchange Comisión, en virtud de la Ley de Compañías de Inversión de 1940, que puede contribuir a una mayor liquidez y a un descuento del mercado más reducido al NAV, lo que prepara el terreno para obtener rendimientos positivos adicionales. La Junta de Directores es muy consciente de la necesidad de liquidez en el Fondo y continuará haciendo lo que esté a su alcance para lograr esta prioridad estratégica.

1 Rendimientos anuales calculados en dividendos acumulados y preservación del NAV, definidos como dividendos en efectivo acumulados más el aumento (o la disminución) en el valor neto de los activos (net asset value, NAV) durante el perĺodo, en relación con el NAV inicial.

1

| | | | |

| | Puerto Rico Family of Funds | | UBSPRFunds.com |

Los nominados para la Junta de Directores del Fondo

Como miembros de la Junta de Directores actual, los directores nominados para la reelección en la reunión anual de accionistas son profesionales financieros altamente calificados, con raíces profundas en Puerto Rico y un compromiso consolidado con el Fondo y con sus accionistas. Ellos entienden los mercados financieros de Puerto Rico:

| • | | Carlos V. Ubiñas se ha desempeñado como director ejecutivo de UBS Financial Services Incorporated of Puerto Rico desde 2009, además de otros cargos sénior en UBS Financial Services Incorporated of Puerto Rico desde 1989. Con décadas de experiencia en el mercado municipal local, que incluyó un cargo sénior en el Banco de Desarrollo Gubernamental, tiene un conocimiento incomparable de los mercados financieros de Puerto Rico. |

| • | | José J. Villamil es presidente de la Junta de Directores y director ejecutivo de Estudios Técnicos, Inc., miembro desde hace mucho tiempo de la Junta de Gobernadores de United Way of Puerto Rico, asesor económico a la Asociación de Industriales de Puerto Rico y presidente de la Junta de Directores de BBVA-PR del 2000 al 2012, entre sus muchos roles de liderazgo privados, públicos y sin fines de lucro en Puerto Rico. |

| • | | Vicente León ha desarrollado una vasta experiencia en finanzas y contabilidad desde 1962, exmiembro y presidente del Comité de Auditoría de la Junta de Directores de Triple S Management Corp. de 2000 a 2012, exsocio de auditoría de KPMG LLP y expresidente de la Sociedad Puertorriqueña de CPAs. |

La Junta de Directores insta a los accionistas a apoyar el momentum positivo y continuo del Fondo y asegurar la estabilidad y viabilidad a largo plazo del Fondo como fuente de ingresos corrientes para sus accionistas mediante la votación “POR TODOS” para reelegir a estos tres nominados en la tarjeta BLANCA.

Si recibe una tarjeta de poder de votación azul de Ocean Capital, descártela

El Fondo ha recibido un aviso de Ocean Capital, en el que se indicaba su intención de nominar a candidatos a director y presentar su propuesta en la reunión anual de accionistas. Hacemos hincapié en que Ocean Capital es un vehículo de inversión, afiliado a First Southern, con sede en Georgia y dirigida por su fundador William Heath Hawk. Ocean Capital ha puesto en su mirilla a las compañías de inversión puertorriqueñas que invierten en bonos de Puerto Rico, con el objetivo de liquidarlos y extraer ganancias a corto plazo, a expensas de los intereses a largo plazo de sus accionistas y los ingresos corrientes devengados por éstos. De hecho, el Sr. Hawk y First Southern tienen una larga historia de ��inversión en bonos en dificultades” y facilitó la liquidación de compañías de inversión puertorriqueñas manejadas por Santander Puerto Rico.2 Notablemente, los ejecutivos principales asociados tanto con Ocean Capital como con First Southern, como lo es Ben Eiler, parecen haberse mudado a Puerto Rico para evitar pagar impuestos sobre las ganancias de capital, de conformidad con la Ley 22 de Puerto Rico, según lo informó Associated Press y múltiples medios informativos.3

VOTE “POR” LOS NOMINADOS DE LA JUNTA DE DIRECTORES EN LA TARJETA DE PODER DE VOTACIÓN BLANCA AHORA

Como su Junta de Directores, nos sentimos honrados de servir como sus fiduciarios y le pedimos que continúe depositando su confianza en nosotros votando POR los nominados de la Junta de Directores en la tarjeta de poder de votación BLANCA. Para obtener más información, visite UBSPRFunds.com.

Muy atentamente,

La Junta de Directores del Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc.

2 First Southern, LLC, First Puerto Rico Family of Funds, https://fssec.com/first-puerto-rico-family-of-funds/.

3 Danica Otto, As middle class flees, Puerto Rico tries luring rich people, Associated Press (Feb. 6, 2015), https://apnews.com/article/91114c2f7cf64516bbcc3c8f7af27adc.

2

| | | | |

| | Puerto Rico Family of Funds | | UBSPRFunds.com |

|

Si tiene alguna pregunta o necesita ayuda para votar su TARJETA DE PODER DE

VOTACIÓN BLANCA, por favor comuníquese con: |

|

Important Additional Information and Where to Find It

Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc. (the “Fund”) has filed a definitive proxy statement on Schedule 14A (the “Proxy Statement”), an accompanying WHITE proxy card and other relevant documents with the SEC in connection with such solicitation of proxies from the Fund’s stockholders for its 2021 annual meeting of stockholders. STOCKHOLDERS OF THE FUND ARE STRONGLY ENCOURAGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders may obtain a copy of the Proxy Statement, an accompanying WHITE proxy card, any amendments or supplements to the Proxy Statement and other documents that the Fund files with the SEC at no charge at the SEC’s website at www.sec.gov. In addition, a stockholder who wishes to receive a copy of the Fund’s definitive proxy materials, without charge, should submit this request to: UBS Trust Company of Puerto Rico, c/o Claudio Ballester, 250 Muñoz Rivera Avenue, American International Plaza, Tenth Floor, San Juan, Puerto Rico 00918.

3