UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23682

TAX-FREE FIXED INCOME FUND III FOR PUERTO RICO RESIDENTS, INC.

(Exact name of registrant as specified in charter)

American International Plaza Building - Tenth Floor

250 Muñoz Rivera Avenue

San Juan, Puerto Rico 00918

(Address of principal executive offices)(Zip code)

Liana Loyola

Secretary

American International Plaza Building - Tenth Floor

250 Muñoz Rivera Avenue

San Juan, Puerto Rico 00918

(Name and Address of Agent for Service)

|

| Copy to: |

|

Alexandre-Cyril Manz ------------------------------------- Alexandre-Cyril Manz UBS Financial Services Incorporated of Puerto Rico American International Plaza Building - Tenth Floor 250 Muñoz Rivera Avenue San Juan, Puerto Rico 00918 |

Registrant’s telephone number, including area code: (787) 250-3600

Date of fiscal year end: June 30

Date of reporting period: December 31, 2021

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”).

| | |

| |

2021 SEMI-ANNUAL REPORT |

Beginning on January 1, 2022, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically. If you own these shares through a financial intermediary, you may contact your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the fund complex or your financial intermediary.

LETTER TO SHAREHOLDERS

The Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc. (formerly known as Puerto Rico Fixed Income Fund III, Inc. and hereinafter referred to as the “Fund”) is pleased to present the Letter to Shareholders for period from July 1, 2021 to December 31, 2021.

The economy and the markets continue to recover from the Coronavirus (otherwise known as “COVID-19”, as it has been named by the World Health Organization) pandemic. The stock market has rebounded from the lows of March 2020. However, performance has been mixed; sectors like technology and health care have rebounded well, with some companies reaching record highs, while other sectors such as retail, airlines, cruise lines, among others, remain under pressure. World-wide supply chain disruptions in many industries continue. By the Fund’s semi-annual period-end in December 31 2021, the major indices continued to improve and were trading at or near their all-time highs. The emergence of the Omicron variant, however, has led to an increase in market volatility.

The Federal Reserve (the “Fed”) maintained interest rates at 0.00% to 0.25% at its December 15, 2021, meeting. Although, the Fed cited progress on vaccinations, significant differences in vaccination rates among states persist. The Fed expects continued progress, but risks to the economic outlook remain. The debate on the recent elevated inflation readings centers on whether they are transitory pandemic related supply disruptions or represent a permanent shift in inflation expectations. The Fed removed the word transitory from its December statement. It also reduced further the pace of its net asset purchases beginning in January 2022. The Central Tendency projections for the Fed funds rates were revised upwards. The market now expects three Fed Funds increase of one quarter percent each in 2022. On December 31, 2021, the yield on the ten-year U.S. Treasury Note increased six basis points to 1.51% versus 1.45% at the beginning of the period.

With a near-zero, short-term interest rate environment and elevated valuations in nearly all asset classes, current market conditions present a challenging environment for the management of the Fund. Notwithstanding, the Investment Adviser remains committed to looking for investment opportunities within the allowed parameters while providing professional asset management services to the Fund for the benefit of its shareholders.

Sincerely,

Leslie Highley, Jr.

Managing Director for the

UBS Asset Managers of Puerto Rico,

a division of UBS Trust Company of

Puerto Rico, as Investment Adviser

1

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

REGISTRATION UNDER THE INVESTMENT COMPANIES ACT OF 1940

The Fund is a non-diversified, closed-end management investment company organized under the laws of the Commonwealth of Puerto Rico (“Puerto Rico”) and registered as an investment company under the U.S. Investment Company Act of 1940, as amended (the “1940 Act”), as of May 14, 2021. Prior thereto, it was registered under the Puerto Rico Investment Companies Act of 1954, as amended.

On May 24, 2018, the Economic Growth, Regulatory Relief, and Consumer Protection Act (Pub. L. No. 115-174) was signed into law and amended the 1940 Act, to repeal the exemption from its registration of investment companies created under the laws of Puerto Rico, the U.S. Virgin Islands, or any other U.S. possession under Section 6(a)(1) thereof. The repeal of the exemption took effect on May 24, 2021. Upon the Fund’s registration under the 1940 Act, it must now register its future offerings of securities under the U.S. Securities Act of 1933, as amended, absent any available exception. In connection with the process required for registration of the Fund’s securities, it was required to change its corporate name and implement certain operational changes including, without limitation, a reduction in the types and/or amount of leverage, as well as a prohibition against engaging in principal transactions with affiliates. The Fund also suspended its current offerings of securities, pending its registration under the U.S. Securities Act of 1933, as amended, absent an applicable exception.

FUND PERFORMANCE*

The following table shows performance for the period from July 1, 2021 to December 31, 2021:

| | |

| | | Six-Month Period |

Based on market price | | (11.70)% |

Based on net asset value (“NAV”) | | 2.03% |

Past performance is not predictive of future results. Performance calculations do not reflect any deduction of taxes that a shareholder may have to pay on Fund distributions or any commissions payable on the sale of Fund shares.

The following table provides summary data on the Fund’s dividends, NAV and market prices for the period from July 1, 2021 to December 31, 2021.

| | | | |

Dividend yield-based on $10 IPO | | | 0.33 | % |

Dividend yield based on market at period-end | | | 2.20 | % |

| * | The following discussion contains financial terms that are defined in the attached Glossary of Fund Terms. |

2

| | |

NAV as of December 31, 2021 | | $2.62 |

Market Price as of December 31, 2021 | | $1.50 |

Premium (discount) to NAV | | (42.8%) |

The Fund seeks to pay monthly dividends out of its net investment income. To permit the Fund to maintain a more stable monthly dividend, the Fund may pay dividends that are more or less than the amount of net income earned during the period. All monthly dividends paid by the Fund during the period were paid from current net investment income. The basis of the distributions is the Fund’s net investment income for tax purposes. See Note 9 to the Financial Statements for a reconciliation of book and tax income.

The Fund’s investment portfolio is comprised of various security classes. The Investment Adviser considers numerous characteristics of each asset class, in an effort to meet the Fund’s investment objective. Many securities in which the Fund has invested have call dates prior to the final maturity.

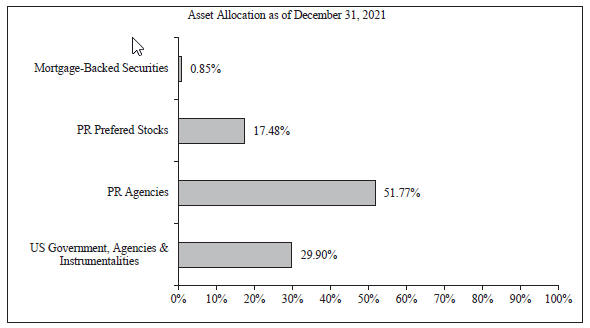

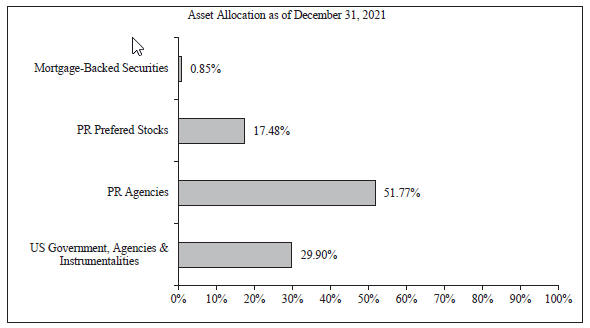

Figure 1 below reflects the breakdown of the investment portfolio as of December 31, 2021. For details of the security categories below, please refer to the enclosed Schedule of Investments.

The largest Puerto Rico municipal bond holdings in the portfolio are the newly-issued Puerto Rico Sales Tax Financing Corporation (“COFINA”) bonds exchanged in on or about February 2019, pursuant to a plan of adjustment approved by the U.S. District Court for the District of Puerto Rico under Title III of the Puerto Rico Oversight, Management, and Economic Stability Act. These newly-issued COFINA bonds, which are secured by 53.65% of the pledged sales and use tax through 2058 (which amount to $420 million for fiscal year 2019 and increase by 4% each year thereafter, capping out at $992.5 million in fiscal year 2041), and representing 38.72% of the Fund’s total investments, had a positive performance (income and price appreciation) during the period from July 1, 2021 to December 31, 2021.

3

Sales and Use Tax (“IVU”) collections exceeded the fiscal plan projections since 2019. The bonds debt service reserve was fully funded during October 2021.

The Fund holds approximately $10.6 million of the Employee Retirement System Pension Obligation Bonds (“POB”). The POB bonds increased in value during the period as the market anticipated the Federal District Court would approve the debt restructuring plan. As a signatory of the April 2021 stipulation, on the effective date, the Fund would receive its pro-rata share of the consummation costs contemplated therein. Shortly after the end of the six-month period, the court approved the plan.

The Fund owns eight hundred thousand preferred shares of Universal Insurance, the largest casualty insurer in Puerto Rico. The Fund has held these shares since they were issued in 2004. There was no turnover on this portfolio during the period and the valuation decreased slightly due to the six basis points increase in the yield of the 10-year U.S. Treasury Note during the period.

The U.S. portfolio is composed of U.S. Agencies. Since the beginning of the pandemic, the holdings of U.S. Agencies bonds have decreased from previous years from calls on the portfolio due to the low interest rate environment. Even though rates have increased from last years’ lows, they are still below historical levels. The valuation of the U.S. Agencies decreased mostly as the result of the six basis points increase in the 10-year Treasury Note during the period.

The NAV of the Fund increased $0.02 from $2.60 at the beginning of the period to $2.62 at the end of the semi-annual period. The majority of the increase was from the Puerto Rico municipal bonds, net of slight decreases in the Universal preferred shares and the U.S. Agencies. The Fund continued to trade at a discount to its NAV during the entire period.

FUND HOLDINGS SUMMARIES

The following tables show the allocation of the portfolio using various metrics as of the end of the period. It should not be construed as a measure of performance for the Fund itself. The portfolio is actively managed, and holdings are subject to change.

| | | | |

| Portfolio Composition | | |

(% of Total Portfolio) | |

Sales and Use Tax | | | 38.72% | |

Pension Obligations | | | 12.22% | |

Preferred | | | 17.48% | |

U.S. Agencies | | | 29.90% | |

Mortgage-Backed Securities | | | 0.85% | �� |

Utilities | | | 0.83% | |

Total | | | 100.00% | |

| | | | |

Geographic Allocation (% of Total Portfolio) | |

Puerto Rico | | | 70.10% | |

U.S. | | | 29.90% | |

Total | | | 100.00% | |

4

The following table shows the ratings of the Fund’s portfolio as of December 31, 2021. The ratings used are the highest rating given by one of the three nationally recognized rating agencies, Fitch Ratings (“Fitch”), Moody’s Investors Service (“Moody’s”), and S&P Global Ratings (“S&P”). Ratings are subject to change.

| | | | |

Rating | | Percent | |

| (% of Total Portfolio) | | | |

| |

AAA | | | 30.75% | |

Below BBB | | | 30.53% | |

Not Rated | | | 38.72% | |

Total | | | 100.00% | |

The Not-Rated category is comprised of the newly-issued COFINA bonds issued in 2019. The bonds were issued without a rating from any of the agencies pending a determination by the Board of Directors of COFINA on the appropriate timing to apply for such rating. As of December 31, 2021, the COFINA Board had not applied for a rating.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors. The views expressed herein are those of the portfolio manager as of the date of this report. The Fund disclaims any obligations to update publicly the views expressed herein.

5

FUND LEVERAGE

THE BENEFITS AND RISKS OF LEVERAGE

As its fundamental policy, the Fund may not (i) issue senior securities, as defined in the 1940 Act, except to the extent permitted under the 1940 Act and except as otherwise described in the prospectus, or (ii) borrow money from banks or other entities, in excess of 33 1/3% of its total assets (including the amount of borrowings and debt securities issued); except that, the Fund may borrow from banks or other financial institutions for temporary or emergency purposes (including, among others, financing repurchases of the Notes and tender offers), in an amount of up to an additional 5% of its total assets.

Leverage can produce additional income when the income derived from investments financed with borrowed funds exceeds the cost of such borrowed funds. In such an event, the Fund’s net income will be greater than it would be without leverage. On the other hand, if the income derived from securities purchased with borrowed funds is not sufficient to cover the cost of such funds, the Fund’s net income will be less than it would be without leverage.

To obtain leverage, the Fund enters into collateralized repurchase agreements with major institutions in the U.S. and/or issues Tax Exempt Secured Obligations (“TSO”) in the local market. Both are accounted for as collateralized borrowings in the financial statements. Typically, the Fund borrows for approximately 30-90 days; the borrowing rate variable and based of short term rates. The TSOs are rated F-1 in accordance with Fitch Ratings published rating guidelines. As stated above, the TSO program was discontinued in May 2021 pending registration to the 1940 Act.

As of December 31, 2021, the Fund had the following leverage outstanding:

| | | | |

Repurchase Agreements | | $ | 11,800,000 | |

| | | | |

Leverage Ratio | | | 13.39 | % |

Refer to the Schedule of Investments for a detail of the pledged securities and to Notes 5 to the Financial Statements for further details on outstanding leverage for the period ending on December 31, 2021.

6

FUND REPURCHASE PROGRAM

REPURCHASE PROGRAM

The Fund’s Board of Directors authorized the repurchase of the Fund’s shares of common stock in the open market when such shares are trading at or below NAV of the shares, up to 60% of the aggregate number of shares of common stock issued by the Fund. During the period, the Shares continued to experience a period of limited liquidity and/or trading at a discount to their net asset value. Although the holders of the Shares do not have the right to redeem their Shares inasmuch as the Fund is closed-ended, the Fund may, at its sole discretion, effect repurchases of Shares in the open market, in an attempt to increase the liquidity of the Shares as well as reduce any market discount from their corresponding net asset value. There is no assurance that, if such action is undertaken, it will result in the improvement of the Shares’ liquidity or reducing any such market discount. Moreover, while such undertaking may have a favorable effect on the market price of the Shares, the repurchase of the Shares by the Fund will decrease the Fund’s total assets and therefore, have the effect of increasing the Fund’s expense ratio. Upon registration under the 1940 Act, any repurchases of Shares by the Fund must be conducted in accordance therewith and rules and regulations issued thereunder.

Prior to May 14, 2021, repurchases of Shares by the Fund were conducted in accordance with the terms and conditions contained in Article 10 of Regulation No. 8469 issued by the Office of the Commissioner of Financial Institutions (“OCFI”) and procedures adopted by the Fund’s Board of Directors.

The Fund’s Share Repurchase Program is implemented on a discretionary basis, under the direction of the Investment Adviser and subject to the rules and regulations issued under the 1940 Act. The Fund’s repurchase activity for the period is disclosed in the Semi-Annual Report to Shareholders attached hereto (see Note 3). The undertaking of a repurchase program does not obligate the Fund to purchase specific amounts of Shares.

There were no repurchases during the period from July 1, 2021 to December 31, 2021. The total shares repurchased as of December 31, 2021 amounts to 31,173,996 and represents 52.16% of the issued shares of the Fund’s common stock since inception.

7

GLOSSARY OF FUND TERMS

Bond - security issued by a government or corporation that obligates the issuer to pay interest income to the bondholder at regular intervals and to repay the entire amount borrowed at maturity date.

Closed-end fund - a fund that issues a fixed amount of common stock.

Coupon- the interest rate that a bond promises to pay over its life, expressed as a percent over its face value.

Dividend - a per-share distribution of the income earned from a fund’s portfolio holdings. When a dividend distribution is made, a fund’s net asset value drops by the amount of the distribution because the distribution is no longer considered part of the fund’s assets.

Expense ratio- the percentage of a fund’s average net assets attributable to common shareholders used to pay fund operating expenses. The expense ratio takes into account, investment management fees, administration fees as well as other operating expenses such as legal, audit, insurance and shareholder communications.

Interest Rate Swap – an agreement to exchange one interest rate stream for another. No principal changes hands.

Maturity- the date on which the face value of a bond must be repaid. For a portfolio it is represented in years and measures the average length to maturity of all the bonds in the portfolio. This measure does not take into account embedded options in the bonds comprising the portfolio.

Net Asset Value (NAV) Per Share – the NAV per share is determined by subtracting the fund’s total liabilities from its total assets, and dividing that amount by the number of fund shares of Common Stock outstanding.

Notional amount - refers to the specified dollar amount of the swap in which the exchange of interest payment is based.

Premium/Discount- the difference between the bid price of the shares of a fund and their NAV. In a case of a premium, the bid price is above the NAV. In the case of a discount, the bid price is below the NAV. These amounts can be expressed as numerical values or percentages. The higher the percentage, the larger the difference (positive or negative) between the market price and the NAV of a fund.

Total Investment Return - the change in value of a fund investment over a specified period of time, taking into account the change in a fund’s market price and the reinvestment of all fund distributions.

Turnover Ratio – the turnover ratio represents the fund’s level of trading activity. The Fund divides the lesser of purchases or sales (expressed in dollars and excluding all securities with maturities of less than one year) by the Fund’s average monthly assets.

Undistributed income- the net income of a fund that has not been distributed to common shareholders as of the latest available audited financial statements. In the case of the target maturity type-funds, it also includes the amounts to be distributed after the target date to return the initial (i.e. $10) investment.

|

| Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc. |

The following table includes selected data for a share outstanding throughout the periods and other performance information derived from the financial statements. It should be read in conjunction with the financial statements and notes thereto.

| | | | | | | | | | | | | | | | |

| | | | | | | For the period from July 1,

2021 to December 31, 2021

(Unaudited) | | | | | | For the fiscal year ended

June 30, 2021 | |

| | | |

Increase (Decrease) in Net Asset Value: | | | | | | | | | | | | |

| | | | | |

Per Share | | | | Net asset value applicable to common stock, beginning of period | | $ | 2.60 | | | | | | | $ | 2.60 | |

Operating | | | | Net investment income (a) | | | 0.04 | | | | | | | | 0.10 | |

Performance: | | | | Net realized gain (loss) and unrealized appreciation (depreciation) from investments (a) | | | 0.01 | | | | | | | | (0.02 | ) |

| | | | Total from investment operations | | | 0.05 | | | | | | | | 0.08 | |

| | | | Less: Dividends from net investment income to common stockholders | | | (0.03 | ) | | | | | | | (0.08 | ) |

| | | | Discount on repurchase of common stock | | | - | | | | | | | | 0.00 | * |

| | | | Net asset value applicable to common stock, end of period | | $ | 2.62 | | | | | | | $ | 2.60 | |

| | | | | |

| | | | Market value, end of period (b) | | $ | 1.50 | | | | | | | $ | 1.72 | |

| | | | | | | | | | | | | | | | | |

| | | | | |

Total | | (b) (f) | | Based on market value per share | | | (11.70)% | | | | | | | | 14.75 % | |

Investment | | | | | | | | | | | | | | | | |

Return: | | (f) | | Based on net asset value per share | | | 2.03 % | | | | | | | | 2.90 % | |

| | | | | | | | | | | | | | | | | |

| | | | | |

Ratios: | | (c) (d) (e) | | Net expenses to average net assets applicable to common shareholders - net of waived fees | | | 1.76% | | | | | | | | 0.99% | |

| | (c) (d) (e) | | Gross expenses to average net assets applicable to common shareholders | | | 2.40% | | | | | | | | 1.63% | |

| | (c) (e) | | Gross operating expenses to average net assets applicable to common shareholders | | | 2.36% | | | | | | | | 1.58% | |

| | (c) | | Interest and leverage related expenses to average net assets applicable to common shareholders | | | 0.04% | | | | | | | | 0.05% | |

| | (c) (e) | | Net investment income to average net assets applicable to common shareholders - net of waived fees | | | 2.81% | | | | | | | | 3.65% | |

| | | | | | | | | | | | | | | | | |

| | | | | |

Supplemental Data: | | | | Net assets applicable to common shareholders, end of period (in thousands) | | $ | 75,180 | | | | | | | $ | 74,769 | |

| | (g) | | Portfolio turnover | | | - | | | | | | | | - | |

| | | | | |

| | (g) | | Portfolio turnover excluding the proceeds from calls and maturities of portfolio securities and the proceeds from mortgage-backed securities paydowns | | | - | | | | | | | | - | |

| | | | | | | | | | | | | | | | | |

| | | * | | Discount on repurchase of common stock represents an amount that rounds to zero. Refer to Note 3. | |

| | |

| | (a) | | Based on average outstanding common shares of 28,713,642 and 28,707,995 for the period from July 1, 2021 to December 31, 2021 and for the fiscal year ended June 30, 2021, respectively. | |

| | |

| | (b) | | Period end market values provided by UBS Financial Services Inc., a dealer of the Fund’s shares and an affiliated party. The market values shown may reflect limited trading in the shares of the Fund. | |

| | |

| | (c) | | Based on average net assets applicable to common shareholders of $75,044,955 and $75,138,658 for the period from July 1, 2021 to December 31, 2021 and for the fiscal year ended June 30, 2021, respectively. Ratios for the period from July 1, 2021 to December 31, 2021 were annualized using a 365 day base. | |

| | |

| | (d) | | “Expenses” include both operating and interest and leverage related expenses. | |

| | |

| | (e) | | The effect of the expenses waived for the period from July 1, 2021 to December 31, 2021 and for the fiscal year ended June 30, 2021 was to decrease the expense ratios, thus increasing the net investment income ratio to average net assets by 0.64% and 0.64%, respectively. | |

| | |

| | (f) | | Dividends are assumed to be reinvested at the per share net asset/market value as defined in the dividend reinvestment plan. Investment return is not annualized for the period from July 1, 2021 to December 31 2021. | |

| | |

| | (g) | | Portfolio turnover is not annualized for the period from July 1, 2021 to December 31, 2021. | |

The accompanying notes are an integral part of these financial statements.

1

|

| TAX-FREE FIXED INCOME FUND III FOR PUERTO RICO RESIDENTS, INC. |

| | |

| | |

| SCHEDULE OF INVESTMENTS | | December 31, 2021 (Unaudited) |

| | | | | | | | | | | | | | | | | | | | |

| Face Amount | | | | | | Issuer | | Coupon | | | Maturity

Date | | | Value | |

| | Puerto Rico Agencies Bonds and Notes - 46.52% of net assets applicable to common shareholders, total cost of $77,839,359 | |

| $ | 8,375,000 | | | | E | | | Employees Retirement System | | | 6.45 | % | | | 07/01/56 | | | $ | 1,088,750 | |

| | 16,475,000 | | | | E | | | Employees Retirement System | | | 6.45 | % | | | 07/01/58 | | | | 2,141,750 | |

| | 6,865,000 | | | | E | | | Employees Retirement System | | | 6.30 | % | | | 07/01/37 | | | | 892,450 | |

| | 3,865,000 | | | | E | | | Employees Retirement System | | | 6.30 | % | | | 07/01/38 | | | | 502,450 | |

| | 8,665,000 | | | | E | | | Employees Retirement System | | | 6.30 | % | | | 07/01/39 | | | | 1,126,450 | |

| | 6,900,000 | | | | E | | | Employees Retirement System | | | 6.55 | % | | | 07/01/55 | | | | 897,000 | |

| | 2,000,000 | | | | E | | | Employees Retirement System | | | 6.25 | % | | | 07/01/38 | | | | 260,000 | |

| | 500,000 | | | | C F | | | Puerto Rico Electric Power Authority | | | 6.13 | % | | | 07/01/40 | | | | 492,500 | |

| | 225,000 | | | | C F | | | Puerto Rico Electric Power Authority | | | 5.00 | % | | | 07/01/18 | | | | 221,085 | |

| | 935,000 | | | | F | | | Puerto Rico Sales Tax | | | 4.50 | % | | | 07/01/34 | | | | 1,022,145 | |

| | 474,000 | | | | F | | | Puerto Rico Sales Tax | | | 4.55 | % | | | 07/01/40 | | | | 540,410 | |

| | 3,467,000 | | | | F | | | Puerto Rico Sales Tax | | | 4.75 | % | | | 07/01/53 | | | | 3,961,311 | |

| | 10,587,000 | | | | F | | | Puerto Rico Sales Tax | | | 5.00 | % | | | 07/01/58 | | | | 12,255,056 | |

| | 4,804,000 | | | | F | | | Puerto Rico Sales Tax | | | 4.33 | % | | | 07/01/40 | | | | 5,413,138 | |

| | 144,000 | | | | F | | | Puerto Rico Sales Tax | | | 4.54 | % | | | 07/01/53 | | | | 162,684 | |

| | 3,917,000 | | | | F | | | Puerto Rico Sales Tax | | | 4.78 | % | | | 07/01/58 | | | | 4,483,449 | |

| $ | 78,198,000 | | | | | | | | | | | | | | | | | $ | 35,460,628 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | Puerto Rico Agencies Zero Coupons Bonds - 12.38% of net assets applicable to common shareholder, total cost of $33,353,172 | |

| $ | 6,000,000 | | | | E | | | Employees Retirement System | | | 0.00 | % | | | 07/01/30 | | | $ | 349,680 | |

| | 9,700,000 | | | | E | | | Employees Retirement System | | | 0.00 | % | | | 07/01/31 | | | | 528,456 | |

| | 28,500,000 | | | | E | | | Employees Retirement System | | | 0.00 | % | | | 07/01/33 | | | | 1,368,285 | |

| | 32,100,000 | | | | E | | | Employees Retirement System | | | 0.00 | % | | | 07/01/34 | | | | 1,446,426 | |

| | 9,954,000 | | | | F | | | Puerto Rico Sales Tax | | | 0.00 | % | | | 07/01/46 | | | | 3,382,668 | |

| | 9,638,000 | | | | F | | | Puerto Rico Sales Tax | | | 0.00 | % | | | 07/01/51 | | | | 2,361,445 | |

| $ | 95,892,000 | | | | | | | | | | | | | | | | | $ | 9,436,960 | |

| | | | | |

| Shares | | | | | | | | | | | | | | | |

| | Puerto Rico Preferred Stock - 19.89% of net assets applicable to common shareholders, total cost of $11,800,000 | |

| | 800,000 | | | | B | | | Universal Group Inc. Class B Cumulative Perpetual Monthly Income Preferred Stock | | | 7.15 | % | | | Perpetual | | | $ | 15,162,400 | |

| | | | | |

Principal Outstanding

Amount | | | | | | | | | | | | | | | |

| | Puerto Rico GNMA Taxable - 0.96% of net assets applicable to common shareholders, total cost of $663,322 | |

| $ | 100,133 | | | | | | | GNMA Pool 631036 | | | 6.00 | % | | | 12/15/34 | | | $ | 110,310 | |

| | 132,321 | | | | | | | GNMA Pool 608658 | | | 6.00 | % | | | 08/15/34 | | | | 145,777 | |

| | 163,687 | | | | | | | GNMA Pool 608684 | | | 6.00 | % | | | 09/15/34 | | | | 180,382 | |

| | 39,648 | | | | | | | GNMA Pool 608685 | | | 6.00 | % | | | 09/15/34 | | | | 43,627 | |

| | 67,305 | | | | | | | GNMA Pool 608726 | | | 6.00 | % | | | 11/15/34 | | | | 74,072 | |

| | 33,542 | | | | | | | GNMA Pool 608727 | | | 6.00 | % | | | 11/15/34 | | | | 36,885 | |

| | 64,026 | | | | | | | GNMA Pool 631029 | | | 6.00 | % | | | 09/15/34 | | | | 70,455 | |

| | 62,657 | | | | | | | GNMA Pool 631033 | | | 6.00 | % | | | 10/15/34 | | | | 68,947 | |

| $ | 663,319 | | | | A | | | | | | | | | | | | | $ | 730,455 | |

| | | | | |

| Face Amount | | | | | | | | | | | | | | | |

| | US Government, Agency and Instrumentalities - 34.02% of net assets applicable to common shareholders, total cost of $27,000,000 | |

| $ | 2,000,000 | | | | | | | Federal Farm Credit | | | 2.95 | % | | | 12/28/37 | | | $ | 2,233,836 | |

| | 5,000,000 | | | | | | | Federal Home Loan Bank | | | 2.20 | % | | | 06/30/45 | | | | 4,688,610 | |

| | 20,000,000 | | | | D | | | Federal Home Loan Bank | | | 2.07 | % | | | 06/29/40 | | | | 19,007,978 | |

| $ | 27,000,000 | | | | | | | | | | | | | | | | | $ | 25,930,424 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

| | Total investments (113.77% of net assets applicable to common shareholders) | | | | | | | | | | $ | 86,720,867 | |

| | Other Assets and Liabilities, net (-13.77% of net assets applicable to common shareholders) | | | | | | | | | | | | |

| | Net assets applicable to common shareholders - 100% | | | | | | | | | | $ | 86,720,867 | |

| | | | | |

| Face Amount | | | | | | | | | | | | | | Value | |

| | Securities Sold Under Repurchase Agreement - 15.48% of net assets applicable to common shareholders | |

| $ | 11,800,000 | | | | | | | Repurchase Agreements with Amherst Pierpoint | | | | | | | | | | $ | 11,800,000 | |

| | | | | | | | 0.26% dated December 14, 2021 due January 11, 2022 (Collateralized by a | | | | | | | | | | | | |

| | | | | | | | US Government, Agency and Instrumentailties with a fair value of $12,868,402; | | | | | | | | | | | | |

| | | | | | | | 2.07%, with a maturity date of June 29, 2040) | | | | | | | | | | | | |

| | |

| | | | | A | | | GNMA - represents mortgage-backed obligations guaranteed by the Government National Mortgage Association. They are subject to principal paydowns as a result of prepayments or refinancing of the underlying mortgage instruments. As a result, the average life may be substantially less than the original maturity. | |

| | |

| | | | | B | | | This security is a private placement and is valued by the Valuation Committee. Significant unobservable inputs were used in the valuation of this security and is classified as Level 3. See Note 1 for further information. | |

| | |

| | | | | C | | | These bonds have defaulted and are not currently accuring interest income. Bond maturing in 2018 also defaulted on their principal payment at maturity. However, they are still trading in the open market. | |

| | |

| | | | | D | | | A portion or all of the security has been pledged as collateral for securities sold under repurchase agreements. | |

| | |

| | | | | E | | | The bonds are limited, non-recourse obligations of the Employees Retirement System. These securities are not accruing interest income. These bonds are under Title III of the Puerto Rico Oversight, Management, and Economic Stability Act (“PROMESA”). | |

| | |

| | | | | F | | | Revenue Bonds - issued by government agencies and payable from revenues and other sources of income of the corresponding agency as specified in the applicable prospectus. These bonds are not obligations of the Commonwealth of Puerto Rico. | |

The accompanying notes are an integral part of these financial statements.

2

| | |

| TAX-FREE FIXED INCOME FUND III FOR PUERTO RICO RESIDENTS, INC. |

| | |

| STATEMENT OF ASSETS AND LIABILITIES | | December 31, 2021 (Unaudited) |

| | | | | | | | | | |

| | | | | | | | | | |

| | | |

Assets: | | Investments in securities: | | | | | | | | |

| | Securities pledged as collateral on repurchase agreements, at value, | | | | | | | | |

| | which has the right to be repledged (identified cost - $13,540,000) | | | | | | $ | 12,868,402 | |

| | Other securities, at value (identified cost - $137,115,853) | | | | | | | 73,852,464 | |

| | | | | | | | | | |

| | | | | | | | $ | 86,720,867 | |

| | | | | | | | | | |

| | Cash | | | | | | | 668,491 | |

| | Interest and dividend receivable | | | | | | | 705,361 | |

| | Prepaid expenses and other assets | | | | | | | 10,209 | |

| | | | | | | | | | |

| | Total assets | | | | | | | 88,104,928 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Liabilities: | | Securities sold under repurchase agreements | | | | | | | 11,800,000 | |

| | Dividends payable to common shareholders | | | | | | | 143,582 | |

| | Directors fees payable | | | | | | | 6,139 | |

| | Payables: | | | | | | | | |

| | Interest and leverage expenses | | | 1,534 | | | | | |

| | Investment advisory fees | | | 18,551 | | | | | |

| | Administration, custody, and transfer agent fees | | | 9,846 | | | | 29,931 | |

| | | | | | | | | | |

| | Puerto Rico bonds restructuring advance | | | | | | | 305,994 | |

| | Proxy contest payable | | | | | | | 246,097 | |

| | Accrued expenses and other liabilities | | | | | | | 393,506 | |

| | | | | | | | | | |

| | Total liabilities | | | | | | | 12,925,249 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Net Assets Applicable to Common Shareholders: | | | | | | $ | 75,179,679 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Net Assets Applicable to Common Shareholders consist of: | | | | | | | | |

| | Paid-in-Capital ($0.01 par value, 88,000,000 shares authorized, 28,716,419 shares issued and outstanding) $ | | | | | | | 438,055,650 | |

| | Total Distributable Earnings (Accumulated Loss) (Note 1 and Note 9) | | | | | | | (362,875,971 | ) |

| | | | | | | | | | |

| | Net assets applicable to common shareholders | | | | | | $ | 75,179,679 | |

| | | | | | | | | | |

| | Net asset value applicable to common shares - per share; 28,716,419 shares outstanding | | | | | | $ | 2.62 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

3

| | |

| TAX-FREE FIXED INCOME FUND III FOR PUERTO RICO RESIDENTS, INC. |

| | | | | | |

| | | | | For the period from July 1, 2021 to

December 31, 2021

(Unaudited) |

| | | | | | |

| | | | | | |

Investment Income: | | Interest | | $ | 1,016,555 | |

| | Dividends | | | 715,000 | |

| | | | | | |

| | | | $ | 1,731,555 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Expenses: | | Interest and leverage related expenses | | | 13,903 | |

| | Investment advisory fees | | | 330,525 | |

| | Administration, custody, and transfer agent fees | | | 80,278 | |

| | Professional fees | | | 81,924 | |

| | Directors’ fees and expenses | | | 18,093 | |

| | Insurance expense | | | 34,800 | |

| | Reporting expense | | | 27,423 | |

| | Proxy contest expenses | | | 302,407 | |

| | Other | | | 19,747 | |

| | | | | | |

| | Total expenses | | | 909,100 | |

| | Waived investment advisory, administration, custodian and transfer agent fees | | | (242,385 | ) |

| | | | | | |

| | Net expenses after waived fees by investment adviser, administration, custodian and transfer agent | | | 666,715 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Net Investment Income: | | | | | 1,064,840 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Realized Loss and | | Net realized loss on investments | | | (7,686 | ) |

Unrealized Appreciation | | Change in net unrealized appreciation (depreciation) on investments | | | 270,614 | |

| | | | | | |

(Depreciation) on Investments: | | Total net realized and unrealized gain on investments | | | 262,928 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | Net increase in net assets resulting from operations | | $ | 1,327,768 | |

| | | | | | |

| | | | | | |

| | | | | | |

The accompanying notes are an integral part of these financial statements.

4

| | |

| TAX-FREE FIXED INCOME FUND III FOR PUERTO RICO RESIDENTS, INC. |

| | |

| STATEMENT OF CHANGES IN NET ASSETS | | |

| | | | | | | | | | |

| | | | | For the period from July 1, 2021 to December 31, 2021 (Unaudited) | | For the fiscal year ended June 30,

2021 |

| Increase (Decrease) in Net Assets: | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | Net investment income | | $ | 1,064,840 | | | $ | 2,744,808 | |

| | Net realized loss on investments | | | (7,686 | ) | | | (267,671 | ) |

| | Change in net unrealized appreciation (depreciation) on investments | | | 270,614 | | | | (274,427 | ) |

| | | | | | | | | | |

| | Net increase in net assets resulting from operations | | | 1,327,768 | | | | 2,202,710 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Dividends to Common Shareholders From: | | Net investment income | | | (933,203 | ) | | | (2,153,112 | ) |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Capital Share | | Reinvestment of dividends on common shares | | | 15,732 | | | | 36,193 | |

Transactions: | | Repurchase of common shares | | | - | | | | (29,380 | ) |

| | | | | | | | | | |

| | | | | 15,732 | | | | 6,813 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Net Assets: | | Net increase in net assets applicable to common shareholders | | | 410,297 | | | | 56,411 | |

| | | |

| | Net assets at the beginning of the period/year | | | 74,769,382 | | | | 74,712,971 | |

| | | | | | | | | | |

| | | |

| | Net assets at the end of the period/year | | $ | 75,179,679 | | | $ | 74,769,382 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

5

| | |

| TAX-FREE FIXED INCOME FUND III FOR PUERTO RICO RESIDENTS, INC. |

| | | | | | |

| | | | | For the period from

July 1, 2021 to

December 31, 2021

(Unaudited) |

Increase (Decrease) in Cash | | | | |

| | |

| | | | | | |

| | | | | | |

Cash Provided by | | Net increase in net assets from operations | | $ | 1,327,768 | |

Operations: | | Adjusted by: | | | | |

| | Legal expenses related to Puerto Rico bond restructurings | | | (21,893 | ) |

| | Class action litigation settlement | | | 14,207 | |

| | Paydowns of portfolio securities | | | 20,415 | |

| | Net realized loss on investments | | | 7,686 | |

| | Change in net unrealized (appreciation) depreciation on investments | | | (270,614 | ) |

| | Accretion of discounts on investments | | | (125,118 | ) |

| | Decrease in interest and dividend receivable | | | 102 | |

| | Decrease in prepaid expenses and other assets | | | 43,737 | |

| | Increase in interest payable | | | 1,382 | |

| | Increase in directors fees payable | | | 99 | |

| | Decrease in administration, custody, and transfer agent fees payable | | | (8,277 | ) |

| | Decrease in investment advisory fees payable | | | (25,179 | ) |

| | Decrease in Puerto Rico bonds restructuring advance | | | (97,484 | ) |

| | Increase in Proxy contest payable | | | 246,097 | |

| | Increase in accrued expenses and other liabilities | | | 67,733 | |

| | | | | | |

| | Total cash provided by operations | | | 1,180,662 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Cash Used in | | | | | | |

Financing Activities: | | Securities sold under repurchase agreements proceeds | | | 69,300,000 | |

| | Securities sold under repurchase agreements repayments | | | (69,425,000 | ) |

| | Dividends to common shareholders paid in cash | | | (953,328 | ) |

| | | | | | |

| | Total cash used in financing activities | | | (1,078,328 | ) |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Cash: | | Net decrease in cash for the period | | | 102,334 | |

| | Cash at the beginning of the period | | | 566,157 | |

| | | | | | |

| | Cash at the end of the period | | $ | 668,491 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Cash Flow | | | | | | |

Information: | | Cash paid for interest and leverage related expenses | | $ | 12,521 | |

| | | | | | |

| | Non-cash activities-dividends reinvested by common shareholders | | $ | 15,732 | |

| | | | | | |

| | | | | | |

| | | | | | |

The accompanying notes are an integral part of these financial statements.

6

Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc.

Notes to Financial Statements

For the six month period from July 1, 2021 to December 31, 2021 (Unaudited)

| 1. | Reporting Entity and Significant Accounting Policies |

Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc. (formerly known as Puerto Rico Fixed Income Fund III, Inc. and hereinafter referred to as the “Fund”) is a non-diversified, closed-end management investment company. The Fund is a corporation organized under the laws of the Commonwealth of Puerto Rico and is registered as an investment company under the Investment Companies Act of 1940, as amended (the “1940 Act”), as of May 14, 2021. Prior to such date and since inception, the Fund was registered and operated under the Puerto Rico Investment Companies Act of 1954, as amended (the “Puerto Rico Investment Companies Act”). The Fund was incorporated on August 13, 2004 and commenced operations on August 27, 2004.. UBS Asset Managers of Puerto Rico, a division of UBS Trust Company of Puerto Rico (“UBSTC”), is the Fund’s Investment Adviser (the “Investment Adviser”). UBSTC is also the Fund’s Administrator (“Administrator”).

The Fund’s investment objective is to provide current income, consistent with the preservation of capital.

On May 24, 2018, the Economic Growth, Regulatory Relief, and Consumer Protection Act (Pub. L. No. 115-174) was signed into law and amended the 1940 Act, to repeal the exemption from its registration of investment companies created under the laws of Puerto Rico, the U.S. Virgin Islands, or any other U.S. possession under Section 6(a)(1) thereof. The repeal of the exemption took effect on May 24, 2021. Upon the Fund’s registration under the 1940 Act, it must now register its future offerings of securities under the U.S. Securities Act of 1933, as amended, absent any available exception. In connection with the process required for registration of the Fund’s securities, it was required to change its corporate name and implement certain operational changes including, without limitation, a reduction in the types and/or amount of leverage, as well as a prohibition against engaging in principal transactions with affiliates. The Fund also suspended the current offerings of its securities, pending the registration of the securities under the U.S. Securities Act of 1933, as amended, absent an exception.

The Fund is considered an investment company under the generally accepted accounting principles in the United States of America (“GAAP”) and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standard Board (“FASB”) Accounting Standards Codification 946 (“ASC 946”), Financial Services-Investment Companies.

The following is a summary of the Fund’s significant accounting policies:

Use of Estimates in Financial Statements Preparation

The accompanying financial statements of the Fund have been prepared on the basis of GAAP. The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Net Asset Value Per Share

The Net Asset Value (“NAV”) per share of the Fund is determined by the Administrator on Wednesday of each week after the close of trading on the New York Stock Exchange (“NYSE”) or, if such day is not a business day in New York City and Puerto Rico, on the next succeeding business day, and at month-end if such date is not a Wednesday. The net asset value per share is computed by dividing the assets of the Fund less its liabilities, by the number of outstanding shares of the Fund.

7

Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc.

Notes to Financial Statements

For the six month period from July 1, 2021 to December 31, 2021 (Unaudited)

Valuation of Investments

All securities are valued by UBSTC on the basis of valuations provided by pricing services or by dealers which were approved by the Fund’s management and the Board of Directors. In arriving at their valuation, pricing sources may use both a grid matrix of securities values as well as the evaluations of their staff. The valuation, in either case, could be based on information concerning actual market transactions and quotations from dealers or a grid matrix performed by an outside vendor that reviews certain market and security factors to arrive at a bid price for a specific security. Certain Puerto Rico obligations have a limited number of market participants and, thus, might not have a readily ascertainable market value and may have periods of illiquidity. Certain securities of the Fund for which quotations are not readily available from any source, are valued at fair value by or under the direction of the Investment Adviser utilizing quotations and other information concerning similar securities obtained from recognized dealers. The Investment Adviser can override any price that it believes is not consistent with market conditions. Valuation adjustments are limited to those necessary to ensure that the financial instrument’s fair value is adequately representative of the price that would be received or paid in the marketplace. These adjustments include amounts that reflect counterparty credit quality, constraints on liquidity, and unobservable parameters that are applied consistently.

The Investment Adviser has established a Valuation Committee (the “Committee”) which is responsible for overseeing the pricing and valuation of all securities held in the Fund. The Committee operates under pricing and valuation policies and procedures established by the Investment Adviser and approved by the Board of Directors. The policies and procedures set forth the mechanisms and processes to be employed on a weekly basis related to the valuation of portfolio securities for the purpose of determining the net asset value of the Fund. The Committee reports to the Board of Directors on a regular basis. At December 31, 2021, one (1) security representing 17.48% of total investment securities fair values was determined by the Committee. In addition, certain Puerto Rico Agencies Bonds and Notes representing 4.26% of total investment securities fair values were valued using the average of two independent valuation providers.

GAAP provides a framework for measuring fair value and expands disclosures about fair value measurements and requires disclosures surrounding the various inputs that are used in determining the fair value of the Fund’s investments. These inputs are summarized in three (3) broad levels listed below:

| | ● | | Level 1 - Quoted prices in active markets for identical assets and liabilities at the measurement date. An active market is one in which transactions for the assets occur with sufficient frequency and volume to provide pricing information on an ongoing basis. |

| | ● | | Level 2 - Significant inputs other than quoted prices that are observable (including quoted prices for similar securities, interest rates, pre-payment speeds, credit risk, etc.), either directly or indirectly. |

| | ● | | Level 3 - Significant unobservable inputs, for example, inputs derived through extrapolation that cannot be corroborated by observable market data. These will be developed based on the best information available in the circumstances, which might include UBSTC’s own data. Level 3 inputs will consider the assumptions that market participants would use in pricing the asset, including assumptions about risk (e.g., credit risk, model risk, etc.). |

The Fund maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the observable inputs be used when available. Fair value is based upon quoted market prices when available.

8

Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc.

Notes to Financial Statements

For the six month period from July 1, 2021 to December 31, 2021 (Unaudited)

The estimated fair value may be subjective in nature and may involve uncertainties and matters of significant judgment for certain financial instruments. Changes in the underlying assumptions used in calculating fair value could significantly affect the results. Therefore, the estimated fair value may materially differ from the value that could actually be realized on sale.

The inputs and methodology used for valuing securities or level assigned are not necessarily an indication of the risk associated with investing in those securities.

Following is a description of the Fund’s valuation methodologies used for assets and liabilities measured at fair value:

Puerto Rico Agencies Bonds and Notes: Obligations of Puerto Rico and political subdivisions are segregated and those with similar characteristics are then divided into specific sectors. The values for these securities are obtained from third-party pricing service providers that use a pricing methodology based on observable market inputs. Market inputs used in the evaluation process include all or some of the following: trades, bid price or spread, quotes, benchmark curves (including, but not limited to, Treasury benchmarks, and swap curves), and discount and capital rates. These bonds are classified as Level 2.

Puerto Rico Preferred Stock: Non-convertible preferred stock is valued by the Investment Adviser taking into consideration the present value of all the future expected dividend payments. Additional factors are also taken into consideration by the Investment Adviser, including the credit rating of the issuer, the issuer’s financial situation, trade data, the economic terms and the liquidity of the preferred stock as compared to other issues, among other factors. Issues with less liquidity are classified as Level 3.

Mortgage and Other Asset-Backed Securities: Fair value for these securities is mostly obtained from third-party pricing service providers that use a pricing methodology based on observable market inputs. Certain agency mortgage and other asset-backed securities (“MBS”) are priced based on a bond’s theoretical value from similar bonds, the term “similar” being defined by credit quality and market sector. Their fair value incorporates an option adjusted spread. The agency MBS are classified as Level 2.

Obligations of U.S. Government Sponsored Entities, State, and Municipal Obligations: The fair value of obligations of U.S. Government sponsored entities, state, and municipal obligations is obtained from third-party pricing service providers that use a pricing methodology based on an active exchange market and based on quoted market prices for similar securities. These securities are classified as Level 2. U.S. agency notes are priced based on a bond’s theoretical value from similar bonds defined by credit quality and market sector, and for which the fair value incorporates an option adjusted spread in deriving their fair value. These securities are classified as Level 2.

The following is a summary of the portfolio by inputs used as of December 31, 2021, in valuing the Fund’s investments carried at fair value:

| | | | | | | | | | | | | | | | |

| | | Investments in Securities |

| | | Level 1 | | Level 2 | | Level 3 | | Balance

12/31/21 |

Puerto Rico Agencies Bonds and Notes | | $ | - | | | $ | 44,897,588 | | | $ | - | | | $ | 44,897,588 | |

Puerto Rico Preferred Securities | | | - | | | | - | | | | 15,162,400 | | | | 15,162,400 | |

Puerto Rico GNMA Taxable | | | - | | | | 730,455 | | | | - | | | | 730,455 | |

US Government, Agencies and Instrumentalities | | | - | | | | 25,930,424 | | | | - | | | | 25,930,424 | |

| | | | | | | | | | | | | | | | |

| | $ | - | | | $ | 71,558,467 | | | $ | 15,162,400 | | | $ | 86,720,867 | |

| | | | | | | | | | | | | | | | |

9

Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc.

Notes to Financial Statements

For the six month period from July 1, 2021 to December 31, 2021 (Unaudited)

The following is a reconciliation of assets for which Level 3 inputs were used in determining fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Level 3 Investment Securities | |

| | | Balance as of

06/30/21 | | | Realized Gain

(Loss) | | | Change in

Unrealized

(Depreciation)/

Appreciation | | | Net

Amortization/

Accretion | | | Purchases/

Exchange | | | Sales/Calls/

Exchange | | | Paydowns | | | Transfers

in (out) to

Level 3 | | | Balance as of

12/31/21 | |

Universal Group Inc. Class B Cumulative Perpetual Monthly Income Preferred Stock | | $ | 15,584,000 | | | $ | - | | | $ | (421,600) | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | 15,162,400 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Quantitative Information about Level 3 Fair Value Measurements:

| | | | | | | | | | | | | | | | | | | | |

| | | Fair Value at

December 31,

2021 | | | Valuation Technique | | | Unobservable Inputs | | | Price | |

| | | | | | | | | | | | | | | | | | | | |

Universal Group Inc. Class B Cumulative Perpetual Monthly Income Preferred Stock | | $ | 15,162,400 | | | | Discounted Cash Flow | | | | Discounted Yield | | | | 9.43 | % | | $ | 18.95 | |

| | | | | | | | | | | | | | | | | | | | |

Significant changes in the unobservable inputs of the pricing process would result in an inverse relationship in the fair value of the security.

Changes in unrealized appreciation (depreciation) included in the Statement of Operations relating to investments classified as Level 3 that are still held at December 31, 2021, amounted to a net unrealized depreciation of $421,600.

There were no transfers into or out of Level 3 during the period from July 1, 2021 to December 31, 2021.

Temporary cash investments are valued at amortized cost, which approximates market value. There were no temporary cash investments as of December 31, 2021.

Taxation

As a registered investment company under the 1940 Act, the Fund will not be subject to Puerto Rico income tax for any taxable year if it distributes at least 90% of its taxable net investment income for such year, as determined for these purposes pursuant to section 1112.01(a)(2) of the Puerto Rico Internal Revenue Code of 2011, as amended. Accordingly, as the Fund intends to meet this distribution requirement, the income earned by the Fund is not subject to Puerto Rico income tax at the Fund level.

The Fund can invest in taxable and tax-exempt securities. In general, distributions of taxable income dividends, if any, to Puerto Rico individuals, estates, and trusts are subject to a withholding tax of 15% in the case of dividends distributed, if certain requirements are met. Moreover, distribution of capital gains dividends, if any, to (a) Puerto Rico individuals, estates, and trusts are subject to a tax of 15% in the case of dividends distributed, and (b) Puerto Rico corporations are subject to a tax of 20% of dividends distributed. Tax withholdings are effected at the time of payment of the corresponding dividend. Individual shareholders may be subject to alternate basic tax on certain fund distributions. Certain Puerto Rico entities receiving taxable income dividends are entitled to claim an 85% dividends received deduction. Fund shareholders are advised to consult their own tax advisers.

10

Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc.

Notes to Financial Statements

For the six month period from July 1, 2021 to December 31, 2021 (Unaudited)

Income Taxes (“Accounting Standard Codifications 740”) requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax return to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the “more-likely-than-not” threshold are recorded as a tax expense in the current year. Management has analyzed the Fund’s tax positions taken on its Puerto Rico income tax returns for all open tax years (prior four (4) tax years) and has concluded that there are no uncertain tax positions. On an ongoing basis, management will monitor the Fund’s tax position to determine if adjustments to this conclusion are necessary. The Fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expenses in the Statement of Operations. During the period from July 1, 2021 to December 31, 2021, the Fund did not incur any interest or penalties.

Statement of Cash Flows

The Fund issues its shares, invests in securities, and distributes dividends from net investment income and net realized gains which are paid in cash. These activities and additional information on cash receipts and payments is presented in the Statement of Cash Flows.

Accounting practices that do not affect the reporting of activities on a cash basis include carrying investments at fair value and amortizing premiums or discounts on debt obligations. Cash, as presented on the Statement of Assets and Liabilities, does not include short-term investments.

Dividends and Distributions to Shareholders

Dividends from net investment income are declared and paid monthly. The Fund may at times pay out less than the entire amount of net investment income earned in any particular period and may at times pay out such accumulated undistributed income earned in other periods, in order to permit the Fund to have a more stable level of distribution. The capital gains realized by the Fund, if any, may be retained by the Fund, as permitted by the Puerto Rico Internal Revenue Code of 2011, as amended, unless the Fund’s Board of Directors, acting through the Dividend Committee, determines that the net capital gains will also be distributed. The Fund records dividends on the ex-dividend date.

Derivative Instruments

In order to attempt to hedge various portfolio positions, to manage its costs of funds or to enhance its return, the Fund may invest in certain instruments which are considered derivatives. Because of their increased volatility and potential leveraging effect, derivative instruments may adversely affect the Fund. The use of these instruments for income enhancement purposes subjects the Fund to risks of losses which would not be offset by gains on other portfolio assets or acquisitions. There is no assurance that the Investment Adviser will employ any derivative strategy, and even where such derivatives investments are used for hedging purposes, there can be no assurance that the hedging transactions will be successful or will not result in losses.

The Fund is a party to ISDA (International Swap and Derivatives Association, Inc.) Master Agreements (“Master Agreements”) with certain counterparties that govern over-the-counter derivative contracts entered into from time to time. The Master Agreements may contain provisions regarding, among other things, the parties’ general obligations, representations, agreements, collateral requirements, events of default, and early termination. Generally, collateral can be in the form of cash or debt securities issued by the U.S. Government or related agencies or other securities as agreed to by the Fund and the applicable counterparty. Collateral requirements are determined based on the Fund’s net position with each such counterparty. Termination events applicable to the Fund may occur in certain instances specified in the Master Agreements, which may include, among other things, a specified decline in the Fund’s net asset value, not complying with eligible collateral requirements or the termination of the Fund’s Investment Adviser. In each case, upon occurrence,

11

Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc.

Notes to Financial Statements

For the six month period from July 1, 2021 to December 31, 2021 (Unaudited)

the counterparty may elect to terminate the swap early and cause the settlement of all or some of the derivative contracts outstanding, including the payment of any losses and costs resulting from such early termination, as reasonably determined by the terminating party. Any decision by one or more of the Fund’s counterparties to elect early termination could impact the Fund’s future derivative activity. There were no derivative instruments during the period from July 1, 2021 to December 31, 2021.

Securities Sold Under Repurchase Agreements

Under these agreements, the Fund sells securities, receives cash in exchange, and agrees to repurchase the securities at a mutually agreed date and price. Ordinarily, those counterparties with which the Fund enters into these agreements require delivery of collateral and are able to sell or repledge the collateral; however, the Fund retains effective control over such collateral through the agreement to repurchase the collateral on or by the maturity of the repurchase agreement. These transactions are treated as financings and recorded as liabilities. Therefore, no gain or loss is recognized on the transaction, and the securities pledged as collateral remain recorded as assets of the Fund. These agreements involve the risk that the market value of the securities purchased with the proceeds from the sale of securities received by the Fund, may decline below the price of the securities that the Fund is obligated to repurchase, and that the value of the collateral posted by the Fund increases in value and the counterparty does not return it. Because the Fund borrows under repurchase agreements based on the estimated fair value of the pledged assets, the Fund’s ongoing ability to borrow under its repurchase facilities may be limited and its lenders may initiate margin calls in the event of adverse changes in the market. A decrease in market value of the pledged assets may require the Fund to post additional collateral or otherwise sell assets at a time when it may not be in the best interest of the Fund to do so.

Short-Term and Medium-Term Notes

The Fund has a short-term and medium-term notes payable program as a funding vehicle to increase the amounts available for investments. The short-term and medium-term notes may be issued from time to time, in denominations of $1,000 or as may otherwise be specified in a supplement to the Offering Circular. The notes are collateralized by the pledge of certain securities of the Fund. The pledged securities are held by UBSTC, as agent for the Fund, for the benefit of the holders of the notes. The Fund suspended the current offerings of its securities, pending the registration of the securities under the U.S. Securities Act of 1933, as amended, absent an exception. There were no short-term and medium-term notes during the period from July 1, 2021 to December 31, 2021.

Paydowns

Realized gains or losses on mortgage-backed security paydowns are recorded as an adjustment to interest income. During the period from July 1, 2021 to December 31, 2021, the Fund had no realized gains/losses on mortgage-backed securities paydowns. The Fund declares and pays monthly dividends from net investment income. For purposes of compliance with the 90% distribution threshold for the Fund’s tax exemption, gains and losses related to mortgage-backed security paydowns are not included in net investment income. See Note 9 for a reconciliation between taxable and book net investment income

Preferred Shares

Pursuant to the Fund’s Certificate of Incorporation, as amended and supplemented, the Fund’s Board of Directors is authorized to issue up to 12,000,000 preferred shares with a par value of $25, in one or more series. During the period from July 1, 2021 to December 31, 2021, no preferred shares were issued or outstanding.

12

Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc.

Notes to Financial Statements

For the six month period from July 1, 2021 to December 31, 2021 (Unaudited)

Other

Security transactions are accounted for on the trade date (the date on which the order to buy or sell is executed). Realized gains and losses on security transactions are determined on the identified cost method. Premiums and discounts on securities purchased are amortized using the interest method over the life or the expected life of the respective securities. Premiums are amortized at the earliest call date for any applicable securities. Income from interest and dividends from cumulative preferred shares is accrued, except when collection is not expected. Expenses are recorded as they are incurred.

| 2. | Investment Advisory, Administrative, Custodian, Transfer Agency Agreements, and Other Transactions With Affiliates |

Pursuant to an investment advisory contract (the “Advisory Agreement”) with UBS Asset Managers of Puerto Rico, a division of UBSTC, and subject to the supervision of the Board of Directors, the Fund receives investment advisory services in exchange for a fee. The investment advisory fee will not exceed 0.75% of the Fund’s average weekly gross assets. For the period from July 1, 2021 to December 31, 2021, investment advisory fees amounted to $330,525 equivalent to 0.38% of the Fund’s average weekly gross assets. The Investment Advisor voluntarily waived investment advisory fees in the amount of $220,350, for a net fee of $110,175, which represents an effective annual rate of 0.13%. The investment advisory fees payable amounted to $18,551 as of December 31, 2021.

UBSTC also provides administrative, custody, and transfer agency services pursuant to Administration, Custodian, and Transfer Agency, Registrar, and Shareholder Servicing Agreements. UBSTC has engaged JP Morgan to act as the sub-custodian for the Fund. UBSTC provides facilities and personnel to the Fund for the performance of its administration duties. The Administration and Transfer Agency, Registrar, and Shareholder Servicing Agreement will not exceed 0.15% and 0.05%, respectively of the Fund’s average weekly gross assets. The Custody fees are solely sub-custodian costs and out of pocket expenses reimbursements. For the period from July 1, 2021 to December 31, 2021, the administrative, custody, and transfer agency services fee amounted to $80,278. The administrator, custodian, and transfer agent voluntarily waived service fees in the amount of $22,035, for a net fee of $58,243, which is equivalent to 0.07% of the Fund’s average weekly gross assets. The administrative, custody, and transfer agent fees payable amounted to $9,846 as of December 31, 2021.

Certain Fund officers and directors are also officers and directors of UBSTC. The six (6) independent directors of the Fund’s Board of Directors are paid based upon an agreed fee of $1,000 per board meeting, plus expenses, and $500 per Audit Committee meeting, plus expenses. For the period from July 1, 2021 to December 31, 2021, the independent directors of the Fund were paid an aggregate compensation and expenses of $18,093. The directors fee payable amounted to $6,139 as of December 31, 2021.

Prior to May 14, 2021, the Fund was not registered under the 1940 Act, and therefore, was not subject to the restrictions contained therein regarding, among other things, transactions between the Fund and UBS Financial Services, Inc. (“UBSFS”), or its affiliates (“Affiliated Transactions”). In that regard, the Board of Directors of the Fund had adopted a set of Procedures for Affiliated Transactions (“Procedures”) in an effort to address potential conflicts of interest that could arise prior to registration under the 1940 Act. See Note 1 for further information on recent events.

Fund affiliates may have lending, banking, brokerage, underwriting, or other business relationships with the issuers of the securities in which the Fund invests.

13

Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc.

Notes to Financial Statements

For the six month period from July 1, 2021 to December 31, 2021 (Unaudited)

The total amount (in thousands) of other affiliated and unaffiliated purchases and sales of investment securities, originations of securities sold under repurchase agreements and short-term notes, listed by counterparty, during the period were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Purchases | | | % | | | Sales | | | % | | | Securities

Sold Under

Repurchase

Agreements | | | % | |

| | | | | | |

Affiliates | | $ | - | | | | - | | | $ | - | | | | - | | | $ | - | | | | - | |

| | | | | | |

Unaffiliated | | | - | | | | - | | | | - | | | | - | | | | 69,300 | | | | 100% | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | $ | - | | | | - | | | $ | - | | | | - | | | $ | 69,300 | | | | 100% | |

| | | | | | | | | | | | | | | | | | | | | | | | |

There were no interest expenses from securities sold under repurchase agreements with UBSFS during the period from July 1, 2021 to December 31, 2021.

| 3. | Capital Share Transactions |

The Fund is authorized to issue up to 88,000,000 common shares, par value $0.01 per share.

Capital share transactions for the period from July 1, 2021 to December 31, 2021 and for the fiscal year ended June 30, 2021 were as follows:

| | | | | | | | |

| Common Shares | | Amount

December 31, 2021 | | | Amount

June 30, 2021 | |

Proceeds from the reinvestment of dividends | | $ | 15,732 | | | $ | 36,193 | |

| | |

Repurchase of shares | | | - | | | | (29,380) | |

| | | | | | | | |

| | |

| | $ | 15,732 | | | $ | 6,813 | |

| | | | | | | | |

Transactions in common shares during the period from July 1, 2021 to December 31, 2021 and for the fiscal year ended June 30, 2021 were as follows:

| | | | | | | | |

| Common Shares | | December 31, 2021 | | | June 30, 2021 | |

| | |

Beginning common shares | | | 28,710,374 | | | | 28,707,731 | |

Shares issued due to the reinvestment of dividends | | | 6,045 | | | | 23,690 | |

Shares repurchased | | | - | | | | (21,047) | |

| | | | | | | | |

| | |

Ending common shares | | | 28,716,419 | | | | 28,710,374 | |

| | | | | | | | |

The Fund’s Board of Directors authorized the repurchase of the Fund’s shares of common stock in the open market when such shares are trading at or below NAV of the shares, up to 60% of the aggregate number of shares of common stock issued by the Fund. As of December 31, 2021, the total shares repurchased represent 52.16% and the total shares available to be repurchased represent 7.84% of the issued shares of the Fund’s common stock since inception. These repurchases were executed prior to registration under the 1940 Act. All repurchases conducted after the 1940 Act registration, must be conducted in accordance with the provisions of the 1940 Act.

14

Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc.

Notes to Financial Statements

For the six month period from July 1, 2021 to December 31, 2021 (Unaudited)

There were no repurchase of common shares for the period from July 1, 2021 to December 31, 2021. The Fund repurchased a total of 21,047 common shares during the fiscal year ended June 30, 2021, as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | Shares

Repurchased | | | | | | Net Asset

Value | | | | | | Cost | |

Affiliates | | | 5,127 | | | | | | | $ | 13,444 | | | | | | | $ | 8,369 | |

Non-Affiliates | | | 15,920 | | | | | | | | 41,432 | | | | | | | | 21,011 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 21,047 | | | | | | | $ | 54,876 | | | | | | | $ | 29,380 | |

| | | | | | | | | | | | | | | | | | | | |

The shares repurchased from affiliates consist of shares held by clients in such affiliates.

The weighted average discount per share is 46.46% for shares repurchased during the fiscal year ended June 30, 2021.

| 4. | Investment Transactions |

There were no purchases and proceeds from sales and calls of portfolio securities for the period from July 1, 2021 to December 31, 2021.

| 5. | Securities Sold Under Repurchase Agreements |

Securities sold under repurchase agreements amounted to $11,800,000 at December 31, 2021, and related information is as follows:

| | | | |

Weighted average interest rate at the end of the period | | | 0.26 % | |

| | | | |

Maximum aggregate balance outstanding at any time of the period | | $ | 11,925,000 | |

| | | | |

Average balance outstanding during the period | | $ | 11,579,891 | |

| | | | |

Average interest rate during the period | | | 0.23% | |

| | | | |

At December 31, 2021, interest rate on securities sold under repurchase agreements is 0.26% with a maturity date of January 11, 2022.

At December 31, 2021, investment securities amounting to $12,868,402 were pledged as collateral for securities sold under repurchase agreements. The counterparties have the right to sell or repledge the assets during the term of the repurchase agreement with the Fund. Interest payable on securities sold under repurchase agreements amounted to $1,534 at December 31, 2021.

The following table presents the Fund’s repurchase agreements by counterparty and the related collateral pledged by the Fund at December 31, 2021:

15

Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc.

Notes to Financial Statements

For the six month period from July 1, 2021 to December 31, 2021 (Unaudited)

| | | | | | | | | | | | | | | | |

| Counterparty | | Gross Amount of Securities Sold Under Repurchase Agreements Presented in the Statement of Assets and Liabilities | | | Securities Sold Under Repurchase Agreements Available for Offset | | | Collateral Posted (a) | | | Net Amount Due To Counterparty

(not less than zero) | |

Amherst Pierpoint, New York | | $ | 11,800,000 | | | $

| -

|

| | $ | 11,800,000 | | | $

| -

|

|

(a) Collateral received or posted is limited to the net securities sold under repurchase agreements liability amounts. See above for actual collateral received and posted.

| 6. | Short-Term Financial Instruments |