UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

TAX-FREE FIXED INCOME FUND III FOR PUERTO RICO RESIDENTS, INC.

(Name of Registrant as Specified In Its Charter)

Ocean Capital LLC

William Heath Hawk

José R. Izquierdo II

Brent D. Rosenthal

Roxana Cruz-Rivera

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): |

| | |

| ☒ | No fee required |

| | |

| ☐ | Fee paid previously with preliminary materials. |

| | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11 |

SUPPLEMENT TO THE DEFINITIVE PROXY STATEMENT AND PROXY SOLICITATION MATERIALS

The disclosures in this filing are intended to supplement the disclosures that Ocean Capital LLC (“Ocean Capital”) previously made with respect to Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc. (the “Fund”) in its definitive proxy statement filed with the Securities and Exchange Commission (the “SEC”) on October 12, 2021 (as amended, the “Proxy Statement”) and certain solicitation materials filed as “DFAN14A” referenced herein (together with the Proxy Statement, the “Solicitation Materials”). These disclosures should be read in conjunction with the Solicitation Materials and the other filings Ocean Capital has submitted to the SEC with respect to the Fund. To the extent that the information set forth herein differs from or updates information contained in the Solicitation Materials, the information set forth herein shall supersede or supplement the information in the Solicitation Materials. Defined terms used but not defined herein have the meanings set forth in the Proxy Statement.

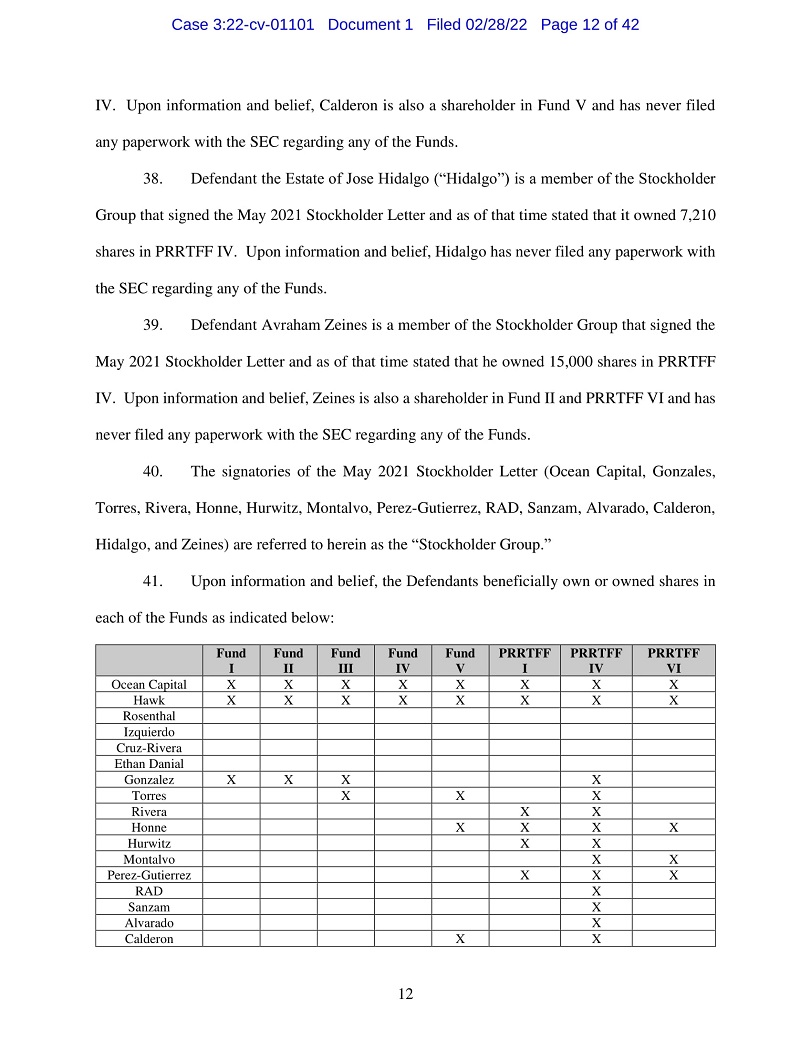

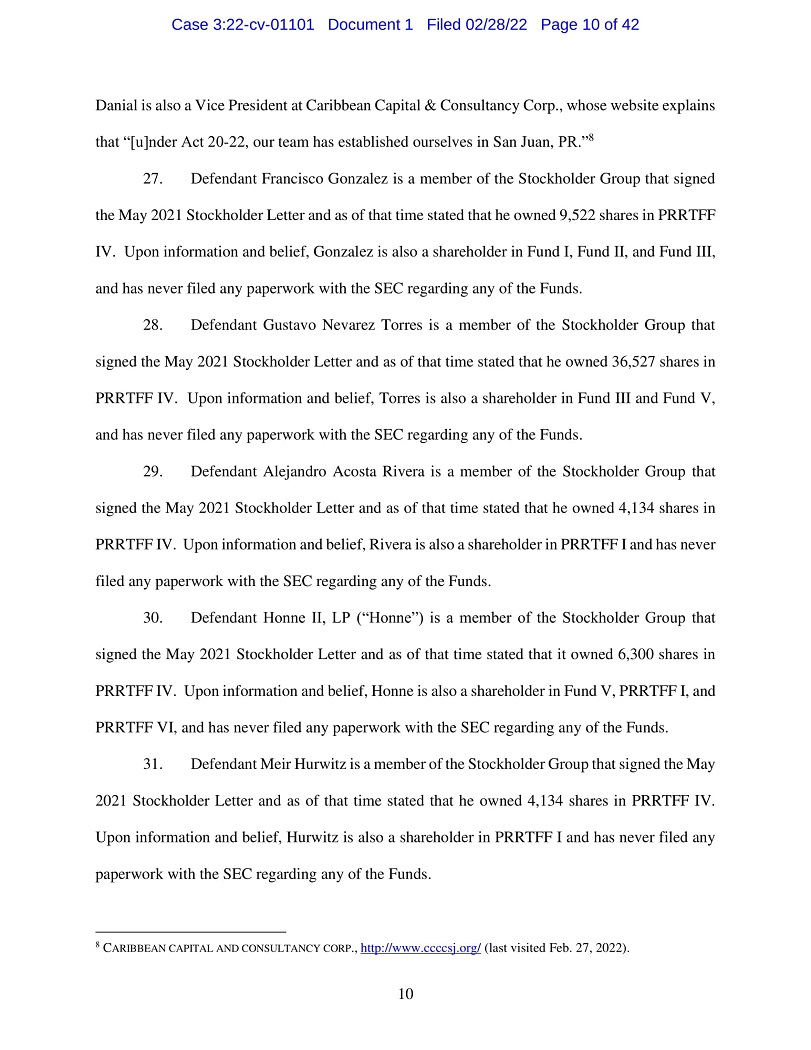

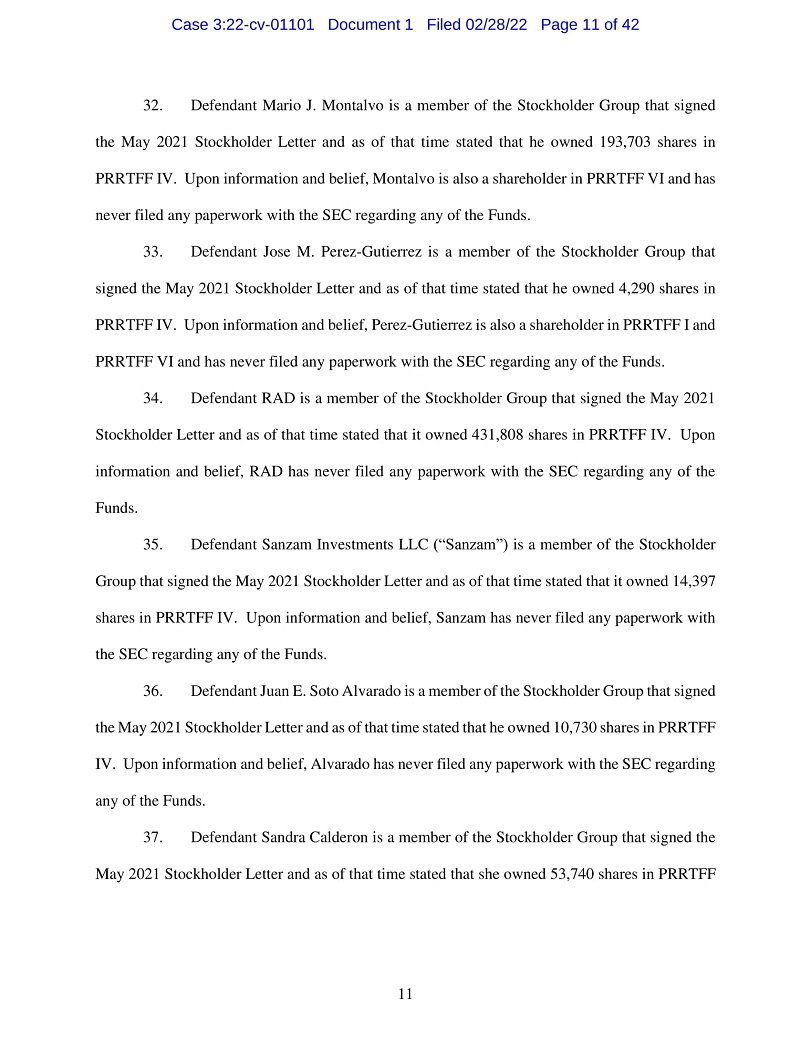

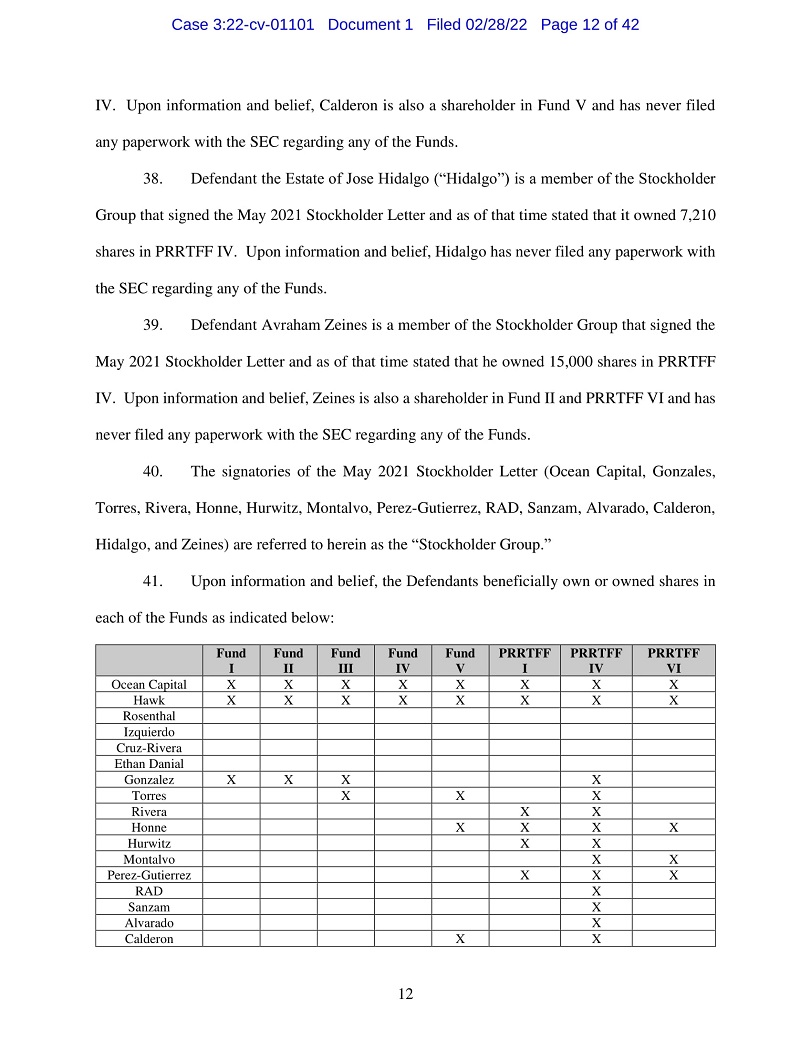

On February 28, 2022, the Fund, along with seven other closed-end mutual funds managed or co-managed by an affiliate of UBS Financial Services Incorporated of Puerto Rico (the “Puerto Rico Bond Funds”) filed a complaint in the United States District Court for the District of Puerto Rico (the “Complaint”) against 15 of their own shareholders, including Ocean Capital, its managing member, Mr. Hawk, and 13 investors in Puerto Rico Residents Tax-Free Fund IV, Inc. (“PRITF IV”) (the “PRITF IV Shareholders”), the majority of whom have no direct or indirect economic or other interest in the Fund. Ocean Capital’s manager, certain of its executives, and its director nominees for the Fund and the other Puerto Rico Bond Funds were also named as defendants. The Complaint alleges violations of Section 13(d) of the Securities Exchange Act of 1934 (the “Exchange Act”), alleging that the PRITF IV Shareholders had agreed to act as a “Group” with Ocean Capital and its nominees “for the purpose of acquiring, holding, voting or disposing of equity securities of” the Fund and the Puerto Rico Bond Funds. The Complaint also alleges violations of Section 14(a) of the Exchange Act and Rule 14a-9 thereunder based on alleged deficiencies in the disclosures issued by Ocean Capital. A copy of the Complaint is filed herewith as Exhibit 1.

Ocean Capital believes that the Complaint is completely without merit and is nothing more than a last-minute attempt to interfere with the right of the Fund’s shareholders to elect directors at the upcoming annual meeting. None of Ocean Capital, its nominees, or Mr. Hawk has agreed to act as a “Group” with any of the PRITF IV Shareholders, and the Puerto Rico Bond Funds identify no actionable deficiency in the Fund’s disclosures.

Nevertheless, to moot what Ocean Capital considers to be unmeritorious disclosure claims, to avoid nuisance, potential expense, and delay, and to provide additional information to shareholders of the Fund, Ocean Capital has determined to voluntarily supplement the Proxy Statement as described herein. Nothing in this supplement to the Proxy Statement shall be deemed an admission of the legal necessity or materiality under applicable laws of any of the disclosures set forth herein. To the contrary, Ocean Capital specifically denies all allegations in the Complaint, including, without limitation, that any additional disclosure was or is required.

The disclosure in the Proxy Statement following the heading “REASONS FOR OUR SOLICITATION” on page 2 is hereby supplemented by amending and restating the disclosure to read as follows:

As one of the largest shareholders of the Fund, Ocean Capital has nominated a slate of two (2) highly-qualified Nominees who would not be “interested persons” (based on Section 2(a)(19) of the Investment Company Act of 1940 (the “1940 Act”)) and are independent (based on Section 301 of the Sarbanes-Oxley Act of 2002) (Proposal 1), and put forth a proposal to repeal any provision of, or amendment to, the Bylaws adopted by the Board without the approval of the Fund’s shareholders subsequent to September 23, 2021 (Proposal 2).

As committed investors, we are looking for the Fund to significantly improve both performance and governance in order to generate maximum returns for all shareholders. We believe shareholders cannot expect the Fund to perform significantly better without fundamental change, beginning in the boardroom by adding fresh perspectives. If elected, our nominees will be committed to putting shareholders’ interests first and evaluating all avenues to maximize value, including, but not limited to, consideration of the reestablishment of a share repurchase program, the liquidation of the Fund to realize its net asset values and other value-unlocking initiatives.

We urge you to support our Proposals by voting the BLUE Proxy Card today, which we believe will help unlock value for investors.

The disclosure in the Proxy Statement following the heading “QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING” beginning on page 11 is hereby supplemented by adding the following question on page 13:

What is the Coalition of Concerned UBS Closed-End Bond Fund Investors?

On July 22, 2021, Ocean Capital launched a public website for “The Coalition of Concerned UBS Closed-End Bond Fund Investors.” The Coalition of Concerned UBS Closed-End Bond Fund Investors is not intended to describe a discernible group of investors, but instead is used to describe a like-mindedness of various shareholders who might understand and think similarly about the Fund and its affiliated funds with respect to which Ocean Capital has made nominations for director elections. Ocean Capital, its managing member, Mr. Hawk, and its nominees have never entered, and have no intention to enter, into any agreement, whether oral or written, express or implied, to act together with any other person who could be described as a “Concerned UBS Closed-End Bond Fund Investor” for the purpose of acquiring, holding, voting or disposing of securities of any of the Funds.

The disclosure in the chart following the third paragraph of the Exhibit 1 to the DFAN14A filed with the SEC on September 27, 2021 and the disclosure in the chart within the fifth and sixth images of Exhibit 1 to the DFAN14A filed with the SEC on September 28, 2021 is hereby supplemented by amending and restating the chart to read as follows:

| Total Returns for Fund I1 | | Total Returns for Fund III2 | | Total Returns for Fund VI3 |

| ● 1 Year: -27.27% | | ● 1 Year: -18.30% | | ● 1 Year: 1.66% |

| ● 3 Year: 0.73% | | ● 3 Year: 7.66% | | ● 3 Year: 23.50% |

| ● 5 Year: 3.92% | | ● 5 Year: 4.62% | | ● 5 Year: 9.01% |

| ● 10 Year: -9.07% | | ● 10 Year: -7.10% | | ● 10 Year: -2.44% |

| ● Lifetime: -2.86% | | ● Lifetime: -2.36% | | ● Lifetime: 2.69% |

| 1 | Average annual total return data sourced from final quarterly report of 2020. |

| 2 | Average annual total return data sourced from final quarterly report of 2020. |

| 3 | Average annual total return data sourced from final quarterly report of 2020. |

The disclosure on the fifth and sixth images in Exhibit 1 to the DFAN14A filed with the SEC on September 28, 2021 is hereby supplemented by amending and restating the disclosure to read as follows:

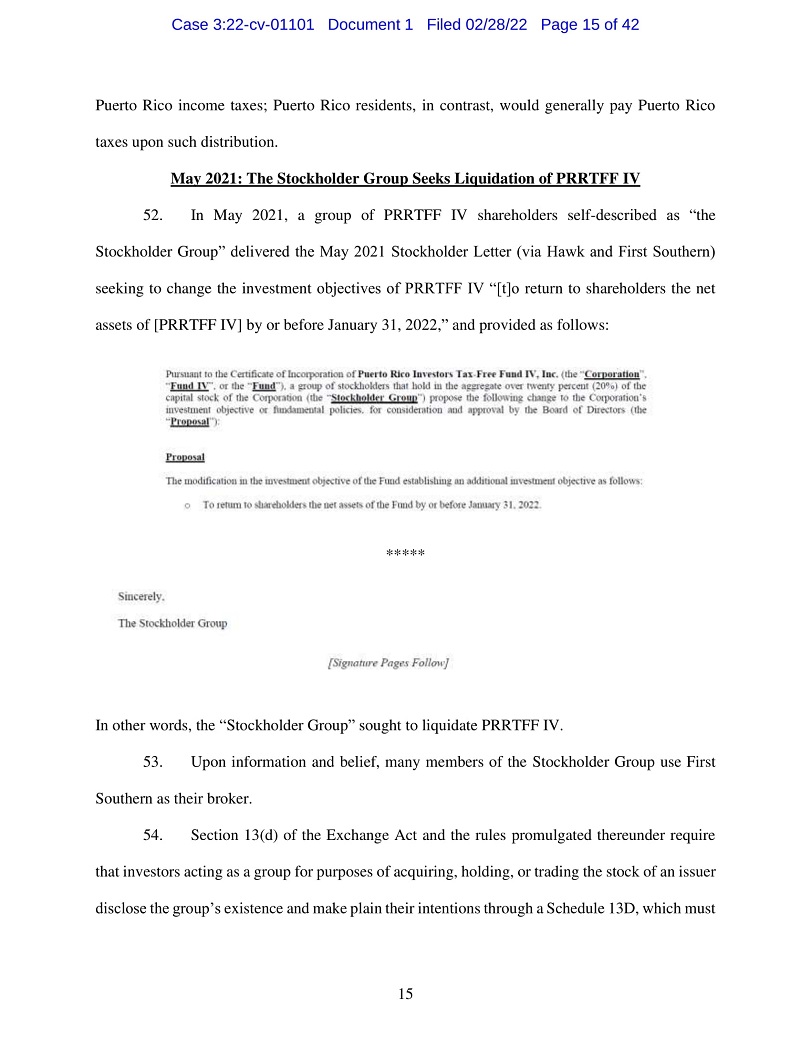

Legal and Regulatory Concerns

��

We recognize that issues with respect to UBS and its Puerto Rico closed-end bond funds have been so troublesome that many investors have filed legal claims. A 2018 article published by CNBC highlighted that there has been a “tsunami of arbitration claims that have been filed against UBS by Puerto Rico-based investors for — among other counts — breach of fiduciary duty, negligence and fraud.” That same article even noted that the former UBS Group AG Chief Executive Officer stated, “we could have done things better” with respect to the Funds.(1)

We also find it notable that regulators such as the U.S. Securities and Exchange Commission (“SEC”) and the Financial Industry Regulatory Authority opened up inquiries into UBS and its Puerto Rico closed-end bond funds. Regulators contended UBS and its executives made material misrepresentations related to the funds. Ultimately, UBS has paid tens of millions of dollars as part of settlements since the spring of 2021.(2)

| (1) | Mr. Sergio Ermotti was quoted by CNBC as saying: “When you go back and you look at the situation, you could always argue that we could have done things better, or some people could have behaved better.” “When there is scope for admitting something went wrong, we do that.” |

| (2) | On May 1, 2012, the SEC initiated two separate proceedings related to the Funds: one against UBS Financial Services Puerto Rico, Inc. (“UBS PR”) and one against two UBS PR executives, Miguel Ferrer and Carlos Ortiz, as disclosed in the SEC’s Press Release dated May 1, 2012. Both proceedings alleged that UBS PR, Ferrer, and Ortiz misrepresented and omitted material facts regarding the pricing and liquidity of the Funds to retail customers in 2008 and 2009. These alleged misrepresentations and omissions included falsely representing that Fund prices were set by supply and demand, when in fact prices were set by UBS PR’s trading desk, and failing to adequately disclose that UBS PR controlled the secondary trading market for the Funds. UBS PR settled the charges brought against it without admitting or denying the SEC’s findings, in part by agreeing to pay more than $26 million in penalties, disgorgement, and interest to the SEC. These funds were disbursed to injured investors according to an SEC order dated June 30, 2020. The proceeding against Ferrer and Ortiz was dismissed without a finding of wrongdoing against them. |

The disclosure in the third paragraph in Exhibit 1 to the second DFAN14A filed with the SEC on October 14, 2021 is hereby supplemented by amending and restating the disclosure to read as follows:

While UBS claims that its preferred nominees have “a long-standing commitment to the Fund[s] and its shareholders,” the reality is that these directors are most experienced in presiding over significant value destruction while collecting six-figure annual salaries.2 We seriously question how the Boards can attempt to solicit shareholder support for the incumbent directors when these individuals have practically no meaningful shareholdings and recently reduced the September 30th dividend for Funds I and III. As shareholders have suffered over the years, Vicente León, Carlos Nido, Luis M. Pellot, Carlos V. Ubiñas and José J. Villamil have collectively received millions in compensation across all of the UBS-affiliated Puerto Rico Family of Funds and failed to purchase meaningful shares on the open market. We firmly believe these directors are misaligned with investors, unlike Ocean Capital, which owns over 6% in each of the Puerto Rico Bond Funds.

The disclosure in the footnote to the first table in Exhibit 1 to the second DFAN14A filed with the SEC on October 14, 2021, with respect to Luis M. Pellot’s director compensation, is hereby supplemented by amending and restating the disclosure to read as follows:

| * | Total aggregated compensation from all of the UBS-affiliated Puerto Rico Family of Funds for the calendar year ended December 31, 2020. Note this amount does not include amounts related to reimbursement for expenses related to attendance at such board meetings or meetings of committees thereof. |

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

To the Shareholders of Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc.:

Ocean Capital and the other participants in its solicitation (collectively, the “Participants”) have filed with the SEC a definitive proxy statement and accompanying form of BLUE proxy card to be used in connection with the solicitation of proxies from the shareholders of the Fund with respect to its upcoming annual meeting of shareholders. All shareholders of the Fund are advised to read the definitive proxy statement and other documents related to the solicitation of proxies by the Participants, as they contain important information, including additional information relating to the Participants and their direct or indirect interests, by security holdings or otherwise. The definitive proxy statement and an accompanying BLUE proxy card have been furnished to some or all of the Fund’s shareholders and are, along with other relevant documents, available at no charge on the SEC’s website at http://www.sec.gov.

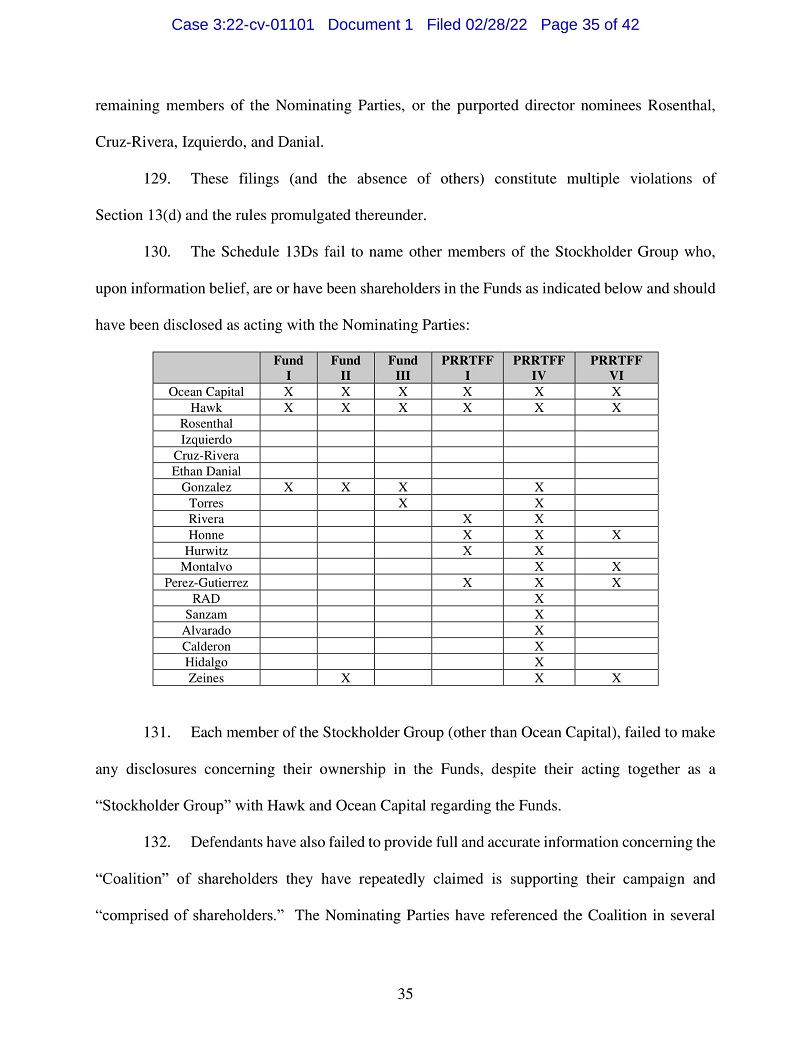

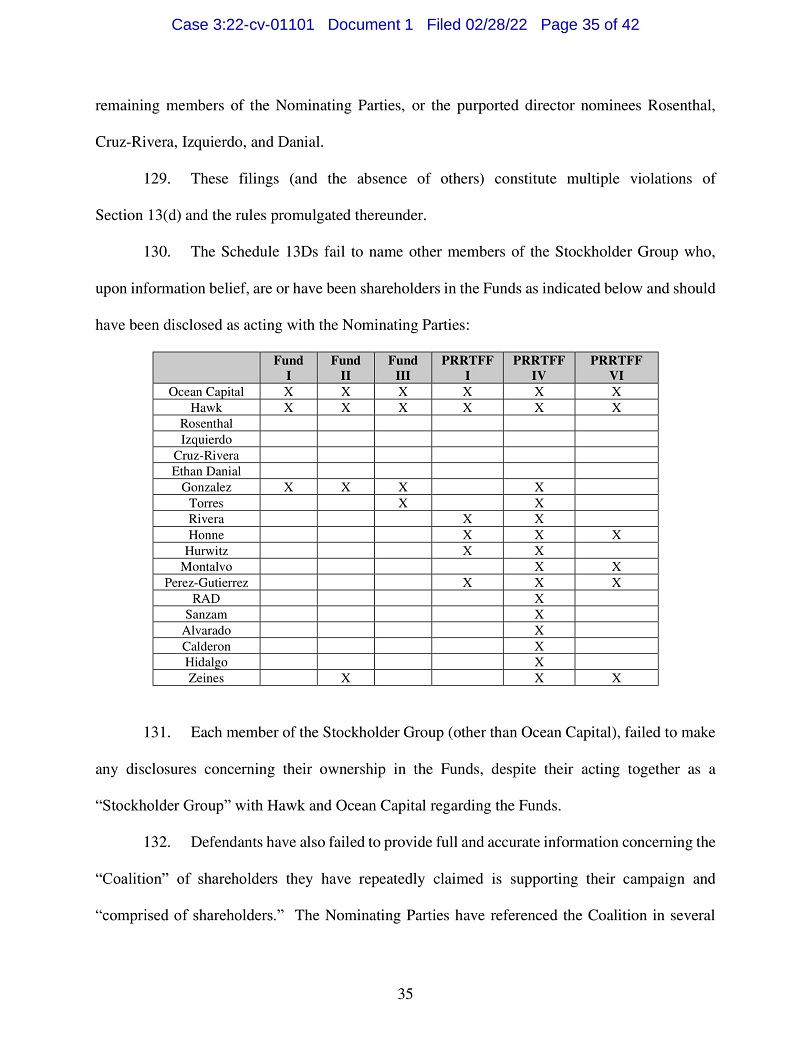

Exhibit 1