UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

TAX-FREE FIXED INCOME FUND III FOR PUERTO RICO RESIDENTS, INC.

(Name of Registrant as Specified In Its Charter)

Ocean Capital LLC

William Heath Hawk

José R. Izquierdo II

Roxana Cruz-Rivera

Brent D. Rosenthal

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

SUPPLEMENT TO THE DEFINITIVE PROXY STATEMENT AND PROXY SOLICITATION MATERIALS

The disclosures in this filing are intended to supplement the disclosures that Ocean Capital LLC (“Ocean Capital”) previously made with respect to Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc. (the “Fund”), including its definitive proxy statement filed with the Securities and Exchange Commission (the “SEC”) on October 12, 2021 (as amended, the “Proxy Statement”) and the solicitation materials Ocean Capital has filed from time to time as “DFAN14A” (together with the Proxy Statement, the “Solicitation Materials”). The Solicitation Materials relate to the Fund’s 2021 annual meeting of stockholders, which was originally scheduled for October 28, 2021 and, after numerous adjournments, is currently scheduled to reconvene on March 9, 2023. These disclosures should be read in conjunction with the Solicitation Materials and the other filings Ocean Capital has submitted to the SEC with respect to the Fund. To the extent that the information set forth herein differs from or updates information contained in the Solicitation Materials, the information set forth herein shall supersede or supplement the information in the Solicitation Materials. Defined terms used but not defined herein have the meanings set forth in the Proxy Statement.

As previously disclosed in the Solicitation Materials, on February 28, 2022, a group of eight funds (collectively, the “Plaintiff Funds”), consisting of the Fund, Tax-Free Fixed Income Fund for Puerto Rico Residents, Inc., Tax-Free Fixed Income Fund II for Puerto Rico Residents, Inc., Tax-Free Fixed Income Fund IV for Puerto Rico Residents, Inc., Tax-Free Fixed Income Fund V for Puerto Rico Residents, Inc., Puerto Rico Residents Tax-Free Fund, Inc., Puerto Rico Residents Tax-Free Fund IV, Inc. (“PRITF IV”) and Puerto Rico Residents Tax-Free Fund VI, Inc., filed a complaint in the United States District Court for the District of Puerto Rico against Ocean Capital, its managing member W. Heath Hawk, certain of its executives and director nominees, and 13 investors in PRITF IV (the “PRITF IV Shareholders”) (the majority of whom are not alleged to have any direct or indirect economic or other interest in the Fund) (collectively, the “Defendants”) (see Tax-Free Fixed Income Fund for Puerto Rico Residents, Inc. et al. v. Ocean Capital LLC et al., No. 22-cv-01101 (D.P.R.)). The Plaintiff Funds allege that Ocean Capital’s proxy campaigns against the Plaintiff Funds and the Defendants’ conduct in connection with these campaigns violated Sections 13(d), 14(a), and 20(a) of the Securities Exchange Act of 1934 (as amended, the “Exchange Act”). The relief the Plaintiff Funds seek includes: (i) a declaration that the Defendants violated these sections of the Exchange Act by not disclosing the names of all persons who they allege are also part of the shareholder group that Ocean Capital disclosed on its Schedule 13D, by not disclosing this same information in various proxy disclosures, and by supposedly including certain other false or misleading information in its proxy disclosures; (ii) an order requiring the Defendants to issue disclosures to publicly correct their purported misstatements or omissions relating to the Plaintiff Funds; and (iii) an injunction prohibiting the Defendants from soliciting proxies regarding the Plaintiff Funds until the Defendants have issued corrective disclosures. Ocean Capital and members of its disclosed 13D group moved to dismiss the complaint, and that motion was fully brief, argued, and submitted by August 29, 2022.

Before any court ruling on the motion to dismiss, on December 14, 2022—just one day before the Plaintiff Funds’ 2021 and/or 2022 annual meetings, as applicable, were to be held following their latest set of adjournments—the Plaintiff Funds filed a motion for leave to file an amended complaint (the “Motion for Leave”), proposing, among other things, to add Tax Free Fund for Puerto Rico Residents, Inc. (“TFF I”) as a new ninth additional plaintiff fund and to make similar allegations against the Defendants with respect to that fund. The Plaintiff Funds also proposed to add another Ocean Capital director nominee as an additional defendant. The federal court granted the motion and, on January 5, 2023, the Plaintiff Funds filed the Amended Complaint.

Ocean Capital believes that the lawsuit is completely without merit and is nothing more than another attempt in an ongoing effort to entrench the boards of directors of the Plaintiff Funds and TFF I and to interfere with the right of the Plaintiff Funds’ shareholders and TFF I’s shareholders to elect directors at their upcoming annual meetings. None of Ocean Capital, its nominees, or Mr. Hawk has agreed to act as a “group” with any of the PRITF IV Shareholders, and the Plaintiff Funds identify no actionable deficiency in the Defendants’ disclosures.

Nevertheless, to moot what Ocean Capital considers to be unmeritorious disclosure claims, to avoid nuisance, potential expense, and delay, and to provide additional information to shareholders of the Fund, Ocean Capital previously determined to voluntarily supplement the Proxy Statement and provided a copy of the Plaintiff Funds’ original complaint in its DFAN14A, filed on March 25, 2022. To further moot the amended claims, a copy of the Amended Complaint is filed herewith as Exhibit 1. Nothing in the Solicitation Materials or in this filing shall be deemed an admission of the legal necessity or materiality under applicable laws of any of the disclosures complained of in the Amended Complaint. To the contrary, Ocean Capital specifically denies all allegations in the Amended Complaint, including, without limitation, that any additional disclosure was or is required.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

To the Shareholders of Tax-Free Fixed Income Fund III for Puerto Rico Residents, Inc.:

Ocean Capital and the other participants in its solicitation (collectively, the “Participants”) have filed with the SEC a definitive proxy statement and accompanying form of BLUE proxy card to be used in connection with the solicitation of proxies from the shareholders of the Fund with respect to its upcoming 2021 annual meeting of shareholders. All shareholders of the Fund are advised to read the definitive proxy statement, any amendments or supplements thereto and other documents related to the solicitation of proxies by the Participants, as they contain important information, including additional information relating to the Participants and their direct or indirect interests, by security holdings or otherwise. The definitive proxy statement and an accompanying BLUE proxy card have been furnished to some or all of the Fund’s shareholders and are, along with other relevant documents, available at no charge on the SEC’s website at http://www.sec.gov. Investors and security holders are urged to read the proxy statement and the amendments or supplements thereto carefully and in their entirety.

Exhibit 1

IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF PUERTO RICO TAX - FREE FIXED INCOME FUND FOR PUERTO RICO RESIDENTS, INC., TAX - FREE FIXED INCOME FUND II FOR PUERTO RICO RESIDENTS, INC., TAX - FREE FIXED INCOME FUND III FOR PUERTO RICO RESIDENTS, INC., TAX - FREE FIXED INCOME FUND IV FOR PUERTO RICO RESIDENTS, INC., TAX - FREE FIXED INCOME FUND V FOR PUERTO RICO RESIDENTS, INC., PUERTO RICO RESIDENTS TAX - FREE FUND, INC., PUERTO RICO RESIDENTS TAX - FREE FUND IV, INC., PUERTO RICO RESIDENTS TAX - FREE FUND VI, INC., and TAX - FREE FUND FOR PUERTO RICO RESIDENTS, INC. Plaintiffs, v. OCEAN CAPITAL LLC, WILLIAM HEATH HAWK, JOSÉ R. IZQUIERDO II, BRENT D. ROSENTHAL, ROXANA CRUZ - RIVERA, ETHAN DANIAL, MOJDEH L. KHAGAN, PRCE MANAGEMENT LLC, BENJAMIN T. EILER, VASILEIOS A. SFYRIS, FRANCISCO GONZALEZ, GUSTAVO NEVAREZ TORRES, ALEJANDRO ACOSTA RIVERA, HONNE II, LP, MEIR HURWITZ, MARIO J. MONTALVO, JOSE M. PEREZ - GUTIERREZ, RAD INVESTMENTS, LLC, SANZAM INVESTMENTS LLC, JUAN E. SOTO ALVARADO, SANDRA CALDERON, THE ESTATE OF JOSE HIDALGO, and AVRAHAM ZEINES Defendants. C.A. No. 22 - CV - 01101 FIRST AMENDED COMPLAINT FOR VIOLATIONS OF THE FEDERAL SECURITIES LAWS Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 1 of 53

2 Plaintiffs Tax - Free Fixed Income Fund for Puerto Rico Residents, Inc . (“Fund I”), Tax - Free Fixed Income Fund II for Puerto Rico Residents, Inc . (“Fund II”), Tax - Free Fixed Income Fund III for Puerto Rico Residents, Inc . (“Fund III”), Tax - Free Fixed Income Fund IV for Puerto Rico Residents, Inc . (“Fund IV”), Tax - Free Fixed Income Fund V for Puerto Rico Residents, Inc . (“Fund V”), Puerto Rico Residents Tax - Free Fund, Inc . (“PRRTFF I”), Puerto Rico Residents Tax - Free Fund IV, Inc . (“PRRTFF IV”), Puerto Rico Residents Tax - Free Fund VI, Inc . (“PRRTFF VI,”) and Tax Free Fund for Puerto Rico Residents, Inc . (“TFF I” and together with Fund I, Fund II, Fund III, Fund IV, Fund V, PRRTFF I, PRRTFF IV, and PRRTFF VI, “Plaintiffs” or the “Funds”), by and through their undersigned counsel, for their claims against Defendants allege the following based upon personal knowledge as to their own acts and upon information and belief as to all other matters . NATURE OF THE ACTION 1. Defendants are engaged in proxy contests to take control of the Plaintiff Funds, a collection of closed - end mutual funds . But in doing so, Defendants have misled the Funds’ shareholders by failing to make the full and accurate disclosures that are required by the federal securities laws . For example, although Defendants formed a self - described “Stockholder Group” comprising 14 individuals and entities, they have disclosed the involvement of only one of those : Ocean Capital LLC (“Ocean Capital”) . Ocean Capital and its putative director nominees have also regularly touted the “Coalition” of stockholders with whom they are purportedly operating, but have likewise not disclosed the identities of the purported “Coalition . ” The disclosures they have made are otherwise riddled with false and misleading statements . 2. Defendants’ efforts began in May 2021 , when defendant William Health Hawk, Ocean Capital’s manager, delivered a letter signed by a “Stockholder Group” that sought the Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 2 of 53

liquidation of PRRTFF IV (the “May 2021 Stockholder Letter”) . 1 The letter reflected the Stockholder Group’s request that all of PRRTFF IV’s assets be returned to shareholders . 3. Ocean Capital and Hawk (and, upon information and belief, other members of the Stockholder Group) soon began eyeing other Funds with which they could seek to implement a similar strategy . In July 2021 , Ocean Capital announced plans to nominate Hawk as well as Defendants José R . Izquierdo II, Brent D . Rosenthal, Roxana Cruz - Rivera (together with Ocean Capital, the “Nominating Parties”) as director candidates for Fund IV and Fund V . The Board of Directors of each of those Funds subsequently rejected those nomination notices as inconsistent with the applicable Fund’s articles of incorporation and bylaws . Days later, the Nominating Parties nevertheless launched a website and issued an open letter to Fund IV and Fund V shareholders announcing their nominations titled “Ocean Capital Announces Formation of the Coalition of Concerned UBS Closed - End Bond Fund Investors,” but did not explain (among other things) who was in their “Coalition . ” 4. In the ensuing months, the Nominating Parties initiated similar campaigns at the remaining Funds, also with reference to their “Coalition . ” But the Nominating Parties continue to be deceptive about their objectives and with whom they are aligned . They still have not disclosed Ocean Capital’s and Hawk’s affiliation with the Stockholder Group, nor have they disclosed the identities of those Coalition and/or Stockholder Group members . They have also not explained that Ocean Capital is managed by another of Hawk’s entities, PRCE Management, LLC (“PRCE”), whose investment objective is “effectuat[ing] a disposition of the assets of any Underlying Fund 1 The Stockholder Group is comprised of Defendants Ocean Capital, Francisco Gonzalez, Gustavo Nevarez Torres, Alejandro Acosta Rivera, Honne II, LP, Meir Hurwitz, Mario J . Montalvo, Jose M . Perez - Gutierrez, RAD Investments, LLC, Sanzam Investments LLC, Juan E . Soto Alvarado, Sandra Calderon, the Estate of Jose Hidalgo, and Avraham Zeines . 3 Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 3 of 53

by effectuating a change in the composition of the board of directors of an Underlying Fund or liquidating such Underlying Fund . ” 2 Stated differently, the Nominating Parties have hidden from the Funds’ shareholders (i) who they are working with and (ii) that their shared objective is the liquidation of all of the Funds . All of this is in violation of the federal securities laws, which require full and fair disclosure so that the Funds’ shareholders can make informed decisions . 5 . The Nominating Parties have also failed to disclose that certain of them hold tax - advantaged statuses that make their incentives very different than many of the Funds’ other investors . Upon information and belief, certain of the Defendants, including Hawk, are beneficiaries of Puerto Rico’s Act to Promote the Relocation of Individual Investors to Puerto Rico (“Act 22 ”) . Act 22 status is unavailable to local Puerto Rico residents ; once obtained, it entitles those individuals to avoid Puerto Rico income tax on, among other things, Puerto Rico source income from capital gains, interest, and dividends . 3 But many of the Funds’ shareholders are long - time Puerto Rico residents who cannot take advantage of the tax benefits of Act 22 . 4 2 4 PRCE Management LLC, Form ADV Part 2A Brochure (Aug. 3, 2021), https://files.adviserinfo.sec.gov/IAPD/Content/Common/crd_iapd_Brochure.aspx?BRCHR_VRSN_ID=722795 . 3 The Statement of Purpose for Act 22 describes its objectives as follows: The purpose of this measure is to encourage individuals who have not been residents of Puerto Rico . . . and who maintain investments within or without the United States to establish residency in Puerto Rico . In order to encourage the relocation of these individuals to Puerto Rico, this Act provides these individuals with a full Puerto Rico tax exemption on the passive income earned from their investments . In the case of long - term capital gains, individuals covered under this legislation shall be exempt from Puerto Rico income taxes on recognized gains after becoming residents of Puerto Rico and during the exemption period provided herein . Act No. 22 of January 17, 2012, http://www.gdb - pur.com/investors_resources/documents/A - 0022 - 2012.pdf ; see P.R. L AWS 13 † 10852. 4 Act 22 and similar Puerto Rico statutes have amassed controversy and even sparked investigations by the U.S. Internal Revenue Service over potential tax evasion. See, e.g. , IRS Targeting Those who “Relocated” to Puerto Rico in the Wake of Act 22 , N AT ’ L L. R EV . (Sept. 23, 2021) , https://www.natlawreview.com/article/irs - targeting - those - who - relocated - to - puerto - rico - wake - act - 22#:~:text=IRS%20Targeting%20Those%20Who%20%E2%80%9CRelocated,the%20Wake%20of%20Act%2022& text=Recently%2C%20the%20IRS%20announced%20a,recent%20relocation%20to%20Puerto%20Rico. Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 4 of 53

6. Acknowledging the importance of this distinction, the Nominating Parties chose to specifically claim that their “interests are squarely aligned with shareholders” and that “Ocean Capital is not a 20 / 22 Act Company and therefore does not enjoy tax benefits under those statutes . ” 5 But Ocean Capital, as an LLC, is a pass - through entity . What matters is the tax status of Ocean Capital’s owners , like Hawk, who tellingly chose to not disclose that they enjoy the tax benefits of Act 22 , and thus the immediate return of the Funds’ assets would likely be a wholly non - taxable event for them (unlike for other shareholders) . 7. This misleading disclosure is particularly salient given the Funds’ purpose and objectives . The Funds invest primarily in securities of Puerto Rico issuers, including Puerto Rico municipal bonds, and aim to provide current income to shareholders consistent with the preservation of capital . In accordance with this objective, the Funds offer monthly dividends, and most of the Funds’ shareholders (the majority of whom are senior citizens) utilize the Funds as a source of long - term retirement income . Defendants’ liquidation plans would therefore deprive many Fund investors of the income stream they sought when investing, and disproportionately benefit Hawk (and other Defendants who are also Act 22 beneficiaries), who would obtain a wholly tax - free distribution . 8. Defendants’ proxy filings are otherwise littered with false and misleading statements that violate the federal securities laws and Puerto Rico law in a variety of ways . Defendants have ignored Plaintiffs’ demands to fix their misleading statements — including the filing of the initial complaint in this action almost a year ago in February 2022 — and have doubled down on their misleading statements in subsequent filings . Plaintiffs respectfully request that the 5 Similar to Act 22, Act 20 offers tax incentives for companies that establish and expand their export services businesses in Puerto Rico. 5 Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 5 of 53

6 Court order Defendants to make corrective disclosures rectifying their many materially false and misleading statements and award the Funds their fees and costs incurred in responding to Defendants’ wrongful proxy campaigns. PARTIES AND RELEVANT NON - PARTIES 9. Plaintiff Fund I, formerly known as Puerto Rico Fixed Income Fund, Inc . , is a closed - end investment company registered under the Investment Company Act of 1940 . Fund I is organized under the laws of the Commonwealth of Puerto Rico and has its principal place of business in Puerto Rico . 10. Plaintiff Fund II, formerly known as Puerto Rico Fixed Income Fund II, Inc . , is a closed - end investment company registered under the Investment Company Act of 1940 . Fund II is organized under the laws of the Commonwealth of Puerto Rico and has its principal place of business in Puerto Rico . 11. Plaintiff Fund III, formerly known as Puerto Rico Fixed Income Fund III, Inc . , is a closed - end investment company registered under the Investment Company Act of 1940 . Fund III is organized under the laws of the Commonwealth of Puerto Rico and has its principal place of business in Puerto Rico . 12. Plaintiff Fund IV, formerly known as Puerto Rico Fixed Income Fund IV, Inc . , is a closed - end investment company registered under the Investment Company Act of 1940 . Fund IV is organized under the laws of the Commonwealth of Puerto Rico and has its principal place of business in Puerto Rico . 13. Plaintiff Fund V, formerly known as Puerto Rico Fixed Income Fund V, Inc . , is a closed - end investment company registered under the Investment Company Act of 1940 . Fund V Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 6 of 53

7 is organized under the laws of the Commonwealth of Puerto Rico and has its principal place of business in Puerto Rico . 14. Plaintiff PRRTFF I, formerly known as Puerto Rico Investors Tax - Free Fund, Inc . , is a closed - end investment company registered under the Investment Company Act of 1940 . PRRTFF I is organized under the laws of the Commonwealth of Puerto Rico and has its principal place of business in Puerto Rico . 15. Plaintiff PRRTFF IV, formerly known as Puerto Rico Investors Tax - Free Fund IV, Inc . , is a closed - end investment company registered under the Investment Company Act of 1940 . PRRTFF IV is organized under the laws of the Commonwealth of Puerto Rico and has its principal place of business in Puerto Rico . 16. Plaintiff PRRTFF VI, formerly known as Puerto Rico Investors Tax - Free Fund VI, Inc . , is a closed - end investment company registered under the Investment Company Act of 1940 . PRRTFF VI is organized under the laws of the Commonwealth of Puerto Rico and has its principal place of business in Puerto Rico . 17. Plaintiff TFF I, formerly known as Tax - Free Puerto Rico Fund, Inc . , is a closed - end investment company registered under the Investment Company Act of 1940 . TFF I is organized under the laws of the Commonwealth of Puerto Rico and has its principal place of business in Puerto Rico . 18. Defendant Ocean Capital is a Puerto Rico limited liability company that is managed by defendant PRCE . Upon information and belief, several Ocean Capital executive officers are Act 22 beneficiaries, including defendants Hawk, Benjamin Eiler, and Vasileios Sfyris . Upon information and belief, Ocean Capital is taxed as a pass - through entity . Ocean Capital is also a member of the Stockholder Group that signed the May 2021 Stockholder Letter . Ocean Capital Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 7 of 53

8 (together with Hawk as the managing member of Ocean Capital) has disclosed beneficial ownership of the approximate following shares of the Funds’ outstanding common stock: Fund II: 2,548,019 (8.3%) Fund III: 1,922,923 (6.7%) Fund IV: 1,484,659 (4.88%) Fund V: 951,108 (4.62%) PRRTFF I: 1,008,052 (12.7%) PRRTFF IV: 747,335.81 (8.1%) PRRTFF VI: 1,144,408 (5.9%) Fund I: 2,244,816 (8.3%) TFF I: 1,479,364 (13.3%) 19. Defendant PRCE is an investment management firm . PRCE is Ocean Capital’s manager (and thereby controls Ocean Capital) . The principal owners of PRCE are Hawk, Eiler, and Sfyris . Upon information and belief, PRCE is taxed as a pass - through entity . PRCE is headquartered in Alpharetta, Georgia, and organized under the laws of the state of Delaware . 20. Defendant William Heath Hawk is an executive officer of Ocean Capital, and also a member of PRCE (which manages Ocean Capital) . Hawk is one of the purported director nominees for Fund IV and Fund V . Hawk is a resident of Puerto Rico and a beneficiary of Act 22 . Hawk signed the May 2021 Stockholder Letter on Ocean Capital’s behalf . Beyond the shares Hawk is deemed to beneficially own with Ocean Capital, Hawk individually owns the approximate following shares in the Funds : Fund III: 9,906 Fund II: 161,589 Fund IV: 8,805 Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 8 of 53

PRRTFF I: 17,000 PRRTFF IV: 7,000 PRRTFF VI: 34,809 Fund V: 12,200 TFF I: 17,978 21. Defendant Benjamin Eiler is an executive officer of Ocean Capital and a principal owner of PRCE . Eiler is a resident of Puerto Rico and a beneficiary of Act 22 . 6 22. Defendant Vasileios A . Sfyris is an executive officer of Ocean Capital and a principal owner of PRCE . Sfyris is a resident of Puerto Rico and a beneficiary of Act 22 . Sfyris, together with Hawk, PRCE, and Eiler, are the “Controlling Persons . ” 23. Non - party First Southern is a financial services company that services clients in the United States and Puerto Rico, and an affiliate of PRCE and Ocean Capital . Hawk is First Southern’s President and CEO, and Eiler and Sfyris both serve it as managing partners . First Southern has a long history of distressed bond investing, and acted as distributor for several of Santander’s Puerto Rico bond funds that were fully liquidated in 2020 and 2021 . 7 First Southern is organized under the laws of Puerto Rico, and has offices in San Juan, Puerto Rico . 6 Danica Coto, As Middle Class Flees, Puerto Rico Tries Luring Rich People , AP N EWS (Feb . 6 , 2015 ), https : //apnews . com/article/ 91114 c 2 f 7 cf 64516 bbcc 3 c 8 f 7 af 27 adc (“[A]t least 500 people have applied and been approved [for Act 22 ], half of whom have made the move like Eiler [to Puerto Rico] . ”) . 7 See, e . g . , F IRST S OUTHERN , First Puerto Rico Tax - Exempt Fund, Inc . , https : //fssec . com/wp - content/uploads/First - Puerto - Rico - Tax - Exempt - Fund - Annual - Report - 2020 . pdf (noting First Southern acted as Distributor for the First Puerto Rico Tax - Exempt Fund, Inc . , which was fully liquidated as of April 28 , 2021 ) ; F IRST S OUTHERN , First Puerto Rico AAA Fixed Income Fund, Inc . , https : //fssec . com/wp - content/uploads/First - Puerto - Rico - AAA - Fixed - Income - Fund - Annual - Report - 2020 . pdf (noting First Southern acted as Distributor for the First Puerto Rico AAA Fixed Income Fund, Inc . , which was fully liquidated as of July 28 , 2021 ) . 9 Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 9 of 53

24. Defendant José R. Izquierdo II has a principal business address in Puerto Rico and is one of the purported director nominees for Fund I, Fund II, Fund III, Fund IV, Fund V, PRRTFF I, PRRTFF IV, PRRTFF VI, and TFF I. 25. Defendant Brent D . Rosenthal has a principal business address in New Jersey and is one of the purported director nominees for Fund I, Fund II, Fund III, Fund V, PRRTFF I, PRRTFF, IV, PRRTFF VI, and TFF I . 26. Defendant Roxana Cruz - Rivera has a principal business address in Puerto Rico and is one of the purported director nominees for Fund II, Fund III, Fund IV, and Fund V . 27. Defendant Ethan Danial is a resident of Puerto Rico, a beneficiary of Act 22 , and a purported director nominee for Fund II and TFF I . Danial is a member and manager of Defendant RAD Investments, LLC (“RAD”), and signed the May 2021 Stockholder Letter on RAD’s behalf . Danial is also a Vice President at Caribbean Capital & Consultancy Corp . , whose website explains that “[u]nder Act 20 - 22 , our team has established ourselves in San Juan, PR . ” 8 28. Defendant Mojdeh L . Khagan is a resident of Florida and a purported director nominee for PRRTFF I and PRRTFF IV . Khagan is also the mother of Defendant Danial . 29. Defendant Francisco Gonzalez is a member of the Stockholder Group that signed the May 2021 Stockholder Letter and as of that time stated that he owned 9 , 522 shares in PRRTFF IV . Upon information and belief, Gonzalez is also a shareholder in Fund I, Fund II, and Fund III, and has never filed any paperwork with the SEC regarding any of the Funds . 30. Defendant Gustavo Nevarez Torres is a member of the Stockholder Group that signed the May 2021 Stockholder Letter and as of that time stated that he owned 36 , 527 shares in 8 C ARIBBEAN CAPITAL AND CONSULTANCY CORP ., http://www.ccccsj.org/ (last visited Feb. 27, 2022). 10 Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 10 of 53

11 PRRTFF IV . Upon information and belief, Torres is also a shareholder in Fund III and Fund V, and has never filed any paperwork with the SEC regarding any of the Funds . 31. Defendant Alejandro Acosta Riv er a is a m e mb e r of the Stockholder Group that signed the May 2021 Stockholder Le tt e r a nd as o f th a t time stated th a t he owned 4 , 134 shares in PRRTFF IV . Upon in f o r m a tion a nd b e li ef , Riv er a is also a shareholder in PRRTFF I a nd has n e v e r f il e d a ny paperwork with the SEC re g ar ding a ny o f the Funds . 32. Defendant Honne II, LP (“Honne”) is a member of the Stockholder Group that signed the May 2021 Stockholder Letter and as of that time stated that it owned 6 , 300 shares in PRRTFF IV . Upon information and belief, Honne is also a shareholder in Fund V, PRRTFF I, and PRRTFF VI, and has never filed any paperwork with the SEC regarding any of the Funds . 33. Defendant Meir Hurwitz is a member of the Stockholder Group that signed the May 2021 Stockholder Letter and as of that time stated that he owned 4 , 134 shares in PRRTFF IV . Upon information and belief, Hurwitz is also a shareholder in PRRTFF I and has never filed any paperwork with the SEC regarding any of the Funds . 34. Defendant Mario J . Montalvo is a member of the Stockholder Group that signed the May 2021 Stockholder Letter and as of that time stated that he owned 193 , 703 shares in PRRTFF IV . Upon information and belief, Montalvo is also a shareholder in PRRTFF VI and has never filed any paperwork with the SEC regarding any of the Funds . 35. Defendant Jose M . Perez - Gutierrez is a member of the Stockholder Group that signed the May 2021 Stockholder Letter and as of that time stated that he owned 4 , 290 shares in PRRTFF IV . Upon information and belief, Perez - Gutierrez is also a shareholder in PRRTFF I and PRRTFF VI and has never filed any paperwork with the SEC regarding any of the Funds . Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 11 of 53

12 36. Defendant RAD is a member of the Stockholder Group that signed the May 2021 Stockholder Letter and as of that time stated that it owned 431 , 808 shares in PRRTFF IV . Upon information and belief, RAD has never filed any paperwork with the SEC regarding any of the Funds . 37. Defendant Sanzam Investments LLC (“Sanzam”) is a member of the Stockholder Group that signed the May 2021 Stockholder Letter and as of that time stated that it owned 14 , 397 shares in PRRTFF IV . Upon information and belief, Sanzam has never filed any paperwork with the SEC regarding any of the Funds . 38. Defendant Juan E . Soto Alvarado is a member of the Stockholder Group that signed the May 2021 Stockholder Letter and as of that time stated that he owned 10 , 730 shares in PRRTFF IV . Upon information and belief, Alvarado has never filed any paperwork with the SEC regarding any of the Funds . 39. Defendant Sandra Calderon is a member of the Stockholder Group that signed the May 2021 Stockholder Letter and as of that time stated that she owned 53 , 740 shares in PRRTFF IV . Upon information and belief, Calderon is also a shareholder in Fund V and has never filed any paperwork with the SEC regarding any of the Funds . 40. Defendant the Estate of Jose Hidalgo (“Hidalgo”) is a member of the Stockholder Group that signed the May 2021 Stockholder Letter and as of that time stated that it owned 7 , 210 shares in PRRTFF IV . Upon information and belief, Hidalgo has never filed any paperwork with the SEC regarding any of the Funds . 41. Defendant Avraham Zeines is a member of the Stockholder Group that signed the May 2021 Stockholder Letter and as of that time stated that he owned 15 , 000 shares in PRRTFF Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 12 of 53

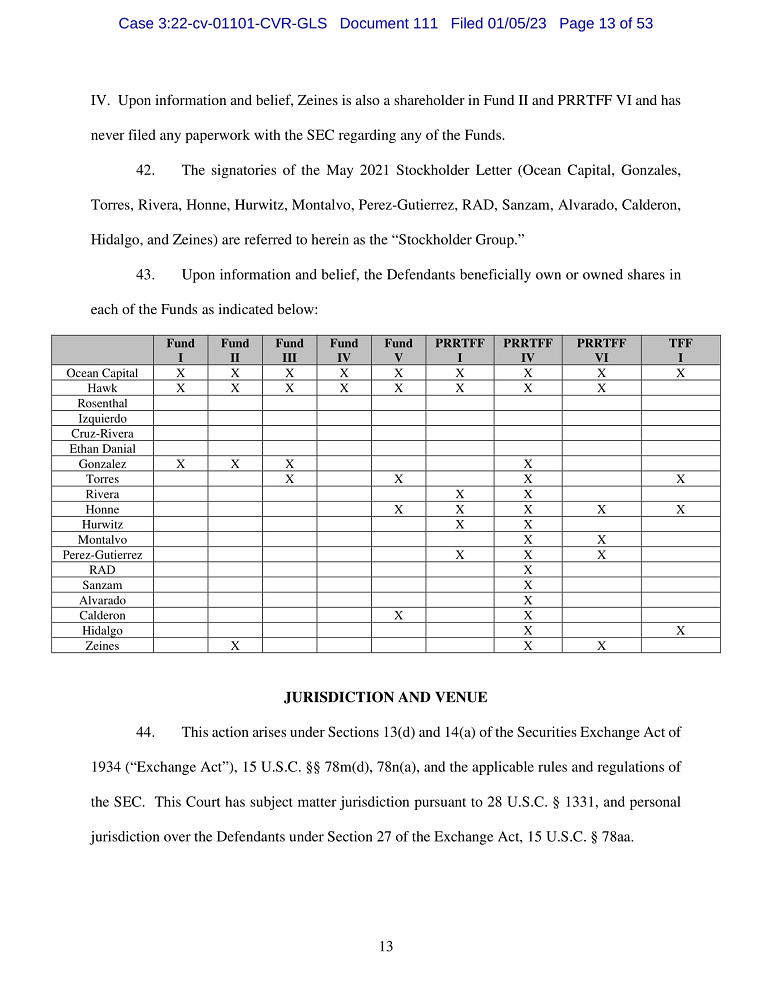

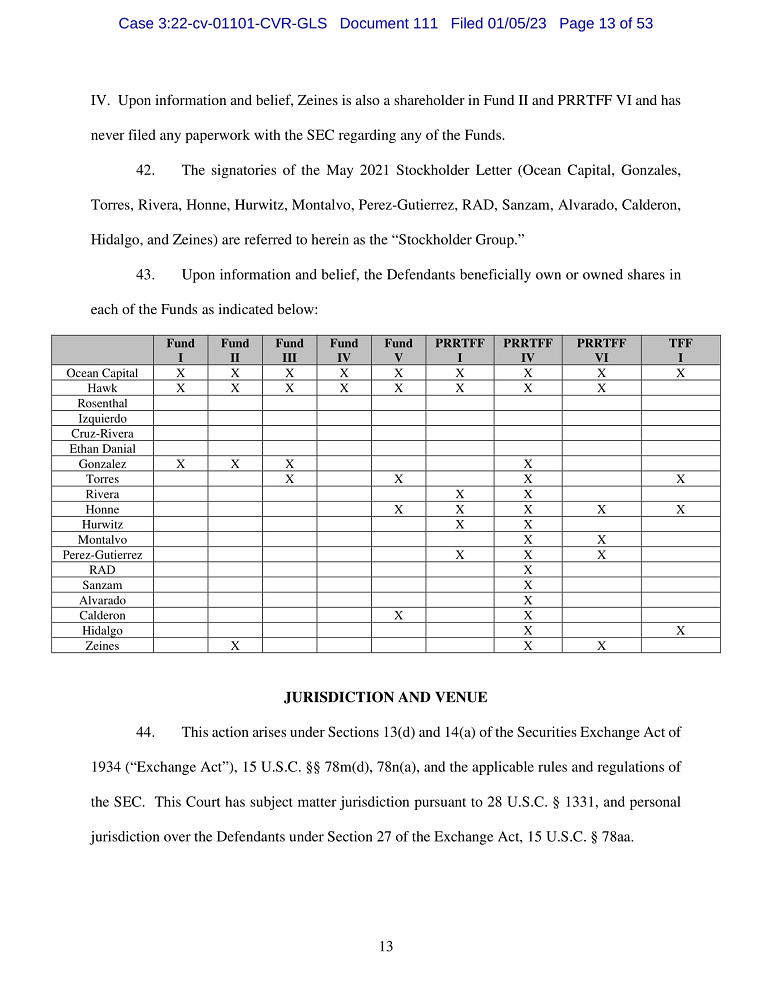

13 IV. Upon information and belief, Zeines is also a shareholder in Fund II and PRRTFF VI and has never filed any paperwork with the SEC regarding any of the Funds . 42. The signatories of the May 2021 Stockholder Letter (Ocean Capital, Gonzales, Torres, Rivera, Honne, Hurwitz, Montalvo, Perez - Gutierrez, RAD, Sanzam, Alvarado, Calderon, Hidalgo, and Zeines) are referred to herein as the “Stockholder Group . ” 43. Upon information and belief, the Defendants beneficially own or owned shares in each of the Funds as indicated below : Fund I Fund II Fund III Fund IV Fund V PRRTFF I PRRTFF IV PRRTFF VI TFF I Ocean Capital X X X X X X X X X Hawk X X X X X X X X Rosenthal Izquierdo Cruz - Rivera Ethan Danial Gonzalez X X X X Torres X X X X Rivera X X Honne X X X X X Hurwitz X X Montalvo X X Perez - Gutierrez X X X RAD X Sanzam X Alvarado X Calderon X X Hidalgo X X Zeines X X X JURISDICTION AND VENUE 44 . This action arises under Sections 13 (d) and 14 (a) of the Securities Exchange Act of 1934 (“Exchange Act”), 15 U . S . C . †† 78 m(d), 78 n(a), and the applicable rules and regulations of the SEC . This Court has subject matter jurisdiction pursuant to 28 U . S . C . † 1331 , and personal jurisdiction over the Defendants under Section 27 of the Exchange Act, 15 U . S . C . † 78 aa . Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 13 of 53

45. Venue in this District is proper under Section 27 of the Exchange Act, 15 U . S . C . † 78 aa, and 28 U . S . C . † 1391 . Various acts or transactions constituting the offenses described herein, relating to public statements regarding the election of directors of Puerto Rico - based closed - end mutual funds, occurred in or targeted the District of Puerto Rico . And further, upon information and belief, most of the Defendants are residents of Puerto Rico . FACTUAL BACKGROUND 46. The Funds are a collection of closed - end mutual funds that invest primarily in securities of Puerto Rico issuers, including Puerto Rico municipal bonds . The Funds distribute dividends to their shareholders monthly ; most shareholders are senior citizens who invest in, and rely on, the Funds as a source of reliable, long - term retirement income . 47. The Funds’ investors are primarily Puerto Rico residents . As Puerto Rico residents, they do not pay U . S . federal income taxes on Puerto Rico source income, but unlike certain of the Defendants, they do pay Puerto Rico income tax . 48. Each year, the Funds hold annual meetings at which their respective shareholders elect directors for the coming year and vote on other matters . 49. Defendants are a web of interrelated individuals and entities that all share one common thread : Defendants are organized or operated by Hawk and his associates, and seek liquidation of the Funds as a short - term payout subject to little or no taxation . 50. Defendant Hawk organized First Southern in Georgia in 2010 . 9 First Southern is managed and controlled by its three managing members : Hawk (also its CEO), and two of his associates : Vasileios Sfyris and Benjamin Eiler . Upon information and belief, Hawk, Sfyris, and 9 First Southern appears to have been formed as First Southern Securities LLC (“FSS”) and in 2020 FSS transferred all of its business to First Southern. 14 Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 14 of 53

15 Eiler own between 25 and 50 percent of First Southern . First Southern — which has a history of facilitating the liquidation of various mutual funds that are similarly situated to the Funds — acts as a broker for most of the members of the Stockholder Group, and has aided in their campaign by delivering dissident materials to the Funds . 51. PRCE, one of First Southern’s affiliates, is an investment management firm that focuses on closed - end mutual funds based in Puerto Rico . One of PRCE’s stated investment objectives is to “effectuate a disposition of the assets of any Underlying Fund by effectuating a change in the composition of the board of directors of an Underlying Fund or liquidating such Underlying Fund . ” 52. PRCE’s principal owners are Hawk, Sfyris, and Eiler . PRCE is the manager of (and therefore controls) Ocean Capital . Ocean Capital’s executive officers are Hawk, Sfyris, Eiler, and Rafael Pagan Marxuach . 53. Defendants seek to impose their agenda on the Funds and their respective shareholders by forcing a near - term liquidation of the Funds’ assets through which those with Act 22 status would reap a substantial, tax - free distribution . Indeed, the capital gains realized by Act 22 grantees upon any such liquidation would be expected to be wholly exempt from federal and Puerto Rico income taxes ; Puerto Rico residents, in contrast, would generally pay Puerto Rico taxes upon such distribution . May 2021 : The Stockholder Group Seeks Liquidation of PRRTFF IV 54. In May 2021 , a group of PRRTFF IV shareholders self - described as “the Stockholder Group” delivered the May 2021 Stockholder Letter (via Hawk and First Southern) seeking to change the investment objectives of PRRTFF IV “[t]o return to shareholders the net assets of [PRRTFF IV] by or before January 31 , 2022 ,” and provided as follows : Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 15 of 53

***** In other words, the “Stockholder Group” sought to liquidate PRRTFF IV . 55. Upon information and belief, many members of the Stockholder Group use First Southern as their broker . 56. Section 13 (d) of the Exchange Act and the rules promulgated thereunder require that investors acting as a group for purposes of acquiring, holding, or trading the stock of an issuer disclose the group’s existence and make plain their intentions through a Schedule 13 D, which must be filed with the SEC within ten days after the group members collectively acquire the beneficial ownership of 5 % or more of the issuer’s stock . 17 C . F . R . † 240 . 13 d - 1 . 10 57. Despite self - describing as a “Stockholder Group” and acting together with regard to PRRTFF IV’s stock, none of the Defendants filed a Schedule 13 D relating to PRRTFF IV or 10 Further, Rule 13 d - 101 outlines the information that must be disclosed in a Schedule 13 D, including the names of each member thereof . Item 6 thereof also requires disclosure of any “contracts, arrangements, understandings or relationships (legal or otherwise)” among members of the group, and “naming the persons with whom such contracts, arrangements, understandings or relationships have been entered into . ” 17 C . F . R . † 240 . 13 d - 101 . Case 3:22 - cv - 01101 - CVR - GLS 16 Document 111 Filed 01/05/23 Page 16 of 53

any of the other Funds. The Stockholder Group existed no later than May 2021; Plaintiffs are presently without knowledge as to when the Stockholder Group was first formed. June - July 2021 : Ocean Capital Expands The Campaign and Seeks to Nominate Directors For Fund IV and Fund V 58. On June 29 , 2021 , Fund IV and Fund V filed their definitive proxy statements setting their 2021 annual meetings for July 29 , 2021 . 11 59. Ocean Capital and the Stockholder Group soon expanded their efforts to those Funds . By letters dated July 9 , 2021 , Ocean Capital sought to nominate Cruz - Rivera, Hawk, and Izquierdo for Fund IV, and Cruz - Rivera, Hawk, Izquierdo, and Rosenthal for Fund V . 60. The July 9 nomination notices failed to comply with the pertinent Fund’s articles of incorporation and bylaws and were consequently rejected by the Fund’s Board of Directors . Ocean Capital sent a letter disagreeing with this conclusion, but did not challenge the Board’s determination in court . 61. Notwithstanding the rejection of their nominations, on July 22 , 2021 , the Nominating Parties launched a proxy campaign relating to Fund IV and Fund V . This began with the launch of a public website and issuance of a letter to shareholders (each filed with the SEC, and together the “July 22 Letters”) . 12 62. The July 22 Letters are materially false and misleading in several respects and therefore violate the federal securities laws . 11 The July 29 meeting dates were subsequently adjourned for Fund IV and Fund V, and are now currently scheduled for December 15 , 2022 . 12 Fund IV, Proxy Statement Pursuant to Section 14 (a) of the Securities Exchange Act of 1934 (Schedule 14 A) (July 22 , 2021 ) https : //www . sec . gov/Archives/edgar/data/ 0001847305 / 000121390021038160 /ea 144628 - dfan 14 a_ocean . htm ; Fund V, Proxy Statement Pursuant to Section 14 (a) of the Securities Exchange Act of 1934 (Schedule 14 A) (July 22 , 2021 ) https : //www . sec . gov/Archives/edgar/data/ 1838395 / 000121390021038024 /ea 144601 - dfan 14 a_ocean . htm . 17 Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 17 of 53

18 63. The July 22 Letters state that the Nominating Parties have formed a “Coalition of Concerned UBS Closed - End Bond Fund Investors,” and claim their purpose is to “effectively advocate for improved governance at Fund IV and Fund V . ” 64. The July 22 Letters, however, do not disclose who is part of this “Coalition” ; rather, the only shareholder participants identified are Ocean Capital and Hawk, thereby concealing from the Funds’ shareholders the interests of others in the “Coalition” (nor did they disclose the existence of or the identities of those among the Stockholder Group) . 65. The July 22 Letters also explained that the Nominating Parties would evaluate “all avenues to maximizing value,” including “a share repurchase program [and] liquidating the funds to realize their respective net asset values . . . . ” But the Letters did not inform the Funds’ shareholders that the Nominating Parties are clearly intent on just one of those options : a liquidation . Further, the July 22 Letters did not disclose that Hawk and certain other Ocean Capital principals are beneficiaries of Act 22 and would therefore benefit from a liquidation in a manner distinct from most of the Funds’ shareholders because they would receive their distribution entirely tax - free . 66. The July 22 Letters go on to describe management of Fund IV and Fund V as follows : The directors of Fund IV and Fund V have demonstrated an apparent disregard for shareholder democracy by ignoring all of our constructive efforts to resolve our concerns before we initiated these campaigns for change . It seems to us that the directors of Fund IV and Fund V are more concerned with preserving their roles than safeguarding shareholders’ resources and allowing fair elections to occur . 67. This statement is materially misleading because there is no factual support for the Nominating Parties’ claim that the funds have disregarded “shareholder democracy . ” Fund IV and Fund V acted pursuant to their governing documents in rejecting Ocean Capital’s nomination Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 18 of 53

notices, and in the nearly six months since Fund IV and Fund V noticed their rejection, the Nominating Parties have not raised any legal challenge . 68. On July 26 , 2021 , the Nominating Parties updated their website to add the heading “The Coalition of Concerned UBS Closed - End Bond Fund Investors” (the “July 26 Statement”) . 13 This too did not disclose any members of the “Coalition” beyond Hawk and Ocean Capital, thereby hiding the interests of its other members (nor did it disclose the existence of or the identities of those among the Stockholder Group) . 69. On July 28 , 2021 , the Nominating Parties filed definitive proxies for Fund IV and Fund V (respectively, the “Fund IV Definitive Proxy” and the “Fund V Definitive Proxy”) . 14 Each states that : Except as set forth in this Proxy Statement . . . no associate of any Participant owns beneficially, directly or indirectly, any securities of the Fund . . . . Except as set forth in this Proxy Statement, (i) there are no arrangements or understandings between Ocean Capital or its affiliates and the Nominees or any other person or persons pursuant to which the nominations are to be made by Ocean Capital, other than the consent by each Nominee to be named in this Proxy Statement and to serve as a director of the Fund, if elected as such at the Annual Meeting . . . . 70. Each of the Fund IV and Fund V Definitive Proxy are materially false and misleading because they failed to disclose ( 1 ) the existence of the Stockholder Group and Coalition 13 19 Fund IV, Information Required in Proxy Statement (Schedule 14A Information) (July 27, 2021) https : //www . sec . gov/Archives/edgar/data/ 1838395 / 000121390021038767 /ea 144825 - dfan 14 a_ocean . htm ; Fund V, Information Required in Proxy Statement (Schedule 14 A Information) (July 27 , 2021 ) https : //www . sec . gov/Archives/edgar/data/ 1838395 / 000121390021038768 /ea 144826 - dfan 14 a_ocean . htm . 14 Fund IV, Definitive Proxy Statement (Schedule 14A) (July 28, 2021) https : //www . sec . gov/Archives/edgar/data/ 1838395 / 000121390021039133 /defc 14 a 0721 _puertorico 4 . htm ; Fund V, Definitive Proxy Statement (Schedule 14 A) (July 28 , 2021 ) https : //www . sec . gov/Archives/edgar/data/ 1838395 / 000121390021039130 /defc 14 a 0721 _puertorico 5 . htm . Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 19 of 53

and their support for the Nominees and (2) the members thereof who owned shares in each (which upon information and belief for Fund V include Defendants Torres, Honne, and Calderon). 71. As of the end of July 2021 , none of the Defendants had filed a Schedule 13 D relating to any of the Funds . August 2021 : The Nominating Parties Falsely Suggest That Their Interests are Aligned With Other Fund Shareholders 72. On August 24 , 2021 , the Nominating Parties issued a letter to Fund IV and Fund V shareholders, both filed with the SEC as additional definitive proxy materials (collectively the “August 24 Letters”) . 15 73. The August 24 Letters state, among other things, that “Ocean Capital’s significant ownership in Fund IV and Fund V means our interests are squarely aligned with shareholders – we are not looking to ‘extract short - term profits’ at the expense of our fellow investors . ” They also state that “Ocean Capital is not a 20 / 22 Act Company and therefore does not enjoy tax benefits under those statutes . ” The August 24 Letters close by suggesting investors “visit our website . . . to learn about our campaigns and the Coalition of Concerned UBS Closed - End Bond Fund Investors . ” 74. These statements in the August 24 Letters are materially false and misleading for several reasons and therefore violate the federal securities laws . 75. First, they do not disclose Defendants’ plan or intent to liquidate the Funds, which is a paradigmatic attempt to generate a short - term return and directly contradicts the claim that they are not seeking to “extract short - term profits . ” 15 See Fund IV, Information Required in Proxy Statement (Schedule 14 A Information) (Aug . 24 , 2021 ) https : //www . sec . gov/Archives/edgar/data/ 1838395 / 000121390021044532 /ea 146365 - dfan 14 a_oceancap . htm ; Fund V, Information Required in Proxy Statement (Schedule 14 A Information) (Aug . 24 , 2021 ) https : //www . sec . gov/Archives/edgar/data/ 1838395 / 000121390021044534 /ea 146370 - dfan 14 a_oceancap . htm . 20 Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 20 of 53

76. Second, the August 24 Letters are materially misleading because Defendants’ interests are not “squarely aligned with shareholders . ” Although the Nominating Parties chose to disclose that “Ocean Capital is not a 20 / 22 Act Company,” they fail to disclose that upon information and belief Ocean Capital’s principals, including Hawk, are beneficiaries of Act 22 , unlike most other Fund shareholders . 16 Hawk, therefore, would pay no Puerto Rico taxes (and as with all Puerto Rico residents, no federal taxes) on any liquidation distribution, while most Fund investors would have to do so . The statement that “Ocean Capital is not a 20 / 22 Act Company and therefore does not enjoy tax benefits under those statutes” thus appears to be intentionally misleading . 77. Finally, although these Letters again reference the “Coalition of Concerned UBS Closed - End Bond Fund Investors,” they again do not identify those individuals or entities (and likewise hide the existence of and identities of those among the Stockholder Group) . 78. As of the end of August 2021 , none of the Defendants had filed a Schedule 13 D relating to any of the Funds . September 2021 : The Nominating Parties’ Misinformation Campaign Continues 79. On September 2 , 2021 , the Nominating Parties issued a statement on their website (the “September 2 Statement”) . 17 80. That statement begins : 16 The same holds for others behind the scenes, like Eiler and Sfyris. 17 See Fund IV, Information Required in Proxy Statement, Exhibit 1 (Schedule 14 A Information) (Aug . 24 , 2021 ) https : //www . sec . gov/Archives/edgar/data/ 1838395 / 000121390021046371 /ea 146868 ex - 1 _ocean . htm ; Fund V, Information Required in Proxy Statement, Exhibit 1 (Schedule 14 A Information) (Aug . 24 , 2021 ) https : //www . sec . gov/Archives/edgar/data/ 1838395 / 000121390021046383 /ea 146869 ex - 1 _ocean . htm . 21 Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 21 of 53

81. Beyond highlighting their — still unexplained (and therefore, false and misleading) — “Coalition,” the September 2 Statement also goes on to claim that Izquierdo “has significant public company board experience . ” 82. Upon information and belief, Izquierdo has never served on any public company board . The September 2 Statement is therefore materially false and misleading . 83. Days later, Defendants expanded their efforts further . 84. On September 17 , 2021 , Fund I and Fund III filed preliminary proxy statements setting an annual meeting date of October 28 , 2021 . 18 On September 21 , 2021 , PRRTFF VI filed its definitive proxy statement, setting an annual meeting date of October 26 , 2021 . 19 85. On September 27 , 2021 , the Nominating Parties issued an open letter to shareholders announcing a proxy campaign relating to Fund I, Fund III, and PRRTFF VI . 18 Both Fund I and Fund III filed definitive proxy statements on September 30, 2021. The October 28, 2021 meeting was subsequently adjourned for both funds, and is currently scheduled for December 15, 2022. 19 The October 26 meeting date was subsequently adjourned, and is now currently scheduled for December 15, 2022. Case 3:22 - cv - 01101 - CVR - GLS 22 Document 111 Filed 01/05/23 Page 22 of 53

86. The following day, the Nominating Parties updated their website with a statement to shareholders (the “September 28 Statement”). 20 The September 28 Statement begins: 87. This, again, did not disclose any members of the “Coalition” beyond Hawk and Ocean Capital, thereby hiding the interests of its other members (and likewise not disclosing the existence of the identities of those among the Stockholder Group) . 88. The September 28 Statement is materially misleading because it either (i) does not disclose the remaining shareholders who are part of the “Coalition,” or (ii) if no other shareholders beyond Ocean Capital and Hawk are involved, creates the misleading impression of broad shareholder support with use of the term “Coalition” to refer to only two shareholders . 89. The September 28 Statement also asserts that the total returns since inception for PRRTFF VI are “ - 0 . 81 % . ” 20 See Fund I, Information Required in Proxy Statement (Schedule 14A Information) (Sept. 28, 2021) https://www.sec.gov/Archives/edgar/data/1838395/000121390021050237/ea148015 - dfan14a_oceanfund1.htm ; Fund III, Information Required in Proxy Statement (Schedule 14A Information) (Sept. 28, 2021) https://www.sec.gov/Archives/edgar/data/1838395/000121390021050242/ea148017 - dfan14a_oceanfund3.htm ; PRRTFF VI, Information Required in Proxy Statement (Schedule 14A Information) (Sept. 28, 2021), https://www.sec.gov/Archives/edgar/data/0001847283/000121390021050225/ea148016 - dfan14a_oceanfund6.htm . Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 23 of 53 23

90. This statement is materially false; PRRTFF VI has delivered positive reinvestment returns since inception of 2.69%. 91. The September 28 Statement also states: We also find it notable that regulators such as the U . S . Securities and Exchange Commission and the Financial Industry Regulatory Authority opened up inquiries into UBS and its Puerto Rico closed - end bond funds . Regulators contended UBS and its executives made material misrepresentations related to the funds . Ultimately, UBS has paid tens of millions of dollars as part of settlements since the spring of 2012 . 21 92. These statements refer to certain cease and desist proceedings initiated by the U . S . Securities and Exchange Commission (“SEC”) captioned In the Matter of Miguel Ferrer and Carlos J . Ortiz . The Nominating Parties’ statement is materially misleading because it fails to disclose that, at the conclusion of the administrative proceedings, an administrative law judge of the SEC found UBS did not make misrepresentations in its prospectuses, brochures, and literature, and found the UBS’ executives did not breach their fiduciary duties . Indeed, directly contrary to the Nominating Parties’ statements, in dismissing the proceedings against the UBS executives 22 in full the administrative law judge found, among other things : UBS PR did not make misrepresentations or omissions to customers or FAs in prospectuses, brochures or other documents . 23 93. In a similar vein, the September 28 Statement also asserts that the “former UBS Group AG Chief Executive Officer stated, ‘we could have done things better’ with respect to the 21 September 28 Statement (emphasis added). 22 UBS Financial Services Inc. of Puerto Rico separately settled the matter without admitting or denying the allegations against it. 24 23 In the Matter of Miguel A. Ferrer, File No. 3 - 14862 (Oct. 29, 2013), https://www.sec.gov/alj/aljdec/2013/id513bpm.pdf ; In the Matter of Miguel A. Ferrer, File No. 3 - 14862 (Dec. 17, 2013) https://www.sec.gov/alj/aljdec/2013/33 - 9496.pdf . Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 24 of 53

Funds.” This too is false and misleading. The statement to which Defendants refer, with context, is: When you go back and you look at the situation, you could always argue that we could have done things better, or some people could have behaved better . 24 94. Despite this flurry of public statements, including several referencing their “Coalition,” as of the end of September 2021 , Defendants had not filed any Schedule 13 D with respect to any of the Funds . October 2021 - February 2022 : Defendants Finally File Incomplete Schedule 13 Ds And Continue To Make Misrepresentations to the Funds’ Shareholders 95. Several months later, incomplete Schedule 13 Ds were filed for six of the Funds (Fund I, Fund II, Fund III, PRRTFF I, PRRTFF IV, and PRRTFF VI), and to date, Schedule 13 Ds have not been filed for two of the Funds (Fund IV and Fund V) . 96. On October 6 , 2021 , nearly five months after the Stockholder Group first sent their May 2021 Stockholder Letter, Ocean Capital, Hawk, Izquierdo, and Rosenthal filed a Schedule 13 D pertaining to Fund I (as amended, the “Fund I Schedule 13 D”) . 25 The Fund I Schedule 13 D disclosed that Ocean Capital and Hawk beneficially owned 2 , 244 , 816 shares of Fund I, comprising 8 . 3 % of Fund I’s outstanding stock, and that neither Izquierdo nor Rosenthal beneficially owned any shares of Fund I . It did not disclose anything about any of the other members of the “Stockholder Group” or the “Coalition,” including those identified above who, upon information and belief, had owned shares of Fund I (including Defendant Gonzalez, see supra ¶ 41 ) . 24 Dawn Giel et al., UBS Group CEO on Puerto Rico: ‘We could have done things better , CNBC (June 18, 2018), https://www.cnbc.com/2018/06/18/ubs - group - ceo - on - puerto - rico - we - could - have - done - things - better.html . 25 25 See Fund I, Schedule 13D (Oct. 6, 2021) https://www.sec.gov/Archives/edgar/data/1838395/000121390021051548/ea148457 - 13docean_taxfree.htm ; Fund I, Schedule 13D (Amendment No. 6) (June 7, 2022) https://www.sec.gov/Archives/edgar/data/1850862/000121390022031413/ea161209 - 13da6ocean_taxfree.htm. Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 25 of 53

97. Also on October 6 , 2021 , the Nominating Parties filed a Schedule 13 D for Fund III (as amended, the “Fund III Schedule 13 D”) . 26 The Fund III Schedule 13 D disclosed that Ocean Capital and Hawk beneficially owned 1 , 922 , 923 shares of Fund III, comprising 6 . 7 % of Fund III’s outstanding common stock ; that Hawk beneficially owned an additional 9 , 906 shares of Fund III ; and that none of Rosenthal, Izquierdo, and Cruz - Rivera beneficially owned any shares of Fund III . It did not disclose anything about any of the other members of the “Stockholder Group” or the “Coalition,” including those identified above who, upon information and belief, had owned shares of Fund III (including Defendants Gonzalez and Torres, see supra ¶ 41 ) . 98. On October 6 , 2021 , Ocean Capital, Hawk, Rosenthal, and Izquierdo filed a Schedule 13 D for PRRTFF VI (as amended, the “PRRTFF VI Schedule 13 D”) . 27 The PRRTFF VI Schedule 13 D disclosed that Ocean Capital and Hawk beneficially owned 1 , 144 , 408 shares of PRRTFF VI, comprising 5 . 9 % of PRRTFF VI’s outstanding stock ; that Hawk beneficially owned an additional 34 , 809 shares ; and that neither Rosenthal nor Izquierdo beneficially owned any shares of PRRTFF VI . It did not disclose anything about any of the other members of the “Stockholder Group” or the “Coalition,” including those identified above who, upon information and belief, had owned shares of PRRTFF VI (including Defendants Honne, Montalvo, Perez - Gutierrez, and Zeines, see supra ¶ 41 ) . 26 26 See Fund III, Schedule 13D (Oct. 6, 2021) https://www.sec.gov/Archives/edgar/data/1838395/000121390021051556/ea148458 - 13doce_taxfree3.htm ; Fund III Schedule 13D (Amendment No. 6) (June 7, 2022) https://www.sec.gov/Archives/edgar/data/1847304/000121390022031409/ea161211 - 13da6ocean_taxfree3.htm . 27 See PRRTFF VI, Schedule 13D (Oct. 6, 2021) https://www.sec.gov/Archives/edgar/data/0001847283/000121390021051551/ea148456 - 13docean_puerto6.htm ; PRRTFF VI, Schedule 13D (Amendment No. 8) (Oct. 3, 2022) https://www.sec.gov/Archives/edgar/data/1847283/000121390022060938/ea166590 - 13da8ocean_puerto6.htm . Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 26 of 53

99. On October 12, 2021, the Nominating Parties filed definitive proxies for Fund I, Fund III, and PRRTFF VI (respectively, the “Fund I Definitive Proxy,” the “Fund III Definitive Proxy,” and the “PRRTFF VI Definitive Proxy”). 28 Each states that: Except as set forth in this Proxy Statement . . . no associate of any Participant owns beneficially, directly or indirectly, any securities of the Fund . . . . Except as set forth in this Proxy Statement, (i) there are no arrangements or understandings between Ocean Capital or its affiliates and the Nominees or any other person or persons pursuant to which the nominations are to be made by Ocean Capital, other than the consent by each Nominee to be named in this Proxy Statement and to serve as a director of the Fund, if elected as such at the Annual Meeting . . . . 100. The Fund I Definitive Proxy is materially false and misleading because it failed to disclose ( 1 ) the existence of the Stockholder Group and Coalition and their support for the Nominees and ( 2 ) the members thereof who owned shares in Fund I (which upon information and belief include Defendant Gonzalez) . 101. The Fund III Definitive Proxy is materially false and misleading because it failed to disclose ( 1 ) the existence of the Stockholder Group and Coalition and their support for the Nominees and ( 2 ) the members thereof who owned shares in Fund III (which upon information and belief include Defendants Gonzalez and Torres) . 102. The PRRTFF VI Definitive Proxy is materially false and misleading because it failed to disclose ( 1 ) the existence of the Stockholder Group and Coalition and their support for the Nominees and ( 2 ) the members thereof who owned shares in PRRTFF VI (which upon information and belief include Defendants Honne, Montalvo, Perez - Gutierrez, and Zeines) . 28 27 Fund I, Definitive Proxy Statement (Schedule 14A) (Oct. 12, 2021) https://www.sec.gov/Archives/edgar/data/1838395/000121390021052235/defc14a1021_oceancap.htm ; Definitive Proxy Statement (Schedule 14A) (Oct. 12, https://www.sec.gov/Archives/edgar/data/1838395/000121390021052234/defc14a1021_oceancap3.htm ; VI, Definitive Proxy Statement (Schedule 14A) (Oct. 12, Fund III, 2021) PRRTFF 2021) https://www.sec.gov/Archives/edgar/data/0001847283/000121390021052233/defc14a1021_oceancapfund6.htm . Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 27 of 53

103. On October 14, 2021, the Nominating Parties issued a letter to shareholders for Fund I, Fund III, and PRRTFF VI, which they filed with the SEC as definitive additional materials (the “October 14 Letters”). 29 104. The October 14 Letters state in part: While UBS claims that its preferred nominees have “a long - standing commitment to the Fund[s] and its shareholders,” the reality is that these directors are most experienced in presiding over significant value destruction while collecting six - figure annual salaries . We seriously question how the Boards can attempt to solicit shareholder support for the incumbent directors when these individuals have practically no meaningful shareholdings and recently reduced the September 30 th dividend for Funds I and III . As shareholders have suffered over the years, Vicente León, Carlos Nido, Luis M . Pellot, Carlos V . Ubiñas and José J . Villamil have collectively received millions in compensation and failed to purchase meaningful shares on the open market . 30 105. These statements are materially false and misleading because they suggest that these individuals received such compensation from the Funds at which they have been nominated . In fact, the Fund I directors up for election — Vicente León and José J . Villamil — and the Fund III directors up for election — Vicente León, Carlos V . Ubiñas and José J . Villamil — each received no compensation from those respective Funds in the last fiscal year . 31 And as for PRRTFF VI, in the 29 28 See Fund I, Information Required in Proxy Statement (Schedule 14A Information) (Oct. 14, https://www.sec.gov/Archives/edgar/data/1838395/000121390021052818/ea148885 - dfan14a_oceancap.htm ; III, Information Required in Proxy Statement (Schedule 14A Information) (Oct. 14, 2021) Fund 2021) https://www.sec.gov/Archives/edgar/data/1838395/000121390021052820/ea148886 - dfan14a_oceancap.htm ; PRRTFF VI, Information Required in Proxy Statement (Schedule 14A Information) (Oct. 14, 2021) https://www.sec.gov/Archives/edgar/data/0001847283/000121390021052819/ea148887 - dfan14a_oceancap.htm . 30 October 14 Letters (emphasis added). 31 Fund I, Definitive Proxy Statement (Schedule 14A) (Sept. 30, 2021) https : //www . sec . gov/Archives/edgar/data/ 0001850862 / 000119312521288119 /d 155566 ddefc 14 a . htm ; Fund III, Definitive Proxy Statement (Schedule 14 A) (Sept . 30 , 2021 ) https : //www . sec . gov/Archives/edgar/data/ 0001847304 / 000119312521288108 /d 183084 ddefc 14 a . htm . Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 28 of 53

last fiscal year Mr . Nido was paid $ 11 , 085 and Mr . Pellot was paid $ 11 , 251 . 32 The Nominating Parties fail to disclose that the compensation amounts included in the October 14 Letters are instead aggregate sums paid to all directors for services rendered across 26 total funds . Defendants’ assertions regarding the Funds’ directors’ compensation are blatantly false, intentionally inflammatory, and misleading . 106. Additionally, the October 14 Letter is materially misleading as it criticizes certain incumbent directors as having “no meaningful shareholdings,” while at the same time failing to mention that the Nominating Parties have proposed three director candidates with no disclosed holdings in the Funds (Izquierdo, Rosenthal, and Cruz - Rivera) . 107. In a November 9 statement to shareholders for Fund IV and Fund V, which the Nominating Parties filed with the SEC as definitive additional materials, those Defendants reiterated several of their false and misleading claims (the “November 9 Statement”) . 33 108. The November 9 Statement again referenced the “Coalition of Concerned Closed - End Bond Fund Investors,” but the statements did not disclose the identities of that “Coalition” beyond Ocean Capital and Hawk (or the existence or identities of any member of the Stockholder Group) . 109. The November 9 Statement also states that Izquierdo has “[s]ignificant public company board experience” but does not disclose any such experience . Upon information and belief, Izquierdo has never served on any public company board . 32 29 PRRTFF VI, Definitive Proxy Statement (Sept. 21, 2021) https://www.sec.gov/Archives/edgar/data/0001847283/000119312521278415/d225314ddef14a.htm 33 See Fund IV, Information Required in Proxy Statement (Schedule 14 A Information) (Nov . 9 , 2021 ) https : //www . sec . gov/Archives/edgar/data/ 1838395 / 000121390021057412 /ea 150155 - dfan 14 a_oceancap 4 . htm ; Fund V, Information Required in Proxy Statement (Schedule 14 A Information) (Nov . 9 , 2021 ) https : //www . sec . gov/Archives/edgar/data/ 1838395 / 000121390021057414 /ea 150156 - dfan 14 a_oceancap 5 . htm . Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 29 of 53

110. On November 12, 2021 PRRTFF I filed a definitive proxy setting its meeting date for December 21 , 2021 . 34 111. On November 16 , 2021 , Ocean Capital, Hawk, Rosenthal, and Izquierdo filed a Schedule 13 D for PRRTFF I (as amended, the “PRRTFF I Schedule 13 D”) . 35 The PRRTFF I Schedule 13 D disclosed that Ocean Capital and Hawk beneficially owned 1 , 008 , 052 shares of PRRTFF I, comprising 12 . 7 % of PRRTFF I’s outstanding stock ; that Hawk beneficially owned an additional 17 , 000 shares of PRRTFF I ; and that neither Rosenthal, Izquierdo, Ethan Danial or Mojdeh Khaghan beneficially owned any shares of PRRTFF I . The PRRTFF I Schedule 13 D does not disclose anything about any of the other members of the “Stockholder Group” or the “Coalition,” including those identified above who, upon information and belief, had owned shares of PRRTFF I (including Defendants Rivera, Honne, Hurwitz, and Perez - Gutierrez, see supra ¶ 41 ) . 112. The following day, Ocean Capital, Hawk, Rosenthal, and Izquierdo also filed a Schedule 13 D for PRRTFF IV (as amended, the “PRRTFF IV Schedule 13 D”) . 36 The PRRTFF IV Schedule 13 D disclosed that Ocean Capital and Hawk beneficially owned 747 , 335 . 81 shares of PRRTFF IV, comprising 8 . 1 % of PRRTFF IV’s outstanding stock ; that Hawk beneficially owned an additional 7 , 000 shares of PRRTFF IV ; and that neither Rosenthal nor Izquierdo 34 The December 21, 2021 meeting date was subsequently adjourned and was held on March 17, 2022. 30 35 See PRRTFF I, Schedule 13D (Nov. 16, 2021) https://www.sec.gov/Archives/edgar/data/0001843995/000121390021059691/ea150673 - 13docean_puerto.htm ; PRRTFF I, Schedule 13D (Amendment No. 7) (Nov. 22, 2022) https://www.sec.gov/Archives/edgar/data/1843995/000121390022074315/ea169076 - 13da7ocean_puerto.htm . 36 See PRRTFF IV, Schedule 13D (Nov. 17, 2021) https://www.sec.gov/Archives/edgar/data/0001847286/000121390021060174/ea150898 - 13docean_puerto4.htm ; PRRTFF IV, Schedule 13D (Amendment No. 3) (June 7, 2022) https://www.sec.gov/Archives/edgar/data/1847286/000121390022031415/ea161213 - 13da3ocean_puerto4.htm . Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 30 of 53

beneficially owned any shares of PRRTFF IV . Despite their submission of letters with the Stockholder Group, signed the “Stockholder Group,” pertaining to this specific Fund roughly six months earlier, the PRRTFF IV Schedule 13 D did not disclose anything about any of the other members of the “Stockholder Group . ” 113. On November 19 , 2021 , Ocean Capital, Hawk, Izquierdo, and Rosenthal filed proxy materials for PRRTFF I and PRRTFF IV which stated that “The Coalition has Nominated Highly - Qualified Director Candidates to Serve on the Boards of Funds I, III, IV and V, and [PRRTFF] I, IV and VI” (the “November 19 Statement”) . 37 As with Defendants prior filings, the November 19 Statement did not disclose the identities of the “Coalition” beyond Ocean Capital and Hawk, nor did it disclose the existence or identities of any member of the Stockholder Group . 114. On December 7 , 2021 , Ocean Capital, Hawk, Rosenthal, and Izquierdo filed definitive proxy statements for PRRTFF I and PRRTFF IV (respectively, the “PRRTFF I Definitive Proxy” and the “PRRTFF IV Definitive Proxy”) . 38 Each of these definitive proxies provided that : Except as set forth in this Proxy Statement . . . no associate of any Participant owns beneficially, directly or indirectly, any securities of the Fund . . . . Except as set forth in this Proxy Statement, (i) there are no arrangements or understandings between Ocean Capital or its affiliates and the Nominees or any other person or persons pursuant to which the nominations are to be made by Ocean Capital, other than the consent by each Nominee to be named in this Proxy Statement and to serve as a director of the Fund, if elected as such at the Annual Meeting . . . . 37 31 PRRTFF I, Information Required in Proxy Statement (Schedule 14A Information) (Nov. 19, 2021) https://www.sec.gov/Archives/edgar/data/1843995/000121390021060694/ea151047 - dfan14a_oceancap.htm ; PRRTFF IV, Information Required in Proxy Statement (Schedule 14A Information) (Nov. 19, 2021) https://www.sec.gov/Archives/edgar/data/1847286/000121390021060697/ea151048 - dfan14a_oceancap.htm . 38 PRRTFF I, Definitive Proxy Statement (Schedule 14A) (December 7, 2021) https://www.sec.gov/Archives/edgar/data/0001843995/000121390021063754/defc14a1221_prresidentstf.htm ; PRRTFF IV, Definitive Proxy Statement (Schedule 14A) (December 7, 2021) https://www.sec.gov/Archives/edgar/data/0001847286/000121390021063755/defc14a1221_prresidentstf4.htm . Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 31 of 53

115. The PRRTFF I Definitive Proxy is materially false and misleading because it failed to disclose ( 1 ) the existence of the Stockholder Group and Coalition and their support for the Nominees and ( 2 ) the members thereof who owned shares in PRRTFF I (which upon information and belief include Defendants Rivera, Honne, Hurwitz, and Perez - Gutierrez) . 116. The PRRTFF IV Definitive Proxy is materially false and misleading because it failed to disclose ( 1 ) the existence of the Stockholder Group and Coalition and their support for the Nominees and ( 2 ) the members thereof who owned shares in PRRTFF IV (which upon information and belief include all members of the Stockholder Group) . 117. On December 21 , 2021 , the Nominating Parties and Danial filed a Schedule 13 D for Fund II (as amended, the “Fund II Schedule 13 D”) . 39 The Fund II Schedule 13 D disclosed that Ocean Capital and Hawk beneficially owned 2 , 548 , 019 shares of Fund II, comprising 8 . 3 % of Fund II’s outstanding stock ; that Hawk beneficially owned an additional 161 , 589 shares of Fund II ; and that neither Cruz - Rivera, Rosenthal, Izquierdo, or Danial beneficially owned any shares of Fund II . It did not disclose anything about any of the other members of the “Stockholder Group” or the “Coalition,” including those identified above who, upon information and belief, had owned shares of Fund II (including Defendants Gonzalez and Zeines, see supra ¶ 41 ) . 118. The Schedule 13 Ds for Fund I, Fund II, Fund III, PRRTFF I, PRRTFF IV, and PRRTFF VI were untimely . The Stockholder Group had formed by the time of the May 2021 Stockholder Letter, and, by August 2 , 2021 , Ocean Capital had informed the Funds of its intent to take control of Fund I, Fund III, Fund IV, Fund V, and PRRTFF VI . However, on information 39 32 See Fund II, Schedule 13D (Dec. 21, 2021) https://www.sec.gov/Archives/edgar/data/1838395/000121390021066486/ea152709 - 13docean_taxfree.htm; Fund II, Schedule 13D (Amendment No. 5) (Nov. 21, 2022) https://www.sec.gov/Archives/edgar/data/1847302/000121390022074277/ea169074 - 13da5ocean_taxfree2.htm . Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 32 of 53

and belief, by at least May 1 , 2021 , the Nominating Parties collectively owned more than 5 % of each of Fund I, Fund II, Fund III, PRRTFF I, PRRTFF IV, and PRRTFF VI, but did not file any Schedule 13 D until more than five months later, on October 6 , 2021 . 119. As of the date of this filing, Defendants have not filed any Schedule 13 D with respect to Fund IV and Fund V, and Plaintiffs are presently unable to discern if Defendants collectively own more than 5 % of the outstanding securities of these funds . 120. On January 6 , 2022 Fund II filed a definitive proxy setting its meeting date for January 27 , 2022 . 40 121. On January 7 , 2022 the Nominating Parties — along with Defendant Danial — filed a definitive proxy for Fund II . 41 The Fund II Definitive Proxy provides that : Except as set forth in this Proxy Statement . . . no associate of any Participant owns beneficially, directly or indirectly, any securities of the Fund . . . . Except as set forth in this Proxy Statement, (i) there are no arrangements or understandings between Ocean Capital or its affiliates and the Nominees or any other person or persons pursuant to which the nominations are to be made by Ocean Capital, other than the consent by each Nominee to be named in this Proxy Statement and to serve as a director of the Fund, if elected as such at the Annual Meeting . . . . 122. The Fund II Definitive Proxy is materially false and misleading because it failed to disclose ( 1 ) the existence of the Stockholder Group and Coalition and their support for the Nominees and ( 2 ) the members thereof who owned shares in Fund II (which upon information and belief include Defendants Gonzalez and Zeines) . 40 The January 27, 2022 meeting date was subsequently adjourned and is now scheduled for December 15, 2022. 33 41 Fund II, Definitive Proxy Statement (Schedule 14A) (Jan. 7, 2022) https://www.sec.gov/Archives/edgar/data/1838395/000121390022001159/defc14a_oceancapitalllc.htm . Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 33 of 53

123. On January 25 , 2022 PRRTFF IV filed a definitive proxy setting its meeting date for February 17 , 2022 . 42 124. In early February 2022 , counsel for Plaintiffs sent a letter to Ocean Capital and Mr . Hawk, noting that many of their proxy disclosures violate the federal securities laws, including Sections 13 (d) and 14 (a) of the Exchange Act, and demanding that they promptly issue corrective disclosures . 43 Ocean Capital and Mr . Hawk have failed to respond to this correspondence or otherwise issue any corrective disclosures . 125. On February 18 , 2022 Ocean Capital initiated legal proceedings against Fund I, Fund III, and PRRTFF VI in the Court of the Commonwealth of Puerto Rico, seeking an order from the court compelling each Fund to hold their shareholder meeting on March 17 , 2022 — the date on which the annual meeting for each Fund is already scheduled — and to waive the quorum requirements in the Funds’ By - Laws . As with its proxy filings, Ocean Capital’s complaint fails to disclose Ocean Capital’s true motives in the proxy contest, the tax - advantaged status of its principals, and the various Fund shareholders it is working with . A hearing was held on March 3 , 2022 , where Ocean Capital had the opportunity to present evidence . The court made a factual finding that “the defendant has scheduled the annual meetings within the term established by [Art . 7 . 01 (D) of the LGC] and that said meetings were held in accordance with the applicable law . ” The court further held that “although it is true that these meetings were adjourned for lack of a quorum of shareholders, this does not imply and cannot imply that the Funds engaged in the 42 The February 17 meeting date was subsequently adjourned and is now currently scheduled for December 15, 2022. 34 43 Fund I, Definitive Additional Materials (Schedule 14A) (Feb. 8, 2022) https://www.sec.gov/Archives/edgar/data/1850862/000138713122001425/pr - defa14a_020722.htm ; Fund III, Definitive Additional Materials (Schedule 14 A) (Feb . 8 , 2022 ) https : //www . sec . gov/Archives/edgar/data/ 1847304 / 000138713122001426 /priii - defa 14 a_ 020722 . htm ; Fund III, Definitive Additional Materials (Schedule 14 A) (Feb . 8 , 2022 ) https : //www . sec . gov/Archives/edgar/data/ 0001847283 / 000138713122001427 /prrtffvi - defa 14 a_ 020722 . htm . Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 34 of 53

unlawful conduct that the aforementioned provision seeks to discourage and that would justify - on an exceptional basis - judicial intervention with the corporate governance of the defendant . ” The Puerto Rico Court of Appeals upheld the lower court’s decision . Ocean Capital petitioned the Puerto Rico Supreme Court for certiorari, which was denied on October 27 , 2022 . 44 March 2022 : Defendants Purport to File Corrective Disclosures 126. Plaintiffs filed this action on February 28 , 2022 . Since then, Defendants have continued to file false and misleading proxy statements, both in their attempts to correct their prior false and misleading statements and in their subsequent proxy filings . 127. On March 16 , 2022 and March 25 , 2022 , the Nominating Parties filed definitive additional materials for Fund I, Fund II, Fund III, Fund IV, Fund V, PRRTFF I, PRRTFF IV, and PRRTFF VI (the “Purported Corrective Disclosures”) 45 attempting to address their former misleading proxy statements . The Purported Corrective Disclosures state : “What/Who is the Coalition of Concerned UBS Closed - End Bond Fund Investors? On July 22 , 2021 , Ocean Capital launched a public website for “The Coalition of Concerned UBS Closed - End Bond Fund Investors . ” The Coalition of Concerned UBS Closed - End Bond Fund Investors is not intended to describe a discernible group of investors , but instead is used to describe a like - mindedness of various shareholders who might understand and think similarly about the Fund and its affiliated funds with respect to which Ocean Capital has made nominations for director elections . Ocean Capital, its managing member, Mr . Hawk, and its nominees have never entered, and have no intention to enter, into any agreement, whether oral or written, express or implied, to act together with any other person who could be described as a “Concerned UBS Closed - End Bond Fund Investor” for the purpose of acquiring, holding, voting or disposing of securities of any of the Funds . ” 44 Ocean Capital has sought reconsideration of the denial of certiorari, which the Puerto Rico Supreme Court has not yet ruled on. 35 45 See, e.g. , PRRTFF I, Definitive Additional Materials (Schedule 14A) (Mar. 16, 2022) https : //www . sec . gov/Archives/edgar/data/ 1843995 / 000121390022012792 /ea 156942 - dfan 14 a_oceancap . htm ; Fund I, Definitive Additional Materials (Schedule 14 A) (Mar . 25 , 2022 ) https : //www . sec . gov/Archives/edgar/data/ 1850862 / 000121390022015004 /ea 157390 - dfan 14 a_oceancap 1 . htm . Case 3:22 - cv - 01101 - CVR - GLS Document 111 Filed 01/05/23 Page 35 of 53