Exhibit 99.3

1895 Bancorp of Wisconsin, Inc.,

Greenfield, Wisconsin

PROPOSED HOLDING COMPANY FOR:

PyraMax Bank, FSB

Greenfield, Wisconsin

As of: February 8, 2020

Prepared By:

Faust Financial, LLC

2009 NE 22nd Street

Fort Lauderdale, FL 33305

216.374.6001

faust-financial.com

TABLE OF CONTENTS

1895 Bancorp of Wisconsin, Inc.

PyraMax Bank, FSB

| PAGE | ||||||||||

| I. | OVERVIEW AND CONVERTING COMPANY ANALYSIS | 1 | ||||||||

| A. | Company History and Current Ownership | 1 | ||||||||

| B. | Plan of Conversion | 2 | ||||||||

| C. | Primary Strategies | 2 | ||||||||

| D. | Historical Balance Sheets and Trends | 5 | ||||||||

| E. | Historical Income Statements and Trends | 8 | ||||||||

| F. | Asset / Liability and Interest Rate Risk Management | 11 | ||||||||

| G. | Lending Activities and Strategies | 13 | ||||||||

| H. | Asset Quality | 16 | ||||||||

| I. | Investment Strategies | 17 | ||||||||

| J. | Funding and Strategies | 18 | ||||||||

| K. | Subsidiaries | 19 | ||||||||

| L. | Legal Proceedings | 19 | ||||||||

| M. | Management | 19 | ||||||||

| II. | ANALYSIS OF OPERATING ENVIRONMENT AND PRIMARY MARKET AREA | 21 | ||||||||

| A. | Physical Office Locations | 21 | ||||||||

| B. | Demographics | 21 | ||||||||

| C. | Economic Indicators | 24 | ||||||||

| D. | Deposit Market and Competition | 29 | ||||||||

| III. | COMPARABLE GROUP SELECTION AND ANALYSIS | 32 | ||||||||

| A. | Introduction | 32 | ||||||||

| B. | Comparable Group Selection Criteria | 32 | ||||||||

| C. | Selection of Comparable Group | 33 | ||||||||

| D. | Comparison of Company to Comparable Group | 36 | ||||||||

| 1. | Financial Condition and Efficiency of Asset Utilization | 36 | ||||||||

| 2. | Profitability and Earnings Capacity | 41 | ||||||||

| 3. | Asset / Liability and Interest Rate Risk Management | 44 | ||||||||

| 4. | Primary Market Economic and Demographic Considerations | 46 | ||||||||

| 5. | Projected Dividend Capacity and Intended Dividend Policy | 47 | ||||||||

| 6. | Marketability of the Issued Stock | 47 | ||||||||

| 7. | Management | 54 | ||||||||

| 8. | Effect of Government Regulations and Regulatory Reform | 54 | ||||||||

| E. | Comparability to Comparable Group | 54 | ||||||||

| IV. | VALUATION ANALYSIS | 55 | ||||||||

| A. | Introduction | 55 | ||||||||

| B. | Valuation Methods | 55 | ||||||||

| C. | Valuation Analysis | 56 | ||||||||

| D. | Summary of Valuation Adjustments | 61 | ||||||||

| E. | Application of Valuation Methods | 62 | ||||||||

| F. | Valuation Range | 67 | ||||||||

| G. | Exchange Ratio | 68 | ||||||||

| H. | Valuation Updates | 68 | ||||||||

LIST OF TABLES

NUMERICAL | DESCRIPTION | PAGE | ||||

I.D.1 | Historical Balance Sheet Trends | 6 | ||||

I.E.1 | Historical Income Statements | 9 | ||||

II.B.1 | Demographic Data | 22 | ||||

II.C.1 | Employment by Sector | 27 | ||||

II.C.2 | Market Area Largest Employers | 28 | ||||

II.C.3 | Unemployment Trends | 29 | ||||

II.D.1 | Trends in Total Deposits | 30 | ||||

II.D.2 | Deposit Competitors | 31 | ||||

III.C.1 | Comparable Group of Publicly-Traded Savings institutions | 34 | ||||

III.C.2 | Summary of Comparable Group Market, Pricing and Financial | 35 | ||||

III.D.1 | Balance Sheet Composition, Capital Ratios and Growth Rates | 37 | ||||

III.D.2 | Loan Portfolio Composition | 38 | ||||

III.D.3 | Credit Risk Measures | 39 | ||||

III.D.4 | Income as Percentage of Average Assets and Yields, Costs and Spreads | 42 | ||||

III.D.5 | Net Interest Margin Volatility | 45 | ||||

III.D.6 | Comparable Group Market Area Comparative Analysis | 46 | ||||

III.D.7 | Recently Converted Savings institution Institutions | 51 | ||||

IV.E.1 | Adjusted Core Earnings | 64 | ||||

IV.E.2 | Market Pricing versus Comparable Group | 66 | ||||

IV.F.1 | Pro Forma Valuation Range | 67 | ||||

| Pro Forma Valuation Report for Second Step Conversion

|

I. OVERVIEW AND CONVERTING COMPANY ANALYSIS

| A. | Company History and Current Ownership |

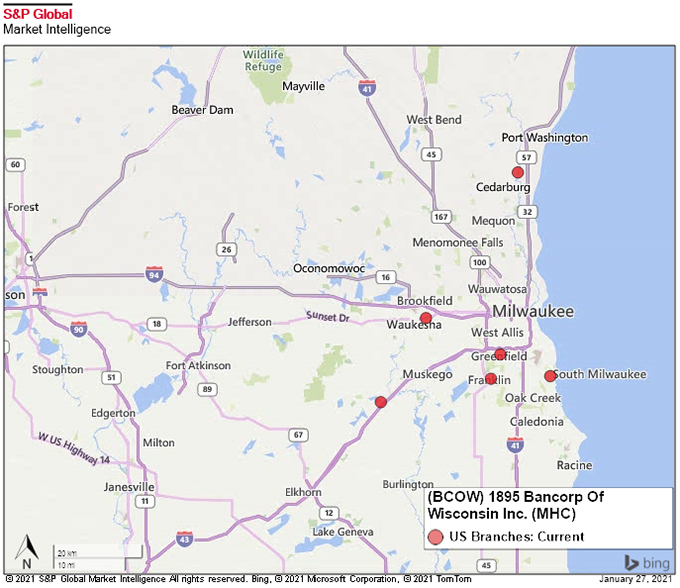

PyraMax Bank, FSB (the “Bank”) was founded in 1895, as a state chartered mutual savings and loan association by the name of South Milwaukee Savings and Loan Association. The Bank later converted its charter to a federal savings bank and changed its name to PyraMax Bank, FSB in 2020 when Mitchell Savings Bank was merged into the Bank. The name emerged from the combination of wanting to retain the pyramid shaped logo of South Milwaukee Savings Bank, hence Pyra, while ensuring clients that they would still receive the same maximized service. The Bank currently conducts operations from the main office / branch in Greenfield, which is in Milwaukee County, Wisconsin and five additional branch offices in Southeast Wisconsin (two in Milwaukee County, one in Ozaukee County and two in Waukesha County). A map of the Bank’s main office and branch office locations is included as Exhibit I-1.

The Bank is subject to regulation and oversight by the Office of the Comptroller of the Currency (“OCC”) and is also subject to certain reserve requirements of the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”). The Bank is a member of the Federal Home Loan Bank (“FHLB”) system, and its deposits are insured up to the regulatory maximums by the Federal Deposit Insurance Corporation (the “FDIC”).

1895 Bancorp of Wisconsin, Inc. (“1895”) is a federally chartered mid-tier holding company for the Bank and owns 100% of the outstanding common stock of the Bank. 1895 was incorporated under federal law on January 8, 2019 and has since been engaged primarily in the business of holding the common stock of the Bank. 1895 completed its initial public offering in January 2019, pursuant to which it sold 2,145,738 shares or approximately 44% of its common stock in its subscription offering for gross proceeds of approximately $21.5 million, including 175,528 shares purchased by the Bank’s employee stock ownership plan. In connection with the reorganization, the Company also issued 48,767 shares or 1% of common stock to 1895 Bancorp of Wisconsin Community Foundation, Inc. and 2,682,172 shares or 55% of common stock to 1895 Bancorp of Wisconsin, MHC (the “MHC”). The MHC and 1895 are subject to supervision and regulation by the Federal Reserve Federal Reserve Board. In January 2020, 1895 adopted a stock repurchase program under which 1895 repurchased 109,725 shares of its common stock, which are included in treasury stock on 1895’s balance sheet as of December 31, 2020. In addition, 1895 has 17,500 treasury shares related to a deferred compensation plan, which are held in a Rabbi Trust. In accordance with Generally Accepted Accounting Principles (“GAAP”) the shares in the Rabbi Trust were reclassified as treasury shares, at cost, in 1895’s consolidated balance sheet as of December 31, 2020.

1

| Pro Forma Valuation Report for Second Step Conversion

|

As of December 31, 2020, 1895 had 4,851,901 shares outstanding net of 109,725 treasury shares of which 2,169,729 or 44.72% were owned by public shareholders (including the 48,767 shares held by the 1895 Bancorp of Wisconsin Community Foundation, Inc. and 17,500 shares held in the Rabbi Trust) and 2,682,172 or 55.28% owned by the MHC (the “MHC Shares”). As of December 31, 2020, 1895 had total consolidated assets of $516.8 million, deposits of $379.8 million and equity of $60.0 million or 11.61% of total assets. As of December 31, 2020, the Company did not report goodwill and core deposit intangibles. 1895’s audited financial statements for the most recent period are included by reference as Exhibit I-2.

| B. | Plan of Conversion |

On March 2, 2021, the respective Board of Directors of the MHC and 1895 adopted a Plan of Conversion, whereby the MHC will convert to stock form. As a result of the conversion, 1895, which currently owns all of the issued and outstanding common stock of the Bank, will be succeeded by 1895 Bancorp of Wisconsin, Inc., a Maryland corporation (“1895 Bancorp” or the “Company”), a newly formed Maryland corporation. Following the conversion, the MHC will no longer exist. For purposes of this document, the existing consolidated entity will also hereinafter be also referred to as the Company or 1895 Bancorp, unless otherwise identified as 1895.

It is our understanding that 1895 Bancorp will offer its stock, representing the majority ownership interest held by the MHC, in a subscription offering to Eligible Account Holders, Tax-Qualified Plans including the Bank’s employee stock ownership plan (the “ESOP”), Supplemental Eligible Account Holders and Other Members. To the extent that shares remain available for purchase after satisfaction of all subscriptions received in the subscription offering, the shares may be offered for sale to the public at large in a community offering and a syndicated community offering. Upon completing of the mutual-to-stock conversion and stock offering (the “second step conversion”), the Company will be 100% owned by public shareholders, the publicly-held shares of 1895 will be exchanged for shares in 1895 Bancorp at an exchange ratio intended to preserve approximately the same aggregate ownership interest in 1895 Bancorp as public stockholders had in 1895, adjusted downward to reflect certain assets held by the MHC, without giving effect to new shares purchased in the offering or cash paid in lieu of any fractional shares.

| C. | Primary Strategies |

The Company’s primary strategy is to operate as a local community bank pursuing a strategy of strengthening its community bank franchise dedicated to meeting the banking needs of small businesses

2

| Pro Forma Valuation Report for Second Step Conversion

|

and retail customers in the communities that are served by the Bank. The Company’s business consists primarily of taking deposits from the general public and investing those deposits, together with funds generated from operations, into commercial real estate (“CRE”) loans (which includes non-owner occupied CRE, multi-family, owner occupied CRE and one- to four-family non-owner occupied loans), commercial business loans, which are also referred to as commercial and industrial (“C&I) loans, one- to four-family residential real estate loans, and consumer loans. Commercial business loans have been the primary source of recent loan growth, and CRE loan originations have also been emphasized. In connection with its origination and sale in the secondary market of one- to four-family residential real estate loans, the Company is also active in mortgage loan servicing, both of its own loans and loans serviced for others.

The Coronavirus Aid, Relief and Economic Security (“CARES”) Act was signed into law at the end of March 2020. The CARES Act authorized the Small Business Administration (“SBA”) to temporarily guarantee loans under a new loan program called the Paycheck Protection Program (“PPP”). As a qualified SBA lender, the Company was automatically authorized to originate PPP loans. On December 27, 2020, the Consolidated Appropriations Act 2021 (the “Relief Act”) became law and provides an additional $284 billion for the PPP and extends the PPP through March 31, 2021. The Company actively participated and is continuing to participate in PPP lending, which has contributed to the Company’s growth in commercial business loans between December 31, 2019 and December 31, 2020. (See Section I.D)

Subject to market conditions and with the benefit of the larger post conversion lending limit, the Company will continue to focus on originating primarily CRE and commercial business loans to increase the overall yield earned on its loans and assist in managing interest rate risk.

The Company also invest in securities, which have historically consisted of mortgage-backed securities issued by U.S. government sponsored enterprises, state and municipal securities, asset-backed securities and to a much lesser extent certificates of deposit and corporate collateralized mortgage-backed obligations.

The Bank offers a variety of deposit accounts, including checking accounts, savings accounts and certificate of deposit accounts as well as treasury management services geared toward small businesses. Through its relationship with LPL Financial, one of the nation’s leading financial services companies and a publicly traded company traded under ticker symbol LPLA, PyraMax Insurance Services LLC, a subsidiary of the Bank, offers insurance and risk management products for personal and business needs on a referral basis and with limited activity. LPL Financial is a third-party provider and neither the Company nor the Bank are affiliated with LPL Financial.

3

| Pro Forma Valuation Report for Second Step Conversion

|

The Bank has also used borrowings consisting primarily of advances from the Federal Home Loan Bank of Chicago (“FHLB”) and brokered deposits, to fund its operations. In 2020, the proportion of FHLB borrowings increased to repay relatively higher costing certificates of deposits, including brokered deposits, and to provide additional on balance sheet liquidity as a precaution to the uncertainty related to the onset of the COVID-19 pandemic. Deposits have consistently served as the primary funding source for the Company, while the Company’s utilization of borrowings was relatively more limited.

The long-term objective of 1895 Bancorp is to grow its balance sheet, control expenses and improve profitability. The Company plans to fund asset growth primarily through deposit growth, emphasizing growth of lower cost core deposits, including non-interest and interest-bearing checking accounts, savings and money market accounts. Core deposit growth is expected to continue to be facilitated by growth of commercial lending relationships, pursuant to which the Bank continuously seeks to establish full-service banking relationship, especially with its commercial loan customers as well as by offering treasury management services to small businesses.

The Company’ earnings are largely dependent upon net interest income to support operating expense levels. The Company has maintained a relatively stable net interest margin, which has declined slightly in 2020. Operating expense to average assets had also been maintained at relatively high and steady levels but decreased measurably for 2020 compared to recent years. Asset growth generated from the origination and funding of PPP loans and related deposit growth provided for some leveraging of operating expenses for the twelve months ended December 31, 2020, the benefits of which the Company does not expect to persist given anticipated repayment/forgiveness of PPP loans and eventual withdrawal of related deposits.

Non-interest operating income mostly increased in recent years, especially for 2020 primarily due to the gain on sale of loans. The Company also recorded a large gain on the sale of investment securities during 2020, while such gains in prior recent years were small or zero. Loan loss provisions were not a factor in the Company’s earnings through 2018. In 2019, the Company recorded a large credit and in 2020 the Company recorded its first provision for loan losses of recent years, to reflect the unknown risk within the Company’s loan portfolio due to the ongoing COVID-19 pandemic.

While the Bank exceeds all minimum regulatory capital ratios to be considered “well capitalized”, and the Company has the ability to infuse additional capital into the Bank, the Company’s planned second step conversion stock offering will further strengthen the Company’s and the Bank’s capital position, enhance its operating flexibility and provide the additional capital to support planned growth strategies. The second step conversion stock offering will significantly increase regulatory capital and if necessary, to provide additional loan loss reserves, greater flexibility to work with borrowers impacted by the COVID-

4

| Pro Forma Valuation Report for Second Step Conversion

|

19-induced economic malaise. The Company’s strengthened capital position will also provide more of a cushion against potential credit quality related losses in future periods. The Company’s higher capital position resulting from the infusion of stock offering proceeds will also serve to increase liquidity and reduce interest rate risk, particularly through enhancing the Company’s interest-earning assets/interest bearing liabilities (“IEA/IBL”) ratio. The additional funds realized from the stock offering will raise the level of interest-earning assets funded with equity and, thereby, reduce the ratio of interest-earning assets funded with interest-bearing liabilities as the balance of interest-bearing liabilities will initially remain relatively unchanged following the second step conversion, which may facilitate a reduction in the Company’s funding costs. Notably, as a fully-converted institution, the Company’s stronger capital position and greater capacity to offer stock as consideration for an acquisition may facilitate increased opportunities to grow through acquisitions, including of whole banking institutions or branches. Currently, the Company has no specific plans for expanding through acquisitions.

The Company is expected to retain up to 50% of the net stock offering proceeds. At present, funds at the Company level, net of the loan to the ESOP, in the short term are expected to be invested into a liquid deposit account at the Bank. Over time, the funds may be utilized for various corporate purposes, possibly including acquisitions, de novo branches, infusing additional equity into the Bank, repurchases of common stock and the payment of cash dividends. The remaining approximate 50% of the net stock offering proceeds will be infused into the Bank and will become part of general operating funds partially offset by deposits withdrawn to fund investor stock purchases. Over time, such funds will be deployed to fund loan growth and to a lesser degree investment portfolio growth, with these efforts anticipated to increase earnings performance.

| D. | Historical Balance Sheet Trends |

The Company’s historical balance sheet data for the past five year-ends are reflected in Table I.D.1.

5

| Pro Forma Valuation Report for Second Step Conversion

|

Table I.D.1

1895 Bancorp of Wisconsin, Inc.

Historical Balance Sheet Trends

| 2016-2020 | ||||||||||||||||||||||||||||||||||||||||||||

| As of December 31, | Annualized | |||||||||||||||||||||||||||||||||||||||||||

| 2016 | 2017 | 2018 | 2019 | 2020 | Growth | |||||||||||||||||||||||||||||||||||||||

| Amount ($000) | Pct (1) (%) | Amount ($000) | Pct (1) (%) | Amount ($000) | Pct (1) (%) | Amount ($000) | Pct (1) (%) | Amount ($000) | Pct (1) (%) | Pct (%) | ||||||||||||||||||||||||||||||||||

Assets | $ | 450,173 | 100.00 | % | $ | 468,361 | 100.00 | % | $ | 481,099 | 100.00 | % | $ | 428,009 | 100.00 | % | $ | 516,757 | 100.00 | % | 3.51 | % | ||||||||||||||||||||||

Cash and Cash Equivalents | 7,779 | 1.73 | % | 12,497 | 2.67 | % | $ | 7,923 | 1.65 | % | $ | 11,707 | 2.74 | % | $ | 92,526 | 17.91 | % | 85.71 | % | ||||||||||||||||||||||||

Investment Securities | 96,458 | 21.43 | % | 88,955 | 18.99 | % | 65,731 | 13.66 | % | 73,928 | 17.27 | % | 61,695 | 11.94 | % | -10.57 | % | |||||||||||||||||||||||||||

Loans Held for Sale | 479 | 0.11 | % | 217 | 0.05 | % | 771 | 0.16 | % | 685 | 0.16 | % | 2,484 | 0.48 | % | 50.91 | % | |||||||||||||||||||||||||||

Loans Receivable, Net | 312,523 | 69.42 | % | 331,206 | 70.72 | % | 369,830 | 76.87 | % | 310,674 | 72.59 | % | 329,073 | 63.68 | % | 1.30 | % | |||||||||||||||||||||||||||

FHLB Stock | 2,170 | 0.48 | % | 1,436 | 0.31 | % | 1,261 | 0.26 | % | 913 | 0.21 | % | 3,032 | 0.59 | % | 8.72 | % | |||||||||||||||||||||||||||

Bank-Owned Life Insurance | 13,321 | 2.96 | % | 13,732 | 2.93 | % | 13,400 | 2.79 | % | 13,085 | 3.06 | % | 13,485 | 2.61 | % | 0.31 | % | |||||||||||||||||||||||||||

Mortgage Servicing Rights, Net | 2,421 | 0.54 | % | 2,270 | 0.48 | % | 2,103 | 0.44 | % | 2,172 | 0.51 | % | 1,806 | 0.35 | % | -7.06 | % | |||||||||||||||||||||||||||

Goodwill and Other Intangibles | 0 | 0.00 | % | 0 | 0.00 | % | 0 | 0.00 | % | 0 | 0.00 | % | 0 | 0.00 | % | 0.00 | % | |||||||||||||||||||||||||||

Deposits | 358,882 | 79.72 | % | 389,291 | 83.12 | % | 406,137 | 84.42 | % | 344,596 | 80.51 | % | 379,848 | 73.51 | % | 1.43 | % | |||||||||||||||||||||||||||

Borrowings | 48,224 | 10.71 | % | 34,693 | 7.41 | % | 30,010 | 6.24 | % | 17,623 | 4.12 | % | 68,398 | 13.24 | % | 9.13 | % | |||||||||||||||||||||||||||

Equity | 37,340 | 8.29 | % | 38,994 | 8.33 | % | 38,181 | 7.94 | % | 58,665 | 13.71 | % | 60,008 | 11.61 | % | 12.59 | % | |||||||||||||||||||||||||||

Tangible Equity | 37,340 | 8.29 | % | 38,994 | 8.33 | % | 38,181 | 7.94 | % | 58,665 | 13.71 | % | 60,008 | 11.61 | % | 12.59 | % | |||||||||||||||||||||||||||

Loans/Deposits | 87.08 | % | 85.08 | % | 91.06 | % | 90.16 | % | 86.63 | % | ||||||||||||||||||||||||||||||||||

| (1) | Ratios are as a percent of ending assets. |

Source: 1895 Bancorp’s Preliminary Offering Prospectus, Draft Audited Financial Statements and Faust Financial, LLC calculations.

Over the five past year-ends depicted in Table I.D.1, the Company’s total assets have fluctuated between a low of $428.0 million for year-end 2019 and a high of $516.8 million for year-end 2020. Overall, assets increased at an average annual rate of 3.51% from year-end 2016 through 2020. Net loans balances fluctuated between a low of $310.7 million for year-end 2019 and a high of $369.8 million for year-end 2018. As of December 31, 2020, loans held for investment, net of reserves for loan losses, were $329.1 million. The Company also had $2.5 million of loans held for sale. Overall, net loans increased at an average annual rate of 1.30% from year-end 2016 through 2020.

The fluctuations in total assets were paralleled by similar fluctuations in total deposits and in some cases also borrowings with assets primarily funded by deposits. The reduction of size in the Company’s balance sheet between year-end 2018 and 2019, including in total assets, net loans and total deposits, were primarily driven by the sale of approximately $30 million of portfolio one-to-four family residential mortgage loans, and payoffs of commercial real estate loans refinanced by other banks, a reduction in brokered deposits of $38.4 million, and the closure of two branches and sale of another branch. The two closed branches were located in Milwaukee and West Allis, Wisconsin; and the other branch, located in Milwaukee, was sold to another financial institution, including approximately $5.0 million of deposits.

The Company also utilizes borrowings as a funding source. Borrowings as of year-ends 2016 through 2020 ranged from a low of $17.6 million as of December 31, 2019 to a high of $68.4 million as of as of December 31, 2020. Between year-end 2019 and 2020, borrowings became a more significant funding source for the Company and consisted entirely of FHLB advances. The increase in borrowings

6

| Pro Forma Valuation Report for Second Step Conversion

|

was used to replace $24.1 million in maturing brokered deposits and to provide the Company with greater on balance sheet liquidity considering the uncertainty surrounding the COVID-19 pandemic’s potential impact on funding sources. A summary of 1895’s key operating ratios for the past five years ended December 31, 2020 is presented in Exhibit I-3.

The Company’s comparatively stronger asset growth relative to loan growth resulted in a decrease in the loans-to-assets ratio from 69.42% at year-end 2016 to 63.68% at year-end 2020. As indicated in Exhibit I-5, loan growth from 2019 to 2020 was primarily driven by the origination of CRE and commercial business loans, primarily PPP and to a lesser degree in one-to-four family mortgage loans, while consumer loans, consisting almost entirely of home equity loans and lines of credit, decreased.

Overall, trends in the Company’s loan portfolio composition since year-end 2016 as set forth in Exhibit I-5, show that the concentration of commercial business loans increased from 4.6% of total loans to 13.9% as of year-end 2020. As of December 31, 2020, PPP loans accounted for 5.2% of total loans outstanding. Between year-end 2016 and year-end 2020, CRE loans (which includes non-owner occupied CRE, multi-family, owner occupied CRE and one- to four-family non-owner-occupied loans) increased from 45.7% of total loans to 57.1% of total loans and one-to-four family mortgage loans decreased from 33.0% to 20.8% of total loans. Construction and land loans remained relatively unchanged at 2.0% at year-end 2016 and 1.40% at year-end 2020. Consumer loans decreased from 14.7% of total loans to 6.8% over the same period.

Between year-ends 2016 and 2020, the Company’s level of cash and investment securities (inclusive of FHLB stock) combined ranged from a low of 15.31% of assets at year-end 2018 to a high of 29.84% of assets at year-end 2020. The increased level of cash held as of December 31, 2020 resulted primarily from additional borrowings to increase on balance sheet liquidity taken as a precaution in light of the ongoing COVID-19 pandemic. As of December 31, 2020, all securities in the Company’s investment portfolio were available for sale and had a net unrealized gain of $1.59 million. Exhibit I-7 provides detail of the Company’s investment portfolio. The Company also held cash and cash equivalents and FHLB stock at year-end 2020, equal to 17.91% and 0.59% of assets, respectively, and maintains an investment in bank-owned life insurance (“BOLI”) policies, which covers the lives of certain officers and former officers of the Company.

Funding needs have been addressed through a combination of deposits, borrowings and internal cash flows. From year-end 2016 through year-end 2020, the Company’s deposits increased at an average annual rate of 1.43%. The average annual rate of growth was negatively impacted in 2019, which is the only year over the past five years during which total deposits decreased (by $61.5 million or 15.15%), primarily because of a decrease in brokered deposits and the closing of two branches and sale of one branch to another financial institution. Deposit growth was 10.23% for 2020 alone and was positively impacted by funds deposited by customers who received PPP loans. As of year-end 2020, core deposits accounted for 76.93% of total deposits compared to 58.68% as of year-end 2019.

7

| Pro Forma Valuation Report for Second Step Conversion

|

Between year-end 2016 through year-end 2020, total equity increased at an average annual rate of 12.59%, with most of the growth occurring in 2019 in connection with the capital raised in the Company’s first-step conversion stock offering and to a lesser degree because of cumulative net income over the past four years. The Company’s equity-to-assets ratio increased from 8.29% at year-end 2016 to 11.61% at year-end 2020. The Company has not reported any intangible assets as of the last five year-ends. The Bank’s regulatory capital levels exceed all regulatory well-capitalized minimum requirements for each of the past five fiscal year-ends. Proceeds from the second step conversion stock offering will further strengthen the Company’s and the Bank’s capital position and provide additional growth capital but are expected to reduce earnings performance measures in the near term.

| E. | Income Statements and Trends |

Table I.E.1 shows the Company’s historical income statements for the years ended December 31, 2016 through December 31, 2020.

8

| Pro Forma Valuation Report for Second Step Conversion

|

Table I.E.1

1895 Bancorp of Wisconsin, Inc.

Historical Income Statements and Trends

| As of December 31, | ||||||||||||||||||||||||||||||||||||||||

| 2016 | 2017 | 2018 | 2019 | 2020 | ||||||||||||||||||||||||||||||||||||

| Amount ($000) | Pct (1) (%) | Amount ($000) | Pct (1) (%) | Amount ($000) | Pct (1) (%) | Amount ($000) | Pct (1) (%) | Amount ($000) | Pct (1) (%) | |||||||||||||||||||||||||||||||

Interest Income | $ | 13,797 | 3.15 | % | $ | 15,256 | 3.32 | % | $ | 16,753 | 3.53 | % | $ | 17,235 | 3.79 | % | $ | 15,393 | 3.26 | % | ||||||||||||||||||||

Interest Expense | (2,685 | ) | -0.61 | % | (3,361 | ) | -0.73 | % | (4,233 | ) | -0.89 | % | (4,933 | ) | -1.09 | % | (3,041 | ) | -0.64 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Net Interest Income | 11,112 | 2.54 | % | 11,895 | 2.59 | % | 12,520 | 2.64 | % | 12,302 | 2.71 | % | 12,352 | 2.61 | % | |||||||||||||||||||||||||

Provision for Loan Losses | 0 | 0.00 | % | 0 | 0.00 | % | 0 | 0.00 | % | 1,032 | 0.23 | % | (500 | ) | -0.11 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Net Interest Income after Provisions | 11,112 | 2.54 | % | 11,895 | 2.59 | % | 12,520 | 2.64 | % | 13,334 | 2.93 | % | 11,852 | 2.51 | % | |||||||||||||||||||||||||

Non-Interest Operating Income | 3,996 | 0.91 | % | 2,892 | 0.63 | % | 2,882 | 0.61 | % | 2,964 | 0.65 | % | 5,943 | 1.26 | % | |||||||||||||||||||||||||

Operating Expense | (14,109 | ) | -3.22 | % | (14,615 | ) | -3.18 | % | (15,655 | ) | -3.30 | % | (16,038 | ) | -3.53 | % | (15,685 | ) | -3.32 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Net Operating Income | 999 | 0.23 | % | 172 | 0.04 | % | (253 | ) | -0.05 | % | 260 | 0.06 | % | 2,110 | 0.45 | % | ||||||||||||||||||||||||

Gain on Sale of OREO | 96 | 0.02 | % | 0 | 0.00 | % | 0 | 0.00 | % | 84 | 0.02 | % | 6 | 0.00 | % | |||||||||||||||||||||||||

Gain on Sale of Securities | 159 | 0.04 | % | 0 | 0.00 | % | 67 | 0.01 | % | 0 | 0.00 | % | 1,023 | 0.22 | % | |||||||||||||||||||||||||

Gain (Loss) on Other Assets | 0 | 0.00 | % | (1,095 | ) | -0.24 | % | (10 | ) | 0.00 | % | 96 | 0.02 | % | (86 | ) | -0.02 | % | ||||||||||||||||||||||

Core Data Processing Conversion Expense | 0 | 0.00 | % | (880 | ) | -0.19 | % | 0 | 0.00 | % | 0 | 0.00 | % | 0 | 0.00 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Total Non-Operating Income (Exp.) | 255 | 0.06 | % | (1,975 | ) | -0.43 | % | 57 | 0.01 | % | 180 | 0.04 | % | 943 | 0.20 | % | ||||||||||||||||||||||||

Net Income (Loss) Before Tax | 1,254 | 0.29 | % | (1,803 | ) | -0.39 | % | (196 | ) | -0.04 | % | 440 | 0.10 | % | 3,053 | 0.65 | % | |||||||||||||||||||||||

Income Tax (Benefit) | 0 | 0.00 | % | (3,462 | ) | -0.75 | % | (177 | ) | -0.04 | % | (9 | ) | 0.00 | % | 1,736 | 0.37 | % | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Net Income (Loss) | 1,254 | 0.29 | % | 1,659 | 0.36 | % | (19 | ) | 0.00 | % | 449 | 0.10 | % | 1,317 | 0.28 | % | ||||||||||||||||||||||||

Adjusted Earnings: | ||||||||||||||||||||||||||||||||||||||||

Net Income | 1,254 | 0.29 | % | 1,659 | 0.36 | % | (19 | ) | 0.00 | % | 449 | 0.10 | % | 1,317 | 0.28 | % | ||||||||||||||||||||||||

Add (Deduct): Non-Operating Inc/Exp | (255 | ) | -0.06 | % | 1,975 | 0.43 | % | (57 | ) | -0.01 | % | (180 | ) | -0.04 | % | (943 | ) | -0.20 | % | |||||||||||||||||||||

Tax Effect (2) | 97 | 0.02 | % | (751 | ) | -0.16 | % | 15 | 0.00 | % | 49 | 0.01 | % | 255 | 0.05 | % | ||||||||||||||||||||||||

Change in DTA Valuation Allowance | 0 | 0.00 | % | 0 | 0.00 | % | 0 | 0.00 | % | 0 | 0.00 | % | 934 | 0.20 | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

Adjusted Earnings | 1,096 | 0.25 | % | 2,884 | 0.63 | % | (61 | ) | -0.01 | % | 318 | 0.07 | % | 1,563 | 0.33 | % | ||||||||||||||||||||||||

Expense Coverage Ratio (3) | 0.79x | 0.81x | 0.80x | 0.77x | 0.79x | |||||||||||||||||||||||||||||||||||

Efficiency Ratio (4) | 93.39 | % | 98.84 | % | 101.64 | % | 105.06 | % | 85.73 | % | ||||||||||||||||||||||||||||||

| (1) | Ratios are as a percent of average assets. |

| (2) | Assumes a 38% effective tax rate for 2016-2017 and a 27% effective tax rate for 2018-2020. |

| (3) | Expense coverage ratio calculated as net interest income before provisions for loan losses divided by operating expenses. |

| (4) | Efficiency ratio calculated as operating expenses divided by the sum of net interest income before provisions for loan losses plus non-interest operating income. |

Source: 1895 Bancorp’s Preliminary Offering Prospectus, Draft Audited Financial Statements and Faust Financial, LLC calculations.

During the period covered in Table I.E.1, the Company’s reported earnings ranged from a net loss of $19,000 for 2018 to net income of $1.7 million or 0.36% of average assets for year 2017. Net earnings adjusted for non-operating income and expense (“core earnings”) ranged from a net loss of $61,000 for 2018 to net income of $2.9 million or 0.63% of average assets for 2017. Adjusted net income for 2020 was $1.6 million or 0.33% of average assets. As further discussed below, non-operating income / (expense) and also tax expense had a meaningful impact on the Company’s reported earnings for 2017 and 2020.

Net interest income and operating expenses represent the primary components of the Company’s earnings, while non-interest operating income has been a meaningful contributor to the Company’s income.

9

| Pro Forma Valuation Report for Second Step Conversion

|

For the period covered in Table I.E.1, the Company’s net interest income to average assets ratio remained in a relatively narrow range between a low of 2.54% for 2016 to a high of 2.71% for 2019 as fluctuations in interest income to average assets and interest expense to average assets were directionally consistent with one another over the past five years. Net interest income to average assets for 2020 was 2.61%. Overall, the general trends in the Company’s net interest income as a percent of average assets remained rather stable over the past five-years. During 2020, the Company recognized approximately $590,205 of PPP loan fees and as of December 31, 2020, had an additional $403,000 of deferred PPP loan fees remaining as of that date.

Loan loss provisions established by the Company were zero for 2016 through 2018, and a loan loss provision credit of $1.0 million was recorded in 2019 based on the Company’s continued improvement in the overall risk profile of its loan portfolio. Provision expense of $500,000 was recorded for 2020 to reflect the unknown risk within the Company’s loan portfolio due to the ongoing COVID-19 pandemic. As of December 31, 2020, the Company maintained an allowance for loan and lease losses equal to 0.82% of total loans, 210.03% of non-performing loans. Exhibit I-8 sets forth the Company’s loan loss allowance activity for 2019 and 2020.

As reflected in Exhibit I-3, the Company’s interest rate spread and net interest rate margin were relatively stable between 2.58% and 2.57% (spread), and 2.85% to 2.79% (margin), respectively, from 2019 to 2020. The Company’s net interest rate spreads, margin, and yields and costs for 2019 to 2020 are reflected in Exhibit I-4.

Non-interest operating income as a percent of average assets has fluctuated as a contributor to the Company’s earnings, ranging from a low of 0.61% of average assets for 2018 to a high 1.26% of average assets for 2020, with gains on the sale of loans as the largest single component of non-interest operating income during most years and especially for 2020. Mortgage loan servicing and deposit related fees were also contributors.

Operating expenses represent the largest component of the Company’s earnings and have been relatively stable in a range of 3.18% and 3.53% between 2016 and 2019. Operating expense was 3.32% for 2020, in part because of the reduction in Bank branch offices and related reduction in salary and benefits as well as occupancy expense between 2019 and 2020.

The Company’s expense coverage ratio (net interest income divided by operating expenses) has been in a relatively narrow range over the past five years from a low of 0.77x to a high of 0.81x. For 2020, the expense coverage ratio was 0.79x. These measures being below 1x indicate the Company’s reliance on non-interest operating income to cover operating expenses, which is not unusual for institutions such as the Company, that are active in the mortgage banking business and derive a significant portion of their non-interest operating income from the gain on sale of loans and to a lesser degree mortgage loan servicing.

10

| Pro Forma Valuation Report for Second Step Conversion

|

Based on adjusted earnings, the efficiency ratio (operating expenses as a percent of the sum of net interest income and other operating income) has generally trended unfavorably, having increased steadily from 93.39% for 2016 to 105.06% for 2019, before improving to 85.73% for 2020, aided by the reduction in branches and associated reduction in operating expenses, higher non-interest income for 2020 stemming primarily from higher gains on the sale of loans, and PPP loan fees recorded as interest income.

Over the past five years, non-operating income / (expense) impacted the Company’s reported net income to varying degrees as shown in Table I.E.1. Non-operating income ranged from a $2.0 million loss (-0.43% of average assets) for 2017, consisting of a $1.1 million loss on sale of a branch office and $880,000 of costs incurred as part of a core data processing conversion to $943,000 income for 2020 (0.20% of average assets), consisting of $1.0 million in gains on the sale of securities and an $86,000 loss on the sale of other assets.

The Company’s net income for years 2017 and 2020 was impacted by the Company’s effective tax rates for those periods. The Company’s effective tax rate was 56.86% for 2020 and an effective tax benefit of 192.01% for 2017. For 2017, the Company reported a $1.8 million pre-tax loss and $3.5 million tax benefit which was related to the reversal of the valuation allowance against the Company’s Federal and State deferred tax asset. At the time of reversal in 2017, management projected taxable income for the years ending 2018, 2019, 2020 and 2021. The Company determined that it was necessary to reestablish a valuation allowance against the deferred tax asset and recorded a $934,000 charge to income tax expense in 2020, reducing the Company’s net deferred tax asset to $3.4 million. As such, there may be additional deferred tax asset impairment in subsequent periods. This charge contributed to the high tax expense for the year ended December 31, 2020.

As set forth in the prospectus, the Company’s marginal tax rate is 27.0%.

| F. | Asset/Liability and Interest Rate Risk Management |

The Company’s asset/liability management strategy endeavors to manage the impact of changes in interest rates on net interest income. As such, in recent years, the Company has emphasized originating commercial business and CRE loans, which tend to have shorter terms and/or adjustable interest rates and higher interest rates than owner occupied one- to four-family residential real estate loans and can result in deposit relationships with larger non-interest-bearing checking accounts. The Company sells substantially all conforming and eligible jumbo, longer-term, fixed-rate one- to four-family residential real estate loans while it retains the nonconforming fixed-rate and adjustable-rate one- to four-family residential real estate loans that the Bank originates, subject to market conditions and a periodic review of the Company’s asset/liability management needs. As of December 31, 2020, of the Company’s total loans due after December 31, 2021, floating and adjustable rate loans accounted for 18.9% (see Exhibit I-10).

11

| Pro Forma Valuation Report for Second Step Conversion

|

In recent years, the Company has also reduced its dependence on jumbo and brokered certificates of deposit to support lending and investment activities and increased reliance on core deposits, including checking, savings and money market accounts, which tend to be less interest rate sensitive than certificates of deposit. Further, as of December 31, 2020 the Company maintained 17.9% of its assets in cash and cash equivalents, which provides for immediate term asset repricing.

Overall, the Company’s balance sheet over the short-term (less than one year) is asset-sensitive with an interest earning assets to interest bearing liabilities ratio of 136% as of December 31, 2020. Consequently, the net interest margin is favorably impacted by higher interest rates in the near term. Based on the Company’s interest rate risk analysis as of December 31, 2020, in the event of a 200-basis point instantaneous parallel increase in the U.S. Treasury yield curve, net interest income would increase by 14.0% in year 1 and net economic value would increase by 17.3% (see Exhibit I-13).

In connection with the second step conversion, the stock offering proceeds will further improve the Company’s interest rate risk exposure, as the net proceeds will primarily be invested into interest-earning assets and the increase in the Company’s capital will further reduce the proportion of interest rate sensitive liabilities as a funding source.

As set forth in Exhibit I-4, the yield on interest-earning assets and the cost of interest-bearing liabilities decreased from 4.00% and 1.42%, respectively, to 3.48% and 0.91%, respectively, from 2019 to 2020. The yield on loans decreased over this same period from 4.40% to 4.30%, in part because of lower yielding PPP loans originated putting downward pressure on the average yield on loans, while the cost of interest-bearing deposits and borrowings also decreased from 1.44% and 1.68%, respectively, to 0.87% to 1.22%, respectively. As a result, the net interest spread for 2019 and 2020 was maintained at 2.58% and 2.57%, respectively.

As of December 31, 2020, transaction, savings and money market deposits combined comprised 76.93% of the Company’s total deposits vs. 58.66% at year-end 2019. See Exhibit I-15. The shift in funding mix toward these account types has been aided by the Company’s treasury management services, which provide additional convenience to small businesses in managing their deposit accounts with the Bank.

12

| Pro Forma Valuation Report for Second Step Conversion

|

| G. | Lending Activities and Strategies |

Over the past five years, the Company’s lending activities have emphasized CRE loans (which includes non-owner occupied CRE, multi-family, owner occupied CRE and one- to four-family non-owner occupied loans) and commercial business loans, as well as SBA loans (including PPP loans), while one- to four-family residential real estate loans, which historically were the largest component of the Company’s loan portfolio, and consumer loans have been steadily decreasing as a proportion of the loan portfolio between 2016 and 2020. Going forward, the Company plans to continue to maintain loan portfolio diversification, primarily emphasizing CRE secured loans. The Company’s loan portfolio compositions for the years ended December 31, 2016 through December 31, 2020 is set forth in Exhibit I-5 with the contractual maturity of the Company’s loan portfolio by loan type as of December 31, 2020 set forth in Exhibit I-11. The majority of the Company’s loans have contractual maturities of five years or less.

Commercial Real Estate Loans

CRE loans (includes non-owner occupied CRE, multi-family, owner occupied CRE and one- to four-family non-owner-occupied loans) are typically collateralized by office and industrial buildings, warehouses, properties with five or more rental units, small retail facilities and restaurants and other special purpose commercial properties, primarily in Milwaukee, Waukesha and Ozaukee Counties, in Southeastern Wisconsin, which the Company considers its primary market area. CRE loans generally have initial terms of five to ten years and amortization terms of 15 to 30 years, with a balloon payment at the end of the initial term and may be fixed-rate or adjustable-rate loans. Adjustable-rate CRE loans are generally tied to a margin above the prime rate or the applicable treasury rate. The maximum loan-to-value ratio of the Company’s loans is generally 80% of the lower of cost or appraised value of the property securing the loan. A debt service-coverage ratio of at least 1.20x is generally required.

From time to time, the Company also purchases CRE loan participations secured by properties within and outside the Company’s primary market area in which the Bank is not the lead lender, but for which the Bank follows its customary loan underwriting and approval policies. As of December 31, 2020, the Company’s outstanding balance of CRE loans totaled $189.3 million equal to 57.1% of total loans outstanding. Of this aggregate amount, the Company had $71.2 million in non-owner occupied non-residential real estate, $65.8 million in multi-family residential real estate, $37.6 million in owner occupied non-residential real estate, $10.2 million in non-owner occupied residential real estate loans, $4.5 million in commercial real estate construction loans.

13

| Pro Forma Valuation Report for Second Step Conversion

|

Commercial Business Loans

Commercial business loans are generally to small businesses in the Company’s primary market area. Such loans are generally used by the borrowers for working capital purposes or for acquiring equipment, inventory or furniture, and are primarily secured by business assets other than real estate, such as business equipment, inventory and accounts receivable. Commercial business loans are generally structured as term loans with terms of three to seven years and lines of credit with terms of one to two years, with a target loan size of $250,000 to $5.0 million. Term loans are generally priced at a spread over the applicable treasury rate. Interest rates are on commercial lines of credit are generally on an adjustable-rate basis tied to the prime rate. The Company generally obtains personal guarantees with commercial business loans.

As of December 31, 2020, the Company’s outstanding balance of commercial business loans totaled $46.2 million equal to 13.9% of total loans outstanding.

Payroll Protection Program Loans

PPP loans originated by the Company have: (a) an interest rate of 1.0%, (b) two-year and five-year loan terms to maturity; and (c) principal and interest payments deferred for ten months after the end date of the borrowers’ forgiveness period. The SBA will guarantee 100% of the PPP loans made to eligible borrowers. The entire principal amount of the borrower’s PPP loan, including any accrued interest, is eligible to be reduced by the loan forgiveness amount under the PPP. As of December 31, 2020, the Company had funded 246 PPP loans with outstanding balances totaling $17.2 million, included within the commercial loan balances above. On December 27, 2020, the Consolidated Appropriations Act, 2021 (the “Relief Act”) became law and provides an additional $284 billion for the PPP and extends the PPP through March 31, 2021.

One- to Four- Family Residential Real Estate Loans

The Company offers both fixed rate and adjustable rate loans secured by one- to four-family residential real estate, which are substantially secured by properties located in the Company’s primary market area. Fixed rate loans are generally underwritten to Freddie Mac and Fannie Mae guidelines when the loan balance meets such guidelines, so as to provide the Company with the flexibility to sell the loans into the secondary market for purposes of managing interest rate risk. Loans originated to sell are closed in the Bank’s name and are subsequently sold to investors who provide Fannie Mae and Freddie Mac conventional products as well as FHA and VA government loans. The maximum conforming loan limits as established by Fannie Mae increased to $510,400 for the year ended December 31, 2020. The Company generally sells such fixed rate loans on both a servicing-released and servicing-retained basis.

14

| Pro Forma Valuation Report for Second Step Conversion

|

Loans above the lending limit for conforming loans (i.e. “jumbo loans”) may be retained in the loan portfolio and typically have 15 to 30 year terms and maximum loan-to-value ratios of 80%. Adjustable-rate one- to four-family residential real estate loans originated by the Company are typically held in the loan portfolio and have terms ranging from 10 to 30 years. They generally have fixed rates for initial terms of five years, although the Company also offers initial terms of three or seven years. Thereafter these loans adjust annually at a margin, which in recent years has been tied to the applicable treasury rate. The maximum amount by which the interest rate may be increased or decreased is generally 2% per adjustment period, with a lifetime interest rate cap of generally 6% over the initial interest rate of the loan and a rate floor.

For the year ended December 31, 2020, the Company sold $193.6 million of one- to four-family residential real estate loans, of which $192.1 million were originated in 2020 and $1.5 million were originated prior to 2020. As of December 31, 2020, the Company had $69.0 million of loans secured by permanent mortgages on one- to four-family residential real estate, representing 20.8% of the total loan portfolio. The Company originates both fixed-rate and adjustable-rate one- to four-family residential real estate loans and as of December 31, 2020, 83.5% of such loans were fixed-rate, and 16.5% were adjustable-rate loans.

Construction and Land Loans

Loans to finance the construction of owner occupied one- to four-family residential properties to the prospective homeowners are typically secured by properties located in the Company’s primary market area. Such loans are generally structured as interest-only for 12 months. Loan value ratios generally do not exceed 80% during the construction phase (up to 95% if private mortgage insurance is obtained). Once the construction project is satisfactorily completed, generally within 12 months, the loan converts to an amortizing loan which is evaluated for sale on the secondary market. At December 31, 2020, residential construction loan balances were $3.0 million, or 0.9% of total loans, with an additional $5.5 million available to borrowers.

The Company also originates loans to finance the construction of commercial properties, multi-family residential projects (including non-owner occupied one- to four family residences) and professional complexes in its primary market area. Such loans are generally structured as interest-only during the anticipated construction period. The interest rate is generally fixed for five years at the five-year Treasury rate plus a margin. Loan to value ratios generally do not exceed 80% of the appraised value on a completed basis or the cost of completion, whichever is less. At the end of the construction phase, the loan may convert to a permanent mortgage loan or the loan may be paid in full. Most of these loans are generally secured by properties located in the Company’s primary market area.

15

| Pro Forma Valuation Report for Second Step Conversion

|

Land Development Loans

The Company also originates loans to finance the development of land for agricultural purposes and for the development of commercial and residential properties. Land development loans are generally secured by vacant land and/or property that is in the process of improvement. Most of these loans are secured by properties located in the Company’s primary market area and are structured as interest-only or amortizing. The interest rate generally floats, at the prime rate or prime rate plus a margin and the maximum loan to value ratio is 65%. When providing financing to improve the land, the maximum loan to value ratio is generally 80% of the appraised value on a completed basis or the cost of completion, whichever is less. At December 31, 2020, land development loans were $1.5 million, or 0.5% of the Company’s total loan portfolio, with no additional funds available to borrowers.

Consumer Loans.

The Company offers a variety of consumer loans to individuals who reside or work in its market area, including home equity lines of credit, new and used automobile loans, boat loans, recreational vehicle loans and loans secured by certificates of deposit. Generally, home equity lines of credit are underwritten with a maximum loan to value of 85% and a maximum debt to income ratio of 43%. At December 31, 2020, the Company’s consumer loan portfolio totaled $22.7 million, or 6.8% of its total loan portfolio. Of that amount, 6.7% of the total loan portfolio, consisted of outstanding balances on home equity loans and home equity lines of credit, which lines of credit had $25.7 million available to draw.

| H. | Asset Quality |

As reflected in Exhibit I-9, between year-ends 2019 and 2020, the Company’ non-performing assets decreased from $2.0 million or 0.47% of assets at year-end 2019 to $1.3 million or 0.25% of assets at year-end 2020. Including restructured loans, the Company’s non-performing assets were $2.5 million or 0.57% of assets at year-end 2019 and $1.7 million or 0.33% of assets at year-end 2020. The Company held no foreclosed or repossessed assets as of any year-end between 2016 and 2020. As of December 31, 2020, the Company had $56,000 of residential real estate loans in process of foreclosure. Non-performing assets at year-end 2020 consisted of $1.29 million of non-accruing loans and $432,000 of accruing restructured loans. The Bank had $219,000 in non-accruing troubled debt restructured loans at year-end 2020. Non-accrual loans decreased $726,000, to $1.3 million at December 31, 2020, compared to $1.8 million at December 31, 2019. Non-accruing loans at year-end 2020 included $1.15 million of one- to four-family residential real estate loans and $136,000 of home equity loans.

16

| Pro Forma Valuation Report for Second Step Conversion

|

The provisions of the March 2020 Coronavirus Aid, Relief and Economic Security (“CARES”) Act included an election to not apply the guidance on accounting for troubled debt restructurings to loan modifications, such as extensions or deferrals, related to COVID-19 made between March 1, 2020 and the earlier of (i) December 31, 2020 or (ii) 60 days after the end of the COVID-19 national emergency. The relief can only be applied to modifications for loans that were not more than 30 days past due as of December 31, 2019. As of December 31, 2020, the Company had deferrals of approximately $308,000 in interest, escrow and principal payments on $14.1 million in outstanding loans.

The Company’s ratios of classified assets to assets increased from $6.7 million or 1.56% of assets at year-end 2019 to $10.4 million or 2.0% of assets at at year-end 2020 (See Exhibit I-6). All classified assets for 2019 and 2020 year-ends consisted entirely of loans classified as substandard no assets classified as doubtful or loss.

The Company’s loan loss allowances as of December 31, 2020 totaled $2.7 million or 0.81% of total loans outstanding. Comparatively, as of December 31, 2019, the allowance for loan losses equaled 0.64% of total loans. The allowance for loan losses to non-accrual loans ratio increased to 210.02% as of December 31, 2020, compared to 99.35% at December 31, 2019 due to a reduction in non-accrual loans and an increase in the allowance for loan losses. The Company recorded provision expense of $500,000 during the year ended December 31, 2020 to reflect the unknown risk within the Company’s loan portfolio due to the ongoing COVID-19 pandemic.

| I. | Investment Strategies |

The Company’s investment strategy is to provide and maintain liquidity to meet deposit withdrawal and loan funding needs, to help mitigate interest rate and market risk, to diversify the Company’s assets, and to generate a reasonable rate of return on funds within the context of the Company’s interest rate and credit risk objectives. The Company plans for net conversion offering proceeds retained at the holding company level to initially be primarily invested into liquid funds held as a deposit at the Bank.

Between year-ends 2016 and 2020, the Company’s level of cash and investment securities (inclusive of FHLB stock) ranged from a low of 15.31% of assets at year-end 2018 to a high of 29.85% of assets at year-end 2020. The higher proportion of cash and investments maintained at year-end 2020 was primarily due to an increase in cash and cash equivalents, as a large portion of the PPP loan funds remained in customers’ deposit accounts. As of year-end 2020, the Company held investment securities totaling $61.7 million or 11.94% of assets, consisting primarily of $38.0 million in U.S. Government sponsored mortgage-backed securities, $11.8 million in municipal securities and $1.6 million in U.S. Government agency securities. The Company also has $7.3 million in asset-backed securities comprised of pools of student loans. As of December 31, 2020, $58.7 million or 95.15% in the Company’s investment portfolio were available for sale and had a net unrealized gain of $1.6 million. See Exhibit I-7. The Company also had $3.0 million in marketable equity securities consisting of mutual fund investments and common stock, which are held in a Rabbi Trust and are related to the Company’s obligations to certain retired and active employees and directors under deferred compensation plans.

17

| Pro Forma Valuation Report for Second Step Conversion

|

The Company also held $3.0 million of FHLB stock and cash and cash equivalents of $92.5 million at year-end 2020, equal to 0.59% of assets and 17.91% of assets, respectively. The Company also maintains an investment BOLI policies, which covers the lives of certain officers and former officers of the Company. The life insurance policies earn tax-exempt income through cash value accumulation and death proceeds. As of year-end 2020, the cash surrender value of the Company’s BOLI equaled $13.5 million or 2.61% of total assets.

As of December 31, 2020, the weighted average yield on investment securities and interest-earning deposits was 1.95% (see Exhibit I-12). Exhibit I-7 provides detail of the Company’s investment portfolio.

| J. | Funding and Strategies |

Over the most recent five year-ends through December 31, 2020, deposits were the Company’s primary funding source, with deposits representing approximately 73% to 85% of total assets over that period. The Bank offers a variety of deposit accounts, including checking accounts, savings accounts and certificate of deposit accounts. Deposits gathered in the Company’s primary market area have consistently served as the primary funding source for the Company. At year-end 2020, the Company had $379.8 million of deposits, or 73.51% of total assets and $68.4 million of borrowings, or 13.24% of total assets, consisting of FHLB advances (See Table I.D.1). In 2020, the proportion of FHLB borrowings increased to repay relatively higher costing brokered certificates of deposits and to provide additional on balance sheet liquidity as a precaution to the uncertainty related to the onset of the COVID-19 pandemic.

As of December 31, 2020, transaction, savings and money market deposits combined comprised 76.93% of the Company’s total deposits vs. 58.67% at year-end 2019. The shift in funding mix toward these account types has been aided by the Company’s treasury management services, which provide additional convenience to small businesses in managing their deposit accounts, including customers who received PPP loans. Between December 31, 2019 and 2020, brokered deposits have decreased from 8.59% of total deposits at year-end 2019 to 1.45% at year-end 2020.

Exhibit I-15 sets forth the Company’s deposit composition from year-end 2019 to 2020. During this period, time deposits have decreased from 41.34% to 23.07%. Exhibit I-16 sets forth the maturity schedule of the time deposits, which shows that, as of December 31, 2020, 93.03% of such deposits were scheduled to mature in one year or less.

18

| Pro Forma Valuation Report for Second Step Conversion

|

For 2020, the weighted average interest rate on the FHLB advances was 1.18%, down from 1.46% for 2019. Exhibit I-14 provides further detail of the Company’s borrowings. The Bank has also used borrowings from the FHLB and brokered deposits, to fund its operations.

| K. | Subsidiaries |

The Company has no subsidiaries other than the Bank.

| L. | Legal Proceedings |

The Company is not involved in any pending legal proceedings as a plaintiff or defendant other than routine legal proceedings occurring in the ordinary course of business, and at December 31, 2020, the Company was not involved in any legal proceedings, the outcome of which would be material to the Company’s financial condition or results of operations.

| M. | Management |

The Company’s senior management consists of the following:

Richard Hurd was appointed Chief Executive Officer of the Bank in 2007. Prior to that, Mr. Hurd was the Chief Operating Officer from 2004 to 2007. Mr. Hurd has been a board member since 2004. He joined the Bank in 2001. Prior to joining the Bank, Mr. Hurd had 30 years of banking experience at First Wisconsin National Bank, Marine Bank and Bank One Corporation. Age 68.

David Ball joined the Company and the Bank at the end of February 2021 as a Director, President and Chief Operating Officer. In this role he will oversee the daily operations of the Bank, design and implement business strategies and set comprehensive goals for profitability and growth. Prior to being employed by the Bank, Mr. Ball was most recently the Managing Director of Correspondent Banking at BMO Harris from 2004 until February 2021. Mr. Ball has over 30 years of banking experience prior to joining the Bank, with a depth of experience in finance, commercial lending and management. Age 52.

Monica Baker was appointed Senior Vice President-Chief Brand Officer in January 2014. Ms. Baker joined the Bank in 1993 as the Vice President of Marketing/Human Resources/Savings. In 2000, she was promoted to Senior Vice President of Marketing/Human Resources and in 2010 she was promoted to Senior Vice President of Marketing/Human Resources/Retail Lending. Ms. Baker has been on the Board of Directors since 2006. Prior to being employed with the Bank, Ms. Baker was the Human Resources Officer at Maritime Savings Bank. She brings with her over 34 years of banking experience, focused on retail banking, retail lending, human resources and marketing. Ms. Baker holds her Master of Business Administration Degree from the University of Wisconsin-Milwaukee and undergraduate with a double major in Human Resources and Marketing from the University of Wisconsin-Milwaukee. Age 51.

19

| Pro Forma Valuation Report for Second Step Conversion

|

Richard J. Krier joined the Bank in April 2011 as Senior Vice President Chief Financial Officer. In this role he oversees the Bank’s financial reporting and finance functions. Prior to being employed by the Bank, Mr. Krier served as the Chief Financial Officer of Partnership Community Bancshares from 2008 until 2011 and was employed at Ozaukee Bank from 1990 to 2008 in a variety of administrative and financial roles including Chief Financial Officer from 2004 to 2008. Mr. Krier has over 30 years of broad-based banking experience in the areas of financial management, operations, performance measurement and decision support. Mr. Krier is also a certified public accountant. Age 60.

Charles Mauer joined the Bank in June 2010 as the Bank’s Chief Credit Officer. He is responsible for the overall management of the Bank’s Credit Administration Department, including loan underwriting, loan review, lending support, loan policies, procedures and processes to ensure the overall quality of the Bank’s loan portfolio. Mr. Mauer has over 30 years of commercial, consumer and mortgage lending as well as credit administration experience. Prior to working at the Bank, he was a First Vice President of Credit Administration at Ozaukee Bank where he also managed client relationships for over 20 years. In 2007, Ozaukee Bank was acquired by BMO Harris. Mr. Mauer remained with BMO Harris for three years serving as Senior Vice President—Concurrence Officer. Age 61.

Over the past five years, the Company’s management has maintained the net interest margin and yield-cost spread relatively stable and subsequent to the Bank branch restructure in 2019, achieved a relatively more favorable efficiency ratio in 2020. As indicated in Exhibit I-5 and I-15, the Company’s increasingly diversified loan portfolio from year-ends 2016 to 2020 and favorable trends in deposit composition from year-ends 2019 to 2020, respectively, as well as improving non-performing assets and minimal net loan chargeoffs (see Exhibit I-9), coupled with mostly improving performance metrics (see Exhibit I-3) over the past three years, all are positive indicators of management’s performance in operating the Company.

20

| Pro Forma Valuation Report for Second Step Conversion

|

II. ANALYSIS OF OPERATING ENVIRONMENT AND PRIMARY MARKET AREA

| A. | Physical Office Locations |

As a locally based community-oriented banking company, the Company’s current value and future prospects are directly or indirectly impacted by economic and demographic characteristics and trends in its primary market area, which consists of Milwaukee, Waukesha and Ozaukee Counties, in Southeastern Wisconsin and by regional and national economic factors impacting its primary market area.

1895 Bancorp has a physical “bricks and mortar” presence through its main office/branch and five additional branch locations. The Company conducts operations from three full-service banking offices in Milwaukee County, two full-service banking offices in Waukesha County and one full-service banking office in Ozaukee County, Wisconsin. The Company considers its primary lending and deposit gathering market area to be Milwaukee, Waukesha and Ozaukee Counties, in Southeastern Wisconsin, and only occasionally makes loans secured by properties located outside of its primary lending market, usually to borrowers with whom the Company has an existing relationship and who have a presence within its primary market. Exhibit II-1 provides information on the Company’s office properties.

| B. | Demographic Trends |

Future growth opportunities for 1895 Bancorp depend in part on the future growth and stability of economies, demographic growth trends, and the nature and intensity of the competitive environment.

Demographic and economic growth trends, measured by changes in population, number of households, age distribution and median household income, provide key insight into the health of the market area served by 1895 Bancorp. Demographic data for Milwaukee, Waukesha, and Ozaukee Counties, as well as for Wisconsin and the U.S., is provided in Table II.B.1 from 2016 to 2021 and projected through 2026.

21

| Pro Forma Valuation Report for Second Step Conversion

|

Table II.B.1

1895 Bancorp of Wisconsin, Inc.

Summary Demographic/Economic Data

| Year | Growth Rate | |||||||||||||||||||

| 2016 | 2021 | 2026 | 2016-2021 | 2021-2026 | ||||||||||||||||

| (%) | (%) | |||||||||||||||||||

Population (000) | ||||||||||||||||||||

USA | 322,431 | 330,946 | 340,574 | 0.5 | % | 0.6 | % | |||||||||||||

Wisconsin | 5,782 | 5,842 | 5,911 | 0.2 | % | 0.2 | % | |||||||||||||

Milwaukee, WI | 958 | 943 | 941 | -0.3 | % | 0.0 | % | |||||||||||||

Waukesha, WI | 397 | 407 | 414 | 0.5 | % | 0.4 | % | |||||||||||||

Ozaukee, WI | 88 | 90 | 91 | 0.4 | % | 0.3 | % | |||||||||||||

Households (000) | ||||||||||||||||||||

USA | 122,265 | 125,733 | 129,596 | 0.6 | % | 0.6 | % | |||||||||||||

Wisconsin | 2,346 | 2,384 | 2,423 | 0.3 | % | 0.3 | % | |||||||||||||

Milwaukee, WI | 389 | 384 | 384 | -0.3 | % | 0.0 | % | |||||||||||||

Waukesha, WI | 158 | 163 | 167 | 0.6 | % | 0.5 | % | |||||||||||||

Ozaukee, WI | 36 | 36 | 37 | 0.4 | % | 0.4 | % | |||||||||||||

Median Household Income ($) | ||||||||||||||||||||

USA | 55,551 | 67,761 | 73,868 | 4.1 | % | 1.7 | % | |||||||||||||

Wisconsin | 54,626 | 66,361 | 72,446 | 4.0 | % | 1.8 | % | |||||||||||||

Milwaukee, WI | 44,142 | 54,231 | 59,873 | 4.2 | % | 2.0 | % | |||||||||||||

Waukesha, WI | 78,303 | 93,695 | 103,084 | 3.7 | % | 1.9 | % | |||||||||||||

Ozaukee, WI | 73,176 | 88,966 | 96,492 | 4.0 | % | 1.6 | % | |||||||||||||

Per Capita Income ($) | ||||||||||||||||||||

USA | 30,002 | 37,689 | 41,788 | 4.7 | % | 2.1 | % | |||||||||||||

Wisconsin | 29,183 | 36,330 | 40,537 | 4.5 | % | 2.2 | % | |||||||||||||

Milwaukee, WI | 24,943 | 30,901 | 34,383 | 4.4 | % | 2.2 | % | |||||||||||||

Waukesha, WI | 39,762 | 50,395 | 56,212 | 4.9 | % | 2.2 | % | |||||||||||||

Ozaukee, WI | 40,968 | 50,915 | 55,889 | 4.4 | % | 1.9 | % | |||||||||||||

Owner Occupied Housing Units (000) |

| |||||||||||||||||||

USA | 79,440 | 81,944 | 84,477 | 0.6 | % | 0.6 | % | |||||||||||||

Wisconsin | 1,596 | 1,624 | 1,651 | 0.3 | % | 0.3 | % | |||||||||||||

Milwaukee, WI | 199 | 196 | 196 | -0.3 | % | 0.0 | % | |||||||||||||

Waukesha, WI | 122 | 125 | 129 | 0.6 | % | 0.5 | % | |||||||||||||

Ozaukee, WI | 27 | 28 | 28 | 0.4 | % | 0.4 | % | |||||||||||||

2021 Age Distribution (%) | 0-14 Yrs. | 15-34 Yrs. | 35-54 Yrs. | 55-69 Yrs. | 70+ Yrs. | |||||||||||||||

USA | 18.3 | 26.8 | 25.1 | 18.4 | 11.4 | |||||||||||||||

Wisconsin | 17.8 | 25.9 | 24.3 | 20.1 | 11.9 | |||||||||||||||

Milwaukee, WI | 20.1 | 28.8 | 24.9 | 16.7 | 9.6 | |||||||||||||||

Waukesha, WI | 16.7 | 22.8 | 25.0 | 22.4 | 13.1 | |||||||||||||||

Ozaukee, WI | 16.7 | 23.0 | 23.8 | 22.4 | 14.0 | |||||||||||||||

2021 HH Income Dist. (%) | Less Than 25,000 | $25,000 to 50,000 | $50,000 to 100,000 | $100,000+ | ||||||||||||||||

USA | 18.0 | 20.3 | 29.0 | 32.7 | ||||||||||||||||

Wisconsin | 16.5 | 21.6 | 32.0 | 29.9 | ||||||||||||||||

Milwaukee, WI | 23.5 | 23.5 | 29.6 | 23.4 | ||||||||||||||||

Waukesha, WI | 10.2 | 15.3 | 27.8 | 46.7 | ||||||||||||||||

Ozaukee, WI | 12.3 | 16.2 | 27.4 | 44.1 | ||||||||||||||||

Source: S&P Global Market Intelligence.

22

| Pro Forma Valuation Report for Second Step Conversion

|

The data highlights that the Company’s market area demographics are reflective of a relatively small local market area. Milwaukee County is primarily an urban community. The Company’s Milwaukee County branches are in more suburban areas but are still in relatively close proximity to downtown Milwaukee. The population in Milwaukee County decreased at an annualized rate of 0.3% over the past five years, from 958,000 in 2016 to 943,000 in 2021 while Waukesha County and Ozaukee County grew at annual population growth rates of 0.5% and 0.4%, respectively. Comparatively, Wisconsin and the U.S. recorded annual population growth rates of 0.2% and 0.5%, respectively, over the past five years. Looking ahead to 2026, Milwaukee County is projected to remain flat at annualized population growth rate of 0.0% while Waukesha County and Ozaukee County are projected to grow at annualized rates of 0.4% and 0.3%, respectively, which are higher than the 0.2% projected for the state of Wisconsin but lower than the 0.6% projected for the U.S.

Household growth rates paralleled population growth trends in both market area counties, as Waukesha County recorded a stronger rate of household growth compared to Milwaukee County and Ozaukee County.

Median household income in Waukesha County and Ozaukee County was well above national and state averages in 2021, with Waukesha County and Ozaukee County recording $93,695 and $88,966 per household, respectively, versus $67,761 and $66,361 for the nation and state of Wisconsin, respectively. Comparatively, Milwaukee County’s median household income was lower than the U.S. and Wisconsin measures. Waukesha County is primarily a suburban community and is the wealthiest county in Wisconsin, with a median household income of $93,695. Projected median household income growth rates for the Company’s market area counties were approximately 2.0% as well as the U.S. and state of Wisconsin.

Household income distribution measures provide another indication of the relative affluence of Waukesha County and Ozaukee County, as these two counties maintained a relatively high percentage of households with incomes above $100,000 and a relatively low percentage of households with incomes below $25,000. Household income distribution measures for Milwaukee County were relatively more like the comparable U.S. and Wisconsin measures. The Company’s market area counties’ demographic and economic growth trends, including projected population, number of households, age distribution and median household income could all be impacted by the ongoing COVID-19 pandemic, but such potential longer-term impact are difficult to predict.

23

| Pro Forma Valuation Report for Second Step Conversion

|

| C. | Economic Indicators |

Economic conditions, the interest rate environment, gross domestic product (“GDP”), housing market, comparative employment data, large employers operating in the Company’s market area, are some of the key economic factors that impact the Company’s future prospects.

U.S. Economic Overview:

The March 2020 recession ended 128 months of expansion, the longest in U.S. history. Many U.S. economic indicators hit their lowest point in April 2020 due to the COVID-19 pandemic. In the second quarter of 2020, the economy contracted by a record 31.4%. Quarterly GDP had never experienced a drop greater than 10% since record-keeping began in 1947. The travel, leisure and hospitality sectors have been hit particularly hard. Hotel occupancy was down 30%, and airline travel, as measured by travelers through TSA checkpoints, was down about 70% since early March 2020. Conditions slowly improved in May and June as coronavirus cases started moderating, unemployment claims began falling and some states started lifting operating restrictions on businesses. However, as the pandemic hit the second wave in the fall, sales started falling again, and states backtracked on reopening. Unemployment claims remained higher than during any pre-pandemic period based on records going back to 1967. During the fourth quarter of 2020, the nation has recovered 12.3 million, or 56%, of the 22.2 million jobs lost in March and April as many furloughed workers were called back. During the third quarter of 2020, many economic indicators showed the economy had largely gone sideways. Six months into the crisis, weekly claims for unemployment benefits were about four times higher than they were before the COVID-19 pandemic. The developments eclipsed Joe Biden’s win in the U.S. presidential election, as well as a stimulus package announced in late December 2020.

While the economy has partially rebounded from a deep contraction in the first half of 2020, there are fresh concerns in early 2021 as COVID-19 cases increased on the heels of the prior year-end holidays, the rollout of vaccines has not met expectations, and further Federal pandemic relief was uncertain.

A variety of factors will determine how the recovery unfolds in 2021. Key variables include: a) the scale of the ongoing COVID-19 resurgence and any resulting lockdowns, b) the deployment and effectiveness of COVID-19 vaccines, c) the status of labor markets and household consumption, e) the degree to which volatility related to the U.S. political transition affects consumer and business confidence; and f) whether or not additional stimulus payments occur and how effective they are.

24

| Pro Forma Valuation Report for Second Step Conversion

|

Interest Rates:

Prior to the onset of the COVID-19 pandemic in the first quarter of 2020, the Federal Reserve had maintained that it would hold interest rates steady. As risks to the World and U.S. economies, stemming from the COVID -19 pandemic, came more into focus, the Federal Reserve reduced the Federal Funds target interest rate twice during March 2020 for a total of 150 basis points setting the target Fed Funds rate at 0% to 0.25%. The prime rate ended at 3.25% in March 2020. Exhibit II-2 provides additional information regarding historical interest rates. The aforementioned interest rate reductions reduced the US Treasury yields and yield curve to historic low levels, resulting in short term interest rates near zero, and intermediate and longer-term Treasury rates also at low levels. From March 2020 through early August 2020, the 10-year Treasury Bond rate ranged between 0.50% and 0.75%, while the 30-year Treasury Bond rate ranged from 1.25% to 1.50% over the same period. After reaching a low of 0.52% on August 4, 2020, the 10-year Treasury Bond rate has trended upward and was 1.19% on February 8, 2021. Similarly, after reaching a low of 1.19% on August 4; 2020, the 30-year Treasury Bond rate has trended upward to 1.96% as of February 8, 2021. The latest Wall Street Journal (“WSJ”) survey of leading economists indicates a modestly rising rate scenario through mid-2023 with longer term rates rising more than short term rates.

Gross Domestic Product: