Exhibit 99.1

PRO FORMA VALUATION REPORT

SECOND-STEP CONVERSION

NorthEast Community Bancorp, Inc. │White Plains, New York

PROPOSED HOLDING COMPANY FOR:

NorthEast Community Bank │ White Plains, New York

Dated as of February 5, 2021

1311-A Dolley Madison Boulevard

Suite 2A

McLean, Virginia 22101

703.528.1700

rpfinancial.com

February 5, 2021

Boards of Directors

NorthEast Community Bancorp, MHC

NorthEast Community Bancorp, Inc.

NorthEast Community Bank

325 Hamilton Avenue

White Plains, New York 10601

Members of the Boards of Directors:

At your request, we have completed and hereby provide an independent appraisal ("Appraisal") of the estimated pro forma market value of the common stock which is to be issued in connection with the mutual-to-stock conversion transaction described below.

This Appraisal is furnished pursuant to the requirements stipulated in the Code of Federal Regulations and has been prepared in accordance with the “Guidelines for Appraisal Reports for the Valuation of Savings and Loan Associations Converting from Mutual to Stock Form of Organization” (the “Valuation Guidelines”) of the Office of Thrift Supervision (“OTS”) and accepted by the Federal Reserve Board (“FRB”), the Federal Deposit Insurance Corporation (“FDIC”) and the Office of the Comptroller of the Currency (“OCC”), and applicable regulatory interpretations thereof.

Description of Plan of Conversion

On November 4, 2020, the Boards of Directors of NorthEast Community Bancorp, MHC (the “MHC”) and NorthEast Community Bancorp, Inc. (“NECB”) adopted a plan of conversion whereby the MHC will convert to stock form. As a result of the conversion, NECB, which currently owns all of the issued and outstanding common stock of NorthEast Community Bank (the “Bank”), will be succeeded by a new Maryland corporation with the name of NorthEast Community Bancorp, Inc. (“NorthEast Community Bancorp” or the “Company”). Following the conversion, the MHC will no longer exist. For purposes of this document, the existing consolidated entity will hereinafter also be referred to as NorthEast Community Bancorp or the Company, unless otherwise identified as NECB. As of December 31, 2020, the MHC had a majority ownership interest in, and its principal asset consisted of, approximately 59.65% of the common stock (the “MHC Shares”) of NECB. The remaining 40.35% of NECB’s common stock is owned by public stockholders.

It is our understanding that NorthEast Community Bancorp will offer its stock, representing the majority ownership interest held by the MHC, in a subscription offering to Eligible Account Holders, Tax-Qualified Plan consisting of the Bank’s employee stock ownership plan (the “ESOP”), Supplemental Eligible Account Holders and Other Members. To the extent that shares remain available for purchase after satisfaction of all subscriptions received in the subscription offering, the shares may be offered for sale to the public at large in a community

| Washington Headquarters | |

| 1311-A Dolley Madison Boulevard | Telephone: (703) 528-1700 |

| Suite 2A | Fax No.: (703) 528-1788 |

| McLean, VA 22101 | Toll-Free No.: (866) 723-0594 |

| www.rpfinancial.com | E-Mail: mail@rpfinancial.com |

Boards of Directors

February 5, 2021

Page 2

offering and a syndicated or firm commitment offering. Upon completing the mutual-to-stock conversion and stock offering (the “second-step conversion”), the Company will be 100% owned by public shareholders, the publicly-held shares of NECB will be exchanged for shares in the Company at a ratio that retains their ownership interest at the time the conversion is completed and the MHC assets will be consolidated with the Company.

RP® Financial, LC.

RP® Financial, LC. (“RP Financial”) is a financial consulting firm serving the financial services industry nationwide that, among other things, specializes in financial valuations and analyses of business enterprises and securities, including the pro forma valuation for savings institutions converting from mutual-to-stock form. The background and experience of RP Financial is detailed in Exhibit V-1. We believe that, except for the fee we will receive for the Appraisal, we are independent of the Company, NECB, the Bank, the MHC and the other parties engaged by the Bank or the Company to assist in the second-step conversion process.

Valuation Methodology

In preparing our Appraisal, we have reviewed the regulatory applications of the Company, the Bank and the MHC, including the prospectus as filed with the FRB and the Securities and Exchange Commission (“SEC”). We have conducted a financial analysis of the Company, the Bank and the MHC that has included a review of audited financial information for the years ended December 31, 2016 through December 31, 2020, a review of various unaudited information and internal financial reports through December 31, 2020, and due diligence related discussions with the Company’s management; BDO USA, LLP, the Company’s independent auditor; Kilpatrick Townsend & Stockton LLP, the Company’s conversion counsel and Piper Sandler & Co., the Company’s marketing advisor in connection with the stock offering. All assumptions and conclusions set forth in the Appraisal were reached independently from such discussions. In addition, where appropriate, we have considered information based on other available published sources that we believe are reliable. While we believe the information and data gathered from all these sources are reliable, we cannot guarantee the accuracy and completeness of such information.

We have investigated the competitive environment within which NorthEast Community Bancorp operates and have assessed NorthEast Community Bancorp’s relative strengths and weaknesses. We have kept abreast of the changing regulatory and legislative environment for financial institutions and analyzed the potential impact on NorthEast Community Bancorp and the industry as a whole. We have analyzed the potential effects of the stock conversion on NorthEast Community Bancorp’s operating characteristics and financial performance as they relate to the pro forma market value of NorthEast Community Bancorp. We have analyzed the assets held by the MHC, which will be consolidated with NorthEast Community Bancorp’s assets and equity pursuant to the completion of the second-step conversion. We have reviewed the economic and demographic characteristics of the Company’s primary market area. We have compared NorthEast Community Bancorp’s financial performance and condition with selected publicly-traded thrifts in accordance with the Valuation Guidelines, as well as all publicly-traded thrifts and thrift holding companies. We have reviewed the current conditions in the securities markets in general and the market for thrift stocks in particular, including the

Boards of Directors

February 5, 2021

Page 3

market for existing thrift issues, initial public offerings by thrifts and thrift holding companies and second-step conversion offerings. We have excluded from such analyses thrifts subject to announced or rumored acquisition, and/or institutions that exhibit other unusual characteristics.

The Appraisal is based on NorthEast Community Bancorp’s representation that the information contained in the regulatory applications and additional information furnished to us by NorthEast Community Bancorp and its independent auditor, legal counsel and other authorized agents are truthful, accurate and complete. We did not independently verify the financial statements and other information provided by NorthEast Community Bancorp, or its independent auditor, legal counsel and other authorized agents nor did we independently value the assets or liabilities of NorthEast Community Bancorp. The valuation considers NorthEast Community Bancorp only as a going concern and should not be considered as an indication of NorthEast Community Bancorp’s liquidation value.

Our appraised value is predicated on a continuation of the current operating environment for NorthEast Community Bancorp and for all thrifts and their holding companies. Changes in the local, state and national economy, the legislative and regulatory environment for financial institutions and mutual holding companies, the stock market, interest rates, and other external forces (such as natural disasters or significant world events) may occur from time to time, often with great unpredictability and may materially impact the value of thrift stocks as a whole or the value of NorthEast Community Bancorp’s stock alone. It is our understanding that there are no current plans for selling control of NorthEast Community Bancorp following completion of the second-step conversion. To the extent that such factors can be foreseen, they have been factored into our analysis.

The estimated pro forma market value is defined as the price at which NorthEast Community Bancorp’s common stock, immediately upon completion of the second-step stock offering, would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or sell and both having reasonable knowledge of relevant facts.

In preparing the pro forma pricing analysis we have taken into account the pro forma impact of the MHC’s net assets (i.e., unconsolidated equity) that will be consolidated with the Company and thus will increase equity. After accounting for the impact of the MHC’s net assets, the public shareholders’ ownership interest was reduced by approximately 0.08%. Accordingly, for purposes of the Company’s pro forma valuation, the public shareholders’ pro forma ownership interest was reduced from 40.35% to 40.27% and the MHC’s ownership interest was increased from 59.65% to 59.73%.

Valuation Conclusion

It is our opinion that, as of February 5, 2021, the estimated aggregate pro forma valuation of the shares of the Company to be issued and outstanding at the end of the conversion offering – including (1) newly-issued shares representing the MHC’s current ownership interest in the Company and (2) exchange shares issued to existing public shareholders of NECB – was $171,593,320 at the midpoint, equal to 17,159,332 shares at $10.00 per share. The resulting range of value and pro forma shares, all based on $10.00 per share, are as follows: $145,854,320 or 14,585,432 shares at the minimum and $197,332,310 or 19,733,231 shares at the maximum.

Boards of Directors

February 5, 2021

Page 4

Based on this valuation and taking into account the ownership interest represented by the shares owned by the MHC, the midpoint of the offering range is $102,500,000 equal to 10,250,000 shares at $10.00 per share. The resulting offering range and offering shares, all based on $10.00 per share, are as follows: $87,125,000 or 8,712,500 shares at the minimum and $117,875,000 or 11,787,500 shares at the maximum,

Establishment of the Exchange Ratio

The conversion regulations provide that in a conversion of a mutual holding company, the minority stockholders are entitled to exchange the public shares for newly issued shares in the fully converted company. The Boards of Directors of the MHC and NECB have independently determined the exchange ratio, which has been designed to preserve the current aggregate percentage ownership in the Company (adjusted for the dilution resulting from the consolidation of the MHC’s unconsolidated equity into the Company). The exchange ratio to be received by the existing minority shareholders of the Company will be determined at the end of the offering, based on the total number of shares sold in the offering and the final appraisal. Based on the valuation conclusion herein, the resulting offering value and the $10.00 per share offering price, the indicated exchange ratio at the midpoint is 1.4041 shares of the Company’s stock for every one share held by public shareholders. Furthermore, based on the offering range of value, the indicated exchange ratio is 1.1935 at the minimum and 1.6147 at the maximum. RP Financial expresses no opinion on the proposed exchange of newly issued Company shares for the shares held by the public stockholders or on the proposed exchange ratio.

Limiting Factors and Considerations

The valuation is not intended, and must not be construed, as a recommendation of any kind as to the advisability of purchasing shares of the common stock. Moreover, because such valuation is determined in accordance with applicable regulatory guidelines and is necessarily based upon estimates and projections of a number of matters, all of which are subject to change from time to time, no assurance can be given that persons who purchase shares of common stock in the conversion offering, or prior to that time, will thereafter be able to buy or sell such shares at prices related to the foregoing valuation of the estimated pro forma market value thereof. The appraisal reflects only a valuation range as of this date for the pro forma market value of NorthEast Community Bancorp immediately upon issuance of the stock and does not take into account any trading activity with respect to the purchase and sale of common stock in the secondary market on the date of issuance of such securities or at anytime thereafter following the completion of the second-step conversion.

RP Financial’s valuation was based on the financial condition, operations and shares outstanding of NECB as of December 31, 2020, the date of the financial data included in the prospectus. The proposed exchange ratio to be received by the current public stockholders of NECB and the exchange of the public shares for newly issued shares of NorthEast Community Bancorp’s common stock as a full public company was determined independently by the Boards of Directors of the MHC and NECB. RP Financial expresses no opinion on the proposed exchange ratio to public stockholders or the exchange of public shares for newly issued shares.

Boards of Directors

February 5, 2021

Page 5

RP Financial is not a seller of securities within the meaning of any federal and state securities laws and any report prepared by RP Financial shall not be used as an offer or solicitation with respect to the purchase or sale of any securities. RP Financial maintains a policy which prohibits RP Financial, its principals or employees from purchasing stock of its client institutions.

This valuation may be updated as provided for in the conversion regulations and guidelines. These updates will consider, among other things, any developments or changes in the financial performance and condition of NorthEast Community Bancorp, management policies, and current conditions in the equity markets for thrift shares, both existing issues and new issues. These updates may also consider changes in other external factors which impact value including, but not limited to: various changes in the legislative and regulatory environment for financial institutions, the stock market and the market for thrift stocks, and interest rates. Should any such new developments or changes be material, in our opinion, to the valuation of the shares, appropriate adjustments to the estimated pro forma market value will be made. The reasons for any such adjustments will be explained in the update at the date of the release of the update. The valuation will also be updated at the completion of NorthEast Community Bancorp’s stock offering.

| | Respectfully submitted, |

| | RP® FINANCIAL, LC. |

| |  |

| | Ronald S. Riggins |

| | President and Managing Director |

| |  |

| | Gregory E. Dunn |

| | Director |

| RP® Financial, LC. | TABLE OF CONTENTS i |

TABLE OF CONTENTS

NORTHEAST COMMUNITY BANCORP, INC.

NORTHEAST COMMUNITY BANK

White Plains, New York

| DESCRIPTION | | PAGE

NUMBER |

| | | | |

| CHAPTER ONE | OVERVIEW AND FINANCIAL ANALYSIS | | |

| | | | |

| Introduction | | I.1 |

| Plan of Conversion | | I.1 |

| Strategic Overview | | I.2 |

| Balance Sheet Trends | | I.5 |

| Income and Expense Trends | | I.8 |

| Interest Rate Risk Management | | I.11 |

| Lending Activities and Strategy | | I.12 |

| Asset Quality | | I.15 |

| Funding Composition and Strategy | | I.16 |

| Subsidiaries | | I.17 |

| Legal Proceedings | | I.17 |

| | | |

| CHAPTER TWO | MARKET AREA ANALYSIS | | |

| | | | |

| Introduction | | II.1 |

| National Economic Factors | | II.2 |

| Market Area Demographics | | II.5 |

| Regional Economy | | II.7 |

| Unemployment Trends | | II.9 |

| Market Area Deposit Characteristics and Competition | | II.10 |

| | | |

| CHAPTER THREE | PEER GROUP ANALYSIS | | |

| | | | |

| Peer Group Selection | | III.1 |

| Financial Condition | | III.5 |

| Income and Expense Components | | III.8 |

| Loan Composition | | III.10 |

| Interest Rate Risk | | III.12 |

| Credit Risk | | III.14 |

| Summary | | III.14 |

| RP® Financial, LC. | TABLE OF CONTENTS ii |

TABLE OF CONTENTS

NORTHEAST COMMUNITY BANCORP, INC.

NORTHEAST COMMUNITY BANK

White Plains, New York

(continued)

| CHAPTER FOUR | VALUATION ANALYSIS | | |

| | | | |

| Introduction | | IV.1 |

| Appraisal Guidelines | | IV.1 |

| RP Financial Approach to the Valuation | | IV.1 |

| Valuation Analysis | | IV.2 |

| | 1. | Financial Condition | | IV.2 |

| | 2. | Profitability, Growth and Viability of Earnings | | IV.4 |

| | 3. | Asset Growth | | IV.6 |

| | 4. | Primary Market Area | | IV.6 |

| | 5. | Dividends | | IV.7 |

| | 6. | Liquidity of the Shares | | IV.8 |

| | 7. | Marketing of the Issue | | IV.8 |

| | | A. | The Public Market | | IV.9 |

| | | B. | The New Issue Market | | IV.14 |

| | | C. | The Acquisition Market | | IV.16 |

| | | D. | Trading in NECB’s Stock | | IV.16 |

| | 8. | Management | | IV.17 |

| | 9. | Effect of Government Regulation and Regulatory Reform | | IV.17 |

| Summary of Adjustments | | IV.18 |

| Valuation Approaches | | IV.18 |

| | 1. | Price-to-Earnings (“P/E”) | | IV.20 |

| | 2. | Price-to-Book (“P/B”) | | IV.21 |

| | 3. | Price-to-Assets (“P/A”) | | IV.21 |

| Comparison to Recent Offerings | | IV.23 |

| Valuation Conclusion | | IV.23 |

| Establishment of the Exchange Ratio | | IV.24 |

| RP® Financial, LC. | LIST OF TABLES iii |

LIST OF TABLES

NORTHEAST COMMUNITY BANCORP, INC.

NORTHEAST COMMUNITY BANK

White Plains, New York

TABLE Number | DESCRIPTION | page |

| | | | |

| 1.1 | Historical Balance Sheet Data | | I.6 |

| 1.2 | Historical Income Statements | | I.9 |

| | | | |

| 2.1 | Summary Demographic Data | | II.6 |

| 2.2 | Primary Market Area Employment Sectors | | II.8 |

| 2.3 | Largest Employers in Local Market Area | | II.9 |

| 2.4 | Unemployment Trends | | II.10 |

| 2.5 | Deposit Summary | | II.11 |

| 2.6 | Market Area Deposit Competitors | | II.13 |

| | | | |

| 3.1 | Peer Group of Publicly-Traded Thrifts | | III.3 |

| 3.2 | Balance Sheet Composition and Growth Rates | | III.6 |

| 3.3 | Income as a % of Average Assets and Yields, Costs, Spreads | | III.9 |

| 3.4 | Loan Portfolio Composition and Related Information | | III.11 |

| 3.5 | Interest Rate Risk Measures and Net Interest Income Volatility | | III.13 |

| 3.6 | Credit Risk Measures and Related Information | | III.15 |

| | | | |

| 4.1 | Market Area Unemployment Rates | | IV.7 |

| 4.2 | Pricing Characteristics and After-Market Trends | | IV.15 |

| 4.3 | Market Pricing Versus Peer Group | | IV.22 |

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.1 |

I. Overview and Financial Analysis

Introduction

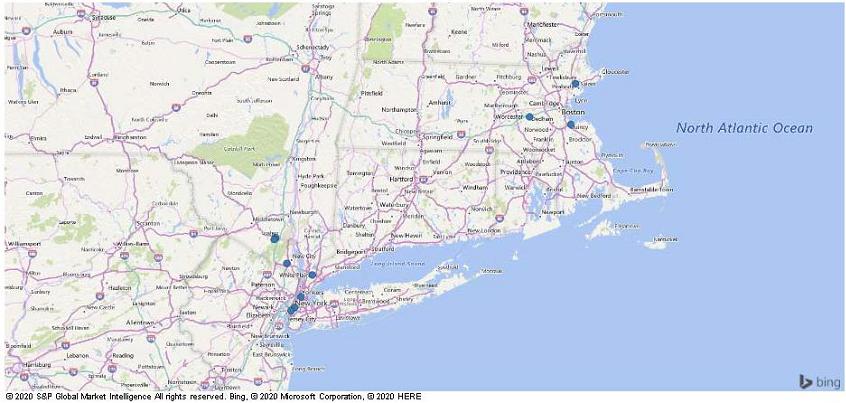

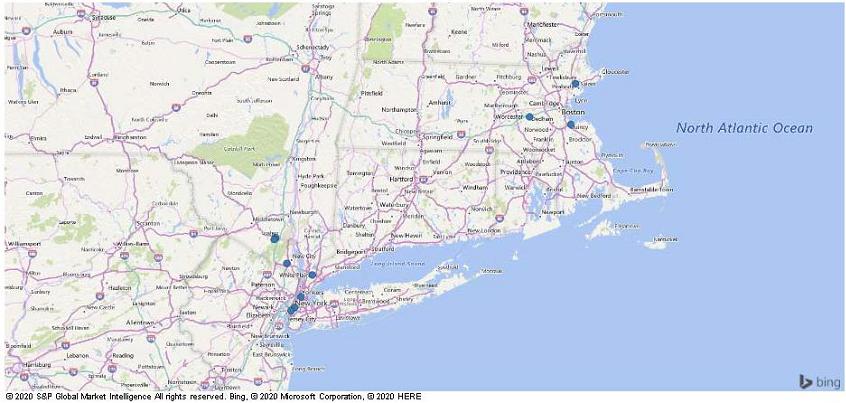

NorthEast Community Bank, or the “Bank”, established in 1934, is a New York chartered stock savings bank headquartered in White Plains, New York. NorthEast Community Bank serves the New York metropolitan area through the main office, six branch offices and two loan production offices (“LPOs”), which are located in the counties of Westchester, New York, Orange, Bronx and Rockland. The Company also maintains three branch offices and one LPO in the Boston metropolitan area, which are located in the counties of Norfolk, Middlesex and Essex. Deposits are generated through the branch offices, while the Company conducts lending activities throughout the Northeastern United States, including New York, Massachusetts, Connecticut, New Jersey, New Hampshire and Pennsylvania. A map of NorthEast Community Bank’s full serve branch office locations is provided in Exhibit I-1. NorthEast Community Bank is a member of the Federal Home Loan Bank (“FHLB”) system and its deposits are insured up to the maximum allowable amount by the Federal Deposit Insurance Corporation (“FDIC”).

NorthEast Community Bancorp, Inc. (“NECB”) is the federally chartered mid-tier holding company of the Bank. NECB owns 100% of the outstanding common stock of the Bank. Since its formation in 2006, NECB has been engaged primarily in the business of holding the common stock of the Bank. NECB completed its initial public offering on July 5, 2006, pursuant to which it sold 5,951,250 shares or 45.0% of its outstanding common stock to the public and issued 7,273,750 shares or 55.0% of its common stock outstanding to NorthEast Community Bancorp, MHC (the “MHC”), the mutual holding company parent of NECB. The MHC and NECB are subject to supervision and regulation by the Board of Governors of the Federal Reserve System (the “Federal Reserve Board” or the “FRB”). At December 31, 2020, NECB had total consolidated assets of $968.2 million, deposits of $771.7 million and equity of $153.8 million or 15.89% of total assets. Excluding goodwill of $651,000, NECB’s tangible equity equaled $153.2 million or 15.82% of total assets at December 31, 2020. NECB’s audited financial statements for the most recent period are included by reference as Exhibit I-2.

Plan of Conversion

On November 4, 2020, the respective Board of Directors of NECB and the MHC adopted

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.2 |

a Plan of Conversion, whereby the MHC will convert to stock form. As a result of the conversion, NECB, which currently owns all of the issued and outstanding common stock of the Bank, will be succeeded by NorthEast Community Bancorp, Inc. (“NorthEast Community Bancorp” or the “Company”), a newly formed Maryland corporation. Following the conversion, the MHC will no longer exist. For purposes of this document, the existing consolidated entity will also hereinafter be also referred to as NorthEast Community Bancorp or the Company, unless otherwise identified as NECB. As of December 31, 2020, the MHC had a majority ownership interest of approximately 59.65% in and its principal asset consisted of 7,273,750 common stock shares of NECB (the “MHC Shares”). The remaining 4,920,861 shares or approximately 40.35% of NECB’s common stock was owned by public shareholders.

It is our understanding that NorthEast Community Bancorp will offer its stock, representing the majority ownership interest held by the MHC, in a subscription offering to Eligible Account Holders, Tax-Qualified Plan consisting of the Bank’s employee stock ownership plan (the “ESOP”), Supplemental Eligible Account Holders and Other Members. To the extent that shares remain available for purchase after satisfaction of all subscriptions received in the subscription offering, the shares may be offered for sale to the public at large in a community offering and a syndicated or firm commitment offering. Upon completing the mutual-to-stock conversion and stock offering (the “second-step conversion”), the Company will be 100% owned by public shareholders, the publicly-held shares of NECB will be exchanged for shares in the Company at a ratio that retains their ownership interest at the time the conversion is completed and the MHC assets will be consolidated with the Company.

Strategic Overview

NorthEast Community Bancorp maintains a local community banking emphasis, with a primary strategic objective of meeting the borrowing and savings needs of its local customer base. The Company is pursuing a strategy of strengthening its community bank franchise dedicated to meeting the banking needs of business and retail customers in the communities that are served by the Company. Growth strategies are emphasizing loan growth that is primarily targeting growth of construction loans and commercial business loans.

The Company’s objective is to fund asset growth primarily through deposit growth, emphasizing growth of lower cost core deposits. Core deposit growth is expected to be in part facilitated by growth of commercial lending relationships, pursuant to which the Company is

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.3 |

seeking to establish a full-service banking relationship with its commercial loan customers through offering a full range of commercial loan products that can be packaged with lower cost commercial deposit products. NorthEast Community Bancorp offers wealth management and financial planning services under the name Harbor West Financial Planning Wealth Management (“Harbor West”), a division of the Bank, through a networking arrangement with a registered broker-dealer and investment advisor.

Loans constitute the major portion of the Company’s composition of interest-earning assets, with construction loans comprising more than half of the Company’s loan portfolio composition. Cash and investments serve as a supplement to the Company’s lending activities, in which cash and cash equivalents account for the largest portion of the Company’s cash and investment holdings for purposes of managing liquidity and interest rate risk.

Deposits have consistently served as the primary funding source for the Company, supplemented with borrowings as an alternative funding source for purposes of managing funding costs and interest rate risk. Core deposits, consisting of transaction and savings account deposits, constitute the largest portion of the Company’s deposit base. Borrowings currently held by the Company consist of FHLB advances.

NorthEast Community Bancorp’s earnings base is largely dependent upon net interest income and operating expense levels. The Company experienced net interest margin expansion in 2017 and 2018, which was supported by an increase the yield-cost spread. Comparatively, the Company experienced net interest margin compression during 2019, as the result of a lower yield-cost spread. For 2020, net interest margin expansion was realized through a wider yield-cost spread. Overall, the Company has maintained a relatively strong net interest margin over the past five years, which has been largely realized through lending diversification into loans with relatively high yields. Operating expense ratios have increased in recent years, primarily in connection with the personnel added to implement growth strategies, manage compliance and staffing a new branch location. Non-interest operating income has been a fairly stable and a relatively limited contributor to the Company’s earnings, reflecting limited diversification into fee-based products and services. Loan loss provisions have had a varied impact on the Company’s earnings over the past five years, based on loan growth, credit quality trends and more recently to address the continued economic uncertainty resulting from the Covid-19 pandemic.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.4 |

A key component of the Company’s business plan is to complete a second-step conversion offering. The Company’s strengthened capital position will increase operating flexibility and facilitate implementation of planned growth strategies, including increasing lending capacity to the Company’s current loan customers as well as to prospective loans customers of the Company. Additionally, in the near term, the second-step offering will serve to substantially increase regulator capital and liquidity and, thereby, facilitate building and maintaining loss reserves while also providing the Company with greater flexibility to work with borrowers affected by the Covid-19-induced recession. The Company’s strengthened capital position will also provide more of a cushion against potential credit quality related losses in future periods. NorthEast Community Bancorp’s higher capital position resulting from the infusion of stock proceeds will also serve to reduce interest rate risk, particularly through enhancing the Company’s interest-earning assets/interest-bearing liabilities (“IEA/IBL”) ratio. The additional funds realized from the stock offering will serve to raise the level of interest-earning assets funded with equity and, thereby, reduce the ratio of interest-earning assets funded with interest-bearing liabilities as the balance of interest-bearing liabilities will initially remain relatively unchanged following the conversion, which may facilitate a reduction in NorthEast Community Bancorp’s funding costs. NorthEast Community Bancorp’s strengthened capital position will also position the Company to pursue additional expansion opportunities. Such expansion could potentially include establishing or acquiring additional banking offices to gain a market presence in nearby markets that are complementary to the Company’s existing branch network. As a fully-converted institution, the Company’s stronger capital position and greater capacity to offer stock as consideration for an acquisition may also facilitate increased opportunities to grow through acquisitions. At this time, the Company has no specific plans for expansion through acquisitions.

The projected uses of proceeds are highlighted below.

| · | NorthEast Community Bancorp. The Company is expected to retain up to 50% of the net offering proceeds. At present, funds at the Company level, net of the loan to the ESOP, are expected to be primarily invested initially into liquid funds, in which some or all may be held as a deposit at the Bank. Over time, the funds may be utilized for various corporate purposes, possibly including acquisitions, infusing additional equity into the Bank, repurchases of common stock and the payment of cash dividends. |

| | | |

| · | NorthEast Community Bank. Approximately 50% of the net stock proceeds will be infused into the Bank in exchange for all of the Bank’s stock. Cash proceeds (i.e., net proceeds less deposits withdrawn to fund stock purchases) infused into |

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.5 |

the Bank are anticipated to become part of general operating funds and are expected to be primarily utilized to fund loan growth over time.

Overall, it is the Company’s objective to pursue growth that will serve to increase returns, while, at the same time, growth will not be pursued that could potentially compromise the overall risk associated with NorthEast Community Bancorp’s operations.

Balance Sheet Trends

Table 1.1 shows the Company’s historical balance sheet data for the past five years. From yearend 2016 through yearend 2020, NorthEast Community Bancorp’s assets increased at a 7.15% annual rate. Asset growth was largely driven by loan growth and was primarily funded by deposit growth. A summary of NorthEast Community Bancorp’s key operating ratios over the past five years is presented in Exhibit I-3.

NorthEast Community Bancorp’s loans receivable portfolio increased at a 6.95% annual rate from yearend 2016 through yearend 2020, which provided for a slight decrease in the loans-to-assets ratio from 85.25% at yearend 2016 to 84.62% at yearend 2020. Northeast Community Bancorp’s emphasis on construction lending is reflected in its loan portfolio composition, as 66.18% of total loans receivable consisted of construction loans at year end 2020.

Trends in the Company’s loan portfolio since yearend 2016 show that the concentration of construction loans comprising total loans increased from 39.84% at yearend 2016 to 66.18% at yearend 2020. Multi-family/mixed-use/non-residential real estate loans and commercial business loans constitute the primary types of lending diversification for the Company. From yearend 2016 to yearend 2020, Multi-family/mixed-use/non-residential real estate loans decreased from 48.86% of total loans to 22.03% of total loans and commercial business loans increased from 9.10% of total loans to 10.98% of total loans. Other areas of lending diversification for the Bank have been fairly limited, consisting primarily of 1-4 family permanent mortgage loans and, to a much lesser extent, consumer loans. As of December 31, 2020, 1-4 family permanent mortgage loans equaled 0.75% of total loans and the balance of consumer loans was nominal.

The intent of the Company’s investment policy is to provide adequate liquidity and to generate a favorable return within the context of supporting overall credit and interest rate risk objectives. It is anticipated that proceeds retained at the holding company level will initially be

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.6 |

| Table 1.1 |

| NorthEast Community Bancorp, Inc. |

| Historical Balance Sheet Data |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 12/31/16- | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 12/31/20 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Annual. | |

| | | At December 31, | | | Growth | |

| | | 2016 | | | 2017 | | | 2018 | | | 2019 | | | 2020 | | | Rate | |

| | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Pct | |

| | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | | | (%) | |

| Total Amount of: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Assets | | $ | 734,504 | | | | 100.00 | % | | $ | 814,821 | | | | 100.00 | % | | $ | 870,325 | | | | 100.00 | % | | $ | 955,171 | | | | 100.00 | % | | $ | 968,221 | | | | 100.00 | % | | | 7.15 | % |

| Cash and cash equivalents | | | 43,173 | | | | 5.88 | % | | | 43,601 | | | | 5.35 | % | | | 51,352 | | | | 5.90 | % | | | 127,675 | | | | 13.37 | % | | | 69,191 | | | | 7.15 | % | | | 12.51 | % |

| Certificates of deposit | | | 648 | | | | 0.09 | % | | | 150 | | | | 0.02 | % | | | 100 | | | | 0.01 | % | | | 100 | | | | 0.01 | % | | | 100 | | | | 0.01 | % | | | -37.32 | % |

| Investment securities | | | 8,005 | | | | 1.09 | % | | | 13,963 | | | | 1.71 | % | | | 14,811 | | | | 1.70 | % | | | 19,198 | | | | 2.01 | % | | | 17,716 | | | | 1.83 | % | | | 21.97 | % |

| Loans receivable, net | | | 626,139 | | | | 85.25 | % | | | 704,124 | | | | 86.41 | % | | | 747,841 | | | | 85.93 | % | | | 747,882 | | | | 78.30 | % | | | 819,281 | | | | 84.62 | % | | | 6.95 | % |

| FHLB stock | | | 3,774 | | | | 0.51 | % | | | 3,306 | | | | 0.41 | % | | | 2,360 | | | | 0.27 | % | | | 1,348 | | | | 0.14 | % | | | 1,595 | | | | 0.16 | % | | | -19.37 | % |

| Bank-owned life insurance | | | 22,363 | | | | 3.04 | % | | | 22,949 | | | | 2.82 | % | | | 23,516 | | | | 2.70 | % | | | 24,082 | | | | 2.52 | % | | | 24,691 | | | | 2.55 | % | | | 2.51 | % |

| Goodwill and other intangible assets | | | 911 | | | | 0.12 | % | | | 850 | | | | 0.10 | % | | | 789 | | | | 0.09 | % | | | 749 | | | | 0.08 | % | | | 651 | | | | 0.07 | % | | | NM | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposits | | $ | 545,346 | | | | 74.25 | % | | $ | 625,211 | | | | 76.73 | % | | $ | 687,096 | | | | 78.95 | % | | $ | 779,158 | | | | 81.57 | % | | $ | 771,706 | | | | 79.70 | % | | | 9.07 | % |

| Borrowings | | | 70,249 | | | | 9.56 | % | | | 62,869 | | | | 7.72 | % | | | 42,461 | | | | 4.88 | % | | | 21,000 | | | | 2.20 | % | | | 28,000 | | | | 2.89 | % | | | -20.54 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Equity | | $ | 109,452 | | | | 14.90 | % | | $ | 116,897 | | | | 14.35 | % | | $ | 129,618 | | | | 14.89 | % | | $ | 142,113 | | | | 14.88 | % | | $ | 153,825 | | | | 15.89 | % | | | 8.88 | % |

| Tangible equity | | | 108,541 | | | | 14.78 | % | | | 116,047 | | | | 14.24 | % | | | 128,829 | | | | 14.80 | % | | | 141,364 | | | | 14.80 | % | | | 153,174 | | | | 15.82 | % | | | 8.99 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans/Deposits | | | | | | | 114.81 | % | | | | | | | 112.62 | % | | | | | | | 108.84 | % | | | | | | | 95.99 | % | | | | | | | 106.16 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Number of Offices | | | | | | | 12 | | | | | | | | 11 | | | | | | | | 12 | | | | | | | | 13 | | | | | | | | 13 | | | | | |

(1) Ratios are as a percent of ending assets.

Sources: NorthEast Community Bancorp's prospectus, audited financial statements and RP Financial calculations.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.7 |

primarily invested into liquid funds, some or all of which may be held as a deposit at the Bank. Since yearend 2016, the Company’s level of cash and investment securities (inclusive of FHLB and ACBB stock) ranged from a low of 7.49% of assets at yearend 2017 to a high of 15.53% of assets at yearend 2019 and equaled 9.15% of assets at yearend 2020. As of December 31, 2020, the Company held investment securities totaling $17.7 million or 1.83% of assets. A $10.3 million in investment in a community development mutual fund comprised the most significant component of the Company’s investment securities portfolio at December 31, 2020. Other investments held by the Company at December 31, 2020 consisted of municipal bonds ($4.2 million) and mortgage-backed securities ($3.2 million). As of December 31, 2020, $7.4 million of the investment securities portfolio was maintained as held to maturity and $10.3 million was maintained as available for sale. Exhibit I-4 provides historical detail of the Company’s investment portfolio. As of December 31, 2020, the Company also held $69.2 million of cash and cash equivalents, $100,000 of certificates of deposit (“CDs”) and $1.6 million of FHLB stock.

The Company also maintains an investment in bank-owned life insurance (“BOLI”) policies, which covers the lives of certain officers of the Company. The life insurance policies earn tax-exempt income through cash value accumulation and death proceeds. As of December 31, 2020, the cash surrender value of the Company’s BOLI equaled $24.7 million or 2.55% of assets.

NorthEast Community Bancorp’s funding needs have been addressed through a combination of deposits, borrowings and internal cash flows. From yearend 2016 through yearend 2020, the Company’s deposits increased at a 9.07% annual rate. Total deposits trended higher from yearend 2016 through yearend 2019, which was followed by deposits declining in 2020. Deposits as a percent of assets ranged from a low of 74.25% at yearend 2016 to a high of 81.57% at yearend 2019. As of December 31, 2020, deposits equaled 79.70% of assets. Transaction and savings account deposits comprise the largest concentration of the Company’s deposits and accounted for 54.95% of the Company’s total deposits as of December 31, 2020, with the remaining 45.05% of total deposits consisting of CDs.

Borrowings serve as an alternative funding source for the Company to address funding needs for growth and to support management of deposit costs and interest rate risk. Over the five-year period covered in Table 1.1, borrowings ranged from a low of $21.0 million or 2.20% of

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.8 |

assets at yearend 2019 to a high of $70.2 million or 9.56% of assets at yearend 2016. As of December 31, 2020, borrowings totaled $28.0 million or 2.89% of assets and consisted entirely of FHLB advances.

The Company’s equity increased at an 8.88% annual rate from yearend 2016 through yearend 2020, as retention of earnings was partially offset by payment of cash dividends and stock repurchases. Stronger equity growth relative to asset growth provided for an increase in the Company’s equity-to-assets ratio from 14.90% at December 31, 2016 to 15.89% at December 31, 2020. Similarly, the Company’s tangible equity-to-assets ratio increased from 14.78% at December 31, 2016 to 15.82% at December 31, 2020. The Company maintained $651,000 of goodwill at December 31, 2020, equal to 0.07% of assets. The Bank maintained capital surpluses relative to all of its regulatory capital requirements at December 31, 2020. The addition of stock proceeds will serve to strengthen the Company’s capital position, as well as support growth opportunities. At the same time, the significant increase in NorthEast Community Bancorp’s pro forma capital position will initially depress its return on equity (“ROE”).

Income and Expense Trends

Table 1.2 shows the Company’s historical income statements for the years ended December 31, 2016 through December 31, 2020. During the period covered in Table 1.2, the Company’s reported earnings from a low of $5.0 million or 0.76% of average assets during 2016 to a high of $13.0 million or 1.53% of average assets during 2018. For 2020, the Company reported earnings of $12.3 million or 1.31% of average assets. Net interest income and operating expenses represent the primary components of the Company’s earnings, while non-interest operating income has been a fairly limited contributor to the Company’s earnings. Loan loss provisions have had a varied impact on the Company’s earnings and non-operating income and losses have been a relatively minor earnings factor throughout the period covered in Table 1.2

For the period covered in Table 1.2, the Company’s net interest income to average assets ratio ranged from a low of 3.49% during 2016 to a high of 4.51% during 2018. The Company’s net interest income to average assets ratio decreased to 4.03% during 2019 and then increased to 4.15% during 2020. The increase in the Company’s net interest income ratio from 2016 through 2018 was realized through a more significant increase in the interest income ratio compared to the increase in the interest expense ratio. The increase in the interest income

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.9 |

Table 1.2

NorthEast Community Bancorp, Inc.

Historical Income Statements

| | | For the Year Ended December 31, | |

| | | 2016 | | | 2017 | | | 2018 | | | 2019 | | | 2020 | |

| | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | �� | Pct(1) | |

| | | | ($000) | | | | (%) | | | | ($000) | | | | (%) | | | | ($000) | | | | (%) | | | | ($000) | | | | (%) | | | | ($000) | | | | (%) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest income | | $ | 28,585 | | | | 4.30 | % | | $ | 37,336 | | | | 4.92 | % | | $ | 47,820 | | | | 5.63 | % | | $ | 53,816 | | | | 5.59 | % | | $ | 48,977 | | | | 5.22 | % |

| Interest expense | | | (5,380 | ) | | | -0.81 | % | | | (6,525 | ) | | | -0.86 | % | | | (9,478 | ) | | | -1.12 | % | | | (15,034 | ) | | | -1.56 | % | | | (9,977 | ) | | | -1.06 | % |

| Net interest income | | $ | 23,205 | | | | 3.49 | % | | $ | 30,811 | | | | 4.06 | % | | $ | 38,342 | | | | 4.51 | % | | $ | 38,782 | | | | 4.03 | % | | $ | 39,000 | | | | 4.15 | % |

| Provision for loan losses | | | (146 | ) | | | -0.02 | % | | | (51 | ) | | | -0.01 | % | | | (1,114 | ) | | | -0.13 | % | | | (727 | ) | | | -0.08 | % | | | (814 | ) | | | -0.09 | % |

| Net interest income after provisions | | $ | 23,059 | | | | 3.47 | % | | $ | 30,760 | | | | 4.05 | % | | $ | 37,228 | | | | 4.38 | % | | $ | 38,055 | | | | 3.95 | % | | $ | 38,186 | | | | 4.07 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other non-interest operating income | | $ | 2,175 | | | | 0.33 | % | | $ | 2,222 | | | | 0.29 | % | | $ | 2,348 | | | | 0.28 | % | | $ | 2,491 | | | | 0.26 | % | | $ | 2,286 | | | | 0.24 | % |

| Operating expense | | | (17,040 | ) | | | -2.57 | % | | | (18,448 | ) | | | -2.43 | % | | | (22,784 | ) | | | -2.68 | % | | | (23,944 | ) | | | -2.49 | % | | | (25,088 | ) | | | -2.67 | % |

| Net operating income | | $ | 8,194 | | | | 1.23 | % | | $ | 14,534 | | | | 1.91 | % | | $ | 16,792 | | | | 1.98 | % | | $ | 16,602 | | | | 1.72 | % | | $ | 15,384 | | | | 1.64 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-Operating Income/(Losses) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gain/(Loss) on disposition of equipment | | $ | (49 | ) | | | -0.01 | % | | $ | (7 | ) | | | 0.00 | % | | $ | 20 | | | | 0.00 | % | | $ | 37 | | | | 0.00 | % | | $ | (61 | ) | | | -0.01 | % |

| Unrealized gain on equity securities | | | - | | | | 0.00 | % | | | - | | | | 0.00 | % | | | - | | | | 0.00 | % | | | 291 | | | | 0.03 | % | | | 288 | | | | 0.03 | % |

| Net non-operating income(losses) | | $ | (49 | ) | | | -0.01 | % | | $ | (7 | ) | | | 0.00 | % | | $ | 20 | | | | 0.00 | % | | $ | 328 | | | | 0.03 | % | | $ | 227 | | | | 0.02 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income before tax | | $ | 8,145 | | | | 1.23 | % | | $ | 14,527 | | | | 1.91 | % | | $ | 16,812 | | | | 1.98 | % | | $ | 16,930 | | | | 1.76 | % | | $ | 15,611 | | | | 1.66 | % |

| Income tax provision | | | (3,118 | ) | | | -0.47 | % | | | (6,477 | ) | | | -0.85 | % | | | (3,785 | ) | | | -0.45 | % | | | (3,977 | ) | | | -0.41 | % | | | (3,282 | ) | | | -0.35 | % |

| Net income (loss) | | $ | 5,027 | | | | 0.76 | % | | $ | 8,050 | | | | 1.06 | % | | $ | 13,027 | | | | 1.53 | % | | $ | 12,953 | | | | 1.34 | % | | $ | 12,329 | | | | 1.31 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Earnings | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 5,027 | | | | 0.76 | % | | $ | 8,050 | | | | 1.06 | % | | $ | 13,027 | | | | 1.53 | % | | $ | 12,953 | | | | 1.34 | % | | $ | 12,329 | | | | 1.31 | % |

| Add(Deduct): Non-operating income | | | 49 | | | | 0.01 | % | | | 7 | | | | 0.00 | % | | | (20 | ) | | | 0.00 | % | | | (328 | ) | | | -0.03 | % | | | (227 | ) | | | -0.02 | % |

| Tax effect (2) | | | (19 | ) | | | 0.00 | % | | | (3 | ) | | | 0.00 | % | | | 4 | | | | 0.00 | % | | | 69 | | | | 0.01 | % | | | 48 | | | | 0.01 | % |

| Adjusted earnings | | $ | 5,057 | | | | 0.76 | % | | $ | 8,054 | | | | 1.06 | % | | $ | 13,011 | | | | 1.53 | % | | $ | 12,694 | | | | 1.32 | % | | $ | 12,150 | | | | 1.29 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Expense Coverage Ratio (3) | | | 1.36 | x | | | | | | | 1.67 | x | | | | | | | 1.68 | x | | | | | | | 1.62 | x | | | | | | | 1.55 | x | | | | |

| Efficiency Ratio (4) | | | 67.28 | % | | | | | | | 55.86 | % | | | | | | | 55.95 | % | | | | | | | 58.04 | % | | | | | | | 60.82 | % | | | | |

(1) Ratios are as a percent of average assets.

(2) Assumes a 38.0% effective tax rate for 2016 and 2017 and a 21.0% effective tax rate for 2018 through 2020.

(3) Expense coverage ratio calculated as net interest income before provisions for loan losses divided by operating expenses.

(4) Efficiency ratio calculated as operating expenses divided by the sum of net interest income before provisions for loan losses plus non-interest operating income.

Sources: NorthEast Community Bancorp's prospectus, audited financial statements and RP Financial calculations.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.10 |

ratio was facilitated by growth of higher yielding loans, which more than offset the increase in the Company’s cost of interest-bearing liabilities. The decline in the Company’s net interest income ratio during 2019 was due to interest rate spread compression that resulted from a more significant increase in the cost of interest of interest-bearing liabilities compared to the increase in the yield on interest-earnings assets, while the increase in the net interest income ratio during 2020 was due to interest rate spread expansion that resulted from a less significant decrease in the yield on interest-earning assets compared to the decrease in the cost of interest-bearing liabilities. Overall, during the past five fiscal years, the Company’s interest rate spread ranged from a low of 3.55% during 2016 to a high of 4.36% during 2018 and equaled 3.94% during 2020. The Company’s net interest rate spreads and yields and costs for the past five years are set forth in Exhibit I-3 and Exhibit I-5.

Non-interest operating income has been somewhat of a limited contributor to the Company’s earnings over the past five years, reflecting the Company’s somewhat limited diversification into products and services that generate non-interest operating income. Throughout the period shown in Table 1.2, sources of non-interest operating income ranged from a low of $2.2 million or 0.33% of average assets during 2016 to a high of $2.5 million or 0.26% of average assets during 2019. For 2020, non-interest operating income amounted to $2.3 million or 0.24% of average assets. Fees and service charges, income earned on BOLI and wealth management advisory fees generated through Harbor West constitute the major sources of the Company’s non-interest operating revenues.

Operating expenses represent the other major component of the Company’s earnings, ranging from a low of $17.0 million or 2.57% of average assets during 2016 to a high of $25.1 million or 2.67% of average assets during 2020. The upward trend in the Company’s operating expenses since 2016 has been primarily related to normal cost increases, as well as personnel added to implement growth strategies, manage regulatory compliance and staff new branch locations.

Overall, the general trends in the Company’s net interest income ratio and operating expense ratio showed an increase in core earnings, as indicated by the Company’s expense coverage ratios (net interest income divided by operating expenses). NorthEast Community Bancorp’s expense coverage ratio equaled 1.36 times during 2016, versus a ratio of 1.55 times during 2020. Likewise, NorthEast Community Bancorp’s efficiency ratio (operating expenses as

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.11 |

a percent of the sum of net interest income and other operating income) of 67.28% during 2016 was less favorable compared to its efficiency ratio of 60.82% recorded during 2020.

During the period covered in Table 1.2, the amount of loan loss provisions recorded by the Company ranged from $51,000 or 0.01% of average assets during 2017 to $1.1 million or 0.13% of average assets during 2018. For 2020, loan loss amounted to $814,000 or 0.09% of average assets. As of December 31, 2020, the Company maintained valuation allowances of $5.1 million, equal to 0.62% of total loans and 142.44% of non-performing loans. As of December 31, 2020, non-performing loans totaled $3.6 million or 0.43%% of total loans. Exhibit I-6 sets forth the Company’s loan loss allowance activity during the past five years.

Non-operating income and losses have not been a significant factor in the Company’s earnings over the past five years, consisting of gains and losses on disposition of equipment and an unrealized gain on equity securities. For 2020, the Company reported a non-operating gain of $227,000 or 0.02% of average assets. The net non-operating gain for 2020 consisted of a $61,000 loss on disposition of equipment and a $288,000 unrealized gain on equity securities. Overall, the items that comprise the Company’s non-operating income and losses are not viewed to be part of the Company’s core or recurring earnings base.

The Company’s effective tax rate ranged from 22.51% during 2018 to 44.59% during 2017 and equaled 21.02% during 2020. The relatively high effective tax rate recorded for fiscal year 2017 includes a reduction in the value of NorthEast Community Bancorp’s deferred tax assets and a corresponding charge to income tax expense of $1.1 million as a result of the enactment of the Tax Cuts and Jobs Act of 2017, which reduced the maximum federal corporate income tax rate to 21% from 35%. As set forth in the prospectus, the Company’s effective marginal tax rate is 21.0%.

Interest Rate Risk Management

The Company’s balance sheet is asset-sensitive in the short-term (less than one year) and, thus, the net interest margin will typically be adversely affected during periods of falling and lower interest rates. After experiencing interest spread compression during 2019, the Company’s interest rate spread increased during 2020. Interest rate spread compression in 2019 was due to a more significant increase in average funding costs relative to the average yield earned on interest-earning assets, while interest rate expansion during 2020 was due to a more significant decline in average funding costs relative to the decline in yield earned on

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.12 |

interest-earning assets. The Company’s interest rate risk analysis indicated that as of December 31, 2020, in the event of a 200 basis point instantaneous parallel increase in interest rates, net interest income would increase by 24.96% in year 1 and net portfolio value would increase by 11.43% (see Exhibit I-7).

The Company pursues a number of strategies to manage interest rate risk, particularly with respect to seeking to limit the repricing mismatch between interest rate sensitive assets and liabilities. The Company manages interest rate risk from the asset side of the balance sheet through lending diversification which emphasizes origination of adjustable rate or shorter term fixed rate balloon loans and maintaining a relatively high level of liquidity in the prevailing low interest rate environment. As of December 31, 2020, of the Company’s total loans due after December 31, 2021, ARM loans comprised 88.4% of those loans (see Exhibit I-8). On the liability side of the balance sheet, management of interest rate risk has been pursued through emphasizing growth of lower costing and less interest rate sensitive transaction and savings account deposits, utilizing longer term fixed rate FHLB advances with laddered extending out to more than five years. Transaction and savings account deposits comprised 54.95% of the Company’s total deposits as of December 31, 2020.

The infusion of stock proceeds will serve to further limit the Company’s interest rate risk exposure, as most of the net proceeds will be redeployed into interest-earning assets and the increase in the Company’s capital position will lessen the proportion of interest rate sensitive liabilities funding assets.

Lending Activities and Strategy

NorthEast Community Bancorp’s lending activities have emphasized the origination of construction loans and such loans comprise the largest concentration of the Company’s loan portfolio. Beyond construction loans, lending diversification by the Company has emphasized multi-family/mixed-use/non-residential real estate loans followed by commercial business loans. Other areas of lending diversification for the Company include 1-4 family permanent mortgage loans and a nominal amount of consumer loans. The Company considers its lending territory to be the Northeastern United States, including New York, Massachusetts, New Jersey, Connecticut, Pennsylvania and New Hampshire. Pursuant to the Company’s strategic plan, the Company is continuing to pursue a diversified lending strategy emphasizing construction and commercial business loans as the primary areas of targeted loan growth. Exhibit I-9 provides

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.13 |

historical detail of NorthEast Community Bancorp’s loan portfolio composition over the past five years and Exhibit I-10 provides the contractual maturity of the Company’s loan portfolio by loan type as of December 31, 2020.

Construction Loans. Construction loans originated by the Company consist of loans to finance the construction of 1-4 family residences, condominium complexes, single-family developments, commercial real estate and multi-family properties. On a limited basis, the Company supplements originations of construction loans with purchased loan participations from local banks. Loan participations are subject to the same underwriting criteria and loan approvals as applied to loans originated by the Company. Construction loans are interest only loans during the construction period, which are typically 18 to 36 months, and are tied to the prime rate as published in The Wall Street Journal. Construction loans are generally offered up to a maximum loan-to-value (“LTV”) ratio of 75%-80% of the appraised market value of the completed property. Construction loans in the New York counties of Orange, Sullivan and Rockland consist primarily of loans to construct contemporary townhouse-style condominium buildings and complexes containing four to 250 units. Construction loans in Bronx County consist primarily of loans to construct affordable rental apartment buildings containing between ten and 50 or more apartments. The average balance of loans in the construction loan portfolio was $1.2 million at December 31, 2020. As of December 31, 2020, the largest outstanding construction loan had a balance of $13.5 million and was performing in accordance with its terms at December 31, 2020. This loan is secured by a non-residential building located in the Town of Palm Tree, New York. All construction loans were performing according to their terms at December 31, 2020. As of December 31, 2020, the Company’s outstanding balance of construction loans totaled $545.8 million equal to 66.18% of total loans outstanding.

Multi-family, Mixed-Use and Non-Residential Real Estate Loans Multi-family, mixed-use and non-residential real estate loans consist of loans originated by the Company, which are largely collateralized by properties in the Company’s regional lending area. Multi-family loans are comprised primarily of loans on moderate income apartment buildings located in the Company’s lending territory and include loans on cooperative apartment buildings (in the New York area) and loans for Section 8 multifamily housing. Mixed-use real estate loans are secured by properties that are intended for both residential and business use. The Company also originates multi-family and mixed-use real estate loans in Massachusetts and several northeastern states. Non-residential real estate loans are generally secured by office buildings, medical facilities and retail shopping centers.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.14 |

The Company originates a variety of adjustable-rate and balloon multi-family and mixed-use real estate loans. The adjustable-rate loans have fixed rates for a period of one, two, three and five years and then adjust every one, two, three or five years thereafter, based on the terms of the loan. Maturities on these loans can be up to 15 years, and typically they amortize over a 20 to 30-year period. Interest rates on adjustable-rate loans are adjusted to a rate that equals the applicable one-, two-, three- or five-year Federal Home Loan Bank (“FHLB”) of New York or FHLB of Boston advance rate plus a margin. The balloon loans have a maximum maturity of five years. The Company’s current policy is to require a minimum debt service coverage ratio of between 1.25x and 1.40x depending on the rating of the underlying property. On multifamily and mixed-use real estate loans, the Company’s current policy is to finance up to 75% of the lesser of the appraised value or purchase price of the property securing the loan on purchases and refinances of Class A and B properties and up to 65% of the lesser of the appraised value or purchase price for properties that are rated Class C.

The Company’s non-residential real estate loans are structured in a manner similar to its multi-family and mixed-use real estate loans, typically at a fixed rate of interest for three to five years and then a rate that adjusts every three to five years over the term of the loan, which is typically 15 years. Interest rates and payments on these loans generally are based on the one-, two-, three- or five-year FHLB of New York or FHLB of Boston advance rate plus a margin. Loans are secured by first mortgages that generally do not exceed 75% of the property’s appraised value.

On December 31, 2020, the largest outstanding multi-family real estate loan had a balance of $8.5 million and was performing according to its terms at December 31, 2020. This loan is secured by a 218 unit apartment complex located in Philadelphia, Pennsylvania. The largest mixed-use real estate loan had a balance of $2.7 million and was performing according to its terms at December 31, 2020. This loan is secured by four mixed-use buildings with 11 apartment units and five commercial units located in Brooklyn, New York. At December 31, 2020, the largest outstanding non-residential real estate loan had an outstanding balance of $10.0 million. This loan is secured by a 16-acre site which is listed on the national and state registries for historic places. The property consists of 12 buildings totaling approximately 160,000 square feet, including a large central convent, chapel, elementary school, high school, administrative building and other ancillary structures located in White Plains, New York. This loan was performing according to its terms at December

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.15 |

31, 2020. As of December 31, 2020, the Company’s outstanding balance of multi-family, mixed-use and non-residential real estate loans totaled $181.7 million, equal to 22.03% of total loans outstanding, and consisted of $90.5 million of multi-family loans, $60.7 million of non-residential real estate loans and $30.5 million of mixed-use real estate loans.

Commercial Business Loans. The commercial business loan portfolio is generated through extending loans to small-to medium-sized businesses operating in the local market area. Commercial business lending is a targeted area of loan growth for the Company, pursuant to which the Company is seeking to become a full-service community bank to its commercial loan customers through offering a full range of commercial loan products that can be packaged with lower cost commercial deposit products. Commercial business loans offered by the Company consist of lines of credit secured by general business assets and equipment, which are indexed to The Wall Street Journal prime rate. At December 31, 2020, the largest outstanding commercial and industrial loan and the largest outstanding commercial and industrial line of credit relationship with one borrower was comprised of three lines of credit totaling $30.0 million, with outstanding balances totaling $2.8 million and remaining available lines of credit totaling $27.2 million. However, the borrower cannot at any one time have an outstanding balance of more than $10 million combined over all three lines of credit. One of the lines of credit totaling $10.0 million, with a $1.5 million outstanding balance and a remaining available line of $8.5 million at December 31, 2020, is the Company’s largest outstanding commercial and industrial line of credit and is secured by the assets of a construction company. At December 31, 2020, these loans was performing in accordance with its terms. As of December 31, 2020, the Company’s outstanding balance of commercial business loans totaled $90.6 million equal to 10.98% of total loans outstanding.

Consumer Loans. Consumer lending has been a very limited area of lending diversification for the Company, with such loans consisting of personal loans, loans secured by savings accounts or CDs (share loans), and overdraft protection for checking accounts which is linked to statement savings accounts and has the ability to transfer funds from the statement savings account to the checking account when needed to cover overdrafts. As of December 31, 2020, the Company held $42,000 of consumer loans equal to 0.01% of total loans outstanding.

Asset Quality

Over the past five years, NorthEast Community Bancorp’s balance of non-performing

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.16 |

assets ranged from a low of $4.0 million or 0.46% of assets at December 31, 2018 to a high of $11.6 million or 1.58% of assets at December 31, 2016. As of December 31, 2020, non-performing assets totaled $5.6 million or 0.58% of assets. As shown in Exhibit I-11, non-performing assets at December 31, 2020 consisted of $3.6 million of non-accruing loans and $2.0 million of real estate owned. The entire balance of non-accruing loans held by the Company at December 31, 2020 consisted of non-residential real estate loans. Likewise, the entire balance of real estate owned held by the Company at December 31, 2020 consisted of non-residential real estate properties.

To track the Company’s asset quality and the adequacy of valuation allowances, the Company has established detailed asset classification policies and procedures which are consistent with regulatory guidelines. Detailed asset classifications are reviewed on a regular basis by senior management and the Board. Pursuant to these procedures, when needed, the Company establishes additional valuation allowances to cover anticipated losses in classified or non-classified assets. As of December 31, 2020, the Company maintained loan loss allowances of $5.1 million, equal to 0.62% of total loans outstanding and 142.44% of non-performing loans.

Funding Composition and Strategy

Deposits have consistently served as the Company’s primary funding source and at December 31, 2020 deposits accounted for 96.50% of NorthEast Community Bancorp’s combined balance of deposits and borrowings. Exhibit I-12 sets forth the Company’s deposit composition for the past three fiscal years. Transaction and savings account deposits constituted 54.95% of total deposits as of December 31, 2020, as compared to 42.48% of total deposits as of December 31, 2018. The increase in the concentration of core deposits comprising total deposits at yearend 2020 compared to yearend 2018 was due to growth of core deposits and a decline in CDs.

The balance of the Company’s deposits consists of CDs, which equaled 45.05% of total deposits as of December 31, 2020 compared to 57.52% of total deposits as of December 31, 2018. NorthEast Community Bancorp’s current CD composition reflects a higher concentration of short-term CDs (maturities of one year or less). The CD portfolio totaled $347.7 million at December 31, 2020 and $211.8 million or 60.92% of the CDs were scheduled to mature in one year or less. Exhibit I-13 sets forth the maturity schedule of the Company’s CDs as of December 31, 2020. As of December 31, 2020, jumbo CDs (CD accounts with balances of

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.17 |

$100,000 or more) amounted to $271.4 million or 78.05% of total CDs. The Company held $71.1 million of brokered CDs at December 31, 2020.

Borrowings serve as an alternative funding source for the Company to facilitate management of funding costs and interest rate risk. FHLB advances have been the only source of borrowings utilized by the Company over the past five years. The Company maintained $28.0 million of FHLB advances at December 31, 2020 with a weighted average rate of 2.52%. FHLB advances held by the Company at December 31, 2020 had laddered terms with maturities extending out to more than five years. Exhibit I-14 provides further detail of the Company’s borrowings activities during the past three years.

Subsidiaries

The Company’s only subsidiary is NorthEast Community Bank. The Bank maintains the following subsidiaries:

New England Commercial Properties LLC was formed in October 2007 to facilitate the purchase or lease of real property by NorthEast Community Bank and to hold real estate owned acquired by NorthEast Community Bank through foreclosure or deed-in-lieu of foreclosure. As of December 31, 2020, New England Commercial Properties, LLC had no assets other than a foreclosed office building located in Pittsburgh, Pennsylvania.

NECB Financial Services Group LLC was formed in April 2012 as a complement to NorthEast Community Bank’s existing investment advisory and financial planning services division, Harbor West Financial Planning Wealth Management, to sell life insurance products and fixed-rate annuities. NECB Financial Services Group LLC is licensed in the States of New York and Connecticut.

72 West Erickson LLC was formed in April 2015 to hold real property that NorthEast Community Bank uses as branch offices.

Legal Proceedings

From time to time, the Company is involved in routine legal proceedings in the ordinary course of business. Such routine legal proceedings, in the aggregate, are believed by management to be immaterial to the Company’s financial condition, results of operations and cash flows.

| RP® Financial, LC. | MARKET AREA II.1 |

II. MARKET AREA

Introduction

NorthEast Community Bancorp serves the New York City metropolitan area through the main office, six branch offices and two loan production offices (“LPOs”), which are located in the counties of Westchester, New York, Orange, Bronx and Rockland. The Company also maintains three branch offices and one LPO in the Boston metropolitan area, which are located in the counties of Norfolk, Middlesex and Essex. Deposits are generated through the branch offices, while the Company conducts lending activities throughout the Northeastern United States, including New York, Massachusetts, Connecticut, New Jersey, Pennsylvania and New Hampshire. Exhibit II-1 provides information on the Bank’s office facilities.

Construction loans originated by the Company in Bronx, Kings, Orange, Rockland and Sullivan Counties in New York and Brooklyn (Kings County) are almost exclusively located within homogeneous communities that demonstrate significant population growth concentrated in well-defined existing, and newer expanding, communities. The communities are substantially different from New York State and nationwide economic fluctuations and are considered to be high absorption areas, i.e., where the demand for rental or purchase properties is far greater than available supply.

With operations in major metropolitan areas, the Company’s competitive environment includes a significant number of thrifts, commercial banks and other financial services companies, some of which have a regional or national presence and are larger than the Company in terms of deposits, loans, scope of operations, and number of branches. These institutions also have greater resources at their disposal than the Company. The New York and Boston metropolitan areas have highly diversified economies, which have been have been significantly impacted by the Covid-19 pandemic.

Future growth opportunities for NorthEast Community Bancorp depend on the future growth and stability of the national and regional economy, demographic growth trends and the nature and intensity of the competitive environment. These factors have been examined to help determine the growth potential that exists for the Company, the relative economic health of the Company’s market area and the resultant impact on value.

| RP® Financial, LC. | MARKET AREA II.2 |

National Economic Factors

The future success of the Company’s operations is partially dependent upon various national and local economic trends. In assessing national economic trends over the past few quarters, July 2020 manufacturing activity increased to an index reading of 54.2 and July service sector activity accelerated to an index reading of 58.1. U.S. employers added 1.8 million jobs in July and the July unemployment rate fell to 10.2%. In late-July, economic data suggested that the economic recovery was stalling, as filings for initial unemployment claims rose for two consecutive weeks after nearly four months of declining weekly unemployment claims and second quarter GDP contracted at a record annual rate of 32.9%. July existing home sales increased 24.7%, while new home sales in July rose 13.9%. At the same time, the number of homeowners that were at least 90 days delinquent soared to a 10-year high in July. August manufacturing activity accelerated to an index reading of 56.0. Comparatively, August service sector activity slowed to an index 56.9. The U.S. economy added 1.4 million jobs in August and the August unemployment rate declined to 8.4%. Record low mortgage rates helped to fuel a 2.4% increase in August existing home sales and a 4.8% increase in August new home sales. August retail sales increased 0.6%, while durable-goods orders for August increased 0.4%. The consumer confidence index for September surged to 101.8, which was its highest level since March. September manufacturing activity increased to an index reading of 55.4, while September service sector activity accelerated to an index reading of 57.8. The U.S. economy added 661,000 jobs in September and the September unemployment rate dropped to 7.9%. Existing home sales for September increased 9.4%, versus a 3.5% decline in September new home sales. Third quarter GDP rebounded from the pandemic-induced slump, increasing at a 33.1% annualized pace.

Manufacturing activity for October 2020 expanded at its quickest pace in more than two years with an index reading of 59.3, while October service sector activity declined to an index reading of 56.6. U.S. employers added 638,000 jobs in October and the October unemployment rate dropped to 6.9%. October existing home sales rose to a 14-year high with an increase of 4.3% from September existing home sales, as low borrowing costs and a shift in living preferences during the pandemic fueled a surge in home purchases. November manufacturing and service activity slowed to respective index readings of 57.5 and 55.9. The U.S. economy added 245,000 job in November, which was less than expected, and the November unemployment rate dropped to 6.7%. November retail sales dropped 1.1%, amid a surge in coronavirus infections and new business restrictions. Existing home sales declined

| RP® Financial, LC. | MARKET AREA II.3 |

2.5% in November, versus an 11.0% decline in November new home sales. Manufacturing activity for December accelerated to an index reading of 60.7, while service sector activity for December accelerated to an index reading of 57.2. U.S. payrolls for December declined by 140,000 which was the first decline since April. The December unemployment rate remained at 6.7%. Retail sales for December were down 0.7%. Existing and new home sales for December increased by 0.7% and 1.6%, respectively. Fourth quarter GDP increased at a 4.0% annualized rate, while GDP for all of 2020 contracted 3.5%.

January 2021 manufacturing activity slowed to an index reading of 58.7, while service sector activity for January accelerated to an index reading of 58.7. U.S. employers added 49,000 jobs in January and the January unemployment rate fell to 6.3%.

In terms of interest rates trends over the past few quarters, a stable interest rate environment prevailed at the start of the third quarter of 2020. Long-term Treasury yields edged lower going into the second half of July, as a surge in coronavirus cases forced a number of states to reimpose lockdown measures. In mid-July, the average rate on a 30-year fixed rate mortgage fell to 2.98%, its lowest level on record. The 10-year Treasury yield edged below 0.60% going into late-July. At the conclusion of its late-July policy meeting, the Federal Reserve left its benchmark rate near zero and reiterated that it would continue to support the economy. The 10-year Treasury yield remained below 0.60% heading into mid-August and then trended up slightly to above 0.70% in late-August after the Federal Reserve dropped its long-standing practice of pre-emptively lifting interest rates to head off higher inflation. At the start of September, the 10-year Treasury yield fell below 0.70% and then edged back up over 0.70% with the release of the August employment report. For the balance of September, the 10-year Treasury yield stabilized in a range between 0.64% and 0.71% as the Federal Reserve signaled that it would keep its benchmark rate near zero through 2023.

Economic reports indicating the U.S. economy was continuing to improve and hopes of a new coronavirus relief deal pushed the 10-year Treasury yield above 0.75% in early-October 2020, which was followed by long-term Treasury yields stabilizing through mid-October. After increasing to a yield of 0.85% heading into late-October, the 10-year Treasury edged lower at the beginning of the last week of October as a surge in coronavirus cases added to worries about the economic outlook in the absence of a stimulus deal. Stronger-than-expected third quarter GDP growth pushed the 10-year Treasury yield up to 0.88% at the end of October. After edging lower with the release of the October employment report, long-term Treasury yields surged higher in the second week of November on news that a coronavirus vaccine being

| RP® Financial, LC. | MARKET AREA II.4 |

developed was 90% effective. Long-term Treasury yields edged lower going into the second half of November, as states implemented new lockdown measures amid a resurgence of coronavirus infections. Promising results for multiple Covid-19 vaccines and signs that U.S. lawmakers were committed to completing a new Covid-19 relief package contributed to long-term Treasury yields edging higher in early-December, which was followed by interest rates stabilizing for the balance of 2020. At its final meeting of the year in mid-December, the Federal Reserve left its benchmark at near zero and made no changes to its asset purchase program.