Exhibit 99.2

NorthEast Community Bank

NorthEast Community Bancorp, Inc.

4/5/21

PROPOSED MAILING AND INFORMATIONAL MATERIALS

INDEX

Produced by the Financial Printer

| 2. | Dear Member Letter for Non Eligible Jurisdictions |

| 3. | Dear Friend Letter - Eligible Account Holders who are no longer Depositors* |

| 4. | Dear Potential Investor Letter* |

| 5. | Dear Prospective Investor Letter - Cover Letter for States Requiring "Agent" Mailing* |

| 10. | Proxy Reminder / Important (immediate follow-up) |

| 11. | Proxy Reminder / Second Request |

| 12. | Proxy Reminder (“final” as needed) |

| 15-16. | Stock Order / Certification Form* |

| 17. | Stock Order Form Guidelines* |

Produced by the Stock Information Center

| 19. | Dear Subscriber/Acknowledgment Letter - Initial Response to Stock Order Received |

| 20. | Dear Interested Investor - No Shares Available Letter |

| 21. | Welcome Stockholder Letter - For Initial DRS Statement Mailing |

| 22. | Dear Interested Subscriber Letter - Subscription Rejection |

| 23. | Dear Community Member* |

| 24. | Tombstone (Offering Advertisement) |

*Accompanied by a Prospectus

Dear Member:

We are pleased to announce that the Boards of Directors of NorthEast Community Bank, NorthEast Community Bancorp, MHC and NorthEast Community Bancorp, Inc. have unanimously approved a plan of conversion and reorganization under which we will convert from the mutual holding company form to the fully public stock holding company form of organization and raise additional capital in a stock offering. Upon the completion of the conversion and reorganization, NorthEast Community Bank will become the wholly-owned subsidiary of our newly formed public holding company, NorthEast Community Bancorp, Inc. The additional capital raised in the offering will enhance our capital position and enable us to support future growth and expansion. Upon completion of the conversion and reorganization:

| • | existing deposit accounts and loans will remain exactly the same |

| • | deposit accounts will continue to be federally insured up to the maximum legal limit |

The Proxy Card

Under banking regulations, the plan of conversion and reorganization require the approval of the members of NorthEast Community Bancorp, MHC (depositors of NorthEast Community Bank). As a voting member, your vote is extremely important to complete the conversion. After reading the enclosed proxy statement, please cast your vote by mail, telephone or internet as instructed on the enclosed proxy card. Voting will not obligate you to purchase shares of NorthEast Community Bancorp, Inc. common stock in the offering.

As a valued customer, your vote is important to us.

On behalf of the Board, I ask that you help us meet our goal by casting your vote

“FOR” approval of the plan of conversion and reorganization.

The Stock Order Form

As a qualifying depositor of NorthEast Community Bank, you have nontransferable rights to subscribe for shares of NorthEast Community Bancorp, Inc. common stock on a priority basis. The enclosed prospectus describes the stock offering in more detail. Please read the prospectus carefully before making an investment decision.

If you wish to subscribe for shares, please complete the enclosed stock order form. Your stock order form, together with payment for the shares, must be physically received (not postmarked) by NorthEast Community Bancorp, Inc. no later than _:00 p.m., Eastern Time, on [day], [month] __, 2021. Stock order forms may be delivered by mail using the enclosed postage-paid envelope marked “STOCK ORDER RETURN,” by overnight delivery service or by hand delivery (drop box) to the address indicated on the stock order form. We will not accept stock order forms at our other offices.

If you have any questions after reading the enclosed material, please call our Stock Information Center at [Stock Center Phone Number], Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Eastern Time. The Stock Information Center will be closed on bank holidays.

Sincerely,

Kenneth A. Martinek

Chairman and Chief Executive Officer

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus.

M

Dear Member:

We are pleased to announce that the Boards of Directors of NorthEast Community Bank, NorthEast Community Bancorp, MHC and NorthEast Community Bancorp, Inc. have unanimously approved a plan of conversion and reorganization under which we will convert from the mutual holding company form to the fully public stock holding company form of organization and raise additional capital in a stock offering. Upon the completion of the conversion and reorganization, NorthEast Community Bank will become the wholly-owned subsidiary of our newly formed public holding company, NorthEast Community Bancorp, Inc. The additional capital raised in the offering will enhance our capital position and enable us to support future growth and expansion. Upon completion of the conversion and reorganization:

| • | existing deposit accounts and loans will remain exactly the same |

| • | deposit accounts will continue to be federally insured up to the maximum legal limit |

The Proxy Card

Under banking regulations, the plan of conversion and reorganization require the approval of the members of NorthEast Community Bancorp, MHC (depositors of NorthEast Community Bank). As a voting member, your vote is extremely important to complete the conversion. After reading the enclosed proxy statement, please cast your vote by mail, telephone or internet as instructed on the enclosed proxy card.

As a valued customer, your vote is important to us.

On behalf of the Board, I ask that you help us meet our goal by casting your vote

“FOR” approval of the plan of conversion and reorganization.

The Stock Offering

We regret that we are unable to offer you the opportunity to subscribe for shares of common stock in the subscription offering because the laws of your jurisdiction require us to register (1) the to-be-issued common stock of NorthEast Community Bancorp, Inc. and (2) as an agent of NorthEast Community Bancorp, Inc. in order to solicit the sale of such stock, and the number of eligible subscribers in your jurisdiction does not justify the expense of such registration.

If you have any questions after reading the enclosed material, please call our Stock Information Center at [Stock Center Phone Number], Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Eastern Time. The Stock Information Center will be closed on bank holidays.

Sincerely,

Kenneth A. Martinek

Chairman and Chief Executive Officer

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus.

M1

Dear Friend of NorthEast Community Bank:

We are pleased to announce that the Boards of Directors of NorthEast Community Bank, NorthEast Community Bancorp, MHC and NorthEast Community Bancorp, Inc. have unanimously approved a plan of conversion and reorganization under which we will convert from the mutual holding company form to the fully public stock holding company form of organization and raise additional capital in a stock offering. Upon the completion of the conversion and reorganization, NorthEast Community Bank will become the wholly-owned subsidiary of our newly formed public holding company, NorthEast Community Bancorp, Inc. The additional capital raised in the offering will enhance our capital position and enable us to support future growth and expansion.

As a qualifying depositor of NorthEast Community Bank, you have nontransferable rights to subscribe for shares of NorthEast Community Bancorp, Inc. common stock on a priority basis. The enclosed prospectus describes the stock offering in more detail. Please read the prospectus carefully before making an investment decision.

If you wish to subscribe for shares, please complete the enclosed stock order form. Your stock order form, together with payment for the shares, must be physically received (not postmarked) by NorthEast Community Bancorp, Inc. no later than _:00 p.m., Eastern Time, on [day], [month] __, 2021. Stock order forms may be delivered by mail using the enclosed postage-paid envelope marked “STOCK ORDER RETURN,” by overnight delivery service or by hand delivery (drop box) to the address indicated on the stock order form. We will not accept stock order forms at our other offices.

If you have any questions after reading the enclosed material, please call our Stock Information Center at [Stock Center Phone Number], Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Eastern Time. The Stock Information Center will be closed on bank holidays.

Sincerely,

Kenneth A. Martinek

Chairman and Chief Executive Officer

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus.

F

Dear Potential Investor:

We are pleased to provide you with the enclosed material regarding the stock offering by NorthEast Community Bancorp, Inc., the proposed holding company for NorthEast Community Bank. The additional capital raised in the offering will enhance our capital position and enable us to support future growth and expansion. This information packet includes the following:

Prospectus: This document provides detailed information about our operations and the proposed conversion from the mutual holding company form to the fully public stock holding company form of organization and the related stock offering by NorthEast Community Bancorp, Inc. Please read it carefully before making an investment decision.

Stock Order Form: If you wish to subscribe for shares, please complete the enclosed stock order form. Your properly completed stock order form, together with payment for the shares, must be physically received (not postmarked) by NorthEast Community Bancorp, Inc. no later than _:00 p.m., Eastern Time, on [day], [month] __, 2021.

Stock order forms may be delivered by mail using the enclosed postage-paid envelope marked “STOCK ORDER RETURN,” by overnight delivery service or by hand delivery (drop box) to the address indicated on the stock order form. We will not accept stock order forms at our other offices.

We are pleased to offer you this opportunity to become one of our stockholders. If you have any questions after reading the enclosed material, please call our Stock Information Center at [Stock Center Phone Number], Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Eastern Time. The Stock Information Center will be closed on bank holidays.

Sincerely,

Kenneth A. Martinek

Chairman and Chief Executive Officer

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus.

C

Dear Prospective Investor:

At the request of NorthEast Community Bancorp, Inc. (the “Company”), we have enclosed materials regarding the Company’s offering of common stock in connection with the conversion and reorganization of NorthEast Community Bancorp, MHC from the mutual holding company form to the fully public stock holding company form of organization. The enclosed materials include a prospectus and a stock order form, which offer you the opportunity to subscribe for shares of common stock of NorthEast Community Bancorp, Inc. Please read the prospectus carefully before making an investment decision.

If you have any questions after reading the enclosed materials, please call the Stock Information Center at [Stock Center Phone Number], Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Eastern Time, and ask for a Piper Sandler representative. If you decide to subscribe for shares, your properly completed stock order form, together with payment for the shares, must be physically received (not postmarked) by NorthEast Community Bancorp, Inc. no later than _:00 p.m., Eastern Time, on [day], [month] __, 2021.

We have been asked to forward these documents to you in view of certain requirements of the securities laws of your jurisdiction. This is not a recommendation or solicitation for any action by you with regard to the enclosed materials.

Piper Sandler & Co.

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus.

BD

| to pay cash dividends on a quarterly basis. Initially, we expect the quarterly dividends to be $0.06 per share. The initial dividend and continued payment of dividends will depend on a number of factors and there can be no assurance that we will pay dividends in the future, or that any such dividends will not be reduced or eliminated in the future. Q. Will my stock be covered by deposit insurance? A. No. Q. Where will the stock be traded? A. Upon completion of the stock offering, shares of our common stock are expected to trade on the Nasdaq Capital Market under the symbol “NECB.” Q. Can I change my mind after I place an order to subscribe for stock? A. No. After receipt, your order may not be modified or withdrawn. Q. If I purchase shares of common stock during the offering, when will I receive my stock? A. Physical stock certificates will not be issued. Our transfer agent, Continental Stock Transfer & Trust Company, will send you a stock ownership statement, via the Direct Registration System (“DRS”), by first class mail as soon as practicable after the completion of the offering. Trading is expected to commence the first business day following closing of the stock offering. Although the shares of NorthEast Community Bancorp, Inc. common stock will have begun trading, brokerage firms may require that you have received your stock ownership statement prior to selling your shares. Your ability to sell the shares of common stock prior to your receipt of the statement will depend on arrangements you may make with your brokerage firm. Q. What is direct registration and DRS? A. Direct registration is the ownership of stock registered in your own name on the books of NorthEast Community Bancorp, Inc. without taking possession of a printed stock certificate. Instead, your ownership is recorded and tracked as an accounting entry (referred to as “book entry”) on the books of NorthEast Community Bancorp, Inc. The Direct Registration System is a system that electronically moves investors’ positions between brokers and transfer agents for issuers that offer direct registration. Q. What happens to the NorthEast Community Bancorp shares I currently own? A. The shares of common stock owned by the existing public stockholders of NorthEast Community Bancorp will be exchanged for shares of common stock of NorthEast Community Bancorp, Inc. based on an exchange ratio that will result in existing public stockholders owning approximately the same percentage of NorthEast Community Bancorp, Inc. common stock as they owned of NorthEast Community Bancorp common stock immediately prior to the completion of the conversion, excluding shares of NorthEast Community Bancorp, Inc. common stock purchased in the offering and the receipt of cash in lieu of fractional exchange shares and as adjusted to reflect the assets of NorthEast Community Bancorp, MHC. The actual number of shares you receive will depend upon the number of shares we sell in our offering and will be announced shortly before the completion of the conversion. Q. What if I have additional questions? A. The prospectus that accompanies this brochure describes the offering in detail. Please read the prospectus carefully before making an investment decision. If you have any questions after reading the enclosed materials, you may call our Stock Information Center at [Stock Center Phone Number], Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Eastern Time. The Stock Information Center will be closed on bank holidays. The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus. Stock Questions and Answers |

| Questions & Answers About the Stock Offering We are pleased to announce that the Boards of Directors of NorthEast Community Bank, NorthEast Community Bancorp, MHC and NorthEast Community Bancorp, Inc. have unanimously approved a plan of conversion and reorganization under which we will convert from the mutual holding company form to the fully public stock holding company form of organization and raise additional capital in a stock offering. Upon the completion of the conversion and reorganization, NorthEast Community Bank will become the wholly-owned subsidiary of our newly formed public holding company, NorthEast Community Bancorp, Inc. The additional capital raised in the offering will enhance our capital position and enable us to support future growth and expansion. This brochure provides some summary information about the offering and how to purchase shares, and is qualified in its entirety by the prospectus delivered with it. Investing in common stock involves certain risks. For a discussion of these risks and other factors that may affect your investment decision, investors are urged to read the accompanying prospectus before making an investment decision, including the section in the prospectus titled “Risk Factors.” Q. Who can purchase stock in the subscription offering? Only eligible depositors of NorthEast Community Bank and NorthEast Community Bank’s tax-qualified employee stock ownership plan may purchase shares of stock in the subscription offering. The common stock is being offered in the subscription offering in the following order of priority: Eligible Account Holders: Depositors with aggregate balances of $50 or more at the close of business on September 30, 2019. NorthEast Community Bank’s tax-qualified employee stock ownership plan. Supplemental Eligible Account Holders: Depositors (other than directors and officers of NorthEast Community Bank) with aggregate balances of $50 or more at the close of business on [•], 2021 and who are not otherwise eligible in category (1) above. Other Members: Depositors at the close of business on [•], 2021 and who are not otherwise eligible in categories (1) or (3) above. Q. I am not eligible to purchase stock in the subscription offering. May I still place an order to purchase shares? A. Subject to the priority rights of qualifying depositors and the Bank’s tax-qualified employee stock ownership plan in the subscription offering, common stock may be offered to the general public in a community offering. Natural persons (including trusts of natural persons) residing in Bronx, Kings, New York, Orange, Rockland, Sullivan and Westchester Counties in New York and in Essex, Middlesex, Norfolk and Suffolk Counties in Massachusetts, will be given preference in the community offering. The community offering may begin concurrently with, or any time after, the commencement of the subscription offering. Q. Am I guaranteed to receive shares if I place an order? A. No. It is possible that orders received during the offering period will exceed the number of shares being sold. Such an oversubscription would result in shares being allocated among subscribers according to the preferences and priorities set forth in the plan of conversion and reorganization and described in the prospectus. If the offering is oversubscribed in the subscription offering, no orders received in the community offering will be filled. Q. How many shares of stock are being offered, and at what price? A. NorthEast Community Bancorp, Inc. is offering a maximum of 11,787,500 shares of common stock at a price of $10.00 per share. Q. How much stock can I purchase? A. The minimum purchase is 25 shares ($250). As more fully described in the plan of conversion and reorganization and in the prospectus, the maximum purchase by any person in the subscription or community offering is 40,000 shares ($400,000). In addition, no person, together with their associates, or group of persons acting in concert, may purchase more than 80,000 shares ($800,000) of common stock in the offering. Q. How do I order stock? A. If you decide to subscribe for shares, you must return your properly completed and signed original stock order form, along with full payment for the shares, to NorthEast Community Bancorp, Inc. Stock order forms may be returned by mail using the enclosed postage-paid envelope marked “STOCK ORDER RETURN,” by overnight delivery service or by hand delivery (drop box) to the address indicated on the stock order form. We will not accept stock order forms at our other offices. Please call the Stock Information Center if you need assistance completing the stock order form. Q. When is the deadline to subscribe for stock? A. A properly completed original stock order form, together with the required full payment, must be physically received (not postmarked) by NorthEast Community Bancorp, Inc. no later than _:00 p.m., Eastern Time, on [day], [month] , 2021. Q. How can I pay for my shares of stock? A. You can pay for the shares of common stock by check, bank check, money order, or withdrawal from your deposit account or certificate of deposit at NorthEast Community Bank. Checks and money orders must be made payable to NorthEast Community Bancorp, Inc. Withdrawals from a certificate of deposit at NorthEast Community Bank to buy shares of common stock may be made without penalty. Q. Can I use my NorthEast Community Bank home equity line of credit to pay for shares of common stock? A. No. NorthEast Community Bank cannot lend funds to anyone to subscribe for shares. This includes the use of funds available through a NorthEast Community Bank home equity or other line of credit. Q. Can I subscribe for shares using funds in my IRA at NorthEast Community Bank? A. No. Federal regulations do not permit the purchase of common stock with funds held in your existing IRA or other qualified retirement plan at NorthEast Community Bank. To use these funds to subscribe for common stock, you need to transfer the funds to a “self-directed” IRA or other trust account at another unaffiliated financial institution that permits investment in equity securities within such account. The transfer of these funds takes time, so please make arrangements as soon as possible. However, if you intend to subscribe for common stock using your eligibility as an IRA account holder but plan to use funds from sources other than your IRA account, you do not need to transfer your IRA account. Please call our Stock Information Center if you require additional information. Q. Can I subscribe for shares in the subscription offering and add someone else who is not on my account to my stock registration? A. No. Applicable regulations prohibit the transfer of subscription rights. Adding the names of other persons who are not owners of your qualifying account(s) will result in the loss of your subscription rights. Q. Can I subscribe for shares in the subscription offering in my name alone if I have a joint account? A. Yes, subject to the overall purchase limitations in the offering. Unless we determine otherwise, spouses, persons having the same address or persons exercising subscription rights through joint accounts or qualifying accounts registered to the same address will be presumed to be associates of, or acting in concert with, each other. Q. I have custodial accounts at NorthEast Community Bank with my minor children. May I use these accounts to purchase stock in the subscription offering? A. Yes. However, the stock must be registered in the custodian’s name for the benefit of the minor child under the Uniform Transfers to Minors Act. A custodial account does not entitle the custodian to purchase stock in his or her own name. If the child has reached the age of majority, the child must subscribe for the shares in his or her own name. Q. I have a business or trust account at NorthEast Community Bank. May I use these accounts to purchase stock in the subscription offering? A. Yes. However, the stock must be purchased in the name of the business or trust. A business or trust account does not entitle the owner of or signatory for the business or the trustee of the trust to purchase stock in his or her own name. Q. Will payments for common stock earn interest until the stock offering closes? A. Yes. Any payment made by check or money order will earn interest at 0. % per annum from the date the order is processed until the completion or termination of the stock offering. Depositors who pay for their stock by withdrawal authorization will receive interest at the contractual rate on the account until the completion or termination of the offering. Q. Will dividends be paid on the stock? Following the completion of the conversion and offering, we intend |

| IMPORTANT REMINDER WE NEED YOUR HELP As a follow-up to our recent mailing regarding our plan of conversion and reorganization, WE URGE YOU TO VOTE ALL OF YOUR PROXY CARDS. You may have received more than one proxy card depending on the ownership structure of your accounts. Please support us by voting all proxy cards. If you have already voted, please accept our thanks Voting “FOR” the proposal will not affect your deposit accounts or loans Deposit accounts will continue to be federally insured Voting does not obligate you to purchase stock in the offering Thank you for choosing NorthEast Community Bank. We appreciate your vote and your continued support of the Bank. If you have any questions, please call our Stock Information Center at [Stock Center Phone Number]. Kenneth A. Martinek Chairman and Chief Executive Officer |

| SECOND REQUEST WE NEED YOUR HELP As a follow-up to our recent mailing regarding our plan of conversion and reorganization, OUR RECORDS SHOW THAT YOU HAVE NOT YET VOTED ALL OF YOUR PROXY CARDS. You may have received more than one proxy card depending on the ownership structure of your accounts. Please support us by voting all proxy cards. If you have already voted, please accept our thanks Voting “FOR” the proposal will not affect your deposit accounts or loans Deposit accounts will continue to be federally insured Voting does not obligate you to purchase stock in the offering Thank you for choosing NorthEast Community Bank. We appreciate your vote and your continued support of the Bank. If you have any questions, please call our Stock Information Center at [Stock Center Phone Number]. Kenneth A. Martinek Chairman and Chief Executive Officer |

| TIME IS RUNNING OUT! WE STILL NEED YOUR HELP! By now, you have received several proxy mailings regarding our vote. Our records show that you have not voted all of your proxy cards received.You may have received more than one proxy card depending on the ownership structure of your accounts. All should be voted. We ask for your support by voting the enclosed proxy card today. Thank you for choosing NorthEast Community Bank. We appreciate your vote and your continued support of the Bank. If you have any questions, please call our Stock Information Center at [Stock Center Phone Number]. Kenneth A. Martinek Chairman and Chief Executive Officer |

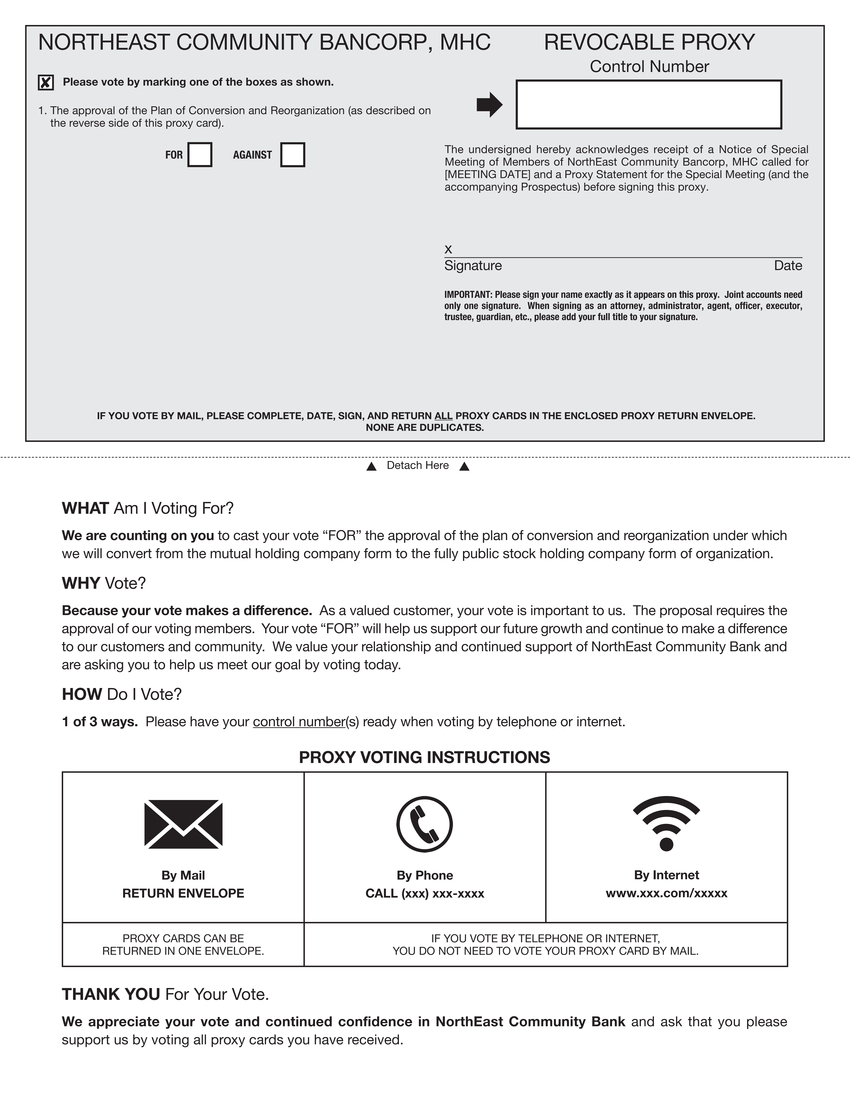

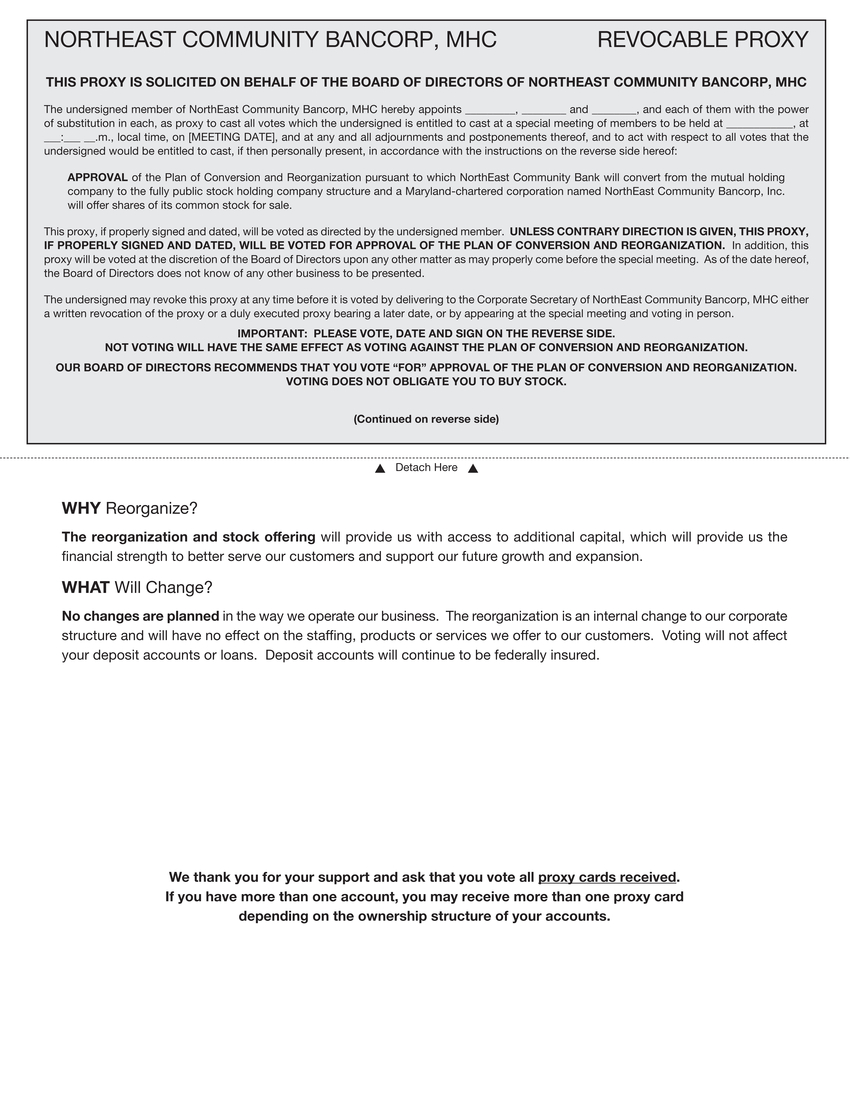

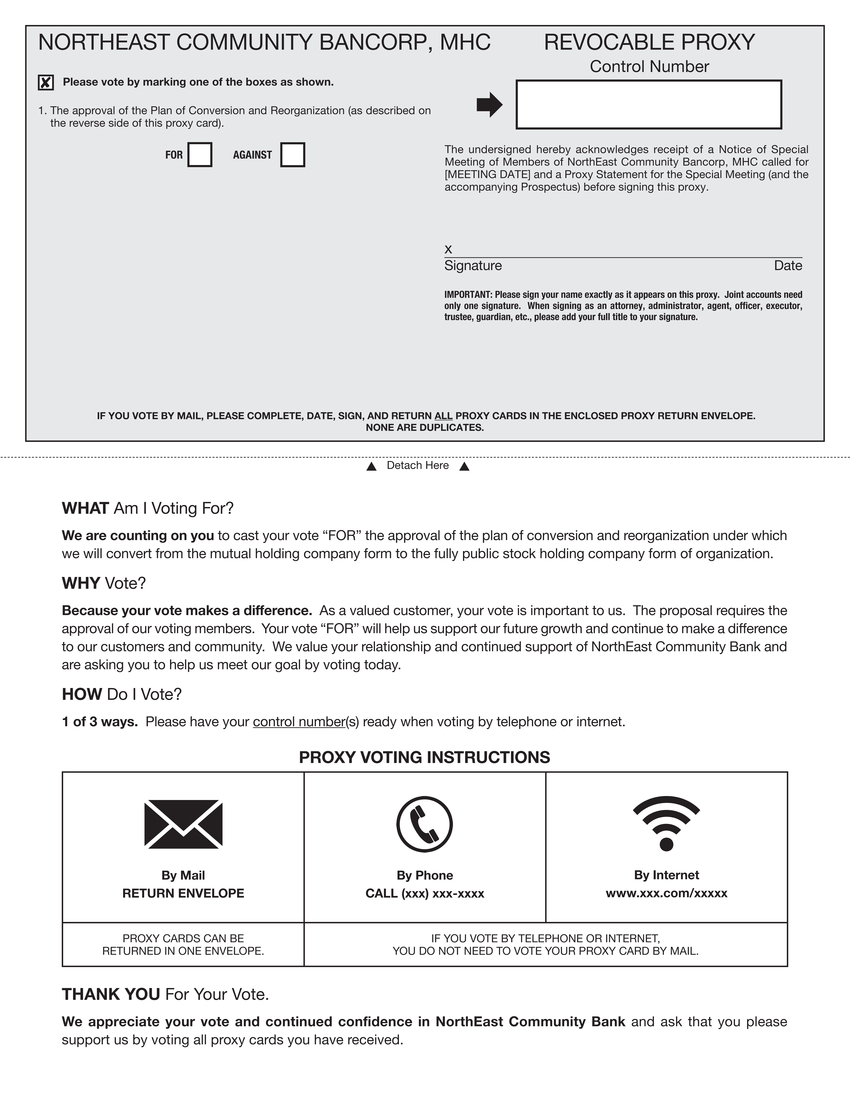

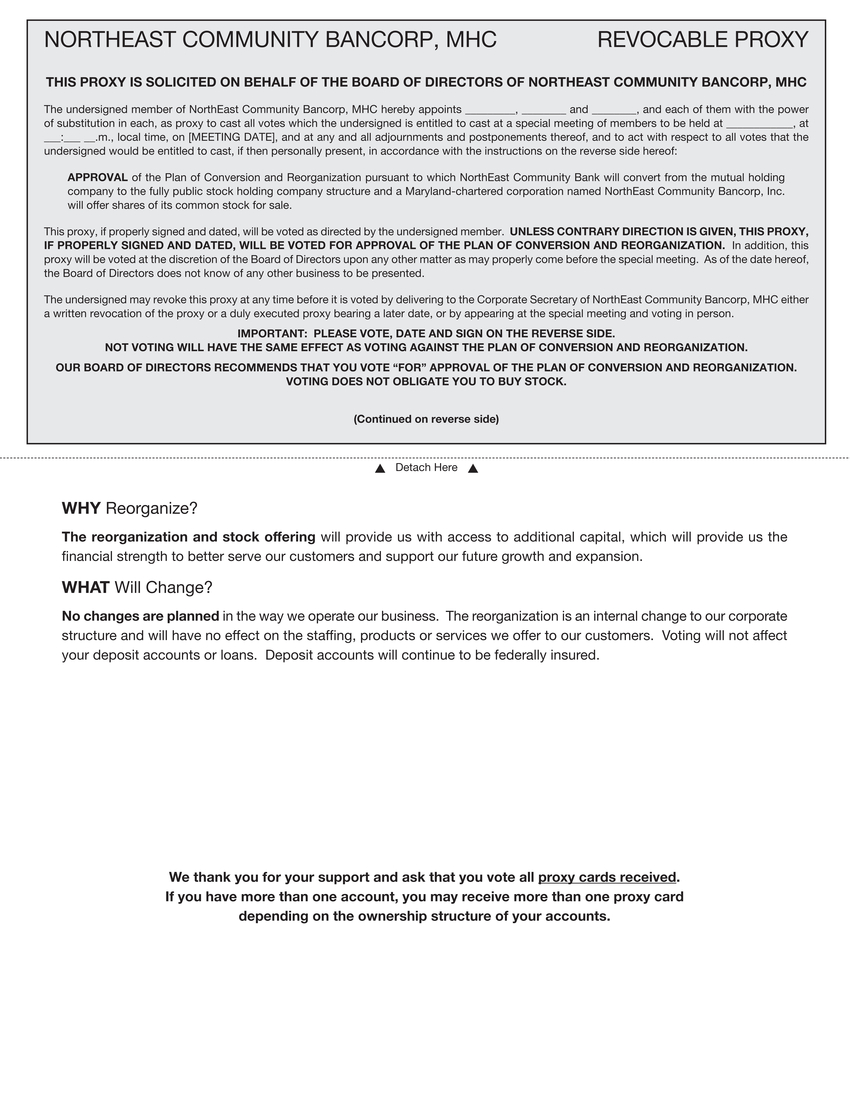

| NORTHEAST COMMUNITY BANCORP, MHC REVOCABLE PROXY Control Number Please vote by marking one of the boxes as shown. 1. The approval of the Plan of Conversion and Reorganization (as described on the reverse side of this proxy card). FORAGAINST The undersigned hereby acknowledges receipt of a Notice of Special Meeting of Members of NorthEast Community Bancorp, MHC called for [MEETING DATE] and a Proxy Statement for the Special Meeting (and the accompanying Prospectus) before signing this proxy. x Signature Date IMPORTANT: Please sign your name exactly as it appears on this proxy. Joint accounts need only one signature. When signing as an attorney, administrator, agent, officer, executor, trustee, guardian, etc., please add your full title to your signature. IF YOU VOTE BY MAIL, PLEASE COMPLETE, DATE, SIGN, AND RETURN ALL PROXY CARDS IN THE ENCLOSED PROXY RETURN ENVELOPE. NONE ARE DUPLICATES. Detach Here WHAT Am I Voting For? We are counting on you to cast your vote “FOR” the approval of the plan of conversion and reorganization under which we will convert from the mutual holding company form to the fully public stock holding company form of organization. WHY Vote? Because your vote makes a difference. As a valued customer, your vote is important to us. The proposal requires the approval of our voting members. Your vote “FOR” will help us support our future growth and continue to make a difference to our customers and community. We value your relationship and continued support of NorthEast Community Bank and are asking you to help us meet our goal by voting today. HOW Do I Vote? 1 of 3 ways. Please have your control number(s) ready when voting by telephone or internet. PROXY VOTING INSTRUCTIONS THANK YOU For Your Vote. We appreciate your vote and continued confidence in NorthEast Community Bank and ask that you please support us by voting all proxy cards you have received. |

| NORTHEAST COMMUNITY BANCORP, MHCREVOCABLE PROXY THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF NORTHEAST COMMUNITY BANCORP, MHC The undersigned member of NorthEast Community Bancorp, MHC hereby appoints,and, and each of them with the power of substitution in each, as proxy to cast all votes which the undersigned is entitled to cast at a special meeting of members to be held at, at : .m., local time, on [MEETING DATE], and at any and all adjournments and postponements thereof, and to act with respect to all votes that the undersigned would be entitled to cast, if then personally present, in accordance with the instructions on the reverse side hereof: APPROVAL of the Plan of Conversion and Reorganization pursuant to which NorthEast Community Bank will convert from the mutual holding company to the fully public stock holding company structure and a Maryland-chartered corporation named NorthEast Community Bancorp, Inc. will offer shares of its common stock for sale. This proxy, if properly signed and dated, will be voted as directed by the undersigned member. UNLESS CONTRARY DIRECTION IS GIVEN, THIS PROXY, IF PROPERLY SIGNED AND DATED, WILL BE VOTED FOR APPROVAL OF THE PLAN OF CONVERSION AND REORGANIZATION. In addition, this proxy will be voted at the discretion of the Board of Directors upon any other matter as may properly come before the special meeting. As of the date hereof, the Board of Directors does not know of any other business to be presented. The undersigned may revoke this proxy at any time before it is voted by delivering to the Corporate Secretary of NorthEast Community Bancorp, MHC either a written revocation of the proxy or a duly executed proxy bearing a later date, or by appearing at the special meeting and voting in person. IMPORTANT: PLEASE VOTE, DATE AND SIGN ON THE REVERSE SIDE. NOT VOTING WILL HAVE THE SAME EFFECT AS VOTING AGAINST THE PLAN OF CONVERSION AND REORGANIZATION. OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” APPROVAL OF THE PLAN OF CONVERSION AND REORGANIZATION. VOTING DOES NOT OBLIGATE YOU TO BUY STOCK. (Continued on reverse side) Detach Here WHY Reorganize? The reorganization and stock offering will provide us with access to additional capital, which will provide us the financial strength to better serve our customers and support our future growth and expansion. WHAT Will Change? No changes are planned in the way we operate our business. The reorganization is an internal change to our corporate structure and will have no effect on the staffing, products or services we offer to our customers. Voting will not affect your deposit accounts or loans. Deposit accounts will continue to be federally insured. We thank you for your support and ask that you vote all proxy cards received. If you have more than one account, you may receive more than one proxy card depending on the ownership structure of your accounts. |

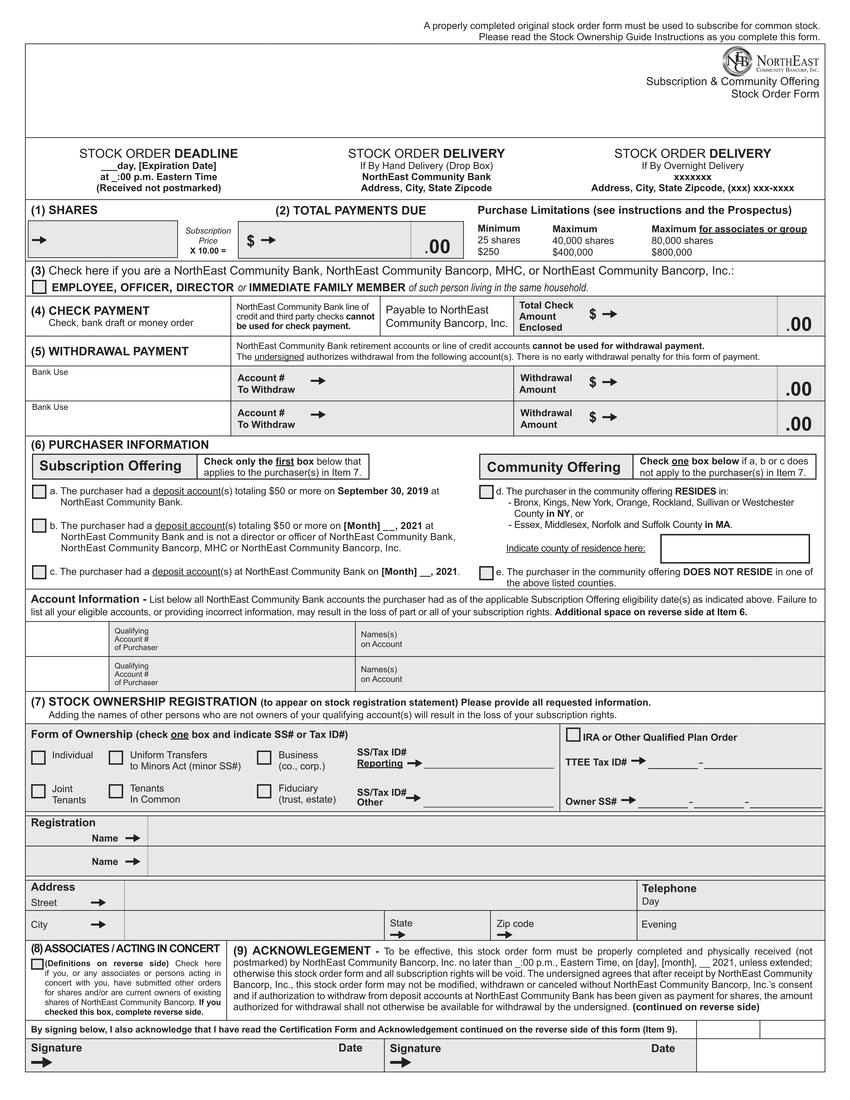

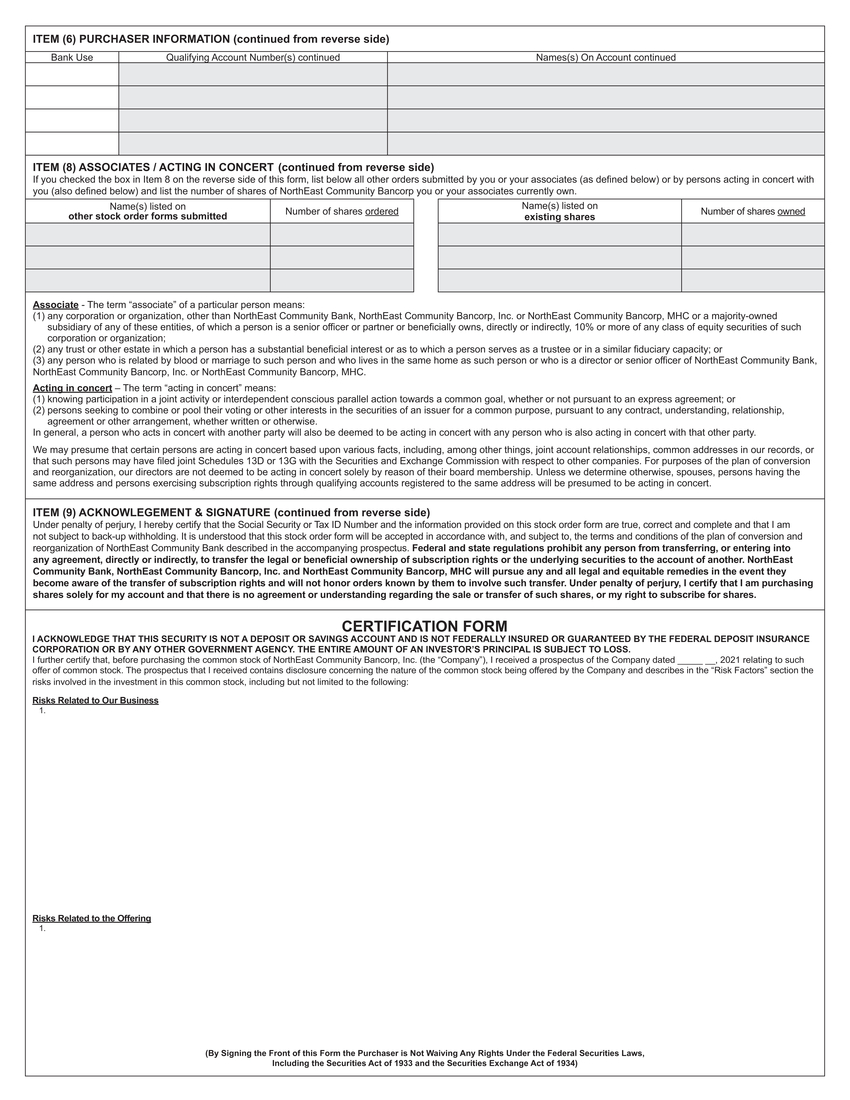

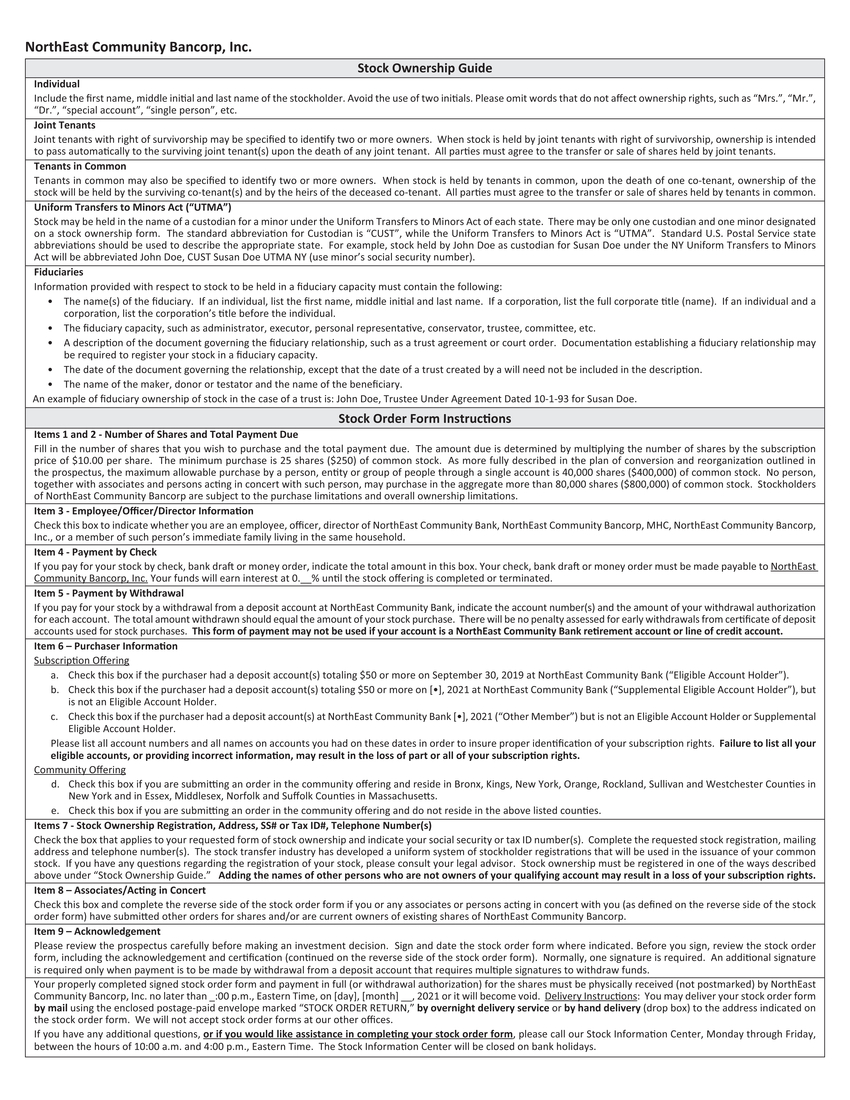

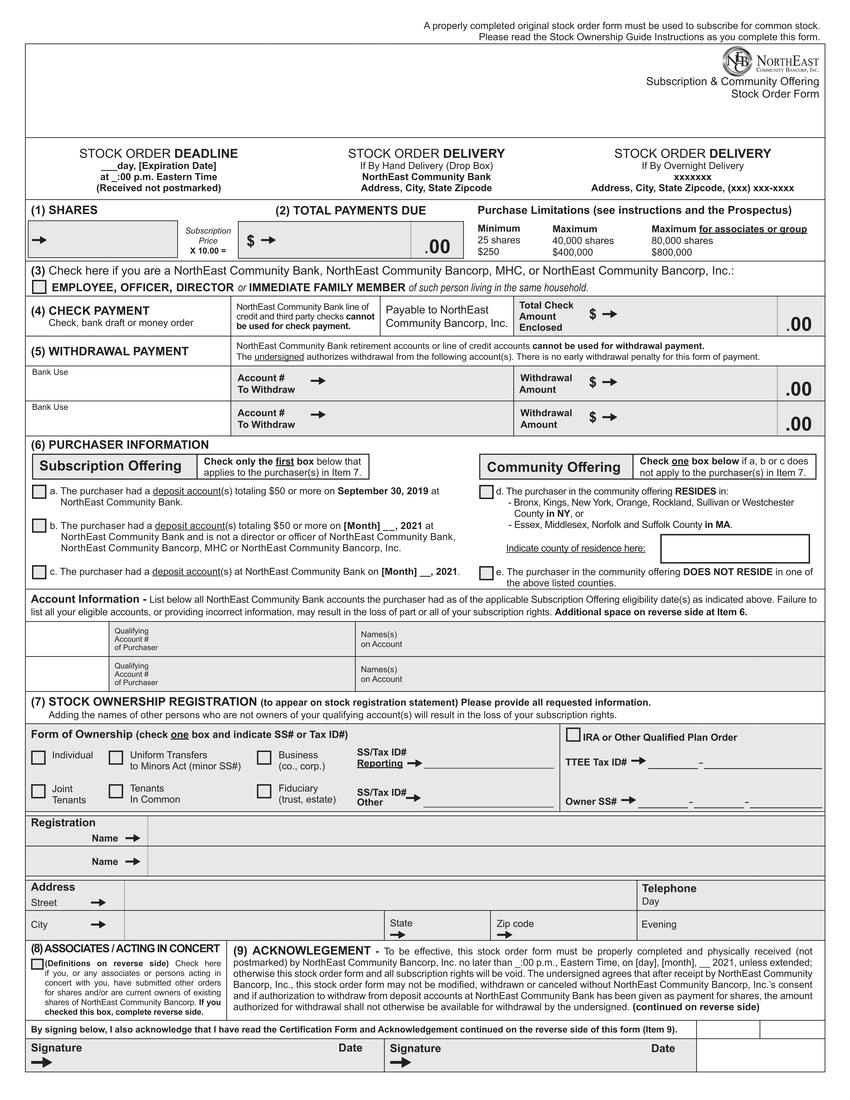

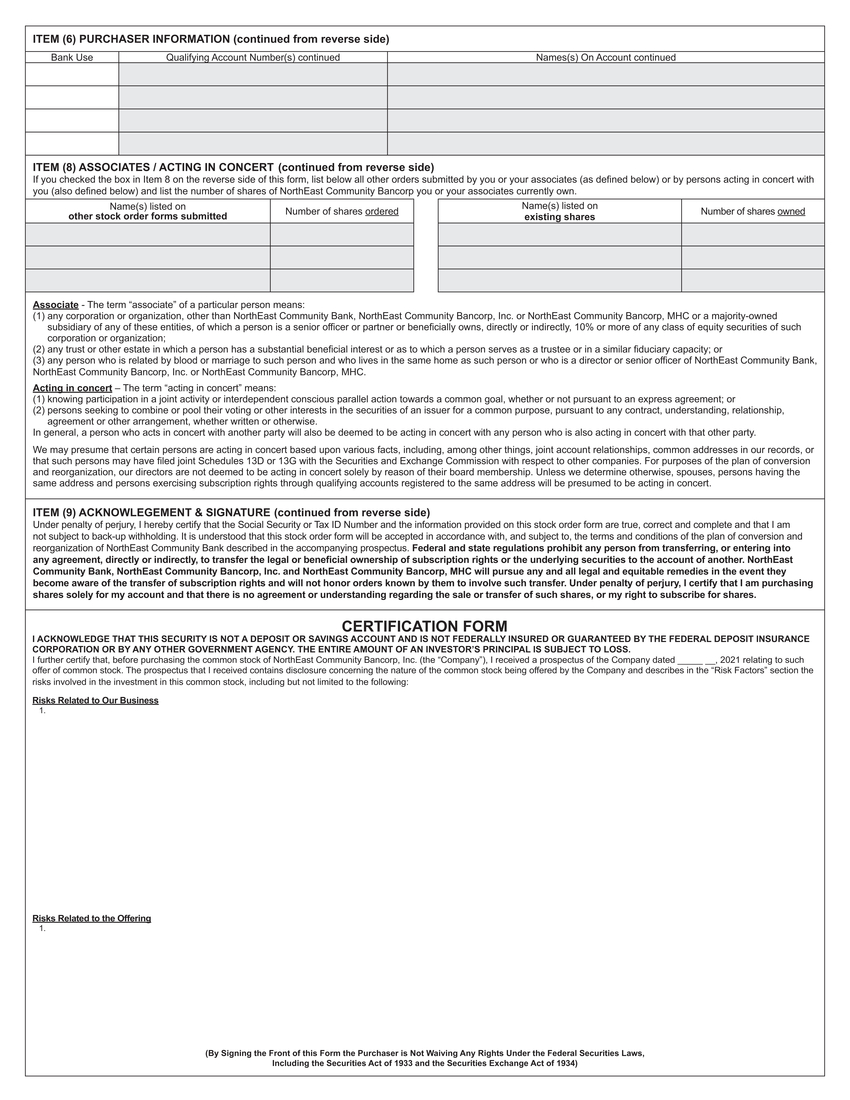

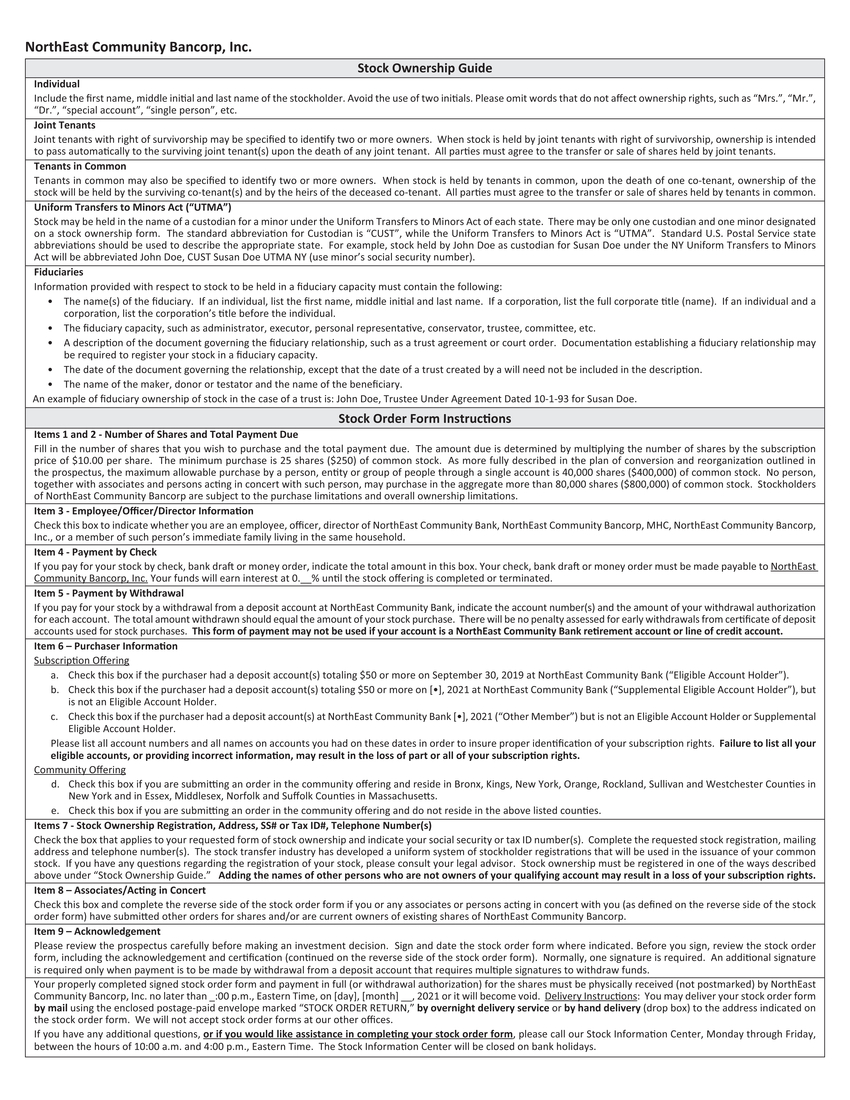

| A properly completed original stock order form must be used to subscribe for common stock. Please read the Stock Ownership Guide Instructions as you complete this form. Subscription & Community Offering Stock Order Form STOCK ORDER DEADLINE day, [Expiration Date] at _:00 p.m. Eastern Time (Received not postmarked) STOCK ORDER DELIVERY If By Hand Delivery (Drop Box) NorthEast Community Bank Address, City, State Zipcode STOCK ORDER DELIVERY If By Overnight Delivery xxxxxxx Address, City, State Zipcode, (xxx) xxx-xxxx SHARES TOTAL PAYMENTS DUE Purchase Limitations (see instructions and the Prospectus) X 10.00 = $ .00 Minimum 25 shares $250 Maximum 40,000 shares $400,000 Maximum for associates or group 80,000 shares $800,000 Check here if you are a NorthEast Community Bank, NorthEast Community Bancorp, MHC, or NorthEast Community Bancorp, Inc.: EMPLOYEE, OFFICER, DIRECTOR or IMMEDIATE FAMILY MEMBER of such person living in the same household. CHECK PAYMENT Check, bank draft or money order NorthEast Community Bank line of credit and third party checks cannot be used for check payment. Payable to NorthEast Community Bancorp, Inc. Enclosed.00 (5) WITHDRAWAL PAYMENT The undersigned authorizes withdrawal from the following account(s). There is no early withdrawal penalty for this form of payment. Bank Use Bank Use Amount Amount .00 .00 PURCHASER INFORMATION Subscription Offering The purchaser had a deposit account(s) totaling $50 or more on September 30, 2019 at NorthEast Community Bank. The purchaser had a deposit account(s) totaling $50 or more on [Month] _ _, 2021 at NorthEast Community Bank and is not a director or officer of NorthEast Community Bank, NorthEast Community Bancorp, MHC or NorthEast Community Bancorp, Inc. The purchaser had a deposit account(s) at NorthEast Community Bank on [Month] , 2021. Community Offering The purchaser in the community offering RESIDES in: Bronx, Kings, New York, Orange, Rockland, Sullivan or Westchester County in NY, or Essex, Middlesex, Norfolk and Suffolk County in MA. Indicate county of residence here: The purchaser in the community offering DOES NOT RESIDE in one of the above listed counties. Account Information - List below all NorthEast Community Bank accounts the purchaser had as of the applicable Subscription Offering eligibility date(s) as indicated above. Failure to list all your eligible accounts, or providing incorrect information, may result in the loss of part or all of your subscription rights. Additional space on reverse side at Item 6. Qualifying Account # of Purchaser Qualifying Account # of Purchaser Names(s) on Account Names(s) on Account STOCK OWNERSHIP REGISTRATION (to appear on stock registration statement) Please provide all requested information. Adding the names of other persons who are not owners of your qualifying account(s) will result in the loss of your subscription rights. Form of Ownership (check one box and indicate SS# or Tax ID#)IRA or Other Qualified Plan Order SS/Tax ID# Individual Joint Tenants Registration Uniform Transfers to Minors Act (minor SS#) Tenants In Common Business (co., corp.) Fiduciary (trust, estate) Reporting SS/Tax ID# TTEE Tax ID# -Owner SS# --_ Address Name Name Telephone Street CityStateZip code Day Evening ASSOCIATES / ACTING IN CONCERT (Definitions on reverse side) Check here if you, or any associates or persons acting in concert with you, have submitted other orders for shares and/or are current owners of existing shares of NorthEast Community Bancorp. If you checked this box, complete reverse side. ACKNOWLEGEMENT - To be effective, this stock order form must be properly completed and physically received (not postmarked) by NorthEast Community Bancorp, Inc. no later than _:00 p.m., Eastern Time, on [day], [month], 2021, unless extended; otherwise this stock order form and all subscription rights will be void. The undersigned agrees that after receipt by NorthEast Community Bancorp, Inc., this stock order form may not be modified, withdrawn or canceled without NorthEast Community Bancorp, Inc.’s consent and if authorization to withdraw from deposit accounts at NorthEast Community Bank has been given as payment for shares, the amount authorized for withdrawal shall not otherwise be available for withdrawal by the undersigned. (continued on reverse side) By signing below, I also acknowledge that I have read the Certification Form and Acknowledgement continued on the reverse side of this form (Item 9). SignatureDateSignatureDate |

| [LOGO] |

| NorthEast Community Bancorp, Inc. |

NorthEast Community Bancorp, Inc.

NorthEast Community Bank

|

|

If you have more than one account, you may have received more than one proxy card depending upon the ownership structure of your accounts. Please vote all proxy cards that you received. None are duplicates. |

|

Please Support Us & Vote Your Proxy Card(s) Today |

NorthEast Community Bancorp, Inc.

____ __, 2021

Dear Subscriber:

We hereby acknowledge receipt of your order for shares, listed below, and payment at $10.00 per share, of shares of NorthEast Community Bancorp, Inc. common stock. If you are issued shares, the shares will be registered as indicated above.

At this time, we cannot confirm the number of shares of NorthEast Community Bancorp, Inc. common stock, if any, that will be issued to you. Following completion of the stock offering, shares will be allocated in accordance with the plan of conversion and reorganization.

Once the offering has been completed, you will receive by mail from our transfer agent Continental Stock Transfer & Trust Company, a statement indicating your ownership of NorthEast Community Bancorp, Inc. common stock.

Please retain this letter and refer to the batch and item number indicated below for any future inquiries you may have regarding this order.

If you have any questions, please call our Stock Information Center at [Stock Center Phone Number], Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Eastern Time. The Stock Information Center will be closed on bank holidays.

NorthEast Community Bancorp, Inc.

Stock Information Center

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

NorthEast Community Bancorp, Inc.

____ __, 2021

Dear Interested Investor:

We recently completed our subscription offering. Unfortunately, due to the demand for shares from persons with priority rights, stock was not available for our [Supplemental Eligible Account Holders], [Other Members] [or] [community members]. If your subscription was paid for by check, bank draft or money order, a refund of the balance due to you with interest will be mailed promptly.

We appreciate your interest in NorthEast Community Bancorp, Inc. and hope you become an owner of our stock in the future. Our common stock has commenced trading on the Nasdaq Capital Market under the symbol “NECB.”

NorthEast Community Bancorp, Inc.

Stock Information Center

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

NorthEast Community Bancorp, Inc.

____ __, 2021

Welcome Stockholder:

Thank you for your interest in NorthEast Community Bancorp, Inc. (the “Company”). Our offering has been completed and we are pleased to enclose a statement from our transfer agent reflecting the number of shares of the Company’s common stock purchased by you in the offering at a price of $10.00 per share. The transaction closed on ____ __, 2021; this is your stock purchase date.

If your subscription was paid for by check, bank draft or money order, we will send you a check for interest on the funds you submitted, and, if your subscription was not filled in full, the refund due.

The enclosed statement is your evidence of ownership of shares of Company common stock. All stock sold in the offering has been issued in book entry form through the Direct Registration System (“DRS”). No physical stock certificates will be issued. Please examine this statement carefully to be certain that it properly reflects the number of shares you purchased and the names in which the ownership of the shares are to be shown on the books of the Company. If you also held a physical stock certificate for shares of NorthEast Community Bancorp prior to completion of the offering, a letter of transmittal regarding the exchange of those shares for NorthEast Community Bancorp, Inc. shares, along with other materials, has been mailed to you separately.

If you have any questions about your statement, please contact our transfer agent (by mail, telephone, email) as follows:

Continental Stock Transfer & Trust Company

Attn: NorthEast Community Bancorp, Inc. Investor Services

1 State Street, 30th Floor

New York, NY 10004

(800) 509-5586

cstmail@continentalstock.com

Trading [is expected to] [commenced] on the Nasdaq Capital Market under the symbol “NECB” on __ __, 2021. Please contact a stockbroker if you choose to sell your stock or purchase any additional shares in the future.

On behalf of the Board of Directors, officers and employees of NorthEast Community Bancorp, Inc., I thank you for supporting our offering and welcome you as a stockholder.

Sincerely,

Kenneth A. Martinek

Chairman and Chief Executive Officer

The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

NorthEast Community Bancorp, Inc.

_______ __, 2021

Dear Interested Subscriber:

We regret to inform you that NorthEast Community Bancorp, Inc., the proposed holding company for NorthEast Community Bank, did not accept your order for shares of NorthEast Community Bancorp, Inc. common stock in its community offering. This action is in accordance with our plan of conversion and reorganization, which gives NorthEast Community Bancorp, Inc. the absolute right to reject the order of any person, in whole or in part, in the community offering.

If your order was paid for by check, enclosed is your original check.

NorthEast Community Bancorp, Inc.

Stock Information Center

The shares of common stock are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

_______ __, 2021

Dear Community Member:

We are enclosing material in connection with the stock offering by NorthEast Community Bancorp, Inc., the proposed holding company for NorthEast Community Bank.

Piper Sandler & Co. is acting as marketing agent in connection with the subscription and community offerings, which will conclude at _:00 p.m., Eastern Time, on [day], [month] __, 2021.

Members of the general public are eligible to participate. If you have any questions about the offering, please do not hesitate to call the Stock Information Center at [Stock Center Phone Number], Monday through Friday, between the hours of 10:00 a.m. and 4:00 p.m., Eastern Time. The Stock Information Center will be closed on bank holidays.

Piper Sandler & Co.

NorthEast Community Bank NorthEast Community Bancorp, Inc. Commences Stock Offering NorthEast Community Bancorp, Inc., the proposed holding company for NorthEast Community Bank, is offering shares of its common stock for sale in a stock offering. Shares of NorthEast Community Bancorp, Inc. common stock are being offered for sale at a price of $10.00 per share. As a member of the community served by NorthEast Community Bank, you may have the opportunity to purchase shares in the offering. If you would like to learn more about our stock offering, we invite you to obtain a prospectus and offering material by calling our Stock Information Center at [Stock Center Phone Number], Monday through Friday between the hours of 10:00 a.m. and 4:00 p.m., Eastern Time. The Stock Information Center will be closed on bank holidays. The shares of common stock being offered are not savings accounts or deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the prospectus. |

| |

EMAIL VOTE REMINDER

HAVE YOU VOTED YET? As a valued customer, your vote is important to us. If you were a NorthEast Community Bank depositor as of [month] [date], 2021, you recently received package containing proxy materials requesting your vote “FOR” our plan of conversion and reorganization. If you have not yet voted, please support us by voting all proxy cards received by mail, telephone, text, or Internet as indicated on the proxy card. If you have any questions, please call our Stock Information Center at [Stock Center Phone Number], Monday through Friday, 10:00 a.m. to 4:00 p.m., Eastern Time. Help us meet our goal by casting your vote “FOR” approval of the plan YOUR SUPPORT YOUR VOTE OUR THANKS www.xxx.com/xxxxx |