Management's Discussion & Analysis

For the three and six months ended April 30, 2021 and 2020

This Management's Discussion and Analysis ("MD&A") of High Tide Inc. ("High Tide" or the "Company") for the three and six months ended April 30, 2021, and 2020 is dated June 28, 2021. This MD&A should be read in conjunction with the audited Consolidated Financial Statements of the Company for the years ended October 31, 2020 (hereafter the "Financial Statements") and with International Accounting Standard ("IAS") 34 Interim Financial Reporting as issued by the International Accounting Standards Board ("IASB").

In this document, the terms "we", "us" and "our" refer to High Tide. This document also refers to the Company's three reportable operating segments: (i) the "Retail" Segment represented by brands, including Canna Cabana, NewLeaf Cannabis, Meta Cannabis Co, KushBar, Grasscity, Smoke Cartel, and CBDcity, (ii) the "Wholesale" Segment represented by brands, including Valiant Distribution ("Valiant") and Famous Brandz ("Famous Brandz"), and (iii) the "Corporate" Segment.

High Tide is a retail-focused cannabis corporation enhanced by the manufacturing and distribution of consumption accessories. The Company's shares are listed on the Nasdaq Capital Market ("Nasdaq") under the ticker symbol "HITI" as of June 2, 2021, the TSX Venture Exchange ("TSXV") under the symbol "HITI", and the Frankfurt Stock Exchange ("FSE") under the securities identification code 'WKN: A2PBPS' and the ticker symbol "2LYA". The address of the Company's corporate and registered office is # 120 - 4954 Richard Road SW, Calgary, Alberta T3E 6L1, while the address of the Company's headquarters is #112, 11127 15 Street NE, Calgary, Alberta, T3K 2M4.

Additional information about the Company, including the October 31, 2020 audited Consolidated Financial Statements, news releases, the Company's short-form prospectus, and other disclosure items of the Company can be accessed at www.sedar.com and at www.hightideinc.com.

Forward-Looking Information and Statements

Certain statements contained within this MD&A, and in certain documents incorporated by reference into this document, constitute forward-looking statements. These statements relate to future events or the Company's future performance. All statements other than statements of historical fact may be forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "budget", "plan", "continue", "estimate", "expect", "forecast", "may", "will", "project", "predict", "potential", "targeting", "intend", "could", "might", "should", "believe" and similar expressions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements.

In particular, this MD&A contains forward-looking statements pertaining, without limitation, to the following: changes in general and administrative expenses; future business operations and activities and the timing thereof; the future tax liability of the Company; the estimated future contractual obligations of the Company; the future liquidity and financial capacity of the Company; and its ability to fund its working capital requirements and forecasted capital expenditures.

We believe the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in, or incorporated by reference into, this MD&A should not be unduly relied upon.

These forward-looking statements speak only as of the date of this MD&A or as of the date specified in the documents incorporated by reference into this MD&A. The actual results could differ materially from those anticipated in these forward-looking statements as a result of the risk factors set forth below and elsewhere in this MD&A: counterparty credit risk; access to capital; limitations on insurance; changes in environmental or legislation applicable to our operations, and our ability to comply with current and future environmental and other laws; changes in income tax laws or changes in tax laws and incentive programs relating to the cannabis industry; and the other factors discussed under "Financial Instruments and Risk Management" in this MD&A.

Readers are cautioned that the foregoing lists of factors are not exhaustive. The forward-looking statements contained in this MD&A and the documents incorporated by reference herein are expressly qualified by this cautionary statement. The forward-looking statements contained in this document speak only as of the date of this document and the Company does not assume any obligation to publicly update or revise them to reflect new events or circumstances, except as may be required pursuant to applicable securities laws.

Changes in Accounting Policies and Critical Accounting Estimates

The significant accounting policies applied in preparation of the unaudited condensed interim consolidated financial statements for the three and six months ended April 30, 2021, and 2020 are consistent with those applied and disclosed in Note 3 of the Company's Consolidated Financial Statements for the year ended October 31, 2020 and 2019.

Non-IFRS Financial Measures

Throughout this MD&A, references are made to non-IFRS financial measures, including earnings before interest, taxes, depreciation, and amortization ("EBITDA") and Adjusted EBITDA. These measures do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. Non-IFRS measures provide investors with a supplemental measure of the Company's operating performance and therefore highlight trends in Company's core business that may not otherwise be apparent when relying solely on IFRS measures. Management uses non-IFRS measures in measuring the financial performance of the Company.

Corporate Overview

Nature of Operations

The Company's vision is to offer a full range of best-in-class products and services to cannabis consumers, while growing organically and through acquisitions, to become the world's premier retail-focused and vertically integrated Cannabis enterprise.

The Company's retail operations are focused on business-to-consumer markets. The operations of Canna Cabana, KushBar, NewLeaf Cannabis and META Cannabis Co are focused on the retail sale of recreational cannabis products for adult use as well as consumption accessories. The Company's e-commerce operations are made up of Grasscity and the newly acquired Smoke Cartel. Grasscity has been operating as a major e-commerce retailer of consumption accessories for over 20 years. It has significant brand equity in the United States and around the world, while providing an established online sales channel for High Tide to sell its proprietary products. Smoke Cartel was founded in 2013 and has grown to become one of the most searchable sites of its kind, further establishing the Company's e-commerce presence.

The wholesale operations of Valiant supports the retail operations of the Company and are primarily focused on the manufacturing and distribution of consumption accessories. Valiant designs and distributes a proprietary suite of branded consumption accessories including overseeing their contract manufacturing by third parties. Valiant also focuses on acquiring celebrity licenses, designing, and distributing branded consumption accessories. Additionally, it also distributes a minority of products that are manufactured by third parties. Valiant does not sell its products directly to consumers but operates an e-commerce platform for wholesale customers.

Established Consumer Brands:

Competitive Landscape

As of the date of this MD&A, the Company operates 80 corporately owned retail cannabis locations represented by 52 Canna Cabana locations, 16 NewLeaf Cannabis locations, 9 META Cannabis Co locations, and 3 KushBar locations. Further, the Company has a 50% interest in a partnership that operates a branded retail Canna Cabana location in Sudbury, Ontario and two joint venture operations with 49% interest that operates three branded retail META Cannabis Co locations in Manitoba. The Company is also represented by three branded locations with 1 location in Toronto, Ontario, 1 in Scarborough, Ontario, and 1 in Guelph, Ontario, as well as one franchise in Calgary. In total, the Company currently has a total of 87 branded retail cannabis stores operating across Canada.

The Company's retail recreational cannabis products segment operates amongst many competitors, both consolidated chains and independent operators. Notable competitors include Fire & Flower, Nova Cannabis, Spiritleaf and Tokyo Smoke, as well as numerous independent retailers.

Most of the Company's competitors applicable to its Wholesale Segment operate primarily as product distributors, while Valiant designs, sources, imports and distributes majority of their own products. This creates advantages through vertical integration, thereby enabling Valiant to bring unique product designs to market and offer wholesale customers favourable terms, proprietary products, and flexible pricing.

In the future, the Company expects its brick-and-mortar retail operations to experience increased competition from the recreational cannabis industry as a greater number of third-party stores are established across Canada, offering both cannabis products and consumption accessories. However, the Company believes that its vertically integrated e-commerce and wholesale operations, product knowledge, and operational expertise will enable it to operate profitably over the long term. In addition, the Company expects opportunities to arise from the legalization of recreational cannabis for its Wholesale Segment to acquire new clients by supplying third-party retailers with consumption accessories on a wholesale basis, thereby offsetting some of the risks associated with the increased competition expected to affect the Retail Segment. While the Company is presently focused on its existing markets in the Provinces of Ontario, Alberta, Saskatchewan, and Manitoba, the Company is looking to expand its presence in Ontario and enter the market in British Columbia. The Company is currently evaluating entering other provinces and territories including Northwest Territories, and the Yukon as regulations permit and anticipates being able to grow both organically as well as through acquisitions in the future.

Select Financial Highlights and Operating Performance

| | | Three months ended April 30 | | | Six months ended April 30 | |

| | | 2021 | | | 2020 | | | Change | | | 2021 | | | 2020 | | | Change | |

| | | $ | | | $ | | | | | | $ | | | $ | | | | |

| Revenue | | 40,868 | | | 20,571 | | | 99% | | | 79,187 | | | 34,286 | | | 131% | |

| Gross Profit | | 14,998 | | | 7,755 | | | 93% | | | 29,766 | | | 12,548 | | | 137% | |

| Gross Profit Margin | | 37% | | | 38% | | | (1%) | | | 38% | | | 37% | | | 1% | |

| Total Operating Expenses | | (19,509 | ) | | (7,599 | ) | | 157% | | | (36,322 | ) | | (14,509 | ) | | 150% | |

| Adjusted EBITDA(a) | | 4,720 | | | 1,773 | | | 166% | | | 9,322 | | | 951 | | | 880% | |

| Net (loss) income from Operations | | (4,511 | ) | | 156 | | | (2992%) | | | (6,556 | ) | | (1,961 | ) | | 234% | |

| Net loss | | (12,266 | ) | | (4,912 | ) | | 150% | | | (29,111 | ) | | (8,857 | ) | | 229% | |

| Loss per share (Basic) | | (0.02 | ) | | (0.02 | ) | | nm | | | (0.06 | ) | | (0.04 | ) | | 50% | |

(a) Adjusted EBITDA is a non-IFRS financial measure. A reconciliation of the Adjusted EBITDA to Net Loss is found under "EBITDA and Adjusted EBITDA" in this MD&A.

nm = not material

Revenue increased by 99% to $40,868 in the second quarter of 2021 (2020: $20,571) and gross profit increased by 93% to $14,998 in the second quarter of 2021 (2020: $7,755). Loss from operations was $4,511 in the second quarter of 2021 (2020: income $156).

The key factors affecting the results for the three-month period ended April 30, 2021, were:

- Merchandise Sales - Merchandise sales increased by 91% for the three-month period ended April 30, 2021, as compared to 2020. Growth in merchandise sales was largely driven by acquired businesses representing $16,941 of total sales increase; the organic increase in the number of Canna Cabana stores and a shift in consumer spending towards e-commerce, which accounts for $950 in total sales increase.

- Operating Expenses - Operating expenses increased by 157% for the three-months ended April 30, 2021, compared to 2020, and as a percentage of revenue increased by 11% in the first quarter of 2021 to 48% (2020: 37%). Operating expenses increased over the same period in 2021 due to the Company's continued growth of their Retail Segment through new store openings and the acquisition of META and Smoke Cartel.

Revenue

Revenue increased by 99% to $40,868 in the second quarter of 2021 (2020: $20,571) and by 131% to $79,187 in the six-month period ended April 30, 2021 (2020: $34,286).

The increase in revenue was driven primarily by the Company's Retail Segment through the acquisition of Meta Growth Corp ("META") on November 18, 2020.

For the three-month period ended April 30, 2021, additions of new stores and the business combination of META and Smoke Cartel into the Company contributed $19,304 of the increase in merchandise revenue. For the six-month period ended April 30, 2021, new stores and business combinations contributed $35,168 to the increase in merchandise revenue.

Canna Cabana, NewLeaf, and META all provide a unique customer experience focused on retention and loyalty through its Cabana Club membership platform. Members of Cabana Club receive short message service ("SMS") and email communications highlighting new and upcoming product arrivals, member-only events, and other special offers. The database communicates with highly relevant consumers who are segmented at the local level by delivering regular content that is specific to their local Canna Cabana, NewLeaf, and META locations. As of the date of this MD&A, approximately 151,240 members have joined Cabana Club, with the majority subscribing in-store, while completing purchase transactions. Over 50% of the Company's daily business is conducted with regular Cabana Club members. During the quarter, Cabana Club members spent, on average, 13% more than non-Cabana Club members, which enhanced the Retail Segment's overall basket-size. This is a confirmation that the Company's one-stop shop ecosystem helps to attract and retain new and existing customers.

Gross Profit

For the three-month period ended April 30, 2021, gross profit increased by 93% to $14,998 (2020: $7,755) and by 137% to $29,766 for the six-month period ended April 30, 2021 (2020: $12,548). The increase in gross profit was driven by the acquisition of META, Smoke Cartel, and an increase in sales volume. The gross profit margin decreased to 37% in the three-month period ended April 30, 2021 (2020: 38%) and increased to 38% in the six-month period ended April 30, 2021 (2020: 37%).

Operating Expenses

Total operating costs increased by 157% to $19,509 in the first quarter of 2021 (2020: $7,599) and by 150% to $36,322 for the six-month period ended April 30, 2021 (2020: $14,509). Operating expenses increased over the same period in 2021 due to the Company's continued growth of their Retail Segment through new store openings and the acquisition of META and Smoke Cartel, resulting in a total of 85 branded retail stores operating across Canada compared to 33 branded retail stores as of April 30, 2020 (increase of 52 stores).

Salaries, wages, and benefits expenses increased by 85% to $6,205 in the second quarter of 2021 (2020: $3,357) and by 85% to $12,055 for the six-month period ended April 30, 2021 (2020: $6,531). The increase in staffing was due primarily to the acquisition of META, Smoke Cartel, and the need for additional personnel within the Retail Segment to facilitate growth in the number of cannabis locations and, by extension, an increase in revenue. For the six-month period ended April 30, 2021, the Company received $264 in Canada Emergency Wage Subsidy, which has been offset against salaries and wages in the consolidated statements of net loss.

Share-based compensation increased by 2,007% for the second quarter of 2021 compared to the same period in the prior year, and by 1,991% for the six-month period ended April 30, 2021, compared to the same period in the prior year. The increase in share-based compensation was primarily due to granting options and RSUs to employees and directors of the company.

General and administrative expenses increased by 97% for the second quarter of 2021 compared to the same period in 2020, and as a percentage of revenue decreased by 0.1% to 7.4% in the second quarter of 2021 compared to the same period in 2020 primarily because of the acquisition of META and Smoke Cartel.

Amortization expense on property, equipment, intangibles, and right-of-use assets of $7,714 for the second quarter of 2021 increased by 399% compared to same period in 2020 primarily because of $78,440 of assets acquired by the acquisition of META.

The Company is progressing well in integrating META's operations. As of the date of this MD&A, the Company has achieved approximately 71% of the synergies. Following is a breakdown of the annualized synergies achieved:

| Synergy category | | Actual savings ($) | | | Target savings ($) | | | % Achieved | |

| Overhead SG&A and other | | 3,700 | | | 4,500 | | | 82% | |

| Store optimization and leases | | 2,300 | | | 4,000 | | | 58% | |

| Total | | 6,000 | | | 8,500 | | | 71% | |

Financing and Other Costs

Financing and other costs of $3,727 was recorded during the second quarter of 2021 (2020: $2,702), representing the expense associated with the interest expense related to convertible debentures, the accretion of lease liabilities, as well as transaction costs related to the Company's acquisitions and business development.

Revaluation of Derivative Liability

The Company recorded a loss from the revaluation of derivative liability of $3,988 during the second quarter of 2021 (2020: loss of $125). This non-cash accounting charge primarily relates to warrants issued to Windsor Private Capital in connection with the loan agreement entered into on January 6, 2020. The cashless exercise feature in the warrants creates a derivative liability which is required to be revalued each reporting period.

Segment Operations

| | | Retail | | | Retail | | | Wholesale | | | Wholesale | | | Corporate | | | Corporate | | | Total | | | Total | |

| For the three months ended April 30, | | 2021 | | | 2020 | | | 2021 | | | 2020 | | | 2021 | | | 2020 | | | 2021 | | | 2020 | |

| | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | |

| Total Revenue | | 38,362 | | | 18,821 | | | 2,487 | | | 1,660 | | | 19 | | | 90 | | | 40,868 | | | 20,571 | |

| Gross Profit | | 14,188 | | | 7,093 | | | 790 | | | 572 | | | 20 | | | 90 | | | 14,998 | | | 7,755 | |

| Income (loss) from operations | | (1,058 | ) | | 1,757 | | | 25 | | | (356 | ) | | (3,478 | ) | | (1,245 | ) | | (4,511 | ) | | 156 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | 86,532 | | | 46,678 | | | 6,331 | | | 5,972 | | | 107,207 | | | 17,161 | | | 200,070 | | | 69,811 | |

| Total liabilities | | 54,598 | | | 22,893 | | | 2,055 | | | 1,894 | | | 36,875 | | | 33,301 | | | 93,528 | | | 58,088 | |

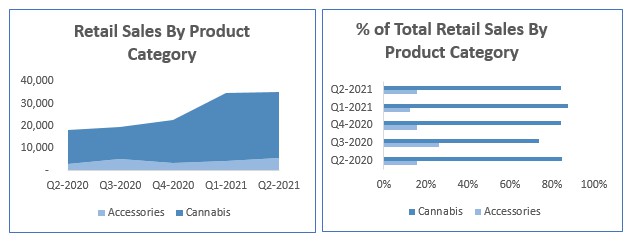

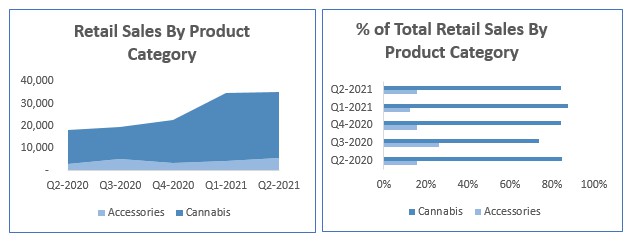

Retail Segment Performance

The Company's Retail Segment demonstrated significant sales growth with an increase in revenue of 104% to $38,362 in the second quarter of 2021 compared to the same period in the prior year. Revenue growth is primarily attributable to its acquired businesses, which resulted in an increased number of retail locations and transactions on Grasscity.com due to shifting consumer habits.

Gross profit for the three-month period ending April 30, 2021, increased by $7,095 compared to the same period in the prior year and the gross profit margin decreased to 37% (2020: 38%). The decrease in the gross margin was due to a change in pricing strategy. The shift in pricing strategy was due to competitive landscape especially in Alberta. In Alberta, as of April 30, 2020, the province had granted 369 cannabis license vs 582 by end of April 30, 2021.

For the three-month period ending April 30, 2021, the Retail Segment recorded a loss from operations of $1,058 compared to income from operations of $1,757 for the same period in the prior year. The loss from operations is primarily due to higher depreciation of property, plant and equipment and higher amortization of the right-of-use assets related to leases of a larger retail store network compared to Q2 2020. Additionally, amortization on intangibles related to licences from acquired Meta locations that were operational during the current period but did not exist in the prior quarter and amortization on proprietary software from Smoke Cartel acquisition also contributed to loss from operations.

Same-store retail revenue

Same-store sales refers to the change in revenue generated by the Company's existing retail cannabis locations over the period. The Company had 27 cannabis locations that were operational for full three-month period ended April 30, 2021, and April 30, 2020. For these 27 cannabis locations, same-store sales decreased by 17% compared to the three-month period ended April 30, 2020. The decrease was primarily related to lockdown brought on by the COVID-19 pandemic in the province of Ontario. Excluding the same-store sales from the Ontario locations, the same-store sales for the remaining locations decreased by only 2% compared to the three-month period ended April 30, 2020, which is primarily due to increased competition.

Grasscity.com

During the second quarter of 2021, Grasscity processed 35,925 orders (2020: 28,442) and increased its customer base by 14% to 577,100 (2020: 506,000). High Tide continues to invest in Grasscity to refresh its online sales platform, increase its searchability, align its supply chain with Valiant, and optimize its distribution channels. Grasscity enables the Company to leverage its vertical integration to improve order fulfillment, customer reach, product margins and its overall profitability.

Smokecartel.com

On March 24, 2021, the Company closed the acquisition of Smoke Cartel Inc. ("Smoke Cartel"). Founded in 2013, SmokeCartel.com has grown to become one of the most searchable websites of its kind. The Company expects Smoke Cartel's proprietary and licensable drop-shipping technology to enhance existing e-commerce businesses. During the second quarter of 2021, for the period Smoke Cartel operated under the Company, Smoke Cartel processed 20,133 orders (2020: 20,157) and increased its customer base by 62% to 255,000 (2020: 157,000).

Wholesale Segment Performance

Revenues in the Company's Wholesale Segment increased by 50% to $2,487 for the three-month period ending April 30, 2021 (2020: $1,660). The Company's Wholesale Segment benefitted from more normalized levels of inventory availability for its customer base.

Gross profit increased by 38% to $790 for the three-month period ending April 30, 2021 (2020: $572).

The Wholesale Segment reported income from operations of $25 for the three-month period ending April 30, 2021 (2020: loss $356).

Corporate Segment Performance

The Corporate Segment's main function is to administer the other two Segments (Retail and Wholesale) and is responsible for the executive management and financing needs of the business. The Corporate Segment earned revenues of $19 for the three-month period ending April 30, 2021 (2020: $90). The revenue was made up of royalty fees and other revenues.

Geographical Markets

Geographical markets represent revenue based on the geographical locations of the customers who have contributed to the revenue. The following is a representation of these geographical markets:

* USA and international revenues are related to sale of consumption accessories and CBD and not related to sale of cannabis.

The following presents information related to the Company's geographical markets:

| For the three months ended April 30 | | 2021 | | | 2020 | | | 2021 | | | 2020 | | | 2021 | | | 2020 | | | 2021 | | | 2020 | |

| | | Retail | | | Retail | | | Wholesale | | | Wholesale | | | Corporate | | | Corporate | | | Total | | | Total | |

| | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | |

| Primary geographical markets (i) | | | | | | | | | | | | | | | | | | | | | | | | |

| Canada | | 33,827 | | | 16,705 | | | 1,184 | | | 773 | | | 19 | | | 90 | | | 35,030 | | | 17,568 | |

| USA | | 4,365 | | | 1,888 | | | 1,303 | | | 888 | | | - | | | - | �� | | 5,668 | | | 2,776 | |

| International | | 170 | | | 227 | | | - | | | - | | | - | | | - | | | 170 | | | 227 | |

| Total revenue | | 38,362 | | | 18,820 | | | 2,487 | | | 1,661 | | | 19 | | | 90 | | | 40,868 | | | 20,571 | |

(i) Represents revenue based on geographical locations of the customers who have contributed to the revenue generated in the applicable segment.

Sales performance increased significantly, on average, with Canna Cabana leading Canadian sales and Grasscity and Smoke Cartel contributing to USA and International sales. Revenues in the International market are comprised of sales made to all countries outside of North America.

Summary of Quarterly Results

| (C$ in thousands, except per | | Q2 | | | Q1 | | | Q4 | | | Q3 | | | Q2 | | | Q1 | | | Q4 | | | Q3 | |

| share amounts) | | 2021 | | | 2021 | | | 2020 | | | 2020 | | | 2020 | | | 2020 | | | 2019 | | | 2019 | |

| Revenue | | 40,868 | | | 38,319 | | | 24,876 | | | 24,104 | | | 20,571 | | | 13,715 | | | 11,409 | | | 8,288 | |

| Adjusted EBITDA | | 4,720 | | | 4,602 | | | 3,626 | | | 3,397 | | | 1,773 | | | (822 | ) | | (5,698 | ) | | (3,369 | ) |

| (Loss) income from Operations | | (4,511 | ) | | (2,045 | ) | | 1,133 | | | 1,624 | | | 156 | | | (2,117 | ) | | (6,393 | ) | | (4,038 | ) |

| Net (loss) income | | (12,266 | ) | | (16,845 | ) | | (1,324 | ) | | 3,827 | | | (4,912 | ) | | (3,945 | ) | | (15,427 | ) | | (3,724 | ) |

| Net (loss) income per share (Basic) | | (0.02 | ) | | (0.04 | ) | | (0.02 | ) | | 0.02 | | | (0.02 | ) | | (0.02 | ) | | (0.07 | ) | | (0.02 | ) |

(a) Adjusted EBITDA is a non-IFRS financial measure. A reconciliation of the Adjusted EBITDA to Net Loss is found under "EBITDA and Adjusted EBITDA" in this MD&A.

Aside from the seasonal increase in consumer spending leading up to the winter holiday period, which occurs in the first quarter of the Company's fiscal year, quarter over quarter revenues are increasing as the Company aggressively expands Canna Cabana operations and integrates acquired businesses such as META into the Company's business.

The adjusted EBITDA increased by 166% or $2,947 in the second quarter of 2021 compared to same period in the prior year due to higher revenues.

EBITDA and Adjusted EBITDA

The Company defines EBITDA and Adjusted EBITDA as per the table below. It should be noted that these performance measures are not defined under IFRS and may not be comparable to similar measures used by other entities. The Company believes that these measures are useful financial metrics as they assist in determining the ability to generate cash from operations. Investors should be cautioned that EBITDA and Adjusted EBITDA should not be construed as an alternative to net earnings or cash flows as determined under IFRS. The reconciling items between net earnings, EBITDA, and Adjusted EBITDA are as follows:

| | | 2021(1) | | | 2020(2) | | | 2019(3) | |

| | | Q2 | | | Q1 | | | Q4 | | | Q3 | | | Q2 | | | Q1 | | | Q4 | | | Q3 | | | Q2 | | | Q1 | |

| Net (loss) income | | (12,266 | ) | | (16,845 | ) | | (1,324 | ) | | 3,827 | | | (4,912 | ) | | (3,946 | ) | | (15,429 | ) | | (3,724 | ) | | (3,319 | ) | | (3,820 | ) |

| Income taxes (recovery) | | (124 | ) | | 588 | | | (165 | ) | | 316 | | | 162 | | | (85 | ) | | 2,998 | | | (1,310 | ) | | (1,166 | ) | | (1,230 | ) |

| Accretion and interest | | 2,838 | | | 2,702 | | | 573 | | | 2,456 | | | 2,529 | | | 1,734 | | | 1,676 | | | 1,040 | | | 231 | | | 36 | |

| Depreciation and amortization | | 7,714 | | | 6,094 | | | 2,213 | | | 1,771 | | | 1,545 | | | 1,269 | | | 478 | | | 462 | | | 275 | | | 186 | |

| EBITDA | | (1,838 | ) | | (7,461 | ) | | 1,297 | | | 8,370 | | | (676 | ) | | (1,028 | ) | | (10,277 | ) | | (3,532 | ) | | (3,979 | ) | | (4,828 | ) |

| Foreign exchange loss (gain) | | 5 | | | 89 | | | (64 | ) | | 4 | | | (17 | ) | | (4 | ) | | 49 | | | (41 | ) | | (39 | ) | | 75 | |

| Transaction and acquisition costs | | 889 | | | 1,581 | | | 1,729 | | | 193 | | | 173 | | | 622 | | | - | | | - | | | - | | | 106 | |

| Debt restructuring gain | | - | | | (1,145 | ) | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | - | |

| Inventory write- off | | - | | | - | | | 252 | | | - | | | - | | | - | | | - | | | - | | | - | | | - | |

| Loss (gain) revaluation of derivative liability | | 3,988 | | | 10,484 | | | 706 | | | 67 | | | 125 | | | (439 | ) | | (732 | ) | | - | | | - | | | - | |

| (Gain) loss on settlement of convertible debenture | | - | | | - | | | 142 | | | - | | | - | | | - | | | - | | | - | | | - | | | - | |

| Gain on extinguishment of debenture | | - | | | 516 | | | (418 | ) | | (3,576 | ) | | 186 | | | - | | | - | | | - | | | - | | | - | |

| Impairment loss | | - | | | - | | | 458 | | | - | | | 247 | | | - | | | 4,820 | | | - | | | - | | | - | |

| Share-based compensation | | 1,517 | | | 553 | | | 29 | | | 2 | | | 72 | | | 27 | | | 180 | | | 207 | | | 590 | | | 1,232 | |

| Revaluation of marketable securities | | 159 | | | (15 | ) | | - | | | (1,663 | ) | | 1,663 | | | - | | | - | | | - | | | - | | | - | |

| Gain on extinguishment of financial liability | | - | | | - | | | (505 | ) | | - | | | - | | | - | | | (129 | ) | | - | | | - | | | - | |

| Related party balances written off | | - | | | - | | | - | | | - | | | - | | | - | | | 34 | | | - | | | - | | | - | |

| Loss (gain) on disposal of property and equipment | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | 2 | | | - | | | (2 | ) |

| Discount on accounts receivable | | - | | | - | | | - | | | - | | | - | | | - | | | 87 | | | (5 | ) | | (58 | ) | | (24 | ) |

| Adjusted EBITDA | | 4,720 | | | 4,602 | | | 3,626 | | | 3,397 | | | 1,773 | | | (822 | ) | | (5,968 | ) | | (3,369 | ) | | (3,486 | ) | | (3,441 | ) |

(1) Cash outflow for the lease liabilities during the three-months ended April 30, 2021, were $1,265, three months ended January 31, 2021 were $1,088.

(2) Cash outflow for the lease liabilities during the three-months ended October 31, 2020, were $987, three-months ended July 31, 2020 were $783, three-months ended April 30, 2020 were $728 and $693 for three months ended January 31, 2020.

(3) Financial information for 2019 has not been restated for the adoption of IFRS 16.

Financial Position, Liquidity and Capital Resources

Assets

As at April 30, 2021, the Company had a cash balance of $29,353 (October 31, 2020: $7,524).

Working capital including cash as of April 30, 2021 was a surplus of $13,308 (October 31, 2020: deficit $8,183). The change is mainly due to the closing of a bought deal of $23,000 that happened in the second quarter of 2021. These transactions and positive cash flow from operations provide the Company enough liquidity for its working capital needs and to pursue its near-term expansion plan.

Total assets of the Company were $200,070 on April 30, 2021, compared to $69,811 on October 31, 2020. The increase in total assets is primarily due to the acquisition of META, which resulted in significant increases in intangible assets, property and equipment, and right-of-use assets. Assets also increased due to capital asset additions and prepaid lease deposits due to the expansion during the period.

Liabilities

Total liabilities increased to $93,528 at April 30, 2021, compared to $58,088 on October 31, 2020 primarily due to the acquisition of META.

Summary of Outstanding Share Data

The Company had the following securities issued and outstanding as at the date of this MD&A:

| Securities (1) | | Units Outstanding (2) | |

| Issued and outstanding common shares | | 49,646,702 | |

| Warrants | | 7,991,784 | |

| Stock options and RSUs | | 1,832,740 | |

| Convertible debentures | | 2,484,758 | |

(1) Refer to the Company's Consolidated Financial Statements for a detailed description of these securities.

(2) Unit's outstanding are post-consolidation of common shares on May 14, 2021 in preparation for listing on the Nasdaq.

Cash Flows

During the period ended April 30, 2021, the Company had an overall increase in cash of $21,829 (2020: $6,238).

Total cash used in operating activities was $2,603 for the period ended April 30, 2021 (2020: $3,134 cash generated in operating activities). The decrease in operating cash inflows is primarily driven by an increase in operating expenses. Cash used by investing activities was $866 (2020: cash used $1,942). Cash provided by financing activities was $25,298 (2020: cash provided $5,046) because of the bought financing of $23,000 closed in the second quarter of 2021.

Liquidity

In addition to cash and non-cash working capital discussed above, the Company acquired META during the first quarter of 2021, and closed a bought deal financing for $23,000 in the second quarter of 2021. These transactions provide the Company enough liquidity for its working capital needs and to pursue its near-term expansion plan.

Capital Management

The Company's objectives when managing capital resources are to:

I. Explore profitable growth opportunities.

II. Deploy capital to provide an appropriate return on investment for shareholders.

III. Maintain financial flexibility to preserve the ability to meet financial obligations; and

IV. Maintain a capital structure that provides financial flexibility to execute on strategic opportunities.

The Company's strategy is formulated to maintain a flexible capital structure consistent with the objectives stated above as well to respond to changes in economic conditions and to the risks inherent in its underlying assets. The Board of Directors does not establish quantitative return on capital criteria for management, but rather promotes year-over-year sustainable profitable growth. The Company is not subject to any externally imposed capital requirements. The Company's capital structure consists of equity and working capital. To maintain or alter the capital structure, the Company may adjust capital spending, take on new debt and issue share capital. The Company anticipates that it will have adequate liquidity to fund future working capital, commitments, and forecasted capital expenditures through a combination of cash flow, cash-on-hand and financings as required.

Off Balance Sheet Transactions

The Company does not have any financial arrangements that are excluded from the Financial Statements as at April 30, 2021, nor are any such arrangements outstanding as of the date of this MD&A.

Transactions Between Related Parties

As at April 30, 2021, the Company had the following transactions with related parties as defined in IAS 24 - Related Party Disclosures, except those pertaining to transactions with key management personnel in the ordinary course of their employment and/or directorship arrangements and transactions with the Company's shareholders in the form of various financing.

Financing transactions

A Director of the Company is Chief of the Opaskwayak Cree Nation ("OCN"). On November 18, 2020, the Company acquired all of the issued and outstanding shares of META which included notes payable to Opaskwayak Cree Nation ("OCN"). As of April 30, 2021 the Company has drawn $13,000 and has $6,750 available to be drawn under the credit facility.

On February 22, 2021, the Company issued, on a bought deal basis, 47,916,665 units of the Company at a price of $0.48 (3,194,444 units at a price of $7.20 post-consolidation) per unit. Two of the officers and the corporate secretary of the Company, collectively participated in the offering and acquired an aggregate of 3,112,084 units (207,472 units post-consolidation) pursuant to the Offering.

Operational transactions

An office and warehouse unit has been developed by Grover Properties Inc., a company that is related through a common controlling shareholder and the President & CEO of the Company. The office and warehouse space were leased to High Tide to accommodate the Company's operational expansion. The lease was established by an independent real estate valuations services company at prevailing market rates and has annual lease payments totalling $386 per annum. The primary lease term is 5 years with two additional 5-year term extensions exercisable at the option of the Company.

An office and warehouse unit located in Savannah Georgia has been leased out by 2G Realty, LLC, a company that is related through the Chief Technology Officer of the company. The office and warehouse space were leased to accommodate the Company's operational needs for Smoke Cartel. The lease was established at prevailing market rates and has annual lease payments totalling $52 per annum. The primary lease term is 1 years with one additional 1-year term extensions exercisable at the option of the Company.

Subsequent events

(i) On May 10, 2021, the Company acquired 80% of Fab Nutrition, LLC, operating as FABCBD ("FABCBD") for US$20,640, and has been granted a three-year option to acquire the remaining 20% of FABCBD at any time. The consideration was comprised of: (i) 15,608,727 common shares of High Tide (the "HT Shares") (1,040,582 HT Shares post-consolidation), having an aggregate value of US$8,080; and (ii) US$12,560 in cash. The cash portion of the Transaction has been funded entirely with cash on hand. In addition, pursuant to the acquisition agreement the vendor may be entitled to an earn out bonus of US$612 if FABCBD exceeds gross revenues of at least US$13,500 in 2021, which will be paid, if due, in High Tide Shares based on the volume weighted average price per High Tide Share for the 10 consecutive trading days preceding payment, subject to a maximum of 1,425,106 (95,007 post-consolidation) High Tide Shares.

(ii) On May 14, 2021, the Company announce that it will be consolidating all of its issued and outstanding common shares ("Common Shares") on the basis of one (1) post-consolidation Common Share for each fifteen (15) pre-consolidation Common Shares (the "Share Consolidation"). The Share Consolidation represented another major step towards the listing of the Common Shares on The Nasdaq Stock Market LLC ("Nasdaq") by meeting the minimum share price requirement set by Nasdaq. The Company listed on Nasdaq om June 2, 2021.

(iii) On May 19, 2021, the Company closed its previously announced "bought deal" short-form prospectus offering (the "Offering") units of the Company (the "Units"), including the exercise in full of the underwriters' over-allotment option. The Offering was led by ATB Capital Markets Inc. and Echelon Wealth Partners Inc., on behalf of the syndicate underwriters. In connection with the Offering, the Company issued an aggregate of 2,100,000 Units at a price of $9.60 per Unit, for aggregate gross proceeds of $20,160. The over-allotment option allowed to purchase an additional 315,000 Units at a price of $9.60 per Unit, for aggregate gross proceeds of $3,024. Each Unit is comprised of one common share of the Company (each, a "Common Share") and one half of one Common Share purchase warrant (each whole warrant, a "Warrant"). Each Warrant entitles the holder thereof to purchase one additional Common Share at an exercise price of $12.25, for a period of 36 months following the closing of the Offering.

(iv) On June 25, 2021, the Company entered into a defininitve agreement pursuant to which the Company, will acquire 100% of the issued and outstanding shares of DHC Supply LLC operating as Daily High Club. The consideration will be comprised of: (i) common shares of High Tide ("High Tide Shares"), having an aggregate value of US$6,750 on the basis of a deemed price per High Tide Share equal to the volume weighted average price per High Tide Share on Nasdaq for the 10 consecutive trading days preceding the closing of the Transaction; and (ii) US$3,250 in cash. The cash portion of the Transaction will be funded entirely with cash on hand.

(v) Subsequent to the period ended April 30, 2021, $2,680 of debt was converted into common shares.

(vi) Subsequent to the period ended April 30, 2021, 1,754 warrants were converted to 115,903 common shares for net proceeds of $831.

Financial Instruments

The Company's activities expose it to a variety of financial risks. The Company is exposed to credit, liquidity, and market risk because of holding certain financial instruments. The Company's overall risk management program focuses on the unpredictability of financial markets and seeks to minimize potential adverse effects on the Company's financial performance. Risk management is carried out by senior management in conjunction with the Board of Directors.

Financial instruments that subject the Company to credit risk consist primarily of cash, accounts receivable, marketable securities and loans receivable. The credit risk relating to cash and cash equivalents balance is limited because the counterparties are large commercial banks. The amount reported for trade receivable in the statement of financial position is net of expected credit loss and the net carrying value represents the Company's maximum exposure to credit risk. Trade receivable credit exposure is minimized by entering into transactions with creditworthy counterparties and monitoring the age and balances outstanding on an ongoing basis. Sales to retail customers are required to be settled in cash or using major credit cards, mitigating credit risk.

The Company performs a regular assessment of collectability of accounts receivables. In determining the expected credit loss amount, the Company considers the customer's financial position, payment history and economic conditions.

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company generally relies on funds generated from operations as well as debt and equity financings to provide sufficient liquidity to meet budgeted operating requirements and to supply capital to expand its operations.

Foreign currency risk is defined as the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in foreign exchange rates. The Company maintains cash balances and enters into transactions denominated in foreign currencies, which exposes the Company to fluctuating balances and cash flows due to variations in foreign exchange rates.

Outlook

High Tide continues to have a leading position in the Canadian brick and mortar cannabis market with 87 locations across the country. The Company is focused on expanding its footprint in Ontario, and expects to increase its store count in the province from 18 today, and reach 30 open stores by September 30, 2021, the date on which the cap for any one retailer can own is set to increase from 30 to 75. Recent COVID related restrictions limited the Company's stores in Ontario to click and collect and delivery only which negatively impacted sales. On June 11, 2021, in store shopping resumed in our stores in Ontario. While still early, we have seen a boost in sales as a result - which would be consistent with our prior experience coming out of the prior two lockdowns in the province. The Company also expects to enter British Columbia in the coming months.

In addition to continued expansion in Canadian brick and mortar cannabis, the Company expects further growth ahead as a result of its U.S.-focused businesses. Specifically, the second quarter's results included only 37 days contribution of Smoke Cartel. Since the end of the second quarter, High Tide has closed the acquisition of FABCBD and expects to close the acquisition of Daily High Club imminently. We believe that strengthening our unique cannabis ecosystem across the value chain by geography and segment offers meaningful synergy opportunities and creates a stronger company which is better positioned to thrive regardless of short-term dynamics in any one area.

The Company has been actively following developments in the U.S. cannabis sector, and while it appears that further liberalisation regarding the federal regulatory and legislative environment is possible, our immediate strategy does not rely on regulatory change. Despite this, we remain just one transaction away from entering the bricks and mortar retail market in the U.S. when federally permissible. High Tide believes it is very well positioned to take advantage of the growing ancillary and hemp derived CBD markets and estimates its current revenue run rate in the U.S., pro forma for the announced acquisitions, to be approximately $50 million today.

Risk Assessment

Management of High Tide defines risk as the evaluation of probability that an event might happen in the future that could negatively affect the financial condition, results of operations and/or reputation of the Company. The following section describes specific and general risks that could affect the Company. The following descriptions of risk do not include all possible risks as there may be other risks of which management is currently unaware.

Changes in Laws and Regulations

The Company is subject to a variety of applicable laws, including those relating to the marketing, acquisition, manufacturing, management, transportation, storage, sale, packaging and labeling, and disposal of cannabis and cannabis products. The Company is also subject to applicable laws relating to health and safety, the conduct of operations, taxation of products and the protection of the environment. As applicable laws pertaining to the cannabis industry are relatively new, it is possible that significant legislative amendments may still be enacted - either provincially or federally - that address current or future regulatory issues or perceived inadequacies in the regulatory framework. Changes to applicable laws could have a Material Adverse Effect.

The legislative framework pertaining to the Canadian adult-use cannabis market is subject to significant provincial and territorial regulation. The legal framework varies across provinces and territories and results in asymmetric regulatory and market environments. Different competitive pressures, additional compliance requirements, and other costs may also limit the Company's ability to participate in such market.

Failure to Manage Growth Successfully

The Company's business has grown rapidly in the last year. The Company's growth places a strain on managerial, financial, and human resources. The Company will need to provide adequate operational, financial and management controls and reporting procedures to manage the continued growth in the number of employees, scope of operations and financial systems as well as the geographic area of operations. Expanding the business into new geographic areas requires the Company to incur costs, which may be significant, before any associated revenues materialize. Future growth beyond the next 12 months will depend upon several factors, including but not limited to the Company's ability to:

• issue further equity and/or take on further debt to fund the completion of the Company's expansion plans, including the build-out of new recreational cannabis stores and the expansion of its client base.

• hire, train, and manage additional employees to provide agreed upon services.

• execute on and successfully integrate acquisitions; and

• expand the Company's internal management to maintain control over operations and provide support to other functional areas within High Tide.

High Tide's inability to achieve any of these objectives could harm the Company's business, financial condition, reputation, and operating results.

Dependence on Key Personnel

The success of High Tide is largely dependent on the performance of its key employees and directors. Failure to retain key employees and directors and to attract and retain additional key employees with necessary skills could have a material adverse impact on the Company's growth and profitability. The departure of any key personnel could have a material adverse effect on the Company's business, results of operations and financial condition.

Ancillary Business in the United States Cannabis Industry

The Company derives a portion of its revenues from the cannabis industry in certain States. The Company is not directly or indirectly engaged in the manufacture, importation, possession, use, sale, or distribution of cannabis in the recreational or medical cannabis industry in the U.S., however, the Company may be considered to have ancillary involvement in the U.S. cannabis industry. Due to the current business and any future opportunities, the Company may become the subject of heightened scrutiny by regulators, stock exchanges and other authorities in Canada. As a result, the Company may be subject to significant direct or indirect interaction with public officials. There can be no assurance that this heightened scrutiny will not in turn lead to the imposition of certain restrictions on the Company's ability to invest in the United States or any other jurisdiction, in addition to those described in this MD&A.

Competition

The Company faces, and will continue to face, intense competition from other companies, some of which can be expected to have longer operating histories and greater financial resources (including technical, marketing, and other resources compared to the Company). Such companies may be able to devote greater resources to the development, promotion, sale and support of their respective products and services. Such companies may also have more extensive customer bases and broader customer relationships and may make it increasingly difficult for the Company to, among other things, enter into favorable business agreements, negotiate favourable prices, recruit, or retain qualified employees, and acquire the capital necessary to fund capital investments by the Company.

In addition, Management estimates that, as of the date of this MD&A, there may be currently hundreds of applications for Retail Store Authorizations being processed by applicable cannabis regulatory authorities. The number of Authorizations granted, and the number of retail cannabis store operators ultimately authorized by applicable cannabis regulatory authorities, could have an adverse impact on the ability of the Company to compete for market share in the cannabis market within various jurisdictions in Canada. The Company also faces competition from illegal cannabis dispensaries, engaged in the sale and distribution of cannabis to individuals without valid Authorizations.

Lastly, as the cannabis market continues to mature, both domestically and internationally, the overall demand for products and the number of competitors may be expected to increase significantly. Such increases may also be accompanied by shifts in market demand, and other factors that Management cannot currently anticipate, and which could potentially reduce the market for the products of the Company, and ultimately have a Material Adverse Effect.

To remain competitive in the evolving cannabis market, the Company will need to invest significantly in, among other things, operational efficiencies, marketing, growing distribution channels, and investing in additional human resources to support growth initiatives. If the Company is not successful in obtaining sufficient resources to invest in these areas, the ability of the Company to compete in the cannabis market may be adversely affected, which could have a Material Adverse Effect.

Failure to Secure Retail Locations

One of the factors in the growth of the Company's Cannabis retail business depends on the Company's ability to secure attractive locations on terms acceptable to the Company. The Company faces competition for retail locations from its competitors and from operators of other businesses. There is no assurance that future locations will produce the same results as past locations.

Cyber Risks

The Company and its third-party services provider's information systems are vulnerable to an increasing threat of continually evolving cybersecurity risks. These risks may take the form of malware, computer viruses, cyber threats, extortion, employee error, malfeasance, system errors or other types of risks, and may occur from inside or outside of the respective organizations. The operations of the Company depend, in part, on how well networks, equipment, information technology systems and software are protected against damage from several threats. The failure of information systems or a component of information system could, depending on the nature of any such failure, could have a material adverse effect on the Company's, business, its reputation, results of operations and financial condition.

Risk of Enforcement of U.S. Federal Laws

There can be no assurance that the U.S. federal government will not seek to prosecute cases involving cannabis businesses, including those of the Company, notwithstanding compliance with the securities laws of the applicable state of the United States. Such proceedings could have a Material Adverse Effect.

Further, violations of any U.S. federal laws and regulations could result in significant fines, penalties, administrative sanctions, convictions, or settlements arising from civil proceedings conducted by either the U.S. federal government or private citizens, or criminal charges, including, but not limited to, disgorgement of profits, cessation of business activities or divestiture. This could have a Material Adverse Effect, including on its reputation and ability to conduct business, its ability to list its securities on stock exchanges, its financial position, its operating results, its profitability or liquidity or the value of its securities. In addition, the time of Management and advisors of the Company and resources that would be needed for the investigation of any such matters, or their final resolution could be substantial.

Epidemics and Pandemics (including COVID-19)

The Company faces risks related to health epidemics, pandemics, and other outbreaks of communicable diseases, which could significantly disrupt its operations and could have a Material Adverse Effect. In particular, the Company could be adversely impacted by the effects of COVID-19, an infectious disease caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). Since December 31, 2019, the outbreak of COVID-19 has led governments worldwide to enact emergency measures to combat the spread of the virus. These measures, which include, among other things, the implementation of travel bans, self-imposed quarantine periods and social distancing, have caused material disruption to businesses globally, resulting in an economic slowdown. Such events may result in a period of business disruption, and in reduced operations, any of which could have a Material Adverse Effect.

As of the date of this MD&A, the duration and the immediate and eventual impact of COVID-19 remains unknown. It is not possible to reliably estimate the length and severity of these developments and the impact on the financial results and condition of the Company and its industry partners. To date, several businesses have suspended or scaled back their operations and development as cases of COVID-19 have been confirmed, for precautionary purposes or as governments have declared a state of emergency or taken other actions. However, the exact extent to which COVID-19 impacts, or will impact the Business will depend on future developments, which are highly uncertain and cannot be predicted at this time, and include the duration, severity and scope of the pandemic and the actions taken to contain or treat COVID-19 (including recommendations from public health officials). In particular, the continued spread of COVID-19 globally could materially and adversely impact the Business, including without limitation, store closures or reduced operational hours or service methods, employee health, workforce productivity, reduced access to supply, increased insurance premiums, limitations on travel, the availability of experts and personnel and other factors that will depend on future developments beyond the Company's control, which could have a Material Adverse Effect. There can be no assurance that the personnel of the Company will not be impacted by these pandemic diseases and ultimately see its workforce productivity reduced or incur increased costs because of these health risks. In addition, COVID-19 represents a widespread global health crisis that could adversely affect global economies and financial markets resulting in an economic downturn that could have a Material Adverse Effect.

Licenses and Permits

The ability of the Company to continue the Business is dependent on the good standing of various Authorizations from time to time possessed by the Company and adherence to all regulatory requirements related to such activities. The Company will incur ongoing costs and obligations related to regulatory compliance, and any failure to comply with the terms of such Authorizations, or to renew the Authorizations after their expiry dates, could have a Material Adverse Effect.

Although Management believes that the Company will meet the requirements of applicable laws for future extensions or renewals of the applicable Authorizations, there can be no assurance that applicable governmental entities will extend or renew the applicable Authorizations, or if extended or renewed, that they will be extended or renewed on the same or similar terms. If the applicable governmental entities do not extend or renew the applicable Authorizations, or should they renew the applicable Authorizations on different terms, any such event or occurrence could have a Material Adverse Effect.

The Company remains committed to regulatory compliance. However, any failure to comply with applicable laws may result in additional costs for corrective measures, penalties, or restrictions on the operations of the Company. In addition, changes in applicable laws or other unanticipated events could require changes to the operations of the Company, increased compliance costs or give rise to material liabilities, which could have a Material Adverse Effect.

Cannabis Prices

A major part of the Company's revenue is derived from the sale and distribution of cannabis in Canada, as such, the profitability of the Company may be regarded as being directly related to the price of cannabis. The cost of production, sale, and distribution of cannabis is dependent on several key inputs and their related costs, including equipment and supplies, labour and raw materials related to the growing operations of cannabis suppliers, as well other overhead costs such as electricity, water, and utilities. Any significant interruption or negative change in the availability or economics of the supply chain for key inputs could have a Material Adverse Effect. Further, any inability to secure required supplies and services or to do so on favourable terms could have a Material Adverse Effect. This includes, among other things, changes in the selling price of cannabis and cannabis products set by the applicable province or territory. There is currently no established market price for cannabis and the price of cannabis is affected by numerous factors beyond the Company's control. Any price decline could have a Material Adverse Effect.

The operations of the Company may be sensitive to changes in the price of cannabis and the overall condition of the cannabis industry.

Difficulty to Forecast

The Company relies, and will need to rely, largely on its own market research to forecast industry statistics as detailed forecasts are not generally obtainable, if obtainable at all, from other sources at this early stage of the adult-use cannabis industry. Failure in the demand for the adult-use cannabis products because of competition, technological change, change in the regulatory or legal landscape or other factors could have a Material Adverse Effect.

Political and Other Risks Operating in Foreign Jurisdictions

The Company has operations in various foreign markets and may have operations in additional foreign and emerging markets in the future. Such operations expose the Company to the socioeconomic conditions as well as the laws governing the controlled substances industry in such foreign jurisdictions. Inherent risks with conducting foreign operations include, but are not limited to, high rates of inflation; fluctuations in currency exchange rates, military repression, war or civil unrest, social and labour unrest, organized crime, terrorism, violent crime, expropriation and nationalization, renegotiation or nullification of existing Authorizations, changes in taxation policies, restrictions on foreign exchange and repatriation, and changes political norms, currency controls and governmental regulations that favour or require the Company to award contracts in, employ citizens of, or purchase supplies from, the jurisdiction.