Exhibit 99.2

STRICTLY CONFIDENTIAL Company Introduction May 2022

STRICTLY CONFIDENTIAL 2 Disclaimer This presentation is for informational purposes only and has been prepared to assist interested parties in making their own e val uation with respect to the proposed business combination between Lakeshore Acquisition I Corp. (“Lakeshore”) and ProSomnus Holdings Inc. (“ProSomnus”). The information contained herein does not purport to be all - inclusive and none of Lakesho re, ProSomnus or any of their prospective affiliates, or any of their control persons, officers, directors, employees or representatives makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this presentation. It is not intended to form the basis of any investment decision or any other decision in respect of the business combination. You should not construe the contents of this presentation as investment, leg al, business or tax advice. You should consult with your own counsel, financial advisor and tax advisor as to legal, business, financial, tax and related matters concerning the matters described herein. Important Information About the Proposed Business Combination and Where to Find It In connection with the proposed business combination, Lakeshore intends to file a Registration Statement on Form S - 4, including a preliminary proxy statement/prospectus and a definitive proxy statement/prospectus with the SEC. Lakeshore’s shareholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus and th e amendments thereto and the definitive proxy statement/prospectus as well as other documents filed with the SEC in connection with the proposed business combination, as these materials will contain important information about ProSomnus, Lak esh ore, and the proposed business combination. When available, the definitive proxy statement/prospectus and other relevant materials for the proposed business combination will be mailed to shareholders of Lakeshore as of a record date to b e e stablished for voting on the proposed business combination. Shareholders will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus, and other documents filed with the SEC tha t w ill be incorporated by reference therein, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: www.lakeshoreacquisition.com. Participants in the Solicitation Lakeshore and its directors and executive officers may be deemed participants in the solicitation of proxies from Lakeshore’s sh areholders with respect to the business combination. A list of the names of those directors and executive officers and a description of their interests in Lakeshore will be included in the proxy statement/prospectus for the proposed business comb ina tion and be available at www.sec.gov. Additional information regarding the interests of such participants will be contained in the proxy statement/prospectus for the proposed business combination when available. ProSomnus and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of Lakeshore in connection with the proposed business combination. A list of the names of such directors and executive officers and information regarding their interests in the proposed business combination will be included in the pr oxy statement/prospectus for the proposed business combination. Forward - Looking Statements Except for historical information contained herein, this presentation contains certain “forward - looking statements” within the m eaning of the federal U.S. securities laws with respect to the proposed business combination between Lakeshore and ProSomnus, the benefits of the transaction, the amount of cash the transaction will provide ProSomnus, the anticipated timing of the transaction, the services and markets of ProSomnus, our expectations regarding future growth, results of operations, performance, future capital and other expenditures, competitive advantages, business prospects and opportunities, fu ture plans and intentions, results, level of activities, performance, goals or achievements or other future events. These forward - looking statements generally are identified by words such as “anticipate,” “believe,” “expect,” “may,” “could,” “will,” “potential,” “intend,” “estimate,” “should,” “plan,” “predict,” or the negative or other variations of such statements, refle ct our management’s current beliefs and assumptions and are based on the information currently available to our management. Forw ard - looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actua l r esults or developments to differ materially from those expressed or implied by such forward - looking statements, including but not limited to: ( i ) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of La kes hore’s securities; (ii) the risk that the transaction may not be completed by Lakeshore’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by Lakes hor e; (iii) the failure to satisfy the conditions to the consummation of the transaction, including the approval of the business combination agreement by the stockholders of Lakeshore, the satisfaction of the minimum cash amount following any redemptions by Lakeshore’s public stockholders and the receipt of certain governmental and regulatory approvals; (iv) the lack of a third - party valuation in determining whether or not to pursue the proposed transaction; (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination agreement; (vi) the effect of the announcement or pendency of the transaction on ProSomnus’s business relationships, operating results and business generally; (vii) risks that the proposed transaction disrupts current pl ans and operations of ProSomnus; (viii) the outcome of any legal proceedings that may be instituted against ProSomnus or Lakeshore related to the business combination agreement or the pro posed transaction; (ix) the ability to maintain the listing of Lakeshore’s securities on a national securities exchange; (x) changes in the competitive industries in which ProSomnus operates, variations in operating performance across competitors, ch ang es in laws and regulations affecting ProSomnus’s business and changes in the combined capital structure; (xi) the ability to implement business plans, forecasts and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities; (xii) the risk of downturns in the market and ProSomnus’s industry including, but not limited to, as a result of the COVID - 19 pandemic; (xiii) costs related to the transaction and the failure to realize anticipated benefits of the transaction or to realize estimated pro forma results and underlying assumptions, including with respect to estimated stockholder redemptions; (xiv) the inability to complete its convertible debt financing; (xv) the risk of potential fu ture significant dilution to stockholders resulting from lender conversions under the convertible debt financing; and (xvi) r isk s and uncertainties related to ProSomnus’s business, including, but not limited to, risks relating to the uncertainty of the projected financial information with respec t to ProSomnus; risks related to ProSomnus’s limited operating history, the roll - out of ProSomnus’s business and the timing of expected business milestones; ProSomnus’s ability to implement its business plan and scale its business, which includes the recruitment of healthcare professionals to pr escribe and dentists to deliver ProSomnus oral devices; the understanding and adoption by dentists and other healthcare professionals of ProSomnus oral devic es for mild - to - moderate OSA; expectations concerning the effectiveness of OSA treatment using ProSomnus oral devices and the potential for patient relapse after completion of treatment; the potential financial benefits to dentists and other h eal thcare professionals from treating patients with ProSomnus oral devices and using ProSomnus’s monitoring tools; ProSomnus’s potential profit margin from sales of ProSomnus oral devices; ProSomnus’s ability to properly train dentists in the use of the ProSomnus oral devices and other services it offers in their dental prac ti ces; ProSomnus’s ability to formulate, implement and modify as necessary effective sales, marketing, and strategic initiatives to drive revenue growth; ProSomnus’s ability to expand internationally; the viability of ProSomnus’s intellectual property and intellectual property created in the future; acceptance by the marketplace of the products and services that ProSomnus markets; government regulations and ProSomnus’s ability to obtain applicable regulatory approvals and comply with government regulations, including under healthcare laws and the rules and regulations of the U.S. Food and Drug Administration; and the extent of patient reimburseme nt by medical insurance in the United States and internationally. The foregoing list of factors is not exclusive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of pro xy statement, when available, and other documents filed by Lakeshore from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those co nta ined in the forward - looking statements. Forward - looking statements speak only as of the date on which they are made, and neither ProSomnus nor Lakeshore assume any obligation to update or revise any forward - looking statements or other information co ntained herein, whether as a result of new information, future events or otherwise. You are cautioned not to put undue reliance on these forward - looking statements. Neither Lakeshore nor ProSomnus gives any assurance that either Lakeshore or ProSomnus, or the combined company, will achieve its expectations.

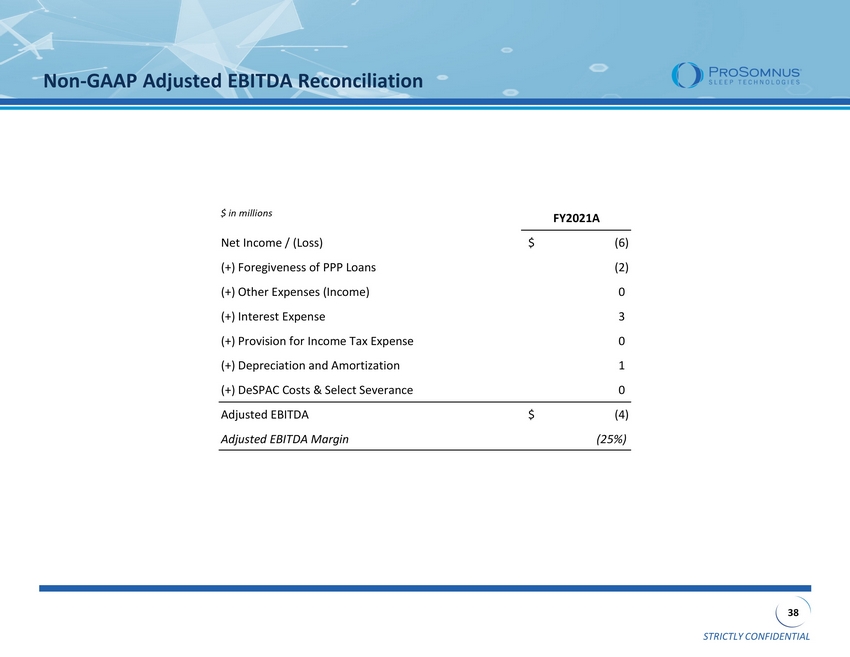

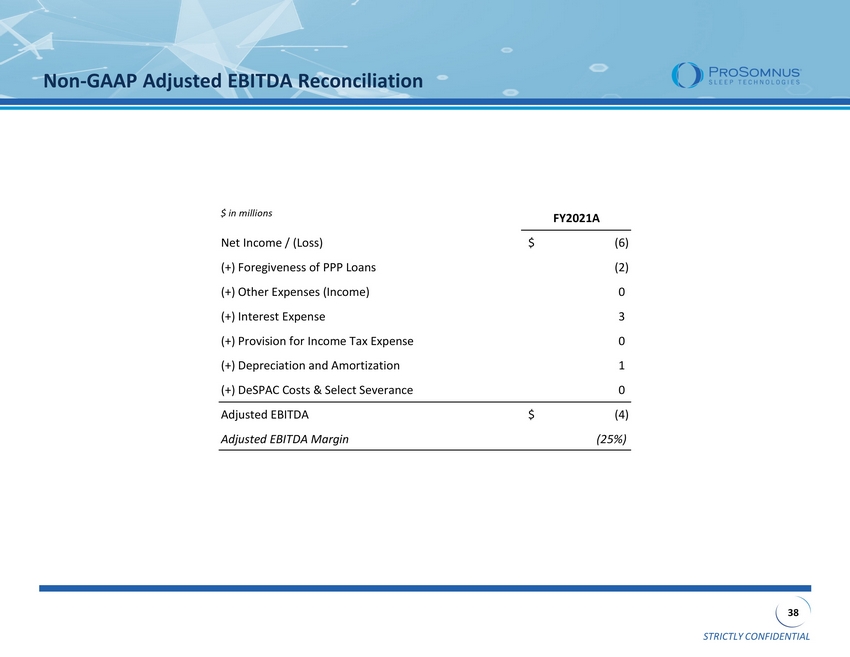

STRICTLY CONFIDENTIAL 3 Disclaimer (cont.) Use of Projections and Non - GAAP Measures This presentation is for informational purposes only and has been prepared to assist interested parties in making their own e val uation with respect to the proposed business combination between Lakeshore Acquisition I Corp. (“Lakeshore”) and This presentation contains projected financial information with respect to ProSomnus, namely revenue, gross margin and EBITDA for ProSomnus’s fiscal years ended December 31, 2022 through December 31, 2025. Such projected financial information constitutes forward - looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties tha t could cause actual results to differ materially from those contained in the prospective financial information. See “Forward - Looking Statements” above. Actual results may differ materially from the results contemplated by the projected financial info rma tion contained in this presentation, and the inclusion of such information in this presentation should not be regarded as a representation by any person that the results reflected in such projections will be achieved. Neither the independent auditors of Lakeshore nor the independent auditors of ProSomnus, audited, reviewed, compiled, or perf orm ed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpos e o f this presentation. While ProSomnus, Lakeshore, and their respective financial advisors have reviewed such projections and believe them to be based on reasonable assumptions, projections are inherently unreliable and the review of such projecti ons or their inclusion in this presentation or elsewhere is not a guarantee of ProSomnus’s financial results. If the projections are not met, it could result in a complete loss of your investment. You should review the projections and underl yin g assumptions carefully and make your own independent determination of the likelihood of ProSomnus meeting such projections. The financial information and data contained in this presentation is unaudited and does not conform to Regulation S - X. According ly, such information and data may not be included in, may be adjusted in or may be presented differently in, any proxy statement, registration statement, or prospectus to be filed by Lakeshore with the SEC. Some of the financial information and da ta contained in this presentation are not measures prepared in accordance with United States generally accepted accounting principles (“GAAP”). EBITDA is a non - GAAP financial measure that ProSomnus defines as Operating Income plus depreciat ion and amortization. Lakeshore and ProSomnus believe this non - GAAP measure of financial results provides useful information to management and investors regarding certain financial and business trends relating to ProSomnus’s financial condition and results of operations and an additional tool for investors to use in evaluating projected operating r es ults and trends in and in comparing ProSomnus’ financial measures with other similar companies, many of which present similar non - GAAP fi nancial measures to investors. ProSomnus management does not consider this non - GAAP measure in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of this non - GAAP financial mea sure is that it excludes significant expenses and income that is required by GAAP to be recorded in ProSomnus’s financial statements. In addition, it is subject to inherent limitations as it reflects the exercise of judgments by management about w hic h expense and income items are excluded or included in determining this non - GAAP financial measures. In order to compensate for these limitations, management presents this measure (EBITDA) with the most closely related GAAP result (net in com e). In addition, all ProSomnus historical financial information included herein is preliminary and subject to change pending finalization of the fiscal year 2020 and 2021 audits of ProSomnus in accordance with PCAOB auditing standards. No Representations or Warranties This presentation does not purport to contain all of the information that may be required to evaluate a possible transaction. No representation or warranty, express or implied, is or will be given by Lakeshore or ProSomnus or any of their respective affiliates, directors, officers, employees, or advisers or any other person as to the accuracy or completeness of the informa tio n in this presentation (including as to the accuracy or reasonableness of statements, estimates, targets, projections, assumptions, or judgments) or any other written, oral, or other communications transmitted or otherwise made available to any pa rty in the course of its evaluation of a possible transaction, and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions, or misstatements, negligent or otherwise, relating thereto. Ac cordingly, none of Lakeshore or ProSomnus or any of their respective affiliates, directors, officers, employees, or advisers or any other person shall be liable for any direct, indirect, or consequential loss or damages suffered by any person as a resul t o f relying on any statement in or omission from this presentation and any such liability is expressly disclaimed. This presentation is not intended to constitute and should not be construed as investment advice and does not constitute investmen t, tax, or legal advice. Certain information contained herein has been derived from sources prepared by third parties. While such information is believed to be reliable for the purposes used herein, none of Lakeshore, ProSomnus, their respective affi lia tes, nor Lakeshore’s or ProSomnus’s or their affiliates’ directors, officers, employees, members, partners, shareholders, or agents makes any representation or warranty with respect to the accuracy of such information. No Offer or Solicitation This presentation shall not constitute a solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the proposed business combination. This presentation shall also not constitute an offer to sell or the solicitatio n of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, so licitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdicti on. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Ac t of 1933, as amended, or an exemption therefrom.

STRICTLY CONFIDENTIAL 4 Large, growing, underserved disease with significant comorbidities Limitations of current therapies (CPAP) result in inadequate alleviation, and do not offer the remote physiologic monitoring data that physicians need to better manage the disease ProSomnus is a pioneer of precision Oral Appliance Therapy (“OAT”), a new category of devices associated with better outcomes and patient preference - Proven product effectiveness, business model, and ability to scale Launch of novel, continuous patient monitoring platform is expected to transform clinicians' ability to better manage the disease with critical, real - time physiologic data Proprietary, digital manufacturing platform enables clinically meaningful precision therapy advantages and quality for customized devices Key Messages ProSomnus precision devices are well - positioned to become the leading treatment for Obstructive Sleep Apnea (“OSA”), one of the few remaining underserved Med Tech markets x x x x x

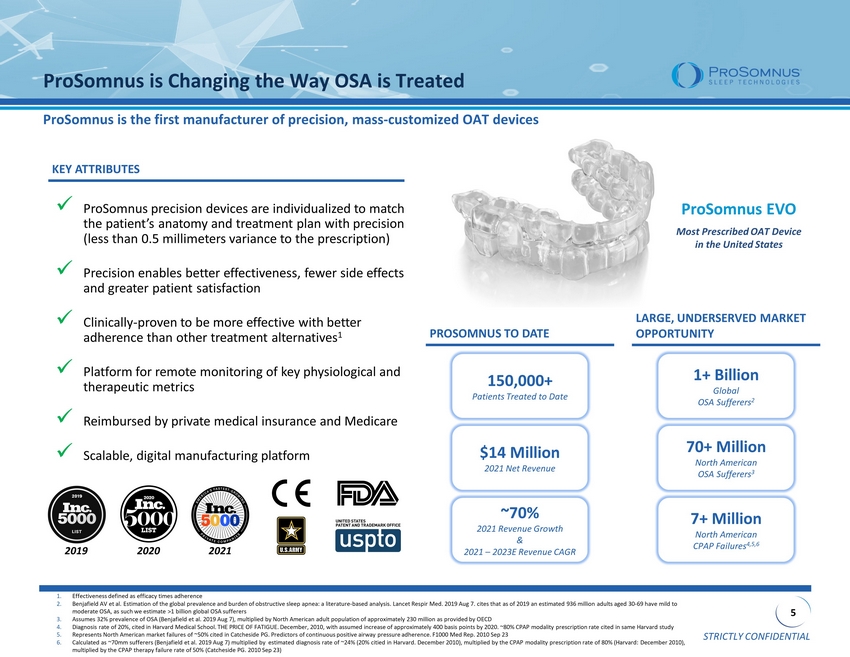

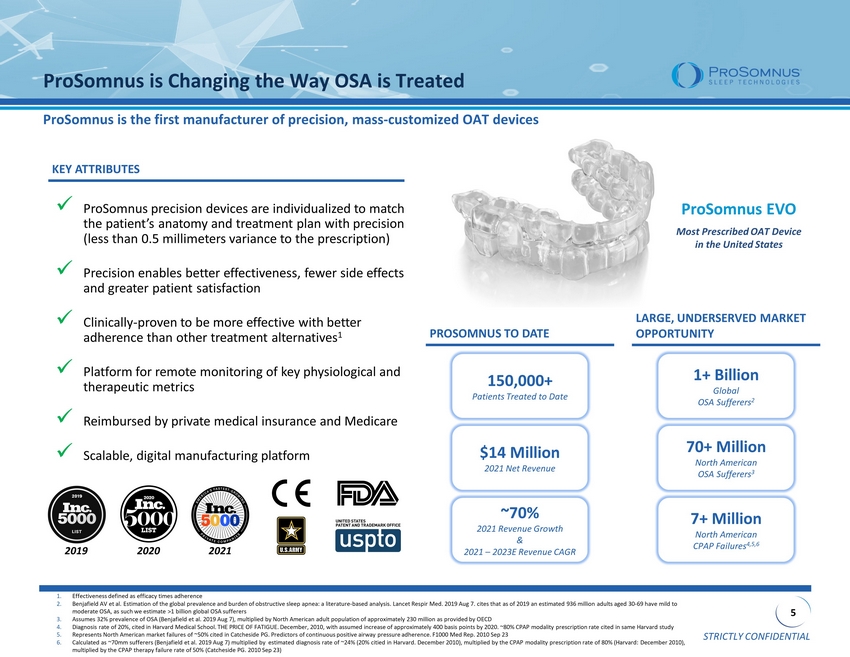

STRICTLY CONFIDENTIAL 5 x ProSomnus precision devices are individualized to match the patient’s anatomy and treatment plan with precision (less than 0.5 millimeters variance to the prescription) x Precision enables better effectiveness, fewer side effects and greater patient satisfaction x Clinically - proven to be more effective with better adherence than other treatment alternatives 1 x Platform for remote monitoring of key physiological and therapeutic metrics x Reimbursed by private medical insurance and Medicare x Scalable, digital manufacturing platform ProSomnus is Changing the Way OSA is Treated 1+ Billion Global OSA Sufferers 2 70+ Million North American OSA Sufferers 3 1. Effectiveness defined as efficacy times adherence 2. Benjafield AV et al. Estimation of the global prevalence and burden of obstructive sleep apnea: a literature - based analysis. Lancet Respir Med. 2019 Aug 7. cites that as of 2019 an estimated 936 million adults aged 30 - 69 have mild to moderate OSA, as such we estimate >1 billion global OSA sufferers 3. Assumes 32% prevalence of OSA ( Benjafield et al. 2019 Aug 7), multiplied by North American adult population of approximately 230 million as provided by OECD 4. Diagnosis rate of 20%, cited in Harvard Medical School. THE PRICE OF FATIGUE. December, 2010, with assumed increase of approx ima tely 400 basis points by 2020. ~80% CPAP modality prescription rate cited in same Harvard study 5. Represents North American market failures of ~50% cited in Catcheside PG. Predictors of continuous positive airway pressure adherence. F1000 Med Rep. 2010 Sep 23 6. Calculated as ~70mm sufferers ( Benjafield et al. 2019 Aug 7) multiplied by estimated diagnosis rate of ~24% (20% citied in Harvard. December 2010), multiplied by the CP AP modality prescription rate of 80% (Harvard: December 2010), multiplied by the CPAP therapy failure rate of 50% ( Catcheside PG. 2010 Sep 23) 7+ Million North American CPAP Failures 4,5,6 150,000+ Patients Treated to Date $14 Million 2021 Net Revenue ProSomnus is the first manufacturer of precision, mass - customized OAT devices ~70% 2021 Revenue Growth & 2021 – 2023E Revenue CAGR KEY ATTRIBUTES 2019 2020 2021 PROSOMNUS TO DATE LARGE, UNDERSERVED MARKET OPPORTUNITY ProSomnus EVO Most Prescribed OAT Device in the United States

STRICTLY CONFIDENTIAL 6 CPAP Significant Disruption of OSA Market is Set to Occur Which would you choose? Low patient adherence Social stigma surrounding therapy Discomfort, confinement Occurrence of upper airway infection, dry - throat and nasal skin irritation Manual, time - intensive cleaning regiment required Costly with large out - of - pocket expenditures Respiratory flow data provides limited clinical utility x Clinically proven therapy x High patient adherence x None of the side effects of legacy OAT devices x Ease of use with minimal cleaning and device maintenance required x Minimal disruption to patient sleeping habits / routines x Cost - effective x Ability to provide continuous oxygen data which contains predictive medical value

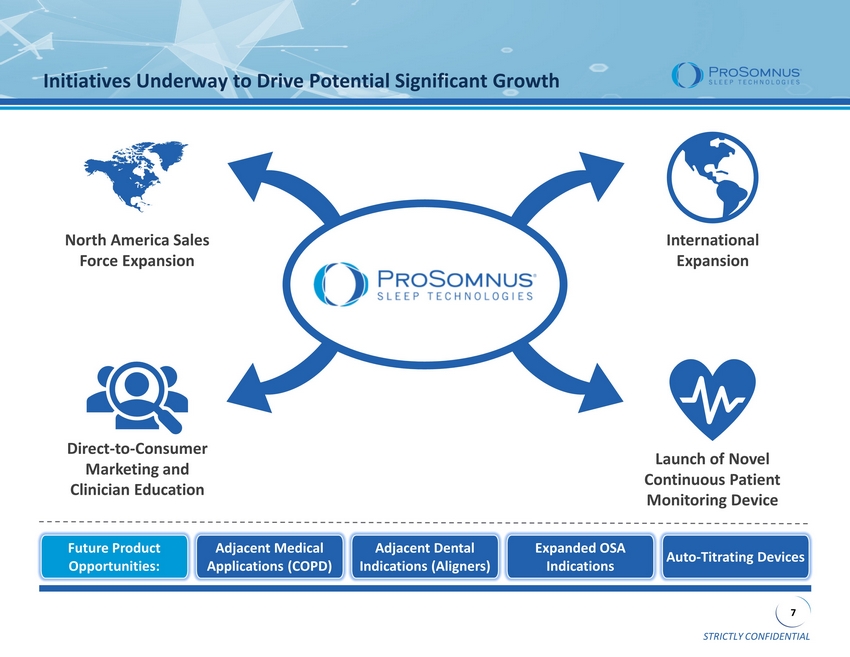

STRICTLY CONFIDENTIAL 7 Initiatives Underway to Drive Potential Significant Growth North America Sales Force Expansion International Expansion Direct - to - Consumer Marketing and Clinician Education Launch of Novel Continuous Patient Monitoring Device Future Product Opportunities: Adjacent Medical Applications (COPD) Auto - Titrating Devices Expanded OSA Indications Adjacent Dental Indications (Aligners)

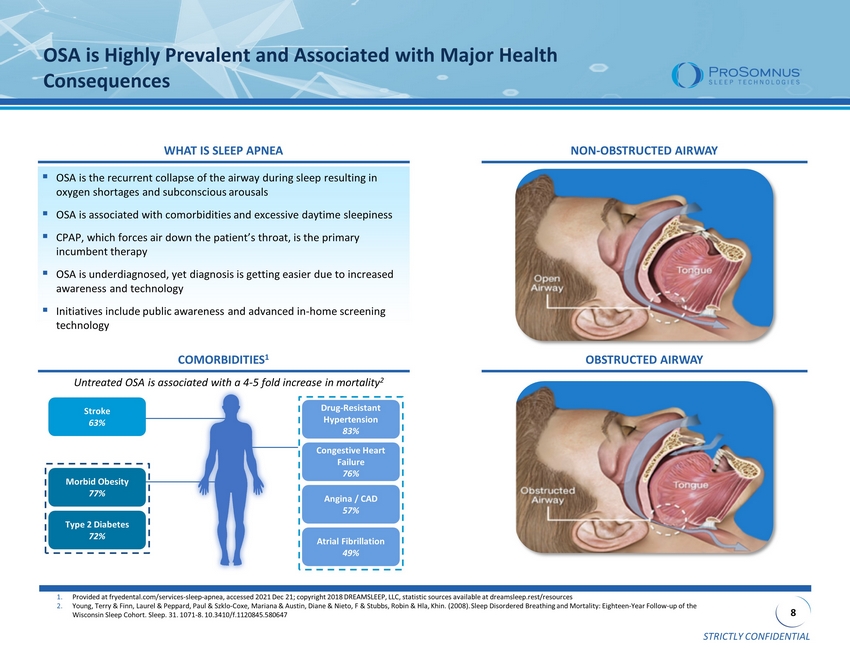

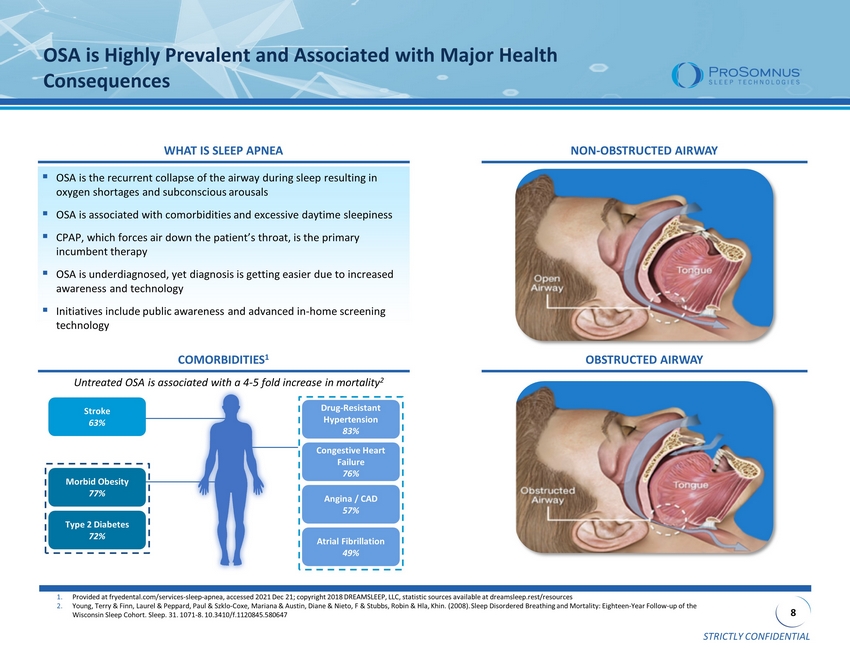

STRICTLY CONFIDENTIAL 8 OSA is Highly Prevalent and Associated with Major Health Consequences ▪ OSA is the recurrent collapse of the airway during sleep resulting in oxygen shortages and subconscious arousals ▪ OSA is associated with comorbidities and excessive daytime sleepiness ▪ CPAP, which forces air down the patient’s throat, is the primary incumbent therapy ▪ OSA is underdiagnosed, yet diagnosis is getting easier due to increased awareness and technology ▪ Initiatives include public awareness and advanced in - home screening technology 1. Provided at fryedental.com/services - sleep - apnea, accessed 2021 Dec 21; copyright 2018 DREAMSLEEP, LLC, statistic sources availab le at dreamsleep.rest /resources 2. Young, Terry & Finn, Laurel & Peppard, Paul & Szklo - Coxe, Mariana & Austin, Diane & Nieto, F & Stubbs, Robin & Hla, Khin. (2008) . Sleep Disordered Breathing and Mortality: Eighteen - Year Follow - up of the Wisconsin Sleep Cohort. Sleep. 31. 1071 - 8. 10.3410/f.1120845.580647 OBSTRUCTED AIRWAY NON - OBSTRUCTED AIRWAY Morbid Obesity 77% Type 2 Diabetes 72% Drug - Resistant Hypertension 83% Congestive Heart Failure 76% Angina / CAD 57% Atrial Fibrillation 49% Stroke 63% Untreated OSA is associated with a 4 - 5 fold increase in mortality 2 COMORBIDITIES 1 WHAT IS SLEEP APNEA

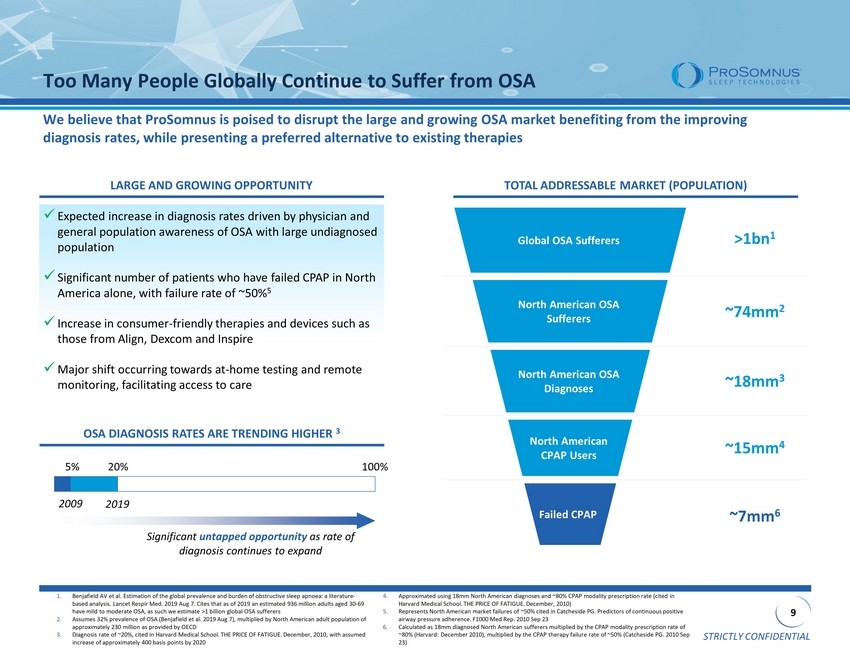

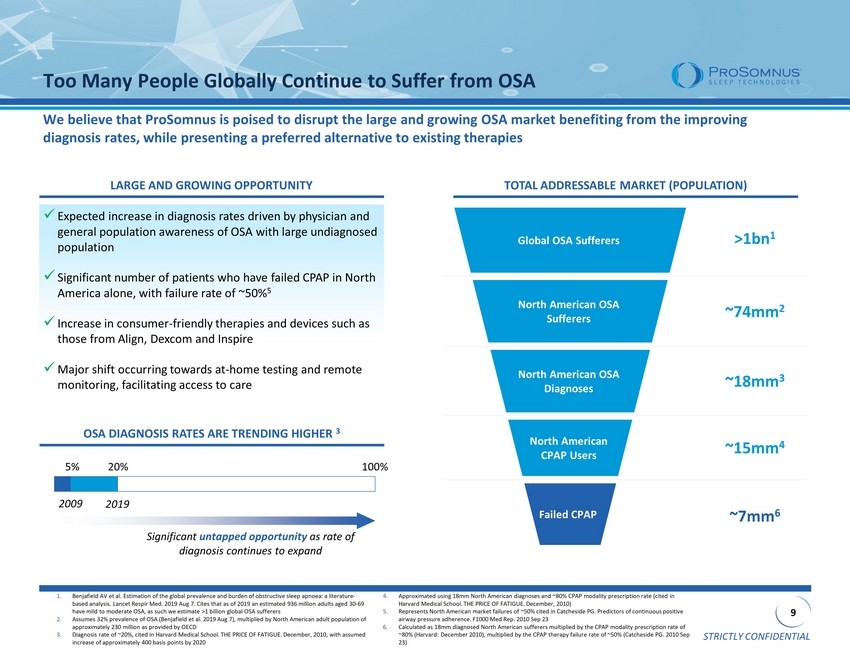

STRICTLY CONFIDENTIAL 9 Failed CPAP North American CPAP Users North American OSA Diagnoses North American OSA Sufferers Global OSA Sufferers >1bn 1 ~74mm 2 ~18mm 3 ~15mm 4 ~7mm 6 1. Benjafield AV et al. Estimation of the global prevalence and burden of obstructive sleep apnoea : a literature - based analysis. Lancet Respir Med. 2019 Aug 7. Cites that as of 2019 an estimated 936 million adults aged 30 - 69 have mild to moderate OSA, as such we estimate >1 billion global OSA sufferers 2. Assumes 32% prevalence of OSA ( Benjafield et al. 2019 Aug 7), multiplied by North American adult population of approximately 230 million as provided by OECD 3. Diagnosis rate of ~20%, cited in Harvard Medical School. THE PRICE OF FATIGUE. December, 2010, with assumed increase of approximately 400 basis points by 2020 4. Approximated using 18mm North American diagnoses and ~80% CPAP modality prescription rate (cited in Harvard Medical School. THE PRICE OF FATIGUE. December, 2010) 5. Represents North American market failures of ~50% cited in Catcheside PG. Predictors of continuous positive airway pressure adherence. F1000 Med Rep. 2010 Sep 23 6. Calculated as 18mm diagnosed North American sufferers multiplied by the CPAP modality prescription rate of ~80% (Harvard: December 2010), multiplied by the CPAP therapy failure rate of ~50% ( Catcheside PG. 2010 Sep 23) Too Many People Globally Continue to Suffer from OSA We believe that ProSomnus is poised to disrupt the large and growing OSA market benefiting from the improving diagnosis rates, while presenting a preferred alternative to existing therapies x Expected increase in diagnosis rates driven by physician and general population awareness of OSA with large undiagnosed population x Significant number of patients who have failed CPAP in North America alone, with failure rate of ~50% 5 x Increase in consumer - friendly therapies and devices such as those from Align, Dexcom and Inspire x Major shift occurring towards at - home testing and remote monitoring, facilitating access to care OSA DIAGNOSIS RATES ARE TRENDING HIGHER 3 2009 2019 Significant untapped opportunity as rate of diagnosis continues to expand 5% 20% 100% TOTAL ADDRESSABLE MARKET (POPULATION) LARGE AND GROWING OPPORTUNITY

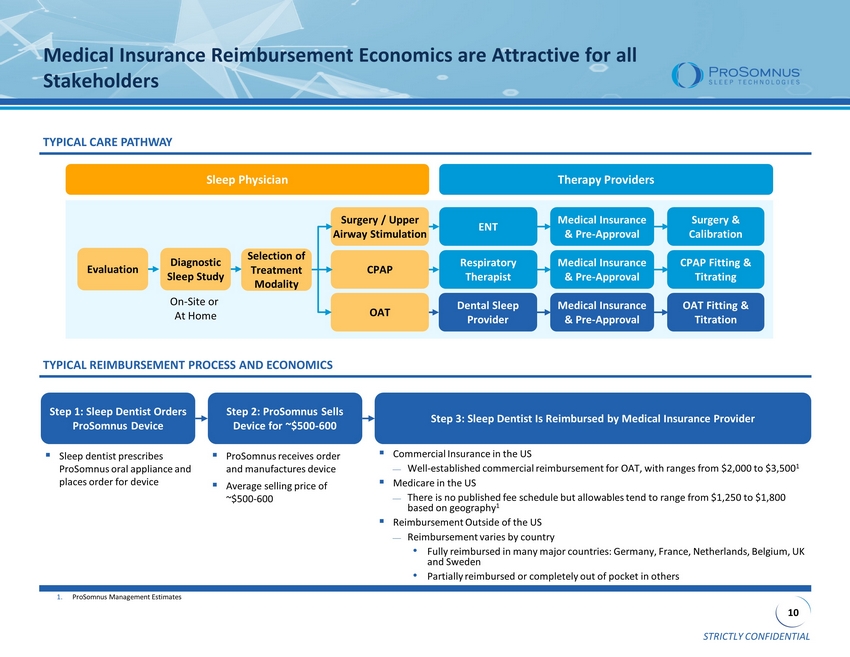

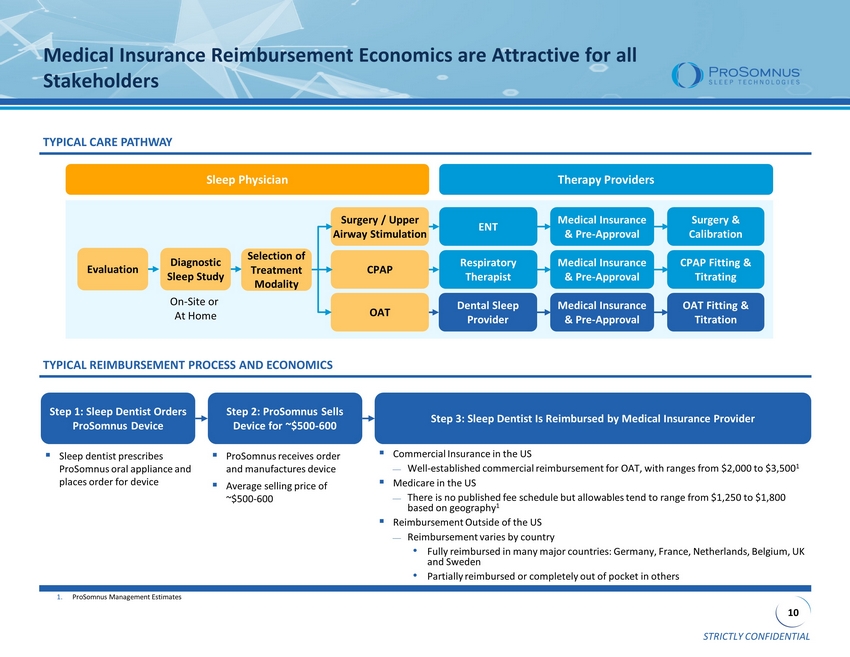

STRICTLY CONFIDENTIAL 10 Medical Insurance Reimbursement Economics are Attractive for all Stakeholders Surgery / Upper Airway Stimulation CPAP OAT Selection of Treatment Modality ENT Respiratory Therapist Medical Insurance & Pre - Approval Dental Sleep Provider OAT Fitting & Titration Evaluation Diagnostic Sleep Study Medical Insurance & Pre - Approval CPAP Fitting & Titrating Medical Insurance & Pre - Approval Surgery & Calibration Sleep Physician Therapy Providers TYPICAL CARE PATHWAY On - Site or At Home Step 1: Sleep Dentist Orders ProSomnus Device Step 2: ProSomnus Sells Device for ~$500 - 600 Step 3: Sleep Dentist Is Reimbursed by Medical Insurance Provider ▪ Sleep dentist prescribes ProSomnus oral appliance and places order for device ▪ ProSomnus receives order and manufactures device ▪ Average selling price of ~$500 - 600 ▪ Commercial Insurance in the US Well - established commercial reimbursement for OAT, with ranges from $2,000 to $3,500 1 ▪ Medicare in the US There is no published fee schedule but allowables tend to range from $1,250 to $1,800 based on geography 1 ▪ Reimbursement Outside of the US Reimbursement varies by country • Fully reimbursed in many major countries: Germany, France, Netherlands, Belgium, UK and Sweden • Partially reimbursed or completely out of pocket in others TYPICAL REIMBURSEMENT PROCESS AND ECONOMICS 1. ProSomnus Management Estimates

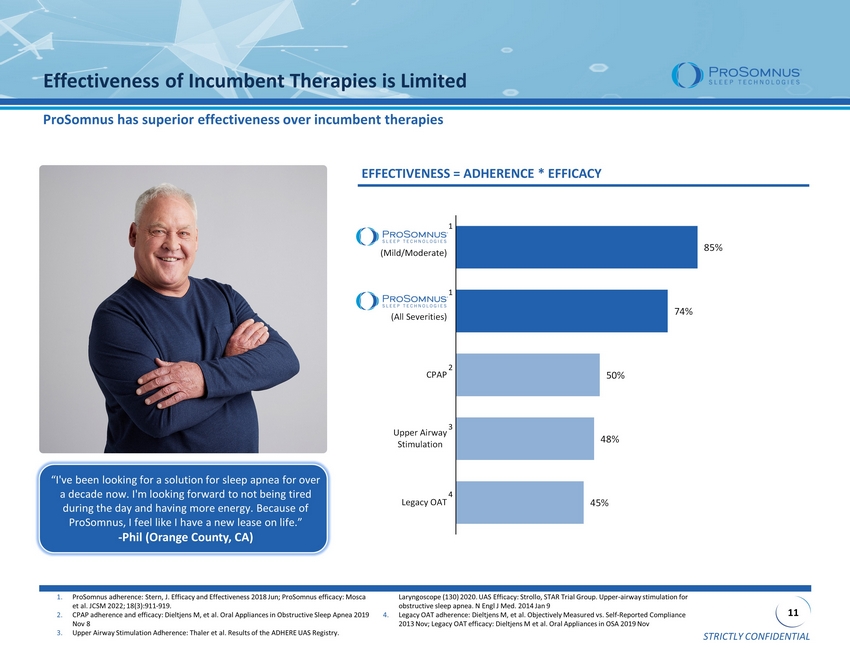

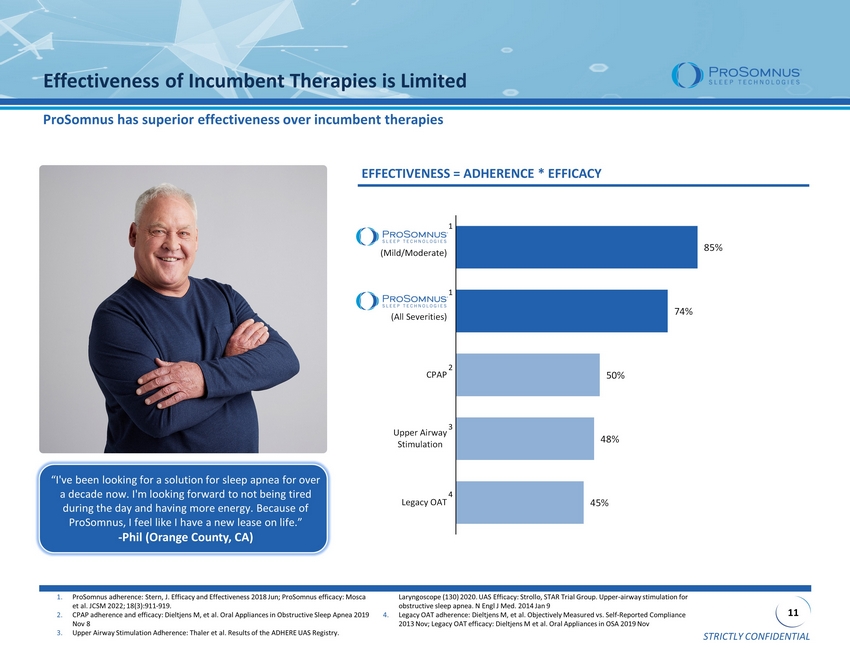

STRICTLY CONFIDENTIAL 11 85% 74% 50% 48% 45% ProSomnus (Mild/Moderate) ProSomnus (All Severities) CPAP Upper Airway Stimulation Legacy OAT Effectiveness of Incumbent Therapies is Limited ProSomnus has superior effectiveness over incumbent therapies 1. ProSomnus adherence: Stern, J. Efficacy and Effectiveness 2018 Jun; ProSomnus efficacy: Mosca et al. JCSM 2022; 18(3):911 - 919. 2. CPAP adherence and efficacy: Dieltjens M, et al. Oral Appliances in Obstructive Sleep Apnea 2019 Nov 8 3. Upper Airway Stimulation Adherence: Thaler et al. Results of the ADHERE UAS Registry. Laryngoscope (130) 2020. UAS Efficacy: Strollo , STAR Trial Group. Upper - airway stimulation for obstructive sleep apnea. N Engl J Med. 2014 Jan 9 4. Legacy OAT adherence: Dieltjens M, et al. Objectively Measured vs. Self - Reported Compliance 2013 Nov; Legacy OAT efficacy: Dieltjens M et al. Oral Appliances in OSA 2019 Nov EFFECTIVENESS = ADHERENCE * EFFICACY “I've been looking for a solution for sleep apnea for over a decade now. I'm looking forward to not being tired during the day and having more energy. Because of ProSomnus , I feel like I have a new lease on life.” - Phil (Orange County, CA) 1 2 3 4 1

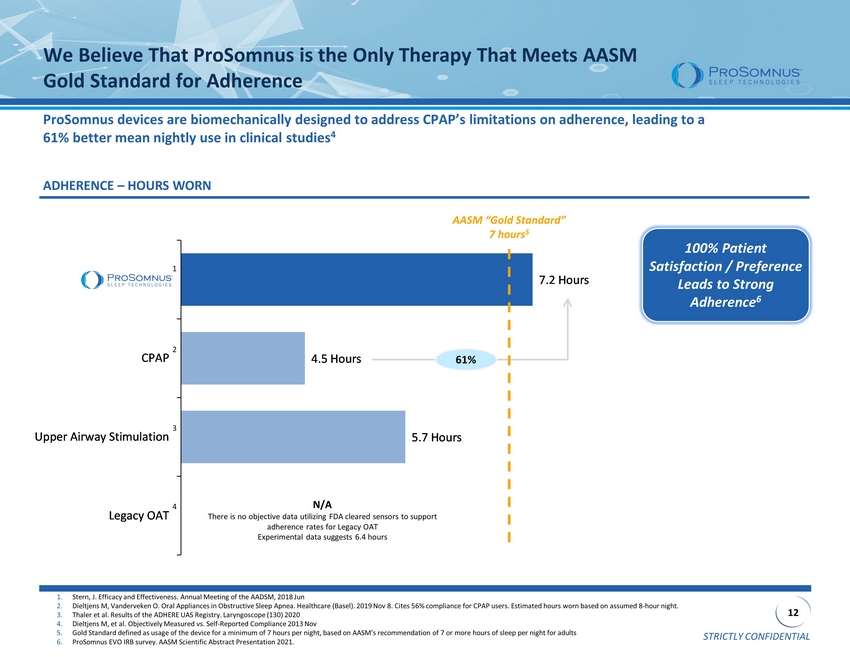

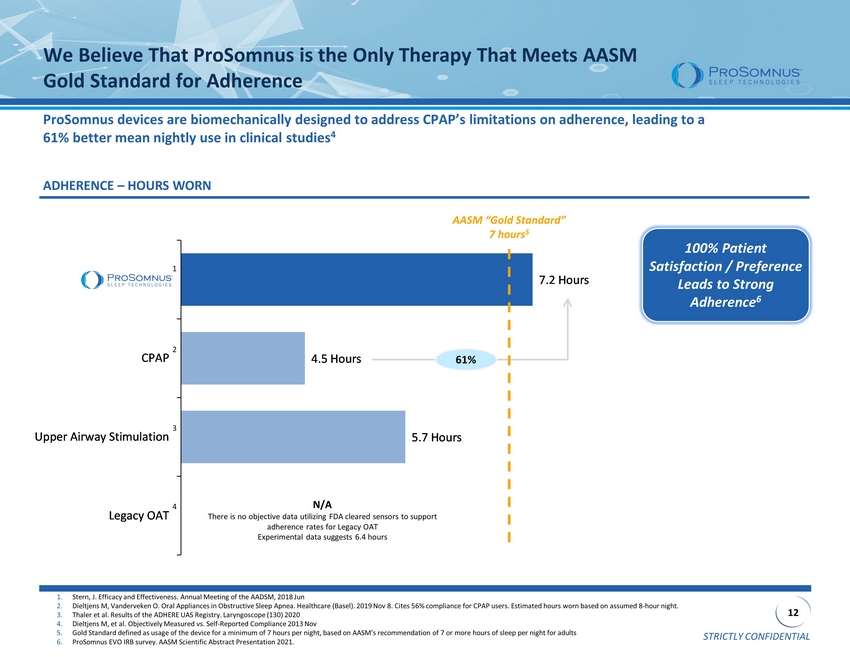

STRICTLY CONFIDENTIAL 12 5.7 Hours 4.5 Hours 7.2 Hours Legacy OAT Upper Airway Stimulation CPAP ProSomnus We Believe That ProSomnus is the Only Therapy That Meets AASM Gold Standard for Adherence ProSomnus devices are biomechanically designed to address CPAP’s limitations on adherence, leading to a 61% better mean nightly use in clinical studies 4 ADHERENCE – HOURS WORN 100% Patient Satisfaction / Preference Leads to Strong Adherence 6 1. Stern, J. Efficacy and Effectiveness. Annual Meeting of the AADSM, 2018 Jun 2. Dieltjens M, Vanderveken O. Oral Appliances in Obstructive Sleep Apnea . Healthcare (Basel). 2019 Nov 8. Cites 56% compliance for CPAP users. Estimated hours worn based on assumed 8 - hour night. 3. Thaler et al. Results of the ADHERE UAS Registry. Laryngoscope (130) 2020 4. Dieltjens M, et al. Objectively Measured vs. Self - Reported Compliance 2013 Nov 5. Gold Standard defined as usage of the device for a minimum of 7 hours per night, based on AASM’s recommendation of 7 or more hou rs of sleep per night for adults 6. ProSomnus EVO IRB survey. AASM Scientific Abstract Presentation 2021. AASM “Gold Standard” 7 hours 5 N/A There is no objective data utilizing FDA cleared sensors to support adherence rates for Legacy OAT Experimental data suggests 6.4 hours 61% 1 2 3 4

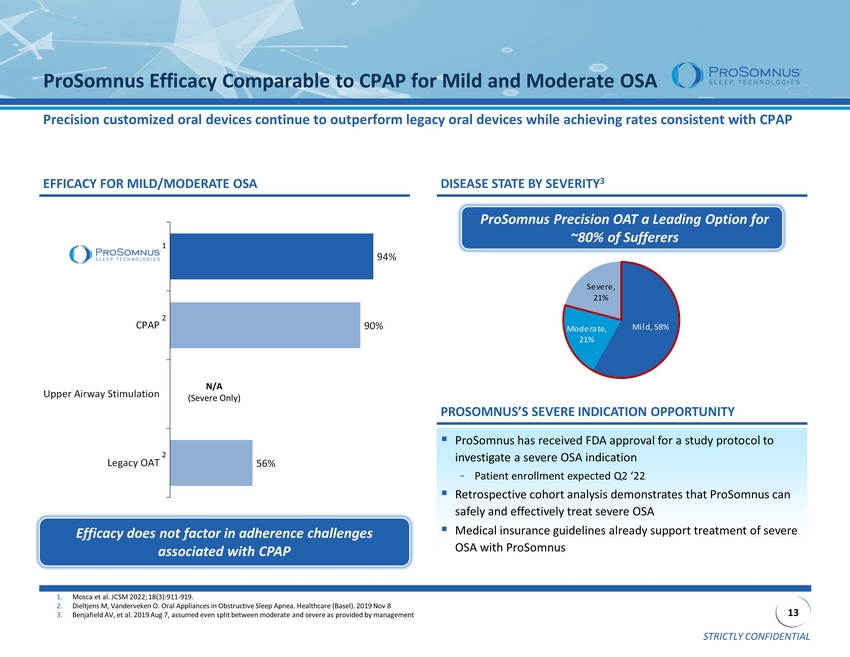

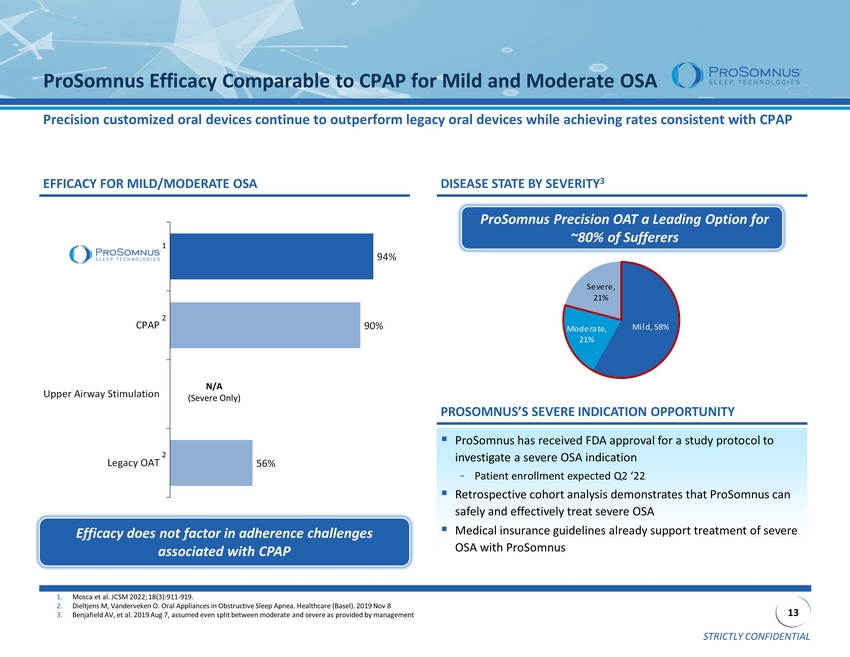

STRICTLY CONFIDENTIAL 13 56% 90% 94% Legacy OAT Upper Airway Stimulation CPAP ProSomnus 1. Mosca et al. JCSM 2022; 18(3):911 - 919. 2. Dieltjens M, Vanderveken O. Oral Appliances in Obstructive Sleep Apnea . Healthcare (Basel). 2019 Nov 8 3. Benjafield AV, et al. 2019 Aug 7, assumed even split between moderate and severe as provided by management ProSomnus Efficacy Comparable to CPAP for Mild and Moderate OSA Precision customized oral devices continue to outperform legacy oral devices while achieving rates consistent with CPAP Mild, 58% Moderate, 21% Severe, 21% ▪ ProSomnus has received FDA approval for a study protocol to investigate a severe OSA indication - Patient enrollment expected Q2 ‘22 ▪ Retrospective cohort analysis demonstrates that ProSomnus can safely and effectively treat severe OSA ▪ Medical insurance guidelines already support treatment of severe OSA with ProSomnus EFFICACY FOR MILD/MODERATE OSA DISEASE STATE BY SEVERITY 3 ProSomnus Precision OAT a Leading Option for ~80% of Sufferers Efficacy does not factor in adherence challenges associated with CPAP N/A (Severe Only) PROSOMNUS’S SEVERE INDICATION OPPORTUNITY 1 2 2

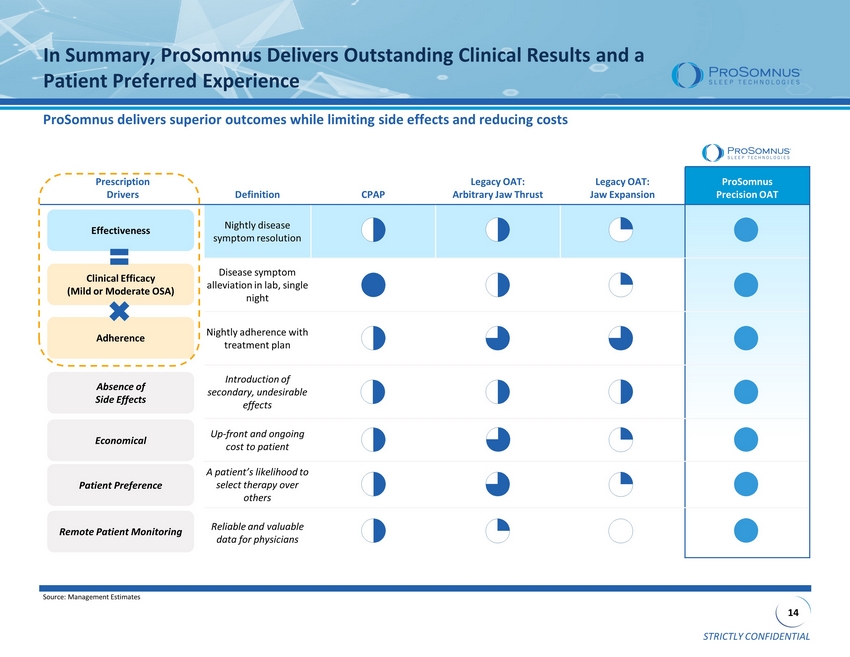

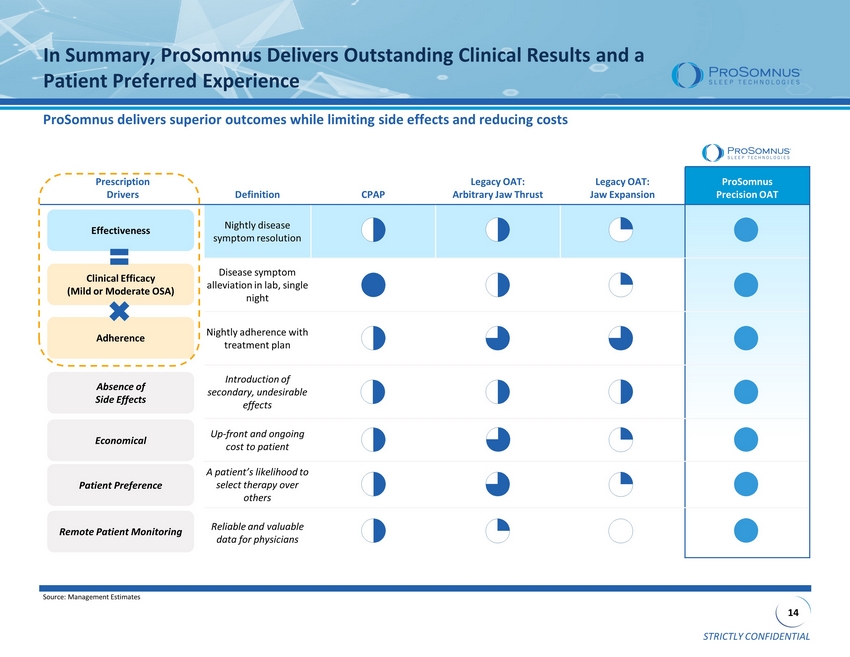

STRICTLY CONFIDENTIAL 14 Prescription Drivers Definition CPAP Legacy OAT: Arbitrary Jaw Thrust Legacy OAT: Jaw Expansion ProSomnus Precision OAT Nightly disease symptom resolution Disease symptom alleviation in lab, single night Nightly adherence with treatment plan Introduction o f secondary, undesirable effects Up - front and ongoing cost to patient A patient’s likelihood to select therapy over others Reliable and valuable data for physicians ProSomnus delivers superior outcomes while limiting side effects and reducing costs In Summary, ProSomnus Delivers Outstanding Clinical Results and a Patient Preferred Experience Clinical Efficacy (Mild or Moderate OSA) Adherence Effectiveness Absence of Side Effects Economical Patient Preference Source: Management Estimates Remote Patient Monitoring

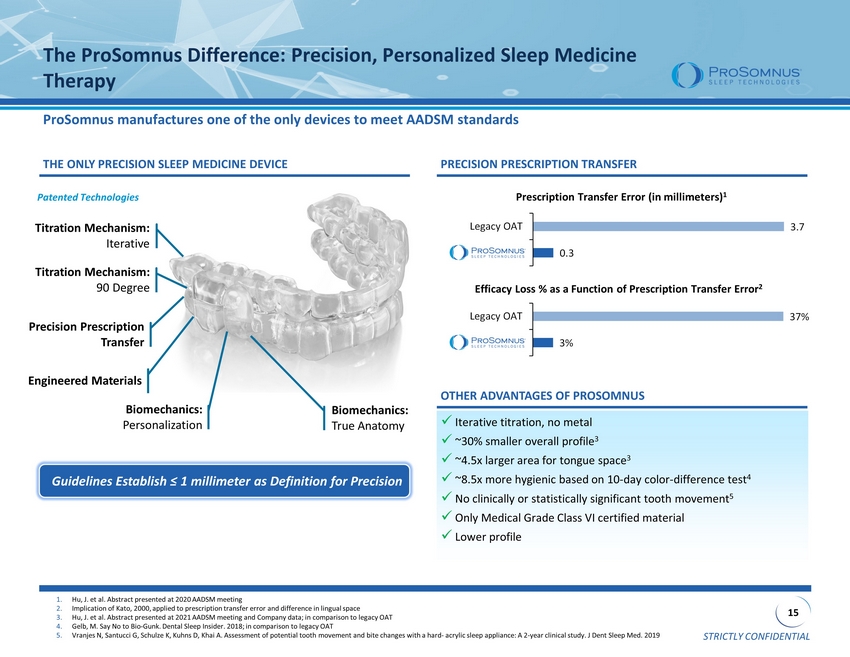

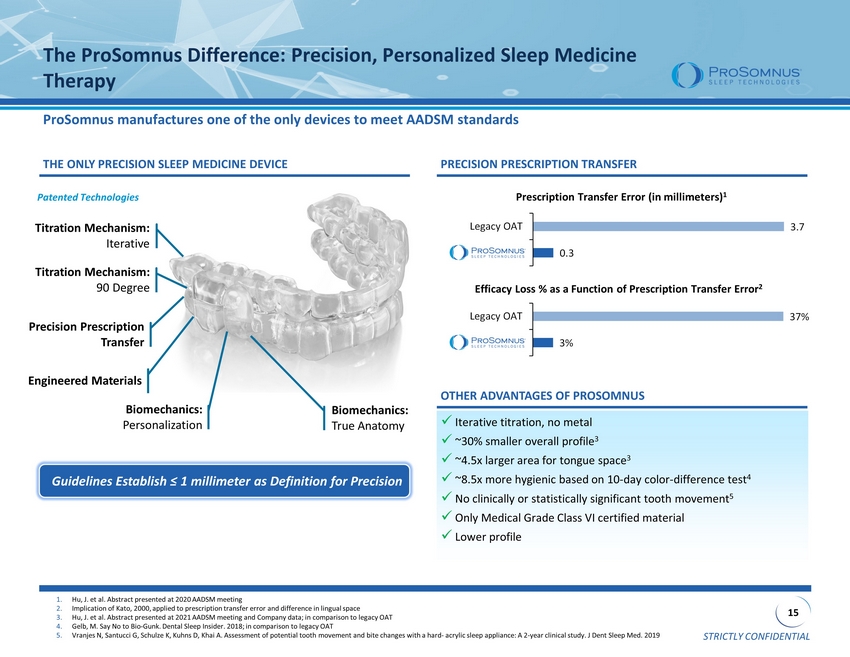

STRICTLY CONFIDENTIAL 15 The ProSomnus Difference: Precision, Personalized Sleep Medicine Therapy ProSomnus manufactures one of the only devices to meet AADSM standards Prescription Transfer Error (in millimeters) 1 Efficacy Loss % as a Function of Prescription Transfer Error 2 Guidelines Establish ≤ 1 millimeter as Definition for Precision PRECISION PRESCRIPTION TRANSFER THE ONLY PRECISION SLEEP MEDICINE DEVICE x Iterative titration, no metal x ~30% smaller overall profile 3 x ~4.5x larger area for tongue space 3 x ~8.5x more hygienic based on 10 - day color - difference test 4 x No clinically or statistically significant tooth movement 5 x Only Medical Grade Class VI certified material x Lower profile OTHER ADVANTAGES OF PROSOMNUS 1. Hu, J. et al. Abstract presented at 2020 AADSM meeting 2. Implication of Kato, 2000, applied to prescription transfer error and difference in lingual space 3. Hu, J. et al. Abstract presented at 2021 AADSM meeting and Company data; in comparison to legacy OAT 4. Gelb, M. Say No to Bio - Gunk. Dental Sleep Insider. 2018; in comparison to legacy OAT 5. Vranjes N, Santucci G, Schulze K, Kuhns D, Khai A. Assessment of potential tooth movement and bite changes with a hard - acrylic sleep appliance: A 2 - year clinical study. J Den t Sleep Med. 2019 Titration Mechanism: 90 Degree Titration Mechanism: Iterative Biomechanics: Personalization Patented Technologies Precision Prescription Transfer Engineered Materials Biomechanics: True Anatomy 0.3 3.7 Legacy OAT 3% 37% Legacy OAT

STRICTLY CONFIDENTIAL 16 Proprietary, Digital Manufacturing Capabilities Enable ProSomnus’s Precision Performance Advantages Utility patents cover unique product features, methods and processes, with 8 granted and 15 pending Tailored in - house manufacturing processes and patented, proprietary technologies enable better therapeutic response to ProSomnus’s products ▪ Highly automated manufacturing process with narrow AI and robotic - driven milling, proprietary algorithm - driven design and finishing Computer Aided Design Computer Assisted Manufacturing Final Quality Control ▪ ProSomnus devices offer patented biomechanically superior features Enhanced Dual 90⁰ Optipost Anatomical Splint Design Anterior Opening ▪ Preferred treatment option due to patient comfort and customizability ▪ Titration technology allows for more accurate prescription delivery and higher effectiveness ALGORITHM - DRIVEN MASS CUSTOMIZATION BIOMECHANICALLY SUPERIOR DEVICES COMFORTABLE AND ITERATIVE TECHNOLOGY Digital Prescription A.I. Device Design Robotic Milling Advanced Materials Precision Medical Devices

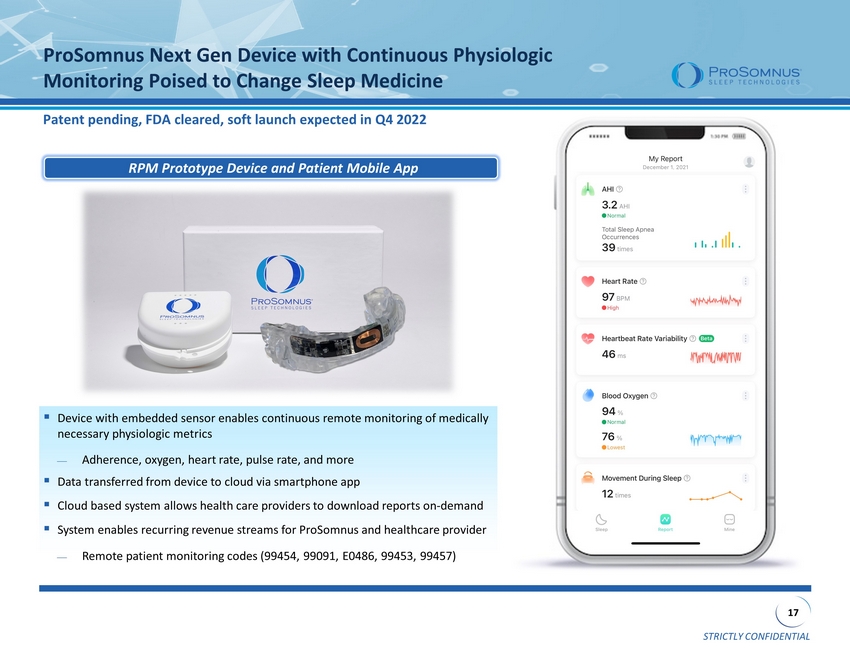

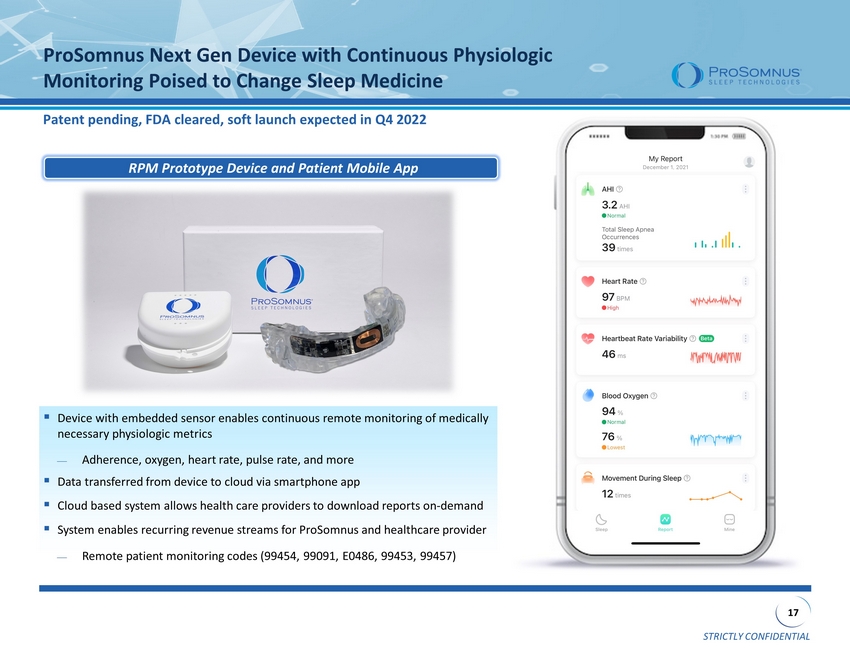

STRICTLY CONFIDENTIAL 17 ProSomnus Next Gen Device with Continuous Physiologic Monitoring Poised to Change Sleep Medicine Patent pending, FDA cleared, soft launch expected in Q4 2022 ▪ Device with embedded sensor enables continuous remote monitoring of medically necessary physiologic metrics Adherence, oxygen, heart rate, pulse rate, and more ▪ Data transferred from device to cloud via smartphone app ▪ Cloud based system allows health care providers to download reports on - demand ▪ System enables recurring revenue streams for ProSomnus and healthcare provider Remote patient monitoring codes (99454, 99091, E0486, 99453, 99457) RPM Prototype Device and Patient Mobile App

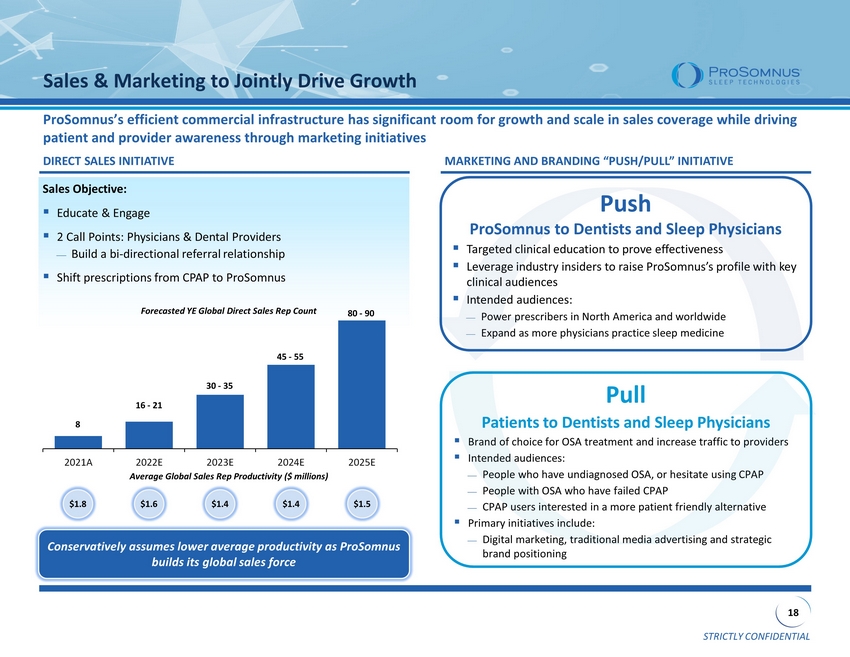

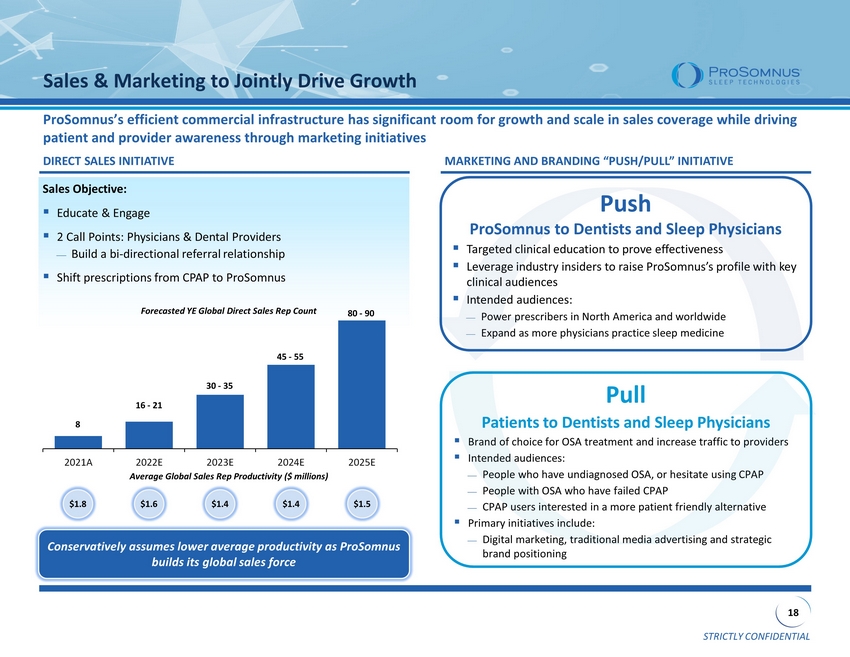

STRICTLY CONFIDENTIAL 18 Sales Objective: ▪ Educate & Engage ▪ 2 Call Points: Physicians & Dental Providers Build a bi - directional referral relationship ▪ Shift prescriptions from CPAP to ProSomnus Pull Patients to Dentists and Sleep Physicians ▪ Brand of choice for OSA treatment and increase traffic to providers ▪ Intended audiences: People who have undiagnosed OSA, or hesitate using CPAP People with OSA who have failed CPAP CPAP users interested in a more patient friendly alternative ▪ Primary initiatives include: Digital marketing, traditional media advertising and strategic brand positioning Push ProSomnus to Dentists and Sleep Physicians ▪ Targeted clinical education to prove effectiveness ▪ Leverage industry insiders to raise ProSomnus’s profile with key clinical audiences ▪ Intended audiences: Power prescribers in North America and worldwide Expand as more physicians practice sleep medicine ProSomnus’s efficient commercial infrastructure has significant room for growth and scale in sales coverage while driving patient and provider awareness through marketing initiatives Sales & Marketing to Jointly Drive Growth MARKETING AND BRANDING “PUSH/PULL” INITIATIVE DIRECT SALES INITIATIVE $1.8 $1.6 $1.4 $1.4 $1.5 Average Global Sales Rep Productivity ($ millions ) Forecasted YE Global Direct Sales Rep Count 8 16 - 21 30 - 35 45 - 55 80 - 90 Conservatively assumes lower average productivity as ProSomnus builds its global sales force 2021A 2022E 2023E 2024E 2025E

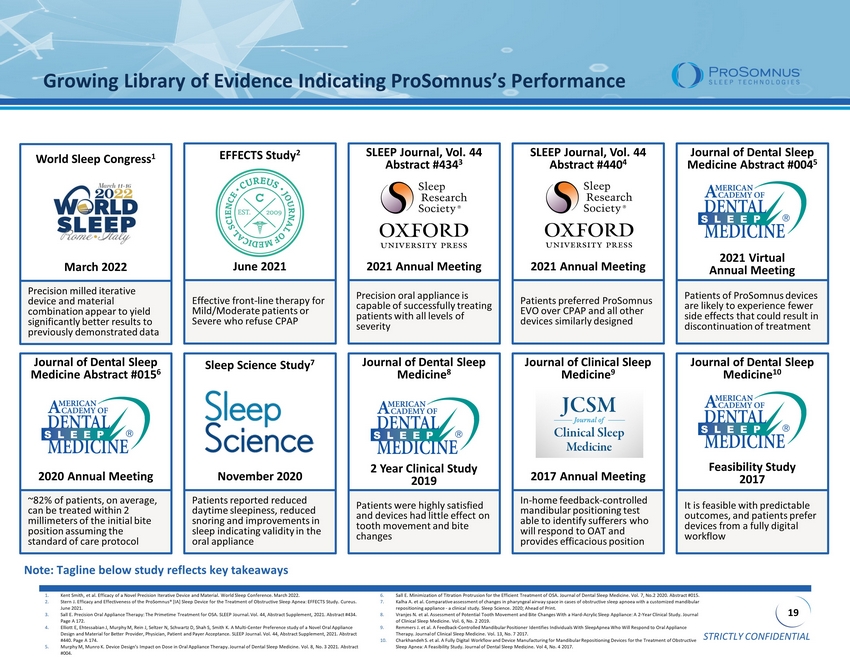

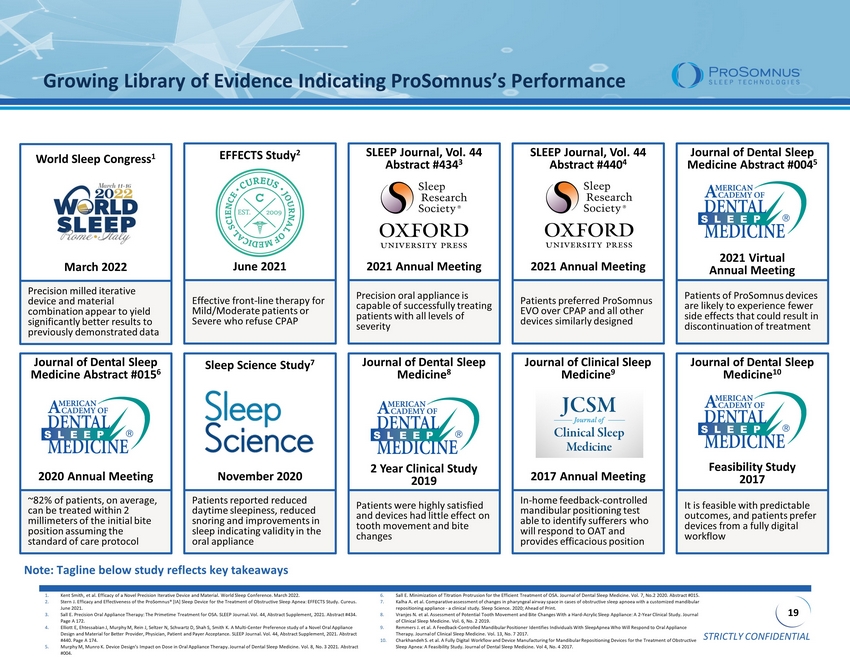

STRICTLY CONFIDENTIAL 19 Growing Library of Evidence Indicating ProSomnus’s Performance EFFECTS Study 2 Effective front - line therapy for Mild/Moderate patients or Severe who refuse CPAP June 2021 SLEEP Journal, Vol. 44 Abstract #434 3 Precision oral appliance is capable of successfully treating patients with all levels of severity 2021 Annual Meeting SLEEP Journal, Vol. 44 Abstract #440 4 Patients preferred ProSomnus EVO over CPAP and all other devices similarly designed 2021 Annual Meeting Journal of Dental Sleep Medicine Abstract #004 5 Patients of ProSomnus devices are likely to experience fewer side effects that could result in discontinuation of treatment 2021 Virtual Annual Meeting 1. Kent Smith, et al. Efficacy of a Novel Precision Iterative Device and Material. World Sleep Conference. March 2022. 2. Stern J. Efficacy and Effectiveness of the ProSomnus ® [IA] Sleep Device for the Treatment of Obstructive Sleep Apnea: EFFECTS Study. Cureus . June 2021. 3. Sall E. Precision Oral Appliance Therapy: The Primetime Treatment for OSA. SLEEP Journal. Vol. 44, Abstract Supplement, 2021. Abst ra ct #434. Page A 172. 4. Elliott E, Ehtessabian J, Murphy M, Rein J, Seltzer N, Schwartz D, Shah S, Smith K. A Multi - Center Preference study of a Novel Oral Appliance Design and Material for Better Provider, Physician, Patient and Payer Acceptance. SLEEP Journal. Vol. 44, Abstract Supplement , 2 021. Abstract #440. Page A 174. 5. Murphy M, Munro K. Device Design’s Impact on Dose in Oral Appliance Therapy. Journal of Dental Sleep Medicine. Vol. 8, No. 3 202 1. Abstract #004. 6. Sall E. Minimization of Titration Protrusion for the Efficient Treatment of OSA. Journal of Dental Sleep Medicine. Vol. 7, No.2 20 20 . Abstract #015. 7. Kalha A. et al. Comparative assessment of changes in pharyngeal airway space in cases of obstructive sleep apnoea with a customized mandibular repositioning appliance - a clinical study. Sleep Science. 2020; Ahead of Print. 8. Vranjes N. et al. Assessment of Potential Tooth Movement and Bite Changes With a Hard - Acrylic Sleep Appliance: A 2 - Year Clinical Study. Journal of Clinical Sleep Medicine. Vol. 6, No. 2 2019. 9. Remmers J. et al. A Feedback - Controlled Mandibular Positioner Identifies Individuals With SleepApnea Who Will Respond to Oral Appliance Therapy. Journal of Clinical Sleep Medicine. Vol. 13, No. 7 2017. 10. Charkhandeh S. et al. A Fully Digital Workflow and Device Manufacturing for Mandibular Repositioning Devices for the Treatment of Obstruc ti ve Sleep Apnea: A Feasibility Study. Journal of Dental Sleep Medicine. Vol 4, No. 4 2017. Journal of Dental Sleep Medicine 8 Patients were highly satisfied and devices had little effect on tooth movement and bite changes 2 Year Clinical Study 2019 Journal of Dental Sleep Medicine 10 It is feasible with predictable outcomes, and patients prefer devices from a fully digital workflow Feasibility Study 2017 Sleep Science Study 7 Patients reported reduced daytime sleepiness, reduced snoring and improvements in sleep indicating validity in the oral appliance November 2020 Journal of Dental Sleep Medicine Abstract #015 6 ~82% of patients, on average, can be treated within 2 millimeters of the initial bite position assuming the standard of care protocol 2020 Annual Meeting Journal of Clinical Sleep Medicine 9 In - home feedback - controlled mandibular positioning test able to identify sufferers who will respond to OAT and provides efficacious position 2017 Annual Meeting World Sleep Congress 1 Precision milled iterative device and material combination appear to yield significantly better results to previously demonstrated data March 2022 Note: Tagline below study reflects key takeaways

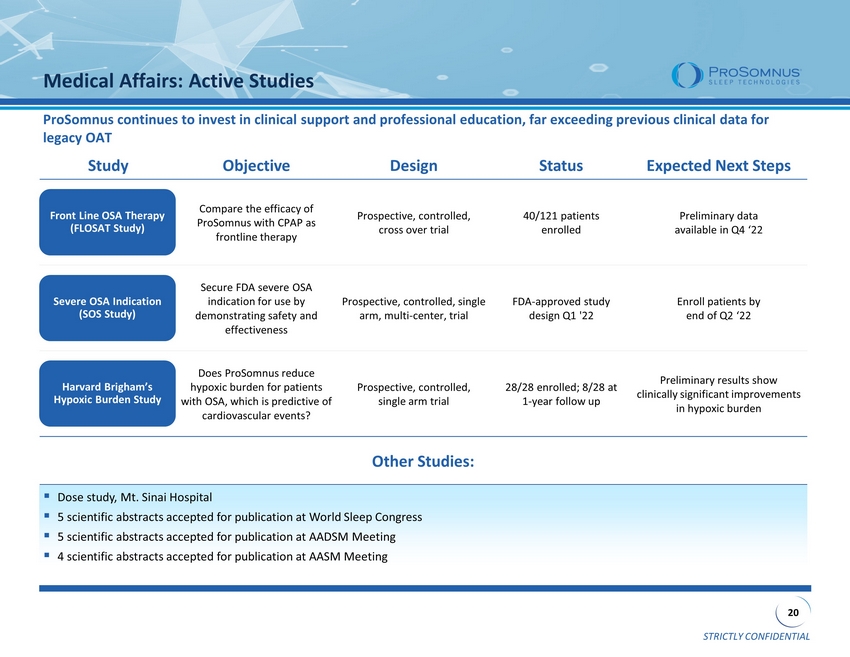

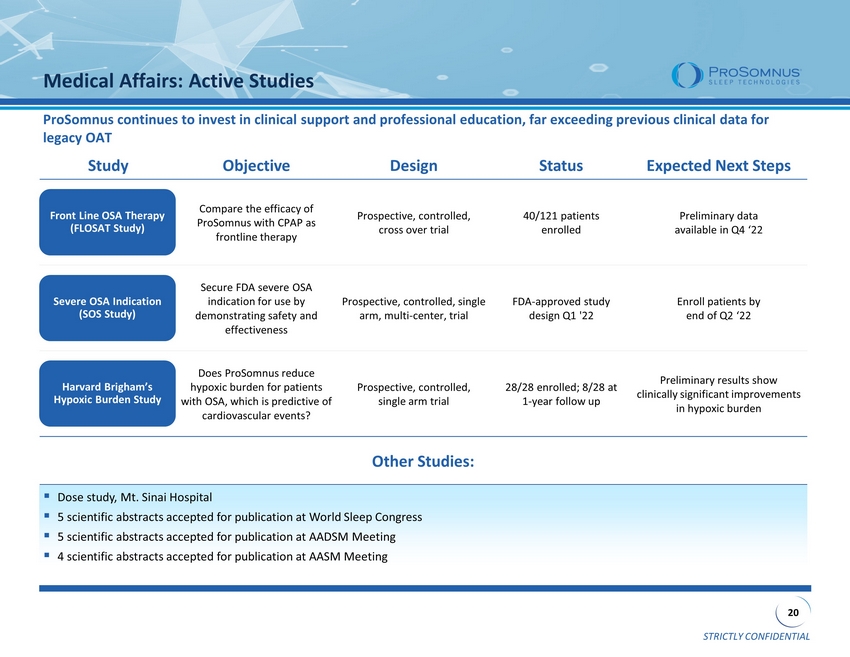

STRICTLY CONFIDENTIAL 20 Medical Affairs: Active Studies Study Objective Design Status Expected Next Steps Compare the efficacy of ProSomnus with CPAP as frontline therapy Prospective, controlled, cross over trial 40/121 patients enrolled Preliminary data available in Q4 ‘22 Secure FDA severe OSA indication for use by demonstrating safety and effectiveness Prospective, controlled, single arm, multi - center, trial FDA - approved study design Q1 '22 Enroll patients by end of Q2 ‘22 Does ProSomnus reduce hypoxic burden for patients with OSA, which is predictive of cardiovascular events? Prospective, controlled, single arm trial 28/28 enrolled; 8/28 at 1 - year follow up Preliminary results show clinically significant improvements in hypoxic burden Other Studies: ▪ Dose study, Mt. Sinai Hospital ▪ 5 scientific abstracts accepted for publication at World Sleep Congress ▪ 5 scientific abstracts accepted for publication at AADSM Meeting ▪ 4 scientific abstracts accepted for publication at AASM Meeting Front Line OSA Therapy (FLOSAT Study) Severe OSA Indication (SOS Study) Harvard Brigham’s Hypoxic Burden Study ProSomnus continues to invest in clinical support and professional education, far exceeding previous clinical data for legacy OAT

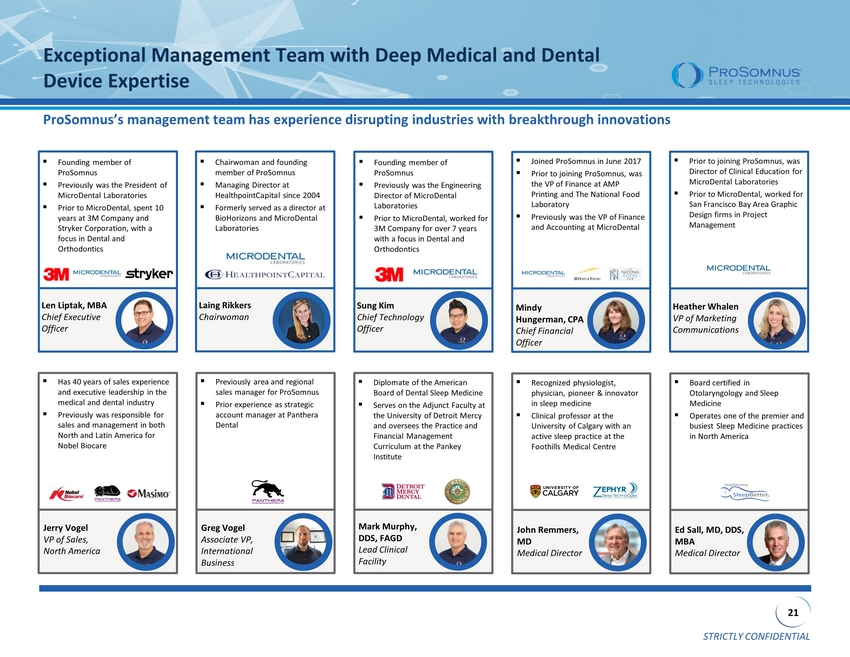

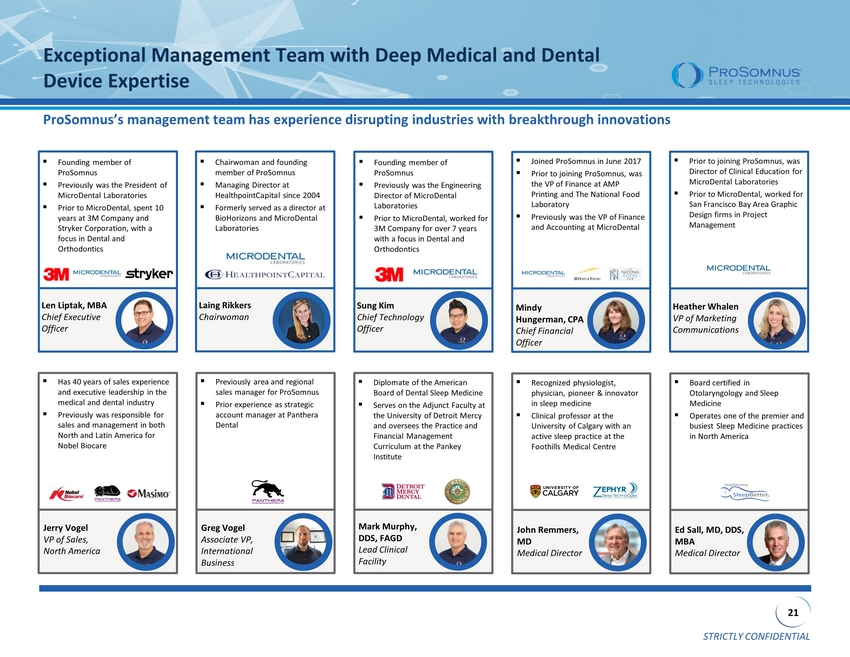

STRICTLY CONFIDENTIAL 21 ProSomnus’s management team has experience disrupting industries with breakthrough innovations Exceptional Management Team with Deep Medical and Dental Device Expertise ▪ Founding member of ProSomnus ▪ Previously was the President of MicroDental Laboratories ▪ Prior to MicroDental, spent 10 years at 3M Company and Stryker Corporation, with a focus in Dental and Orthodontics Len Liptak, MBA Chief Executive Officer ▪ Joined ProSomnus in June 2017 ▪ Prior to joining ProSomnus , was the VP of Finance at AMP Printing and The National Food Laboratory ▪ Previously was the VP of Finance and Accounting at MicroDental Mindy Hungerman, CPA Chief Financial Officer ▪ Founding member of ProSomnus ▪ Previously was the Engineering Director of MicroDental Laboratories ▪ Prior to MicroDental , worked for 3M Company for over 7 years with a focus in Dental and Orthodontics Sung Kim Chief Technology Officer ▪ Board certified in Otolaryngology and Sleep Medicine ▪ Operates one of the premier and busiest Sleep Medicine practices in North America Ed Sall, MD, DDS, MBA Medical Director Heather Whalen VP of Marketing Communications ▪ Prior to joining ProSomnus, was Director of Clinical Education for MicroDental Laboratories ▪ Prior to MicroDental, worked for San Francisco Bay Area Graphic Design firms in Project Management ▪ Diplomate of the American Board of Dental Sleep Medicine ▪ Serves on the Adjunct Faculty at the University of Detroit Mercy and oversees the Practice and Financial Management Curriculum at the Pankey Institute Mark Murphy, DDS, FAGD Lead Clinical Facility ▪ Previously area and regional sales manager for ProSomnus ▪ Prior experience as strategic account manager at Panthera Dental Greg Vogel Associate VP, International Business ▪ Recognized physiologist, physician, pioneer & innovator in sleep medicine ▪ Clinical professor at the University of Calgary with an active sleep practice at the Foothills Medical Centre John Remmers , MD Medical Director ▪ Has 40 years of sales experience and executive leadership in the medical and dental industry ▪ Previously was responsible for sales and management in both North and Latin America for Nobel Biocare Jerry Vogel VP of Sales, North America ▪ Chairwoman and founding member of ProSomnus ▪ Managing Director at HealthpointCapital since 2004 ▪ Formerly served as a director at BioHorizons and MicroDental Laboratories Laing Rikkers Chairwoman

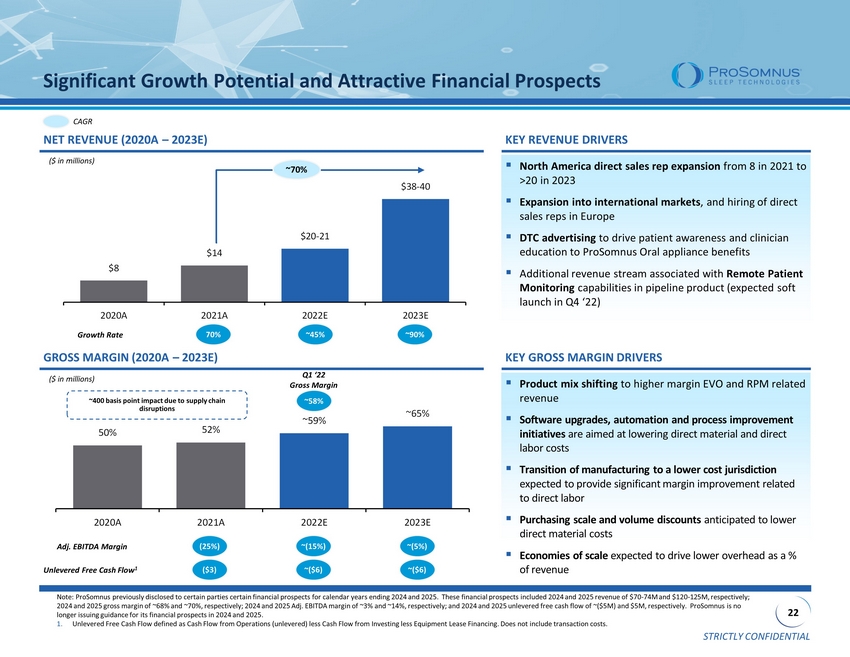

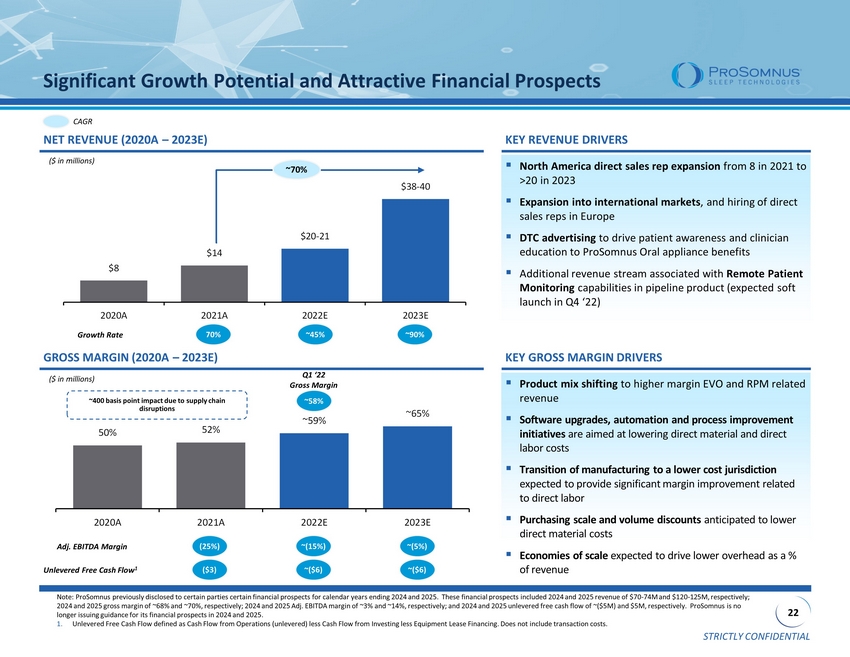

STRICTLY CONFIDENTIAL 22 50% 52% ~59% ~65% 2020A 2021A 2022E 2023E $8 $14 $20 - 21 $38 - 40 2020A 2021A 2022E 2023E Significant Growth Potential and Attractive Financial Prospects GROSS MARGIN (2020A – 2023E) CAGR ~70% NET REVENUE (2020A – 2023E) ($ in millions) KEY REVENUE DRIVERS 70% Growth Rate ~45% ~90% ▪ North America direct sales rep expansion from 8 in 2021 to >20 in 2023 ▪ Expansion into international markets , and hiring of direct sales reps in Europe ▪ DTC advertising to drive patient awareness and clinician education to ProSomnus Oral appliance benefits ▪ Additional revenue stream associated with Remote Patient Monitoring capabilities in pipeline product (expected soft launch in Q4 ‘22) KEY GROSS MARGIN DRIVERS ▪ Product mix shifting to higher margin EVO and RPM related revenue ▪ Software upgrades, automation and process improvement initiatives are aimed at lowering direct material and direct labor costs ▪ Transition of manufacturing to a lower cost jurisdiction expected to provide significant margin improvement related to direct labor ▪ Purchasing scale and volume discounts anticipated to lower direct material costs ▪ Economies of scale expected to drive lower overhead as a % of revenue ($ in millions) ~400 basis point impact due to supply chain disruptions ~58% Q1 ‘22 Gross Margin (25%) Adj. EBITDA Margin ~(15%) ~(5%) ($3) Unlevered Free Cash Flow 1 ~($6) ~($6) Note: ProSomnus previously disclosed to certain parties certain financial prospects for calendar years ending 2024 and 2025. Th ese financial prospects included 2024 and 2025 revenue of $70 - 74M and $120 - 125M, respectively; 2024 and 2025 gross margin of ~68% and ~70%, respectively; 2024 and 2025 Adj. EBITDA margin of ~3% and ~14%, respectively; an d 2 024 and 2025 unlevered free cash flow of ~($5M) and $5M, respectively. ProSomnus is no longer issuing guidance for its financial prospects in 2024 and 2025. 1. Unlevered Free Cash Flow defined as Cash Flow from Operations (unlevered) less Cash Flow from Investing less Equipment Lease Fin ancing. Does not include transaction costs.

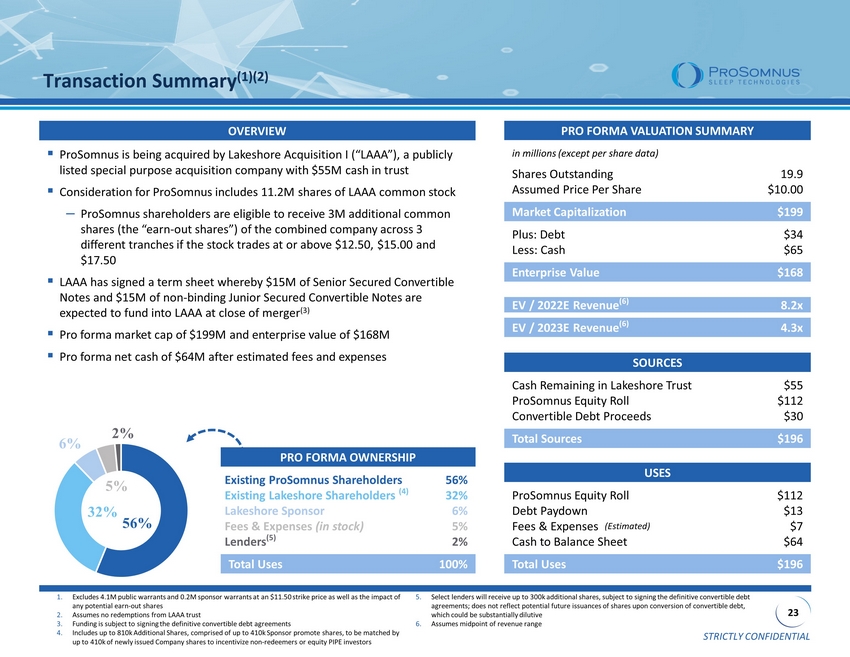

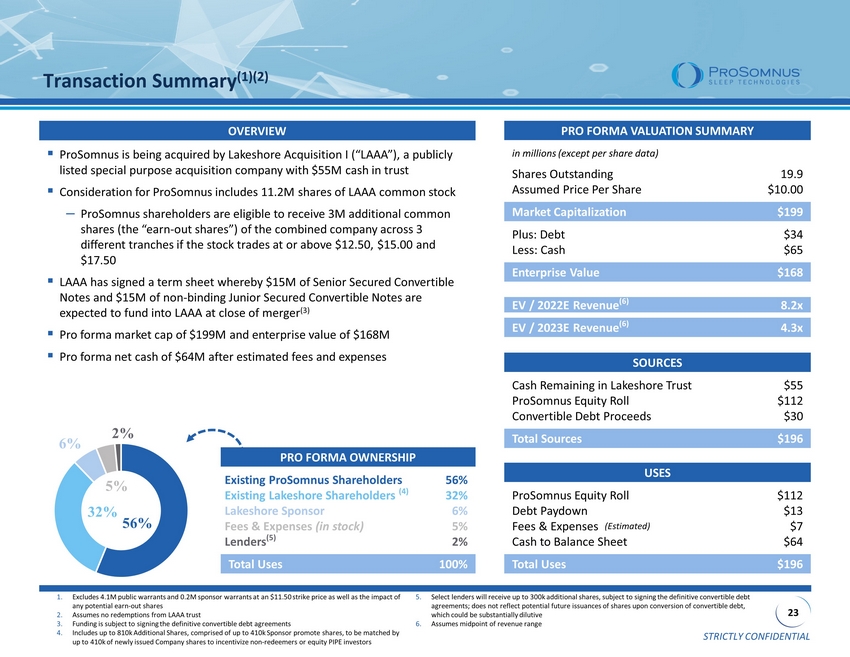

STRICTLY CONFIDENTIAL 23 56% 32% 6% 5% 2% PRO FORMA OWNERSHIP Existing ProSomnus Shareholders 56% Existing Lakeshore Shareholders (4) 32% Lakeshore Sponsor 6% Fees & Expenses (in stock) 5% Lenders (5) 2% Total Uses 100% Transaction Summary (1)(2) PRO FORMA VALUATION SUMMARY in millions (except per share data) Shares Outstanding 19.9 Assumed Price Per Share $10.00 Market Capitalization $199 Plus: Debt $34 Less: Cash $65 Enterprise Value $168 EV / 2022E Revenue (6) 8.2x EV / 2023E Revenue (6) 4.3x USES ProSomnus Equity Roll $112 Debt Paydown $13 Fees & Expenses (Estimated) $7 Cash to Balance Sheet $64 Total Uses $196 ▪ ProSomnus is being acquired by Lakeshore Acquisition I (“LAAA”), a publicly listed special purpose acquisition company with $55M cash in trust ▪ Consideration for ProSomnus includes 11.2M shares of LAAA common stock ‒ ProSomnus shareholders are eligible to receive 3M additional common shares (the “earn - out shares”) of the combined company across 3 different tranches if the stock trades at or above $12.50, $15.00 and $17.50 ▪ LAAA has signed a term sheet whereby $15M of Senior Secured Convertible Notes and $15M of non - binding Junior Secured Convertible Notes are expected to fund into LAAA at close of merger (3) ▪ Pro forma market cap of $199M and enterprise value of $168M ▪ Pro forma net cash of $64M after estimated fees and expenses OVERVIEW SOURCES Cash Remaining in Lakeshore Trust $55 ProSomnus Equity Roll $112 Convertible Debt Proceeds $30 Total Sources $196 1. Excludes 4.1M public warrants and 0.2M sponsor warrants at an $11.50 strike price as well as the impact of any potential earn - out shares 2. Assumes no redemptions from LAAA trust 3. Funding is subject to signing the definitive convertible debt agreements 4. Includes up to 810k Additional Shares, comprised of up to 410k Sponsor promote shares, to be matched by up to 410k of newly issued Company shares to incentivize non - redeemers or equity PIPE investors 5. Select lenders will receive up to 300k additional shares, subject to signing the definitive convertible debt agreements; does not reflect potential future issuances of shares upon conversion of convertible debt, which could be substantially dilutive 6. Assumes midpoint of revenue range

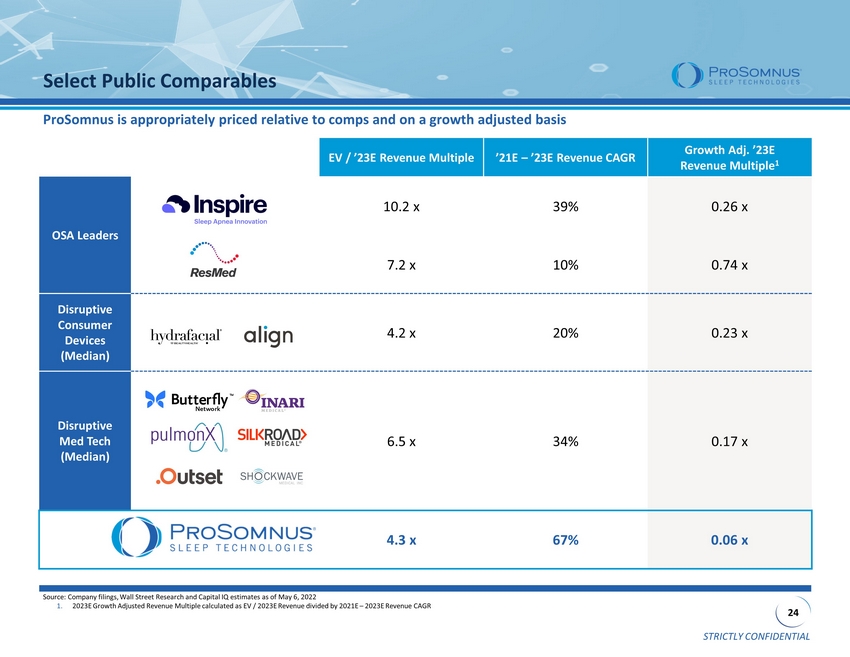

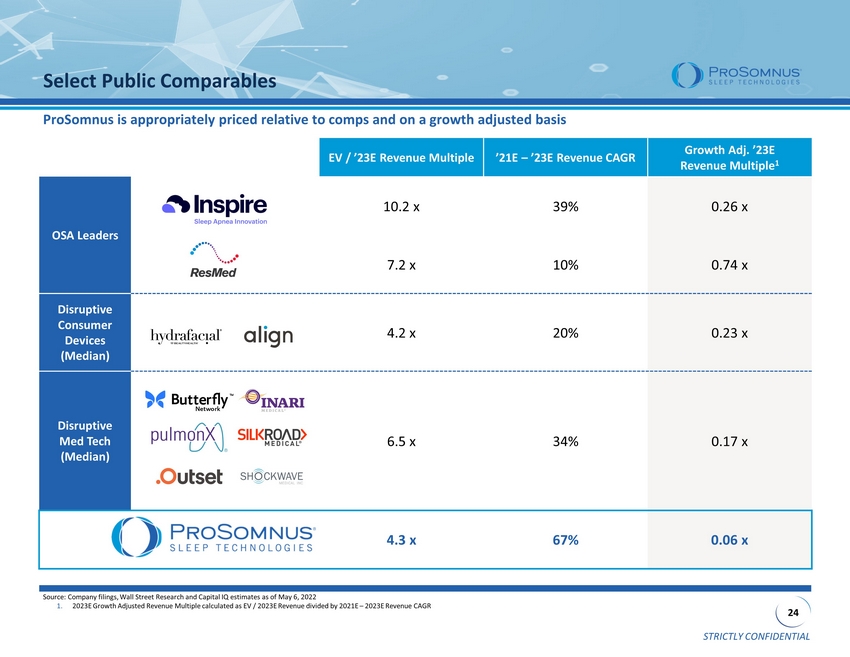

STRICTLY CONFIDENTIAL 24 Select Public Comparables Source: Company filings, Wall Street Research and Capital IQ estimates as of May 6, 2022 1. 2023E Growth Adjusted Revenue Multiple calculated as EV / 2023E Revenue divided by 2021E – 2023E Revenue CAGR EV / ’23E Revenue Multiple ’21E – ’23E Revenue CAGR Growth Adj. ’23E Revenue Multiple 1 OSA Leaders 10.2 x 39% 0.26 x 7.2 x 10% 0.74 x Disruptive Consumer Devices (Median) 4.2 x 20% 0.23 x Disruptive Med Tech (Median) 6.5 x 34% 0.17 x 4.3 x 67% 0.06 x ProSomnus is appropriately priced relative to comps and on a growth adjusted basis

STRICTLY CONFIDENTIAL 25 OSA is a Massive, Rapidly Growing and Underserved Market ProSomnus Precision OAT Devices Deliver a Patient - Preferred, Clinically Proven and More Economical Treatment Patented, Innovative Technologies & Digital Capabilities Create More Effective & Preferred Outcomes Efficient Commercial Model Focused on Sleep Dentists as Therapy Providers Multiple Expected Upcoming Catalysts to Drive Market Conversion Including Remote Patient Monitoring Attractive Growth Trajectory and Financial Profile Experienced Team to Lead ProSomnus Through Next Stage of Growth An Opportunity to Transform the OSA Market 1 2 3 4 5 6 7

STRICTLY CONFIDENTIAL Appendix “The precision engineering used in fabricating ProSomnus Medical Devices is second to none . They make me a better sleep dentist.” - B. Kent Smith, DDS, D.ABDSM, D.ASBA

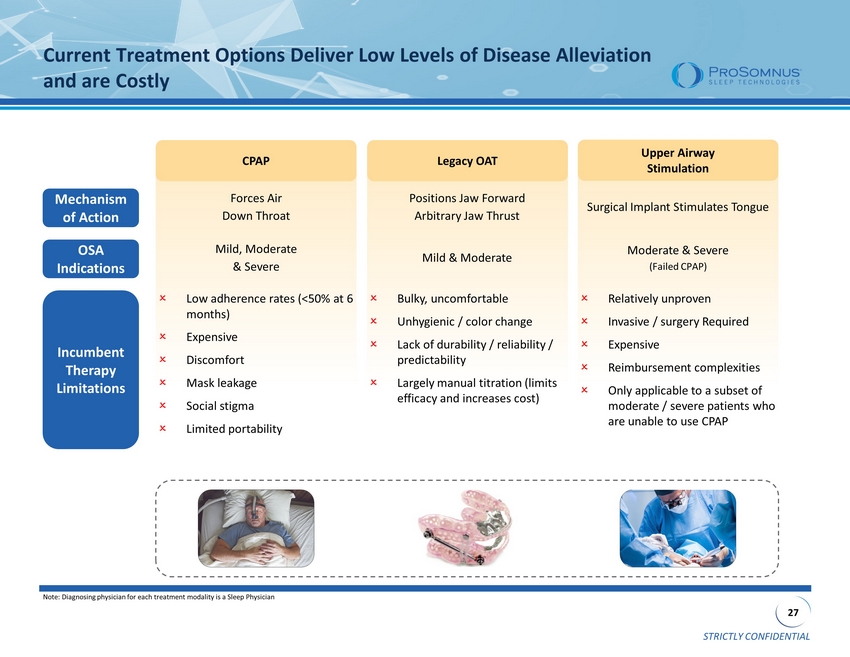

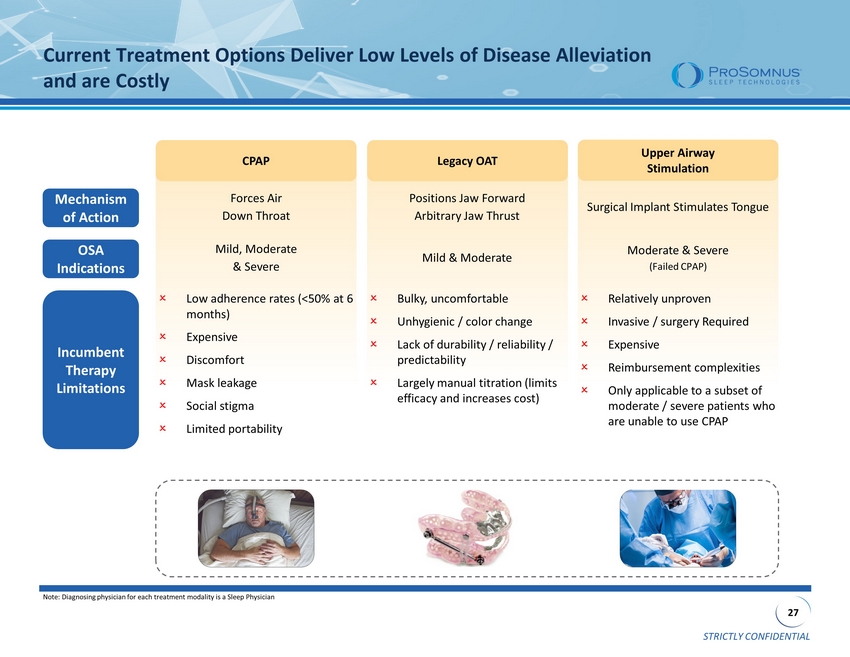

STRICTLY CONFIDENTIAL 27 Forces Air Down Throat Positions Jaw Forward Arbitrary Jaw Thrust Surgical Implant Stimulates Tongue Mild, Moderate & Severe Mild & Moderate Moderate & Severe (Failed CPAP) Low adherence rates (<50% at 6 months) Expensive Discomfort Mask leakage Social stigma Limited portability Bulky, uncomfortable Unhygienic / color change Lack of durability / reliability / predictability Largely manual titration (limits efficacy and increases cost) Relatively unproven Invasive / surgery Required Expensive Reimbursement complexities Only applicable to a subset of moderate / severe patients who are unable to use CPAP Upper Airway Stimulation CPAP Current Treatment Options Deliver Low Levels of Disease Alleviation and are Costly Mechanism of Action OSA Indications Note: Diagnosing physician for each treatment modality is a Sleep Physician Legacy OAT Incumbent Therapy Limitations

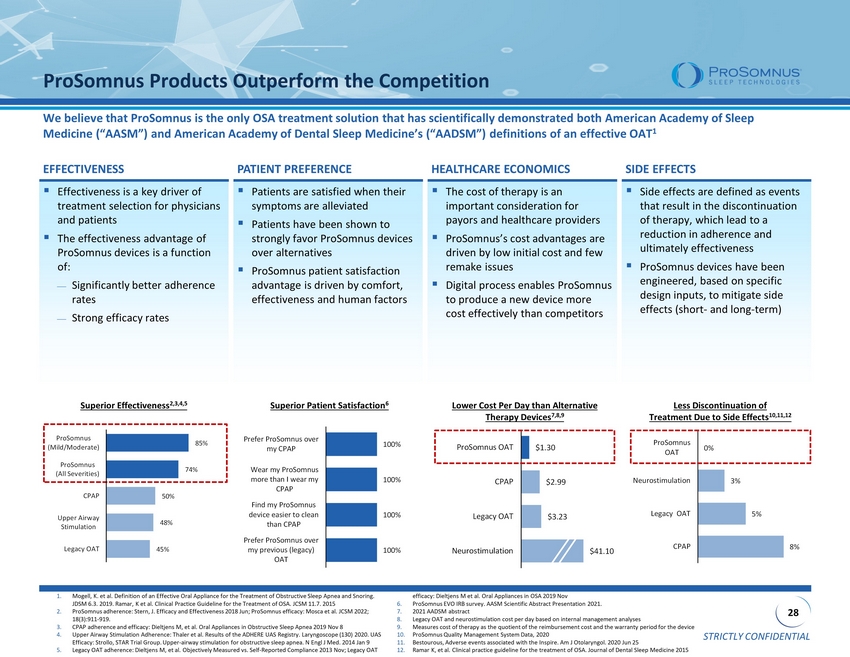

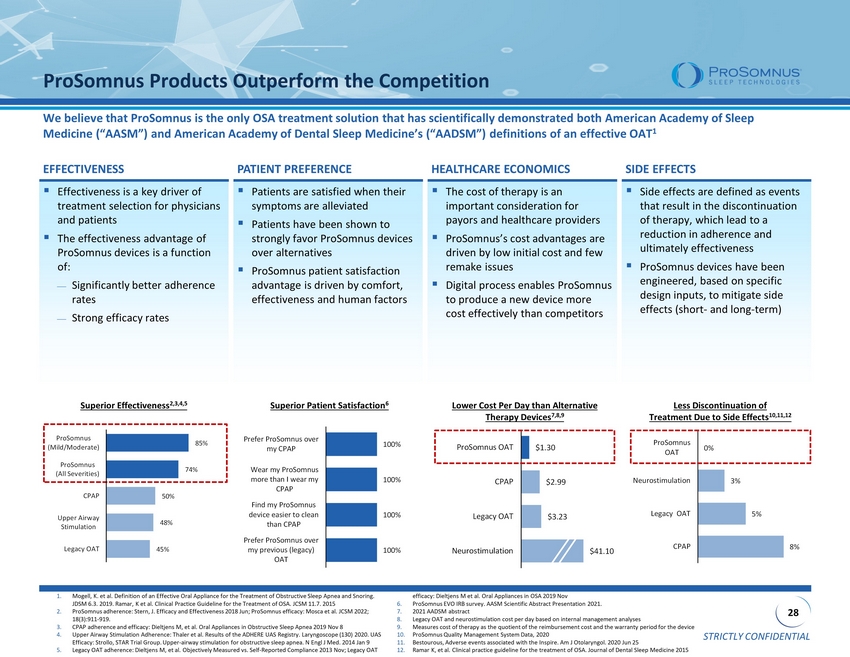

STRICTLY CONFIDENTIAL 28 $1.30 $2.99 $3.23 $41.10 ProSomnus OAT CPAP Legacy OAT Neurostimulation ▪ Effectiveness is a key driver of treatment selection for physicians and patients ▪ The effectiveness advantage of ProSomnus devices is a function of: Significantly better adherence rates Strong efficacy rates ▪ Patients are satisfied when their symptoms are alleviated ▪ Patients have been shown to strongly favor ProSomnus devices over alternatives ▪ ProSomnus patient satisfaction advantage is driven by comfort, effectiveness and human factors ▪ The cost of therapy is an important consideration for payors and healthcare providers ▪ ProSomnus’s cost advantages are driven by low initial cost and few remake issues ▪ Digital process enables ProSomnus to produce a new device more cost effectively than competitors ▪ Side effects are defined as events that result in the discontinuation of therapy, which lead to a reduction in adherence and ultimately effectiveness ▪ ProSomnus devices have been engineered, based on specific design inputs, to mitigate side effects (short - and long - term) ProSomnus Products Outperform the Competition We believe that ProSomnus is the only OSA treatment solution that has scientifically demonstrated both American Academy of Sleep Medicine (“AASM”) and American Academy of Dental Sleep Medicine’s (“AADSM”) definitions of an effective OAT 1 EFFECTIVENESS PATIENT PREFERENCE HEALTHCARE ECONOMICS SIDE EFFECTS Superior Effectiveness 2,3,4,5 Less Discontinuation of Treatment Due to Side Effects 10,11,12 Superior Patient Satisfaction 6 Lower Cost Per Day than Alternative Therapy Devices 7,8,9 1. Mogell , K. et al. Definition of an Effective Oral Appliance for the Treatment of Obstructive Sleep Apnea and Snoring. JDSM 6.3. 2019. Ramar , K et al. Clinical Practice Guideline for the Treatment of OSA. JCSM 11.7. 2015 2. ProSomnus adherence: Stern, J. Efficacy and Effectiveness 2018 Jun; ProSomnus efficacy: Mosca et al. JCSM 2022; 18(3):911 - 919. 3. CPAP adherence and efficacy: Dieltjens M, et al. Oral Appliances in Obstructive Sleep Apnea 2019 Nov 8 4. Upper Airway Stimulation Adherence: Thaler et al. Results of the ADHERE UAS Registry. Laryngoscope (130) 2020. UAS Efficacy: Strollo , STAR Trial Group. Upper - airway stimulation for obstructive sleep apnea. N Engl J Med. 2014 Jan 9 5. Legacy OAT adherence: Dieltjens M, et al. Objectively Measured vs. Self - Reported Compliance 2013 Nov; Legacy OAT efficacy: Dieltjens M et al. Oral Appliances in OSA 2019 Nov 6. ProSomnus EVO IRB survey. AASM Scientific Abstract Presentation 2021. 7. 2021 AADSM abstract 8. Legacy OAT and neurostimulation cost per day based on internal management analyses 9. Measures cost of therapy as the quotient of the reimbursement cost and the warranty period for the device 10. ProSomnus Quality Management System Data, 2020 11. Bestourous , Adverse events associated with the Inspire. Am J Otolaryngol . 2020 Jun 25 12. Ramar K, et al. Clinical practice guideline for the treatment of OSA. Journal of Dental Sleep Medicine 2015 100% 100% 100% 100% Prefer ProSomnus over my previous (legacy) OAT Find my ProSomnus device easier to clean than CPAP Wear my ProSomnus more than I wear my CPAP Prefer ProSomnus over my CPAP 8% 5% 3% 0% CPAP Legacy OAT Neurostimulation ProSomnus OAT 85% 74% 50% 48% 45% ProSomnus (Mild/Moderate) ProSomnus (All Severities) CPAP Upper Airway Stimulation Legacy OAT

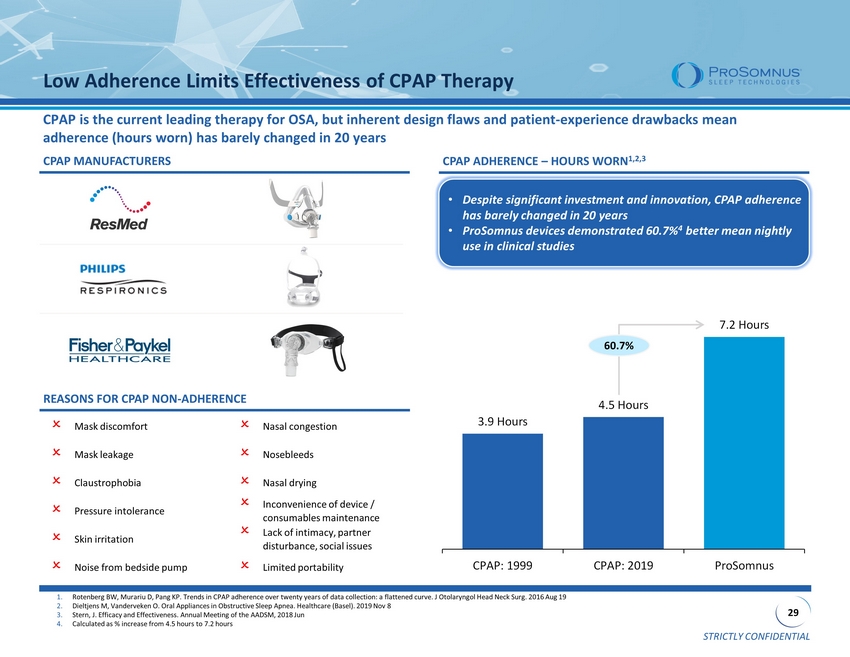

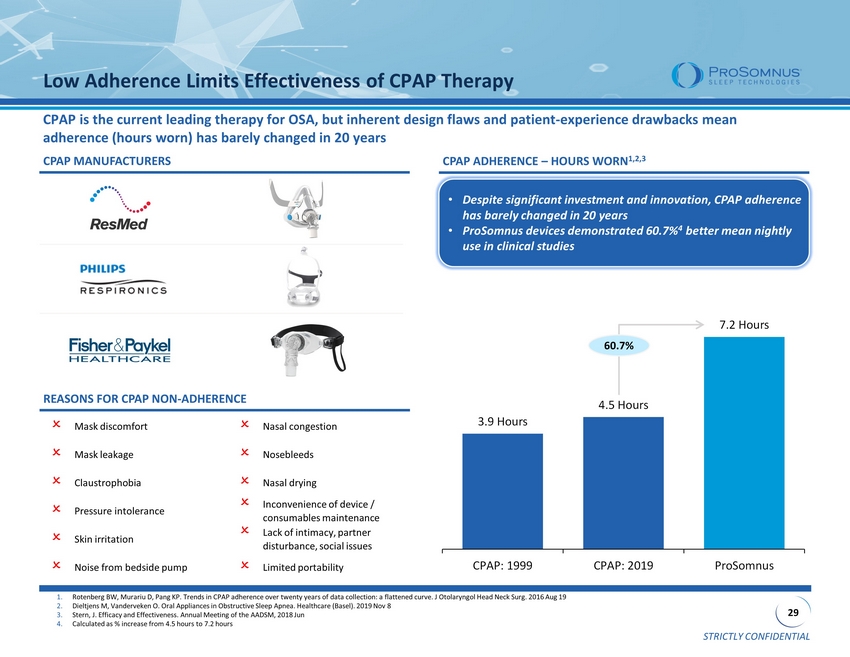

STRICTLY CONFIDENTIAL 29 3.9 Hours 4.5 Hours 7.2 Hours CPAP: 1999 CPAP: 2019 ProSomnus Low Adherence Limits Effectiveness of CPAP Therapy CPAP is the current leading therapy for OSA, but inherent design flaws and patient - experience drawbacks mean adherence (hours worn) has barely changed in 20 years CPAP MANUFACTURERS CPAP ADHERENCE – HOURS WORN 1,2,3 Mask discomfort Nasal congestion Pressure intolerance Nosebleeds Inconvenience of device / consumables maintenance Claustrophobia Skin irritation Nasal drying Noise from bedside pump Mask leakage Lack of intimacy, partner disturbance, social issues Limited portability 1. Rotenberg BW, Murariu D, Pang KP. Trends in CPAP adherence over twenty years of data collection: a flattened curve. J Otolary ngo l Head Neck Surg. 2016 Aug 19 2. Dieltjens M, Vanderveken O. Oral Appliances in Obstructive Sleep Apnea . Healthcare (Basel). 2019 Nov 8 3. Stern, J. Efficacy and Effectiveness. Annual Meeting of the AADSM, 2018 Jun 4. Calculated as % increase from 4.5 hours to 7.2 hours REASONS FOR CPAP NON - ADHERENCE • Despite significant investment and innovation, CPAP adherence has barely changed in 20 years • ProSomnus devices demonstrated 60.7% 4 better mean nightly use in clinical studies 60.7%

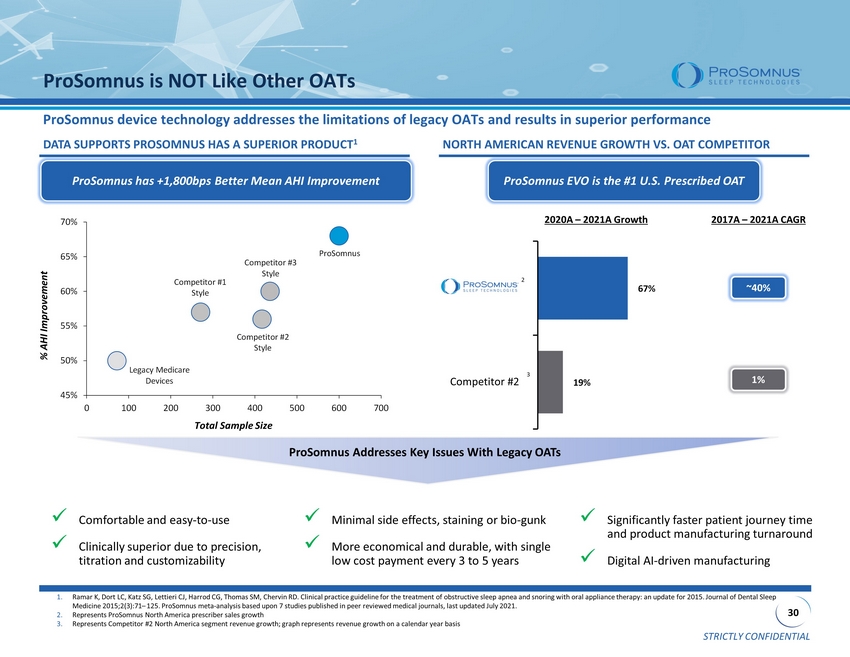

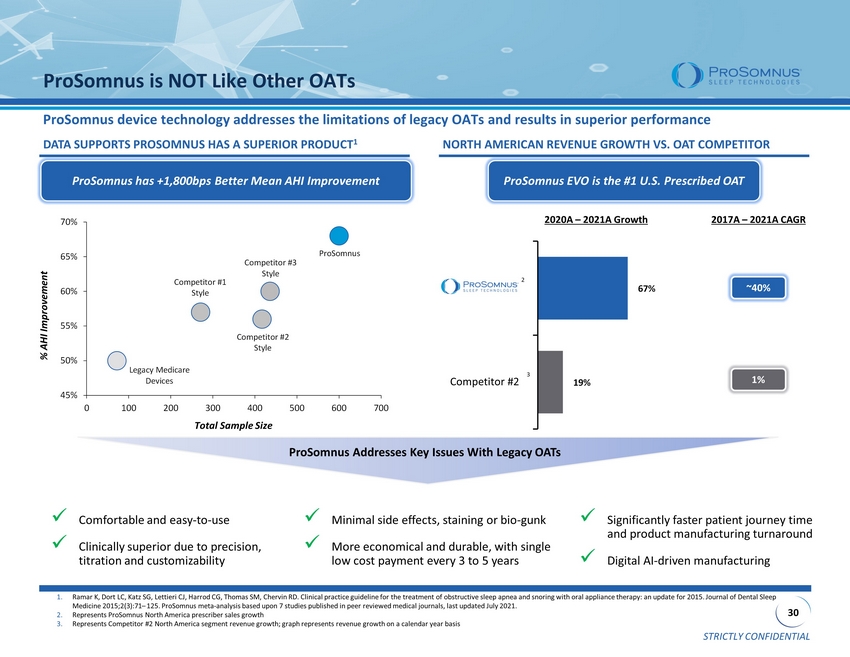

STRICTLY CONFIDENTIAL 30 Competitor #2 ProSomnus is NOT Like Other OATs ProSomnus device technology addresses the limitations of legacy OATs and results in superior performance DATA SUPPORTS PROSOMNUS HAS A SUPERIOR PRODUCT 1 NORTH AMERICAN REVENUE GROWTH VS. OAT COMPETITOR 1. Ramar K, Dort LC, Katz SG, Lettieri CJ, Harrod CG, Thomas SM, Chervin RD. Clinical practice guideline for the treatment of ob str uctive sleep apnea and snoring with oral appliance therapy: an update for 2015. Journal of Dental Sleep Medicine 2015;2(3):71 – 125. ProSomnus meta - analysis based upon 7 studies published in peer reviewed medical journals, last updated July 2021. 2. Represents ProSomnus North America prescriber sales growth 3. Represents Competitor #2 North America segment revenue growth; graph represents revenue growth on a calendar year basis % AHI Improvement Total Sample Size ProSomnus has +1,800bps Better Mean AHI Improvement x Comfortable and easy - to - use x Clinically superior due to precision, titration and customizability x Minimal side effects, staining or bio - gunk x More economical and durable, with single low cost payment every 3 to 5 years x Significantly faster patient journey time and product manufacturing turnaround x Digital AI - driven manufacturing ProSomnus Addresses Key Issues With Legacy OATs ProSomnus EVO is the #1 U.S. Prescribed OAT 3 2 ~40% 1% 2017A – 2021A CAGR 2020A – 2021A Growth Competitor #1 Style Competitor #2 Style ProSomnus Legacy Medicare Devices Competitor #3 Style 45% 50% 55% 60% 65% 70% 0 100 200 300 400 500 600 700 67% 19%

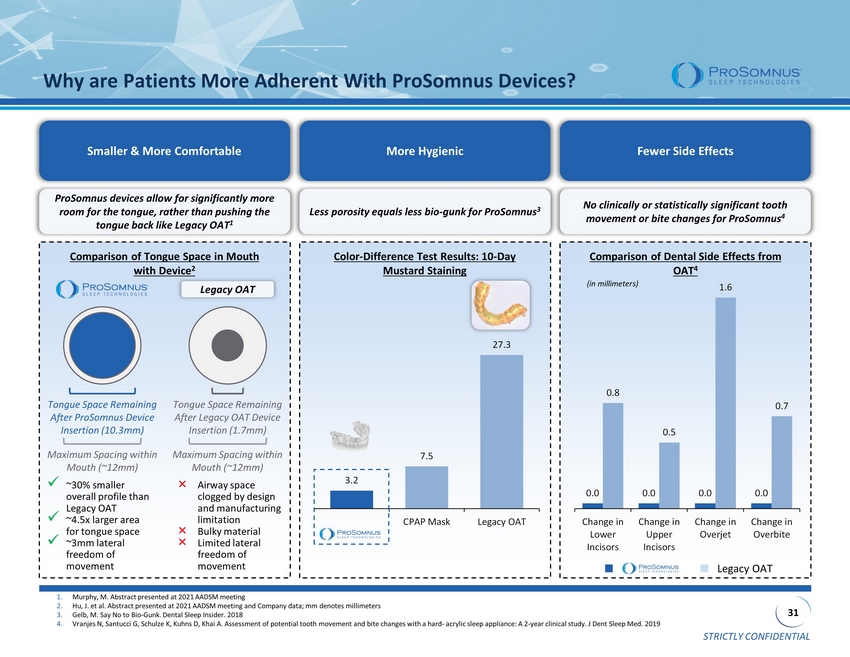

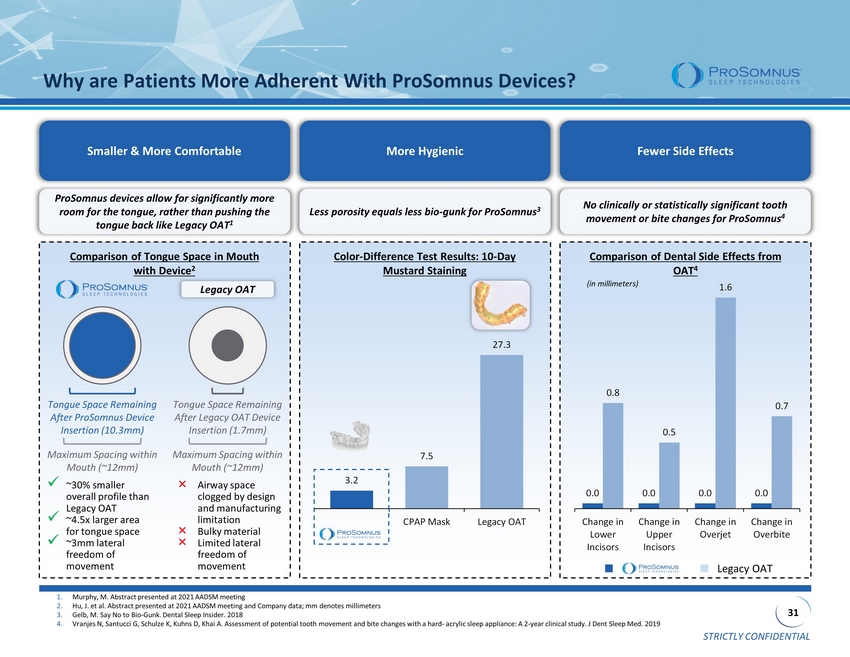

STRICTLY CONFIDENTIAL 31 0.0 0.0 0.0 0.0 0.8 0.5 1.6 0.7 Change in Lower Incisors Change in Upper Incisors Change in Overjet Change in Overbite Why are Patients More Adherent With ProSomnus Devices? Smaller & More Comfortable More Hygienic Fewer Side Effects ProSomnus devices allow for significantly more room for the tongue, rather than pushing the tongue back like Legacy OAT 1 Less porosity equals less bio - gunk for ProSomnus 3 No clinically or statistically significant tooth movement or bite changes for ProSomnus 4 Comparison of Tongue Space in Mouth with Device 2 Color - Difference Test Results: 10 - Day Mustard Staining Comparison of Dental Side Effects from OAT 4 1. Murphy, M. Abstract presented at 2021 AADSM meeting 2. Hu, J. et al. Abstract presented at 2021 AADSM meeting and Company data; mm denotes millimeters 3. Gelb, M. Say No to Bio - Gunk. Dental Sleep Insider. 2018 4. Vranjes N, Santucci G, Schulze K, Kuhns D, Khai A. Assessment of potential tooth movement and bite changes with a hard - acrylic sleep appliance: A 2 - year clinical study. J Den t Sleep Med. 2019 Legacy OAT Tongue Space Remaining After ProSomnus Device Insertion (10.3mm) Tongue Space Remaining After Legacy OAT Device Insertion (1.7mm) Maximum Spacing within Mouth (~12mm) Maximum Spacing within Mouth (~12mm) x ~30% smaller overall profile than Legacy OAT x ~4.5x larger area for tongue space x ~3mm lateral freedom of movement × Airway space clogged by design and manufacturing limitation × Bulky material × Limited lateral freedom of movement 3.2 7.5 27.3 CPAP Mask Legacy OAT Legacy OAT (in millimeters)

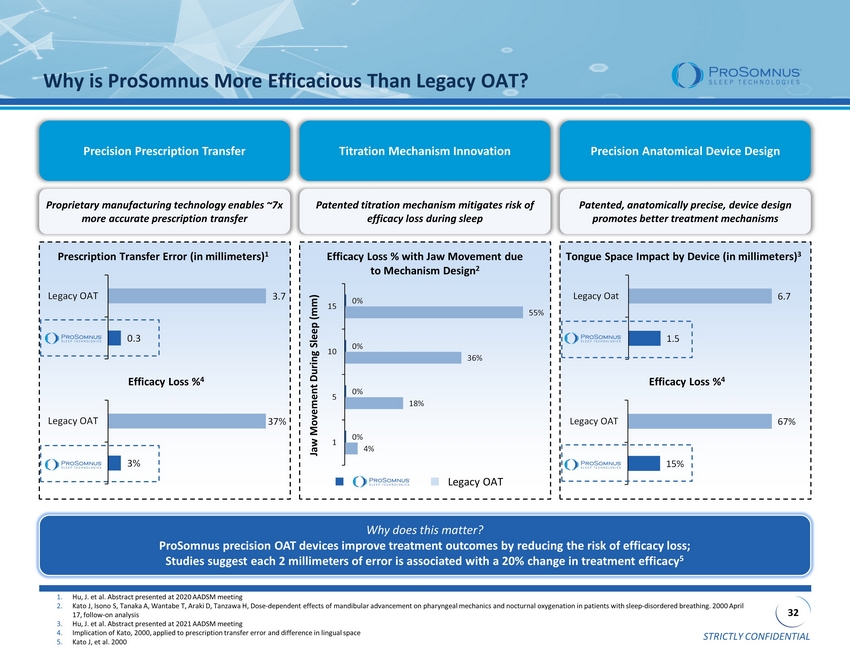

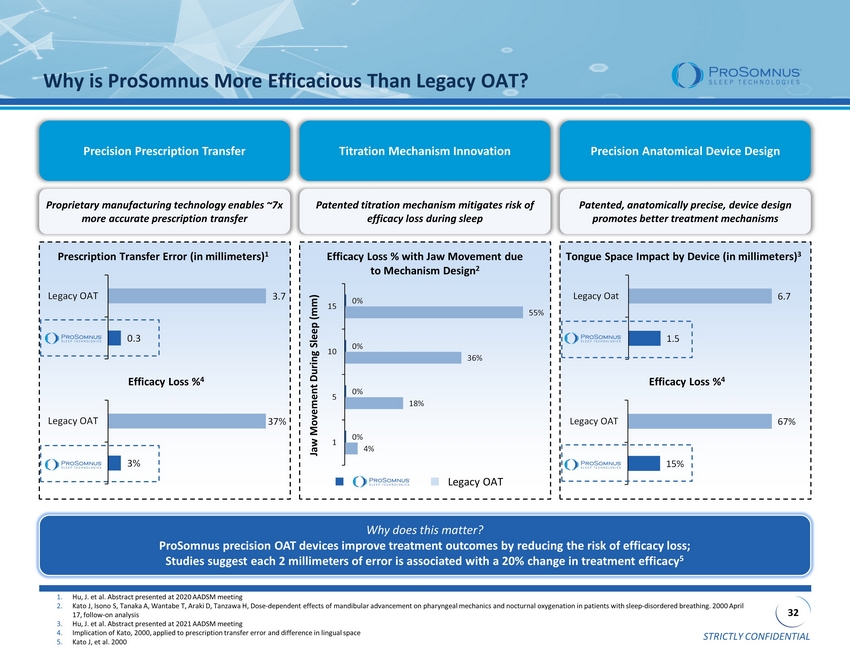

STRICTLY CONFIDENTIAL 32 Why is ProSomnus More Efficacious Than Legacy OAT? Precision Prescription Transfer Titration Mechanism Innovation Precision Anatomical Device Design Proprietary manufacturing technology enables ~7x more accurate prescription transfer Patented titration mechanism mitigates risk of efficacy loss during sleep Patented, anatomically precise, device design promotes better treatment mechanisms Prescription Transfer Error (in millimeters) 1 Efficacy Loss % 4 Efficacy Loss % with Jaw Movement due to Mechanism Design 2 Jaw Movement During Sleep (mm) Tongue Space Impact by Device (in millimeters) 3 Efficacy Loss % 4 0% 0% 0% 0% 55% 36% 18% 4% 15 10 5 1 1.5 6.7 Legacy Oat 15% 67% Legacy OAT Why does this matter? ProSomnus precision OAT devices improve treatment outcomes by reducing the risk of efficacy loss; Studies suggest each 2 millimeters of error is associated with a 20% change in treatment efficacy 5 Legacy OAT 1. Hu, J. et al. Abstract presented at 2020 AADSM meeting 2. Kato J, Isono S, Tanaka A, Wantabe T, Araki D, Tanzawa H, Dose - dependent effects of mandibular advancement on pharyngeal mechanics and nocturnal oxygenation in patients with sleep - di sordered breathing. 2000 April 17, follow - on analysis 3. Hu, J. et al. Abstract presented at 2021 AADSM meeting 4. Implication of Kato, 2000, applied to prescription transfer error and difference in lingual space 5. Kato J, et al. 2000 0.3 3.7 Legacy OAT 3% 37% Legacy OAT

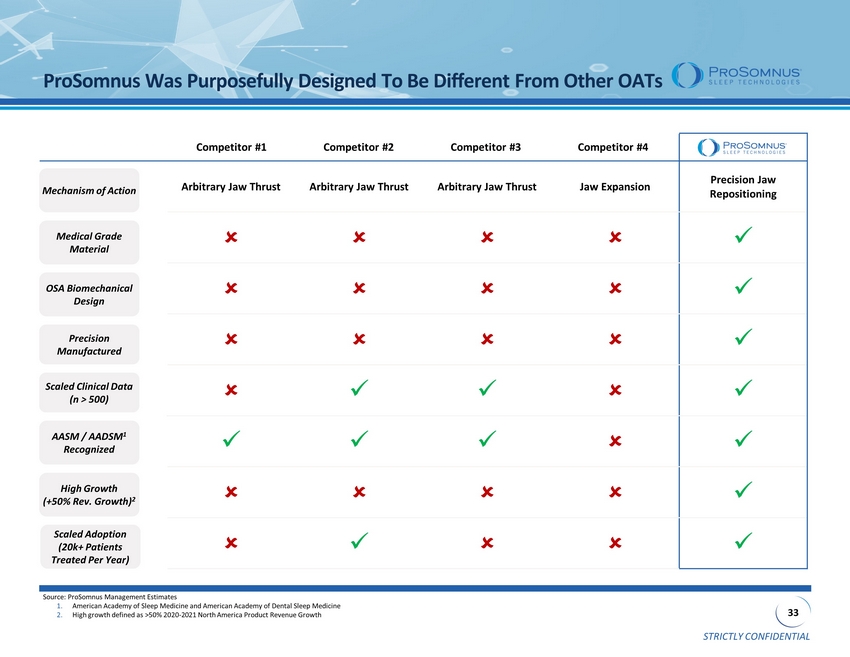

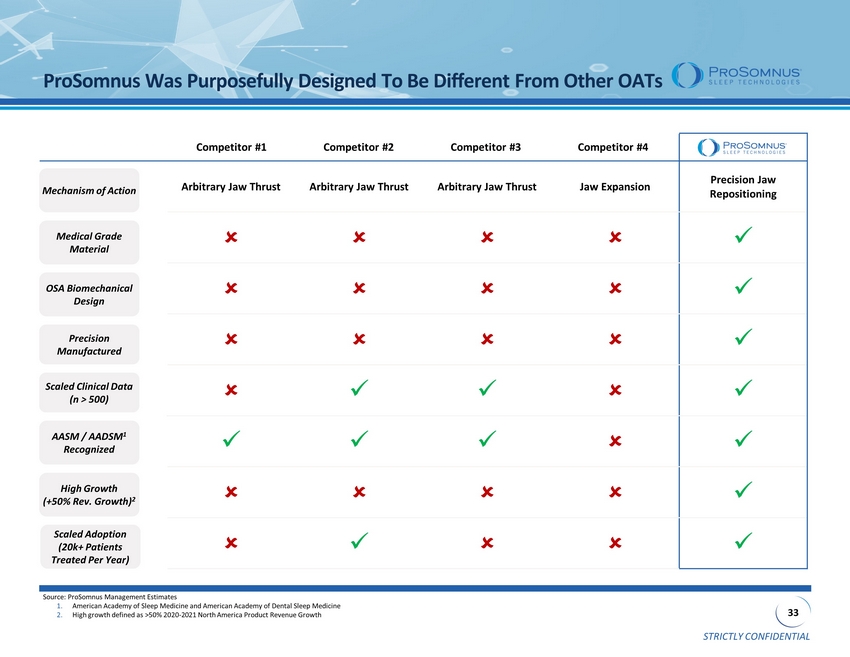

STRICTLY CONFIDENTIAL 33 Arbitrary Jaw Thrust Arbitrary Jaw Thrust Arbitrary Jaw Thrust Jaw Expansion Precision Jaw Repositioning x x x x x x x x x x x x x ProSomnus Was Purposefully Designed To Be Different From Other OATs OSA Biomechanical Design Precision Manufactured AASM / AADSM 1 Recognized Scaled Clinical Data (n > 500) Source: ProSomnus Management Estimates 1. American Academy of Sleep Medicine and American Academy of Dental Sleep Medicine 2. High growth defined as >50% 2020 - 2021 North America Product Revenue Growth Mechanism of Action Medical Grade Material High Growth (+50% Rev. Growth) 2 Scaled Adoption (20k+ Patients Treated Per Year) Competitor #1 Competitor #2 Competitor #3 Competitor #4

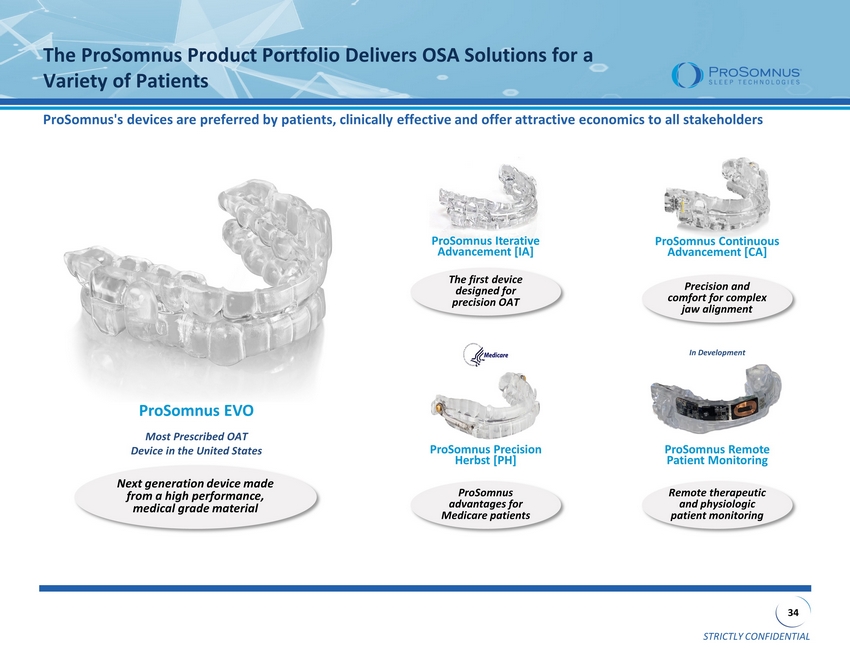

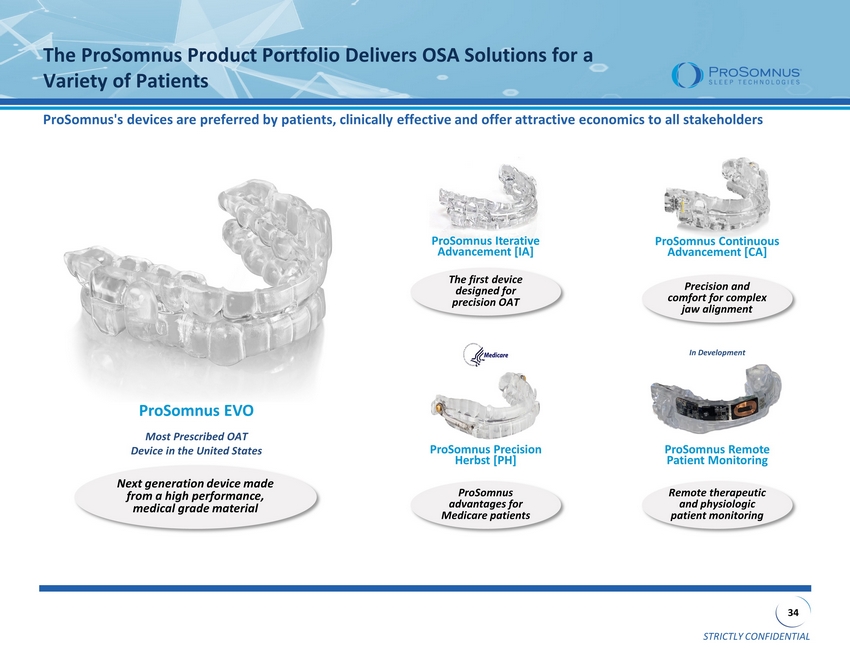

STRICTLY CONFIDENTIAL 34 The ProSomnus Product Portfolio Delivers OSA Solutions for a Variety of Patients ProSomnus's devices are preferred by patients, clinically effective and offer attractive economics to all stakeholders ProSomnus Iterative Advancement [IA] ProSomnus Continuous Advancement [CA] ProSomnus EVO The first device designed for precision OAT Precision and comfort for complex jaw alignment ProSomnus advantages for Medicare patients Most Prescribed OAT Device in the United States ProSomnus Precision Herbst [PH] Next generation device made from a high performance, medical grade material ProSomnus Remote Patient Monitoring Remote therapeutic and physiologic patient monitoring In Development

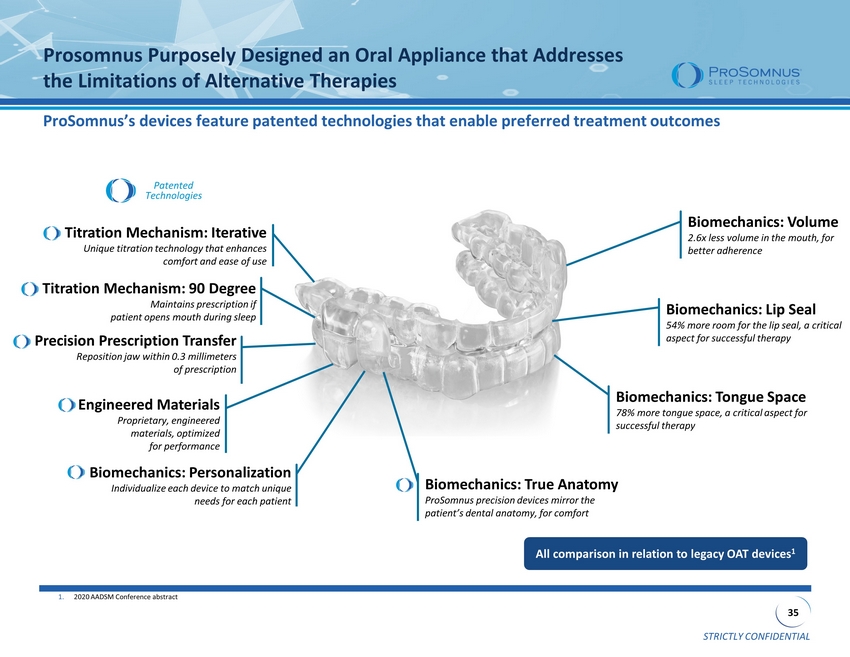

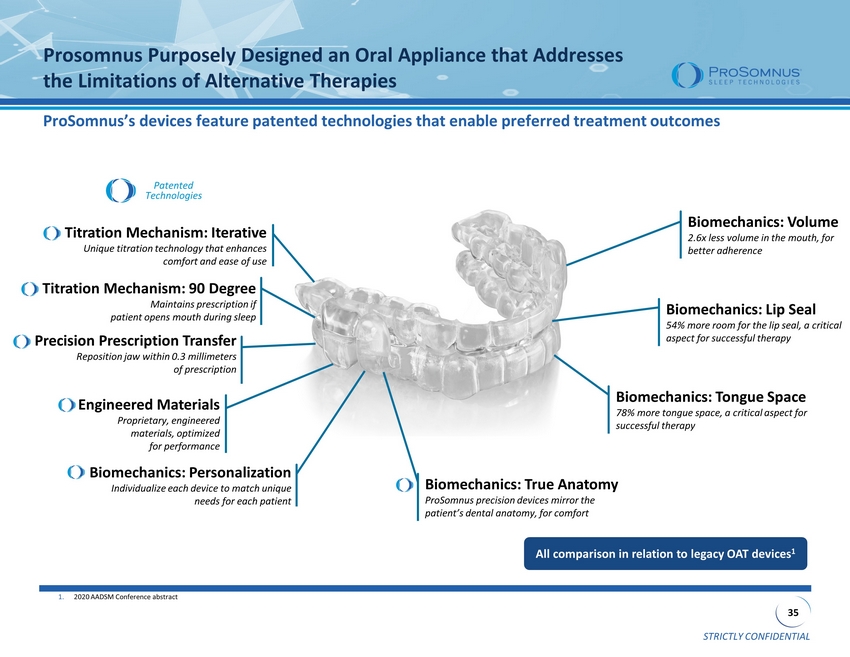

STRICTLY CONFIDENTIAL 35 Prosomnus Purposely Designed an Oral Appliance that Addresses the Limitations of Alternative Therapies All comparison in relation to legacy OAT devices 1 1. 2020 AADSM Conference abstract Titration Mechanism: 90 Degree Maintains prescription if patient opens mouth during sleep Biomechanics: Lip Seal 54% more room for the lip seal, a critical aspect for successful therapy Biomechanics: Volume 2.6x less volume in the mouth, for better adherence Titration Mechanism: Iterative Unique titration technology that enhances comfort and ease of use Biomechanics: Personalization Individualize each device to match unique needs for each patient Patented Technologies Biomechanics: Tongue Space 78% more tongue space, a critical aspect for successful therapy Precision Prescription Transfer Reposition jaw within 0.3 millimeters of prescription Engineered Materials Proprietary, engineered materials, optimized for performance Biomechanics: True Anatomy ProSomnus precision devices mirror the patient’s dental anatomy, for comfort ProSomnus’s devices feature patented technologies that enable preferred treatment outcomes

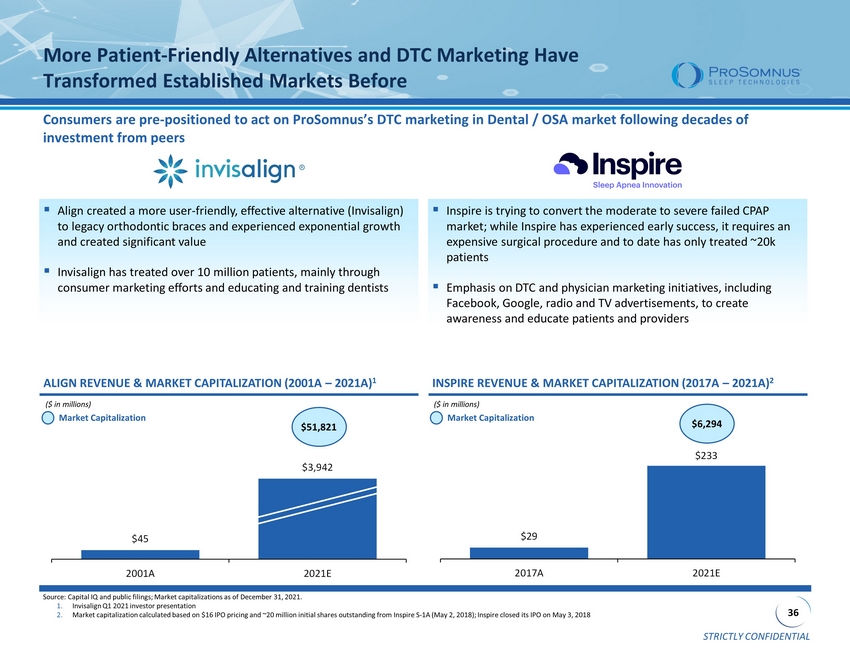

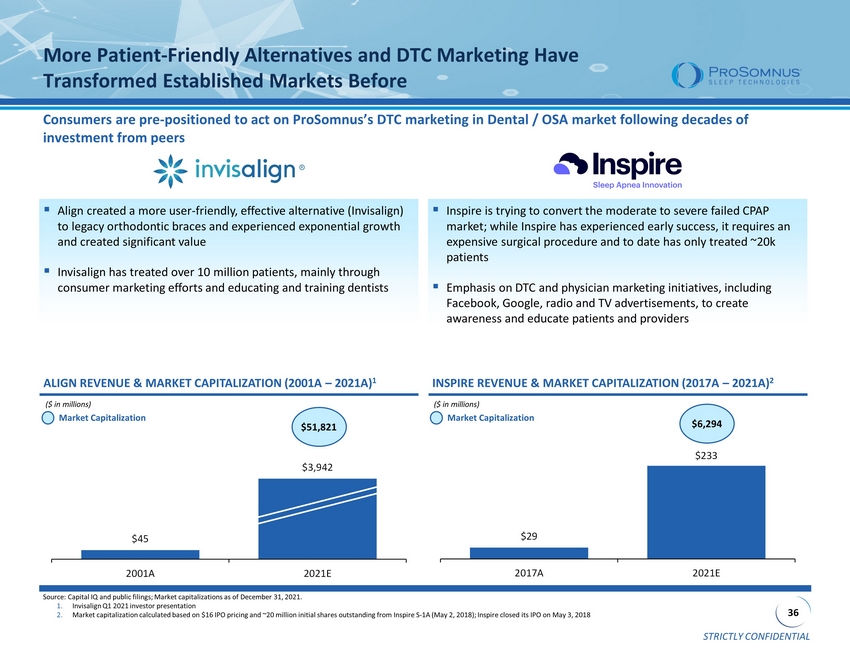

STRICTLY CONFIDENTIAL 36 $29 $233 2017A 2021E $45 $3,942 2001A 2021E More Patient - Friendly Alternatives and DTC Marketing Have Transformed Established Markets Before Consumers are pre - positioned to act on ProSomnus’s DTC marketing in Dental / OSA market following decades of investment from peers ▪ Align created a more user - friendly, effective alternative (Invisalign) to legacy orthodontic braces and experienced exponential growth and created significant value ▪ Invisalign has treated over 10 million patients, mainly through consumer marketing efforts and educating and training dentists Source: Capital IQ and public filings; Market capitalizations as of December 31, 2021. 1. Invisalign Q1 2021 investor presentation 2. Market capitalization calculated based on $16 IPO pricing and ~20 million initial shares outstanding from Inspire S - 1A (May 2, 2 018); Inspire closed its IPO on May 3, 2018 ALIGN REVENUE & MARKET CAPITALIZATION (2001A – 2021A) 1 INSPIRE REVENUE & MARKET CAPITALIZATION (2017A – 2021A) 2 ($ in millions) Market Capitalization $51,821 ($ in millions) Market Capitalization $6,294 ▪ Inspire is trying to convert the moderate to severe failed CPAP market; while Inspire has experienced early success, it requires an expensive surgical procedure and to date has only treated ~20k patients ▪ Emphasis on DTC and physician marketing initiatives, including Facebook, Google, radio and TV advertisements, to create awareness and educate patients and providers

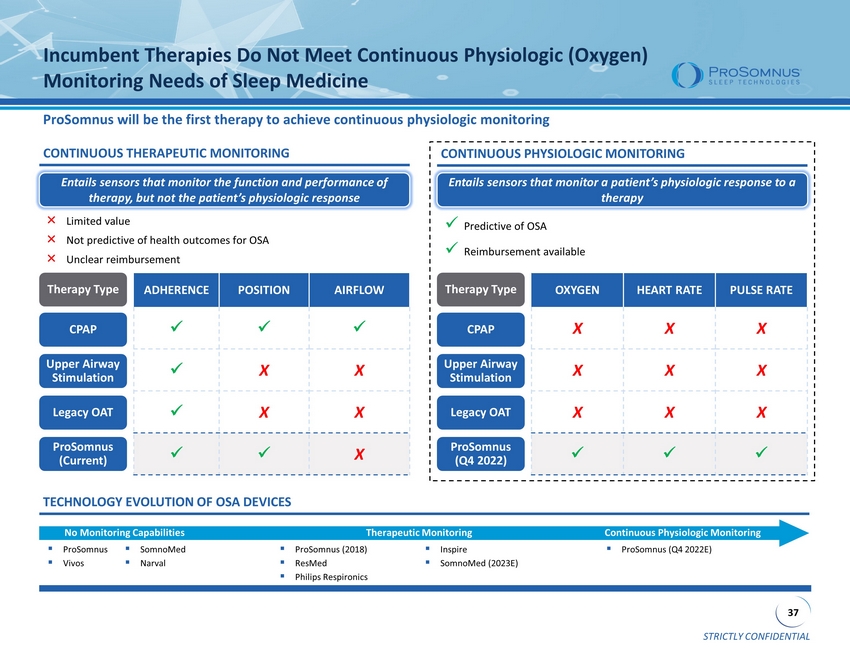

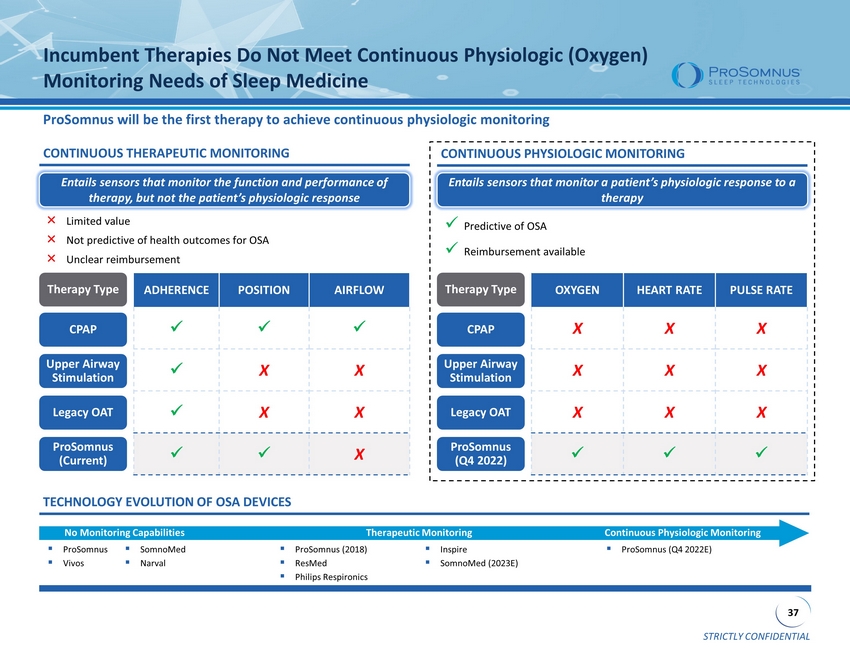

STRICTLY CONFIDENTIAL 37 Incumbent Therapies Do Not Meet Continuous Physiologic (Oxygen) Monitoring Needs of Sleep Medicine ProSomnus will be the first therapy to achieve continuous physiologic monitoring ADHERENCE POSITION AIRFLOW x x x x X X x X X x x X Legacy OAT ProSomnus (Q4 2022) CPAP Upper Airway Stimulation Therapy Type OXYGEN HEART RATE PULSE RATE X X X X X X X X X x x x CONTINUOUS PHYSIOLOGIC MONITORING x Predictive of OSA x Reimbursement available TECHNOLOGY EVOLUTION OF OSA DEVICES ▪ ProSomnus ▪ Vivos ▪ SomnoMed ▪ Narval ▪ ProSomnus (2018) ▪ ResMed ▪ Philips Respironics ▪ Inspire ▪ SomnoMed (2023E) No Monitoring Capabilities Therapeutic Monitoring Continuous Physiologic Monitoring ▪ ProSomnus (Q4 2022E) CONTINUOUS THERAPEUTIC MONITORING Legacy OAT ProSomnus (Current) CPAP Upper Airway Stimulation Therapy Type × Limited value × Not predictive of health outcomes for OSA × Unclear reimbursement Entails sensors that monitor the function and performance of therapy, but not the patient’s physiologic response Entails sensors that monitor a patient’s physiologic response to a therapy

STRICTLY CONFIDENTIAL 38 Non - GAAP Adjusted EBITDA Reconciliation $ in millions FY2021A Net Income / (Loss) (6)$ (+) Foregiveness of PPP Loans (2) (+) Other Expenses (Income) 0 (+) Interest Expense 3 (+) Provision for Income Tax Expense 0 (+) Depreciation and Amortization 1 (+) DeSPAC Costs & Select Severance 0 Adjusted EBITDA (4)$ Adjusted EBITDA Margin (25%)