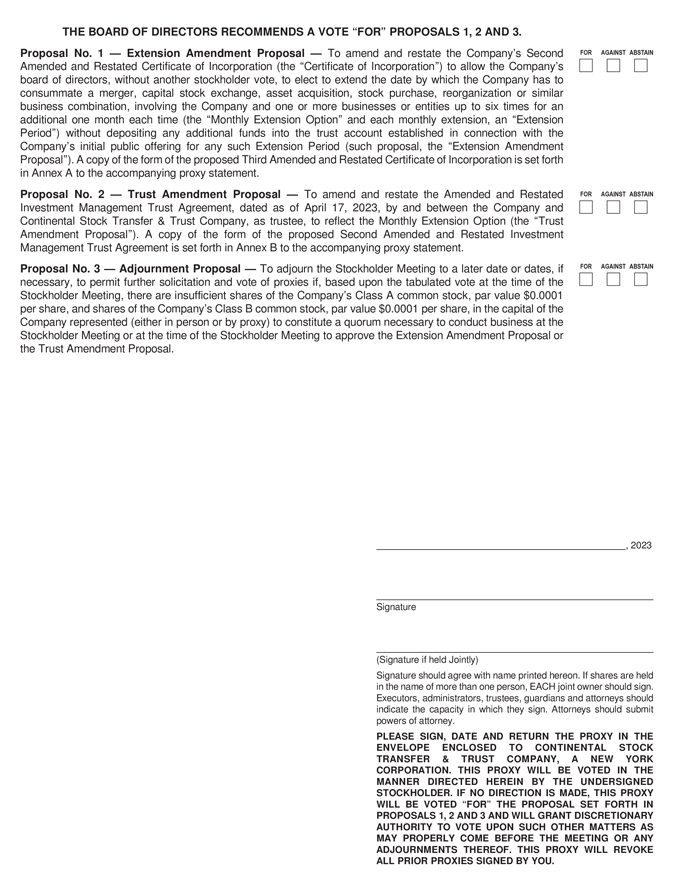

THE EXTENSION AMENDMENT PROPOSAL AND THE TRUST AMENDMENT PROPOSAL

Background

The Company is a blank check company incorporated as a Delaware corporation on February 10, 2021 and formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination, involving the Company and one or more businesses or entities.

On October 18, 2021, the Company consummated its IPO of 24,000,000 Units, at a price of $10.00 per Unit generating gross proceeds of $240,000,000. Following the full exercise of the underwriters’ option to purchase an additional 3,600,000 Units at a price of $10.00 per Unit to cover over-allotments on October 22, 2021, the Company generated additional gross proceeds of $36,000,000. Each Unit consists of one share of Class A Common Stock and three-quarters of one redeemable public warrant, with each whole warrant entitling the holder thereof to purchase one share of Class A Common Stock for $11.50 per share. The securities in the IPO were registered under the Securities Act of 1933, as amended (the “Securities Act”), on a registration statement on Form S-1 (No. 333-259469). The SEC declared the registration statement effective on October 13, 2021.

Simultaneously with the closing of the IPO, the Company consummated the sale of 11,600,000 Private Placement Warrants to the Sponsor at a price of $1.00 per Private Placement Warrant, generating gross proceeds of $11,600,000. On October 22, 2021, simultaneously with the exercise of the underwriters’ over-allotment option, the Company completed a private placement with the Sponsor for an additional 1,440,000 Private Placement Warrants at a price of $1.00 per Private Placement Warrant, generating gross proceeds of $1,440,000.

Following the closing of the IPO and the full exercise of the underwriters’ over-allotment, $281,520,000 from the net proceeds of the sale of the Units in the IPO and the sale of the Private Placement Warrants were deposited in a trust account established for the benefit of the Company’s public stockholders.

On April 14, 2023, the Company held a special meeting (the “First Extension Meeting”) at which the Company’s stockholders approved, among other things, a proposal to amend and restate the Company’s then-effective Amended and Restated Certificate of Incorporation (the “Original Charter”) to (a) extend the Deadline Date from April 18, 2023 to June 18, 2023 and (b) allow the Board, without another stockholder vote, to elect to extend the date by which the Company has to consummate a Business Combination up to six times for an additional one month each time, provided that the Sponsor (or its affiliates or designees) deposits into the Trust Account, for each monthly extension, $160,000 in exchange for a non-interest bearing, unsecured promissory note.

In connection with the First Extension Meeting, stockholders holding 22,656,774 shares of Public Stock exercised their option to redeem their shares for a pro rata portion of the funds in the Trust Account (the “First Extension Redemption”). As a result, approximately $235.7 million (or approximately $10.40 per share of Public Stock) was removed from the Trust Account to pay such holders, and 4,943,226 shares of Public Stock remain outstanding. Following the First Extension Meeting, the Company has deposited an aggregate of $1.12 million into the Trust Account to extend the Deadline Date from April 18, 2023 to November 18, 2023 pursuant to the Certificate of Incorporation.

Overview

The Company is proposing to amend its Certificate of Incorporation and the Trust Agreement to allow the Board, without another stockholder vote, to elect to extend the Deadline Date up to six times for an additional one month each time without depositing any additional funds into the Trust Account for any such Extension Period, so as to give the Company additional time to complete a Business Combination.

Without the Charter Amendment, the Company believes that the Company may not be able to complete a Business Combination on or before the Current Termination Date (or on or before December 18, 2023 if the Existing Extension Option is effectuated in accordance with the Certificate of Incorporation). If that were to occur, the Company would be forced to liquidate.

24