Exhibit 99.2

Sustainable Internet of Things for Commercial Smart Spaces Smart Building, Occupancy & Sustainability Solutions Date: November 2022

© EnOcean 2022 | Sustainable IoT 2 About this Presentation This investor presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to the proposed business combination between Parabellum Acquisitio n Corp . (“ Parabellum ” or “ SPAC ”) and EnOcean GmbH ( together with its subsidiaries, the “ Company ” or “ EnOcean ” ) and for no other purpose . The information contained herein does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of the Company or the Proposed Business Combination, and none of Parabellum, the Company , B . Riley Securities, Inc . (" B . Riley ") or their respective directors, officers, employees, agents, advisors or affiliates makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation, which has not been verified and is subject to change at any time . Viewers of this presentation should each make their own evaluation of the Company, the Proposed Business Combination and of the relevance and accuracy of the information and should make such other investigations as they deem necessary . To the fullest extent permitted by law, no responsibility or liability whatsoever is accepted by Parabellum, the Company , B . Riley, or their respective directors, officers, employees, agents, advisors or affiliates for any loss howsoever arising, directly or indirectly, from any use of this Presentation or such information or opinions contained herein or otherwise arising in connection herewith . This Presentation and any oral statements made in connection with this Presentation do not constitute ( i ) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Proposed Business Combination or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security of Parabellum, the Company, or any of their respective affiliates, nor shall there be any sale, issuance or transfer of securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale would be unlawful . You should not construe the contents of this Presentation as legal, tax, accounting or investment advice or a recommendation . You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision . Any offer to sell securities will be made only pursuant to a definitive subscription agreement (a “ Subscription Agreement ”) and will be made in reliance on an exemption from registration under the Securities Act of 1933 , as amended (the “ Securities Act ”), for offers and sales of securities that do not involve a public offering . Parabellum, the Company and their respective affiliates reserve the right to withdraw or amend for any reason any offering and to reject any Subscription Agreement for any reason . Any public offering of securities shall be made only by means of a prospectus meeting the requirements of the Securities Act . The communication of this Presentation is restricted by law ; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation . The distribution of this Presentation may also be restricted by law and persons into whose possession this Presentation comes should inform themselves about and observe any such restrictions . The recipient acknowledges that it is (a) aware that the United States securities laws prohibit any person who has material, non - public information concerning a company from purchasing or selling securities of such company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and (b) familiar with the Securities Exchange Act of 1934 , as amended, and the rules and regulations promulgated thereunder (collectively, the “Exchange Act”), and that the recipient will neither use, nor cause any third party to use, this Presentation or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10 b - 5 thereunder . Neither the Company nor any recipient of this Presentation will be an investment advisory client of Parabellum ; recipients must consult their own advisors for investment advice, and investment performance of Parabellum presented herein is for illustrative purposes only, to indicate the experience of relevant Parabellum personnel working in the Company’s industry .

3 Forward - Looking Statements This Presentation includes “forward - looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements generally relate to future events or Parabellum’s or the Company’s future financial or operating performance . In some cases, you can identify forward - looking statements by terminology such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “seek,” “target,” “project,” “forecast,” “plan,” “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology or expressions that predict or indicate future events or trends or that are not statements of historical matters . These forward - looking statements include, but are not limited to, statements regarding projections, estimates and forecasts of future revenue and other financial and performance metrics, and projections of market opportunity and market share . These forward - looking statements are ( i ) based on various assumptions, whether or not identified in this Presentation, and on the current expectations of management of the Company, (ii) are not predictions of actual performance, (iii) are provided for illustrative purposes only and (iv) not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability or any representation by any person that the forward - looking statements set forth in this Presentation or the results contemplated thereby will be achieved . Actual events and circumstances are difficult or impossible to predict and will differ from assumptions . Many actual events and circumstances are beyond the control of the Company . These forward - looking statements are subject to a number of risks, uncertainties, and other factors, including, but not limited to, (a) changes in domestic and foreign business, market, financial, political, and legal conditions ; (b) the inability of the parties to successfully or timely consummate the Proposed Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Proposed Business Combination or that the approval of stockholders is not obtained ; (c) failure to realize the anticipated benefits of the Proposed Business Combination ; (d) risks relating to the uncertainty of the projected financial information with respect to the Company ; (e) reductions in discretionary consumer spending, including as a result of global and regional economic downturns ; (f) risks related to the rollout of the Company's business and the timing of expected business milestones, and to relationships with customers, retailers and distributors, and the use of third - party manufacturers ; (g) the effects of competition on the Company’s future business ; (h) disruption of the Company’s relationships with its customers, suppliers, business partners and others resulting from the announcement of the Proposed Business Combination ; ( i ) the amount of redemption requests made by Parabellum’s public stockholders in connection with the Proposed Business Combination ; (j) the ability of Parabellum or the combined company to issue equity or equity - linked securities in connection with the Proposed Business Combination or in the future ; (k) that, if the Proposed Business Combination’s benefits do not meet the expectations of investors or securities analysts, the market price of Parabellum’s securities or, following the consummation of the Proposed Business Combination, the combined company’s securities, may decline ; (l) that the valuation ascribed to the combined company may not be indicative of the price that will prevail in the trading market following the consummation of the Proposed Business Combination ; (m) that, if an active market for the combined company’s securities develops and continues, the trading price of the combined company’s securities following the Proposed Business Combination could be volatile and subject to wide fluctuations in response to various factors, which could contribute to the loss of all or part of your investment ; (n) that the combined company may be required to take write - downs or write - offs, or be subject to restructuring, impairment or other charges that could have a significant negative effect on the combined company’s financial condition, results of operations and the price of its common stock, which could cause you to lose some or all of your investment ; (o) that the combined company will incur significant transaction costs in connection with the Proposed Business Combination ; (p) that legal proceedings in connection with the Proposed Business Combination, the outcomes of which are uncertain, could delay or prevent the completion of the Proposed Business Combination ; (q) that following the consummation of the Proposed Business Combination, the combined company will incur significant increased expenses and administrative burdens as a public company, which could have an adverse effect on its business, financial condition and results of operations ; and (r) that the Proposed Business Combination or the post - combination company may be materially adversely affected by COVID - 19 . If any of these risks, uncertainties or other factors materialize or the Company’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements . There may be additional risks that neither Parabellum nor the Company presently know or that they currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements contained in this Presentation . In addition, forward looking statements in this Presentation speak only as of the date of this Presentation . While Parabellum and the Company may elect to update these forward - looking statements at some point in the future, Parabellum and the Company specifically disclaim any obligation to do so . These forward - looking statements should not be relied upon as representing Parabellum’s and the Company’s assessments as of any date subsequent to the date of this Presentation . Accordingly, undue reliance should not be placed upon these forward - looking statements . Information and opinions expressed in this Presentation were obtained from sources believed to be reliable and in good faith, and no representation or warranty, express or implied, is made as to the accuracy or completeness thereof . This Presentation contains preliminary information only, is subject to change at any time and is not, and should not be assumed to be, complete or constitute all the information necessary to adequately make an informed decision regarding your engagement with the Company or Parabellum . © EnOcean 2022 | Sustainable IoT

4 Industry and Market Data In this Presentation, the Company relies on and refer to certain information and statistics obtained from third - party sources, w hich it believes to be reliable. The Company has not independently verified the accuracy or completeness of any such third - party information. You are cautioned not to give undue weight to such industry and market data. Participants in the Solicitation The Company, Parabellum and certain of their respective directors, executive officers and other members of management and employ ees may, under SEC rules, be deemed to be participants in the solicitation of proxies from Parabellum’s stockholders in connection with the Proposed Business Combination. You can find more information about Parabellum’s directors and executive officers in Parabellum’s final prospectus dated September 27, 2021, and filed with the SEC on September 29, 2021. Additional information regarding the participants in the proxy solicitat ion and a description of their direct and indirect interests will be included in the proxy statement/prospectus when it becomes available. Stockholders, potential investors and other interested persons should read the p roxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents, once available, at the SEC’s website at www.sec.gov. Trademarks Parabellum and the Company own or have proprietary rights to various trademarks, service marks and trade names used in this Presentation that are important to their respective businesses, many of which are registered under applicable intellectual property laws . This Presentation also contains trademarks, trade names and service marks of other companies, which are the property of their respective owners . The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not, imply a relationship with Parabellum or the Company, or an endorsement or sponsorship by or of Parabellum or the Company . Solely for convenience, trademarks, trade names and service marks referred to in this presentation may appear without the ®, Œ or SM symbols, but such references are not intended to indicate, in any way, that the Company or Parabellum or any third party, as applicable, will not assert, to the fullest extent permitted under applicable law, its rights or the right of the applicable licensor to these trademarks, trade names and service marks . Important Information for Investors and Stockholders In connection with the Proposed Business Combination, it is intended that there will be filed with the SEC a registration statement on Form F - 4 , including a joint proxy statement / prospectus (the “ Registration Statement ”), which will include a preliminary proxy statement, and following review by the SEC, a definitive proxy statement to be distributed to the holders of Parabellum’s common stock in connection with Parabellum’s solicitation of proxies for the vote by Parabellum’s stockholders with respect to the Proposed Business Combination and other matters described in the Registration Statement, and a prospectus relating to the offer of the securities to be issued in connection with the Proposed Business Combination . Parabellum’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement / prospectus and the amendments thereto and the proxy statement / prospectus and other documents filed with the SEC in connection with the Proposed Business Combination, as these materials will contain important information about the Company, Parabellum and the Proposed Business Combination . When available, the joint definitive proxy statement / prospectus and other relevant materials for the Proposed Business Combination will be mailed to stockholders of Parabellum as of a record date to be established for voting on the Proposed Business Combination . Stockholders will also be able to obtain copies of the preliminary proxy statement / prospectus, the definitive proxy statement / prospectus and other documents filed with the SEC, without charge, once available, at the SEC’s website at www . sec . gov, or by directing a request to the Company at Kolpingring 18 a, 82041 Oberhaching , Germany or to Parabellum at 3811 Turtle Creek Blvd, Suite 2125 , Dallas, TX 75219 . Investment in any securities described herein has not been approved or disapproved by the SEC or any other regulatory authority nor has any authority passed upon or endorsed the merits of the Proposed Business Combination or the accuracy or adequacy of the information contained herein . Any representation to the contrary is a criminal offense . © EnOcean 2022 | Sustainable IoT

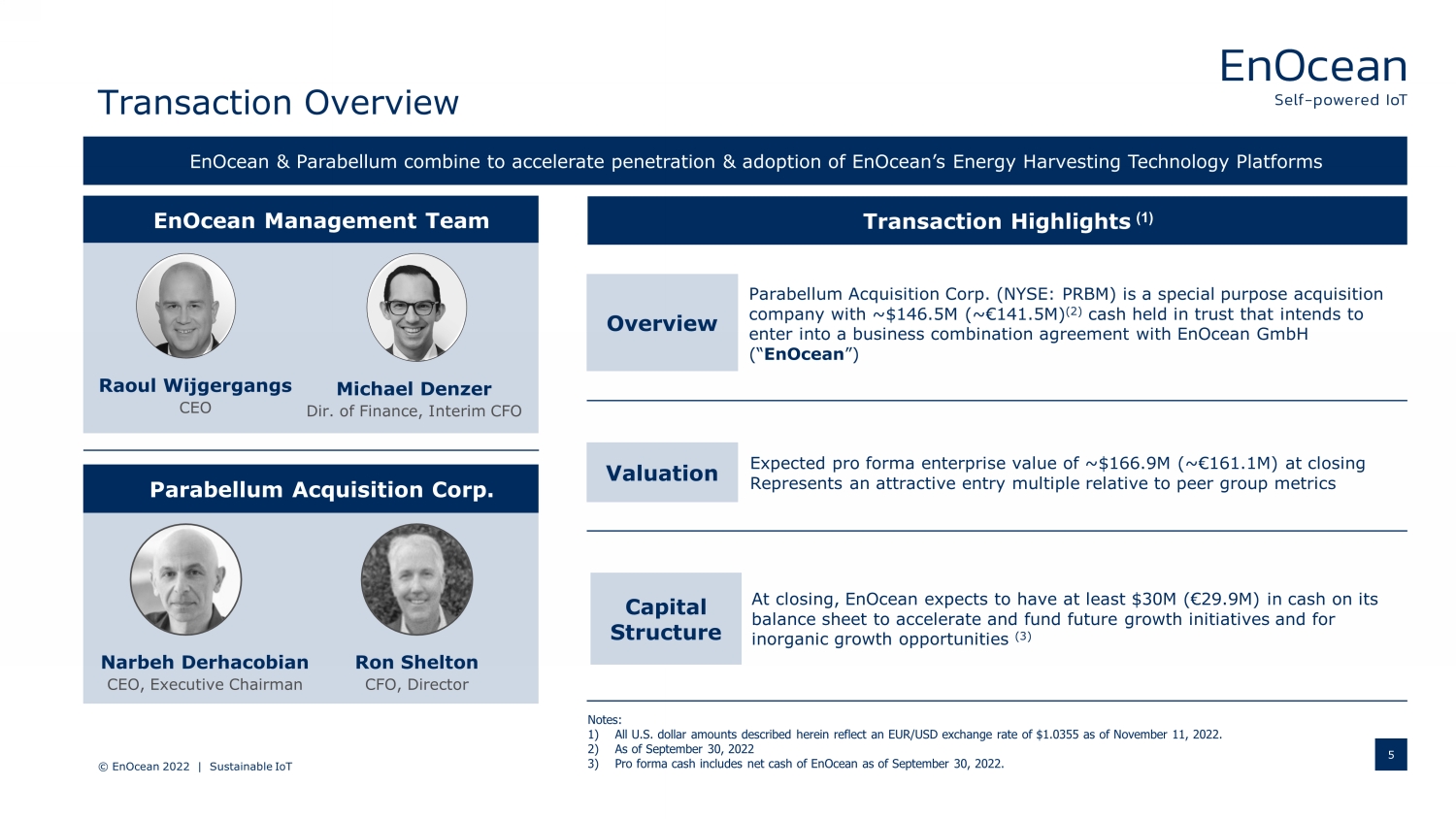

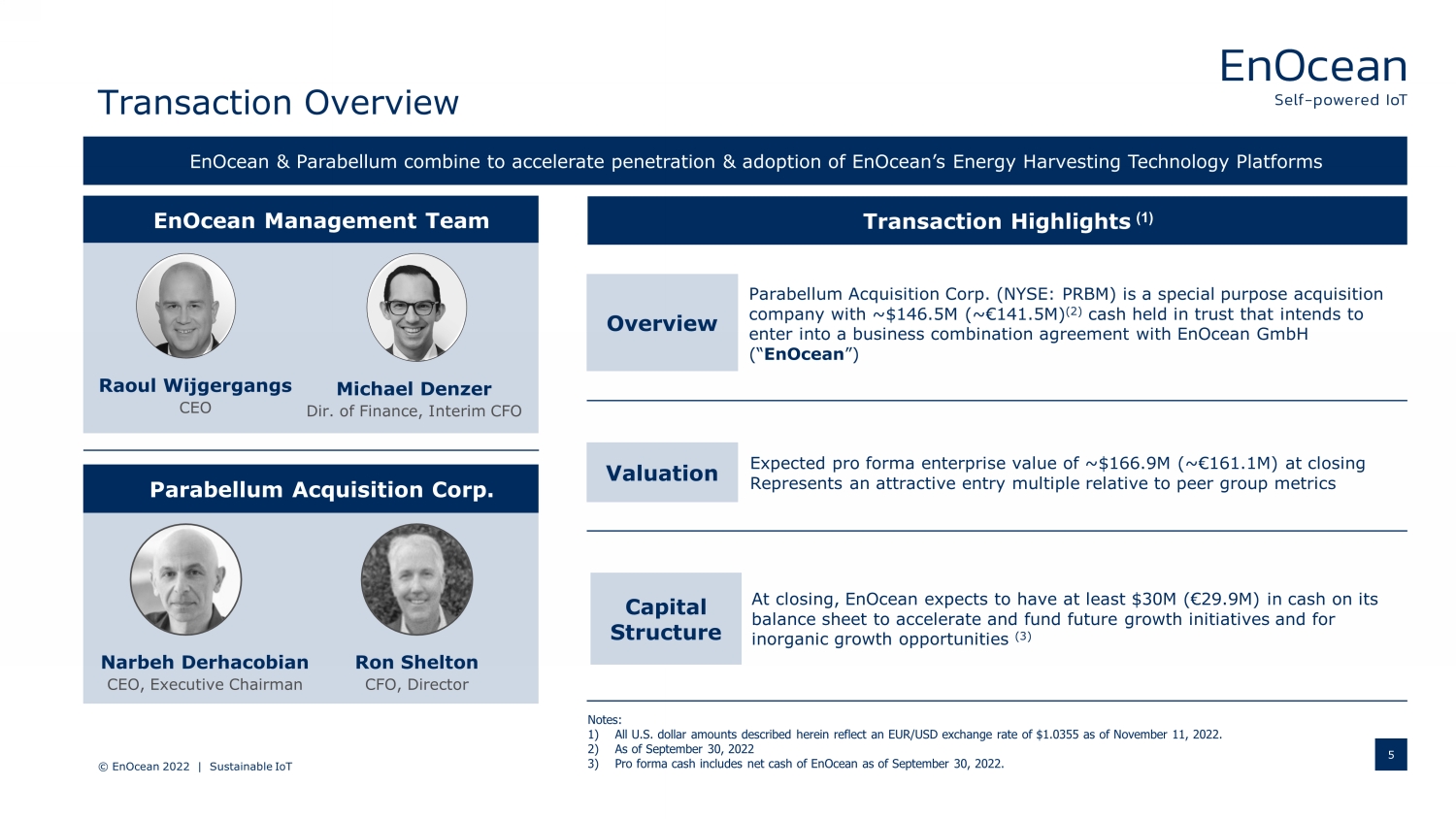

Transaction Overview © EnOcean 2022 | Sustainable IoT 5 Notes: 1) All U.S. dollar amounts described herein reflect an EUR/USD exchange rate of $1.0355 as of November 11, 2022. 2) As of September 30, 2022 3) Pro forma cash includes net cash of EnOcean as of September 30, 2022. EnOcean Management Team Parabellum Acquisition Corp. Narbeh Derhacobian CEO, Executive Chairman Ron Shelton CFO, Director Raoul Wijgergangs CEO Michael Denzer Dir. of Finance, Interim CFO Transaction Highlights (1) Parabellum Acquisition Corp. (NYSE: PRBM) is a special purpose acquisition company with ~$146.5M (~ € 141.5M) (2) cash held in trust that intends to enter into a business combination agreement with EnOcean GmbH (“ EnOcean ”) Overview Expected pro forma enterprise value of ~$166.9M (~ € 161.1M) at closing Represents an attractive entry multiple relative to peer group metrics Valuation At closing, EnOcean expects to have at least $30M (€29.9M) in cash on its balance sheet to accelerate and fund future growth initiatives and for inorganic growth opportunities (3) Capital Structure EnOcean & Parabellum combine to accelerate penetration & adoption of EnOcean’s Energy Harvesting Technology Platforms

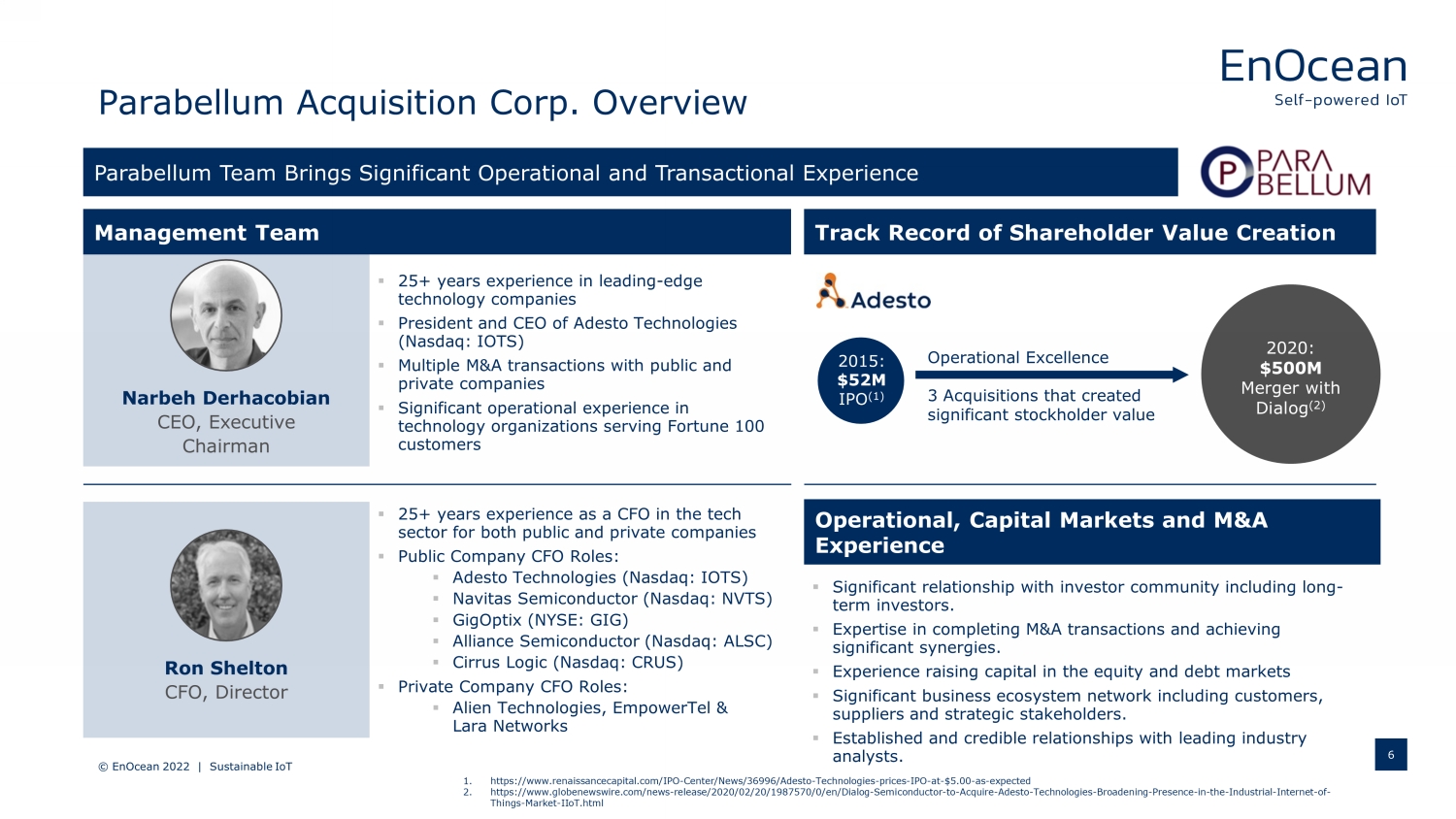

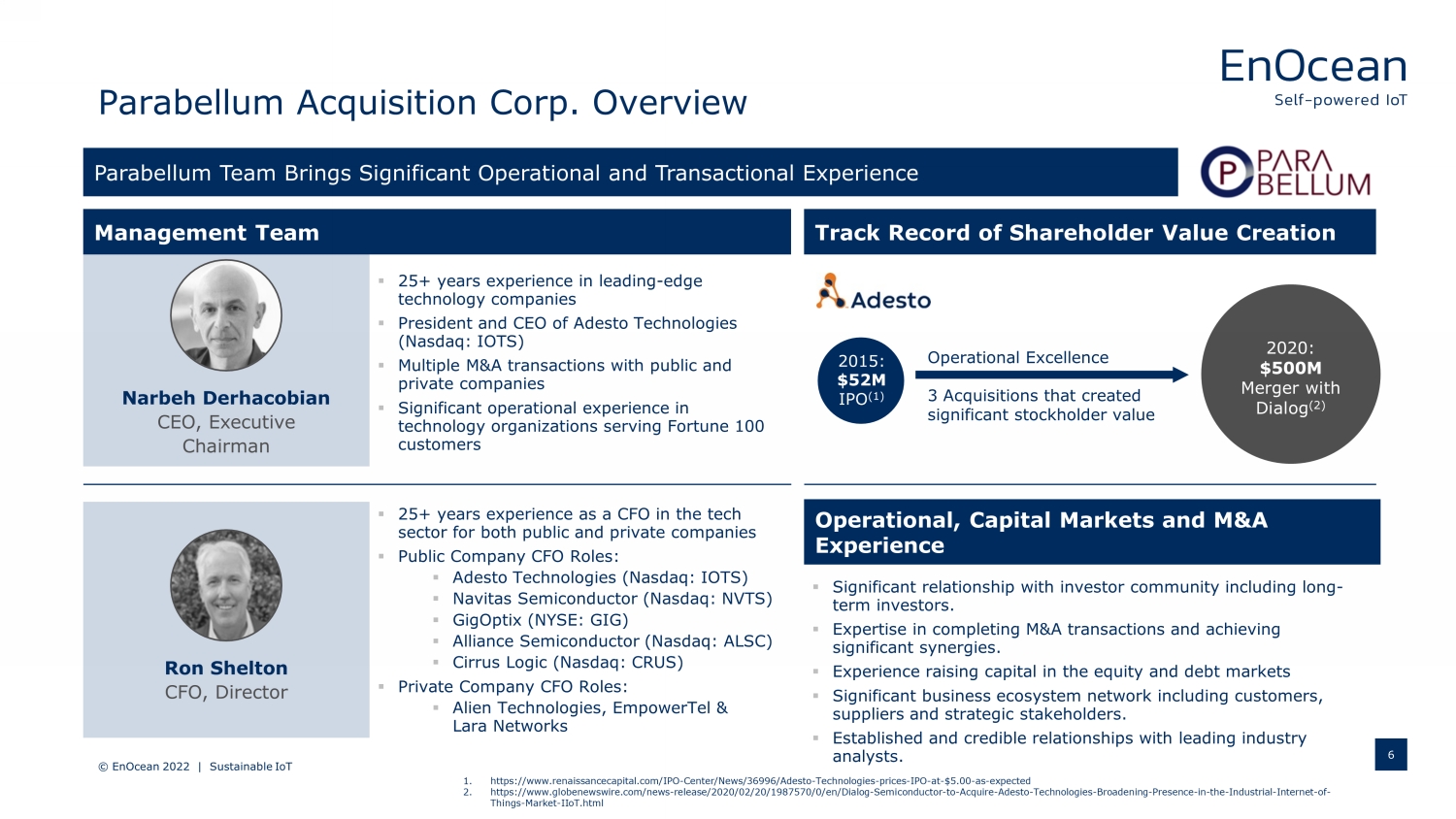

Parabellum Acquisition Corp. Overview © EnOcean 2022 | Sustainable IoT 6 Parabellum Team Brings Significant Operational and Transactional Experience Narbeh Derhacobian CEO, Executive Chairman Ron Shelton CFO, Director ▪ 25+ years experience in leading - edge technology companies ▪ President and CEO of Adesto Technologies (Nasdaq: IOTS) ▪ Multiple M&A transactions with public and private companies ▪ Significant operational experience in technology organizations serving Fortune 100 customers ▪ 25+ years experience as a CFO in the tech sector for both public and private companies ▪ Public Company CFO Roles: ▪ Adesto Technologies (Nasdaq: IOTS) ▪ Navitas Semiconductor (Nasdaq: NVTS) ▪ GigOptix (NYSE: GIG) ▪ Alliance Semiconductor (Nasdaq: ALSC ) ▪ Cirrus Logic (Nasdaq: CRUS) ▪ Private Company CFO Roles: ▪ Alien Technologies, EmpowerTel & Lara Networks Management Team Track Record of Shareholder Value Creation Operational Excellence 3 Acquisitions that created significant stockholder value 2015: $52M IPO (1) 2020: $500M Merger with Dialog (2) Operational, Capital Markets and M&A Experience ▪ Significant relationship with investor community including long - term investors. ▪ Expertise in completing M&A transactions and achieving significant synergies. ▪ Experience raising capital in the equity and debt markets ▪ Significant business ecosystem network including customers, suppliers and strategic stakeholders. ▪ Established and credible relationships with leading industry analysts. 1. https:// www.renaissancecapital.com /IPO - Center /News/36996/ Adesto - Technologies - prices - IPO - at - $5.00 - as - expected 2. https:// www.globenewswire.com /news - release/2020/02/20/1987570/0/ en /Dialog - Semiconductor - to - Acquire - Adesto - Technologies - Broadening - Presence - in - the - Industrial - Internet - of - Things - Market - IIoT.html

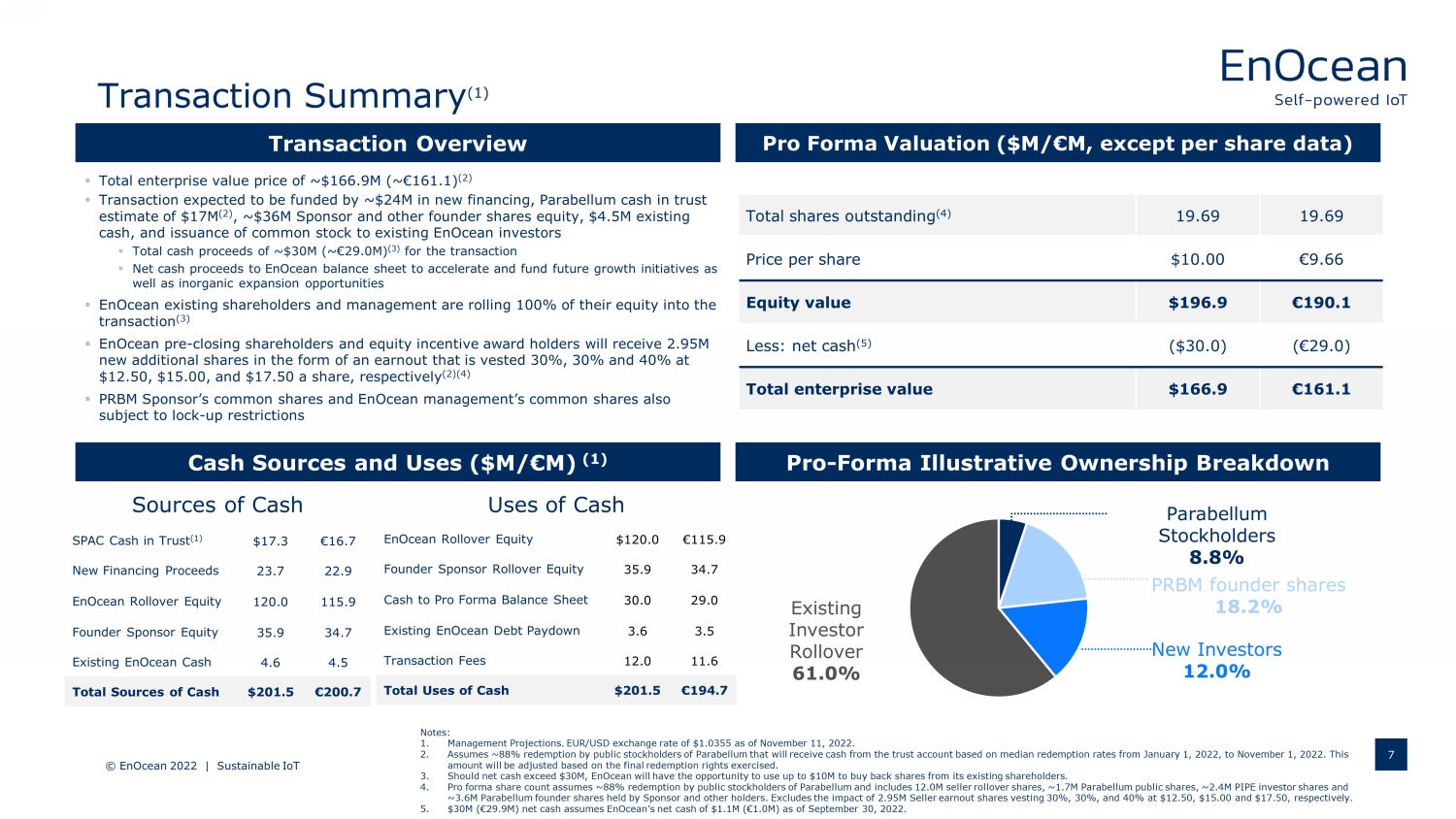

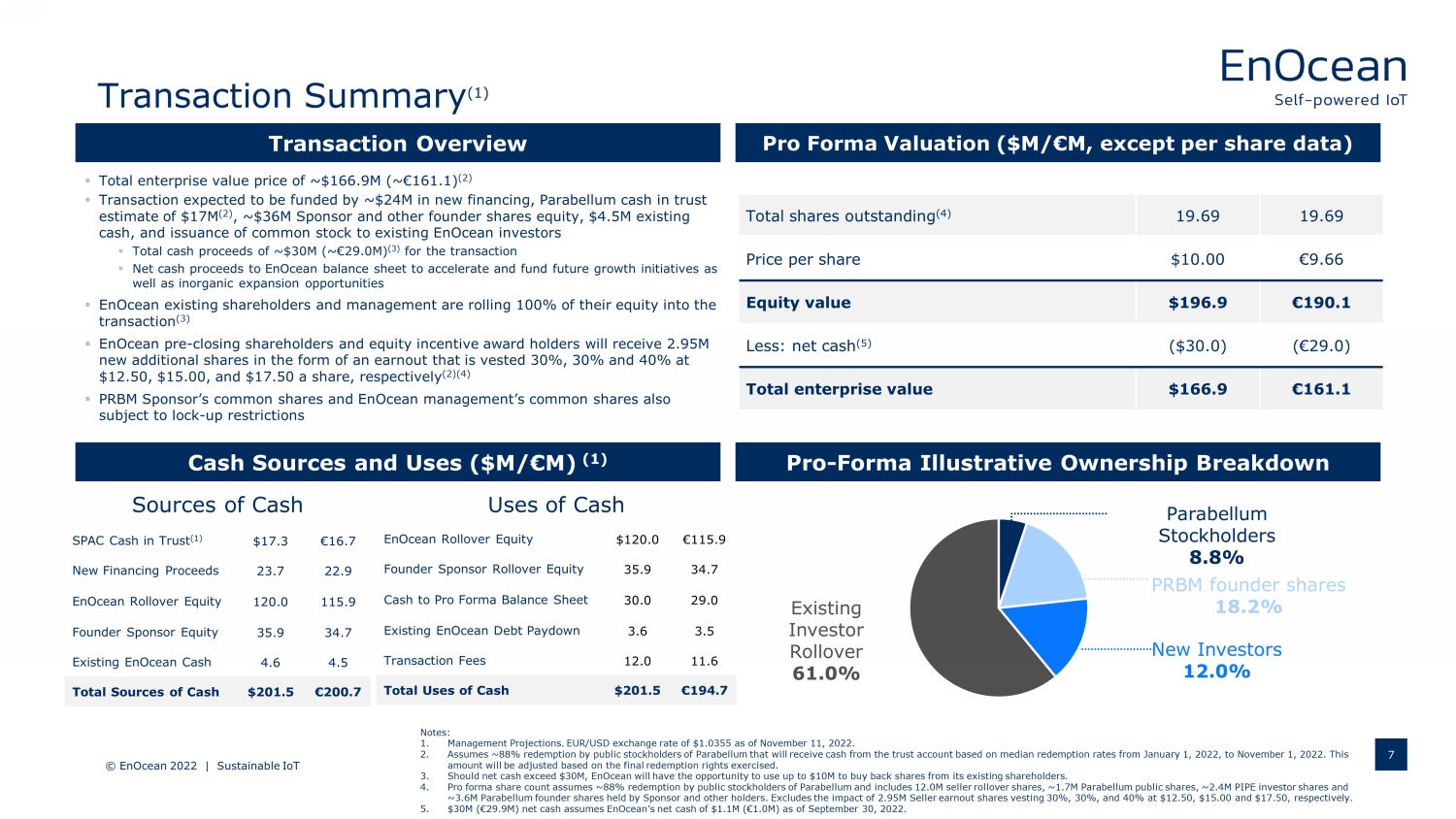

Transaction Overview Pro Forma Valuation ($M/€M, except per share data) Pro - Forma Illustrative Ownership Breakdown Cash Sources and Uses ($M/€M) (1) ▪ Total enterprise value price of ~$166.9M (~€161.1) (2) ▪ Transaction expected to be funded by ~$24M in new financing, Parabellum cash in trust estimate of $17M (2) , ~$36M Sponsor and other founder shares equity, $4.5M existing cash, and issuance of common stock to existing EnOcean investors ▪ Total cash proceeds of ~$30M (~€29.0M) (3) for the transaction ▪ Net cash proceeds to EnOcean balance sheet to accelerate and fund future growth initiatives as well as inorganic expansion opportunities ▪ EnOcean existing shareholders and management are rolling 100% of their equity into the transaction (3) ▪ EnOcean pre - closing shareholders and equity incentive award holders will receive 2.95M new additional shares in the form of an earnout that is vested 30%, 30% and 40% at $12.50, $15.00, and $17.50 a share, respectively (2)(4) ▪ PRBM Sponsor’s common shares and EnOcean management’s common shares also subject to lock - up restrictions Total shares outstanding (4) 19.69 19.69 Price per share $10.00 €9.66 Equity value $196.9 € 190.1 Less: net cash (5) ($30.0) ( €29.0) Total enterprise value $166.9 €161.1 SPAC Cash in Trust (1) $17.3 €16.7 New Financing Proceeds 23.7 22.9 EnOcean Rollover Equity 120.0 115.9 Founder Sponsor Equity 35.9 34.7 Existing EnOcean Cash 4.6 4.5 Total Sources of Cash $201.5 €200.7 Sources of Cash Uses of Cash EnOcean Rollover Equity $120.0 €115.9 Founder Sponsor Rollover Equity 35.9 34.7 Cash to Pro Forma Balance Sheet 30.0 29.0 Existing EnOcean Debt Paydown 3.6 3.5 Transaction Fees 12.0 11.6 Total Uses of Cash $201.5 €194.7 Notes: 1. Management Projections. EUR/USD exchange rate of $1.0355 as of November 11, 2022. 2. Assumes ~88% redemption by public stockholders of Parabellum that will receive cash from the trust account based on median redemption rates from January 1, 2022, to November 1, 2022. This amount will be adjusted based on the final redemption rights exercised. 3. Should net cash exceed $30M, EnOcean will have the opportunity to use up to $10M to buy back shares from its existing shareholders. 4. Pro forma share count assumes ~88% redemption by public stockholders of Parabellum and includes 12.0M seller rollover shares, ~1.7M Parabellum public shares, ~2.4M PIPE investor shares and ~ 3.6M Parabellum founder shares held by Sponsor and other holders. Excludes the impact of 2.95M Seller earnout shares vesting 30% , 30%, and 40% at $12.50, $15.00 and $17.50, respectively. 5. $30M ( €29.9M) net cash assumes EnOcean’s net cash of $1.1M ( €1.0M) as of September 30, 2022. Transaction Summary ( 1 ) © EnOcean 2022 | Sustainable IoT 7 Existing Investor Rollover 61.0% Parabellum Stockholders 8.8% PRBM founder shares 18.2% New Investors 12.0%

Investment highlights © EnOcean 2022 | Sustainable IoT 8 Proven Technology Leader in Energy Harvesting Customers value proposition focused on Efficiency and Sustainability Adopted by 350+ Manufacturing Partners and Deployed in 1M+ Buildings (1) 1 2 3 Positive Adjusted EBITDA beginning in mid - 2023 through increasing SaaS and expanded hardware revenues 4 Focus on highly scalable Enterprise Sales 5 Experienced Leadership Team 6 (1) Based on EnOcean’s historical shipments, customers and deployment profiles. https://www.enocean - alliance.org/about - us/membership/our - members/

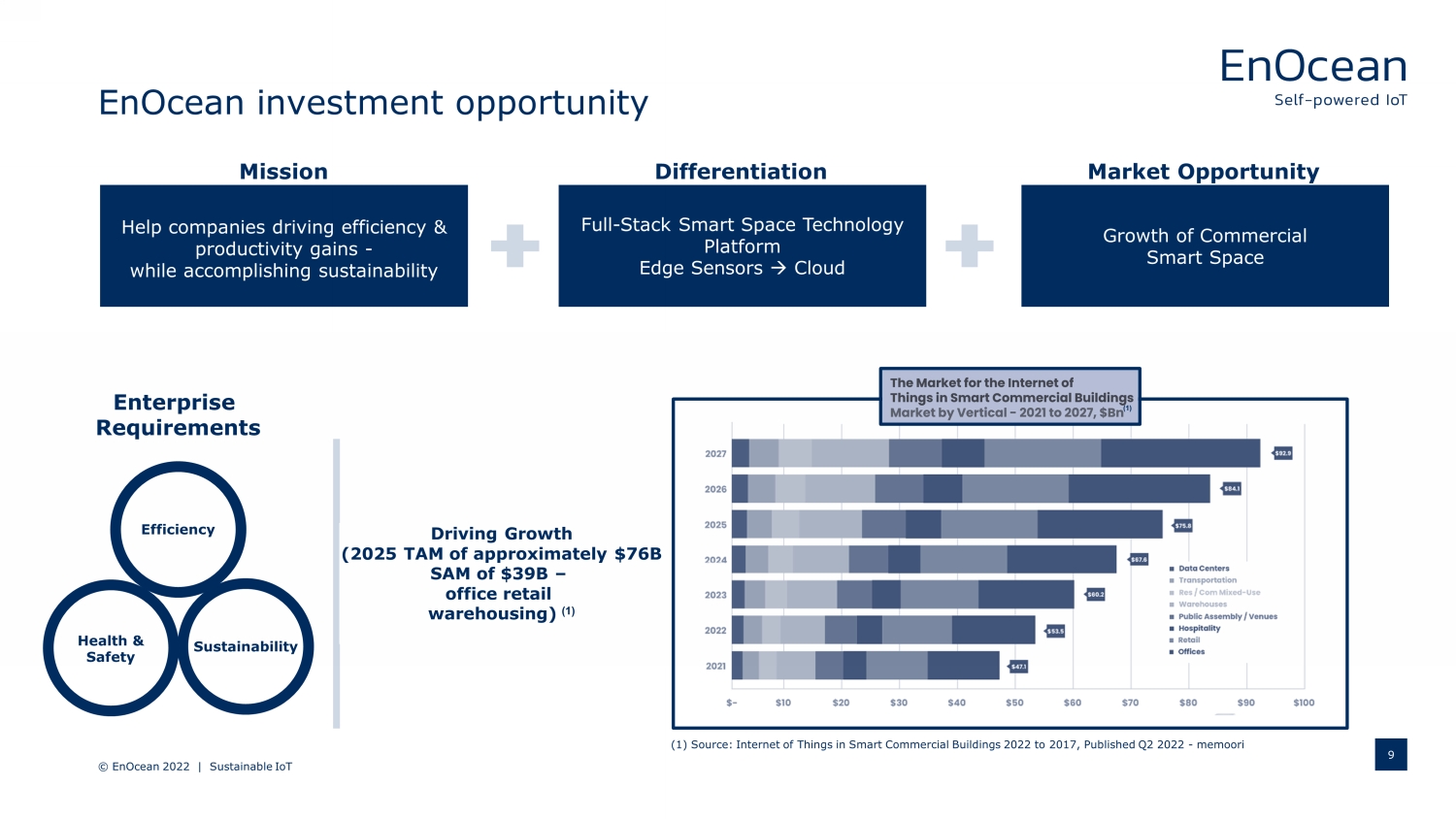

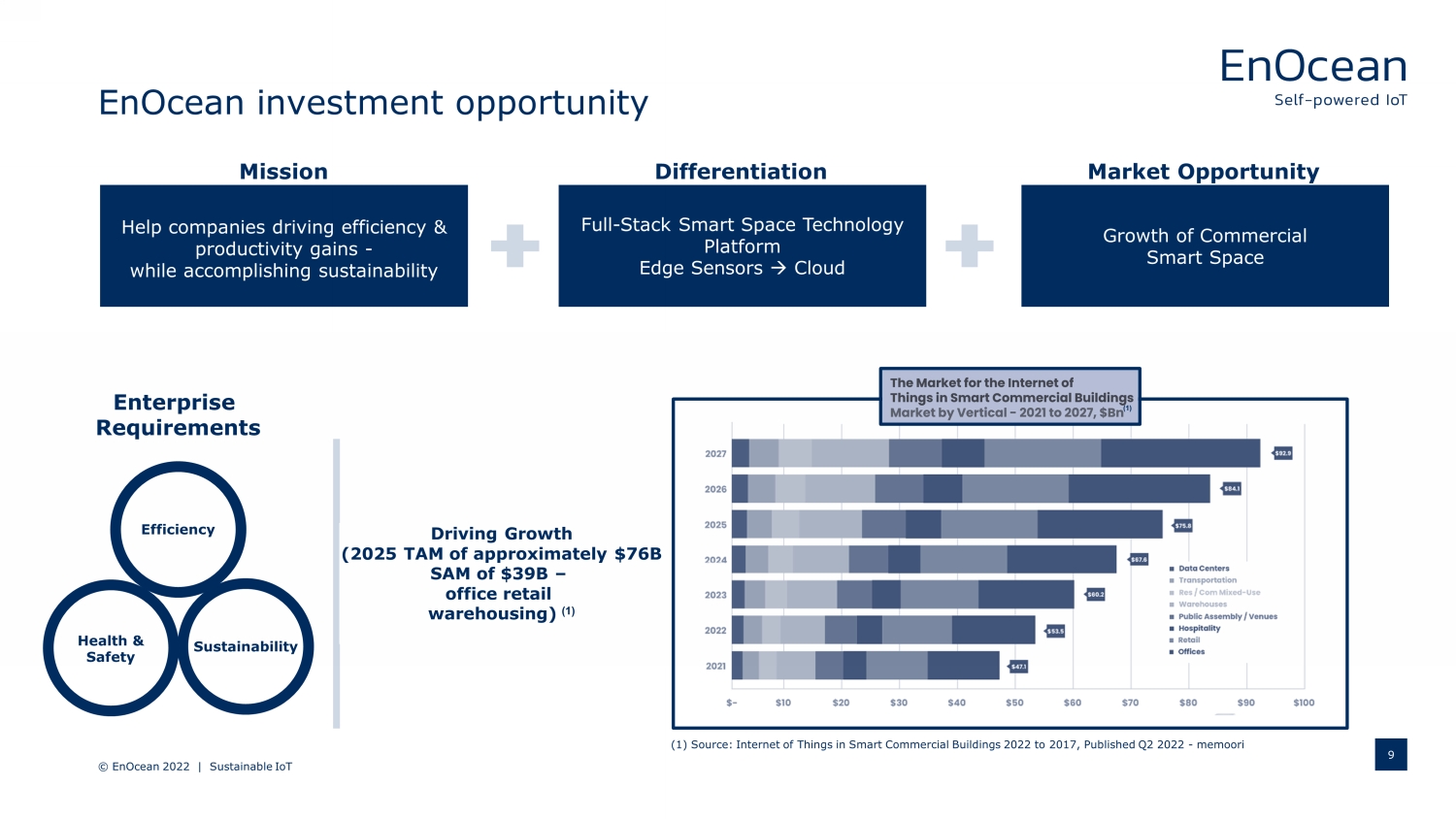

EnOcean investment opportunity © EnOcean 2022 | Sustainable IoT 9 Differentiation Mission Help companies driving efficiency & productivity gains - while accomplishing sustainability Full - Stack Smart Space Technology Platform Edge Sensors Cloud (1) Source: Internet of Things in Smart Commercial Buildings 2022 to 2017, Published Q2 2022 - memoori Sustainability Efficiency Health & Safety Market Opportunity Growth of Commercial Smart Space Enterprise Requirements Driving Growth (2025 TAM of approximately $76B SAM of $39B – office retail warehousing) (1) (1)

EnOcean : Leader in self - powered IoT solutions © EnOcean 2022 | Sustainable IoT Source: Company information. 10 Strong Performance, High Barriers to Competition Significant Market Opportunity and Existing Tier 1 Customers and Partners Strong Strategic and Financial Investors Order Backlog NTM: €13M+ 3 - Yr Rev. CAGR (1) : ~27% Customers (2)(3) >245 Significant IP Portfolio (3) +40 patents issued Notes: EUR/USD exchange rate of $1.0355 as of November 11, 2022. All amounts listed are inclusive of contributions from edge computi ng solutions business acquired from Renesas Electronics Corporation. 1. Fiscal year is October 1 to September 30 . 2. Shipping in volume. Customers describe end - users of products obtained through sales distribution channel 3. As of September 30, 2022 4. TAM is for 2025; Number is approximation only. Source: Internet of Things in Smart Commercial Buildings 2022 to 2017, Published Q2 2022 - memoori 5. Number is approximation only, S ub - segment: Building Infrastructure (Source: Internet of Things in Smart Commercial Buildings 2022 to 2017, Published Q2 2022 – memoori ) TAM $76B (4) | 13% CAGR 21 - 25 (5) Sales Pipeline Opportunities >230 customers 2021 Launched IoT software for Aruba 2016 Entering BLE market 2012 Launch of electrodynamic harvester (PTM) 2014 Entering ZigBee market 2022 Acquisition of edge computing solutions business from Renesas Building Automation Smart Spaces Devices Installed (3) >20M

Value of Smart Spaces (1) Significant savings for an exemplary company with 100k employees - while doing the right thing Desk sharing savings $270M/ Yr Compelling application because of monetary & environmental benefits - space & resource savings. Productive office savings $13M/ Yr Air quality monitoring reduces employee sick leave and enables pandemic compliance as applicable . (2) Increased employee efficiency further improves ROI. Energy reduction $2.6M/ Yr 40% of global CO2 emissions are caused by buildings. IoT - based HVAC solutions can beneficially assist with energy saving by providing reasonable ROI compared to replacing the building envelope. Economic Benefit © EnOcean 2022 | Sustainable IoT 11 (1) Management projections. Assumes a company with 100,000 employees and 30% of employees not going to the office. (2) Pandemic compliance requirements vary by jurisdiction.

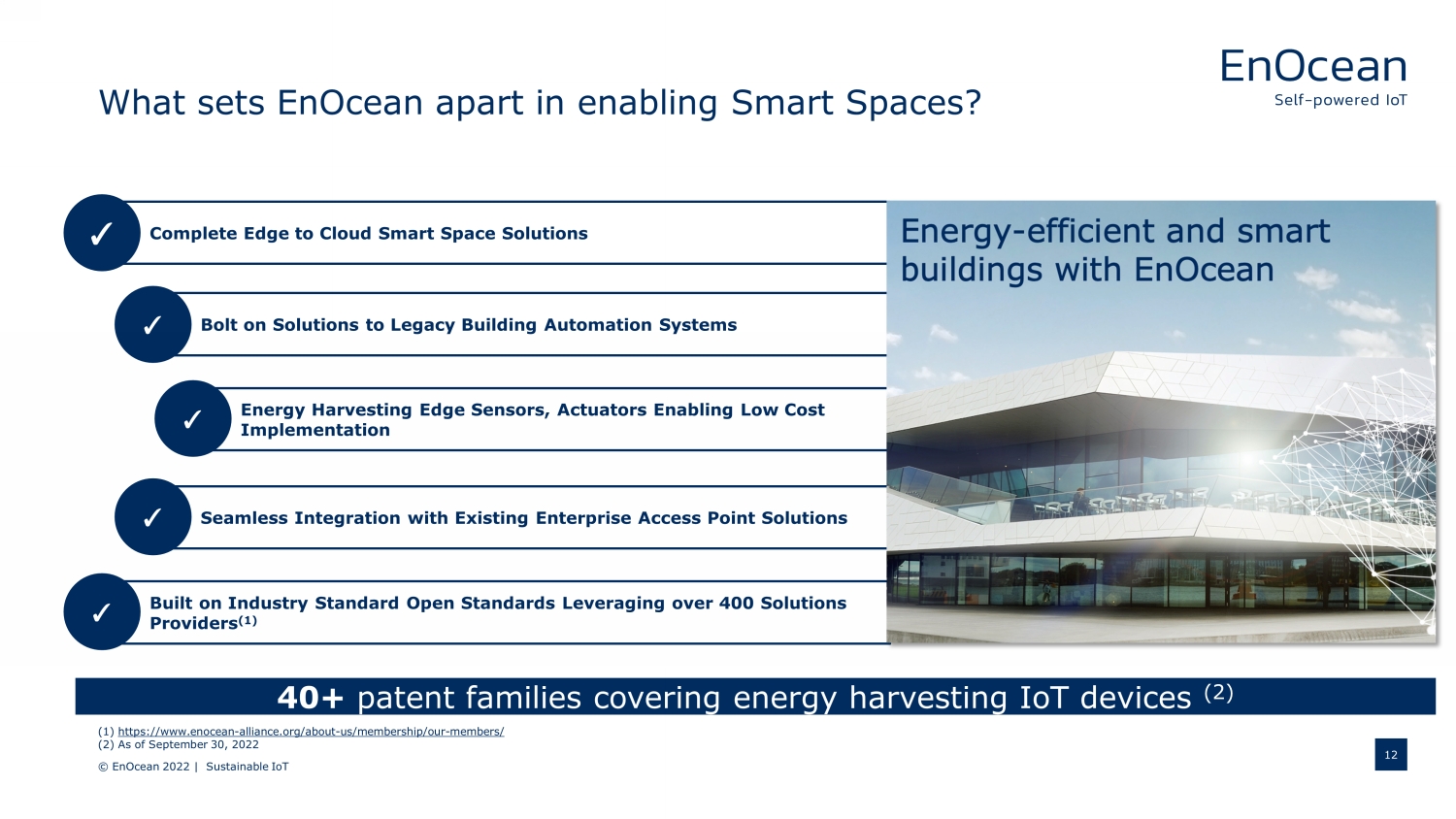

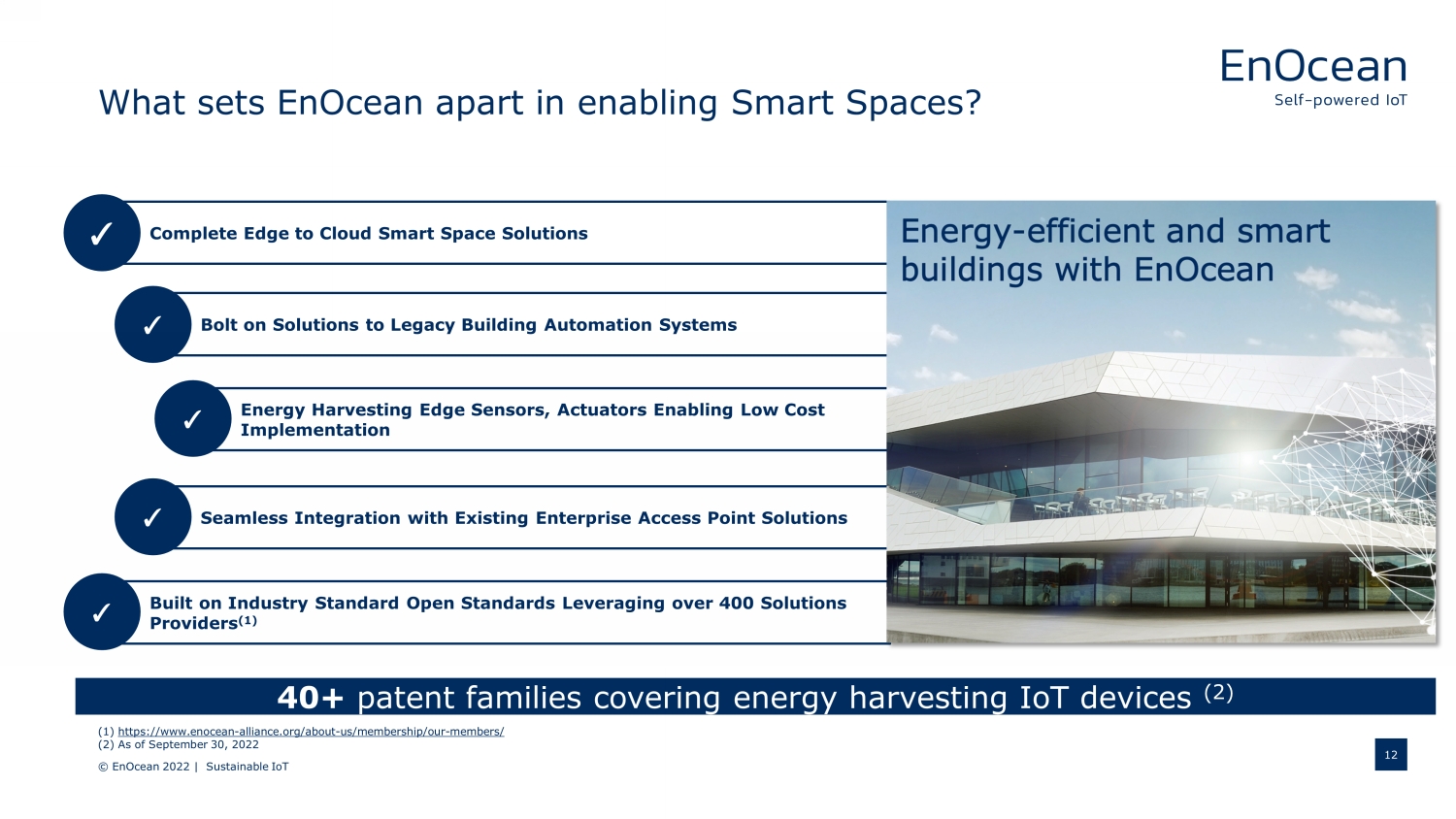

What sets EnOcean apart in enabling Smart Spaces ? © EnOcean 2022 | Sustainable IoT 12 Complete Edge to Cloud Smart Space Solutions Bolt on Solutions to Legacy Building Automation Systems Energy Harvesting Edge Sensors, Actuators Enabling Low Cost Implementation ✓ ✓ ✓ Seamless Integration with Existing Enterprise Access Point Solutions ✓ Built on Industry Standard Open Standards Leveraging over 400 Solutions Providers (1) ✓ 40+ patent families covering energy harvesting IoT devices (2) (1) https://www.enocean - alliance.org/about - us/membership/our - members/ (2) As of September 30, 2022

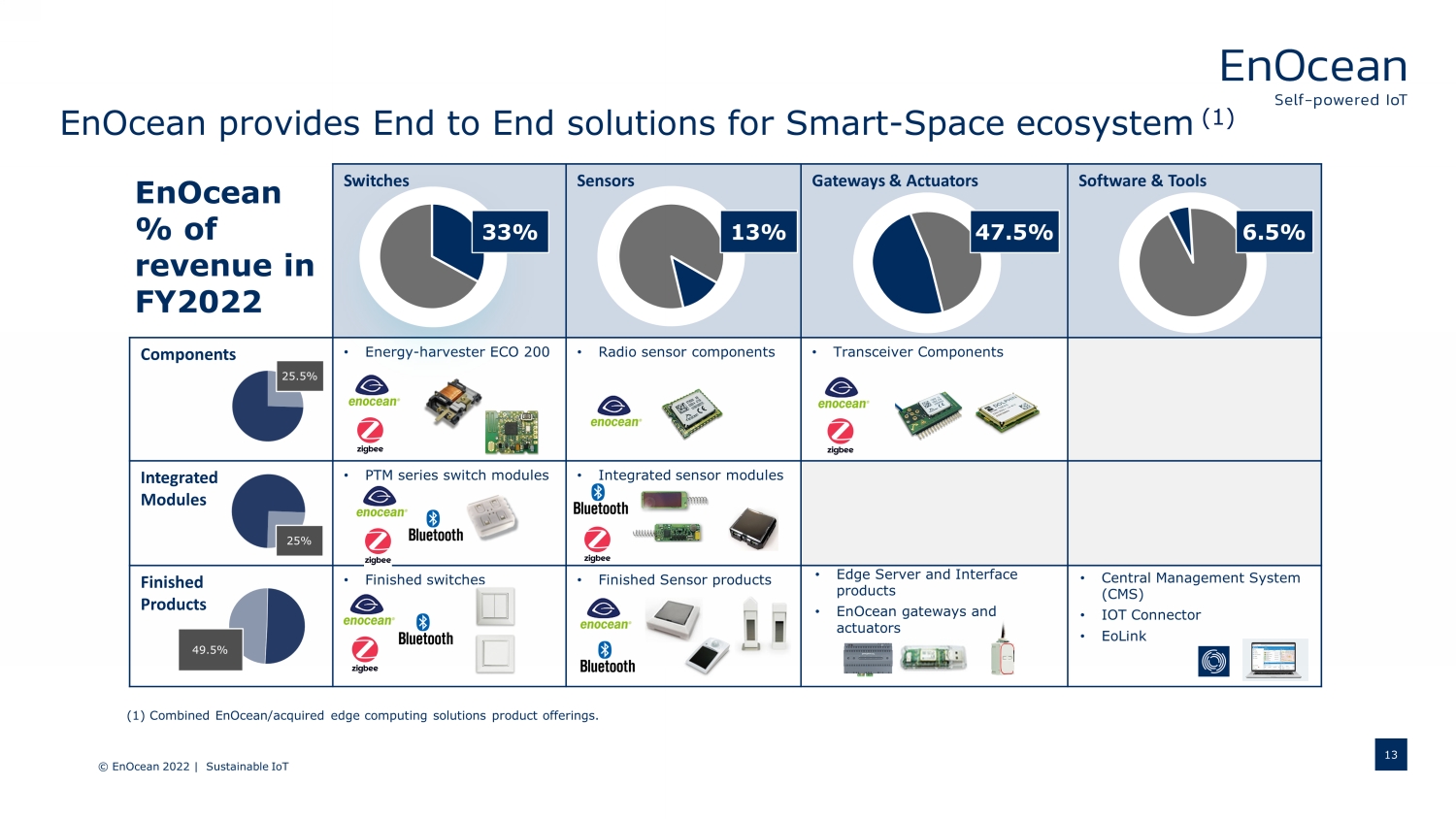

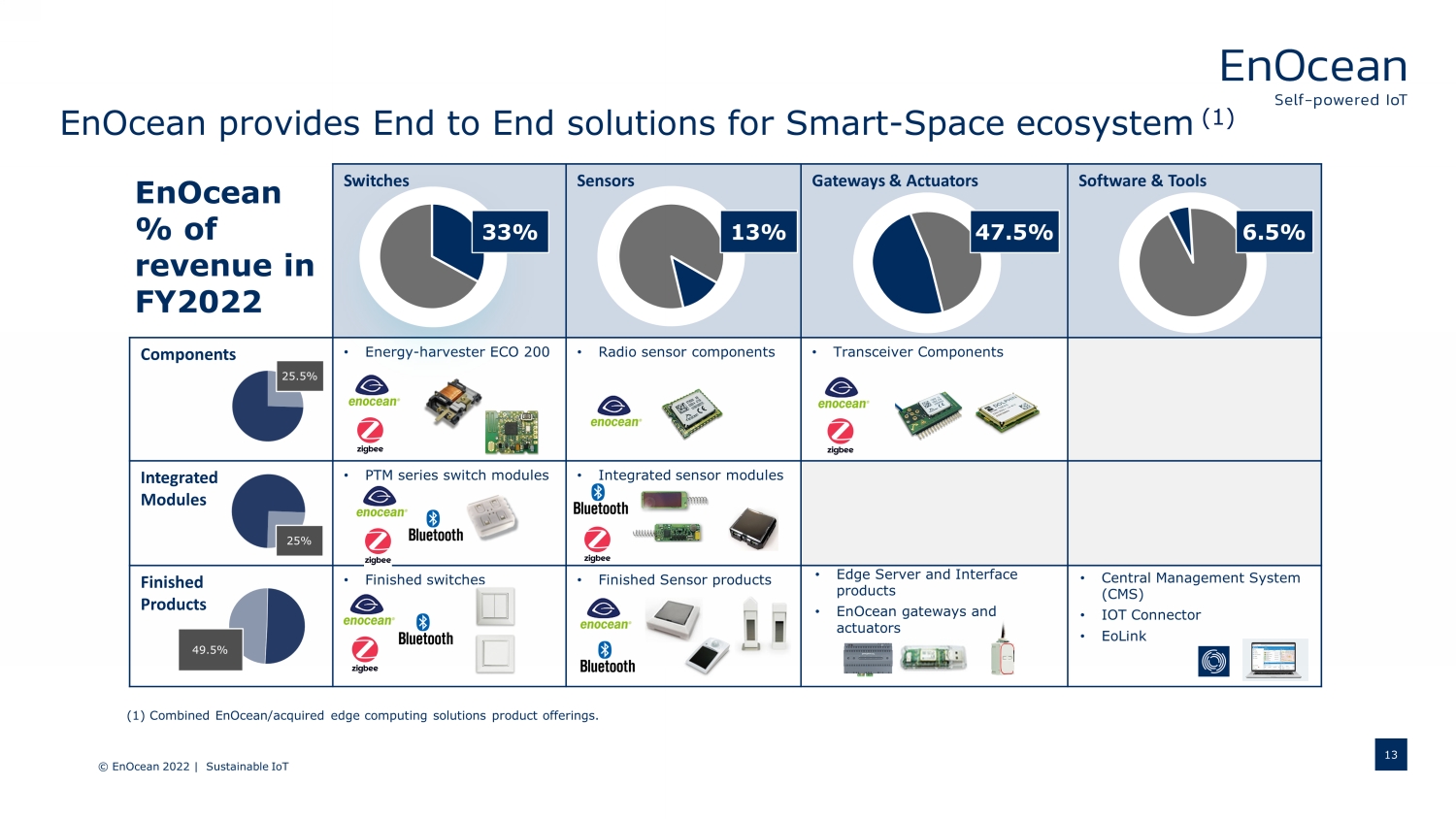

EnOcean provides End to End solutions for Smart - Space ecosystem (1) © EnOcean 2022 | Sustainable IoT 13 Switches Sensors Gateways & Actuators Software & Tools Components • Energy - harvester ECO 200 • Radio sensor components • Transceiver Components Integrated Modules • PTM series switch modules • Integrated sensor modules Finished Products • Finished switches • Finished Sensor products EnOcean % of revenue in FY2022 38% 25% 25.5% • Edge Server and Interface products • EnOcean gateways and actuators • Central Management System (CMS) • IOT Connector • EoLink 49.5% 13% 47.5% 6.5% 33% (1) Combined EnOcean /acquired edge computing solutions product offerings.

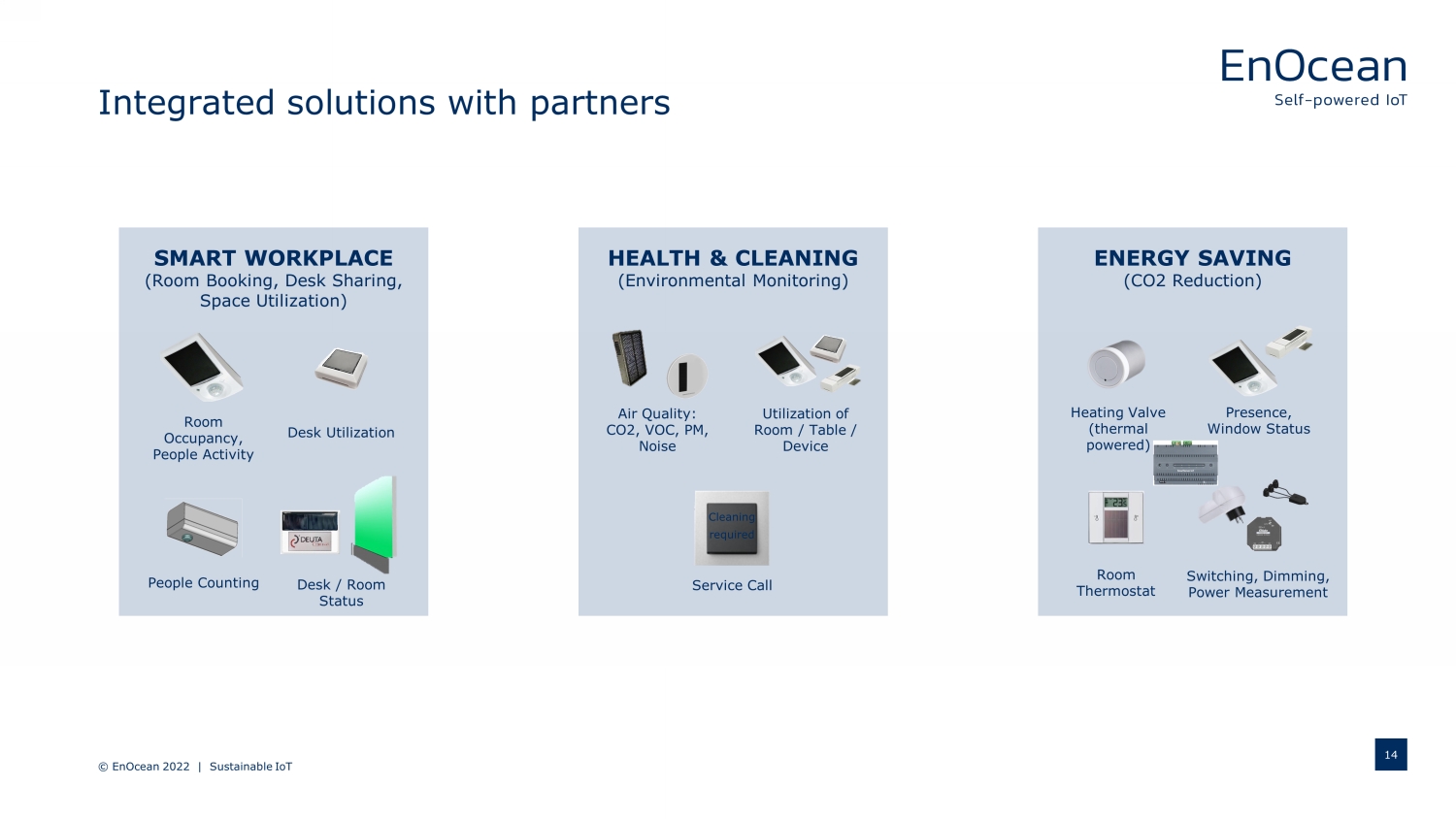

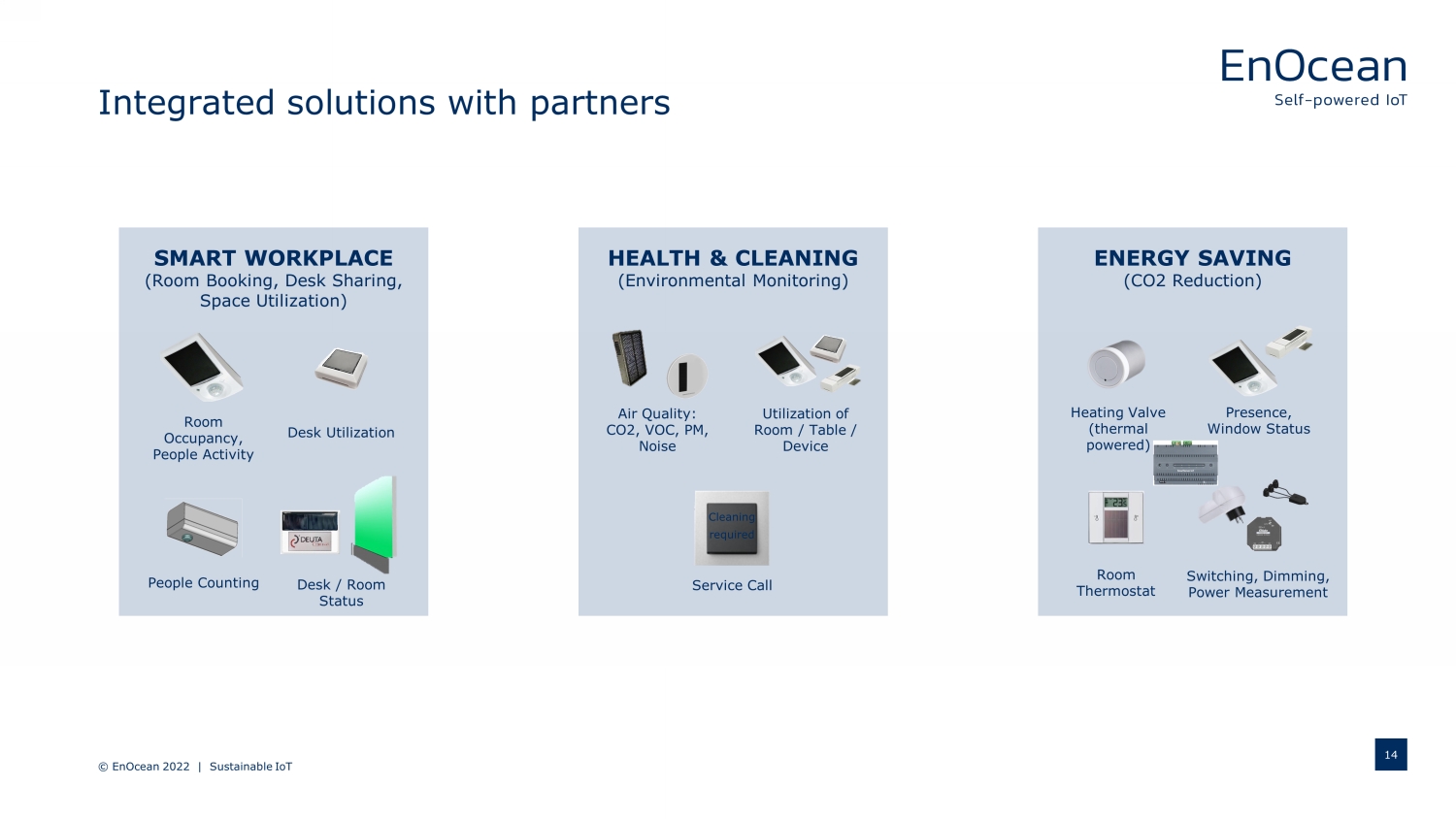

Integrated solutions with partners © EnOcean 2022 | Sustainable IoT SMART WORKPLACE (Room Booking, Desk Sharing, Space Utilization) Room Occupancy, People Activity Desk Utilization People Counting Desk / Room Status HEALTH & CLEANING (Environmental Monitoring) Air Quality: CO2, VOC, PM, Noise Utilization of Room / Table / Device Cleaning required Service Call ENERGY SAVING (CO2 Reduction) Heating Valve (thermal powered) Presence, Window Status Room Thermostat Switching, Dimming, Power Measurement 14

15 • Employees can use the mobile app to find and book available spaces • Cost savings on the required real estate • Reductions in energy bills • Enables compliance with COVID - 19 regulations (1) Approach Benefits Commercial traction • EnOcean occupancy, temperature and air quality sensors • Sensor data is transmitted through Deuta’s gateways • Data is managed analysed through an App by Thing - IT • 8000 sensors deployed for > 2 years Case Study: German Sportswear Manufacturer (1) Pandemic compliance requirements vary by jurisdiction. © EnOcean 2022 | Sustainable IoT

© EnOcean 2022 | Sustainable IoT 16 • EnOcean occupancy, temperature and air quality sensors • Sensor data is transmitted via Microsoft Azure, creating a digital twin • Data is correlated with capacity utilization and energy consumption • Better office experience for employees • A flexible planning tool for facility managers • T - Systems has a team focused on the Smart Space solutions • ~200k EnOcean devices expected (1) Approach Benefits Commercial traction (1) Number of employees at Deutsche Telecom as of December 31, 2021. https://report.telekom.com/annual - report - 2021/management - re port/group - organization/business - activities.html#:~:text=We%20have%20an%20international%20focus,in%20the%202021%20financial%20year. Source: https://perpetuum.enocean.com/not - rated/t - systems - the - new - work - megatrend - for - a - good - work - life - balance/?lang=en Heat maps use infrared sensors to display current occupancy status.

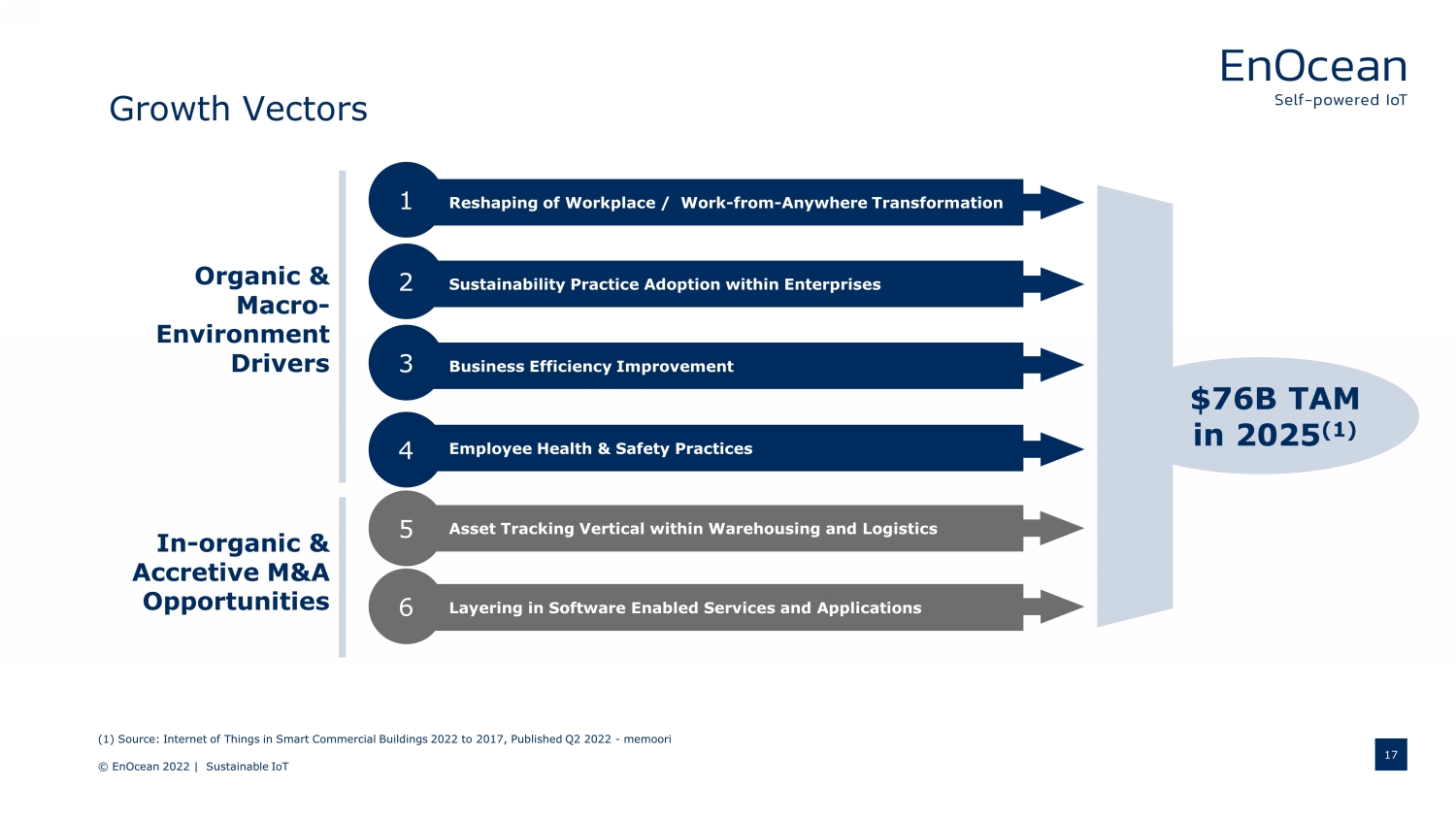

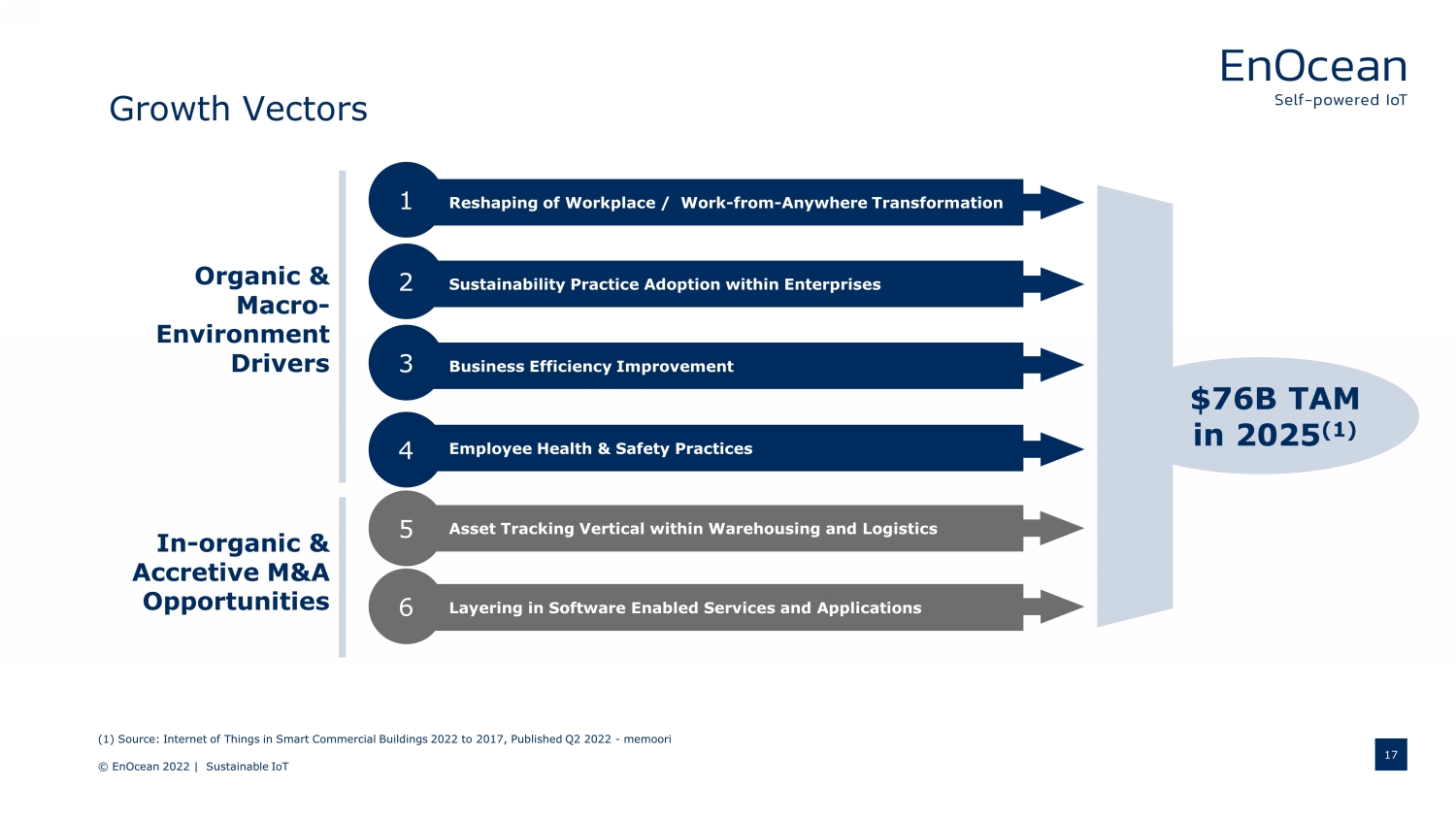

© EnOcean 2022 | Sustainable IoT 17 Growth Vectors Reshaping of Workplace / Work - from - Anywhere Transformation Sustainability Practice Adoption within Enterprises Business Efficiency Improvement 1 2 3 Employee Health & Safety Practices 4 Asset Tracking Vertical within Warehousing and Logistics Layering in Software Enabled Services and Applications 5 6 Organic & Macro - Environment Drivers In - organic & Accretive M&A Opportunities $76B TAM in 2025 (1) (1) Source: Internet of Things in Smart Commercial Buildings 2022 to 2017, Published Q2 2022 - memoori

Leadership team – 200+ years of technology leadership positions 18 RAOUL WIJGERGANGS CEO GRAHAM MARTIN ENOCEAN ALLIANCE MATTHIAS KASSNER VP PRODUCT OLIVER SCZESNY VP CUSTOMER SUCCESS MARKUS FLORIAN CCO FRANK SCHMIDT VP INNOVATION MICHAEL DENZER DIR. FINANCE & INTERIM CFO © EnOcean 2022 | Sustainable IoT EDIN GOLUBOVIC VP R&D BRIAN SHEEHY VP OPERATIONS

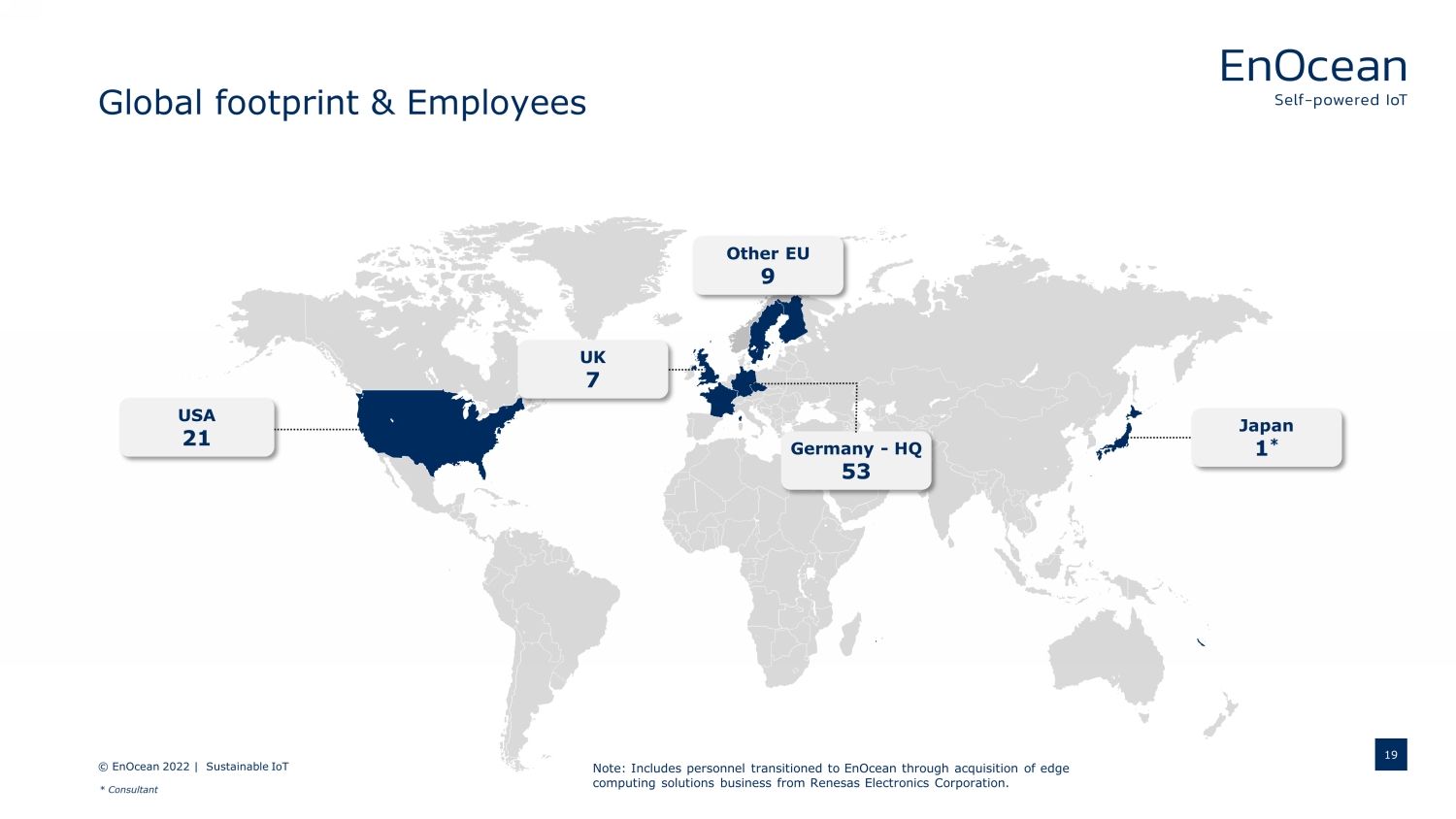

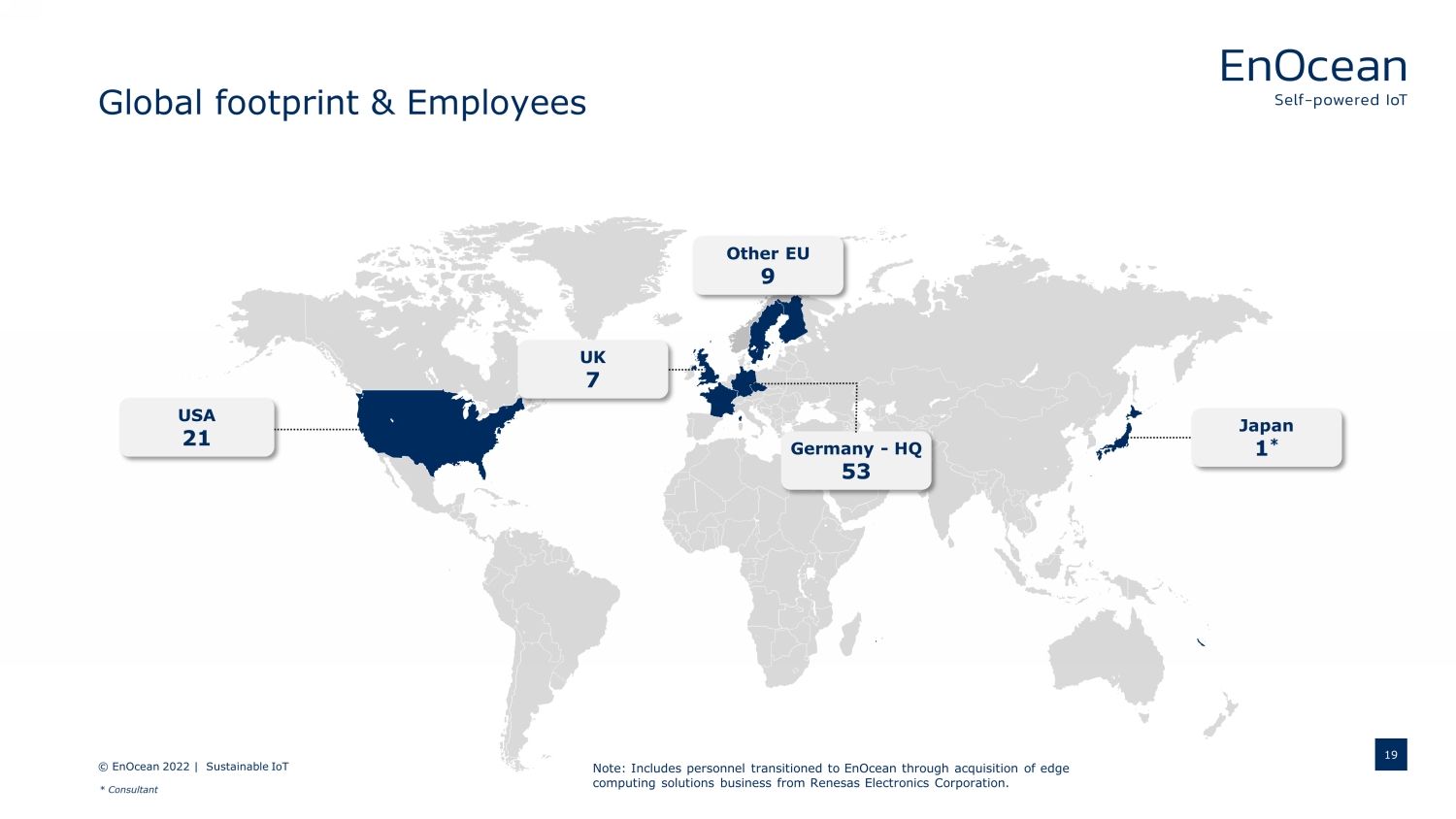

Global footprint & Employees © EnOcean 2022 | Sustainable IoT 19 USA 21 Germany - HQ 53 Other EU 9 UK 7 Japan 1 * * Consultant Note: Includes personnel transitioned to EnOcean through acquisition of edge computing solutions business from Renesas Electronics Corporation.

Investment highlights © EnOcean 2022 | Sustainable IoT 20 Proven Technology Leader in Energy Harvesting Customers value proposition focused on Efficiency and Sustainability Adopted by 350+ Manufacturing Partners and Deployed in 1M+ Buildings (1) 1 2 3 Positive Adjusted EBITDA beginning in mid - 2023 through increasing SaaS and expanded hardware revenues 4 Focus on highly scalable Enterprise Sales 5 Experienced Leadership Team 6 (1) Based on EnOcean’s historical shipments, customers and deployment profiles. https://www.enocean - alliance.org/about - us/membership/our - members/ SJ0

Thank you for your attention. © EnOcean 2022 | Sustainable IoT Would you like to learn more? Simply contact us. 21 www.enocean.com www.easyfit - solutions.com info@enocean.com EnOcean GmbH Kolpingring 18a 82041 Oberhaching Germany

Appendix: Data Sources © EnOcean 2022 | Sustainable IoT 22 “ EnOcean is the world leader in energy harvesting wireless technologies .” : mikroe.com , 22 Oct 2015 “ a world leader in energy harvesting wireless technology” : Ken Sinclair, automatedbuildings.com , Dec 2018 “a pioneer in energy harvesting“: Neil Tyler, newelectronics.co.uk , 1 Jun 2020 “Marktführer im Bereich energieautarker Funksysteme ” : Thomas Kuther, elektronikpraxis.vogel.de , 30 Oct 2009 “der weltweit führende Entwickler batterieloser Funktechnologie“: BUS Systeme, 2019 “Pionier der batterielosen Funktechnologie ” : K. Jungk, elektropraktiker.de , 27 Jan 2020 “Pionier für die batterielose Funktechnik ” : K. Jungk, elektropraktiker.de , 32 Mar 2020 “Pionier im Bereich der batterielosen Lösungen für die Gebäudeautomation ” : Andreas Stöcklhuber, elektro.net , Jul 2020 “Energy Harvesting Pionier Enocean ” : developmentscout.com , 4 Aug 2020 “EnOcean als Pionier des zukunftsträchtigen Energy Harvesting ” : Sven Häwel, homeandsmart.de , 1 Sep 2020 “EnOcean ist der Pionier für Energy Harvesting ” : Florian Beckmann, smarthomeassistent.de , 4 Oct 2020 “Marktführer im Segment Energy Harvesting ” : bvkap.de

Risk Factors © EnOcean 2022 | Sustainable IoT All references to the “Company,” “we,” “us” or “our” refer to the business EnOcean GmbH (together with its subsidiaries) . The risks presented below are certain of the general risks related to the business of the Company, Parabellum Acquisition Corp . (“SPAC”), and the proposed transactions between the Company and SPAC (the “Proposed Business Combination”), and such list is not exhaustive . The list below has been prepared solely for purposes of the private placement transaction, and solely for potential private placement investors, and not for any other purpose . You should carefully consider these risks and uncertainties, together with the information in the Company’s consolidated financial statements and related notes and should carry out your own diligence and consult with your own financial and legal advisors concerning the risks and suitability of an investment in this offering before making an investment decision . Risks relating to the business of the Company will be disclosed in future documents filed or furnished by the Company and/or SPAC with the United States Securities and Exchange Commission (the “SEC”), including the documents filed or furnished in connection with the proposed transactions between the Company and SPAC . The risks presented in such filings will be consistent with those that would be required for a public company in their SEC filings, including with respect to the business and securities of the Company and SPAC and the proposed transactions between the Company and SPAC, and may differ significantly from, and be more extensive than, those presented below . Risks Related to our Business and Industry : • We have a history of generating net losses, and if we are unable to achieve adequate revenue growth while our expenses increase, we may not achieve or maintain profitability in the future . • If we fail to manage our growth effectively or to sustain our revenue growth, we may be unable to execute our business plan, maintain customer satisfaction or adequately address competitive challenges . • Members of the Company’s management have limited experience in operating a public company . The requirements of being a public company may strain our resources and divert management’s attention, and the increases in legal, accounting and compliance expenses that will result from being a public company may be greater than we anticipate . • If we do not attract new customers and increase our customers’ use of our products and services, our business will suffer . • Our limited operating history, especially with the edge computing solutions business acquired from Renesas Electronics Corporation, makes it difficult to evaluate our current business and future prospects and may increase the risk that we will not be successful . • We generate a significant portion of our revenue from our largest customers, and the loss or decline in revenue from any of these customers could harm our business, results of operations, and financial condition . • If we fail to continue to improve and enhance the functionality, performance, reliability, design and security in a manner that responds to our customers’ evolving needs, our business may be adversely affected . • Our brand is integral to our success . If we fail to effectively maintain, promote, and enhance our brand, our business and competitive advantage may be harmed . • We are dependent on the continued services and performance of our senior management and other key employees, the loss of any of whom could adversely affect our business, operating results, and financial condition . • Our ability to recruit, retain, and develop qualified personnel is critical to our success and growth . • If our technical and maintenance support services are not satisfactory to our customers, they may not buy future products, which could materially and adversely affect our future results of operations and financial condition . • Any future litigation against us could be costly and time - consuming to defend . • Our pricing decisions and pricing models may adversely affect our ability to attract new customers and retain existing customers . 23

Risk Factors (continued) © EnOcean 2022 | Sustainable IoT Risks Related to our Business and Industry (continued) : • If our technical and maintenance support services are not satisfactory to our customers, they may not buy future products, which could materially and adversely affect our future results of operations and financial condition . • Increases in labor and component costs, and supply - chain delays could adversely affect results of operations . • We transmit and store personal information of our customers and consumers . If the security of this information is compromised, our reputation may be harmed, and we may be exposed to liability and loss of business . • We are subject to stringent and changing privacy laws, regulations and standards, and contractual obligations related to data privacy and security . Our actual or perceived failure to comply with such obligations could harm our reputation, subject us to significant fines and liability, or adversely affect our business . • Security breaches, denial of service attacks, or other hacking and phishing attacks on our systems or the systems with which our platform integrates could harm our reputation or subject us to significant liability, and adversely affect our business and financial results . • Interruptions or performance problems associated with our technology may adversely affect our business and operating results . • Defects, errors, or vulnerabilities in our hardware, software or other technology systems and those of third - party technology providers could harm our reputation and brand and adversely impact our business, financial condition, and results of operations . • We may require additional capital, which additional financing may result in restrictions on our operations or substantial dilution to our stockholders, to support the growth of our business, and this capital might not be available on acceptable terms, if at all . • Our business is highly competitive . We may not be able to compete successfully against current and future competitors . • The estimates of market opportunity and forecasts of market growth included in this presentation may prove to be inaccurate, and even if the market in which we compete achieves the forecasted growth, our business could fail to grow at similar rates, if at all . Risks Related to the COVID - 19 Pandemic : • The ongoing COVID - 19 pandemic has adversely impacted and may continue to adversely impact our business, financial condition, and results of operations . • The COVID - 19 pandemic has resulted in global supply chain shortages, that we expect to continue in the foreseeable future, which could have a material adverse effect on our business, results of operations, and financial results . 24

Risk Factors (continued) © EnOcean 2022 | Sustainable IoT Risks Related to our Intellectual Property : • If we fail to adequately protect our intellectual property rights, our competitive position could be impaired and we may lose valuable assets, generate reduced revenue and become subject to costly litigation to protect our rights . • We may be subject to claims by third parties of intellectual property infringement . • We use open - source software in our platform, which could negatively affect our ability to sell our services or subject us to litigation or other actions . • Third - party claims that we are infringing intellectual property, whether successful or not, could subject us to costly and time - consuming litigation or expensive licenses, and our business could be adversely affected . • Our intellectual property applications, including patent applications, may not be approved or granted or may take longer than expected to be approved, which may have a material adverse effect on our ability to prevent others from commercially exploiting products similar to ours . • In addition to patented technology, we rely on trade secrets, designs, experiences, work flows, data processes, software and know - how . General Risks • Downturns or volatility in general economic conditions could have a material adverse effect on the Company’s business, financial condition, results of operations and liquidity . • Industry consolidation may result in increased competition, which could result in a reduction in revenue . • The Company depends on growth in the end markets that use its products . Any slowdown in the growth of these end markets could adversely affect its financial results . • The Company is dependent on a limited number of distributors and end customers . The loss of, or a significant disruption in the relationships with any of these distributors or end customers, could significantly reduce the Company’s revenue and adversely impact the Company’s operating result . A significant portion of the Company’s chip supplies are generated through customers in Taiwan which subjects the Company to risks associated with supplier interest and governmental or regulatory changes as well as geopolitical developments, particularly related to Taiwan and China . • If the Company fails to accurately anticipate and respond to rapid technological change in the industries in which the Company operates, the Company’s ability to attract and retain customers could be impaired and its competitive position could be harmed . • The Company's competitive position could be adversely affected if it is unable to meet customers’ or device manufacturers’ quality requirements . • If the Company is unable to expand or further diversify its customer base, its business, financial condition, and results of operations could suffer . • If the Company’s products do not conform to, or are not compatible with, existing or emerging industry standards, demand for its products may decrease, which in turn would harm the Company’s business and operating results . • Reliability is especially critical in the automotive industry, and any adverse reliability result by the Company with any of its customers could negatively affect the Company’s business, financial condition, and results of operations . • The Company is subject to risks and uncertainties associated with international operations, which may harm its business . • The Company's company culture has contributed to its success and if the Company cannot maintain this culture as it grows, its business could be harmed . 25

Risk Factors (continued) © EnOcean 2022 | Sustainable IoT General Risks (continued) • The Company may not be able to effectively manage its growth and may need to incur significant expenditures to address the additional operational and control requirements of its growth, either of which could harm the Company’s business and operating results . • Shifts in the Company’s product mix or customer mix may result in declines in gross margin . • The Company may from time - to - time desire to exit certain programs or businesses, or to restructure its operations, but may not be successful in doing so . • The Company may pursue mergers, acquisitions, investments and joint ventures, which could divert its management’s attention or otherwise disrupt its operations and adversely affect its results of operations . • The Company may not be able to convert its pipeline or orders in backlog into revenue . • The Company may not manage its growth effectively . • Our forecasts and projections are based on assumptions, analyses and internal estimates developed by our management . If these assumptions, analyses or estimates prove to be incorrect or inaccurate, our actual operating results may differ materially from those forecasted or projected . • The market adoption of our product is evolving and may develop more slowly or differently than we expect . Our future success depends on the growth and expansion of these markets and our ability to adapt and respond effectively to evolving markets . • Interruption or failure of our information technology and communication systems could impact our ability to effectively provide our products and services . • We are subject to cybersecurity risks to operational systems, security systems, infrastructure, integrated software in our products and customer data processed by us or third - party vendors or suppliers and any material failure, weakness, interruption, cyber event, incident or breach of security could hinder the effective operation of our business . Stock and Capitalization Risks • The Company has a history of losses and may incur significant expenses and continuing losses for the foreseeable future . • The market price of the combined company’s common stock may be highly volatile . • The Company’s operating results may have significant period - to - period fluctuations, which would make it difficult to predict our future performance . • Raising additional funds by issuing securities may cause dilution to existing stockholders or restrict the combined company’s operations . • The combined company does not intend to pay cash dividends . Consequently, any gains from an investment in its securities will likely depend on whether the price of the common stock increases . • The combined company’s executive officers and directors will own a significant percentage of the common stock and could exert significant influence over matters requiring stockholder approval, including takeover attempts . • Failure to meet the maintenance criteria of the stock exchange may result in the delisting of the combined company’s common stock, which could result in lower trading volumes, liquidity and prices of the common stock and make it more difficult for the combined company to raise capital . • If industry or financial analysts do not publish research or reports about the combined company’s business, or if they issue inaccurate or unfavorable research regarding the common stock, the share price and trading volume could decline . 26

Risk Factors (continued) © EnOcean 2022 | Sustainable IoT Risks Related to the Business Combination • The Proposed Business Combination may disrupt current plans and operations of the Company . • If the Proposed Business Combination’s benefits do not meet the expectations of investors or securities analysts, the market price of SPAC’s securities or, following the consummation of the Proposed Business Combination, the combined company’s securities, may decline . • The valuation ascribed to the combined company may not be indicative of the price that will prevail in the trading market following the Proposed Business Combination . If an active market for the combined company’s securities develops and continues, the trading price of the combined company’s securities following the Proposed Business Combination could be volatile and subject to wide fluctuations in response to various factors, which could contribute to the loss of all or part of your investment . • The combined company may be required to take write - downs or write - offs, or be subject to restructuring, impairment or other charges that could have a significant negative effect on the combined company’s financial condition, results of operations and the price of our common stock, which could cause you to lose some or all of your investment . • Both SPAC and the Company will incur significant transaction costs in connection with the Proposed Business Combination . • SPAC and the Company may not successfully or timely consummate the Proposed Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Proposed Business Combination or that the approval of the stockholders of SPAC is not obtained . • The consummation of the Proposed Business Combination is subject to a number of conditions and if those conditions are not satisfied or waived, the Proposed Business Combination agreement may be terminated in accordance with its terms and the Proposed Business Combination may not be completed . • There is no guarantee that a stockholder’s decision whether to redeem its shares for a pro rata portion of the trust account will put the stockholder in a better future economic position . • Legal proceedings in connection with the Proposed Business Combination, the outcomes of which are uncertain, could delay or prevent the completion of the Proposed Business Combination . • Following the consummation of the Proposed Business Combination, the combined company will incur significant increased expenses and administrative burdens as a public company, which could have an adverse effect on its business, financial condition and results of operations . • Changes in laws or regulations, or a failure to comply with any laws and regulations, may adversely affect the Company’s or the combined company’s business, including the ability of the parties to consummate the Proposed Business Combination, and results of operations of the Company or the combined company . • The ability to successfully effect the Proposed Business Combination and the combined company’s ability to successfully operate the business thereafter will be largely dependent upon the efforts of certain key personnel of the Company, all of whom we expect to stay with the combined company following the Proposed Business Combination . The loss of such key personnel could negatively impact the operations and financial results of the combined business . • Engaging in a cross - border business combination increases uncertainty on the ability to successfully close the deal as a cross - border transaction and it is significantly more complicated, time - consuming and expensive, and the parties may not be able to negotiate a transaction that is acceptable to SPAC’s stockholders or obtain all necessary approvals . 27

Risk Factors (continued) © EnOcean 2022 | Sustainable IoT Risks Related to the Business Combination (continued) • The parties have not settled on a corporate structure for the transaction and a corporate jurisdiction may be selected which is different from the United States, which could present other risks which are not currently disclosed . The laws governing non - U . S . entities may be different to the laws governing entities formed in the U . S . Material differences may include differences with respect to, among other things, distributions, dividends, repurchases and redemptions, the election of directors, the removal of directors, the fiduciary and statutory duties of directors, conflicts of interests of directors, the indemnification of directors and officers, limitations on director liability, notice provisions for meetings, the exercise of voting rights, certain stockholder actions and uncertainty regarding tax policies of the jurisdiction of the combined company . • SPAC’s ability to complete an initial business combination may be adversely affected by downturns in the financial markets or in economic conditions, increases in oil prices, inflation, increases in interest rates, supply chain disruptions, declines in consumer confidence and spending, the ongoing effects of the COVID - 19 pandemic, including resurgences and the emergence of new variants, and geopolitical instability, such as the military conflict in the Ukraine . 28